Fiscal Policy Effects on Private Expenditure for Sustainable Economic Growth: A Panel VAR Study from Selected Developing Countries

Abstract

1. Introduction

2. Literature Review

3. Some Trends in Developing Countries

4. Methodology

4.1. Data

4.2. The Specification Panel Var (PVAR) Model

5. Empirical Results

5.1. Estimation of Coefficients

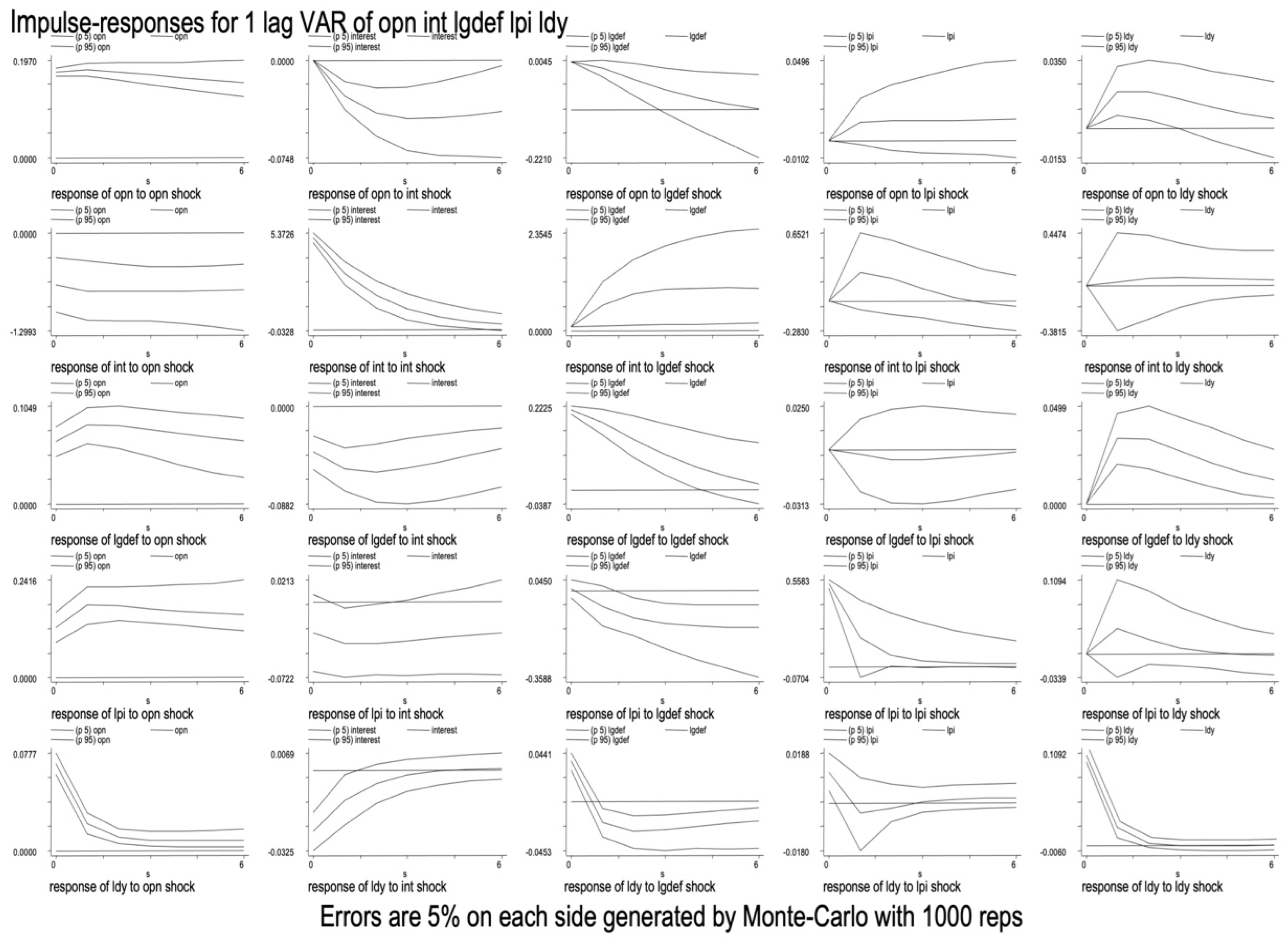

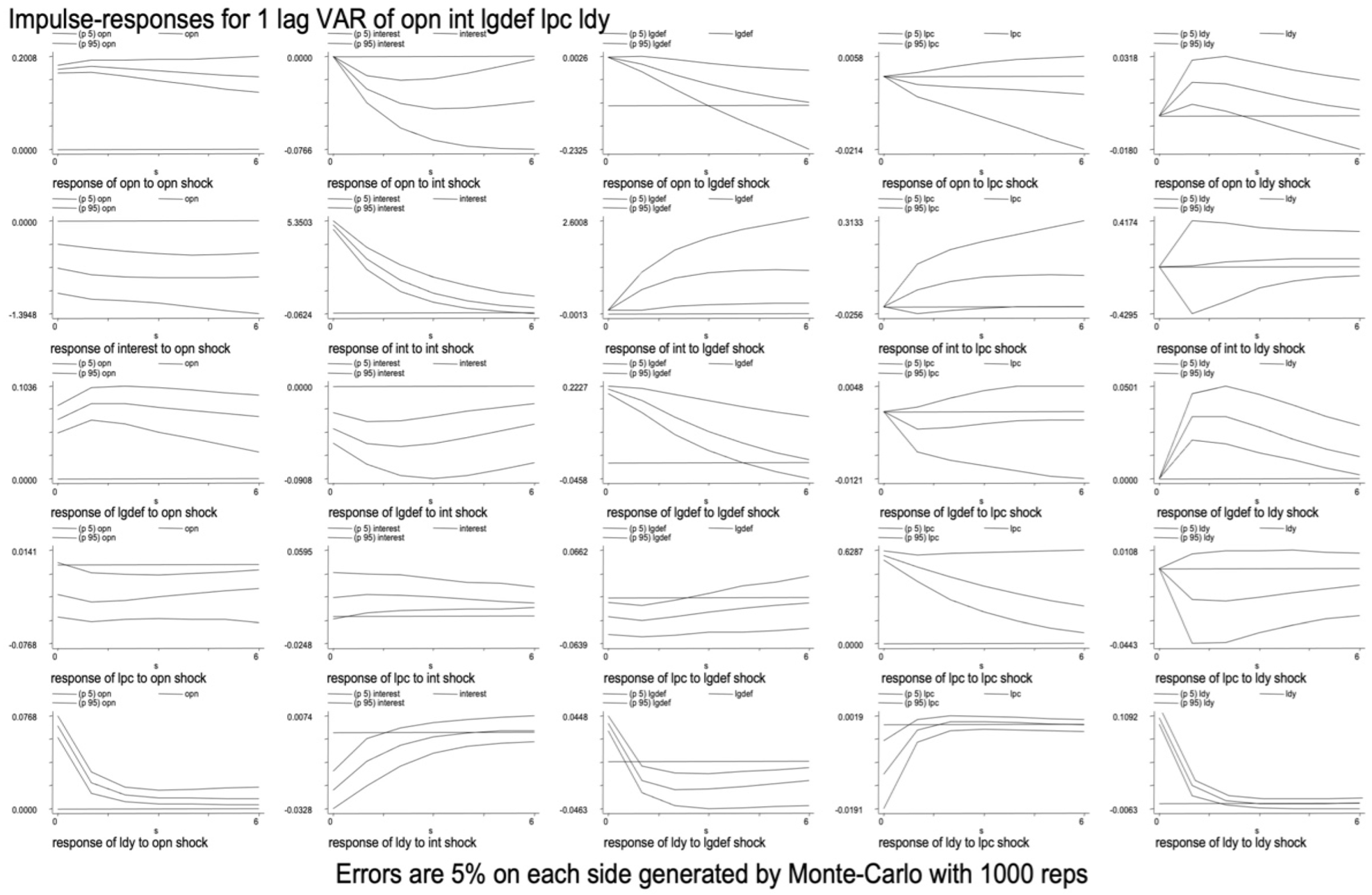

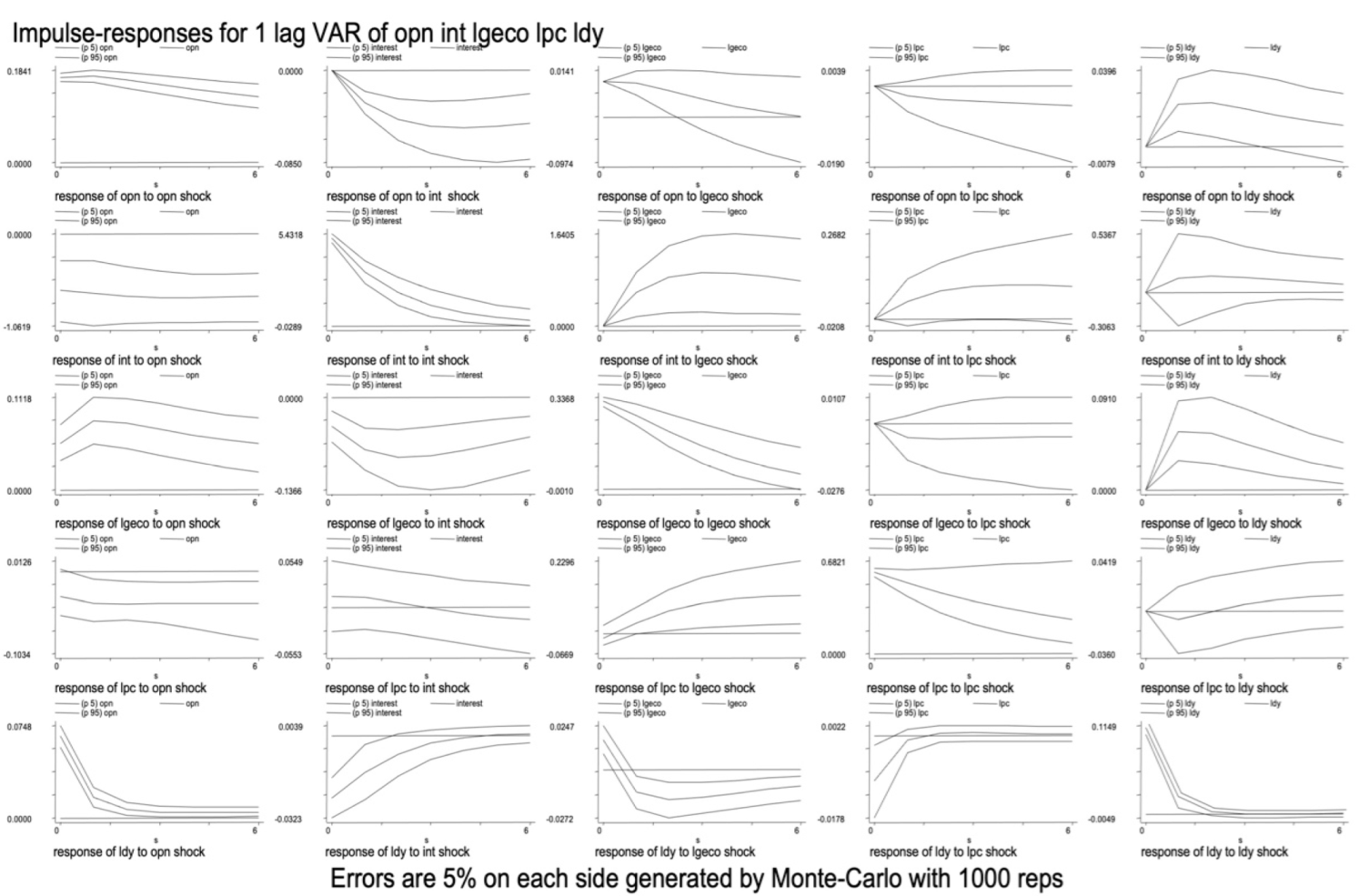

5.2. Impulse Response Function

5.3. The Disaggregated Government Expenditure on Private Investment and Macroeconomic Variables

5.3.1. Defense Expenditure

5.3.2. Economic Expenditure

5.3.3. Social Expenditure

5.4. The Disaggregated Government Expenditure on Private Consumption and Macroeconomic Variables

5.4.1. Defense Expenditure

5.4.2. Economic Expenditure

5.4.3. Social Expenditure

5.5. Variance Decomposition

5.5.1. Variance Decompositions for Disaggregated Government Expenditure on Private Investment

5.5.2. Variance Decompositions for Disaggregated Government Expenditure on Private Consumption

6. Robustness Checking

Model without Monetary Policy

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| No | Country | No | Country |

|---|---|---|---|

| 1 | Afghanistan | 31 | Lithuania |

| 2 | Albina | 32 | Madagascar |

| 3 | Bangladesh | 33 | Malaysia |

| 4 | Belarus | 34 | Mexico |

| 5 | Belize | 35 | Moldova |

| 6 | Bolivia | 36 | Mongolia |

| 7 | Bostwana | 37 | Morocco |

| 8 | Bulgaria | 38 | Myanmar |

| 9 | Burundi | 39 | Namibia |

| 10 | Cambodia | 40 | Nepal |

| 11 | Cameroon | 41 | Pakistan |

| 12 | Chile | 42 | Panama |

| 13 | China | 43 | Papua |

| 14 | Colombia | 44 | Filipina |

| 15 | Egypt | 45 | Romania |

| 16 | El-savador | 46 | Rusia |

| 17 | Ethopia | 47 | Seychelles |

| 18 | Fiji | 48 | Sri Lanka |

| 19 | Georgia | 49 | Syria |

| 20 | Ghana | 50 | Tajikistan |

| 21 | Guatemala | 51 | Thailand |

| 22 | India | 52 | Tunisia |

| 23 | Indonesia | 53 | Uganda |

| 24 | Iran | 54 | Ukraine |

| 25 | Jamaica | 55 | Uruguay |

| 26 | Jordon | 56 | Vanuatu |

| 27 | Kenya | 57 | Venezuela |

| 28 | Kyrgyz | 58 | Vietnam |

| 29 | Latvia | 59 | Yemen |

| 30 | Lebanon | 60 | Zambia |

| Variables | Sources |

|---|---|

| Defense Expenditure | Government Financial Statistics (GFS), IMF and Key Indicators for Asia and the Pacific 2021, Asian Development Bank |

| Economic Expenditure | Government Financial Statistics (GFS), IMF |

| Social Expenditure | Government Financial Statistics (GFS), IMF |

| Trade Opennes | Calculation for Trade Openness: |

| Interest Rate | International Financial Statistics (IFS), IMF |

| National Income | International Financial Statistics (IFS), IMF and World Development Indicators |

| Private Investment | International Financial Statistics (IFS), IMF and World Development Indicators |

| Private Consumption | International Financial Statistics (IFS), IMF and World Development Indicators |

References

- Aschauer, D.A. Fiscal policy and aggregate demand. Am. Econ. Rev. 1985, 75, 117–128. [Google Scholar]

- Monadjemi, M.S. Fiscal policy and private investment expenditure: A study of Australia and the United States. Appl. Econ. 1993, 25, 143–148. [Google Scholar] [CrossRef]

- Aschauer, D.A. Does public capital crowd out private capital? J. Monet. Econ. 1989, 24, 171–188. [Google Scholar] [CrossRef]

- Erenburg, S.J.; Wohar, M.E. Public and private investment: Are there causal lingkage? J. Macroecon. 1995, 17, 1–30. [Google Scholar] [CrossRef]

- Bairam, E.; Ward, B. The externality effect of government expenditure on investment in OECD countries. Appl. Econ. 1993, 25, 711–716. [Google Scholar] [CrossRef]

- Karras, G. Government Spending and Private Consumption: Some International Evidence. J. Money Credit Bank. 1994, 26, 9. [Google Scholar] [CrossRef]

- Erenburg, S.J. The real effects of public investment on private investment: A rational expectations model. Appl. Econ. 1993, 25, 831–837. [Google Scholar] [CrossRef]

- Argimon, I.; Gonzalez-Paramo, J.M.; Roldan, J.M. Evidence of public spending crowding-out from a panel of OECD countries. Appl. Econ. 1997, 29, 1001–1010. [Google Scholar] [CrossRef]

- Sie, S.J.; Kueh, J.; Abdullah, M.A.; Mohamad, A.A. Impact of public spending on private investment in Malaysia: Crowding-in or crowding-out effect. Glob. Bus. Manag. Res. Int. J. 2021, 13, 28–34. [Google Scholar]

- Hussain, A.; Muhammad, S.D.; Akram, K.; Lal, I. Effectiveness of government expenditure crowding-in or crowding-out: Empirical evidence in case of Pakistan. Eur. J. Econ. Financ. Adm. Sci. 2009, 16, 136–142. [Google Scholar]

- Heppke-Falk, K.; Tenhofen, J.; Wolff, G. The macroeconomic effects of exogenous fiscal policy shocks in Germany: A disaggregated SVAR analysis. In Deutsche Bundesbank Discussion Paper; 2006; Available online: https://dx.doi.org/10.2139/ssrn.2785268 (accessed on 1 May 2022).

- Gali, J.; Lopez-Salido, J.D.; Valles, J. Understanding the effects of government spending on consumption. J. Eur. Econ. Assoc. 2007, 5, 227–270. [Google Scholar] [CrossRef]

- Afonso, A.; Sousa, R.M. The macroeconomic effects of fiscal policy in Portugal: A Bayesian SVAR analysis. Port. Econ. J. 2011, 10, 61–82. [Google Scholar] [CrossRef]

- Afonso, A.; Sousa, R.M. The macroeconomic effects of fiscal policy. Appl. Econ. 2011, 44, 4439–4454. [Google Scholar] [CrossRef]

- Yadav, S.; Upadhyay, V.; Sharma, S. Impact of fiscal policy shocks on the Indian economy. J. Appl. Econ. Res. 2012, 6, 415–444. [Google Scholar] [CrossRef][Green Version]

- Wang, T.-P.; Shyu, S.H.-P.; Chou, H.-C. The impact of defense expenditure on economic productivity in OECD countries. Econ. Model. 2012, 29, 2104–2114. [Google Scholar] [CrossRef]

- Laopodis, N.T. Effects of government spending on private investment. Appl. Econ. 2001, 33, 1563–1577. [Google Scholar] [CrossRef]

- Miller, S.M.; Russek, F.S. Fiscal structure and economic growth. Econ. Inq. 1997, 35, 603–613. [Google Scholar] [CrossRef]

- Mahmoudzadeh, M.; Sadeghi, S.; Sadeghi, S. Fiscal spending and crowding out effect: A comparison between developed and developing countries. Inst. Econ. 2013, 5, 31–40. [Google Scholar]

- Ahmed, H.; Miller, S.M. Crowding-out and crowding-in effects of the components of government expenditure. Contemp. Econ. Policy 2000, 18, 124–133. [Google Scholar] [CrossRef]

- Wang, B. Effects of government expenditure on private investment: Canadian empirical evidence. Empir. Econ. 2005, 30, 493–504. [Google Scholar] [CrossRef]

- Barro, R. Government Spending in a Simple Model of Endogenous Growth. J. Political Econ. 1990, 998, S103–S125. [Google Scholar] [CrossRef]

- Serven, L. Does Public Capital Crowd Out Private Capital? Evidence from India; Working Paper; The World Bank: Washington, DC, USA, 1996. [Google Scholar]

- Xu, X.; Yan, Y. Does government investment crowd out private investment in China? J. Econ. Policy Reform 2014, 17, 1–12. [Google Scholar] [CrossRef]

- Asri, N.M.; Tahir, M.Z.M.; Endut, W. Komposisi perbelanjaan kerajaan dan pertumbuhan ekonomi: Kajian empirikal di Malaysia. J. Kemanus. 2010, 8, 23–45. [Google Scholar]

- Ismail, N.A.; Ismail, A.G.; Osman, Z. Dasar fiskal dan asakan keluar mengikut sub-sektor perbelanjaan kerajaan di Malaysia. J. Kemanus. 2011, 9, 1–16. [Google Scholar]

- Bernanke, B.S.; Blinder, A.S. The federal funds rate and the channels of monetary transmission. Am. Econ. Rev. 1992, 82, 901–921. [Google Scholar]

- Bernanke, B.S.; Minhov, I. The liquidity effect and long-run neutrality. In Carnegie-Rochester Conference Series on Public Policy; North-Holland: Amsterdam, The Netherlands, 1998; pp. 49–100. [Google Scholar]

- Christiano, L.J.; Eichenbaum, M.; Evans, C. Chapter 2 Monetary policy shocks: What have we learned and what end? In Handbook of Macroeconomics; North-Holland: Amsterdam, The Netherlands, 1999; Volume 1, pp. 65–148. [Google Scholar]

- Rodrik, J. Why do more open economies have bigger governments? J. Polit. Econ. 1998, 106, 997–1032. [Google Scholar] [CrossRef]

- Levine, R.; Renelt, D. A sensitivity analysis of cross-country Growth Regression. Am. Econ. Rev. 1992, 82, 942–963. [Google Scholar]

- Love, I.; Zicchino, L. Financial development and dynamic investment behaviour: Evidence from panel VAR. Q. Rev. Econ. Finance 2006, 46, 190–210. [Google Scholar] [CrossRef]

- Malizard, J. Does military expenditure crowd out private investment? A disaggregated perspective for the case of France. Econ. Model. 2015, 46, 44–52. [Google Scholar] [CrossRef]

- Marattin, L.; Salotti, S. On the usefulness of government spending in the EU area. J. Socio-Econ. 2011, 40, 780–795. [Google Scholar] [CrossRef][Green Version]

| Response of | Response to | ||||

| OPN | INT | LGDEF | LPI | LDY | |

| Panel A: Defense expenditure | |||||

| OPN | 1.168 (5.00) * | −0.034 (−0.751) * | −0.123 (−1.24) * | 0.025 (0.10) | 0.404 (1.68) ** |

| INT | −7.801 (−1.65) * | 0.222 (1.18) * | 0.031 (0.02) *** | 6.177 (1.35) | 8.380 (1.53) |

| LGDEF | 0.041 (0.32) | 0.004 (0.190) *** | 0.891 (12.76) * | −0.011 (−0.11) | 0.109 (0.71) * |

| LPI | 0.082 (0.53) * | −0.004 (−1.43) | −0.385 (−0.53) ** | 0.934 (5.71) | 0.209 (1.27) |

| LDY | 0.491 (1.88) * | −0.007 (−1.31) ** | −0.164 (−1.47) * | −0.103 (−0.39) | 0.045 (0.02) * |

| OPN | INT | LGECO | LPI | LDY | |

| Panel B: Economic expenditure | |||||

| OPN | 1.268 (3.77) * | −0.005 (−0.83) * | −0.115 (−1.17) | 0.138 (0.04) | 0.540 (1.42) * |

| INT | −6.904 (−1.27) * | 0.247 (1.34) * | 0.550 (0.34) ** | 5.141 (0.97) | 6.501 (1.01) |

| LGECO | 0.384 (0.93) | 0.012 (1.47) *** | 0.876 (7.08) * | 0.355 (0.95) *** | 0.540 (1.06) * |

| LPI | 0.142 (0.65) * | −0.003 (−0.73) | −0.020 (−0.32) | 0.870 (3.89) | 0.308 (1.26) |

| LDY | 0.642 (1.57) ** | −0.109 (−1.26) *** | −0.131 (−1.02) * | −0.262 (−0.65) | 0.248 (0.53) * |

| OPN | INT | LGSOC | LPI | LDY | |

| Panel C: Social expenditure | |||||

| OPN | 1.245 (3.78) * | −0.004 (−0.78) * | −0.148 (−1.35) | 0.129 (0.37) | 0.409 (1.27) * |

| INT | −7.382 (−1.24) * | 0.241 (1.26) * | 0.937 (0.509) ** | 5.738 (0.96) | 6.407 (0.98) |

| LGSOC | 0.022 (0.13) | 0.001 (0.48) | 0.914 (1.64) * | 0.013 (0.09) *** | 0.064 (0.34) * |

| LPI | 0.108 (0.51) * | −0.003 (−0.93) | −0.043 (0.59) ** | 0.898 (3.95) | 0.212 (0.99) |

| LDY | 0.632 (1.58) * | −0.010 (−1.23) | −0.176 (−1.29) * | 0.273 (0.67) | 0.110 (0.26) * |

| Response of | Response to | ||||

| OPN | INT | LGDEF | LPC | LDY | |

| Panel A: Defense expenditure | |||||

| OPN | 1.208 (6.27) * | −0.004 (−0.91) * | −0.178 (−1.16) ** | −0.082 (−0.38) | 0.562 (4.49) ** |

| INT | −5.031 (−1.60) * | 0.255 (1.55) * | 0.575 (0.28) *** | 6.667 (1.70) ** | 1.185 (0.52) |

| LGDEF | 0.032 (0.29) | 0.007 (0.33) *** | 0. 894 (9.58) * | 0.027 (2.54) | 0.111 (0.76) * |

| LPC | 0.152 (1.33) | 0.002 (0.09) | −0.032 (−0.36) | 0.786 (5.66) * | −0.193 (−1.84) |

| LDY | 0.514 (2.45) * | −0.008 (−1.49) ** | −0.238 (−1.36) * | −0.057 (−0.22) | 0.148 (1.01) * |

| OPN | INT | LGECO | LPC | LDY | |

| Panel B: Economic expenditure | |||||

| OPN | 1.257 (5.67) * | −0.005 (−1.06) * | −0.144 (−1.21) | 0.085 (0.27) | 0.538 (4.73) * |

| INT | −4.515 (−1.36) * | 0.279 (1.71) * | 0.299 (0.19) * | 4.734 (1.06) ** | 0.974 (0.47) |

| LGECO | 0.201 (0.98) | 0.009 (1.91) ** | 0.840 (7.55) * | 0.377 (1.20) * | 0.773 (0.69) * |

| LPC | −0.162 (−1.22) *** | 0.008 (0.26) | 0.005 (0.08) *** | 0.723 (3.79) * | 0.189 (1.95) |

| LDY | 0.574 (2.34) * | −0.011 (−1.58) *** | −0.154 (−1.06) * | 0.193 (0.59) | 0.118 (0.83) * |

| OPN | INT | LGSOC | LPC | LDY | |

| Panel C: Social expenditure | |||||

| OPN | 1.34 (4.14) * | −0.007 (−0.95) * | −0.272 (−1.42) | 0.048 (0.13) | 0.677 (3.07) * |

| INT | −5.375 (−1.26) * | 0.259 (1.46) * | 0.753 (0.33) ** | 4.964 (1.01) | 2.231 (0.67) |

| LGSOC | 0.086 (0.68) | 0.002 (0.93) | 0.964 (1.24) * | 0.051 (0.35) | 0.202 (1.81) * |

| LPC | 0.169 (1.02) | −0.007 (−0.18) | −0.042 (−0.42) | 0.782 (4.44) * | −0.211 (−1.46) |

| LDY | 0.687 (1.93) * | −0.012 (−1.40) | −0.309 (−1.32) * | 0.053 (0.13) | 0.306 (1.22) * |

| OPN | INT | LGDEF | LPI | LDY | |

|---|---|---|---|---|---|

| Panel A: Defense expenditure | |||||

| OPN | 0.813 | 0.001 | 0.187 | 0.017 | 0.149 |

| INT | 0.008 | 0.827 | 0.077 | 0.048 | 0.038 |

| LGDEF | 0.017 | 0.030 | 0.950 | 0.009 | 0.009 |

| LPI | 0.032 | 0.062 | 0.054 | 0.800 | 0.008 |

| LDY | 0.013 | 0.463 | 0.056 | 0.559 | 0.325 |

| OPN | INT | LGECO | LPI | LDY | |

| Panel B: Economic expenditure | |||||

| OPN | 0.811 | 0.0002 | 0.049 | 0.002 | 0.136 |

| INT | 0.003 | 0.797 | 0.047 | 0.098 | 0.055 |

| LGECO | 0.013 | 0.033 | 0.938 | 0.011 | 0.005 |

| LPI | 0.042 | 0.059 | 0.095 | 0.743 | 0.061 |

| LDY | 0.020 | 0.057 | 0.064 | 0.506 | 0.351 |

| OPN | INT | LGSOC | LPI | LDY | |

| Panel C: Social expenditure | |||||

| OPN | 0.809 | 0.002 | 0.032 | 0.014 | 0.143 |

| INT | 0.004 | 0.854 | 0.028 | 0.067 | 0.046 |

| LGSOC | 0.030 | 0.004 | 0.909 | 0.0822 | 0.001 |

| LPI | 0.031 | 0.050 | 0.095 | 0.756 | 0.067 |

| LDY | 0.020 | 0.047 | 0.086 | 0.454 | 0.393 |

| OPN | INT | LGDEF | LPC | LDY | |

|---|---|---|---|---|---|

| Panel A: Defense expenditure | |||||

| OPN | 0.778 | 0.006 | 0.070 | 0.147 | 0.004 |

| INT | 0.026 | 0.785 | 0.069 | 0.060 | 0.061 |

| LGDEF | 0.013 | 0.027 | 0.946 | 0.006 | 0.013 |

| LPC | 0.013 | 0.042 | 0.087 | 0.839 | 0.019 |

| LDY | 0.043 | 0.019 | 0.063 | 0.458 | 0.417 |

| OPN | INT | LGECO | LPC | LDY | |

| Panel B: Economic expenditure | |||||

| OPN | 0.796 | 0.006 | 0.134 | 0.063 | 0.006 |

| INT | 0.003 | 0.829 | 0.034 | 0.099 | 0.034 |

| LGECO | 0.011 | 0.033 | 0.950 | 0.006 | 0.005 |

| LPC | 0.041 | 0.042 | 0.228 | 0.680 | 0.009 |

| LDY | 0.028 | 0.044 | 0.075 | 0.386 | 0.465 |

| OPN | INT | LGSOC | LPC | LDY | |

| Panel C: Social expenditure | |||||

| OPN | 0.534 | 0.002 | 0.036 | 0.403 | 0.024 |

| INT | 0.035 | 0.817 | 0.052 | 0.062 | 0.033 |

| LGECO | 0.048 | 0.008 | 0.411 | 0.392 | 0.148 |

| LPC | 0.187 | 0.002 | 0.358 | 0.387 | 0.067 |

| LDY | 0.206 | 0.020 | 0.248 | 0.239 | 0.285 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kaharudin, I.H.; Ab-Rahman, M.S. Fiscal Policy Effects on Private Expenditure for Sustainable Economic Growth: A Panel VAR Study from Selected Developing Countries. Sustainability 2022, 14, 10786. https://doi.org/10.3390/su141710786

Kaharudin IH, Ab-Rahman MS. Fiscal Policy Effects on Private Expenditure for Sustainable Economic Growth: A Panel VAR Study from Selected Developing Countries. Sustainability. 2022; 14(17):10786. https://doi.org/10.3390/su141710786

Chicago/Turabian StyleKaharudin, Iszan Hana, and Mohammad Syuhaimi Ab-Rahman. 2022. "Fiscal Policy Effects on Private Expenditure for Sustainable Economic Growth: A Panel VAR Study from Selected Developing Countries" Sustainability 14, no. 17: 10786. https://doi.org/10.3390/su141710786

APA StyleKaharudin, I. H., & Ab-Rahman, M. S. (2022). Fiscal Policy Effects on Private Expenditure for Sustainable Economic Growth: A Panel VAR Study from Selected Developing Countries. Sustainability, 14(17), 10786. https://doi.org/10.3390/su141710786