1. Introduction

Artificial intelligence (AI) plays a vital role in the enhancement of different fields of activity, from transportation to medicine, as it facilitates the implementation of disruptive innovations. Currently, a growing body of literature is focusing on the importance of AI in the accounting field. As the volume of data started to increase exponentially, the current technologies used in the profession started to become obsolete in analysing a significant volume of data in a timely manner so that the information produced would still generate benefits. AI in accounting and auditing is not a new object of research, as, for many decades, different studies have emphasised the benefits of adopting into the field different AI-based solutions that were suitable for improving the quality of the reporting, reducing time and error rates and enabling new ways of performing the activities by decreasing the level of redundancy and allowing professional accountants to concentrate on activities with a higher impact on the companies [

1,

2].

The problem-based situation approached in this paper concerns the human impact of AI in business, as recent developments have challenged human perceptions both in terms of labour but also in terms of new technological implementation. Previous research has been focused majorly on AI technologies implemented within multinational companies and their businesses, mostly setting aside the human component and the impact upon it. Consequently, our research aims to cover the existing gap regarding both the human component and the MNCs in Romania.

Since the initial research on the benefits of adopting AI into the accounting field, there has been an impressive evolution in this field, such as nowadays, without the AI-based solutions, the modern accounting rules could not have been implemented [

3]; however, as more significant benefits emerge, these also bring challenges to the profession. These recent developments have heightened the need for analysing the advantages and disadvantages of using AI-based solutions in the accounting field. Moreover, as job insecurity has increased in recent years, as an effect of the restrictions imposed by the pandemic in different fields of activity, a considerable body of research has been conducted to understand the psychological component and possible measures that employers can implement to reduce the stress of their employees [

4,

5,

6]. However, less attention has been paid to the accounting field, as most of the employees had the possibility of working from home at least several days per week.

This study explores the perceptions of accounting practitioners from Romania regarding the benefits and challenges of using AI-based solutions in accounting and analyses whether the professionals consider this abrupt AI adoption as a factor that increases job insecurity and impacts employability. The data for this explorative study were collected from Romanian accounting practitioners by using a questionnaire. In the analyses performed, we used a combination of qualitative and quantitative approaches. Therefore, this paper aims to contribute to the current research by providing a glimpse of the main drivers that encourage professionals to embrace AI in accounting.

This paper is structured into four parts. The first examines the relevant literature review for this research, focusing on the current identified benefits and disadvantages of AI solutions used in accounting, along with the job insecurity generated by AI adoption. The second part details the methodology used to conduct the research, mentioning the purpose and objectives. The third part reflects the study’s results, which present the perceptions of the practitioners regarding AI use in accounting. The last part presents the conclusions, the limits of the present study, and the future research directions.

AI contributions to business development in terms of sustainability are obvious. Long-term business sustainability involves the transition towards an AI approach and implementation aiming to achieve efficiency, as well as scaling, by means of the scalable process and uniformization. Furthermore, countries in Central and Eastern Europe are importing such processes based on Western countries’ experiences and thus achieving business sustainability on several tiers while implementing already-proven best practices, including resources efficiency. According To Price Waterhouse and Coopers:

AI levers could reduce worldwide greenhouse gas (GHG) emissions by 4% in 2030, an amount equivalent to 2.4 Gt CO2e-equivalent to the 2030 annual emissions of Australia, Canada and Japan combined. At the same time as productivity improvements, AI could create 38.2 million net new jobs across the global economy offering more skilled occupations as part of this transition. [

7]

Consequently, AI implemented in international business accounting is definitely an essential factor towards a sustainable economy.

The main hypothesis of this paper is that AI has long crossed the engineering barrier and has been implemented in different economic and social areas but, especially, into businesses, from the energy area to the medical field. Basic AI definitions, theories and applications have been perfected and adapted to numerous types of applications.

2. Literature Review

The benefits and challenges of using AI in the accounting profession continue to be a subject of interest [

8] because of the complexity of AI’s many branches. As our objective is to analyse the perceptions of accounting practitioners regarding both the advantages and disadvantages, we analysed the relevant literature to identify those with greater importance.

One of the main advantages that AI brings to the accounting field is represented by the reduced process time [

9,

10,

11]. AI-based solutions can independently conduct several tasks, and the practitioners can focus more on activities with a higher added value. For example, with the use of optical character recognition (OCR) solutions, data can be inputted automatically, thus saving time and resources. This will also improve the reliability of the accounting information, which is vital [

12]. Moreover, AI can significantly reduce the error rate [

13,

14,

15], thus improving the reliability. There are different processes in accounting in which the error rate can be decreased, from data entry to predictions. Besides the financial risk that incorrect data might generate, the companies’ reputations might also be affected, so companies and practitioners should leverage AI-based solutions to decrease error rates.

Fraud detection continues to remain an essential topic in the accounting area, and with the help of AI-based solutions such as machine learning techniques, practitioners could identify possible cases of fraud in a timelier manner [

16,

17]. Nowadays, different software can flag suspicious transactions, such as possible duplicated entries, unauthorised transactions, or unapproved changes. However, practitioners should keep in mind that professional scepticism cannot be simply automated. Especially for more complex analyses, they should not rely only on technology, as almost all (if not all) of these AI-based solutions still have a residual risk that cannot always be completely mitigated.

As the volume of data analysed by practitioners continues to increase, there is a clear need for better reporting and improved predictions, benefits that can also be leveraged with the use of AI-based solutions [

17,

18,

19]. Real-time reporting allows companies to identify the key challenges better and address them in a timely manner.

The undeniable benefits that AI brings to the accounting process should not draw attention from related challenges, such as the threats regarding the security of accounting information [

20], that might endanger the vital characteristics of data due to improper use of technologies, incompatible IT systems, incorrect manipulation of the data stored or in transit, or the incorrect implementation of IT solutions. Another challenge is represented by the weakness of the internal controls [

12] that can influence the reliability of the accounting information. To address this challenge, the practitioners should work together with the internal control and IT departments to identify and mitigate the risks related to the controls in place and implement new controls, if feasible, to reduce the residual risks.

Another significant challenge that might affect the reliability of the accounting information is represented by the subjectivity of the algorithms used in the accounting processes. Although AI objectively perform activities, not the same can be stated about the algorithms that are behind the AI-based solutions, as, in fact, all these algorithms have a foundation of human logic, and this might bias the results provided by these technologies [

21]. When using an AI-based solution, practitioners should have sufficient knowledge to identify these kinds of issues.

In this new era where the profession is shifting from computerised to intelligence accounting, previous research has emphasised that the pressure on the practitioners might increase [

20], as these changes require the transformation of skills so that accountants can work effectively with AI to reduce redundancies and allow a better focus on decision analysis [

12].

The academic environment is actively engaged in adapting the curricula so that the future practitioners will develop the required skills to use these technologies effectively [

22,

23], and researchers continue to provide valuable solutions for including emerging technologies in the study plans [

24,

25]. Nevertheless, this might solve only some of the issues faced by graduates when working in an entry-level position, and as for the experienced accountants that have not been trained in this area, additional support is needed from professional bodies and employers [

23,

26].

3. Research Methodology

The wide adoption of AI in accounting processes supports the view that the activities are transforming, thus enabling innovative disruptions in the profession. The main objectives of this paper, as presented in the introduction, are the following:

O1. Analysing the practitioners’ perceptions regarding the main benefits and disadvantages of using AI in accounting processes.

O2. Analysing whether the accounting practitioners consider AI as a threat.

In order to collect the data analysed, we used a questionnaire, as this type of method is appropriate to collect high-quality data in social science research [

27], as it allows scholars to capture new perspectives regarding the subject researched [

28] by collecting the information in a standardised approach. The questionnaire was sent to the respondents via professional social media platforms and by email, targeting just employees from the financial field. Using this distribution method, we decreased the risk of receiving responses from non-practitioners and excluded those from the database.

The survey had 15 questions in total, and in terms of the type of items, the majority was represented as categorical and rating questions for which we used matrixes and a Likert-scale rating with 5 points (1—Strongly disagree/Not important; 5—Strongly agree/Very important). These types of questions are considered appropriate when collecting data about the behaviours and perceptions of individuals [

29].

The questionnaire was directed at professional accountants employed within relevant MNCs, as these companies are the ones operating with AI technologies, and consequently, their answers are relevant for our analysis. Additionally, from the total number of distributed questionnaires, 12 were set aside and not considered relevant given some objectives aspects, such as very few questions answered or incomplete/insufficient answers provided. The questions comprised within the questionnaire focused on AI technologies and their definitions, without examples on how to use AI, as accounting professionals are familiar with such applications within their companies, even if the Body of Expert Accountants and Chartered Accountants in Romania does not provide direct directed courses on AI. Awareness, has thus only been raised through the professional experience and training within MNCs or from abroad.

The data were collected between June and August 2021, and the respondents were professionals working in the accounting field with at least one year of experience. The total number of participants was 116, from which we excluded 13 due to incomplete responses. All the participants were working in Romania. The dataset was relevant and generalisable from the perspective of the present research, given the fact that the analysed sample of respondents represented a significant share of the total AI-involved professionals in different business areas of the MNCs in Romania. Professionals include both current AI processes users but also AI implementation consultants for international business. Most MNC businesses in Romania have developed towards AI and machine learning by implementing technical solutions such as Chatbots as means of interactions between clients and the company, resulting in a complete chain processing of a demand both addressing the client’s needs but also supporting the company’s workflow (accounting, invoicing, payments, reporting, purchasing, etc.). The size of the chosen representative collected data was not small, reflecting the top five multinationals in Romania, because we had respondents from the areas of financial accounting who knew and worked with artificial intelligence (software bots, RPA, and iRPA). The sample was sent to a large number of practitioners belonging to the financial–accounting area, but not all of them responded. A total of 268 practitioners were sent a questionnaire, of which 116 responded, and we excluded 13 because the data were not completed correctly. The 268 employees were from multinational companies, but not all of them worked with AI and not all of them had heard of AI, so that was probably why some did not even answer the questionnaire. Of those analysed in each of the five companies—MNCs—there was an average of ~30 employees who had heard of, saw the benefits, and worked with AI. According to CECCAR, there are 30,000 accounting practitioners in Romania; the representativeness of this article refers to those who work in the top five MNCs. The details of the respondents are presented in

Table 1.

The responses were collected using Google Forms, and the respondents’ personal information was not requested (email address or name). In this manner, the participants’ anonymity and privacy were respected. Moreover, there were no rewards offered for attendance. To achieve the objectives formulated in this paper, the data were statistically analysed using SPSS software. We used the non-parametrical Mann–Whitney U and Levene tests. The decision to use these tests was determined by the sample size and the distribution of the data.

4. Conceptual Framework of AI Used and Its Implications

This article was written with respondents from Romania. Those who answered the questions provided by the authors were part of the accounting and auditing departments. Most of the companies from which the authors collected information were companies found as turnovers in the top five in Romania.

These companies are part of large groups of companies worldwide, so the integration of new technologies was possible very quickly and easily, but not all existing economic processes in Romania could be adapted to use artificial intelligence through the forms where they existed in the various software found here. The five companies from which the existing questionnaires in this article were completed are part of the following fields of activity: oil and gas, electricity, gas transport–gas sales, painting production, and steel production.

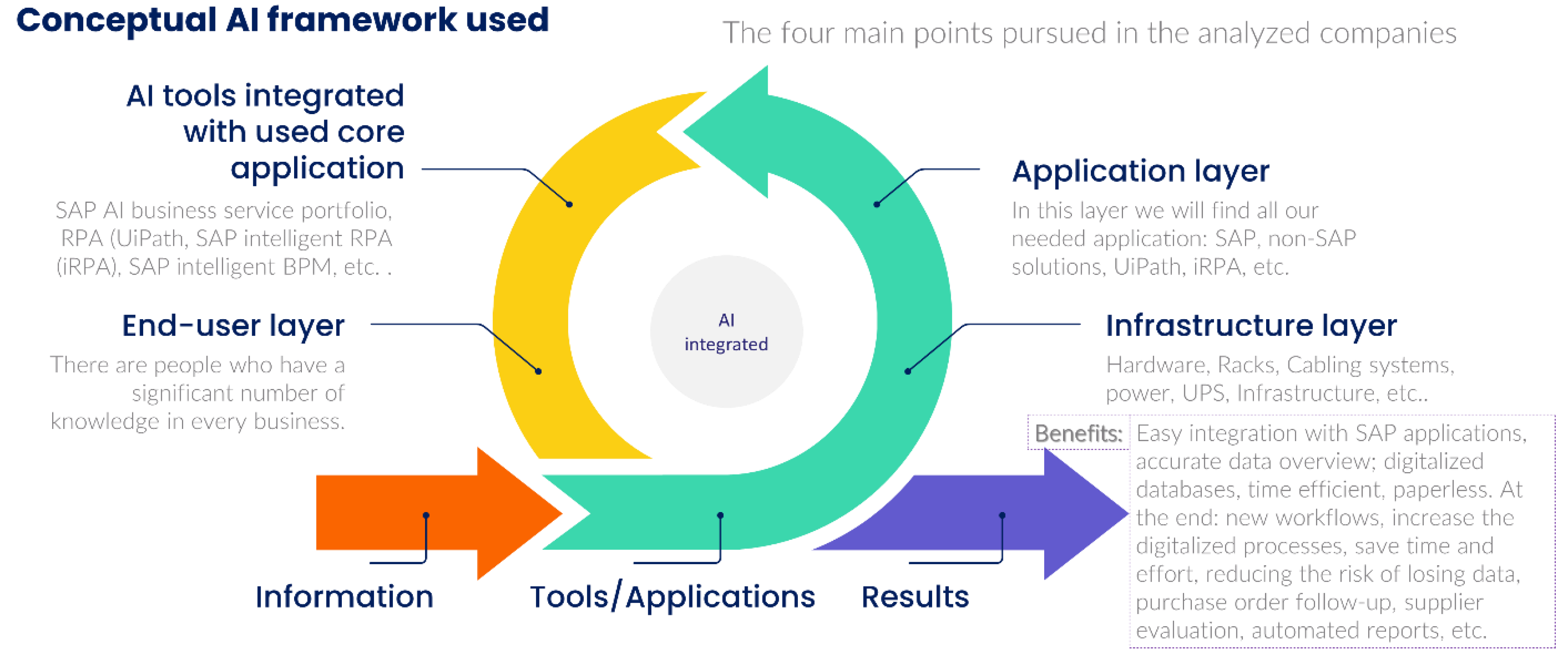

The conceptual framework used in all the analysed companies used the four points found in

Figure 1.

The image above highlights the existing core system (SAP) and the possibility that all applications used built-in AI, from RPA in the classic case (UiPath) to iRPA integrated with the core system—SAP. Thus, in all companies, the authors dealt with people who, through their training, their adaptability, and their creativity, faced the challenges that came with the incorporation of these new technologies.

Another aspect mentioned by the authors was about the percentage, considered good, taking into account the situation in our country that the questionnaire was answered by people who could see, from college, from a Master’s, how to use such technologies, what are the benefits they bring, and what are the advantages they come with.

From the study found in this article, corroborated with the authors’ discussions with the respondents, we can state that the studies made in all higher education environments can have an increasing influence. Many of those surveyed had learned about AI in the workplace without having a solid knowledge of this way of working integrated into new state-of-the-art technology software.

5. Results and Discussion

By analysing the data collected, to achieve the study’s objectives, we discovered that, from the 103 valid responses, 57 participants admitted using AI solutions in their professional activities, and 34 revealed they do not use any AI-based solution. The rest (12 practitioners) declared that they do not have enough knowledge regarding the accounting information systems (AIS) used to admit if they are using AI or not. As supported by the international professional bodies [

30,

31], practitioners should clearly understand the AIS used. Moreover, the company providing the AIS should clearly state if the solution provided is using any AI technique.

As the objectives of this study were focused on the perceptions of practitioners regarding AI, we decided to exclude the 12 participants from the analyses, assuring the accuracy of the data and conclusions of the study.

To achieve the first research objective, we analysed the assessments of the benefits and risks perceived by both AI users and non-users.

As shown in

Table 2, the practitioners considered that almost all the benefits and risks assessed in the survey had above average importance. Regarding the subjective algorithm issues that might pose a risk in the accounting field, respondents evaluated this risk as having a slightly below average importance.

In order to test whether there is a statistically significant difference between the respondents based on the use of AI in terms of the perceptions of the benefits and challenges, we performed a Mann–Whitney U test, where the independent variable was the use and non-use of AI and the dependent variables were the scores given by the participants to the benefits and challenges of using AI in the accounting field.

As the Mann–Whitney

U test has a homogeneity assumption [

32], we used the non-parametric Levene’s test of the homogeneity of variance, and the results can be observed in

Table 3. Since all

p-values are greater than 0.05, the homogeneity assumption is met, and the Mann–Whitney

U test can be performed.

As observed from the above table (

Table 4), there were no significant differences between AI users and non-users in terms of the perceived benefits. This outcome can be explained by the fact that, even though not all the participants in the study have used AI in their professional activities, they are aware of the benefits brought by the solutions in the accounting processes. Another survey question was assessing their perceptions regarding the appropriateness of AI in accounting using a 5-point Likert scale (1—Not appropriate; 5—Extremely appropriate). After testing the homogeneity assumption (based on median/based on median and with adjusted df = 0.354), we performed another Mann–Whitney

U test that revealed no significant differences between AI users (Md = 4,

n = 57) and non-users (Md = 4,

n = 34),

U = 961.50, z = −0.065,

p = 0.948.

The first objective of the research was achieved and, according to the results obtained, accounting practitioners consider AI as appropriate in the accounting field, and they are aware of both the benefits and challenges brought about by the use of AI-based solutions in the accounting profession. Moreover, it seems that the use of AI does not statistically influence the perception, and this result is most likely generated by the continuous developments of the skills and knowledge of the practitioners.

The second objective of the research is to determine whether accounting professionals consider AI a threat. To achieve this objective, we included five questions in the survey focusing on the perceived possibility for AI to replace accountants (job reduction), the most vulnerable categories of practitioners, and finding new jobs and developing skills to maintain or improve the employability rate.

The participants were asked to evaluate the following statement, “AI will transform accounting processes without replacing the accounting practitioners”, using a 5-point Likert scale (1—Strongly disagree; 5—Strongly agree). After testing the homogeneity assumption (based on median/based on median and with adjusted df = 0.318), we analysed if there is any significant difference between AI users (Md = 4, n = 57) and non-users (Md = 4, n = 34), and the results revealed that the majority of the respondents agree that AI will not contribute to job loss but, rather, job transformation (non-users mean 3.58 and users mean = 3.87); however, between groups, there were no significant differences: U = 812, z = −1.363, p = 0.173.

International professional bodies and researchers [

16,

33,

34] highlighted that accountants should not fear AI but embrace innovative disruptions by improving processes and reducing redundant tasks. However, the continuous development of their skills to match business requirements should not be overlooked [

17], and both professional bodies and academia play a crucial role in maintaining and increasing the employability of practitioners. Nevertheless, we must acknowledge that the pandemic context accelerated the adoption of emerging technologies in accounting, primarily due to the work from home policies in place and the unavailability of employees due to health issues.

When asked to assess the most vulnerable categories of employees for which AI might represent a real threat, the majority of the participants considered that this will be the case for employees that do not continue to improve their IT skills to work efficiently with AI solutions (79.12%), employees close to retirement (25.27%), and employees without significant experience in the field (12.08%). Only three participants considered that none of these categories could be affected by adopting AI-based solutions in accounting.

To assess the job insecurity of the respondents and their perceptions regarding the probability that the adoption of AI might jeopardise their ability to get a new position, we asked the participants to assess on a 5-point Likert scale (1—Strongly disagree; 5—Strongly agree) the probability that AI will decrease their employability and make them redundant. After analysing the homogeneity of the data using the non-parametric Levene’s test, having the same independent variable used for the previous analysis and three new dependent variables (AI can affect the current job—CJOB, AI can decrease the chances of getting a new job—FJOB, and the development of the required future AI skills without the help of the employer or the professional bodies—SKILL), we performed another Mann–Whitney U test. The different skills that an employee must have in the context in which he will work in jobs where new technologies will appear can never guarantee a stable job, and it is not productive for a company for this to happen. In this case, the continuous improvement of skills is encouraged from a normal working perspective. Perhaps insecurity in the workplace could be alleviated through courses, involvement in technology implementation projects that use AI at the group level, and knowing that all the companies analysed are part of groups worldwide. Another big difference was in accepting that AI can achieve, through automation, a much greater fluency of documents, and there is no longer an interruption in the posting of data in ERP information systems.

The results of the analysis can be observed in

Table 5.

The majority of the participants did not consider that AI can affect their current job or the probability of getting a new job, as highlighted by the analysis conducted. Moreover, in terms of skills development, the majority consider themselves fit to undergo the changes without the help of employers or professional bodies. These results also highlight no statistically significant differences between AI users and non-users.

This outcome can be explained through two perspectives—the first one is that the respondents evaluate themselves as fit to cope with the technological changes and consider that they have the potential to acquire sufficient knowledge to maintain their employability. Another possible explanation might be that the participants do not yet fully understand the capabilities of AI and the magnitude of automation that can be facilitated.

Most of the respondents who use automated business processes, through various forms of AI, responded positively to the challenge of the impact of these transformations on their past activities compared to what they are doing now, as their lives have changed, and they can use their knowledge in the area of creativity to improve the economic process itself. We can say now that a number of respondents carry out the design part of the processes, analysing more closely what is missing in the past and what could be useful now, along with automation.

The authors had discussions with those who are engaged in monitoring automated economic processes, trying to find out what impact these transformations have had on how daily activity is impacted, and their response was that the time allotted to how creativity can be improved in their job is much more.

6. Conclusions

The aim of this present research was to examine the perception of the accounting practitioners regarding the main benefits and challenges of using AI-based solutions in accounting processes and to evaluate whether the amplified adoption of AI increases the pressure regarding the replacement of professionals. The analyses conducted highlighted that accountants consider almost all of the benefits and challenges assessed as having an above average significance; however, there were no statistically significant differences between the AI users and non-users. Moreover, most of the respondents do not consider AI a threat to their employability as long as they continue to improve their knowledge and skills to efficiently use AI-based technologies.

These findings suggest that, in general, practitioners understand that AI can bring both significant benefits and challenges. However, due to the rapid changes determined by working remotely during the pandemic, practitioners might need more support from both the employers and the professional bodies to quickly adapt to this transformation that will most likely be continued.

The study contributes to our understanding of accountants’ perceptions regarding the benefits and challenges of AI, as they play a vital role in the companies. AI is indeed managing to perform a series of tasks better, usually those that require lower professional judgement; however, accountants possess a series of skills that cannot be completely automated. This study lays the ground for future research into the main challenges encountered by practitioners in the era of intelligence accounting. Furthermore, the results of his article are addressed at those who work in financial accounting precisely as the purpose of the research has been focused on assessing the perception of new technologies application within the business environment. Apart from that, business owners and engineers can benefit from depicting the impact of AI technologies within international business.

The results of the present study are relevant both domestically and internationally, as they provide insight into the awareness of MNC accounting professionals, thus creating an image of further intervention from both the technological and the business areas given the development perspective for such business in Romania. The results indicate the required need for input in terms of implementation and of raising awareness as well.

A limitation of this study is that there were not enough participants that have an affiliation with international professional bodies, so we could not analyse whether this independent variable impacts the perceived benefits and challenges associated with the use of AI in accounting. Despite its limitations, the study certainly adds to our understanding of practitioners’ perceptions regarding the intelligence accounting.

Since the number of AI users in accounting is significant, a further study could assess whether the pandemic context has increased the adoption rate of AI-based solutions and improved practitioners’ eagerness to embrace these techniques.

The findings of this study have several important implications for future practice for employers, professional bodies, and the academic environment. The transformation of the skills required to maintain and improve employability is the practitioners’ responsibility; yet, there is the need for support in this continuous training process.

Another finding reached by the authors of this article, after verifying all the questionnaires and after the discussions with the respondents who responded positively to the discussions about the impact of AI in their daily activity, was that the university environment should introduce a series of courses that teaches students, future graduates, about some of the following skills: strong written and oral communication, systems analysis, strategic and critical thinking, organization and attention to detail, active learning, mathematical and deductive reasoning, time management, analytical and problem solving skills, anticipating and serving evolving needs.

One more conclusion, which we should not be afraid of, is that it is quite clear that there will be no more jobs in which technology does not reach and help in some way. It is increasingly visible that the identification of new technologies and their integration into the business can only do good; moreover, employees must be supported to understand why these technologies help them and to arouse their curiosity about them and the benefits they bring.

From the point of view of continuing the research, the authors aim to produce a link with a strong scientific support between the results obtained for the studies carried out for companies in Romania and those in other countries.