Non-Renewable Resources and Sustainable Resource Extraction: An Empirical Test of the Hotelling Rule’s Significance to Gold Extraction in South Africa

Abstract

:1. Introduction

2. Literature Review

2.1. Theoretical Literature

2.1.1. Hotelling’s Rule

2.1.2. Hartwick Rule

2.1.3. Marxism

2.1.4. Non-Declining Natural Capital Stock Approach

2.2. Empirical Literature

3. Methodology

3.1. Data Sources

3.2. Estimation Techniques

- (i)

- First, there are descriptive studies which examine the price behaviour.

- (ii)

- Second, a specific model can be tested by estimating equations. This approach relies on econometric estimations.

- (iii)

- The third approach refers to a reformulation of Hotelling’s Rule in the form of the HVP.

3.2.1. Descriptive Statistics

- Firms will always try to extract low-cost resources before high-cost resources, causing resource extraction costs to increase over time.

- In general, greater scarcity caused by in situ reserves increases the value of a resource, causing the price to increase over time.

- Since the price of a resource increases over time, then demand and production should decrease over time.

3.2.2. Inferential Statistics: Econometric Estimation of Equations

- (i)

- The autoregressive distributed lags method allows us to express the cointegrated behaviour of variables which have a different order of integration.

- (ii)

- The ARDL procedure is irrespective of whether variables used in a model are I(0), I(1), or mutually cointegrated [48].

4. Presentation of Results

4.1. Descriptive Statistics

4.1.1. Gold Price Trends

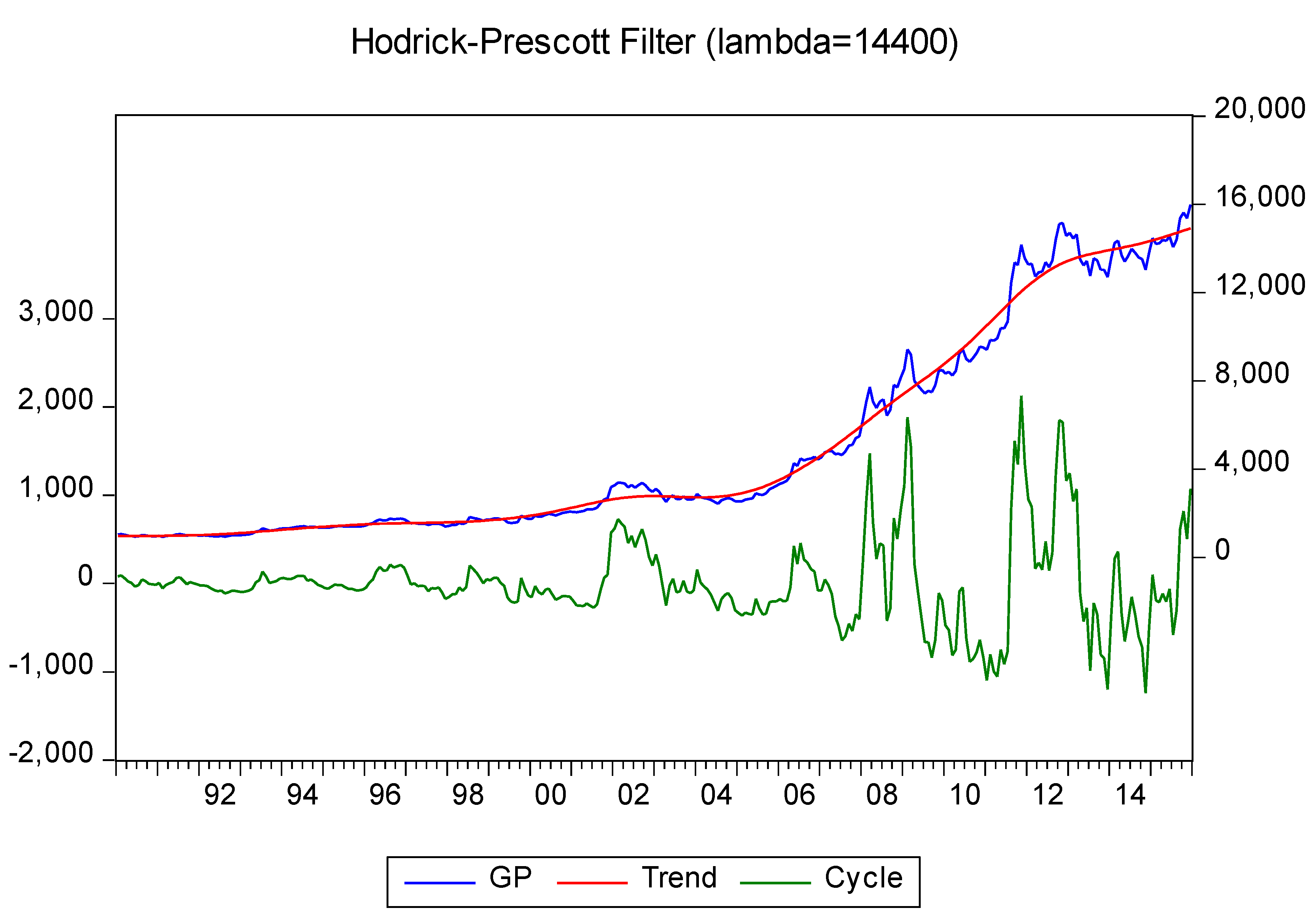

4.1.2. Gold Production

- (i)

- In general, greater scarcity caused by in situ reserves increases the value of a resource, causing the price to increase over time.

- (i)

- Since the price of a resource increases over time, then demand and production should decrease over time [59].

4.1.3. Gold Consumption

4.2. Inferential Statistics

4.2.1. Unit Root Tests

4.2.2. Cointegration Test: ARDL Bound Test

4.2.3. ARDL Results

4.2.4. Diagnostic Checks

5. Conclusions and Recommendations

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Shogren, J.F. Natural Resource Economics; University of Wyoming: Laramie, WY, USA, 2000. [Google Scholar]

- Rodrigo, T. Analysis of Harold Hotelling’s Theory. 2014. Available online: https://writepass.com/journal/2014/04/analysis-of-harold-hotellings-theory/ (accessed on 17 June 2015).

- Hotelling, H. The Economics of Exhaustible Resources. J. Political Econ. 1931, 39, 137–175. Available online: https://zielonygrzyb.wordpress.com/2014/06/16/resource-economicss-most-problematic-assumption/ (accessed on 20 July 2016). [CrossRef]

- Heal, G. A Celebration of Environmental and Resource Economics. Rev. Environ. Econ. Policy 2007, 1, 7–25. [Google Scholar] [CrossRef]

- Minnitt, R.C.A. Cut-off grade determination for the maximum value of a small Wits-type gold mining operation. In Proceedings of the 31st International Symposium on Application of Computers and Operations Research in the Minerals Industries, Cape Town, South Africa, 14–16 May 2003; pp. 415–421. [Google Scholar]

- Brock, W.A.; Xepapadeas, A. Handbook of Environmental Economics. 2018. Available online: https://econpapers.repec.org/bookchap/eeeenvhes/3.htm (accessed on 2 May 2015).

- Landry, C.E.; Turner, D.; Dorfman, J.H. Hotelling Meets Crypto-Currency: Do Bitcoin Rents Follow Hotelling’s Rule? 2019. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3506730 (accessed on 2 May 2015).

- Lundstøl, O. Revenue Sharing in Mining in Africa: Empirical Proxies and Determinants of Government Take. 2018. Available online: https://www.ictd.ac/publication/revenue-sharing-in-mining-in-africa-empirical-proxies-and-determinants-of-government-take/ (accessed on 13 December 2016).

- Ferreira da Cunha, R.P.; Missemer, A. The Hotelling Rule in Non-Renewable Resource Economics: A Reassessment. Can. J. Econ. 2020, 53, 800–820. [Google Scholar] [CrossRef]

- Lin, C.C.Y.; Wagner, G. Steady-state growth in a Hotelling model of resource extraction. J. Environ. Econ. Manag. 2007, 54, 68–83. [Google Scholar]

- Okullo, S.J. The Hotelling Rule: Maxim or Fallacy? 2017. Available online: https://ethz.ch/content/dam/ethz/special-interest/mtec/cer-eth/resource-econ-dam (accessed on 13 December 2016).

- Van Veldhuizen, R.; Sonnemans, J.H. Nonrenewable Resources, Strategic Behavior and the Hotelling Rule: An Experiment (June 2018). J. Ind. Econ. 2018, 66, 481–516. Available online: https://ssrn.com/abstract=3275624 (accessed on 12 April 2015). [CrossRef]

- Department Of Mineral Resources. New Technological Applications in Deep level Gold Mining. 2011. Available online: https://www.dmr.gov.za/LinkClick.aspx?fileticket=CIEuCiHYXlA%3D&portalid=0 (accessed on 7 May 2016).

- Mantashe, G. The Decline of the Mining Industry and the Response of the Mining Unions. Doctoral Dissertation, University of the Witwatersrand, Johannesburg, South Africa, 2008. [Google Scholar]

- Stats, S.A. Mining production and sales Preliminary—Statistics South Africa. 2016. Available online: www.statssa.gov.za/publications/P2041/P2041August2016.pdf (accessed on 10 September 2016).

- Mpanza, M.; Adam, E.; Moolla, R. A critical review of the impact of South Africa’s mine closure policy and the winding-up process of mining companies. J. Transdiscipl. Res. South. Afr. 2021, 17, a985. [Google Scholar] [CrossRef]

- US Geological Survey. Minerals Year Book. 2007. Available online: https://books.google.co.za/books?id=HnrrPR___BkC&pg=SA1-PA4&dq=The+North+West,+Ergo,+Tau+Tona,+and+St.+Helena+mines+have+been+all+closed+down&hl=en&sa=X&ved=2ahUKEwjK_Lvg8d35AhVBqaQKHTy-BGYQ6AF6BAgCEAI#v=onepage&q=The%20North%20West%2C%20Ergo%2C%20Tau%20Tona%2C%20and%20St.%20Helena%20mines%20have%20been%20all%20closed%20down&f=false (accessed on 20 February 2016).

- Ruffin, T. Harmony’s Expansion Projects. 2010. Available online: https://www.miningreview.com/top-stories/harmony-s-expansion-projects/ (accessed on 6 February 2015).

- Van Zyl, G. Cry, the Beloved Gold Industry: South Africa’s Output Experiences Record Plunge. 2018. Available online: https://www.biznews.com/gold/2018/07/12/sa-gold-industry-output-record-plunge (accessed on 13 December 2016).

- Molopyane, M. SA Has Only 39 Years Worth of Gold Left. 2018. Available online: http://www.702.co.za/articles/288611/sa-has-only-39-years-worth-of-gold-left (accessed on 5 October 2015).

- Steinbach, V.; Wellmer, F. Consumption and Use of Non-Renewable Mineral and Energy Raw Materials from an Economic Geology Point of View. Sustainability 2010, 2, 1408–1430. [Google Scholar] [CrossRef]

- Sainsbury, P. Commodities: 50 Things You Really Need to Know. 2015. Available online: https://books.google.co.za/books?op=lookup&id=J_PiCgAAQBAJ&continue=https://books.google.co.za/books%3Fid%3DJ_PiCgAAQBAJ%26pg%3DPP19%26lpg%3DPP19%26dq%3Dthe%2Bprofitable%2Bextraction%2Bpath,%2Bboth%2Bsocially%2Band%2Beconomically,%2Bis%2Bone%2Bin%2Bwhich%2Bthe%2Bprice%2Bof%2Bthe%2Bnonrenewable%2Bresource%2Bincreases%2Bat%2Bthe%2Brate%2Bof%2Bthe%2Binterest%2Brate%26source%3Dbl%26ots%3D7xsCM7ZI- (accessed on 13 December 2016).

- Krautkraemer, J.A. Nonrenewable Resource Scarcity. J. Econ. Lit. 1998, 36, 2065–2107. [Google Scholar]

- Hartwick, J. Intergenerational equity and investing of rents from exhaustible resources. Am. Econ. Rev. 1977, 66, 972–974. [Google Scholar]

- Boos, A. Genuine Savings as an Indicator for “Weak” Sustainability: Critical Survey and Possible Ways forward in Practical Measuring. Sustainability 2015, 7, 4146–4182. [Google Scholar] [CrossRef]

- Dixit, A.; Hammond, P.; Hoel, M. On Hartwick’s rule for regular maximin paths of capital accumulation and resource depletion. Rev. Econ. Stud. 1980, 47, 551–556. [Google Scholar] [CrossRef]

- Williams, C. Marxism and the Environment. International Socialist Review. 2015. Available online: https://isreview.org/issue/72/marxism-and-environment/index.html (accessed on 5 October 2015).

- Summers, C. Introduction to Education for Sustainable Development. 2009. Available online: https://webcache.googleusercontent.com/search?q=cache:ZL8HDRvc0PoJ:https://www.plymouth.ac.uk/uploads/production/document/path/5/5392/Introduction_to_ESD__PowerPoint_.ppt+&cd=2&hl=en&ct=clnk&gl=uk (accessed on 10 March 2015).

- Pearce, D.W.; Hamilton, K.; Atkinson, G. Measuring sustainable development: Progress on indicators. Environ. Dev. Econ. 1996, 1, 85–101. [Google Scholar] [CrossRef]

- Envis. Sustainability Issues. 2016. Available online: http://envis.mse.ac.in/Sustainability%20Issues.asp (accessed on 5 May 2016).

- Halvorsen, R.; Smith, T.R. A Test of the Theory of Exhaustible Resources. Q. J. Econ. 1991, 106, 123–140. [Google Scholar] [CrossRef]

- Moazzami, B.; Anderson, F.J. Modeling natural-resource scarcity using the error-correction approach. Can. J. Econ. 1994, 27, 801–812. [Google Scholar] [CrossRef]

- Berck, P.; Roberts, M. Natural resource prices: Will they ever turn up. J. Environ. Econ. Manag. 1996, 9, 122–137. [Google Scholar] [CrossRef]

- Chermak, J.M.; Patrick, R.H. A microeconomic test of the theory of exhaustible resources. J. Environ. Econ. Manag. 2001, 42, 82–103. [Google Scholar] [CrossRef]

- Banks, F.E. Beautiful and not so beautiful minds: An introductory essay on economic theory and the supply of oil. OPEC Rev. 2004, 28, 27–62. [Google Scholar] [CrossRef]

- André, F.J.; Smulders, S. Energy Use, Endogenous Technical Change and Economic Growth. In Proceedings of the EAERE 13th Annual Conference in Budapest, Budapest, Hungary, 25–28 June 2004. [Google Scholar]

- Livernois, J.; Thille, H.; Xhang, X. A test of the Hotelling rule using old–growth timber. Can. J. Econ. 2006, 39, 163–186. [Google Scholar] [CrossRef]

- Gaudet, G.; Lasserre, P.; van Long, N. Optimal Resource Royalties with Unknown and Temporally Independent Extraction Cost Structures. Int. Econ. Rev. 1995, 36, 715–749. [Google Scholar] [CrossRef]

- Kronenberg, T. Should we worry about the failure of the Hotelling rule? Ph.D. Thesis, Maastricht University, Postbus, The Netherlands, 2006. [Google Scholar]

- Chakravorty, U.; Leach, A.; Moreaux, M. “Twin Peaks” in Energy Prices: A Hotelling Model with Pollution and Learning; School of Business and Department of Economics, University of Alberta: Edmonton, AB, Canada, 2009. [Google Scholar]

- Mason, C.F.; Veld, K. Hotelling Meets Darcy: A New Model of Oil Extraction. 2013. Available online: http://www2.toulouse.inra.fr/lerna/seminaires/Hotelling_Darcy.pdf (accessed on 10 March 2015).

- Ukani, U. Hotelling’s Rule and Oil Prices. 2016. Available online: http://ltu.diva-portal.org/smash/get/diva2:1059465/FULLTEXT02.pdf (accessed on 9 May 2016).

- Uberman, R. The Hotelling’s Rule in practice—Analysis of gold mining sector. Miner. Resour. Manag. 2021, 37, 63–68. [Google Scholar]

- Neumann, C.; Erlei, M. Price Formation of Exhaustible Resources: An Experimental Investigation of the Hotelling Rule. 2014. Available online: http://www.wiwi.tuclausthal.de/fileadmin/Volkswirtschaftslehre/RePEc/pdf/Price_Formation_of_Exhaustible_Resources_2014_10_10.pdf (accessed on 23 April 2016).

- Brown, C. The Evidence-Based Practitioner: Applying Research to Meet Client Needs. 2016. Available online: https://books.google.co.za/books?id=R7SdDQAAQBAJ&pg=PA60&lpg=PA60&dq=Descriptive+statistics+is+the+term+given+to+the+analysis+of+data+that+helps+describe,+show+or+summarize+data+in+a+meaningful+way+such+that,+for+example,+patterns+might+emerge+from+the+data&source=bl&ots=WqVASwZaaq&sig=sOncjnLpdb_CQqRrisx3dm5ElQM&hl=en&sa=X&ved=0ahUKEwiIqPPtlcXRAhUKI8AKHeLVBNkQ6AEIXTAO#v=onepage&q=Descriptive%20statistics%20is%20the%20term%20given%20to%20the%20analysis%20of%20data%20that%20helps%20describe%2C%20show%20or%20summarize%20data%20in%20a%20meaningful%20way%20such%20that%2C%20for%20example%2C%20patterns%20might%20emerge%20from%20the%20data&f=false (accessed on 12 September 2015).

- Slade, M.E.; Thille, H. Whither Hotelling: Tests of the Theory of Exhaustible Resources. Ann. Rev. Resour. Econ. 2009, 1, 239–260. [Google Scholar] [CrossRef]

- De Jong, R. The Econometrics of the Hodrick-Prescott Filter. Rev. Econ. Stat. 2016, 98, 310–317. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Shin, Y.; Smith, R. Bounds Testing Approaches to the Analysis of Level Relationships. J. Appl. Econom. 2001, 16, 289–326. [Google Scholar] [CrossRef]

- Gujarati, D. Basic Econometrics; McGraw-Hill Education: New York, NY, USA, 2004. [Google Scholar]

- Pesaran, M.H.; Shin, Y. An Autoregressive Distributed Lag Modelling Approach to Cointegration Analysis. In Econometrics and Economic Theory in the 20th Century: The Ragnar Frisch Centennial Symposium; Strom, S., Ed.; Cambridge University Press: Cambridge, UK, 1999. [Google Scholar]

- Ghosh, D.; Levin, J.; Macmillan, P.; Wright, E. Gold as an inflation hedge? Stud. Econ. Finan. 2004, 16, 1–25. [Google Scholar] [CrossRef] [Green Version]

- Pindyck, R.S. The Optimal Exploration and Production of Nonrenewable Resources. J. Political Econ. 1978, 86, 841–861. [Google Scholar] [CrossRef]

- Cuddington, J.T.; Nülle, G. Variable long-term trends in mineral prices: The ongoing tug-of-war between exploration, depletion, and technological change. J. Int. Money Financ. 2014, 42, 224–252. [Google Scholar] [CrossRef]

- Neumayer, E. Scarce or abundant? The economics of natural resource availability. J. Econ. Surv. 2000, 14, 307–335. [Google Scholar] [CrossRef]

- Ahrens, W.A.; Sharma, V.R. ‘Trends in natural resource commodity prices: Deterministic or stochastic?’. J. Environ. Econ. Manag. 1997, 33, 59–74. [Google Scholar] [CrossRef]

- Scott, A.; Peter, P. Natural Resources in a high-tech Economy: Scarcity Versus Resourcefulness. Resour. Policy 1992, 8, 154–166. [Google Scholar] [CrossRef]

- Simon, J.L. The Ultimate Resource 2; Princeton University Press: Princeton, NJ, USA, 1996. [Google Scholar]

- Mudd, G.M. The Sustainability of Mining in Australia: Key Production Trends and their Environmental Implications for the Future. Res. Rep. 2009, 35, 98–115. [Google Scholar] [CrossRef]

- Reynolds, D.B. The mineral economy: How prices and costs can falsely signal decreasing scarcity. Ecol. Econ. 1999, 31, 155–166. [Google Scholar] [CrossRef]

- Dasgupta, P.; Heal, G. The Optimal Depletion of Exhaustible Resources. Rev. Econ. Stud. Sympos. 1974, 40, 3–28. [Google Scholar] [CrossRef]

- Bahmani-Oskooee, M.; Wang, Y. Impact of Exchange Rate Uncertainty on Commodity Trade between the US and Australia. J. Compil. 2008, 47, 235–258. [Google Scholar] [CrossRef]

| T Statistic | Value | K |

|---|---|---|

| F Statistic | 4.8523 | 2 |

| Critical value bounds | ||

| Significance | I(0) Bound | I(1) Bound |

| 10% | 2.1 | 3.13 |

| 5% | 2.43 | 3.54 |

| 2.5% | 2.74 | 3.61 |

| 1% | 3.12 | 4.54 |

| Variable | Coefficient | Standard Error | t-Statistic | p-Value |

|---|---|---|---|---|

| GP | 0.217066 | 0.028445 | 7.631162 | 0.0000 |

| INT | 0.303575 | 0.466545 | 0.650688 | 0.5168 |

| LM3 | −0.048382 | 0.008921 | −5.423479 | 0.0000 |

| LPG | 0.108165 | 0.017013 | 6.357574 | 0.0000 |

| LGDP | 0.162778 | 0.078210 | 2.081287 | 0.0401 |

| Variable | Coefficient | Standard Error | t-Statistic | p-Value |

|---|---|---|---|---|

| ECM | −0.037720 | 0.01951 | −1.93306 | 0.0593 |

| D(INT) | −0.022048 | 0.00713 | −0.00402 | 0.6871 |

| D(LM3) | 0.000338 | 0.00010 | 3.38427 | 0.0001 |

| D(LPG) | −0.000187 | 9.88105 | −1.89788 | 0.0824 |

| D(LGDP) | −0.000287 | 0.00012 | −2.29532 | 0.0321 |

| Heteroskedasticity Test | ||

|---|---|---|

| Chi-Sq | Df | Prob |

| 183.2053 | 180 | 0.4196 |

| Breusch-Godfrey Serial Correlation LM Test | |||

|---|---|---|---|

| F Statistic | 0.008002 | Prob.F | 0.9303 |

| Obs * R Squared | 0.025443 | Prob.Chi-Squared | 0.8733 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mlambo, C. Non-Renewable Resources and Sustainable Resource Extraction: An Empirical Test of the Hotelling Rule’s Significance to Gold Extraction in South Africa. Sustainability 2022, 14, 10619. https://doi.org/10.3390/su141710619

Mlambo C. Non-Renewable Resources and Sustainable Resource Extraction: An Empirical Test of the Hotelling Rule’s Significance to Gold Extraction in South Africa. Sustainability. 2022; 14(17):10619. https://doi.org/10.3390/su141710619

Chicago/Turabian StyleMlambo, Courage. 2022. "Non-Renewable Resources and Sustainable Resource Extraction: An Empirical Test of the Hotelling Rule’s Significance to Gold Extraction in South Africa" Sustainability 14, no. 17: 10619. https://doi.org/10.3390/su141710619