Sustainable Development of Economic Growth, Energy-Intensive Industries and Energy Consumption: Empirical Evidence from China’s Provinces

Abstract

:1. Introduction

2. Transmission Mechanism of Economic Growth, Energy-Intensive Industries’ Development and Energy Consumption

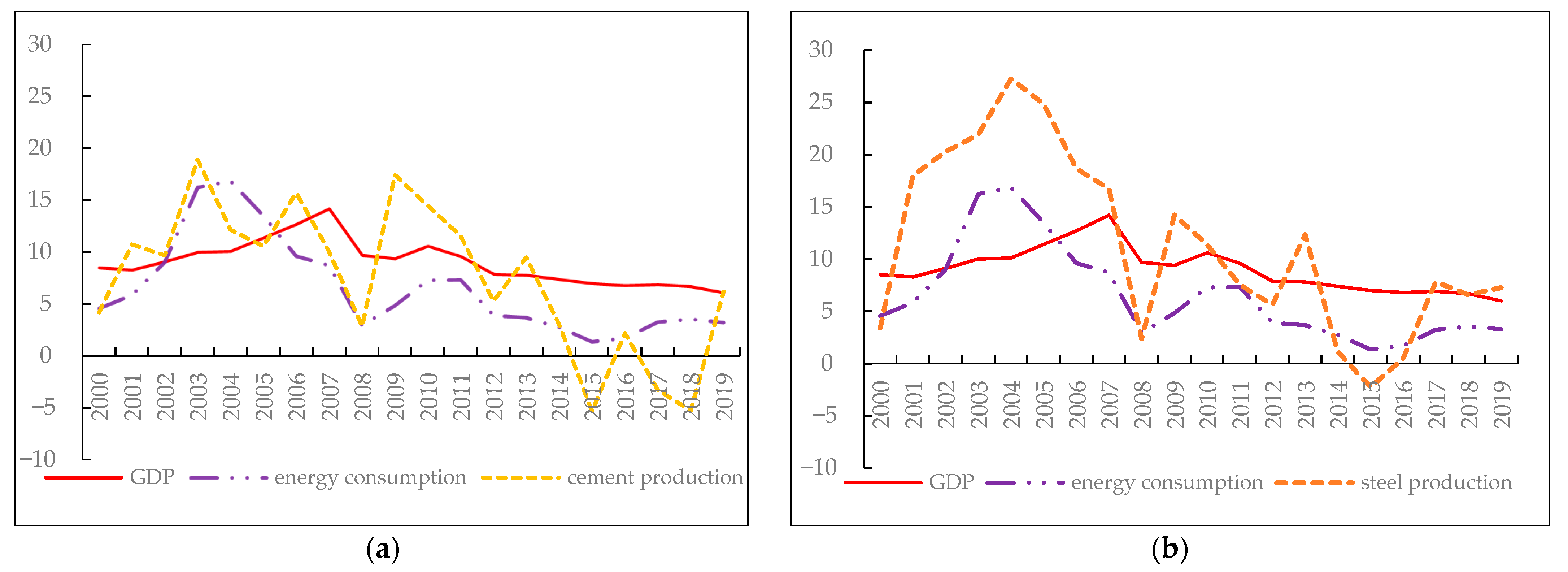

2.1. Factual Features

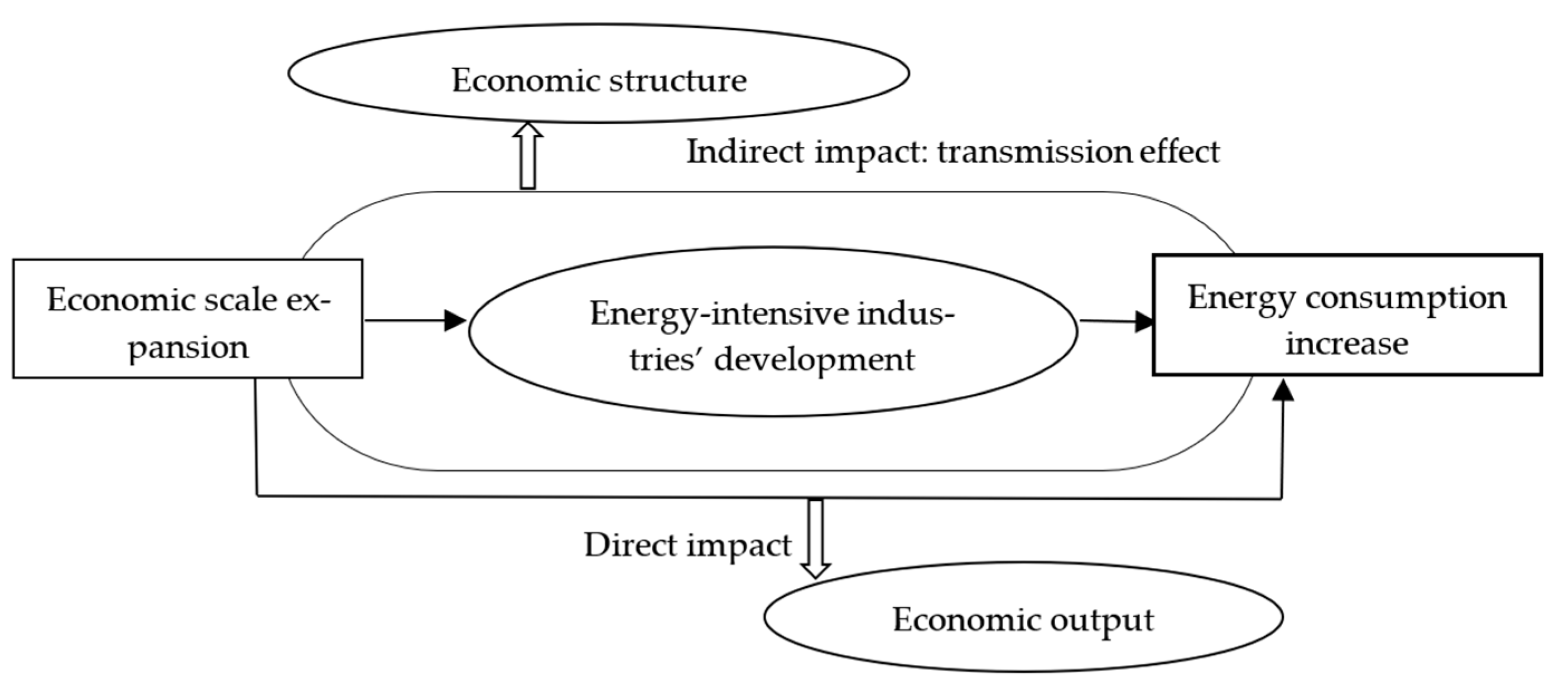

2.2. Transmission Mechanism

3. Methods, Variables and Data

3.1. Methods

3.2. Variables

3.2.1. Dependent Variable and Core Independent Variables

3.2.2. Control Variables

- Energy price (). Energy price was one of the important factors affecting energy demand [73]. Considering that the total amount of energy includes coal, oil and other varieties, this paper adopted the fuel and power purchasing price index in the industrial producers purchasing price index to measure energy prices. Referring to the practice of Kenneth et al. [31], take 2000 as 1, and multiply the indexes over the years to obtain the energy price data of 29 provinces in the corresponding years.

- Technological progress (). R&D investment and independent R & D contribute to the decline of energy intensity [10,35]. However, if the technological advance is not green-biased but of production scale expansion, it will stimulate an increase in energy demand [39]. This paper adopts the measure of science and technology innovation, which specifically uses the ratio of provincial R&D expenditure to GDP, namely the measure of science and technology investment intensity.

- Industrial structure (). Industrial structure adjustment has a major impact on energy demand [17]. In order to fully describe the impact of economic restructuring on China’s energy consumption, the proportion of the tertiary industry is introduced into the model as a control variable. Compared with the primary and secondary industries, the tertiary industry is relatively “cleaner” and thus contributes to the reduction in energy consumption. This paper adopts the measurement of the share of the tertiary industry’s added value in GDP.

- Urbanization level (). Energy demand has rigid growth characteristics in the rapid urbanization stage [74]. At present, China’s urbanization level is still in the stage of accelerated development. Therefore, urbanization is a factor that cannot be ignored in analyzing China’s energy demand [75]. This paper adopts the proportion of the urban resident population to the regional resident population to measure the urbanization level.

- Level of opening-up (). In theory, trade liberalization can bring knowledge and technology spillovers to the host country, thereby improving energy efficiency and reducing energy demand [41]. However, due to the looser environmental standards of the host country, may also lead to a “pollution paradise effect” [40]. Moreover, related research showed that China’s foreign trade affected its energy intensity mainly through exports, and imports had no significant impact [1]. Therefore, this paper uses the proportion of export trade to GDP to measure the level of opening-up.

3.3. Data Sources and Processing

3.4. Descriptive Statistical Analysis

4. Results and Discussion

4.1. Full-Sample Analysis

4.1.1. Direct Effect of Economic Growth on Energy Consumption

4.1.2. Indirect Effect of Economic Growth on Energy Consumption—Transmission Effect of Energy-Intensive Industries’ Development

4.2. Robustness Test Based on Different Estimation Methods

4.3. Regional Analysis

5. Conclusions and Enlightenment

5.1. Conclusions

5.2. Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Chen, S.S.; Zhang, H.Y.; Wang, S.H. Trade openness, economic growth, and energy intensity in China. Technol. Forecast. Soc. Change 2022, 179, 121608. [Google Scholar] [CrossRef]

- Kahrl, F.; Roland-Holst, D.; Zilberman, D. Past as prologue? Understanding energy use in post-2002 China. Energy Econ. 2013, 36, 759–771. [Google Scholar] [CrossRef]

- Liao, H.; Fan, Y.; Wei, Y.M. What induced China’s energy intensity to fluctuate: 1997–2006? Energy Policy 2007, 35, 4640–4649. [Google Scholar] [CrossRef]

- Lin, B.Q.; Chen, G.Y. Energy efficiency and conservation in China’s manufacturing industry. J. Clean. Prod. 2018, 174, 492–501. [Google Scholar] [CrossRef]

- Meng, G.F.; Liu, H.X.; Li, J.H.; Sun, C.W. Determination of driving forces for China’s energy consumption and regional disparities using a hybrid structural decomposition analysis. Energy 2022, 239, 122191. [Google Scholar] [CrossRef]

- Li, Y.; Sun, L.Y.; Feng, T.W.; Zhu, C.Y. How to reduce energy intensity in China: A regional comparison perspective. Energy Policy 2013, 61, 513–522. [Google Scholar] [CrossRef]

- Appiah, M.O. Investigating the multivariate Granger causality between energy consumption, economic growth and CO2 emissions in Ghana. Energy Policy 2018, 112, 198–208. [Google Scholar] [CrossRef]

- Chen, L.; Li, W.L.; Yuan, K.B.; Zhang, X.Q. Can informal environmental regulation promote industrial structure upgrading? Evidence from China. Appl. Econ. 2022, 54, 2161–2180. [Google Scholar] [CrossRef]

- Wei, C.; Zheng, X.Y. A new perspective on raising energy efficiency: A test based on market segmentation. Soc. Sci. China 2020, 41, 59–78. [Google Scholar]

- Dong, K.Y.; Sun, R.J.; Hochman, G.; Li, H. Energy intensity and energy conservation potential in China: A regional comparison perspective. Energy 2018, 155, 782–795. [Google Scholar] [CrossRef]

- Kraft, J.; Kraft, A. On the relationship between energy and GNP. J. Energy Dev. 1978, 3, 401–403. [Google Scholar]

- Yu Eden, S.H.; Jin, J.C. Cointegration tests of energy consumption, income, and employment. Resour. Energy 1992, 14, 259–266. [Google Scholar]

- Yuan, J.H.; Kang, J.G.; Zhao, C.H.; Zhao, G.H. Energy consumption and economic growth: Evidence from China at both aggregated and disaggregated levels. Energy Econ. 2008, 30, 3077–3094. [Google Scholar] [CrossRef]

- Wang, S.S.; Zhou, D.Q.; Zhou, P.; Wang, Q.W. CO2 emissions, energy consumption and economic growth in China: A panel data analysis. Energy Policy 2011, 39, 4870–4875. [Google Scholar] [CrossRef]

- Li, F.; Suo, C.D.; Li, X.; Quan, X.L.; Wang, Z.Y. Energy consumption-economic growth relationship and carbon dioxide emissions in China. Energy Policy 2011, 39, 568–574. [Google Scholar]

- Adom, P.K.; Bekoe, W.; Akoena, S.K.K. Modelling aggregate domestic electricity demand in Ghana: An autoregressive distributed lag bounds cointegration approach. Energy Policy 2012, 42, 530–537. [Google Scholar] [CrossRef]

- Fan, Y.; Xia, Y. Exploring energy consumption and demand in China. Energy 2012, 40, 23–30. [Google Scholar] [CrossRef]

- Mi, Z.F.; Pan, S.Y.; Yu, H.; Wei, Y.M. Potential impacts of industrial structure on energy consumption and CO2 emission: A case study of Beijing. J. Clean. Prod. 2015, 103, 455–462. [Google Scholar] [CrossRef] [Green Version]

- Hofman, B.; Labar, K. Structural change and energy use: Evidence from China’s provinces. World Bank China Work. Pap. Ser. 2007. [Google Scholar] [CrossRef]

- Chan, H.L.; Lee, S.K. Forecasting the demand for energy in China. Energy J. 1996, 1, 19–30. [Google Scholar]

- Chai, J.; Guo, J.E.; Wang, S.Y.; Lai, K.K. Why does energy intensity fluctuate in China? Energy Policy 2009, 37, 5717–5731. [Google Scholar] [CrossRef]

- Zheng, X.Y.; Wu, S.M.; Li, F.H. Changes in the economic structure and trends in China’s future energy demands. Soc. Sci. China 2021, 42, 116–137. [Google Scholar]

- Liou, H.M. Policies and legislation driving Taiwan’s development of renewable energy. Renew. Sustain. Energy Rev. 2010, 14, 1763–1781. [Google Scholar] [CrossRef]

- Uchiyama, Y.H. Present efforts of saving energy and future energy demand/supply in Japan. Energy Convers. Manag. 2002, 43, 1123–1131. [Google Scholar] [CrossRef]

- Tae, Y.J.; Tae, S.P. Structural change of the manufacturing sector in Korea: Measurement of real energy intensity and CO2 emissions. Mitig. Adapt. Strateg. Glob. Change 2000, 5, 221–238. [Google Scholar]

- Mukherjee, K. Energy use efficiency in U.S. manufacturing: A nonparametric analysis. Energy Econ. 2008, 30, 76–96. [Google Scholar] [CrossRef]

- Carmona, M.; Feria, J.; Golpe, A.A.; Iglesias, J. Energy consumption in the US reconsidered. Evidence across sources and economic sectors. Renew. Sustain. Energy Rev. 2017, 77, 1055–1068. [Google Scholar] [CrossRef]

- Cheng, B.S. Causality between energy consumption and economic growth in India: An application of cointegration and error-correction modeling. Indian Econ. Rev. 1999, 34, 39–49. [Google Scholar]

- Lee, C.C. Energy consumption and GDP in developing countries: A cointegrated panel analysis. Energy Econ. 2005, 27, 415–427. [Google Scholar] [CrossRef]

- Tiwari, A.K.; Eapen, L.M.; Nair, S.R. Electricity consumption and economic growth at the state and sectoral level in India: Evidence using heterogeneous panel data methods. Energy Econ. 2021, 94, 105064. [Google Scholar] [CrossRef]

- Kenneth, B.; Medlock, I.; Ronald, S. Economic development and end-use energy demand. Energy J. 2001, 22, 77–105. [Google Scholar]

- Amusa, H.; Amusa, K.; Mabugu, R. Aggregate demand for electricity in South Africa: An analysis using the bounds testing approach to cointegration. Energy Policy 2009, 37, 4167–4175. [Google Scholar] [CrossRef]

- Song, F.; Zheng, X.Y. What drives the change in China’s energy intensity: Combining decomposition analysis and econometric analysis at the provincial level. Energy Policy 2012, 51, 445–453. [Google Scholar] [CrossRef]

- Alam, M.M.; Murad, M.W. The impacts of economic growth, trade openness and technological progress on renewable energy use in organization for Economic Co-operation and Development countries. Renew. Energy 2020, 145, 382–390. [Google Scholar] [CrossRef]

- Huang, J.B.; Du, D.; Tao, Q.Z. An analysis of technological factors and energy intensity in China. Energy Policy 2017, 109, 1–9. [Google Scholar] [CrossRef]

- Lin, B.Q.; Zhu, J.P. Energy and carbon intensity in China during the urbanization and industrialization process: A panel VAR approach. J. Clean. Prod. 2017, 168, 780–790. [Google Scholar] [CrossRef]

- Liu, Y.B. Exploring the relationship between urbanization and energy consumption in China using ARDL (autoregressive distributed lag) and FDM (factor decomposition model). Energy 2009, 34, 1846–1854. [Google Scholar] [CrossRef]

- Sharif Hossain, M. Panel estimation for CO2 emissions, energy consumption, economic growth, trade openness and urbanization of newly industrialized countries. Energy Policy 2011, 39, 6991–6999. [Google Scholar] [CrossRef]

- Shahbaz, M.; Chaudhary, A.R.; Ozturk, I. Does urbanization cause increasing energy demand in Pakistan? Empirical evidence from STIRPAT model. Energy 2017, 122, 83–93. [Google Scholar] [CrossRef] [Green Version]

- Zheng, Y.M.; Qi, J.H.; Chen, X.L. The effect of increasing exports on industrial energy intensity in China. Energy Policy 2011, 39, 2688–2698. [Google Scholar] [CrossRef]

- Sbia, R.; Shahbaz, M.; Hamdi, H. A contribution of foreign direct investment, clean energy, trade openness, carbon emissions and economic growth to energy demand in UAE. Econ. Modell. 2014, 36, 191–197. [Google Scholar] [CrossRef] [Green Version]

- Destek, M.A.; Sinha, A. Renewable, non-renewable energy consumption, economic growth, trade openness and ecological footprint: Evidence from organization for Economic Co-operation and Development countries. J. Clean. Prod. 2020, 242, 118537. [Google Scholar] [CrossRef]

- Shiu, A.; Lam, P.L. Electricity consumption and economic growth in China. Energy Policy 2004, 32, 47–54. [Google Scholar] [CrossRef]

- Boontome, P.; Therdyothin, A.; Chontanawat, J. Investigating the causal relationship between non-renewable and renewable energy consumption, CO2 emissions and economic growth in Thailand. Energy Proc. 2017, 138, 925–930. [Google Scholar] [CrossRef]

- Masih, A.M.M.; Masih, R. Energy consumption, real income and temporal causality: Results from a multi-country study based on cointegration and error-correction modelling techniques. Energy Econ. 1996, 18, 165–183. [Google Scholar] [CrossRef]

- Ozturk, I.; Aslan, A.; Kalyoncu, H. Energy consumption and economic growth relationship: Evidence from panel data for low and middle income countries. Energy Policy 2010, 38, 4422–4428. [Google Scholar] [CrossRef]

- Coers, R.; Sanders, M. The energy–GDP nexus; addressing an old question with new methods. Energy Econ. 2013, 36, 708–715. [Google Scholar] [CrossRef] [Green Version]

- Ben Jebli, M.; Ben Youssef, S. The environmental Kuznets curve, economic growth, renewable and non-renewable energy, and trade in Tunisia. Renew. Sustain. Energy Rev. 2015, 47, 173–185. [Google Scholar] [CrossRef] [Green Version]

- Fang, Z.; Chang, Y.H. Energy, human capital and economic growth in Asia Pacific countries—Evidence from a panel cointegration and causality analysis. Energy Econ. 2016, 56, 177–184. [Google Scholar] [CrossRef]

- Aslan, A. The causal relationship between biomass energy use and economic growth in the United States. Renew. Sustain. Energy Rev. 2016, 57, 362–366. [Google Scholar] [CrossRef]

- Bhattacharya, M.; Paramati, S.R.; Ozturk, I.; Bhattacharya, S. The effect of renewable energy consumption on economic growth: Evidence from top 38 countries. Appl. Energy 2016, 162, 733–741. [Google Scholar] [CrossRef]

- Salim, R.H.; Rafiq, S. Why do some emerging economies proactively accelerate the adoption of renewable energy? Energy Econ. 2012, 34, 1051–1057. [Google Scholar] [CrossRef]

- Lin, B.Q.; Moubarak, M. Renewable energy consumption–Economic growth nexus for China. Renew. Sustain. Energy Rev. 2014, 40, 111–117. [Google Scholar] [CrossRef]

- Kahia, M.; Aïssa, M.S.B.; Lanouar, C. Renewable and non-renewable energy use-economic growth nexus: The case of MENA net oil importing countries. Renew. Sustain. Energy Rev. 2017, 71, 127–140. [Google Scholar] [CrossRef]

- Alsaleh, M.; Abdul-Rahim, A.S. Bioenergy consumption and economic growth in the EU-28 region: Evidence from a panel cointegration model. GeoJournal 2020, 86, 1245–1260. [Google Scholar] [CrossRef]

- Justice, G.; Seth, P.; George, N.; Philip, S.; Hayford, I.S. Do globalization and economic development promote renewable energy use in Ghana? Int. J. Adv. Eng. Res. Sci. 2021, 8, 109–117. [Google Scholar] [CrossRef]

- Akif Destek, M.A.; Aslan, A. Renewable and non-renewable energy consumption and economic growth in emerging economies: Evidence from bootstrap panel causality. Renew. Energy 2017, 111, 757–763. [Google Scholar] [CrossRef]

- Alper, A.; Oguz, O. The role of renewable energy consumption in economic growth: Evidence from asymmetric causality. Renew. Sustain. Energy Rev. 2016, 60, 953–959. [Google Scholar] [CrossRef]

- Mutascu, M. A bootstrap panel Granger causality analysis of energy consumption and economic growth in the G7 countries. Renew. Sustain. Energy Rev. 2016, 63, 166–171. [Google Scholar] [CrossRef]

- Chang, T.Y.; Chu, H.P.; Chen, W.Y. Energy consumption and economic growth in 12 Asian countries: Panel data analysis. Appl. Econ. Lett. 2013, 20, 282–287. [Google Scholar] [CrossRef]

- Wang, J.; Zhang, S.L.; Zhang, Q.J. The relationship of renewable energy consumption to financial development and economic growth in China. Renew. Energy 2021, 170, 897–904. [Google Scholar] [CrossRef]

- Kahsai, M.S.; Nondo, C.L.; Schaeffer, P.V.; Gebremedhin, T.G. Income level and the energy consumption–GDP nexus: Evidence from Sub-Saharan Africa. Energy Econ. 2012, 34, 739–746. [Google Scholar] [CrossRef]

- Dogan, E. Analyzing the linkage between renewable and non-renewable energy consumption and economic growth by considering structural break in time-series data. Renew. Energy 2016, 99, 1126–1136. [Google Scholar] [CrossRef]

- Costantini, V.; Martini, C. The causality between energy consumption and economic growth: A multi-sectoral analysis using non-stationary cointegrated panel data. Energy Econ. 2010, 32, 591–603. [Google Scholar] [CrossRef] [Green Version]

- Greening, L.A.; Gale, B.; Joseph, M.R. Modeling of industrial energy consumption: An introduction and context. Energy Econ. 2007, 29, 599–608. [Google Scholar] [CrossRef]

- Zhang, C.G.; Yan, L.Y. Panel estimation for urbanization, energy consumption and CO2 emissions: A regional analysis in China. Energy Policy 2012, 49, 488–498. [Google Scholar] [CrossRef]

- Wang, Q.; Wu, S.D.; Zeng, Y.E.; Wu, B.W. Exploring the relationship between urbanization, energy consumption, and CO2 emissions in different provinces of China. Renew. Sustain. Energy Rev. 2016, 54, 1563–1579. [Google Scholar] [CrossRef]

- Lin, B.Q.; Xie, X. Energy conservation potential in China’s petroleum refining industry: Evidence and policy implications. Energy Convers. Manag. 2015, 91, 377–386. [Google Scholar] [CrossRef]

- Yue, Q.; Chai, X.C.; Zhang, Y.J.; Wang, Q.; Wang, H.M.; Zhao, F.; Ji, W.; Lu, Y.Q. Analysis of iron and steel production paths on the energy demand and carbon emission in China’s iron and steel industry. Environ. Dev. Sustain. 2022, prepublish. [Google Scholar] [CrossRef]

- Dong, K.Y.; Hochman, G.; Zhang, Y.Q.; Sun, R.J.; Li, H.; Liao, H. CO2 emissions, economic and population growth, and renewable energy: Empirical evidence across regions. Energy Econ. 2018, 75, 180–192. [Google Scholar] [CrossRef]

- Bilgen, S. Structure and environmental impact of global energy consumption. Renew. Sustain. Energy Rev. 2014, 38, 890–902. [Google Scholar] [CrossRef]

- Zhao, D.Y.; Ma, Y.Y.; Lin, H.L. Using the Entropy and TOPSIS Models to Evaluate Sustainable Development of Islands: A Case in China. Sustainability 2022, 14, 3707. [Google Scholar] [CrossRef]

- Kaufmann, R.K. The effect of expected energy prices on energy demand: Implications for energy conservation and carbon taxes. Resour. Energy Econ. 1994, 16, 167–188. [Google Scholar] [CrossRef]

- Lin, B.Q.; Ouyang, X.L. Energy demand in China: Comparison of characteristics between the US and China in rapid urbanization stage. Energy Convers. Manag. 2014, 79, 128–139. [Google Scholar] [CrossRef]

- Jiang, Z.J.; Lin, B.Q. China’s energy demand and its characteristics in the industrialization and urbanization process: A reply. Energy Policy 2013, 60, 538–585. [Google Scholar] [CrossRef]

- Vo, X.V. Net private capital flows and economic growth—The case of emerging Asian economics. Appl. Econ. 2010, 42, 3135–3146. [Google Scholar] [CrossRef]

- Ju, K.Y.; Su, B.; Zhou, D.Q.; Wu, J.M. Does energy-price regulation benefit China’s economy and environment? Evidence from energy-price distortions. Energy Policy 2017, 105, 108–119. [Google Scholar] [CrossRef]

- Yan, H.J. Provincial energy intensity in China: The role of urbanization. Energy Policy 2015, 86, 635–650. [Google Scholar] [CrossRef]

- Jones, D.W. How urbanization affects energy-use in developing countries. Energy Policy 1991, 19, 621–630. [Google Scholar] [CrossRef]

- Ma, B. Does urbanization affect energy intensities across provinces in China? Long-run elasticities estimation using dynamic panels with heterogeneous slopes. Energy Econ. 2015, 49, 390–401. [Google Scholar] [CrossRef]

- Lin, B.Q.; Zhu, J.P. Impact of China’s new-type urbanization on energy intensity: A city-level analysis. Energy Econ. 2021, 99, 105292. [Google Scholar] [CrossRef]

- Zhong, K.Y. Does the digital finance revolution validate the Environmental Kuznets Curve? Empirical findings from China. PLoS ONE 2022, 17, e0257498. [Google Scholar] [CrossRef] [PubMed]

- Zhong, K.; Li, C.; Wang, Q. Evaluation of Bank Innovation Efficiency with Data Envelopment Analysis: From the Perspective of Uncovering the Black Box between Input and Output. Mathematics 2021, 9, 3318. [Google Scholar] [CrossRef]

| Variable | Obs | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| (lntons of standrad coal) | 580 | 0.9337 | 0.5655 | −0.6469 | 2.3983 |

| (lnRMB yuan) | 580 | 10.1347 | 0.8602 | 7.9226 | 12.0090 |

| 580 | 0.1488 | 0.1081 | 0.0104 | 0.5531 | |

| (%) | 580 | 2.0525 | 0.7396 | 0.9208 | 5.5135 |

| (%) | 580 | 42.8468 | 9.0944 | 28.6000 | 83.5000 |

| (%) | 580 | 1.4041 | 1.0707 | 0.2012 | 6.3147 |

| (%) | 580 | 50.9173 | 15.4096 | 23.2000 | 86.9000 |

| (%) | 580 | 15.7050 | 18.0142 | 0.6811 | 90.5325 |

| Variable | (1) | (2) | (3) |

|---|---|---|---|

| 0.4220 *** (17.63) | 0.3485 *** (16.85) | 0.0905 *** (28.09) | |

| 1.2138 *** (14.30) | |||

| −0.0133 (−0.94) | −0.0131 (−1.09) | ||

| −0.0099 *** (−8.12) | −0.0075 *** (−7.54) | ||

| −0.0287 (−1.58) | −0.0094 (−0.61) | ||

| 0.0077 *** (3.72) | 0.0019 (1.07) | ||

| 0.0019 ** (2.24) | 0.0020 *** (2.80) | ||

| C | — | — | — |

| N | 522 | 522 | 522 |

| Adj.R2 | 0.8990 | 0.9283 | 0.6138 |

| F | 719.81 *** | 893.46 *** | 787.23 *** |

| Under identification test | 459.594 *** | 458.528 *** | 489.781 *** |

| Weak identification test | 3343.12 *** | 3225.653 *** | 37,000 *** |

| Over identification test | 8.858 *** | 46.239 *** | 7.224 *** |

| TSLS | TW-FE | |||

|---|---|---|---|---|

| Relative Impact (%) | Relative Impact (%) | |||

| Direct effect | 0.3485 | 76.04 | 0.3005 | 58.40 |

| Indirect effect | 0.1098 | 23.96 | 0.2141 | 41.60 |

| Total effects | 0.4583 | 100 | 0.5146 | 100 |

| Cement | Plate Glass | Soda | Ten Non-Ferrous Metals | Coke | Steel | Thermal Power | Total | |

|---|---|---|---|---|---|---|---|---|

| Weight | 8.84 | 13.51 | 17.50 | 20.12 | 16.49 | 12.58 | 10.96 | 100.00 |

| Relative impact (%) | 2.12 | 3.24 | 4.19 | 4.82 | 3.95 | 3.01 | 2.63 | 23.96 |

| Variable | |||

|---|---|---|---|

| 0.3780 *** (7.98) | 0.3005 *** (8.09) | 0.1557 *** (9.45) | |

| 1.3749 *** (18.50) | |||

| Control | Yes | Yes | Yes |

| Year fixed effect | Yes | Yes | Yes |

| Province fixed effect | Yes | Yes | Yes |

| N | 580 | 580 | 580 |

| Adj.R2 | 0.9350 | 0.9606 | 0.6609 |

| F | 302.48 *** | 492.66 *** | 51.75 *** |

| Variable | (4) | (5) | (6) | (7) | (8) | (9) |

|---|---|---|---|---|---|---|

| 0.3762 *** (9.73) | 0.0724 *** (13.99) | 0.3045 *** (6.91) | 0.0609 *** (23.54) | 0.4240 *** (6.87) | 0.1192 *** (20.14) | |

| 1.3850 *** (6.27) | 0.1683 (0.39) | 1.2190 *** (9.70) | ||||

| −0.0210 (−1.19) | −0.1219 *** (−3.86) | −0.0016 (−0.08) | ||||

| −0.0104 *** (−5.87) | −0.0082 *** (−3.97) | −0.0041 * (−1.88) | ||||

| 0.0096 (0.48) | −0.0327 (−0.57) | −0.0367 (−0.88) | ||||

| 0.0010 (0.39) | 0.0062 (1.40) | −0.0048 (−0.84) | ||||

| 0.0015 * (1.78) | 0.0043 (1.04) | 0.0059 *** (2.60) | ||||

| C | — | — | — | — | — | — |

| N | 180 | 180 | 144 | 144 | 198 | 198 |

| Adj.R2 | 0.9109 | 0.5330 | 0.9188 | 0.8052 | 0.9479 | 0.6809 |

| F | 237.57 *** | 194.48 *** | 206.78 *** | 550.20 *** | 466.16 *** | 403.49 *** |

| Under identification test | 154.493 *** | 168.690 *** | 123.784 *** | 135.055 *** | 155.154 *** | 185.960 *** |

| Weak identification test | 806.974 *** | 11,000 *** | 648.529 *** | 9571.940 *** | 436.039 *** | 17,000 *** |

| Over identification test | 7.555 *** | 3.619 ** | 10.333 *** | 4.784 ** | 25.087 *** | 18.185 *** |

| Eastern | Central | Western | ||||

|---|---|---|---|---|---|---|

| Relative Impact (%) | Relative Impact (%) | Relative Impact (%) | ||||

| Direct effect | 0.3762 | 78.95 | 0.3045 | 96.76 | 0.4240 | 74.48 |

| Indirect effect | 0.1003 | 21.05 | 0.0102 | 3.24 | 0.1453 | 25.52 |

| Total effects | 0.4765 | 100 | 0.3147 | 100 | 0.5693 | 100 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ji, Y.; Xue, J.; Fu, Z. Sustainable Development of Economic Growth, Energy-Intensive Industries and Energy Consumption: Empirical Evidence from China’s Provinces. Sustainability 2022, 14, 7009. https://doi.org/10.3390/su14127009

Ji Y, Xue J, Fu Z. Sustainable Development of Economic Growth, Energy-Intensive Industries and Energy Consumption: Empirical Evidence from China’s Provinces. Sustainability. 2022; 14(12):7009. https://doi.org/10.3390/su14127009

Chicago/Turabian StyleJi, Yanli, Jie Xue, and Zitian Fu. 2022. "Sustainable Development of Economic Growth, Energy-Intensive Industries and Energy Consumption: Empirical Evidence from China’s Provinces" Sustainability 14, no. 12: 7009. https://doi.org/10.3390/su14127009