Analysis on the Effect of the Targeted Poverty Alleviation Policy on Narrowing the Urban-Rural Income Gap: An Empirical Test Based on 124 Counties in Yunnan Province

Abstract

:1. Introduction

2. Materials and Methods

2.1. Overview of Poverty in China

2.2. Research Methods

2.2.1. Difference-In-Difference (DID) Model

2.2.2. Selection of Indicators

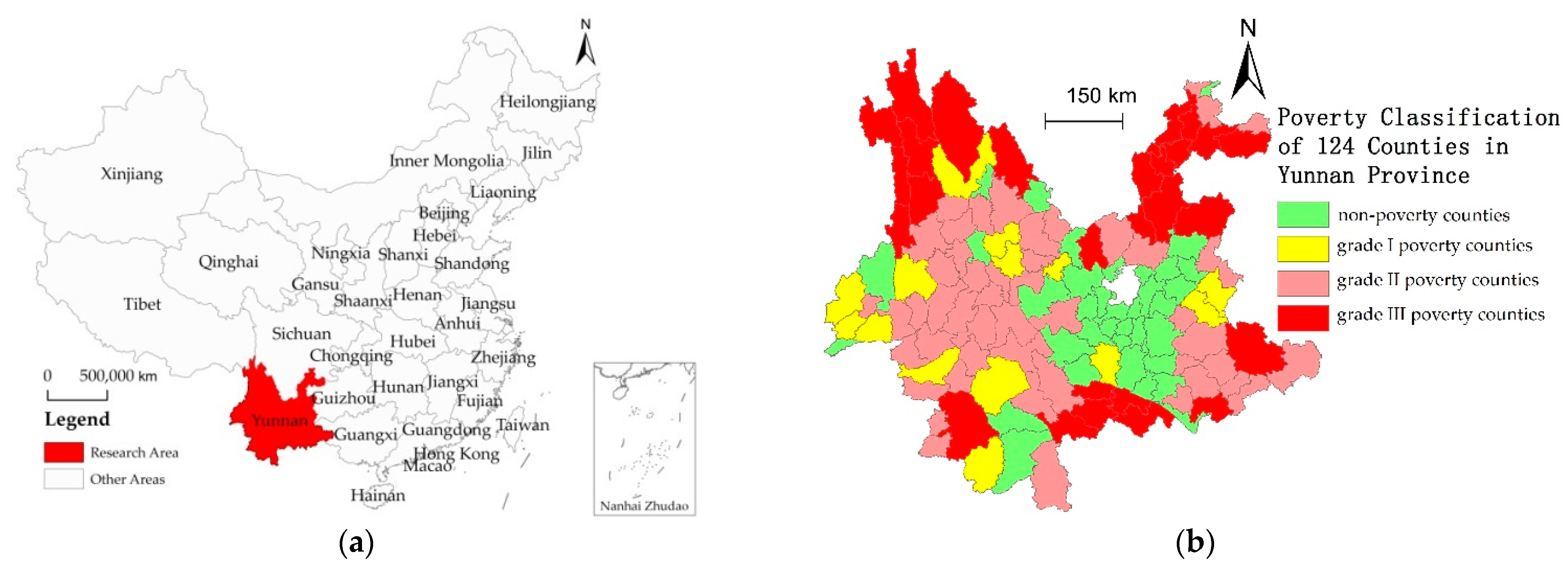

2.2.3. Poverty Classification Method

2.2.4. Mediation Effect Analysis Method

2.2.5. Research Hypothesis

2.2.6. Summary of Research Methods

3. Results

3.1. DID Model Estimation and Test Results

3.1.1. DID Model Estimation Results

3.1.2. Parallel Trend Test Results of DID Model

3.1.3. DID Estimation Results after Excluding COVID-19 Outbreak Years

3.1.4. Placebo Test of DID Model

3.2. Full-Sample Spatial DID Model Estimation and Test Results

3.3. Impact Mechanism Analysis

4. Conclusions and Discussion

- (1)

- In terms of innovation, we further developed the theoretical relationship between the elimination of absolute and relative poverty. Through analysis, we found that the targeted poverty-alleviation policy has substantially reduced the urban–rural income gap while eliminating absolute poverty, which means that the targeted poverty-alleviation policy has further promoted the reduction in and the elimination of relative poverty, which not only provides a useful reference for Yunnan province and even the whole of China to formulate practical and feasible specific strategies for rural revitalization in the future, but also enriches and develops the organic relationship between absolute and relative poverty and provides a reference for China to achieve common prosperity in the future.

- (2)

- Regarding the analysis method, given the shortcomings in the literature, such as not using appropriate policy evaluation tools, not detailing the annual dynamic changes, and the results not passing the parallel trend test, we adopted a method of poverty classification, and we set different treatment and control groups to pass the parallel trend test. As such, we more-accurately evaluated the effects of targeted poverty-alleviation on narrowing the urban–rural income gap. In addition, we used the full-sample spatial DID model to further explore the effects of the targeted poverty-alleviation policy. Compared with the existing studies, these research methods are innovative and can provide a reference and basis for other related research.

- (3)

- Regarding the reality in China, we used innovative technical methods, such as poverty classification, to deeply explore the specific effect of a targeted poverty-alleviation policy on narrowing the urban–rural income gap, which produced more accurate, objective, and credible results. In addition, we used the intermediary effect analysis method to deeply explore the mechanism through which the targeted poverty-alleviation policy impacted the urban–rural income gap. This will not only help Yunnan province and even the whole country to consolidate and expand upon the poverty-alleviation achievements and effectively connect the implementation of rural revitalization strategies in the future, but also help to better formulate countermeasures to narrow the urban–rural income gap and gradually achieve the goal of common prosperity.

- (4)

- Although we focused on Yunnan, China, our findings may be applicable to other countries. Poverty is a major global challenge, and China has embarked on a successful path to eliminating absolute poverty. Although the problem of absolute poverty has been solved, relative-poverty remains a problem, and understanding the effect that China’s targeted poverty-alleviation policy has had on narrowing the urban–rural income gap is also an important topic worthy of worldwide attention. The results of this study can also be a useful reference for other countries and regions when designing countermeasures for the eradication of absolute poverty and the reduction in relative poverty. First, we found that the implementation of the targeted poverty-alleviation policy in Yunnan Province has substantially narrowed the urban–rural income gap, which can provide a reference for other countries to formulate policies to eliminate poverty and narrow the gap between the rich and poor. Second, we discussed the mechanism of the effects of the targeted poverty-alleviation policy in depth. Other developing countries can learn from China’s successful practice of targeted poverty-alleviation, fundamentally solving the problem of inaccurate poverty identification and increasing poverty-alleviation efforts while accurately identifying poor households. Considering the impact of regional differences, other countries can direct their funds toward impoverished regions, set up special poverty-alleviation funds, allocate more human and material resources to eliminate poverty, and narrow the urban–rural income gap. In addition, the results of this study provide a reference for other countries in formulating local poverty-reduction policies and measures according to local conditions.

5. Countermeasures and Suggestions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Molero-Simarro, R. Inequality in China revisited. The effect of functional distribution of income on urban top incomes, the urban–rural gap and the Gini index, 1978–2015. China Econ. Rev. 2017, 42, 101–117. [Google Scholar] [CrossRef]

- Zhao, H.; Zheng, X.; Yang, L. Does Digital Inclusive Finance Narrow the Urban–rural Income Gap through Primary Distribution and Redistribution? Sustainability 2022, 14, 2120. [Google Scholar] [CrossRef]

- Ma, X.; Wang, F.; Chen, J.; Zhang, Y. The income gap between urban and rural residents in China: Since 1978. Comput. Econ. 2018, 52, 1153–1174. [Google Scholar] [CrossRef]

- Miu, X.; Wang, T.; Gao, Y. The effect of fiscal transfer on the gap between urban–rural public services based on a grouping comparison of different economic catching-up provinces. Econ. Res. J. 2017, 52, 52–66. [Google Scholar]

- Xi, J. To Win the Great Victory of Socialism with Chinese Characteristics in the New Era by Building a Well-Off Society in an All-Round Way: A Report at the Nineteenth National Congress of the Communist Party of China; People’s Publishing House: Beijing, China, 2017. [Google Scholar]

- Xinhua News Agency. Premier Li Keqiang Attended the Press Conference and Answered Questions from Chinese and Foreign Journalists. Available online: http://www.gov.cn/premier/2020-05/29/content_5515798.htm#allContent (accessed on 29 May 2020).

- Sicular, T.; Yue, X.; Gustafsson, B.; Li, S. The Urban–rural Income Gap and Inequality in China. Rev. Income Wealth 2007, 53, 93–126. [Google Scholar] [CrossRef] [Green Version]

- National Bureau of Statistics of China. China Statistical Yearbook-2021; China Statistics Press: Beijing, China, 2021. [Google Scholar]

- Zhang, Y.; Chai, D. Relationship between urban–rural income gap and urbanization. Popul. Res. 2018, 42, 61–73. [Google Scholar]

- Zhang, Y.; Wan, H. Determinants and Forecast on the Urban–rural Household Income Gap in China. J. Quant. Tech. Econ. 2019, 36, 59–75. [Google Scholar]

- Colin, C. Conditions of Economic Progress; Macmillan: London, UK, 1940. [Google Scholar]

- David, R. The Principles of Political Economy and Taxation; Dover Publications: New York, NY, USA, 2004. [Google Scholar]

- Kuznets, S. Economic growth and income inequality. Am. Econ. Rev. 1955, 45, 42–48. [Google Scholar]

- Ahiuwalia, M. Inequality, poverty and development. J. Dev. Econ. 1976, 3, 307–342. [Google Scholar] [CrossRef]

- Anand, S.; Kanbur, S.M.R. Inequality and development: A critique. J. Dev. Econ. 1993, 41, 19–43. [Google Scholar] [CrossRef]

- T Tunali, C.B.; Yilanci, V. Are per papita incomes of MENA countries converging or diverging? Stat. Mech. Appl. 2010, 21, 4855–4862. [Google Scholar] [CrossRef]

- Deininger, K.; Squire, L. New ways of looking at old issues: Inequality and growth. J. Dev. Econ. 1998, 57, 259–287. [Google Scholar] [CrossRef]

- Piketty, T. The dynamics of the wealth distribution and the interest rate with credit rationing. Rev. Econ. Stud. 1997, 64, 173–189. [Google Scholar] [CrossRef] [Green Version]

- Li, S.; Luo, C. Re-estimating the income gap between urban and rural households in China. J. Peking Univ. Philos. Soc. Sci. 2007, 44, 111–120. [Google Scholar]

- Wan, H.; Li, S. The effects of household registration system discrimination on urban–rural income inequality in China. Econ. Res. J. 2013, 48, 43–55. [Google Scholar]

- Forbes, K.J. A reassessment of the relationship between inequality and growth. Am. Econ. Rev. 2000, 90, 869–887. [Google Scholar] [CrossRef]

- Castello, A.; Domenech, R. Human capital inequality and economic growth: Some new evidence. Econ. J. 2002, 112, 187–200. [Google Scholar] [CrossRef]

- Chen, B.; Lin, Y. Development strategy, urbanization and the urban–rural income gap in China. Soc. Sci. China 2013, 81–102, 206. [Google Scholar]

- Knowles, S. Inequality and economic growth: The empirical relationship reconsidered in the light of comparable data. J. Dev. Stud. 2005, 41, 135–159. [Google Scholar] [CrossRef] [Green Version]

- Ding, Z.; Zhang, G.; Wang, F. Spatial-temporal differentiation of urban–rural income in Central Plains Region at different scales. Geogr. Res. 2015, 34, 131–148. [Google Scholar]

- Sun, X.; Xu, Y.; Liu, Y. Residents’ income disparity and spatial difference in China. Econ. Geogr. 2015, 35, 18–25+42. [Google Scholar]

- Fang, D.; Guo, Y. Rural Land Circulation, Capital Organic Composition and Urban–rural Income Gap—Based on the Experience and Empirical Evidence of Marxist Political Economy. Economist 2020, 11, 107–115. [Google Scholar]

- Yang, Z.; Yang, R.; Liu, F. Spatio-temporal evolution and influencing factors of urban–rural income gap in Yunnan province based on poverty classification. Geogr. Res. 2021, 40, 2252–2271. [Google Scholar]

- Guo, J. Analysis on the Effect of Agricultural Industrialization on Increasing Farmers’ Income: A Case Study of Shanxi Province. Chin. Rural. Econ. 2008, 24, 8–17. [Google Scholar]

- Liu, Z.; Wang, J.; Wang, L. An analysis of farmers’ income increase effect through Targeted Poverty Alleviation policies. J. Lanzhou Univ. (Soc. Sci.) 2018, 46, 63–72. [Google Scholar]

- Zhao, Z.; Hou, Y.; Wen, Y. Research on the impact of precision poverty alleviation projects on the income of rural residents: Based on the Propensity Score Match method. Stat. Inf. Forum 2018, 33, 104–110. [Google Scholar]

- Cai, J.; Yu, Y.; Qiu, J. Evaluation on effect of national accurate poverty alleviation policy on rural poor households: Based on Difference-In-Difference Model. Hum. Geogr. 2019, 34, 90–96. [Google Scholar]

- Dai, X.; Wang, L.; Ren, Y. The Effects of China’s Targeted Poverty Alleviation Policy on the Health and Health Equity of Rural Poor Residents: Evidence from Shaanxi Province. Healthcare 2020, 8, 256. [Google Scholar] [CrossRef]

- Li, F.; Zhang, Y.; Zheng, X. Impact of Targeted Poverty Alleviation: Micro Tracking Data of Poor Populations. Econ. Res. J. 2020, 55, 171–187. [Google Scholar]

- Huang, W.; Zhu, W. Multidimensional Evaluation of the Consolidation and Expansion of Targeted Poverty Alleviation: An Empirical Analysis of Poverty Alleviation Practice in B city of G Province in China. J. Manag. World 2021, 37, 111–128. [Google Scholar]

- Zhang, S.; Liu, J. Is the Targeted Poverty-Relief Policy Narrowing the Income Gap between the Urban and RuralAreas?—An Empirical Study Based on Spatial Panel Data. J. Xinjiang Univ. 2018, 46, 1–9. [Google Scholar]

- Liu, M.; Li, J.; Li, Q. Impact of targeted poverty alleviation on the urban–rural household income gap—A case study of shanxi province. Chin. J. Agric. Resour. Reg. Plan. 2020, 41, 228–237. [Google Scholar]

- Zhang, B.; Cao, X. Impact of Targeted Poverty Alleviation policy on the urban–rural income gap in national poverty-stricken counties. Resour. Sci. 2021, 43, 1549–1561. [Google Scholar] [CrossRef]

- Yang, Z.; Liu, Z.; Lama, X.; Xiong, R.; Zhao, X. The Poverty Alleviation Model of Kunming Municipal Rural Areas in the Context of World Poverty Reduction; Social Sciences Academic Press: Beijing, China, 2020. [Google Scholar]

- Wang, S. Targeted Poverty Alleviation: Changing “flood irrigation” to “drip irrigation”. Party Build. Sichuan (Rural. Ed.) 2014, 4, 16–17. [Google Scholar]

- Xi, J. Speech at the Central Conference on Poverty Alleviation and Development. In Research Institute of CPC Central Committee History and documents. A Selection of Important Documents since the 18th National Congress of CPC (II); Central Literature Publishing House: Beijing, China, 2018. [Google Scholar]

- Xi, J. Speech at a National Conference to Review the Fight against Poverty and Commend Individuals and Groups Involved. People’s Daily, 26 February 2021. [Google Scholar]

- Li, X.; Li, X. Effect of Targeted Poverty Alleviation policies in contiguous poverty-stricken areas. J. Arid. Land Resour. Environ. 2020, 34, 34–42. [Google Scholar]

- Outline of the Fourteenth Five Year Plan for National Economic and Social Development and the Long-Term Goals for 2035 of the People’s Republic of China. People’s Daily, 13 March 2021. Available online: https://en.ndrc.gov.cn/policies/202203/P020220315511326748336.pdf(accessed on 14 September 2022).

- Sun, X. Does agricultural mechanization narrow the urban–rural income gap? J. Cap. Univ. Econ. Bus. 2021, 23, 81–93. [Google Scholar]

- Yao, Y. Difference-In-Difference and Difference-In-Difference-In-Difference models: A brief introduction. J. Transl. Foreign Lit. Econ. 2019, 26, 24–28. [Google Scholar]

- Ye, F.; Wang, Y. Introduction and application of Difference-In-Difference model. Chin. J. Health Stat. 2013, 30, 131–134. [Google Scholar]

- Ren, A.; Yang, R. Analysis on the Spatial and Temporal Characteristics of the Income Gap between Urban and Rural Areas in China. Success. Mark. 2021, 23, 146–148. [Google Scholar]

- Campello, M.; Larrain, M. Enlarging the contracting space: Collateral menus, access to credit, and economic activity. Rev. Financ. Stud. 2016, 29, 349–383. [Google Scholar] [CrossRef]

- Vig, V. Access to collateral and corporate debt structure: Evidence from a natural experiment. J. Financ. 2013, 68, 881–928. [Google Scholar] [CrossRef]

- Liu, H.; Cao, T. The Economic Impacts of Rollover Restrictions on Enterprises. Econ. Res. J. 2018, 53, 108–121. [Google Scholar]

- Qian, X.; Fang, S. Does Reform on Security Interests System Affect Corporate Debt Financing? Evidence from a Natural Experiment in China. Econ. Res. J. 2017, 52, 146–160. [Google Scholar]

- State Council Leading Group Office of Poverty Alleviation and Development. Guide Book for Cadres on Framework of Poverty Alleviation and Development in Rural China: 2011–2020; China Financial and Economic Publishing House: Beijing, China, 2012. [Google Scholar]

- State Council Leading Group Office of Poverty Alleviation and Development. Note on the Publication of a National List of Districts Divided into Contiguous Areas of Extreme Poverty. Available online: http://www.cpad.gov.cn/art/2012/6/14/art_343_41.html (accessed on 14 June 2012).

- Baron, R.M.; Kenny, D.A. The Moderator-Mediator Variable Distinction in Social Psychological Research: Conceptual, Strategic, and Statistical Considerations. J. Personal. Soc. Psychol. 1986, 51, 1173–1182. [Google Scholar] [CrossRef]

- Aroian, L.A. The probability function of the product of two normally distributed variables. Ann. Math. Stat. 1947, 18, 265–271. [Google Scholar] [CrossRef]

- Goodman, L.A. On the Exact Variance of Products. J. Am. Stat. Assoc. 1960, 55, 708–713. [Google Scholar] [CrossRef]

- Sobel, M.E. Asymptotic Confidence Intervals for Indirect Effects in Structural Equation Models. Sociol. Methodol. 1982, 13, 290–312. [Google Scholar] [CrossRef]

- Chen, Y.; Wang, B. Application of free software R in regression outlier detection. Stat. Decis. 2005, 21, 24–25. [Google Scholar]

- Zhao, J. The Fatal Attacks to the Unit Root Tests from Outlier. J. Bus. Econ. 2009, 29, 76–83. [Google Scholar]

- Zhao, J. Typical cases of the impact of outliers on measurement modeling. Stat. Res. 2010, 27, 92–98. [Google Scholar]

- Ren, S.; Zheng, J.; Liu, D.; Chen, X. Does Emissions Trading System Improve Firm’s Total Factor Productivity—Evidence from Chinese Listed Companies. China Ind. Econ. 2019, 5, 5–23. [Google Scholar]

- Liu, R.; Mao, Y.; Kang, Y. Deregulation, Market Vitality and Tourism Economy Development: Evidence from Chinese Cultural System Reform. Econ. Res. J. 2020, 55, 115–131. [Google Scholar]

- Chen, Q. Advanced Econometrics and Stata Applications, 2nd ed.; Higher Education Press: Beijing, China, 2014. [Google Scholar]

| Dimension | Variable | Computing Method | Name | Unit |

|---|---|---|---|---|

| Industrial development | Development level of primary industry | Output value of primary industry/conversion index/total population | X1 | CNY/person |

| Development level of secondary industry | Output value of secondary industry/conversion index/total population | X2 | CNY/person | |

| Development level of tertiary industry | Output value of tertiary industry/conversion index/total population | X3 | CNY/person | |

| Economic level | Investment in fixed assets | Fixed asset investment/total population/conversion index | X4 | CNY/person |

| Land economic density | Current year GDP/total land area/conversion index | X5 | CNY 10,000/km2 | |

| Economic catch-up pressure | Highest per capita GDP of neighboring counties/local per capita GDP × highest per capita GDP of counties in the province/local per capita GDP | X6 | None | |

| Financial expenditure level | Public budget expenditure/conversion index/total population | X7 | CNY/person | |

| Population structure | Population density | Total population/land area of the county (city, district) | X8 | person/km2 |

| Poverty Classification | Meaning or Division Basis | Number of Counties | Degree of Poverty |

|---|---|---|---|

| Non-poverty counties | All non-poverty counties in Yunnan province | 36 | Shallow |

| Grade-I poverty counties | A contiguous poverty-stricken area or county, but not a national key county for poverty-alleviation and development or a deeply poverty-stricken county | 14 | Medium |

| Grade-II poverty counties | A national key county for poverty-alleviation and development, but not a deeply poverty-stricken county | 47 | Deep |

| Grade-III poverty counties | All deeply poverty-stricken counties determined by the Yunnan Poverty-Alleviation and Development Leading Group | 27 | Very deep |

| Variable | Non-Poverty Counties as Control Group; Grade-I Poverty Counties as Treatment Group | Grade-I Poverty Counties as Control Group; Grade-II Poverty Counties Treatment Group | Grade-II Poverty Counties as Control Group; Grade-III Poverty Counties as Treatment Group | Grade I-Poverty Counties as Control Group; Grade III-Poverty Counties as Treatment Group | ||||

|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| time × treat | −0.0939 *** (0.0242) | −0.0756 *** (0.0246) | −0.0218 (0.0244) | −0.0141 (0.0244) | −0.0488 * (0.0263) | −0.0324 (0.0227) | −0.0706 ** (0.0319) | −0.0458 (0.0298) |

| Control Variable | No | Yes | No | Yes | No | Yes | No | Yes |

| Time Effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Individual Effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Number | 500 | 500 | 610 | 610 | 740 | 740 | 410 | 410 |

| R2 | 0.9825 | 0.9841 | 0.9861 | 0.9873 | 0.9860 | 0.9875 | 0.9871 | 0.9886 |

| Variable | Non-Poverty Counties as Control Group; Grade-I Poverty Counties as Treatment Group | Grade-I Poverty Counties as Control Group; Grade-II Poverty Counties as Treatment Group | Grade-II Poverty Counties as Control Group; Grade-III Poverty Counties as Treatment Group | Grade I-Poverty Counties as Control Group; Grade-III Poverty Counties as Treatment Group | ||||

|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| time × treat | −0.0905 *** (0.0242) | −0.0740 *** (0.0247) | −0.0184 (0.0243) | −0.0109 (0.0245) | −0.0421 * (0.0250) | −0.0231 (0.0218) | −0.0604 * (0.0310) | −0.0420 (0.0288) |

| Control Variable | No | Yes | No | Yes | No | Yes | No | Yes |

| Time Effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Individual Effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Number | 450 | 450 | 549 | 549 | 666 | 666 | 369 | 369 |

| R2 | 0.9817 | 0.9839 | 0.9860 | 0.9871 | 0.9866 | 0.9880 | 0.9878 | 0.9893 |

| Variable | Traditional DID Model | Cochran–Oster Iteration Method | Spatial Autocorrelation Model | Spatial Autoregressive Model | Spatial Error Model | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | |

| time × treat | −0.0949 *** (0.0252) | −0.0687 *** (0.0263) | −0.0701 *** (0.0186) | −0.0585 *** (0.0212) | −0.0473 ** (0.0197) | −0.0457 ** (0.0224) | −0.0697 *** (0.0204) | −0.0460 ** (0.0203) | −0.0694 *** (0.0225) | −0.0484 ** (0.0229) |

| Iteration Parameter ρ | 0.5421 | 0.5036 | ||||||||

| Spatial Parameter ρ | −0.5773 *** | −0.1103 | 0.4553 *** | 0.4419 *** | ||||||

| Spatial Parameter λ | 0.7824 *** | 0.5401 *** | 0.4489 *** | 0.4504 *** | ||||||

| Control Variable | No | Yes | No | Yes | No | Yes | No | Yes | No | Yes |

| Time Effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Individual Effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Number | 1240 | 1240 | 1240 | 1240 | 1240 | 1240 | 1240 | 1240 | 1240 | 1240 |

| R2/Within R2 | 0.9856 | 0.9869 | 0.9909 | 0.9911 | 0.9047 | 0.9145 | 0.9100 | 0.9179 | 0.9079 | 0.9154 |

| Variable | Traditional DID Model | Cochran–Oster Iteration Method | Spatial Autocorrelation Model | Spatial Autoregressive Model | Spatial Error Model | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | |

| time × treat | −0.0851 *** (0.0240) | −0.0645 *** (0.0244) | −0.0673 *** (0.0189) | −0.0552 *** (0.0211) | −0.0577 *** (0.0207) | −0.0480 ** (0.0224) | −0.0641 *** (0.0197) | −0.0452 ** (0.0194) | −0.0639 *** (0.0217) | −0.0473 ** (0.0224) |

| Iteration Parameter ρ | 0.4815 | 0.4465 | ||||||||

| Spatial Parameter ρ | −0.1942 *** | 0.0344 | 0.4257 *** | 0.4066 *** | ||||||

| Spatial Parameter λ | 0.5647 *** | 0.3747 *** | 0.4179 *** | 0.4078 *** | ||||||

| Control Variable | No | Yes | No | Yes | No | Yes | No | Yes | No | Yes |

| Time Effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Individual Effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Number | 1116 | 1116 | 1116 | 1116 | 1116 | 1116 | 1116 | 1116 | 1116 | 1116 |

| R2/Within R2 | 0.9862 | 0.9874 | 0.9910 | 0.9912 | 0.8942 | 0.9041 | 0.8974 | 0.9067 | 0.8954 | 0.9038 |

| Variable | Hypothesis 1 | Hypothesis 2 | Hypothesis 3 | ||||||

|---|---|---|---|---|---|---|---|---|---|

| ln income (1) | gap (2) | gap (3) | ln light (4) | gap (5) | gap (6) | finance (7) | ln income (8) | ln income (9) | |

| time × treat | 0.0372 * | −0.0702 ** | −0.0627 | −0.0788 *** | 650.55 *** | 0.0222 | |||

| ln income | −0.2930 *** | −0.2584 ** | |||||||

| ln light | 0.0206 * | 0.0178 | |||||||

| finance | 0.00002 *** | 0.00002 *** | |||||||

| Control Variable | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Time Effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Individual Effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Number | 1240 | 1240 | 1240 | 1240 | 1240 | 1240 | 1240 | 1240 | 1240 |

| R2 | 0.9573 | 0.9865 | 0.9872 | 0.9569 | 0.9858 | 0.9866 | 0.9133 | 0.9600 | 0.9602 |

| Variable | Hypothesis 4 | Hypothesis 5 | Hypothesis 6 | ||||||

| work (10) | ln income (11) | ln income (12) | ln industry (13) | ln income (14) | ln income (15) | ln income (16) | gap (17) | gap (18) | |

| time × treat | 2.9797 *** | 0.0399 * | 0.0404 * | 0.0366 | |||||

| work | −0.0004 | −0.0002 | |||||||

| ln industry | 0.0239 | 0.0158 | |||||||

| finance | 0.00003 *** | −0.00001 | |||||||

| ln income | −0.2930 *** | −0.2563 *** | |||||||

| Control Variable | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Time Effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Individual Effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Number | 1106 | 1106 | 1106 | 1240 | 1240 | 1240 | 1240 | 1240 | 1240 |

| R2 | 0.5496 | 0.9606 | 0.9615 | 0.9885 | 0.9566 | 0.9573 | 0.9600 | 0.9865 | 0.9867 |

| Inspection Items and Intermediary Effect | Hypothesis 1 (ln income is Intermediary Variable) | Hypothesis 3 (finance is Intermediary Variable) | Hypothesis 6 (ln income is Intermediary variable) |

|---|---|---|---|

| Indirect effect (according to Sobel test) | −0.0096 (−3.871) *** | 0.0150 (5.517) *** | −6.3 × 10−6 (5.692) *** |

| Indirect effect (according to Aroian test) | −0.0096 (−3.846) *** | 0.0150 (5.496) *** | −6.3 × 10−6 (5.672) *** |

| Indirect effect (according to Goodman test) | −0.0096 (−3.897) *** | 0.0150 (5.539) *** | −6.3 × 10−6 (5.712) *** |

| Direct effect (according to Sobel test) | −0.0702 (−7.349) *** | 0.0222 (2.741) *** | −1.1 × 10−5 (3.562) *** |

| Total effect (according to Sobel test) | −0.0799 (−8.233) *** | 0.0372 (4.534) *** | −1.8 × 10−5 (5.651) *** |

| Proportion of intermediary effect (%) | 12.05 | 40.36 | 35.69 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yang, R.; Zhong, C.; Yang, Z.; Wu, Q. Analysis on the Effect of the Targeted Poverty Alleviation Policy on Narrowing the Urban-Rural Income Gap: An Empirical Test Based on 124 Counties in Yunnan Province. Sustainability 2022, 14, 12560. https://doi.org/10.3390/su141912560

Yang R, Zhong C, Yang Z, Wu Q. Analysis on the Effect of the Targeted Poverty Alleviation Policy on Narrowing the Urban-Rural Income Gap: An Empirical Test Based on 124 Counties in Yunnan Province. Sustainability. 2022; 14(19):12560. https://doi.org/10.3390/su141912560

Chicago/Turabian StyleYang, Renyi, Changbiao Zhong, Zisheng Yang, and Qiuju Wu. 2022. "Analysis on the Effect of the Targeted Poverty Alleviation Policy on Narrowing the Urban-Rural Income Gap: An Empirical Test Based on 124 Counties in Yunnan Province" Sustainability 14, no. 19: 12560. https://doi.org/10.3390/su141912560

APA StyleYang, R., Zhong, C., Yang, Z., & Wu, Q. (2022). Analysis on the Effect of the Targeted Poverty Alleviation Policy on Narrowing the Urban-Rural Income Gap: An Empirical Test Based on 124 Counties in Yunnan Province. Sustainability, 14(19), 12560. https://doi.org/10.3390/su141912560