An Evaluation of Critical Capabilities and Improvement Areas for Competitive Manufacturing in a Developed-Country Environment

Abstract

:1. Introduction

2. Critical Capabilities for Competitive Manufacturing in Developed Countries

2.1. Competitiveness Models

2.2. Critical Capabilities

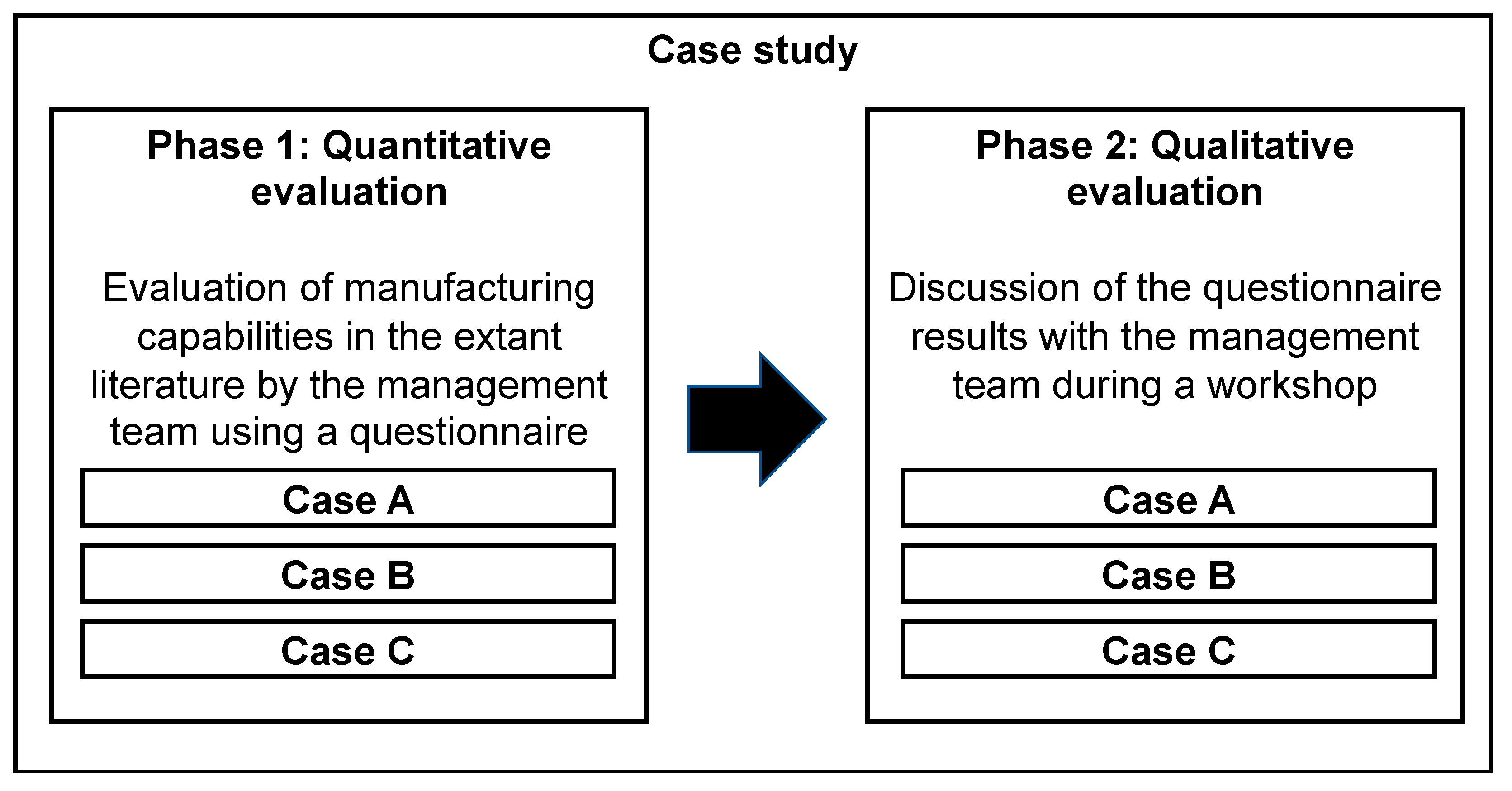

3. Methodology

4. Empirical Findings

4.1. Critical Manufacturing Capabilities

4.2. Critical Manufacturing Capabilities

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Battistella, C.; DE Toni, A.F.; De Zan, G.; Pessot, E. Cultivating business model agility through focused capabilities: A multiple case study. J. Bus. Res. 2017, 73, 65–82. [Google Scholar] [CrossRef]

- Koufteros, X.A.; Vonderembse, M.A.; Doll, W.J. Examining the Competitive Capabilities of Manufacturing Firms. Struct. Equ. Model. A Multidiscip. J. 2002, 9, 256–282. [Google Scholar] [CrossRef]

- Slack, N.; Lewis, M. Operations Strategy; Pearson: London, UK, 2019. [Google Scholar]

- Tempelmayr, D.; Ehrlinger, D.; Stadlmann, C.; Überwimmer, M.; Mang, S.; Biedersberger, A. The Performance Effect of Dynamic Capabilities in Servitizing Companies. J. Int. Bus. Res. Mark. 2019, 4, 42–48. [Google Scholar] [CrossRef]

- Hilmola, O.-P.; Lorentz, H.; Hilletofth, P.; Malmsten, J. Manufacturing strategy in SMEs and its performance implications. Ind. Manag. Data Syst. 2015, 115, 1004–1021. [Google Scholar] [CrossRef]

- Liu, Y.; Liang, L. Evaluating and developing resource-based operations strategy for competitive advantage: An exploratory study of Finnish high-tech manufacturing industries. Int. J. Prod. Res. 2014, 53, 1019–1037. [Google Scholar] [CrossRef]

- Gupta, S.; Drave, V.A.; Dwivedi, Y.K.; Baabdullah, A.M.; Ismagilova, E. Achieving superior organizational performance via big data predictive analytics: A dynamic capability view. Ind. Mark. Manag. 2019, 90, 581–592. [Google Scholar] [CrossRef]

- Größler, A.; Grübner, A. An empirical model of the relationships between manufacturing capabilities. Int. J. Oper. Prod. Manag. 2006, 26, 458–485. [Google Scholar] [CrossRef]

- Lorentz, H.; Hilmola, O.-P.; Malmsten, J.; Srai, J.S. Cluster analysis application for understanding SME manufacturing strategies. Expert Syst. Appl. 2016, 66, 176–188. [Google Scholar] [CrossRef]

- Ketokivi, M.; Turkulainen, V.; Seppälä, T.; Rouvinen, P.; Ali-Yrkkö, J. Why locate manufacturing in a high-cost country? A case study of 35 production location decisions. J. Oper. Manag. 2017, 49-51, 20–30. [Google Scholar] [CrossRef]

- Sergi, B.S.; Popkova, E.G.; Bogoviz, A.V.; Ragulina, J.V. Entrepreneurship and economic growth: The experience of developed and developing countries. In Entrepreneurship and Development in the 21st Century; Emerald Publishing Limited: Bingley, UK, 2019; pp. 3–32. [Google Scholar] [CrossRef]

- Arunachalam, S.; Bahadir, S.C.; Bharadwaj, S.G.; Guesalaga, R. New product introductions for low-income consumers in emerging markets. J. Acad. Mark. Sci. 2019, 48, 914–940. [Google Scholar] [CrossRef]

- Johansson, M.; Olhager, J. Manufacturing relocation through offshoring and backshoring: The case of Sweden. J. Manuf. Technol. Manag. 2017, 29, 637–657. [Google Scholar] [CrossRef] [Green Version]

- Lund, H.B.; Steen, M. Make at home or abroad? Manufacturing reshoring through a GPN lens: A Norwegian case study. Geoforum 2020, 113, 154–164. [Google Scholar] [CrossRef]

- Chukwuemeka, O.W.; Onuoha, B.C. Dynamic Capabilities and Competitive Advantage of Fast Foods Restaurants. Int. J. Manag. Sci. Bus. Adm. 2018, 4, 7–14. [Google Scholar] [CrossRef]

- Gold, S.; Schodl, R.; Reiner, G. Cumulative manufacturing capabilities in Europe: Integrating sustainability into the sand cone model. J. Clean. Prod. 2017, 166, 232–241. [Google Scholar] [CrossRef]

- Brennan, L.; Ferdows, K.; Godsell, J.; Golini, R.; Keegan, R.; Kinkel, S.; Srai, J.S.; Taylor, M. Manufacturing in the world: Where next? Int. J. Oper. Prod. Manag. 2015, 35, 1253–1274. [Google Scholar] [CrossRef]

- Vanchan, V.; Mulhall, R.; Bryson, J. Repatriation or Reshoring of Manufacturing to the U.S. and UK: Dynamics and Global Production Networks or from Here to There and Back Again. Growth Chang. 2017, 49, 97–121. [Google Scholar] [CrossRef]

- Gylling, M.; Heikkilä, J.; Jussila, K.; Saarinen, M. Making decisions on offshore outsourcing and backshoring: A case study in the bicycle industry. Int. J. Prod. Econ. 2015, 162, 92–100. [Google Scholar] [CrossRef]

- Spring, M.; Hughes, A.; Mason, K.; McCaffrey, P. Creating the competitive edge: A new relationship between operations management and industrial policy. J. Oper. Manag. 2017, 49-51, 6–19. [Google Scholar] [CrossRef]

- Pinheiro, R.; Yang, M. The Evolution of the Labor Share across Developed Countries, Federal Reserve Bank of Cleveland, Economic Commentary. 2018. Number 2018-08. Available online: https://www.clevelandfed.org/en/newsroom-and-events/publications/economic-commentary/2018-economic-commentaries/ec-201808-evolution-of-the-labor-share-across-developed-countries.aspx (accessed on 31 January 2022).

- Houseman, S.N. Understanding the Decline of U.S. Manufacturing Employment; Upjohn Institute Working Paper 18-287; W.E. Upjohn Institute for Employment Research: Kalamazoo, MI, USA, 2018. [Google Scholar] [CrossRef]

- Arlbjørn, J.S.; Mikkelsen, O.S. Backshoring manufacturing: Notes on an important but under-researched theme. J. Purch. Supply Manag. 2014, 20, 60–62. [Google Scholar] [CrossRef]

- Stentoft, J.; Mikkelsen, O.S.; Johnsen, T.E. Going Local: A Trend towards Insourcing of Production? Supply Chain Forum Int. J. 2015, 16, 2–13. [Google Scholar] [CrossRef]

- Wiesmann, B.; Snoei, J.R.; Hilletofth, P.; Eriksson, D. Drivers and barriers to reshoring: A literature review on offshoring in reverse. Eur. Bus. Rev. 2017, 29, 15–42. [Google Scholar] [CrossRef] [Green Version]

- Handfield, R.; Graham, G.; Burns, L. Corona virus, tariffs, trade wars and supply chain evolutionary design. Int. J. Oper. Prod. Manag. 2020, 40, 1649–1660. [Google Scholar] [CrossRef]

- Shih, W.C. Global Supply Chains in a Post-Pandemic World, Harvard Business Review. 2020. Available online: https://hbr.org/2020/09/global-supply-chains-in-a-postpandemic-world (accessed on 25 November 2021).

- Sheffi, Y. What everyone gets wrong about the never-ending COVID-19 supply chain crisis. MIT Sloan Manag. Rev. 2021, 63, 1–5. [Google Scholar]

- Notteboom, T.; Pallis, T.; Rodrigue, J.-P. Disruptions and resilience in global container shipping and ports: The COVID-19 pandemic versus the 2008–2009 financial crisis. Marit. Econ. Logist. 2021, 23, 179–210. [Google Scholar] [CrossRef]

- Habermann, M.; Blackhurst, J.; Metcalf, A.Y. Keep Your Friends Close? Supply Chain Design and Disruption Risk. Decis. Sci. 2015, 46, 491–526. [Google Scholar] [CrossRef]

- Simon, H. Why Germany still has so many middle-class manufacturing jobs? Harv. Bus. Rev. 2017, 2–4. [Google Scholar]

- Dangayach, G.; Deshmukh, S. Manufacturing strategy literature review and some issues. Int. J. Oper. Prod. Manag. 2001, 21, 884–932. [Google Scholar] [CrossRef]

- Sansone, C.; Hilletofth, P.; Eriksson, D. Critical operations capabilities for competitive manufacturing: A systematic review. Ind. Manag. Data Syst. 2017, 117, 801–837. [Google Scholar] [CrossRef]

- Sansone, C.; Hilletofth, P.; Eriksson, D. Evaluation of critical operations capabilities for competitive manufacturing in a high-cost environment. J. Glob. Oper. Strat. Sourc. 2020, 13, 229–250. [Google Scholar] [CrossRef]

- Pimenta, M.L.; Cezarino, L.O.; Piato, E.L.; da Silva, C.H.P.; Oliveira, B.G.; Liboni, L.B. Supply chain resilience in a Covid-19 scenario: Mapping capabilities in a systemic framework. Sustain. Prod. Consum. 2021, 29, 649–656. [Google Scholar] [CrossRef]

- Sansone, C.; Hilletofth, P.; Eriksson, D. Critical Operations Capabilities for Competitive Manufacturing in a High-Cost Environment: A Multiple Case Study. Oper. Supply Chain Manag. Int. J. 2020, 13, 94–107. [Google Scholar] [CrossRef]

- Engström, G.; Sollander, K.; Hilletofth, P.; Eriksson, D. Reshoring drivers and barriers in the Swedish manufacturing industry. J. Glob. Oper. Strat. Sourc. 2018, 11, 174–201. [Google Scholar] [CrossRef] [Green Version]

- Hilletofth, P.; Eriksson, D.; Tate, W.; Kinkel, S. Right-shoring: Making resilient offshoring and reshoring decisions. J. Purch. Supply Manag. 2019, 25, 100540. [Google Scholar] [CrossRef]

- Brandon-Jones, E.; Dutordoir, M.; Neto, J.Q.F.; Squire, B. The impact of reshoring decisions on shareholder wealth. J. Oper. Manag. 2017, 49–51, 31–36. [Google Scholar] [CrossRef]

- Martín-Peña, M.L.; Díaz-Garrido, E. A taxonomy of manufacturing strategies in Spanish companies. Int. J. Oper. Prod. Manag. 2008, 28, 455–477. [Google Scholar] [CrossRef]

- Hayes, R.H.; Wheelwright, S.C. Restoring Our Competitive Edge: Competing through Manufacturing; Wiley: New York, NY, USA, 1984; Volume 8. [Google Scholar] [CrossRef]

- Miller, J.G.; Roth, A.V. A Taxonomy of Manufacturing Strategies. Manag. Sci. 1994, 40, 285–304. [Google Scholar] [CrossRef] [Green Version]

- Singh, P.; Wiengarten, F.; Nand, A.; Betts, T. Beyond the trade-off and cumulative capabilities models: Alternative models of operations strategy. Int. J. Prod. Res. 2014, 53, 4001–4020. [Google Scholar] [CrossRef]

- Skinner, W. Manufacturing–missing link in corporate strategy. Harv. Bus. Rev. 1969, 47, 136–145. [Google Scholar]

- Skinner, W. The focused factory. Harv. Bus. Rev. 1974, 52, 113–121. [Google Scholar]

- Sum, C.; Singh, P.; Heng, H. An examination of the cumulative capabilities model in selected Asia-Pacific countries. Prod. Plan. Control 2012, 23, 735–753. [Google Scholar] [CrossRef]

- Avella, L.; Vazquez-Bustelo, D.; Fernández, E. Cumulative manufacturing capabilities: An extended model and new empirical evidence. Int. J. Prod. Res. 2011, 49, 707–729. [Google Scholar] [CrossRef] [Green Version]

- Schroeder, R.G.; Shah, R.; Peng, D.X. The cumulative capability ‘sand cone’ model revisited: A new perspective for manufacturing strategy. Int. J. Prod. Res. 2011, 49, 4879–4901. [Google Scholar] [CrossRef]

- Bortolotti, T.; Danese, P.; Flynn, B.B.; Romano, P. Leveraging fitness and lean bundles to build the cumulative performance sand cone model. Int. J. Prod. Econ. 2015, 162, 227–241. [Google Scholar] [CrossRef] [Green Version]

- Ferreira, J.; Prokopets, L. Does offshoring still make sense? Supply Chain. Manag. Rev. 2009, 13, 20–27. [Google Scholar]

- Ellram, L.M. Offshoring, Reshoring and the Manufacturing Location Decision. J. Supply Chain Manag. 2013, 49, 3–5. [Google Scholar] [CrossRef]

- Ellram, L.M.; Tate, W.L.; Petersen, K.J. Offshoring and Reshoring: An Update on the Manufacturing Location Decision. J. Supply Chain Manag. 2013, 49, 14–22. [Google Scholar] [CrossRef]

- Bolívar-Cruz, A.; Rodríguez, T.F.E. An analysis of operations strategy in the food and beverage sector. Int. J. Serv. Oper. Manag. 2008, 4, 102. [Google Scholar] [CrossRef]

- Kaipia, R.; Turkulainen, V. Managing integration in outsourcing relationships—The influence of cost and quality priorities. Ind. Mark. Manag. 2017, 61, 114–129. [Google Scholar] [CrossRef] [Green Version]

- Chi, T. Corporate competitive strategies in a transitional manufacturing industry: An empirical study. Manag. Decis. 2010, 48, 976–995. [Google Scholar] [CrossRef]

- Ward, P.T.; Bickford, D.J.; Leong, G.K. Configurations of Manufacturing Strategy, Business Strategy, Environment and Structure. J. Manag. 1996, 22, 597–626. [Google Scholar] [CrossRef]

- Christiansen, T.; Berry, W.L.; Bruun, P.; Ward, P. A mapping of competitive priorities, manufacturing practices, and operational performance in groups of Danish manufacturing companies. Int. J. Oper. Prod. Manag. 2003, 23, 1163–1183. [Google Scholar] [CrossRef]

- Hong, P.; Tran, O.; Park, K. Electronic commerce applications for supply chain integration and competitive capabilities: An empirical study. Benchmark. Int. J. 2010, 17, 539–560. [Google Scholar] [CrossRef]

- Frohlich, M.T.; Dixon, J. A taxonomy of manufacturing strategies revisited. J. Oper. Manag. 2001, 19, 541–558. [Google Scholar] [CrossRef]

- Longoni, A.; Cagliano, R. Environmental and social sustainability priorities. Int. J. Oper. Prod. Manag. 2015, 35, 216–245. [Google Scholar] [CrossRef]

- Corbett, L.M. A comparative study of the operations strategies of globally- and domestically-oriented New Zealand manufacturing firms. Int. J. Prod. Res. 1996, 34, 2677–2689. [Google Scholar] [CrossRef]

- da Silveira, G.J. Improving trade-offs in manufacturing: Method and illustration. Int. J. Prod. Econ. 2005, 95, 27–38. [Google Scholar] [CrossRef]

- Gao, T.; Tian, Y. Mechanism of supply chain coordination cased on dynamic capability framework-the mediating role of manufacturing capabilities. J. Ind. Eng. Manag. 2014, 7, 1250–1267. [Google Scholar] [CrossRef] [Green Version]

- Jayaram, J.; Narasimhan, R. The Influence of New Product Development Competitive Capabilities on Project Performance. IEEE Trans. Eng. Manag. 2007, 54, 241–256. [Google Scholar] [CrossRef]

- Szász, L.; Demeter, K. How do companies lose orders? A multi-country study of internal inconsistency in operations strategies. Oper. Manag. Res. 2014, 7, 99–116. [Google Scholar] [CrossRef]

- Bouranta, N.; Psomas, E. A comparative analysis of competitive priorities and business performance between manufacturing and service firms. Int. J. Prod. Perform. Manag. 2017, 66, 914–931. [Google Scholar] [CrossRef]

- Pooya, A.; Faezirad, M. A taxonomy of manufacturing strategies and production systems using self-organizing map. J. Ind. Prod. Eng. 2016, 50, 1–12. [Google Scholar] [CrossRef]

- Garo, W.R., Jr.; Guimarães, M.R.N. Competitive priorities and strategic alignment as mediators in the relationship between companies in the Brazilian automotive supply chain. S. Afr. J. Ind. Eng. 2018, 29, 184–194. [Google Scholar] [CrossRef]

- Ho, T.C.; Ahmad, N.H.; Ramayah, T. Competitive Capabilities and Business Performance among Manufacturing SMEs: Evidence from an Emerging Economy, Malaysia. J. Asia-Pacific Bus. 2016, 17, 37–58. [Google Scholar] [CrossRef]

- Chi, T.; Kilduff, P.P.; Gargeya, V.B. Alignment between business environment characteristics, competitive priorities, supply chain structures, and firm business performance. Int. J. Prod. Perform. Manag. 2009, 58, 645–669. [Google Scholar] [CrossRef]

- Gligor, D.M.; Esmark, C.L.; Holcomb, M.C. Performance outcomes of supply chain agility: When should you be agile? J. Oper. Manag. 2014, 33–34, 71–82. [Google Scholar] [CrossRef]

- Bulak, M.E.; Turkyilmaz, A. Performance assessment of manufacturing SMEs: A frontier approach. Ind. Manag. Data Syst. 2014, 114, 797–816. [Google Scholar] [CrossRef]

- Zhao, X.; Yeung, J.H.Y.; Zhou, Q. Competitive priorities of enterprises in mainland China. Total Qual. Manag. 2002, 13, 285–300. [Google Scholar] [CrossRef]

- Christensen, C.M.; McDonald, R.; Altman, E.J.; Palmer, J.E. Disruptive Innovation: An Intellectual History and Directions for Future Research. J. Manag. Stud. 2018, 55, 1043–1078. [Google Scholar] [CrossRef] [Green Version]

- Hilmola, O.P. Technological change and performance deterioration of mobile phone suppliers. Int. J. Technol. Intell. Plan. 2012, 8, 374. [Google Scholar] [CrossRef]

- Ferrer, M.; Santa, R.; Storer, M.; Hyland, P. Competences and capabilities for innovation in supply chain relationships. Int. J. Technol. Manag. 2011, 56, 272. [Google Scholar] [CrossRef]

- Lau, A.K.; Baark, E.; Lo, W.L.; Sharif, N. The effects of innovation sources and capabilities on product competitiveness in Hong Kong and the Pearl River Delta. Asian J. Technol. Innov. 2013, 21, 220–236. [Google Scholar] [CrossRef]

- Sarkar, S.; Pansera, M. Sustainability-driven innovation at the bottom: Insights from grassroots ecopreneurs. Technol. Forecast. Soc. Change 2017, 114, 327–338. [Google Scholar] [CrossRef]

- Díaz, M.R.; Rodríguez, T.F.E. Determining the Sustainability Factors and Performance of a Tourism Destination from the Stakeholders’ Perspective. Sustainability 2016, 8, 951. [Google Scholar] [CrossRef] [Green Version]

- Seuring, S.; Müller, M. From a literature review to a conceptual framework for sustainable supply chain management. J. Clean. Prod. 2008, 16, 1699–1710. [Google Scholar] [CrossRef]

- Kronfeld-Goharani, U. Maritime economy: Insights on corporate visions and strategies towards sustainability. Ocean Coast. Manag. 2018, 165, 126–140. [Google Scholar] [CrossRef]

- Chen, L.; Zhao, X.; Tang, O.; Price, L.; Zhang, S.; Zhu, W. Supply chain collaboration for sustainability: A literature review and future research agenda. Int. J. Prod. Econ. 2017, 194, 73–87. [Google Scholar] [CrossRef]

- Eisenhardt, K.M. Building Theories from Case Study Research. Acad. Manag. Rev. 1989, 14, 532. [Google Scholar] [CrossRef]

- Yin, R. Case Study Research: Design and Methods; SAGE Publications: Thousand Oaks, CA, USA, 2007. [Google Scholar]

- Barbour, R.S. Mixing Qualitative Methods: Quality Assurance or Qualitative Quagmire? Qual. Health Res. 1998, 8, 352–361. [Google Scholar] [CrossRef]

- Childerhouse, P.; Towill, D.R. Simplified material flow holds the key to supply chain integration. Omega 2003, 31, 17–27. [Google Scholar] [CrossRef]

- Alsmadi, M.; Khan, Z.; McTavish, A.M. Evaluating competitive advantage priorities of SMEs in Jordan. Int. J. Netw. Virtual Organ. 2011, 9, 25–43. [Google Scholar] [CrossRef]

- Nair, A.; Boulton, W.R. Innovation-oriented operations strategy typology and stage-based model. Int. J. Oper. Prod. Manag. 2008, 28, 748–771. [Google Scholar] [CrossRef]

- Heikkilä, J.; Martinsuo, M.; Nenonen, S. Backshoring of production in the context of a small and open Nordic economy. J. Manuf. Technol. Manag. 2018, 29, 658–675. [Google Scholar] [CrossRef]

| Case Firms | Firm A | Firm B | Firm C |

|---|---|---|---|

| Location | Sweden | Sweden | Sweden |

| Founding year | 1958 | 1955 | 1974 |

| Ownership type | Corporation | Limited liability | Limited liability |

| Type | Manufacturing | Manufacturing | Manufacturing |

| Market | Global | Global | Global |

| Product | Forklifts | Suspension systems | Punched products |

| Turnover (MSEK) | 2800 | 150 | 120 |

| Employees | 1100 | 40 | 60 |

| Participants | Firm A | Firm B | Firm C |

|---|---|---|---|

| Plant manager | X | X | X |

| Production manager | X | X | X |

| R&D manager | X | X | |

| Quality manager | X | X | |

| Improvement manager | X | ||

| Purchasing manager | X | X | |

| Financial manager | X | X | |

| Marketing manager | X | X | X |

| Human resources manager | X | ||

| Total | 8 | 6 | 5 |

| Capability (Group) | Case A | Case B | Case C |

|---|---|---|---|

| Cost efficiency (C) | Rank 1 (Mean 4.75, SD 0.46) | Rank 1 (Mean 4.60, SD 0.49) | Rank 2 (Mean 4.80, SD, 0.40) |

| Resource efficiency (C) | Rank 9 (Mean 4.00, SD 0.76) | Rank 11 (Mean 4.20, SD 0.75) | Rank 14 (Mean 3.80, SD, 0.75) |

| Process efficiency (C) | Rank 2 (Mean 4.38, SD 0.74) | Rank 5 (Mean 4.40, SD 0.49) | Rank 5 (Mean 4.20, SD, 0.40) |

| Product quality (Q) | Rank 6 (Mean 4.25, SD 0.46) | Rank 1 (Mean 4.60, SD 0.49) | Rank 14 (Mean 3.80, SD, 0.75) |

| Process quality (Q) | Rank 7 (Mean 4.25, SD 0.71) | Rank 1 (Mean 4.60, SD 0.49) | Rank 6 (Mean 4.20, SD, 0.75) |

| Delivery dependability (Q) | Rank 8 (Mean 4.00, SD 0.00) | Rank 1 (Mean 4.60, SD 0.49) | Rank 1 (Mean 5.00, SD, 0.00) |

| Brand quality (Q) | Rank 15 (Mean 3.50, SD 0.53) | Rank 11 (Mean 4.20, SD 0.75) | Rank 13 (Mean 3.80, SD, 0.40) |

| Delivery time (T) | Rank 14 (Mean 3.63, SD 1.06) | Rank 9 (Mean 4.20, SD 0.40) | Rank 4 (Mean 4.40, SD, 0.80) |

| Time to market (T) | Rank 16 (Mean 3.50, SD 0.93) | Rank 5 (Mean 4.40, SD 0.49) | Rank 6 (Mean 4.20, SD, 0.75) |

| Product flexibility (F) | Rank 2 (Mean 4.38, SD 0.74) | Rank 9 (Mean 4.20, SD 0.40) | Rank 11 (Mean 4.00, SD, 1.10) |

| Production-mix flexibility (F) | Rank 10 (Mean 4.00, SD 1.07) | Rank 16 (Mean 3.60, SD 0.49) | Rank 19 (Mean 3.60, SD, 0.49) |

| Volume flexibility (F) | Rank 2 (Mean 4.38, SD 0.74) | Rank 13 (Mean 3.80, SD 0.40) | Rank 17 (Mean 3.80, SD, 0.98) |

| Product-line flexibility (F) | Rank 11 (Mean 3.63, SD 0.74) | Rank 13 (Mean 3.80, SD 0.40) | Rank 14 (Mean 3.80, SD, 0.75) |

| Labor flexibility (F) | Rank 12 (Mean 3.63, SD 0.92) | Rank 17 (Mean 3.60, SD 1.02) | Rank 9 (Mean 4.00, SD, 0.63) |

| Delivery flexibility (F) | Rank 2 (Mean 4.38, SD 0.74) | Rank 13 (Mean 3.80, SD 0.40) | Rank 17 (Mean 3.80, SD, 0.98) |

| Product innovation (I) | Rank 16 (Mean 3.50, SD 0.93) | Rank 5 (Mean 4.40, SD 0.49) | Rank 6 (Mean 4.20, SD, 0.75) |

| Service innovation (I) | Rank 22 (Mean 3.00, SD 1.31) | Rank 19 (Mean 3.00, SD 0.63) | Rank 21 (Mean 2.60, SD, 0.49) |

| Process innovation (I) | Rank 18 (Mean 3.38, SD 0.92) | Rank 18 (Mean 3.20, SD 0.75) | Rank 21 (Mean 2.60, SD, 0.49) |

| Technology innovation (I) | Rank 12 (Mean 3.63, SD 0.92) | Rank 19 (Mean 3.00, SD 0.63) | Rank 20 (Mean 3.60, SD, 1.02) |

| Market innovation (I) | Rank 19 (Mean 3.13, SD 0.83) | Rank 8 (Mean 4.40, SD 0.80) | Rank 9 (Mean 4.00, SD, 0.63) |

| Product sustainability (S) | Rank 20 (Mean 3.00, SD 0.53) | Rank 22 (Mean 2.60, SD 1.02) | Rank 3 (Mean 4.40, SD, 0.49) |

| Process sustainability (S) | Rank 21 (Mean 3.00, SD 0.53) | Rank 21 (Mean 2.80, SD 0.98) | Rank 11 (Mean 4.00, SD, 1.10) |

| Capability (Group) | Case A | Case B | Case C |

|---|---|---|---|

| Cost efficiency (C) | “Cost is always a central aspect. What are our overhead costs in relation to the value we produce? Cost, cost and cost.” (Plant manager) | “We are constantly working on reducing our costs.” (Production manager) | “By increasing automation in production, we can achieve a higher cost reduction” (Plant manager) |

| Process efficiency (C) | “Investments in automation is increasingly important aspect for our business” (Improvement manager) | “Improving the productivity is very important and it is an aspect that is improved continuously” (Production manager) | “We have invested in automation to increase our productivity” (Production manager) |

| Process quality (Q) | “Our customers expect that the products correspond to the desired requirement” (Quality manager) | “Our research and development department works closely with our customers to ensure that customers receive the requested solutions” (Production manager) | “We talk a lot about conformance and reducing customer claims is very important.” (Quality manager) |

| Product quality (Q) | “We work with the lean philosophy and strive to involve our employees to provide suggestions for improvements” (Improvement manager) | “Quality is a core aspect in our strategy and we aim at providing high performance products” (Plant manager) | |

| Delivery dependability (Q) | “Providing our customers with accurate deliveries is critical and an area in which we perform well.” (Plant manager) | “Dependability is a basic requirement. We cannot have low dependability and win orders.” (Plant manager) | |

| Time to market (T) | “To outcompete our competitors, we have realized the importance of reducing the time it takes for us to launch new products” (Marketing manager) | “We strive to launch our new products faster than our competitors” (Marketing manager) | |

| Delivery time (T) | “Maintaining short lead-time to customers is important for our business.” (Production manager) | “Our customers require short lead times and we are actively trying to reduce lead-times” (Production manager) | |

| Product flexibility (F) | “This is an important area for us. We have a very high level of customization. We offer very much but at the same time it is very expensive.” (R&D manager) | “We are keen on having a strong customer focus, which also reflects our strategy” (Production manager) | |

| Product innovation (I) | “In order for us to develop as a firm and expand our sales, we need to develop new products” (Plant manager) | “In order for us to attract new customers, it is of great importance to consider innovation and the development of new products.” (Marketing manager) | |

| Resource efficiency (C) | “In production, we strive to increase resource utilization“ (Production manager) | ||

| Brand quality (Q) | “We work with advertising new products directly to our customers and at various trade fairs, in addition to our website” (Marketing manager) | ||

| Volume flexibility (F) | “To be able to satisfy our customers we have to respond quickly to volume changes” (R&D manager) | ||

| Delivery flexibility (F) | “Our customers require a high degree of flexibility and we strive to be as agile as possible to the changes that occur” (Production manager) | ||

| Market innovation (I) | “It has been difficult for us to identify new markets. Therefore, our focus has shifted more towards developing new products to current market segments.” (Plant manager) | ||

| Product sustainability (S) | “The sustainability aspect is a selling point for us, we believe we can sell more if we provide sustainable products.” (Plant manager) |

| Capability (Group) | Case A | Case B | Case C |

|---|---|---|---|

| Cost efficiency (C) | Rank 4 (1.25) | Rank 4 (1.00) | Rank 2 (1.60) |

| Resource efficiency (C) | Rank 3 (1.50) | Rank 6 (0.67) | Rank 10 (0.40) |

| Process efficiency (C) | Rank 5 (1.13) | Rank 6 (0.67) | Rank 3 (1.20) |

| Product quality (Q) | Rank 9 (0.87) | Rank 10 (0.17) | Rank 10 (0.40) |

| Process quality (Q) | Rank 6 (1.12) | Rank 12 (0.00) | Rank 6 (0.80) |

| Delivery dependability (Q) | Rank 20 (−0.13) | Rank 12 (0.00) | Rank 1 (2.00) |

| Brand quality (Q) | Rank 10 (0.75) | Rank 4 (1.00) | Rank 18 (−0.40) |

| Delivery time (T) | Rank 17 (0.25) | Rank 17 (−0.17) | Rank 3 (1.20) |

| Time to market (T) | Rank 15 (0.37) | Rank 1 (1.33) | Rank 10 (0.40) |

| Product flexibility (F) | Rank 12 (0.63) | Rank 17 (−0.17) | Rank 18 (−0.40) |

| Production-mix flexibility (F) | Rank 6 (1.12) | Rank 12 (0.00) | Rank 18 (−0.40) |

| Volume flexibility (F) | Rank 1 (1.88) | Rank 17 (−0.17) | Rank 10 (0.40) |

| Product-line flexibility (F) | Rank 22 (−0.25) | Rank 6 (0.67) | Rank 18 (−0.40) |

| Labor flexibility (F) | Rank 8 (0.88) | Rank 9 (0.33) | Rank 7 (0.60) |

| Delivery flexibility (F) | Rank 1 (1.88) | Rank 17 (−0.17) | Rank 10 (0.40) |

| Product innovation (I) | Rank 15 (0.37) | Rank 1 (1.33) | Rank 10 (0.40) |

| Service innovation (I) | Rank 17 (0.25) | Rank 11 (0.13) | Rank 17 (0.20) |

| Process innovation (I) | Rank 13 (0.50) | Rank 12 (0.00) | Rank 22 (−0.60) |

| Technology innovation (I) | Rank 10 (0.75) | Rank 12 (0.00) | Rank 7 (0.60) |

| Market innovation (I) | Rank 13 (0.50) | Rank 1 (1.33) | Rank 10 (0.40) |

| Product sustainability (S) | Rank 20 (−0.13) | Rank 22 (−0.67) | Rank 7 (0.60) |

| Process sustainability (S) | Rank 19 (0.12) | Rank 21 (−0.33) | Rank 5 (1.00) |

| Capability (Group) | Case A | Case B | Case C |

| Cost efficiency | “No matter what we try to improve, you look at how much such an improvement cost. Therefore, it’s important to work with cost reduction.” (Plant manager) | “Reducing costs in our operations is a constant target and something we need to continue to improve.” (Production manager) | “We believe that this area should be improved further since it is an important aspect in our type of business.” (Plant manager) |

| Process efficiency | “The process output is important to improve because it has an effect on delivery precision.” (Production manager) | “Process output is an area that we have invested in but there are still certain aspects in our daily operations that we believe should be developed further.” (Production manager) | |

| Process quality | “It is important to work with conformance. If we can ensure that our process produce the right quality over and over again, cost savings can be achieved.” (Quality manager) | “We are not performing as we should with regard to process quality and this is something that must be improved.” (Plant manager) | |

| Resource efficiency | “Resource productivity is an important aspect for us and it is also an area we strive to continuously improve” (Plant manager) | ||

| Delivery dependability | “Since this is a highly important aspect for our customers, additional improvement actions should be implemented to enhance our competitiveness.” (Plant manager) | ||

| Time to market | “We have a lot of products in our pipeline and it is crucial for us to launch our new solutions in time, before our competitors” (Research and development manager) | ||

| Delivery time | “In order for us to secure customer loyalty, we have to offer fast and reliable deliveries.” (Marketing manager) | ||

| Volume flexibility | “This is an area we need to improve in order to provide a higher level of flexibility” (Improvement manager) | ||

| Delivery flexibility | “Improving our delivery flexibility can allow us to adapt faster to changes from our customers” (Improvement manager) | ||

| Production-mix flexibility | “Adapting to changes is a key factor for us and we must have a high readiness in production” (Production manager) | ||

| Product innovation | “Currently, we need to be better at developing new products and identifying new markets, it is our long-term challenge.” (Plant manager) | ||

| Market innovation | “We have previously made attempts to identify new markets, without any major success.” (Plant manager) | ||

| Product quality | “The customers require high quality products and we as a firm must improve this and aiming for being a high-performance supplier”. (Marketing manager) | ||

| Brand quality | “We need to enhance our brand value by finding out important values for our customers and communicate in the best possible way.” (Marketing manager) | ||

| Labor flexibility | “Have a staff with multi-skills is becoming more and more important and we need to further improve this in our operations. (Production manager) | ||

| Process sustainability | “Process sustainability is becoming increasing important and we must improve our performance here.” (Production manager) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ascic, I.; Ascic, J.; Hilletofth, P.; Pimenta, M.L.; Hilmola, O.-P. An Evaluation of Critical Capabilities and Improvement Areas for Competitive Manufacturing in a Developed-Country Environment. Sustainability 2022, 14, 6678. https://doi.org/10.3390/su14116678

Ascic I, Ascic J, Hilletofth P, Pimenta ML, Hilmola O-P. An Evaluation of Critical Capabilities and Improvement Areas for Competitive Manufacturing in a Developed-Country Environment. Sustainability. 2022; 14(11):6678. https://doi.org/10.3390/su14116678

Chicago/Turabian StyleAscic, Ivana, Josip Ascic, Per Hilletofth, Márcio Lopes Pimenta, and Olli-Pekka Hilmola. 2022. "An Evaluation of Critical Capabilities and Improvement Areas for Competitive Manufacturing in a Developed-Country Environment" Sustainability 14, no. 11: 6678. https://doi.org/10.3390/su14116678

APA StyleAscic, I., Ascic, J., Hilletofth, P., Pimenta, M. L., & Hilmola, O.-P. (2022). An Evaluation of Critical Capabilities and Improvement Areas for Competitive Manufacturing in a Developed-Country Environment. Sustainability, 14(11), 6678. https://doi.org/10.3390/su14116678