3. Methodology

Considering the objective of this study and the literature review related to tourism development, the impact of COVID-19 on the restaurant industry and the measures and strategies that have been adopted for the recovery of businesses in this sector of activity are followed by a rigorous analysis of the impact of this disease on profitability, payroll costs, headcount, and indebtedness in the restaurant industry. The period selected for data analysis was between 2019 and 2020, to compare the year when restaurants and tourism reached historic highs and the year when there was a significant decline in restaurant management issues resulting in significant losses.

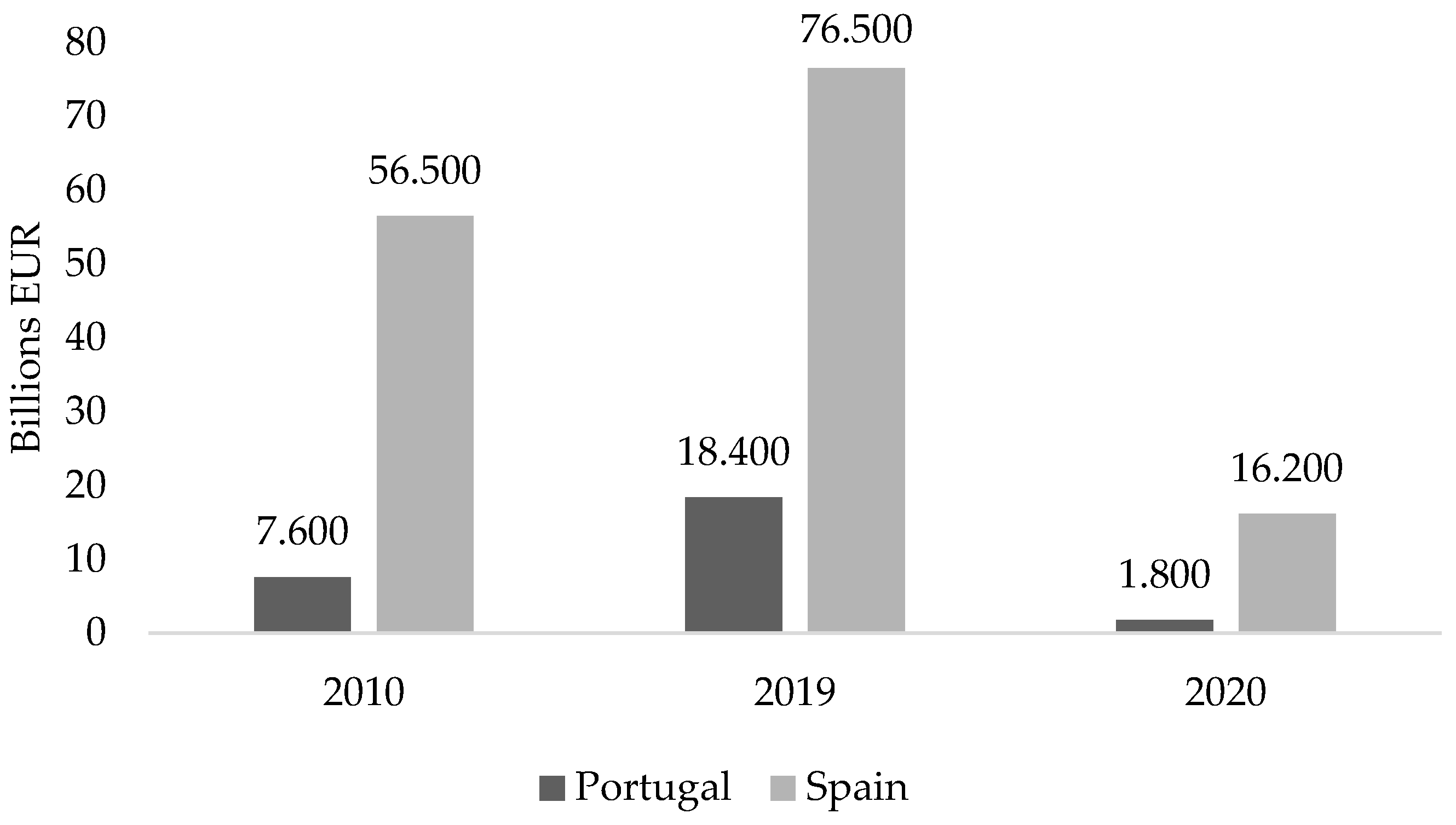

Portugal and Spain are countries where the tourism sector and the restaurant industry are very important in the economy. Quantitative research has had a wide application in various studies [

63], for example, Galstian et al. [

64], Lucas and Ramires [

13], and Silva et al. [

65]. Then, it was used to study the impacts of the COVID-19 pandemic on the restaurant industry in Portugal and Spain. Descriptive analysis and hypothesis testing were the techniques used for data analysis. Secondary data were used through SABI database [

66] on 20 May 2022, and the research focused on Portuguese and Spanish restaurant companies, which are assigned the economic activity code 5610, in Portugal by the Código de Atividades Económicas (CAE) and in Spain by the Clasificación Nacional de Actividades Económicas (CNAE). Kim et al. [

52] prepared a similar study, collecting data on restaurant companies’ monthly sales between 2019 and the first quarter of 2020 in China.

The search on the SABI platform [

66] started with the extraction of several variables concerning the years 2019 and 2020: region, net income, equity, debt, long-term bank debt, short-term bank debt, total assets, turnover, headcount, payroll costs, income before income taxes and interests. All these data obtained from the SABI platform allowed the calculation of profitability ratios, debt ratios, headcount growth, and payroll costs, according to

Table 4.

All the variables were used in the comparison of the various regions of Portugal and Spain between the years under study.

Data collection started with 16,958 restaurants from Portugal and 29,850 from Spain. A total of 8041 Portuguese restaurants and 8218 Spanish restaurants were eliminated for lack of information, as they assumed negative equity, and it made it impossible to calculate ROE. Thus, the final sample consisted of 8917 Portuguese restaurants and 21,632 Spanish restaurants.

Statistics Packages for Social Sciences (SPSS) software (IBM, Armonk, NY, USA) was used to analyze the data to obtain the results of this research. Poon and Low [

67] also used the same software in their study. For the hypothesis testing, non-parametric tests were used insofar as variables failed normality through Kolmogorov–Smirnov test (K–S test), an assumption required for the adoption of parametric tests. Thus, Kruskal–Wallis test was performed instead of one-way ANOVA as data are not normally distributed, and the Friedman test was conducted as it is a non-parametric test equivalent to the parametric two-way ANOVA. These two tests were also used by Fu [

56] in a similar study.

Kruskal–Wallis test had the aim of analyzing if there were significant differences in the variables are study among diverse regions in 2019 and 2020 [

56]. In other words, variables’ median was compared among regions groups in other to know if the variables present equal distribution in them. First of all, it was formulated and tested the hypothesis “H0: ROE/ROA/ROS/payroll costs percentage/headcount growth/indebtedness distribution is equal across region categories” with a level of significance of 0.01.

The Friedman test [

68] is a non-parametric test that analyses the scatter between two factors; it can compare various ranking methods on different data sets [

69]. “The Friedman test is used to verify the relation between the categorical and ordinal variables (factor)” [

70], p. 290. The same authors state that samples behave as repeated evaluations of similar objects, measured at different time points, and can also be measured under different conditions. In this study, the Friedman test was used to analyze if the COVID-19 pandemic had had an impact on the restaurant industry.

As happened with Gligor-Cimpoieru et al. [

71] and Fu [

56], the Kruskal–Wallis test and the Friedman test were efficient in this study.

4. Results and Discussion

4.1. Overall Performance of the Variables

The sample in the study is made up of 8917 Portuguese restaurants (including mobile food service activities) belonging to Portuguese EAC Rev.3—561 and 21,632 Spanish restaurants belonging to Spanish EAC Rev.2—561. The restaurants are geographically distributed according to the Nomenclature of Territorial Units for Statistics (NUTS). This nomenclature of territorial units is segmented into three levels, and the chosen level was two (NUTS 2), as can be consulted in the appendices. The years under review were 2019 and 2020 to analyze the effect of the COVID-19 pandemic. The restaurants in both countries present huge but different volatility. In Portugal, there were 7980 active restaurants in 2019, yet 937 restaurants were born, and 709 died, ending up with 8208 active restaurants in 2020. In this way, despite the COVID-19 pandemic, there was an increase in the number of restaurants in Portugal. This is confirmed by the Bank of Portugal [

72] and may be related to the fact that this sector is quite volatile [

73] and that the birth and death rates of these companies are non-constant [

72].

In Spain, the situation is different, as, in 2019, there were 20,734 active restaurants, whereas, in 2020, 898 restaurants were registered and 3987 were eliminated, ending up with 17,645 active restaurants. According to Martínez Jorge and Galindo [

74], based on data from the Bank of Spain, small and medium-sized Spanish companies represented a large part of the restaurant supply and were the most affected by the COVID-19 pandemic. The decrease in the number of Spanish restaurant companies may be related to the vulnerability of this sector, which increased by 6 p.p. in the year 2020 (20%) compared to the year 2019 (14%), registering a drop in the number of companies at the very beginning of the same year, due to the confinement imposed by the government and the forced closing of companies [

75]. The same authors state that there was a peak in the insolvency rate of restaurant companies, standing at 15% at the end of the year 2020.

In

Table 5 and

Table 6, the sample is presented by region. In Portugal, Lisbon Metropolitan Area is the region with the largest number of restaurants, followed by the North region. In Spain, Cataluña should be highlighted with 4327 restaurants, closely followed by Madrid. Ceuta and Melilla are distinguished by the small number of restaurants.

4.2. Profitability

According to

Appendix A, the average profitability of restaurants in Portugal decreased between 2019 and 2020. ROE, ROA, and ROS decreased by 297 p.p., 17 p.p., and 78 p.p., respectively. This describes the state of the restaurant industry under the COVID-19 pandemic. The position of Portuguese regions is similar, with all regions presenting a drop between 2019 and 2020. It should be emphasized that all regions have negative average profitability either on assets, sales, or equity, which highlights the impact of COVID-19 in all regions. In 2020, the Autonomous Region of Azores (ARA) had the highest ROE (−69.37%), the Center presented the highest ROA (−2.93%), and the North attained the highest ROS (−14.71%). The Autonomous Region of Madeira (ARM) has the worst scenario when ROE and ROA are analyzed.

Observing

Appendix B, Spain presents a drop in ROE and ROA, of 79.29 p.p. and 6.81 p.p., respectively. Curiously, it shows a rise in ROS and positive values in ROA and ROS. Analyzing the ROE of the regions, in 2019, Cataluña has the highest value (281%), followed by Asturias (240%), while in 2020, the primacy goes to Ceuta (18%) and Melilla (12%), the regions with the smallest number of restaurants. ROA and ROS show a fall in all regions except in Ceuta, Andalucía, Canarias, and Extremadura. The influence of the COVID-19 pandemic is obvious.

Based on these results, “Hypothesis H1: Restaurants’ profitability is expected to be negatively affected by COVID-19 pandemic” was not rejected since all the regions analyzed decreased their profitability.

4.3. Payroll Costs/Headcount

In Portugal, a slight decrease of 0.9% was recorded in relation to the number of employees in restaurants, with Algarve having the most accentuated decrease (−13%). The percentage of staff costs to sales increased in 2020, compared to 2019, i.e., a decrease in efficiency was noted in all the regions. In 2020, Alentejo registered the highest value (72%), while the North obtained the lowest value (42%) (

Appendix B).

In Spain, concerning the number of employees, an increase of 5.27% was recorded. However, most regions recorded a decrease except Ceuta, Madrid, and Murcia. The most pronounced decrease was in Baleares. The evolution of the percentage of staff costs to sales was a little different in Spain compared with Portugal. In the country overview, a decrease was verified (42% to 38%) excluding Aragón, Canarias, Cantabria, Castilla e León, Castilla-La Mancha, Ceuta, Comunidad Valenciana, Galicia, Murcia, Navarra, and País Vasco. Nevertheless, the percentages are lower than the Portuguese ones (

Appendix B).

“Hypothesis H2: Restaurants’ employment is expected to be negatively affected by COVID-19 pandemic” and “Hypothesis H3: Restaurants’ payroll cost is expected to be increased by COVID-19 pandemic” were tested, but the solutions are not the same for all regions. H2 is not rejected for Portugal and Spain, excluding Ceuta, Madrid, and Murcia, where it recorded an increase. H3 is not rejected for Portugal but is rejected for Spain excluding the following regions Aragón, Canarias, Cantabria, Castilla e León, Castilla-La Mancha, Ceuta, Comunidad Valenciana, Galicia, Murcia, Navarra, and País Vasco.

4.4. Indebtedness

The increase in the indebtedness of restaurants in Portugal is evident in all regions without exception (51% to 57%). This increase occurred both in the short-term bank debt and in the long-term bank debt (

Appendix C). The highest increases in indebtedness in terms of p.p. were registered in ARM and ARA, as well as the highest percentages of debt. It is worth noting that the percentages of long-term bank debt are higher than those of short-term bank debt, with ARA standing out as having the highest percentage (81%).

In Spain, the long-term bank debt is higher than the short-term bank debt for all the regions and for both years. Everything indicates that the COVID-19 pandemic has made restaurants more indebted in Spain, as the debt ratio has increased in all Spanish regions except Ceuta. Comunidad Valenciana, La Rioja, Cataluña and Madrid were the regions that increased the most in p.p. (3 p.p.) (

Appendix C). Both short-term bank debt and long-term bank debt recorded rises in all the Spanish regions. According to López [

76], Spain was the country that recorded a higher percentage (24%) of business bankruptcies in relation to the year 2019.

Regarding Hypothesis H4: Restaurants’ indebtedness is expected to be increased by the COVID-19 pandemic, according to the results, is not rejected.

4.5. Comparing Regions’ Profitability, Payroll Costs/Headcount, and Indebtedness

Despite presenting different values, restaurant profitability, payroll costs/headcount, and indebtedness should be analyzed statistically across the regions. Therefore, the Kruskal–Wallis test was used to compare whether the behavior of restaurants regarding these variables differs according to the region in 2019 and 2020. The hypothesis “H0: ROE/ROA/ROS/payroll costs percentage/headcount growth/indebtedness distribution is equal across region categories” was formulated and tested. This hypothesis was rejected for all the Portuguese regions with a level of significance lower than 0.01, except for the short-term bank debt, where the same pattern was detected in all regions (

Table 7). The Kruskal–Wallis test shows, regardless of the COVID-19 pandemic, that most of the variables behave differently across regions.

In

Table 8, the great discrepancies are presented. In both 2019 and 2020, the behavior across regions is divergent. The COVID-19 pandemic has not mitigated the differences, but it may have influenced them differently. Regarding profitability, ARM, ARA, and Center stand out with the lowest profitability in Portugal. Between 2019 and 2020, the Center recorded a higher value in the growth of the number of employees, contrasting with Algarve, with a decrease of 13%. Percentage of payroll costs are higher in Alentejo and ARM, differing from the North and Alentejo in 2019, which registered lower values. Alentejo changes its position with the COVID-19 pandemic. Indebtedness is evident in ARM, and it seems that this region should be looked at carefully as there are low profitability and high debt rates in the restaurant industry. The ARA already stands out for its high percentages of long-term bank debt.

The same analysis was applied to Spain, and it is presented in

Table 8. The Kruskal–Wallis test was also used to compare whether the behavior of restaurants regarding their profitability, payroll costs/headcount, and indebtedness differs according to region. The hypothesis “H0: ROE/ROA/ROS/payroll costs percentage/headcount growth/indebtedness distribution is equal across region categories in 2019 and 2020” was formulated and tested. This hypothesis was rejected for each variable analyzed in all the Spanish regions with a level of significance lower than 0.01 (

Table 9). The Kruskal–Wallis test demonstrates, independent of the COVID-19 pandemic, that all the variables behave differently across regions. The location influences the restaurants in terms of profitability, payroll costs, and indebtedness.

In

Table 10, the extremes are displayed. In both 2019 and 2020, the performance across regions is different. In Spain, the COVID-19 pandemic did not mitigate the differences, just as it did not in Portugal. Regarding profitability, the worst ROE values found are in País Vasco (−100%), Cataluña (−69%), and Madrid (−69%). ROA and ROS present superior values but are also negative, the worst regions being La Rioja (−1%) and Baleares (−7%), respectively.

Between 2019 and 2020, Ceuta recorded a higher value in the growth of the number of employees, contrasting with Baleares, with a decrease of 18%. Percentage of payroll costs are higher in Canarias (2020) and Andalucía (2019), differing from Asturias, Ceuta and Murcia in 2020 and Murcia and Ceuta in 2019. Some regions maintain the percentage while others decrease the payroll cost percentage, and other regions have increased the percentage. The situation in the regions is completely different, and it would be interesting to find out the causes. This implied, in average terms, a decrease in the payroll cost percentage in Spain.

Indebtedness is evident in Madrid (61%), with an increase of 3 p.p. Ceuta and Melilla already stand out for their high percentages of long-term bank debt and La Rioja (43%) for its short-term bank debt.

Hypothesis H5: Location influences the profitability, employment, payroll cost, and indebtedness of the restaurants is validated; therefore, and according to the year, the situation diverges, so it can be noted that several factors inherent to the location influence the restaurant’s performance, indebtedness, and efficiency. When restaurant managers conduct benchmarking activities, they should compare with the averages of the region due to their divergences.

The Friedman test was used to check whether the COVID-19 pandemic influenced the behavior of restaurants. Payroll costs/headcount variables, profitability variables, and indebtedness variables were analyzed to see if they had the same behavior in 2019 and 2020. This analysis was performed for the countries as a whole (Portugal and Spain) and for the regions of each country. Hypothesis H0: All the variables ROE/ROA/ROS/payroll costs percentage/headcount growth/indebtedness applied in relation to the region and countries are not different between 2019 and 2020 and were rejected, except in the situations presented in

Table 11. The COVID-19 pandemic implied significant differences in all the variables comparing 2019 with 2020, with more severe values in all regions (except Ceuta) but significantly diverging.

Concluding, the results of the Friedman test allow for significantly validated H1, H2, H3, and H4, excluding Ceuta. The COVID-19 pandemic has had an impact on profitability, efficiency, and indebtedness in the restaurant industry, being a generalized situation in both countries, in all regions except for Ceuta. Profitability has decreased, indebtedness has increased, and efficiency measured through payroll costs percentage diverges between Portugal and Spain. In Portugal, this percentage has increased while in Spain it has decreased. What is the explanation? The decrease in sales is a justification, or the employment policies of each country can be another reason.

5. Conclusions

The restaurant industry is considered a very volatile sector of economic activity, and it is sensitive to external factors such as financial crises [

49]. In 2020, under the effects of the COVID-19 pandemic, the number of restaurants unexpectedly increased in Portugal, which can be explained by the birth and death rates which are highly variable [

73,

77]. As for Spain, according to the increased vulnerability of this activity sector, the number of companies decreased in 2020 compared to 2019 [

63].

The global crisis caused by COVID-19 in 2020 seriously damaged the profitability of restaurants, increased their indebtedness, and put several jobs at risk [

1,

50]. Thus, comparing the years 2019 and 2020 by analyzing the profitability, payroll costs, headcount, and indebtedness of the restaurants in the two countries belonging to the Iberian Peninsula made it possible to achieve the six specific objectives of this study initially stipulated.

Overall, the variables under analysis reveal the financial weaknesses of the companies; COVID-19 influenced all these variables in the restaurant industry in Portugal and Spain. Ceuta was the only region that remained stable, the region with the fewest restaurants. The Friedman test confirmed the influence of the COVID-19 pandemic on all the variables analyzed in the restaurant industry.

As regards Portuguese profitability, it generally decreased; ARM was the region that registered the worst ROE and ROA values in 2020; as regards ROS, the Center was the one that registered the worst values for this indicator. In Spain, the region of Ceuta obtained the highest result on ROE, even though at the national level, there was a decrease in 2020. ROA and ROS also suffered declines. Despite the decrease in profitability, which was expected in 2020 given the conditions of the companies during this year [

1,

41], the regions that showed higher profitability ratios in 2019 are different in 2020 in both countries.

In terms of the number of employees, while there was a slight decrease in Portugal, Spain showed an increase in the number of employees. The tourist regions were the ones that lost the highest number of jobs in 2020, in both Portugal and Spain. The regions with more employees (2019) are not the ones that lost the most jobs (2020); for example, Madrid is the region with the highest number of employees and, on average, recorded an increase.

Portugal increased the payroll costs percentage, which could be the reason for the decrease in the efficiency of the restaurants. The reduction in payroll costs due to “lay-off” has not covered the decrease in sales in Portugal. Spain, despite the increase in the number of employees, managed to decrease its costs; thus, the employment policies of each country can be another explanation.

In Portugal and Spain, all regions experienced a worsening in their indebtedness. An increase in company indebtedness was seen in both countries under study, except in the regions of Ceuta, Navarra, and Murcia (Spain). In Portugal, the most affected regions were ARM and ARA. According to López [

76], it was expected that the indebtedness of companies would increase, as it was considered the country with the highest percentage of company bankruptcies in the year 2020. The percentages of long-term bank debt are higher than short-term bank debt in both countries.

In order to understand if the location has an influence, the behavior of all the variables was compared among regions through the Kruskal–Wallis test to understand if the behavior of the regions of each country is different. It was found that there are differences in the behavior of the variables among the regions studied except for short-term bank debt among Portuguese regions. The location has an influence on the variables under study, which is the reason why restaurant managers are encouraged to compare the averages for the region due to their divergences when benchmarking is carried out.

The conclusions of this study support the importance of the analysis of these variables for restaurant managers and all restaurant operators through more informed decision-making in situations of change and volatility of financial crises. In addition, this study sought to contribute to the evaluation of each restaurant against the average of the variables by location, in this case, by region, as these reflect divergences in both countries studied. The implementation of proactive strategies, creating agreements [

47], strengthening the collaboration among countries and companies [

52], and using European programs [

53] may help managers to avoid situations of financial unsustainability caused by other pandemics or economic crises that may arise in the future, thus adapting to the change that nowadays is increasingly constant. Other recommendations at the operational level can also be applied according to Freitas and Stedefeldt [

51], Kim et al. [

52], Madeira et al. [

48], and Yost et al. [

57], such as purchasing raw materials, implementing takeaway and delivery, innovate restaurant services, increase the average number of meals and service hours and train employees. Moreover, a management control system should be implemented to offer a detailed vision of the future of the restaurant.

In terms of theoretical implications, this study has contributed to broadening research on several important variables in the restaurant sector: profitability, payroll costs, headcount, and indebtedness, relating them to location and analyzing the COVID-19 pandemic impact.

Restaurant management presents strong challenges inherent to its characteristics. The widespread idea that restaurant management is simple is wrong and is proven, in particular, by the high birth and death rates that the sector presents. In addition to these challenges, managers in this area also face the problem of a lack of relevant information for decision-making.

Nevertheless, hospitality industry statistics are published regularly as well as useful studies for management. For example, in Portugal, average occupancy rate, RevPAR, and ADR are indicators published nationally and regionally on a regular basis, and access to this information is free. In the case of restaurants, however, there is no equivalent, and one way to access data involves joining industry associations, which entails costs and only represents members and not the entire industry.

This study, therefore, represents an important contribution, as it allows comparison against average management indicators so that managers can evaluate the performance of their business and anticipate some problems, particularly in terms of profitability, payroll costs, headcount, and indebtedness, considering the location. This research also aims to improve the management of future crises in this subsector and, despite having made the comparison between the two countries of the Iberian Peninsula, a starting point for the expansion of knowledge in other countries is truly feasible.

As a limitation, the use of a database where large restaurants are mixed with small ones and accounting information processing is different among companies of different sizes since large restaurants are more professional in providing accurate data.

As for future research, researchers can focus not only on the analysis of different financial ratios but also on the analysis of operating ratios that are poorly used in this industry. Another possibility is the medium-term analysis of the impact of COVID-19 on restaurant companies.