Corporate Carbon Information Disclosure and Financing Costs: The Moderating Effect of Sustainable Development

Abstract

:1. Introduction

1.1. Backgrounds

1.2. Literature Review

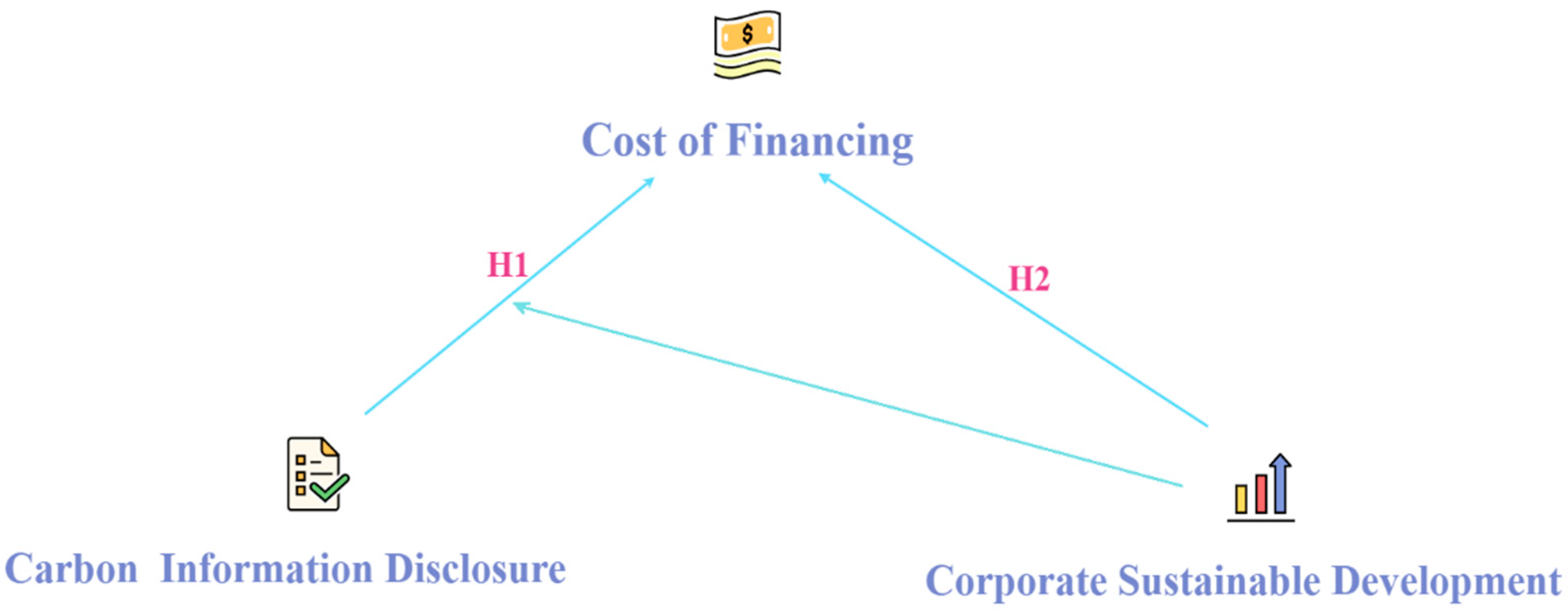

1.3. Research Hypothesis

2. Materials and Methods

2.1. Data Sources

2.2. Variables

2.3. Research Model

- Model 1:

- Model 2:

3. Results

3.1. Descriptive Statistics

3.2. Result of Correlation Coefficients

3.3. Regression Analyses

3.4. Robustness Check

4. Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Bai, Y.H. Key research on financial strategy of sustainable growth of enterprises. Mod. Econ. Inf. 2019, 9, 254. [Google Scholar]

- Jowitt, P.W. Systems and sustainability: Sustainable development, civil engineering and the formation of the civil engineer. Civ. Eng. Environ. Syst. 2020, 37, 253–263. [Google Scholar] [CrossRef]

- Mortimer, F.; Isherwood, J.; Wilkinson, A.; Vaux, E. Sustainability in quality improvement: Redefining value. Future Healthc. J. 2018, 5, 88–93. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Lu, W.-C. The impacts of information and communication technology, energy consumption, financial development, and economic growth on carbon dioxide emissions in 12 Asian countries. Mitig. Adapt. Strat. Glob. Chang. 2018, 23, 1351–1365. [Google Scholar] [CrossRef]

- Yang, J.; Zhang, M.; Liu, Y.C. How carbon disclosure affects debt financing cost: A mediating effect based on debt default risk. J. Beijing Inst. Tech. (Soc. Sci. Ed.) 2020, 22, 28–38. [Google Scholar] [CrossRef]

- Cai, W.C. Research on the Relationship between financial innovation, Dynamic financial capability and sustainable Development capability of enterprises. Southeast Acad. Res. 2012, 5, 106–115. [Google Scholar] [CrossRef]

- Liu, X.S.; Pan, C.L.; Xu, Y.D.; Zhou, C. An empirical study on the impact of corporate carbon disclosure on sustainable development: A case study of Changzhou listed companies. Econ. Res. Guide 2020, 9, 16–19. [Google Scholar]

- Skaife, H.A.; Collins, D.W.; LaFond, R. Corporate governance and the cost of equity capital. SSRN Electron. J. 2004, 26, 2006. [Google Scholar] [CrossRef] [Green Version]

- Elyasiani, E.; Jia, J. Distribution of institutional ownership and corporate firm performance. J. Bank Financ. 2010, 34, 606–620. [Google Scholar] [CrossRef]

- Wang, Y.T.; Jiang, F.X. Can multiple major shareholders reduce the cost of corporate debt financing? J. World Econ. 2017, 40, 119–143. [Google Scholar]

- Lin, Z.G.; Ding, M.H. The impact of internal control defects and their repair on corporate debt financing costs: An empirical study from the perspective of internal control regulatory system change. Account. Res. 2017, 4, 73–80. [Google Scholar] [CrossRef]

- Hu, Z.H.; Hu, S.S. Research on debt structure, innovation investment and the growth of SMEs: Based on the interactive effect model. Ind. Technol. Econ. 2016, 35, 53–59. [Google Scholar] [CrossRef]

- Chen, C.; Rao, Y.L. Capital Structure, Enterprise Characteristics and Performance of Chinese Listed Companies. J. Ind. Eng. Eng. Manag. 2003, 17, 70–74. [Google Scholar] [CrossRef]

- Ghoul, S.E.; Guedhami, O.; Kim, Y. Country-level institutions, firm value, and the role of corporate social responsibility initiatives. J. Int. Bus. Stud. 2017, 48, 360–385. [Google Scholar] [CrossRef] [Green Version]

- Hong, X.X.; Shen, Y.F. Empirical Analysis on the influencing factors of capital structure of listed companies in China. J. Xiamen Univ. (Arts Soc. Sci.) 2000, 3, 114–120. [Google Scholar] [CrossRef]

- Zhang, R. CEO change and debt financing cost. Mod Bus 2018, 14, 106–107. [Google Scholar] [CrossRef]

- Borio, C.E.V.; Lowe, P.W. Asset prices, financial and monetary stability: Exploring the nexus. SSRN Electron. J. 2011. [Google Scholar] [CrossRef] [Green Version]

- Wei, Z.H.; Wang, Z.J.; Wu, Y.H. Financial Ecological Environment, Audit Opinion and debt financing cost. Audit. Res. 2012, 3, 98–105. [Google Scholar]

- Qi, Y.; Roth, L.; Wald, J.K. Political rights and the cost of debt. J. Financ. Econ. 2010, 95, 202–226. [Google Scholar] [CrossRef] [Green Version]

- Wang, Y.C.; Jiang, G.H.; Xin, Q.Q. Litigation Risk, Legal Environment and Debt Cost. Account. Res. 2016, 6, 30–37. [Google Scholar] [CrossRef]

- Han, G.; Yuan, Y.F.; Wu, B.Q. Short-term International Capital Flows and financing costs of Listed firms in China. Econ. Res. 2017, 6, 77–89. [Google Scholar]

- Shi, M.; Cai, X.; Geng, X.L. Corporate social responsibility, R&D investment and debt financing costs in a dynamic environment: An empirical study of Private listed manufacturing companies in China. J. Shanxi Financ. Econ. Univ. 2017, 39, 14. [Google Scholar] [CrossRef]

- Dimson, E.; Karakaş, O.; Li, X. Active ownership. Rev. Financ. Stud. 2015, 28, 3225–3268. [Google Scholar] [CrossRef] [Green Version]

- Cheng, B.; Ioannou, I.; Serafeim, G. Corporate Social Responsibility and Access to Finance. Strateg. Manag. J. 2014, 35, 1–23. [Google Scholar] [CrossRef]

- Krueger, P. Corporate Goodness and Shareholder Wealth. J. Financ. Econ. 2015, 115, 304–329. [Google Scholar] [CrossRef]

- Zeng, Y.; Lu, Z.F. Information Disclosure quality and equity financing Cost. Econ. Res. 2006, 41, 12. [Google Scholar]

- Richardson, A.J.; Welker, M. Social disclosure, financial disclosure and the cost of equity capital. Account. Organ. Soc. 2001, 26, 597–616. [Google Scholar] [CrossRef]

- Meng, X.J.; Xiao, Z.P.; Qu, J.L. Corporate social responsibility information disclosure and cost of capital: An analysis framework based on information asymmetry. Account. Res. 2010, 9, 25–29. [Google Scholar] [CrossRef]

- Gao, H.X.; Zhu, H.Y.; Meng, F.J. Does the quality of environmental information Disclosure affect debt financing cost? Empirical evidence from Listed Companies in Environment-sensitive Industries in China. J. Nanjing Audit. Univ. 2018, 15, 20–28. [Google Scholar]

- Wang, Q. Analysis of the Impact of carbon information disclosure on corporate financial risk. Times Financ. 2014, 1, 253–255. [Google Scholar]

- Lu, W.; Zhu, N.; Zhang, J. The Impact of Carbon Disclosure on Financial Performance under Low Carbon Constraints. Energies 2021, 14, 4126. [Google Scholar] [CrossRef]

- Li, L.; Liu, Q.; Wang, J. Carbon Information Disclosure, Marketization, and Cost of Equity Financing. Int. J. Environ. Res. Public Health 2019, 16, 150. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- He, Y.; Tang, Q.L.; Wang, K.T. Carbon information Disclosure, Carbon Performance and capital cost. Account. Res. 2014, 1, 79–86. [Google Scholar] [CrossRef]

- Li, L.; Liu, Q.Q.; Tang, D.L. Carbon performance, carbon information disclosure quality and equity financing cost. Manag. Rev. 2019, 31, 221–235. [Google Scholar]

- Ma, Z.M.; Yuan, Z.H.; Zhou, Z.Z. Carbon disclosure, accounting conservatism and cost of capital: An empirical study based on A-share listed companies. Commun. Financ. Account. 2017, 34, 10–14. [Google Scholar]

- Kleimeier, S.; Viehs, M. Carbon Disclosure, Emission Levels, and the Cost of Debt. SSRN Electron. J. 2016. [Google Scholar] [CrossRef] [Green Version]

- Long, F.Y. Research on the Relationship between Green Credit, Corporate Social Responsibility and Debt Cost. Master’s Thesis, Beijing Jiaotong University, Beijing, China, 2018. [Google Scholar]

- Zhang, J.N.; Sun, H.; Ma, X.Y. The impact of carbon disclosure on corporate debt financing costs: Based on the dual moderating effects of environmental regulation and executive incentives. Chin. Certif. Public Account. 2021, 12, 48–54. [Google Scholar]

- Liu, R. Environmental regulation, Carbon Disclosure and debt financing cost. Master’s Thesis, Zhejiang University of Finance and Economics, Zhejiang, China, 2018. [Google Scholar]

- Freeman, R.E. Strategic Management: A Stakeholder Perspective; Pitman: Boston, MA, USA, 1984; p. 39. [Google Scholar]

- China Banking and Insurance Regulatory Commission. Available online: http://www.cbirc.gov.cn/cn/view/pages/ItemDetail.html?docId=2511&itemId=928&generaltype=0 (accessed on 20 July 2022).

- China Banking and Insurance Regulatory Commission. Available online: http://www.cbirc.gov.cn/cn/view/pages/ItemDetail.html?docId=9636&itemId=928&generaltype=0 (accessed on 20 July 2022).

- China Banking and Insurance Regulatory Commission. Available online: http://www.cbirc.gov.cn/cn/view/pages/ItemDetail.html?docId=66611&itemId=928&generaltype=0 (accessed on 20 July 2022).

- Tu, J.M.; Ou, Z.Q.; Ye, T. Financial supervision and green and low-carbon development of enterprises under the “double carbon” target. Chin. Certif. Public Account. 2022, 18, 89–93. [Google Scholar] [CrossRef]

- Bhattacharya, C.B.; Sen, S.; Korschun, D. Using Corporate Social Responsibility to Win the War for Talent. MIT. Sloan. Manag. Rev. 2008, 49, 37–44. [Google Scholar]

- Turban, D.B.; Greening, D.W. Corporate Social Performance and Organizational Attractiveness to Prospective Employees. Acad. Manag. J. 1997, 40, 658–672. [Google Scholar] [CrossRef]

- Liu, Y.F.; Liu, Y. Carbon information disclosure, Investor confidence and enterprise value. Commun. Financ. Account. 2019, 18, 39–42. [Google Scholar]

- Zhou, K.T.; Ma, Z.M.; Wu, L.S. Executive academic experience and corporate debt financing costs. Econ. Res. J. 2017, 52, 169–183. [Google Scholar]

- Yang, M.; Yuan, Y.N.; Wan, P.B. Environmental regulation, banking competition and corporate debt financing costs: Evidence from the 11th Five-Year Emission reduction policy. Econ. Rev. 2022, 234, 122–136. [Google Scholar] [CrossRef]

- Zhu, Y.J.; Zhou, Q.L. Company size, risk characteristics and bond financing cost: Empirical evidence from Private listed companies in China. Zhejiang Financ. 2016, 3, 53–59. [Google Scholar]

- Yin, W.Q. Research on the impact of corporate profitability on debt financing cost. China Bus. Trade 2021, 6, 78–80. [Google Scholar] [CrossRef]

- Huang, R.T. Solvency, Accounting Soundness and Corporate debt Financing. Commun. Financ. Account. 2018, 12, 21–25. [Google Scholar] [CrossRef]

- Yang, A.J. Investor Relationship Management, Equity Concentration and Equity Financing Cost. Master’s Thesis, Shandong University of Finance and Economics, Jinan, China, 2021. [Google Scholar] [CrossRef]

- Caragnano, A.; Mariani, M.; Pizzutilo, F.; Zito, M. Is It Worth Reducing GHG Emissions? Exploring the Effect on the Cost of Debt Financing. J. Environ. Manag. 2020, 270, 110860. [Google Scholar] [CrossRef]

- Kim, J.-B.; Ma, M.L.; Wang, H. Financial development and the cost of equity capital: Evidence from China. China J. Account. Res. 2015, 8, 243–277. [Google Scholar] [CrossRef] [Green Version]

| Variables | Name | Proxy Variables | Code | Variable Description |

|---|---|---|---|---|

| Explained Variable | Financing cost | Debt financing cost | DebtCost | the ratio of interest expenses and interest-bearing debt |

| Explanatory Variables | Carbon information disclosure | Quality of carbon information disclosure | CarbDisc | the number of carbon information disclosure items |

| Sustainable development | Sustainable growth rate | SustaDe | (current net profit/beginning shareholders’ equity) × current earnings retention rate × 100% | |

| Control variables | Carbon intensity | Carbon-intensive industries | Indus | dummy variable (0 = low carbon, 1 = carbon-intensive industries) |

| Size | Asset | Asset | ||

| Liabilities | Liab | |||

| Profitability (Profit) | Operating income | Sales | ||

| Return on total assets | ROA | |||

| Solvency (Solven) | Quick ratio | QuickRa | ||

| Capital utilization (CapiU) | Fixed asset ratio | FixedRa | ||

| Total asset turnover ratio | TotalTu | |||

| Equity concentration (EquityConcen) | Shareholding ratio of the first largest shareholder | EC1 | ||

| Shareholding ratio of top 5 shareholders | EC5 | |||

| Shareholding ratio of top 10 shareholders | EC10 | |||

| Number of shareholders | EC11 | Natural logarithm of the number of shareholders at the end of the period | ||

| Stock liquidity (StockLiq) | Proportion of tradable A-shares | TrdaSP | RMB ordinary stocks | |

| Proportion of tradable H-shares | TrdhSP | State-owned shares listed in Hong Kong |

| Year | Freq. | Percent | Cum. |

|---|---|---|---|

| 2009 | 2 | 0.42 | 0.42 |

| 2010 | 8 | 1.69 | 2.11 |

| 2011 | 13 | 2.74 | 4.85 |

| 2012 | 18 | 3.80 | 8.65 |

| 2013 | 20 | 4.22 | 12.87 |

| 2014 | 30 | 6.33 | 19.20 |

| 2015 | 36 | 7.59 | 26.79 |

| 2016 | 45 | 9.49 | 36.29 |

| 2017 | 65 | 13.71 | 50.00 |

| 2018 | 52 | 10.97 | 60.97 |

| 2019 | 60 | 12.66 | 73.63 |

| 2020 | 60 | 12.66 | 86.29 |

| 2021 | 65 | 13.71 | 100.00 |

| Total | 474 | 100.00 |

| Variable | Obs | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| DebtCost | 474 | 0.055 | 0.046 | 0.009 | 0.341 |

| SustaDe | 474 | 0.079 | 0.087 | −0.251 | 0.366 |

| CarbDisc | 474 | 8.344 | 5.560 | 0 | 31 |

| Sales | 474 | 1129.291 | 3327.139 | 3.670 | 29,661.93 |

| Asset | 474 | 6938.539 | 27,952.573 | 18.187 | 302,539.81 |

| Liab | 474 | 5932.202 | 25,591.827 | 5.013 | 276,398.59 |

| ROA | 474 | 0.043 | 0.048 | −0.200 | 0.281 |

| FixedRa | 474 | 0.295 | 0.215 | 0.001 | 0.876 |

| QuickRa | 474 | 1.048 | 0.749 | 0.085 | 7.958 |

| TotalTu | 474 | 0.585 | 0.442 | 0.023 | 2.561 |

| EC1 | 474 | 0.423 | 0.175 | 0.078 | 0.990 |

| EC5 | 474 | 0.659 | 0.174 | 0.232 | 1.005 |

| EC10 | 474 | 0.699 | 0.162 | 0.278 | 1.012 |

| EC11 | 474 | 11.453 | 1.268 | 0.693 | 14.054 |

| TrdaSP | 474 | 0.861 | 0.182 | 0 | 1.000 |

| TrdhSP | 474 | 0.125 | 0.167 | 0 | 0.962 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) | (12) | (13) | (14) | (15) | (16) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (1) DebtCost | 1.000 | |||||||||||||||

| (2) SustaDe | −0.180 *** (0.000) | 1.000 | ||||||||||||||

| (3) CarbDisc | −0.006 | −0.006 | 1.000 | |||||||||||||

| (0.897) | (0.895) | |||||||||||||||

| (4) Sales | 0.062 (0.177) | 0.011 (0.804) | 0.444 *** (0.000) | 1.000 | ||||||||||||

| (5) Asset | −0.028 (0.543) | 0.044 (0.340) | 0.334 *** (0.000) | 0.330 *** (0.000) | 1.000 | |||||||||||

| (6) Liab | −0.029 (0.534) | 0.045 (0.331) | 0.318 *** (0.000) | 0.299 *** (0.000) | 0.999 *** (0.000) | 1.000 | ||||||||||

| (7) ROA | −0.099 ** | 0.660 *** | 0.002 | −0.031 | −0.134 *** | −0.138 *** | 1.000 | |||||||||

| (0.030) | (0.000) | (0.958) | (0.496) | (0.003) | (0.003) | |||||||||||

| (8) FixedRa | −0.097 ** | −0.075 | −0.305 *** | −0.091 ** | −0.271 *** | −0.274 *** | 0.095 ** | 1.000 | ||||||||

| (0.035) | (0.103) | (0.000) | (0.047) | (0.000) | (0.000) | (0.038) | ||||||||||

| (9) QuickRa | 0.133 *** | 0.067 | 0.037 | −0.069 | 0.027 | 0.027 | 0.305 *** | −0.304 *** | 1.000 | |||||||

| (0.004) | (0.145) | (0.426) | (0.133) | (0.558) | (0.555) | (0.000) | (0.000) | |||||||||

| (10) TotalTu | −0.089 * | 0.173 *** | 0.202 *** | 0.224 *** | −0.234 *** | −0.241 *** | 0.365 *** | −0.049 | −0.004 | 1.000 | ||||||

| (0.053) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.288) | (0.932) | ||||||||

| (11) EC 1 | −0.112 ** | 0.023 | 0.137 *** | 0.189 *** | 0.075 | 0.065 | 0.009 | 0.193 *** | −0.041 | 0.071 | 1.000 | |||||

| (0.015) | (0.610) | (0.003) | (0.000) | (0.104) | (0.160) | (0.850) | (0.000) | (0.372) | (0.123) | |||||||

| (12) EC 5 | −0.095 ** | −0.022 | 0.266 *** | 0.214 *** | 0.172 *** | 0.162 *** | −0.015 | 0.083 * | −0.036 | 0.046 | 0.736 *** | 1.000 | ||||

| (0.038) | (0.637) | (0.000) | (0.000) | (0.000) | (0.000) | (0.748) | (0.072) | (0.431) | (0.314) | (0.000) | ||||||

| (13) EC 10 | −0.076 * | −0.022 | 0.298 *** | 0.224 *** | 0.196 *** | 0.186 *** | −0.026 | 0.063 | −0.026 | 0.015 | 0.693 *** | 0.985 *** | 1.000 | |||

| (0.099) | (0.635) | (0.000) | (0.000) | (0.000) | (0.000) | (0.568) | (0.174) | (0.568) | (0.739) | (0.000) | (0.000) | |||||

| (14) EC 11 | 0.061 | −0.049 | 0.250 *** | 0.299 *** | 0.229 *** | 0.218 *** | −0.054 | −0.080 * | −0.031 | −0.154 *** | −0.222 *** | −0.161 *** | −0.143 *** | 1.000 | ||

| (0.186) | (0.292) | (0.000) | (0.000) | (0.000) | (0.000) | (0.238) | (0.084) | (0.506) | (0.001) | (0.000) | (0.000) | (0.002) | ||||

| (15) TrdaSP | −0.022 | −0.074 | −0.426 *** | −0.216 *** | −0.480 *** | −0.477 *** | 0.085 * | 0.345 *** | −0.046 | 0.008 | −0.112 ** | −0.389 *** | −0.397 *** | 0.106 ** | 1.000 | |

| (0.639) | (0.108) | (0.000) | (0.000) | (0.000) | (0.000) | (0.066) | (0.000) | (0.322) | (0.867) | (0.015) | (0.000) | (0.000) | (0.021) | |||

| (16) TrdhSP | 0.043 | 0.028 | 0.454 *** | 0.256 *** | 0.540 *** | 0.536 *** | −0.108 ** | −0.361 *** | 0.072 | −0.082 * | 0.022 | 0.394 *** | 0.409 *** | 0.207 *** | −0.865 *** | 1.000 |

| (0.352) | (0.541) | (0.000) | (0.000) | (0.000) | (0.000) | (0.019) | (0.000) | (0.118) | (0.075) | (0.628) | (0.000) | (0.000) | (0.000) | (0.000) |

| Model 1 | |||

|---|---|---|---|

| (1) FE | (2) RE | (3) FGLS | |

| VARIABLES | DebtCost | ||

| CarbDisc | −0.103 ** (−2.46) | −0.129 *** (−3.31) | −0.065 *** (−2.58) |

| SustaDe | 0.014 (0.53) | 0.018 (0.70) | 0.020 (1.59) |

| Indus | 0.051 (0.13) | −0.237 (−1.63) | −0.127 ** (−2.16) |

| Sales | 0.659 *** (5.52) | 0.313 *** (3.53) | 0.104 ** (2.17) |

| Asset | −0.816 *** (−3.26) | −0.384 * (−1.87) | −0.115 (−1.00) |

| Liab | 0.012 (0.06) | 0.046 (0.28) | −0.046 (−0.49) |

| ROA | −0.361 (−0.43) | −0.349 (−0.44) | −0.307 (−0.57) |

| FixedRa | 1.189 *** (3.89) | 0.873 *** (3.40) | 0.513 *** (3.79) |

| QuickRa | 0.086 (1.29) | 0.088 (1.57) | 0.050 (1.27) |

| TotalTu | −1.039 *** (−4.68) | −0.681 *** (−3.77) | −0.328 *** (−2.78) |

| EC1 | 0.265 (0.51) | 0.167 (0.43) | −0.070 (−0.40) |

| EC5 | −1.392 (−0.99) | −1.814 (−1.46) | −1.774 *** (−2.99) |

| EC10 | 0.769 (0.59) | 1.072 (0.89) | 1.748 *** (2.88) |

| EC11 | −0.000 (−0.00) | −0.020 (−0.43) | 0.057 ** (2.11) |

| TrdaSP | −0.001 (−0.10) | 0.001 (0.19) | −0.003 (−0.85) |

| TrdhSP | 0.014 (1.33) | 0.010 * (1.68) | −0.000 (−0.02) |

| Constant | −0.971 (−1.33) | −1.777 *** (−4.35) | −2.959 *** (−11.57) |

| F | 5.40 *** | - | - |

| chi2 | - | 64.12 *** | 126.43 *** |

| Observations | 471 | 471 | 460 |

| R-squared | 0.193 | 0.162 | - |

| Number of idcode | 95 | 95 | 84 |

| idcode FE | YES | YES | YES |

| Year FE | YES | YES | YES |

| Model 2 | |||

|---|---|---|---|

| (1) FE | (2) RE | (3) FGLS | |

| VARIABLES | DebtCost | ||

| CarbDisc | −0.094 ** (−2.22) | −0.124 *** (−3.16) | −0.061 ** (−2.43) |

| SustaDe | −0.043 (−0.86) | −0.023 (−0.47) | −0.033 (−1.08) |

| CarbDisc * SustaDe | 0.030 (1.31) | 0.021 (0.97) | 0.023 * (1.85) |

| Indus | 0.037 (0.10) | −0.237 (−1.62) | −0.134 ** (−2.32) |

| Sales | 0.678 *** (5.64) | 0.324 *** (3.63) | 0.112 ** (2.32) |

| Asset | −0.878 *** (−3.45) | −0.412 ** (−1.99) | −0.131 (−1.15) |

| Liab | 0.037 (0.20) | 0.059 (0.36) | −0.037 (−0.40) |

| ROA | −0.089 (−0.10) | −0.183 (−0.23) | 0.014 (0.03) |

| FixedRa | 1.146 *** (3.73) | 0.864 *** (3.35) | 0.523 *** (3.96) |

| QuickRa | 0.085 (1.28) | 0.087 (1.56) | 0.048 (1.24) |

| TotalTu | −1.102 *** (−4.85) | −0.710 *** (−3.88) | −0.345 *** (−2.93) |

| EC1 | 0.199 (0.39) | 0.157 (0.40) | −0.095 (−0.56) |

| EC5 | −1.347 (−0.96) | −1.831 (−1.48) | −1.705 *** (−2.98) |

| EC10 | 0.763 (0.59) | 1.113 (0.93) | 1.713 *** (2.92) |

| EC11 | −0.005 (−0.09) | −0.021 (−0.45) | 0.058 ** (2.16) |

| TrdaSP | −0.000 (−0.01) | 0.001 (0.20) | −0.003 (−0.92) |

| TrdhSP | 0.014 (1.37) | 0.010 * (1.71) | −0.000 (−0.12) |

| Constant | −0.961 (−1.32) | −1.866 *** (−4.44) | −3.117 *** (−11.66) |

| F | 5.19 *** | - | - |

| chi2 | - | 65.27 *** | - |

| Observations | 471 | 471 | 460 |

| R-squared | 0.197 | 0.165 | - |

| Number of idcode | 95 | 95 | 84 |

| idcode FE | YES | YES | YES |

| Year FE | YES | YES | YES |

| Model 1 | Model 2 | |||||

|---|---|---|---|---|---|---|

| (1) FE | (2) RE | (3) FGLS | (1) FE | (2) RE | (3) FGLS | |

| VARIABLES | DebtCost | |||||

| CarbDisc | −0.131 *** (−2.97) | −0.148 *** (−3.57) | −0.083 *** (−2.99) | −0.123 *** (−2.74) | −0.143 *** (−3.42) | −0.081 *** (−2.94) |

| SustaDe | 0.012 (0.47) | 0.016 (0.63) | 0.020 * (1.66) | −0.050 (−0.82) | −0.030 (−0.52) | −0.043 (−1.17) |

| CarbDisc * SustaDe | - | - | - | 0.027 (1.12) | 0.020 (0.87) | 0.024* (1.78) |

| Indus | 0.027 (0.07) | −0.226 (−1.55) | −0.120 ** (−2.08) | 0.014 (0.04) | −0.225 (−1.54) | −0.127 ** (−2.25) |

| Sales | 0.670 *** (5.63) | 0.317 *** (3.58) | 0.103 ** (2.13) | 0.686 *** (5.72) | 0.327 *** (3.66) | 0.111 ** (2.30) |

| Asset | −0.795 *** (−3.19) | −0.377 * (−1.84) | −0.107 (−0.95) | −0.844 *** (−3.34) | −0.400 * (−1.94) | −0.124 (−1.10) |

| Liab | −0.009 (−0.05) | 0.040 (0.25) | −0.049 (−0.53) | 0.010 (0.06) | 0.051 (0.31) | −0.038 (−0.42) |

| ROA | −0.344 (−0.41) | −0.334 (−0.42) | −0.307 (−0.57) | −0.109 (−0.13) | −0.180 (−0.22) | 0.032 (0.06) |

| FixedRa | 1.191 *** (3.92) | 0.871 *** (3.40) | 0.508 *** (3.78) | 1.149 *** (3.75) | 0.859 *** (3.34) | 0.522 *** (4.02) |

| QuickRa | 0.085 (1.28) | 0.088 (1.58) | 0.047 (1.20) | 0.084 (1.27) | 0.087 (1.57) | 0.045 (1.15) |

| TotalTu | −1.048 *** (−4.74) | −0.683 *** (−3.78) | −0.324 *** (−2.74) | −1.098 *** (−4.87) | −0.708 *** (−3.88) | −0.343 *** (−2.90) |

| EC1 | 0.286 (0.56) | 0.174 (0.44) | −0.061 (−0.35) | 0.234 (0.45) | 0.167 (0.43) | −0.093 (−0.56) |

| EC5 | −1.500 (−1.07) | −1.863 (−1.50) | −1.768 *** (−2.99) | −1.456 (−1.04) | −1.869 (−1.51) | −1.643 *** (−2.91) |

| EC10 | 0.790 (0.61) | 1.072 (0.90) | 1.702 *** (2.82) | 0.762 (0.59) | 1.092 (0.91) | 1.612 *** (2.77) |

| EC11 | −0.003 (−0.06) | −0.023 (−0.49) | 0.056 ** (2.07) | −0.010 (−0.18) | −0.025 (−0.53) | 0.056 ** (2.08) |

| TrdaSP | −0.000 (−0.07) | 0.001 (0.23) | −0.002 (−0.82) | 0.000 (0.03) | 0.001 (0.27) | −0.002 (−0.86) |

| TrdhSP | 0.014 (1.34) | 0.011 * (1.80) | 0.001 (0.21) | 0.014 (1.39) | 0.011 * (1.84) | 0.000 (0.13) |

| Constant | −0.868 (−1.20) | −1.699 *** (−4.15) | −2.892 *** (−11.15) | −0.891 (−1.23) | −1.804 *** (−4.21) | −3.076 *** (−11.13) |

| F | 5.61 *** | - | - | 5.35 *** | - | - |

| chi2 | - | 66.25 *** | 130.22 *** | - | 67.17 *** | 141.74 *** |

| Observations | 471 | 471 | 460 | 471 | 471 | 460 |

| R-squared | 0.199 | 0.168 | 0.202 | 0.170 | ||

| Number of idcode | 95 | 95 | 84 | 95 | 95 | 84 |

| idcode FE | YES | YES | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES | YES | YES |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, G.; Lou, X.; Shen, J.; Dan, E.; Zheng, X.; Shao, J.; Li, J. Corporate Carbon Information Disclosure and Financing Costs: The Moderating Effect of Sustainable Development. Sustainability 2022, 14, 9159. https://doi.org/10.3390/su14159159

Wang G, Lou X, Shen J, Dan E, Zheng X, Shao J, Li J. Corporate Carbon Information Disclosure and Financing Costs: The Moderating Effect of Sustainable Development. Sustainability. 2022; 14(15):9159. https://doi.org/10.3390/su14159159

Chicago/Turabian StyleWang, Guangyang, Xinxuan Lou, Jianfei Shen, Erli Dan, Xinyuan Zheng, Jiaxin Shao, and Jingjie Li. 2022. "Corporate Carbon Information Disclosure and Financing Costs: The Moderating Effect of Sustainable Development" Sustainability 14, no. 15: 9159. https://doi.org/10.3390/su14159159

APA StyleWang, G., Lou, X., Shen, J., Dan, E., Zheng, X., Shao, J., & Li, J. (2022). Corporate Carbon Information Disclosure and Financing Costs: The Moderating Effect of Sustainable Development. Sustainability, 14(15), 9159. https://doi.org/10.3390/su14159159