Blockchain and Firm Total Factor Productivity: Evidence from China

Abstract

:1. Introduction

2. Literature and Hypothesis

2.1. Digital Economy and Firm Total Factor Productivity

2.2. Blockchain Technology and Firm Total Factor Productivity

3. Methodology and Data

3.1. Empirical Models

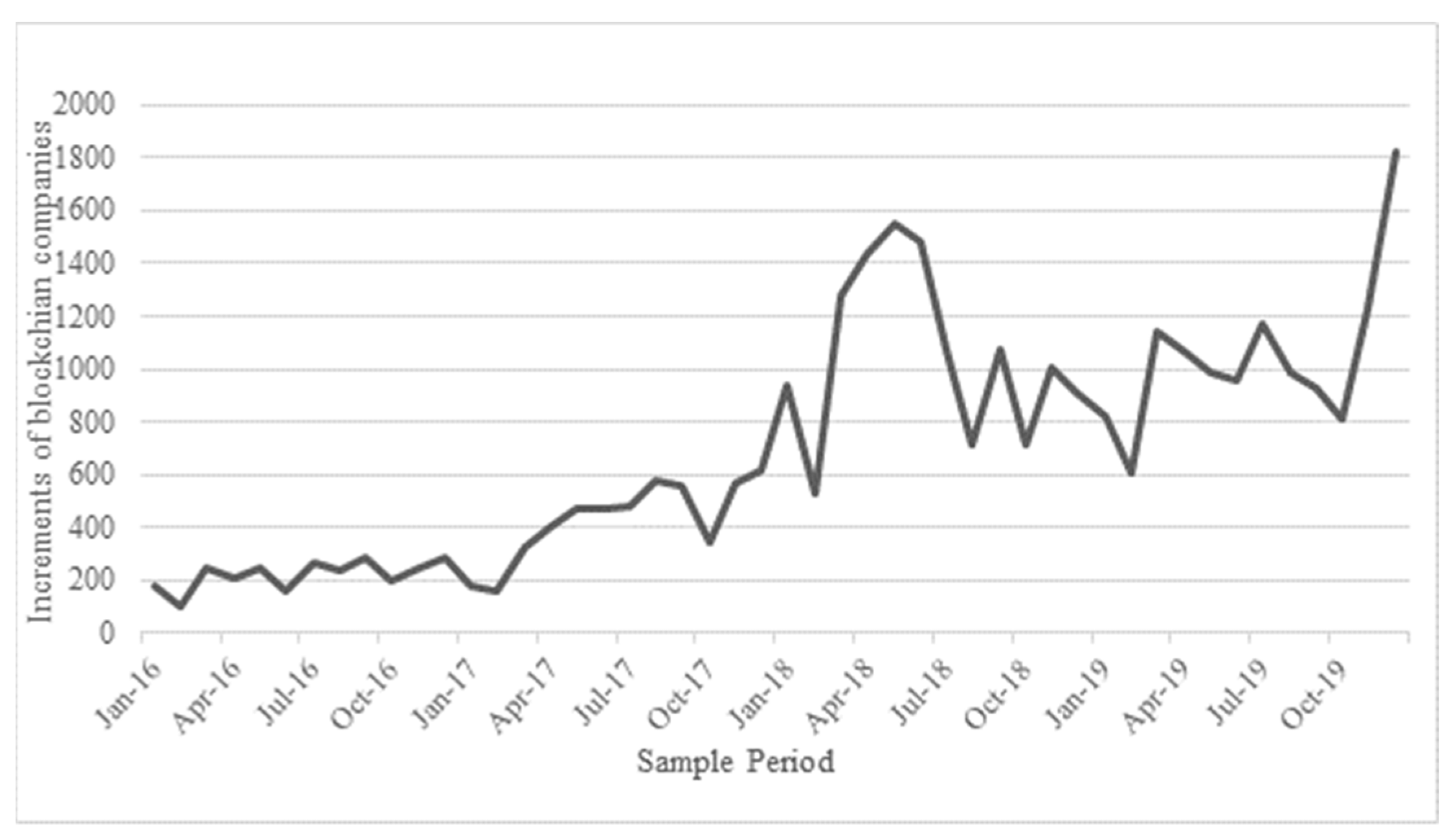

3.2. Data Collection

3.3. Variable Measurement

3.4. Summary Statistics

4. Results

4.1. Basic Regression Results

4.2. Endogeneity Concerns

4.3. Heterogeneity Analysis

4.3.1. Firm Ownership, Blockchain Development, and Total Factor Productivity

4.3.2. Industry, Blockchain Development, and Total Factor Productivity

4.3.3. Initial Productivity, Blockchain Development, and Total Factor Productivity

4.4. Robustness Checks

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Evangelista, R.; Guerrieri, P.; Meliciani, V. The economic impact of digital technologies in Europe. Econ. Innov. New Technol. 2014, 23, 802–824. [Google Scholar] [CrossRef]

- Magomedov, I.A.; Murzaev, H.A.; Bagov, A.M. The role of digital technologies in economic development. IOP Conf. Ser. Mater. Sci. Eng. 2020, 862, 052071. [Google Scholar] [CrossRef]

- Akter, S.; Michael, K.; Uddin, M.R.; McCarthy, G.; Rahman, M. Transforming business using digital innovations: The application of AI, blockchain, cloud and data analytics. Ann. Oper. Res. 2022, 308, 7–39. [Google Scholar] [CrossRef]

- Qi, Y.; Cai, C. Research on the Multiple Effects of Digitalization on the Performance of Manufacturing Enterprises and Their Mechanisms. Study Explor. 2020, 7, 108–119. [Google Scholar]

- Luo, J.; Meng, Q.; Cai, Y. Analysis of the Impact of Artificial Intelligence application on the Development of Accounting Industry. Open J. Bus. Manag. 2018, 6, 850–856. [Google Scholar] [CrossRef]

- Goralski, M.A.; Tan, T.K. Artificial intelligence and sustainable development. Int. J. Manag. Educ. 2020, 18, 100330. [Google Scholar] [CrossRef]

- Chen, Y. Application of “Blockchain+ 5G” Technology in the Transformation of Financial Digital Intelligence. In The International Conference on Cyber Security Intelligence and Analytics; Springer: Cham, Switzerland, 2022; pp. 248–255. [Google Scholar] [CrossRef]

- Dinh, T.N.; Thai, M.T. AI and blockchain: A disruptive integration. Computer 2018, 51, 48–53. [Google Scholar] [CrossRef]

- Frizzo-Barker, J.; Chow-White, P.A.; Adams, P.R.; Mentanko, J.; Ha, D.; Green, S. Blockchain as a disruptive technology for business: A systematic review. Int. J. Inf. Manag. 2020, 51, 102029. [Google Scholar] [CrossRef]

- Du, L.; Lin, W. Does the application of industrial robots overcome the Solow paradox? Evidence from China. Technol. Soc. 2022, 68, 101932. [Google Scholar] [CrossRef]

- Acemoglu, D.; Dorn, D.; Hanson, G.H.; Price, B. Return of the Solow paradox? IT, productivity, and employment in US manufacturing. Am. Econ. Rev. 2014, 104, 394–399. [Google Scholar] [CrossRef]

- Triplett, J.E. The Solow productivity paradox: What do computers do to productivity? Can. J. Econ. Rev. Can. D’economique 1999, 32, 309–334. [Google Scholar] [CrossRef]

- Solow, R.M. We’d better watch out. In The New York Review of Books; The New York Times: New York, NY, USA, 1987; Volume 36. [Google Scholar]

- Akyildirim, E.; Corbet, S.; Sensoy, A.; Yarovaya, L. The impact of blockchain related name changes on corporate performance. J. Corp. Financ. 2020, 65, 101759. [Google Scholar] [CrossRef]

- Cioroianu, I.; Corbet, S.; Larkin, C. The differential impact of corporate blockchain-development as conditioned by sentiment and financial desperation. J. Corp. Financ. 2021, 66, 101814. [Google Scholar] [CrossRef]

- Autore, D.M.; Clarke, N.; Jiang, D. Blockchain speculation or value creation? Evidence from corporate investments. Financ. Manag. 2021, 50, 727–746. [Google Scholar] [CrossRef]

- Mukim, M. Coagglomeration of formal and informal industry: Evidence from India. J. Econ. Geogr. 2015, 15, 329–351. [Google Scholar] [CrossRef]

- Gausdal, A.H.; Czachorowski, K.V.; Solesvik, M.Z. Applying blockchain technology: Evidence from Norwegian companies. Sustainability 2018, 10, 1985. [Google Scholar] [CrossRef]

- Davidson, S.; De Filippi, P.; Potts, J. Blockchains and the economic institutions of capitalism. J. Inst. Econ. 2018, 14, 639–658. [Google Scholar] [CrossRef]

- Queiroz, M.M.; Wamba, S.F. Blockchain adoption challenges in supply chain: An empirical investigation of the main drivers in India and the USA. Int. J. Inf. Manag. 2019, 46, 70–82. [Google Scholar] [CrossRef]

- Solow, R.M. A contribution to the theory of economic growth. Q. J. Econ. 1956, 70, 65–94. [Google Scholar] [CrossRef]

- Nakatani, R. Total factor productivity enablers in the ICT industry: A cross-country firm-level analysis. Telecommun. Policy 2021, 45, 102188. [Google Scholar] [CrossRef]

- Monrat, A.A.; Schelén, O.; Andersson, K. A survey of blockchain from the perspectives of applications, challenges, and opportunities. IEEE Access 2019, 7, 117134–117151. [Google Scholar] [CrossRef]

- Jung, J.; López-Bazo, E. On the regional impact of broadband on productivity: The case of Brazil. Telecommun. Policy 2020, 44, 101826. [Google Scholar] [CrossRef]

- Chu, S. Internet, Economic Growth and Recession. Mod. Econ. 2013, 4, 209–213. [Google Scholar] [CrossRef]

- Treleaven, P.; Brown, R.G.; Yang, D. Blockchain technology in finance. Computer 2017, 50, 14–17. [Google Scholar] [CrossRef]

- Tapscott, A.; Tapscott, D. How Blockchain Is Changing Finance. Harv. Bus. Rev. 2017, 1, 2–5. Available online: https://capital.report/Resources/Whitepapers/40fc8a6a-cdbd-47e6-83f6-74e2a9d36ccc_finance_topic2_source2.pdf (accessed on 21 July 2022).

- Dahl, D.; Meyer, A.P.; Wiggins, N. How Fast Will Banks Adopt New Technology This Time? Reg. Econ. Fed. Reserve Bank St. Louis 2017, 25. Available online: https://www.stlouisfed.org/-/media/project/frbstl/stlouisfed/Publications/Regional-Economist/2017/Fourth_quarter_2017/Banks_Technology.pdf (accessed on 4 March 2021).

- Jeon, C.; Han, S.H.; Kim, H.J.; Kim, S. The effect of government 5G policies on telecommunication operators’ firm value: Evidence from China. Telecommun. Policy 2020, 46, 102040. [Google Scholar] [CrossRef]

- Fuster, A.; Plosser, M.; Schnabl, P.; Vickery, J. The role of technology in mortgage lending. Rev. Financ. Stud. 2019, 32, 1854–1899. [Google Scholar] [CrossRef]

- Huang, Y.; Lin, C.; Sheng, Z.; Wei, L. FinTech credit and service quality. In Geneva Financial Research Institute, Working Papers; Geneva Financial Research Institute: Geneva, Switzerland, 2018; Available online: http://matteocrosignani.com/site/wp-content/uploads/2018/05/Crosignani_Discussion_Cavalcade18.pdf (accessed on 21 July 2022).

- Christ, K.L.; Helliar, C.V. Blockchain technology and modern slavery: Reducing deceptive recruitment in migrant worker populations. J. Bus. Res. 2021, 131, 112–120. [Google Scholar] [CrossRef]

- Autio, E.; Nambisan, S.; Thomas, L.D.; Wright, M. Digital affordances, spatial affordances, and the genesis of entrepreneurial ecosystems. Strateg. Entrep. J. 2018, 12, 72–95. [Google Scholar] [CrossRef]

- Yoo, M.; Won, Y. A Study on the Transparent Price Tracing System in Supply Chain Management Based on Blockchain. Sustainability 2018, 10, 4037. [Google Scholar] [CrossRef]

- Liu, L.; Li, F.; Qi, E. Research on Risk Avoidance and Coordination of Supply Chain Subject Based on Blockchain Technology. Sustainability 2019, 11, 2182. [Google Scholar] [CrossRef]

- Saberi, S.; Kouhizadeh, M.; Sarkis, J.; Shen, L. Blockchain technology and its relationships to sustainable supply chain management. Int. J. Prod. Res. 2019, 57, 2117–2135. [Google Scholar] [CrossRef]

- Olley, G.S.; Pakes, A. The dynamics of productivity in the telecommunications equipment industry. Econometrica 1996, 64, 1263–1297. [Google Scholar] [CrossRef]

- Ye, J.; Zhang, A.; Dong, Y. Banking reform and industry structure: Evidence from China. J. Bank. Financ. 2019, 104, 70–84. [Google Scholar] [CrossRef]

- Evans, O. Blockchain Technology and the Financial Market: An Empirical Analysis. Actual Probl. Econ. 2019, 211, 82–101. Available online: https://mpra.ub.uni-muenchen.de/99212/2/MPRA_paper_99212.pdf (accessed on 21 July 2022).

- Yao, Z.; Ye, K.; Xiao, L.; Wang, X. Radiation Effect of Urban Agglomeration’s Transportation Network: Evidence from Chengdu–Chongqing Urban Agglomeration, China. Land 2021, 10, 520. [Google Scholar] [CrossRef]

- Lee, H.-H.; Yang, S.; Kim, K. The Role of Fintech in Mitigating Information Friction in Supply Chain Finance, Asian Development Bank. 2019. Available online: https://policycommons.net/artifacts/392471/the-role-of-fintech-in-mitigating-information-friction-in-supply-chain-finance/1357202/ (accessed on 21 July 2022).

- Jin, X.; Ke, Y.; Chen, X. Credit pricing for financing of small and micro enterprises under government credit enhancement: Leverage effect or credit constraint effect. J. Bus. Res. 2022, 138, 185–192. [Google Scholar] [CrossRef]

- Liu, H.; Fang, C.; Zhang, X.; Wang, Z.; Bao, C.; Li, F. The effect of natural and anthropogenic factors on haze pollution in Chinese cities: A spatial econometrics approach. J. Clean. Prod. 2017, 165, 323–333. [Google Scholar] [CrossRef]

- Du, X.; Jian, W.; Zeng, Q.; Du, Y. Corporate environmental responsibility in polluting industries: Does religion matter? J. Bus. Ethics 2014, 124, 485–507. [Google Scholar] [CrossRef]

- Levinsohn, J.; Petrin, A. Estimating production functions using inputs to control for unobservables. Rev. Econ. Stud. 2003, 70, 317–341. [Google Scholar] [CrossRef]

- Wu, S.R.; Shirkey, G.; Celik, I.; Shao, C.; Chen, J. A Review on the Adoption of AI, BC, and IoT in Sustainability Research. Sustainability 2022, 14, 7851. [Google Scholar] [CrossRef]

| Variable Name | Variable Label |

|---|---|

| Panel A: Dependent variables | |

| TFP_OP | Firm i’s Total Factor Productivity calculated by OP method during year t. |

| TFP_LP | Firm i’s Total Factor Productivity calculated by LP method during year t. |

| Panel B: Independent variables | |

| Blockdev | Logarithm of (1 + no. of blockchain companies in city). |

| Blocknum | Logarithm of (1 + no. of blockchain companies within 30 km of listed company). |

| Panel B: control variables | |

| Finance | Loan balance of financial institutions/Gross Domestic Product of city where firm i is located |

| Internet | Logarithm of (1 + no. of Internet users in city). |

| Perdensity | The population density of city where firm i is located. |

| Pergdp | The per-capita GDP of city where firm i is located. |

| ROE | Firm i’s return on equity, which equals to net income divided by total assets during year t. |

| Tobin’s Q | Firm i’s ratio of the sum of market value of equity plus book value of debt to book value of assets at year t. |

| Level | Firm i’s book value of total debts divided by the book value of total assets during year t. |

| Stockowner | Firm i’s shareholding ratio of the largest shareholder. |

| Total asset | Firm i’s total asset growth rate. |

| Size | Logarithm of (Total Assets). |

| Director | Firm i’s independent directors percentage on the board of directors. |

| Variables | Obs. | Mean | SD | Min | Max |

|---|---|---|---|---|---|

| lnTFP_OP | 8772 | 2.303 | 0.127 | 2.167 | 2.895 |

| lnTFP_LP | 8772 | 2.435 | 0.194 | 2.183 | 2.934 |

| Blockdev | 8772 | 3.069 | 2.167 | 0 | 8.611 |

| Blocknum | 8772 | 1.955 | 1.946 | 0 | 5.358 |

| Finance | 8772 | 0.554 | 0.876 | 0 | 2.682 |

| Internet | 8772 | 0.541 | 0.241 | 0.152 | 1.112 |

| Perdensity | 8772 | 6.644 | 0.752 | 4.262 | 7.923 |

| Pergdp | 8772 | 10.967 | 13.418 | 0 | 53.235 |

| ROE | 8772 | 0.062 | 0.138 | −0.829 | 0.327 |

| Tobin’s Q | 8772 | 1.782 | 0.969 | 0.841 | 6.731 |

| Level | 8772 | 0.413 | 0.196 | 0.064 | 0.879 |

| Stockowner | 8772 | 0.336 | 0.144 | 0.085 | 0.724 |

| Total asset | 8772 | 0.141 | 0.277 | −0.342 | 1.785 |

| Size | 8772 | 21.629 | 1.776 | 17.928 | 25.405 |

| Director | 8772 | 0.378 | 0.054 | 0.333 | 0.571 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| Blockdev | 0.037 *** | 0.027 *** | 0.022 *** | 0.021 *** | 0.019 *** | 0.019 *** |

| (0.002) | (0.003) | (0.003) | (0.003) | (0.003) | (0.003) | |

| Internet | 0.145 *** | 0.085 *** | 0.086 *** | 0.076 ** | 0.070 ** | |

| (0.029) | (0.030) | (0.031) | (0.034) | (0.034) | ||

| Finance | 0.028 *** | 0.031 *** | 0.036 *** | 0.037 *** | ||

| (0.004) | (0.006) | (0.007) | (0.007) | |||

| Perdensity | 0.049 | 0.079 | 0.076 | |||

| (0.061) | (0.062) | (0.061) | ||||

| Pergdp | 0.001 * | 0.001 * | 0.001 * | |||

| (0.001) | (0.001) | (0.001) | ||||

| Tobin’s Q | 0.013 * | 0.016 ** | ||||

| (0.007) | (0.007) | |||||

| Total asset | 0.006 | −0.039 *** | ||||

| (0.014) | (0.014) | |||||

| Size | 0.049 *** | 0.031 *** | ||||

| (0.013) | (0.011) | |||||

| Level | 0.181 *** | |||||

| (0.064) | ||||||

| Stockowner | −0.002 | |||||

| (0.001) | ||||||

| ROE | 0.363 *** | |||||

| (0.031) | ||||||

| Director | 0.211 | |||||

| (0.130) | ||||||

| Cons | 7.720 *** | 6.912 *** | 7.267 *** | 7.582 *** | 7.919 *** | 7.834 *** |

| (0.007) | (0.159) | (0.170) | (0.425) | (0.434) | (0.427) | |

| Firm FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Province × Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| N | 8772 | 8772 | 8772 | 8772 | 8772 | 8772 |

| R2 | 0.051 | 0.055 | 0.064 | 0.064 | 0.067 | 0.099 |

| The First Stage | The Second Stage | |||

|---|---|---|---|---|

| Variables | (1) | (2) | (3) | (4) |

| pcblock | 0.041 *** | 0.033 *** | ||

| (0.001) | (0.002) | |||

| blockdev | 0.021 *** | 0.020 *** | ||

| (0.003) | (0.003) | |||

| Controls | Yes | Yes | Yes | Yes |

| Firm FE | No | Yes | No | Yes |

| Province × Year FE | No | Yes | No | Yes |

| F-Vlaue | 16.462 | 38.576 | ||

| N | 8536 | 8630 | 8536 | 8630 |

| R2 | 0.046 | 0.048 | 0.064 | 0.098 |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| SOEs | Non-SOEs | Surplus Ind | Non-Surplus Ind | High Initial Productivity | Low Initial Productivity | |

| Blockdev | 0.002 | 0.024 *** | 0.019 | 0.025 *** | 0.015 *** | −0.001 |

| (0.008) | (0.009) | (0.027) | (0.009) | (0.006) | (0.008) | |

| Cons | 7.655 *** | 7.800 *** | 6.161 | 7.115 *** | 8.764 *** | 6.662 *** |

| (0.708) | (0.492) | (5.182) | (1.425) | (0.531) | (1.253) | |

| Controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Firm FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Province × Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| N | 2893 | 3715 | 3212 | 3715 | 1916 | 1493 |

| R2 | 0.121 | 0.084 | 0.143 | 0.128 | 0.073 | 0.086 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| lnTFP_OP | lnTFP_LP | lnTFP_OP | lnTFP_OP | lnTFP_OP | lnTFP_OP | |

| Blockdev | 0.025 *** | 0.023 *** | 0.011 ** | 0.016 ** | 0.022 ** | |

| (0.005) | (0.007) | (0.005) | (0.006) | (0.010) | ||

| Blocknum | 0.036 *** | |||||

| (0.006) | ||||||

| L. Blockdev | 0.004 ** | |||||

| (0.002) | ||||||

| L2. Blockdev | 0.009 * | |||||

| (0.005) | ||||||

| Cons | 7.506 *** | 10.886 *** | 8.357 *** | 8.778 *** | 8.046 *** | 7.764 *** |

| (0.281) | (0.223) | (0.359) | (0.318) | (0.265) | (0.233) | |

| Controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Firm FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Province × Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| N | 8652 | 8772 | 4878 | 4176 | 5482 | 5416 |

| R2 | 0.093 | 0.118 | 0.053 | 0.072 | 0.055 | 0.082 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Cao, Q.; Li, J.; Zhang, H.; Liu, Y.; Luo, X. Blockchain and Firm Total Factor Productivity: Evidence from China. Sustainability 2022, 14, 10165. https://doi.org/10.3390/su141610165

Cao Q, Li J, Zhang H, Liu Y, Luo X. Blockchain and Firm Total Factor Productivity: Evidence from China. Sustainability. 2022; 14(16):10165. https://doi.org/10.3390/su141610165

Chicago/Turabian StyleCao, Qilong, Jinglei Li, Hongru Zhang, Yue Liu, and Xun Luo. 2022. "Blockchain and Firm Total Factor Productivity: Evidence from China" Sustainability 14, no. 16: 10165. https://doi.org/10.3390/su141610165

APA StyleCao, Q., Li, J., Zhang, H., Liu, Y., & Luo, X. (2022). Blockchain and Firm Total Factor Productivity: Evidence from China. Sustainability, 14(16), 10165. https://doi.org/10.3390/su141610165