Abstract

The code of corporate governance in Saudi Arabia places a greater focus on social responsibility initiatives by Saudi companies and the reporting of such activities to the community. The current study examines the relationship between corporate governance mechanisms and environmental, social, and governance (ESG) disclosures amongst Saudi companies. In particular, we extend previous studies by covering unique Saudi corporate governance mechanisms (i.e., the presence of members of the royal family on the board (BROY) and of external members on the audit committee (ACEXT)), and their impact on ESG disclosure. Using 206 company-year observations for Saudi listed companies spanning the period 2010 to 2019, we find the presence of BROY and ACEXT has a positive and significant association with ESG disclosure. The findings of this study may help policymakers to develop regulations regarding corporate governance mechanisms to enhance ESG disclosure.

1. Introduction

Sustainable development approaches have become a popular issue for public listed companies and their various stakeholders over recent decades [1,2,3]. Sustainable development is defined by the World Commission on Environment and Development (1987) as development that meets present requirements without compromising future generations’ capability to meet their own needs. Hence, companies currently employ environmental, social, and governance (ESG) policies and engage in a variety of ESG-linked practices to warrant sustainable business practices [4]. According to Ref. [4], ESG helps companies to find a balance between their commercial and social objectives, as well as making effective use of scarce resources. In addition, ESG emphasises the interests of all stakeholders, not just shareholders, by taking into consideration societal, environmental, and ethical aspects [3].

Prior research provides rich evidence on the benefits of ESG disclosure for companies and their stakeholders. Ref. [5] proposed ESG as a strategic device to improve corporate reputation and enhance access to financial resources. Empirical literature suggests that companies with higher ESG performance are inclined to reveal more information because they seek to signal their credibility and trustworthiness as well as to solidify their image as generous corporate citizens, affecting investors’ and other stakeholders’ favourable perception of them [6]. Hence, disclosing information on ESG activities can be utilised to legitimise the company in the eyes of consumers, bringing competitive advantages to the company and thereby improving its performance and value [7,8,9]. In relation to the agency problem, ESG reporting diminishes information asymmetry between the company insiders and stakeholders [10,11].

Corporate governance is responsible for balancing economic, social and environmental issues [5,9,12]. Corporate governance structures, for example, the board of directors and the audit committee, are established to monitor and control managers’ decisions and company activities that involve community and society engagement in order to bring direct and indirect benefits to stakeholders. The board of directors as corporate governance’s main mechanism is responsible for overseeing executives and ensuring that stakeholders’ needs are met. Hence, the structure of the board is critical for the effectiveness of its monitoring duties. For instance, independence, diligence, and relevant expertise of board members motivate managers to reach high levels of integrity, transparency, and disclosure [13,14]. Interestingly, in the Gulf Cooperation Council (GCC) countries, a unique feature of the board of directors is the presence of royal family members (BROY). Most of the listed companies in GCC countries have at least one ruling family member on their boards [15,16]. However, little is known about how such companies are governed or how their ESG activities differ from their counterparts which have no royal family involvement [17]. As responsible stewards and community leaders, BROY may prioritise stakeholders’ concerns and eschew self-serving benefits, and influence management to further the interests of stakeholders by pursuing an ESG agenda.

In addition, the audit committee, which is a board of directors sub-committee, is responsible for monitoring the reporting of both financial and non-financial information with the purpose of reducing information asymmetry between companies, executives, and stakeholders [14]. The audit committee has a major role in supervising both mandatory and voluntary disclosures, including ESG information. In the Saudi context, it is permissible to appoint an external member to audit committees, someone not among the board of directors, i.e., non-director member (ACEXT). According to the Saudi Code of Corporate Governance (SCCG), audit committees can thus include members from outside the board, usually with financial or legal experience [18]. For example, based on the annual report for the year ending 2019, three of the six members of the audit committee of SABIC (Saudi Basic Industries Corporation) are non-directors, including the audit committee chair [19]. These non-director members are expected to be intense monitors as they are more independent and more attentive. They are not over-committed with a heavy workload as they are not required to attend board meetings and other board sub-committee meetings. According to Ref. [20], the audit committee chair’s lack of attention is connected with poor internal audit processes due to the heavy workload and limited time and expertise.

A rich empirical literature has investigated the influence of board and audit committee attributes on ESG disclosure, providing evidence that certain board and audit committee features enhance ESG disclosure. Most of these studies was heavily concentrated on developed countries, with a few from East Asian emerging markets [5,14,15,21,22]. Nevertheless, to the best of our knowledge, there is a shortage of empirical research addressing the association between BROY and ESG disclosure in the Saudi context. The absence of empirical research might be due to the limited disclosure of BROY in the annual reports. Further, no research has yet examined the relationship between ACEXT and ESG disclosure. Thus, our paper attempts to add to this sparse empirical literature, and assess the efficacy of Saudi’s regulation on audit committee composition.

Our study is focused on the Saudi market for the following reasons. First, the Saudi listed companies have commitments towards ESG practices, as Saudi Vision 2030 imposes certain requirements related to the environment and society (see Section 2.2 below). According to SCCG, all Saudi public listed companies are required to provide non-financial reports on their ESG activities. Ref. [23] noted that Saudi Arabia ranked second in the Middle East and North Africa regions for adopting and implementing ESG concepts. Second, Saudi Arabia is a member of the G20 and has been classified as the Middle East’s largest market, responsible for 25% of the Arab world’s gross domestic product (GDP) [24]. Saudi is also one of the largest oil exporters in the world [25]. These make it an attractive market for scholars to conduct scientific research, particularly on topics linked to corporate governance and sustainability.

The current study adds to the corporate governance and ESG disclosure literature in several ways. First, our study is conducted to investigate the role of BROY in legitimising ESG, which is considered a unique board characteristic of GCC countries of which Saudi Arabia represents the largest market. Second, although the majority of corporate governance mechanisms have rules to ensure audit committee independence, the SCCG allows companies to assign someone from outside the board of directors to be a member of the audit committee, provided the person holds relevant qualifications and experience that is more likely to enhance the monitoring duties. Thus, our study is among the first that examines the role of ACEXT on ESG reporting. Our findings show that BROY and ACEXT have positive effects on ESG disclosures by Saudi companies.

The rest of our paper is organised as follows. The development of hypotheses for BROY and ACEXT is discussed in Section 2. Section 3 describes the methodology. Section 4 presents the results and discussion. Finally, the study’s conclusion, policy implications and limitations are reported in Section 5.

2. Literature Review and Hypotheses Development

2.1. Theoretical Framework of the Study

Several organisational theories have been used to investigate the relationship between business and society. These theories explain why businesses willingly share data on their ESG activities [2]. The literature on ESG disclosure focused on four primary theories: legitimacy theory, agency theory, signalling theory, and stakeholder theory. Based on agency theory, a specific association exists between the shareholders and management, characterised by the presence of mutual interests [26]. Managers’ interests, however, are not necessarily aligned with the interests of other shareholders [27]. Hence, firms provide ESG disclosure in order to reduce this information asymmetry [28]. Indeed, increased ESG disclosure by management, which represents additional non-financial information, improves the information environment and reduces the knowledge barrier between a firm and its shareholders [29].

According to stakeholder theory, in order to sustain a healthy and long-term connection with stakeholders, firms respond to the worries and expectations of key stakeholders such as employees, creditors, customers, auditors, suppliers, and the government, in addition to the general public by disclosing sustainability information on ESG pursuits [21,30,31]. As this study seeks to find out to what extent BROY and ACEXT influence organisational activities to meet the expectations of various stakeholders and society in general, we use agency theory and stakeholder theory to develop our theoretical framework and hypotheses.

Furthermore, legitimacy theory and signalling theory are also widely used to explain environmental and social disclosures. According to the legitimacy theory, an entity must reveal more social activities at the back of changes in the marketplace [32]. If a company is rewarded for behaving more socially than other companies, the legitimacy gap between the company and society can be bridged. ESG disclosure, according to signalling theory, signals to investors and other influential and economic stakeholders that the company is actively participating in ESG practices to create long term value. As part of its ESG strategy, top management plans to educate its stakeholders on its ESG efforts and expand its board expertise, as this leads to better corporate responsibility and a closer relationship between business and society [33]. A company with a strong ESG performance might find it easier to build a reputation for dependability in the capital and debt markets [34].

2.2. Corporate Governance and ESG Regulations in Saudi Arabia

A variety of rules and legislation enhances corporate governance in Saudi listed companies. The Ministry of Commerce and Industry released the disclosure and transparency rules in 1985. As transparency and disclosure are two of the most important aspects of good corporate governance practice [35,36], the implementation of these rules should improve corporate governance standards. Saudi Arabia has made significant progress in corporate governance over the last two decades, beginning with the issuing of internal control guidelines in 2000 and the SCCG in 2006. Starting from 2010, SCCG became compulsory for all Saudi listed companies [37].

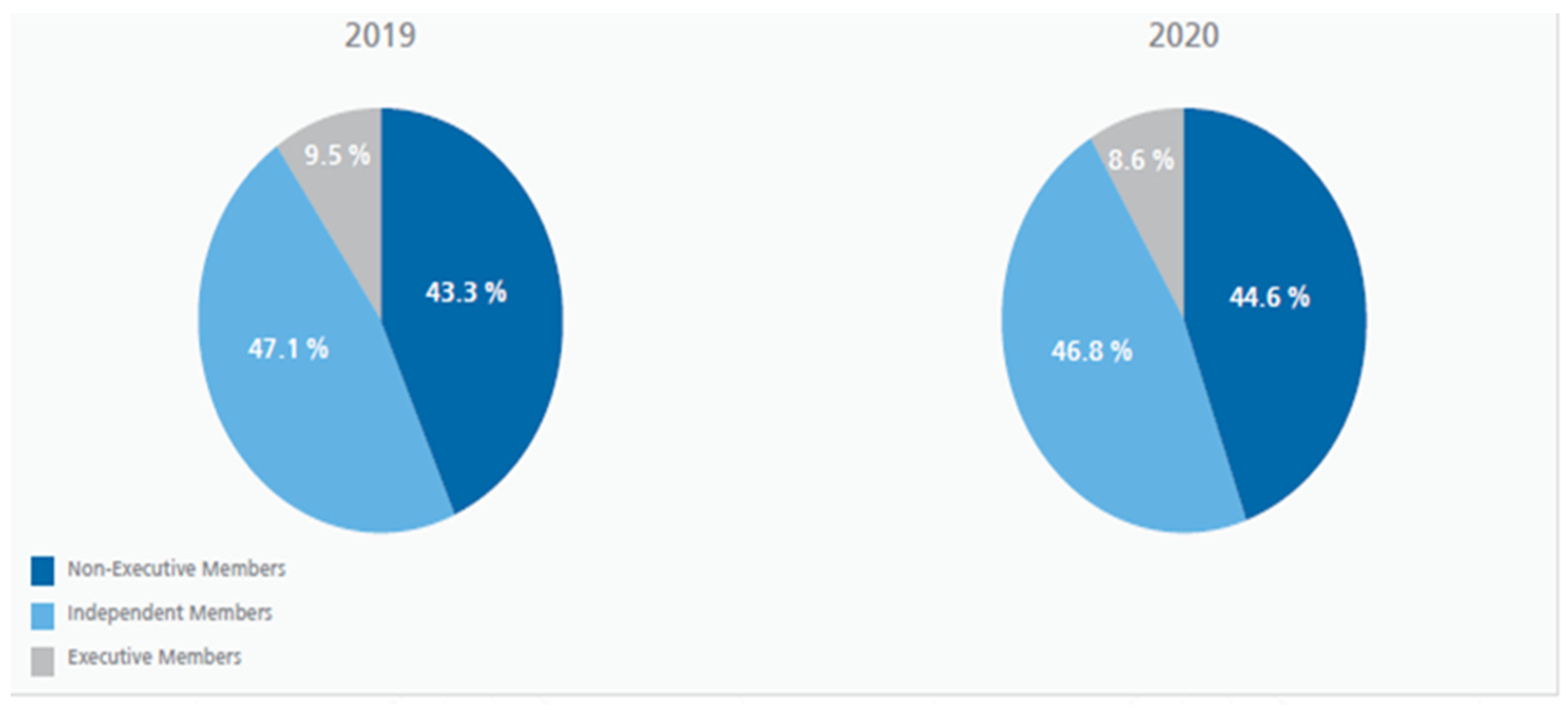

The Code comprises several important areas including the board of directors, shareholders’ rights, board committees, external auditor, transparency and disclosure, and, finally, the code’s implementation. The code establishes regulations for the formation, responsibilities, and composition of the board of directors in order to ensure its independence in carrying out its statutory tasks. According to SCCG, Articles 16 and 17, the board size must be appropriate to the size and nature of the company’s activities, and non-executive directors should form a majority. Pertaining to the composition of the audit committee, SCCG in Chapter 2 section A states that “An audit committee shall be formed by a resolution of the Company’s Ordinary General Assembly, and the members of the audit committee shall be from the shareholders or others, provided that at least one of its members is an Independent Director and that no Executive Director is among its members”. According to Ref. [38], in 2020, non-executive and independent directors account for 91.4 percent of total seats on boards of directors of Saudi publicly traded companies (see Figure 1). In addition, the audit committee member seats from outside the board of directors represented 49.2 (47) percent in 2020 (2019).

Figure 1.

Boards of Directors Composition of Saudi Listed Companies Classified by Membership Type. Source: Saudi Capital Market Authority Annual Report 2020.

Saudi Arabia launched the strategic Saudi Vision 2030 in 2016 to diversify its economy away from oil. As a result, the role of corporate governance in strengthening the ESG disclosure policy is an empirical issue. Saudi Arabia’s current corporate governance code was created to be in alignment with global best practice, such as the Organization for Economic Cooperation and Development (OECD) standards [39]. Saudi companies’ ESG activities were given more weight in the Code. As stated on page 46 of Article 87: Social Responsibilities “The Ordinary General Assembly, on the recommendation of the Board, shall establish a policy that ensures a balance between its objectives and those of the community for the purposes of developing the community’s social and economic conditions” [18]. Furthermore, on page 46, Article 88: Social Initiatives stated that “The Board shall establish programs and determine the necessary methods for proposing social initiatives by the Company”.

2.3. Royal Family Member (BROY)

The board of directors is the most important monitoring mechanism for controlling management’s actions and ensuring that they are aligned with the interests of shareholders. According to a National Association of Corporate Directors (NACD) survey, 55 percent of directors say their boards have allocated ESG supervision to the whole board, and almost 80 percent of public firm boards interact with ESG issues in some meaningful way, such as their linkages with strategy and risk [40]. Meanwhile, in the GCC countries, BROY have a crucial role in the growth of businesses in GCC markets, together with the formation of local businesses. The presence of BROY avails critical resources to firms, and promotes active stakeholder engagement due to their political and social status [41]. They are also well-liked and respected in the community, therefore companies employ them as directors to boost their legitimacy and reputation, and to provide external linkages through their networks [42]. BROY are also influencers with vast wealth who attract media and public attention. Thus, BROY are more inclined to focus on societal issues to improve their social reputations and gain favourable media coverage. As a result, BROY are likely to urge the management to implement appropriate ESG activities and strategies that meet the interests of numerous stakeholders. In addition, BROY are considered as vital leaders in their communities, and have a responsible position in serving their society as well as their charity organisations [16]. While BROY may not necessarily play a part in the actual management, executives are inspired by their style of servant leadership. For example, if BROY direct managers to contribute to charity activities, the managers will instantly comply with their requests [16].

Ref. [43] claims that BROY play a crucial role in minimising agency problems and information asymmetry, as well as influencing ESG reporting. In GCC countries, royal family representation on boards of directors is a cultural norm. At least one member of the ruling family serves on the boards of directors of many GCC-listed companies [44]. Servant leaders, according to signalling theory, serve individuals, organisations, and communities. In Arabic culture, leaders are responsible for the community, which can send a positive message to stakeholders. Hence, BROY can influence management to further the interests of stakeholders [16].

A few empirical studies have explored the effect of a board containing royal family members in GCC countries on corporate disclosure and have documented contradictory results. For instance, Ref. [16] reported a positive relationship between BROY serving on the board of directors and ESG disclosure. Using a sample of banks in GCC countries, Ref. [41] found that the existence of BROY is positively associated with the level of voluntary corporate responsibility disclosure. However, Ref. [45] found a negative influence of concentrated ownership on ESG disclosure, where firms with concentrated ownership typically have members of the royal family on the board and hold significant ownership in GCC listed companies. In addition, Ref. [46] found that the presence of the royal family on the boards of Kuwaiti companies has a negligible impact on voluntary disclosure policies. From the discussion above, our study proposes the following hypothesis:

Hypothesis 1 (H1).

The presence of royal family members on the boards of directors positively influences ESG disclosure.

2.4. Audit Committee External Members

The audit committee’s primary responsibility is to oversee the financial and non-financial reporting processes and to reduce information asymmetry among companies, managers, and stakeholders [14]. Specifically, the audit committee is responsible for supervising both mandatory and voluntary disclosures related to ESG. The audit committee plays a crucial role in how companies tell their story and convey ESG performance. The audit committee members should understand how ESG risks and opportunities are identified and prioritised, and oversee the disclosure practices. Due to the potential influence on shareholder value, investors want to know how companies are dealing with ESG risks and opportunities [47]. Boards can leverage the audit committee’s expertise in financial reporting by appointing the audit committee the responsibility to oversee ESG disclosures. The audit committee has the expertise to comprehend and evaluate the validity of the methodologies and procedures used by management to create ESG indicators and other ESG disclosures. The audit committee may also assist in determining if a company’s internal controls are adequate for assuring the accuracy, reliability, and consistency of ESG data across time.

The audit committee needs to be independent of executives to achieve its duties [22,48]. Independent directors, according to agency theory, are more likely to supervise management’s operations and promote disclosure. Ref. [49] found that involving directors from outside the company reduces the opportunity for management to expropriate the company’s assets. As a result, agency conflict and information asymmetry may be reduced [26]. In Saudi Arabia, it is permitted to appoint non-board directors, the so-called “external members”, who are invariably independent with wide financial experience and not over-burdened with commitment, to the audit committees.

Ref. [50] emphasised that a firm’s audit committee should be carefully chosen, with only members who have the time, dedication, and experience to execute the job successfully. In addition, Ref. [51] deemed it unfavourable for audit committee members to serve on other board monitoring committees. When members of the audit committee are also on the board of directors and serve on other board monitoring committees within the same firm, their time commitment may be stretched. The SCCG which encourages non-board directors as audit committee member believes that having “external member” in the audit committee is a desirable corporate governance mechanism because it allows the person to devote sufficient time to oversee the ESG practices, as he/she is not overburdened with other board and sub-committee duties. Ref. [52] found that independent members serving on audit committees were positively related to voluntary disclosure. According to Ref. [14], audit committee independence has a strong favourable impact on ESG disclosure. Furthermore, Ref. [22] found evidence of a relationship between the independence of audit committee and ESG disclosure. Ref. [53], on the other hand, found no evidence of a relationship between intellectual capital disclosure and the independence of audit committee.

Although research on this topic has found a positive and significant association between voluntary financial disclosure and audit committee independence [13,14,21,54], to our best understanding, there has been no empirical research on the association between ESG disclosure and ACEXT. As a result, this relationship is an empirical issue that motivates this research. ACEXT is expected to participate actively in pursuing ESG efforts aimed at strategically improving the company’s image. Based on this logic, this study anticipates a positive association between ESG disclosure and ACEXT, leading to the following hypothesis:

Hypothesis 2 (H2).

The presence of audit committee members from outside the board on the audit committee positively influences ESG disclosure.

3. Research Methodology and Data

3.1. Data and Sample

To examine the association between the independent variables (Royal Family Member and Audit Committee External Member) with ESG reporting, the Bloomberg database has been used to collect the ESG data. For the purpose of this study, we used only Saudi companies that have an annual ESG rating on the Bloomberg database and have the required data for the analysis from 2010 to 2019. Therefore, our final sample comprises 206 company-year observations (included in the study’s main model) representing 34 companies spanning the period 2010 to 2019. The year 2010 was selected as the starting point of our study because the SCCG became mandatory for all Saudi listed companies effective from 2010 [37]. The study period ended in 2019, two years after the issuance of SCCG in its current status, in 2017, and three years after the launched of Saudi Vision 2030, which devotes more attention to environment and society issues [25]. Furthermore, by excluding sample period beyond 2019, we control for extraordinary events such as the COVID-19 pandemic which started in early 2020. Table 1 shows the final sample distribution over the study period. The data related to our main independent variables and some control variables were manually collected from Saudi companies’ annual reports downloaded from the Saudi exchange market website (www.saudiexchange.sa). Thomson Reuters DataStream was used to collect the data related to other financial control variables.

Table 1.

Sample selection.

3.2. Variables Measurements

3.2.1. Dependent Variable: ESG Reporting

Most empirical ESG studies have used a self-constructed ESG disclosure index [55]. In this study, we utilise the ESG scores with a 0 to 100 scale from the Bloomberg database to measure our dependent variable (i.e., ESG disclosure). The Bloomberg ESG scores are considered appropriate to measure ESG activities for several reasons. First, these scores are based on raw data mapped to the Global Reporting Initiative (GRI) sustainability disclosure framework, and hence are expected to be useful by highlighting the companies’ strengths and weaknesses related to ESG issues [16,25,56,57]. Second, the Bloomberg database employs wide-ranging methods to evaluate companies’ ESG data and provides a 0 to 100 score for each ESG category [58,59].

3.2.2. Independent Variables

A royal family member on the board (BROY) as the first independent variable is measured as a dummy variable that equals 1 if at least one of the board members is from the royal family, 0 otherwise [16]. The second independent variable, audit committee external member (ACEXT) is measured as a dummy variable that equals 1 if at least one of the audit committee members is from outside the board, i.e., a non-board director.

3.2.3. Control Variables

ESG disclosure could be the result of other company attributes and their management [57,60], so in the current study we control for several board characteristics variables such as board meeting (BMET), board size (BSIZ), and board independence (BIND). BMET is calculated as the number of board of directors meetings, BSIZ as the total number of directors on the company board, and BIND as the percentage of independent directors on the board [16,24,35,61,62,63,64,65,66,67,68].

According to Refs. [67,68,69], the BMET, as well as member attendance, is a crucial way via which directors can obtain specific relevant information to help them in completing their controlling and monitoring responsibilities. Moreover, Ref. [70] argues that more frequent BMET provide more opportunities to transform board expertise, knowledge, and skills into promoting a companies’ results. Refs. [61,71,72] empirically documented evidence that the frequency of BMET positively and significantly associated with ESG disclosure. Hence, we expect a positive association between BMET and ESG reporting. The BSIZ is a crucial feature of corporate governance as it significantly improves the board monitoring position [61]. Agency theory argues that the large number of BSIZ contributes to lessen the agency cost via embarking on more socially responsible activities [73]. Previous empirical studies found a positive association between BSIZ and ESG reporting [2,61,74,75,76]. As a result, we anticipate a positive relationship between BSIZ and ESG reporting. BIND assist the top management to embrace wider approaches to make a sustainable partnership with society as well as higher levels of ESG disclosure [5]. The viewpoint of agency theory argued that BIND are important because they can control and make decisions [26]. Empirically, the existing literature revealed controversial results between BIND and ESG disclosure. For example, Refs. [2,13,61] found a significant positive correlation between BIND and ESG disclosure. However, a second group of studies showed that BIND was negatively related to the level of ESG disclosure [73,77,78]. Hence, we expect a nondirectional effect of BIND on the ESG reporting.

Furthermore, we control for some audit committee variables such as audit committee independence (ACIND), and audit committee meeting (ACMET). ACIND is calculated as the ratio of audit committee members who are independent directors to the audit committee size, and ACMET as the number of meetings held by the audit committee [14,22,79,80,81,82,83]. The existence of independent members is considered an essential factor that enhances audit committee effectiveness [84,85]. Ref. [53] observed that audit committee members are appointed to perform independently in order to manage conflicts among executives and outside players, and that ACIND helps in strengthening financial reporting integrity. Prior empirical studies found a positive association between ACIND and ESG reporting [14,22]. Therefore, we anticipate a positive relationship between ACIND and ESG reporting. The ACMET frequency is seen as metric to the level of diligence and monitoring that members of an audit committee exercise [86,87]. In this regard, the empirical research found a link between ACMET frequency and ESG disclosure [14]. As a result, a positive association between ACMET and ESG reporting is expected in this study.

Government-owned institutional investors (IOGOV), company profitability (ROE), company leverage (LEV), Tobin Q (TQ), company loss (LOSS), and company size (FSIZE) are also included as potential determinants of ESG disclosure. IOGOV is calculated as the ratio of shares owned by government-owned institutions [10,88,89]. ROE is the return on equity [65], LEV is the percentage of total debt to total assets [16], and TQ is the ratio of a company’s market value to the replacement cost of its assets [90]. LOSS is measured as a dummy variable that equals 1 if a company’s net income is negative, 0 otherwise [91,92], and FSIZE is calculated as the natural logarithm of the company’s total assets [13,35,88]. In this study, we anticipate a positive relationship between IOGOV, ROE, TQ, and FSIZE and CSR disclosure, but a negative relationship between LEV, LOSS, and CSR disclosure.

3.3. Model Specification

To investigate the study hypotheses, we use the ordinary least squares (OLS) regression model. OLS regression is widely used examining the impact of firm attributes on the corporate disclosure level [24,88,93,94]. The following OLS model is used to investigate the effect of corporate governance variables on ESG disclosure:

All variables employed in the study have been Winsorized at values of 1% and 5% at the top and bottom to solve outlier issues. To avoid heteroscedasticity and serial correlation issues, OLS regression with Huber–White robust standard errors was used.

4. Empirical Results

4.1. Descriptive Statistics

The descriptive statistics for all variables are shown in Table 2. The average of ESG disclosure is 14.621 ranging from 2.193 to 48.347, which suggests that ESG scores during the study period are low among Saudi listed companies, consistent with previous studies [16,35,94]. This low score could be due to ESG disclosure being voluntary in Saudi Arabia during the study period. The results in Table 3 also show that the mean of BROY is 0.175 and the mean of ACEXT is 0.922, which suggests that 17.5% of the sample firms have at least one royal family director and more than 90% have at least one non-board director on the audit committee. The mean frequency of board meetings is six times per year, and the mean board size is almost 10 directors. The mean percentage of board independence is slightly above 40%. The mean percentage of ACIND is almost 80%, and the mean of ACMET is six times a year. Further, the mean percentage of ownership by government-owned institutional investors is 24%. Finally, the mean values of return on equities, leverage, Tobin’s Q, and total assets are 12%, 24%, 1.394, and SAR 120 billion, respectively. Eight percent of the sample firms incur losses.

Table 2.

Descriptive statistics.

Table 3.

Correlation matrix.

4.2. Correlation Analysis

Prior to conducting the regression analysis, correlation analysis is carried out. The Pearson correlation matrix in Table 3 displays the correlation between all variables employed in the study model to help in diagnosing the issue of multicollinearity. The results in Table 3 show that the highest correlation is 0.596 between IOGOV and FSIZE, followed by 0.587 between ROE and LOSS and 0.545 between ROE and TQ. Therefore, multicollinearity was not a cause for concern in this study, as these values do not exceed 0.8 [95]. Furthermore, we perform the variance inflation factor (VIF) test to check for the presence of multicollinearity. As the results of VIF for all exploratory variables are less than 4.0 (unreported) and far from the benchmark 10 as suggested by Ref. [96], we conclude that no multicollinearity issue is present in this study.

4.3. Regression Results and Discussion

The influence of independent variables (i.e., BROY and ACEXT) on ESG disclosure is investigated using OLS regression analysis. We performed the tests for heteroscedasticity and autocorrelation, and the findings show the existence of these two problems; to solve these econometric issues, OLS regression with robust standard errors was used, following the recommendation of Ref. [97]. In the regression results reported in Table 4, overall, the model was significant (R2 = 0.360; p-value < 0.001) suggesting that the majority of independent variables had a significant impact on ESG disclosure.

Table 4.

OLS Regression Results.

The findings in Table 4 show a significant and positive association between BROY and CSR disclosure (coefficient = 6.318; p-value = 0.001). Hence, hypothesis 1 is supported. This finding suggests that in companies with royal family members on the boards, ESG disclosure is higher (better) than in companies without this category of directors on boards. This result is aligned with that of Ref. [16], who find a positive association between the BROY and ESG in GCC countries. In contrast, it does not support Ref. [46], who find an insignificant association between voluntary disclosure and the presence of royal family members on the boards of Kuwaiti companies.

As shown in Table 4, ACEXT is positively and significantly associated with ESG disclosure (coefficient = 4.034; p-value = 0.030), supporting our second hypothesis. This result indicates that the presence on the audit committee of an external member, who is a non-board director, is related with more ESG disclosure. This suggests that the existence of an audit committee member who is from outside the board is associated with better ESG oversight and more coherent ESG disclosure. This shows that, the audit committee’s attention to ESG performance may decline if its members are chosen from among the existing board of directors, due to a heavy workload and time constraint. It seems that firms are more transparent when reporting the ESG efforts when at least one member of the audit committee is not overburdened with other roles as a member of the full board and overlapping memberships in other board sub-committees. Thus, our results echo the SCCG’s position regarding the desirability in having an “external member” in the audit committee, and reinforces the finding by Ref. [20] that an over-committed audit committee chair harms the internal audit effectiveness.

Regarding the control variables, there is a negative and significant association between BMET and ESG disclosure (coefficient = −0.822; p-value = 0.006), implying that more frequent board meetings lead to lower ESG disclosure. This finding is not consistent with Ref. [68] who find that BMET is significantly and positively linked with integrated reporting quality. However, it is consistent with Ref. [69], who find a negative relationship between BMET and ESG in Malaysia. Furthermore, Ref. [67] find no significant relation between BMET and CSR in Malaysian context. Ref. [69] claims that, although the frequency of BMET has been related with better performance and high reporting quality by the companies, these meetings can be less beneficial, particularly when focusing on the work discussion instead of important topics that may relate to enhance companies’ performance and reporting disclosure. BSIZE has a positive and significant association with ESG disclosure at the 1% significant level (coefficient = 2.907; p-value = 0.009). This finding implies that Saudi firms with larger board size have a greater tendency to reveal more information about their ESG activities. This result is consistent with those of many prior studies [2,61,65,67,69,74,75,98]. Table 4 also shows that IOGOV is positively and significantly associated with ESG disclosure (coefficient = 0.159; p-value = 0.001), implying that higher ownership by government institutions is linked with more ESG disclosure by Saudi companies, in tandem with previous Saudi research [13,88]. Finally, Table 4 shows no significant association between BIND, ACIND, ACMET, return on equity, leverage, Tobin’s Q, losses, and firm size and ESG disclosure.

5. Further Investigation

5.1. Endogeneity Issues

According to Ref. [99], the endogeneity problem (or reverse causality) happens when the dependent variable is affected by factors that simultaneously influence the independent variables. Earlier studies emphasise that the association between board of directors’ variables and companies’ disclosure could experience an endogeneity problem [31,100,101,102] that may occur due to simultaneity or omission of variables. In our study, the significant and positive relationship between BROY, ACEXT, and ESG reporting may occur due to endogenous factors (e.g., causality effects or omitted control variables). In other words, ESG reporting might be determined by board characteristics other than the presence of BROY and ACEXT. According to Ref. [103], employing statistical models such as pooled OLS could generate biased results as this estimator is unable to handle the possible risk of endogeneity. However, to alleviate the harmful effect of endogeneity in our model, we apply the widely used lagged independent variables technique [31,104,105,106,107]. Thus, we re-estimate our baseline model by regressing the lagged independent variables (i.e., corporate governance variables) on our dependent variables (i.e., ESG disclosure). The results in Table 5 show that the significant associations are maintained (albeit, the significance level for ACEXT dwindles to 10%), implying that any reverse causality was likely to be mitigated.

Table 5.

Endogeneity Test (lag for All IVs).

5.2. Without Winsor (OLS Regression)

In our baseline regression, all variables were Winsorized to limit the influence of extreme values in the data. As an additional test, we re-examine our main model by utilising original/Unwinsorized data. As shown in Table 6, the findings are qualitatively similar to those using Winsorized data as reported in Table 4.

Table 6.

Without Winsor (OLS Regression).

5.3. Alternative Measurement of ACEXT

As a further check, we re-estimate our main model using different measurement of ACEXT (i.e., the percentage of ACEXT over the audit committee size) (ACEXTPCT). The findings are reported in Table 7 and are qualitatively comparable to the baseline findings in Table 4.

Table 7.

Alternative Measurement of ACEXT.

5.4. FGLS, PCSE and SCC Regressions Results

We used OLS regression in our baseline regression, as explained in Section 3.3. We used Feasible Generalised Least Squares (FGLS), Panel Corrected Standard Errors (PCSE), and Driscoll–Kraay Standard Errors (SCC) regressions to corroborate the strength of the study’s main findings, with the results shown in Table 8 [108,109,110]. The coefficients of BROY and ACMET in Table 8 are qualitatively comparable to those in our main regression, corroborating the findings of the main study.

Table 8.

FGLS, PCSE, and SCC Regressions results.

5.5. Exclude the Periods with Few Observations

As an additional analysis, we re-estimate our main model after excluding the years 2010, 2011, and 2019 which have less than 20 observations from the analysis. The results reported in Table 9 show that the coefficients of BROY and ACMET are positively and significantly associated with ESG reporting, consistent with the results in our main regression in Table 5.

Table 9.

Exclude the Periods with Few Observations.

6. Conclusions

The main goal of this research is to investigate the association between corporate governance mechanisms and ESG disclosure in Saudi companies in order to fill a gap in the literature for emerging Arab economies. The current study is significant because it allows for an assessment of the effects of the new SCCG, which came into effect in 2017, on voluntary disclosure. Unlike earlier studies on ESG disclosure, in particular Saudi studies which commonly focused on non-financial firms, our research fills this gap in the literature by examining the relationship between corporate governance mechanisms and ESG disclosure in both financial and non-financial companies. Investors are interested to know how firms are addressing ESG risks and opportunities such as climate change and inequality due to their potential impact on the cost of capital, long term value creation, and, ultimately, the business sustainability. Saudi firms have already raised their voluntary disclosures in accordance with the Saudi Vision 2030, as capital market regulators, investors, and other stakeholders demand for more ESG information. Given the critical role that the board of directors and board sub-committee play in ensuring the firm’s transparency around sustainability practices, board and audit committee performance has remained a major topic of discussion in the ESG discourse. Thus, our study examines the roles of board and audit committees in pushing for greater ESG transparency. Using Bloomberg ESG datasets for Saudi firms over the period 2010–2019, our findings confirm the vital role of boards and audit committees in directing ESG activities. Specifically, the empirical results show that BROY is positively related with ESG disclosure, suggesting that royal family directors might help to legitimise a company’s operations by encouraging management to provide voluntary ESG information. In addition, ACEXT is positively and significantly associated with ESG disclosure. This implies that audit committee members who are from outside the board can play a significant role in influencing companies to disclose more ESG information.

The current study has several theoretical and practical implications. In terms of theoretical implication, the current study adds to the existing literature by providing further evidence to support the conjecture that companies with good corporate governance practices are more likely to disclose ESG activities [23,25,71,72,78,88,111,112]. The study also adds to the ever growing literature on the determinants of sustainability disclosures in majority Muslim countries [31,35,41,65,74,88,90,93,112,113]. Our study provides evidence that BROY and ACEXT have a positive effect on ESG reporting practices in a developing country with unique corporate governance settings, where the servant leadership style and an audit committee member without a full board role are ubiquitous. Our findings confirm the positive role of royal family directors in inculcating responsible ESG behaviour not just among banks in the GCC, but also in Saudi non-financial firms.

The current study offers several potential implications for practice. First, Saudi companies should include sustainable business activities and provide ESG information to legitimise their operations. Second, our results imply that royal family directors and non-directors in the audit committee are important governance mechanisms for Saudi companies. Board composition, such as BROY on the board, as well as audit committee attributes such as ACEXT, in particular, might improve Saudi companies’ ESG policies. In addition, our findings have significant implications for regulators and policy makers elsewhere. The introduction of the new Saudi code of corporate governance in 2017 is likely to have contributed significantly to the improvement in ESG disclosure. As the audit committee is anticipated to have a significant role in establishing the value of assurance on ESG information, including climate risk and human capital management disclosures, the results of this study could help regulators around the world to consider audit committee escalating workload and the appropriateness of introducing similar policies such as Ref. [51] and SCCG (2017).

This research, like previous studies, has limitations that open the path for future empirical research. First, the research sample is rather small, as not all the requisite data from 2010 to 2019 was available; hence, only publicly listed Saudi companies with Bloomberg ESG data were examined, which somewhat limits the generalisability of the findings. Second, the difficulty in collecting data on boards of directors’ profiles, such as education level and background, tenure, and age, impeded us from examining additional board and audit committee characteristics. Third, while we believe that royal family directors inspire executives to step up ESG activities, and audit committee’s overcommitment through full board membership and overlapping membership in other board sub-committees affects the ability to monitor ESG efforts effectively, our study only finds an association—not causation. Future research can perform difference-in-differences analysis, looking at what happens to ESG reporting when a company experiences BROY and/or ACEXT for the first time. Despite the limitations outlined above, we contend that our study is appropriate to the contemporary Saudi context, where the agenda of corporate governance and sustainability is gaining greater public attention.

Author Contributions

Conceptualization, A.Q. and A.A.; methodology, A.Q. and S.D.A.-D.; software, A.Q. and S.D.A.-D.; validation A.Q. and S.D.A.-D.; formal analysis, A.Q. and S.D.A.-D.; investigation, W.N.W.-H.; resources, A.Q. and S.D.A.-D.; data curation, S.D.A.-D. and A.Q.; writing—original draft preparation, A.A. and A.Q.; writing—review and editing, A.Q., W.N.W.-H. and H.M.B.; visualization, W.N.W.-H.; supervision, W.N.W.-H.; project administration, H.M.B.; funding acquisition, H.M.B., M.T., S.N.S. and H.M.A.K. All authors have read and agreed to the published version of the manuscript.

Funding

This research has been funded by Scientific Research Deanship at University of Ha’il—Saudi Arabia through project number RG-20 109.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data that support the findings of this study are available on request from the corresponding author. The data are not publicly available due to privacy or ethical restrictions.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Ludwig, P.; Sassen, R. Which Internal Corporate Governance Mechanisms Drive Corporate Sustainability? J. Environ. Manag. 2022, 301, 113780. [Google Scholar] [CrossRef] [PubMed]

- Ben Fatma, H.; Chouaibi, J. Corporate Governance and CSR Disclosure: Evidence from European Financial Institutions. Int. J. Discl. Gov. 2021, 18, 346–361. [Google Scholar] [CrossRef]

- Mittal, R.K.; Sinha, N.; Singh, A. An Analysis of Linkage between Economic Value Added and Corporate Social Responsibility. Manag. Decis. 2008, 46, 1437–1443. [Google Scholar] [CrossRef]

- Ullah, M.S.; Muttakin, M.B.; Khan, A. Corporate Governance and Corporate Social Responsibility Disclosures in Insurance Companies. Int. J. Account. Inf. Manag. 2019, 27, 284–300. [Google Scholar] [CrossRef]

- Guerrero-Villegas, J.; Pérez-Calero, L.; Hurtado-González, J.M.; Giráldez-Puig, P. Board Attributes and Corporate Social Responsibility Disclosure: A Meta-Analysis. Sustainability 2018, 10, 4808. [Google Scholar] [CrossRef] [Green Version]

- Zahller, K.A.; Arnold, V.; Roberts, R.W. Using CSR Disclosure Quality to Develop Social Resilience to Exogenous Shocks: A Test of Investor Perceptions. Behav. Res. Account. 2015, 27, 155–177. [Google Scholar] [CrossRef]

- Ng, A.C.; Rezaee, Z. Business Sustainability Performance and Cost of Equity Capital. J. Corp. Financ. 1978, 34, 128–149. [Google Scholar] [CrossRef]

- Cormier, D.; Ledoux, M.J.; Magnan, M. The Informational Contribution of Social and Environmental Disclosures for Investors. Manag. Decis. 2011, 49, 1276–1304. [Google Scholar] [CrossRef] [Green Version]

- Ying, M.; Tikuye, G.A.; Shan, H. Impacts of Firm Performance on Corporate Social Responsibility Practices: The Mediation Role of Corporate Governance in Ethiopia Corporate Business. Sustainability 2021, 13, 9717. [Google Scholar] [CrossRef]

- Habbash, M.; Haddad, L. The Impact of Corporate Social Responsibility on Earnings Management Practices: Evidence from Saudi Arabia. Soc. Responsib. J. 2020, 16, 1073–1085. [Google Scholar] [CrossRef]

- Guping, C.; Sial, M.S.; Wan, P.; Badulescu, A.; Badulescu, D.; Brugni, T.V. Do Board Gender Diversity and Non-Executive Directors Affect CSR Reporting? Insight from Agency Theory Perspective. Sustainability 2020, 12, 8597. [Google Scholar] [CrossRef]

- Graus, S.; Rehman, S.U.; García, J.S. Corporate Social Responsibility and Environmental Performance: The Mediating Role of Environmental Strategy and Green Innovation. Technol. Forecast. Soc. Change 2020, 16, 120262. [Google Scholar]

- Habbash, M. Corporate Governance and Corporate Social Responsibility Disclosure: Evidence from Saudi Arabia. Soc. Responsib. J. 2016, 12, 740–754. [Google Scholar] [CrossRef] [Green Version]

- Appuhami, R.; Tashakor, S. The Impact of Audit Committee Characteristics on CSR Disclosure: An Analysis of Australian Firms. Aust. Account. Rev. 2017, 27, 400–420. [Google Scholar] [CrossRef]

- Garas, S.; ElMassah, S. Corporate Governance and Corporate Social Responsibility Disclosures: The Case of GCC Countries. Crit. Perspect. Int. Bus. 2018, 14, 2–26. [Google Scholar] [CrossRef]

- Alazzani, A.; Aljanadi, Y.; Shreim, O. The Impact of Existence of Royal Family Directors on Corporate Social Responsibility Reporting: A Servant Leadership Perspective. Soc. Responsib. J. 2019, 15, 120–136. [Google Scholar] [CrossRef]

- Farah, B.; Elias, R.; Aguilera, R.; Abi Saad, E. Corporate Governance in the Middle East and North Africa: A Systematic Review of Current Trends and Opportunities for Future Research. Corp. Gov. Int. Rev. 2021, 29, 630–660. [Google Scholar] [CrossRef]

- Saudi Capital Market Authority. Corporate Governance Regulations in Saudi Arabia; Capital Market Authority: Riyadh, Saudi Arabia, 2021. [Google Scholar]

- SABIC. Annual Report 2019; SABIC: Riyadh, Saudi Arabia, 2019. [Google Scholar]

- Wan-Hussin, W.N.; Fitri, H.; Salim, B. Audit Committee Chair Overlap, Chair Expertise, and Internal Auditing Practices: Evidence from Malaysia. J. Int. Account. Audit. Tax. 2021, 44, 100413. [Google Scholar] [CrossRef]

- Mohammadi, S.; Saeidi, H.; Naghshbandi, N. The Impact of Board and Audit Committee Characteristics on Corporate Social Responsibility: Evidence from the Iranian Stock Exchange. Int. J. Product. Perform. Manag. 2020, 1, 2207–2236. [Google Scholar] [CrossRef]

- Qaderi, S.A.; Ghaleb, B.A.A.; Alhmoud, T.R. Audit Committee Features and CSR Disclosure: Additional Evidence from an Emerging Market. Int. J. Financ. Res. 2020, 11, 226–237. [Google Scholar] [CrossRef]

- Ghardallou, W. Corporate Sustainability and Firm Performance: The Moderating Role of CEO Education and Tenure. Sustainability 2022, 14, 3513. [Google Scholar] [CrossRef]

- Habbash, M.; Hussainey, K.; Awad, A.E. The Determinants of Voluntary Disclosure in Saudi Arabia: An Empirical Study. Int. J. Account. Audit. Perform. Eval. 2016, 12, 213–236. [Google Scholar] [CrossRef] [Green Version]

- Al-Duais, S.D.; Qasem, A.; Wan-Hussin, W.N.; Bamahros, H.M.; Thomran, M.; Alquhaif, A. CEO Characteristics, Family Ownership and Corporate Social Responsibility Reporting: The Case of Saudi Arabia. Sustainability 2021, 13, 12237. [Google Scholar] [CrossRef]

- Fama, E.F.; Jensen, M.C. Separation of Ownership and Control. J. Law Econ. 1983, 26, 301–325. [Google Scholar] [CrossRef]

- Jensen, M.C.; Meckling, W.H. Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structure. J. Financ. Econ. 1976, 3, 305–360. [Google Scholar] [CrossRef]

- Harjoto, M.A.; Jo, H. Corporate Governance and CSR Nexus. J. Bus. Ethics 2011, 100, 45–67. [Google Scholar] [CrossRef]

- Kim, Y.; Li, H.; Li, S. Corporate Social Responsibility and Stock Price Crash Risk. J. Bank. Financ. 2014, 43, 1–13. [Google Scholar] [CrossRef] [Green Version]

- Deegan, C.; Blomquist, C. Stakeholder Influence on Corporate Reporting: An Exploration of the Interaction between WWF-Australia and the Australian Minerals Industry. Account. Organ. Soc. 2006, 31, 343–372. [Google Scholar] [CrossRef]

- Katmon, N.; Mohamad, Z.Z.; Mat Norwani, N.; Al Farooque, O. Comprehensive Board Diversity and Quality of Corporate Social Responsibility Disclosure: Evidence from an Emerging Market. J. Bus. Ethics 2019, 157, 447–481. [Google Scholar] [CrossRef]

- Sadou, A.; Alom, F.; Laluddin, H. Corporate Social Responsibility Disclosures in Malaysia: Evidence from Large Companies. Soc. Responsib. J. 2017, 13, 177–202. [Google Scholar] [CrossRef]

- Velte, P.; Stawinoga, M. Do Chief Sustainability Officers and CSR Committees Influence CSR-Related Outcomes? A Structured Literature Review Based on Empirical-Quantitative Research Findings; Springer: Berlin/Heidelberg, Germany, 2020; ISBN 0123456789. [Google Scholar]

- Sun, N.; Salama, A.; Hussainey, K.; Habbash, M. Corporate Environmental Disclosure, Corporate Governance and Earnings Management. Corp. Environ. Discl. 2010, 34, 1–5. [Google Scholar] [CrossRef] [Green Version]

- Alotaibi, K.O.; Hussainey, K. Determinants of CSR Disclosure Quantity and Quality: Evidence from Non-Financial Listed Firms in Saudi Arabia. Int. J. Discl. Gov. 2016, 13, 364–393. [Google Scholar] [CrossRef]

- Al-Janadi, Y.; Rahman, R.A.; Haj Omar, N. Corporate Governance Mechanisms and Voluntary Disclosure in Saudi Arabia. Res. J. Financ. Account. 2013, 4, 25–35. [Google Scholar]

- Al-Janadi, Y.; Abdul Rahman, R.; Alazzani, A. Does Government Ownership Affect Corporate Governance and Corporate Disclosure? Evidence from Saudi Arabia. Manag. Audit. J. 2016, 31, 871–890. [Google Scholar] [CrossRef]

- Saudi Capital Market Authority. Annual Report 2020; Capital Market Authority: Riyadh, Saudi Arabia, 2020. [Google Scholar]

- Alshehri, A.; Solomon, J. The Evolution of Corporate Governance in Saudi Arabia. In Proceedings of the British Accounting and Finance Association (BAFA) 2012 Conference, Brighton, UK, 17–19 April 2012. [Google Scholar]

- NACD. 2019–2020 NACD Public Company Governance Survey; NACD: Arlington, VA, USA, 2019. [Google Scholar]

- Issa, A.; Zaid, M.A.A.; Hanaysha, J.R.; Gull, A.A. An Examination of Board Diversity and Corporate Social Responsibility Disclosure: Evidence from Banking Sector in the Arabian Gulf Countries. Int. J. Account. Inf. Manag. 2022, 30, 22–46. [Google Scholar] [CrossRef]

- Ramón-Llorens, M.C.; García-Meca, E.; Pucheta-Martínez, M.C. The Role of Human and Social Board Capital in Driving CSR Reporting. Long Range Plann. 2019, 52, 101846. [Google Scholar] [CrossRef]

- Al-Hadi, A.; Taylor, G.; Al-Yahyaee, K.H. Ruling Family Political Connections and Risk Reporting: Evidence from the GCC. Int. J. Account. 2016, 51, 504–524. [Google Scholar] [CrossRef]

- Halawi, A. Power Matters: A Survey of GCC Boards; Hawkamah: Dubai, United Arab Emirates, 2008. [Google Scholar]

- Al-Bassam, W.M.; Ntim, C.G.; Opong, K.K.; Downs, Y. Corporate Boards and Ownership Structure as Antecedents of Corporate Governance Disclosure in Saudi Arabian Publicly Listed Corporations. Bus. Soc. 2018, 57, 335–377. [Google Scholar] [CrossRef]

- Alfraih, M.M.; Almutawa, A.M. Voluntary Disclosure and Corporate Governance: Empirical Evidence from Kuwait. Int. J. Law Manag. 2017, 59, 217–236. [Google Scholar] [CrossRef]

- Pricewaterhouse Coopers. The Audit Committee’s Role in Sustainability/ESG Oversight; Pricewaterhouse Coopers: London, UK, 2021. [Google Scholar]

- Ryu, H.; Chae, S.J.; Song, B. Corporate Social Responsibility, Audit Committee Expertise, and Financial Reporting: Empirical Evidence from Korea. Sustainability 2021, 13, 10517. [Google Scholar] [CrossRef]

- Fama, E.F. Agency Problems and the Theory of the Firm. J. Polit. Econ. 1980, 88, 288–307. [Google Scholar] [CrossRef]

- White, M.J. Maintaining High-Quality, Reliable Financial Reporting: A Shared and Weighty Responsibility. In Proceedings of the 2015 AICPA National Conference, Washington DC, USA, 9 December 2015. Available online: https//www.sec.gov/news/speech/keynote-2015-aicpa-white.html (accessed on 16 September 2020).

- Higgs, D. Review of the Role and Effectiveness of Non-Executive Directors; European Corporate Governance Institute: Brussels, Belgium, 2003. [Google Scholar]

- Mangena, M.; Tauringana, V. Disclosure, Corporate Governance and Foreign Share Ownership on the Zimbabwe Stock Exchange. J. Int. Financ. Manag. Account. 2007, 18, 53–85. [Google Scholar] [CrossRef]

- Li, J.; Mangena, M.; Pike, R. The Effect of Audit Committee Characteristics on Intellectual Capital Disclosure. Br. Account. Rev. 2012, 44, 98–110. [Google Scholar] [CrossRef] [Green Version]

- Akhtaruddin, M.; Haron, H. Board Ownership, Audit Committees’ Effectiveness, and Corporate Voluntary Disclosures. Asian Rev. Account. 2010, 18, 245–259. [Google Scholar] [CrossRef]

- Vafaei, A.; Ahmed, K.; Mather, P. Board Diversity and Financial Performance in the Top 500 Australian Firms. Aust. Account. Rev. 2015, 25, 413–427. [Google Scholar] [CrossRef]

- Sariannidis, N.; Giannarakis, G.; Litinas, N.; Konteos, G. A GARCH Examination of Macroeconomic Effects on U.S. Stock Market: A Distinction between the Total Market Index and the Sustainability Index. Eur. Res. Stud. J. 2010, 13, 129–142. [Google Scholar] [CrossRef] [Green Version]

- Nadeem, M.; Zaman, R.; Saleem, I. Boardroom Gender Diversity and Corporate Sustainability Practices: Evidence from Australian Securities Exchange Listed Firms. J. Clean. Prod. 2017, 149, 874–885. [Google Scholar] [CrossRef]

- Marquis, C.; Beunza, D.; Ferraro, F.; Thomason, B. Driving Sustainability at Bloomberg LP.; Harvard Business School Organizational Behavior Unit Case No. 411-025; Harvard Business School: Boston, MA, USA, 2011. [Google Scholar]

- Wang, Z.; Sarkis, J. Corporate Social Responsibility Governance, Outcomes, and Financial Performance. J. Clean. Prod. 2017, 162, 1607–1616. [Google Scholar] [CrossRef]

- Hillman, A.J.; Keim, G.D. Shareholder Value, Stakeholder Management, and Social Issues: What’s the Bottom Line? Strateg. Manag. J. 2001, 22, 125–139. [Google Scholar] [CrossRef]

- Naseem, M.A.; Riaz, S.; Rehman, R.U.; Ikram, A.; Malik, F. Impact of Board Characteristics on Corporate Social Responsibility Disclosure. J. Appl. Bus. Res. 2017, 33, 799–808. [Google Scholar] [CrossRef]

- Aslam, S.; Abdul, M.; Makki, M.; Mahmood, S.; Amin, S. Gender Diversity and Managerial Ownership Response to Corporate Social Responsibility Initiatives: Empirical Evidence from Australia. J. Manag. Sci. 2018, 12, 131–152. [Google Scholar]

- Qasem, A.; Aripin, N.; Wan-Hussin, W.N. Financial Restatements and Sell-Side Analysts’ Stock Recommendations: Evidence from Malaysia. Int. J. Manag. Financ. 2020, 16, 501–524. [Google Scholar] [CrossRef]

- Ghaleb, B.A.A.; Qaderi, S.A.; Almashaqbeh, A.; Qasem, A. Corporate Social Responsibility, Board Gender Diversity and Real Earnings Management: The Case of Jordan. Cogent Bus. Manag. 2021, 8, 1883222. [Google Scholar] [CrossRef]

- Wasiuzzaman, S.; Wan Mohammad, W.M. Board Gender Diversity and Transparency of Environmental, Social and Governance Disclosure: Evidence from Malaysia. Manag. Decis. Econ. 2020, 41, 145–156. [Google Scholar] [CrossRef]

- Alquhaif, A.; Al Gamrh, B.; Abdul Latif, R.; Chandren, S. Board Independence Tenure and Real Earnings Management: Accretive Share Buyback Activities in Malaysia. Int. J. Bus. Gov. Ethics 2021, 15, 266–284. [Google Scholar] [CrossRef]

- Ahmed Haji, A. Corporate Social Responsibility Disclosures over Time: Evidence from Malaysia. Manag. Audit. J. 2013, 28, 647–676. [Google Scholar] [CrossRef]

- Vitolla, F.; Raimo, N.; Rubino, M. Board Characteristics and Integrated Reporting Quality: An Agency Theory Perspective. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 1152–1163. [Google Scholar] [CrossRef]

- Ju Ahmad, N.B.; Rashid, A.; Gow, J. Board Meeting Frequency and Corporate Social Responsibility (CSR) Reporting: Evidence from Malaysia. Corp. Board Role Duties Compos. 2017, 13, 87–99. [Google Scholar] [CrossRef]

- Wincent, J.; Anokhin, S.; Örtqvist, D. Does Network Board Capital Matter? A Study of Innovative Performance in Strategic SME Networks. J. Bus. Res. 2010, 63, 265–275. [Google Scholar] [CrossRef]

- Choi, J.H.; Kim, S.; Lee, A. CEO Tenure, Corporate Social Performance, and Corporate Governance: A Korean Study. Sustainability 2020, 12, 99. [Google Scholar] [CrossRef] [Green Version]

- Alshbili, I.; Elamer, A.A.; Beddewela, E. Ownership Types, Corporate Governance and Corporate Social Responsibility Disclosures: Empirical Evidence from a Developing Country. Account. Res. J. 2020, 33, 148–166. [Google Scholar] [CrossRef] [Green Version]

- Kiliç, M.; Kuzey, C.; Uyar, A. The Impact of Ownership and Board Structure on Corporate Social Responsibility (CSR) Reporting in the Turkish Banking Industry. Corp. Gov. 2015, 15, 357–374. [Google Scholar] [CrossRef]

- Said, R.; Zainuddin, Y.H.; Haron, H. The Relationship between Corporate Social Responsibility Disclosure and Corporate Governance Characteristics in Malaysian Public Listed Companies. Soc. Responsib. J. 2009, 5, 212–226. [Google Scholar] [CrossRef] [Green Version]

- Esa, E.; Mohd Ghazali, N.A. Corporate Social Responsibility and Corporate Governance in Malaysian Government-Linked Companies. Corp. Gov. Int. J. Bus. Soc. 2012, 12, 292–305. [Google Scholar] [CrossRef] [Green Version]

- Liao, L.; Luo, L.; Tang, Q. Gender Diversity, Board Independence, Environmental Committee and Greenhouse Gas Disclosure. Br. Account. Rev. 2015, 47, 409–424. [Google Scholar] [CrossRef]

- Uyar, A.; Kilic, M.; Bayyurt, N. Association between Firm Characteristics and Corporate Voluntary Disclosure: Evidence from Turkish Listed Companies. Intang. Cap. 2013, 9, 1080–1112. [Google Scholar] [CrossRef]

- Al Maeeni, F.; Ellili, N.O.D.; Nobanee, H. Impact of Corporate Governance on Corporate Social Responsibility Disclosure of the UAE Listed Banks. J. Financ. Rep. Account. 2022. online ahead of print. [Google Scholar] [CrossRef]

- Ghaleb, B.A.A.; Al-Duais, S.D.; Hashed, A.A. Audit Committee Chair’s Legal Expertise and Real Activities Manipulation: Empirical Evidence from Malaysian Energy and Utilities Sectors. Int. J. Energy Econ. Policy 2021, 11, 65–73. [Google Scholar] [CrossRef]

- Ghaleb, B.A.A.; Kamardin, H.; Hashed, A.A. Investment in Outside Governance Monitoring and Real Earnings Management: Evidence from an Emerging Market. J. Account. Emerg. Econ. 2022, 12, 52–76. [Google Scholar] [CrossRef]

- Al-Duais, S.D.; Malek, M.; Abdul Hamid, M.A.; Almasawa, A.M. Ownership Structure and Real Earnings Management: Evidence from an Emerging Market. J. Account. Emerg. Econ. 2022, 12, 380–404. [Google Scholar] [CrossRef]

- Zalata, A.M.; Tauringana, V.; Tingbani, I. Audit Committee Financial Expertise, Gender, and Earnings Management: Does Gender of the Financial Expert Matter? Int. Rev. Financ. Anal. 2018, 55, 170–183. [Google Scholar] [CrossRef] [Green Version]

- Zgarni, I.; Hliout, K.; Zehri, F. Effective Audit Committee, Audit Quality and Earnings Management. J. Account. Emerg. Econ. 2016, 6, 138–155. [Google Scholar] [CrossRef]

- Ghafran, C.; O’Sullivan, N. The Governance Role of Audit Committees: Reviewing a Decade of Evidence. Int. J. Manag. Rev. 2013, 15, 381–407. [Google Scholar] [CrossRef]

- Song, J.; Windram, B. Benchmarking Audit Committee Effectiveness in Financial Reporting. Int. J. Audit. 2004, 8, 195–205. [Google Scholar] [CrossRef]

- Ghosh, A.; Marra, A.; Moon, D. Corporate Boards, Audit Committees, and Earnings Management: Pre- and Post-SOX Evidence. J. Bus. Financ. Account. 2010, 37, 1145–1176. [Google Scholar] [CrossRef]

- Raghunandan, K.; Rama, D.V. Determinants of Audit Committee Diligence. Account. Horiz. 2007, 21, 265–279. [Google Scholar] [CrossRef]

- Boshnak, H.A. Determinants of Corporate Social and Environmental Voluntary Disclosure in Saudi Listed Firms. J. Financ. Report. Account. 2021. ahead-of-print. [Google Scholar] [CrossRef]

- Qasem, A.; Aripin, N.; Wan-Hussin, W.N.; Al-Duais, S. Institutional Investor Heterogeneity and Analyst Recommendation: Malaysian Evidence. Cogent Bus. Manag. 2021, 8, 1908005. [Google Scholar] [CrossRef]

- Alazzani, A.; Wan-Hussin, W.N.; Jones, M.; Al-hadi, A. ESG Reporting and Analysts’ Recommendations in GCC: The Moderation Role of Royal Family Directors. J. Risk Financ. Manag. 2021, 14, 72. [Google Scholar] [CrossRef]

- El Ghoul, S.; Guedhami, O.; Kwok, C.C.Y.; Mishra, D.R. Does Corporate Social Responsibility Affect the Cost of Capital? J. Bank. Financ. 2011, 35, 2388–2406. [Google Scholar] [CrossRef]

- Al-Shaer, H. Sustainability Reporting Quality and Post-Audit Financial Reporting Quality: Empirical Evidence from the UK. Bus. Strateg. Environ. 2020, 29, 2355–2373. [Google Scholar] [CrossRef]

- Mohd Ghazali, N.A. Ownership Structure and Corporate Social Responsibility Disclosure: Some Malaysian Evidence. Corp. Gov. Int. J. Bus. Soc. 2007, 7, 251–266. [Google Scholar] [CrossRef]

- Issa, A.I.F. The Factors Influencing Corporate Social Responsibility Disclosure in the Kingdom of Saudi Arabia. Aust. J. Basic Appl. Sci. 2017, 11, 1–19. [Google Scholar]

- Gujarati, D.N.; Porter, D.C. Basci Econometrics, 5th ed.; The McGraw-Hill Companies: New York, NY, USA, 2009; ISBN 9780073375779. [Google Scholar]

- Kline, R.B. Principles and Practice of Structural Equation Modeling, 3rd ed.; The Guilford Press: New York, NY, USA, 2011; ISBN 978-1-60623-876-9. [Google Scholar]

- Petersen, M.A. Estimating Standard Errors in Finance Panel Data Sets: Comparing Approaches. Rev. Financ. Stud. 2009, 22, 435–480. [Google Scholar] [CrossRef] [Green Version]

- Nuskiya, M.N.F.; Ekanayake, A.; Beddewela, E.; Meftah Gerged, A. Determinants of Corporate Environmental Disclosures in Sri Lanka: The Role of Corporate Governance. J. Account. Emerg. Econ. 2021, 11, 367–394. [Google Scholar] [CrossRef]

- Brauer, M.; Wiersema, M. Analyzing Analyst Research: A Review of Past Coverage and Recommendations for Future Research. J. Manag. 2018, 44, 218–248. [Google Scholar] [CrossRef] [Green Version]

- Ben-Amar, W.; Chang, M.; McIlkenny, P. Board Gender Diversity and Corporate Response to Sustainability Initiatives: Evidence from the Carbon Disclosure Project. J. Bus. Ethics 2017, 142, 369–383. [Google Scholar] [CrossRef] [Green Version]

- Dwekat, A.; Seguí-Mas, E.; Zaid, M.A.A.; Tormo-Carbó, G. Corporate Governance and Corporate Social Responsibility: Mapping the Most Critical Drivers in the Board Academic Literature. Meditari Account. Res. 2021, in press. [Google Scholar] [CrossRef]

- Al-Dah, B.; Dah, M.; Jizi, M. Is CSR Reporting Always Favorable? Manag. Decis. 2018, 56, 1506–1525. [Google Scholar] [CrossRef]

- Zaid, M.A.A.; Abuhijleh, S.T.F.; Pucheta-Martínez, M.C. Ownership Structure, Stakeholder Engagement, and Corporate Social Responsibility Policies: The Moderating Effect of Board Independence. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 1344–1360. [Google Scholar] [CrossRef]

- Wan-Hussin, W.N.; Qasem, A.; Aripin, N.; Ariffin, M.S.M. Corporate Responsibility Disclosure, Information Environment and Analysts’ Recommendations: Evidence from Malaysia. Sustainability 2021, 13, 3568. [Google Scholar] [CrossRef]

- AL-Qadasi, A.A.; Abidin, S.; Al-Jaifi, H.A. The Puzzle of Internal Audit Function Budget toward Specialist Auditor Choice and Audit Fees: Does Family Ownership Matter? Malaysian Evidence. Manag. Audit. J. 2019, 34, 208–243. [Google Scholar] [CrossRef]

- Al-Jaifi, H.A. Ownership Concentration, Earnings Management and Stock Market Liquidity: Evidence from Malaysia. Corp. Gov. Int. J. Bus. Soc. 2017, 17, 490–510. [Google Scholar] [CrossRef]

- AlQadasi, A.; Abidin, S. The Effectiveness of Internal Corporate Governance and Audit Quality: The Role of Ownership Concentration—Malaysian Evidence. Corp. Gov. Int. J. Bus. Soc. 2018, 18, 233–253. [Google Scholar] [CrossRef]

- Ren, S.; Wang, Y.; Hu, Y.; Yan, J. CEO Hometown Identity and Firm Green Innovation. Bus. Strateg. Environ. 2021, 30, 756–774. [Google Scholar] [CrossRef]

- Musteen, M.; Barker, V.L.; Baeten, V.L. The Influence of CEO Tenure and Attitude toward Change on Organizational Approaches to Innovation. J. Appl. Behav. Sci. 2010, 46, 360–387. [Google Scholar] [CrossRef]

- Sheikh, S. An Examination of the Dimensions of CEO Power and Corporate Social Responsibility. Rev. Account. Financ. 2019, 18, 221–244. [Google Scholar] [CrossRef]

- Ntim, C.G.; Soobaroyen, T. Corporate Governance and Performance in Socially Responsible Corporations: New Empirical Insights from a Neo-Institutional Framework. Corp. Gov. Int. Rev. 2013, 21, 468–494. [Google Scholar] [CrossRef]

- Khan, A.; Muttakin, M.B.; Siddiqui, J. Corporate Governance and Corporate Social Responsibility Disclosures: Evidence from an Emerging Economy. J. Bus. Ethics 2013, 114, 207–223. [Google Scholar] [CrossRef]

- Alazzani, A.; Wan-Hussin, W.N.; Jones, M. Muslim CEO, Women on Boards and Corporate Responsibility Reporting: Some Evidence from Malaysia. J. Islam. Account. Bus. Res. 2019, 10, 274–296. [Google Scholar] [CrossRef] [Green Version]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).