Does Retirement Affect Household Energy Consumption Structure? Evidence from a Regression Discontinuity Design

Abstract

:1. Introduction

2. Institution Background and Identification Design

2.1. Institution Background

2.2. Identification Design

3. Data and Variables

3.1. Data

3.2. Variables

4. Empirical Results and Discussion

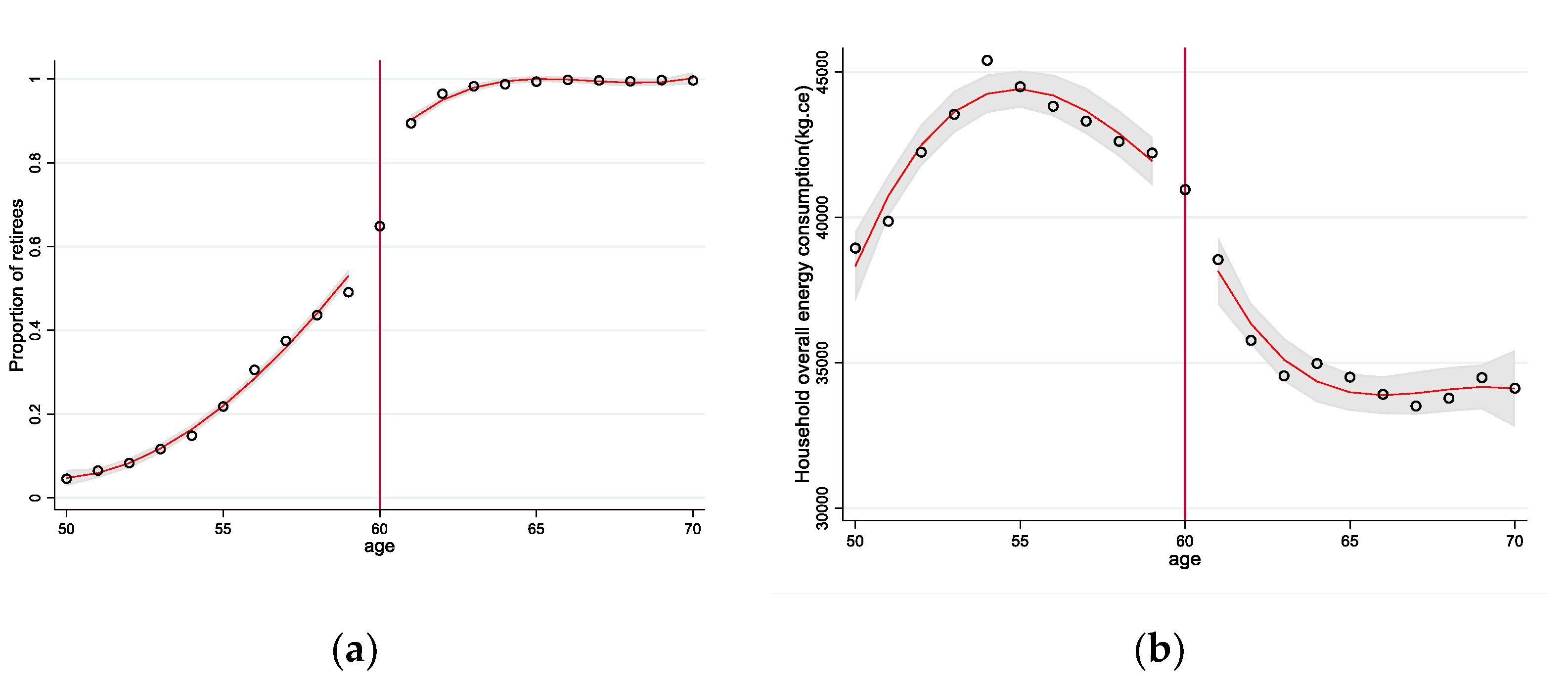

4.1. The Treatment Effect of Retirement on Household Energy Consumption

4.2. Mechanisms Analysis

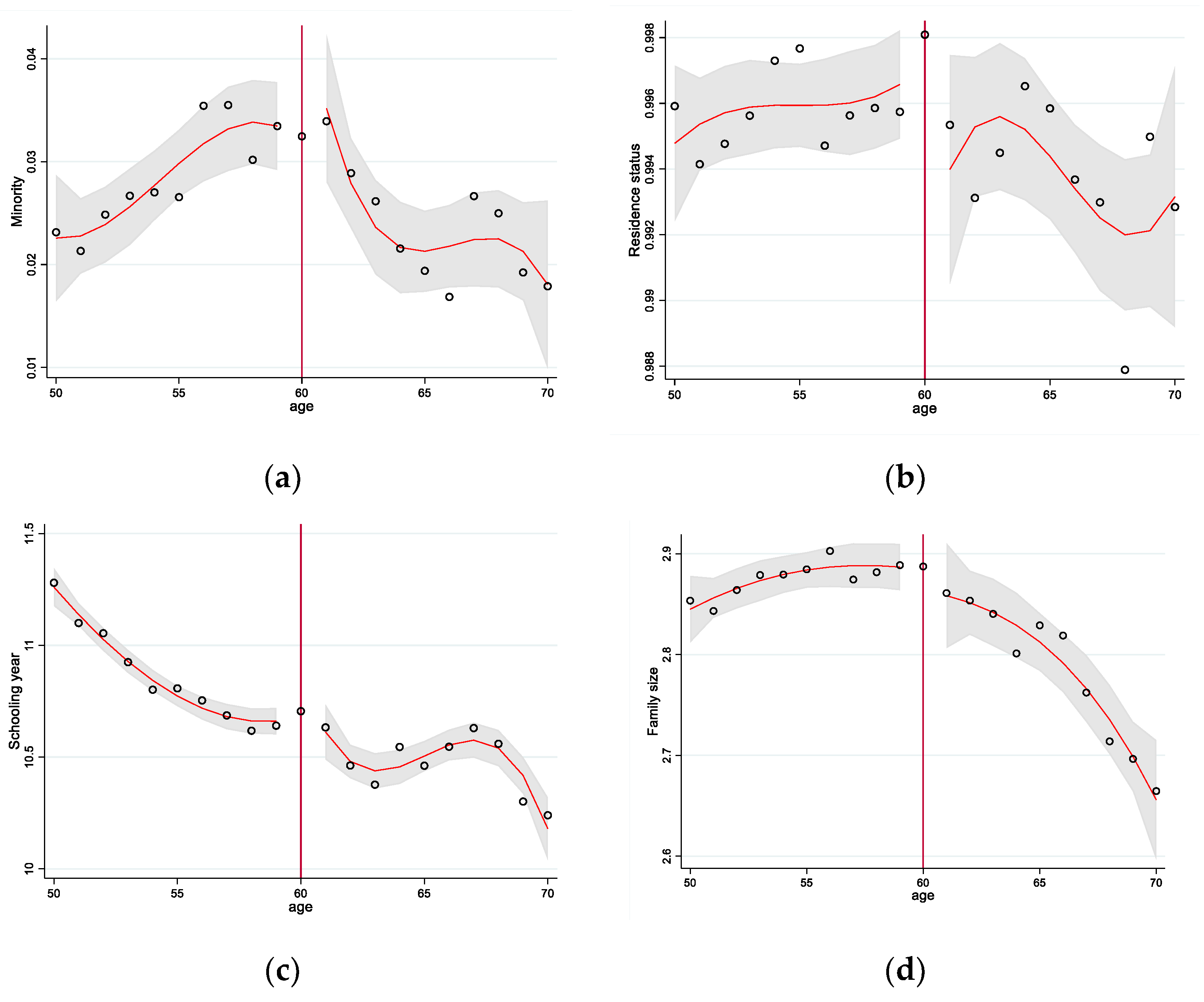

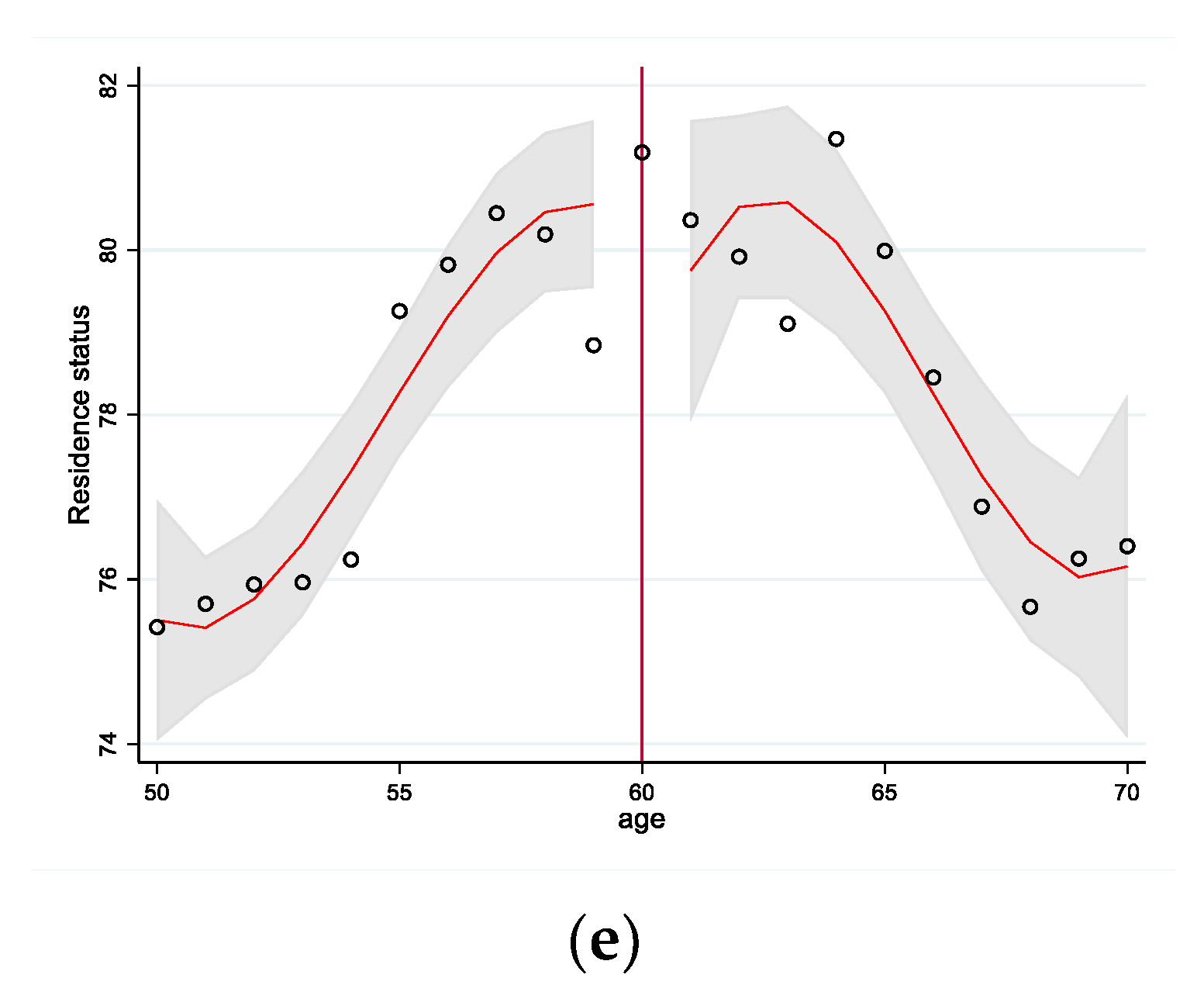

4.3. Validity of the RDD

4.4. Robustness Checks

4.4.1. Considering Wealth Level

4.4.2. Considering Female Head of Household

4.4.3. Excluding 60-Year-Olds

4.4.4. Using Samples of Different Age Groups

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Pablo-Romero, M.D.P.; Pozo-Barajas, R.; Yñiguez, R. Global changes in residential energy consumption. Energ. Policy 2017, 101, 342–352. [Google Scholar] [CrossRef]

- Creutzig, F.; Baiocchi, G.; Bierkandt, R.; Pichler, P.; Seto, K.C. Global typology of urban energy use and potentials for an urbanization mitigation wedge. Proc. Natl. Acad. Sci. USA 2015, 112, 6283–6288. [Google Scholar] [CrossRef] [PubMed]

- Salari, M.; Kelly, I.; Doytch, N.; Javid, R.J. Economic growth and renewable and non-renewable energy consumption: Evidence from the U.S. states. Renew. Energ. 2021, 178, 50–65. [Google Scholar] [CrossRef]

- Dhakal, S. Urban energy use and carbon emissions from cities in China and policy implications. Energ. Policy 2009, 37, 4208–4219. [Google Scholar] [CrossRef]

- Lin, J.; Cao, B.; Cui, S.; Wang, W.; Bai, X. Evaluating the effectiveness of urban energy conservation and GHG mitigation measures: The case of Xiamen city, China. Energ. Policy 2010, 38, 5123–5132. [Google Scholar] [CrossRef]

- Liang, S.; Zhang, T. Managing urban energy system: A case of Suzhou in China. Energ. Policy 2011, 39, 2910–2918. [Google Scholar] [CrossRef]

- Madlener, R.; Sunak, Y. Impacts of urbanization on urban structures and energy demand: What can we learn for urban energy planning and urbanization management? Sustain. Cities Soc. 2011, 1, 45–53. [Google Scholar] [CrossRef]

- Zhao, X.; Li, N.; Ma, C. Residential energy consumption in urban China: A decomposition analysis. Energ. Policy 2012, 41, 644–653. [Google Scholar] [CrossRef]

- Cai, B.; Zhang, L. Urban CO2 emissions in China: Spatial boundary and performance comparison. Energ. Policy 2014, 66, 557–567. [Google Scholar] [CrossRef]

- Zhou, N.; Fridley, D.; Khanna, N.Z.; Ke, J.; McNeil, M.; Levine, M. China’s energy and emissions outlook to 2050: Perspectives from bottom-up energy end-use model. Energ. Policy 2013, 53, 51–62. [Google Scholar] [CrossRef]

- Mi, Z.; Meng, J.; Guan, D.; Shan, Y.; Song, M.; Wei, Y.; Liu, Z.; Hubacek, K. Chinese CO2 emission flows have reversed since the global financial crisis. Nat. Commun. 2017, 8, 1712. [Google Scholar] [CrossRef] [PubMed]

- Meng, J.; Mi, Z.; Yang, H.; Shan, Y.; Guan, D.; Liu, J. The consumption-based black carbon emissions of China’s megacities. J. Clean Prod. 2017, 161, 1275–1282. [Google Scholar] [CrossRef]

- Meng, J.; Liu, J.; Yi, K.; Yang, H.; Guan, D.; Liu, Z.; Zhang, J.; Ou, J.; Dorling, S.; Mi, Z.; et al. Origin and Radiative Forcing of Black Carbon Aerosol: Production and Consumption Perspectives. Environ. Sci. Technol. 2018, 52, 6380–6389. [Google Scholar] [CrossRef] [PubMed]

- Wu, X.D.; Guo, J.L.; Ji, X.; Chen, G.Q. Energy use in world economy from household-consumption-based perspective. Energ. Policy 2019, 127, 287–298. [Google Scholar] [CrossRef]

- Pachauri, S.; Jiang, L. The household energy transition in India and China. Energ. Policy 2008, 36, 4022–4035. [Google Scholar] [CrossRef]

- Donglan, Z.; Dequn, Z.; Peng, Z. Driving forces of residential CO2 emissions in urban and rural China: An index decomposition analysis. Energ. Policy 2010, 38, 3377–3383. [Google Scholar] [CrossRef]

- Feng, Z.; Zou, L.; Wei, Y. The impact of household consumption on energy use and CO2 emissions in China. Energy (Oxford) 2011, 36, 656–670. [Google Scholar] [CrossRef]

- Biying, Y.; Zhang, J.; Fujiwara, A. Analysis of the residential location choice and household energy consumption behavior by incorporating multiple self-selection effects. Energ. Policy 2012, 46, 319–334. [Google Scholar] [CrossRef]

- Golley, J.; Meng, X. Income inequality and carbon dioxide emissions: The case of Chinese urban households. Energ. Econ. 2012, 34, 1864–1872. [Google Scholar] [CrossRef]

- Yu, B.; Zhang, J.; Fujiwara, A. Representing in-home and out-of-home energy consumption behavior in Beijing. Energ. Policy 2011, 39, 4168–4177. [Google Scholar] [CrossRef]

- Yu, B.; Zhang, J.; Fujiwara, A. Evaluating the direct and indirect rebound effects in household energy consumption behavior: A case study of Beijing. Energ. Policy 2013, 57, 441–453. [Google Scholar] [CrossRef]

- Thøgersen, J. Housing-related lifestyle and energy saving: A multi-level approach. Energ. Policy 2017, 102, 73–87. [Google Scholar] [CrossRef]

- Hu, Z.; Wang, M.; Cheng, Z.; Yang, Z. Impact of marginal and intergenerational effects on carbon emissions from household energy consumption in China. J. Clean Prod. 2020, 273, 123022. [Google Scholar] [CrossRef]

- Liu, M.; Huang, X.; Chen, Z.; Zhang, L.; Qin, Y.; Liu, L.; Zhang, S.; Zhang, M.; Lv, X.; Zhang, Y. The transmission mechanism of household lifestyle to energy consumption from the input-output subsystem perspective: China as an example. Ecol. Indic. 2021, 122, 107234. [Google Scholar] [CrossRef]

- Zi, C.; Qian, M.; Baozhong, G. The consumption patterns and determining factors of rural household energy: A case study of Henan Province in China. Renew. Sustain. Energy Rev. 2021, 146, 111142. [Google Scholar] [CrossRef]

- Belaïd, F.; Garcia, T. Understanding the spectrum of residential energy-saving behaviours: French evidence using disaggregated data. Energ. Econ. 2016, 57, 204–214. [Google Scholar] [CrossRef]

- Belaïd, F. Understanding the spectrum of domestic energy consumption: Empirical evidence from France. Energ. Policy 2016, 92, 220–233. [Google Scholar] [CrossRef]

- Belaïd, F. Untangling the complexity of the direct and indirect determinants of the residential energy consumption in France: Quantitative analysis using a structural equation modeling approach. Energ. Policy 2017, 110, 246–256. [Google Scholar] [CrossRef]

- Feng, Q.; Yeung, W.J.; Wang, Z.; Zeng, Y. Age of Retirement and Human Capital in an Aging China, 2015–2050. Eur. J. Popul. 2019, 35, 29–62. [Google Scholar] [CrossRef]

- United Nations. World Population Prospects: The 2015 Revision; United Nations Publications: New York, NY, USA, 2015. [Google Scholar]

- Ota, T.; Kakinaka, M.; Kotani, K. Demographic effects on residential electricity and city gas consumption in the aging society of Japan. Energ. Policy 2018, 115, 503–513. [Google Scholar] [CrossRef] [Green Version]

- Hamza, N.; Gilroy, R. The challenge to UK energy policy: An ageing population perspective on energy saving measures and consumption. Energ. Policy 2011, 39, 782–789. [Google Scholar] [CrossRef]

- Liddle, B.; Lung, S. Age-structure, urbanization, and climate change in developed countries: Revisiting STIRPAT for disaggregated population and consumption-related environmental impacts. Popul. Environ. 2010, 31, 317–343. [Google Scholar] [CrossRef]

- Kanaroglou, P.; Mercado, R.; Maoh, H.; Páez, A.; Scott, D.M.; Newbold, B. Simulation Framework for Analysis of Elderly Mobility Policies. Transp. Res. Rec. J. Transp. Res. Board 2008, 2078, 62–71. [Google Scholar] [CrossRef]

- Okada, A. Is an increased elderly population related to decreased CO2 emissions from road transportation? Energ. Policy 2012, 45, 286–292. [Google Scholar] [CrossRef]

- Yamasaki, E.; Tominaga, N. Evolution of an aging society and effect on residential energy demand. Energ. Policy 1997, 25, 903–912. [Google Scholar] [CrossRef]

- Li, H.; Shi, X.; Wu, B. The retirement consumption puzzle revisited: Evidence from the mandatory retirement policy in China. J. Comp. Econ. 2016, 44, 623–637. [Google Scholar] [CrossRef]

- Dong, Y.; Yang, D.T. Mandatory retirement and the consumption puzzle: Disentangling price and quantity declines. Econ. Inq. 2017, 55, 1738–1758. [Google Scholar] [CrossRef]

- Bertogg, A.; Strauß, S.; Vandecasteele, L. Linked lives, linked retirement? Relative income differences within couples and gendered retirement decisions in Europe. Adv. Life Course Res. 2021, 47, 100380. [Google Scholar] [CrossRef]

- Kuhn, U.; Grabka, M.M.; Suter, C. Early retirement as a privilege for the rich? A comparative analysis of Germany and Switzerland. Adv. Life Course Res. 2021, 47, 100392. [Google Scholar] [CrossRef]

- Borozan, D. Unveiling the heterogeneous effect of energy taxes and income on residential energy consumption. Energ. Policy 2019, 129, 13–22. [Google Scholar] [CrossRef]

- Giles, J.; Wang, D.; Cai, W. The Labor Supply and Retirement Behavior of China’s Older Workers and Elderly in Comparative Perspective; World Bank Policy Research Working Paper No. 5853; World Bank: Washington, DC, USA, 2011. [Google Scholar]

- Iyer, L.; Meng, X.; Qian, N.; Zhao, X. Economic transition and private-sector labor: Evidence from urban China. J. Comp. Econ. 2019, 47, 579–600. [Google Scholar] [CrossRef]

- Hahn, J.; Todd, P. Wilbert Identification and Estimation of Treatment Effects with a Regression-Discontinuity Design Source. Econom. Soc. 2001, 1, 201–209. [Google Scholar] [CrossRef]

- Thistlewaite, D.L.; Campbell, D.T. Regression-Discontinuity Analysis: An Alternative to the Ex-Post Facto Experiment. J. Educ. Psychol. 1960, 2, 119–128. [Google Scholar] [CrossRef]

- Imbens, G.W.; Lemieux, T. Regression discontinuity designs: A guide to practice. J. Econom. 2008, 142, 615–635. [Google Scholar] [CrossRef]

- Dong, Y. Regression Discontinuity Applications with Rounding Errors in the Running Variable. J. Appl. Econ. 2015, 3, 422–446. [Google Scholar] [CrossRef]

- Kolesar, M.; Rothe, C. Inference in Regression Discontinuity Designs with a Discrete Running Variable. Am. Econ. Rev. 2018, 108, 2277–2304. [Google Scholar] [CrossRef]

- Wei, Y.; Liu, L.; Fan, Y.; Wu, G. The impact of lifestyle on energy use and CO2 emission: An empirical analysis of China’s residents. Energ. Policy 2007, 35, 247–257. [Google Scholar] [CrossRef]

- Aguiar, M.; Hurst, E. Deconstructing Lifecycle Expenditure. In Proceedings of the 2008 Annual Meeting of the Society for Economic Dynamics, Cambridge, MA, USA, 10–12 July 2008; p. 771. [Google Scholar]

- Zhang, H. The Hukou system’s constraints on migrant workers’ job mobility in Chinese cities. China Econ. Rev. 2010, 21, 51–64. [Google Scholar] [CrossRef]

- Modigliani, F.; Brumberg, R. Utility analysis and the consumption function: An interpretation of cross-section data. Fr. Modigliani 1954, 1, 388–436. [Google Scholar]

- Friedman, M. The permanent income hypothesis. In A Theory of the Consumption Function; Princeton University Press: Princeton, NJ, USA, 1957; pp. 20–37. [Google Scholar]

| Full Sample (obs = 35,948) | Retired Sample (obs = 18,827) | Non-Retired Sample (obs = 17,121) | |

|---|---|---|---|

| Variable | Mean (S.D.) | Mean (S.D.) | Mean (S.D.) |

| Household energy consumption structure (kg.ce) | |||

| household_energy | 1678 (2648) | 1544 (2077) | 1825 (3151) |

| direct | 542.4 (362.2) | 541.4 (351.3) | 543.5 (373.8) |

| indirect | 1135 (2579) | 1002 (2002) | 1282 (3085) |

| work_relate | 68.06 (115.7) | 52.70 (87.50) | 84.96 (138.3) |

| non_work_relate | 1610 (2615) | 1491 (2052) | 1740 (3114) |

| cigar | 16.68 (27.29) | 15.31 (24.01) | 18.20 (30.43) |

| alcoh | 8.990 (14.35) | 8.339 (12.03) | 9.707 (16.50) |

| outfood | 48.30 (87.45) | 37.96 (68.65) | 59.67 (103.1) |

| homefood | 242.0 (124.9) | 246.7 (123.8) | 236.8 (125.9) |

| non_durable | 443.3 (364.9) | 404.0 (314.3) | 486.6 (409.2) |

| durable | 1234 (2541) | 1140 (1980) | 1339 (3037) |

| household_energy | 1678 (2648) | 1544 (2077) | 1825 (3151) |

| Household characteristics | |||

| hukou | 0.995 (0.0698) | 0.995 (0.0705) | 0.995 (0.0690) |

| minzu | 0.0265 (0.161) | 0.0252 (0.157) | 0.0280 (0.165) |

| Education(years) | 10.72 (2.457) | 10.33 (2.598) | 11.15 (2.213) |

| family size(number) | 2.842 (0.992) | 2.819 (1.110) | 2.868 (0.843) |

| housing area(M2) | 78.11 (39.46) | 77.15 (38.42) | 79.17 (40.45) |

| First Stage Results | Second Stage Results | |||||

|---|---|---|---|---|---|---|

| Variables | Retired | Lnhouse_Energy | Lndirect | Lnindirect | Lnwork_Relate | Lnnon_Work_Relate |

| Age > 60 | 0.334 *** | |||||

| (0.025) | ||||||

| Retired | −0.025 *** | 0.077 *** | −0.070 *** | −0.554 *** | −0.003 | |

| (IV:Age > 60) | (0.009) | (0.011) | (0.011) | (0.014) | (0.009) | |

| Constant | 0.563 *** | 6.006 *** | 4.643 *** | 5.423 *** | 2.357 *** | 5.955 *** |

| (0.020) | (0.064) | (0.091) | (0.076) | (0.100) | (0.064) | |

| Observations | 35,948 | 35,948 | 35,948 | 35,948 | 35,948 | 35,948 |

| R-squared | 0.601 | 0.203 | 0.141 | 0.177 | 0.258 | 0.190 |

| F-value | 449.15 | |||||

| Second Stage Results | |||||||

|---|---|---|---|---|---|---|---|

| Variables | Ln(Income) | Lnnon_Durable | Lndurable | Lnhomefood | Lnoutfood | Lncigar | Lnalcoh |

| Retired | −0.326 *** | −0.121 *** | 0.038 *** | 0.092 *** | −0.553 *** | −0.385 *** | −0.186 *** |

| (IV:Age > 60) | (0.025) | (0.008) | (0.011) | (0.006) | (0.020) | (0.021) | (0.014) |

| Constant | 10.686 *** | 4.918 *** | 5.438 *** | 4.632 *** | 1.905 *** | 1.655 *** | 1.408 *** |

| (0.020) | (0.053) | (0.080) | (0.041) | (0.125) | (0.122) | (0.087) | |

| Observations | 35,948 | 35,948 | 35,948 | 35,948 | 35,948 | 35,948 | 35,948 |

| R-squared | 0.317 | 0.311 | 0.133 | 0.294 | 0.209 | 0.055 | 0.114 |

| Second Stage Results | |||||

|---|---|---|---|---|---|

| Variables | Minority | Residence_Status | Schooling_Year | Housing_Area | Family_Size |

| Retired | −0.005 | −0.001 | 0.036 | −0.011 | −1.187 |

| (IV:Age > 60) | (0.008) | (0.003) | (0.128) | (0.053) | (1.794) |

| Constant | 0.068 *** | 1.003 *** | 10.846 *** | 3.027 *** | 64.746 *** |

| (0.007) | (0.002) | (0.122) | (0.039) | (1.678) | |

| Observations | 35,948 | 35,948 | 35,948 | 35,948 | 35,948 |

| R-squared | 0.025 | 0.003 | 0.029 | 0.026 | 0.093 |

| Variables | Housing Area in the Bottom 50 Percentile | Housing Area in the Top 50 Percentile |

|---|---|---|

| lnhousehold_energy | −0.023 (0.012) ** | −0.037 (0.013) *** |

| lndirect | 0.097 (0.015) *** | 0.063 (0.016) *** |

| lnindirect | −0.081 (0.015) *** | −0.074 (0.016) *** |

| lnwork_relate | −0.611 (0.020) *** | −0.521 (0.021) *** |

| lnnon_work_relate | −0.000 (0.012) | −0.015 (0.013) |

| lnnon_durable | −0.148 (0.010) *** | −0.105 (0.011) *** |

| lndurable | 0.057 (0.014) *** | 0.011 (0.015) |

| lnhomefood | 0.073 (0.008) *** | 0.101 (0.009) *** |

| lnoutfood | −0.627 (0.027) *** | −0.502 (0.029) *** |

| lncigar | −0.399 (0.029) *** | −0.363 (0.030) *** |

| lnalcoh | −0.175 (0.020) *** | −0.204 (0.021) *** |

| First-Stage Results | Second-Stage Results | |||||

|---|---|---|---|---|---|---|

| Variables | Retired | Lnhouse_Energy | Lndirect | Lnindirect | Lnwork_Relate | Lnnon_Work_Relate |

| Age > 60 | 0.240 *** | |||||

| (0.018) | ||||||

| Retired | −0.021 ** | 0.093 *** | −0.067 *** | −0.622 *** | 0.005 | |

| (IV:Age > 60) | (0.009) | (0.012) | (0.012) | (0.015) | (0.009) | |

| Constant | 0.685 *** | 6.023 *** | 4.632 *** | 5.450 *** | 2.569 *** | 5.967 *** |

| (0.015) | (0.057) | (0.079) | (0.068) | (0.089) | (0.058) | |

| Observations | 48,723 | 48,723 | 48,723 | 48,723 | 48,723 | 48,723 |

| R-squared | 0.426 | 0.202 | 0.125 | 0.183 | 0.243 | 0.189 |

| F-value | 415.09 | |||||

| First-Stage Results | Second-Stage Results | |||||

|---|---|---|---|---|---|---|

| Variables | Retired | Lnhouse_Energy | Lndirect | Lnindirect | Lnwork_Relate | Lnnon_Work_Relate |

| Age > 60 | 0.296 *** | |||||

| (0.013) | ||||||

| Retired | −0.026 *** | 0.078 *** | −0.071 *** | −0.553 *** | −0.004 | |

| (IV:Age > 60) | (0.009) | (0.011) | (0.011) | (0.014) | (0.009) | |

| Constant | 0.660 *** | 6.019 *** | 4.677 *** | 5.437 *** | 2.379 *** | 5.968 *** |

| (0.029) | (0.064) | (0.086) | (0.077) | (0.100) | (0.065) | |

| Observations | 34,377 | 34,377 | 34,377 | 34,377 | 34,377 | 34,377 |

| R-squared | 0.202 | 0.202 | 0.140 | 0.177 | 0.261 | 0.189 |

| F-value | 19.08 | |||||

| Variables | [55, 64] | [56, 63] | [57, 62] | [58, 62] |

|---|---|---|---|---|

| Retired | −0.069 *** | −0.062 *** | −0.084 *** | −0.090 ** |

| (IV:Age > 60) | (0.019) | (0.023) | (0.029) | (0.042) |

| Constant | 6.094 *** | 6.022 *** | 5.997 *** | 5.919 *** |

| (0.094) | (0.107) | (0.134) | (0.167) | |

| Observations | 15,919 | 12,584 | 9315 | 6172 |

| R-squared | 0.206 | 0.203 | 0.204 | 0.204 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lv, X.; Lin, K.; Chen, L.; Zhang, Y. Does Retirement Affect Household Energy Consumption Structure? Evidence from a Regression Discontinuity Design. Sustainability 2022, 14, 12347. https://doi.org/10.3390/su141912347

Lv X, Lin K, Chen L, Zhang Y. Does Retirement Affect Household Energy Consumption Structure? Evidence from a Regression Discontinuity Design. Sustainability. 2022; 14(19):12347. https://doi.org/10.3390/su141912347

Chicago/Turabian StyleLv, Xiaofeng, Kun Lin, Lingshan Chen, and Yongzhong Zhang. 2022. "Does Retirement Affect Household Energy Consumption Structure? Evidence from a Regression Discontinuity Design" Sustainability 14, no. 19: 12347. https://doi.org/10.3390/su141912347