The Influence of Relational Capital on the Sustainability Risk: Findings from Chinese Non-State-Owned Manufacturing Enterprises

Abstract

:1. Introduction

2. Theoretical Basis and Hypotheses

2.1. Theoretical Basis

2.1.1. Social Capital Theory and Relational Capital

2.1.2. Sustainability Risk and Relational Capital

2.2. Hypotheses

2.2.1. Relational Capital and Sustainability Risk

2.2.2. Enterprise Growth, Relational Capital, and Sustainability Risk

2.2.3. Enterprise Development, Relational Capital, and Sustainability Risk

2.2.4. Marketization, Relational Capital, and Sustainability Risk

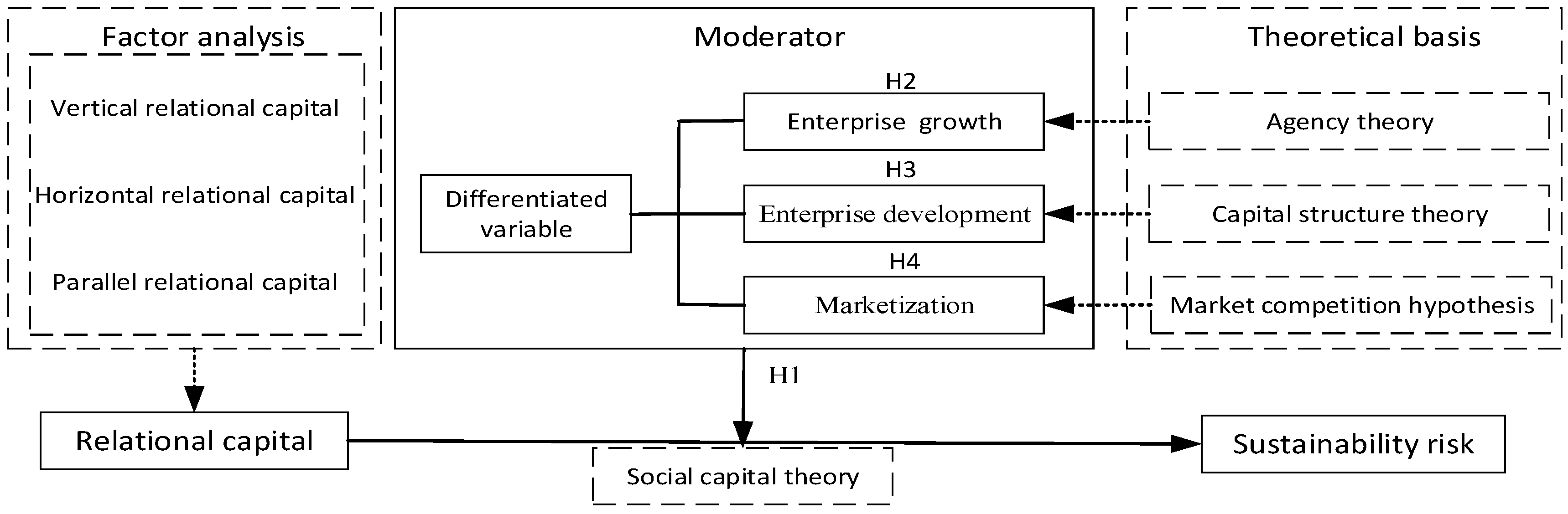

2.3. Theoretical Framework

3. Material and Methods

3.1. Factor Analysis

3.1.1. Variable Measurement

3.1.2. Feasibility Test

3.1.3. Model Construction

3.2. Empirical Analysis

3.2.1. Data Collection

3.2.2. Variable Definition

3.2.3. Hypothetical Model Construction

4. Results

4.1. Descriptive Analysis

4.2. Correlation Analysis

4.3. Regression Analysis

4.4. Robustness Check

5. Discussion

5.1. Empirical Findings

5.2. Research Contribution

6. Conclusions

6.1. Research Summary

6.2. Management Implications

6.3. Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Tian, X.; Zhao, C.; Ge, X. Entrepreneurial traits, relational capital and social enterprise performance: Regulatory effects of cognitive legitimacy. Sustainability 2022, 14, 3336. [Google Scholar] [CrossRef]

- Veronica, H.V.; Revilla, E.; Thomas, Y.C. The dark side of buyer-supplier relationships: A social capital perspective. J. Oper. Manag. 2011, 29, 561–576. [Google Scholar]

- Yan, W.; Schiehll, E.; Muller-Kahle, M.I. Human and relational capital behind the structural power of CEOs in Chinese listed firms. Asia Pac. J. Manag. 2019, 36, 715–743. [Google Scholar] [CrossRef]

- Fang, W.; Cavusgil, S.T. Organizational learning, commitment and joint value creation in interfirm relationships. J. Bus. Res. 2006, 59, 81–89. [Google Scholar]

- Vidot, H.D. Opportunism and unilateral commitment: The moderating effect of relational capital. Manag. Decis. 2006, 44, 737–753. [Google Scholar] [CrossRef]

- Cousins, P.D.; Handfield, R.B.; Lawson, B.; Petersen, K.J. Creating supply chain relational capital: The impact of formal and informal socialization processes. J. Oper. Manag. 2006, 24, 851–863. [Google Scholar] [CrossRef]

- Blatt, R. Tough Love: How communal schemas and contracting practices build relational capital in entrepreneurial teams. Acad. Manag. Rev. 2009, 34, 533–551. [Google Scholar] [CrossRef]

- Cullen, J.B.; Johnson, J.L.; Sakano, T. Success through commitment and trust: The soft side of strategic alliance management. J. World Bus. 2000, 35, 223–240. [Google Scholar] [CrossRef]

- Capello, R.; Faggian, A. Collective learning and relational capital in local innovation processes. Reg. Stud. 2005, 39, 75–87. [Google Scholar] [CrossRef]

- Granovetter, M. Economic action and social structure: The problem of embeddedness. Am. J. Sociol. 1985, 91, 481–510. [Google Scholar] [CrossRef]

- Morgan, B.W. Relationship capital, and the theory of the firm. Int. Adv. Econ. Res. 1996, 2, 197. [Google Scholar] [CrossRef]

- Subramony, M.; Segers, J.; Chadwick, C.; Shyamsunder, A. Leadership development practice bundles and organizational performance: The mediating role of human capital and social capital. J. Bus. Res. 2018, 83, 120–129. [Google Scholar] [CrossRef]

- Kale, P.; Singh, H.; Perlmutter, H. Learning and protection of proprietary assets in strategic alliances: Building relational capital. Strateg. Manag. J. 2000, 21, 217–237. [Google Scholar] [CrossRef]

- Li, E.Y.; Liao, C.H.; Yen, H.R. Co-authorship networks and research impact: A social capital perspective. Res. Policy 2013, 42, 1515–1530. [Google Scholar] [CrossRef]

- Agostini, L.; Nosella, A.; Soranzo, B. Measuring the impact of relational capital on customer performance in the SME B2B sector: The moderating role of absorptive capacity. Bus. Process. Manag. J. 2017, 23, 144–166. [Google Scholar] [CrossRef]

- Inkpen, A.C.; Tsang, E. Social capital, networks, and knowledge transfer. Acad. Manag. Rev. 2005, 30, 146–165. [Google Scholar] [CrossRef] [Green Version]

- Merino, D.G.; Zambrano, L.G.; Castellanos, A.R. Impact of relational capital on business value. J. Inf. Knowl. Manag. 2014, 13, 1450002. [Google Scholar]

- Sambasivan, M.L.; Siew-Phaik, L.; Abidin, M.Z.; Leong, Y.C. Impact of interdependence between supply chain partners on strategic alliance outcomes: Role of relational capital as a mediating construct. Manag. Decis. 2011, 49, 548–569. [Google Scholar] [CrossRef]

- Fang, W.; Yeniyurt, S.; Kim, D.; Cavusgil, S.T. The impact of information technology on supply chain capabilities and firm performance: A resource-based view. Ind. Mark. Manag. 2006, 35, 493–504. [Google Scholar]

- Bao, F.N.; Peng, Z.Y. The influence of corporate relational capital on knowledge transfer based on network capability. Nankai Bus. Rev. 2015, 18, 95–101. [Google Scholar]

- Hammervoll, T. Honeymoons in supply chain relationships. Int. J. Logist. Manag. 2011, 22, 264–279. [Google Scholar] [CrossRef]

- Navarro, J.G.C.; Dewhurst, F.W. Linking shared organizational context and relational capital through unlearning: An initial empirical investigation in SMEs. Learn. Organ. 2006, 13, 49–62. [Google Scholar] [CrossRef]

- Kotabe, M.; Jiang, C.X.; Murray, J.Y. Managerial ties, knowledge acquisition, realized absorptive capacity and new product market performance of emerging multinational companies: A case of China. J. World. Bus. 2011, 46, 166–176. [Google Scholar] [CrossRef]

- Jing, Z.; Justin, T.; Poh, K.W. When does investment in political ties improve firm performance? The contingent effect of innovation activities. Asia Pac. J. Manag. 2015, 32, 363–387. [Google Scholar]

- Lavie, D. The competitive advantage of interconnected firms: An extension of the resource-based view. Acad. Manag. Rev. 2006, 31, 638–658. [Google Scholar] [CrossRef]

- Kaipia, R.; Holmstrom, J.; Smaros, J. Information sharing for sales and operations planning: Contextualized solutions and mechanisms. J. Oper. Manag. 2017, 52, 15–29. [Google Scholar] [CrossRef] [Green Version]

- Fernandez-Gimenez, W. Effects of community-based collaborative group characteristics on social capital. Environ. Manag. 2009, 44, 632–645. [Google Scholar]

- Krysiak, F.C. Risk management as a tool for sustainability. J. Bus. Ethics 2009, 85, 483–492. [Google Scholar] [CrossRef] [Green Version]

- Hofmann, H.; Busse, C.; Bode, C.; Henke, M. Sustainability-related supply chain risks: Conceptualization and management. Bus. Strategy Environ. 2014, 23, 160–172. [Google Scholar] [CrossRef]

- Dyllick, T.; Hockerts, K. Beyond the business case for corporate sustainability. Bus. Strategy Environ. 2002, 11, 130–141. [Google Scholar] [CrossRef]

- Schulte, J.; Villamil, C.; Hallstedt, S.I. Strategic sustainability risk management in product development companies: Key aspects and conceptual approach. Sustainability 2020, 12, 10531. [Google Scholar] [CrossRef]

- Anderson, D.R. The critical importance of sustainability risk management. Risk. Manag. 2006, 53, 66–72. [Google Scholar]

- Giannakis, M.; Papadopoulos, T. Supply chain sustainability: A risk management approach. Int. J. Prod. Econ. 2016, 171, 455–470. [Google Scholar] [CrossRef]

- Altman, E.I. Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. J. Financ. 1968, 23, 589–609. [Google Scholar] [CrossRef]

- Roehrich, J.K.; Grosvold, J.; Hoejmose, S.U. Reputational risks and sustainable supply chain management. Int. J. Oper. Prod. Manag. 2014, 34, 695–719. [Google Scholar] [CrossRef]

- Trujillo-Barrera, A.; Pennings, J.M.; Hofenk, D. Understanding producers’ motives for adopting sustainable practices: The role of expected rewards, risk perception and risk tolerance. Eur. Rev. Agric. Econ. 2016, 43, 359–382. [Google Scholar] [CrossRef] [Green Version]

- Kothari, S.P.; Leone, A.J.; Wasley, C.E. Performance matched discretionary accrual measures. J. Account. Econ. 2005, 39, 163–197. [Google Scholar] [CrossRef]

- Huang, J.; Li, J.; Zhang, P.; Cai, Z.; Wang, X. Symbiotic marketing and trust-related issues: Empirical evidence from an emerging economy. J. Glob. Mark. 2011, 24, 417–432. [Google Scholar] [CrossRef]

- Faccio, M.; Masulis, R.W.; Mcconnell, J.J. Political connections and corporate bailouts. J. Financ. 2006, 61, 2597–2635. [Google Scholar] [CrossRef]

- Fandino, M.; Formiga, N.S.; Rui, M. Organizational social capital, resilience and innovation validation of a theoretical model for specialized workers. J. Strategy Manag. 2019, 12, 137–152. [Google Scholar] [CrossRef]

- Williamson, O.E. Corporate finance and corporate governance. J. Financ. 1988, 43, 567–591. [Google Scholar] [CrossRef]

- Chang, K.H.; Gotcher, D.F. Relationship learning and dyadic knowledge creation in international subcontracting relationships: The supplier’s perspective. Int. J. Technol. Manag. 2008, 41, 55–74. [Google Scholar] [CrossRef]

- Fazzari, S.M.; Hubbard, R.G.; Petersen, B.C. Financing constraints and corporate investment. Brook. Pap. Econ. Act. 1988, 2, 141–195. [Google Scholar] [CrossRef] [Green Version]

- Hayashi, F.; Inoue, T. The relation between firm growth and Q with multiple capital goods: Theory and evidence from panel data on Japanese firms. Econometrica 1991, 59, 731–753. [Google Scholar] [CrossRef]

- Caers, R.; Bois, C.D.; Jegers, M.; Gieter, S.D.; Cooman, R.D.; Pepermans, R. A micro-economic perspective on manager selection in nonprofit organizations. Eur. J. Oper. Res. 2009, 192, 173–197. [Google Scholar] [CrossRef]

- Guth, W.D.; Ginsberg, A. Guest editors’ introduction: Corporate entrepreneurship. Strateg. Manag. J. 2014, 19, 24–25. [Google Scholar]

- Lee, G.; Cho, S.Y.; Arthurs, J.; Lee, E.K. CEO pay inequity, CEO-TMT pay gap and acquisition premiums. J. Bus. Res. 2019, 98, 105–116. [Google Scholar] [CrossRef]

- Agiomirgianakis, G.; Voulgaris, F.; Papadogonas, T. Financial factors affecting profitability and employment growth: The case of Greek manufacturing. Int. J. Financ. Serv. Manag. 2006, 3, 232–242. [Google Scholar] [CrossRef]

- Dittmar, A.; Mahrt-Smith, J.; Servaes, H. International corporate governance and corporate cash holdings. J. Financ. Quant. Anal. 2003, 38, 111–133. [Google Scholar] [CrossRef]

- Jensen, M.C.; Meckling, W. Theory of the firm: Managerial behavior, agency costs, and capital structure. J. Financ. Econ. 1976, 3, 305–360. [Google Scholar] [CrossRef]

- Alchian, A.A. Uncertainty, evolution, and economic theory. J. Political Econ. 1950, 58, 211–221. [Google Scholar] [CrossRef] [Green Version]

- Davatgaran, V.; Saniei, M.; Mortazavi, S.S. Optimal bidding strategy for an energy hub in energy market. Energy 2018, 148, 482–493. [Google Scholar] [CrossRef]

- Treiblmaier, H.; Filzmoser, P. Exploratory factor analysis revisited: How robust methods support the detection of hidden multivariate data structures in IS research. Inf. Manag. 2010, 47, 197–207. [Google Scholar] [CrossRef]

- Altman, E.I.; Haldeman, R.G.; Narayanan, P. ZETATM analysis a new model to identify bankruptcy risk of corporations. J. Bank. Financ. 1977, 1, 29–54. [Google Scholar] [CrossRef]

- Altman, E.I.; Drozdowska, M.I.; Laitinen, E.K.; Suvas, A. Financial distress prediction in an international context: A review and empirical analysis of Altman’s Z-score model. J. Int. Financ. Manag. Account. 2017, 28, 131–171. [Google Scholar] [CrossRef]

- Armanios, D.E.; Eesley, C.E.; Li, J.; Eisenhardt, K.M. How entrepreneurs leverage institutional intermediaries in emerging economies to acquire public resources. Strateg. Manag. J. 2017, 38, 1373–1390. [Google Scholar] [CrossRef]

- Lee, L.S.; Zhong, W. Opportunism, identification asymmetry, and firm performance in Chinese interorganizational relationships. Manag. Organ. Rev. 2020, 16, 825–865. [Google Scholar] [CrossRef]

- Ansoff, H.I. Strategic management of technology. J. Bus. Strategy 1987, 7, 28–39. [Google Scholar] [CrossRef]

| Type | Interpretation | Symbol | Assignment |

|---|---|---|---|

| Vertical relational capital | Customer relationship | X1 | Expressed as accounts receivable turnover |

| Supplier relationship | X2 | Expressed as accounts payable turnover | |

| Horizontal relational capital | Concurrence relationship | X3 | Expressed by the ratio of related party transaction amount to main business income |

| Other inter-enterprise relationship | X4 | Expressed by the proportion of senior executives working part-time in other companies | |

| Parallel relational capital | Bank-enterprise relationship | X5 | Expressed by the ratio of short-term Borrowings to current assets |

| External reputation | X6 | Expressed by the natural logarithm of intangible asset items |

| KMO Sampling Suitability Quantity | 0.562 | |

|---|---|---|

| Bartlett sphericity test | Approximate χ2 | 871.550 |

| df | 15 | |

| Significance | 0.000 | |

| Initial Eigenvalues | Extract the Load Sum of Squares | Rotational Load Sum of Squares | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Total | Percent Variance | Cumulative | Total | Percent Variance | Cumulative | Total | Percent Variance | Cumulative | |

| 1 | 1.432 | 23.870 | 23.870% | 1.293 | 21.552 | 21.552% | 1.293 | 21.548 | 21.548% |

| 2 | 1.153 | 19.216 | 43.086% | 1.037 | 17.278 | 38.830% | 1.033 | 17.212 | 38.760% |

| 3 | 0.972 | 17.204 | 60.290% | 1.009 | 16.817 | 55.647% | 1.013 | 16.888 | 55.647% |

| 4 | 0.870 | 14.498 | 73.788% | ||||||

| 5 | 0.838 | 13.959 | 87.747% | ||||||

| 6 | 0.735 | 12.253 | 100.000% | ||||||

| Type | Variable | Symbol | Definition and Formula |

|---|---|---|---|

| Explained variable | Sustainability risk | Z-score | 1.2 × Net Working Capital/Total Assets + 1.4 × Retained Earnings/Total Assets + 3.3 × EBIT/Total Assets + 0.6 × Stock Market Value/Total Liabilities + 1.0 × Sales Revenue/Total Assets |

| Explanatory variable | Relational capital | Capital | Equation (1) |

| Moderating variables | Enterprise growth | Tobin Q | (Market Value + Current Liabilities + Noncurrent Liabilities)/Total Assets |

| Enterprise development | QR | (Current Assets–Inventory)/Current Liabilities | |

| Marketization | MI | Marketization Index Report by Provinces in China | |

| Control variables | Equity concentration | Top 10 | The shareholding ratio of the top 10 shareholders |

| Age | Age | Add 1 to the listing year, take the natural logarithm | |

| Size | Size | Natural logarithm of Total Assets at the end of the year | |

| Leverage level | Lev | Total Assets/Total Liabilities | |

| Cash ratio | CR | Cash Flow/Total Liabilities |

| Mean | Median | Standard Deviation | Minimum | Maximum | |

|---|---|---|---|---|---|

| Z-score | 5.025 | 4.009 | 3.405 | 0.891 | 20.486 |

| Capital | 6.624 | 4.619 | 10.089 | 3.262 | 114.759 |

| Tobin Q | 1.977 | 1.667 | 1.002 | 0.832 | 6.373 |

| QR | 1.446 | 1.196 | 0.894 | 0.230 | 5.168 |

| MI | 9.131 | 9.680 | 1.587 | 4.150 | 10.960 |

| Top 10 | 0.579 | 0.586 | 0.138 | 0.266 | 0.914 |

| Age | 2.840 | 2.890 | 0.296 | 2.079 | 3.497 |

| Size | 22.369 | 22.277 | 1.013 | 20.584 | 26.434 |

| Lev | 0.414 | 0.409 | 0.152 | 0.117 | 0.868 |

| CR | 0.462 | 0.313 | 0.473 | 0.033 | 2.670 |

| Z-Score | Capital | Tobin Q | QR | MI | Top 10 | Age | Size | Lev | CR | |

|---|---|---|---|---|---|---|---|---|---|---|

| Z-score | 1 | |||||||||

| Capital | 0.044 * | 1 | ||||||||

| Tobin Q | 0.446 ** | –0.002 | 1 | |||||||

| QR | 0.675 *** | –0.072 *** | 0.255 *** | 1 | ||||||

| MI | –0.003 | –0.069 ** | –0.040 * | 0.049 ** | 1 | |||||

| Top 10 | 0.079 ** | 0.063 ** | 0.013 | 0.058 ** | 0.121 *** | 1 | ||||

| Age | –0.045 * | 0.036 | –0.101 *** | –0.029 | –0.021 | –0.062 ** | 1 | |||

| Size | –0.386 *** | 0.144 *** | –0.372 *** | –0.288 *** | –0.093 *** | –0.042 * | 0.121 ** | 1 | ||

| Lev | –0.486 *** | 0.026 | –0.285 *** | –0.701 *** | –0.026 | –0.085 *** | 0.042 * | 0.465 *** | 1 | |

| CR | 0.470 *** | 0.017 | 0.265 *** | 0.775 *** | –0.015 | 0.047 * | –0.008 | –0.206 *** | –0.543 *** | 1 |

| Model 1a | Model 2a | Model 3a | Model 4a | Model 1b | Model 2b | Model 3b | Model 4b | |

|---|---|---|---|---|---|---|---|---|

| Z-Score | Z-Score | Z-Score | Z-Score | Lagging Z-Score | Lagging Z-Score | Lagging Z-Score | Lagging Z-Score | |

| Capital | 0.067 *** | 0.039 *** | 0.131 *** | 0.077 *** | 0.058 ** | 0.036 ** | 0.117 *** | 0.076 *** |

| Tobin Q | 0.596 *** | 0.452 ** | ||||||

| Capital × Tobin Q | 0.022 ** | 0.030 * | ||||||

| QR | 0.336 *** | 0.230 *** | ||||||

| Capital × QR | 0.087 *** | 0.090 *** | ||||||

| MI | –0.020 | 0.013 * | ||||||

| Capital × MI | 0.040 *** | 0.056 ** | ||||||

| Top 10 | 0.047 ** | 0.018 * | 0.049 ** | 0.048 ** | 0.096 *** | 0.073 *** | 0.096 *** | 0.096 *** |

| Age | –0.010 | 0.025 ** | –0.009 | –0.012 | 0.019 | 0.045 ** | 0.019 | 0.116 |

| Size | –0.112 *** | 0.075 *** | –0.122 *** | –0.115 *** | –0.117 *** | 0.025 | –0.124 *** | –0.116 *** |

| Lev | –0.480 *** | –0.456 *** | –0.346 *** | –0.477 *** | –0.375 *** | –0.357 ** | –0.285 *** | –0.372 *** |

| CR | 0.285 *** | 0.178 *** | 0.090 *** | 0.283 *** | 0.267 *** | 0.184 *** | –0131 *** | 0.266 *** |

| F | 340.891 | 1086.346 | 293.710 | 257.230 | 192.064 | 286.820 | 155.639 | 145.777 |

| R2 | 0.541 | 0.834 | 0.576 | 0.541 | 0.399 | 0.570 | 0.418 | 0.403 |

| Adjusted R2 | 0.540 | 0.833 | 0.574 | 0.543 | 0.397 | 0.568 | 0.416 | 0.400 |

| p | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| Model 1c | Model 2c | Model 3c | Model 4c | Model 1c | Model 2d | Model 3d | Model 4d | |

|---|---|---|---|---|---|---|---|---|

| Z-Score | Z-Score | Z-Score | Z-Score | Z-Score | Z-Score | Z-Score | Z-Score | |

| Capital | 0.067 *** | 0.039 ** | 0.126 *** | 0.077 *** | 0.063 *** | 0.039 ** | 0.087 *** | 0.075 *** |

| Tobin Q | 0.596 *** | 0.596 *** | ||||||

| Capital × Tobin Q | 0.022 ** | 0.022 ** | ||||||

| QR | 0.330 *** | 0.336 *** | ||||||

| Capital × QR | 0.088 *** | 0.131 *** | ||||||

| MI | −0.020 | −0.021 | ||||||

| Capital × MI | 0.040 ** | 0.043 ** | ||||||

| Top 10 (Top 1) | 0.047 ** | 0.026 ** | 0.015 | 0.048 ** | 0.016 | 0.026 ** | 0.049 ** | 0.020 |

| Age | −0.010 | 0.027 ** | −0.007 | −0.012 | −0.009 | 0.027 ** | −0.009 | −0.011 |

| Size | −0.112 *** | 0.076 *** | −0.119 *** | −0.115 *** | −0.111 *** | 0.075 *** | −0.122 *** | −0.113 *** |

| Lev | −0.480 *** | −0.454 *** | −0.349 *** | −0.477 *** | −0.480 *** | −0.456 *** | −0.346 *** | −0.477 *** |

| CR | 0.285 *** | 0.178 *** | 0.095 *** | 0.283 *** | 0.286 *** | 0.178 *** | 0.090 *** | 0.284 *** |

| F | 340.891 | 1087.562 | 0.572 | 0.541 | 337.490 | 1086.346 | 0.576 | 0.543 |

| R2 | 0.541 | 0.834 | 0.570 | 0.539 | 0.539 | 0.834 | 0.574 | 0.541 |

| Adjusted R2 | 0.540 | 0.833 | 289.658 | 254.917 | 0.537 | 0.833 | 293.710 | 257.230 |

| p | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, D.; Wang, H.; Wang, W. The Influence of Relational Capital on the Sustainability Risk: Findings from Chinese Non-State-Owned Manufacturing Enterprises. Sustainability 2022, 14, 6904. https://doi.org/10.3390/su14116904

Zhang D, Wang H, Wang W. The Influence of Relational Capital on the Sustainability Risk: Findings from Chinese Non-State-Owned Manufacturing Enterprises. Sustainability. 2022; 14(11):6904. https://doi.org/10.3390/su14116904

Chicago/Turabian StyleZhang, Dongsheng, Hongwei Wang, and Wenfu Wang. 2022. "The Influence of Relational Capital on the Sustainability Risk: Findings from Chinese Non-State-Owned Manufacturing Enterprises" Sustainability 14, no. 11: 6904. https://doi.org/10.3390/su14116904

APA StyleZhang, D., Wang, H., & Wang, W. (2022). The Influence of Relational Capital on the Sustainability Risk: Findings from Chinese Non-State-Owned Manufacturing Enterprises. Sustainability, 14(11), 6904. https://doi.org/10.3390/su14116904