1. Introduction

The explosive growth of information and tremendous advancements in science and technology have resulted in human civilization experiencing rapid change in the period between the “IT” and “Data” ages. New data is being produced from all industries at an unprecedented rate. International Business Machines Corporation (IBM) observed that in excess of 2.5 trillion bytes of data are generated globally every day, with unstructured data accounting for 90 percent of this amount [

1]. However, the phenomenon of the “big data productivity paradox” in management practices has often been observed.

The growing application of big data notwithstanding, it is hugely important for a firm to understand how to utilize big data to transform its outdated value creation, as this will provide competitive advantages in the new economy [

2]. Of the organizational capabilities, big data capability (BDC) has become key to accumulating the power of data and capitalizing on its value in order to create competitive advantages for businesses (see

Appendix A for a check list of abbreviations). This is the ability to identify sources where large volumes of various kinds of data flow out at high speed, and to collect, store and analyze big data with the aim of accomplishing the firm’s strategic and operational goals [

3]. Most studies have primarily focused on the definition, measurements and dimensions of big data-related capabilities, and have also addressed their effects on organizational performance [

4,

5,

6], supply chain performance [

7,

8], organizational innovation [

9,

10,

11], strategic decision-making [

12,

13] and competitive advantage [

14,

15,

16]. Some researchers have dynamically and systematically taken BDC into account with the Dynamic Capability Theory [

3,

9] framework to further clarify the mechanism for transforming BDC into organizational actions and operational value. In providing a way to enhance the performance expression of organizational ability, sustainable competitive advantage (SCA) has a crucial contribution to make to firm’s core competitiveness, survival and sustainability [

17,

18]. As noted in the reference, BDC is an important factor that influences the development of SCA for companies in the digital economy context [

15].

Research into the subject has been mostly restricted to limited perspectives of organizational behavior [

19], organizational capacity and employees’ activity [

20]. Innovation Strategy Theory provides appropriate strategic management techniques and measures that can be used to augment the impact of the firm’s innovation activities on firm growth and performance [

21], and it is well-suited to provide theoretical insight into how BDC can be transformed into SCA. The literature has focused in particular on the mechanisms that may enable big data analytics capabilities to enhance the strategic flexibility of organizations through ambidextrous innovation [

22] and has also confirmed the impact that big data-related capabilities can have on organizational capabilities by providing a competitive advantage [

23]. From this, we deduce that organizations can build BDC into the resource and capability guarantee for innovation strategy implementation that will ultimately drive innovation strategy selection and implementation. In addition, we also propose that this will promote an ambidextrous development that helps to achieve SCA and superior performance.

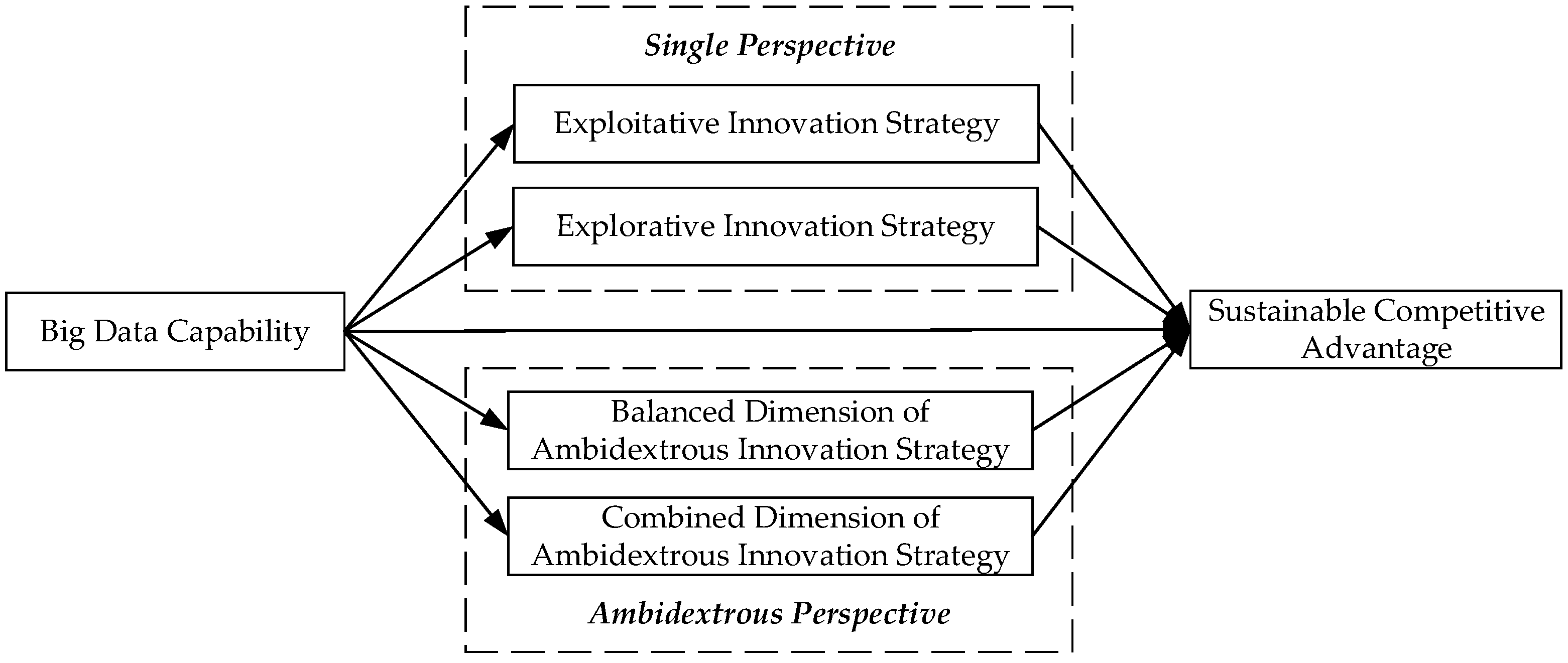

Innovation strategy is the process of planning for the implementation of innovative practices and is critical for businesses to remain competitive [

24]. From a single perspective, exploitation and exploration represent two opposite modes of innovation strategy based on differences in the magnitude of innovation [

24]. Exploitative innovation strategy (EIIS) is market-oriented and adapts innovation practice on the basis of existing knowledge and learning about how to respond to user needs [

25,

26]; exploratory innovation strategy (ERIS), meanwhile, is technology-oriented and breaks down old technological barriers to gain a competitive advantage by experimenting with new knowledge and fields [

25,

27]. Although there are logical differences between the two, they complement each other. From an ambidextrous perspective, innovation strategy can be classified into balanced dimension of ambidextrous innovation strategy (BDAIS) and combined dimension of ambidextrous innovation strategy (CDAIS) [

28,

29]. The ”balanced dimension of ambidextrous” perspective seeks to reduce the risk of innovation imbalance and resource allocation imbalance by narrowing the gap between the two, thereby avoiding polarization and over-skewing, and realizing innovation by “avoiding shortcomings”; meanwhile, research based on the “combined dimension of ambidextrous” perspective centers on the theory of synergy, which clarifies how strengthening the complementarity between the two can enable the “width” of technology to be broadened and the “depth” of technology to be deepened, in a way that helps to achieve the “growth” of innovation [

28].

Some research into innovation strategies has engaged from a single perspective [

30,

31], which indicate that innovation strategy enables the business organization to have a successful formulation and implementation of innovation related activities [

30]. Chen et al. [

31] state that in the group of organizations exhibiting either exploratory or exploitative innovation strategy, the more similar the organizational culture configurations are to those of the top performers, the higher their innovation speed and innovation quality are. Other studies have begun to focus on how the relatively balanced or combined relationship between EIIS and ERIS can impact on firm performance. Luo et al.’s [

29] research indicates that balanced dimension and combined dimension of ambidextrous strategy have different correlations with firm performance in growth and maturity stage. As suggested by previous studies, the effect of big data analytics capability on organizational performance could be mediated by exploitative innovation, explorative innovation or ambidextrous innovation [

1,

19]. However, the question of why some firms prefer one innovation strategy mode over another, and the related question of the specific insights that different levels of BDC can offer in this regard, have been largely overlooked. There is still an incomplete understanding about the mediation mechanism of innovation strategy between data capability and sustainable competitive advantage from single or ambidextrous perspective. Those studies that have engaged with these questions have rarely done so in sufficient theoretical detail or depth. Research into how EIIS and ERIS work independently and collaboratively in the wider context of the relationship between BDC and SCA therefore needs to be further clarified, and this is the essential contribution that this paper seeks to make. It achieves this by drawing on the perspective of both singularity and ambidexterity to explore how innovation strategy mediates between BDC and SCA.

We seek to answer the following research questions:

RQ1: What effect does BDCs have on firm’s SCA?

RQ2: From a single perspective, does the firm’s EIIS and ERIS influence the relationship between BDC and SCA? If so, through what mechanism?

RQ3: From an ambidextrous perspective, does the firm’s BDAIS and CDAIS influence the relationship between BDC and SCA? If so, through what mechanism?

According to Dynamic Capability, Innovation Strategy and Organizational Ambidexterity Theory, this study aims to analyze the role that BDC plays in influencing SCA under the mediations of innovation strategy from both single and ambidextrous perspectives. The research expands basic research related to BDC and provides suggestions for how organizations can seek to achieve sustainable development by drawing on BDC. Overall, the results of this study offer useful guidelines to help firms comprehend the important role of BDC on SCA.

5. Discussion and Conclusions

There is a widespread consensus within the academic and practical fields that it is important and necessary to use big data management and innovation to improve SCA in a dynamic competitive environment. This paper draws on theories of Dynamic Capability, Innovation Strategy and Organizational Ambidexterity to explore how BDCs impact on SCA. In addition, it also assesses how innovation strategy mediates by reviewing the existing literature.

5.1. Discussion

First, this study’s empirical analysis shows that BDC is a significant antecedent of firms’ SCA. Following the Dynamic Capability Theory, this study used the initial work conducted by Lin and Kunnathur [

3] and Ramadan et al. [

15] to explore the effects of BDC in determining SCA. The results support Bag et al.’s [

54] and Hao et al.’s [

10] view (that “enterprises cultivate a high level of BDCs for management support in order to shape sustainable performance”), which broadens the meaning ascribed to the internalization of BDCs into organizations. Additionally, in contrast to previous research that focused on the impact of BDC on organizational performance [

4,

6], supply chain performance [

7,

8], organizational innovation [

9,

10,

11], strategic decision-making [

12,

13] and competitive advantage [

14,

15,

16], this study asserts that SCA is linked to an enterprise’s survival and sustainability, and proposes that it is a critical representational element that will enable businesses to shape their core competences, improve organizational performance and achieve long-term development. The research also adds further exploration of how decision-makers take advantage of data and analytical capabilities to activate and generate competitive advantage [

14].

Second, this study examines how innovation strategy mediates the relationship between BDC and SCA from both single and ambidextrous perspectives. In this framework, BDC is theorized to strengthen SCA, directly and indirectly. When perceived from a single perspective, it is apparent that increases in the level of BDCs will make firms more inclined to implement EIIS and construct SCA, as opposed to ERIS. This mediated research builds on Rialti et al. [

19] and Shamim et al. [

20], which indicate that big data-related capability is an important driver of exploitative and exploratory innovation in firms. It is also in accordance with previous research, which shows that EIIS and ERIS encourage superior innovation speed, innovation quality and performance [

31,

55]. Contrary to previous studies, this interesting finding shows that the mediation effect of ERIS was not found to be significant. This means ERIS does not only need to rely on the “opportunity insights” brought by BDC to create new innovative changes, but also need to consider other factors, including the rational allocation of innovation resources, the path dependence of the organization’s sustainable development and the importance of balancing the present and long-term.

When viewed from an ambidextrous perspective, CDAIS is found to partially mediate between BDC and SCA; however, the mediating effect of BDAIS between BDC and SCA was not found to be significant. The findings support Luo et al.’s [

29] and Soetanto and Jack’s [

55] conclusion that “integrated ambidextrous innovation techniques are advantageous for firm performance enhancement”. Contrary to the hypotheses of previous studies, this paper does not find BDAIS significantly mediate the relation between BDC and SCA, which leads us to ask if potential influences affect how firms balance EIIS and ERIS in a big data context when seeking to build a core competitive advantage. According to Sirén et al. [

56], companies may end up in an exploitation trap, where high levels of exploitation consume the firm’s limited strategic learning resources, weakening the possibility of explorative innovations arising by neglecting the role of exploration strategy. Firms need to overcome more uncertainties and influence factors to establish a good balance of ambidextrous innovation, which means there may be a longtime lag in the enhancement of competitive advantage. On balance, this strategy may not significantly affect firms’ SCA within a certain time period. It adds further exploration of Revilla et al.’s study [

57], which indicates that the “unbalanced” innovation strategy may result in superior outcomes compared with a more “balanced” strategy. In addition, the process mechanism through which BDAIS affects SCA and its role in the relationship between BDC and SCA both need to be further explored.

5.2. Theoretical Contribution

This paper’s contribution mostly relates to two main aspects. The first is enriching the research of BDCs for businesses and using Dynamic Capability Theory to increase awareness of the mechanism through which BDCs influence SCA. Researchers typically regard BDC as a resource and investigate its impact on organizational performance by using Resource-Based Theory [

1,

4], which means the dynamic and systematic consideration of organizational capability has not yet been investigated [

3]. This finding will help academics and practitioners to conceive and understand BDC as a contextual factor and will also provide insights into the endogenous factors of enterprises’ competitive advantage.

Second, this article incorporates both single and ambidextrous viewpoints to investigate how the mechanism of innovation strategy mediates between BDC and SCA. As suggested by previous studies, the effect of big data-related capability on sustainable competitive advantage could be mediated by ambidextrous innovation [

19,

20]. However, there is still an incomplete understanding about the relationships among BDC, EIIS, ERIS and SCA. This is the question we explored in this study. The finding (that “as the level of BDCs increases, firms are more inclined to implement EIIS to build SCA”) provides two important strategic perspectives: (1) “In the new context of big data, the advantage of big data-based capabilities enhances firms’ adaptive improvement of internal innovation practices and insight into the external dynamic competitive environment”; (2) “As the level of BDCs increases, firms are more inclined to implement EIIS to build SCA.”

Following this, consider the conclusion that “as the level of BDCs increases, companies tend to implement CDAIS to build SCA “. In contrast to previous research that focused on a single aspect of singularity or ambidexterity, this paper investigates the mediating role of EIIS and ERIS, with specific reference to their ambidexterity (balanced and combined dimensions), role in the transformation mechanism that turns BDC into SCA and the value transformation mechanism of BDC that operates through innovation strategy. This helpfully clarifies that, in the new big data context, EIIS and ERIS mediate in the causal chain of BDC that acts on SCA; they also provide SCA in the form of strategic synergy and answer the request for “business practice to pay adequate attention to the synergy between exploitative innovation and exploration innovation. This will help to avoid the undesired scenario of over-exploration or exploitation”. It expands the theoretical study of strategic synergy between enterprise exploitative and exploration innovation by clarifying the mediation mechanism that enables the value transformation of BDC through innovation strategy; in addition, it also provides theoretical and empirical support to the exploration of ambidexterity in a big data context.

5.3. Managerial Implications

The paper’s main findings provide new insight into how businesses can use BDCs to trigger innovation strategies, apply their ambidexterity to gain SCA and implement big data practice that help to overcome the “Big Data productivity paradox.” This framework has important practical implications.

First, our analysis shows that BDC can make a positive contribution to SCA. This finding improves managers’ understanding of the impact big data and data capabilities have on the sustainability of competitive advantage. Businesses must therefore consider how to rethink management in the digital era. A data swamp can easily emerge within an organization if they do not make proper use of the massive amounts of data they collect. In order to provide effective management support to big data practice and build SCA, they should concentrate on developing BDCs, acquiring accurate and efficient internal and external data resources and storing and processing data for analysis; they should then use big data algorithms to analyze the integrated data, transform hidden value information into knowledge and improve data re-use value. These steps will increase business revenue, profit, market share and market area expansion, enhance product launch degree and contribute in other aspects. With regard to market region expansion, market share, product introduction, profit and revenue, the data may help to provide better indicators of SCA.

Second, an innovation strategy is essential for enhancing competitive advantage and achieving long-term success. This finding of the research suggests that when the level of BDCs is higher, a firm will be more inclined to build SCA by implementing EIIS. EIIS adapts innovation practice on the basis of existing knowledge and learning about how to respond to user needs [

25,

26]; while ERIS breaks down old technological barriers to gain a competitive advantage by experimenting with new knowledge and fields [

25,

27]. In initially engaging with the strategy formulation stage, businesses should focus on the logic of exploitation and exploration in the development of innovation practice activities. BDCs can be used to gain a better understanding of the current state of business innovation and potential development space and can also track cutting-edge technology development trends and real-time competitive situations, which will contribute to the scientific and effective formulation of innovation strategies. Thus, managers can make appropriate strategic decision-making by developing BDC from this perspective.

Moreover, the accumulation and maintenance of an enterprise’s competitive advantage should not only focus on the present, and more specifically on the short-term improvement in performance created by an innovation strategy. This means that businesses should, in internalizing BDCs into SCA, focus on the utility of both EIIS and ERIS and, in so doing, place particular emphasis on their synergistic interaction. Our research further offers some interesting insights that CDAIS is found to partially mediate between BDC and SCA while BDAIS does not. This finding can be used to enhance innovation strategy formulation from the viewpoint of ambidexterity in the big data era. When an enterprise’s EIIS is slow, explorative innovation can be used to explore exploitative innovation’s improvement space. Enterprises should strengthen innovation exploration, constantly inject new innovative blood into the enterprise and shape the leading advantage of competitive/potentially competitive enterprises in ways that are difficult to imitate. When ERIS produces little performance output, its innovation energy can be sparked by increasing investment and support for EIIS in a way that builds core competitiveness and contributes SCA. These findings not only help in overcoming the challenges of exploitative or explorative innovation strategy formulation, but also in achieving BDAIS and CDAIS through BDC. Managers can consider factors of BDC for the further implementation of innovation strategy.

5.4. Limitations and Future Directions

Although the paper’s research design was scientific and systematic and made it possible to obtain some useful results, there are a number of ways in which it can be improved. First, this study only looks at firms based in a single country; regional sampling could limit the generalizability of the results obtained. Future research could seek to address this. Second, our collecting data is self-reported. Despite considerable efforts being undertaken to confirm data quality, the potential of biases cannot be excluded. Future research can collect more large-scale and more types of sample data to improve the quality and reliability of the research. Third, this study examined the mediating role of innovation strategy and its ambidexterity in the mechanism that influences the impact of BDCs on SCA. However, in doing so it only revealed one feasible “black box” mechanism. Additional research will hopefully help to identify other mechanisms.