The Spatial Effect of Financial Innovation on Intellectualized Transformational Upgrading of Manufacturing Industry: An Empirical Evidence from China

Abstract

:1. Introduction

2. Theory and Hypotheses

2.1. Financial Innovation Theory

2.2. Mechanism of Financial Innovation Affecting Intelligent Transformational Upgrading of the Manufacturing Industry

2.3. Spatial Spillover Effects Related to Financial Innovation and Intelligent Transformation of the Manufacturing Industry

3. Methods and Data

3.1. Sample Selection

3.2. Model Construction and Variable Measurement

3.3. Variable Description

4. Results and Discussion

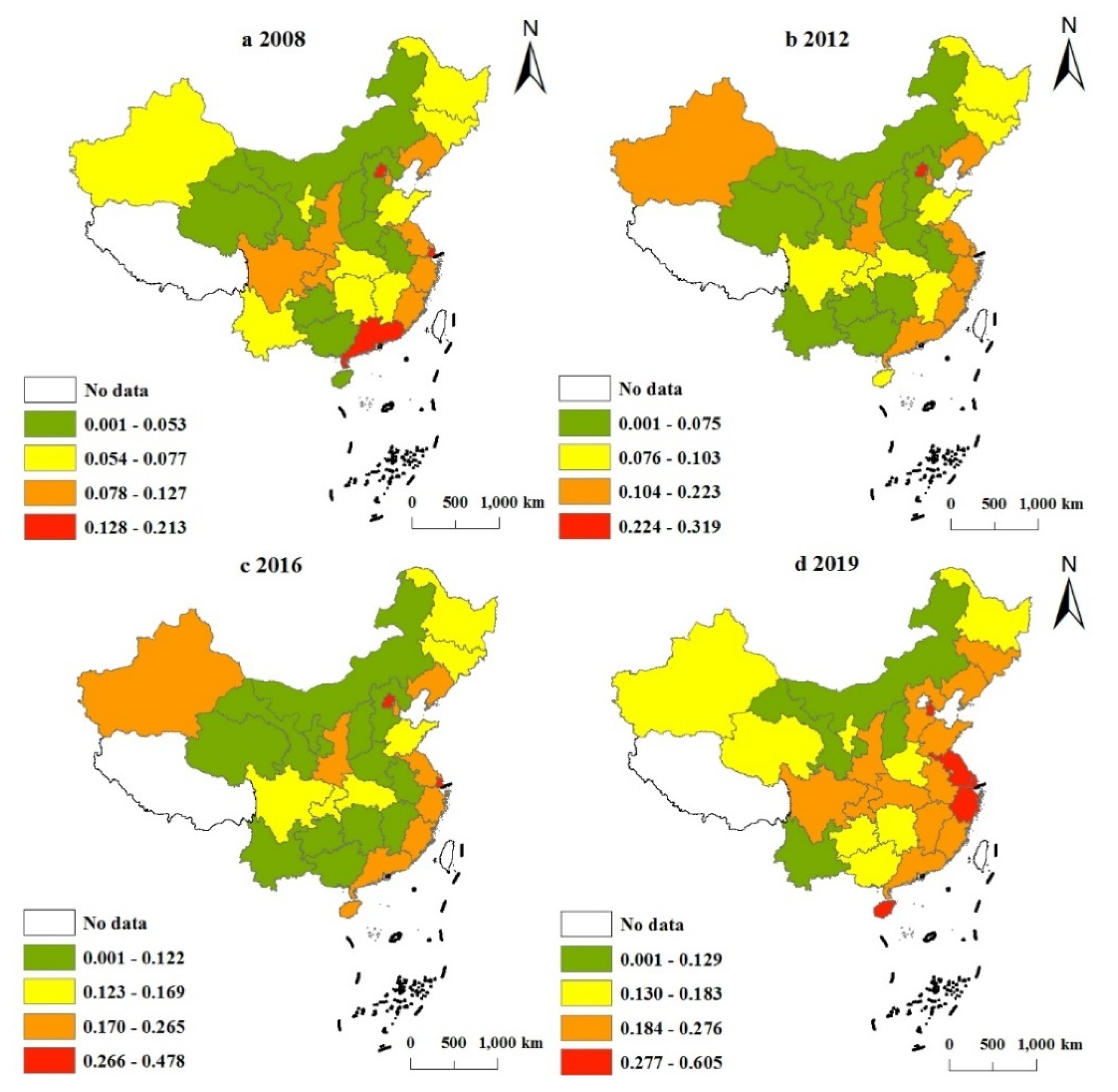

4.1. Analysis of Measurement Results of Intelligent Transformation and Upgrading Level of the Manufacturing Industry

4.2. Empirical Test of Spatial Effect

4.2.1. Spatial Correlation Test

4.2.2. Spatial Econometric Analysis

4.2.3. Endogenous Analysis

4.2.4. Spatial Spillover Effects

4.3. Mechanism Analysis

5. Conclusions and Implications

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Hill, T.J. Manufacturing’s Strategic Role. J. Oper. Res. Soc. 2017, 34, 853–860. [Google Scholar] [CrossRef]

- Shen, G.; Chen, B. Zombie firms and over-capacity in Chinese manufacturing. China Econ. Rev. 2017, 44, 327–342. [Google Scholar] [CrossRef]

- Ducanes, S.D.; Bautista, M.G. Aspects of financial development and manufacturing and services growth: Which matter? Int. J. Financ. Econ. 2020, 26, 2560–2580. [Google Scholar] [CrossRef]

- Montero, J.M.; Urtasun, A. Markup dynamics and financial frictions: The Spanish case. Int. Rev. Econ. Financ. 2021, 71, 316–341. [Google Scholar] [CrossRef]

- Kiendrebeogo, Y.; Minea, A. Financial Factors and Manufacturing Exports: Firm-Level Evidence from Egypt. J. Dev. Stud. 2017, 53, 2197–2213. [Google Scholar] [CrossRef] [Green Version]

- Beck, T.; Chen, T.; Lin, C.; Song, F.M. Financial Innovation: The Bright and the Dark Sides. J. Bank. Financ. 2012, 72, 28–51. [Google Scholar] [CrossRef]

- Elul, R. Financial Innovation in Incomplete Markets Economies with Several Consumption Goods. J. Econ. Theory 1995, 65, 43–78. [Google Scholar] [CrossRef]

- Levine, R.; Loayza, N.; Beck, T. Financial intermediation and growth: Causality and causes. J. Monet. Econ. 2000, 46, 31–77. [Google Scholar] [CrossRef] [Green Version]

- Dy, A.; Ake, B. Testing the pecking order theory of capital structure: Evidence from Turkey using panel quantile regression approach. Borsa Istanb. Rev. 2020, 21, 317–331. [Google Scholar]

- Brouthers, K.D.; Brouthers L, E. Why Service and Manufacturing Entry Mode Choices Differ: The Influence of Transaction Cost Factors, Risk and Trust. J. Manag. Stud. 2003, 40, 1179–1204. [Google Scholar] [CrossRef]

- Neuenkirch, M.; Nockel, M. The risk-taking channel of monetary policy transmission in the euro area. J. Bank. Financ. 2018, 93, 71–91. [Google Scholar] [CrossRef] [Green Version]

- Lin, R.; Xie, Z.; Hao, Y.; Wang, J. Improving high-tech enterprise innovation in big data environment: A combinative view of internal and external governance. Int. J. Inf. Manag. 2020, 50, 575–585. [Google Scholar] [CrossRef]

- Levine, R. Bank-Based or Market-Based Financial Systems: Which is Better? J. Financ. Intermed. 2002, 11, 398–428. [Google Scholar] [CrossRef] [Green Version]

- Fleisher, B.; Li, H.; Zhao, M.Q. Human Capital, Economic Growth, and Regional Inequality in China. J. Dev. Econ. 2009, 92, 215–231. [Google Scholar] [CrossRef] [Green Version]

- Bempong Nyantakyi, E.; Munemo, J. Technology gap, imported capital goods and productivity of manufacturing plants in Sub-Saharan Africa. J. Int. Trade Econ. Dev. 2017, 26, 209–227. [Google Scholar] [CrossRef]

- Croix, D.; Delavallade, C. Growth, public investment and corruption with failing institutions. Econ. Gov. 2009, 10, 187–219. [Google Scholar] [CrossRef] [Green Version]

- Li, X.L.; Li, J.; Si, D.K.; Wang, J. Trade policy uncertainty, political connection and government subsidy: Evidence from Chinese energy firms. Energy Econ. 2021, 99, 105272. [Google Scholar] [CrossRef]

- Liu, D.; Chen, T.; Liu, X. Do more subsidies promote greater innovation? Evidence from the Chinese electronic manufacturing industry. Econ. Model. 2019, 80, 441–452. [Google Scholar] [CrossRef]

- Guo, Y.Q.; Li, H.M. An empirical study on the impact of scientific and technological financial investment on manufacturing innovation efficiency—Based on China’s Provincial Panel Data. J. Ind. Technol. Econ. 2019, 38, 29–35. [Google Scholar]

- Zhang, P.; Chen, Q.W. Will bank credit expansion help upgrade manufacturing—Intermediary influence based on R & D innovation. Ind. Econ. Res. 2021, 4, 42–54. [Google Scholar]

- Wang, Y.; Guo, X.Q.; Gan, C.H. Theoretical research on financial agglomeration and the construction of international financial center—From the perspective of dynamic stochastic general equilibrium system and message shock. China Econ. Q. 2015, 14, 331–335. [Google Scholar]

- Wang, R.Y.; Wang, Z.G.; Liang, Q.; Chen, J.L. Financial agglomeration and city level. Econ. Res. J. 2019, 54, 165–179. [Google Scholar]

- Zhang, W.L.; Xuan, Y. Spatial spillover effect of industrial intelligence on Industrial Structure Upgrading—The regulating effect of labor structure and income distribution inequality. Bus. Manag. J. 2020, 42, 77–101. [Google Scholar]

- Schumpeter, J.A. The theory of economics development. J. Polit. Econ. 1934, 1, 170–172. [Google Scholar]

- Tufano, P. Financial innovation and first-mover advantages. J. Financ. Econ. 1989, 25, 213–240. [Google Scholar] [CrossRef]

- Boot, A.; Thakor, A.V. Banking Scope and Financial Innovation. Rev. Financ. Stud. 1997, 10, 1099–1131. [Google Scholar] [CrossRef]

- Dynan, K.E.; Elmendorf, D.W.; Sichel, D.E. Can financial innovation help to explain the reduced volatility of economic activity? J. Monet. Econ. 2006, 53, 123–150. [Google Scholar] [CrossRef] [Green Version]

- Sunaga, M. Endogenous growth cycles with financial intermediaries and entrepreneurial innovation. J. Macroecon. 2017, 53, 191–206. [Google Scholar] [CrossRef]

- Trinugroho, I.; Law, S.H.; Lee, W.C.; Wiwoho, J.; Sergi, B.S. Effect of financial development on innovation: Roles of market institutions. Econ. Model. 2021, 103, 105598. [Google Scholar] [CrossRef]

- Ang, J.B.; Kumar, S. Financial development and barriers to the cross-border diffusion of financial innovation. J. Bank. Financ. 2014, 39, 43–56. [Google Scholar] [CrossRef]

- Ireland, P.N. Economic growth, financial evolution, and the long-run behavior of velocity. J. Econ. Dyn. Control 1994, 18, 815–848. [Google Scholar] [CrossRef]

- Carvajal, A.; Rostek, M.; Weretka, M. Competition in Financial Innovation. Econometrica 2012, 80, 1895–1936. [Google Scholar] [CrossRef] [Green Version]

- Basak, S.; Croitoru, B. International good market segmentation and financial innovation. J. Int. Econ. 2007, 71, 267–293. [Google Scholar] [CrossRef]

- Merton, R.C. Financial Innovation and the Management and Regulation of Financial Institutions. J. Bank. Financ. 1995, 19, 461–481. [Google Scholar] [CrossRef] [Green Version]

- Hannan, T.H.; McDowell, J.M. Market concentration and the diffusion of new technology in the banking industry. Rev. Econ. Stat. 1984, 66, 686–691. [Google Scholar] [CrossRef]

- Deyoung, R.; Lang, W.W.; Nolle, D.L. How the Internet affects output and performance at community banks. J. Bank. Financ. 2007, 31, 1033–1060. [Google Scholar] [CrossRef]

- Consoli, D. The Dynamics of Technological Change in UK Retail Banking Services: An Evolutionary Perspective. Res. Policy 2005, 34, 461–480. [Google Scholar] [CrossRef]

- Nguyen, B. The relative importance of regional institutions and external finance for small business investment: Evidence from Vietnam. J. Inst. Econ. 2020, 16, 911–929. [Google Scholar] [CrossRef]

- Chen, S.; Zhang, H. Does digital finance promote manufacturing servitization: Micro evidence from China. Int. Rev. Econ. Financ. 2021, 76, 856–869. [Google Scholar] [CrossRef]

- Patrick, H.T. Financial Development and Economic growth in Underdeveloped countries. Econ. Dev. Cult. Change 1966, 14, 174–189. [Google Scholar] [CrossRef]

- He, Q.; Xue, C.; Zhu, C. Financial Development and Patterns of Industrial Specialization: Evidence from China. Rev. Financ. 2017, 21, 1593–1638. [Google Scholar] [CrossRef]

- Pasiouras, F. Financial Consumer Protection and the Cost of Financial Intermediation. Manag. Sci. 2018, 64, 902–924. [Google Scholar] [CrossRef]

- Mann, K. Does foreign capital go where the returns are? Financial integration and capital allocation efficiency 1. Int. J. Financ. Econ. 2020, 26, 3945–3971. [Google Scholar] [CrossRef]

- Vesnaver, P.L. Enterprise finance and investment in listed Hungarian firms. J. Comp. Econ. 2004, 32, 73–87. [Google Scholar]

- Yao, L.; Yang, X. Can digital finance boost SME innovation by easing financing constraints? Evidence from Chinese GEM-listed companies. PLoS ONE 2022, 17, e0264647. [Google Scholar] [CrossRef]

- Groot, H.D.; Poot, J.; Smit, M.J. Which agglomeration externalities matter most and why? J. Econ. Surv. 2015, 30, 756–782. [Google Scholar] [CrossRef]

- Anselin, L. Local Indicators of Spatial Association—ISA. Geogr. Anal. 2010, 27, 93–115. [Google Scholar] [CrossRef]

- Jie, H.; Wzb, C.; Wr, B. Spatial spillover and impact factors of the internet finance development in China. Phys. A 2020, 26, 3945–3971. [Google Scholar]

- Bart, V. A new empirical approach to catching up or falling behind—ScienceDirect. Struct. Change Econ. Dyn. 1991, 2, 359–380. [Google Scholar]

- Anselin, L. Geographical Spillovers and University Research: A Spatial Econometric Perspective. Growth Change 2000, 31, 501–515. [Google Scholar] [CrossRef]

- Efthyvoulou, G.; Vahter, P. Financial Constraints, Innovation Performance and Sectoral Disaggregation. Manch. Sch. 2015, 84, 125–158. [Google Scholar] [CrossRef] [Green Version]

- Bertocco, G. Finance and development: Is Schumpeter’s analysis still relevant? J. Bank. Financ. 2008, 32, 1161–1175. [Google Scholar] [CrossRef]

- Cheng, S.Y.; Ho, C.C.; Hou, H. The Finance-growth Relationship and the Level of Country Development. J. Financ. Serv. Res. 2014, 45, 117–140. [Google Scholar] [CrossRef]

- Dooley, M.P.; Spinelli, F. The early stages of financial innovation and money demand in france and italy. Manch. Sch. 1989, 57, 107–124. [Google Scholar] [CrossRef]

- Choi, E.K. Informality, innovation, and aggregate productivity growth. Rev. Dev. Econ. 2020, 24, 125–143. [Google Scholar]

- Liu, J.; Ma, L. Research on Economic Spillover Effect and Time and Space Differentiation of Financial Agglomeration—Spatial Econometric Analysis Based on Provincial Data. J. Financ. Dev. Res. 2019, 2, 17–25. [Google Scholar]

- Ugarte, M.D. Introduction to Spatial Econometrics. J. Reg. Sci. 2011, 174, 513–514. [Google Scholar]

- Liu, J.; Cao, Y.R.; Bao, Y.F.; Zhao, Y.H. Research on the impact of manufacturing intelligence on income gap. China Soft Sci. 2021, 3, 43–52. [Google Scholar]

- Li, L.S.; Shi, X.A.; Liu, J. 40 Years of Manufacturing in China: Intelligentization Process and Outlook. China Soft Sci. 2019, 1, 1–9. [Google Scholar]

- Yu, L.; Zhu, J.; Wang, Z. Green Taxation Promotes the Intelligent Transformation of Chinese Manufacturing Enterprises: Tax Leverage Theory. Sustainability 2021, 13, 13321. [Google Scholar] [CrossRef]

- Nguyen, T.P.; Nghiem, S.H.; Roca, E.; Sharma, P. Bank reforms and efficiency in Vietnamese banks: Evidence based on SFA and DEA. Appl. Econ. 2016, 48, 2822–2835. [Google Scholar] [CrossRef] [Green Version]

- Afza, T.; Asghar, M. Efficiency of Commercial Banks in Pakistan: Application of SFA and Value Added Approach. Argum. Oecon. 2017, 38, 195–220. [Google Scholar] [CrossRef] [Green Version]

- Mensi, W.; Xuan, V.V.; Sang, H.K. Upward/downward multifractality and efficiency in metals futures markets: The impacts of financial and oil crises. Resour. Policy 2022, 76, 102645. [Google Scholar] [CrossRef]

- Basso, A.; Funari, S. DEA models with a constant input for SRI mutual funds with an application to European and Swedish funds. Int. Trans. Oper. Res. 2014, 21, 979–1000. [Google Scholar] [CrossRef]

- Cummins, J.D.; Weiss, M.A.; Xie, X.; Zi, H. Economies of scope in financial services: A DEA efficiency analysis of the US insurance industry. J. Bank Financ. 2010, 34, 1525–1539. [Google Scholar] [CrossRef]

- Llewellym. Basic Cardiopulmonary Resuscitation. Can it be included in the school curriculum? Resuscitation 1992, 24, 181. [Google Scholar] [CrossRef]

- Moki, N.M.; Ndung, S.K.; Godfrey, M. Financial innovation strategy and financial performance of deposit taking sacco’s in nairobi city county. Int. J. Financ. Econ. 2021, 3, 398–417. [Google Scholar]

- Fernández, A.C.; Quiroga, M.; Araya, I.; Pino, G. Can local financial depth and dependence on external funding impact regional creation of new firms in chile? Ann. Reg. Sci. 2021, 68, 387–406. [Google Scholar] [CrossRef]

- Chen, C. Estimation of Variable Depreciation Rate and Measurement of Capital Stock. Econ. Res. J. 2014, 49, 72–85. [Google Scholar]

- Murakami, N. Changes in Japanese industrial structure and urbanization: Evidence from prefectural data. J. Asia Pac. Econ. 2015, 20, 385–403. [Google Scholar] [CrossRef]

- Stein, L.; Constantine, Y. Financial Inclusion, Human Capital, and Wealth Accumulation: Evidence from the Freedman’s Savings Bank. Rev. Financ. Stud. 2020, 33, 5333–5377. [Google Scholar] [CrossRef]

- Havlik, P. Restructuring of manufacturing industry in the central and east European countries. Prague Econ. Pap. 2003, 12, 19–36. [Google Scholar] [CrossRef]

- O’Brien, P.; O’Neill, P.; Pike, A. Funding, financing and governing urban infrastructures. Urban Stud. 2019, 56, 1291–1303. [Google Scholar] [CrossRef]

- Han, Z.; Liu, Y.; Guo, X.; Xu, J. Regional differences of high-quality development level for manufacturing industry in China. Math. Biosci. Eng. 2022, 19, 4368–4395. [Google Scholar] [CrossRef] [PubMed]

- Elhorst, J.P. Matlab Software for Spatial Panels. Int. Reg. Sci. Rev. 2014, 37, 389–405. [Google Scholar] [CrossRef] [Green Version]

- Daway-Ducanes, S.L.S.; Gochoco-Bautista, M.S. Manufacturing and Services Growth in Developing Economies: ‘Too Little’ Finance? Prog. Dev. Stud. 2019, 19, 55–82. [Google Scholar] [CrossRef]

- Feng, Y.Q.; Zhang, H.L. Has fintech promoted innovation performance? Foreign Econ. Manag. 2021, 43, 50–67. [Google Scholar]

- Kaur, P.; Nakai, G.P.; Kaur, N. Spatial Spillover of Product Innovation in the Manufacturing Sector: Evidence from India. J. Knowl. Econ. 2022, 13, 447–473. [Google Scholar] [CrossRef]

- Wurgler, J. Financial markets and the allocation of capital. J. Bank. Financ. 2001, 58, 187–214. [Google Scholar]

| Main Index | Primary Index | Secondary Index | Tertiary Indicators | Measure Index |

|---|---|---|---|---|

| Intelligent transformation and upgrading of manufacturing industry | Foundation input layer | R&D investment | R&D investment in high-tech manufacturing industry | R&D funds for high-tech manufacturing/R&D funds for industrial enterprises |

| Intelligent device input | Manufacturing fixed assets investment | Fixed asset investment in telecommunications/fixed asset investment in manufacturing | ||

| Investment in fixed assets of information service industry | Investment in fixed assets of information technology service industry | |||

| Internet based investment | Internet coverage | Optical cable line length/provincial area | ||

| Internet penetration | Number of Internet users/population in province | |||

| Personnel input | Number of employees in high-tech manufacturing industry | Number of employees in high-tech manufacturing industry/number of employees | ||

| Number of personnel in information transmission, software and information technology services | Number of personnel/employees in information transmission, software and information technology services | |||

| Production application layer | Equipment intelligence | Software development and service | Software business income/manufacturing business income | |

| Management intelligence | Data processing and operation | Sum of software product revenue and embedded system software revenue/manufacturing owner’s business revenue | ||

| Product intelligence | Industrialization degree of Intelligent Technology | Output value of new products in high-tech manufacturing industry/business income of manufacturing owners | ||

| Effective invention patents of high-tech manufacturing industry/effective invention patents of industrial enterprises | ||||

| Service intelligence | Information service | Information technology service income/manufacturing owner’s business income | ||

| Market benefit layer | Economic performance | Smart device market profit | Total profits of high-tech manufacturing | |

| Smart device market efficiency | Business income/number of employees of high-tech manufacturing owners | |||

| Social results | Environmental improvement | Manufacturing wastewater discharge/manufacturing added value | ||

| Manufacturing emissions/manufacturing value added | ||||

| Industrial solid waste emissions/manufacturing value added | ||||

| Energy intensity | Manufacturing energy consumption/manufacturing value added |

| Variable | Describe | Sample Size | Mean Value | Standard Deviation | Minimum Value | Maximum |

|---|---|---|---|---|---|---|

| Dependent variable | Intelligent transformation and upgrading level of manufacturing industry | 360 | 0.135 | 0.084 | 0.025 | 0.605 |

| Independent variable | Financial innovation | 360 | 0.547 | 0.214 | 0.199 | 1.000 |

| Control variables | Urbanization level | 360 | 0.558 | 0.130 | 0.291 | 0.896 |

| Human capital level | 360 | 9.817 | 1.171 | 6.991 | 13.829 | |

| Industrial upgrading level | 360 | 1.000 | 0.412 | 0.010 | 2.016 | |

| Infrastructure construction | 360 | 0.050 | 0.014 | 0.022 | 0.104 | |

| Government grants | 360 | 0.004 | 0.003 | 0.001 | 0.034 |

| Year | Geographical Distance | Economic Distance | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| I | E (I) | sd (I) | z | p-Value | I | E (I) | sd (I) | z | p-Value | |

| 2008 | 0.160 ** | −0.034 | 0.091 | 2.151 | 0.031 | 0.246 *** | −0.034 | 0.082 | 3.422 | 0.001 |

| 2009 | 0.185 ** | −0.034 | 0.090 | 2.444 | 0.015 | 0.223 *** | −0.034 | 0.081 | 3.174 | 0.002 |

| 2010 | 0.156 ** | −0.034 | 0.087 | 2.180 | 0.029 | 0.240 *** | −0.034 | 0.079 | 3.467 | 0.001 |

| 2011 | 0.133 * | −0.034 | 0.088 | 1.907 | 0.057 | 0.266 *** | −0.034 | 0.079 | 3.780 | 0.000 |

| 2012 | 0.154 ** | −0.034 | 0.089 | 2.109 | 0.035 | 0.266 *** | −0.034 | 0.081 | 3.717 | 0.000 |

| 2013 | 0.144 ** | −0.034 | 0.089 | 2.020 | 0.043 | 0.261 *** | −0.034 | 0.080 | 3.688 | 0.000 |

| 2014 | 0.112 | −0.034 | 0.090 | 1.630 | 0.103 | 0.199 *** | −0.034 | 0.082 | 2.858 | 0.004 |

| 2015 | 0.119 * | −0.034 | 0.089 | 1.732 | 0.083 | 0.244 *** | −0.034 | 0.080 | 3.467 | 0.001 |

| 2016 | 0.115 * | −0.034 | 0.087 | 1.717 | 0.086 | 0.260 *** | −0.034 | 0.079 | 3.729 | 0.000 |

| 2017 | 0.144 ** | −0.034 | 0.085 | 2.088 | 0.037 | 0.251 *** | −0.034 | 0.077 | 3.696 | 0.000 |

| 2018 | 0.116 * | −0.034 | 0.081 | 1.855 | 0.064 | 0.211 *** | −0.034 | 0.074 | 3.327 | 0.001 |

| 2019 | 0.196 *** | −0.034 | 0.085 | 2.713 | 0.007 | 0.197 *** | −0.034 | 0.077 | 3.013 | 0.003 |

| Quadrant | 2008 | 2019 |

|---|---|---|

| First quadrant High concentration | Beijing Tianjin Shanghai Fujian Guangdong Qinghai Jiangsu | Beijing Tianjin Shanghai Fujian Guangdong Qinghai Jiangsu Zhejiang Hubei Chongqing Sichuan Guangxi |

| Beta Quadrant Low high concentration | Nothing | Shandong Jiangxi Hainan Anhui Guizhou |

| Third quadrant Low concentration | Hebei Shanxi Liaoning Jilin Henan Ningxia Gansu Xinjiang Heilongjiang Inner Mongolia | Hebei Shanxi Liaoning Jilin Heilongjiang Hunan Inner Mongolia |

| Delta Quadrant High and low agglomeration | Zhejiang Anhui Jiangxi Shandong Hubei Guangxi Hainan Chongqing Sichuan Guizhou Yunnan Shaanxi | Henan Yunnan Shaanxi Gansu Ningxia Xinjiang |

| Statistic | Number | p-Value | Statistic | Number | p-Value |

|---|---|---|---|---|---|

| LM—spatial lag | 54.663 *** | 0.000 | Wald—spatial lag | 17.730 *** | 0.007 |

| Robust LM—spatial lag | 6.380 ** | 0.012 | Wald—spatial error | 30.500 *** | 0.000 |

| LM—spatial error | 224.498 *** | 0.000 | LR—spatial lag | 40.050 *** | 0.000 |

| Robust LM—spatial error | 176.215 *** | 0.000 | LR—spatial error | 46.650 *** | 0.000 |

| LR test (spatial fixed effect) | 54.940 *** | 0.000 | LR test (time fixed effect) | 414.370 *** | 0.000 |

| Hausman test | 31.210 *** | 0.003 |

| Variables | Main | Wx | Spatial | Variance |

|---|---|---|---|---|

| Lnfin | 0.085 * | 0.095 * | ||

| (0.06) | (0.03) | |||

| Lncity | 0.714 *** | 1.468 *** | ||

| (0.00) | (0.00) | |||

| Lnedu | 1.386 *** | −1.963 ** | ||

| (0.00) | (0.02) | |||

| Lnins | −0.118 *** | 0.024 | ||

| (0.00) | (0.78) | |||

| Lntrans | −0.240 *** | −1.041 *** | ||

| (0.00) | (0.00) | |||

| Lngov | 0.007 | −0.036 | ||

| (0.86) | (0.74) | |||

| rho | 0.280 *** | |||

| (0.01) | ||||

| sigma2_e | 0.061 *** | |||

| (0.00) | ||||

| Observations | 360 | 360 | 360 | 360 |

| R-squared | 0.717 | 0.717 | 0.717 | 0.717 |

| Number of code | 30 | 30 | 30 | 30 |

| Variable | Lnfin | Lncity | Lnedu | Lnins | Lntrans | Lngov | R2 | N |

|---|---|---|---|---|---|---|---|---|

| OLS model | 0.016 ** | 0.729 *** | 1.762 *** | −0.051 * | −0.296 *** | 0.165 *** | 0.671 | 360 |

| (0.04) | (0.00) | (0.00) | (0.09) | (0.00) | (0.00) | |||

| Instrumental variable method | 0.361 *** | 1.021 *** | 1.402 *** | −0.023 | −0.296 *** | 0.299 *** | 0.613 | 330 |

| (0.00) | (0.00) | (0.00) | (0.47) | (0.00) | (0.00) |

| Variable | (1) | (2) | (3) |

|---|---|---|---|

| Direct Effect | Indirect Effect | Total Effect | |

| lnfin | 0.083 * | 0.058 | 0.141 * |

| (0.08) | (0.50) | (0.09) | |

| lncity | 0.649 *** | 1.035 *** | 1.684 *** |

| (0.00) | (0.00) | (0.00) | |

| lnedu | 1.526 *** | −1.934 *** | −0.408 |

| (0.00) | (0.00) | (0.50) | |

| lnins | −0.119 *** | 0.051 | −0.068 |

| (0.01) | (0.50) | (0.28) | |

| lntrans | −0.193 *** | −0.812 *** | −1.005 *** |

| (0.00) | (0.00) | (0.00) | |

| lngov | 0.009 | −0.029 | −0.021 |

| (0.81) | (0.75) | (0.83) | |

| Observations | 360 | 360 | 360 |

| R-squared | 0.717 | 0.717 | 0.717 |

| Number of code | 30 | 30 | 30 |

| Variable | Consumer Demand | Capital Allocation | Technological Innovation | |

|---|---|---|---|---|

| Direct effect | lnfin | 0.196 *** | 0.155 *** | 0.672 *** |

| (0.01) | (0.00) | (0.00) | ||

| lnmedium | 0.230 * | 0.015 | 0.260 *** | |

| (0.05) | (0.62) | (0.00) | ||

| lnmedium * lnfin | 0.225 ** | 0.131 *** | 0.063 ** | |

| (0.02) | (0.00) | (0.01) | ||

| Indirect effect | lnfin | 0.023 | 0.021 | 0.106 |

| (0.86) | (0.80) | (0.15) | ||

| lnmedium | −0.033 | 0.013 | 0.105 | |

| (0.88) | (0.86) | (0.14) | ||

| lnmedium * lnfin | −0.081 | 0.187 ** | 0.576 * | |

| (0.65) | (0.04) | (0.08) | ||

| Total effect | lnfin | 0.219 * | 0.176 ** | 0.902 ** |

| (0.08) | (0.02) | (0.01) | ||

| lnmedium | 0.197 | 0.028 | 0.119 | |

| (0.26) | (0.69) | (0.15) | ||

| lnmedium * lnfin | 0.144 | 0.318 *** | 0.147 ** | |

| (0.39) | (0.00) | (0.03) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhou, J.; Cui, F.; Wang, W. The Spatial Effect of Financial Innovation on Intellectualized Transformational Upgrading of Manufacturing Industry: An Empirical Evidence from China. Sustainability 2022, 14, 7665. https://doi.org/10.3390/su14137665

Zhou J, Cui F, Wang W. The Spatial Effect of Financial Innovation on Intellectualized Transformational Upgrading of Manufacturing Industry: An Empirical Evidence from China. Sustainability. 2022; 14(13):7665. https://doi.org/10.3390/su14137665

Chicago/Turabian StyleZhou, Juanmei, Fenfang Cui, and Wenli Wang. 2022. "The Spatial Effect of Financial Innovation on Intellectualized Transformational Upgrading of Manufacturing Industry: An Empirical Evidence from China" Sustainability 14, no. 13: 7665. https://doi.org/10.3390/su14137665

APA StyleZhou, J., Cui, F., & Wang, W. (2022). The Spatial Effect of Financial Innovation on Intellectualized Transformational Upgrading of Manufacturing Industry: An Empirical Evidence from China. Sustainability, 14(13), 7665. https://doi.org/10.3390/su14137665