Structural Evolution and Sustainability of Agricultural Trade between China and Countries along the “Belt and Road”

Abstract

:1. Introduction

2. Materials and Methods

2.1. Research Methods

2.1.1. Planar Structure Quantification Method

2.1.2. Quantification Method of Spatial Structure

2.1.3. Analysis Methods of Spatial Network Influence Factors

2.2. Description of Study Subjects and Data

2.2.1. Definition of the Research Area

2.2.2. Agricultural Product Scoping and Data Sources

3. Results

3.1. Planar Structure Analysis

3.1.1. Trade Type Structure

3.1.2. Trade Region Structure

3.1.3. Trade Intensity Structure

3.1.4. Trade Concentration Structure

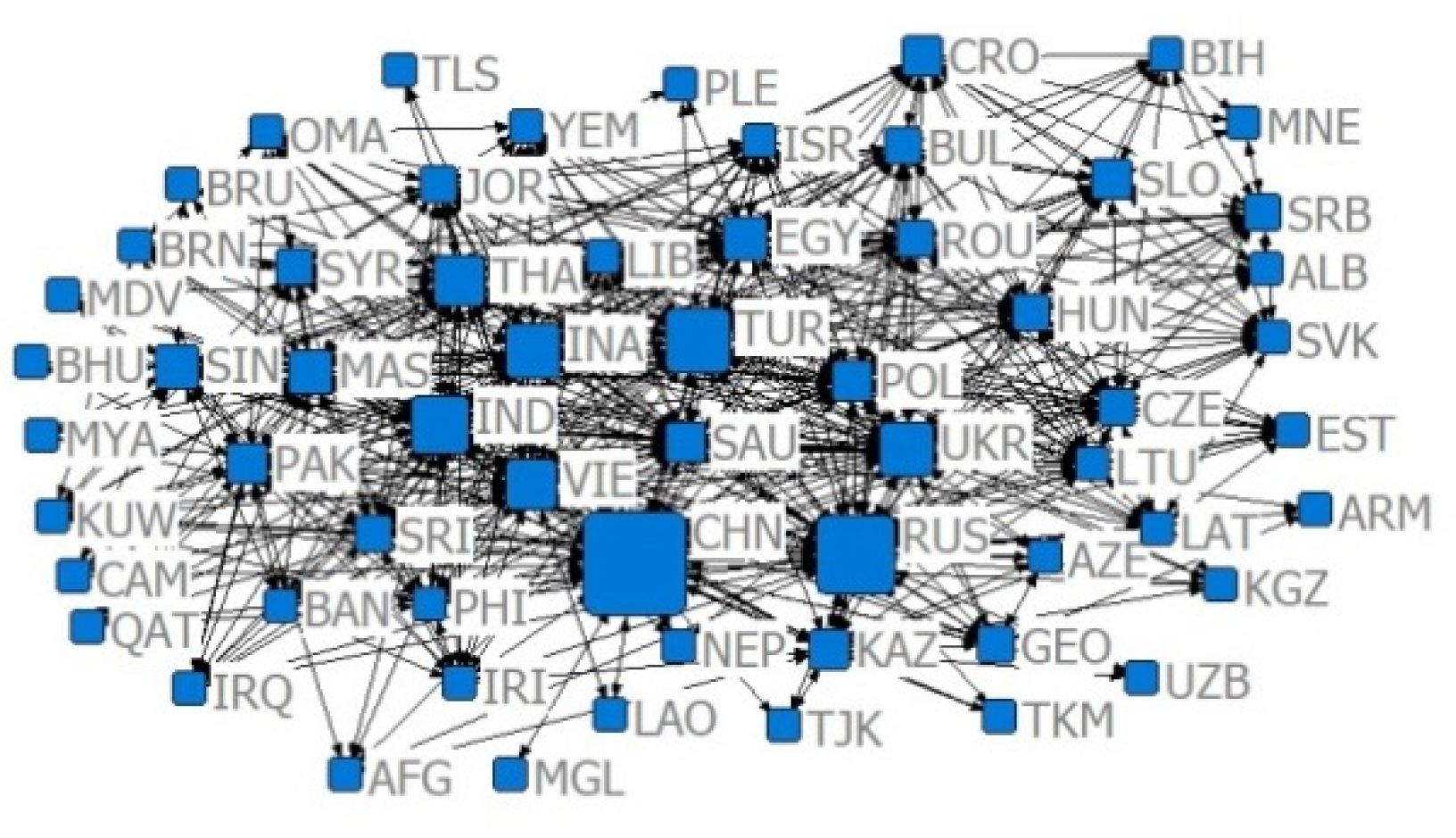

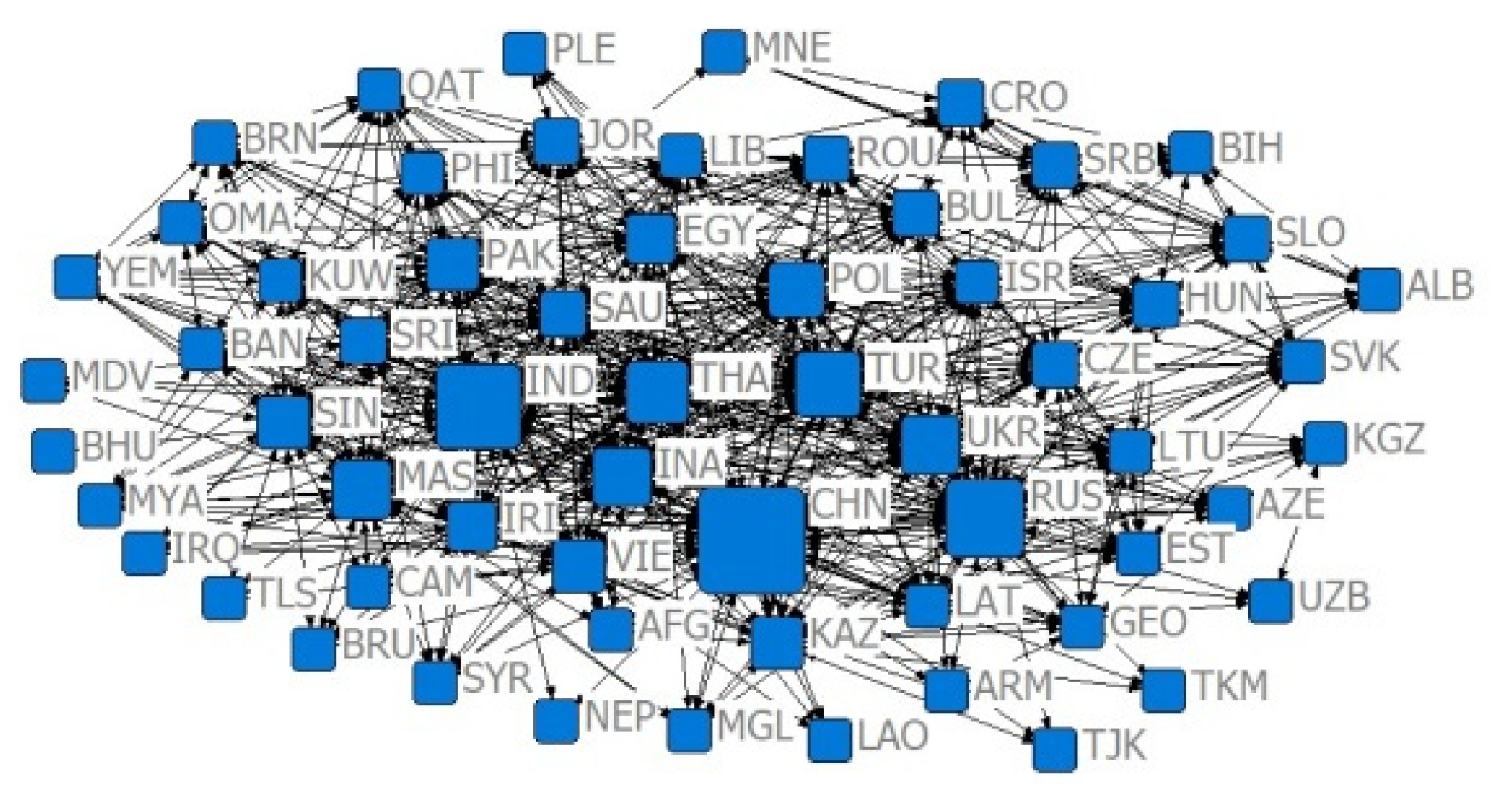

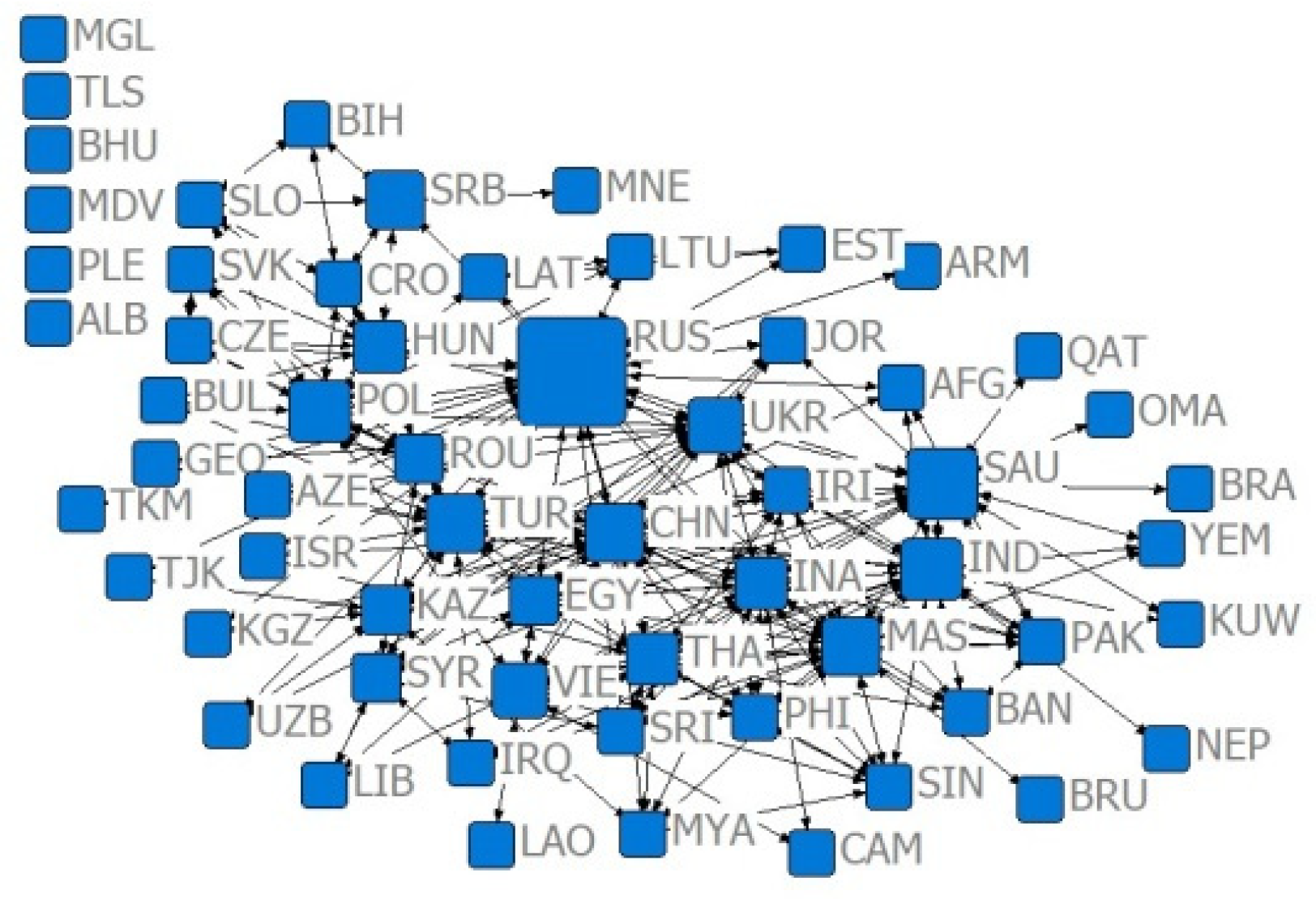

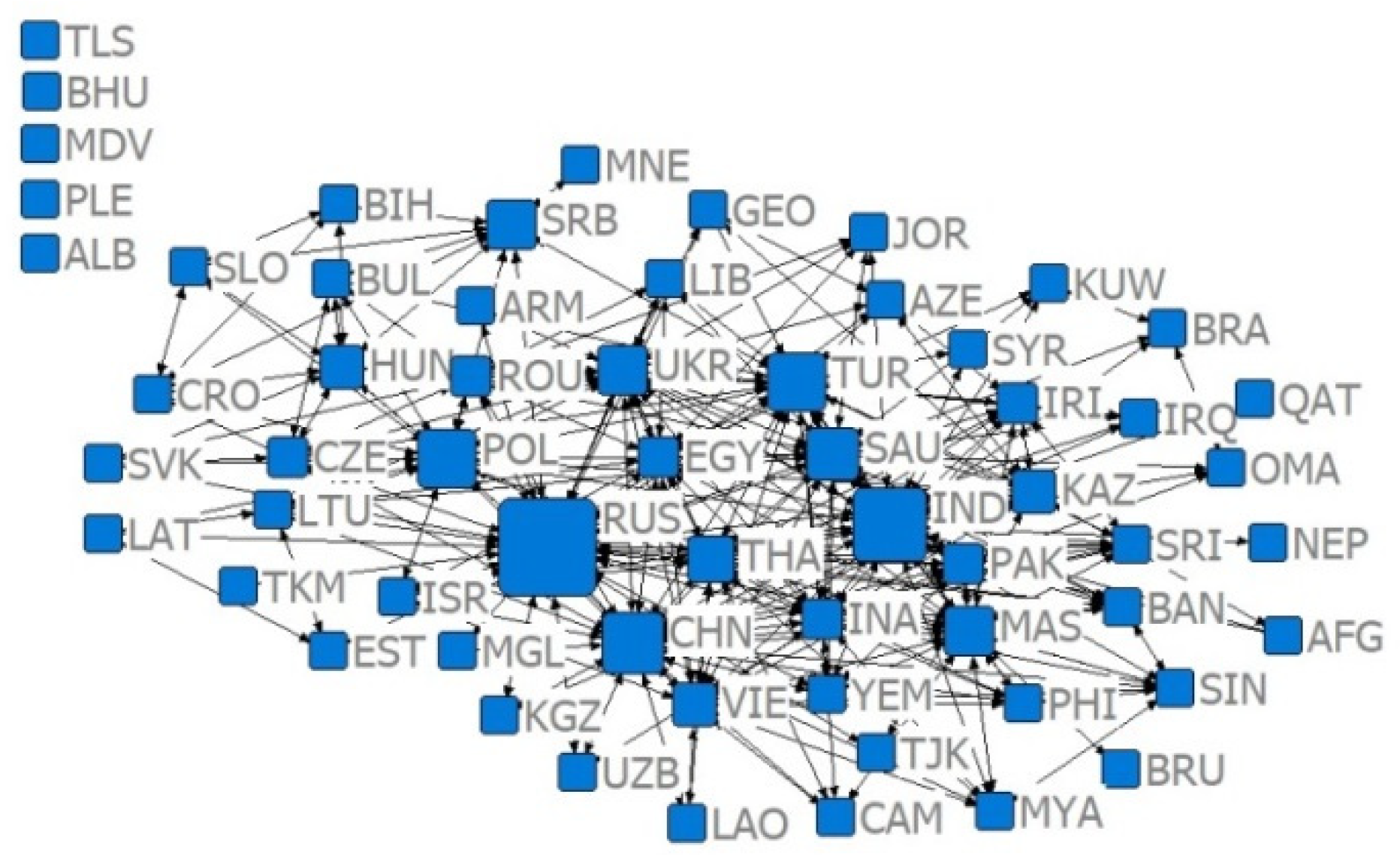

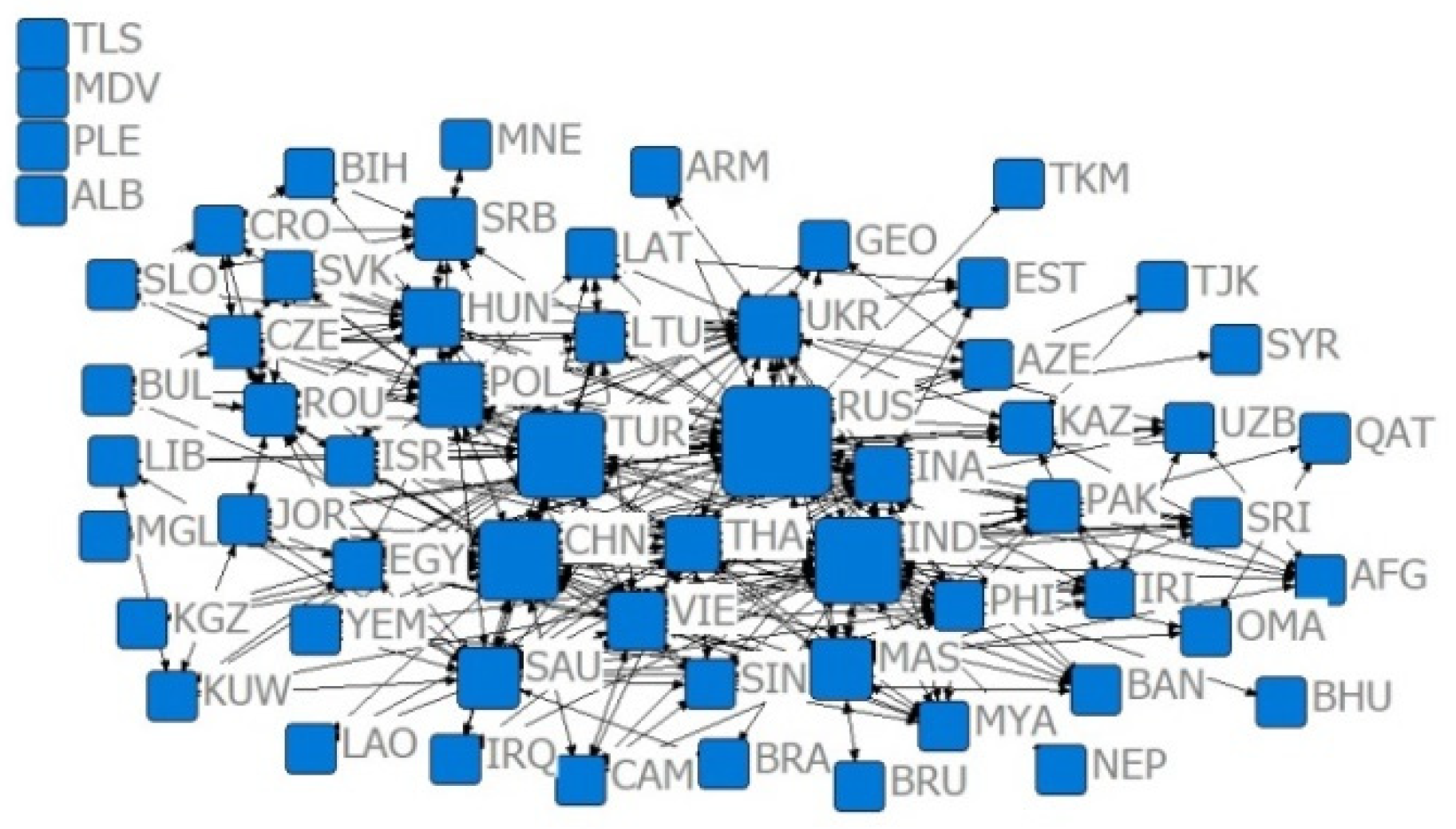

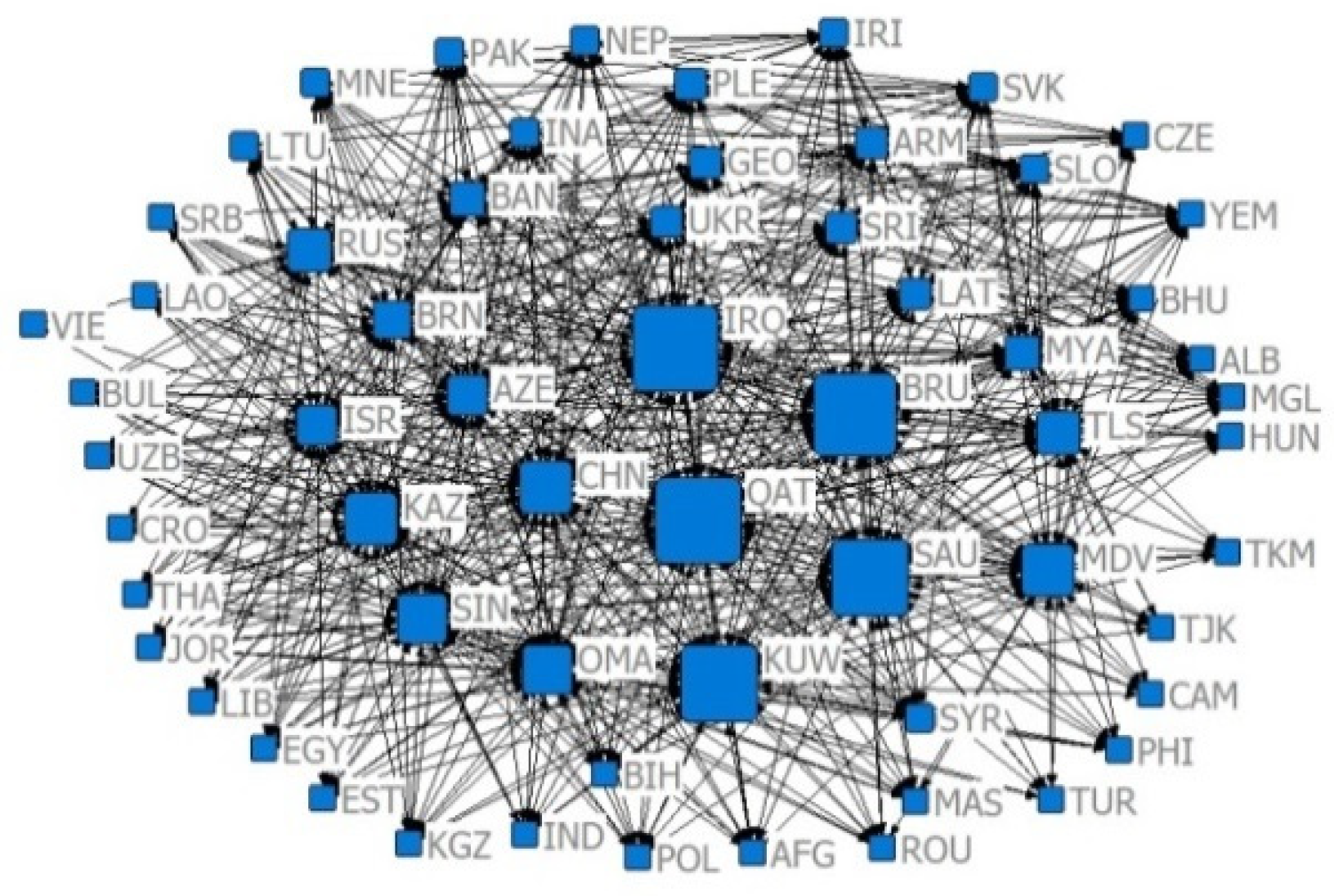

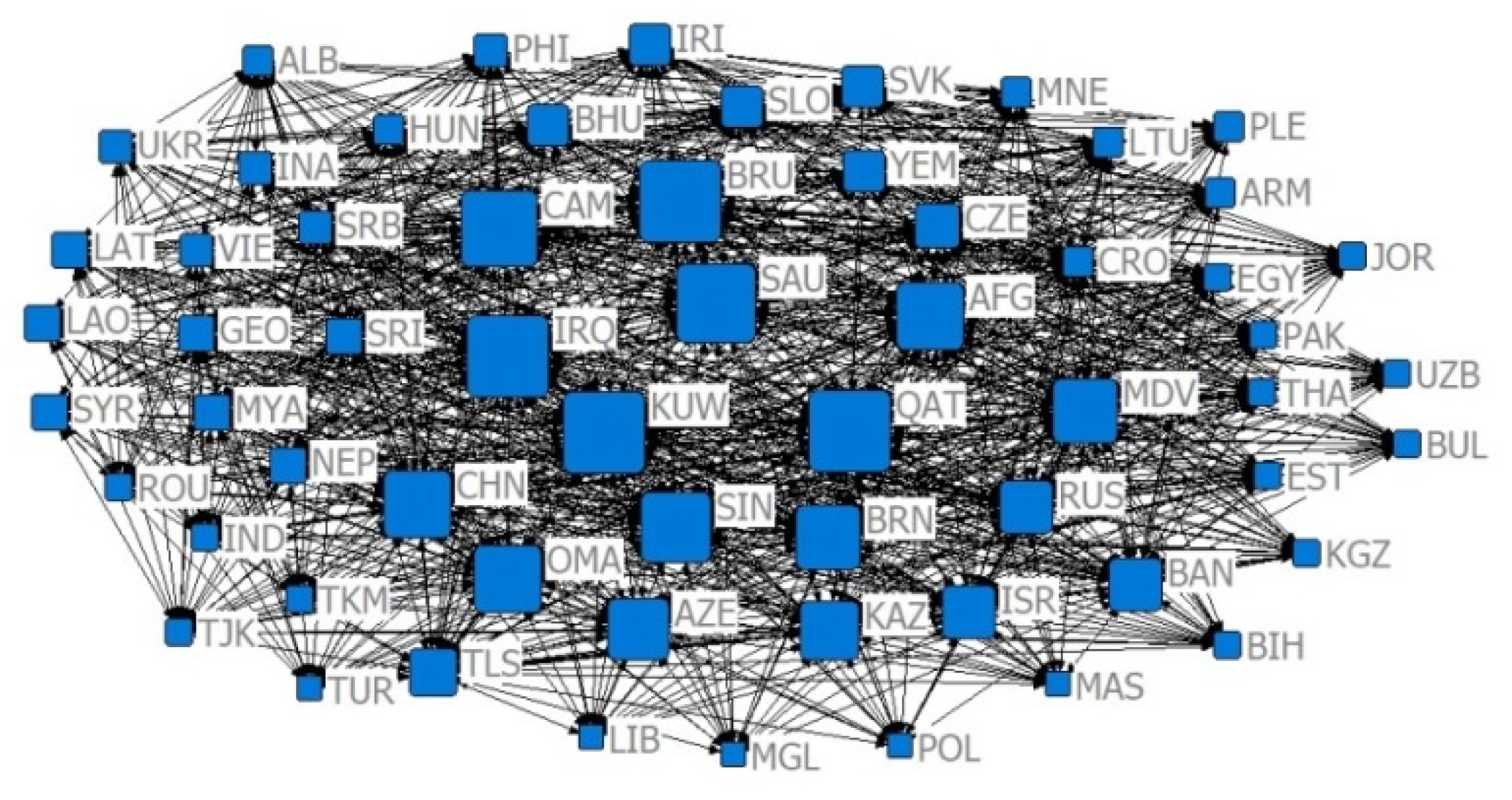

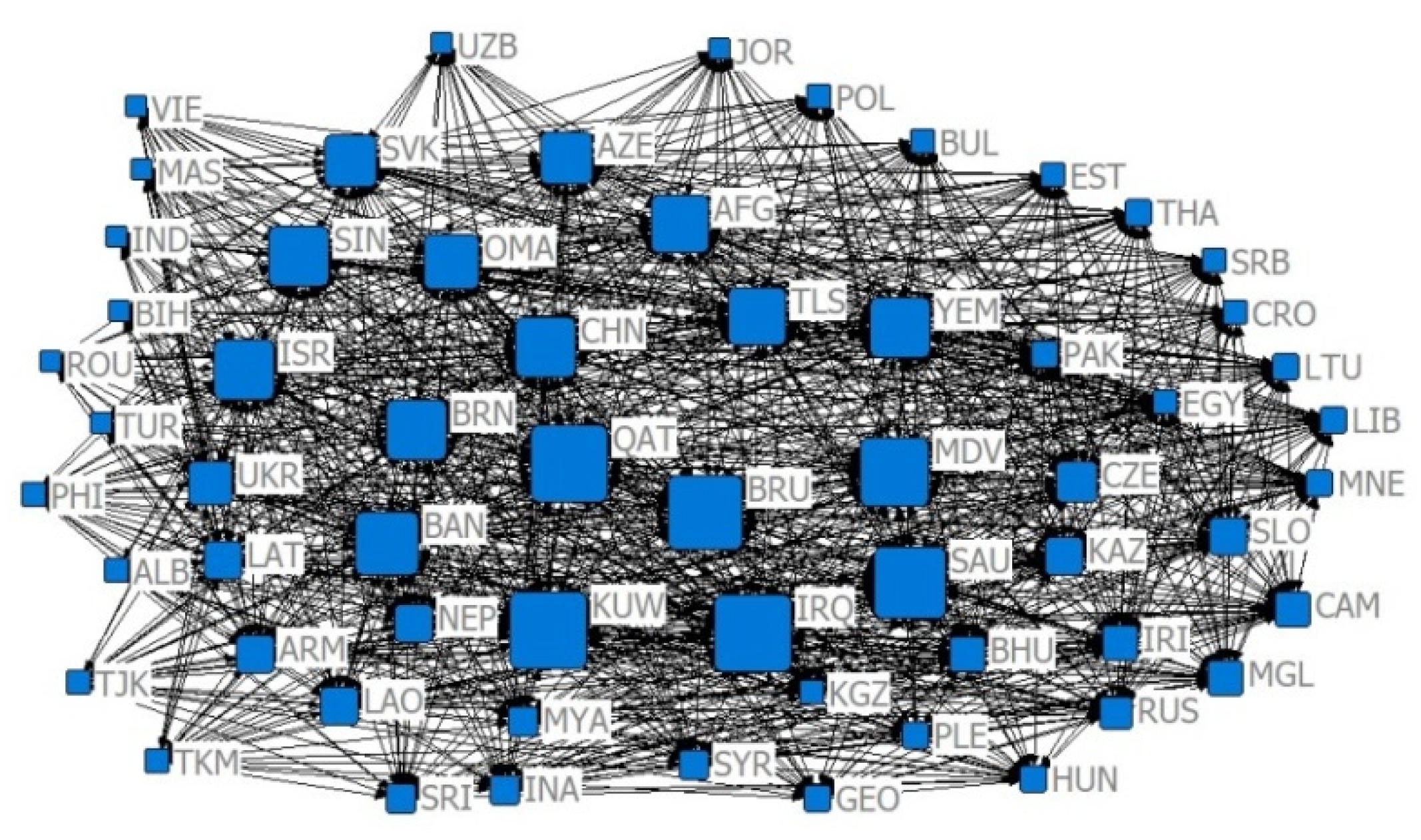

3.2. Spatial Network Structure Analysis

3.2.1. Analysis of the Density of Trade Networks

3.2.2. Analysis of the Centrality of Trade Networks

3.2.3. Analysis of the Trade Block Model

3.3. Analysis of Spatial Network Influencing Factors

3.3.1. QAP Correlation Analysis

3.3.2. QAP Regression Analysis

4. Discussion

4.1. Comparison to Prior Studies

4.2. Sustainability Implications

4.3. Limitations and Future Research Directions

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Glogovețan, A.I.; Dabija, D.C.; Fiore, M.; Pocol, C.B. Consumer Perception and Understanding of European Union Quality Schemes: A Systematic Literature Review. Sustainability 2022, 14, 1667. [Google Scholar] [CrossRef]

- Guo, J.; Mao, K.; Yuan, Z.; Qin, Z.; Xu, T.; Bateni, S.M.; Zhao, Y.; Ye, C. Global Food Security Assessment during 1961–2019. Sustainability 2021, 13, 14005. [Google Scholar] [CrossRef]

- Majerova, J.; Sroka, W.; Krizanova, A.; Gajanova, L.; Lazaroiu, G.; Nadanyiova, M. Sustainable Brand Management of Ali-mentary Goods. Sustainability 2020, 12, 556. [Google Scholar] [CrossRef] [Green Version]

- Du, Z.X.; Gao, M.; Han, L. Study on the impact of supply side import end change on China’s food security. Chin. Rural Econ. 2021, 1, 15–30. [Google Scholar]

- Zhao, Y.L.; Lin, G. Analysis of bilateral agricultural trade flow and trade potential between China and 10 ASEAN countries—A study based on Trade Gravity Model. J. Int. Trade 2008, 12, 69–77. [Google Scholar]

- Li, T.; Li, Y.X. Analysis on complementarity of agricultural trade between China and five Central Asian countries. J. Int. Trade 2011, 1, 53–62. [Google Scholar]

- Zhu, X.X.; Li, Y.X. Analysis on the competitiveness and complementarity of agricultural trade between China and five Central Asian countries. Int. Econ. Trade Res. 2011, 27, 17–22. [Google Scholar]

- Yu, M.Z.; Liang, Y.F.; Gao, Y. One belt, one road strategy and the competition and complementarity of agricultural products trade between China and South Asia. Issues Agric. Econ. 2016, 37, 83–94. [Google Scholar]

- Geng, Z.Z.; Xiao, H.F. Analysis on the trade characteristics of agricultural products between China and countries along the “21st century Maritime Silk Road”. Issues Agric. Econ. 2016, 37, 81–88. [Google Scholar]

- Yang, F.M.; Tian, Y.Y. Research on agricultural trade between China and countries along the “21st century Maritime Silk Road”—From the perspective of competitiveness, complementarity and trade potential. Mod. Econ. Res. 2018, 8, 54–65. [Google Scholar]

- Tong, G.J.; Shi, L. Empirical analysis of Sino Russian agricultural trade based on intra industry. Issues Agric. Econ. 2017, 38, 89–100. [Google Scholar]

- Bai, X.B.; Xu, Z.; Zhou, Y.H. Analysis of the characteristics of China-Russia agricultural trade and prospects of cooperation. Russ. Stud. 2021, 4, 176–196. [Google Scholar]

- Liu, C.P.; Xiao, H.F. A study on the causes of agricultural trade growth between China and 16 countries in central and Eastern Europe—An Empirical Analysis Based on CMS model. J. Agrotech. Econ. 2018, 9, 135–144. [Google Scholar]

- Yao, C.M.; Xu, X.K.; Wang, Y. Dynamic decomposition of the causes of agricultural trade growth between China and Eastern European countries. Stat. Deci. 2021, 37, 155–159. [Google Scholar]

- An, X.N.; Xin, L. Analysis of the current situation and potential of agricultural trade between China and Southeast Asia based on the “One Belt, One Road” initiative. Chin. J. Agri. Res. Reg. 2019, 40, 118–127. [Google Scholar]

- Wang, R.; Wen, H.D. Research on China’s export potential of agricultural products to countries along the “Silk Road Economic Belt”—An Empirical Analysis Based on Stochastic Frontier gravity model. J. Agrotech. Econ. 2016, 10, 116–126. [Google Scholar]

- Wang, L.; Liu, S.G.; Duan, P.L.; Yin, P. Structural characteristics of agricultural products trade network in countries along the Silk Road Economic Belt. Econ. Geogra. 2019, 39, 198–206. [Google Scholar]

- Yang, J.Q. Spring Festival Study on the export trade potential of China’s agricultural products from countries along the “Silk Road Economic Belt”—An analytical framework based on TPI and extended stochastic frontier gravity model. J. Int. Trade 2020, 6, 127–142. [Google Scholar]

- Ya, Z.; Pei, K. Factors Influencing Agricultural Products Trade between China and Africa. Sustainability 2022, 14, 5589. [Google Scholar] [CrossRef]

- Zhao, X.; Sun, Z.L. Analysis of the prospects of agricultural trade between China and Ukraine in the context of “Belt and Road”. World Agric. 2021, 3, 90–99. [Google Scholar]

- Manitra, R.A.G. Competitiveness and trade potential of India’s dairy industry. Food Policy 2006, 31, 216–227. [Google Scholar]

- Zhao, M.Z. Study on the dependence of corn on the international market—Based on the comparative analysis of four food crops. J. Int. Trade 2015, 9, 109–121. [Google Scholar]

- Li, C.; Wang, L.Y. China’s leading Belt and Road, and other countries’ regional value chain construction: Take aquatic products export trade as an example. Macroeconomics 2018, 9, 72–84. [Google Scholar]

- Zhang, Y.; Zhao, L.; Chen, Y.S. Belt and Road strategy of aquatic products export trade in China: A case study of Shandong province. J. Xiamen Univ. 2018, 4, 135–144. [Google Scholar]

- Zhang, F.H.; Zhang, J.G.; Song, X.L.; Pang, G.J. Comparative analysis of Belt and Road, and the other countries’ export market in China and the United States. J. Agrotech. Econ. 2019, 1, 135–144. [Google Scholar]

- Chen, Y.W.; Li, E.L. “Belt and Road” national grain trade network spatial pattern and its evolution mechanism. Progress Geogra. 2019, 38, 1643–1654. [Google Scholar] [CrossRef]

- Sun, Z.L.; Jia, X.L.; Li, X.D. Belt and Road, China’s grain trade trend and the estimation of its virtual cultivated land flow. J. Huazhong Agric. Univ. 2019, 1, 24–32. [Google Scholar]

- Han, D.; Li, G.S.; Zhong, Y. A comparison of grain competitiveness and factors influencing grain trade between China and countries along the “Belt and Road”. J. Jiangxi Univ. Finance Econ. 2020, 4, 76–92. [Google Scholar]

- Han, D.; Li, G.S. Evolution of Food Trade Patterns and Influence Mechanisms between China and Countries Along the “Belt and Road”—Based on Social Networking Perspective. Issues Agric. Econ. 2020, 8, 24–40. [Google Scholar]

- Peng, S.G.; Zhou, Y.H. China’s export growth Belt and Road country -- from the perspective of three yuan margin. Issues Agric. Econ. 2021, 4, 132–144. [Google Scholar]

- Wei, S.H. China’s Agricultural Trade with “Belt and Road” Countries: Network Structure, Linkage Characteristics and Strategic Options. Issues Agric. Econ. 2018, 11, 101–113. [Google Scholar]

- Zhan, M.H. Belt and Road, the competition and complementarity of agricultural products trade in the countries along the belt—Based on social network analysis method. Issues Agric. Econ. 2018, 2, 103–114. [Google Scholar]

- Su, X.; Zhang, H. China’s Belt and Road, and other countries’ agricultural trade network structure and cooperation situation. Reform. 2019, 7, 96–110. [Google Scholar]

- Yang, Y.W.; Dong, W.L.; Yang, J. The evolution of agricultural trade characteristics between China and countries along the Belt and Road. Soc. Sci. 2021, 1, 67–73. [Google Scholar]

- Liu, Y.J.; Liu, Y.T. Evolution and optimization strategies of agricultural trade pattern between China and countries along the “Belt and Road”. Zhejiang Acad. J. 2021, 4, 113–122. [Google Scholar]

- Sun, Z.L.; Li, X.D.; Li, S.J. Research on intra-industry trade of agricultural products between China and countries along the Belt and Road and its influencing factors. J. Huazhong Agri. Univ. 2021, 1, 57–68+176. [Google Scholar]

- Li, J.; Chen, N.; Wan, G.H.; Chen, S. Belt and Road, the state of trade, the complementary relationship and dynamic change of goods trade -- Based on network analysis method. J. Manag. World 2017, 4, 10–19. [Google Scholar]

- Lin, D.Y.; Zhu, J. Study on the comparative advantage and import market structure of main grain varieties in China. World Econ. Stud. 2015, 2, 115–126. [Google Scholar]

- Zheng, L.; Song, Z.Y.; Liu, W.D.; Liu, Y. Analysis of trade pattern and trade structure in Western China. Geographical Res. 2015, 34, 1933–1942. [Google Scholar]

- Sun, D.S.; Su, J.X.; Li, N.H.; Zhang, L. Study on the impact of Sino US trade friction on Sino US agricultural trade structure. Issues Agric. Econ. 2021, 1, 95–106. [Google Scholar]

- Li, J.; Chen, S.; Wan, G.H.; Fu, C.M. Spatial correlation of China’s regional economic growth and its explanation—Based on network analysis method. Econ. Res. J. 2014, 49, 4–16. [Google Scholar]

- Ma, S.Z.; Ren, W.W.; Wu, G.J. Characteristics of a country’s agricultural trade network and its impact on the division of labor in the global value chain—From the perspective of social network analysis. J. Manag. World 2016, 3, 60–72. [Google Scholar]

- Baster, A.S.J.; Brown, A.J. Applied Economics: Aspects of the World Economy in War and Peace. Economica 1949, 16, 78. [Google Scholar] [CrossRef]

- Kojima, K. The Pattern of International Trade Among Advanced Countries. Hitotsubashi J. Econ. 1964, 5, 16–36. [Google Scholar]

- Chen, Y.S.; Chang, K.C. The relationship between a firm’s patent quality and its market value—The case of US pharmaceutical industry. Technol. Forecast. Soc. Chang. 2010, 77, 20–33. [Google Scholar] [CrossRef]

- Granovetter, M. Economic Action and Social Structure: The Problem of Embeddedness. Am. J. Sociol. 1985, 91, 481–510. [Google Scholar] [CrossRef]

- Harrison, C.W.; Scott, A.B.; Ronald, L.B. Social Structure from Multiple Networks. I. Block-models of Roles and Positions. Am. J. Sociol. 1976, 81, 730–780. [Google Scholar]

- Liu, J. QAP: A method to measure the relationship between “relationships”. Chin. J. Sociol. 2007, 4, 164–174. [Google Scholar]

- David, K.; Wilbur, I.; Smith, K.O.; John, A.C. A Gravity Model Analysis of the Benefits of Economic Integration in the Pacific Rim. J. Econ. Integra. 1999, 14, 347–367. [Google Scholar]

- Cemal, A.; Jun, F. Regional Blocs and Agricultural Trade Flow: The Case of ASEAN. Japan Int. Res. Cent. Agric. Sci. 2008, 42, 115–121. [Google Scholar]

- Liu, H.M.; Li, G.J.; Wang, K.Q. Study on Influencing Factors of international trade of Agricultural Virtual Water in China—Analysis Based on gravity model. J. Manag. World 2010, 9, 76–87. [Google Scholar]

- Zhong, Z.H.; Qin, C.L. Trade Network Structure of “Belt and Road” and Its Influencing Factors—A Study Based on Network Analysis Method—Based on network analysis method. Int. Econ. Trade Res. 2017, 33, 16–28. [Google Scholar]

- Yao, X.; Pu, Y.; Wu, G.; Wang, B.; Wang, L. China’s industrial integration and status along the “Belt and Road”: Industry comparison, regional differences and correlation factors. Econ. Res. J. 2019, 54, 172–186. [Google Scholar]

- Feng, L.Y.; Xu, H.L.; Wu, G.; Zhao, Y.; Xu, J.L. Exploring the structure and influence factors of trade competitive advantage network along the Belt and Road. Phys. Stat. Mech. Appl. 2020, 559. [Google Scholar] [CrossRef]

- Vătămănescu, E.M.; Alexandru, V.A.; Mitan, A.; Dabija, D.C. From the Deliberate Managerial Strategy towards International Business Performance: A Psychic Distance vs. Global Mindset Approach. Syst. Res. Behav. Sci. 2020, 3, 374–387. [Google Scholar] [CrossRef]

| China’s Import of Agricultural Products to B&R Countries (%) | China’s Export of Agricultural Products to B&R Countries (%) | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| SITC | 2001 | 2009 | 2013 | 2017 | 2018 | 2019 | SITC | 2001 | 2009 | 2013 | 2017 | 2018 | 2019 |

| 02 | 28.28 | 17.93 | 18.61 | 18.38 | 17.76 | 15.37 | 05 | 25.40 | 46.03 | 42.68 | 47.66 | 44.35 | 45.82 |

| 23 | 12.61 | 17.11 | 18.52 | 23.55 | 18.17 | 15.07 | 03 | 5.79 | 12.21 | 17.88 | 13.84 | 13.14 | 13.57 |

| 05 | 7.27 | 10.74 | 12.07 | 10.78 | 12.49 | 14.28 | 26 | 9.19 | 6.59 | 7.13 | 6.73 | 7.28 | 6.09 |

| 42 | 9.55 | 24.72 | 16.40 | 12.82 | 11.74 | 12.77 | 07 | 4.51 | 4.28 | 3.54 | 4.50 | 4.83 | 5.18 |

| 03 | 12.03 | 8.39 | 5.71 | 5.88 | 9.12 | 12.47 | 29 | 5.00 | 5.73 | 4.99 | 5.16 | 5.63 | 5.12 |

| 25 | 14.74 | 6.04 | 5.32 | 7.16 | 8.22 | 7.18 | 04 | 14.26 | 2.51 | 2.87 | 1.89 | 2.57 | 3.40 |

| 04 | 2.05 | 1.37 | 3.53 | 6.55 | 6.33 | 5.75 | 06 | 3.42 | 3.70 | 3.38 | 3.39 | 3.56 | 3.35 |

| 26 | 3.11 | 5.54 | 9.91 | 3.03 | 2.78 | 2.61 | 22 | 4.24 | 1.89 | 2.00 | 2.57 | 3.12 | 2.75 |

| 09 | 1.24 | 2.32 | 2.16 | 2.21 | 2.46 | 2.59 | 08 | 2.65 | 3.47 | 2.64 | 2.81 | 3.20 | 2.66 |

| 07 | 0.71 | 0.78 | 1.21 | 1.42 | 1.75 | 2.28 | 12 | 8.08 | 3.28 | 2.84 | 2.43 | 2.07 | 2.08 |

| Total | 91.59 | 94.94 | 93.44 | 91.78 | 90.82 | 90.37 | Total | 82.54 | 89.69 | 89.95 | 90.98 | 89.75 | 90.02 |

| Distribution of China’s Agricultural Products Imports from B&R Countries (%) | Distribution of China’s Agricultural Products Exports to B&R Countries (%) | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Country | 2001 | 2009 | 2013 | 2017 | 2018 | 2019 | Country | 2001 | 2009 | 2013 | 2017 | 2018 | 2019 |

| Thailand | 18.41 | 18.04 | 22.38 | 24.29 | 22.89 | 21.01 | Vietnam | 4.61 | 10.04 | 12.81 | 19.92 | 21.58 | 20.67 |

| Indonesia | 23.26 | 18.89 | 17.34 | 20.04 | 18.60 | 17.72 | Thailand | 4.86 | 8.98 | 13.85 | 13.10 | 13.29 | 13.60 |

| Russia | 28.46 | 22.95 | 13.72 | 16.93 | 18.97 | 16.79 | Malaysia | 16.19 | 12.59 | 13.95 | 10.13 | 9.69 | 10.87 |

| Vietnam | 3.07 | 4.93 | 8.71 | 11.29 | 11.49 | 10.64 | Indonesia | 12.05 | 10.83 | 9.47 | 10.29 | 9.70 | 9.46 |

| Malaysia | 14.20 | 19.74 | 13.50 | 9.75 | 8.11 | 7.56 | Philippine | 6.01 | 7.12 | 7.40 | 8.43 | 8.08 | 7.51 |

| India | 2.21 | 4.90 | 8.59 | 2.70 | 3.43 | 5.65 | Russia | 10.52 | 11.44 | 10.72 | 8.11 | 7.96 | 6.90 |

| Ukraine | 0.05 | 0.07 | 1.86 | 2.60 | 3.06 | 4.93 | Turkey | 1.04 | 2.47 | 1.89 | 2.06 | 2.36 | 2.58 |

| Philippine | 1.91 | 1.43 | 1.73 | 1.92 | 2.25 | 2.11 | Myanmar | 2.24 | 0.78 | 1.22 | 2.05 | 2.24 | 2.50 |

| Laos | 0.13 | 0.39 | 1.46 | 1.17 | 1.43 | 1.68 | Bengal | 0.82 | 1.91 | 1.43 | 1.49 | 1.76 | 2.41 |

| Myanmar | 2.08 | 1.97 | 2.37 | 1.01 | 1.07 | 1.59 | India | 8.15 | 5.16 | 3.64 | 3.17 | 2.40 | 2.25 |

| Total | 93.78 | 93.30 | 91.68 | 91.70 | 91.30 | 89.68 | Total | 66.51 | 71.33 | 76.38 | 78.76 | 79.06 | 78.76 |

| China’s Agricultural Trade Intensity with B&R Countries | B&R Countries Agricultural Trade Intensity with China | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Region | 2001 | 2009 | 2013 | 2017 | 2018 | 2019 | Region | 2001 | 2009 | 2013 | 2017 | 2018 | 2019 |

| Mongolia | 73.95 | 141.87 | 104.38 | 125.07 | 97.01 | 95.84 | Mongolia | 9.10 | 5.03 | 2.56 | 3.86 | 3.55 | 3.40 |

| Central Asia | 1.18 | 2.02 | 1.66 | 2.65 | 2.33 | 2.85 | Central Asia | 1.80 | 1.48 | 1.72 | 1.51 | 1.43 | 1.48 |

| Southeast Asia | 1.70 | 3.27 | 3.59 | 4.84 | 4.38 | 4.85 | Southeast Asia | 2.55 | 2.38 | 2.05 | 2.68 | 2.43 | 2.49 |

| South Asia | 0.93 | 1.30 | 1.00 | 1.09 | 1.06 | 1.25 | South Asia | 0.44 | 0.89 | 0.84 | 0.52 | 0.59 | 0.97 |

| Western Asia and Middle East | 0.33 | 0.65 | 0.48 | 0.70 | 0.65 | 0.70 | Western Asia and Middle East | 0.18 | 0.10 | 0.10 | 0.20 | 0.20 | 0.33 |

| Central and Eastern Europe | 0.03 | 0.04 | 0.03 | 0.03 | 0.03 | 0.03 | Central and Eastern Europe | 0.17 | 0.05 | 0.16 | 0.30 | 0.30 | 0.44 |

| Year | Trade Volume | CN Index | Network Density (Dn) | Significant |

|---|---|---|---|---|

| (US $ Million) | ||||

| 2001 | 10 | 0.1785 | 653 | |

| 100 | 0.0404 | 148 | ||

| 0.7 | 0.3221 | 1179 | ||

| 0.8 | 0.4975 | 1821 | ||

| 2009 | 10 | 0.2809 | 1028 | |

| 100 | 0.1121 | 410 | ||

| 0.7 | 0.3582 | 1311 | ||

| 0.8 | 0.5339 | 1954 | ||

| 2013 | 10 | 0.3251 | 1190 | |

| 100 | 0.1421 | 520 | ||

| 0.7 | 0.3339 | 1222 | ||

| 0.8 | 0.5063 | 1853 | ||

| 2019 | 10 | 0.3178 | 1163 | |

| 100 | 0.1505 | 551 | ||

| 0.7 | 0.3509 | 1284 | ||

| 0.8 | 0.5426 | 1986 |

| Year | Trade Volume (US $ Million) | CN Index | Top Five Countries in Terms of Relative Degree of Centrality (De %) | China Ranking | NC (%) Index |

|---|---|---|---|---|---|

| 2001 | 10 | Russia (34), China (31), India (27), Turkey (27), Saudi Arabia (24) | 2 | 40 | |

| 100 | India (13), China (10), Malaysia (10), Russia (9), Thailand (8) | 2 | 18.16 | ||

| 0.7 | Brunei (51), Qatar (51), Kuwait (50), Saudi Arabia (47), Bahrain (46) | 31 (15) | 54.55 | ||

| 0.8 | Afghanistan (57), Qatar (55), Kuwait (53), Saudi Arabia (52), Brunei (51) | 29 (29) | 46.58 | ||

| 2009 | 10 | China (49), Russia (46), Turkey (44), India (38), Ukraine (37) | 1 | 55.11 | |

| 100 | Russia (30), China (22), India (21), Turkey (20), Malaysia (19) | 2 | 40.11 | ||

| 0.7 | Brunei (49), Iraq (48), Qatar (48), Kuwait (48), Saudi Arabia (40) | 11 (31) | 47.20 | ||

| 0.8 | Iraq (54), Brunei (54), Qatar (54), Kuwait (54), Afghanistan (50) | 10 (44) | 37.63 | ||

| 2013 | 10 | China (54), India (46), Russia (46), Turkey (44), Thailand (41) | 1 | 59.1 | |

| 100 | Russia (35), China (29), India (29), Turkey (26), Ukraine (24) | 2 | 45.45 | ||

| 0.7 | Iraq (49), Qatar (49), Brunei (48), Kuwait (44), Saudi Arabia (45), | 10 (33) | 49.75 | ||

| 0.8 | Iraq (55), Kuwait (55), Qatar (55), Brunei (54), Saudi Arabia (50) | 11 (43) | 42.12 | ||

| 2019 | 10 | China (54), Russia (49), India (47), Turkey (45), Thailand (42) | 1 | 59.66 | |

| 100 | Russia (37), China (33), Turkey (30), India (29), Ukraine (24) | 2 | 48.16 | ||

| 0.7 | Iraq (51), Qatar (52), Kuwait (52), Brunei (47), Saudi Arabia (42) | 15 (29) | 53.28 | ||

| 0.8 | Iraq (57), Kuwait (57), Qatar (57), Brunei (55), Maldives (51) | 11 (44) | 41.78 |

| Year | Plate | Plate 1 | Plate 2 | Plate 3 | Plate 4 | Year | Plate | Plate 1 | Plate 2 | Plate 3 | Plate 4 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2001 | 1 | 21.60 | 2.10 | 0 | 1.00 | 2009 | 1 | 30.40 | 8.70 | 0 | 3.70 |

| 2 | 2.10 | 18.70 | 0 | 8.60 | 2 | 8.70 | 7.10 | 0 | 0.70 | ||

| 3 | 0 | 0 | 0 | 0 | 3 | 0 | 0 | 0 | 0 | ||

| 4 | 1.00 | 8.60 | 0 | 30.00 | 4 | 3.70 | 0.70 | 0 | 2.10 | ||

| 2013 | 1 | 54.10 | 12.70 | 14.40 | 1.90 | 2019 | 1 | 59.10 | 20.60 | 12.60 | 7.00 |

| 2 | 13.60 | 4.40 | 1.20 | 0 | 2 | 20.60 | 4.50 | 7.90 | 1.40 | ||

| 3 | 14.70 | 1.20 | 14.00 | 4.90 | 3 | 12.90 | 7.90 | 7.80 | 7.40 | ||

| 4 | 2.30 | 0 | 4.90 | 19.70 | 4 | 7.00 | 1.40 | 7.40 | 27.30 |

| Year | Plate | Plate 1 | Plate 2 | Plate 3 | Plate 4 | Year | Plate | Plate 1 | Plate 2 | Plate 3 | Plate 4 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2001 | 1 | 0 | 38.90 | 75.40 | 0.50 | 2009 | 1 | 0.80 | 31.50 | 66.70 | 99.70 |

| 2 | 38.90 | 4.40 | 99.50 | 79.10 | 2 | 31.50 | 0 | 0 | 65.80 | ||

| 3 | 75.40 | 99.50 | 1.80 | 11.00 | 3 | 67.90 | 0 | 0 | 10.20 | ||

| 4 | 0.50 | 79.10 | 11.20 | 0 | 4 | 99.00 | 65.80 | 10.20 | 2.20 | ||

| 2013 | 1 | 0 | 40.50 | 94.60 | 72.00 | 2019 | 1 | 14.10 | 29.50 | 86.30 | 99.00 |

| 2 | 40.50 | 0 | 55.20 | 0 | 2 | 30.00 | 0 | 1.20 | 56.30 | ||

| 3 | 96.00 | 55.90 | 0 | 5.90 | 3 | 86.30 | 1.20 | 0 | 13.40 | ||

| 4 | 72.00 | 0 | 5.90 | 0 | 4 | 99.00 | 56.30 | 12.90 | 3.30 |

| Variable | Actual Correlation Coefficient | Significance Level | Mean of Correlation Coefficient | Standard Deviation | Minimum | Maximum | P ≥ 0 | P ≤ 0 |

|---|---|---|---|---|---|---|---|---|

| PCWR | −0.045 | 0.046 | 0.001 | 0.072 | −0.123 | 0.268 | 0.955 | 0.046 |

| PCLA | 0.043 | 0.231 | <0.001 | 0.068 | −0.147 | 0.299 | 0.231 | 0.770 |

| SCI | 0.055 | 0.184 | −0.001 | 0.065 | −0.138 | 0.268 | 0.184 | 0.816 |

| DIS | 0.313 | <0.001 | <0.001 | 0.026 | −0.083 | 0.101 | <0.001 | 1.000 |

| TRA | 0.362 | <0.001 | <0.001 | 0.071 | −0.153 | 0.286 | <0.001 | 1.000 |

| DGDP | 0.253 | 0.002 | 0.001 | 0.074 | −0.103 | 0.275 | 0.002 | 0.998 |

| DE | −0.015 | 0.400 | 0.001 | 0.039 | −0.077 | 0.210 | 0.601 | 0.400 |

| TA | 0.225 | <0.001 | <0.001 | 0.051 | −0.122 | 0.204 | <0.001 | 1.000 |

| CUL | 0.103 | 0.012 | −0.001 | 0.040 | −0.090 | 0.163 | 0.012 | 0.989 |

| IS | −0.107 | 0.020 | <0.001 | 0.072 | −0.139 | 0.294 | 0.980 | 0.020 |

| Variable | Normalized Regression Coefficient | Probability of Significance | P ≥ 0 | P ≤ 0 |

|---|---|---|---|---|

| PCWR | −0.000002 | 0.015 ** | 0.986 | 0.015 |

| DIS | 0.360666 | <0.001 *** | <0.001 | 1.000 |

| TRA | 0.053962 | 0.001 *** | 0.001 | 1.000 |

| DGDP | 0.0000001 | 0.440 | 0.440 | 0.560 |

| TA | 0.179529 | 0.001 *** | 0.001 | 1.000 |

| CUL | 0.098974 | 0.036 ** | 0.036 | 0.965 |

| IS | −0.000983 | 0.007 *** | 0.994 | 0.007 |

| Sample size | 3660 | R2 = 0.240 | Adjusted R2 = 0.238 | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhou, L.; Tong, G. Structural Evolution and Sustainability of Agricultural Trade between China and Countries along the “Belt and Road”. Sustainability 2022, 14, 9512. https://doi.org/10.3390/su14159512

Zhou L, Tong G. Structural Evolution and Sustainability of Agricultural Trade between China and Countries along the “Belt and Road”. Sustainability. 2022; 14(15):9512. https://doi.org/10.3390/su14159512

Chicago/Turabian StyleZhou, Lunzheng, and Guangji Tong. 2022. "Structural Evolution and Sustainability of Agricultural Trade between China and Countries along the “Belt and Road”" Sustainability 14, no. 15: 9512. https://doi.org/10.3390/su14159512

APA StyleZhou, L., & Tong, G. (2022). Structural Evolution and Sustainability of Agricultural Trade between China and Countries along the “Belt and Road”. Sustainability, 14(15), 9512. https://doi.org/10.3390/su14159512