The Quality of Fair Revaluation of Fixed Assets and Additional Calculations Aimed at Facilitating Prospective Investors’ Decisions

Abstract

:1. Introduction

2. Literature Review

3. Research Methodology

3.1. Data

3.2. Variables

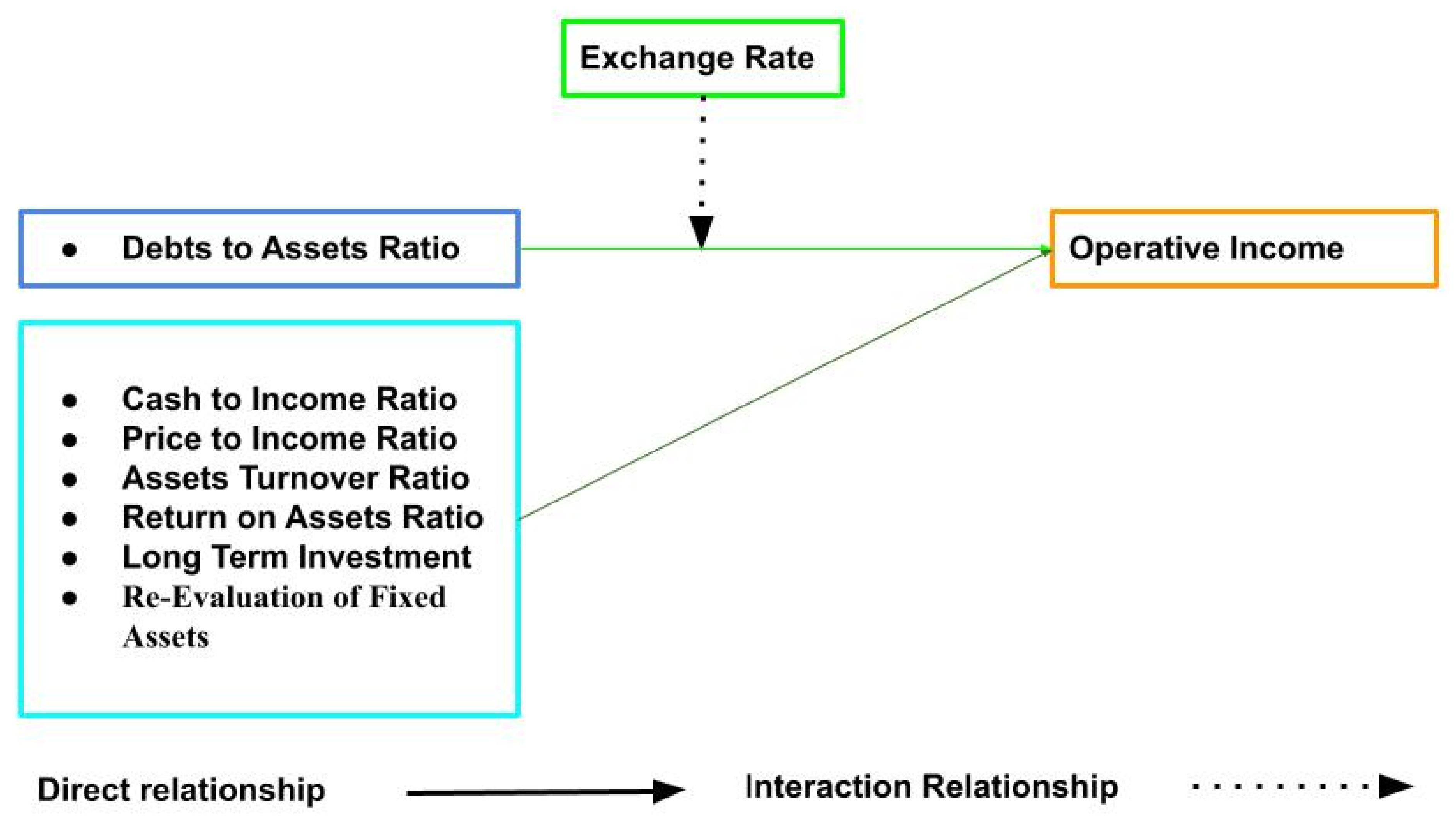

3.3. Model

Dynamic Panel Model

4. Results and Discussion

4.1. Descriptive Statistics

4.2. Inferential Statistics

5. Conclusions

Contribution/Origin

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Robinson, T.R. International Financial Statement Analysis; John Wiley & Sons: Hoboken, NJ, USA, 2020. [Google Scholar]

- Green, S.D. Non-Debt and Non-Bank Financing for Home Purchase: Promises and Risks. Am. Univ. Bus. Law Rev. 2022, 10, 2. [Google Scholar]

- Beck, M.J.; Glendening, M.; Hogan, C.E. Financial Statement Disaggregation and Auditor Effort. Audit. A J. Pract. Theory 2022, 41, 27–55. [Google Scholar] [CrossRef]

- Huang, X.; Wang, X.; Han, L.; Laker, B. Does sound lending infrastructure foster better financial reporting quality of SMEs? Eur. J. Financ. 2022, 1–25. [Google Scholar] [CrossRef]

- Reginato, L.; Durso, S.; Nascimento, C.; Cornacchione, E. Transfer of learning in accounting programs: The role of business games. Int. J. Manag. Educ. 2022, 20, 100592. [Google Scholar] [CrossRef]

- Zhu, H.H.; Sun, Y.Y.; Li, J.B. Study on Enterprise Value and Asset Structure Optimization of the Iron and Steel Industry in China under Carbon Reduction Strategy. J. Asian Financ. Econ. Bus. 2022, 9, 11–22. [Google Scholar]

- Morshed, A. Comparative Analysis of Accounting Treatments Between the IFRS’s and AAOIFI for The Islamic Financial Leasing Provided by Islamic Banks. Ph.D. Thesis, University of Sopron, Sopron, Hungary, 2022. [Google Scholar]

- Mert, I. Assessment of Accounting Evaluation Practices: A Research-Based Review of Turkey and Romania; Springer: Berlin/Heidelberg, Germany, 2022. [Google Scholar]

- Seiberlich, K. A Study of Accounting and Economic Concepts with Reflection on Various Speakers. Undergraduate Thesis, The University of Mississippi, Oxford, MS, USA, 2022. [Google Scholar]

- Gallo, S.; Verdoliva, V. Highlights of Private Equity and Venture Capital Valuation. In Private Equity and Venture Capital; Springer: Cham, Switzerland, 2022; pp. 75–92. [Google Scholar]

- Lafta, M.H. Reassessment of Fixed Assets in Petroleum Licensing Contracts in Accordance with International Financial Reporting Standards and Their Impact on The Quality of Financial Reporting. World Econ. Financ. Bull. 2022, 8, 91–107. [Google Scholar]

- Olante, M.E.; Lassini, U. Investment property: Fair value or cost model? Recent evidence from the application of IAS 40 in Europe. Adv. Account. 2022, 56, 100568. [Google Scholar] [CrossRef]

- Rahman, M.T.; Hossain, S.Z. Impact of Fixed Asset Revaluation Practice on Investor Perception in Bangladesh Stock Market. Int. J. Econ. Manag. Account. 2022, 30, 75–99. [Google Scholar]

- Aseinimieyeofori, P.A. Non-Current Assets Investment and Financial Performance of Listed Insurance Companies in Nigeria. BW Acad. J. 2022, 1, 17. [Google Scholar]

- Khan, M.A.; Hussain, A.; Ali, M.M.; Tajummul, M.A. Assessing the impact of liquidity on the value of assets return. Glob. Bus. Manag. Rev. 2022, 14, 54–76. [Google Scholar]

- Pavlovich, A. How Should New Zealand Tax Its Inbound Investors? The Development of a Tax Policy Framework and an Analysis of Current Settings against the Framework. Ph.D. Thesis, The University of Auckland, Auckland, New Zealand, 2022. [Google Scholar]

- Khan, M.A. ESG disclosure and Firm performance: A bibliometric and Meta Analysis. Res. Int. Bus. Financ. 2022, 61, 101668. [Google Scholar] [CrossRef]

- Kjellevold, K. Monitoring of Fair Value Reliability by Third-Party Specialists: A Review and Integration of Empirical Research. Available online: https://ssrn.com/abstract=3496001 (accessed on 11 March 2020).

- Delgado-Vaquero, D.; Morales-Díaz, J.; Villacorta, M.Á. Relevance of fair value disclosures in Spanish credit institutions. Rev. De Contab.-Span. Account. Rev. 2022, 25, 175–189. [Google Scholar] [CrossRef]

- Tanggamani, V.; Amran, A.; Ramayah, T. CSR Practices Disclosure’s Impact on Corporate Financial Performance and Market Performance: Evidence of Malaysian Public Listed Companies. Int. J. Bus. Soc. 2022, 23, 604–613. [Google Scholar] [CrossRef]

- Shamsadini, H.; Bekhradi Nasab, V.; Mulla, J.R. The Moderating Effect of the Inflation on the Relationship between Asset Revaluation and the Financial Statements of Companies Listed on the Tehran and Bombay Stock Exchanges. Iran. J. Account. Audit. Financ. 2022, 6, 53–68. [Google Scholar]

- Suvorov, N.V.; Rutkovskaya, E.A.; Balashova, E.E.; Maksimtsova, S.I.; Treschina, S.V.; Beletskii, Y.V. Assessing the Performance of Fixed Assets in the Russian Economy. Stud. Russ. Econ. Dev. 2022, 33, 367–376. [Google Scholar] [CrossRef]

- Khalil, R.; Asad, M.; Khan, S.N. Management motives behind the revaluation of fixed assets for sustainability of entrepreneurial companies. Int. J. Entrep. 2018, 22, 1–9. [Google Scholar]

- Bae, J.; Lee, J.; Kim, E. Does Fixed Asset Revaluation Build Trust between Management and Investors? Sustainability 2019, 11, 3700. [Google Scholar] [CrossRef]

- Fu, W.; Lim, K.F. The constitutive role of state structures in strategic coupling: On the formation and evolution of Sino-German production networks in Jieyang, China. Econ. Geogr. 2022, 98, 25–48. [Google Scholar] [CrossRef]

- Jin, Y.; Niu, F.; Sheng, L. Fair Value Accounting for Property, Plant & Equipment: Impact of IFRS 1 Adoption. J. Int. Account. Res. 2022. [Google Scholar] [CrossRef]

- Mert, I. Theoretical Approaches of Value and Valuation. In Assessment of Accounting Evaluation Practices; Springer: Cham, Switzerland, 2022; pp. 11–60. [Google Scholar]

- Milašinović, M.; Obradović, V.; Karapavlović, N. Subsequent measurement of property, plant and equipment in hotel companies in the Republic of Serbia and the Republic of Croatia. Anal. Ekon. Fak. Subotici 2022, 58, 15–29. [Google Scholar] [CrossRef]

- Devine, A.; Yönder, E. Impact of environmental investments on corporate financial performance: Decomposing valuation and cash flow effects. J. Real Estate Financ. Econ. 2021, 1–28. [Google Scholar] [CrossRef]

- Young, S. Are Financial Statements More Comparable When GAAP Restricts Managers’ Discretion? Available online: https://ssrn.com/abstract=3795631 (accessed on 14 April 2020).

- Coulon, Y. Asset-Based Approach to Valuation. In Small Business Valuation Methods; Palgrave Macmillan: Cham, Switzerland, 2022; pp. 21–70. [Google Scholar]

- Andersen, K.; Tekula, R. Value, Values, and Valuation: The Marketization of Charitable Foundation Impact Investing. J. Bus. Ethics 2022, 1–20. [Google Scholar] [CrossRef]

- Nguyen, V.C.; Do, T.T. Impact of exchange rate shocks, inward FDI and import on export performance: A cointegration analysis. J. Asian Financ. Econ. Bus. 2020, 7, 163–171. [Google Scholar] [CrossRef]

- Li, S.; Fu, H.; Wen, J.; Chang, C.P. Separation of ownership and control for Chinese listed firms: Effect on the cost of debt and the moderating role of bank competition. J. Asian Econ. 2020, 67, 101179. [Google Scholar] [CrossRef]

- Becher, D.A.; Griffin, T.P.; Nini, G. Creditor control of corporate acquisitions. Rev. Finan. Stud. 2022, 35, 1897–1932. [Google Scholar] [CrossRef]

- Hutagalung, L.; Siagian, H. The Effect of Gross Profit, Operating Profit and Net Profit on Future Cash Flow Prediction at the Company of Telecommunications Sub Sector on IDX in 2014–2019. Ekon. J. Econ. Bus. 2022, 6, 348–358. [Google Scholar] [CrossRef]

- Bowsher, C.G. On testing overidentifying restrictions in dynamic panel data models. Econ. Lett. 2002, 77, 211–220. [Google Scholar] [CrossRef]

- Yu, H.; Lowie, W.; Peng, H. Understanding salient trajectories and emerging profiles in the development of Chinese learners’ motivation: A growth mixture modeling approach. Int. Rev. Appl. Linguist. Lang. Teach. 2022. [Google Scholar] [CrossRef]

- Alonso-Borrego, C.; Arellano, M. Symmetrically normalized instrumental-variable estimation using panel data. J. Bus. Econ. Stat. 1999, 17, 36–49. [Google Scholar]

- Blundell, R.; Bond, S. Initial conditions and moment restrictions in dynamic panel data models. J. Econom. 1998, 87, 115–143. [Google Scholar] [CrossRef]

- Nestler, S.; Humberg, S. A Lasso and a Regression tree mixed-effect model with random effects for the level, the residual variance, and the autocorrelation. Psychometrika 2022, 87, 506–532. [Google Scholar] [CrossRef] [PubMed]

- Blundell, R.; Bond, S. GMM estimation with persistent panel data: An application to production functions. Econom. Rev. 2000, 19, 321–340. [Google Scholar] [CrossRef]

- Arellano, M.; Bond, S. Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev. Econ. Stud. 1991, 58, 277–297. [Google Scholar] [CrossRef]

- Baltagi, B.H. Dynamic panel data models. In Econometric Analysis of Panel Data; Springer: Cham, Switzerland, 2021; pp. 187–228. [Google Scholar]

- Mohd, A.S.; Siddiqui, D.A. Effect of Macroeconomic Factors on Firms ROA: A Comparative Sectorial Analysis from Pakistan. Int. J. Publ. Soc. Stud. 2020, 5, 1–17. [Google Scholar] [CrossRef]

- Datta, S.; Iskandar-Datta, M.; Raman, K. Managerial stock ownership and the maturity structure of corporate debt. J. Financ. 2005, 60, 2333–2350. [Google Scholar] [CrossRef]

- Sheikh, S. CEO power and the likelihood of paying dividends: Effect of profitability and cash flow volatility. J. Corp. Financ. 2022, 73, 102186. [Google Scholar] [CrossRef]

- Ghodrati, H.; Ghanbari, J. Earnings quality and P/E ratio: Evidence from Tehran Stock Exchange. Manag. Sci. Lett. 2014, 4, 1815–1824. [Google Scholar] [CrossRef]

- Christianto, D.; Munir, A. Analysis of the Effect of Liquidity, Leverage and Fixed Asset Turnover to Return on Assets of Oil Gas Mining Sub-Sector Companies (Listed in Idx for The Period 2018–2021). J. Manag. Leadersh. 2022, 5, 14–26. [Google Scholar] [CrossRef]

- Woo, D.; Suresh, N.C. Voluntary agreements for sustainability, resource efficiency & firm performance under the supply chain cooperation policy in South Korea. Int. J. Prod. Econ. 2022, 252, 108563. [Google Scholar]

- Hussain, S.; Hassan, A.A.G. The Reflection of Exchange Rate Exposure and Working Capital Management on Manufacturing Firms of Pakistan. Talent. Dev. Excell. 2020, 12, 684–698. [Google Scholar]

- Zhang, Y.; Wei, J.; Zhu, Y.; George-Ufot, G. Untangling the relationship between Corporate Environmental Performance and Corporate Financial Performance: The double-edged moderating effects of environmental uncertainty. J. Clean. Prod. 2020, 263, 121584. [Google Scholar] [CrossRef]

- Behera, J.; Mishra, A.K. Renewable and non-renewable energy consumption and economic growth in G7 countries: Evidence from panel autoregressive distributed lag (P-ARDL) model. Int. Econ. Econ. Policy 2020, 17, 241–258. [Google Scholar] [CrossRef]

- Carstensen, K.; Heinrich, M.; Reif, M.; Wolters, M.H. Predicting ordinary and severe recessions with a three-state Markov-switching dynamic factor model: An application to the German business cycle. Int. J. Forecast. 2020, 36, 829–850. [Google Scholar] [CrossRef]

- Deng, L.; Zhao, Y. Investment Lag, Financially Constraints and Company Value—Evidence from China. Emerg. Mark. Financ. Trade 2022, 58, 1–14. [Google Scholar] [CrossRef]

- Nkam, F.M.; Akume, A.D.; Sama, M.C. Macroeconomic Drivers of Private Equity Penetration in Sub-Saharan African Countries. Int. Bus. Res. 2020, 13, 192–205. [Google Scholar] [CrossRef]

- Smaoui, H.; Ghouma, H. Sukuk market development and Islamic banks’ capital ratios. Res. Int. Bus. Financ. 2020, 51, 101064. [Google Scholar] [CrossRef]

| OI | EXR | LTI | REFA | DAR | CIR | PER | ATR | ROA | |

|---|---|---|---|---|---|---|---|---|---|

| Mean | 9.271 | 4.655 | 4.676 | 13.450 | 0.584 | 5.749 | 17.844 | 0.801 | 4.607 |

| Median | 11.294 | 4.664 | 0.000 | 13.884 | 0.657 | 1.864 | 3.901 | 0.771 | 2.820 |

| Maximum | 13.577 | 4.706 | 14.477 | 16.021 | 1.248 | 56.817 | 490.791 | 2.241 | 18.084 |

| Minimum | 0.000 | 4.593 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| Std. Dev. | 4.706 | 0.039 | 5.923 | 2.363 | 0.322 | 10.573 | 57.821 | 0.459 | 4.636 |

| Skewness | −1.328 | −0.372 | 0.528 | −4.850 | −0.589 | 3.131 | 6.070 | 0.559 | 1.128 |

| Kurtosis | 3.081 | 1.796 | 1.377 | 28.193 | 2.449 | 13.472 | 44.569 | 3.369 | 3.201 |

| Observations | 114 | 114 | 114 | 114 | 113 | 113 | 113 | 114 | 114 |

| OI | EXR | LTI | REFA | DAR | CIR | PER | ATR | ROA | |

|---|---|---|---|---|---|---|---|---|---|

| OI | 1.000 | ||||||||

| EXR | −0.223 *** | 1.000 | |||||||

| LTI | 0.038 *** | 0.022 *** | 1.000 | ||||||

| RVFA | 0.067 *** | −0.087 *** | 0.178 *** | 1.000 | |||||

| DAR | 0.804 *** | −0.290 *** | −0.145 *** | 0.082 *** | 1.000 | ||||

| CIR | 0.068 *** | −0.297 *** | 0.058 *** | 0.121 *** | 0.156 *** | 1.000 | |||

| PER | 0.021 *** | −0.287 *** | 0.127 *** | 0.109 *** | 0.019 *** | 0.826 *** | 1.000 | ||

| ATR | −0.166 *** | 0.234 *** | −0.008 *** | −0.214 *** | −0.227 *** | −0.081 *** | −0.079 *** | 1.000 | |

| ROA | 0.133 *** | 0.018 *** | −0.126 *** | −0.061 *** | 0.102 *** | −0.423 *** | −0.261 *** | −0.206 *** | 1.000 |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Variables | OLS | RE | FE | PCSE AR1 | PCSE AR1 HetOnly | 2StepSys GMM |

| OI = L | 0.048 * | |||||

| (0.025) | ||||||

| EXR | 0.159 | 0.159 | 0.668 | 0.289 | 0.289 | 3.233 *** |

| (7.265) | (7.265) | (5.739) | (6.043) | (6.137) | (1.157) | |

| LTI | 0.127 *** | 0.127 *** | −0.149 | 0.125 *** | 0.125 *** | 0.128 ** |

| (0.045) | (0.045) | (0.111) | (0.031) | (0.048) | (0.064) | |

| REFA | −0.036 | −0.036 | −0.317 ** | −0.076 | −0.076 | −0.572 *** |

| (0.113) | (0.113) | (0.130) | (0.193) | (0.182) | (0.017) | |

| DAR | 12.34 *** | 12.34 *** | 15.25 *** | 13.18 *** | 13.18 *** | 0.578 |

| (0.888) | (0.888) | (0.836) | (1.290) | (0.918) | (0.435) | |

| CIR | −0.071 | −0.073 | −0.135 *** | −0.101 ** | −0.101 ** | −0.068 *** |

| (0.049) | (0.049) | (0.042) | (0.040) | (0.047) | (0.014) | |

| PER | 0.011 | 0.011 | 0.014* | 0.0119 * | 0.012 * | 0.005 *** |

| (0.008) | (0.008) | (0.008) | (0.007) | (0.007) | (0.002) | |

| ATR | 0.306 | 0.306 | 0.818 | 0.520 | 0.520 | 0.933 ** |

| (0.610) | (0.610) | (0.909) | (0.699) | (0.701) | (0.472) | |

| ROA | 0.036 | 0.036 | 0.007 | 0.030 | 0.031 | 0.212 *** |

| (0.066) | (0.066) | (0.069) | (0.044) | (0.069) | (0.030) | |

| Constant | 1.100 | 1.100 | 2.149 | 0.465 | 0.465 | 1.692 |

| (33.95) | (33.95) | (26.84) | (28.08) | (28.73) | (5.355) | |

| Observations | 113 | 113 | 113 | 113 | 113 | 95 |

| R-squared | 0.684 | 0.684 | 0.828 | 0.633 | 0.633 | |

| Number of firms | 19 | 19 | 19 | 19 | 19 | 19 |

| Diagnostic Checks | ||||||

| Breusch and Pagan LM test for random effects | (8) *** | |||||

| Hausman test | (18) *** | |||||

| Multicollinearity test (VIF) | 1.87 | |||||

| Heteroskedasticity test | 333.59 *** | |||||

| Wooldridge test | 11.583/(0.0032) | |||||

| Sargan test chi2(9)/(p-Value) | (7.178) (0.618) | |||||

| Arellano Bond Test AR (1) (Z) p-Value | (−1.8675) (0.0618) | |||||

| AR (2) (z) p-Value | (1.557) (0.1195) | |||||

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Variables | OLS | RE | FE | PCSE AR1 | PCSE Hetonly | Twostep Sys GMM |

| OI = L | 0.0810 *** | |||||

| (0.0158) | ||||||

| EXR | −28.07 * | −28.07 * | −40.99 *** | −32.13 | −32.13 * | 26.01 *** |

| (16.96) | (16.96) | (14.19) | (19.94) | (18.40) | (3.121) | |

| LTI | 0.123 *** | 0.123 *** | −0.142 | 0.122 *** | 0.122 *** | 0.170 *** |

| (0.0446) | (0.0446) | (0.105) | (0.0251) | (0.0460) | (0.0612) | |

| REFA | −0.0349 | −0.0349 | −0.392 *** | −0.0762 | −0.0762 | −0.577 *** |

| (0.112) | (0.112) | (0.126) | (0.207) | (0.189) | (0.0163) | |

| DAR | −189.9 * | −189.9 * | −275.0 *** | −215.3 * | −215.3 ** | 157.0 *** |

| (110.0) | (110.0) | (91.24) | (114.5) | (109.4) | (18.97) | |

| CIR | −0.0745 | −0.0745 | −0.143 *** | −0.105 *** | −0.105 ** | −0.0477 *** |

| (0.0488) | (0.0488) | (0.0406) | (0.0408) | (0.0453) | (0.0119) | |

| PER | 0.00990 | 0.00990 | 0.0126 * | 0.0113 | 0.0113 * | 0.00477 *** |

| (0.00825) | (0.00825) | (0.00694) | (0.00703) | (0.00645) | (0.00158) | |

| ATR | 0.364 | 0.364 | 0.904 | 0.566 | 0.566 | 1.680 *** |

| (0.604) | (0.604) | (0.865) | (0.650) | (0.704) | (0.273) | |

| ROA | 0.0388 | 0.0388 | −0.0292 | 0.0267 | 0.0267 | 0.223 *** |

| (0.0649) | (0.0649) | (0.0667) | (0.0473) | (0.0700) | (0.0270) | |

| EXDAR | 43.31 * | 43.31 * | 62.12 *** | 48.90 ** | 48.90 ** | −33.36 *** |

| (23.57) | (23.57) | (19.52) | (24.48) | (23.37) | (4.076) | |

| Constant | 133.0 * | 133.0 * | 198.1 *** | 152.1 | 152.1 * | −106.5 *** |

| (79.23) | (79.23) | (66.66) | (93.20) | (86.19) | (14.56) | |

| Observations | 113 | 113 | 113 | 113 | 113 | 95 |

| R-squared | 0.6593 | 0.6937 | 0.846 | 0.652 | 0.652 | |

| Diagnostic Checks | ||||||

| Breusch and Pagan LM test for random effects | (9) *** | |||||

| Hausman test | (18) *** | |||||

| Multicollinearity test (VIF) | 1.86 | |||||

| Heteroskedasticity test | 255.26 *** | |||||

| Wooldridge test | 10.423/(0.0047) | |||||

| Sargan test chi2(9)/(p-Value) | (11.77) (0.462) | |||||

| Arellano Bond Test AR (1) (Z) p-Value | (−1.658) (0.095) | |||||

| AR (2) (z) p-Value | (1.278) (0.201) | |||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hussain, S.; Hoque, M.E.; Susanto, P.; Watto, W.A.; Haque, S.; Mishra, P. The Quality of Fair Revaluation of Fixed Assets and Additional Calculations Aimed at Facilitating Prospective Investors’ Decisions. Sustainability 2022, 14, 10334. https://doi.org/10.3390/su141610334

Hussain S, Hoque ME, Susanto P, Watto WA, Haque S, Mishra P. The Quality of Fair Revaluation of Fixed Assets and Additional Calculations Aimed at Facilitating Prospective Investors’ Decisions. Sustainability. 2022; 14(16):10334. https://doi.org/10.3390/su141610334

Chicago/Turabian StyleHussain, Sarfraz, Mohammad Enamul Hoque, Perengki Susanto, Waqas Ahmad Watto, Samina Haque, and Pradeep Mishra. 2022. "The Quality of Fair Revaluation of Fixed Assets and Additional Calculations Aimed at Facilitating Prospective Investors’ Decisions" Sustainability 14, no. 16: 10334. https://doi.org/10.3390/su141610334