Evaluating the Effect of Redundant Resources on Corporate Entrepreneurial Performance

Abstract

:1. Introduction

2. Theoretical Backgrounds

2.1. Redundancy Resources

2.2. Resource Bricolage

2.3. Corporate Entrepreneurial Performance

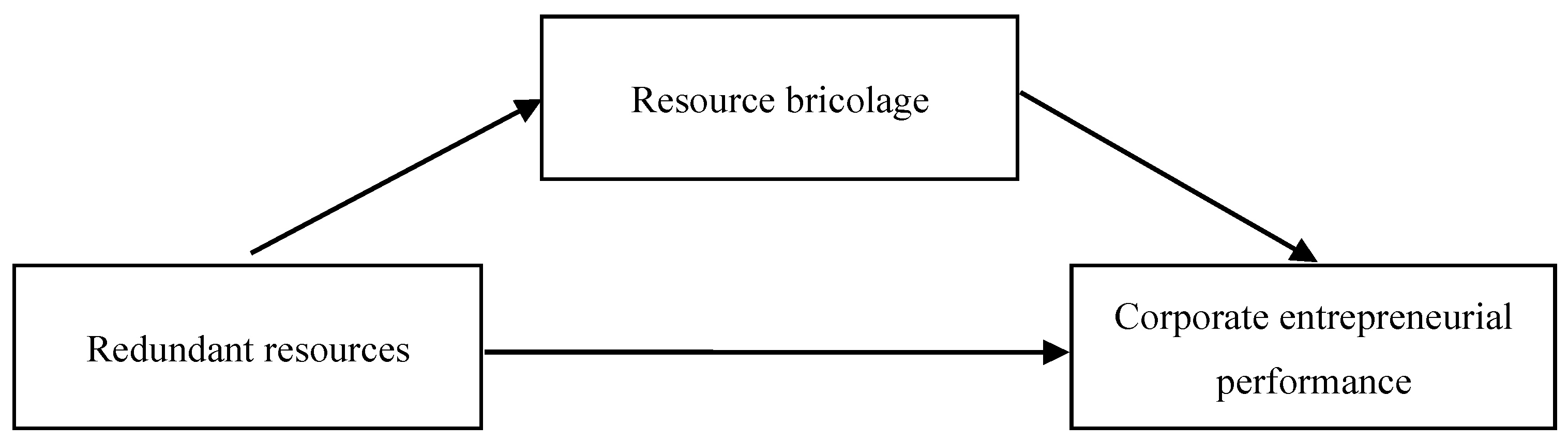

3. Research Hypotheses

3.1. The Impact of Redundant Resources on Corporate Entrepreneurial Performance

3.2. The Impact of Redundant Resources on Resource Bricolage

3.3. The Impact of Resource Bricolage on Corporate Entrepreneurial Performance

3.4. The Mediation Effect of Resource Bricolage

4. Methodology

4.1. Measures

4.2. Data Collection

5. Results

5.1. Reliability and Validity Test

5.2. Hypothesis Test

5.3. Mediation Effect Test

6. Discussion

7. Implications

7.1. Theoretical Implication

7.2. Managerial Implication

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Kuratko, D.F. Handbook of Entrepreneurship Research; Springer: New York, NY, USA, 2010. [Google Scholar]

- Sharma, P.; Chrisman, J.J. Entrepreneurship; Springer: Berlin/Heidelberg, Germany, 1999. [Google Scholar]

- Choi, S.B.; Lee, W.R.; Kang, S.W. Entrepreneurial orientation, resource orchestration capability, environmental dynamics and firm performance: A test of three-way interaction. Sustainability 2020, 12, 5415. [Google Scholar] [CrossRef]

- Timmons, J.A.; Spinelli, S.; Tan, Y. New Venture Creation: Entrepreneurship for the 21st Century; McGraw-Hill: New York, NY, USA, 2004. [Google Scholar]

- Bierwerth, M.; Schwens, C.; Isidor, R.; Kabst, R. Corporate entrepreneurship and performance: A meta-analysis. Small Bus. Econ. Group 2015, 45, 255–278. [Google Scholar] [CrossRef]

- Sirmon, D.G.; Hitt, M.A.; Ireland, R.D.; Gilbert, B.A. Resource orchestration to create competitive advantage breadth, depth, and life cycle effects. J. Manag. 2011, 37, 1390–1412. [Google Scholar]

- Welter, C.; Mauer, R.; Wuebker, R.J. Bridging behavioral models and theoretical concepts: Effectuation and bricolage in the opportunity creation framework. Strateg. Entrep. J. 2016, 10, 5–20. [Google Scholar] [CrossRef]

- Burgelman, R.A. Designs for corporate entrepreneurship in established firms. Calif. Manag. Rev. 1984, 26, 154–166. [Google Scholar] [CrossRef]

- Zahra, S.A. A conceptual model of entrepreneurship as firm behavior: A critique and extension. Entrep. Theory Pract. 1993, 17, 5–21. [Google Scholar] [CrossRef]

- Lumpkin, G.T.; Dess, G.G. Clarifying the entrepreneurial orientation construct and linking it to performance. Acad. Manag. Rev. 1996, 21, 135–172. [Google Scholar] [CrossRef]

- Simsek, Z.; Veiga, J.F.; Lubatkin, M.H. The impact of managerial environmental perceptions on corporate entrepreneurship: Towards understanding discretionary slack’s pivotal role. J. Manag. Stud. 2007, 44, 1398–1424. [Google Scholar] [CrossRef]

- Simsek, Z.; Lubatkin, M.H.; Veiga, J.F.; Dino, R.N. The role of an entrepreneurially alert information system in promoting corporate entrepreneurship. J. Bus. Res. 2009, 62, 810–817. [Google Scholar] [CrossRef]

- Sebora, T.C.; Theerapatvong, T.; Sang, M.L. Corporate entrepreneurship in the face of changing competition. J. Organ. Chang. Manag. 2013, 23, 453–470. [Google Scholar] [CrossRef]

- Klerk, S.D. The creative industries: An entrepreneurial bricolage perspective. Manag. Decis. 2015, 53, 828–842. [Google Scholar] [CrossRef]

- Lanza, A.; Simone, G.; Bruno, R. Resource orchestration in the context of knowledge resources acquisition and divestment. The empirical evidence from the Italian “Serie A” football. Eur. Manag. J. 2016, 34, 145–157. [Google Scholar] [CrossRef] [Green Version]

- Song, J.; Li, F.; Wu, D.D.; Dolgui, A. Supply chain coordination through integration of innovation effort and advertising support. Appl. Math. Model. 2017, 49, 108–123. [Google Scholar] [CrossRef]

- Yu, X.; Li, Y.; Su, Z.; Tao, Y.; Nguyen, B.; Xia, F. Entrepreneurial bricolage and its effects on new venture growth and adaptiveness in an emerging economy. Asia Pac. J. Manag. 2019, 37, 1141–1163. [Google Scholar] [CrossRef]

- Sun, Y.; Du, S.; Ding, Y. The relationship between slack resources, resource bricolage, and entrepreneurial opportunity identification—Based on resource opportunity perspective. Sustainability 2020, 12, 1199. [Google Scholar] [CrossRef] [Green Version]

- Cohen, M.D.; March, J.G.; Olsen, J.P. A garbage can model of organizational choice. Adm. Sci. Q. 1972, 17, 1–25. [Google Scholar] [CrossRef] [Green Version]

- Kiss, A.N.; Fernhaber, S.; McDougall–Covin, P.P. Slack, innovation, and export intensity: Implications for small–and medium–sized enterprises. Entrep. Theory Pract. 2018, 42, 671–697. [Google Scholar] [CrossRef]

- Harrison, S.; Smith, C. Trust and moral motivation: Redundant resources in health and social care? Policy Polit. 2004, 32, 371–386. [Google Scholar] [CrossRef]

- Carlier, J.; Néron, E. Computing redundant resources for the resource constrained project scheduling problem. Eur. J. Oper. Res. 2007, 176, 1452–1463. [Google Scholar] [CrossRef]

- Ying, L.; Li, M.; Yang, J. Agglomeration and driving factors of regional innovation space based on intelligent manufacturing and green economy. Environ. Technol. Innov. 2021, 22, 101398. [Google Scholar] [CrossRef]

- George, G. Slack resources and the performance of privately held firms. Acad. Manag. J. 2005, 48, 661–676. [Google Scholar] [CrossRef]

- Gentry, R.; Dibrell, C.; Kim, J. Long-term orientation in publicly traded family businesses: Evidence of a dominant logic. Entrep. Theory Pract. 2016, 40, 733–757. [Google Scholar] [CrossRef]

- Singh, J.V. Performance, slack, and risk taking in organizational decision making. Acad. Manag. J. 1986, 29, 562–585. [Google Scholar]

- Hu, H.; Lu, H.; Huang, T.; Wei, W.X.; Mao, C.; Thomson, S.B. The process of resource bricolage and organizational improvisation in information technology innovation: A case study of BDZX in China. Inform. Technol. Dev. 2020, 1–22. [Google Scholar] [CrossRef]

- Zheng, A. Applying resource bricolage theory to the city integration of new-generation migrant workers in China. PLoS ONE 2021, 16, e0256332. [Google Scholar] [CrossRef]

- Tan, J.; Peng, M.W. Organizational slack and firm performance during economic transitions: Two studies from an emerging economy. Strateg. Manag. J. 2003, 24, 1249–1263. [Google Scholar] [CrossRef]

- Baker, T.; Nelson, R.E. Creating something from nothing: Resource construction through entrepreneurial bricolage. Adm. Sci. Q. 2005, 50, 329–366. [Google Scholar] [CrossRef]

- Rönkkö, M.; Peltonen, J.; Arenius, P. Selective or Parallel? Toward Measuring the Domains of Entrepreneurial Bricolage; Emerald Group Publishing Limited: Bingley, UK, 2014. [Google Scholar]

- Senyard, J.; Baker, T.; Steffens, P.; Davidsson, P. Bricolage as a path to innovativeness for resource-constrained new firms. J. Prod. Innov. Manag. 2014, 31, 211–230. [Google Scholar] [CrossRef]

- Arfi, W.; Hikkerova, L. Corporate entrepreneurship, product innovation, and knowledge conversion: The role of digital platforms. Small Bus. Econ. Group 2021, 56, 1191–1204. [Google Scholar] [CrossRef]

- Ghalwash, S.; Ismail, A. Resource Orchestration Process in the Limited-Resource Environment: The Social Bricolage Perspective. J. Soc. Entrep. 2022. [Google Scholar] [CrossRef]

- Hornsby, J.S.; Kuratko, D.F.; Holt, D.T.; Wales, W.J. Assessing a measurement of organizational preparedness for corporate entrepreneurship. J. Prod. Innov. Manag. 2013, 30, 937–955. [Google Scholar] [CrossRef]

- O’Brien, K. Innovation types and the search for new ideas at the fuzzy front end: Where to look and how often? J. Bus. Res. 2020, 107, 13–24. [Google Scholar] [CrossRef]

- Miocevic, D.; Morgan, R.E. Operational capabilities and entrepreneurial opportunities in emerging market firms. Int. Market. Rev. 2018, 35, 320–341. [Google Scholar] [CrossRef]

- Kim, K.; Hann, I.H. Crowdfunding and the democratization of access to capital—An illusion? Evidence from housing prices. Inf. Syst. Res. 2019, 30, 276–290. [Google Scholar] [CrossRef]

- Blanka, C. An individual-level perspective on intrapreneurship: A review and ways forward. Rev. Manag. Sci. 2019, 13, 919–961. [Google Scholar] [CrossRef] [Green Version]

- Rigtering, J.P.C.C.; Weitzel, G.U.U.; Muehlfeld, K.K. Increasing quantity without compromising quality: How managerial framing affects intrapreneurship. J. Bus. Ventur. 2019, 34, 224–241. [Google Scholar] [CrossRef]

- Stritar, R. Resource hijacking as a bricolage technique. Econ. Bus. Rev. 2012, 14, 5–15. [Google Scholar] [CrossRef]

- Suddaby, R.; Bruton, G.D.; Si, S.X. Entrepreneurship through a qualitative lens: Insights on the construction and/or discovery of entrepreneurial opportunity. J. Bus. Ventur. 2015, 30, 1–10. [Google Scholar] [CrossRef]

- Garud, N.; Prabhu, G.N. Linking R&D inventors’ social skills and bricolage to R&D performance in resource constrained environments in emerging markets. IEEE Trans. Eng. Manag. 2020, 68, 713–724. [Google Scholar]

- Voss, G.B.; Sirdeshmukh, D.; Voss, Z.G. The effects of slack resources and environmental threat on product exploration and exploitation. Acad. Manag. J. 2008, 51, 147–164. [Google Scholar] [CrossRef] [Green Version]

- Liao, Z.; Weng, C.; Long, S.; Xiao, Z. Do social ties foster firms’ environmental innovation? The moderating effect of resource bricolage. Technol. Anal. Strateg. Manag. 2021, 33, 476–490. [Google Scholar] [CrossRef]

- Zahra, S.A.; Neubaum, D.A.; Huse, M. Entrepreneurship in Medium-Size Companies: Exploring the effects of ownership and governance systems. J. Manag. 2000, 26, 947–976. [Google Scholar] [CrossRef]

- Yang, M. International entrepreneurial marketing strategies of MNCs: Bricolage as practiced by marketing managers. Int. Bus. Rev. 2018, 27, 1045–1056. [Google Scholar] [CrossRef]

- An, W.; Zhao, X.; Cao, Z.; Zhang, J.; Liu, H. How bricolage drives corporate entrepreneurship: The roles of opportunity identification and learning orientation. J. Prod. Innov. Manag. 2018, 35, 49–65. [Google Scholar] [CrossRef]

- Hoffman, M.; Schenck, C.J.; Herbst, F. Exploring the Intersection Where Business Models, a Circular Economy and Sustainability Meet in the Waste Economy: A Scoping Review. Sustainability 2022, 14, 3687. [Google Scholar] [CrossRef]

- Busch, C.; Barkema, H. From necessity to opportunity: Scaling bricolage across resource-constrained environments. Strateg. Manag. J. 2021, 42, 741–773. [Google Scholar] [CrossRef]

- Sarasvathy, S.D. Causation and effectuation: Toward a theoretical shift from economic inevitability to entrepreneurial contingency. Acad. Manag. Rev. 2001, 26, 243–263. [Google Scholar] [CrossRef] [Green Version]

- Yu, X.; Lu, J.; Liu, X.; Wang, Y.; Jia, Y. Fractal characteristics of discontinuous growth of digital company: An entrepreneurial bricolage perspective. Complexity 2021, 21, 8839941. [Google Scholar] [CrossRef]

- Steffens, P.R.; Baker, T.; Davidsson, P.; Senyard, J.M. When is less more? Boundary conditions of effective entrepreneurial bricolage. J. Manag. 2022. [Google Scholar] [CrossRef]

- Liu, Z.; Xiao, Y.; Jiang, S.; Hu, S. Social entrepreneurs’ personal network, resource bricolage and relation strength. Manag. Decis. 2020, 59, 2774–2791. [Google Scholar] [CrossRef]

- Wang, J.; Xue, Y.; Yang, J. Boundary-spanning search and firms’ green innovation: The moderating role of resource orchestration capability. Bus. Strateg. Environ. 2020, 29, 361–374. [Google Scholar] [CrossRef]

- Baron, R.A. Opportunity recognition as pattern recognition: How entrepreneurs “connect the dots” to identify new business opportunities. Acad. Manag. Perspect. 2006, 20, 104–119. [Google Scholar] [CrossRef]

- Wales, W.J.; Patel, P.C.; Parida, V.; Kreiser, P.M. Nonlinear effects of entrepreneurial orientation on small firm performance: The moderating role of resource orchestration capabilities. Strateg. Entrep. J. 2013, 7, 93–121. [Google Scholar] [CrossRef]

- Zhu, W.; Mou, J.; Benyoucef, M. Exploring purchase intention in cross-border E-commerce: A three stage model. J. Retail. Consum. Serv. 2019, 51, 320–330. [Google Scholar] [CrossRef]

- Zhu, W.; Yan, R.; Song, Y. Analysing the impact of smart city service quality on citizen engagement in a public emergency. Cities 2022, 120, 103439. [Google Scholar] [CrossRef] [PubMed]

- Li, Y.; Kou, G.; Li, G.; Peng, Y. Consensus reaching process in large-scale group decision making based on bounded confidence and social network. Eur. J. Oper. Res. 2022, in press. [Google Scholar] [CrossRef]

- Li, G.; Kou, G.; Peng, Y. Heterogeneous large-scale group decision-making using fuzzy cluster analysis and its application to emergency response plan selection. IEEE Trans. Syst. Man Cybern.-Syst. 2021, 52, 3391–3403. [Google Scholar] [CrossRef]

- Vanacker, T.; Collewaert, V.; Zahra, S.A. Slack resources, firm performance, and the institutional context: Evidence from privately held E uropean firms. Strateg. Manag. J. 2017, 38, 1305–1326. [Google Scholar] [CrossRef]

- Marlin, D.; Geiger, S.W. The organizational slack and performance relationship: A configurational approach. Manag. Decis. 2015, 53, 2339–2355. [Google Scholar] [CrossRef]

- Malen, J.; Vaaler, P.M. Organizational slack, national institutions, and innovation effort. J. World Bus. 2016, 52, 782–797. [Google Scholar] [CrossRef]

- Bromiley, P. Testing a causal model of corporate risk taking and performance. Acad. Manag. J. 1991, 34, 37–59. [Google Scholar]

- Wu, J.; Wu, Z. Local and international knowledge search and product innovation: The moderating role of technology boundary spanning. Int. Bus. Rev. 2014, 23, 542–551. [Google Scholar] [CrossRef]

- Desa, G.; Basu, S. Optimization or bricolage? Overcoming resource constraints in global social entrepreneurship. Strateg. Entrep. J. 2013, 7, 26–49. [Google Scholar] [CrossRef]

| Influencing Factors | Authors | Journals | Topics | Methods | Main Conclusions |

|---|---|---|---|---|---|

| External environment | O’Brien (2020) [36] | Journal of Business Research | Examined the relationship between creative search strategies within and outside firm boundaries and enterprise innovation performance. | Logit regressions | Cross-border search can break down organizational boundaries and provide opportunities for companies to access innovative resources. |

| Arfi and Hikkerova (2021) [33] | Small Business Economics | Analyzed the effect of enterprise entrepreneurship on product innovation. | Multiple case studies | The turbulent external environment was conducive to stimulating enterprise entrepreneurship. | |

| Organization | Miocevic and Morgan (2018) [37] | International Marketing Review | Evaluated the interaction between business organization and entrepreneurial opportunities. | Structural equation modeling (SEM) | The behavioral characteristics of employees were influenced by organization culture. Additionally, organization culture played an important role in entrepreneurial activities. |

| Kim and Hann (2019) [38] | Information Systems Research | Tested the role of credit on crowdfunding use. | Regression analysis | An organizational structure that provided support and encouragement was the key to a company’s entrepreneurial development. | |

| Individual | Blanka (2019) [39] | Review of Managerial Science | Summarized the research status of entrepreneurship. | Theoretical analysis | The entrepreneurial or innovative activities of employees in an organization can improve enterprise performance on the basis of obtaining resource support and transforming organizational strategy. |

| Rigtering et al. (2019) [40] | Journal of Business Venturing | Examining the role of managerial communication in motivating individuals to engage in entrepreneurial creativity. | Probit and logit regression | Human factors were necessary factors that maintained or regained a company’s competitive advantage in the process of entrepreneurship. |

| Variables | Items | References |

|---|---|---|

| Absorbed redundant resources (ARR) | ARR1: The enterprise has underutilized equipment or technology. | Tan and Peng (2003) [27] |

| ARR2: The enterprise has many professionals. | ||

| ARR3: The enterprise has excess production capacity. | ||

| Unabsorbed redundant resources (URR) | URR1: The enterprise has sufficient financial resources. | Tan and Peng (2003) [27] |

| URR2: The enterprise has sufficient potential relationship resources. | ||

| URR3: The enterprise can obtain loans from banks or other financial institutions when needed. | ||

| Elements bricolage (EB) | EB1: Despite various constraints, the enterprise can use resources such as labor, raw materials, and skills in a profitable manner. | Rönkkö et al. (2013) [31]; Senyard et al. (2014) [32] |

| EB2: Most of the enterprise’s technology, human, material resources and other resources are developed by the enterprise itself. | ||

| EB3: The enterprise will guide employees to use existing resources. | ||

| Customer bricolage (CB) | CB1: The enterprise is in close contact with its customers and invites them to improve its products and services. | Rönkkö et al. (2013) [31] |

| CB2: The enterprise provides customers with products and services that other competitors cannot provide. | ||

| CB3: The enterprise serves customers that competitors find unattractive. | ||

| Institution bricolage (IB) | IB1: The enterprise develops new rules and regulations. | Rönkkö et al. (2013) [31]; Senyard et al. (2014) [32] |

| IB2: The enterprise will abandon traditional industry standards if they can do better. | ||

| IB3: The enterprise uses unconventional regulations in their operations. | ||

| Management innovation (MI) | MI1: The enterprise invests heavily in new products, services and production processes. | Hornsby et al. (2013) [35] |

| MI2: The enterprise launches many new products or services. | ||

| MI3: The enterprise leads industry innovation. | ||

| MI4: The enterprise applies for and obtains more patents than its competitors. | ||

| Product innovation (PI) | PI1: The enterprise substantially updates its original product or business. | Hornsby et al. (2013) [35] |

| PI2: The enterprise has implemented multiple management changes to improve organizational efficiency. | ||

| PI3: The enterprise restructures its organization to increase collaboration and communication between businesses. | ||

| Business expansion (BE) | BE1: The enterprise enters a new business. | Hornsby et al. (2013) [35] |

| BE2: The enterprise acquires another company. | ||

| BE3: The enterprise spins off some underperforming industry or business. |

| Demographics | Category | Frequency | Percentage (%) |

|---|---|---|---|

| Gender | Male | 216 | 53.60 |

| Female | 187 | 46.40 | |

| Age | ≤20 | 30 | 7.44 |

| 21–30 | 76 | 18.86 | |

| 31–40 | 103 | 25.56 | |

| 41–50 | 98 | 24.32 | |

| ≥51 | 97 | 24.07 | |

| Education | High school and below | 8 | 1.99 |

| Junior college | 96 | 23.82 | |

| University | 165 | 40.94 | |

| Master’s degree or higher | 134 | 33.25 | |

| Position | Middle manager | 240 | 59.55 |

| Senior manager | 163 | 40.45 | |

| ≤5 years | 39 | 9.68 | |

| 6–10 years | 132 | 32.75 | |

| 11–14 years | 179 | 44.42 | |

| ≥15 years | 53 | 13.15 | |

| State-owned enterprises | 46 | 11.41 | |

| Private enterprises | 166 | 41.91 | |

| Joint ventures | 45 | 11.17 | |

| Sole proprietorship | 98 | 24.32 | |

| Mixed-ownership enterprises | 30 | 7.44 | |

| Others | 18 | 4.47 |

| Variables | Items | Cronbach’s α | CR | AVE |

|---|---|---|---|---|

| ARR | ARR1 | 0.871 | 0.872 | 0.694 |

| ARR2 | ||||

| ARR3 | ||||

| URR | URR1 | 0.904 | 0.904 | 0.702 |

| URR2 | ||||

| URR3 | ||||

| EB | EB1 | 0.865 | 0.869 | 0.688 |

| EB2 | ||||

| EB3 | ||||

| CB | CB1 | 0.812 | 0.812 | 0.591 |

| CB2 | ||||

| CB3 | ||||

| IB | IB1 | 0.832 | 0.832 | 0.622 |

| IB2 | ||||

| IB3 | ||||

| MI | MI1 | 0.826 | 0.828 | 0.617 |

| MI2 | ||||

| MI3 | ||||

| MI4 | ||||

| PI | PI1 | 0.829 | 0.833 | 0.556 |

| PI2 | ||||

| PI3 | ||||

| BE | BE1 | 0.853 | 0.855 | 0.662 |

| BE2 | ||||

| BE3 |

| Variables | ARR | URR | EB | CB | IB | PI | MI | BE |

|---|---|---|---|---|---|---|---|---|

| ARR | 0.833 | |||||||

| URR | 0.370 | 0.838 | ||||||

| EB | 0.394 | 0.355 | 0.829 | |||||

| CB | 0.405 | 0.335 | 0.448 | 0.768 | ||||

| IB | 0.429 | 0.422 | 0.506 | 0.447 | 0.789 | |||

| PI | 0.513 | 0.478 | 0.586 | 0.565 | 0.584 | 0.746 | ||

| MI | 0.501 | 0.457 | 0.577 | 0.569 | 0.582 | 0.681 | 0.785 | |

| BE | 0.508 | 0.452 | 0.533 | 0.519 | 0.653 | 0.649 | 0.654 | 0.814 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yun, L.; Yao, X.; Zhu, W.; Zhang, Z. Evaluating the Effect of Redundant Resources on Corporate Entrepreneurial Performance. Sustainability 2022, 14, 7101. https://doi.org/10.3390/su14127101

Yun L, Yao X, Zhu W, Zhang Z. Evaluating the Effect of Redundant Resources on Corporate Entrepreneurial Performance. Sustainability. 2022; 14(12):7101. https://doi.org/10.3390/su14127101

Chicago/Turabian StyleYun, Lexin, Xiaolin Yao, Wenlong Zhu, and Zishan Zhang. 2022. "Evaluating the Effect of Redundant Resources on Corporate Entrepreneurial Performance" Sustainability 14, no. 12: 7101. https://doi.org/10.3390/su14127101