Power Battery Echelon Utilization and Recycling Strategy for New Energy Vehicles Based on Blockchain Technology

Abstract

:1. Introduction

- 1.

- Under the reasonable echelon utilization ratio, who should bear the responsibility of recycling in the CLSC?

- 2.

- What factors affect the application of blockchain technology in the CLSC?

- 3.

- When blockchain technology is adopted, how can the traceability level be determined based on blockchain technology?

2. Literature Review

2.1. Blockchain Technologies

2.2. Reverse Recycling of CLSC

2.3. Reuse of Retired NEVs Batteries

3. Model Description and Assumptions

3.1. Notations and Assumptions

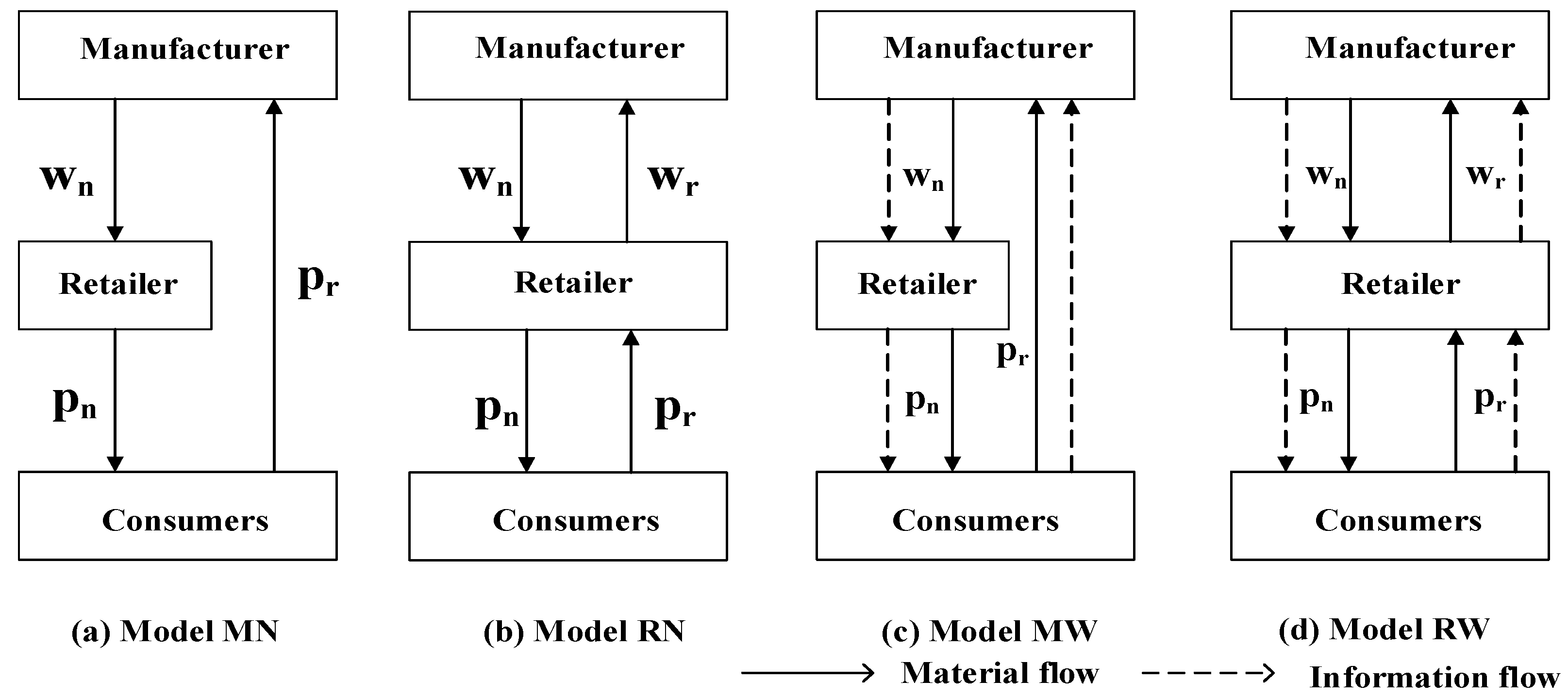

3.2. Model Description

3.3. Market Demand and Cost Structure

4. Model Solving and Equilibrium Analysis

4.1. Benchmark Model without Adopting Blockchain Technology

4.1.1. Model MN

4.1.2. Model RN

4.2. Model of Adopting Blockchain Technology

4.2.1. Model MW

4.2.2. Model RW

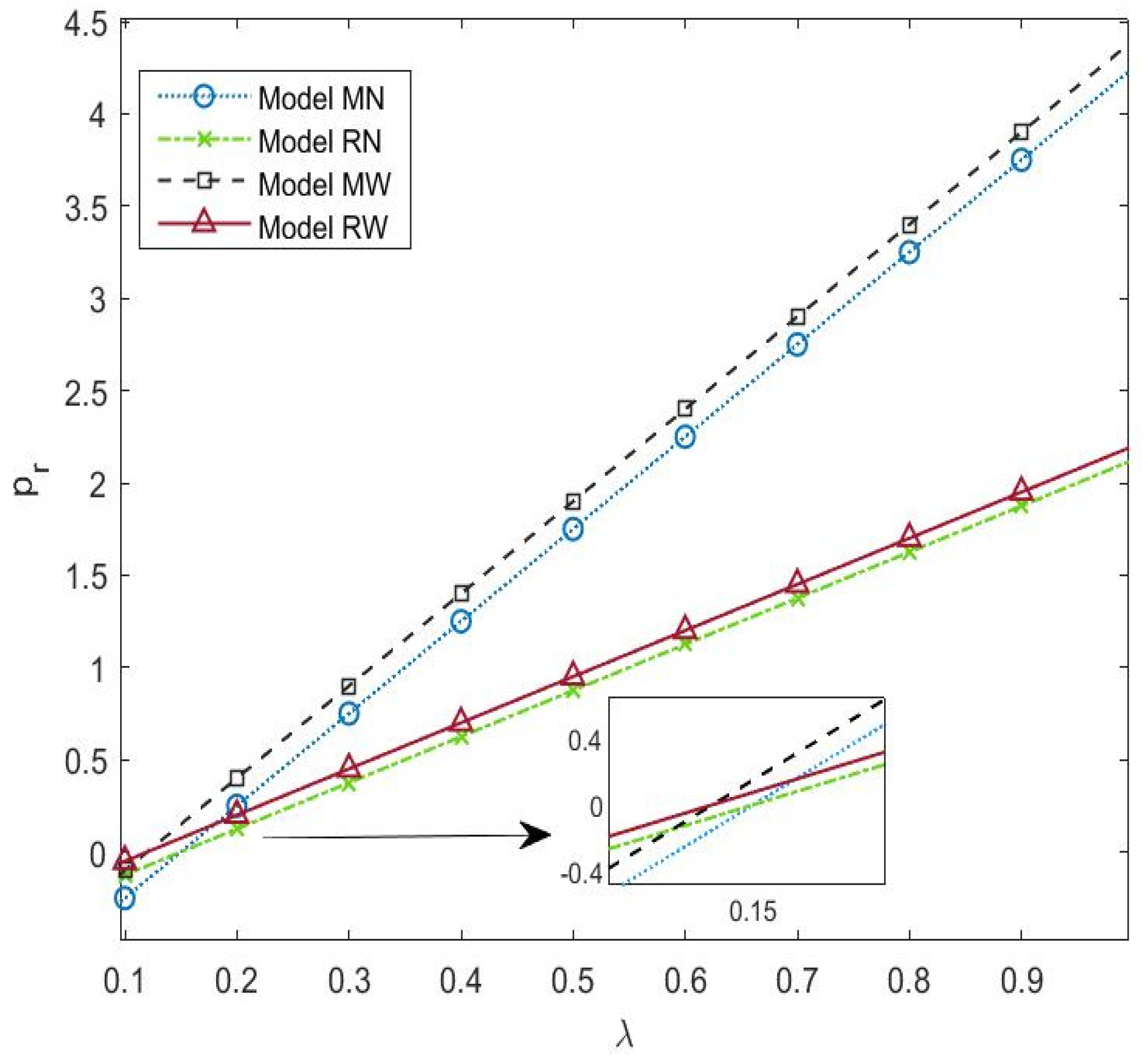

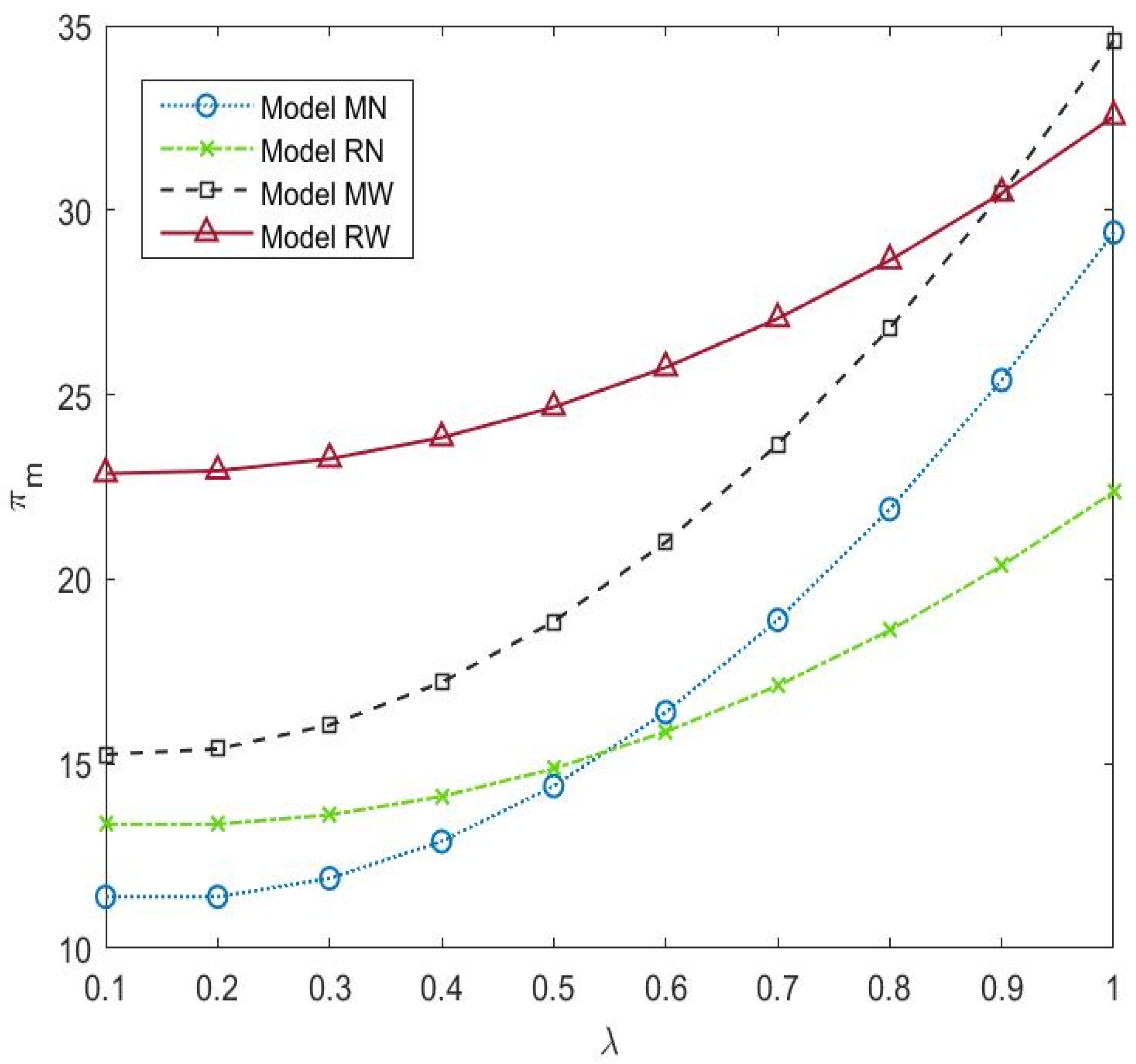

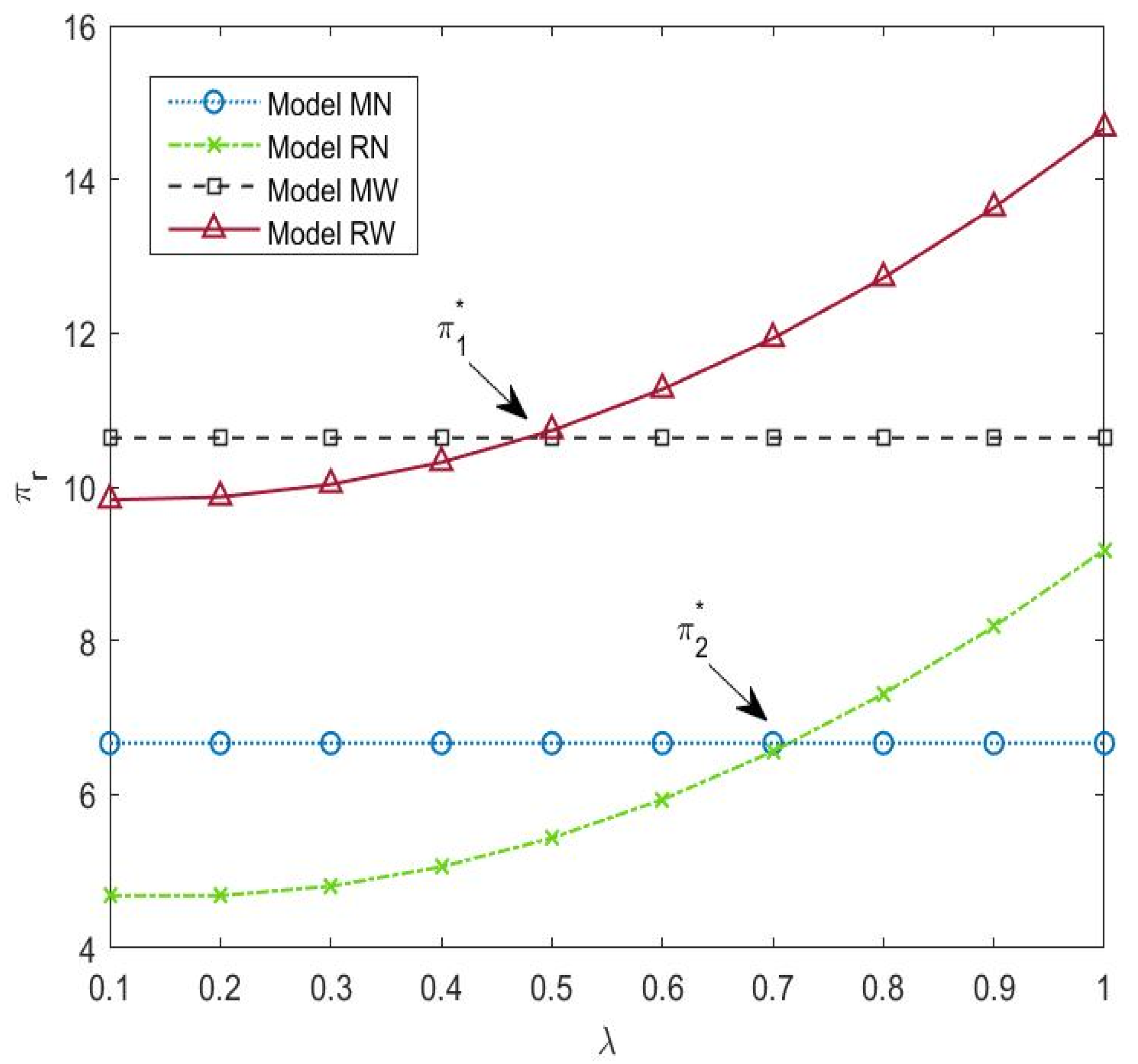

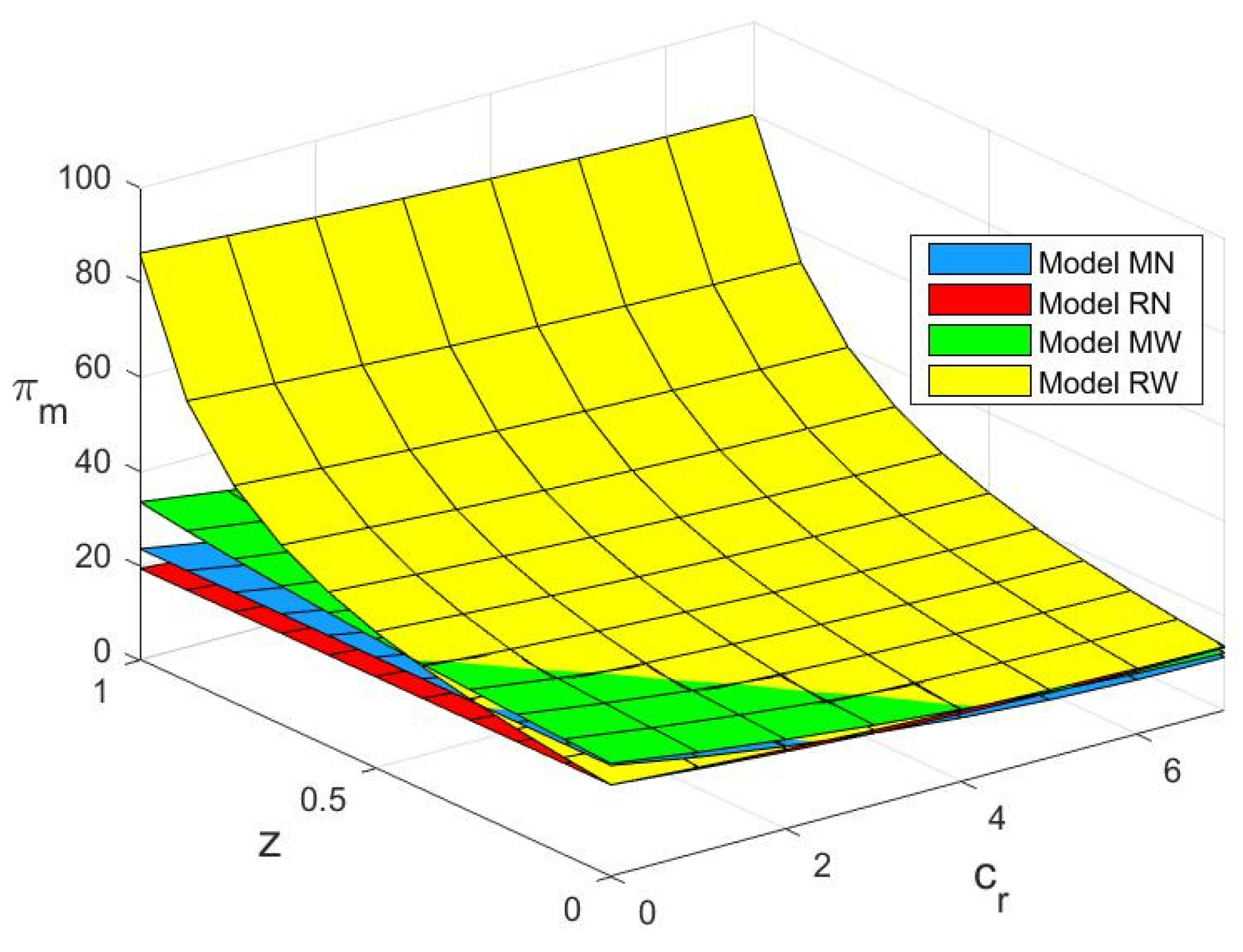

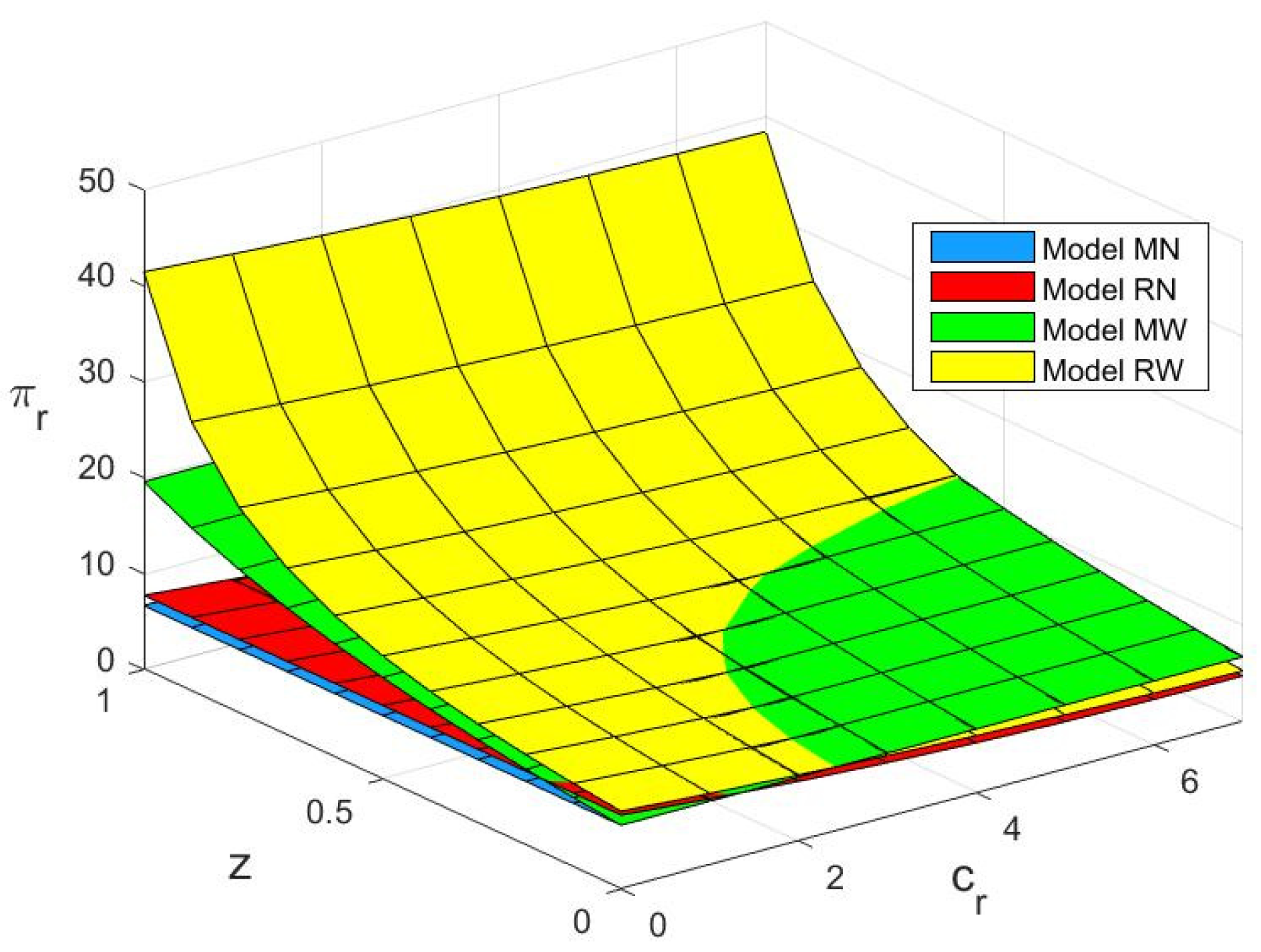

5. Numerical Analysis

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A

References

- Pei, H.; Hu, X.; Yang, Y.; Tang, X.; Hou, C.; Cao, D. Configuration optimization for improving fuel efficiency of power split hybrid powertrains with a single planetary gear. Appl. Energy 2018, 214, 103–116. [Google Scholar] [CrossRef]

- Gu, X.; Zhou, L.; Huang, H.; Shi, X.; Ieromonachou, P. Electric vehicle battery secondary use under government subsidy: A closed-loop supply chain perspective. Int. J. Prod. Econ. 2021, 234, 108035. [Google Scholar] [CrossRef]

- Yu, H.; Dai, H.; Tian, G.; Xie, Y.; Wu, B.; Zhu, Y.; Li, H.; Wu, H. Big-Data-Based Power Battery Recycling for New Energy Vehicles: Information Sharing Platform and Intelligent Transportation Optimization. IEEE Access 2020, 8, 99605–99623. [Google Scholar] [CrossRef]

- Gu, X.; Ieromonachou, P.; Zhou, L.; Tseng, M.-L. Optimising quantity of manufacturing and remanufacturing in an electric vehicle battery closed-loop supply chain. Ind. Manag. Data Syst. 2018, 118, 283–302. [Google Scholar] [CrossRef]

- Wu, X.-Y.; Fan, Z.-P.; Cao, B.-B. An analysis of strategies for adopting blockchain technology in the fresh product supply chain. Int. J. Prod. Res. 2021, 1–18. [Google Scholar] [CrossRef]

- Park, A.; Li, H. The Effect of Blockchain Technology on Supply Chain Sustainability Performances. Sustainability 2021, 13, 1726. [Google Scholar] [CrossRef]

- Wang, M.; Wang, B.; Abareshi, A. Blockchain Technology and Its Role in Enhancing Supply Chain Integration Capability and Reducing Carbon Emission: A Conceptual Framework. Sustainability 2020, 12, 10550. [Google Scholar] [CrossRef]

- Li, Z.-P.; Ceong, H.-T.; Lee, S.-J. The Effect of Blockchain Operation Capabilities on Competitive Performance in Supply Chain Management. Sustainability 2021, 13, 12078. [Google Scholar] [CrossRef]

- Lim, M.K.; Li, Y.; Wang, C.; Tseng, M.L. A literature review of blockchain technology applications in supply chains: A com-prehensive analysis of themes, methodologies and industries. Comput. Ind. Eng. 2021, 154, 14. [Google Scholar] [CrossRef]

- Fan, Z.P.; Wu, X.Y.; Cao, B.B. Considering the traceability awareness of consumers: Should the supply chain adopt the blockchain technology? Ann. Oper. Res. 2022, 309, 837–860. [Google Scholar] [CrossRef]

- Yin, W.; Ran, W. Theoretical Exploration of Supply Chain Viability Utilizing Blockchain Technology. Sustainability 2021, 13, 8231. [Google Scholar] [CrossRef]

- Liu, L.; Li, F.T.; Qi, E.S. Research on Risk Avoidance and Coordination of Supply Chain Subject Based on Blockchain Tech-nology. Sustainability 2019, 11, 14. [Google Scholar]

- Kouhizadeh, M.; Sarkis, J. Blockchain Practices, Potentials, and Perspectives in Greening Supply Chains. Sustainability 2018, 10, 3652. [Google Scholar] [CrossRef]

- Sundarakani, B.; Ajaykumar, A.; Gunasekaran, A. Big data driven supply chain design and applications for blockchain: An action research using case study approach & nbsp. Omega-Int. J. Manag. Sci. 2021, 102, 19. [Google Scholar]

- Saberi, S.; Kouhizadeh, M.; Sarkis, J.; Shen, L. Blockchain technology and its relationships to sustainable supply chain management. Int. J. Prod. Res. 2018, 57, 2117–2135. [Google Scholar] [CrossRef]

- Chang, Y.; Iakovou, E.; Shi, W. Blockchain in global supply chains and cross border trade: A critical synthesis of the state-of-the-art, challenges and opportunities. Int. J. Prod. Res. 2019, 58, 2082–2099. [Google Scholar] [CrossRef]

- Xia, S.; Lin, F.; Chen, Z.; Tang, C.; Ma, Y.; Yu, X. A Bayesian Game Based Vehicle-to-Vehicle Electricity Trading Scheme for Blockchain-Enabled Internet of Vehicles. IEEE Trans. Veh. Technol. 2020, 69, 6856–6868. [Google Scholar] [CrossRef]

- Shen, B.; Xu, X.; Yuan, Q. Selling secondhand products through an online platform with blockchain. Transp. Res. Part E Logist. Transp. Rev. 2020, 142, 102066. [Google Scholar] [CrossRef]

- Wu, J.; Yu, J. Blockchain’s impact on platform supply chains: Transaction cost and information transparency perspectives. Int. J. Prod. Res. 2022, 1–14. [Google Scholar] [CrossRef]

- Choi, T.-M.; Feng, L.; Li, R. Information disclosure structure in supply chains with rental service platforms in the blockchain technology era. Int. J. Prod. Econ. 2019, 221, 107473. [Google Scholar] [CrossRef]

- Joo, J.; Han, Y. An Evidence of Distributed Trust in Blockchain-Based Sustainable Food Supply Chain. Sustainability 2021, 13, 10980. [Google Scholar] [CrossRef]

- Zhu, L. Economic Analysis of a Traceability System for a Two-Level Perishable Food Supply Chain. Sustainability 2017, 9, 682. [Google Scholar] [CrossRef] [Green Version]

- Casino, F.; Kanakaris, V.; Dasaklis, T.K.; Moschuris, S.; Stachtiaris, S.; Pagoni, M.; Rachaniotis, N.P. Blockchain-based food supply chain traceability: A case study in the dairy sector. Int. J. Prod. Res. 2020, 59, 5758–5770. [Google Scholar] [CrossRef]

- Li, K.; Lee, J.-Y.; Gharehgozli, A. Blockchain in food supply chains: A literature review and synthesis analysis of platforms, benefits and challenges. Int. J. Prod. Res. 2021, 1–20. [Google Scholar] [CrossRef]

- Liu, P.; Long, Y.; Song, H.-C.; He, Y.-D. Investment decision and coordination of green agri-food supply chain considering information service based on blockchain and big data. J. Clean. Prod. 2020, 277, 123646. [Google Scholar] [CrossRef]

- Santos, L.P.; Proença, J.F. Developing Return Supply Chain: A Research on the Automotive Supply Chain. Sustainability 2022, 14, 6587. [Google Scholar] [CrossRef]

- Su, J.; Li, C.; Zeng, Q.; Yang, J.; Zhang, J. A Green Closed-Loop Supply Chain Coordination Mechanism Based on Third-Party Recycling. Sustainability 2019, 11, 5335. [Google Scholar] [CrossRef]

- Gu, X.; Ieromonachou, P.; Zhou, L.; Tseng, M.-L. Developing pricing strategy to optimise total profits in an electric vehicle battery closed loop supply chain. J. Clean. Prod. 2018, 203, 376–385. [Google Scholar] [CrossRef]

- Shekarian, E.; Marandi, A.; Majava, J. Dual-channel remanufacturing closed-loop supply chains under carbon footprint and collection competition. Sustain. Prod. Consum. 2021, 28, 1050–1075. [Google Scholar] [CrossRef]

- Li, L.; Dababneh, F.; Zhao, J. Cost-effective supply chain for electric vehicle battery remanufacturing. Appl. Energy 2018, 226, 277–286. [Google Scholar] [CrossRef]

- Wang, N.; He, Q.; Jiang, B. Hybrid closed-loop supply chains with competition in recycling and product markets. Int. J. Prod. Econ. 2019, 217, 246–258. [Google Scholar] [CrossRef]

- Huang, Z.; Shao, W.; Meng, L.; Zhang, G.; Qiang, Q. Pricing Decision for a Closed-Loop Supply Chain with Technology Licensing under Collection and Remanufacturing Cost Disruptions. Sustainability 2022, 14, 3354. [Google Scholar] [CrossRef]

- Wu, C.-H. OEM product design in a price competition with remanufactured product. Omega 2013, 41, 287–298. [Google Scholar] [CrossRef]

- Zhu, X.D.; Yu, L.F.; Li, W. Warranty Period Decision and Coordination in Closed-Loop Supply Chains Considering Re-manufacturing and Consumer Behavior. Sustainability 2019, 11, 4237. [Google Scholar] [CrossRef]

- Li, J.; Du, W.; Yang, F.; Hua, G. The Carbon Subsidy Analysis in Remanufacturing Closed-Loop Supply Chain. Sustainability 2014, 6, 3861–3877. [Google Scholar] [CrossRef]

- Sun, H.; Li, J. Behavioural Choice of Governments, Enterprises and Consumers on Recyclable Green Logistics Packaging. Sustain. Prod. Consum. 2021, 28, 459–471. [Google Scholar] [CrossRef]

- Xie, B.; Guo, T.; Zhao, D.; Jiang, P.; Li, W. A Closed-Loop Supply Chain Operation Problem under Different Recycling Modes and Patent Licensing Strategies. Sustainability 2022, 14, 4471. [Google Scholar] [CrossRef]

- Tang, S.; Wang, W.; Zhou, G. Remanufacturing in a competitive market: A closed-loop supply chain in a Stackelberg game framework. Expert Syst. Appl. 2020, 161, 113655. [Google Scholar] [CrossRef]

- Zhang, F.; Li, N. The Impact of CSR on the Performance of a Dual-Channel Closed-Loop Supply Chain under Two Carbon Regulatory Policies. Sustainability 2022, 14, 3021. [Google Scholar] [CrossRef]

- Wang, N.; Song, Y.; He, Q.; Jia, T. Competitive dual-collecting regarding consumer behavior and coordination in closed-loop supply chain. Comput. Ind. Eng. 2020, 144, 106481. [Google Scholar] [CrossRef]

- Wan, P.; Ma, L.X.; Liu, J.N. Analysis of Carbon Emission Reduction and Pricing for Sustainable Closed-Loop Supply Chain Considering the Quality of Recycled Products. Appl. Ecol. Env. Res. 2019, 17, 9947–9963. [Google Scholar] [CrossRef]

- Gong, Y.; Chen, M.; Zhuang, Y. Decision-Making and Performance Analysis of Closed-Loop Supply Chain under Different Recycling Modes and Channel Power Structures. Sustainability 2019, 11, 6413. [Google Scholar] [CrossRef] [Green Version]

- Kumar, P.; Singh, R.K.; Paul, J.; Sinha, O. Analyzing challenges for sustainable supply chain of electric vehicle batteries using a hybrid approach of Delphi and Best-Worst Method. Resour. Conserv. Recycl. 2021, 175, 105879. [Google Scholar] [CrossRef]

- Yun, L.; Linh, D.; Shui, L.; Peng, X.; Garg, A.; LE, M.L.P.; Asghari, S.; Sandoval, J. Metallurgical and mechanical methods for recycling of lithium-ion battery pack for electric vehicles. Resour. Conserv. Recycl. 2018, 136, 198–208. [Google Scholar] [CrossRef]

- Glöser-Chahoud, S.; Huster, S.; Rosenberg, S.; Baazouzi, S.; Kiemel, S.; Singh, S.; Schneider, C.; Weeber, M.; Miehe, R.; Schultmann, F. Industrial disassembling as a key enabler of circular economy solutions for obsolete electric vehicle battery systems. Resour. Conserv. Recycl. 2021, 174, 105735. [Google Scholar] [CrossRef]

- Heymans, C.; Walker, S.B.; Young, S.B.; Fowler, M. Economic analysis of second use electric vehicle batteries for residential energy storage and load-levelling. Energy Policy 2014, 71, 22–30. [Google Scholar] [CrossRef]

- Mazzeo, D. Nocturnal electric vehicle charging interacting with a residential photovoltaic-battery system: A 3E (energy, economic and environmental) analysis. Energy 2018, 168, 310–331. [Google Scholar] [CrossRef]

- Gu, H.; Liu, Z.; Qing, Q. Optimal electric vehicle production strategy under subsidy and battery recycling. Energy Policy 2017, 109, 579–589. [Google Scholar] [CrossRef]

- Tang, Y.; Zhang, Q.; Li, Y.; Li, H.; Pan, X.; McLellan, B. The social-economic-environmental impacts of recycling retired EV batteries under reward-penalty mechanism. Appl. Energy 2019, 251, 113313. [Google Scholar] [CrossRef]

- Zheng, Z.; Chen, M.; Wang, Q.; Zhang, Y.; Ma, X.; Shen, C.; Xu, D.; Liu, J.; Liu, Y.; Gionet, P.; et al. High Performance Cathode Recovery from Different Electric Vehicle Recycling Streams. ACS Sustain. Chem. Eng. 2018, 6, 13977–13982. [Google Scholar] [CrossRef]

- Moore, E.A.; Russell, J.D.; Babbitt, C.W.; Tomaszewski, B.; Clark, S.S. Spatial modeling of a second-use strategy for electric vehicle batteries to improve disaster resilience and circular economy. Resour. Conserv. Recycl. 2020, 160, 104889. [Google Scholar] [CrossRef]

- Zhao, X.; Peng, B.; Zheng, C.; Wan, A. Closed-loop supply chain pricing strategy for electric vehicle batteries recycling in China. Environ. Dev. Sustain. 2021, 24, 7725–7752. [Google Scholar] [CrossRef]

- Rana, S.K.; Kim, H.C.; Pani, S.K.; Rana, S.K.; Joo, M.I.; Rana, A.K.; Aich, S. Blockchain-Based Model to Improve the Per-formance of the Next-Generation Digital Supply Chain. Sustainability 2021, 13, 10008. [Google Scholar] [CrossRef]

- Sun, S.; Wang, X.; Zhang, Y. Sustainable Traceability in the Food Supply Chain: The Impact of Consumer Willingness to Pay. Sustainability 2017, 9, 999. [Google Scholar] [CrossRef]

- Feng, L.; Govindan, K.; Li, C. Strategic planning: Design and coordination for dual-recycling channel reverse supply chain considering consumer behavior. Eur. J. Oper. Res. 2017, 260, 601–612. [Google Scholar] [CrossRef]

- Ghoshal, A.; Kumar, S.; Mookerjee, V. Dilemma of Data Sharing Alliance: When Do Competing Personalizing and Non-Personalizing Firms Share Data. Prod. Oper. Manag. 2018, 29, 1918–1936. [Google Scholar] [CrossRef]

- Wang, L.; Wang, X.; Yang, W. Optimal design of electric vehicle battery recycling network—From the perspective of electric vehicle manufacturers. Appl. Energy 2020, 275, 115328. [Google Scholar] [CrossRef]

- Liu, W.; Yan, X.; Li, X.; Wei, W. The impacts of market size and data-driven marketing on the sales mode selection in an Internet platform based supply chain. Transp. Res. Part E: Logist. Transp. Rev. 2020, 136, 101914. [Google Scholar] [CrossRef]

- Shao, Y.; Deng, X.; Qing, Q.; Wang, Y. Optimal Battery Recycling Strategy for Electric Vehicle under Government Subsidy in China. Sustainability 2018, 10, 4855. [Google Scholar] [CrossRef] [Green Version]

| Notations | Descriptions |

|---|---|

| Market size. | |

| Price of the new product. | |

| Collecting price of used products paid to the consumers. | |

| Demand for the new product. | |

| Recycling quantity. | |

| Wholesale price of a new product. | |

| Transferring price of a used product from the retailer to the manufacturer. | |

| Collecting cost of a used product. | |

| Cost of producing a new product. | |

| Recycling cost (including disassembly, testing, evaluation, etc.). | |

| Unit income obtained by using retired batteries in echelon. | |

| Proportion of detected retired batteries that can be used in echelon. | |

| Traceability information transmission level based on blockchain technology. | |

| Optimization coefficient of recycling cost. | |

| Optimization coefficient of collection cost. | |

| Consumer sensitivity to traceability information. | |

| Price sensitive coefficient. | |

| The cost coefficient of traceability by using blockchain technology | |

| Profit for in the model . Superscript takes values MN, RN, MW, and RW, and subscript takes values of , , which mean the retailer and the manufacturer, respectively. |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xing, P.; Yao, J. Power Battery Echelon Utilization and Recycling Strategy for New Energy Vehicles Based on Blockchain Technology. Sustainability 2022, 14, 11835. https://doi.org/10.3390/su141911835

Xing P, Yao J. Power Battery Echelon Utilization and Recycling Strategy for New Energy Vehicles Based on Blockchain Technology. Sustainability. 2022; 14(19):11835. https://doi.org/10.3390/su141911835

Chicago/Turabian StyleXing, Peng, and Junzhu Yao. 2022. "Power Battery Echelon Utilization and Recycling Strategy for New Energy Vehicles Based on Blockchain Technology" Sustainability 14, no. 19: 11835. https://doi.org/10.3390/su141911835