Investigating the Mediating Roles of Income Level and Technological Innovation in Africa’s Sustainability Pathways Amidst Energy Transition, Resource Abundance, and Financial Inclusion

Abstract

:1. Introduction

Research Objective/Contributions

2. Literature Review

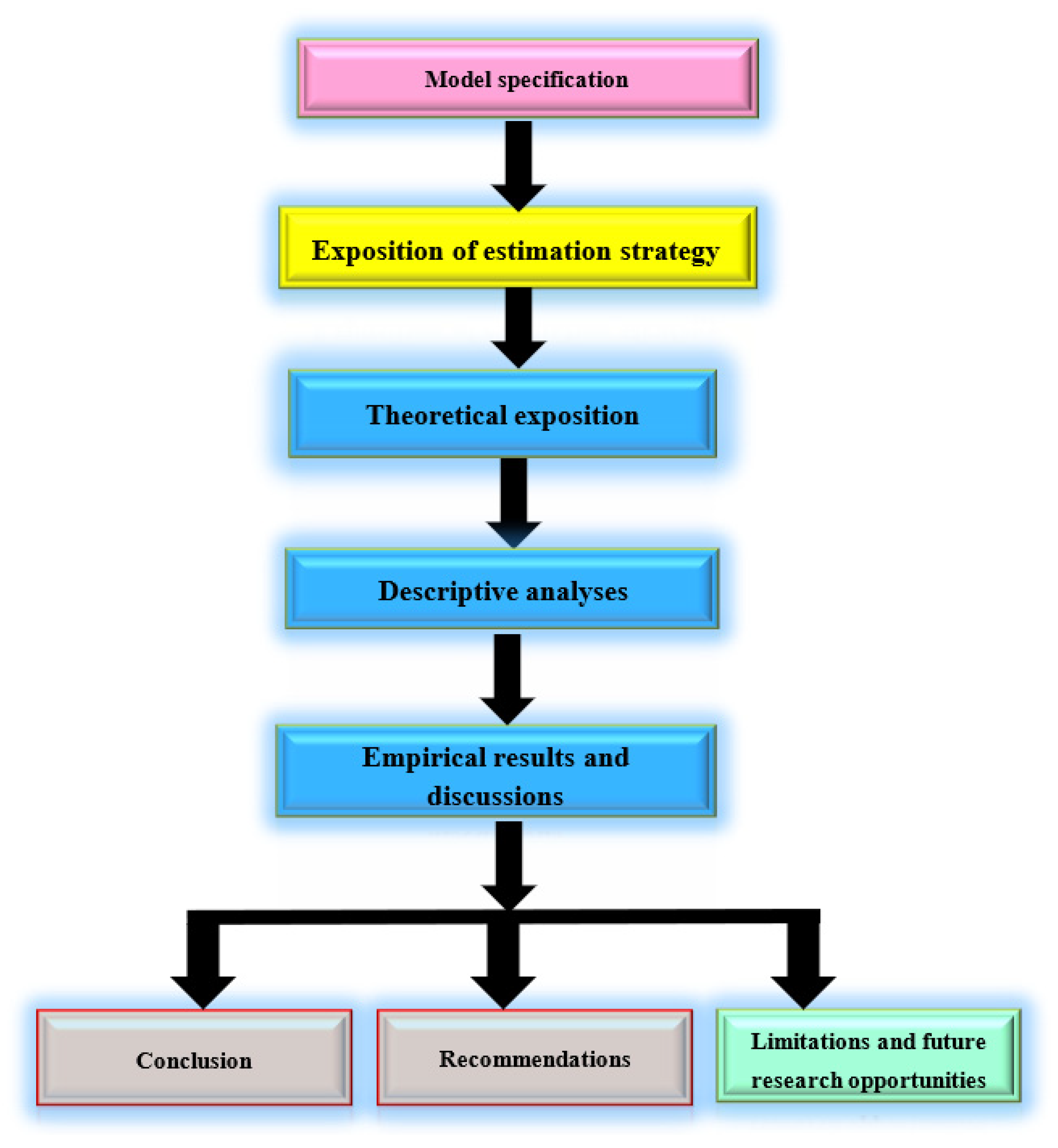

3. Method

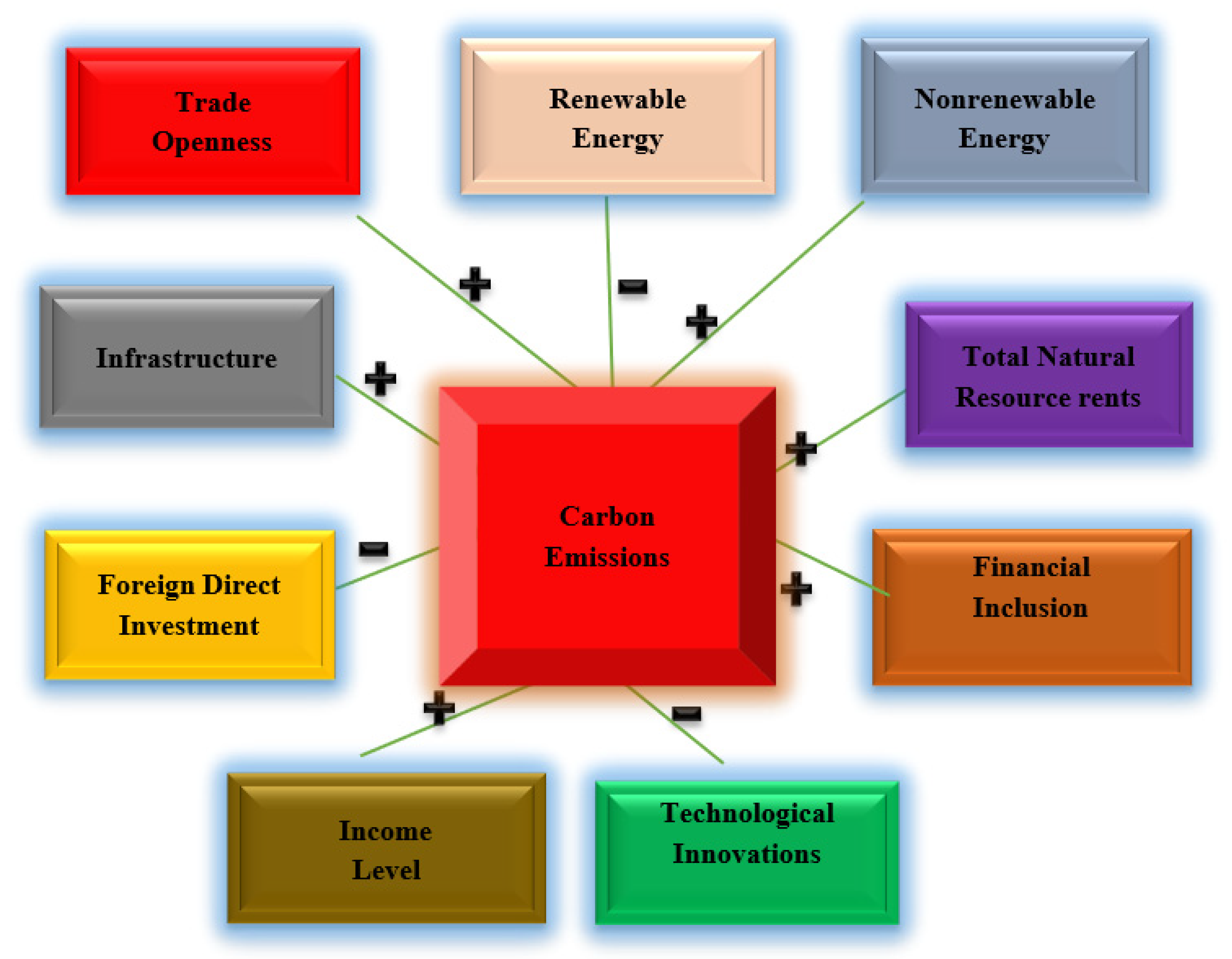

3.1. Model Specification

3.2. Estimation Technique

3.3. Brief Expositions on System GMM Post Estimation Tests

3.4. Theoretical Intuition of the a Priori Expectations

3.5. Data, Descriptive and Contextual Analyses

4. Empirical Results and Discussion

4.1. Technological Enhanced Model

4.2. Income Level Enhanced Model

4.3. Robustness Check: Extensions for Other Levels of Carbon Emissions

5. Conclusions and Policy Recommendations

- I.

- Since renewable energy promotes environmental quality, the government should encourage more investments and enact policies that will promote renewable energy consumption. This can be achieved by subsidizing prices of products that are renewable energy-intensive.

- II.

- To moderate the devastating effects of non-renewable energy, the government should employ fiscal policy in the form of tax imposition on goods and services to discourage consumption.

- III.

- To check impeding effects of natural resource rents, the government should intensify efforts by diversifying to other sectors of the economy where revenues can be earned with little or no threat to the ecosystem.

- IV.

- The streams of income generated from resource rents can be invested in promoting clean and renewable energy sources to offset the adverse effects on the environment.

- V.

- With the hindering impacts recorded from population growth and the projected explosion in the future, there should be policy checking of the sky-rocketing rate of the population increase.

- VI.

- The government should put an economic sustainability plan in place to reduce the strain of the increasing population on the environment.

- VII.

- The government and policymakers should check the contribution of human capital to carbon emissions by structuring a human capital development plan to promote green growth.

- VIII.

- There should be a solid national orientation program and curriculum restructuring plan to enlighten the populace on the best practices that will promote green growth.

- IX.

- To control the likely environmental challenges that may emanate from financial inclusion, the government should sponsor and encourage the production and import of environmentally conducive products and services. Ensuring that financially empowered citizens have access to products will promote green growth.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Lu, X.; White, H. Robustness checks and robustness tests in applied economics. J. Econom. 2014, 178, 194–206. [Google Scholar] [CrossRef]

- Ibrahim, R.L.; Ajide, K.B. Nonrenewable and renewable energy consumption, trade openness, and environmental quality in G-7 countries: The conditional role of technological progress. Environ. Sci. Pollut. Res. 2021, 28, 45212–45229. [Google Scholar] [CrossRef] [PubMed]

- United Nations Environment Programme. Emissions Gap Report 2019; UNEP: Nairobi, Kenya, 2019. [Google Scholar]

- Khan, S.A.R.; Yu, Z.; Belhadi, A.; Mardani, A. Investigating the effects of renewable energy on international trade and environmental quality. J. Environ. Manag. 2020, 272, 111089. [Google Scholar] [CrossRef] [PubMed]

- Ibrahim, R.L.; Ajide, K.B. The dynamic heterogeneous impacts of nonrenewable energy, trade openness, total natural resource rents, financial development and regulatory quality on environmental quality: Evidence from BRICS economies. Resour. Policy 2021, 74, 102251. [Google Scholar] [CrossRef]

- Khan, S.A.R.; Yu, Z.; Sharif, A.; Golpîra, H. Determinants of economic growth and environmental sustainability in South Asian Association for Regional Cooperation: Evidence from panel ARDL. Environ. Sci. Pollut. Res. 2020, 27, 45675–45687. [Google Scholar] [CrossRef] [PubMed]

- Shahbaz, M.; Nasreen, S.; Ahmed, K.; Hammoudeh, S. Trade openness–carbon emissions nexus: The importance of turning points of trade openness for country panels. Energy Econ. 2017, 61, 221–232. [Google Scholar] [CrossRef]

- Xie, M.; Irfan, M.; Razzaq, A.; Dagar, V. Forest and mineral volatility and economic performance: Evidence from frequency domain causality approach for global data. Resour. Policy 2022, 76, 102685. [Google Scholar] [CrossRef]

- Raghutla, C.; Chittedi, K.R. Financial development, energy consumption, technology, urbanization, economic output and carbon emissions nexus in BRICS countries: An empirical analysis. Manag. Environ. Qual. Int. J. 2020, 31, 1138–1154. [Google Scholar] [CrossRef]

- Kayani, G.M.; Ashfaq, S.; Siddique, A. Assessment of financial development on environmental effect: Implications for sustainable development. J. Clean. Prod. 2020, 261, 1–8. [Google Scholar] [CrossRef]

- Le, T.-H.; Le, H.-C.; Taghizadeh-Hesary, F. Does financial inclusion impact CO2 emissions? Evidence from Asia. Financ. Res. Lett. 2020, 34, 101451. [Google Scholar] [CrossRef]

- Khan, S.A.R. The nexus between carbon emissions, poverty, economic growth, and logistics operations-empirical evidence from southeast Asian countries. Environ. Sci. Pollut. Res. 2019, 26, 13210–13220. [Google Scholar] [CrossRef]

- Irfan, M.; Elavarasan, R.M.; Ahmad, M.; Mohsin, M.; Dagar, V.; Hao, Y. Prioritizing and overcoming biomass energy barriers: Application of AHP and G-TOPSIS approaches. Technol. Forecast. Soc. Change 2022, 177, 121524. [Google Scholar] [CrossRef]

- Sarkodie, S.A.; Adams, S.; Leirvik, T. Foreign direct investment and renewable energy in climate change mitigation: Does governance matter? J. Clean. Prod. 2020, 263, 121262. [Google Scholar] [CrossRef]

- Ibrahim, R.L.; Ajide, K.B. Disaggregated environmental impacts of non-renewable energy and trade openness in selected G-20 countries: The conditioning role of technological innovation. Environ. Sci. Pollut. Res. 2021, 28, 67496–67510. [Google Scholar] [CrossRef]

- Sinha, A.; Sengupta, T. Impact of natural resource rents on human development: What is the role of globalization in Asia Pacific countries? Resour. Policy 2019, 63, 101413. [Google Scholar] [CrossRef]

- Sulaiman, C.; Abdul-Rahim, A.S. Population growth and CO2 emission in Nigeria: A recursive ARDL approach. Sage Open 2018, 8, 2158244018765916. [Google Scholar] [CrossRef]

- Liddle, B. What are the carbon emissions elasticities for income and population? Bridging STIRPAT and EKC via robust heterogeneous panel estimates. Glob. Environ. Change 2015, 31, 62–73. [Google Scholar] [CrossRef]

- Bano, S.; Zhao, Y.; Ahmad, A.; Wang, S.; Liu, Y. Identifying the impacts of human capital on carbon emissions in Pakistan. J. Clean. Prod. 2018, 183, 1082–1092. [Google Scholar] [CrossRef]

- Fang, Z.; Chang, Y. Energy, human capital and economic growth in Asia Pacific countries—Evidence from a panel cointegration and causality analysis. Energy Econ. 2016, 56, 177–184. [Google Scholar] [CrossRef]

- Ahmed, Z.; Zafar, M.W.; Ali, S. Linking urbanization, human capital, and the ecological footprint in G7 countries: An empirical analysis. Sustain. Cities Soc. 2020, 55, 102064. [Google Scholar] [CrossRef]

- Jiang, C.; Ma, X. The impact of nancial development on carbon emissions: A Global Perspective. Sustainability 2019, 11, 5241. [Google Scholar] [CrossRef]

- Charfeddine, L.; Kahia, M. Impact of renewable energy consumption and financial development on CO2 emissions and economic growth in the MENA region: A panel vector autoregressive (PVAR) analysis. Renew. Energy 2019, 139, 198–213. [Google Scholar] [CrossRef]

- Ibrahim, R.L.; Ajide, K.B. Trade facilitation, institutional quality, and sustainable environment: Renewed evidence from Sub-Saharan African Countries. J. Afr. Bus. 2020, 23, 281–303. [Google Scholar] [CrossRef]

- Ibrahim, R.L.; Ajide, K.B. Trade facilitation and environmental quality: Empirical evidence from some selected African countries. Environ. Dev. Sustain. 2021, 24, 1282–1312. [Google Scholar] [CrossRef]

- Boden, T.A.; Marland, G.; Andres, R.J. Global, Regional, and National Fossil-Fuel CO2 Emissions; Carbon Dioxide Information Analysis Center Oak Ridge National Laboratory: Oak Ridge, TN, USA, 2009. [Google Scholar]

- IEA. Africa Energy Outlook 2019. World Energy Outlook Special Report. Available online: https://www.iea.org/reports/africa-energy-outlook-2019 (accessed on 10 August 2022).

- United Nations University. Population Growth: A Ticking Time Bomb for Sub-Saharan Africa? 2011. Available online: https://unu.edu/news/news/population-growth-a-ticking-time-bomb-for-sub-saharan-africa.html (accessed on 28 July 2021).

- The Economist. Africa’s Population Will Double by 2050. 2020. Available online: https://www.economist.com/special-report/2020/03/26/africas-population-will-double-by-2050 (accessed on 28 July 2021).

- Mabiso, A.; Benfica, R. The Narrative on Rural Youth and Economic Opportunities in Africa: Facts, Myths and Gaps; Papers of the 2019 Rural Development Report, IFAD Research Series 61; IFAD: Rome, Italy, 2019. [Google Scholar]

- Edo, S.; Okodua, H.; Odebiyi, J. Internet Adoption and Financial Development in Sub-Saharan Africa: Evidence from Nigeria and Kenya. Afr. Dev. Rev. 2019, 31, 144–160. [Google Scholar] [CrossRef]

- Asongu, S.A.; Boateng, A. Introduction to special issue: Mobile technologies and inclusive development in Africa. J. Afr. Bus. 2018, 19, 297–301. [Google Scholar] [CrossRef]

- Khan, I.; Zakari, A.; Zhang, J.; Dagar, V.; Singh, S. A study of trilemma energy balance, clean energy transitions, and economic expansion in the midst of environmental sustainability: New insights from three trilemma leadership. Energy 2022, 248, 123619. [Google Scholar] [CrossRef]

- Güney, T. Solar energy and sustainable development: Evidence from 35 countries. Int. J. Sustain. Dev. World Ecol. 2022, 29, 187–194. [Google Scholar] [CrossRef]

- Li, R.; Wang, X.; Wang, Q. Does renewable energy reduce ecological footprint at the expense of economic growth? An empirical analysis of 120 countries. J. Clean. Prod. 2022, 346, 131207. [Google Scholar] [CrossRef]

- Adebayo, T.S. Environmental consequences of fossil fuel in Spain amidst renewable energy consumption: A new insights from the wavelet-based Granger causality approach. Int. J. Sustain. Dev. World Ecol. 2022, 29, 579–592. [Google Scholar] [CrossRef]

- Mahalik, M.K.; Mallick, H.; Padhan, H. Do educational levels influence the environmental quality? The role of renewable and non-renewable energy demand in selected BRICS countries with a new policy perspective. Renew. Energy 2021, 164, 419–432. [Google Scholar] [CrossRef]

- Khan, S.A.R.; Zhang, Y.; Kumar, A.; Zavadskas, E.; Streimikiene, D. Measuring the impact of renewable energy, public health expenditure, logistics, and environmental performance on sustainable economic growth. Sustain. Dev. 2020, 28, 833–843. [Google Scholar] [CrossRef]

- Zafar, M.W.; Zaidi, S.A.H.; Khan, N.R.; Mirza, F.M.; Hou, F.; Kirmani, S.A.A. The impact of natural resources, human capital, and foreign direct investment on the ecological footprint: The case of the United States. Resour. Policy 2019, 63, 101428. [Google Scholar] [CrossRef]

- Sarkodie, S.A.; Ozturk, I. Investigating the environmental Kuznets curve hypothesis in Kenya: A multivariate analysis. Renew. Sustain. Energy Rev. 2020, 117, 109481. [Google Scholar] [CrossRef]

- Destek, M.A.; Sarkodie, S.A. Investigation of environmental Kuznets curve for ecological footprint: The role of energy and financial development. Sci. Total Environ. 2019, 650, 2483–2489. [Google Scholar] [CrossRef]

- Yao, Y.; Ivanovski, K.; Inekwe, J.; Smyth, R. Human capital and CO2 emissions in the long run. Energy Econ. 2020, 91, 104907. [Google Scholar] [CrossRef]

- Destek, M.A.; Okumuş, İ. Biomass energy consumption, economic growth and CO2 emission in G-20 countries. Anemon Muş Alparslan Üniversitesi Sos. Bilimler Derg. 2017, 7, 347–353. [Google Scholar] [CrossRef]

- Inglesi-Lotz, R.; Dogan, E. The role of renewable versus non-renewable energy to the level of CO2 emissions a panel analysis of sub-Saharan Africa’s Βig 10 electricity generators. Renew. Energy 2018, 123, 36–43. [Google Scholar] [CrossRef]

- Mesagan, E.P.; Isola, W.A.; Ajide, K.B. The capital investment channel of environmental improvement: Evidence from BRICS. Environ. Dev. Sustain. 2019, 21, 1561–1582. [Google Scholar] [CrossRef]

- Bilgili, F.; Öztürk, İ.; Koçak, E.; Bulut, Ü.; Pamuk, Y.; Muğaloğlu, E.; Bağlıtaş, H.H. The influence of biomass energy consumption on CO2 emissions: A wavelet coherence approach. Environ. Sci. Pollut. Res. 2016, 23, 19043–19061. [Google Scholar] [CrossRef]

- Ahmad, A.; Zhao, Y.; Shahbaz, M.; Bano, S.; Zhang, Z.; Wang, S.; Liu, Y. Carbon emissions, energy consumption and economic growth: An aggregate and disaggregate analysis of the Indian economy. Energy Policy 2016, 96, 131–143. [Google Scholar] [CrossRef]

- Jiang, X.; Guan, D. Determinants of global CO2 emissions growth. Appl. Energy 2016, 184, 1132–1141. [Google Scholar] [CrossRef]

- Tang, C.; Irfan, M.; Razzaq, A.; Dagar, V. Natural resources and financial development: Role of business regulations in testing the resource-curse hypothesis in ASEAN countries. Resour. Policy 2022, 76, 102612. [Google Scholar] [CrossRef]

- Mahmood, H.; Furqan, M. Oil rents and greenhouse gas emissions: Spatial analysis of Gulf Cooperation Council countries. Environ. Dev. Sustain. 2021, 23, 6215–6233. [Google Scholar] [CrossRef]

- Tufail, M.; Song, L.; Adebayo, T.S.; Kirikkaleli, D.; Khan, S. Do fiscal decentralization and natural resources rent curb carbon emissions? Evidence from developed countries. Environ. Sci. Pollut. Res. 2021, 28, 49179–49190. [Google Scholar] [CrossRef]

- Yang, X. Health expenditure, human capital, and economic growth: An empirical study of developing countries. Int. J. Health Econ. Manag. 2019, 20, 163–176. [Google Scholar] [CrossRef]

- Ganda, F. The Environmental Impacts of Human Capital in the BRICS Economies. J. Knowl. Econ. 2021, 13, 611–634. [Google Scholar] [CrossRef]

- O’Neill, B.C.; Liddle, B.; Jiang, L.; Smith, K.R.; Pachauri, S.; Dalton, M.; Fuchs, R. Demographic change and carbon dioxide emissions. Lancet 2012, 380, 157–164. [Google Scholar] [CrossRef]

- Raupach, M.R.; Marland, G.; Ciais, P.; Le Quéré, C.; Canadell, J.G.; Klepper, G.; Field, C.B. Global and regional drivers of accelerating CO2 emissions. Proc. Natl. Acad. Sci. USA 2007, 104, 10288–10293. [Google Scholar] [CrossRef]

- Kangalawe, R.Y.; Lyimo, J.G. Population dynamics, rural livelihoods and environmental degradation: Some experiences from Tanzania. Environ. Dev. Sustain. 2010, 12, 985–997. [Google Scholar] [CrossRef]

- Ray, S.; Ray, I.A. Impact of population growth on environmental degradation: Case of India. J. Econ. Sustain. Dev. 2011, 2, 72–77. [Google Scholar]

- Doğan, B.; Driha, O.M.; Balsalobre Lorente, D.; Shahzad, U. The mitigating effects of economic complexity and renewable energy on carbon emissions in developed countries. Sustain. Dev. 2021, 29, 1–12. [Google Scholar] [CrossRef]

- Sharif Ali, S.S.; Razman, M.R.; Awang, A. The nexus of population, growth domestic product growth, electricity generation, electricity consumption and carbon emissions output in Malaysia. Int. J. Energy Econ. Policy 2020, 10, 84–89. [Google Scholar]

- Alam, M.M.; Murad, M.W.; Noman, A.H.M.; Ozturk, I. Relationships among carbon emissions, economic growth, energy consumption and population growth: Testing Environmental Kuznets Curve hypothesis for Brazil, China, India and Indonesia. Ecol. Indic. 2016, 70, 466–479. [Google Scholar] [CrossRef]

- Casey, G.; Galor, O. Population Growth and Carbon Emissions; No. w22885; National Bureau of Economic Research: Cambridge, MA, USA, 2016. [Google Scholar]

- Ma, Q.; Murshed, M.; Khan, Z. The nexuses between energy investments, technological innovations, emission taxes, and carbon emissions in China. Energy Policy 2021, 155, 112345. [Google Scholar] [CrossRef]

- Godil, D.I.; Yu, Z.; Sharif, A.; Usman, R.; Khan, S.A.R. Investigate the role of technology innovation and renewable energy in reducing transport sector CO2 emission in China: A path toward sustainable development. Sustain. Dev. 2021, 29, 694–707. [Google Scholar] [CrossRef]

- Mahalik, M.K.; Villanthenkodath, M.A.; Mallick, H.; Gupta, M. Assessing the effectiveness of total foreign aid and foreign energy aid inflows on environmental quality in India. Energy Policy 2021, 149, 112015. [Google Scholar] [CrossRef]

- Ahmad, M.; Jiang, P.; Majeed, A.; Umar, M.; Khan, Z.; Muhammad, S. The dynamic impact of natural resources, technological innovations and economic growth on ecological footprint: An advanced panel data estimation. Resour. Policy 2020, 69, 101817. [Google Scholar] [CrossRef]

- Álvarez-Herránz, A.; Balsalobre, D.; Cantos, J.M.; Shahbaz, M. Energy innovations-GHG emissions nexus: Fresh empirical evidence from OECD countries. Energy Policy 2017, 101, 90–100. [Google Scholar] [CrossRef]

- Yin, J.; Zheng, M.; Chen, J. The effects of environmental regulation and technical progress on CO2 Kuznets curve: An evidence from China. Energy Policy 2015, 77, 97–108. [Google Scholar] [CrossRef]

- Hussain, S.; Ahmad, T.; Shahzad, S.J.H. Financial Inclusion and CO2 Emissions in Asia: Implications for Environmental Sustainability. 2021. Available online: https://assets.researchsquare.com/files/rs-245990/v1/4b5103eb-eff5-4757-918b-c0d79add266e.pdf?c=1631877208 (accessed on 10 August 2022).

- Zaidi, S.A.H.; Hussain, M.; Zaman, Q.U. Dynamic linkages between financial inclusion and carbon emissions: Evidence from selected OECD countries. Resour. Environ. Sustain. 2021, 4, 100022. [Google Scholar] [CrossRef]

- Qin, L.; Raheem, S.; Murshed, M.; Miao, X.; Khan, Z.; Kirikkaleli, D. Does financial inclusion limit carbon dioxide emissions? Analyzing the role of globalization and renewable electricity output. Sustain. Dev. 2021, 29, 1138–1154. [Google Scholar] [CrossRef]

- Renzhi, N.; Baek, Y.J. Can financial inclusion be an effective mitigation measure? evidence from panel data analysis of the environmental Kuznets curve. Financ. Res. Lett. 2020, 37, 101725. [Google Scholar] [CrossRef]

- Dietz, T.; Rosa, E.A. Effects of Population and Affluence on CO2 Emissions. Proc. Natl. Acad. Sci. USA 1997, 94, 175. [Google Scholar] [CrossRef]

- Wang, S.; Zhao, T.; Zheng, H.; Hu, J. The STIRPAT analysis on carbon emission in Chinese cities: An asymmetric laplace distribution mixture model. Sustainability 2017, 9, 2237. [Google Scholar] [CrossRef]

- Anderson, T.W.; Hsiao, C. Formulation and estimation of dynamic models using panel data. J. Econ. 1982, 18, 47–82. [Google Scholar] [CrossRef]

- Nickell, S. Biases in dynamic models with fixed effects. Econometrica 1981, 49, 1399–1416. [Google Scholar] [CrossRef]

- Arellano, M.; Bover, O. Another look at the instrumental variable estimation of error components models. J. Econom. 1995, 68, 29–52. [Google Scholar] [CrossRef]

- Blundell, R.; Bond, S. Initial conditions and moment restrictions in dynamic panel data models. J. Econom. 1998, 87, 115–143. [Google Scholar] [CrossRef]

- Roodman, D. A Note on the Theme of Too Many Instruments. Oxf. Bull. Econ. Stat. 2009, 71, 135–158. [Google Scholar] [CrossRef]

- Brambor, T.; Clark, W.M.; Golder, M. Understanding interaction models: Improving empirical analyses. Political Anal. 2006, 14, 63–82. [Google Scholar] [CrossRef]

- Ibrahim, R.L.; Ajide, K.B.; Omokanmi, O.J. Non-renewable energy consumption and quality of life: Evidence from Sub-Saharan African economies. Resour. Policy 2021, 73, 102176. [Google Scholar] [CrossRef]

- Ibrahim, R.L.; Julius, O.O.; Nwokolo, I.C.; Ajide, K.B. The role of technology in the non-renewable energy consumption-quality of life nexus: Insights from sub-Saharan African countries. Econ. Change Restruct. 2022, 55, 257–284. [Google Scholar] [CrossRef]

- Sala, H.; Trivin, P. Openness, Investment and Economic Growth in Sub-Saharan Africa. J. Afr. Econ. 2014, 23, 257–289. [Google Scholar] [CrossRef]

- African Development Bank. Africa Ecological Footprint Report: Green Infrastructure for Africa’s Ecological Security. 2012. Available online: https://www.afdb.org/sites/default/files/documents/projects-and-operations/africa_ecological_footprint_report_-_green_infrastructure_for_africas_ecological_security.pdf (accessed on 25 May 2021).

- Olaoye, O.; Ibukun, C.O.; Razzak, M.; Mose, N. Poverty prevalence and negative spillovers in Sub-Saharan Africa: A focus on extreme and multidimensional poverty in the region. Int. J. Emerg. Mark. 2021. [Google Scholar] [CrossRef]

- Zhang, M.; Ajide, K.B.; Ridwan, L.I. Heterogeneous dynamic impacts of nonrenewable energy, resource rents, technology, human capital, and population on environmental quality in Sub-Saharan African countries. Environ. Dev. Sustain. 2022, 24, 11817–11851. [Google Scholar] [CrossRef]

- Osabohien, R. Afolabi A and Godwin A 2018. Agricultural credit facility and food security in Nigeria: An analytic review. Open Agric. J. 2018, 12, 227–239. [Google Scholar] [CrossRef]

- Oke, D.M.; Ibrahim, R.L.; Bokana, K.G. Can renewable energy deliver African quests for sustainable development? J. Dev. Areas 2021, 55. [Google Scholar] [CrossRef]

- Global Insight. Productivity Report. 2015. Available online: http://www.global-insight.net/ (accessed on 18 August 2021).

- FAO. The Future of Food and Agriculture: Trends and Challenges. 2017. Available online: http://www.fao.org/3/a-i6583e.pdf (accessed on 18 August 2021).

- Asongu, S.A.; Le Roux, S. Enhancing ICT for inclusive human development in Sub-Saharan Africa. Technol. Forecast. Soc. Change 2017, 118, 44–54. [Google Scholar] [CrossRef]

- Demena, B.A.; Afesorgbor, S.K. The effect of FDI on environmental emissions: Evidence from a meta-analysis. Energy Policy 2020, 138, 111192. [Google Scholar] [CrossRef]

- Zhu, H.; Duan, L.; Guo, Y.; Yu, K. The effects of FDI, economic growth and energy consumption on carbon emissions in ASEAN-5: Evidence from panel quantile regression. Econ. Model. 2016, 58, 237–248. [Google Scholar] [CrossRef] [Green Version]

| Variables | Name and Measurements | Mean | Std. Dev. | Maximum | Minimum | Signs |

|---|---|---|---|---|---|---|

| CO2 | CO2 emissions (metric tons per capita) | 1.54231 | 2.544378 | 9.979458 | 0.02801 | Nil |

| REC | Renewable energy consumption (% of total final energy consumption) | 31.08094 | 29.71533 | 97.01889 | 0.354019 | −ve |

| NRE | Non-renewable energy (Fossil fuel energy consumption % of total) | 61.16206 | 28.50543 | 88.14867 | 0 | +ve |

| TNRR | Total natural resource rents (% of GDP) | 12.10421 | 12.68515 | 59.20581 | 0.001259 | ±ve |

| FININCL | Financial inclusion (automated teller machines (ATMs) per 100,000 adults) | 13.12443 | 16.12839 | 65.69298 | 0.019368 | ±ve |

| POPG | Population growth (annual %) | 2.253501 | 1.01767 | 3.907245 | −0.61666 | +ve |

| HC | Human capital (school enrollment, primary % gross) | 104.2626 | 13.13886 | 139.9336 | 62.70836 | ±ve |

| TECH | Technology (ICT service exports % of service exports, BoP) | 6.243425 | 6.815692 | 52.30411 | 0.338888 | −ve |

| INCOME | GDP per capita (constant 2010 US$) | 2877.072 | 2811.481 | 11124.66 | 215.1546 | ±ve |

| FDI | Foreign direct investment, net inflows (% of GDP) | 4.616172 | 5.887718 | 39.4562 | −3.85111 | ±ve |

| INFR | Fixed telephone subscriptions (per 100 people | 5.168841 | 8.127514 | 31.06683 | 0 | −ve |

| TO | Trade-in services (% of GDP) | 18.66079 | 13.56806 | 70.23726 | 4.699146 | ±ve |

| Variables | Independent Variable: Carbon Emissions per Capita (co2pc) | |||||

|---|---|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | |

| L.co2 | 0.7268 *** | 0.9287 *** | 0.7835 *** | 0.8969 *** | 0.7671 *** | 0.7736 *** |

| (0.009) | (0.0034) | (0.0039) | (0.0027) | (0.0069) | (0.0029) | |

| rec | −0.0056 *** | |||||

| (0.0012) | ||||||

| nre | 0.0031 *** | |||||

| (0.0003) | ||||||

| tnrr | 0.0064 *** | |||||

| (0.0016) | ||||||

| popg | 0.2059 *** | |||||

| (0.0071) | ||||||

| hc | 0.0033 * | |||||

| (0.0017) | ||||||

| finincl | 0.0003 | |||||

| (0.0003) | ||||||

| tech | −0.0257 *** | −0.0022 ** | −0.0073 *** | −0.0122 *** | −0.0252 *** | −0.0022 *** |

| (0.0047) | (0.0009) | (0.0021) | (0.0018) | (0.0084) | (0.0002) | |

| tech*PIV | −0.0003 *** | 0.0022 | −0.0005 *** | −0.0049 *** | 0.0003 *** | 0.0011 *** |

| (0.0001) | (0.00034) | (0.0001) | (0.0008) | (0.0001) | (0.0001) | |

| Net effects | −0.0128 | na | 0.0004 | 0.1949 | 0.0279 | na |

| to | 0.0053 *** | 0.0024 *** | 0.0028 *** | 0.0083 *** | −0.0026 ** | 0.0039 *** |

| (0.001) | (0.0008) | (0.0004) | (0.0007) | (0.001) | (0.0005) | |

| fdi | −0.001 ** | 0.0006 | −0.0027 *** | −0.0008 * | −0.0026 *** | −0.0008 ** |

| (0.0004) | (0.0005) | (0.0003) | (0.0004) | (0.0004) | (0.0003) | |

| infr | 0.0779 *** | 0.0036 | 0.0671 *** | 0.0112 *** | 0.0637 *** | 0.0564 *** |

| (0.007) | (0.0025) | (0.0034) | (0.0028) | (0.0048) | (0.0017) | |

| _cons | −0.4736 *** | −0.0488 ** | −0.147 *** | −0.5894 *** | 0.3015 | −0.0877 *** |

| (0.1011) | (0.0187) | (0.0302) | (0.0144) | (0.1913) | (0.0142) | |

| AR1 | 0.227 | 0.027 | 0.212 | 0.168 | 0.266 | 0.213 |

| AR2 | 0.289 | 0.210 | 0.277 | 0.223 | 0.316 | 0.274 |

| Sargan OIR | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| Hansen OIR | 0.229 | 0.580 | 0.162 | 0.177 | 0.114 | 0.410 |

| DHT for instruments (a) Instruments in levels | ||||||

| H excluding group | 0.317 | 0.213 | 0.026 | 0.108 | 0.199 | 0.104 |

| Dif(null, H = exogenous | 0.246 | 0.821 | 0.695 | 0.394 | 0.162 | 0.796 |

| (b) IV (years, eq(diff)) | ||||||

| H excluding group | 0.192 | 0.521 | 0.1840. | 0.162 | 0.098 | 0.360 |

| Dif(null, H = exogenous | 0.753 | 0.000 | 0.179 | 0.411 | 0.499 | 0.752 |

| Fisher | 63.86 *** | 84.58 *** | 10.90 *** | 19.59 *** | 80.46 *** | 17.67 *** |

| Instruments | 32 | 32 | 32 | 32 | 32 | 32 |

| Country | 42 | 42 | 42 | 42 | 42 | 42 |

| Observations | 391 | 219 | 426 | 426 | 359 | 344 |

| Variables | Independent Variable: Carbon Emissions (co2pc) | |||||

|---|---|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | |

| L.co2 | 0.7956 *** | 0.8699 *** | 0.7384 *** | 0.6845 *** | 0.7614 *** | 0.7545 *** |

| (0.0026) | (0.0348) | (0.0159) | (0.018) | (0.0101) | (0.0187) | |

| rec | −0.0201 *** | |||||

| (0.0017) | ||||||

| nre | 0.0043 *** | |||||

| (0.0017) | ||||||

| tnrr | 0.0226 * | |||||

| (0.0131) | ||||||

| popg | 1.3609 *** | |||||

| (0.4747) | ||||||

| hc | 0.0095 | |||||

| (0.0157) | ||||||

| finincl | 0.0991 | |||||

| (0.1219) | ||||||

| lnincome | 0.3112 *** | 0.2032 *** | 0.1482 *** | 0.6199 *** | 0.3299 | 0.5093 *** |

| (0.0179) | (0.0593) | (0.0404) | (0.2016) | (0.265) | (0.1114) | |

| Income*IV | −0.0029 *** | 0.0002 | −0.003 * | −0.1607 ** | −0.0018 | 0.0103 *** |

| (0.0003) | (0.0002) | (0.0017) | (0.0611) | (0.0026) | (0.0023) | |

| Net effects | −0.0382 | na | 0.0088 | −1.6379 | na | na |

| to | 0.0018 *** | 0.0017 | 0.0034 ** | 0.0083 *** | 0.0007 | 0.0019 * |

| (0.0003) | (0.0031) | (0.0015) | (0.0025) | (0.0008) | (0.0011) | |

| fdi | −0.0005 *** | −0.0004 | 0.0003 | −0.0011 | −0.0015 | −0.0029 *** |

| (0.0001) | (0.0018) | (0.0004) | (0.0008) | (0.0015) | (0.0007) | |

| infr | 0.012 *** | 0.0319 *** | 0.0718 *** | 0.1057 *** | 0.0525 *** | 0.0066 |

| (0.0036) | (0.0114) | (0.0117) | (0.0162) | (0.0072) | (0.0172) | |

| _cons | −2.0475 *** | −1.2753 *** | −0.9668 *** | −4.8286 *** | −1.9069 | −3.2581 *** |

| (0.1037) | (0.3956) | (0.3024) | (1.5293) | (1.6038) | (0.7285) | |

| AR1 | 0.213 | 0.026 | 0.214 | 0.242 | 0.261 | 0.201 |

| AR2 | 0.270 | 0.245 | 0.278 | 0.289 | 0.308 | 0.257 |

| Sargan OIR | 0.000 | 0.000 | 0.000 | 0.003 | 0.000 | 0.000 |

| Hansen OIR | 0.265 | 0.607 | 0.156 | 0.603 | 0.744 | 0.382 |

| DHT for instruments (a) Instruments in levels | ||||||

| H excluding group | 0.093 | 0.384 | 0.261 | 0.690 | 0.649 | 0.154 |

| Dif(null, H = exogenous | 0.605 | 0.657 | 0.177 | 0.453 | 0.653 | 0.620 |

| (b) IV (years, eq(diff)) | ||||||

| H excluding group | 0.251 | 0.384 | 0.139 | 0.535 | 0.768 | 0.332 |

| Dif(null, H = exogenous | 0.381 | 0.987 | 0.404 | 0.796 | 0.271 | 0.601 |

| Fisher | 67.62 *** | 26.06 *** | 17.93 *** | 95.08 *** | 12.03 *** | 22.13 *** |

| Instruments | 32 | 24 | 24 | 24 | 24 | 24 |

| Countries | 42 | 42 | 42 | 42 | 42 | 42 |

| Observations | 431 | 237 | 471 | 471 | 394 | 381 |

| rec-lnco2kt | nre-lnco2kt | rec- co2res | nre- co2res | rec-co2trans | nre-co2trans | rec- co2agr | nre- co2agr | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Model 1 | Model 2 | Model 1 | Model 2 | Model 1 | Model 2 | Model 1 | Model 2 | Model 1 | Model 2 | Model 1 | Model 2 | Model 1 | Model 2 | Model 1 | Model 2 | |

| L.lnco2kt | 0.803 *** | 1.016 *** | 0.866 *** | 0.89 *** | 0.951 *** | 0.936 *** | 0.911 *** | 0.922 *** | 0.722 *** | 0.744 *** | 0.723 *** | 0.817 *** | 0.722 *** | 0.724 *** | 0.831 *** | 0.909 *** |

| (0.054) | (0.029) | (0.038) | (0.017) | (0.034) | (0.056) | (0.045) | (0.033) | (0.039) | (0.033) | (0.081) | (0.044) | (0.039) | (0.041) | (0.036) | (0.042) | |

| rec | −0.009 *** | −0.005 ** | 0.026 | −0.013 | −0.077 | −0.075 | 69.685 *** | 18.461 | ||||||||

| (0.002) | (0.002) | (0.032) | (0.017) | (0.106) | (0.044) | (21.348) | (24.895) | |||||||||

| nre | 0.005 *** | 0.008 *** | 0.045 * | 0.003 | 0.077 * | 0.032 * | 5.773 *** | 2.784 ** | ||||||||

| (0.001) | (0.002) | (0.022) | (0.012) | (0.032) | (0.016) | (1.657) | (0.632) | |||||||||

| tnrr | 0.017 *** | 0.002 | 0.009 *** | 0.001 | 0.064 *** | 0.005 | 0.058 *** | 0.014 | 0.085 | −0.127 | 0.140 | −0.067 | 0.1210.363 * | −30.21 | 43.226 | 11.276 |

| (0.004) | (0.003) | (0.002) | (0.003) | (0.015) | (0.018) | (0.015) | (0.017) | (0.052) | (0.082) | (0.134) | (0.088) | (58.7) | (56.496) | (49.307) | (111.369) | |

| hc | 0.011 ** | 0.005 ** | −0.003 | 0.001 | 0.053 *** | 0.085 *** | 0.036 ** | 0.075 *** | 0.344 ** | 0.174 ** | 0.16 | 0.107 | 93.807 * | 54.26 ** | 95.713 | −11.276 |

| (0.004) | (0.002) | (0.002) | (0.001) | (0.018) | (0.010) | (0.012) | (0.011) | (0.158) | (0.07) | (0.12) | (0.082) | (53.767) | (24.753) | (97.489) | (50.608) | |

| popg | 0.097 *** | 0.012 ** | 0.153 *** | 0.017 | 0.802 | 0.335 | 0.681 *** | 0.368 *** | 4.395 ** | 3.181 ** | 2.714 *** | 1.777 *** | 1893.53 | 1036.001 * | 20.603 *** | 89.243 *** |

| (0.017) | (0.004) | (0.052) | (0.053) | (0.831) | (0.289) | (0.064) | (0.072) | (1.855) | (1.188) | (0.9) | (0.234) | (1182.107) | (590.179) | (1.421) | (9.768) | |

| finincl | 0.005 ** | 0.011 *** | 0.001 | 0.003 | 0.012 | 0.017 | 0.016 | 0.023 ** | 0.018 | 0.182 *** | 0.023 | −0.014 | −19.216 | −34.072 | −42.334 | −43.635 |

| (0.002) | (0.001) | (0.002) | (0.002) | (0.009) | (0.016) | (0.012) | (0.01) | (0.03) | (0.045) | (0.032) | (0.05) | (49.485) | (42.514) | (117.671) | (77.465) | |

| tech | −0.01 *** | −0.014 *** | −0.035 ** | −0.003 | −0.095 * | 0.082 | −39.549 | −214.513 ** | ||||||||

| (0.002) | (0.003) | (0.017) | (0.002) | (0.048) | (0.053) | (104.309) | (86.161) | |||||||||

| to | −0.016 *** | −0.005 ** | −0.009 *** | −0.006 ** | −0.067 ** | −0.015 | −0.069 ** | 0.028 | 0.053 | −0.055 | 0.148 | −0.025 | −19.249 | −56.137 ** | −20.73 | −11.626 |

| (0.003) | (0.002) | (0.003) | (0.003) | (0.029) | (0.03) | (0.042) | (0.025) | (0.07) | (0.083) | (0.17) | (0.043) | (46.588) | (21.163) | (32.158) | (49.771) | |

| fdi | 0.001 | 0.002 | −0.004 | 0.001 | −0.101 ** | −0.039 * | −0.099 ** | −0.061 ** | −0.17 * | −0.123 ** | −0.021 | −0.027 | 65.047 | 76.297 | 28.208 | −0.062 |

| (0.001) | (0.004) | (0.003) | (0.003) | (0.021) | (0.02) | (0.039) | (0.022) | (0.087) | (0.05) | (0.111) | (0.032) | (211.573) | (56.92) | (144.899) | (124.828) | |

| _cons | 3.814 *** | 0.725 * | 1.423 *** | 0.797 *** | −0.248 ** | −0.753 ** | −2.893 | −0.914 ** | −30.381 | −4.992 | −12.857 | −3.67 | 7027.816 | 6026.432 * | −10,606.406 | 1037.686 |

| (0.865) | (0.416) | (0.422) | (0.23) | (0.063) | (0.204) | (2.949) | (0.312) | (19.373) | (8.944) | (18.521) | (8.844) | (8380.527) | (3019.672) | (13,117.383) | (7353.675) | |

| AR1 | 0.033 | 0.012 | 0.168 | 0.020 | 0.125 | 0.107 | 0.130 | 0.110 | 0.167 | 0.159 | 0.089 | 0.063 | 0.071 | 0.090 | 0.000 | 0.026 |

| AR2 | 0.599 | 0.711 | 0.314 | 0.500 | 0.483 | 0.414 | 0.468 | 0.458 | 0.582 | 0.412 | 0.216 | 0.131 | 0.706 | 0.837 | 0.453 | 0.465 |

| Sargan OIR | 0.000 | 0.000 | 0.000 | 0.000 | 0.673 | 0.523 | 0.690 | 0.499 | 0.000 | 0.000 | 0.001 | 0.000 | 0.865 | 0.374 | 0.766 | 0.660 |

| Hansen OIR | 0.623 | 0.231 | 0.631 | 0.639 | 0.987 | 0.972 | 0.990 | 0.929 | 0.971 | 0.999 | 0.978 | 0.957 | 0.750 | 0.799 | 0.899 | 0.991 |

| DHT for instruments (a) Instruments in levels | ||||||||||||||||

| H excluding group | 0.687 | 0.388 | 0.910 | 0.425 | 0.774 | 0.950 | 0.428 | 0.865 | 0.577 | 0.722 | 0.447 | 0.467 | 0.429 | 0.731 | 0.931 | 0.761 |

| Dif(null, H = exogenous | 0.482 | 0.208 | 0.348 | 0.682 | 0.982 | 0.870 | 0.872 | 0.819 | 0.986 | 0.896 | 0.998 | 0.991 | 0.789 | 0.548 | 0.999 | 0.989 |

| (b) IV (years, eq(diff)) | ||||||||||||||||

| H excluding group | 0.584 | 0.190 | 0.570 | 0.480 | 0.980 | 0.960 | 0.984 | 0.904 | 0.974 | 0.964 | 0.892 | 0.941 | 0.832 | 0.521 | 0.999 | 0.924 |

| Dif(null, H = exogenous | 0.556 | 0.826 | 0.987 | 0.988 | 0.873 | 0.865 | 0.866 | 0.764 | 0.334 | 0.989 | 0.667 | 0.876 | 0.137 | 0.956 | 0.844 | 0.675 |

| Fisher | 91.44 *** | 13.84 *** | 58.69 *** | 30.31 *** | 19.85 *** | 11.08 **** | 23.49 *** | 13.65 *** | 49.81 *** | 84.95 *** | 11.17 *** | 90.28 *** | 63.45 *** | 28.49 *** | 65.37 *** | 48.95 *** |

| Instruments | 32 | 32 | 32 | 32 | 32 | 32 | 32 | 32 | 32 | 32 | 32 | 32 | 32 | 32 | 32 | 3 |

| Countries | 42 | 42 | 42 | 42 | 42 | 42 | 42 | 42 | 42 | 42 | 42 | 42 | 42 | 42 | 42 | 42 |

| Observations | 264 | 290 | 149 | 159 | 136 | 146 | 135 | 145 | 142 | 152 | 134 | 144 | 79 | 90 | 54 | 59 |

| rec-lnco2kt | nre-lnco2kt | rec-co2res | nre-co2res | rec-co2trans | nre-co2trans | rec-co2agr | nre-co2agr | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Model 1 | Model 2 | Model 1 | Model 2 | Model 1 | Model 2 | Model 1 | Model 2 | Model 1 | Model 2 | Model 1 | Model 2 | Model 1 | Model 2 | Model 1 | Model 2 | |

| L.lnco2kt | 0.831 *** | 0.99 *** | 0.765 *** | 0.857 *** | 0.724 *** | 0.862 *** | 0.741 *** | 0.887 *** | 0.491 *** | 0.744 *** | 0.817 *** | 0.817 *** | 0.857 *** | 0.831 *** | 0.929 *** | 0.926 *** |

| (0.037) | (0.025) | (0.036) | (0.035) | (0.046) | (0.046) | (0.05) | (0.04) | (0.033) | (0.033) | (0.044) | (0.044) | (0.038) | (0.036) | (0.041) | (0.036) | |

| rec | −0.006 *** | −0.002 | −0.066 ** | −0.020 | −0.308 *** | −0.075 | 0.526 | 18.461 | ||||||||

| (0.002) | (0.002) | (0.026) | (0.019) | (0.074) | (0.044) | (26.187) | (24.895) | |||||||||

| nre | 0.008 *** | 0.007 *** | 0.096 *** | 0.002 | 0.032 *** | 0.032 | 1.838 ** | 2.784 ** | ||||||||

| (0.002) | (0.001) | (0.031) | (0.018) | (0.006) | (0.036) | (0.988) | (0.632) | |||||||||

| tnrr | 0.001 | 0.003 | 0.003 | 0.005 *** | 0.06 *** | 0.033 | 0.073 *** | 0.025 ** | 0.134 | −0.127 | −0.067 | −0.067 | 9.366 | −30.21 | 8.65 | 11.276 |

| (0.003) | (0.002) | (0.003) | (0.002) | (0.018) | (0.020) | (0.021) | (0.01) | (0.124) | (0.082) | (0.088) | (0.088) | (62.519) | (56.496) | (113.32) | (111.369) | |

| hc | 0.002 * | 0.007 *** | 0.005 | 0.003 ** | 0.029 | 0.058 ** | 0.033 | 0.046 | 0.195 * | 0.174 ** | 0.107 | 0.107 | 45.511 * | 54.26 ** | −7.603 | −11.276 |

| (0.001) | (0.002) | (0.003) | (0.001) | (0.028) | (0.025) | (0.026) | (0.028) | (0.1) | (0.07) | (0.082) | (0.082) | (25.061) | (24.753) | (51.385) | (50.608) | |

| popg | 0.023 *** | 0.024 *** | 0.131 * | 0.186 *** | 1.003 *** | 1.039 ** | 0.227 *** | 2.208 *** | 2.534 *** | 3.181 ** | 1.777 *** | 1.977 *** | 658.41 | 1036.001 * | 922.062 *** | 892.427 *** |

| (0.003) | (0.008) | (0.069) | (0.053) | (0.715) | (0.582) | (0.079) | (0.543) | (0.715) | (1.188) | (0.234) | (0.234) | (640.504) | (590.179) | (100.446) | (276.8) | |

| finincl | 0.007 *** | 0.005 * | 0.002 | 0.001 | 0.042 *** | 0.044 * | 0.032 ** | 0.030 ** | 0.053 | 0.182 *** | 0.014 | 0.014 | 20.255 | 34.072 | 46.577 | 43.635 |

| (0.001) | (0.003) | (0.002) | (0.001) | (0.012) | (0.021) | (0.015) | (0.013) | (0.091) | (0.045) | (0.050) | (0.050) | (39.368) | (42.514) | (80.479) | (77.465) | |

| lnincome | 0.289 *** | 0.122 ** | 1.565 *** | 2.431 *** | 9.337 *** | 6.127 *** | −601.724 ** | 20.189 | ||||||||

| (0.056) | (0.045) | (0.283) | (0.570) | (1.894) | (1.094) | (252.973) | (1087.334) | |||||||||

| to | 0.001 | 0.004 | 0.01 *** | 0.003 ** | 0.014 | 0.018 | 0.017 | 0.046 ** | 0.038 | 0.055 | 0.025 | 0.025 | 53.174 ** | 56.137 ** | 10.266 | 11.626 |

| (0.002) | (0.002) | (0.002) | (0.001) | (0.031) | (0.013) | (0.029) | (0.022) | (0.091) | (0.083) | (0.043) | (0.043) | (21.328) | (21.163) | (57.337) | (49.771) | |

| fdi | 0.001 | −0.001 *** | −0.004 | −0.002 | −0.013 *** | −0.023 *** | −0.016 *** | 0.003 | 0.090 | −0.123 ** | −0.027 | −0.027 | 53.037 | 76.297 | 1.419 | −0.062 |

| (0.001) | (0.000) | (0.004) | (0.002) | (0.003) | (0.004) | (0.003) | (0.003) | (0.055) | (0.050) | (0.032) | (0.032) | (57.643) | (56.92) | (124.906) | (124.828) | |

| _cons | −0.676 | 1.078 *** | 0.964 * | 1.88 *** | 14.579 *** | −4.298 | 13.029 ** | −3.897 | 97.902 *** | −4.992 | −3.67 | −3.67 | 10,510.15 ** | 6026.432 * | 411.862 | 1037.686 |

| (0.445) | (0.317) | (0.552) | (0.354) | (4.907) | (3.044) | (5.433) | (4.585) | (21.722) | (8.944) | (8.844) | (8.844) | (3876.709) | (3019.672) | (9267.357) | (7353.675) | |

| AR1 | 0.010 | 0.013 | 0.014 | 0.011 | 0.111 | 0.100 | 0.111 | 0.102 | 0.178 | 0.063 | 0.089 | 0.012 | 0.032 | 0.033 | 0.043 | 0.044 |

| AR2 | 0.813 | 0.995 | 0.871 | 0.469 | 0.345 | 0.373 | 0.329 | 0.342 | 0.610 | 0.131 | 0.827 | 0.122 | 0.531 | 0.114 | 0.887 | 0.151 |

| Sargan OIR | 0.000 | 0.000 | 0.023 | 0.000 | 0.676 | 0.627 | 0.770 | 0.608 | 0.007 | 0.000 | 0.320 | 0.000 | 0.125 | 0.000 | 0.311 | 0.000 |

| Hansen OIR | 0.699 | 0.546 | 0.927 | 0.414 | 0.960 | 0.917 | 0.954 | 0.919 | 0.988 | 0.957 | 0.854 | 0.346 | 0.987 | 0.927 | 0.126 | 0.927 |

| DHT for instruments (a) Instruments in levels | ||||||||||||||||

| H excluding group | 0.387 | 0.678 | 0.833 | 0.872 | 0.570 | 0.774 | 0.748 | 0.742 | 0.586 | 0.467 | 0.656 | 0.122 | 0.665 | 0.457 | 0.606 | 0.217 |

| Dif(null, H = exogenous | 0.774 | 0.392 | 0.838 | 0.172 | 0.981 | 0.852 | 0.932 | 0.873 | 0.997 | 0.991 | 0.804 | 0.876 | 0.845 | 0.901 | 0.829 | 0.801 |

| (b) IV (years, eq(diff)) | ||||||||||||||||

| H excluding group | 0.648 | 0.495 | 0.901 | 0.357 | 0.570 | 0.890 | 0.936 | 0.892 | 0.981 | 0.941 | 0.840 | 0.140 | 0.128 | 0.813 | 0.672 | 0.850 |

| Dif(null, H = exogenous | 0.762 | 0.690 | 0.998 | 0.1000 | 0.981 | 0.899 | 0.879 | 0.995 | 0.994 | 0.876 | 0.459 | 0.234 | 0.219 | 0.409 | 0.459 | 0.402 |

| Fisher | 30.02 *** | 13.09 *** | 80.25 *** | 14.88 *** | 20.60 *** | 33.13 *** | 10.60 *** | 26.49 *** | 22.72 *** | 90.23 *** | 26.22 ** | 28.49 *** | 23.13 *** | 32.11 *** | 22.41 *** | 22.409 *** |

| Instruments | 32 | 32 | 32 | 32 | 32 | 32 | 32 | 32 | 32 | 32 | 32 | 32 | 32 | 32 | 32 | 32 |

| Countries | 42 | 42 | 42 | 42 | 42 | 42 | 42 | 42 | 42 | 42 | 42 | 42 | 42 | 42 | 42 | 42 |

| Observation | 290 | 290 | 159 | 159 | 146 | 146 | 145 | 145 | 152 | 152 | 144 | 144 | 90 | 90 | 59 | 59 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ibrahim, R.L.; Al-Mulali, U.; Ajide, K.B.; Mohammed, A.; Bolarinwa, F.O. Investigating the Mediating Roles of Income Level and Technological Innovation in Africa’s Sustainability Pathways Amidst Energy Transition, Resource Abundance, and Financial Inclusion. Sustainability 2022, 14, 12212. https://doi.org/10.3390/su141912212

Ibrahim RL, Al-Mulali U, Ajide KB, Mohammed A, Bolarinwa FO. Investigating the Mediating Roles of Income Level and Technological Innovation in Africa’s Sustainability Pathways Amidst Energy Transition, Resource Abundance, and Financial Inclusion. Sustainability. 2022; 14(19):12212. https://doi.org/10.3390/su141912212

Chicago/Turabian StyleIbrahim, Ridwan Lanre, Usama Al-Mulali, Kazeem Bello Ajide, Abubakar Mohammed, and Fatimah Ololade Bolarinwa. 2022. "Investigating the Mediating Roles of Income Level and Technological Innovation in Africa’s Sustainability Pathways Amidst Energy Transition, Resource Abundance, and Financial Inclusion" Sustainability 14, no. 19: 12212. https://doi.org/10.3390/su141912212

APA StyleIbrahim, R. L., Al-Mulali, U., Ajide, K. B., Mohammed, A., & Bolarinwa, F. O. (2022). Investigating the Mediating Roles of Income Level and Technological Innovation in Africa’s Sustainability Pathways Amidst Energy Transition, Resource Abundance, and Financial Inclusion. Sustainability, 14(19), 12212. https://doi.org/10.3390/su141912212