1. Introduction

The knowledge-based economy refers to economies in which wealth is created mainly through the production of products and services with considerable intellectual content rather than through natural resources or industrial-era manufacturing methods [

1]. However, one of the most critical challenges when studying the knowledge-based economy is the absence of a comprehensive and universal definition that explains which elements and pillars should be included. As Hvidt [

2] highlighted, the term “knowledge economy” remains unclear despite being used frequently for decades. Even in discussions on knowledge-based economies, the term “knowledge” has gotten little attention and is generally used simplistically and instrumentally as science and technology [

2]. In the literature, terms like “knowledge economy”, “knowledge society”, “information society”, “digital society”, “knowledge-based society”, etc., are used interchangeably [

3]. From a systemic viewpoint, Chen and Dahlman [

4] defined it as the economy “that utilizes knowledge as the key engine of economic growth. It is an economy where knowledge is acquired, created, disseminated and used effectively to enhance economic development” (p. 4). The UK Economic and Research Council (ESRC) emphasized that “economic success is increasingly based on the effective utilization of intangible assets such as knowledge, skills, and innovative potential as the key resources for competitive advantage. The term ‘knowledge economy’ is used to describe this emerging economic structure.” [

5]. According to the OECD [

6], the knowledge-based economy is “an expression coined to describe trends in advanced economies towards greater dependence on knowledge, information and high skill levels, and the increasing need for ready access to all of these by the business and public sectors.” Powell and Snellman [

1] outlined that the knowledge-based economy includes “…production and services based on knowledge-intensive activities that contribute to an accelerated rate of technological and scientific advance as well as equally rapid obsolescence. The key components of a knowledge-based economy include a greater reliance on intellectual capabilities than on physical input of natural resources, combined with efforts to integrate improvements in every stage of the production process.” (p. 199). While several definitions of the knowledge economy exist, the basic concept stresses the necessity of managing intangible assets rather than raw resources [

7]. Research and development (R&D) and technological innovation, human resources skills and education, and new and more effective ways to organize and manage work will all contribute to the creation of economic value in the era of the knowledge-based economy, according to the OECD [

6]. Consequently, many scholars established that information and communications technology (ICT), innovation, R&D, education, entrepreneurship, and the economic and institutional regime are central pillars and dimensions of the knowledge-based economy [

8].

The knowledge-based economy has risen to the top of the agenda for economic development. A considerable body of research has experimentally shown the growing importance of knowledge creation and application in economic development, mainly via innovation and human capital capacities [

9,

10]. The world’s most advanced nations acknowledge the importance of the knowledge-based economy, which contributes to GDP and creates jobs [

11]. Recent economic growth has resulted in a more robust development centered on more efficient technology and research. The competitiveness of national economies is becoming more reliant on their capacity to create and use knowledge since knowledge, education, and innovation are the critical determinants of economic development in a globalizing world [

12]. Further, knowledge leads to a more efficient, strong, and resilient economy, which is particularly vital in the event of sudden and unexpected shocks [

13]. Indeed, the ongoing COVID-19 pandemic has shown the fundamental need to rapidly deploy the knowledge-based economy’s pillars [

13]. As a result, an increasing number of governments, particularly in emerging and developing countries such as the Gulf Cooperation Council (GCC), are adopting knowledge-based policies to promote socio-economic development [

14,

15].

The Gulf Cooperation Council (GCC) is a group of six Arab Middle Eastern nations surrounding the Arabian Gulf, encompassing an area of 2,672,700 square kilometers, with a total population of around 57.6 million and a combined GDP of US

$B 1.407 in 2020 [

16]. The region has become one of the richest in the world due to the abundance of hydrocarbon resources (30% of the world’s proven oil reserves and 22.2% of the world’s confirmed natural gas reserves) compared with small national populations. Oil, natural gas, and petrochemical industries still form the central part of the national income and government revenues in GCC countries [

17]. However, depending on one single source of revenue puts a nation at risk, particularly if that source is non-renewable and its price is volatile. Accordingly, economic diversification is vital for states like the GCC that rely on non-renewable natural resources: oil and gas. The GCC’s leadership has thus been concerned for decades about the sustainability of its hydrocarbon income [

18,

19].

Prior to the COVID-19 pandemic, these countries were already in a period of economic transition. Indeed, due to the cumulative effects of globalization, new technology, free trade and investment, social changes, and development imperatives, economic diversification has been central to the GCC’s political agenda since the 1990s [

20,

21,

22]. Accordingly, most of the national visions and economic development strategies of the GCC countries (e.g., Qatar National Vision 2030, Kuwait Vision 2035, Oman Vision 2040, and Saudi Vision 2030) strive to transition away from oil and gas toward knowledge-based economies with stable and sustainable foundations [

2], with greater participation of the private sector in non-hydrocarbon sectors [

23]. Over the last decades, concentrated efforts to promote economic diversification and improve ICT, education, innovation, and entrepreneurship have helped boost their international competitiveness, as seen by the advancement in global rankings [

24,

25].

The COVID-19 pandemic had a tremendous effect on health systems but also harmed socio-economic development and people’s lives globally [

26]. COVID-19 caused a dramatic slump in the global economy in 2020, increasing unemployment and poverty worldwide [

27]. However, the economic damage has varied greatly; some countries were heavily affected, while others weathered the crisis significantly better. A lack of economic diversification has considerably worsened the shock, as seen by an overreliance on the tourist industry or oil extraction [

28]. Indeed, the pandemic double-hit GCC nations. Containment measures saved lives, but they also induced demand and supply shocks [

29]. Oil demand plummeted in 2020 during the pandemic when lockdowns caused the price to go below zero for the first time in history, owing to a significant drop in economic activity. Low oil prices weaken foreign balances, and high-debt countries face budgetary constraints [

30]. Consequently, GCC countries have taken several measures to alleviate economic harm, including tax packages and financial injections. Spending on pandemic-related health and economic implications raised concerns about long-term economic development goals [

31,

32]. Furthermore, the pandemic caused an economic crisis, and the decline in oil prices compelled regional governments to step up their diversification efforts. The pandemic has highlighted the region’s need to cut its dependency on oil, enhance private sector competitiveness, and illustrate the severe repercussions which will occur if reforms are delayed [

29]. Oil prices have been continuously rising since 2021. Because of the Ukraine war, they breached USD 120 per barrel in the first quarter of 2022. Likewise, natural gas prices have risen globally. This has made energy security a top priority for big importers, potentially accelerating the global green growth transition and emphasizing the need for economic diversification in the GCC area [

33].

With their political stability, sizeable financial buffers, and stable credit rating, these countries have a strong base for future sustainable development to transition to knowledge-based economies. Additionally, the economic crisis caused by the COVID-19 pandemic might be an opportunity to promote GCC nations’ diversification efforts toward knowledge-based post-oil economies. More recently, despite high oil prices, which are presently over USD 100 per barrel—levels not seen since 2014—several Gulf nations are pursuing financially conservative policies [

31].

However, turning the GCC nations into knowledge-based economies presents several challenges that must be addressed via systemic reforms tackling the several pillars of a knowledge-based economy. Accordingly, this paper has three goals. Firstly, it aims to present the GCC’s socio-economic features and highlight the importance and relevance of economic diversification. Secondly, it aims to analyze the impact of the COVID-19 pandemic on GCC economies and evaluate how the pandemic spurred diversification initiatives. Thirdly, the paper aims to analyze the present state of the knowledge-based economy in the GCC region, including its strengths, drawbacks, and prospects for the future.

2. Methods

This research aimed mainly to provide a thorough analysis of the influence of the COVID-19 pandemic on GCC economies and the current situation of the GCC region’s knowledge-based economy as portrayed in the scientific literature. For that purpose, we created a semi-systematic literature review inspired by Wong et al. [

34]. This approach was used since it is intended for topics that have been framed differently and explored by several groups of researchers from various fields, making a thorough systematic review approach challenging [

35].

The study covers a review of academic literature with a review of gray literature (e.g., reports, policy documents). It does, in fact, comprise a review of academic, peer-reviewed scientific literature from the Scopus, Web of Science, and Google Scholar databases on knowledge-based economy and diversification in the GCC area. The search was conducted using various keyword combinations that were carefully selected to achieve the study objectives and refer to “knowledge-based economy” themes (cf. “knowledge-based economy”, “knowledge economy”, diversification, innovation, “innovation system”, entrepreneurship, “entrepreneurship ecosystem”, and “private sector”). A document had to not only relate to the knowledge-based economy but also explicitly refer to at least one GCC country, including the United Arab Emirates, Qatar, Saudi Arabia, Kuwait, and Bahrain in order to be deemed acceptable and included in the review.

The gray literature consists of studies, policy documents/briefs, and working/discussion papers published by various organizations, including international organizations [e.g., World Bank, International Monetary Fund (IMF), and Organization for Economic Co-operation and Development (OECD)], regional and national organizations [e.g., United Nations Economic and Social Commission for West Asia (ESCWA), GCC Statistical Center, The General Secretariat for Development Planning (GSDP) of Qatar, etc.], and consulting firms [e.g., Deloitte, KPMG, McKinsey, Oxford Business Group, etc.].

The analytical approach applied in this research considers the six pillars of the knowledge-based economy as presented above: information and communications technology (ICT), innovation, R&D, education, entrepreneurship, and the economic and institutional regime. Furthermore, it explores the what and how of the COVID-19 pandemic’s impact on diversification efforts in the GCC region:

- -

What: What were the pandemic’s significant implications on the knowledge-based economy?

- -

How: How did the pandemic affect the GCC region’s diversification efforts? And how did the effect paths differ across countries?

3. The GCC’s Socio-Economic Features: The Relevance of Economic Diversification

The GCC nations have a plethora of natural resources. Oil and natural gas revenues are key components of national income, accounting for up to 50% and 90% of GDP, export, and fiscal earnings in 2019, respectively [

36]. Since the discovery of oil in the early 20th century, the region’s economic and social systems have experienced significant transformations. The 1970s oil boom changed the region’s physical, cultural, and demographic characteristics. Consequently, physical infrastructure, education, and health care improvements have led to rapid economic development [

37]. With a seemingly unlimited supply of petrodollars, the Gulf States have made significant investments in building modern infrastructure and in communication, education, healthcare, transportation, and government institutions [

38].

Since then, the main development strategy in the region has been based on economic growth, large public jobs creation for national citizens, overreliance on immigrant labor, and an ecosystem for distribution of economic and social benefits among nationals [

39]. Meanwhile, importing knowledge and human resources addressed a large part of their development needs [

38]. Further, all of the Gulf countries have built highly allocative “rentier states” that provide substantial benefits to their citizens in several forms, including free health care and education, important pensions, and, most significantly, employment in the public sector [

40]. Many jobs were created for distributional reasons rather than to accomplish a specific task [

2]. This has resulted in an overstuffed public sector, which will be unsustainable in the future, given the progressive reduction of oil reserves [

41].

Compared to small national populations, immense hydrocarbon reserves (30% of the proven oil reserves and 22.2% of the world’s proven natural gas reserves) have rendered the region one of the richest globally, with a very high oil income per capita [

17]. However, both of these variables have now shifted [

42]. The fiscal viability of their socio-economic model has lately been called into doubt due to rising demands for financial assistance from a growing population and economy [

39]. Firstly, the population has considerably increased, as has the national labor force, putting pressure on local economies’ ability to provide enough jobs. For instance, more than half the population in Saudi Arabia is under 25, and that figure is expected to rise to roughly 6 million by 2030, according to government projections. By 2030, at least 4.5 million more working-age Saudis might enter the workforce due to this demographic bulge. To absorb this influx, the Kingdom would need to produce almost three times as many jobs for Saudis as it did during the 2003–13 oil boom [

43]. Meanwhile, the public sector cannot absorb this influx alone. Most new entrants among working-age youth must seek employment in the private sector [

44].

Secondly, oil prices are under long-term downward pressure for two reasons. First, new oil production methods bring cheaper oil supplies from unconventional sources, such as shale oil, to global markets [

45]. Second, as part of the worldwide effort to fight climate change, “black” energy sources are being replaced with “greener” ones, particularly in the transportation sector. These factors put downward pressure on oil prices and, therefore, on the GCC countries’ revenues, highlighting their vulnerability to the volatility of global oil and gas markets [

46]. Oil exporters will likely face a decrease in revenues, and their finances and external reserves will be under pressure [

46]. More recently, the war in Ukraine has pushed energy security to the top of the priority list for major importers countries, potentially speeding up the global green growth transition [

33]. Consequently, larger populations and more complex and expensive societies to govern, coupled with stagnant or declining oil revenues, make it challenging to maintain the previous affluent economic growth model—the rentier state model [

40,

47].

For hydrocarbon resource-rich countries, such as those in the GCC, economic diversification is a critical structural reform policy for development and long-term prosperity for many reasons [

44]. First, diversification is a medium to long-lasting hedge to generate growth sources when the resource demand or supply begins to decrease. Second, diversification is framed in terms of reducing risk since it allows an economy to avoid depending on a few sources of revenue [

44]. In the case of the GCC, diversification makes it possible to manage commodity price volatility. Economic measures such as GDP and net foreign reserves have closely tracked hydrocarbon production and prices due to their reliance on oil. As Beblawi [

48] highlighted: “the Gulf states’ drama is that it [oil extraction] is not simply another economic activity added to the other existing productive sources within a viable and modern economy, as it is with the Netherlands or, for that matter, Canada, Australia, and the Scandinavian countries. In the Gulf, the oil sector dominates the economy; it is almost the unique source of wealth.” (p. 188). Accordingly, as seen during the COVID-19 pandemic, a drop in oil prices significantly affects consumption, production, and public finance, resulting in an uncertain economic environment.

Third, since oil and gas production is capital intensive and does not generate many jobs, demanding diversification aids in creating employment opportunities [

20]. Finally, diversification may increase production and per capita income [

29]. It is often assumed that diverse economies are more sustainable than those of the Gulf oil-exporting countries [

49]. Also, the benefits of diversification are numerous, as detailed by the General Secretariat for Development Planning in Qatar: “A more diversified economy is inherently more stable, more capable of creating jobs and opportunities for the next generation and less vulnerable to the boom and bust cycles of oil and natural gas prices.” [

50] (p. 10).

For the GCC nations, there are several diversification formulas. Firstly, fiscal income diversification is crucial for stabilizing government finances over time. Countries in the region have been exploring various ways to bolster government finances. For example, the Omani government announced its 2020–24 budget strategy in October 2020. The plan, which draws on the long-standing development strategy Oman Vision 2040, strives towards a range of initiatives and tax changes that diversify national income. The proposal highlighted measures to enhance efficiency in collecting taxes, introduced a value-added tax, and spent USD 965 million (OMR 371 million) on several development projects across the country. The government is also contemplating setting up personal income tax for the first time to extend the income base [

51]. Secondly, export diversification counts since macroeconomic volatility is affected via trade terms volatility. Thirdly, diversification via its impact on the essential factors influencing the effective exchange rate and price competitiveness is vital in monetary and fiscal policy. The fourth aspect that may affect the speed of non-oil economic diversification is structural changes [

29].

The GCC nations are aware that the significant drop in oil prices during the pandemic has prompted this transformation and that the “oil era” is ending. Diversification is becoming increasingly critical as a result of governments’ depleting reserves and large populations, most notably in Saudi Arabia [

52]. Further, with the COVID-19 pandemic, economic diversification has gained a renewed sense of urgency in the GCC region [

53]. However, economic diversification has been a persistent problem since 1970, and GCC nations have been worried for decades about the long-term viability of their hydrocarbon income. Indeed, prior to the COVID-19 outbreak, GCC nations had been attempting, with varying degrees of success, to diversify their economy away from hydrocarbons [

29,

51]. In the 1970s, with cheap hydrocarbon feedstock and energy, they started a diversification process focused on downstream industries such as metallurgy and petrochemical [

54]. Significant projects, like aluminum smelting in Bahrain and in the industrial cities of Yanbu and Jubail in Saudi Arabia, and the erection of ports in Dubai were part of an attempt to diversify the local economies by investing oil revenue in productive assets. However, most of these diversification initiatives have had limited outcomes. It is clear that diversification via expansion of the oil sector will not decrease reliance on oil and gas since these industries are entirely dependent on the cheap cost and abundant supply of oil and gas in the region [

20].

Given the limits of the classic oil-based economy, there is an agreement among GCC policymakers that the region needs a long-term plan to reduce its reliance on hydrocarbons revenues and build a more stable and diversified economy. GCC nations have also adopted more comprehensive methods for their diversification initiatives in recent years. They have integrated economic diversification into national policies and set up commissions to incorporate the private sector better in continuing economic operations [

53]. Recently, each GCC country adopted national vision programs: e.g., Oman Vision 2040; Vision Kuwait 2035; Economic Vision for Bahrain 2030; Qatar National Vision 2030; the UAE Economic Vision 2030, and Saudi Arabia Economic Vision 2030 [

2]. Although differing in substance, they aim to transform their economies from dependence on oil and become advanced, knowledge-based post-oil economies with solid and economically sustainable foundations. For example, with its Economic Vision 2030, Bahrain “…aspire to shift from an economy built on oil wealth to a productive, globally competitive economy, shaped by the government and driven by a pioneering private sector—an economy that raises a broad middle class of Bahrainis who enjoy good living standards through increased productivity and high-wage jobs.” [

41].

Consequently, each GCC country has embarked on new projects to change their economic, social, and political structure to propel internal dynamics to transform their economies and societies. All the declared national visions emphasize human capital development with a central aim of transitioning toward a post-petroleum era [

55]. For instance, through the strategy Vision 2030, implemented in 2016, the Saudi government has set out to diversify the country’s economy away from its reliance on oil and create a new social contract. To achieve the “thriving economy” envisioned in Vision 2030, a fundamental transformation in the economic model is expected, with an emphasis on increasing productivity and shifting the state’s responsibilities from driving the economy to facilitating private sector development. Human capital development, business environment improvement, quality public administration, and an open and competitive labor market are the four pillars of the transition [

56].

Non-oil sectors in all GCC nations have progressively expanded, with non-oil development often outperforming oil sector growth, although from a lower base. Non-oil growth rates have varied per country, as have the relative sizes of the oil and non-oil industries. Bahrain and the UAE had the most diverse economies in the region at the end of 2019, while Kuwait, Qatar, and Saudi Arabia were the most reliant on oil and gas (

Table 1).

Diversification efforts, however, have lately been hampered due to the COVID-19 outbreak, which has affected all non-oil businesses. The pandemic has brought attention to the region’s need to reduce its reliance on oil and improve the competitiveness of the private sector, as well as the dire consequences of delaying reforms [

29]. Further diversification is pivotal for a robust future.

4. The Impact of the COVID-19 Pandemic on GCC Economies

Lockdowns, social distance, and other restrictions adopted since March 2020 to limit the virus propagation have resulted in significant worldwide economic activity declines, leading to the worst global recession since the Great Depression [

30]. Meanwhile, the pandemic has posed unprecedented health and financial challenges to the GCC, compelling rapid and far-reaching responses. The dual effects of the pandemic and reduced oil prices have significantly affected the GCC nations. Firstly, social distancing measures and travel restrictions have affected activities across all sectors, including retail and tourism, dragging down the services sector, the backbone of non-oil economies (60–70% of non-oil GDP) [

57]. In the meantime, supply chain interruptions and increases in material and shipping costs, caused by a downturn in global commerce, hampered industrial activity, hurting manufacturing, construction, and utilities [

29].

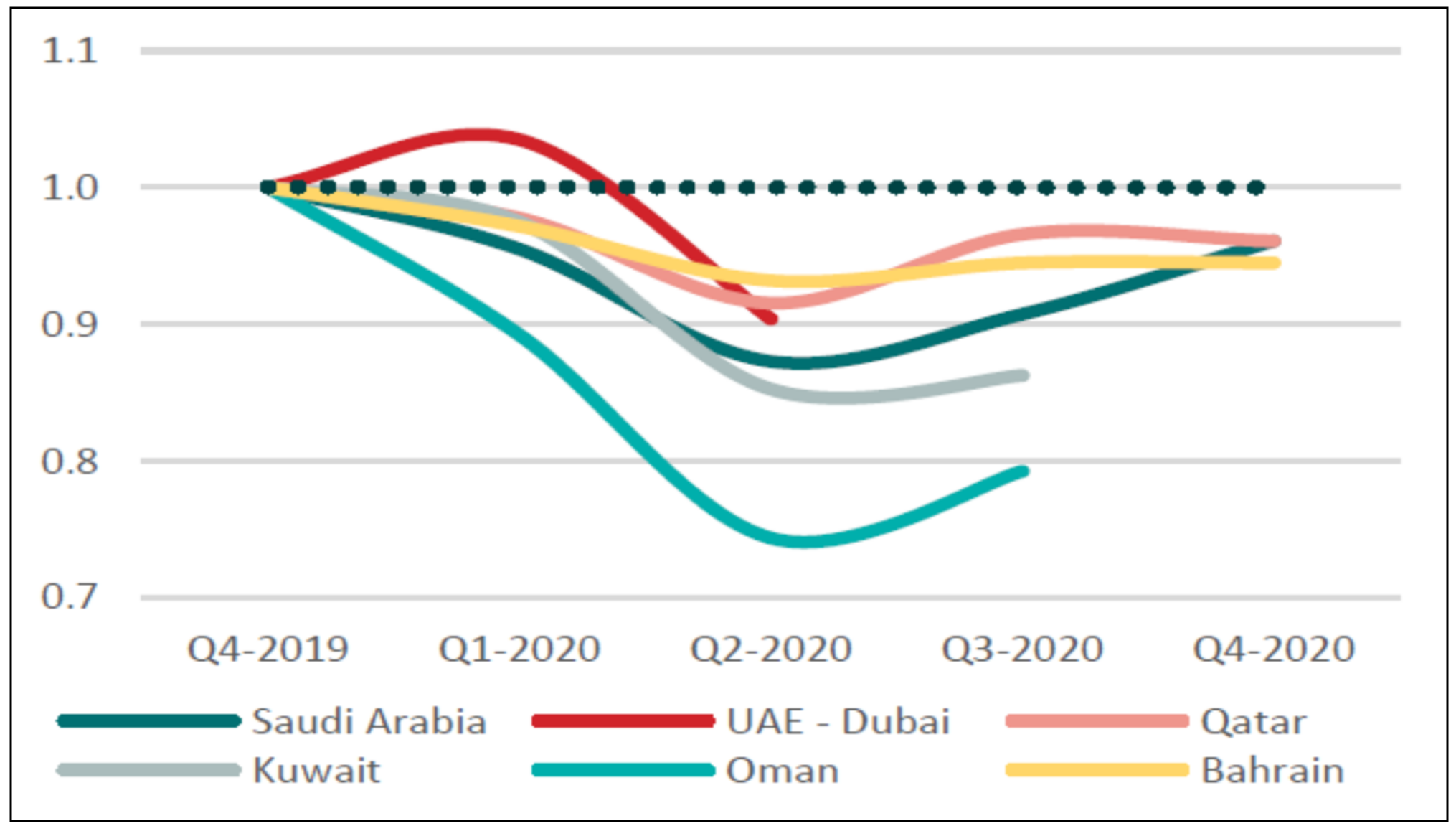

The extreme contraction in global activity and the abrupt drop in travel and transport have substantially reduced worldwide oil consumption. Overall oil consumption reduced by 10% to 94.7 million barrels daily in 2020 despite OPEC+ efforts, while average oil prices dropped by 33%, from USD 61.41 per barrel in 2019 to USD 41.26 per barrel in 2020 [

29]. The International Energy Agency [

58] reported that lockdowns reduced road traffic by 50–75%, resulting in a worldwide drop in global road transport activity of less than half that of 2019. By the end of the first quarter of 2020, air travel had dropped by 60%. Oil demand and price declines exacerbated the 2020 economic recession for the Gulf Cooperation Council (GCC), which is still strongly reliant on hydrocarbons, accounting for 40% of GDP, 70% of government revenue, and 75% of exports. Thus, GDP in the GCC countries shrank by 4.8% in 2020, exceeding the declines seen during the worst years of the global financial crisis in 2008–09 and the collapse in oil prices during 2014–17. The contraction in GDP was exacerbated by a decrease in private consumption of 4.9% [

29] (

Figure 1).

This has significantly strained the GCC nations’ budgetary positions [

53]. The disruptive fiscal price of the oil (budget pricing) and the disruptive external price (current account pricing of zero) indicate a significant mismatch throughout the 2020 period. Before the pandemic, the International Monetary Fund (IMF) [

59] projected that GCC nations would deplete their saved wealth by 2034 unless significant fiscal and economic reforms were initiated. The pandemic has likely shortened this timeline.

At the same time as the rest of the world, the GCC authorities undertook health, containment measure, and economic efforts to combat the COVID-19 pandemic [

29]. Several appropriate steps to alleviate financial harm were taken by GCC authorities, including fiscal packages, easing of monetary and macro-prudential regulations, and liquidity injection into the banking system [

30]. Moreover, governments have been compelled to re-evaluate their economies. GCC central banks hastened to offer substantial stimulus packages to support the private sector, especially small- and medium-sized enterprises. However, despite simultaneously dropping oil prices, Bahrain, Oman, and Saudi Arabia announced drastic budget cuts. Labor policies prioritized the protection of national workforces. Bahrain and Saudi Arabia, for instance, dedicated around USD 570 million and 2.3 billion, respectively, to cover citizens’ private-sector salaries. Oman prohibited terminating the contracts of nationals working in the private sector [

30]. In addition, central banks established additional liquidity tools to help banks and the private sector. For example, the Central Bank of the United Arab Emirates announced a monetary mitigation program of USD 70 billion, highlighted by 13.7 billion in zero-interest-rate loans to banks [

29].

Overall, the GCC governments maintained reforms to diversify their economies and encourage private sector activity during 2020 and 2021. The structural reforms, such as private sector participation in the economy and greater flexibility in job markets, helped sustain the momentum of private sector development and provided hope for a more substantial post-COVID economic recovery [

29]. For instance, Oman implemented many reforms to restore budgetary stability and sustainability. Major fiscal reforms introduced during this period include increasing revenue mobilization by instituting a 5% VAT rate beginning in April 2021, improving subsidy targeting to vulnerable social groups by rationalizing utility subsidies, managing the public wage bill, and limiting public employment. Likewise, Saudi Arabia modified its Kafala system to allow expatriate employees more job mobility. Aside from structural reforms that improve the business environment, GCC authorities have prioritized investment in areas critical to economic diversification, such as telecommunications [

29]. Having learned a painful lesson from the pandemic that crippled the global oil sector, the GCC governments have an excellent opportunity to further their diversification goals toward knowledge-based economies. However, this shift is challenged by several functional, structural, and cultural factors.

5. The Knowledge-Based Economy in the GCC: The Key Strengths and Drawbacks

Several structural issues might help or impede the transition toward a knowledge-based economy. In fact, an economic and institutional environment that promotes good economic policies and stimulates entrepreneurial activity, investment in ICT infrastructure to enable the diffusion and processing of information and knowledge, investment in education and learning to create and use knowledge and improve entrepreneurial skills, and, finally, an effective innovation system are all required for the transition to the knowledge-based economy, according to Dahlman and Andersson [

60].

In the GCC, the transformation to a knowledge-based economy mainly results from top-down economic policies that promote entrepreneurship, R&D, and innovation while also reforming the education system [

14]. Indeed, in terms of the economic incentive regime, GCC countries outperform the rest of the Middle East and North Africa (MENA) region and the globe. This reflects a stable fiscal situation, reasonably trustworthy political institutions, and a relatively easy economic environment. However, the shift to a post-industrial society creates functional, structural, and cultural challenges for economies reliant on hydrocarbons, such as those in the GCC [

61].

Firstly, regarding human capital, thanks to their oil wealth, during the last six decades, the GCC nations have achieved significant progress in improving their educational systems through many reforms [

62]. In 1999, for example, the United Arab Emirates launched its “Vision 2020” education reform program. Bahrain launched “Schools of the Future” in 2004, while “Education for a New Era” in Qatar was established in 2002 [

63]. However, the region’s top-down reform model manifests more significant systemic problems in national education systems. Sponsored and governed by the government, education systems in the region are bureaucratic, slow to adapt, and unwilling to look beyond the historical paradigm of how they work and organize as an institution [

38].

Consequently, despite these reforms, there is rising evidence that graduates in GCC countries do not acquire the skills required to succeed in the contemporary economy [

64]. Indeed, according to Wiseman et al. [

61], GCC nations still have “seemingly low quality and low impact education systems” (p. 2). Further, graduates of secondary and post-secondary education in the GCC lack the necessary skills and knowledge to compete in the job market [

65]. This underperformance has to do with “the shortage of skilled teachers, and the widespread prevalence of rote learning in classrooms, which hinders creativity and creates an environment that eliminates flexibility in learning” [

66] (13). For instance, despite significant efforts, students in Qatar continue to underperform in educational accomplishments [

66]. They continue to perform somewhat behind the international average in the Trends in International Mathematics and Science Study (TIMSS) and the Program for International Student Assessment (PISA) [

67]. In 2012, PISA results showed that 70% of students in Qatar had low performance in math, reading, and science [

68]. With restricted soft skills, leadership qualities, or knowledge that match the job market needs, the economy has little benefit from increasing education [

69].

Furthermore, according to Ben Hassen [

14], the main shortcoming of the knowledge-based economy in the GCC is a lack of human resources in technology-related fields, particularly engineers, and other critical science, technology, engineering, and mathematics (STEM) sectors in general. Only a tiny proportion of students are interested in a career in STEM fields, whereas a substantial proportion chooses careers in the public sector. Jobs in the public sector are much more appealing, well-paying, and less demanding than those in the private sector [

70]. Finally, as Abu-Shawish et al. [

54] highlighted, GCC countries face a dilemma: can existing local cultures and traditions that are firmly entwined with national identity coexist with the expansion of the knowledge economy and human capital? Indeed, the GCC region has been founded on traditions and cultural norms handed down through generations, making implementing fundamental and structural changes challenging [

38]. However, many Gulf states still believe importing educational systems, curriculums, and providers is better than developing creative and local systems.

Secondly, despite substantial efforts and high investments in establishing several R&D centers and institutions in various fields, innovation systems in the GCC suffer from some limitations. The Global Innovation Index (GII) of 2020 highlighted that the innovation output in the region is below its projected level, producing fewer results than those invested in innovation [

71]. Indeed, GCC countries suffer from low performance in several innovation output indicators, such as patents, publications, and share of high technology exports, etc. (

Table 2).

Additionally, these countries have much room for improvement in areas such as institutions, market sophistication, and business sophistication. This phenomenon is similar to what has been referred to as the resource curse or the paradox of abundance [

72]. Additionally, according to Hvidt [

2], the GCC spends less than 0.5% of GDP on research and education, which is lower than the global average of 2.3%. Further, local innovation systems suffer from several structural weaknesses, such as in Kuwait (

Box 1).

Box 1. The main features of Kuwait’s innovation system. Source: OECD [

73].

At 0.33–0.37% of GDP, R&D investment is less than half the amount achieved in Saudi Arabia and the United Arab Emirates and less than a fifth of a goal established in the Blue Ribbon report in 2007 to spend 2% on R&D expenditures.

There is no official financing organization for research or innovation, and there are few or no financial tools to support STI activities.

No governmental organization—ministry or agency—is responsible for policymaking in science, technology, and innovation (STI), and there is no national STI plan.

The two significant research institutes, Kuwait University (KU), and the Kuwait Institute for Scientific Research (KISR), create their plans and agendas mainly from the bottom up. Their research funding is directly negotiated with the Ministry of Finance. There is no clear linkage to the “New Kuwait Development Plan”.

Moreover, according to Callen et al. [

74], GCC technological innovation rates remain relatively low, accounting for fewer than 3% of new ventures. The rate of medium or high technological innovation in GCC nations has decreased from 3% (2006) to 2.3% (2011) compared to developed countries such as Norway with 14.3%. Furthermore, as highlighted by Hvidt [

2], the GCC nations have not been obliged to create or innovate but have been allowed to base their growth on learning or imitation, importing technology, know-how, and talent already accessible elsewhere. Finally, in the GCC, the borders between the private and public sectors are unclear, with intricate interactions between the two spheres shaping private enterprises’ incentives and the degree to which they must innovate to survive [

75].

Regarding entrepreneurship, GCC nations have been attempting to establish vibrant entrepreneurial ecosystems in recent years as part of a larger effort to diversify their economies away from hydrocarbons. This entails creating venture-friendly marketplaces, legislation, financing mechanisms, a dynamic culture, and various support mechanisms [

76]. According to Yaseen [

77], entrepreneurs in the United Arab Emirates are also confronted with a lack of entrepreneurial knowledge, education, and training opportunities. Further, women from GCC nations are underrepresented in the region’s entrepreneurship ecosystem due to a lack of necessary skills, knowledge, culture, and experience [

18]. Miniaoui and Schilirò [

78] indicated that the percentage of women entrepreneurs is meager, with just 6% in Qatar, 3% in Bahrain, and 2% in Kuwait, the UAE, and Saudi Arabia.

Moreover, regional start-ups face two significant challenges: a lack of human resources and a mismatch between the skills demanded by the sector and those supplied by the education system [

25]. Overall, the GCC private sector continues to depend mainly on government-funded projects and consumption, which are ultimately financed by oil and gas income [

53]. Entrepreneurship is also influenced by the fear of failure, which prevents people from establishing businesses. There is a considerable gap between people who aspire to develop a company and those who actually do so [

25]. In addition, as observed in Qatar, entrepreneurship is seen as a second income rather than a primary source of revenue in society. The most prevalent category of entrepreneurs is the “passive” model, in which the entrepreneur works full-time in the public sector and runs a side company to supplement their income. It is risky for him to quit his job and establish his firm as a full-time entrepreneur [

25]. Finally, access to capital is a significant barrier for many entrepreneurs in the region. Most banks in the region choose to finance more secure businesses, such as real estate. It is difficult to secure bank loans since most banks in GCC nations are typically averse to lending to small, unknown enterprises, preferring the security and predictability of financing to major firms, such as those with governmental ties [

79]. In Qatar, most new firms are financed via informal sources (family, relatives, friends, work colleagues, neighbors, strangers, etc.) [

80].

Finally, despite these challenges and issues, the GCC region’s foundations appear to align well with the goal of a knowledge-based economy. Besides Saudi Arabia, most GCC nations are small and home to a small native population. Consequently, a development strategy that strives to produce large numbers of industrial employment with low or medium knowledge content would not be desirable, since the workforce would mostly be imported. However, it is rational to strive for less employment with greater knowledge content and better remuneration for the region’s people [

2]. However, transforming a state into a knowledge economy is not straightforward, since a thriving knowledge-based economy depends on a complex connection between entrepreneurship, motivation, supportive economic, and institutional regimes (

Table 3).

6. Discussion: Can the GCC Nations Maintain their Diversification Efforts in the Face of Rising Oil Prices?

Despite the economic challenges posed by COVID-19, the pandemic has shown how critical it is to deploy the pillars of the knowledge-based economy at record speed [

81]. Firstly, the COVID-19 crisis underlined the crucial significance of ICT in society’s continuing functioning via remote work, online education, and e-commerce [

82]. Furthermore, governments and organizations that use digital technology have higher adaptability in the face of adversity, enabling them to recover faster and more successfully [

83]. Second, the COVID-19 pandemic has shown the need for having a significant R&D capacity and proven talents used in the short period on new and unanticipated difficulties. Innovation will also play an essential role in post-pandemic recovery [

84]. To capitalize on the possibilities created by the COVID-19 issue, new business models, customer expectations, market realities, etc., will be required [

85]. Finally, the pandemic has shown the critical significance of public institutions in coordinating the fight against COVID-19, particularly in mobilizing all knowledge sources [

81].

Furthermore, as customers adjust to the post-COVID lifestyle, the present pandemic has created new and expanded economic opportunities. For instance, COVID-19 challenges have required quicker adoption of digital financial services, creating significant opportunities for FinTech enterprises [

86]. Likewise, the pandemic has been an incredible learning experience, especially for aspiring entrepreneurs. In Qatar, in 2020, even though many businesses have been negatively affected by the pandemic, COVID-19 has sparked an uptick in new company ventures. According to the GEM Qatar Report 2020, the Total Early-stage Entrepreneurial Activity (TEA) rate rose from 14.7% to 17.2% throughout 2020. About 45.6% of the respondents who are not already participating in entrepreneurial activity want to become so within the next three years. Half of these people cited COVID-19 as an influence. Four out of ten early-stage entrepreneurs (41.9%) and one-third of experienced company owners feel that COVID-19 has presented new business prospects they want to explore [

87].

More recently, despite high oil prices, several Gulf nations have lately implemented budgetary austerity measures. With oil prices presently over USD 100 per barrel—levels not seen since 2014—the expected turnaround will be driven by an increase in income as well as a decrease in expenditure. According to the International Monetary Fund’s (IMF) most recent Regional Economic Outlook, the windfall from higher oil prices is likely to enhance GCC fiscal and external balances and GDP growth [

88]. Most regional governments declared that the surplus would be utilized to replenish government reserves depleted by the pandemic, assist national development funds, reinforce critical economic and social programs, and partly repay debt. Despite rising oil prices, Gulf nations remain dedicated to their transformation strategies, with some even aiming to expedite them [

31]. Meanwhile, even if domestic inflation is not as high as globally, some countries, such as Saudi Arabia and the United Arab Emirates, are increasing governmental expenditure on social welfare by billions of dollars to protect their citizens from growing living costs [

89].

Given the cyclical nature of oil demand and pricing, the present high levels of oil income should serve as a drive for additional diversification rather than reverting to previous boom-bust cycles [

90]. The faster and more extensive measures to decarbonize the global economy, which the Ukraine war is likely to accelerate, imply that the windfall must be invested in the GCC’s economic and environmental transformation. These global developments heighten the urgency for countries to accelerate economic diversification to reduce their reliance on hydrocarbons, especially as many countries are moving to greener development paths, and the rise in hydrocarbon prices is already accelerating this shift in many countries [

33].

However, this study has two main limitations. Firstly, research on the impacts of the COVID-19 pandemic on diversification is still in its early stages. Accordingly, this study focuses on the pandemic’s short- and medium-term impacts. As a result, systematic reviews of the medium- to long-term consequences of the COVID-19 pandemic on diversification and the development of the knowledge-based economy in the GCC are highly needed. Secondly, this research looks at all six pillars of the knowledge-based economy. Future studies should concentrate only on one of these pillars and conduct a thorough examination of its characteristics as well as the influence of the pandemic on it. For instance, future research might use the innovation system concept to study innovation dynamics in the GCC area. Indeed, a systematic approach enables the consideration of all elements of the innovation system, their inter-relationships, and associated impacts.

7. Conclusions

This paper has three goals. Firstly, it aims to present the GCC’s socio-economic features and highlight the importance and relevance of economic diversification. Secondly, it aims to analyze the impact of the COVID-19 pandemic on GCC economies and evaluate how the pandemic spurred diversification initiatives. Thirdly, the paper aims to analyze the present state of the knowledge-based economy in the GCC region, including its strengths, drawbacks, and prospects for the future.

The findings highlighted that throughout the previous several decades, continuous efforts to develop the status of ICT, education, innovation, and entrepreneurship in several GCC countries have contributed to improving their international competitiveness, as seen by advancements in rankings issued by various international organizations. Furthermore, political stability, significant financial resources, and a stable credit rating provide these countries with solid foundations for future sustainable development.

The findings also indicated that although many Gulf nations were already attempting to diversify their economies before the COVID-19 outbreak, the accompanying economic downturn and drop in oil prices meant that the governments had to re-evaluate and, in some cases, accelerate their strategic plans. A renewed sense of urgency has arisen around diversification. Indeed, having learned a painful lesson from the pandemic that crippled the global oil sector, the GCC governments have an excellent opportunity to further their diversification goals. Consequently, governments may design and implement rigorous policies that are vibrant, diverse, and based on innovation and research. With the present global situation, the GCC economies are likely to increase their efforts at economic diversification. To get fast results, policymakers must think outside the box and do something new and creative. They may reduce budgets and focus on developing critical components to create a stable and booming post-hydrocarbon economy. GCC countries must guarantee that their crisis response sets the foundation for a long-term recovery that supports economic diversification and transformation. Governments should rescue today’s economy to construct the future economy rather than reconstruct the past economy. The success of such development strategies depends on a participatory process that involves a wide range of actors in government, the business community, academia, research organizations, and other vital institutions.

However, establishing a knowledge-based economy requires much more than a well-educated workforce. It is a distinct mentality that dominates such cultures, focused on generating and winning chances, visions, and a dynamic home base for internationally competitive enterprises. One issue for the Gulf region in creating knowledge economies is that human capital is embedded in the person, which means that it can only be unlocked for the benefit of society and the individual if the person is willing to do so. The success of the knowledge economy thus needs a more widespread cultural shift focused on citizen engagement, process ownership, and active learning, such that motivation, ambitions, and entrepreneurship become the individual’s inherent ethos [

2]. Further, the four pillars of the knowledge-based economy are interlinked, and investments in them—and adequate performance—are considered prerequisites for achieving a prosperous knowledge economy. There is a widespread conclusion that the Gulf states have an excellent “economic incentive and institutional system” and “information infrastructures”.

On the other hand, since GCC countries rank poorly on the pillars of “education” and “innovation”, governments must concentrate on improving the state of innovation and education in order to accelerate their transition to a knowledge-based economy. Further, regarding human capital, the GCC nations’ future prosperity will depend mainly on the capacity of their education systems to generate national workforces with the necessary knowledge, and effectively integrate them into the labor market as knowledge-based economies evolve.

Our findings contributed to the rentier state theory (RST) advancement. Firstly, the paper’s results suggest that a fundamental structural challenge is hampering the GCC’s transformation to a knowledge-based economy: the rentier system, which is hegemonic in the region, imposes several constraints. For instance, with limited private-sector engagement, the rentier model elevates the government to the forefront of the knowledge-based economy, mirroring the government’s role in the rentier state. Secondly, the paper’s findings show that the GCC government’s strong commitment to diversifying the economy and developing dynamic knowledge-based sectors validates a new phase in rentier state theory, with “late rentierism” as proposed by Gray [

47].