Abstract

In this paper, waste electrical and electronic equipment (WEEE) is collected both with online and traditional methods in a reverse channel. We obtain a quantity for recycling based on online popularity and reference price by considering their impact on consumer recycling behaviors. On this basis, we build a Stackelberg game model in which the recycling dealer acts as the leader and the recycler acts as the follower in a reverse supply chain. We explore a combination contract comprising a revenue cost-sharing contract and a two-part tariff contract to enhance the performance of the reverse supply chain with a dual channel. The conclusion shows that the reference price degree can alleviate the recycling channel’s conflict in order to improve the operation efficiency of the reverse supply chain. The well-designed coordination mechanism enables the perfect coordination of the entire supply chain system.

1. Introduction

Currently, the rapid growth of the social economy and electronic technology compels the extensive use of electrical and electronic equipment (EEE) [1]. In recent years, the frequent updates and upgrades of recycling treatment types and the quantity of electronic products have become the primary motivation for innovations in recycling treatments [2,3]. According to statistics, China has entered the peak stage of EEE waste scrap. In China, around 50 million household electrical appliances and 70 million mobile phones are abandoned every year. Consequently, the amount of waste electrical and electronic equipment (WEEE) has reached 20% growth, and about 170 million tons of waste is generated each year in China, which is becoming a considerable pollution source. Most WEEEs have not entered the regular recycling channels for recycling and reuse. The Internet has played a crucial role in recycling.

Considering the background of advocating a circular economy, low-carbon economy, and sustainable development, the reverse channel is a growing concern among scientists, businesses, and the public. Some countries have, thus, issued a set of correlative regulations and laws that require enterprises to address the issue of WEEE recycling used by users while selling products for further treatment and reuse to resolve the problem of economic development and resource-shortage conflicts.

With the increasing shortage of global resources and the consumers’ growing awareness for environmental protection, the problem of used-product recycling has aroused widespread concern in industries. Some forward-looking enterprises found that the recycling of waste products can significantly save manufacturing costs and improve the enterprise’s benefits. In particular, Xerox reduces manufacturing costs by 40–65% by recycling and remanufacturing waste products, which dramatically improved financial benefits. Many enterprises, such as Philips, Chrysler, Xerox, and Kodak, establish their own reverse-recycling network to recycle and remanufacture waste products. Many enterprises are involved in remanufacture and collection. However, one of the pressing problems confronting our sustainable society today is the correct design of available reverse channels for recycling.

The concept of a dual-channel supply chain was proposed for the first time in the Journal of Marketing Science. The authors found that the combination of online and offline sales obviously promotes market sales [4]. With the development of Internet technologies, methods in product sales, consumption, and recycling have changed greatly, and the online channel has gradually become a force that cannot be ignored. At the same time, the wide application of Internet technologies in the supply chain has given birth to a new recycling mode. The Internet platform can effectively improve the convenience and transparency of transactions in the process of recycling waste products. Using an online recycling channel is a process in which recycling enterprises, consumers, and other participants conduct a series of transactions on waste products using Internet technology [5]. With the popularity of the Internet, there are more and more dual channels for recycling waste products, with the online channel being more prevalent. Some companies acting as recyclable dealers (RDs) previously collected WEEEs in the traditional recycling channel, such as Shanghai Xin Jinqiao Environmental Protection Company Limited and Changhong Green Group Company Limited, and they have began to collect WEEEs by utilizing an online recycling channel. These companies’ recycling programs create a new pattern for the effective utilization of resources and environmental sustainability.

With the vigorous development of e-commerce, comparing prices between online and offline methods has become a typical consumer behavior. In this paper, we consider the online popularity and reference price in strategic consumer behaviors and build a Stackelberg game model in which the recyclable dealer acts as the leader and the recyclers act as followers in a reverse supply chain. We propose an appropriate coordination mechanism to promote the collection of WEEEs and examine how online popularity and reference price degree affect the supply-chain members’ strategy.

This paper is organized as follows. We outline the related literature in Section 2. Then, we describe a reverse supply chain with a dual collection channel and build analytical models. Next, sensitivity analyses and numerical results are presented in Section 4. After that, we detail the coordination of a dual-channel reverse supply chain and include a discussion based on the results in Section 5. Finally, we provide concluding remarks in Section 6.

2. Literature Review

There are three streams of relevant work: channel competition, channel management, and channel coordination.

Recently, there has been a growing number of papers focused on channel management. Many researchers have researched different recycling-channel choice strategies on recycling price [6,7,8]. Savaskan et al. studied a model of a two-level supply chain and provided theoretical references for manufacturers by comparing three different channel structures. They further studied different recovery cost structures and established recovery strategies for reverse supply chains [9]. Chuang et al. studied and compared three types of reverse channel structures to provide the theoretical basis for manufacturers by comparing three different circumstances [10]. Jena et al. studied price competition and coordination strategies in different situations for a closed-loop supply chain [11]. Liu et al. pioneered a study on both online and offline channels to investigate the optimal price-acquisition strategy for dual channels [12]. Likewise, some papers explored a multi-echelon closed-loop supply chain and investigated the problem of coordination mechanisms [13,14,15]. Xiong and Yan suggested that the sale of remanufactured goods is influenced by a channel’s structure [16]. In addition, some papers researched the influence of various factors in a closed-loop supply chain [17,18,19,20,21,22].

Zou [23] further emphasized that environmental friendliness and convenient and safe recycling services are significant characteristics of an online recycling channel. In research studies with respect to dual-channel reverse supply chains, most scholars focus on channel selection and contract coordination. Some scholars found that the dual recycling channel has an advantage over single recycling channels in promoting the recovery of waste products and improving recovery efficiencies [24]. Wu [25] found that income cost-sharing contracts, income-sharing contracts, cost-sharing contracts, and other contracts can effectively reduce efficiency loss and achieve supply-chain coordination. The recycling price of online recycling channels is generally higher than that of offline channels. The main reason is that, on the one hand, recycling enterprises in online channels directly deal with consumers so as to avoid a situation in which offline recyclers earn the intermediate price difference; on the other hand, the recycling center can scientifically price the electronic waste products based on equipment conditions, such as the use time, standby status, and wear degree, reducing the occurrence of excessive prices in offline channels [26]. Chen et al. [27] studied the pricing strategy of closed-loop supply chains in which retailers are responsible for recycling processes and manufacturers are responsible for remanufacturing processes. Zhang et al. [28] studied the impact of consumers’ environmental protection preferences and retailers’ fair preferences on enterprise pricing decisions for a supply chain, including the examination of one manufacturer and one retailer. Mr A. et al. constructed four models to study pricing, return policies, and return insurance strategies [29].

Other papers have made outstanding contributions to the practice of green supply-chain management, reverse logistics, and green procurement, manufacturing, and distribution. Likewise, Ismail [30] explored the effect of green supply-chain management practices, reverse logistics, and green procurement, manufacturing, and distribution practices (GSCMPs) with respect to the organisational performance (OP) of pharmaceutical manufacturers in Jordan.

As far as we know, all of these papers only pay attention to traditional recycling channels within a single recycling channel and not on the hybrid reverse dual-channel supply chain. We mainly examine the problem of hybrid recycling channels.

In addition, the coordination of the reverse supply chain, an important and emerging topic, has attracted exploration from different perspectives. Under this research category, further extended retailer pricing competition and reverse channel choice problems are presented in Savaskan and Wassenhove [6]. More details about hybrid-channel reverse supply chains are discussed in [31,32,33]. The most relevant papers pay attention to the strategic analysis of the design of dual-channel recycling systems. Some research on reverse supply chains mainly focused on marketing strategies and government subsidies in reverse supply-chain coordination [34]. Notice that, in the literature, some use appropriate contracts. In this manner, some contracts can also coordinate reverse supply chains as forward supply chains [35,36]. These papers pay attention to reverse supply chains with a single channel. There is some research involving a combination of some contracts with respect to multi-channels [37,38,39,40].

Based on most studies, the effect of price comparisons is commonly used in the consideration of forward supply chains [41,42,43,44,45,46,47,48]. Unlike previous studies, this article focuses on addressing the coordination of the reverse supply chain by considering both the effect of reference prices [49,50] and online popularity with a recycling price-dependent recycling quantity.

The new generation of consumers with multiple mobile devices can compare recycling prices between online and offline recycling channels at any time when faced with different recycling channel options. When the actual recycling price exceeds the reference recycling price, consumers’ recycling willingness will be strengthened. Under these circumstances, the consumer experiences benefits when collecting waste products. When the reference recycling price exceeds the actual recycling price, the situation is the opposite.

The main objective of this paper is to address the following questions: Considering the new changes in consumers’ recycling decisions in a dual-channel environment, how will the reference-price effect and online popularity affect changes in recycling quantities and channel configuration strategies in different channels? How can we achieve reasonable pricing differences between different channels? How can recyclable dealers design coordination mechanisms to maximize their profits? The discussion of the above issues will refer to decision-making methods for the effective management of reverse supply chains with dual channels.

3. Analytical Models

3.1. Problem Description

Similarly to the existing literature such as Lipan et al. [51] but with some differences, in our paper, we incorporate the reference-price effect into strategic consumer recycling behaviors. The new generation of consumers, using multiple mobile devices, can compare recycling prices between online and offline recycling channels at any time when faced with different recycling channel options. When the actual recycling price exceeds the reference recycling price, consumers’ recycling willingness will be strengthened. Under these circumstances, the consumer experiences benefits when collecting waste products. When the reference recycling price exceeds the actual recycling price, the situation is the opposite. Thus, the reference price can affect consumers’ recycling behaviors.

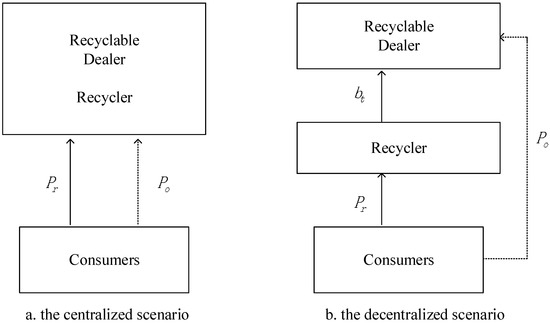

This paper studies a reverse supply chain with a dual channel comprising one recycler and one recyclable dealer, and the recycling quantity is necessarily affected by many factors such as reference price and consumers’ preference between online and offline recycling channels (see Figure 1). In this paper, the recyclable dealer abbreviated as “RD”. Note that “RD” represents the recyclable dealer in the following sections. Hence, our model is more practical by considering the impacts of reference prices and consumer preferences. There are three actions among them: (1) First, the RD, as the recycling center, settles the recycling price ; (2) then, the RD settles the transfer price for the recycler; (3) finally, the recycler needs to address and collect WEEES from consumers at recycling pricing . Under centralized and decentralized settings, we first construct a Stackelberg model consisting of one RD with an online recycling channel and one recycler with a traditional channel. Next, we research the optimal recycling decisions of a recycler and RD under a decentralized case. In addition, the centralized model is set up as the benchmark case for comparisons with the decentralized model in which a dominant RD determines both optimal recycling prices and transfers collection-price decisions. We also analyzed the effects of reference price and consumer preference parameters on the equilibrium outcomes of decentralized cases. Finally, the centralized case acts as a standard in the following, which aims to coordinate the reverse supply chain with a dual-channel and enables both the recycler and RD to attain a win–win situation.

Figure 1.

Dual-channel reverse supply chain.

We study a dual-channel reverse supply chain, where a Stackelberg RD collects waste products using a traditional recycler at a transfer price indirectly and an online recycling channel directly. First, we present the symbols (see Table 1) used in the rest of the article. In this paper, the RD takes charge of building offline and online recycling channels. Meanwhile, RDs are responsible for recycling using an online channel and for the disposal of used products to make a profit. We set up the following modelling assumptions to achieve the primary target.

Table 1.

Model parameters.

In this section, we introduce the notation used in the following table:

3.2. Basic Assumption

We consider the RD as a Stackelberg leader, and it has strong influences in determining recycling quantities and transferring prices. This means that there are two recycling channels for waste-product recycling: One is collected by RD from a recycler indirectly, and the other one is directly collected by an online recycling channel. Then, the used products can be returned from consumers to the RD through these recycling channels. Simultaneously, RDs take charge of collecting and disposing scrap products to make a profit. To develop the proposed model, we provide the following modelling hypothesis.

The RDs have technical superiority in inspections, processing, and shifts in the collection process; thus, they do not need to pay costs in terms of seeking, awaiting, and logistics. Therefore, for the RD, the cost of collecting one unit of second-hand product through online recycling channels is lower than that of offline recycling channels during the collection process. Thus, we have .

In this paper, represents the consumer popularity of the online recycling method, which satisfies . If , all consumers generally tend to choose the online channel to return waste products instead of the offline channel. Online recycling currently plays a leading role in the recycling channel because it improves consumer utility. The problem observed during the coordination operation of dual recycling channels is the focus of our research; thus, the feasibility of traditional recycling channels should be maintained. Therefore, our paper mainly concentrates on the case where is assumed. The smaller the , the greater the consumer popularity of the online recycling method. Stated differently, the smaller the value of , the more the consumer will choose an online channel to return the old product. That is to say that the recycler/RD will lower the recycling price if the consumer popularity of the online recycling is greater. On the contrary, if the value of is larger, the consumer’s popularity of the online channel will be lower and consumers will more likely choose traditional recycling channels.

When customers return a product from a traditional recycling channel, the recycler can physically inspect the used product and obtain it immediately; thus, the used product in the consumer’s psychological value is worth , where . However, the used product is worth , when it is recycle through an online channel due to the lack of detailed physical inspections. We also have to consider the effect of reference prices: and represent the influence of the reference price’s effect on traditional and online recycling methods, respectively, and denotes the reference price’s effect degree. When the recycling price of the channel chosen by the consumer is higher than that of the unchosen one, consumers will perceive “acquisition”; on the contrary, consumers will perceive “loss” in the opposing case. In daily life, a consumer chooses traditional recycling channels as a pairing with consumer utility; that is, the recycler sets price for one unit of second-hand product for the consumer; thus, the consumers will prefer to turn obsolete products by using the offline channel, if the utility they derive from it is positive (). As mentioned above, we consider heterogeneous consumers with a willingness-to-return .

We use and to denote the utilities of the consumers in the online recycling channel and offline recycling channel, respectively, when collecting obsolete products. Based on the above description, customer utility is defined by and . Specifically, if the consumer’s willingness to return belongs to , consumers will prefer to return scrap products using an offline channel at a price .

To simplify the analysis, we set the amount of market consumers as 1. Therefore, the function of the amount of recycling scrap products in the offline recycling channel is denoted by . It is expressed by the following formula:, where .

Similarly, compared to the offline channel, according to the above model’s framework, if the consumer’s willingness to return is defined as , that is, , then consumers will prefer to return scraps product through an online channel at a price . Therefore, when , that is, , consumers will prefer to return scrap products through an online channel. Therefore, we will find the function of the amount of recycling scrap products in the offline recycling channel denoted by . It is expressed by the following formula: , where .

Consumers own two return options; their decision depends on comparing net consumer surplus generated by offline and online recycling channels: versus . Therefore, when customers return scrap products through the online channel, customer utility is defined by ; when customers return scrap products through the traditional channel, customer utility is determined by where and . Hence, in this paper, because of the influence of the consumer popularity of online recycling method and reference-price effect degree , we represent that the definition of online/offline recycling quantity using Equations (1) and (2).

Equations (1) and (2) show that the expression of consumer’s utility is linearly correlated to the recycling price, reference-price effect degree, and consumer popularity relative to the online recycling method. It also indicates that consumer’s utility increases in the recycling price of the RD/recycler and reference-price effect degree while it decreases in the consumer popularity of online channels and the recycling price of the recycler/RD.

This study mainly researches a model for a dual-channel reverse supply chain. It is necessary that the dual-channel reverse supply system consists of both the RD and the recycler. The reasonable profit of recycling using an offline channel ensures that the recycler remains in the supply chain system. Therefore, constraint must hold to ensure that both online and offline recycling quantities are greater than zero. Therefore, this constraint is necessarily a guarantee of the strategic alliance between RDs and recyclers.

The following corresponding decision model and the optimal decision problem are discussed using the online/offline recycling quantity function.

4. Optimization Problems

4.1. The Benchmark Case

The RD can indirectly recycle scrap products from the recycler and also directly recycle used products from online channels. We examine the case of centralized decision making to test whether a contract for coordinating reverse supply chains can be implemented. The paper sets an assumption of the centralized case to compare the decentralized scenario and discusses achieving the perfect coordination of an entire supply-chain system by using contract coordination.

The recycler and RD in the reverse supply chain with a dual-channel jointly determines the recycling price through joint decisions to maximize the system’s profit. At this point, the RD and recycler comprise one union with two reverse recycling channels, i.e., offline channel and online channel (as shown in Figure 1a). For the centralized decision, the RD and recycler would jointly operate as a single system (denoted by a superscript C) in order to maximize the overall channel’s profit. The overall profit function of online and offline recycling channels in the centralized scenario can be characterized as follows.

Theorem 1.

In the centralized scenario, we can derive the reverse dual-channel recycler’s optimal pricing polices and RD’s optimal pricing policies, shown as follows:

Proof of Theorem 1.

From Equation (6), we derive the Hessian matrix, , associated with and as follows.

must be negative and definite in order to produce an optimal solution. We thus have , which implies . □

Therefore, det . According to the Kuhn–Tucker condition, we obtain the following expression:

and

where

Furthermore, under a centralized case, we obtain the optimal amount of recycling scrap products in the offline and online recycling channel, the total amount of recycling scrap products, and the maximum profit of recycling scrap products in the entire reverse supply-chain system, respectively, as follows.

4.2. The Model of Reverse Supply Chain with Dual-Channel in Decentralized Case (SG Model)

In a decentralized channel, we model the decentralized system as a basic model of a Stackelberg recycle dealer, in which the RD is the leader. Both recyclers and RDs are deemed as independent entities that aim to gain their own individual profit maximization (as shown in Figure 1b). Currently, these large RDs have powerful market dominance for deciding the recycling price and return quantity; many RDs play a leading role in the respective supply chain in real life. As such, we model a Stackelberg game in the decentralized system (SG model) in which the RD is the leader, and the recycler is the follower. There is a chronology of events among the reverse dual-channel supply chain as follows: (1) The RD collects the used product at recycling price through an online recycling channel and recovers the scrap product from a recycler at transferring price ; (2) then, the recycler collects the used product at recycling price by using an offline recycling channel. To facilitate discernment, all functions and equalization variables are denoted by the superscript in a decentralized case. We assume that the online recycling channel’s price is lower than the transferring price to avoid a situation in which the recycler sells gathered waste products by using an online channel. Therefore, is assumed. As mentioned above, we can write the function of the recycling scrap product in the online recycling channel and offline recycling channel in the decentralized case as follows.

From Equations (5) and (6), we derive the set of optimal decisions in the decentralized case as follows.

Theorem 2.

In the model of reverse supply chains with a dual channel in the decentralized case (SG model), the optimal recycling price for the offline channel and online channel in the decentralized case is as follows:

Proof of Theorem 2.

The RD dominates, the RD decides , and then the recycler uses to obtain the derivative of in . Since , therefore, when the recycler’s profit reaches the maximum, optimal pricing should satisfy the following.

Obviously, the RD’s profit function is jointly concave and is associated with and , which proves it has a unique solution. According to Equation (6), we take the derivative of and and implement them in . □

We derive the following:

where the following is the case.

Furthermore, we substitute and in the following formulation.

In addition, the optimal amount of recycling scrap products in offline and online recycling channels is described as follows:

and the total collected quantity is described as follows.

Let us record the sum of the two optimal profits . When the supply chain’s parameters change, the equilibrium results are analyzed, and the following conclusions are true.

4.3. A Numerical Example

Given the complexity of the formula’s expressions, it is hard to directly make an analysis and comparison of the RD and recyclers’ decisions, collection quantity, and the reference price and consumer preference parameter’s impact induced by consumer behaviors; we assess the impact of the consumer preference parameter and reference-price effect on the recovery of RDs and recyclers by using a numerical analysis to research the relationship between the optimal pricing strategies, the optimal amount of recycling scrap products, and the maximum profits in different channels.

Because of the complexity of the game equilibrium solution, the numerical examples are provided in the following to illustrate how popularities of the online recycling method and reference-price effect degree affect channel strategies.

In this section, the numerical example parameters are summarized as follows.

Proposition 1.

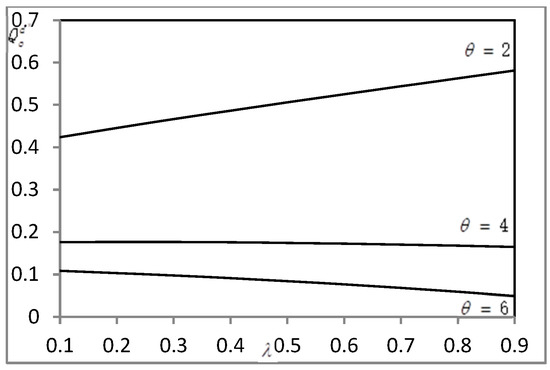

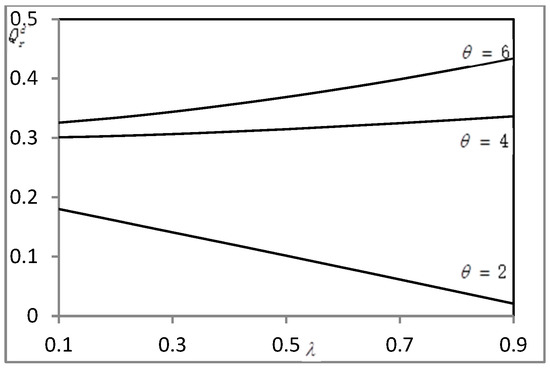

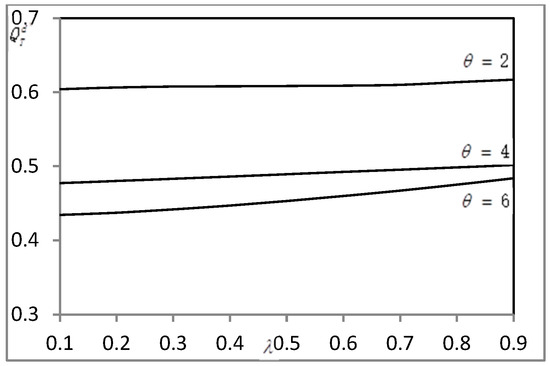

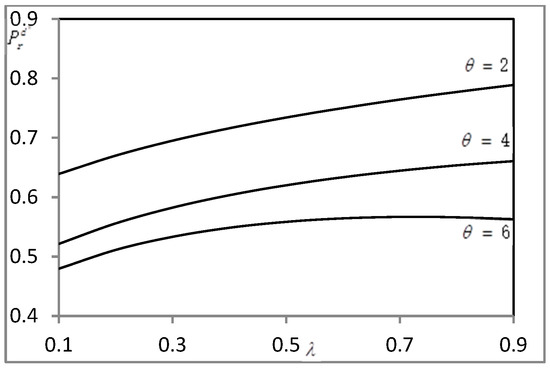

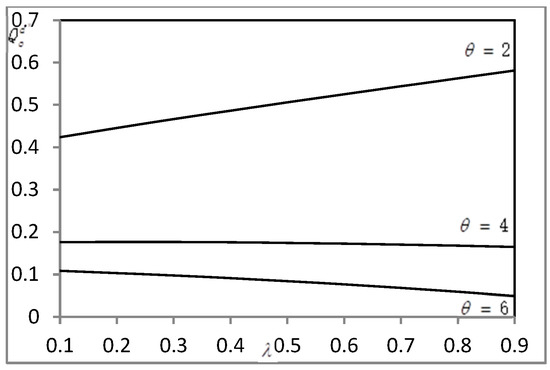

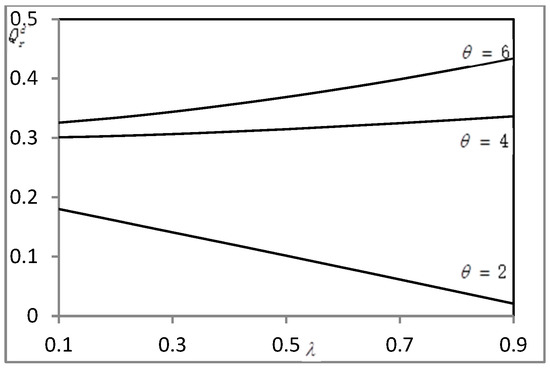

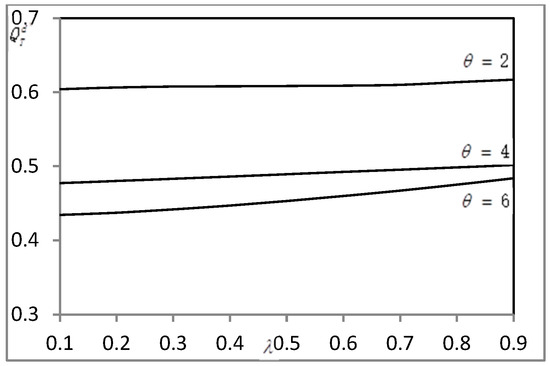

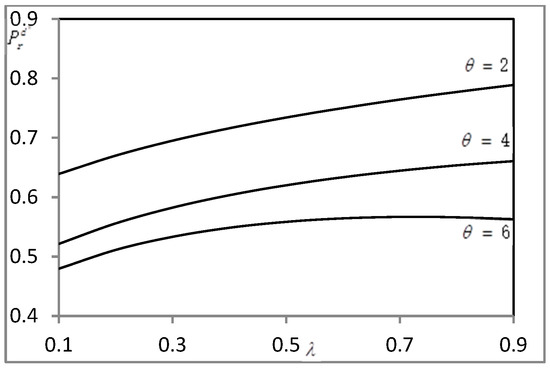

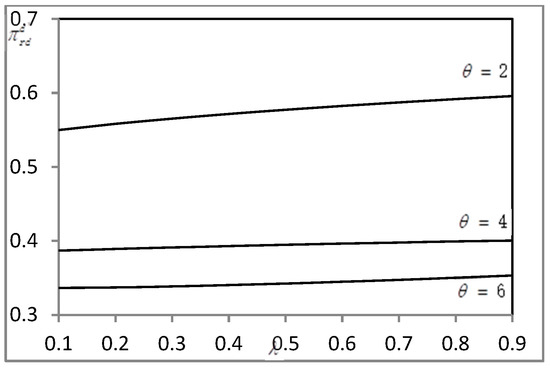

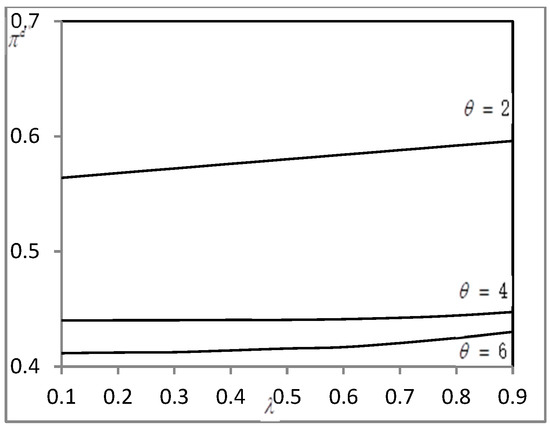

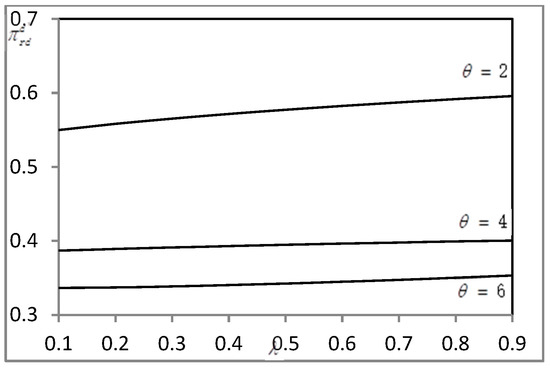

From Figure 1, Figure 2, Figure 3, Figure 4, Figure 5 and Figure 6, we can see that in a decentralized case, the optimal amount of recycling scrap products in the online recycling channel, , decreases with; moreover, the optimal amount of recycling scrap products in the offline channel,, increases with; the total amount of scarp products in both channels,, decreases with. The optimal price for the online recycling channel,, and the offline recycling channel,, decreases with.

Figure 2.

Effect on .

Figure 3.

Effect on .

Figure 4.

Effect on .

Figure 5.

Effect on .

Figure 6.

Effect on .

In real life, compared with traditional recycling channels, the RD collects through an online recycling channel in order to face customers directly, which saves many intermediate links and naturally makes more profit. Then, they can offer customers a higher recycling price than the recycler collected through the traditional channel in order to ensure that more customers will choose online channels to return waste products. Thus, the optimal price for the online recycling channel, , is greater than that for the traditional recycling channel, . For the above reasons, generally, the bigger the , the lower the popularity of the online recycling method; i.e., consumers prefer to return scarp products in the offline recycling channel compared with the recycling channel. That is to say that the recycler offers customers a lower recycling price than the RD collected through an online channel. As the value of increases, the quantity of recycling scrap products in the offline recycling channel increases, while the quantity of recycling scarp products in the online recycling channel decreases. The recycler will lower the optimal price for the traditional recycling channel to make more profits, and the RD will also reduce the optimal price for the online recycling channel in order to ensure their profits. If the value of is lower, the situation is the opposite.

Proposition 2.

From Figure 1, Figure 2, Figure 3, Figure 4, Figure 5 and Figure 6, when the value ofis low, as the value ofincreases, the optimal amount of recycling scrap products in offline recycling channeland the optimal recycling price through online channeldecreases, while the optimal amount of recycling scrap products in online recycling channel and the optimal price for the traditional recycling channelincreases; on the other hand, when the value ofis large, the opposite is true.

Generally, when more consumers are willing to return the used product through an online channel, the optimal recycling price of online channel is always higher than that of traditional recycling channel . Affected by the reference-price effect, we can understand that higher reference-price effects will attract more consumers who return used products through a traditional channel for transfers to an online channel. Meanwhile, the recycler has to improve to attract more consumers to choose a traditional recycling channel for fear of a transfer in consumers’ recycling behavior, while the RD will lower to attain more profits.

Proposition 3.

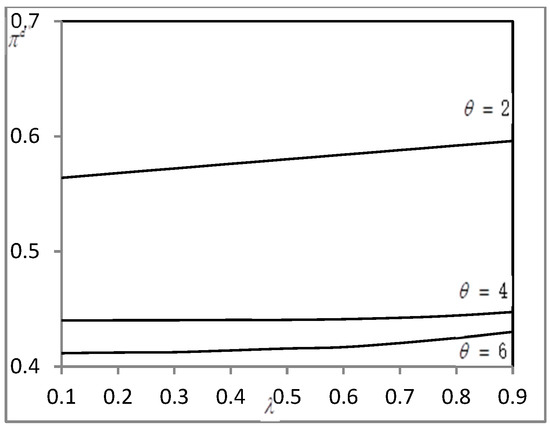

From Figure 7 and Figure 8, with the increase in the value, the optimal profit of the recycler increases, while that of the RD and the entire supply-chain system decreases.

Figure 7.

Effect on .

Figure 8.

Effect on .

We realize that the profit of the RD and the entire reverse supply-chain system decreases with the popularity of online recycling method , whereas that of the recycler increases. The recycler has to enhance to encourage more customers in returning scrap products in offline channels when the popularity of online channel decreases; hence, the marginal profit due to the increased recovery is lower than the corresponding marginal cost. Therefore, the double marginal effect is more serious between the recyclers and the RD, which results in both the profit of RD, and the entire supply-chain system decreases with .

Proposition 4.

This shows that as the reference-price effect coefficient increases, in the decentralized case, the overall profit level of the entire reverse supply chain increases. This indicates that the reference-price’s effect coefficient can help alleviate the price competition between channels for the sake of improvements in the operation efficiency of the reverse supply chain with a dual channel.

5. Coordination

5.1. Coordination via Revenue Cost-Sharing Contracts

The traditional revenue-sharing contract is ineffective for coordinating the reverse supply chain due to cost recoveries. Some scholars improved the revenue cost-sharing contract [4], which demonstrates that the members of the supply chain should not only share the recovery revenue but also share waste recycling costs in the same proportion. Therefore, this paper will focus on using revenue cost-sharing contracts to coordinate the reverse supply chain.

It is assumed that the recycler and the RD share the residual and waste-recycling incomes as a revenue–cost-sharing ratio and , respectively, and they also share the direct recycling cost of waste products in the same proportion correspondingly. As for the transferring price paid by the RD to the recycler, belongs to the internal cost of the entire reverse supply chain; thus, it is not included in the scope of sharing. Let us note that superscript “” represents the pattern of coordination. Under this circumstance, the profits of RD and recycler are, respectively, as follows.

The first-order derivatives of in Equation (10) are obtained by using Stackelberg game inverse inductions. We derive the following optimal response function with respect to the recycler.

By comparing Equations (11) and (7), it can be concluded that the RD’s optimal pricing is described as follows.

Equation , , will be satisfied; that is, the entire reverse supply-chain system will achieve an equilibrium under joint decision circumstances.

Under the framework of the contract, in order to maximize profits, neither side will maliciously claim subsidies. If the recycler chooses to accept the revenue cost-sharing contract, the recycler and RD can share recovery revenues to ensure profits. In this case, the recycler’s objective function can be expressed as follows.

The RD’s objective function can be expressed as follows.

As long as the reverse supply chain is coordinated by the contract from the RD, we have the following: , , . The above results show that the sum of profits of the RD and the recycler reaches the optimal level under a joint decision, namely .

Therefore, the revenue cost-sharing contract coordinates the supply chain system. However, from the profit function expression of the RD and R, we can see that the profit of the recycler is higher than that of the proportion relative to the revenue cost-sharing contract. This also shows that the RD’s profit does not reach the maximum due to the conflict between recycling channels. As the leader of the reverse supply chain, the RD will strive to pursue the maximum profit.

5.2. Coordination via a Two-Part Tariff Contract

From the above analysis, we know that when the revenue cost-sharing contract can achieve an overall coordination, the two-part tariff contract can perfectly coordinate the reverse supply chain. To coordinate the entire reverse supply chain, the RD attempts to design a two-part tariff contract, which has the following operation mechanism: The RD collects recycling scraps from the recycler at a lower transferring price, and the RDs will provide subsidies to the recycler for each unit of used products directly recycled by the online reverse channel. At this point, the coordination process is as follows:

where is the recovery agency fee charged by the RD to the recycler. According to the profit function under the coordination of the entire reverse supply chain (Formulas (13) and (14)), the RD only needs to decide the recycler’s recovery agency fee as follows.

Then, by the combination coordination model (MC model) of the revenue cost-sharing contract and the two-part tariff contract, the RD’s and recycler’s profit function can be expressed as follows.

At this time, the RD’s profit is improved, and the RD and recycler share the profit of the entire reverse supply chain as a revenue–cost-sharing ratio: and respectively. Therefore, the optimal total profit of the system’s supply chain under the MC model can be obtained as follows: .

As long as , (that is, based on , (19)), the perfect coordination of the entire supply-chain system and each member can be achieved by determining the revenue–cost-sharing ratio . The reasonable range of can be obtained from Equation (19), and we derive the following: .

Theorem 3.

Under condition, when the RD’s optimal decision is, the MC’s pricing model can perfectly coordinate the reverse supply-chain system.

Theorem 3 indicates that the range of depends on RD’s and recycler’s bargaining power. When the reference-price effect exists, RD can alleviate the price competition between channels by giving subsidies to recyclers. Due to the aggravation of the double marginal effect, RD must make more concessions to achieve an overall optimization. The RDs, with dominant roles in the Stackelberg game, can require the recycler to provide a transfer payment, , to capture all profit increments after the coordination of the supply chain to maximize its own profit and the entire system’s profit.

Theorem 4.

Comparing the results of SG model and MC model, we can draw the following conclusions:

- (1)

- , ;

- (2)

- ;

- (3)

- , , .

Theorem 4 indicates that the combination coordination pricing produces a significantly improved decision-making result from members in the supply chain compared to that of the Stackelberg game and reaches the optimal level under a centralized scenario. At this time, the entire reverse supply-chain system can realize profit maximization, and the profits of each member are higher than that under a decentralized case without coordination; therefore, MC pricing strategies can achieve perfect improvements compared to the traditional revenue cost-sharing contract.

6. Conclusions

With the booming development of e-commerce, frequent price comparisons between online and offline channels constitute prevalent consumer choice behaviors. This paper depicts consumer behaviors that are affected by online popularity and reference prices. By incorporating the aforementioned two effects, a decision model in which RD is a dominated Stackelberg leader is built. In this paper, we study coordination strategies in a reverse supply chain with a dual channel. Furthermore, we explored how a reasonably designed contract can be effective in improving the operational efficiency of a supply-chain system. Specially, the RD can use the reference price degree to alleviate price competitions between channels.

In addition, the following managerial implications were obtained from this study: When most consumers are willing to return the used product through an online channel, the existence of reference-price effects will attract more consumers who originally returned used products through a traditional channel to return used products through an online channel. Meanwhile, the recycler has to improve recycling prices, while the recycling price in the online channel decreases. Moreover, when most consumers are willing to return the used product through a traditional channel, the situation is the opposite. Therefore, RDs can use the reference-price effect to alleviate price competitions in channel conflicts. In addition, a combinational contract can promote the efficiency of the reverse supply chain

The limitation of this research gap is that the multi-cycle case of the reverse supply chain is not considered. The topic is meaningful but complex. In future, there are interesting extensions in this paper. For example, the multi-cycle case of reverse supply chains will be included.

Author Contributions

B.W. raised the research question and wrote the manuscript. N.W. supervised the research study and provided constructive suggestions to improve this paper. All authors have read and agreed to the published version of the manuscript.

Funding

This study is supported by the Humanities and Social Science Foundation of the Ministry of Education of China (No. 17YJC630146).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

Not applicable.

Acknowledgments

The authors particularly thank the editors and anonymous reviewers for their kind reviews and helpful comments.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Appolloni, A.; D’Adamo, I.; Gastaldi, M.; Santibanez-Gonzalez, D.R.E.; Settembre-Blundo, D. Growing e-waste management risk awareness points towards new recycling scenarios: The view of the Big Four’s youngest consultants. Environ. Technol. Innov. 2021, 23, 101716. [Google Scholar] [CrossRef]

- Ali Qazi, A.; Appolloni, A. Systematic review on barriers and enablers toward circular procurement management. Sustain. Prod. Consum. 2022, 33, 343–359. [Google Scholar] [CrossRef]

- Mathiyazhagan, K.; Bharathi, U.; Appolloni, A. Pathways towards reverse logistics adoption in Indian educational institutes: A challenging factors analysis. Opsearch 2021, 58, 661–689. [Google Scholar] [CrossRef]

- Balasubramaruan, S. Mailversus Mall: A Strategic analysis of competition between direct marketers and conventional retailers. Mark. Sci. 1998, 17, 181–195. [Google Scholar] [CrossRef]

- Wang, B.; Ren, C.; Dong, X.; Zhang, B.; Wang, Z. Determinants shaping willingness towards on-line recycling behaviour: An empirical study of household e-waste recycling in China. Resour. Conserv. Recycl. 2019, 143, 218–225. [Google Scholar] [CrossRef]

- .Savaskan, R.C.; Wassenhove, L.N. Reverse channel design: The case of competing retailers. Manag. Sci. 2006, 52, 1–14. [Google Scholar] [CrossRef]

- Huang, M.; Song, M.; Lee, L.H.; Ching, W.K. Analysis for strategy of closed-loop supply chain with dual recycling channel. Int. J. Prod. Econ. 2013, 144, 510–520. [Google Scholar] [CrossRef]

- Atasu, A.; Toktay, L.B.; Van Wassenhove, L.N. How collection cost structure drives a manufacture’s reverse channel choice. Prod. Oper. Manag. 2013, 22, 1089–1102. [Google Scholar]

- Savaskan, R.C.; Bhattacharya, B.; Wassenhove, L.N. Closed-loop supply chain models with product remanufacturing. Manag. Sci. 2004, 50, 239–252. [Google Scholar] [CrossRef]

- Chuang, C.H.; Wang, C.X.; Zhao, Y. Closed-loop supply chain Models for a High-tech product under alternative reverse channel and collection cost Structures. Int. J. Prod. Econ. 2014, 156, 108–123. [Google Scholar] [CrossRef]

- Jena, S.K.; Sarmah, S.P. Price competition and co-operation in a duopoly closed-loop supply chain. Int. J. Prod. Econ. 2014, 156, 346–360. [Google Scholar] [CrossRef]

- Liu, H.; Lei, M.; Deng, H.; Leong, G.K.; Huang, T. A dual channel, quality-based price competition model for the WEEE recycling market with government subsidy. Omega 2016, 59, 290–302. [Google Scholar] [CrossRef]

- Zu-Jun, M.; Zhang, N.; Dai, Y.; Hu, S. Managing channel profits of different cooperative models in closed-loop supply chains. Omega 2016, 59, 251–262. [Google Scholar] [CrossRef]

- Xiong, Y.; Zhao, Q.; Zhou, Y. Manufacturer-remanufacturing vs supplier-remanufacturing in a closed-loop supply chain. Int. J. Prod. Econ. 2016, 176, 21–28. [Google Scholar] [CrossRef]

- Govindan, K.; Popiuc, M.N. Reverse supply chain coordination by revenue sharing contract: A case for the personal computers industry. Eur. J. Oper. Res. 2014, 233, 326–336. [Google Scholar] [CrossRef]

- Xiong, Y.; Yan, W. Implications of channel structure for marketing remanufactured products. Eur. J. Ind. Eng. 2016, 10, 126–144. [Google Scholar] [CrossRef]

- Souza, G.C. Closed-loop supply chains: A critical review, and future research. Decis. Sci. 2013, 44, 7–38. [Google Scholar] [CrossRef]

- Atasu, A.; Wassenhove, L.N.V. An operations perspective on product take-back legislation for e-waste: Theory, practice, and research needs. Prod. Oper. Manag. 2012, 21, 407–422. [Google Scholar] [CrossRef]

- Govindan, K.; Soleimani, H.; Kannan, D. Reverse logistics and closed-loop supply chain: A comprehensive review to explore the future. Eur. J. Oper. Res. 2015, 240, 603–626. [Google Scholar] [CrossRef]

- Cai, X.; Lai, M.; Li, X.; Li, Y.; Wu, X. Optimal acquisition and production policy in a hybrid manufacturing/remanufacturing system with core acquisition at different quality levels. Eur. J. Oper. Res. 2014, 233, 374–382. [Google Scholar] [CrossRef]

- Hong, I.H.; Lee, Y.T.; Chang, P.Y. Socially optimal and fund-balanced advanced recycling fees and subsidies in a competitive forward and reverse supply chain. Resour. Conserv. Recycl. 2014, 82, 75–85. [Google Scholar] [CrossRef]

- Choi, T.M.; Li, Y.J.; Xu, L. Channel leadership, performance and coordination in closed loop supply chains. Int. J. Prod. Econ. 2013, 146, 371–380. [Google Scholar] [CrossRef]

- Zuo, L.; Wang, C.; Sun, Q. Sustaining WEEE collection business in China: The case of online to offline (O2O) development strategies. Waste Manag. 2020, 101, 222–230. [Google Scholar] [CrossRef] [PubMed]

- Li, C.; Feng, L.; Luo, S. Strategic introduction of an online recycling channel in the reverse supply chain with a random demand. J. Clean. Prod. 2019, 236, 117683. [Google Scholar] [CrossRef]

- Wu, D.; Chen, J.; Li, P.; Zhang, R. Contract coordination of dual channel reverse supply chain considering service level. J. Clean. Prod. 2020, 260, 121071. [Google Scholar] [CrossRef]

- Wu, D.; Chen, J.; Yan, R.; Zhang, R. Pricing strategies in dual-channel reverse supply chains considering fairness concern. Int. J. Environ. Res. Public Health 2019, 16, 1657. [Google Scholar] [CrossRef]

- Chen, D.; Ignatius, J.; Sun, D.; Zhan, S.; Zhou, C.; Marra, M.; Demirbag, M. Reverse logistics pricing strategy for a green supply chain: A view of customers’ environmental awareness. Int. J. Prod. Econ. 2019, 217, 197–210. [Google Scholar] [CrossRef]

- Zhang, L.; Zhou, H.; Liu, Y.; Lu, R. Optimal environmental quality and price with consumer environmental awareness and retailer’s fairness concerns in supply chain. J. Clean. Prod. 2019, 213, 1063–1079. [Google Scholar] [CrossRef]

- Ren, M.; Liu, J.; Feng, S.; Yang, A. Pricing and return strategy of online retailers based on return insurance. J. Retail. Consum. Serv. 2021, 59, 102350. [Google Scholar] [CrossRef]

- Ismail, L.B.; Alawamleh, M.; Aladwan, K.; Alragheb, A.A. The relationship between green SCM practices and organisational performance: Evidence from Jordanian pharmaceutical manufacturers. Int. J. Logist. Syst. Manag. 2019, 34, 172–192. [Google Scholar] [CrossRef]

- Atasu, A.; Subramanian, R. Extended producer responsibility for e-waste: Individual or collective producer responsibility? Prod. Oper. Manag. 2012, 21, 1042–1059. [Google Scholar] [CrossRef]

- Hong, X.; Wang, Z.; Wang, D.; Zhang, H. Decision models of closed-loop supply chain with remanufacturing under hybrid dual-channel collection. Int. J. Adv. Manuf. Technol. 2013, 68, 1851–1865. [Google Scholar] [CrossRef]

- Örsdemir, A.; Kemahlıoğlu-Ziya, E.; Parlaktürk, A.K. Competitive quality choice and remanufacturing. Prod. Oper. Manag. 2014, 23, 48–64. [Google Scholar] [CrossRef]

- Zhang, F.; Zhang, P.R. Trade-in remanufacturing, strategic customer behavior, and government subsidies. Customer Behavior 2015, and Government Subsidies. 14 September 2015. Available online: https://web.archive.org/web/20160626201810id_/http://apps.olin.wustl.edu:80/faculty/zhang/Zhang-Journal/Remanufacturing.pdf (accessed on 16 July 2022).

- Ferguson, M.; Guide VD, R.; Souza, G.C. Supply chain coordination for false failure returns. Manuf. Serv. Oper. Manag. 2006, 8, 376–393. [Google Scholar] [CrossRef]

- Zeng, A.Z. Coordination mechanisms for a three-stage reverse supply chain to increase profitable returns. Nav. Res. Logist. 2013, 60, 31–45. [Google Scholar] [CrossRef]

- Xu, G.Y.; Dan, B.; Zhang, X.M.; Liu, C. Coordinating a dual-channel supply chain with risk-averse under a two-way revenue sharing contract. Int. J. Prod. Econ. 2014, 147, 171–179. [Google Scholar] [CrossRef]

- Chen, J.; Zhang, H.; Sun, Y. Implementing coordination contracts in a manufacturer Stackelberg dual-channel supply chain. Omega 2012, 40, 571–580. [Google Scholar] [CrossRef]

- Cao, E.B.; Ma, Y.J.; Wan, C.; Lai, M.Y. Contracting with asymmetric cost information in a dual-channel supply chain. Oper. Res. Lett. 2013, 41, 410–414. [Google Scholar] [CrossRef]

- Cai, G.G. Channel selection and coordination in dual-channel supply chain. J. Retail. 2010, 86, 22–36. [Google Scholar] [CrossRef]

- Tridib, M.; Raj, S.R.; Indrajit, S. Reference price research: Review and propositions. J. Mark. 2005, 69, 84–102. [Google Scholar]

- Winer, R.S. A reference price model of demand for frequently purchased products. J. Consum. Res. 1986, 13, 250–256. [Google Scholar] [CrossRef]

- Zhang, J.U.; Gou, Q.L.; Zhang, J.; Liang, L. Supply chain pricing decisions with price reduction during the selling season. Int. J. Prod. Res. 2014, 52, 165–187. [Google Scholar] [CrossRef]

- Rajendran, K.N.; Tellis, G.J. Contextual and temporal components of reference price. J. Marking 1994, 58, 22–34. [Google Scholar] [CrossRef]

- Chandrashekaran, R.; Grewal, D. Assimilation of advertised reference prices: The moderating of involvemen. J. Retail. 2003, 79, 53–62. [Google Scholar] [CrossRef]

- Martin-Herran, G.; Taboubi, S. Price coordination in distribution channels: A dynamic perspective. Eur. J. Oper. Res. 2015, 240, 401–414. [Google Scholar] [CrossRef]

- Zhang, J.; Kevin, W.Y.; Liang, L. Strategic pricing with reference effects in a competitive supply chain. Omega 2014, 44, 126–135. [Google Scholar] [CrossRef]

- Zhang, J.; Gou, Q.L.; Liang, L.; Huang, Z. Supply chain coordination through cooperative advertising with reference price effect. Omega 2013, 41, 345–353. [Google Scholar] [CrossRef]

- Geng, Q.; Wu, C.Q.; Li, K.P. Pricing and promotion frequency in the presence of reference price effects in supply chains. Calif. J. Oper. Manag. 2010, 8, 74–82. [Google Scholar]

- Qian, L.; Song, Z. Price and quality competition in a duopoly with reference-dependent preferences. In Proceedings of the 7th International Conference on Service Systems and Service Management(ICSSM), IEEE, Tokyo, Japan, 28–30 June 2010; pp. 1–4. [Google Scholar]

- Feng, L.; Govindan, K.; Li, C. Strategic planning: Design and coordination for dual-recycling channel reverse supply chain considering consumer behavior. Eur. J. Oper. Res. 2017, 260, 601–612. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).