From Biogas to Hydrogen: A Techno-Economic Study on the Production of Turquoise Hydrogen and Solid Carbons

Abstract

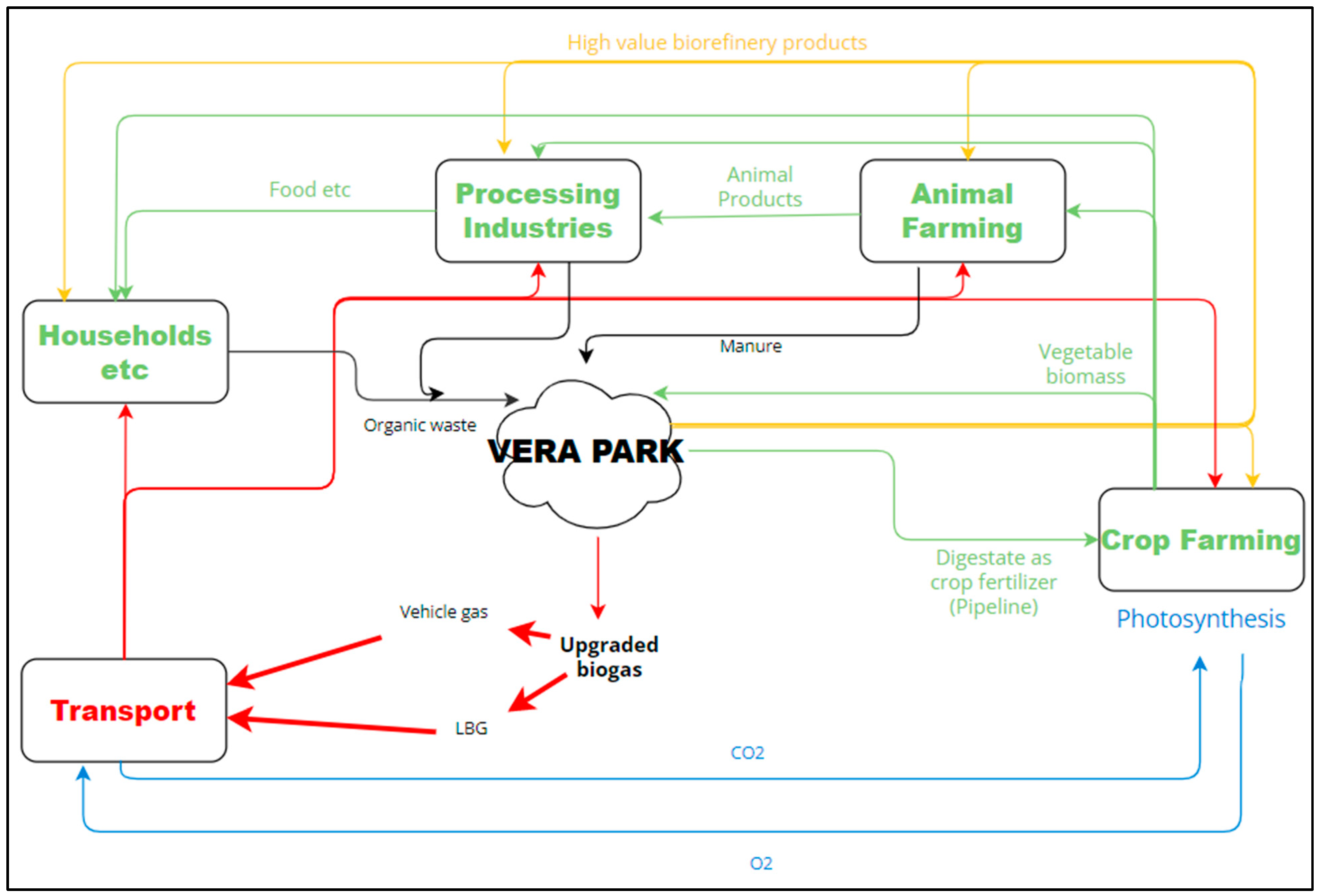

:1. Introduction

- As an energy carrier;

- Through the reduction in greenhouse gas emissions;

- Energy security;

- As a raw material where CO2 and CH4 are used;

- As a scavenger for organic waste streams;

- Better water quality.

2. Materials and Methods

2.1. Feedstock Composition

2.2. Process Flow Configurations

2.3. Biogas Digester Scenarios and Mass Balances

2.4. Techno-Economic Assessments Assumptions

3. Results and Discussion

3.1. Summary of the Calculated Potential Product Streams from South African Organic Waste

3.2. Mass Balances of the Three Main Potential Products (500 m3/h Biogas Plants)

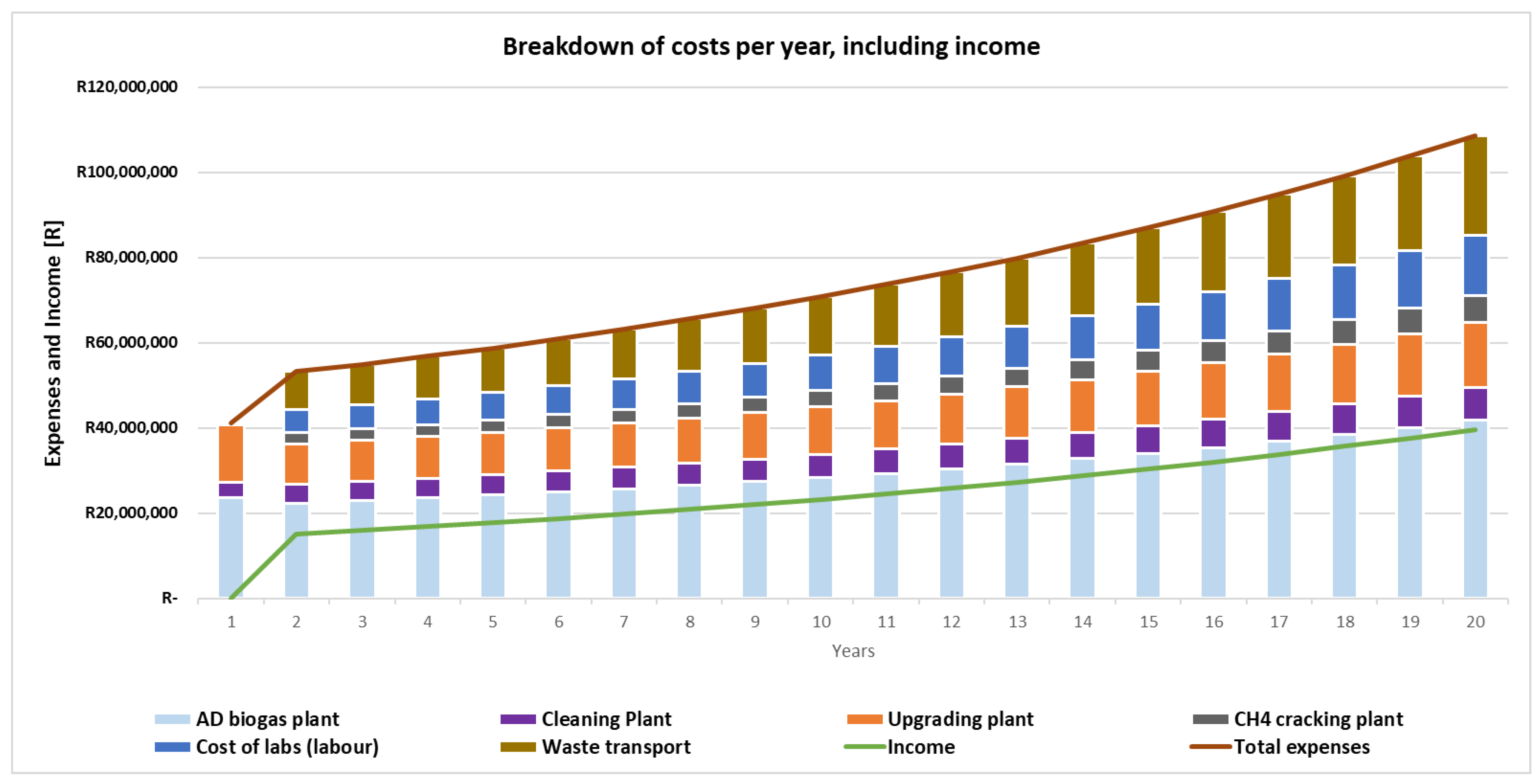

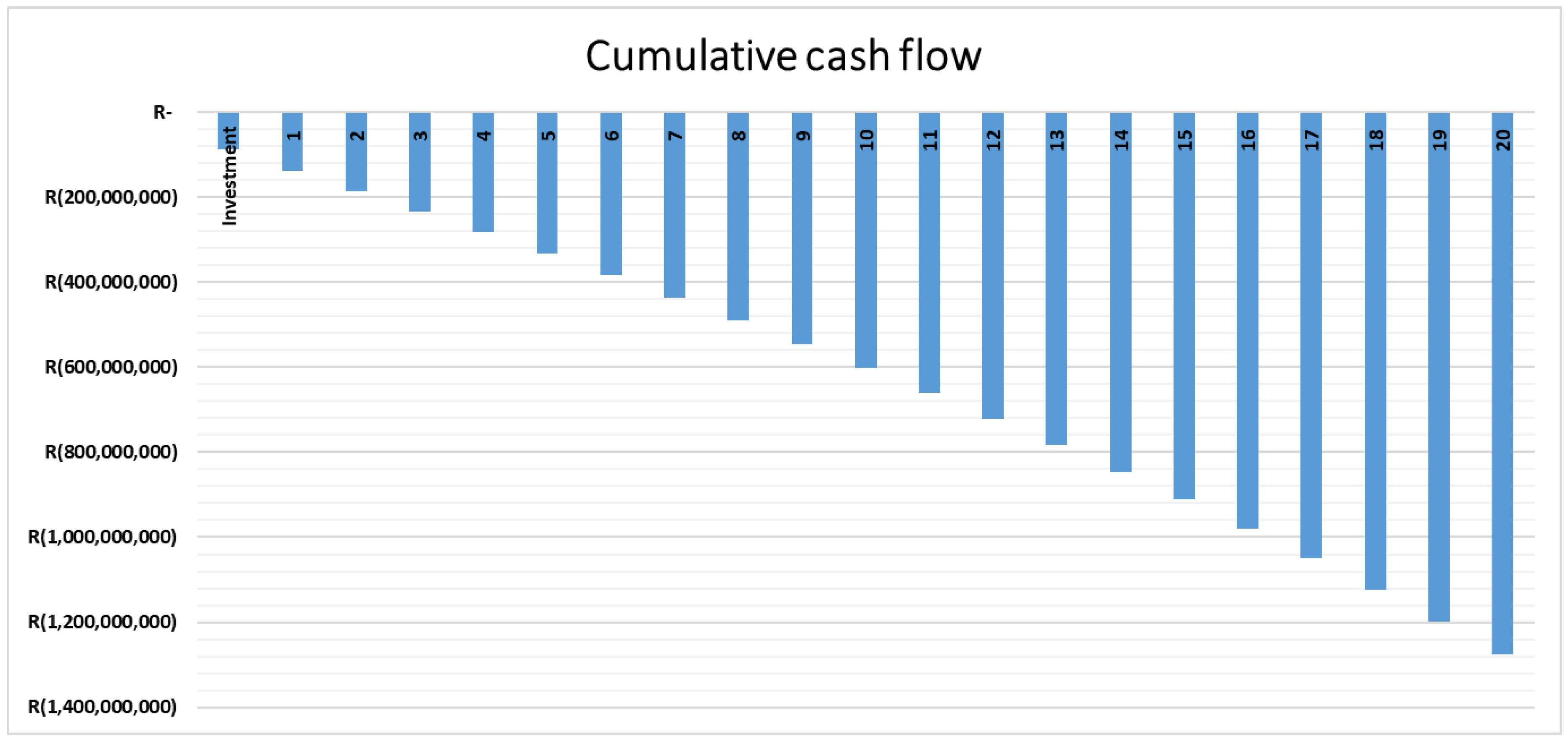

3.3. Economic Evaluations for Different Scenarios

3.3.1. Base Case Scenario

3.3.2. Scenario 1

3.3.3. Scenario 2

3.3.4. Scenario 3 (No CAPEX and OPEX)

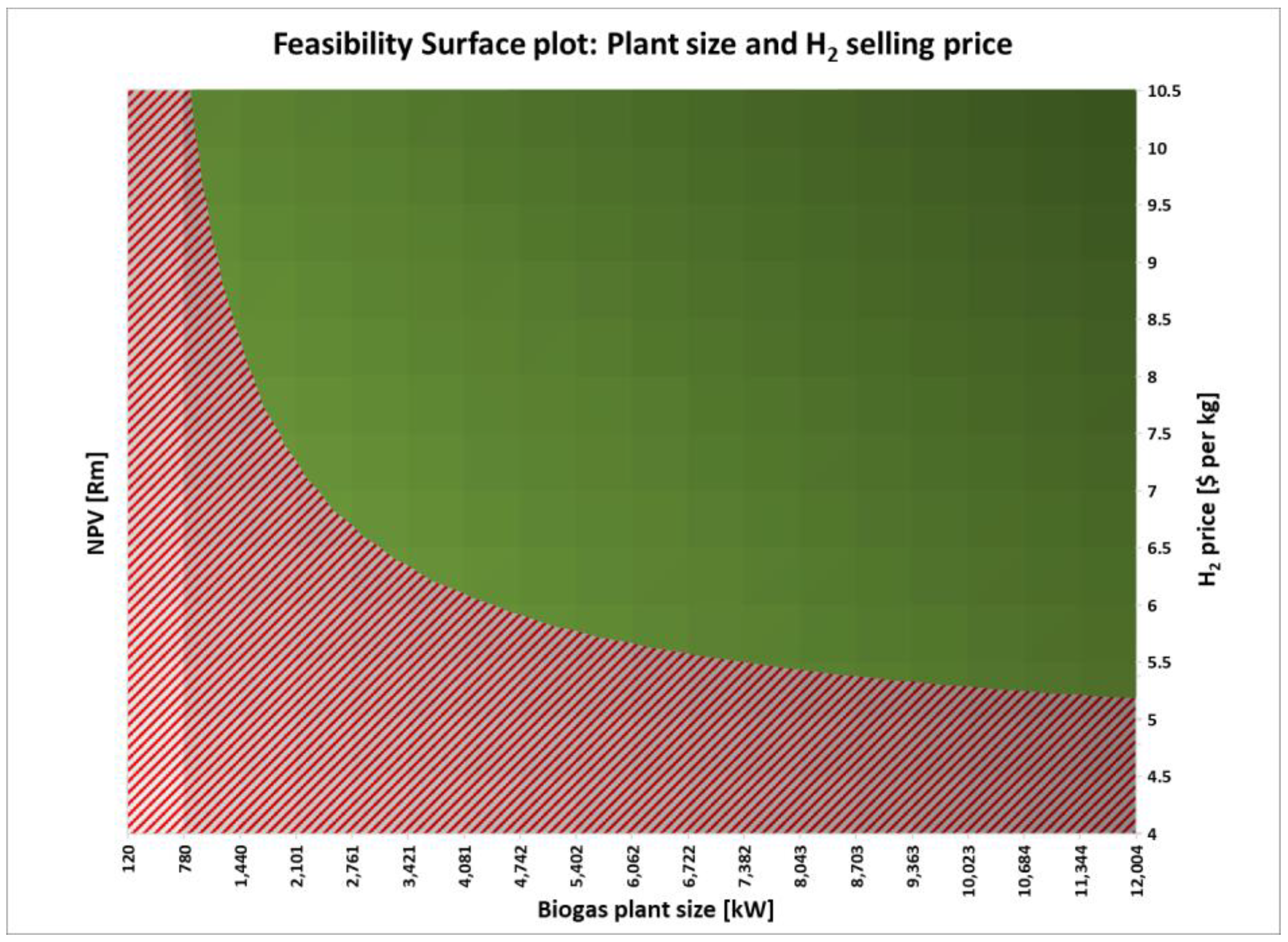

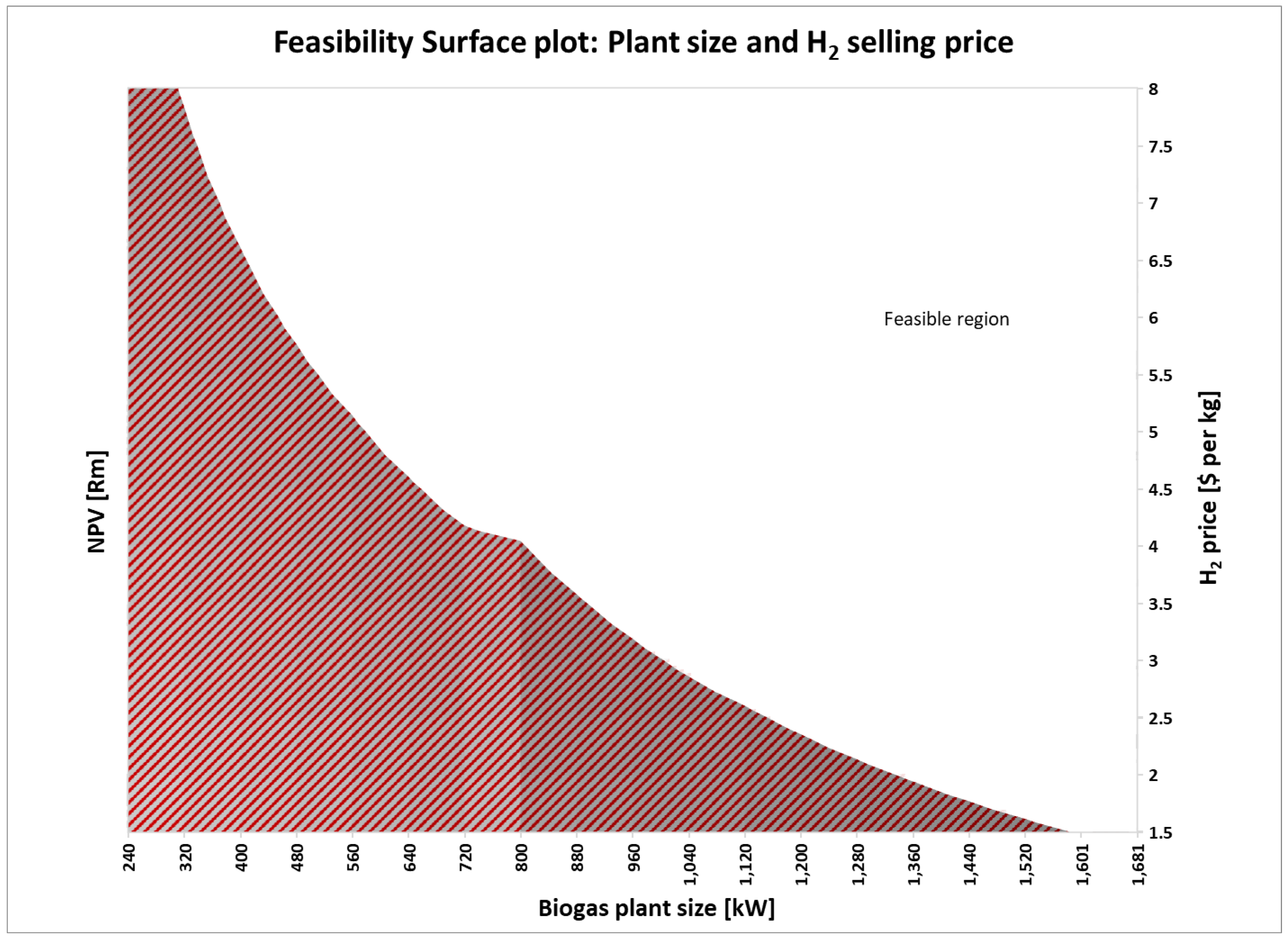

3.4. Sensitivity Analysis

Sensitivity around the Reactor Costing

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Acknowledgments

Conflicts of Interest

References

- World—World Energy Balances: Overview-Analysis—IEA. Available online: https://www.iea.org/reports/world-energy-balances-overview/world (accessed on 4 February 2022).

- Huaman, R.N.E.; Jun, T.X. Energy related CO2 emissions and the progress on CCS projects: A review. Renew. Sustain. Energy Rev. 2014, 31, 368–385. [Google Scholar] [CrossRef]

- Govender, I.; Thopil, G.A.; Inglesi-Lotz, R. Financial and economic appraisal of a biogas to electricity project. J. Clean. Prod. 2018, 214, 154–165. [Google Scholar] [CrossRef]

- Sustainable Development Goals|United Nations Development Programme. Available online: https://www.undp.org/sustainable-development-goals#sustainable-cities-and-communities (accessed on 11 July 2021).

- Awe, O.W.; Zhao, Y.; Nzihou, A.; Minh, D.P.; Lyczko, N. A Review of Biogas Utilisation, Purification and Upgrading Technologies. Waste Biomass Valoriz. 2017, 8, 267–283. [Google Scholar] [CrossRef]

- Nape, K.M.; Magama, P.; Moeletsi, M.; Tongwane, M.; Nakana, P.; Mliswa, V.; Motsepe, M.; Madikiza, S. Introduction of household biogas digesters in rural farming households of the Maluti-a-Phofung municipality, South Africa. J. Energy S. Afr. 2019, 30, 28–37. [Google Scholar] [CrossRef]

- Amigun, B.; von Blottnitz, H. Investigation of scale economies for African biogas installations. Energy Convers. Manag. 2007, 48, 3090–3094. [Google Scholar] [CrossRef]

- Msibi, S.S.; Kornelius, G. Potential for domestic biogas as household energy supply in South Africa. J. Energy S. Afr. 2017, 28, 1–13. [Google Scholar] [CrossRef]

- Bhat, I.K.; Prakash, R. LCA of renewable energy for electricity generation systems—A review. Renew. Sustain. Energy Rev. 2009, 13, 1067–1073. [Google Scholar] [CrossRef]

- Rosha, P.; Rosha, A.K.; Ibrahim, H.; Kumar, S. Recent advances in biogas upgrading to value added products: A review. Int. J. Hydrogen Energy 2021, 46, 21318–21337. [Google Scholar] [CrossRef]

- Kougias, P.G.; Angelidaki, I. Biogas and its opportunities—A review. Front. Environ. Sci. Eng. 2018, 12, 14. [Google Scholar] [CrossRef]

- Fagerström, A.; Al Seadi, T.; Rasi, S.; Briseid, T. The Role of Anaerobic Digestion and Biogas in the Circular Economy; IEA Bioenergy Task 37; IEA Bioenergy: Cork, Ireland, 2018. [Google Scholar]

- Golmakani, A.; Nabavi, S.A.; Wadi, B.; Manovic, V. Advances, challenges, and perspectives of biogas cleaning, upgrading, and utilisation. Fuel 2022, 317, 123085. [Google Scholar] [CrossRef]

- Sun, Q.; Li, H.; Yan, J.; Liu, L.; Yu, Z.; Yu, X. Selection of appropriate biogas upgrading technology-a review of biogas cleaning, upgrading and utilisation. Renew. Sustain. Energy Rev. 2015, 51, 521–532. [Google Scholar] [CrossRef]

- Santos, M.P.S.; Grande, C.A.; Rodrigues, A.E. Pressure Swing Adsorption for Biogas Upgrading. Effect of Recycling Streams in Pressure Swing Adsorption Design. Ind. Eng. Chem. Res. 2011, 50, 974–985. [Google Scholar] [CrossRef]

- Vrbová, V.; Ciahotný, K. Upgrading Biogas to Biomethane Using Membrane Separation. Energy Fuels 2017, 31, 9393–9401. [Google Scholar] [CrossRef]

- Angelidaki, I.; Treu, L.; Tsapekos, P.; Luo, G.; Campanaro, S.; Wenzel, H.; Kougias, P.G. Biogas upgrading and utilization: Current status and perspectives. Biotechnol. Adv. 2018, 36, 452–466. [Google Scholar] [CrossRef]

- Adnan, A.I.; Ong, M.Y.; Nomanbhay, S.; Chew, K.W.; Show, P.L. Technologies for Biogas Upgrading to Biomethane: A Review. Bioengineering 2019, 6, 92. [Google Scholar] [CrossRef] [PubMed]

- Brunetti, A.; Scura, F.; Barbieri, G.; Drioli, E. Membrane technologies for CO2 separation. J. Membr. Sci. 2010, 359, 115–125. [Google Scholar] [CrossRef]

- Khan, A.; Qyyum, M.A.; Saulat, H.; Ahmad, R.; Peng, X.; Lee, M. Metal–organic frameworks for biogas upgrading: Recent advancements, challenges, and future recommendations. Appl. Mater. Today 2020, 22, 100925. [Google Scholar] [CrossRef]

- Canevesi, R.L.S.; Andreassen, K.A.; da Silva, E.A.; Borba, C.E.; Grande, C.A. Pressure Swing Adsorption for Biogas Upgrading with Carbon Molecular Sieve. Ind. Eng. Chem. Res. 2018, 57, 8057–8067. [Google Scholar] [CrossRef]

- Nahar, G.; Mote, D.; Dupont, V. Hydrogen production from reforming of biogas: Review of technological advances and an Indian perspective. Renew. Sustain. Energy Rev. 2017, 76, 1032–1052. [Google Scholar] [CrossRef]

- Kludpantanapan, T.; Nantapong, P.; Rattanaamonkulchai, R.; Srifa, A.; Koo-Amornpattana, W.; Chaiwat, W.; Sakdaronnarong, C.; Charinpanitkul, T.; Assabumrungrat, S.; Wongsakulphasatch, S.; et al. Simultaneous production of hydrogen and carbon nanotubes from biogas: On the effect of Ce addition to CoMo/MgO catalyst. Int. J. Hydrogen Energy 2021, 46, 38175–38190. [Google Scholar] [CrossRef]

- Xu, J.; Zhou, W.; Li, Z.; Wang, J.; Ma, J. Biogas reforming for hydrogen production over nickel and cobalt bimetallic catalysts. Int. J. Hydrogen Energy 2009, 34, 6646–6654. [Google Scholar] [CrossRef]

- Gao, Y.; Jiang, J.; Meng, Y.; Yan, F.; Aihemaiti, A. A review of recent developments in hydrogen production via biogas dry reforming. Energy Convers. Manag. 2018, 171, 133–155. [Google Scholar] [CrossRef]

- Upham, D.C.; Agarwal, V.; Khechfe, A.; Snodgrass, Z.R.; Gordon, M.J.; Metiu, H.; McFarland, E.W. Catalytic molten metals for the direct conversion of methane to hydrogen and separable carbon. Science 2017, 358, 917–921. [Google Scholar] [CrossRef] [PubMed]

- Pérez, B.J.L.; Jiménez, J.A.M.; Bhardwaj, R.; Goetheer, E.; Annaland, M.V.S.; Gallucci, F. Methane pyrolysis in a molten gallium bubble column reactor for sustainable hydrogen production: Proof of concept & techno-economic assessment. Int. J. Hydrogen Energy 2020, 46, 4917–4935. [Google Scholar] [CrossRef]

- IRENA. Hydrogen: A Renewable Energy Perspective. 2019. Available online: www.irena.org (accessed on 23 March 2022).

- Oelofse, S.H.; Polasi, T.; Haywood, L.; Musvoto, C. Increasing Reliable, Scientific Data and Information on Food Losses and Waste in South Africa. May 2021. Available online: https://wasteroadmap.co.za/wp-content/uploads/2021/06/17-CSIR-Final_Technical-report_Food-waste.pdf (accessed on 22 April 2022).

- Bayat, N.; Rezaei, M.; Meshkani, F. Methane decomposition over Ni–Fe/Al2O3 catalysts for production of COx-free hydrogen and carbon nanofiber. Int. J. Hydrogen Energy 2016, 41, 1574–1584. [Google Scholar] [CrossRef]

- Chen, L.; Qi, Z.; Zhang, S.; Su, J.; Somorjai, G.A. Catalytic Hydrogen Production from Methane: A Review on Recent Progress and Prospect. Catalysts 2020, 10, 858. [Google Scholar] [CrossRef]

- US EPA. 2022. Available online: https://globalmethane.org/resources/details.aspx?r (accessed on 22 April 2022).

- Nagel, B.M. An Update on the Process Economics of Biogas in South Africa based on Observations from Recent Installations. Master’s Thesis, Faculty of Engineering and the Built Environment, University of Cape Town, Cape Town, South Africa, 2019. [Google Scholar]

- Towler, G.; Sinnott, R. Chemical Engineering Design: Principles, Practice and Economics of Plant and Process Design; Butterworth-Heinemann: Oxford, UK, 2013. [Google Scholar] [CrossRef]

- Baena-Moreno, F.M.; Gonzalez-Castaño, M.; Arellano-García, H.; Reina, T. Exploring profitability of bioeconomy paths: Dimethyl ether from biogas as case study. Energy 2021, 225, 120230. [Google Scholar] [CrossRef]

- ChemAnalyst. Available online: https://www.chemanalyst.com/Pricing-data/carbon-black-42 (accessed on 18 February 2022).

- South African Reserve Bank. 2022. Available online: https://www.resbank.co.za/en/home/what-we-do/statistics/key-statistics/current-market-rates (accessed on 18 February 2022).

- Kapanji, K.K.; Haigh, K.F.; Görgens, J.F. Techno-economics of lignocellulose biorefineries at South African sugar mills using the biofine process to co-produce levulinic acid, furfural and electricity along with gamma valeractone. Biomass Bioenergy 2021, 146, 106008. [Google Scholar] [CrossRef]

| Process Properties | Reference | Process Type | |

|---|---|---|---|

| CH4 removal efficiency | 95% | [16] | Membrane separation |

| CO2 removal efficiency | 95% | [16] | Membrane separation |

| CH4 cracking conversion | 87% | [30] | Catalytic reactor |

| Catalyst activity | 100 gH2/gcat | [31] | |

| Base Case | Scenario 1 | Scenario 2 | Scenario 3 | |

|---|---|---|---|---|

| Feedstock | Mixed cafeteria and canteen waste | |||

| Feed rate | 51,500 kg/day | Existing AD | ||

| Biogas production | 500 m3/h | Existing AD | ||

| Product stream | H2 only | H2 and CO2 | H2, CO2, and Csolid | H2, CO2, and Csolid |

| Sales Pricing | |||

| Natural gas price | USD 27.05/MWh | [35] | |

| Subsidies for bio-methane into a grid | USD 0/MWh | South Africa does not have a gas grid | |

| Feed-in tariff for electricity (biogas) | USD 0.11/kWh | [35] | |

| Industrial electricity tariff | USD 0.07/kWh | Eskom tariff to industrial users | |

| CO2 costs | USD 48.69/tonne | [35] | |

| Green H2 price | USD 3/kg | US DoE target price | |

| Carbon price | USD 1670/tonne | [36] | EU price for carbon black |

| Transport cost | USD 29.60/tonne | Disposal cost/gate fees in City of Cape Town | |

| Financial Interests | |||

| Preferred discount rate | 15% | Commonly used for high-risk investments | |

| Loan interest rate | 7.5% | [37] | SA prime lending rate |

| Expected inflation | 5.5% | [37] | SA CPI rate |

| Corporate tax rate | 28% | ||

| Insurance rate | 1% | ||

| Rand/euro exchange rate | R17/euro | www.xe.com | Accessed on 22 April 2022 |

| Rand/USD exchange rate | R15.20/USD | www.xe.com | Accessed on 22 April 2022 |

| Operational Assumptions | |||

| Construction period | 1 year | ||

| Operational availability | 90% | ||

| Operational time | 7884 h | ||

| Plant life | 20 years | ||

| Maintenance (% of CAPEX) | 10 | [16] | |

| Installation (% of CAPEX) | 20 | [16] | |

| AD operating cost | R2 per m3 | [16] | |

| Cleaning operation cost | 0.017 euro/m3 | [16] | |

| Upgrading operating cost | 0.29 kWh/m3 | [16] | Operational costs for a membrane upgrading unit |

| Electrolyser operating costs | 45 euro/kW | ||

| Industrial electricity cost | 0.07 euro/kWh | ||

| Methane cracking operations | 52.21 euro/tonne CH4 | ||

| Indirect cost Assumptions | |||

| Site establishment (% of CAPEX) | 10 | [34] | |

| Warehouse costing (% of CAPEX) | 7 | [34] | |

| Project contingency (% of CAPEX) | 10 | [34] | |

| Other costs (permits, licensing, etc.) (% of CAPEX) | 6 | [34] | |

| Potential Income Stream | Quantity |

|---|---|

| Biogas potential | 186,407 m3/h |

| Electricity potential | 460,425 kWe |

| CHP plant potential (38% efficiency) | 3630 GWh |

| Biomethane potential | 104,481 m3/h |

| Carbon dioxide potential | 143,759 kg/h |

| Hydrogen potential | 14,930 kg/h |

| Carbon potential | 44,790 kg/h |

| Income Streams | Value | Unit |

|---|---|---|

| Carbon dioxide released | 2,883,383 | kg/year |

| Hydrogen production | 299,454 | kg/year |

| Carbon production | 1,197,816 | kg/year |

| Anaerobic Digester | ZAR 49,276,577 | USD 3,241,880 |

| Cleaning | ZAR 11,525,973 | USD 758,287 |

| Upgrading | ZAR 28,115,109 | USD 1,849,678 |

| Methane cracking | ZAR 910,123 | USD 59,876 |

| Total investment | ZAR 89,827,785 | USD 5,909,722 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Swartbooi, A.; Kapanji-Kakoma, K.K.; Musyoka, N.M. From Biogas to Hydrogen: A Techno-Economic Study on the Production of Turquoise Hydrogen and Solid Carbons. Sustainability 2022, 14, 11050. https://doi.org/10.3390/su141711050

Swartbooi A, Kapanji-Kakoma KK, Musyoka NM. From Biogas to Hydrogen: A Techno-Economic Study on the Production of Turquoise Hydrogen and Solid Carbons. Sustainability. 2022; 14(17):11050. https://doi.org/10.3390/su141711050

Chicago/Turabian StyleSwartbooi, Ashton, Kutemba K. Kapanji-Kakoma, and Nicholas M. Musyoka. 2022. "From Biogas to Hydrogen: A Techno-Economic Study on the Production of Turquoise Hydrogen and Solid Carbons" Sustainability 14, no. 17: 11050. https://doi.org/10.3390/su141711050