1. Introduction

With the promulgation of the No. 9 Document of Electric Power Reform, China has entered a new round of electric power system reform, and the market has gradually realized diversification. One of the most important features of the current power system reform is to restore the commodity nature of power, transform the original integrated distribution market into a free market, and realize the marketization of power transactions. At the same time, the electricity transaction price equation was changed from the government to a market transaction formation. Therefore, for market players, a more accurate understanding of the electricity price formation mechanism and the ability to forecast future trends in electricity prices will become an important link for the adaptation to market-oriented electricity trading.

In a market economy, the market mechanism plays a certain role in regulating the sustainable development of power and can effectively regulate the supply–demand relationship in the electricity market. The price of electricity is the fundamental basis for production and consumption behavior. To achieve the sustainable development goals of energy-saving and environmental protection, it is necessary to have more accurate electricity price forecasting so as to provide a more scientific and effective decision-making basis for the market players. In recent years, in order to achieve China’s sustainable development, China has been building a new energy system focused on promoting the consumption of new energy. On the one hand, effective electricity price forecasting can save the economic cost of the operation of the new power system and optimize the operation efficiency of market operators; on the other hand, one of the characteristics of the new power system is that the new energy generation capacity will increase the instability of the power system. Effective electricity-price forecasting can send power system regulation signals to the market players, effectively regulate the power system balance, and establish the stability and sustainable development of the power system.

The price of electricity is an economic reflection of the market operation mode, which is formed by the interaction of various factors. Therefore, it is complex and comprehensive. Importantly, the volatility of the spot market increases the difficulty of price forecasting. At present, many experts at home and abroad research the characteristics of spot market price formation to analyze the spot market price forecast, arriving at a number of notable conclusions. Among them, the forecasting methods are mainly divided into three methods: time series models, machine learning, and the combination of time series and machine learning.

The time series model represents a time series composed of a series of discrete numbers observed at a series of times by one or a group of variables, and are mainly the following: moving average method, weighted moving average method, exponential smoothing method, and trend forecasting method. The use of the time series model currently takes three main forms: (a) The use of optimization algorithms to correct the core parameters of the time series model to ensure that the weights of the time series and the fluctuations of the series are within a reasonable range, such as Wang Ruiqing et al. in the use of particle swarm algorithm to correct the weights of GM (1,2) to achieve the purpose of improving the accuracy of short-term electricity price forecasting [

1]; (b) The time series model is mainly composed of four components: seasonal component, trend component, cyclical component, and residuals. Due to the fine time granularity of spot electricity price forecasting, more experts choose to correct for residuals [

2,

3]; (c) Using the adaptability of different time series models, multiple time series are combined with each other, for example, using generalized autoregressive conditionally heteroscedastic (GARCH) to ARIMA to correct for heteroskedasticity [

4,

5].

Time series models perform forecasting with the prerequisite assumption that historical trends and future development change in the same pattern, so when large external changes occur, a certain bias can occur. To overcome this drawback, many experts focus on machine learning algorithms, which are trained on a large amount of data by machine learning to analyze the interaction between forecast data and other factors to predict future trends. Machine learning is an interdisciplinary specialty, covering probability theory knowledge, statistics knowledge, approximate theory knowledge, and complex algorithm knowledge. It uses a computer as a tool and is committed to real-time simulation of human learning. It divides the existing content into knowledge structures to effectively improve learning efficiency. Machine learning is applied to forecasting in a similar way to time series: (a) Using echo state network (ESN), convolutional neural network, limit learning machine, and other algorithms, combined with load, historical price, and supply and demand as inputs, it can build relevant prediction models [

6,

7,

8]. For example, Hafeez et al. Proposed a restricted Boltzmann machine (RBM) -based predictor module [

9]; (b) Combining optimization algorithms with different machine learning algorithms to improve the prediction accuracy of machine learning [

10,

11,

12,

13]; (c) The focus of the first two approaches is on improving machine learning forecasting capabilities. Additionally, many experts focus on the correlation analysis of factors, using methods such as principal component analysis and maximum information coefficient to analyze the correlation of the factors related to prior electricity price [

14,

15,

16], Hafeez et al. Used modified cultural information (MMI) to extract historical data features, and used a GWDO optimization algorithm combined with factored conditional restricted Boltzmann machine (FCRBM) to construct day-ahead load forecasting [

17]. In terms of the way machine learning is used, more optimization is currently done for the model itself [

18,

19]; therefore, in this paper, we add the screening of historical data to these three ways to improve the reliability of the original data and achieve the optimization of the machine learning model.

In addition, some experts also combine time series and machine learning algorithms to form combined time series–machine learning models, which are combined in two ways: (a) Using time series models to correct for the prediction errors of machine learning [

20,

21]; (b) Decomposing the original data curve to form high-frequency data and low-frequency data, with high-frequency data using machine learning models for prediction and low-frequency data prediction using machine learning [

22,

23,

24]. These two combined models have the risk of increasing the prediction error because a certain amount of error is generated in the error correction process and in the data decomposition process, and this error leads to an increase in the final prediction error [

25,

26].

In combination with the use of the three models mentioned above, the current ideas for building electricity price-forecasting models include the following: One is to decompose and reconstruct the original price series, that is, to decompose the original price series by using many modal decomposition algorithms and wavelet models [

27,

28]. Then the improved forecasting model is used to forecast different price decomposition sequences. Finally, the forecasted values of several decomposition sequences are reconstructed to form the final electricity price-forecasted values [

29]. This method can decompose the volatility to a certain extent, reduce the impact of price volatility on the learning ability of the prediction model, and retain the original curve characteristics. However, this approach often makes it difficult to take the relevant factors into account, and thus cannot fully reflect the real-time changes in the market. Because the relevant factors can not completely correspond to each decomposition curve, the predicted effect will be affected in the process of model training. This kind of model still belongs to time series extrapolation. Another model is to analyze the formation characteristics of electricity price, taking electricity price and its related factors as the input of the model to improve the accuracy of the prediction model. This kind of model can reflect the real-time change of electricity price on the market and the relationship between different factors, and can reflect the structural change of the market to some extent [

30]. But this type of model is strict regarding the choice of characteristic value, as the weak correlation with characteristic value will affect the forecast effect in the model training process, causing the deviation to increase [

31,

32,

33].

According to the above analysis, some key elements are missing from the current studies on electricity price forecasting, namely:

- (a)

Many current studies ignore the useless information brought by the large amount of electricity price data when screening data features, which not only causes a reduction in forecasting accuracy but also affects the operational efficiency of forecasting models [

34].

- (b)

The existing prediction models are generally based on a single sample set composed of features, which leads to the extraction of too much data, resulting in poor prediction accuracy [

35,

36].

In order to overcome the above shortcomings, this paper proposes a price forecasting model for day-ahead spot market based on hybrid extreme learning machine technology. Firstly, the formation mechanism of electricity price in the spot market is analyzed, the relevant factors of electricity price prediction in the spot market are sorted out, and the correlation degree of relevant factors of electricity price is verified by Spearman model. Secondly, the Criteria Importance Though Intercriteria Correlation (CRITIC) model is improved, the difference coefficient and Spearman model are used to improve the traditional CRITIC, the comprehensive weights of relevant factors are obtained, and the weights are assigned to the gray correlation (GRA) screen to obtain similar daily data, which can ensure that the prediction model will not cause overfitting due to data differences. Third, the Marine Predators Algorithm (MPA) is used to optimize the regularization coefficient and hidden layer node parameters of the traditional Regularized extreme learning machine (RELM) to obtain the best prediction model, and predict the predicted daily electricity price according to the best prediction model. Fourth, in order to further verify the prediction effect of the price prediction model based on the hybrid extreme learning machine technology proposed in this paper, MPA-RELM, GA-ELM, GA-SVM, ELM, and SVM are used as the reference for the prediction results. Additionally, according to the root mean square error (RMSE), the mean absolute error (MAE), the mean square error (MSE), and the residual sum of squares (SSE) act as a variety of prediction model output effect evaluation indicators. Through the case analysis of the actual data of the spot pilot in China, it is shown that the model proposed in this paper improves the accuracy of the original data to a certain extent, improves the generalization ability of the RELM model, and achieves greater accuracy of prediction results. This research has certain guiding significance for forecasting spot market price. The abbreviations and acronyms are in Abbreviations section.

The main contributions of this paper are as follows:

- (1)

Through the analysis of sample factor correlation degree and sample factor similarity, a massive amount of data is cleaned up, the amount of data is reduced, the useful information is fully used, the accuracy of the RELM model is improved, and the calculation efficiency of the model is improved.

- (2)

Considering the characteristics of the RELM model, the MPA model is used for optimization to reduce the probability of the prediction model falling into the local optimal solution.

- (3)

A framework of electricity price forecasting based on similar days is proposed, which realizes 96-point forecasting in a day instead of single-point forecasting

According to the idea of constructing the forecast model, the following chapters of this paper are arranged as follows: the second chapter constructs the similar day screening model, mainly from the aspects of the formation mechanism of electricity price, relevant elements of electricity price and the construction of similar day screening model. The third chapter will build the RELM electricity price forecasting model based on MPA optimization. This part mainly introduces the RELM model and MPA model, combines the characteristics of the two models, and describes the forecasting process of the forecasting model. In the fourth chapter, a case study of the spot market in Shanxi Province of China will be carried out to verify the effectiveness of the model proposed in this paper. The last chapter will summarize the whole paper.

3. Construction of Electricity Price Forecasting Model

3.1. Regularized Extreme Learning Machine (RELM)

China’s electricity spot market construction is still in the initial stage, and there are many uncertainties regarding the price of electricity on the spot market. The spot price is characterized by strong volatility and nonlinearity, which increases the difficulty of electricity price forecasting. Therefore, the price-forecasting model of spot market needs to solve the nonlinear relation of electricity price to some extent. Regularized limit learning machine is an improvement to the traditional limit learning machine. The regularization coefficient is added to ELM, which can increase the generalization ability of ELM to some extent [

57]. In this paper, RELM is used to construct the spatial mapping relationship between electricity price and related factors, which can improve the accuracy of electricity price prediction and enhance the anti-interference of the model. The RELM network can be represented as:

where

is the sum of training errors, where

and

are empirical and structural risks, respectively, and

is the regularization coefficient. The weights matrix can be obtained by processing the Lagrange Equation (8):

where

I is the identity matrix,

Z is the parameter matrix of the model training settlement input, and

H is the output matrix of the hidden layer.

In the prediction process, according to the results of previous training, the weight matrix w and the hidden layer offset matrix b are generated randomly. Then the hidden layer output weight matrix

is calculated according to the ELM output function, forming the RELM regression model as Equation (9):

3.2. Marine Predator Algorithm (MPA)

Marine Predators Algorithm (MPA) is a new meta- heuristic optimization algorithm proposed by Afshin Faramarzi and others in 2020. MPA optimization is divided into three stages: the initialization stage, the optimization stage, and the FADs effect or eddy current stage. The specific MPA optimization process can be described as follows [

58]:

- (1)

Initialization phase. Set algorithm parameters to initialize the location of the prey within the search scope. It can be described as:

In Equation (10), , denote the search space of the prey, and rand(·) is a random number within (0, 1).

- (2)

Optimization stage. The optimization phase is divided into early iteration, middle iteration and late iteration. At the beginning of the iteration, the current iterations are less than 1/3 of the maximum iterations. Predators are faster than prey, performing globes and updating prey through Brown random.

In Equation (11), is the step size, is the Brownian walk random vector with normal distribution, is the prey matrix with the same dimension as the static matrix, is the elitist matrix constructed by the top predator, is a multiplicative operation item by item, P equals 0.5, and R is a (0, 1) uniform random vector. N is the population size, and and represent the current and maximum iterations.

In the middle of an iteration, the current iteration is less than 2/3 of the maximum. The population is divided into two parts, in which the prey does the levy movement, being responsible for the algorithm development in the search space. Predators do Brownian motion, being responsible for the algorithm’s exploration in the search space, shifting gradually from an exploration to a development strategy.

At the end of the iteration, the current iteration number is more than 2/3 of the maximum iteration number, mainly to improve the local development, the predator is slower than the prey speed, predator roaming based on levy.

In Equation (12), is the Levy distributed random vector, and is the adaptive parameter controlling predator movement compensation.

- (3)

FADs effect or eddy current. Fish aggregation devices (

FADs) or vortex effects often change the behavior of marine predators, which enables the MPA to overcome the premature convergence problem and adjust the local extremum.

In Equation (13), is the influence probability, takes 0.2, is the binary vector, r is the random number in (0, 1), r1, r2 is the random index of the prey matrix respectively.

3.3. MPA-RELM Model Construction

Through the explanation of RELM above, we know that the prediction precision of RELM is greatly influenced by the regularization coefficient

and the number of hidden layer nodes

L. Therefore, the RELM model is further optimized by MPA to obtain more accurate regularization coefficient

and hidden layer node number

L. The root mean square error (

RMSE) of the training sample is selected as the fitness function of the MPA:

In Equation (14), represents the training prediction, represents the training observation, and n represents the number of training samples.

The specific process of MPA-RELM-based spot price forecasting algorithm is as follows:

- (1)

Divide the similar day data selected by CRITIC-GRA above into training and testing sets and normalize them;

- (2)

Set parameters such as the maximum number of iterations and population size. According to the Equations (1)–(10), the prey initialization position is set and the current iteration number is 0 to calculate the management matrix.

- (3)

According to the three stages of the optimization process, continuously update the location of prey, complete the elite update, calculate the fitness value, and update the final position.

- (4)

In combination with the FADs effect, the Equations (1)–(13) are used to update the prey so that the algorithm can iteratively jump out of the local optimal solution.

- (5)

Evaluate and update the elite matrix and determine the relationship between the number of iterative operations and the maximum number of iterations. If the iterative algorithm is equal to the maximum number of iterations, the best iterative elitist matrix is output. Elitist matrix is the best key parameter of RELM, which is brought into RELM model for prediction. The specific process structure is shown in

Figure 3.

3.4. Construction of a Day-Ahead Spot Market Price Prediction Model Based on Hybrid Extreme Learning Machine Technology

In this section, the improved electricity price forecasting hybrid algorithm, denoted as CRITIC-GRA-MPA-RELM, is developed and shown in

Figure 4. Its main procedure is summarized as follows:

Aiming at the research on the formation mechanism of electricity price in the electricity market, combined with domestic and foreign research on spot electricity price forecasting models, collect and organize relevant data on electricity price forecasting.

- (2)

Identify the core factors of electricity price forecasting

Based on the formation factors of electricity price in the spot market, combined with the actual operation information of spot pilots in various provinces in China, the relevant factors of electricity price prediction are screened out, and the Spearman correlation coefficient is used to calculate the influence degree of each factor on electricity price.

- (3)

Build a similar day screening model

Similar day screening model consists of two parts: improved CRITIC and weighted grey relational degree. First, the factor correlation obtained by the Spearman correlation coefficient is replaced by the conflict index of the traditional CRITIC. Second, the difference coefficient is replaced by the standard deviation to calculate the contrast strength index of CRITIC. Third, the comprehensive weight of CRITIC is formed, and the gray relational degree model is given weight. Fourth, the original dataset is screened according to the improved CRITIC-GRA model to form a similar daily dataset.

- (4)

Select the optimal model to predict

First, the data of similar days are divided into training set and test set. Second, using the training set data as the input of the model, the Marine Predator Algorithm (MPA) is used to optimize the RELM to obtain the optimal regularization coefficient and hidden layer nodes. Third, use the test set data as the optimal RELM model for prediction, and finally get the prediction result.

- (5)

Model prediction result verification

In order to verify the validity of the model, according to the characteristics of the RELM model selected in this paper, MPA-RELM, GA-ELM, GA-SVM, ELM, and SVM are selected as the model prediction results reference, and

SSE,

MSE,

RMSE, and

MAE as model evaluation metrics.

where

denotes the real electricity price and

denotes the forecast electricity price.

- (6)

Diebold–Mariano test

In order to better verify that the model proposed in this paper is superior to other models, the Diebold–Mariano test is used to determine whether there are significant differences between different prediction models. The DM test is a widely-used prediction test method [

59,

60,

61,

62].

Let

and

be the residuals for the two forecasts, i.e.,

and let

be defined as one of the following

Find the mean and standard deviation of a series

d

where

γk is the autovariance at lag

k.

For

h ≥ 1, define the Diebold–Mariano statistic as follows:

4. Case Analysis

Although foreign spot markets are more mature and have abundant data, there are relatively few studies on electricity prices in the Chinese spot market, and since the Chinese spot market is in its infancy, market players have a more urgent and practical need for electricity price forecasting in the Chinese spot market. Therefore, this paper mainly selects the 96 points-per-day data of the spot market in Shanxi Province from 1 October 2021 to 25 February 2022, and in order to better demonstrate the operation of the Shanxi spot market, this paper intercepts one week of data for display (

Figure 5 and

Figure 6).

Select MATLAB2019b as the simulation computing platform, the computer operating system is Windows 11, the memory is 16G, and the hard disk is 1T.

4.1. Similar Day Filter

The model instance dataset is mainly composed of the day-ahead spot electricity price data from 1 October 2021 to 25 February 2022, with a time granularity of 96 points-per-day. Among them, the data from 1 October 2021 to 24 February 2022 is used as the training set, and 25 February 2022 is used as the prediction day. The relevant factors on 25 February 2022 are shown in

Figure 7. According to the similar daily screening model based on the improved CRITIC-GRA constructed above, the 147 sets of training set data were further extracted to obtain a more accurate training set, and the first 50 sets of training data sets were screened out according to the data requirements of RELM. The result is as follows:

In the process of screening similar days in this paper, the following conclusions can be drawn: First, thermal power output has the greatest impact on electricity price, so the similarity in this paper is affected by the similarity of thermal power output to a certain extent. Secondly, according to the similarity of various factors every day, it can be seen that the inter-provincial dispatch load on most days has a high similarity, indicating that the demand in the Shanxi spot market is basically stable, but the New energy has great uncertainty and is negatively correlated with spot electricity prices, which is in line with Shanxi province’s rule of preferential consumption of New energy. The sorting results of similar days are shown in

Figure 8.

In this paper, the similarity of historical days is calculated, and the similarity interval of historical days is (0.627006, 0.878184). In this paper, the first 50 groups of similar days are selected for the following reasons: firstly, the historical days ahead of similar days are more related to the predicted daily electricity price. Secondly, the more obvious the similarity difference, the more stable the market operation, the stronger the correlation of factors, and the smaller the interference to the prediction model. Thirdly, 50 groups of historical data can prevent too much or too little data from affecting the training efficiency.

According to

Table 2, the following conclusions can be further obtained: firstly, thermal power output has the greatest impact on electricity price, so the similarity in this paper is affected by thermal power output similarity to a certain extent. Secondly, according to the similarity of each factor every day, it can be seen that the provincial dispatching load on most days has a high similarity, indicating that the demand of the Shanxi spot market is basically stable, but the New energy has great uncertainty and is negatively correlated with the spot electricity price, which is in line with the rule that the Shanxi spot market gives priority to the consumption of New energy.

Table 3,

Table 4,

Table 5,

Table 6 and

Table 7 further analyze the characteristics of data on similar days and historical days, indicating that similar days are more in line with the need to reduce data errors.

4.2. Day-Ahead Spot Market Price Forecast Based on a Hybrid Extreme Learning Machine Technique

According to the analysis in the previous section, this paper uses 50 groups of similar daily data as the training set, and the prediction day on February 25 as the test set to train the CRITIC-GRA-MPA-RELM model. Among them, the basic parameters of the MPA model are set to the maximum number of iterations of 1000, the search group is set to 50, the FADs is set to 0.3, the value range of the parameter γ of the RELM model is (2

−10, 2

−9, …, 2

9, 2

10), the initial value of the parameter L is 10, and each time it increases by 10, with a maximum increase of 20. At the same time, in order to verify the effectiveness of the model proposed in this paper, MPA-RELM, GA-ELM, GA-SVM, ELM, and SVM models are used as references. The prediction effect of CRITIC-GRA-MPA-RELM is shown in

Figure 9.

It can be seen in

Figure 9 that the electricity price predicted by the model proposed in this paper is basically the same as the actual electricity price curve trend, which can reflect the price trend of the real market to a certain extent, and has a good fitting effect. It can be seen that the model proposed in this paper has a good reflection on the peak electricity price and the trough electricity price.

In order to better verify the effectiveness of the CRITIC-GRA-MPA-RELM model, we further conducted a comparative analysis of multiple models, in which ELM and SVM were trained with 50 randomly selected groups of data, without similar day screening, using MPA-RELM and similar daily data. It is verified that the optimization algorithm proposed in this paper can improve the prediction accuracy better than the traditional optimization algorithm. GA-ELM and GA-SVM are used to verify the prediction difference between the traditional optimization model and RELM. The specific optimization results follow.

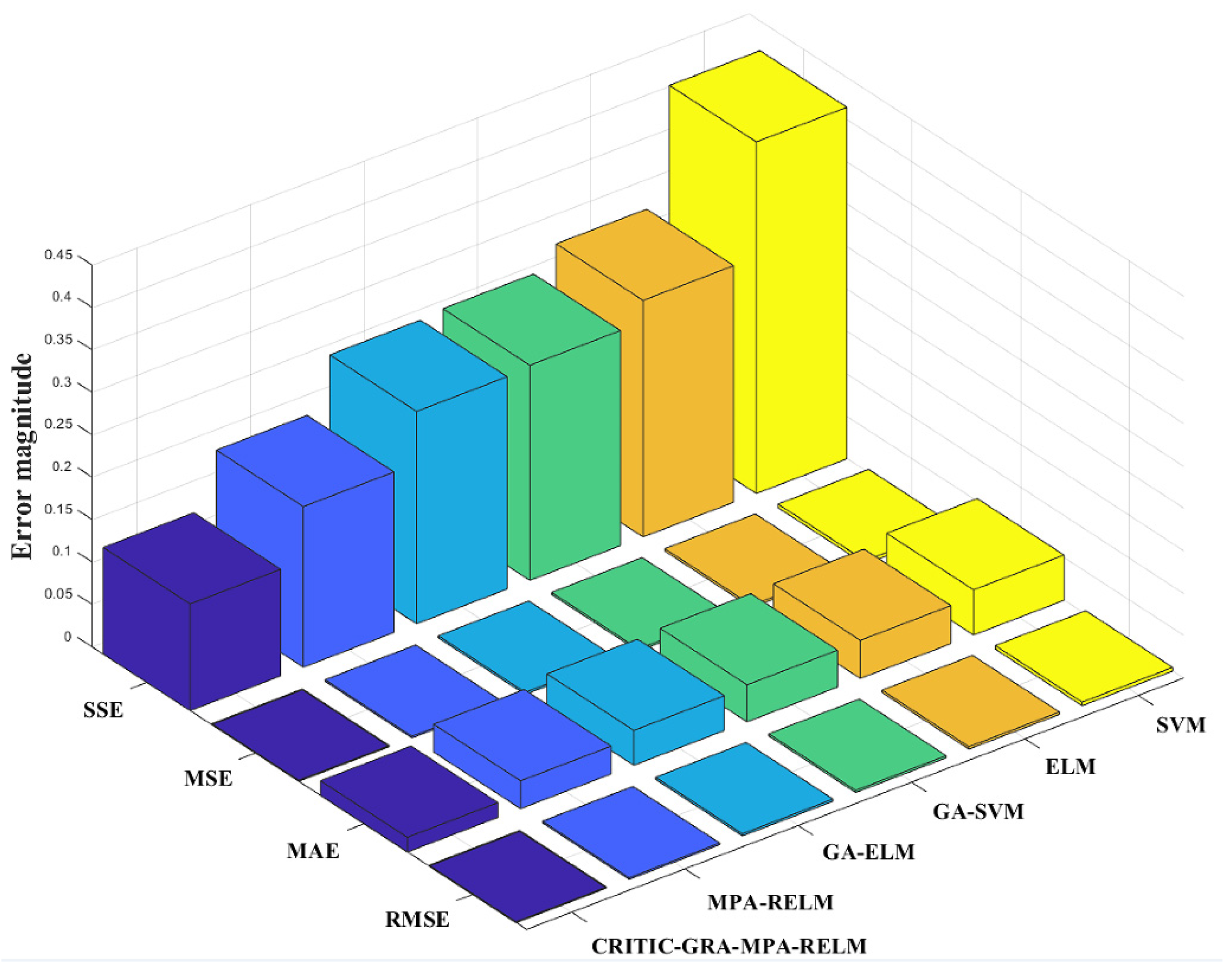

In order to better show the prediction effect of the six models, this paper selects the error indicators SSE, MSE, MAE, and RMSE. The result shows that all the error indicators of the spot market price prediction model constructed in this paper are the lowest, and are better than other models. After screening similar days, the data was further optimized, so that the SSE of the MPA-RELM model was improved by 0.0636, the MSE was improved by 0.0007, the MAE was improved by 0.0154, and the RMSE was improved by 0.0007.

In order to further verify that the prediction model constructed in this paper has more accurate prediction performance, DM test was used to test the significance of the prediction results of MPA-RELM, GA-ELM, GA-SVM, ELM, and SVM, and the p-values of different models are shown in the following table.

According to the prediction effect and prediction deviation of different models in

Figure 10,

Figure 11 and

Figure 12, it shows that the CRITIC-GRA-MAP-RELM model proposed in this paper has strong applicability to the forecast of day-ahead spot electricity prices, and according to the error analysis in

Table 8 and the significance analysis in

Table 9, the fitting effect and error of the forecast model are as follows: CRITIC-GRA-MPA-RELM > MPA-RELM > GA-ELM > GA-SVM > ELM > SVM. From the deviation trend and distribution characteristics of each prediction model, the following conclusions can be further drawn:

- (1)

The prediction error of the ELM model is lower than that of the SVM model, indicating that ELM is more adaptable than SVM for electricity price forecasting. From the forecast trend, it can be seen that the electricity price predicted by SVM is generally higher than that of ELM, and the electricity price trend of SVM during the evening peak is opposite to that of ELM, indicating that the SVM forecast curve is more volatile. The basic RELM model used in this paper is a model further optimized on the basis of ELM, which shows that the model proposed in this paper has a certain model foundation and is more suitable for electricity price forecasting than other machine learning algorithms.

- (2)

The error of MPA-RELM is lower than that of GA-ELM, indicating that using MPA to optimize RELM can improve the accuracy of machine learning more than the GA model to optimize ELM. The electricity price prediction curve from MPA-RELM is basically the same as that of GA-ELM. The electricity price curve predicted by the MPA-RELM model still has a large deviation, but MPA-RELM reduces the deviation of each time point, especially in the evening peak, meaning MPA-RELM is closer to the real electricity price.

- (3)

CRITIC-GRA-MPA-RELM has the highest prediction accuracy, and MPA-RELM is second only to the model proposed in this paper, indicating that further screening of historical data, obtaining historical daily data similar to the market on the forecast day, which can better adapt to the volatility of electricity prices in the spot market, can improve the prediction accuracy of the MPA-RELM model and prevent the model from overfitting.

Through the comparative analysis of the above models, it can be seen that the CRITIC-GRA-MPA-RELM model proposed in this paper is more suitable for spot market electricity price forecasting, and can better reflect the trend of spot market electricity price fluctuations, especially peaks and troughs. It can make up for the shortcomings of RELM and ELM to a certain extent.

From

Figure 13, the error trends of different prediction models can be obtained: firstly, the prediction accuracy of different models is different, but the prediction errors of the six models are all larger in the evening peak, and none of the six models currently predict outliers at 10:45 and 22:30, indicating that the forecast of the day-ahead electricity price not only needs to consider the public information of the electricity market, but also needs to consider the main body’s quotation decision plan. Secondly, according to the historical electricity price trend, the morning peak period is relatively stable, the prediction results of the six models are relatively stable, and all have relatively calibrated prediction results. Among the six models, the prediction results of five models are relatively concentrated. The model proposed in this paper is closer to the real history information, indicating that when forecasting the day-ahead spot electricity price, it is necessary to focus on selecting a historical day that is closer to the forecast date.