Dynamic Relationships between Seafood Exports, Exchange Rate and Industrial Upgrading

Abstract

:1. Introduction

2. Literature Review

3. Materials and Methods

3.1. Data and Variable Description

3.2. Methods

3.2.1. Model Specification and Estimation Technique

3.2.2. Construction of Exchange Rate Variable

3.3. Estimation Techniques

3.3.1. Unit Root Test

3.3.2. Structural Break Unit Root Test

3.3.3. Cointegration

4. Empirical Results

4.1. Unit Root Tests

4.2. Structural Break Test

4.3. Cointegration Test

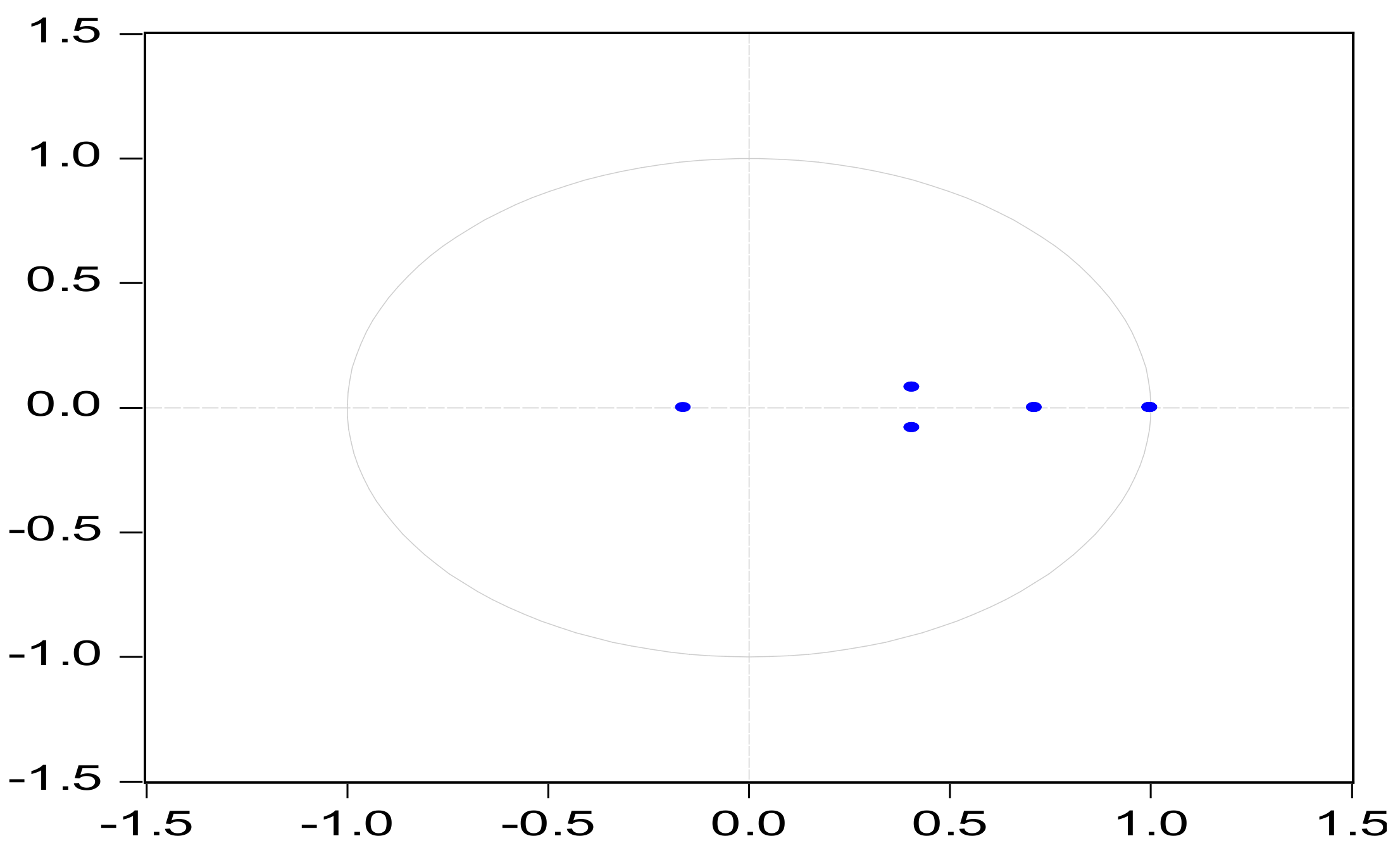

4.4. VECM Results

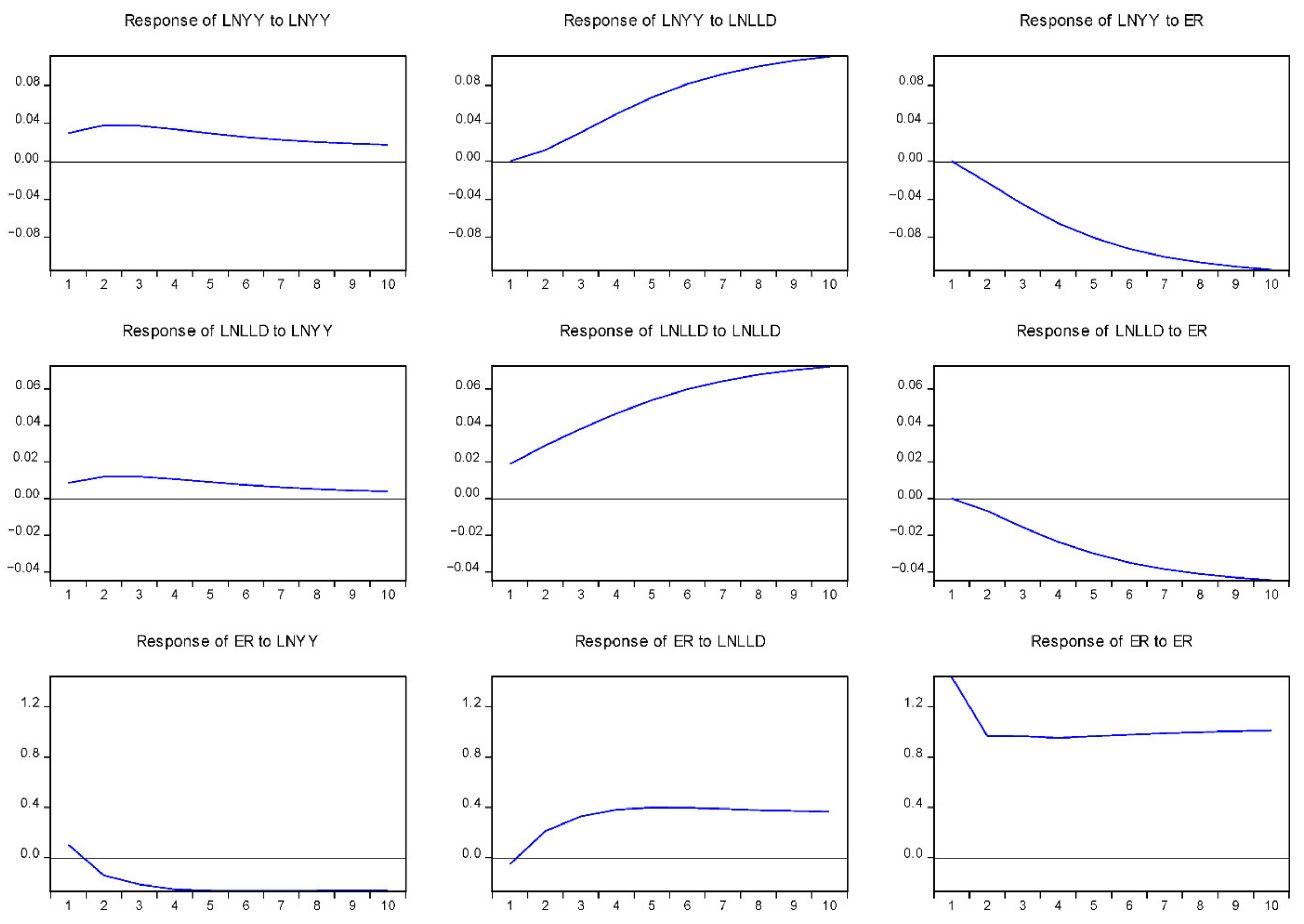

4.5. Contemporaneous Causality and Dynamic Relationship among Variables

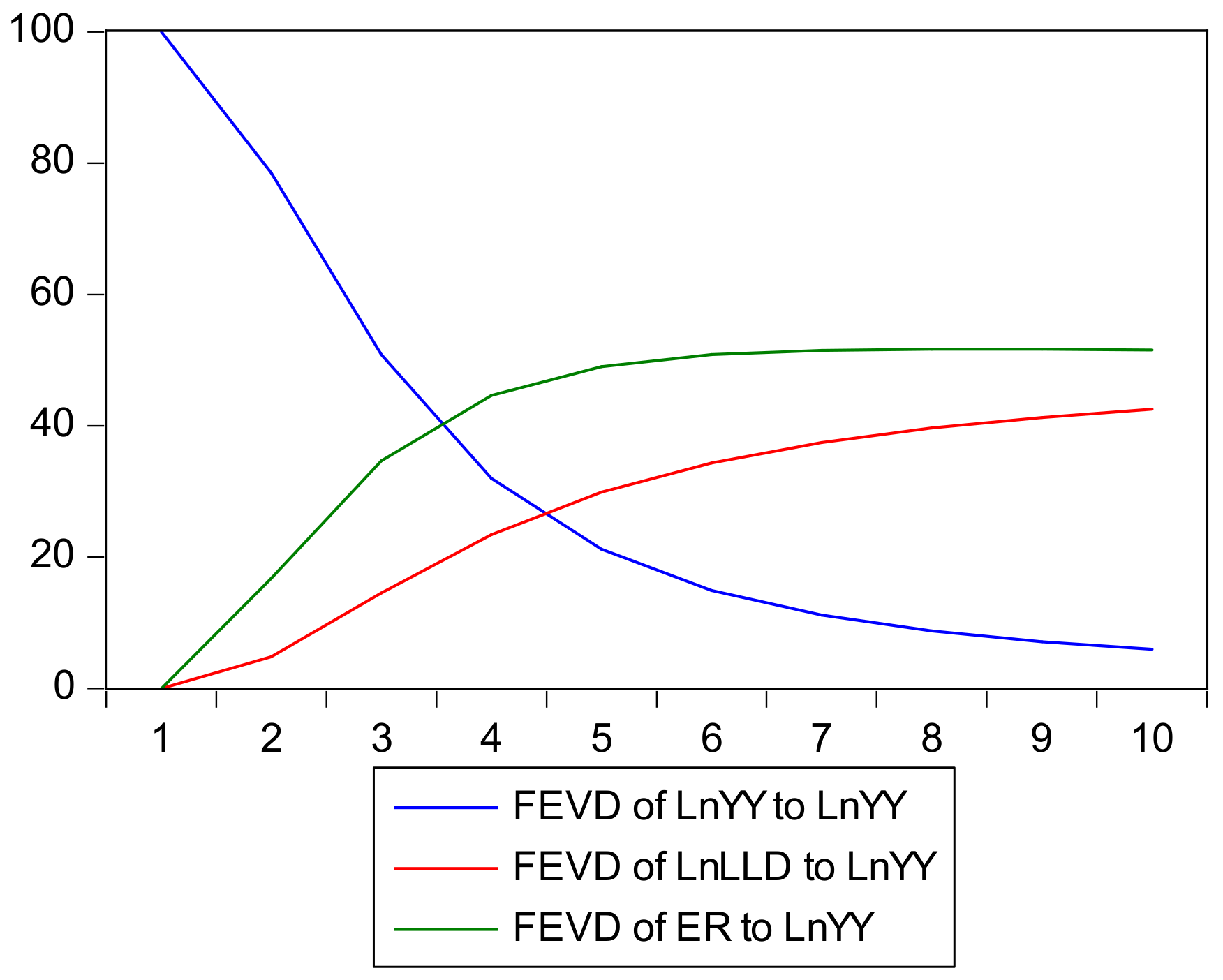

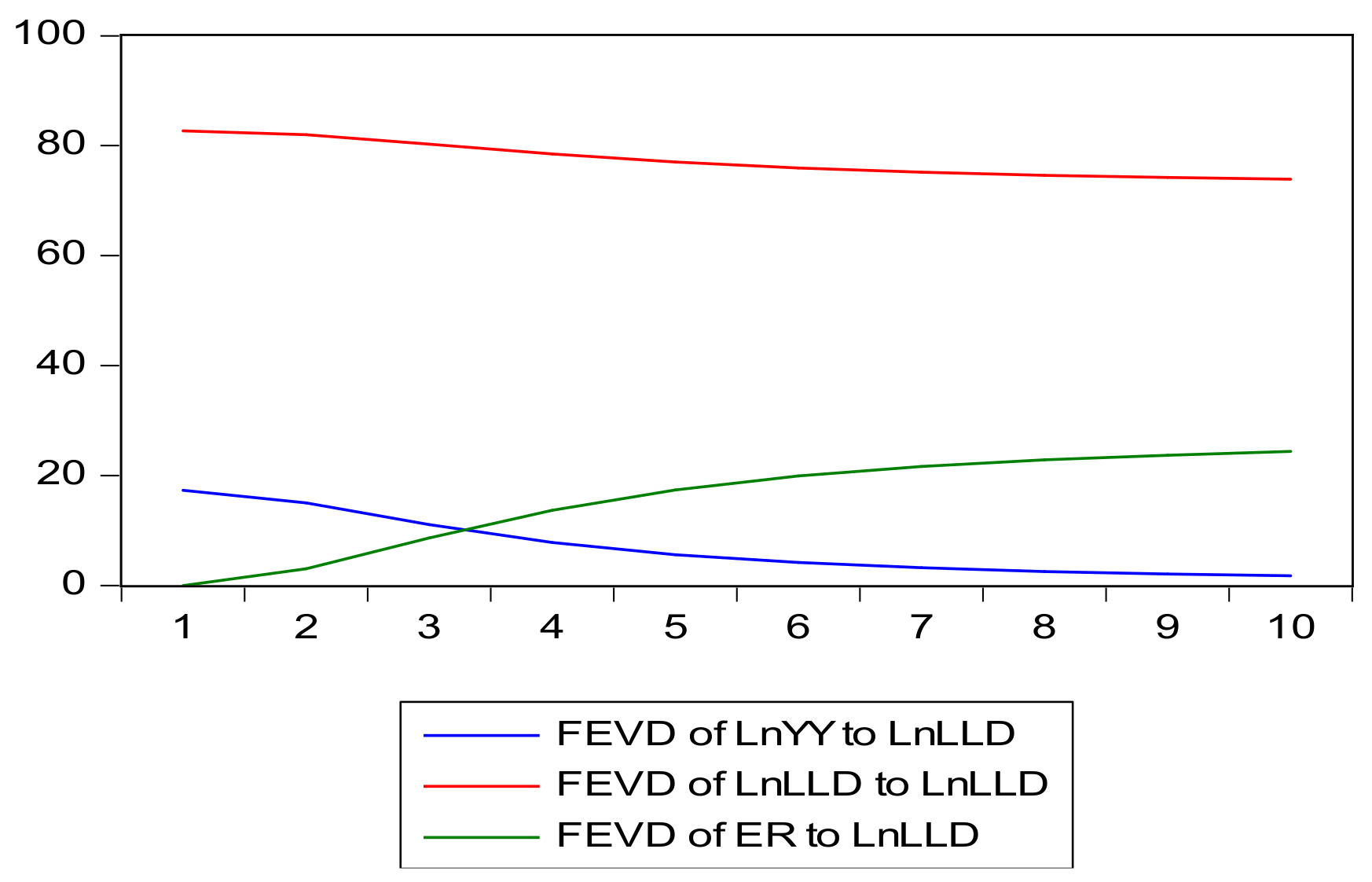

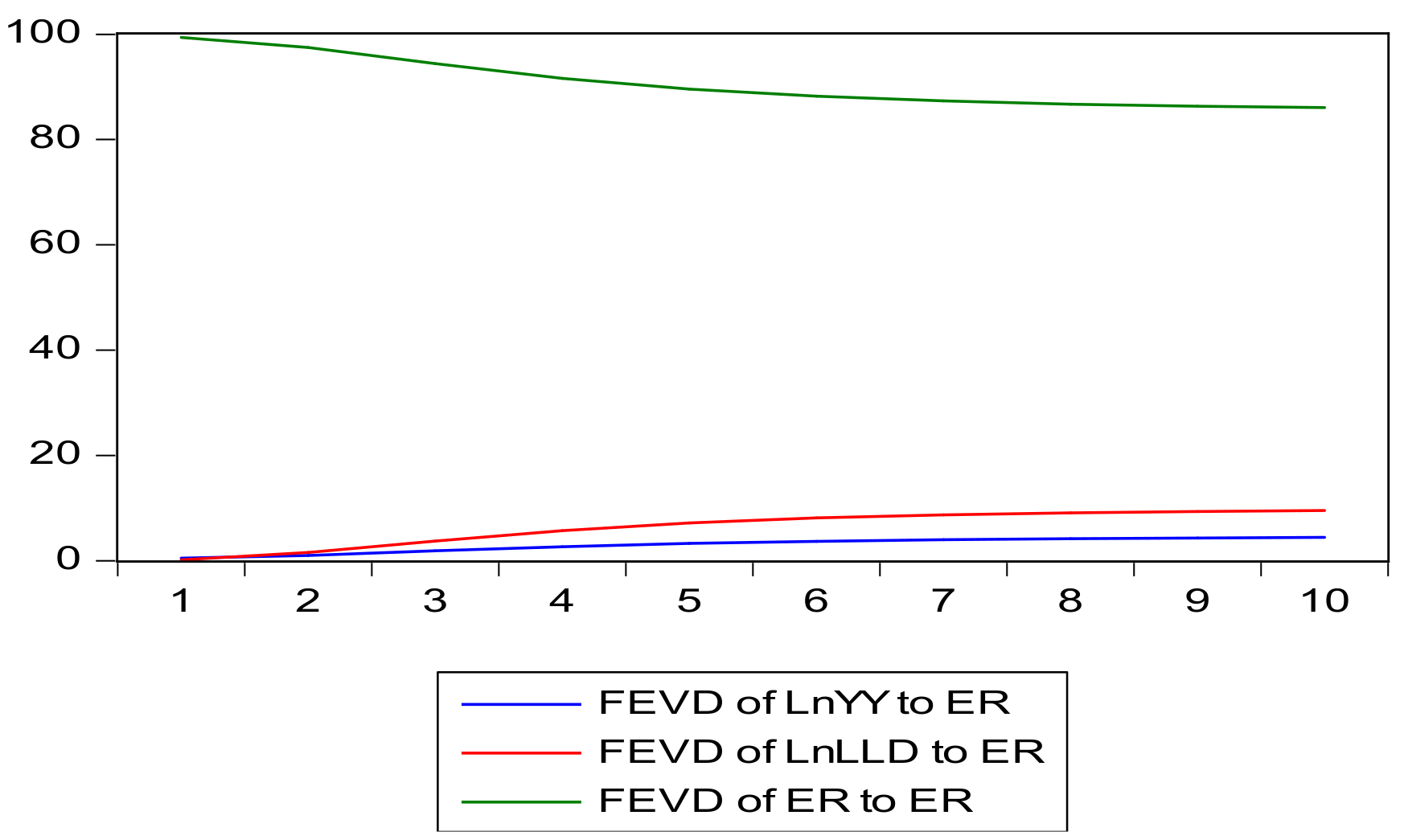

4.6. Variance Decomposition

4.7. Robustness Checks

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Product | HS (6 Digit) Code |

|---|---|

| Gutted and chilled | 030254, 030244, 030245, 030264 |

| Frozen | 030378, 030354, 030366, 030355, 030374 |

| Fillets-fresh, chilled or frozen | 030474, 030479, 030449, 030420 |

| Prepared or preserved | 160415 |

| Variable | Proxy | Description | Source |

|---|---|---|---|

| LYY | Processed exports | Total processed seafood exports expressed in tons | UN TRADEMAP |

| LLD | Investment expenditure in industrial upgrading | NPC 2021. | |

| ER | Exchange rate | Real effective exchange rate | BON |

References

- Al-Busaidi, A.; David, J.J.; Shekar, B. Seafood Safety and Quality: An Analysis of the Supply Chain in the Sultanate of Oman. Food Control 2016, 59, 651–662. [Google Scholar] [CrossRef] [Green Version]

- Bandara, T.; Abeywickrama, L.M.; Radampola, K. Growth Performance and Competitiveness of Finfish and Frozen Shrimp Exports in Sri Lanka. Indian J. Fish. 2020, 67, 118–126. [Google Scholar] [CrossRef]

- Burhaz, M.; Soborova, O. Fisheries Development and the Formation of the Fish Products Market in Ukraine and in the Central and Eastern European Countries. Balt. J. Econ. Stud. 2020, 6, 10–18. [Google Scholar] [CrossRef]

- Naabi, A.A.; Bose, S. Do Regulatory Measures Necessarily Affect Oman’s Seafood Export-Supply? SAGE Open 2020, 10. [Google Scholar] [CrossRef]

- United Nations Conference on Trade and Development (UNCTAD). Fishery Exports and the Economic Development of Least Developed Countries 2017. United Nations, Gen. Available online: http://www.unctad.org/system/files/officialdocument/aldc2017d2_en.pdf (accessed on 27 March 2022).

- Khasanah, M.; Nadiarti, N.; Yvonne, S.M.; Jamaluddin, J. Management of the Grouper Export Trade in Indonesia. Rev. Fish. Sci. Aquac. 2020, 28, 1–15. [Google Scholar] [CrossRef]

- Carlucci, D.; Giuseppe, N.; Biagia, D.D.; Rosaria, V.; Francesco, B.; Gianluca, R. Consumer Purchasing Behaviour towards Fish and Seafood Products. Patterns and Insights from a Sample of International Studies. Appetite 2015, 84, 212–227. [Google Scholar] [CrossRef]

- Macfadyen, G.; Ahmed, M.N.; Diaa, A.; Mohamed, F.; Hussien, H.; Ahmed, M.D.; Samy, M.H.; Ramadan, M.A.; Gamal, E. Value-Chain Analysis—An Assessment Methodology to Estimate Egyptian Aquaculture Sector Performance. Aquaculture 2012, 362, 18–27. [Google Scholar] [CrossRef]

- Radhakrishnan, E.V.; Bruce, F.P.; Gopalakrishnan, A. Updated checklist of the world’s marine lobsters. In Lobsters: Biology, Fisheries and Aquaculture; Springer: Singapore, 2019; pp. 35–64. [Google Scholar]

- Bennett, A.; Basurto, X.; Virdin, J.; Lin, X.; Betances, S.; Smith, M.; Allison, E.; Best, B.; Brownell, K. Recognise fish as food in policy discourse and development funding. Ambio 2021, 50, 981–989. [Google Scholar] [CrossRef]

- Natale, F.; Alessandra, B.; Arina, M. Analysis of the Determinants of International Seafood Trade Using a Gravity Model. Mar. Policy 2015, 60, 98–106. [Google Scholar] [CrossRef]

- Zhang, D.; Henry, W.K. Exchange Rate Volatility and US Import Demand for Salmon. Mar. Resour. Econ. 2014, 29, 411–430. [Google Scholar] [CrossRef]

- Gianelli, I.; Omar, D. Uruguayan Fisheries under an Increasingly Globalised Scenario: Long-Term Landings and Bioeconomic Trends. Fish. Res. 2017, 190, 53–60. [Google Scholar] [CrossRef] [Green Version]

- Goulart, P.; Francisco, J.V.; Catarina, G. The Evolution of Fisheries in Portugal: A Methodological Reappraisal with Insights from Economics. Fish. Res. 2018, 199, 76–80. [Google Scholar] [CrossRef]

- Latief, R. The Effect of Exchange Rate Volatility on International Trade and Foreign Direct Investment (FDI) in Developing Countries along ‘One Belt and One Road’. Int. J. Financ. Stud. 2018, 6, 86. [Google Scholar] [CrossRef] [Green Version]

- Monnaie, B.F. Upgrading and Allied Impacts on Contract Seafood Producers. OIDA J. Sustain. Dev. 2017, 2, 25–36. [Google Scholar]

- Li, Q.; Li, Y. Economic marketing model of seafood in Beibu Gulf economic area. J. Coast. Res. 2020, 112, 248–251. [Google Scholar] [CrossRef]

- Feng, S. Exchange Rate Flexibility of Marine Export Trade Based on Artificial Neural Network. J. Coast. Res. 2020, 104, 641–644. [Google Scholar] [CrossRef]

- Asche, F.; Marc, F.B.; Cathy, R.; Martin, D.S.; Sigbjørn, T. Fair Enough? Food Security and the International Trade of Seafood. World Dev. 2015, 67, 151–160. [Google Scholar] [CrossRef]

- Roheim, C.; Bush, S.; Asche, F.; Sanchirico, J.; Uchida, H. Evolution and future of the sustainable seafood market. Nat. Sustain. 2018, 8, 392–398. [Google Scholar] [CrossRef]

- Straume, H.M. Currency Invoicing in Norwegian Salmon Export. Mar. Resour. Econ. 2014, 29, 391–409. [Google Scholar] [CrossRef] [Green Version]

- Lee, M.; Mudziviri, N.; Sung, K.A. Transformation Strategy and Economic Performance: Hungary and Poland. East. Eur. Econ. 2014, 42, 25–42. [Google Scholar] [CrossRef]

- Intarakumnerd, P.; Meng, L. Industrial Technology Upgrading and Innovation Policies: A Comparison of Taiwan and Thailand; Springer: Singapore, 2019. [Google Scholar]

- Philippe, A.; Peter, H. A Model of Growth Through Creative Destruction. Econom. Soc. 1992, 60, 323–351. [Google Scholar]

- Arrow, K.J. The Economic Implications of Learning by Doing. In Readings of the Theory of Growth; Macmillian Palgrave: London, UK, 1971; pp. 131–149. [Google Scholar]

- Romer, P.M. Endogenous Technological Change. J. Political Econ. 1990, 98 Pt 2, S71–S102. [Google Scholar] [CrossRef] [Green Version]

- Humphrey, J.; Hubert, S. How Does Insertion in Global Value Chains Affect Upgrading in Industrial Clusters? Reg. Stud. 2002, 36, 1017–1027. [Google Scholar] [CrossRef]

- Ethier, W. International Trade and the Forward Exchange Market. Am. Econ. Rev. 1973, 63, 494–503. [Google Scholar]

- Gagnon, E. Exchange Rate Variability International Trade. J. Int. Econ. 1993, 34, 269–287. [Google Scholar] [CrossRef] [Green Version]

- Viaene, J.M.; De Vries, C.G. International Trade and Exchange Rate Volatility. Eur. Econ. Rev. 1992, 36, 1311–1321. [Google Scholar] [CrossRef] [Green Version]

- Broll, U.; Eckwert, B. Exchange Rate Volatility and International Trade. South. Econ. J. 1999, 66, 178–185. [Google Scholar] [CrossRef] [Green Version]

- Barkoulas, J.T.; Christopher, F.B. Exchange Rate Effects on the Volume and Variability of Trade Flows. J. Int. Money Financ. 2002, 21, 481–496. [Google Scholar] [CrossRef] [Green Version]

- Aghion, P.; Bacchetta, P.; Ranciere, R.; Rogoff, K. Exchange Rate Volatility and Productivity Growth. The role of financial development. J. Monet. Econ. 2009, 56, 494–513. [Google Scholar] [CrossRef] [Green Version]

- Grier, K.B.; Aaron, D.S. Uncertainty and Export Performance: Evidence from 18 countries. J. Money Credit. Bank. 2007, 39, 965–979. [Google Scholar] [CrossRef]

- Bahmani, M.; Abera, G. Exchange-Rate Volatility and International Trade Performance: Evidence from 12 African Countries. Econ. Anal. Policy 2018, 58, 14–21. [Google Scholar] [CrossRef] [Green Version]

- Intarakumnerd, P.; Pun, A.C.; Rungroge, K. Innovation System of the Seafood Industry in Thailand. Asian J. Technol. Innov. 2015, 23, 271–287. [Google Scholar] [CrossRef]

- Fabinyi, M. Producing for Chinese Luxury Seafood Value Chains: Different Outcomes for Producers in the Philippines and North America. Mar. Policy 2016, 63, 184–190. [Google Scholar] [CrossRef]

- Belton, B.; Thomas, R.; David, Z. Sustainable Commoditization of Seafood. Nat. Sustain. 2020, 3, 677–684. [Google Scholar] [CrossRef]

- Wang, S.; Lu, B.; Yin, K. Financial Development, Productivity, and High-Quality Development of the Marine Economy. Mar. Policy 2021, 130, 104553. [Google Scholar] [CrossRef]

- Péridy, N.; Patrice, G.; Pascal, B. The Impact of Prices on Seafood Trade: A Panel Data Analysis of the French Seafood Market. Mar. Resour. Econ. 2020, 15, 45–66. [Google Scholar] [CrossRef]

- Nguyen, G.V.; Curtis, M.J. A Cointegration Analysis of Seafood Import Demand in Caribbean Countries. Appl. Econ. 2013, 45, 803–815. [Google Scholar] [CrossRef]

- Marvasti, A.; David, W.C. Domestic and Imports Sources of Supply to the US Shrimp Market and Anti-Dumping Duties. J. Econ. Stud. 2016, 43, 1039–1056. [Google Scholar] [CrossRef]

- Xie, J.; Henry, W.K.; Øystein, M. The Effects of Exchange Rates on Export Prices of Farmed Salmon. Mar. Resour. Econ. 2008, 23, 439–457. [Google Scholar] [CrossRef]

- Zhang, D.; Ragnar, T. A Fish out of Water? Survival of Seafood Products from Developing Countries in the EU Market. Mar. Policy 2019, 103, 50–58. [Google Scholar] [CrossRef]

- He, C.; Quagrainie, K.; Wang, H. Determinants of shrimp importation into the USA: An application of an augmented gravity model. J. Chin. Econ. Bus. Stud. 2013, 11, 219–228. [Google Scholar] [CrossRef]

- Shao, Q.; Lijuan, C.; Ruoyu, Z.; Hongtao, W. Marine Economic growth, Technological Innovation, and Industrial Upgrading: A Vector Error Correction Model for China. Ocean. Coast. Manag. 2021, 200, 105481. [Google Scholar] [CrossRef]

- Engle, R.F.; Granger, C.W.J. Co-Integration and Error Correction: Representation, Estimation, and Testing. Econom. Soc. 1987, 55, 251–276. [Google Scholar] [CrossRef]

- Sims, C.A. Comparison of Interwar and Postwar Cycles: Monetarism Considered. Am. Econ. Rev. 1980, 70, 250–257. [Google Scholar]

- Aghion, P.; Peter, H. Model of Growth through Creative Destruction. NBER Work. Pap. Ser. 1990, 3223, 1–50. [Google Scholar]

- Sherbourne, R. A Guide to the Namibian Economy; Institute of Public Policy Research: Khomas, Namibia, 2017. [Google Scholar]

- Johansen, S. Estimation and Hypothesis Testing of Cointegration Vectors in Gaussian Vector Autoregressive Models. Econometrica 1991, 59, 1551–1580. [Google Scholar] [CrossRef]

- Bessler, D.A.; Yang, J.; Wongcharupan, M. Price Dynamics in the International Wheat Market: Modeling with Error Correction and Directed Acyclic Graphs. J. Reg. Sci. 2003, 43, 1–33. [Google Scholar] [CrossRef]

- Seung, C.K. Estimating Dynamic Impacts of the Seafood Industry in Alaska. Mar. Resour. Econ. 2008, 23, 87–104. [Google Scholar] [CrossRef]

- Phillips, P.C.B.; Pierre, P. Testing for a Unit Root in Time Series Regression. Biometrika 1988, 75, 335–346. [Google Scholar] [CrossRef]

- Dickey, D.A.; Fuller, W.A. Likelihood Ratio Statistics for Autoregressive Time Series with a Unit Root. Econ. Soc. 1981, 46, 1057–1072. [Google Scholar] [CrossRef]

- Kwiatkowski, D.; Phillips, P.C.; Schmidt, P.; Shin, Y. Testing the Null Hypothesis of Stationarity against the Alternative of a Unit Root How Sure Are We That Economic Time Series Have a Unit Root? J. Econ. 1992, 54, 159–178. [Google Scholar] [CrossRef]

- Awokuse, T.O.; Joshua, M.D. The Causal Structure of Land Price Determinants. Can. J. Agric. Econ. 2006, 1303, 227–245. [Google Scholar] [CrossRef] [Green Version]

- Zivot, E.; Andrews, D.W.K. Further evidence on the great crash, the oil-price shock, and the unit-root hypothesis. J. Bus. Econ. Stat. 2002, 20, 25–44. [Google Scholar] [CrossRef]

- Johansen, S. Determination of cointegration rank in the presence of a linear trend. Oxf. Bull. Econ. Stat. 1992, 54, 383–397. [Google Scholar] [CrossRef]

- Halpern, B.S. A Global Map of Human Impact on marine ecosystems. Science 2008, 319, 948–953. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Ministry of Industrialisation, Trade and SMS Development (MITSMED). Strategic Plan 2017—2022. Republic of Namibia, Windhoek. 2017. Available online: https://www.mit.gov.na (accessed on 24 January 2022).

| ADF | Phillips Perron | KPSS | ||||

|---|---|---|---|---|---|---|

| Variable | Intercept | Intercept and Trend | Intercept | Intercept and Trend | Intercept | Intercept and Trend |

| LnYY | −0.560 | −2.084 | −0.211 | −1.473 | 0.913 | 0.174 |

| LnLLD | −1.279 | −2.621 | −1.614 | −2.410 | 0.973 | 0.111 |

| ER | −1.966 | −1.504 | −1.743 | −1.689 | 0.227 | 0.227 |

| ADF | Phillips Perron | KPSS | ||||

|---|---|---|---|---|---|---|

| Variable | Intercept | Intercept and Trend | Intercept | Intercept and Trend | Intercept | Intercept and Trend |

| LnYY | −3.392 *** | −3.350 *** | −3.250 *** | −3.204 *** | 0.115 *** | 0.103 *** |

| LnLLD | −4.651 *** | −4.725 *** | −4.548 *** | −4.643 *** | 0.240 *** | 0.156 *** |

| ER | −9.204 *** | −9.410 *** | −9.204 *** | −9.509 *** | 0.277 *** | 0.102 *** |

| Level | 1st Difference | |||

|---|---|---|---|---|

| Variable | t-Statistic | Break Date | t-Statistic | Break Date |

| LnYY | −4.147 | 2005 | −5.568 ** | 2008 |

| LnLLD | −3.478 | 2008 | −6.421 ** | 2012 |

| ER | −8.120 | 2006 | −9.742 ** | 2015 |

| Lag | LogL | LR | FPE | AIC | SC | HQ |

|---|---|---|---|---|---|---|

| 0 | −74.83397 | - | 0.005141 | 3.243082 | 3.360032 | 3.287278 |

| 1 | 134.7868 | 384.3047 | 1.21 × 10−6 | −5.116116 | −4.648615 | −4.939333 |

| 2 | 154.0842 | 32.96646 | 7.89 × 10−7 | −5.545176 | −4.726525 * | −5.235806 |

| 3 | 166.9774 | 20.41427 * | 6.79 × 10−7 * | −5.545176 | −4.537892 | −5.265437 * |

| 4 | 171.4254 | 6.486610 | 8.40 × 10−7 | −5.517725 | −3.997374 | −4.943182 |

| Trace Test | Maximum Eigenvalue Test | |||||

|---|---|---|---|---|---|---|

| Rank | Statistic | Critical Value at 5% | Probability | Statistic | Critical Value at 5% | Probability |

| 0 | 55.130 | 35.192 | 0.0001 *** | 35.843 | 22.299 | 0.0004 ** |

| 1 | 19.287 | 20.262 | 0.067 | 15.429 | 15.892 | 0.059 |

| 2 | 3.857 | 9.164 | 0.434 | 3.857 | 9.165 | 0.434 |

| Variable | Minimum | Maximum | Mean | Std Deviation | Observations |

|---|---|---|---|---|---|

| LnYY | 14.925 | 17.100 | 15.982 | 0.660 | 53 |

| LnLDD | 13.573 | 14.954 | 14.331 | 0.380 | 53 |

| ER | 6.000 | 18.090 | 11.044 | 3.50 | 53 |

| Model 1 DlnYY | Model 2 DlnLLD | Model 3 DER | |

|---|---|---|---|

| Ecm (t−1) | −0.419 * (−5.394) | −0.148 * (−5.067) | −5.713 (−1.516) |

| DlnYY (−1) | 0.584 (5.539) | 0.126 ** (1.703) | −5.206 (−1.018) |

| DlnLLD (−1) | −0.144 (−0.561) | 0.269 (1.503) | −3.057 (0.246) |

| DER (−1) | 0.00026 *** (0.084) | 0.000931 ** (0.380) | −0.111 (−0.653) |

| Lag | LMstatistic | Probability |

|---|---|---|

| 1 | 8.927 | 0.445 |

| 2 | 16.920 | 0.170 |

| Chi-square Statistic | 64.628 |

| Prob. | 0.0549 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Eegunjobi, R.; Ngepah, N. Dynamic Relationships between Seafood Exports, Exchange Rate and Industrial Upgrading. Sustainability 2022, 14, 7893. https://doi.org/10.3390/su14137893

Eegunjobi R, Ngepah N. Dynamic Relationships between Seafood Exports, Exchange Rate and Industrial Upgrading. Sustainability. 2022; 14(13):7893. https://doi.org/10.3390/su14137893

Chicago/Turabian StyleEegunjobi, Ruth, and Nicholas Ngepah. 2022. "Dynamic Relationships between Seafood Exports, Exchange Rate and Industrial Upgrading" Sustainability 14, no. 13: 7893. https://doi.org/10.3390/su14137893