Effect of Corporate Social Responsibility on Consumer Satisfaction and Consumer Loyalty of Private Banking Companies in Peru

Abstract

:1. Introduction

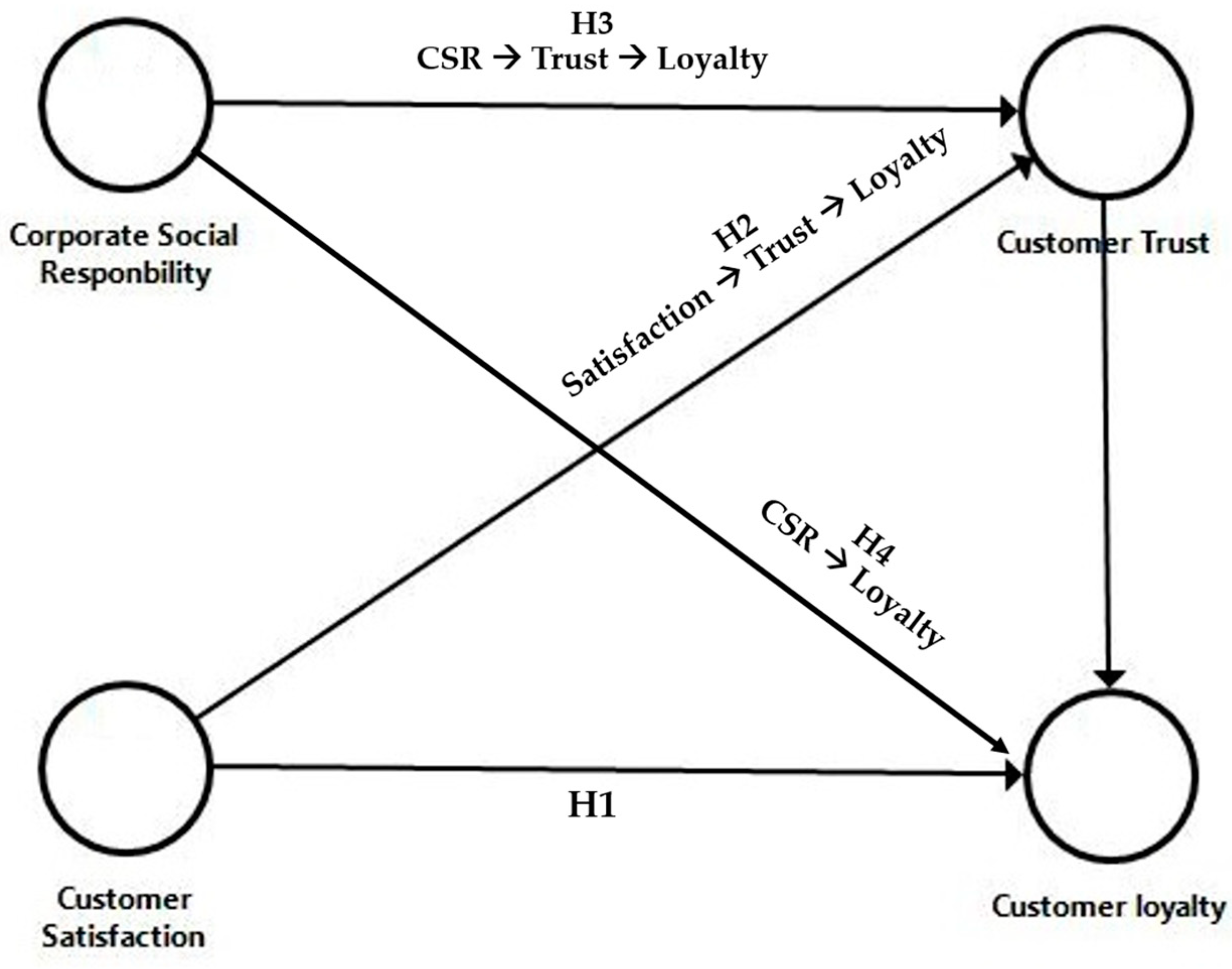

2. Theoretical Framework and Hypothesis

2.1. Corporate Social Responsibility

2.2. Customer Satisfaction and Customer Loyalty

2.3. Customer Trust as a Mediating Factor between Customer Satisfaction and Customer Loyalty

2.4. Customer Trust as a Mediating Factor between Corporate Social Responsibility and Customer Loyalty

3. Methodology

3.1. Research Design and Sample

3.2. Instrument

3.3. Sample

3.4. Data Analysis

4. Results

4.1. Demographic Data

4.2. Reliability and Validity

4.2.1. Reliability

4.2.2. Validation with SEM-PLS

4.3. Composite Reliability

4.4. Discriminant Validity Using Fornell-Larcker Criterion

4.5. Discriminant Validity Using Heterotrait-Monotrait Ratio (HTMT)

4.6. Bootstrapping

4.7. Goodness of Fit (GoF)

4.8. Test of Hypothesis

5. Discussion and Conclusions

6. Implications

6.1. Theoretical Implications

6.2. Managerial Implications

6.3. Limitations and Future Research Directions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. Questionnaire to Evaluate the Influence of Corporate Social Responsibility in Consumer Satisfaction and Consumer Loyalty of Private Banking Companies in Peru

| YES | NO | |

| I have freely decided to participate in this study | ||

| I understand that my participation is voluntary | ||

| I have received information about the objectives of the present study |

| N° | Questions | Alternatives |

| 1 | Gender | ◯ Female ◯ Male |

| 2 | How old are you? | I am ______ years old |

| 3 | What country do you live in? | |

| 4 | What is your occupation? | Study Work Study and Work Other (specify) |

| 5 | Do you have at least one bank account? | Yes No |

- (1)

- Strongly disagree

- (2)

- Disagree

- (3)

- Neither Agree nor Disagree

- (4)

- Agree

- (5)

- Strongly agree

| 1 | 2 | 3 | 4 | 5 | ||

| Corporate Social Responsibility | ||||||

| 6. | This bank helps to solve the social problem | |||||

| 7. | This bank plays a role in society beyond the economic benefits generation | |||||

| 8. | This bank contributes money to cultural and social events (e.g., music, sports) | |||||

| 9. | This bank uses part of its budget for donations and social projects to advance the situation of the most unprivileged groups of the society | |||||

| 10. | This bank is concerned with improving the general well-being of society | |||||

| 11. | This bank is concerned with respecting and protecting the natural environment | |||||

| Customer Satisfaction | ||||||

| 12. | This bank helps to solve social problem | |||||

| 13. | This bank plays a role in society beyond the economic benefits generation | |||||

| 14. | This bank contributes money to cultural and social events (e.g., music, sports) | |||||

| 15. | This bank uses part of its budget for donations and social projects to advance the situation of the most unprivileged groups of the society | |||||

| 16. | This bank is concerned with improving the general well-being of society | |||||

| 17. | This bank is concerned with respecting and protecting the natural environment | |||||

| Trust | ||||||

| 18. | Our organization knows what items of plastic waste can be recycled | |||||

| 19. | Whether our organization recycles plastic waste is entirely up to us | |||||

| 20. | Whether our organization recycles plastic waste effectively is entirely within our control | |||||

| Loyalty | ||||||

| 21. | Our organization knows what items of plastic waste can be recycled | |||||

| 22. | Whether our organization recycles plastic waste is entirely up to us | |||||

| 23. | Whether our organization recycles plastic waste effectively is entirely within our control | |||||

| 24. | Our organization knows what items of plastic waste can be recycled | |||||

| 25. | Whether our organization recycles plastic waste is entirely up to us | |||||

References

- Bouslah, K.; Kryzanowski, L.; M’Zali, B. Social Performance and Firm Risk: Impact of the Financial Crisis. J. Bus. Ethics 2018, 149, 643–669. [Google Scholar] [CrossRef] [Green Version]

- Wong, H.S.M.; Wong, R.K.H.; Leung, S. Enhancing sustainability in banking industry: Factors affecting customer loyalty. Acad. Account. Financ. Stud. J. 2019, 23, 1–12. [Google Scholar]

- Boonlertvanich, K. Service quality, satisfaction, trust, and loyalty: The moderating role of main-bank and wealth status. Int. J. Bank Mark. 2019, 37, 278–302. [Google Scholar] [CrossRef]

- Wahyuni, S.; Ghozali, I. The impact of brand image and service quality on consumer loyalty in the banking sector. Int. J. Econ. Bus. Adm. (IJEBA) 2019, VII, 395–402. [Google Scholar]

- Lerma Kirchner, A.E. Desarrollo de Productos. Una Visión Integral; Cengage Learning: Mexico City, Mexico, 2017. [Google Scholar]

- Özkan, P.; Süer, S.; Keser, İ.K.; Kocakoç, İ.D. The effect of service quality and customer satisfaction on customer loyalty. Int. J. Bank Mark. 2020, 38, 384–405. [Google Scholar] [CrossRef]

- Aldas-Manzano, J.; Ruiz-Mafe, C.; Sanz-Blas, S.; Lassala-Navarré, C. Internet banking loyalty: Evaluating the role of trust, satisfaction, perceived risk and frequency of use. Serv. Ind. J. 2011, 31, 1165–1190. [Google Scholar] [CrossRef]

- Islam, T.; Islam, R.; Pitafi, A.H.; Xiaobei, L.; Rehmani, M.; Irfan, M.; Mubarak, M.S. The impact of corporate social responsibility on customer loyalty: The mediating role of corporate reputation, customer satisfaction, and trust. Sustain. Prod. Consum. 2021, 25, 123–135. [Google Scholar] [CrossRef]

- Albaity, M.; Rahman, M. Customer Loyalty towards Islamic Banks: The Mediating Role of Trust and Attitude. Sustainability 2021, 13, 10758. [Google Scholar]

- Sitorus, T.; Yustisia, M. The influence of service quality and customer trust toward customer loyalty: The role of customer satisfaction. Int. J. Qual. Res. 2018, 12, 639–654. [Google Scholar] [CrossRef]

- Famiyeh, S.; Asante-Darko, D.; Kwarteng, A. Service quality, customer satisfaction, and loyalty in the banking sector. Int. J. Qual. Reliab. Manag. 2018, 35, 1546–1567. [Google Scholar] [CrossRef]

- Gallarza, M.G.; Gil-Saura, I.; Holbrook, M.B. The value of value: Further excursions on the meaning and role of customer value. J. Consum. Behav. 2011, 10, 179–191. [Google Scholar] [CrossRef]

- Voss, C.A.; Roth, A.V.; Rosenzweig, E.D.; Blackmon, K.; Chase, R.B. A Tale of Two Countries’ Conservatism, Service Quality, and Feedback on Customer Satisfaction. J. Serv. Res. 2004, 6, 212–230. [Google Scholar] [CrossRef]

- Thompson, A. Administración Estratégica: Teoría y Casos; McGraw-Hill: New York, NY, USA, 2018. [Google Scholar]

- Carroll, A.B. A Three-Dimensional Conceptual Model of Corporate Performance. Acad. Manag. Rev. 1979, 4, 497–505. [Google Scholar] [CrossRef] [Green Version]

- Larzelere, R.E.; Huston, T.L. The Dyadic Trust Scale: Toward Understanding Interpersonal Trust in Close Relationships. J. Marriage Fam. 1980, 42, 595–604. [Google Scholar] [CrossRef]

- McWilliams, A.; Siegel, D.S.; Wright, P.M. Corporate Social Responsibility: Strategic Implications. J. Manag. Stud. 2006, 43, 1–18. [Google Scholar] [CrossRef] [Green Version]

- Mosaid, E.; Boutti, R. Relationship between corporate social responsibility and financial performance in Islamic Banking. Res. J. Financ. Account. 2012, 3, 93–103. [Google Scholar]

- Porter, M.; Kramer, M. Strategy and society: The link between corporate social responsibility and competitive advantage. Harv. Bus. Rev. 2006, 84, 78–92. [Google Scholar]

- Jayachandran, S.; Sharma, S.; Kaufman, P.; Raman, P. The Role of Relational Information Processes and Technology Use in Customer Relationship Management. J. Mark. 2005, 69, 177–192. [Google Scholar] [CrossRef] [Green Version]

- Japutra, A.; Ekinci, Y.; Simkin, L. Tie the knot: Building stronger consumers’ attachment toward a brand. J. Strateg. Mark. 2018, 26, 223–240. [Google Scholar] [CrossRef]

- Li, J.; Zhang, F.; Sun, S. Building Consumer-Oriented CSR Differentiation Strategy. Sustainability 2019, 11, 664. [Google Scholar] [CrossRef] [Green Version]

- Dupire, M.; M’Zali, B. CSR Strategies in Response to Competitive Pressures. J. Bus. Ethics 2018, 148, 603–623. [Google Scholar] [CrossRef]

- Bhattacharya, C.B.; Sen, S. Doing Better at Doing Good: When, Why, and How Consumers Respond to Corporate Social Initiatives. Calif. Manag. Rev. 2004, 47, 9–24. [Google Scholar] [CrossRef]

- Ángel Del Brío, J.; Lizarzaburu Bolaños, E. CSR Actions in Companies and Perception of Their Reputation by Managers: Analysis in the Rural Area of an Emerging Country in the Banking Sector. Sustainability 2018, 10, 920. [Google Scholar] [CrossRef] [Green Version]

- INEI. Panorama de la Economía Peruana 1950–2018. Available online: https://www.inei.gob.pe/media/MenuRecursivo/publicaciones_digitales/Est/Lib1654/libro.pdf (accessed on 1 January 2022).

- Raza, A.; Saeed, A.; Iqbal, M.K.; Saeed, U.; Sadiq, I.; Faraz, N.A. Linking Corporate Social Responsibility to Customer Loyalty through Co-Creation and Customer Company Identification: Exploring Sequential Mediation Mechanism. Sustainability 2020, 12, 2525. [Google Scholar] [CrossRef] [Green Version]

- Raza, A.; Rather, R.A.; Iqbal, M.K.; Bhutta, U.S. An assessment of corporate social responsibility on customer company identification and loyalty in banking industry: A PLS-SEM analysis. Manag. Res. Rev. 2020, 43, 1337–1370. [Google Scholar] [CrossRef]

- Muflih, M. The link between corporate social responsibility and customer loyalty: Empirical evidence from the Islamic banking industry. J. Retail. Consum. Serv. 2021, 61, 102558. [Google Scholar] [CrossRef]

- Zimmermann, S. Same Same but Different: How and Why Banks Approach Sustainability. Sustainability 2019, 11, 2267. [Google Scholar] [CrossRef] [Green Version]

- Oliver, R.L. A cognitive model of the antecedents and consequences of satisfaction decisions. J. Mark. Res. 1980, 4, 460–469. [Google Scholar] [CrossRef]

- Oliver, R.L. Satisfaction: A Behavioral Perspective on the Consumer; The McGraw-Hill Companies, Inc.: New York, NY, USA, 1997. [Google Scholar]

- Levesque, T.; McDougall, G.H.G. Determinants of customer satisfaction in retail banking. Int. J. Bank Mark. 1996, 14, 12–20. [Google Scholar] [CrossRef]

- Karyose, H.; Astuti, W.; Ferdiansjah, A. Customer Loyalty: The Effect of Service Quality, Corporate Image, Customer Relationship Marketing and Customer Satisfaction as Intervening Variable-An Empirical Analysis of Bank Customers in Malang City. Mark. Brand. Res. 2017, 4, 336–347. [Google Scholar] [CrossRef]

- Hayati, S.; Suroso, A.; Suliyanto, S.; Kaukab, M. Customer satisfaction as a mediation between micro banking image, customer relationship and customer loyalty. Manag. Sci. Lett. 2020, 10, 2561–2570. [Google Scholar] [CrossRef]

- Chung, K.; Yu, J.; Choi, M.; Shin, J. The effects of CSR on customer satisfaction and loyalty in China: The moderating role of corporate image. J. Econ. Bus. Manag. 2015, 3, 542–547. [Google Scholar] [CrossRef] [Green Version]

- Anderson, E.W.; Sullivan, M.W. The Antecedents and Consequences of Customer Satisfaction for Firms. Mark. Sci. 1993, 12, 125–143. [Google Scholar] [CrossRef]

- Bloemer, J.; de Ruyter, K. On the relationship between store image, store satisfaction and store loyalty. Eur. J. Mark. 1998, 32, 499–513. [Google Scholar] [CrossRef]

- Zeithaml, V.A.; Berry, L.L.; Parasuraman, A. The Behavioral Consequences of Service Quality. J. Mark. 1996, 60, 31–46. [Google Scholar] [CrossRef]

- Chiguvi, D.; Guruwo, P. Impact of Customer Satisfaction on Customer Loyalty in the Banking Sector. Int. J. Sci. Eng. Res. 2017, 5, 55–63. [Google Scholar]

- Oliver, R.L. Whence Consumer Loyalty? J. Mark. 1999, 63, 33–44. [Google Scholar] [CrossRef]

- Kim, H.-S.; Yoon, C.-H. Determinants of subscriber churn and customer loyalty in the Korean mobile telephony market. Telecommun. Policy 2004, 28, 751–765. [Google Scholar] [CrossRef]

- McIlroy, A.; Barnett, S. Building customer relationships: Do discount cards work? Manag. Serv. Qual. An. Int. J. 2000, 10, 347–355. [Google Scholar] [CrossRef]

- Fornell, C. A National Customer Satisfaction Barometer: The Swedish Experience. J. Mark. 1992, 56, 6–21. [Google Scholar] [CrossRef]

- Rust, R.T.; Zahorik, A.J.; Keiningham, T.L. Return on Quality (ROQ): Making Service Quality Financially Accountable. J. Mark. 1995, 59, 58–70. [Google Scholar] [CrossRef]

- Anwar, M.; Rahman, A. Customer Loyalty toward Islamic and Conventional Banks; Mediator Role of Customer Satisfaction. J. Mark. Manag. Consum. Behav. 2016, 5, 1–23. [Google Scholar]

- Stella, Z.-C. Does CSR Enhance Young Bank Customers’ Satisfaction and Loyalty in a Developing Economy? The Mediating Role of Trust. J. Account. Financ. Emerg. Econ. 2019, 5, 325–342. [Google Scholar] [CrossRef] [Green Version]

- Sun, H.; Rabbani, M.R.; Ahmad, N.; Sial, M.S.; Cheng, G.; Zia-Ud-Din, M.; Fu, Q. CSR, Co-Creation and Green Consumer Loyalty: Are Green Banking Initiatives Important? A Moderated Mediation Approach from an Emerging Economy. Sustainability 2020, 12, 10688. [Google Scholar] [CrossRef]

- Han, H.; Back, K.-J. Relationships Among Image Congruence, Consumption Emotions, and Customer Loyalty in the Lodging Industry. J. Hosp. Tour. Res. 2008, 32, 467–490. [Google Scholar] [CrossRef]

- Martínez, P.; Rodríguez del Bosque, I. CSR and customer loyalty: The roles of trust, customer identification with the company and satisfaction. Int. J. Hosp. Manag. 2013, 35, 89–99. [Google Scholar] [CrossRef]

- Susilo, W.H. An Impact of Behavioral Segmentation to Increase Consumer Loyalty: Empirical Study in Higher Education of Postgraduate Institutions at Jakarta. Procedia Soc. Behav. Sci. 2016, 229, 183–195. [Google Scholar] [CrossRef] [Green Version]

- Taylor, S.A.; Donovan, L.A.N.; Ishida, C. Consumer Trust and Satisfaction in the Formation of Consumer Loyalty Intentions in Transactional Exchange: The Case of a Mass Discount Retailer. J. Relatsh. Mark. 2014, 13, 125–154. [Google Scholar] [CrossRef]

- Secinaro, S.; Calandra, D.; Biancone, P. Blockchain, trust, and trust accounting: Can blockchain technology substitute trust created by intermediaries in trust accounting? A theoretical examination. Int. J. Manag. Pract. 2021, 14, 129–145. [Google Scholar] [CrossRef]

- Sagar, P.; Singla, A. Trust and corporate social responsibility: Lessons from India. J. Commun. Manag. 2004, 8, 282–290. [Google Scholar] [CrossRef]

- Ruiz, B.; García, J.A.; Revilla, A.J. Antecedents and consequences of bank reputation: A comparison of the United Kingdom and Spain. Int. Mark. Rev. 2016, 33, 781–805. [Google Scholar] [CrossRef] [Green Version]

- Kitsios, F.; Kamariotou, M.; Talias, M.A. Corporate Sustainability Strategies and Decision Support Methods: A Bibliometric Analysis. Sustainability 2020, 12, 521. [Google Scholar] [CrossRef] [Green Version]

- Paulík, J.; Kombo, F.; Ključnikov, A. CSR as a driver of satisfaction and loyalty in commercial banks in the Czech Republic. J. Int. Stud. 2015, 8, 112–127. [Google Scholar] [CrossRef]

- Kitsios, F.; Stefanakakis, S.; Kamariotou, M.; Dermentzoglou, L. E-service Evaluation: User satisfaction measurement and implications in health sector. Comput. Stand. Interfaces 2019, 63, 16–26. [Google Scholar] [CrossRef]

- Amin, M.; Isa, Z.; Fontaine, R. Islamic banks. Int. J. Bank Mark. 2013, 31, 79–97. [Google Scholar] [CrossRef]

- Burmann, C.; Schaefer, K.; Maloney, P. Industry image: Its impact on the brand image of potential employees. J. Brand Manag. 2008, 15, 157–176. [Google Scholar] [CrossRef] [Green Version]

- Hsieh, A.T.; Li, C.K. The moderating effect of brand image on public relations perception and customer loyalty. Mark. Intell. Plan. 2008, 26, 26–42. [Google Scholar] [CrossRef]

- Aramburu, I.A.; Pescador, I.G. The Effects of Corporate Social Responsibility on Customer Loyalty: The Mediating Effect of Reputation in Cooperative Banks Versus Commercial Banks in the Basque Country. J. Bus. Ethics 2019, 154, 701–719. [Google Scholar] [CrossRef]

- Fatma, M.; Rahman, Z. The CSR’s influence on customer responses in Indian banking sector. J. Retail. Consum. Serv. 2016, 29, 49–57. [Google Scholar] [CrossRef]

- van Esterik-Plasmeijer, P.W.J.; van Raaij, W.F. Banking system trust, bank trust, and bank loyalty. Int. J. Bank Mark. 2017, 35, 97–111. [Google Scholar] [CrossRef]

- Oliver, R.L. Satisfaction: A Behavioral Perspective on the Consumer: A Behavioral Perspective on the Consumer; Routledge: Abingdon-on-Thames, UK, 2010. [Google Scholar]

- Dick, A.S.; Basu, K. Customer Loyalty: Toward an Integrated Conceptual Framework. J. Acad. Mark. Sci. 1994, 22, 99–113. [Google Scholar] [CrossRef]

- Lee, H.; Lee, S.H. The Impact of Corporate Social Responsibility on Long-Term Relationships in the Business-to-Business Market. Sustainability 2019, 11, 5377. [Google Scholar] [CrossRef] [Green Version]

- Pérez, A.; Rodríguez del Bosque, I. Corporate social responsibility and customer loyalty: Exploring the role of identification, satisfaction and type of company. J. Serv. Mark. 2015, 29, 15–25. [Google Scholar] [CrossRef]

- Algharabat, R.; Rana, N.P.; Alalwan, A.A.; Baabdullah, A.; Gupta, A. Investigating the antecedents of customer brand engagement and consumer-based brand equity in social media. J. Retail. Consum. Serv. 2020, 53, 101767. [Google Scholar] [CrossRef]

- Fandos-Roig, J.C.; Sánchez-García, J.; Tena-Monferrer, S.; Callarisa-Fiol, L.J. Does CSR Help to Retain Customers in a Service Company? Sustainability 2021, 13, 300. [Google Scholar] [CrossRef]

- Ajina, A.S.; Japutra, A.; Nguyen, B.; Syed Alwi, S.F.; Al-Hajla, A.H. The importance of CSR initiatives in building customer support and loyalty. Asia Pac. J. Mark. Logist. 2019, 31, 691–713. [Google Scholar] [CrossRef]

- Park, E.; Kim, K.J.; Kwon, S.J. Corporate social responsibility as a determinant of consumer loyalty: An examination of ethical standard, satisfaction, and trust. J. Bus. Res. 2017, 76, 8–13. [Google Scholar] [CrossRef]

- Morgan, R.M.; Hunt, S.D. The Commitment-Trust Theory of Relationship Marketing. J. Mark. 1994, 58, 20–38. [Google Scholar] [CrossRef]

- Rotter, J.B. A new scale for the measurement of interpersonal trust1. J. Personal. 1967, 35, 651–665. [Google Scholar] [CrossRef]

- Glaveli, N. Corporate social responsibility toward stakeholders and customer loyalty: Investigating the roles of trust and customer identification with the company. Soc. Responsib. J. 2021, 17, 367–383. [Google Scholar] [CrossRef]

- Pérez, A.; Martínez, P.; Rodríguez del Bosque, I. The development of a stakeholder-based scale for measuring corporate social responsibility in the banking industry. Serv. Bus. 2013, 7, 459–481. [Google Scholar] [CrossRef]

- Sarstedt, M.; Ringle, C.M.; Hair, J.F. Partial Least Squares Structural Equation Modeling. In Handbook of Market Research; Homburg, C., Klarmann, M., Vomberg, A., Eds.; Springer International Publishing: Cham, Switzerland, 2017; pp. 1–40. [Google Scholar]

- Ringle, C.M.; Wende, S.; Becker, J.M. SmartPLS 3; SmartPLS GmbH: Boenningstedt, Germany, 2015. [Google Scholar]

- Lopez-Odar, D.; Alvarez-Risco, A.; Vara-Horna, A.; Chafloque-Cespedes, R.; Sekar, M.C. Validity and reliability of the questionnaire that evaluates factors associated with perceived environmental behavior and perceived ecological purchasing behavior in Peruvian consumers. Soc. Responsib. J. 2020, 16, 403–417. [Google Scholar] [CrossRef]

- Ab Hamid, M.R.; Sami, W.; Mohmad Sidek, M.H. Discriminant Validity Assessment: Use of Fornell & amp; Larcker criterion versus HTMT Criterion. J. Phys. Conf. Ser. 2017, 890, 012163. [Google Scholar] [CrossRef]

- Streukens, S.; Leroi-Werelds, S. Bootstrapping and PLS-SEM: A step-by-step guide to get more out of your bootstrap results. Eur. Manag. J. 2016, 34, 618–632. [Google Scholar] [CrossRef]

- Gunawan, S.; Budiarsi, S.Y.; Hartini, S. Authenticity as a corporate social responsibility platform for building customer loyalty. Cogent Bus. Manag. 2020, 7, 1775023. [Google Scholar] [CrossRef]

- Hossain, M.S.; Yahya, S.B.; Khan, M.J. The effect of corporate social responsibility (CSR) health-care services on patients’ satisfaction and loyalty—A case of Bangladesh. Soc. Responsib. J. 2020, 16, 145–158. [Google Scholar] [CrossRef]

- Lombart, C.; Louis, D. A study of the impact of Corporate Social Responsibility and price image on retailer personality and consumers’ reactions (satisfaction, trust and loyalty to the retailer). J. Retail. Consum. Serv. 2014, 21, 630–642. [Google Scholar] [CrossRef]

- Ahn, J.; Shamim, A.; Park, J. Impacts of cruise industry corporate social responsibility reputation on customers’ loyalty: Mediating role of trust and identification. Int. J. Hosp. Manag. 2021, 92, 102706. [Google Scholar] [CrossRef]

- Cesar, S.; Jhony, O. Corporate Social Responsibility supports the construction of a strong social capital in the mining context: Evidence from Peru. J. Clean. Prod. 2020, 267, 122162. [Google Scholar] [CrossRef]

- Gamu, J.K.; Dauvergne, P. The slow violence of corporate social responsibility: The case of mining in Peru. Third World Q. 2018, 39, 959–975. [Google Scholar] [CrossRef]

- Saenz, C. The Context in Mining Projects Influences the Corporate Social Responsibility Strategy to Earn a Social Licence to Operate: A Case Study in Peru. Corp. Soc. Responsib. Environ. Manag. 2018, 25, 554–564. [Google Scholar] [CrossRef]

- Sotomayor, S.; Ventes, N.; Gronau, W. Corporate social responsibility in luxury hotels in Cusco (Peru) to benefit indigenous communities. Hosp. Soc. 2021, 11, 137–157. [Google Scholar] [CrossRef]

- Alvarez-Risco, A.; Del-Aguila-Arcentales, S.; Yanez, J.A. Telemedicine in Peru as a Result of the COVID-19 Pandemic: Perspective from a Country with Limited Internet Access. Am. J. Trop. Med. Hyg. 2021, 105, 6–11. [Google Scholar] [CrossRef]

- Yáñez, J.A.; Alvarez-Risco, A.; Delgado-Zegarra, J. COVID-19 in Peru: From supervised walks for children to the first case of Kawasaki-like syndrome. BMJ Br. Med. J. 2020, 369, m2418. [Google Scholar] [CrossRef]

- Alvarez-Risco, A.; Del-Aguila-Arcentales, S.; Yáñez, J.A.; Rosen, M.A.; Mejia, C.R. Influence of Technostress on Academic Performance of University Medicine Students in Peru during the COVID-19 Pandemic. Sustainability 2021, 13, 8949. [Google Scholar]

- Rojas Román, B.; Moscoso, S.; Chung, S.A.; Limpias Terceros, B.; Álvarez-Risco, A.; Yáñez, J.A. Tratamiento de la COVID-19 en Perú y Bolivia y los riesgos de la automedicación. Rev. Cuba. Farm. 2020, 53, 1–20. [Google Scholar]

- Villena-Tejada, M.; Vera-Ferchau, I.; Cardona-Rivero, A.; Zamalloa-Cornejo, R.; Quispe-Florez, M.; Frisancho-Triveño, Z.; Abarca-Meléndez, R.C.; Alvarez-Sucari, S.G.; Mejia, C.R.; Yañez, J.A. Use of medicinal plants for COVID-19 prevention and respiratory symptom treatment during the pandemic in Cusco, Peru: A cross-sectional survey. PLoS ONE 2021, 16, e0257165. [Google Scholar] [CrossRef]

- Vizcardo, D.; Salvador, L.F.; Nole-Vara, A.; Dávila, K.P.; Alvarez-Risco, A.; Yáñez, J.A.; Mejia, C.R. Sociodemographic Predictors Associated with the Willingness to Get Vaccinated against COVID-19 in Peru: A Cross-Sectional Survey. Vaccines 2022, 10, 48. [Google Scholar]

- Ruiz-Aquino, M.; Trinidad, V.G.C.; Alvarez-Risco, A.; Yáñez, J.-A. Validation of an instrument to assess self-care behaviors against COVID-19 in university students of Huanuco, Peru. Int. J. Ment. Health Promot. 2022; online first. [Google Scholar]

- Gonzáles-Gutierrez, V.; Alvarez-Risco, A.; Estrada-Merino, A.; Anderson-Seminario, M.d.l.M.; Mlodzianowska, S.; Del-Aguila-Arcentales, S.; Yáñez, J.-A. Multitasking Behavior and Perceptions of Academic Performance in University Business Students in Mexico during the COVID-19 Pandemic. Int. J. Ment. Health Promot. 2022, 24, 565–581. [Google Scholar] [CrossRef]

- Del-Aguila-Arcentales, S.; Alvarez-Risco, A.; Villalobos-Alvarez, D.; Carhuapoma-Yance, M.; Yáñez, J.-A. COVID-19, Mental Health and Its Relationship with Workplace Accidents. Int. J. Ment. Health Promot. 2022, 24, 503–509. [Google Scholar] [CrossRef]

- Chen, J.; Zhang, S.X.; Yin, A.; Yáñez, J.A. Mental health symptoms during the COVID-19 pandemic in developing countries: A systematic review and meta-analysis. J. Glob. Health 2022, 12, 05011. [Google Scholar] [CrossRef]

- Mao, Y.; He, J.; Morrison, A.M.; Andres Coca-Stefaniak, J. Effects of tourism CSR on employee psychological capital in the COVID-19 crisis: From the perspective of conservation of resources theory. Curr. Issues Tour. 2021, 24, 2716–2734. [Google Scholar] [CrossRef]

- Shin, H.; Sharma, A.; Nicolau, J.L.; Kang, J. The impact of hotel CSR for strategic philanthropy on booking behavior and hotel performance during the COVID-19 pandemic. Tour. Manag. 2021, 85, 104322. [Google Scholar] [CrossRef]

- Palazzo, M.; Vollero, A.; Siano, A. From strategic corporate social responsibility to value creation: An analysis of corporate website communication in the banking sector. Int. J. Bank Mark. 2020, 38, 1529–1552. [Google Scholar] [CrossRef]

- Shah, S.S.A.; Khan, Z. Corporate social responsibility: A pathway to sustainable competitive advantage? Int. J. Bank Mark. 2020, 38, 159–174. [Google Scholar] [CrossRef]

- Industrial and Commercial Bank of China. 2020 Corporate Social Responsibility Report. Available online: http://v.icbc.com.cn/userfiles/Resources/ICBCLTD/download/2021/2020shzrEN202103.pdf (accessed on 17 October 2021).

- China Construction Bank. China Construction Bank Corporation Corporate Social Responsibility Report 2020. Available online: http://www.ccb.com/en/newinvestor/upload/20210327_1616775640/20210327001724508034.pdf (accessed on 17 October 2021).

- Agricultural Social Responsibility. Corporate Social Responsibility 2020 CSR Report. Available online: http://www.abchina.com/en/AboutUs/csr-report/ (accessed on 17 October 2021).

- Bank of China. Announcement-Corporate Social Responsibility Report of Bank of China Limited for 2020. Available online: https://www.boc.cn/en/investor/ir2/202103/t20210330_19206122.html (accessed on 17 October 2021).

- JP Morgan Chase & Co. Environmental Social & Governance Report. Available online: https://www.jpmorganchase.com/content/dam/jpmc/jpmorgan-chase-and-co/documents/jpmc-esg-report-2020.pdf (accessed on 17 October 2021).

- NBNP Paribas. CSR. Available online: https://group.bnpparibas/en/all-news/csr (accessed on 17 October 2021).

- HSBC. HSBC—CSR Report 2020. Available online: https://www.about.hsbc.co.uk/-/media/uk/en/hsbc-uk/community/pdf/200612-csr-report.pdf (accessed on 15 June 2022).

- Bank of America. Our commitment to Environmental Sustainability. Available online: https://about.bankofamerica.com/en/making-an-impact/environmental-sustainability (accessed on 17 October 2021).

- Mahmud, A.; Ding, D.; Hasan, M.M. Corporate Social Responsibility: Business Responses to Coronavirus (COVID-19) Pandemic. SAGE Open 2021, 11, 2158244020988710. [Google Scholar] [CrossRef]

- Cheng, G.; Cherian, J.; Sial, M.S.; Mentel, G.; Wan, P.; Álvarez-Otero, S.; Saleem, U. The Relationship between CSR Communication on Social Media, Purchase Intention, and E-WOM in the Banking Sector of an Emerging Economy. J. Theor. Appl. Electron. Commer. Res. 2021, 16, 1025–1041. [Google Scholar] [CrossRef]

- Schröder, P. Corporate social responsibility (CSR) communication via social media sites: Evidence from the German banking industry. Corp. Commun. Int. J. 2021, 26, 636–654. [Google Scholar] [CrossRef]

- Zhang, D.; Mahmood, A.; Ariza-Montes, A.; Vega-Muñoz, A.; Ahmad, N.; Han, H.; Sial, M.S. Exploring the Impact of Corporate Social Responsibility Communication through Social Media on Banking Customer E-WOM and Loyalty in Times of Crisis. Int. J. Environ. Res. Public Health 2021, 18, 4739. [Google Scholar] [CrossRef]

- Lagasio, V.; Cucari, N.; Åberg, C. How corporate social responsibility initiatives affect the choice of a bank: Empirical evidence of Italian context. Corp. Soc. Responsib. Environ. Manag. 2021, 28, 1348–1359. [Google Scholar] [CrossRef]

- Bugandwa, T.C.; Kanyurhi, E.B.; Bugandwa Mungu Akonkwa, D.; Haguma Mushigo, B. Linking corporate social responsibility to trust in the banking sector: Exploring disaggregated relations. Int. J. Bank Mark. 2021, 39, 592–617. [Google Scholar] [CrossRef]

- Amegbe, H.; Dzandu, M.D.; Hanu, C. The role of brand love on bank customers’ perceptions of corporate social responsibility. Int. J. Bank Mark. 2021, 39, 189–208. [Google Scholar] [CrossRef]

| Demographic | Specifications | Counts | Proportion (in %) |

|---|---|---|---|

| Gender | Female | 210 | 53.7% |

| Male | 181 | 46.3% | |

| Age | 18–25 years | 327 | 83.6% |

| 26–33 years | 21 | 5.4% | |

| 34–41 years | 13 | 3.3% | |

| 42–49 years | 15 | 3.8% | |

| 50–57 years | 10 | 2.6% | |

| 58–64 years | 5 | 1.3% | |

| Occupation | Studying | 189 | 48.34% |

| Working | 51 | 13.04% | |

| Studying and Working | 11 | 36.57% | |

| Other | 3 | 2.05% |

| Scale–Item | Factorial Weight | Cronbach’s Alpha | Composite Reliability | Extracted Variance |

|---|---|---|---|---|

| Corporate Social Responsibility | 0.909 | 0.929 | 0.687 | |

| This bank helps to solve social problem | 0.829 | |||

| This bank plays a role in society beyond the economic benefits generation | 0.865 | |||

| This bank contributes money to cultural and social events (e.g., music, sports) | 0.787 | |||

| This bank uses part of its budget for donations and social projects to advance the situation of the most unprivileged groups of the society | 0.817 | |||

| This bank is concerned with improving the general well-being of society | 0.847 | |||

| This bank is concerned with respecting and protecting the natural environment | 0.825 | |||

| Customer satisfaction | 0.906 | 0.930 | 0.727 | |

| This bank establishes procedures to comply with customers’ complaints | 0.842 | |||

| This bank treats its customers honestly | 0.880 | |||

| This bank has employees who offer complete information about corporate products/services to customers | 0.891 | |||

| This bank use customer satisfaction as an indicator to improve product or services marketing | 0.797 | |||

| This bank makes an effort to know customer needs | 0.851 | |||

| Trust | 0.901 | 0.938 | 0.834 | |

| Our organization knows what items of plastic waste can be recycled | 0.902 | |||

| Whether our organization recycles plastic waste is entirely up to us | 0.928 | |||

| Whether our organization recycles plastic waste effectively is entirely within our control | 0.909 | |||

| Loyalty | 0.936 | 0.951 | 0.796 | |

| I am a loyal customer of this bank | 0.887 | |||

| I intend to remain a customer of this bank | 0.882 | |||

| I am likely to say positive things about this bank | 0.916 | |||

| I will recommend this bank to my family members and friends | 0.899 | |||

| I will recommend this bank if asked by others | 0.876 |

| Scale | CSR | Satisfaction | Trust | Loyalty |

|---|---|---|---|---|

| CSR | 0.829 | |||

| Satisfaction | 0.689 | 0.853 | ||

| Trust | 0.741 | 0.724 | 0.913 | |

| Loyalty | 0.636 | 0.770 | 0.701 | 0.892 |

| Scale | CSR | Loyalty | Satisfaction | Trust |

|---|---|---|---|---|

| CSR | ||||

| Loyalty | 0.155 | |||

| Satisfaction | 0.277 | 0.126 | ||

| Trust | 0.264 | 0.107 | 0.889 |

| Scale | Original Simple | Mean Sample | Standard Deviation | t-Statistics | p-Value |

|---|---|---|---|---|---|

| CSR | 0.461 | 0.458 | 0.056 | 8.235 | 0.000 |

| Satisfaction | 0.407 | 0.410 | 0.052 | 7.774 | 0.000 |

| Trust | 0.553 | 0.551 | 0.049 | 11.302 | 0.000 |

| Loyalty | 0.300 | 0.302 | 0.044 | 6.775 | 0.000 |

| Saturated Model | Estimated Model | |

|---|---|---|

| SRMR | 0.054 | 0.054 |

| d_ULS | 0.554 | 0.554 |

| d_G | 0.342 | 0.342 |

| Chi-Square | 823.053 | 823.053 |

| NFI | 0.848 | 0.848 |

| Scale | Original Simple | Mean Sample | Standard Deviation | t-Statistics | p-Value |

|---|---|---|---|---|---|

| CSR → Trust | 0.461 | 0.458 | 0.056 | 8.235 | 0.000 |

| CSR → Loyalty | 0.138 | 0.138 | 0.023 | 6.040 | 0.000 |

| Satisfaction → Trust | 0.407 | 0.410 | 0.052 | 7.774 | 0.000 |

| Satisfaction → Loyalty | 0.675 | 0.676 | 0.034 | 20.107 | 0.000 |

| Trust → Loyalty | 0.300 | 0.302 | 0.044 | 6.775 | 0.000 |

| Scale | Original Simple | Mean Sample | Standard Deviation | t-Statistics | p-Value |

|---|---|---|---|---|---|

| Satisfaction → Trust → Loyalty | 0.138 | 0.138 | 0.023 | 6.040 | 0.000 |

| CSR → Trust → Loyalty | 0.300 | 0.302 | 0.044 | 6.775 | 0.000 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Leclercq-Machado, L.; Alvarez-Risco, A.; Esquerre-Botton, S.; Almanza-Cruz, C.; de las Mercedes Anderson-Seminario, M.; Del-Aguila-Arcentales, S.; Yáñez, J.A. Effect of Corporate Social Responsibility on Consumer Satisfaction and Consumer Loyalty of Private Banking Companies in Peru. Sustainability 2022, 14, 9078. https://doi.org/10.3390/su14159078

Leclercq-Machado L, Alvarez-Risco A, Esquerre-Botton S, Almanza-Cruz C, de las Mercedes Anderson-Seminario M, Del-Aguila-Arcentales S, Yáñez JA. Effect of Corporate Social Responsibility on Consumer Satisfaction and Consumer Loyalty of Private Banking Companies in Peru. Sustainability. 2022; 14(15):9078. https://doi.org/10.3390/su14159078

Chicago/Turabian StyleLeclercq-Machado, Luigi, Aldo Alvarez-Risco, Sharon Esquerre-Botton, Camila Almanza-Cruz, Maria de las Mercedes Anderson-Seminario, Shyla Del-Aguila-Arcentales, and Jaime A. Yáñez. 2022. "Effect of Corporate Social Responsibility on Consumer Satisfaction and Consumer Loyalty of Private Banking Companies in Peru" Sustainability 14, no. 15: 9078. https://doi.org/10.3390/su14159078

APA StyleLeclercq-Machado, L., Alvarez-Risco, A., Esquerre-Botton, S., Almanza-Cruz, C., de las Mercedes Anderson-Seminario, M., Del-Aguila-Arcentales, S., & Yáñez, J. A. (2022). Effect of Corporate Social Responsibility on Consumer Satisfaction and Consumer Loyalty of Private Banking Companies in Peru. Sustainability, 14(15), 9078. https://doi.org/10.3390/su14159078