1. Introduction

Culminating roughly two decades of industrial planning, the Chinese government released the country’s first-ever

Medium and Long-term Plan of the Hydrogen Industry (Hydrogen Plan), covering the period of 2021–2035 [

1]. The origins of China’s current Hydrogen Plan can be traced back as far as the early 2000s, when a series of workshops organized between 2004 and 2005, consisting of senior industry executives, government officials, environmental organizations, research institutions, and foreign experts, culminated in the publication of China’s first-ever vision and roadmap towards the hydrogen economy (2005 Vision and Roadmap) [

2]. Albeit in a much more simplified state, the 2005 Vision and Roadmap provided a three-stage development process towards achieving a hydrogen economy: by 2020—the technology development phase, by 2050—the market penetration phase, and beyond 2050—the fully developed market and infrastructure phase [

2]. In jumpstarting the national focus towards the hydrogen economy, the 2005 Vision and Roadmap was immediately followed-up by the

National Medium and Long-term Sci-Tech Plan in 2006, to cover the periods of 2006–2020, where hydrogen was named as one of seven priority areas for research and development [

2,

3].

Over the following decade, and consistent with the first phase of technological development outlined by the 2005 Vision and Roadmap, developmental efforts in China’s hydrogen economy consisted largely of demonstration technologies and pilot projects [

2]. For example, as noted by Yuan and Lin, administrative institutions such as the Ministry of Science and Technology (MOST) awarded several tens to hundreds of millions of RMB in research funding between the periods of 2000–2010 [

2]. It was not until the late 2010s when more deployment related policies such as the

Notice on Financial Support for new Energy Vehicles 2016–2020 (2016),

Vehicle and Vessel Tax Law of the People’s Republic of China (2018), and

Energy Development of 13th Five-Year Plan (2016–2020) (2016) began to emerge [

4,

5,

6,

7]. The progressive ascension of the hydrogen economy from a hypothetical sector under the 2005 Vision and Roadmap, to a national strategic sector for development under the Hydrogen Plan, is indicative of the importance of the hydrogen economy to China’s future development strategies.

Accounting for nearly 30% of global green-house gas emissions, the prospect of a Chinese hydrogen economy will have significant domestic and international implications [

8]. While the hydrogen economy has garnered significant academic attention [

9], academic discussions on the topic of China’s hydrogen economy have primarily been focused on its technology, policy, and prospective strategies. For example, papers concerning China’s hydrogen economy can be separated into three categories. In the first category of research, a number of scholars have dedicated to exploring and discussing the prospects to China’s hydrogen economy [

2,

4,

10,

11,

12,

13]. X. Ren et al., for example, provided an in-depth overview of the current progress of China’s hydrogen economy, its feasibility, and development strategies [

4]. Similarly, works by J. Ren et al. and Tu have conducted further analyses on the strength/weakness/opportunities/threats, technological prioritization, and prospects regarding China’s hydrogen economy, respectively [

11,

12,

13]. In the second category, a number of scholars have focused on exploring hydrogen’s role in specific sectors of China’s national economy, such as the transportation sector. For example, J. Ren used Interpretative Structuring Modeling to investigate the potential impact of China’s development policies on new energy vehicles [

14]. Similarly, other works by Meng extend the academic discussion to the entirety of China’s transportation sector [

15]. In the third and last category, while not directly related to China, a large number of research has been dedicated to the hydrogen economy, its possibilities, opportunities, costs, barriers, and R&D needs from the international perspective [

16,

17,

18]. All in all, however, the academic discussions applicable to China’s prospective hydrogen economy have consisted largely of issue identification plus policy recommendations [

2,

4,

11,

12,

13,

14,

15,

19] and has, therefore, left open for discussion, the question of how best to approach the regulatory construction of China’s emerging hydrogen economy.

Taking into account the emerging status of China’s hydrogen economy, this paper explores the core issue of how best to approach developing a regulatory framework for China’s hydrogen economy. To do so, this primary question is further broken down into four questions. First, what is China’s current and standardized model of industrial development, and which of its characteristics would most likely impact regulatory developments? Second, recognizing the above, what are the aspects of the hydrogen supply-chain which would likely present a regulatory challenge for China? Third, having identified a set of regulatory characteristics and challenges, what are the possible solutions? Synthesizing the answers to questions above, what would be the most functional way to implement the solutions within the context of China’s overall state model?

Given the highly inter-disciplinary nature of the associated theories and discussions involved with the above, the discussions and contributions of this paper will be organized in the form of a conceptual article. In this context, the discussions of this paper aim to advance the current literature concerning the hydrogen economy in three main aspects. One, it provides the first complete look at the regulatory characteristics of the hydrogen economy, i.e., the scientific, economic, and technological aspects of the hydrogen supply-chain which would require direct forms of legal and/or administrative intervention. Two, the regulatory characteristics above is then contextualized within China’s industrial development model. By using the developmental experiences of China’s industries with similar regulatory characteristics, the discussions, therefore, specifically identify and analyze the challenges and root causes to China’s emerging hydrogen economy. Most importantly, as this paper finds, not all challenges and policy recommendations regarding the regulatory framework construction of the hydrogen economy should be treated equally, and their specific value must be determined by both the immediate needs and overall maturity of the hydrogen economy. In this context, and as the third contribution of this paper, a step-by-step regulatory pathway towards the hydrogen economy is presented. With the Hydrogen Plan (2021–2035) establishing a 2025 deadline for the regulatory framework construction, the integrative view provided by the discussions herein are both timely and highly relevant.

This paper is organized as follows.

Section 2 presents the conceptual framework of this paper.

Section 3 applies the fragmented authoritarianism model to China’s emerging regulated industries and highlights the unique characteristics to China’s industrial development model.

Section 4 outlines the regulatory characteristics of the hydrogen economy. Utilizing the above,

Section 5 discusses the potential regulatory challenges in forming a hydrogen economy within China, with additional context derived from the comparable experiences of China’s other regulated industries where necessary.

Section 6 offers a step-by-step regulatory approach towards achieving a hydrogen economy within China.

Section 7 concludes our research.

2. Conceptual Framework towards an Integrated Regulatory Solution

As briefly introduced above, an inquiry into the question of how best to approach the regulatory development of a hydrogen economy within China yielded a series of independent, but correlated, questions. Among the subject areas involved, includes theories, reviews, and industry case-studies ranging from multiple academic fields, such as Contemporary China Studies, Energy and Technological Sciences, Regulatory Sciences, and Legal Theories. While an academic inquiry through one individual lens is, in and of itself, more than capable of offering significant insight over China’s prospective hydrogen economy, it would, however, fail to provide a more new and integrative view of the issues at hand. For example, and analyzed in further detail below, a scientific and technological review over the methods of hydrogen production would yield policy recommendations concerning the potential challenges to a future grey-to-green hydrogen transition. At the same time, a stand-alone study on the relevant domestic and international experiences of developing networked industries would yield policy recommendations concerning the methods to unbundling. Both policy recommendations, while equally important, offer little understanding as to their relationship to one another, i.e., matters such as sequence, importance, and impact.

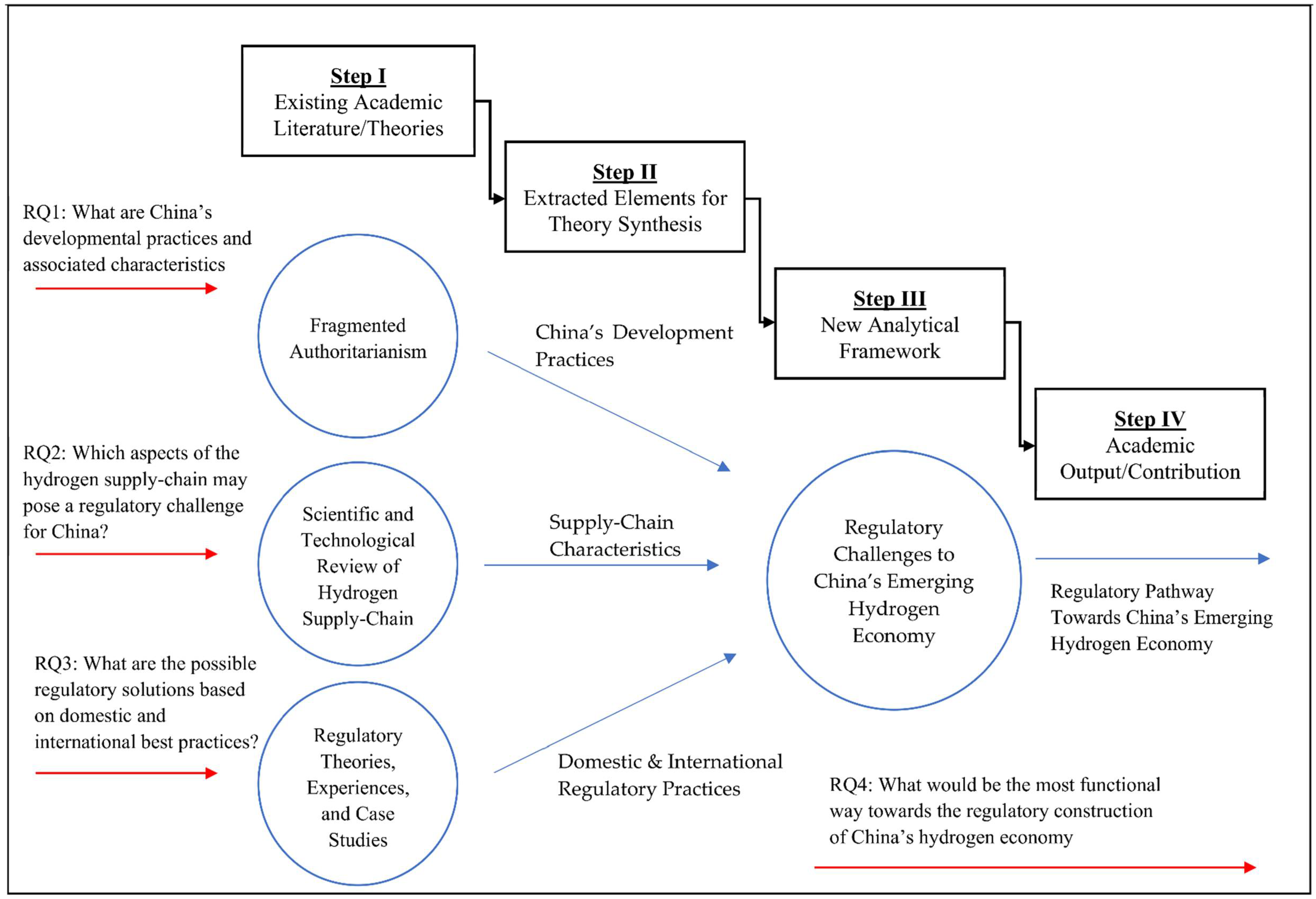

As such, the aim of this paper is to offer a new integrative view of the potential regulatory challenges to China’s emerging hydrogen economy, by using the conceptual article model, and, more specifically, theory synthesis [

20]. Under this format, this paper aims to answer each of the four specific academic questions presented above by, first, identifying the specific and relevant subject-area theories and, second, presenting or applying them in a manner specifically focused to the core academic question of this paper, i.e., the regulatory construction of China’s emerging hydrogen economy. For example, in relation to questions of China’s current and standardized industrial development model, the Fragmented Authoritarianism model, an important and widely accepted theory within Contemporary China Studies, is used below. However, rather than providing a limited literature review of the subject matter, elements directly applicable to the development of China’s prospective hydrogen economy, such as its encouragement towards forming industrial interest groups, is presented. An illustration of this research design is provided in

Figure 1 below.

3. China’s Industrial Development Model under the Fragmented Authoritarianism Framework

As early as the 1980s, the framework of fragmented authoritarianism has been used to both understand the processes of decision-making and policy implementation in post-economic reform China [

21]. Naturally, by extension of China’s nation-wide decentralization efforts, which saw Beijing seek to cooperate with its lower-level governments as opposed to dictate to them, the seminal works by Lieberthal et al. on the fragmented authoritarianism model sought to reconcile two contemporary schools of thought categorizing China’s state governance model as an either-or between complete centralization vs. complete decentralization [

21,

22]. Instead, the fragmented authoritarianism framework demonstrated that “authority below the very peak of the Chinese political system is fragmented and disjointed” [

21]. In their arguments, Lieberthal et al. presented several important characteristics to China’s state governance model. In the context of discussing the hydrogen economy, the following three characteristics were selected. One, there is a structural component to China’s bureaucratic governance system, consisting of both vertical and horizontal orientations, which shape the types of available resources and strategies utilized in the decision-making process [

21]. Two, China’s transition towards decentralization fell short of the rule-based modern polity, and to a large extent, expanded its historical bureaucratic practices of bargaining [

21]. Three, as an extension of the above, despite having greatly changed China’s governance framework, significant elements and practices continue to remain highly centralized [

21].

Since then, the fragmented authoritarianism framework and its constituent elements have been adapted and used to analyze the emergence of China’s regulated industries. Specifically, the three characteristics described above have also evolved within the context of China’s emerging regulatory state. First, from the structural perspective, the extension of China’s bureaucratic model to its industrial model under the state-owned holding company framework has institutionalized bureaucratic practices within its regulated industries [

23]. Specifically, within contemporary China, a significant portion of the market players within a regulated industry is wholly or partially owned by governmental organs such as the central and local governmental bodies [

24]. More importantly, the integration of state and market interests within China’s regulated industries has created both the opportunity and incentive for the formation of industrial interest groups, whereby closely affiliated enterprises work hand-in-hand with their government counterparts to advance their collective interests. For example, in China’s automotive industry, Oh has documented the significant level of political support provided by the Beijing Municipal government to the Beijing Hyundai Motor Company, many of which were in direct violation of relevant government rules and regulations [

25]. Second, the propensity of the Chinese bureaucracy for bargaining, in the process of decision-making has also replicated itself within the industrial governance framework. Far from the jurisdictional and rules-based order envisioned at the outset of the economic reforms, decisions within China’s regulated industries are also heavily influenced by the presence of bargaining, leading to instances such as regulatory creep [

26], limited information disclosure [

27], and challenges to enforcement [

28]. Third, despite of efforts to institutionalize governance through the decentralization of law-making to sub-national governments [

29], certain critical components to the rulemaking process, particularly on how the rulemaking process is initiated within China’s regulated industries, continues to be in practice, controlled by China’s central administrative institutions [

30].

It should be noted that these characteristics are generalized norms towards understanding China’s regulated industries—such as the how, where, and what technologies that can be successfully developed, as well as the overall pace and quality of development. From one perspective, the fragmented and aggressive approach to industry development, has allowed China to quickly develop highly technologically advanced industries, such as its electric car industry [

31]. However, at the same time, this development model is prone to creating market inefficiencies, such as over-investments in China’s electric car and wind energy generation industries [

32,

33]. Furthermore, instances of deviation from these general norms, i.e., solutions, exist on a case-by-case basis. For example, over-lapping jurisdictions and regulatory creep has long been associated with fragmented authoritarianism, but solutions like an explicit administrative document to outline certain jurisdictional boundaries can also exist, such as the one between the National Development and Reform Commission (NDRC) and the Ministry of Industry and Information Technology (MIIT) within China’s telecommunications [

34].

4. The Regulatory Characteristics of the Hydrogen Economy

This section will discuss the regulatory characteristics of the hydrogen economy. For the purposes of the discussions below, the hydrogen economy is divided into its three main constituent supply-chain categories: generation, or the production of hydrogen; transmission, covering the technologies associated with the transporting hydrogen from the points of production to the points of distribution; and distribution, which covers the down-stream applications to hydrogen.

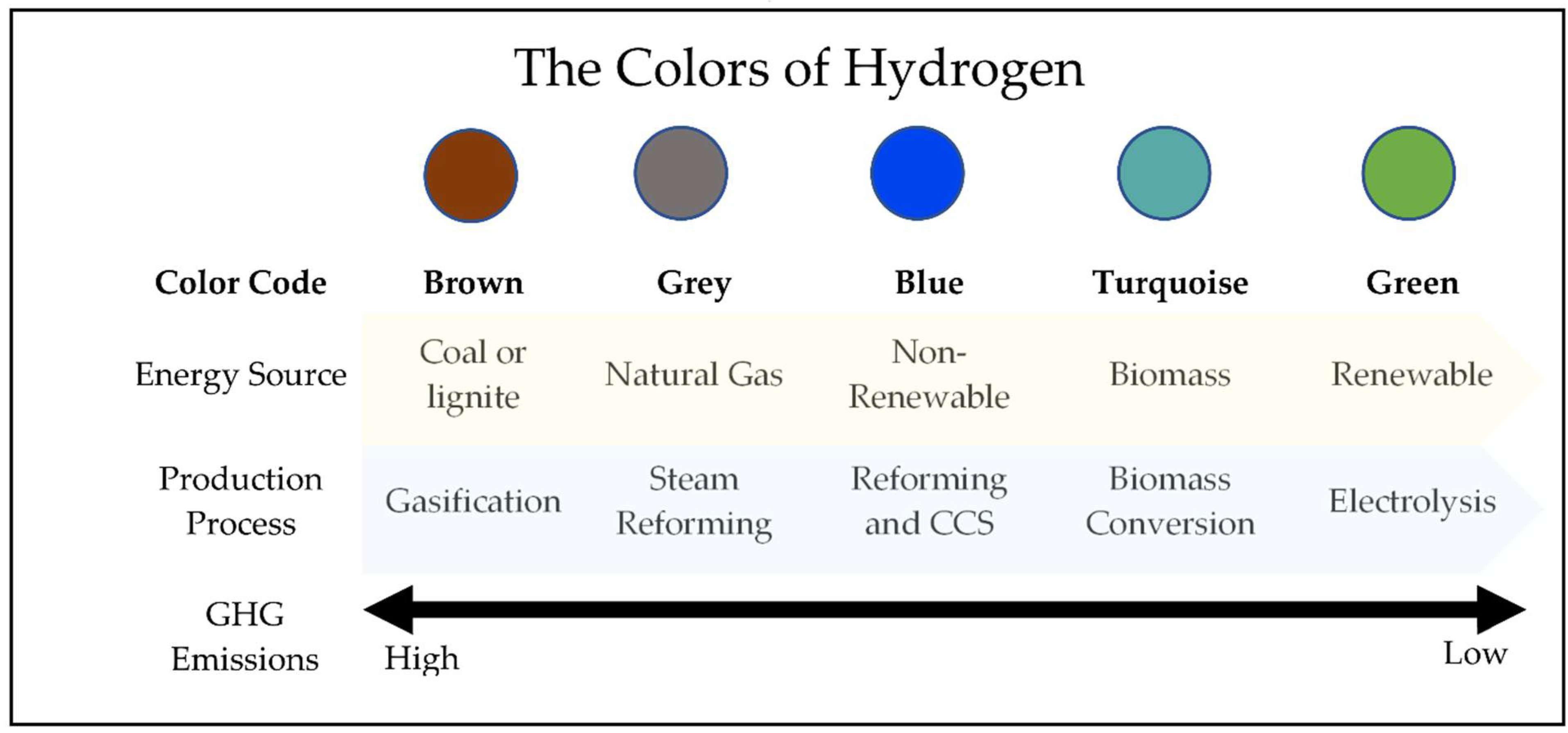

4.1. Generation: Not All Hydrogen Is Created Equal

Not all hydrogen is created equal, but once produced and mixed into circulation, it becomes impossible to differentiate. The characteristics of hydrogen as a commodity, i.e., being interchangeable and homogeneous, raise important regulatory questions regarding the environmental sustainability of hydrogen based on its industrial origins. At one end of the spectrum, the majority of hydrogen produced today is via conventional fossil fuel resources such as the steam reforming process, and as such, produce significant CO

2 emissions [

35,

36]. Alternatively, at the other end of the spectrum, producing hydrogen using renewable energy would produce negligible emissions [

37]. In addition, hydrogen production is also associated with various other life-cycle emissions [

38]. For example, the emissions derived from the production of hydrogen from non-renewable feedstocks such as coal and natural gas can be reduced by 85% with carbon capture and storage (CCS) technologies [

16]. Altogether, a number of factors contribute to the overall environmental desirability of the different types of hydrogen (

Figure 2) and will require specific regulatory intervention to enable markets to differentiate between their origins of production.

4.2. Transmission: The Networked Characteristics of the Hydrogen Economy

The intersection between law and economic development within a modern economy is such that the scope of allowable and discouraged economic activities are determined through theories of competition and antitrust laws. For example, “[t]he logic of competition and antitrust laws in the United States (US) and the European Union is to guard against restrictions and impediments to competition that are not likely to be naturally corrected by competitive forces” [

39]. However, despite the primacy of the competition-antitrust law framework in modern industrial regulatory practice, a select number of industries have bucked this trend and are instead subject to alterative theories of economic regulation. Specifically, there are three exceptional cases in which industries have deviated from the competition-antitrust law frameworks: “(1) for those markets where it is clear that competition cannot be achieved by market forces; (2) where deviation from efficiency is deemed socially desirable; and (3) where the social and private benefits are clearly different” [

39].

In each of these three cases, the deviation is predicated on the practicalities of certain industries, whereby government intervention into the market is required to produce the desired industrial and/or social outcomes. Such a market phenomenon is particularly widespread in the economic activities of networked industries. Take the electricity industry for example. First, the significant upfront infrastructural and technological investment requirements in the transmission and distribution (T&D) segment of the industry make the electricity sector highly susceptible to monopolistic practices [

40]. Second, providing equal and universal access to electricity services requires systems to deviate away from maximizing economic efficiency [

40]. Third, there are clear and explicit conflicts between public and private stakeholders in the electricity sector. For example, the latter is primarily concerned with maximizing profits, and the former is more concerned with having access to affordable and consistent electricity services [

40,

41]. Therefore, in context of the above, industries like the electricity, telecommunications, and railway industry are subject to different forms of regulations.

What are therefore the special features of a networked economy, and to what extent does a hydrogen economy exhibit the same characteristics/features?

First and foremost, networked industries exhibit increasing returns to scale in production, i.e., the average unit cost required to produce a particular unit of good decreases with increasing scales of production [

39]. This particular economic characteristic of a networked industry is derived by the large upfront infrastructural investments needed within the T&D systems. Examples include transmission and signal towers for the telecommunication network, powerlines for the electricity sector, and water/sewage pipelines for water services. The logic therefore being, any additional production-based investments after the initial T&D investments lowers the overall per unit cost of production of the entire system.

Second, an industry’s propensity to increasing returns to scale in production, in and of itself, is not the defining feature of a networked industry, but rather that networked industries exhibit increasing returns to scale in consumption, more commonly referred to as “network effects” [

39]. For example, computer software results in the similar economic phenomenon of increasing returns to scale in production, but not increasing returns to scale in consumption. Specifically, due to the existence of “network externalities”, the products of a networked industry deviate from the fundamental economic law of demand. In a traditional non-networked industry, “the willingness to pay for the last unit of good produced decreases with the number of units sold [

39]. For example, as the use and sale of a computer software proliferates, the overall demand for the software decreases from increased market saturation. On the other hand, in a networked industry, externalities in producing complimentary goods, i.e., the ability of networked products to expand the sale and production of another good/service, makes it such that “the willingness to pay for the last unit may be higher” [

39].

Altogether, the hydrogen economy exhibits strong networked characteristics. First, the large and upfront infrastructure and technological requirements to facilitate the T&D of hydrogen (i.e., pipelines, pressured storage facilities, and distribution stations) will create increasing returns to scale. Second and more importantly, the universality of hydrogen as both an industrial feedstock and energy vector within the modern economy, would further create network effects of increasing returns to scale in consumption. In this context, the networked characteristics of the hydrogen economy would therefore, warrant a departure from conventional competition–antitrust regulatory framework, and, instead, support more regulated forms of market intervention.

4.3. Distribution: Decentralized and Diverse Downstream Industrial Applications to Hydrogen

As an industrial feedstock and energy vector of both the contemporary and future economy, there are numerous existing and undiscovered industrial applications to hydrogen. At the present, hydrogen has common applications in the agricultural industry as a feedstock for the production of ammonia [

42], petroleum and petrochemical refining [

43,

44,

45,

46], food processing industry [

47] metallurgical applications [

48], electronics manufacturing [

35], power sector applications [

49], and the transportation industry [

50]. More importantly, there are many applications of hydrogen which have yet to reach technical and/or commercial maturity, such that any future attempts towards regulatory formation must take into consideration of hydrogen’s flexible nature and provide equally flexible regulatory mechanisms to support their integration.

For example, different downstream applications to hydrogen such as food processing and petroleum refining, will not only rely on different technologies to utilize hydrogen within their industrial processes, but as well as, require different purity levels [

51]. For diverse downstream applications, the role played by product and technological standardization such as hydrogen purity levels will become an especially important regulatory consideration in the formation of China’s hydrogen economy. The importance of industrial standardization is also echoed by the academic literature [

52,

53,

54]. “[Standards] increase competition by enlarging markets through reduction of inter-firm transaction costs and reducing barriers to entry, facilitating the development of complementary and compatible products” [

54].

From the regulatory standpoint, both the emerging status and the diverse applications of the hydrogen economy will, therefore, not only require the development of many standards from both governmental and private industry actors, but as well as, high degrees of compatibility. Stated differently, as “technology standards are not fully public goods”, and are at times derived from the intellectual property of private market participants, regulations must therefore, create the necessary regulatory flexibility and processes to allow coordination between and amongst various private, governmental, and international entities [

54]. For example, standard SAEJ2601 on the industry-wide fueling protocol guidelines (i.e., standards H35 and H70) was developed by the cooperation of major automakers, energy companies, laboratories and government organizations [

55,

56]. Therefore, in anticipation of the emerging present and future needs of standardization within the hydrogen economy, regulatory design must also take into account and incorporate mechanisms for market participants in the standard and rulemaking processes.

5. The Regulatory Challenges to Forming China’s Hydrogen Economy

Having identified the impacts of China’s industrial development model on the formation of its regulated industries, and the regulatory characteristics of the hydrogen economy, this section looks at the domestic and international best practices and/or experiences in handling the challenges presented above. However, given the early-stage of development and the general absence of real-world experiences, either domestically or internationally, towards the regulatory formation of a hydrogen economy, this section aims to answer the academic question above through analogizing the experiences of the electric power industry. Several reasons justify using the experiences of China’s electricity industry as a baseline for China’s hydrogen economy. One, electricity is not only a secondary energy source, but can also be produced from diverse industrial processes. Its renewable energy transition experiences would therefore, serve as the perfect case study to assess the potential medium-to-long-term challenges associated with a grey-to-green hydrogen transition. Second, the electricity industry’s experiences in isolating the uncompetitive natural monopolistic segments from the otherwise competitive parts of China’s electricity supply-chain, provides an excellent structural example for the T&D segments of China’s hydrogen economy. Third, the diverse downstream applications and by extension the regulatory challenges associated with integrating new technologies within the electricity industry, provides yet another point of reference to the hydrogen economy’s technological innovation and integration processes.

5.1. The Challenges of a Grey-to-Green Hydrogen Transition

A number of reasons such as, the ease to scale and technological maturity of grey hydrogen technologies, places it at the forefront of China’s hydrogen development strategy. For example, the survey conducted by Li et al. consisting of several industry experts from government bodies, industries, and academia, has identified grey hydrogen as one of the core components to helping the hydrogen economy reach scale within China [

10]. Additionally, as noted by the International Renewable Energy Agency, the costs to produce green hydrogen, at present, is two-to-three times the cost of blue hydrogen, and would require sustained research and financial commitments globally to reduce its costs by 40% and 80% in the medium to long-term respectively [

57]. According to market estimates by Bloomberg in December 2021, the cost of green-hydrogen in China stood at USD

$3.22 per kilogram, which is double the price of grey hydrogen production [

58]. Therefore, as China’s hydrogen economy inches closer to scale through grey hydrogen, there will be reciprocal and increasing demand for green production in its medium-to-long-term development. This eventual transition of grey-to-green hydrogen production makes the hydrogen economy highly susceptible to the formation of industrial interest groups and the aggressive pursuit of their respective interests, commonly associated with China’s fragmented authoritarianism framework.

Specifically, within China’s fragmented authoritarianism framework model, development is achieved through the interpretation of national-level policies by successive levels of government [

59]. For example, China’s five-year plans will be interpreted by ministerial-level agencies whose outcome will be further interpreted by the subsequent lower branch of government, and so on, becoming increasingly more specific through each iteration. While this fragmentation in policy implementation has contributed to China’s overall economic reform miracle [

60], it has created its own unique challenges towards to the administration of central policies. Substantively, the absence of standards, such as standards to assess the validity of interpretations made by lower-levels of government and administrative institutions, has essentially enabled interest groups to aggressively pursue their respective interests, irrespective of central government policies. In China’s renewable energy transition for example, provinces with large wind potential have seen their government institutions aggressively pursue capacity additions well beyond their own infrastructural capacity, and directly violating the National Energy Administration’s orders to prevent over-expansion [

32]. Procedurally, the administration of authority is not applied uniformly from one administrative institution to the next, and to a large extent, is not regulated to explicit standards. The ad-hoc nature over the administrative of authority from one institution to the next, in the electricity for example, create the opportunity for institutions to provide preferential treatment for incumbent interest groups, who exercise the authority itself or is closely related to the institution in question [

27].

Therefore, the diverse means of hydrogen production, and particularly the importance of grey-hydrogen production in the earliest phases of developing a hydrogen economy, would highly likely encourage and result in the formation of industrial interest groups within China’s fragmented authoritarianism framework. Such a result would create medium-to-long term challenges towards the eventual grey-to-green hydrogen transition.

5.2. Harnessing the Networked Characteristics of the Hydrogen Economy

Integral to China’s planned marketization of the hydrogen economy, will be the regulatory framework design used to account for its networked characteristics. Under modern theories and experiences of regulating commodities exhibiting networked characteristics like, both electricity and hydrogen, greater levels of industry efficiency could be achieved by limiting competition and monopolizing the T&D, as opposed to the generation and retail segments of the electricity supply chain [

61]. Additionally, the monopolization over the T&D systems need only to be applied to systems operation, and is irrespective of ownership [

61]. For example, electricity systems, and by extension hydrogen networks, can also be functionally unbundled by imposing a strict legal separation of operational control from the ownership rights, such that a single institution can be organized to monopolize the control of the T&D systems owned by multiple companies.

This clear and legal separation of the transmission system is especially important in the economic context. For example, very recent evidence by Heim et al. revealed that “legally unbundled firms charge 9% lower prices [for electricity] than vertically integrated utilities” within Germany [

62]. For the hydrogen economy, the challenge is therefore, the specific regulatory arrangements needed to facilitate unbundling.

Among existing models, and from decades of international experiences, the degree of regulatory framework neutrality is the most critical element to unbundling [

61,

63,

64]. Specifically, neutrality refers to the ability of the T&D operators to provide non-discriminatory access to, and services for, all eligible market participants (i.e., ability to incentivize and create market competition) [

61,

63]. In the US, for example, neutrality is enforced by legally institutionalizing the authority to coordinate, control, and monitor the T&D system within an independent third-party T&D operator [

63]. Structurally, the T&D operator is regulated and responsive to a supervisory agency, and at the same time, hold exclusive control and responsibility to execute their assigned industrial mandate [

61]. The regulatory responsibilities of the T&D operator consist of two main functions. First, the T&D operator must formulate and communicate the rules and procedures to participation [

65]. For example, the T&D operator must publish the requirements to interconnection with specific rules such as, technical eligibility requirements, a set number of day to respond, and the standards to which acceptance and rejection will be determined. Second, the T&D operator must also make available, the relevant services required for all eligible participants to make fair and sound market judgements. For example, the US T&D operators are required to create and make available an online information system providing all the relevant industry data needed in the determination of electricity demand, supply, and pricing [

66].

In contrast to international best practices, China’s process towards unbundling stopped just short of neutrality. In theory, China’s electricity should have achieved neutrality when it imposed ownership unbundling when it created two regional monopolies to take ownership and control of all its T&D assets [

61]. In practice, however, China did not follow-up its process of unbundling with legal reforms to guarantee market neutrality [

26,

61]. For example, to this day, China’s electricity laws have yet to specifically separate and identify the legal authorities and functions of relevant market players. As such, and pursuant to the second characteristics to China’s fragmented authoritarianism framework discussed above, the institutionalization and delegation of state power within China’s electricity industry, proceeded via ambiguous policy-driven mandates, as opposed to specific legal authorities and functions. Because of both the rapidly growing nature of the electricity sector, and the absence of legally defined authorities and functions, China’s electricity industry suffered from overlapping jurisdictional mandates (i.e., many institutions having control over the same function), regulatory creep, and other forms of direct political competition [

27,

61,

67].

For example, in China’s efforts to follow-up the ownership unbundling with concrete efforts to install institutional neutrality, China created its first ever ministerial-level agency, the State Energy Regulatory Commission (SERC) to oversee the marketization and reform process of China’s electricity industry [

26]. However, without legally identifying the specific authority and responsibility of the SERC, vis-à-vis China’s other regulatory agencies, such as the NDRC, and sector participants such as the transmission and generation SOEs, the SERC’s lacked both immediate and sufficient authority to impose effective reforms, as it was immediately subject to bureaucratic competition [

26]. Rather, the functions of the SERC were slowly absorbed by the NEA of the NDRC in the following decade, and was eventually dissolved in 2013 [

26].

For the hydrogen economy, the regulatory challenge will, therefore, be coming to the exact vertical and horizontal orientation as to limit the negative monopolistic impacts of its networked characteristics.

5.3. Managing Industrial Development, Innovation and Technological Upgrading of the Hydrogen Economy

As an extension of the characteristics and challenges discussed above, networked industries like the electricity industry and the hydrogen economy, are categorized and regulated by specific asset categories. From a regulator’s perspective, this more complex regulatory arrangement serves to better reinforce policy objectives and promote the ease of coordination. This is because different infrastructural assets are more responsive to different policy objectives. For example, market rules and standards on generation assets contribute more to shaping the environmental and sustainability outcomes of the industry. Alternatively, from the participant’s perspective, these same rules and/or standards outline both the specific scope and standards of allowable activity within an industry. For example, transmission operators within an ownership unbundled electricity jurisdiction are legally excluded from owning generation assets [

30]. Importantly, the secondary role of rules and standards, as, effectively, gate keepers to market participation, raises significant challenges to the disruptive nature of emerging hydrogen economy related technologies.

By definition, disruptive innovation refers to technologies or applications of technological methods which have yet to reach commercial maturity, and, as such, do not have existing rules and standards to market participation [

68]. For technologies with high upfront financial costs and long construction times, the absence of regulatory finality, i.e., a definitive regulatory understanding of its eligibility to participate, create administrative barriers for emerging technological innovations. Within China’s regulated industries, the process of rulemaking and technical standardization is achieved through central government-led initiatives [

30]. Specifically, in spite of the fragmentation of state authority, China’s central government continues to hold de facto control over rulemaking activities. Procedurally, rulemaking and standardization within China’s regulated industries starts with a generalized national-level policy by China’s central leadership such as the

National Action Plan on Climate Change (2007),

Eleventh Five-Year Plan for Renewable Energy Development (2007), and

Mid-and Long-Term Plan for Renewable Energy Development (2007), which identifies specific trajectory of technological research, development, and investments [

30]. Next, following this national-level policy document, the relevant ministerial-level agencies within China’s State Council are tasked to further interpret and transform the more generalized policy objectives into more concrete activities, such as the creation of demonstration and/or pilot projects [

30]. For example, the NDRC launched several demonstration and pilot projects, such as a 100 KWh energy storage solution for a storage-plus car park project with Redflow Limited and the Haidong Transportation Group, in response to the above national-level policies identifying energy storage solutions as “frontier” technologies for development [

30]. Once complete, more industry specific administrative units such as sub-ministerial-level agencies like the NEA will oversee the technical and regulatory experimentation of the project to create the necessary market rules, regulations, and standards for future commercial applications [

30].

While China’s proactive regulatory approach ensures progressive advancements, it does however, neglective to provide necessary regulatory support to technologies not directly specified by national-level policies [

30]. In practice, the regulatory framework disincentivizes technological innovation and experimentation outside applications not identified by central government policies. As noted above, national-level policies for the hydrogen economy are severely generalized, with little specificity outside of applications within the transportation industry. Most importantly, this form of centralized rulemaking is in direct conflict to the hydrogen economy’s diverse downstream applications.

6. A Regulatory Pathway towards China’s Hydrogen Economy

As noted above, and through the regulatory experiences of China’s electricity industry within its fragmented authoritarianism framework of industrial development, there are several regulatory challenges to the upcoming development of China’s hydrogen economy. Under a strict status-quo approach, and absent any deliberate regulatory actions, China’s hydrogen economy will more than likely develop through progressive stages of small-scale reforms, alternating between periods of decentralization and recentralization. During the former periods, decentralization will most likely consist of the state green-lighting infrastructural investments and handing out market participation rights. Following the periods of decentralization, China will most likely amend the administrative framework of the hydrogen economy by recentralizing industry functions and/or activities within regulatory institutions. While the specific activities associated with each reform cycle may differ from the scenario just discussed, the inherent pitfalls to China’s fragmented approach such as the institutionalization of rent-seeking behavior, the politicization of state authority, and the ability of market participants to ignore central government policies, will more than likely proliferate in the absence of regulatory framework designs otherwise.

For example, Sinopec, China’s largest oil producer and central SOE, has plans to spend approximately 30 billion yuan on the hydrogen economy by 2025, and has so far completed 25 hydrogen filling stations, with another 60 under the planning and approval stages [

69]. Sinopec’s investment closely mirrors China’s decentralized phase towards industry construction. In view of the regulatory characteristics and challenges to the hydrogen economy discussed above, there are several cautionary developments worth noting here. One, the investments, once completed, would provide Sinopec with a vertical monopoly over the generation, transmission, and distribution of hydrogen. Such a structure, as discussed in detail above, would be contrary to modern experiences and theories on networked industries; and subjects the industry to regulatory capture. Two, large scale investments into the hydrogen economy, in advance of an explicit regulatory regime, risks allowing companies to establish practices, behaviors, and interest’s contrary to the marketization of the hydrogen economy. For example, different vertically integrated monopolies, could develop different internal technologies, and standards, and practices to generate, transport, and distribute hydrogen, making future efforts to create a unified T&D system much harder.

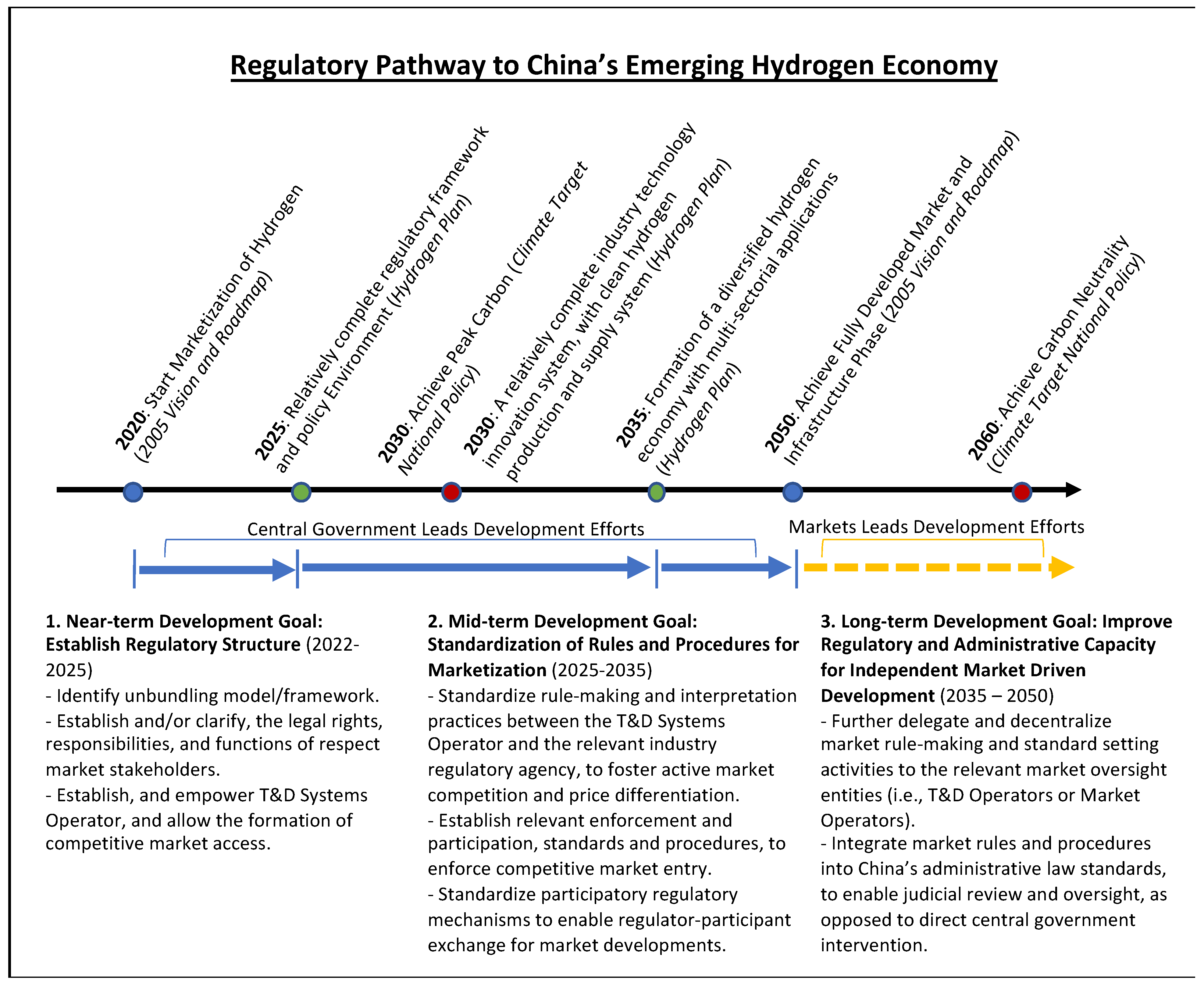

More importantly, the discussions to the academic questions presented above, have highlighted two important findings. First and foremost, policy recommendations to the regulatory developments of the hydrogen economy should not be treated equally, and exhibits strong procedural relationships. Rather, regulatory recommendations and developments must correspond to the immediate industrial needs and maturity of the hydrogen economy’s development. For example, while policy and governmental efforts to promote green hydrogen production are extremely important, significant regulatory and/or incentive policies such as tariff-based incentive policies would significantly undermine overall industrial growth, in the absence of a defined regulatory framework. The reason being incentivized tariff policies would severely undermine a designated T&D or market operator from establishing and regulating market-based hydrogen exchanges, i.e., subject to hydrogen economy to the challenges of regulatory-creep and overlapping jurisdictional mandates.

Second, and by extension, this is not however, to say that China’s current approach towards the hydrogen economy is doomed to failure, but rather, that it has an opportunity to address and lay-out a more efficient regulatory pathway towards a hydrogen economy. As such, a step-by-step regulatory pathway towards the hydrogen economy is provided below: (1) determining the regulatory structure through unbundling; (2) standardizing industry rules and procedures for marketization; and (3) cultivating institutional capacity for future-proofing. A complete illustration of the proposed regulatory pathway, including relevant policy and/or strategy benchmarks, is provided in

Figure 3 Below. More concrete discussions following thereafter.

6.1. Determining the Regulatory Structure to China’s Hydrogen Economy

Multiple reasons justify prioritizing the immediate unbundling of the hydrogen economy as the first step in the regulatory pathway. One, as highlighted by the Sinopec example, addressing the regulatory structure of the hydrogen economy prior to industrial expansion provides a more efficient basis for future marketization by isolating its monopolistic segments from competition. Two, the structural unbundling of the hydrogen economy serve as a foundational element for further regulatory developments. While one argument against this approach could be that the hydrogen economy is more similar in character to the fossil fuel industry because of the transmission equipment utilized (i.e., pipeline systems) and could, therefore, justify the creation of vertically integrated national monopolies like China’s petroleum industry, whereby multiple SOEs are allowed to own and operate its own extraction or purchase and distribution of oil. Such arguments however, neglects the characteristics of hydrogen as a secondary resource that has to be generated, and as such, create additional regulatory considerations such as environmental and competition policy necessitating at a minimum, functional separation of the T&D systems. Furthermore, such arguments are also moot on account of the anti-competitive behaviors exhibited by China’s vertically integrated oil and gas industry, which have also ignited recent government reforms to separate the transmission system within a newly formed central SOE, PipeChina [

70].

More importantly, regulatory solutions to the issue of unbundling are structural by nature, and would be a necessary pre-requisite towards formalizing the distribution of industry roles and/or authority discussed below. This is because, while many models to unbundling exist, there is a minimum threshold requirement of institutional neutrality. Discussed above, solutions to the issue of institutional neutrality are structural by nature and involve the arrangement of vertical and horizontal relationships vis-à-vis relevant market participants and regulators. Horizontally, a solution to the issue of unbundling must clearly delineate the jurisdictional roles and authorities of the relevant institutions, for example arrangement between the MIIT and NDRC discussed above. Vertically, the relationship of the T&D operator, whether a SOE or administrative institution under ownership and functional unbundling respectively, and its supervisory regulatory agency must also be clearly outlined, including, among others, activities subject to supervision, assessment standards, and procedural mechanisms in case of ambiguity. For example, China could develop a functionally unbundled system by legally creating independent system operators, to hold exclusive authority over implementing the purchase and sale of hydrogen, subject to the NDRC’s regulatory standards and oversight, within a geographically defined region.

Certainly, an argument can be made at this point highlighting the successful experiences of many other networked industries globally at addressing unbundling during much later stages of development. However, a deeper look into this argument reveals several cracks. One, networked industries have always relied on cross-sectorial experiences for development [

61]. For example, the US electricity marketization relied heavily on the experiences with the oil and gas industries. As such, ignoring the various experiences, both international and domestic, would be unnecessarily detrimental to China’s national objectives for the hydrogen economy. Two, a determination on the unbundling regime does not necessarily need to be enforced right away; rather, it can be scheduled for implementation, and used to provide higher levels of finality towards the hydrogen economy. The progressive energy reform packages of the EU’s internal energy markets are good examples of the additional advantages that could be derived from highlighting a structural pathway towards marketization and unbundling of networked industries. Third, a determination over the regulatory structure, regardless of its implementation status, provides greater finality, direction, and notice for industry stakeholders, whether government or enterprises, to engage in future decision-making processes. Finality will be particularly important for long-term infrastructural investments such as the ones needed for the hydrogen economy.

6.2. Standardizing Rules and Procedures for Marketization

Following its structural formation, the second stage to the hydrogen economy’s regulatory pathway is comprised of substantive and procedural standardization over market activities. Among the potential medium-term regulatory challenges to the hydrogen economy will be facilitating the grey-to-green hydrogen transition. Specifically, the combined effects of the hydrogen economy’s susceptibility to interest group formation, and the practices of industry stakeholders to engage in market activities irrespectively to central government policies and/or guidelines, will significantly hamper this transitional process. Following the experiences of China’s electricity industry, central policies, and initiatives to promote green hydrogen production could be either abused to generate overcapacity, or ignored by incumbent regulatory interest. For example, financial incentives can spur local governments to aggressively pursue capacity expansion well beyond real-time demand; alternatively, large-scale grey hydrogen producers can politicize and delay regional market efforts. Regulatory solutions must, therefore, exist beyond straightforward policies and financial incentives to create preferences for particular forms of hydrogen production. Rather, as demonstrated by both China’s renewable energy transition and international best practices, preferential policies and/or financial incentives must be grounded within an existing competitive market framework [

27,

61,

71].

Namely, when the T&D monopoly of the hydrogen economy is subject to regulated access, market rules and procedural standards become vital safeguard to competition, and, by extension, a grey-to-green hydrogen transition. Theoretically, the reasoning is simple. When market entry is standardized, incumbent industry interest cannot exert their influence to prohibit entry [

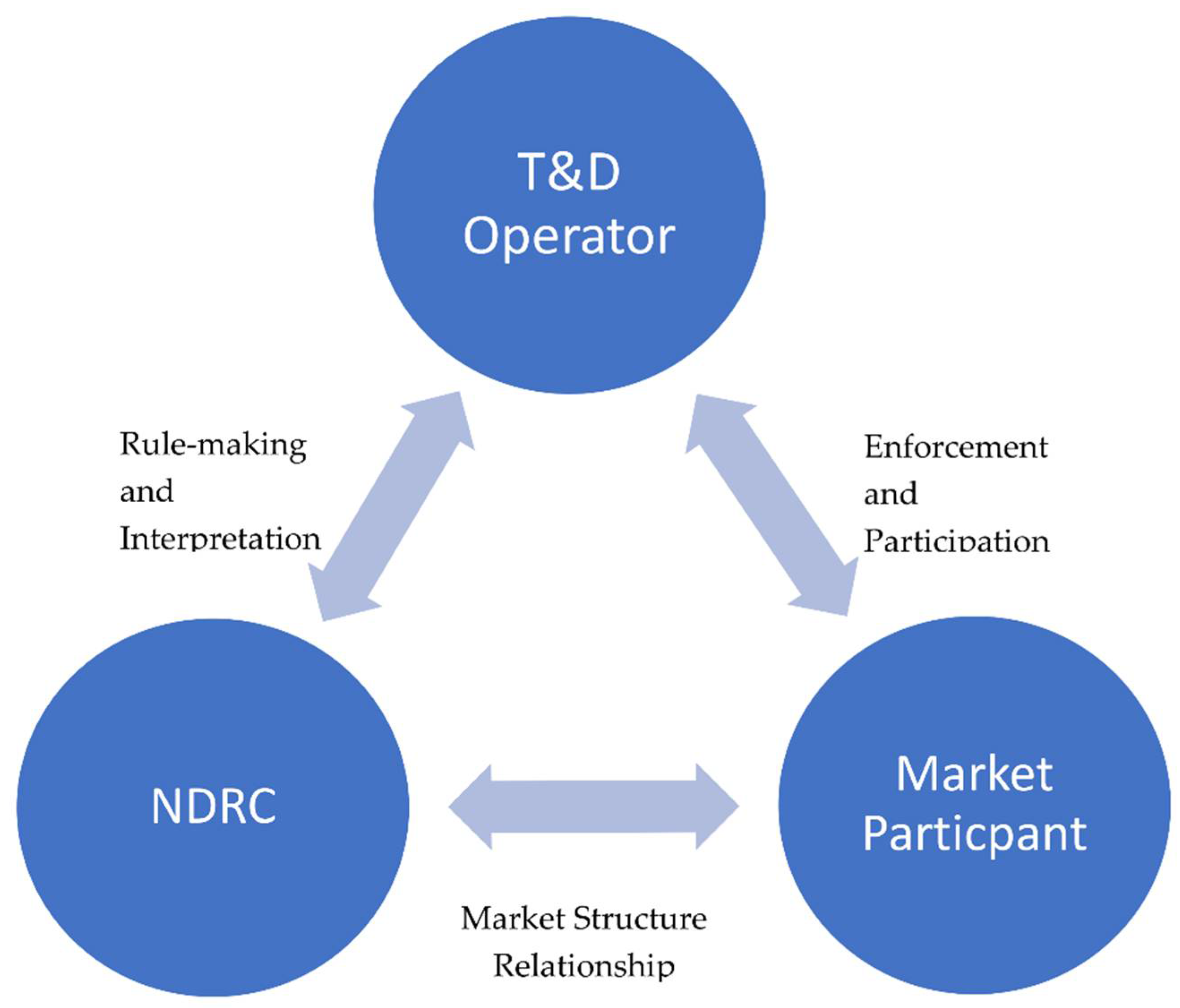

71]. Functionally however, efforts towards standardization goes well beyond just the task of creating rules and procedures at a market level, but instead, involves harmonizing the regulatory rights and responsibilities of its participating institutions in the form of market rules. For example, extending the functional unbundling hypothetical above, three main institutions would preside over an interconnection process (In most networked industries like the electricity and natural gas industry, whereby market entry is regulated, the interconnection process refers to the administrative application of a new production facility to seen connection onto the national grid or pipeline (i.e., regulated) system.) within the hydrogen economy: the T&D operator, the supervisory agency (NDRC), and the producer. Respectively, their rights and responsibilities should be organized as follows. The T&D operator would have the right to independently interpret the policies of the NDRC into market rules and enforce them against the market participants. Additionally, the T&D operator is responsible to both interpret the policies consistent to the standards established by the NDRC, and allow the universal participation of all eligible market participants. In addition to its ability to influence the T&D interpretation process, the NDRC has the right to subject market participants to its desired market model, and responsible to be preside over market participant complaints. Lastly, the producer would seek connection onto the pipeline system under an interconnection process mandated by the NDRC, pursuant to an analysis of eligibility by the rules and technical standards of the T&D operator, and subject to possible applicant appeal. A figure representing the discussion above is presented in

Figure 4 below.

It is therefore, the reciprocity of rights and responsibilities shared by the institutions which safeguards competition in the standardization process. If, in the example above, the T&D was not responsible to the operational parameters of the NDRC, no structural elements would be in place to protect participants from arbitrary rules and decisions of the T&D operator, and would instead have to rely on the intermittent intervention of China’s central government for course corrections.

6.3. Future-Proofing the Administrative Framework to the Hydrogen Economy

Following a successful marketization and scaling of China’s hydrogen economy, the final stage in the regulatory pathway consists of developing and increasing regulatory capacity to wean its dependence on central government intervention for development. Specifically, among the likely regulatory challenges to the long-term developments to China’s hydrogen economy will be its diverse downstream applications. Specifically, as illustrated by the experiences of its electricity industry, the reliance by China’s regulated industries and their resulting central initiative centric practices present significant administrative barriers to the development of new technologies. For example, China’s central government has already paved an extensive industrial pathway towards the hydrogen economy. To no one’s surprise, R&D, financial investments, and projects up to now have exactly mirrored the initiatives within these central government policies. While China has time and again demonstrated the effectiveness of its signature proactive approach to development to help industries reach scale, it does, however, pose long-term transitional challenges to industry innovation and technological development.

This is because in the practical sense, large infrastructural investments within the hydrogen economy would require both substantial investments in time and money, making the probability to participate and seek economic recovery paramount to interested market participants. Excluding technological factors aside, many controllable legal and regulatory factor such as transparency to rulemaking, legal rights to initiate an interconnection study, and administrative review standards, could also positively impact the probability the outcomes to market participation. Furthermore, as a regulated industry, whereby market activities are determined strictly on the basis of market rules and technical standards, the central government’s de facto control, and by extension the reliance of China’s regulated industries, on central government initiatives in the rulemaking and standard setting processes negatively impacts the probabilities for success. As noted by Zhang and Yang, technologies which are not explicitly identified by China’s central government policies for development, do not have access to the necessary administrative support to develop demonstration and pilot projects, and in-turn market rules and technical standards for market participation [

30]. In this regard, the probabilities to success of technologies which have central identification far outweigh those which do not.

If the problem is the strong presence of centralization, the solution should therefore be, in theory, decentralization. Practically however, the decentralization of central government authority within China’s regulated industries is highly complicated. For example, under the assumption that local governments better understood local demand for electricity, China decentralized the power generation approval processes to the local provincial governments in 2014 [

72]. Without further administrative restructuring, the experiment led to an immediate increase in low-tech coal powered investments, causing irreparable harm to the long-term development of China’s electricity industry [

72]. While factors such as institutional misalignment and China’s unique cadre advancement system are at fault, it could also be argued that the specific method to decentralization failed to both take into consideration these characteristics, and tailored the delegation of authority consistent to the actual policy objectives. Stated differently, the reform did not create sufficient regulatory capacity within the electricity industry as to allow it to generate positive industrial outcomes through its decision-making and industrial activities.

The challenge is, therefore, how to build regulatory capacity within the hydrogen economy, i.e., enable its regulatory framework to create flexible, responsive, and positive industry outcomes independent of central government intervention. While industrial experiences have demonstrated solutions to on a case-by-case basis, but it would be highly inefficient to the development of the hydrogen economy to necessitate central government intervention each time. From international experiences, regulatory solutions to promote industrial independence have primarily focused on delegating wide-ranging authority to limited subject-matter, in the form of quasi-legislative and quasi-judicial processes. For instance, industries can by law, create quasi-legal processes whereby a regulatory agency is able to adjudicate and/or promulgate regulations on the basis of a petition by the participant. The rate-case mechanism of the US Federal Energy Regulatory Commission (FERC), whereby a utility regulator, “at the petition of the power generator, determine whether or not the utility’s proposed rate is consistent with the relevant legal and regulatory requirements” is a representative example of an administrative proceeding with quasi-judicial and quasi-legislative properties [

30].

While these solutions would require the same structural balance between authorities and responsibilities, such as parameters to delegated authority and oversight, demonstrated by the standardization process above, they are however, different in two key aspects. One, the processes to engage in administrative activities, such as rulemaking or judiciary review, are not initiated by central government mandates, but rather by institutions and participants within the industry. Two, determinations from these internal processes are not afforded with the same level of legal rights. For example, a quasi-judicial determination would grant only a temporary right to conduct a particular activity, and could be overturned by central policies to the contrary. Collectively, these processes, in theory, would enable the hydrogen economy to make legally binding determinations on a limited subset of industry activities, without the direct involvement of the central government.

7. Conclusions

As China begins to move full steam ahead towards realizing a hydrogen economy under its first ever national-level Hydrogen Plan (2021–2035), an important question arises as to how best to approach the development of its regulatory framework. To answer this question, this paper has broken down this core research question to its four constituent parts. First, concerning the emerging status of the hydrogen economy, as one that has to be developed from the ground-up, the question was asked as to how China has traditionally approached the regulatory development of new and emerging industries. In answering this question, the fragmented authoritarianism model was used to understand the specific characteristics to which China’s industrial practices. Three such characteristics were identified, its propensity to incentivize (1) the formation of industrial interest groups; (2) bureaucratic bargaining; and (3) the central government’s preference for centralized law and rule-making.

Second, concerning the scientific and technological characteristics to the hydrogen supply-chain, a review was conducted to identify its aspects which may pose a regulatory challenge for China. In conducting a literature review of modern scientific and technological studies, three such characteristics were identified. One, the ability to produce hydrogen from a variety of different industrial methods with wide-ranging emission characteristic, raises both the regulatory challenge of both differentiating between and incentivizing more cleaner forms of production. Two, the networked characteristics exhibited by the transmission segment of the hydrogen economy, raises the regulatory challenge of how to isolate its monopolistic, i.e., anti-competitive effects from the otherwise competitive segments of the overall supply-chain. Finally, with hydrogen’s capability to serve as a universal commodity for a multitude of down-stream applications, comes the challenge of requiring decentralized forms of rule-making and technological standard setting mechanisms.

Third, recognizing the challenges above, a case-study on the comparable experiences of China’s electricity industry was conducted to find the possible experiences and solutions. In instances where domestic experiences proved to be insufficient, international best practices were used. One, in response to the challenges of interest group formations and the grey-to-green hydrogen transition, both domestic and international experiences have shown that the legal standardization of market rules and procedures would enable market-competition to prevent incumbent hydrogen producers from discriminating against new green-market entrants. Two, in response to the industry practice of bureaucratic bargaining as opposed to the use of explicit jurisdiction, and the networked characteristics of the hydrogen supply-chain, the solution of structural unbundling was identified. More specifically, unbundling, as was demonstrated by international best practices, required the legal separation of operational control, to allow independent, and, therefore, conflict of interest free application of the transmission system. Three, with a preference for a more top-down based rule-making approach, and the need for more decentralized mechanisms of rule-making to match the hydrogen economy’s diverse down-stream applications, experiences have demonstrated the need for improved administrative and regulatory capacity.

Most importantly, and in addition to the characteristics, challenges, and solutions above, the findings of this paper reveal that not all policy solutions and/or recommendations should be treated equally. Instead, an integrated view of the core academic question revealed a procedural relationship among the regulatory solutions identified above. Therefore, recognizing that each solution should correspond to a different phase of regulatory development, a three-step regulatory pathway towards the hydrogen economy is proposed.