Coordination of Perishable Product Supply Chains with a Joint Contract under Yield and Demand Uncertainty

Abstract

:1. Introduction

2. Related Literature

2.1. Supply Chain Demand and Yield Uncertainty

2.2. The Supply Chain Coordination

3. Model Description and Assumptions

3.1. Parameters

- p: The retail price of the product, a constant determined by the market;

- c: The raw materials cost for the unit product;

- g: The shortage cost for the unit product;

- v: The residual value of the unit product at the end of the selling period;

- s: The unit price in the secondary market;

- X: The stochastic demand when the retail price is p;

- f(x): The probability density function of the stochastic demand;

- F(x): The distribution function of the stochastic demand;

- : The mean value of the stochastic demand, ;

- : The standard deviation of the stochastic demand;

- Y: The rate of production, which is a random variable;

- g(y): The probability density distribution function of the production rate;

- G(y): The distribution function of the production rate;

- : The mean value of the production rate, ;

- : The standard deviation of the production rate.

3.2. Decision Variables

- Q: The quantity of the product ordered by the retailer;

- L: The quantity of the raw materials devoted by the manufacturer;

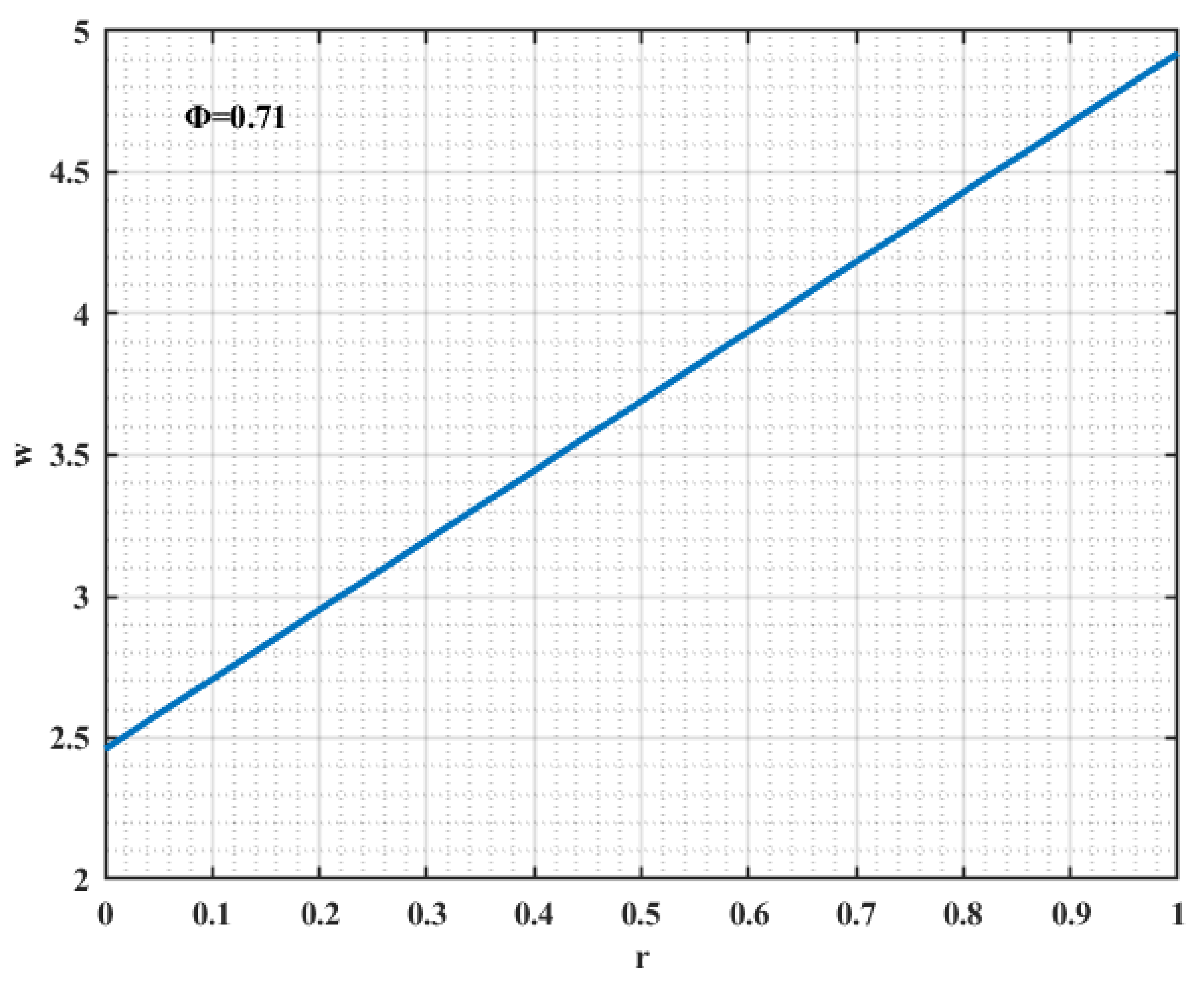

- w: The wholesale price of the product by the manufacturer.

3.3. Assumptions

- The retailer’s demand is stochastic, which obeys normal distribution. The manufacturer’s yield is random, and the production rate obeys uniform distribution , , [20].

- p > w > c/y > 0, the wholesale price set by the manufacturer is greater than the manufacturer’s production cost, which ensures that every member of the supply chain can obtain profits.

- The secondary market can be only accessible to the manufacturer, and the retailer can only purchase from the manufacturer. For convenient to discuss, the secondary market can meet all the manufacturers’ needs.

- s > c/y, the price of production replenished from the secondary market is greater than that produced by the manufacturer, which prevents the manufacturer from never producing; w > s, the wholesale price is always greater than the price of restocking from the secondary market in order to ensure that the manufacturer is willing to replenish from the secondary market.

4. Optimal Decisions in the Centralized Model

5. Optimal Decisions in the Decentralized Model

5.1. The Decision of Retailer

5.2. The Decision of Manufacturer

5.3. Comparison of Optimal Decisions in the Decentralized and Centralized Model

6. Contract Coordination in the Supply Chain

6.1. Joint Contract Based on Credit Payment

6.2. Influence of the Secondary Market on Coordination

7. Numerical Analysis

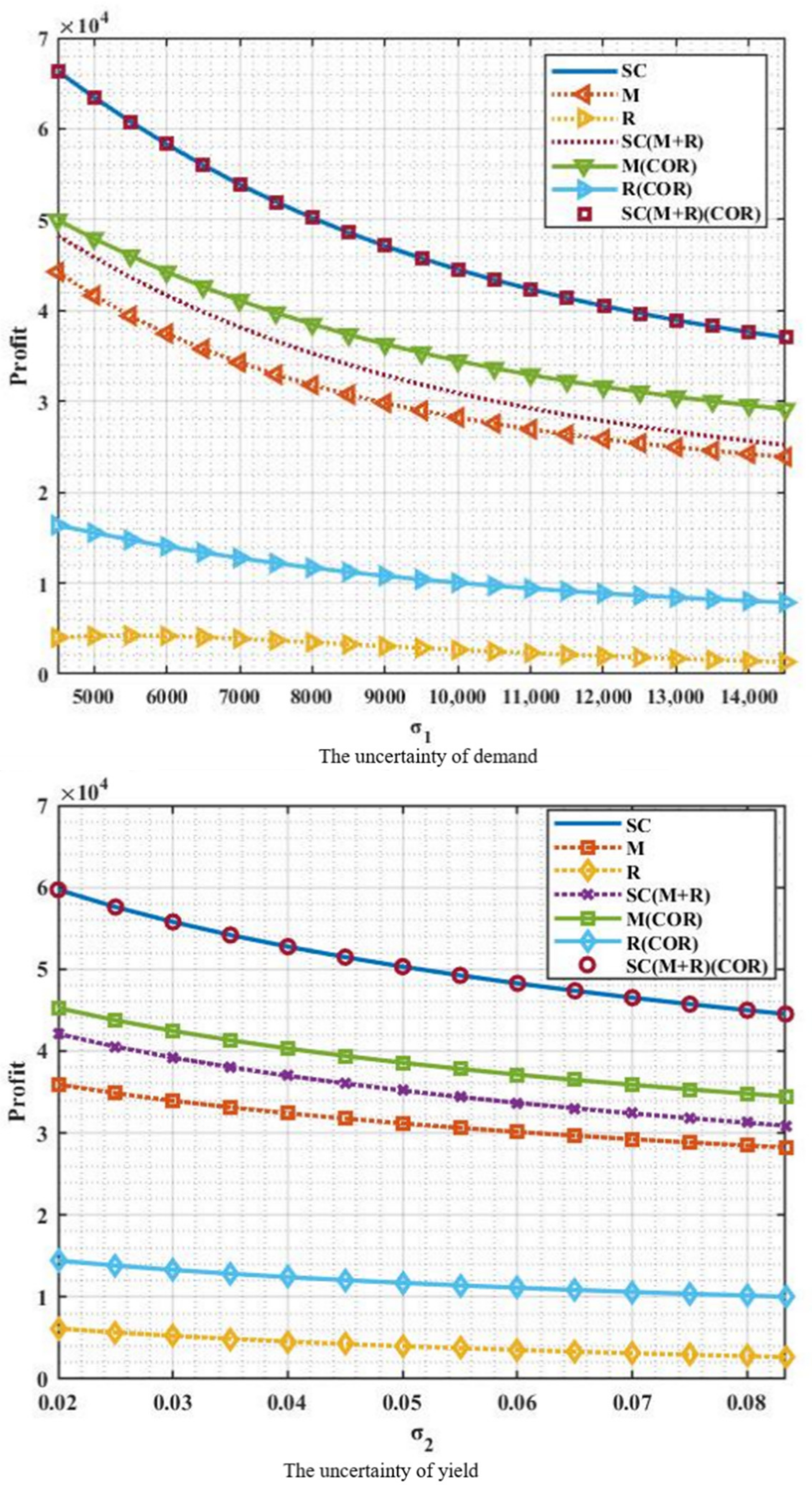

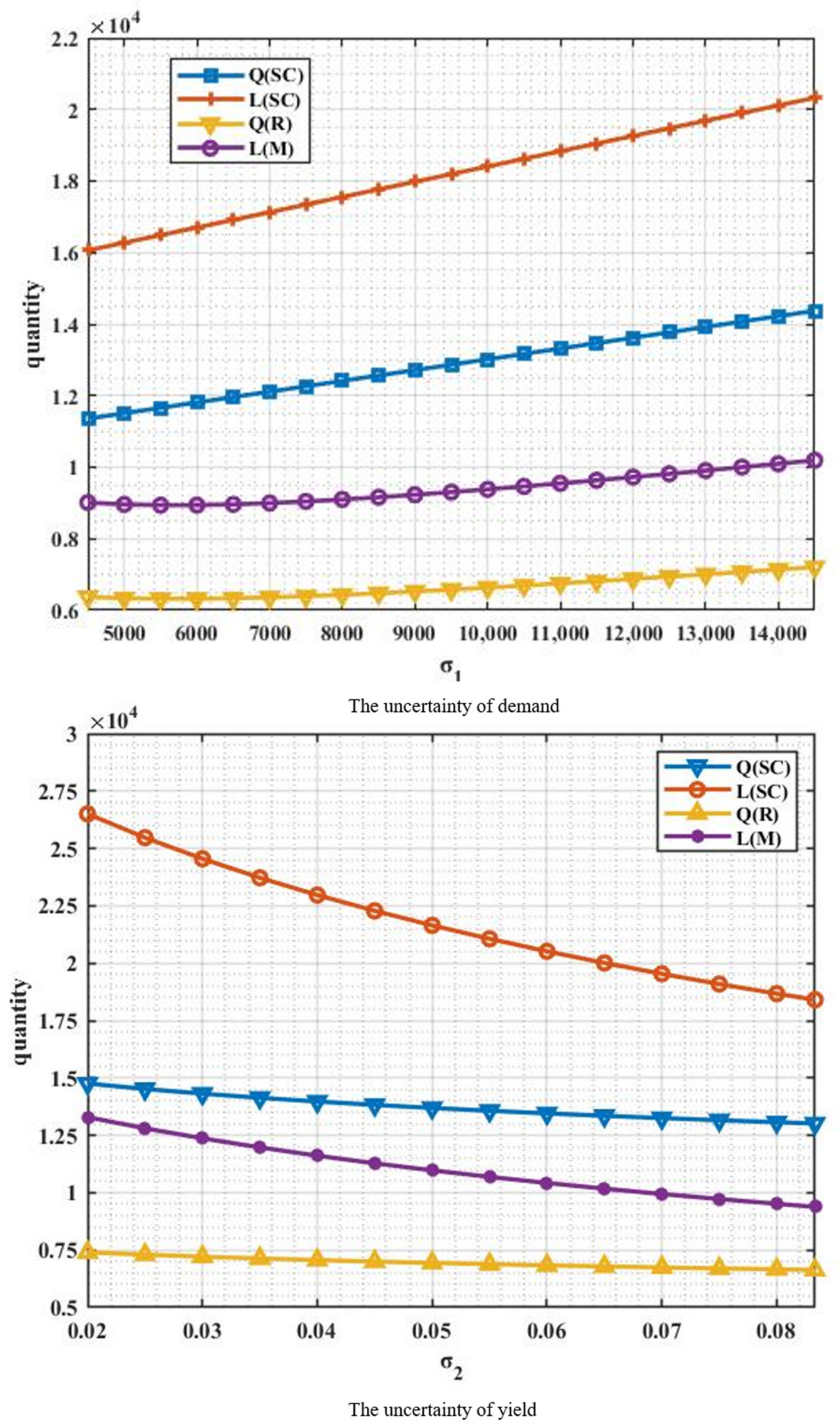

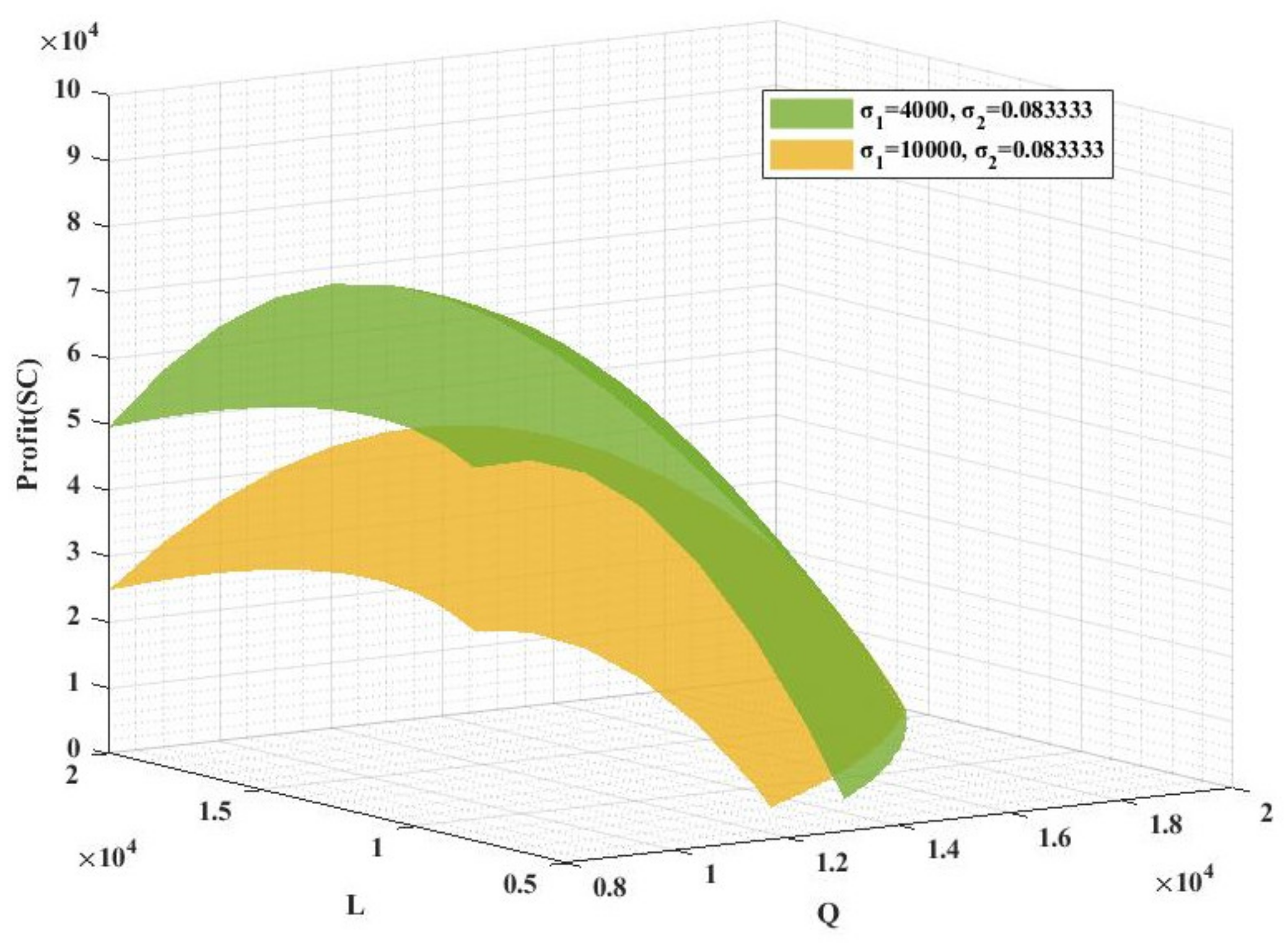

7.1. The Effect of Uncertainty on the Supply Chain

7.2. The Profits under Decisions and the Joint Contract

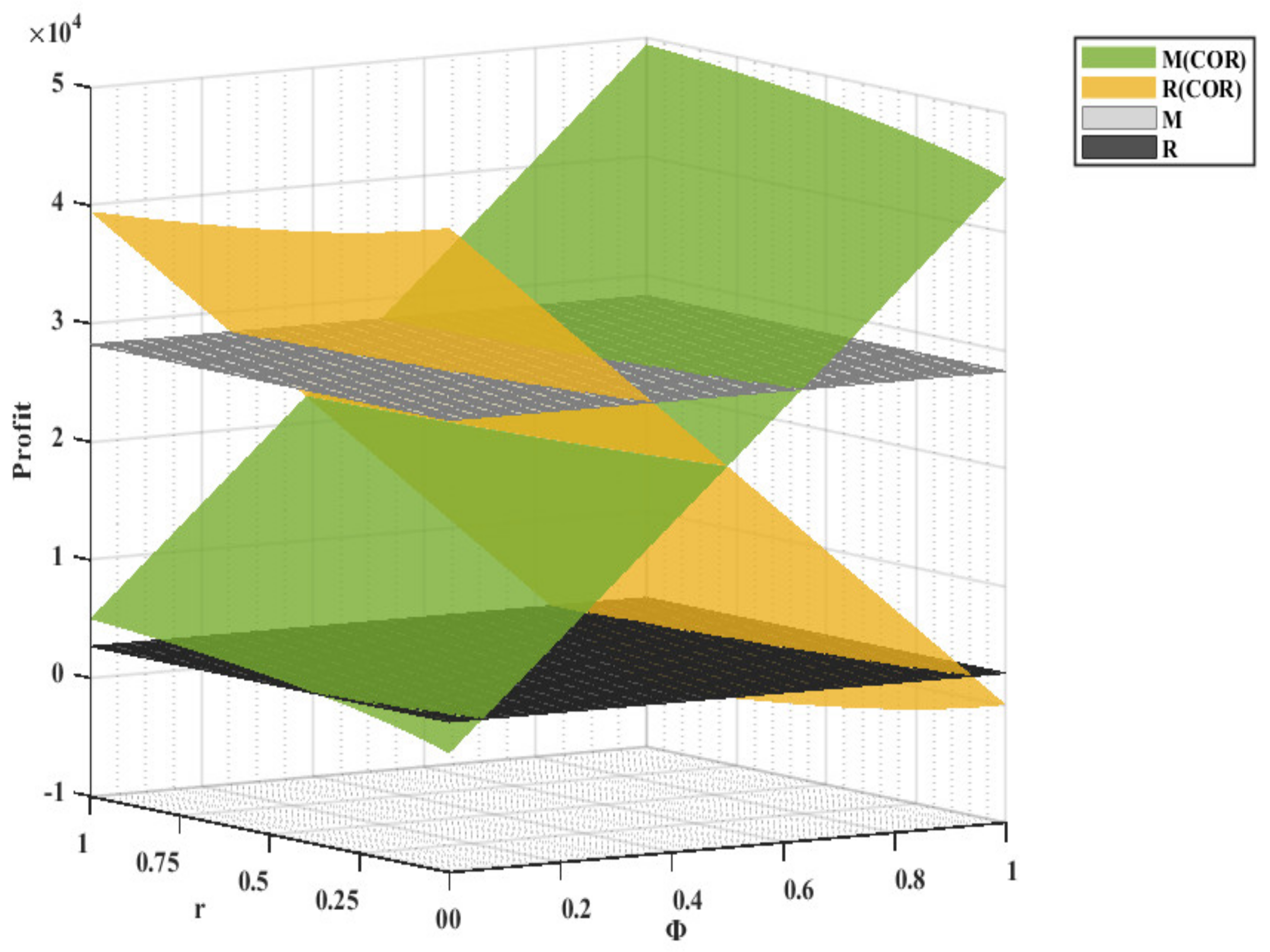

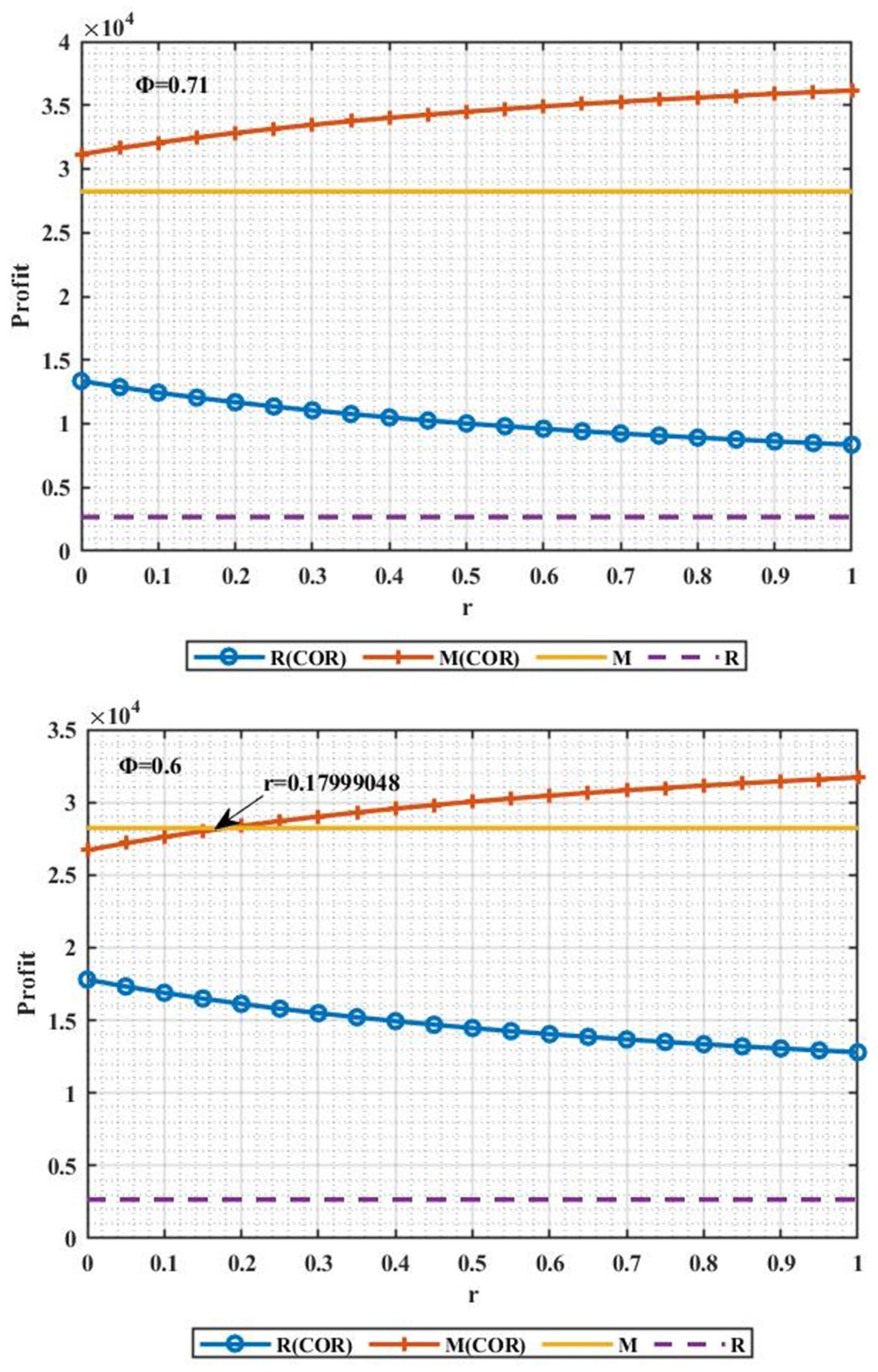

7.3. The Effects of Coordination Coefficients on the Supply Chain

8. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Qazi, A.A.; Appolloni, A. A systematic review on barriers and enablers toward circular procurement management. Sustain. Prod. Consump. 2022, 33, 343–359. [Google Scholar] [CrossRef]

- Hosseini-Motlagh, S.M.; Choi, T.M.; Johari, M.; Nouri-Harzvili, M. A profit surplus distribution mechanism for supply chain coordination: An evolutionary game-theoretic analysis. Eur. J. Oper. Res. 2022, 301, 561–575. [Google Scholar] [CrossRef]

- Peng, Y.; Yan, X.M.; Jiang, Y.J.; Ji, M.; Cheng, T.C.E. Competition and coordination for supply chain networks with random yields. Int. J. Prod. Econ. 2021, 239, 108204. [Google Scholar] [CrossRef]

- Zhang, H.; Wang, Z.; Hong, X.; Gong, Y.; Zhong, Q. Fuzzy closed-loop supply chain models with quality and marketing effort-dependent demand. Expert Syst. Appl. 2022, 207, 118081. [Google Scholar] [CrossRef]

- Shi, Y.; Wang, F. Agricultural Supply Chain Coordination under Weather-Related Uncertain Yield. Sustainability 2022, 14, 5271. [Google Scholar] [CrossRef]

- Lin, Q.; Zhao, Q.H.; Lev, B. Influenza vaccine supply chain coordination under uncertain supply and demand. Eur. J. Oper. Res. 2022, 297, 930–948. [Google Scholar] [CrossRef]

- Taleizadeh, A.A.; Noori-Daryan, M.; Soltani, M.R.; Askari, R. Optimal pricing and ordering digital goods under piracy using game theory. Ann. Oper. Res. 2022, 315, 931–968. [Google Scholar] [CrossRef]

- Taleizadeh, A.A.; Noori-Daryan, M.; Govindan, K. Pricing and ordering decisions of two competing supply chains with different composite policies: A Stackelberg game-theoretic approach. Int. J. Prod. Res. 2016, 54, 2807–2836. [Google Scholar] [CrossRef]

- Gurtu, A. Optimization of inventory holding cost due to price, weight, and volume of items. J. Risk Financ. Manag. 2021, 14, 65. [Google Scholar] [CrossRef]

- Yang, S.; Xiao, Y.J.; Kuo, Y.H. The Supply Chain Design for Perishable Food with Stochastic Demand. Sustainability 2017, 9, 1195. [Google Scholar] [CrossRef] [Green Version]

- Spengler, J.J. Vertical integration and antitrust policy. J. Polit. Econ. 1950, 8, 347–352. [Google Scholar] [CrossRef]

- Forrester, J.W. Industrial dynamics: A major breakthrough for decision makers. Harv. Bus. Rev. 1958, 36, 37–66. [Google Scholar]

- Rejeb, A.; Rejebb, K.; Zailani, S.; Keoghd, J.G.; Appolloni, A. Examining the interplay between artificial intelligence and the agri-food industry. Artif. Intell. Agric. 2022, 6, 111–128. [Google Scholar] [CrossRef]

- Ding, X.; Appolloni, A.; Shahzad, M. Environmental administrative penalty, corporate environmental disclosures and the cost of debt. J. Clean. Prod. 2022, 332, 129919. [Google Scholar] [CrossRef]

- Tsay, A.A. The quantity flexibility contract and supplier-customer incentives. Manag. Sci. 1999, 45, 1339–1358. [Google Scholar] [CrossRef]

- Gurnani, H.; Akella, R.; Lehoczky, J. Supply management in assembly systems with random yield and random demand. IIE Trans. 2000, 32, 701–714. [Google Scholar] [CrossRef]

- Zhao, J.; Wei, J. The coordination contracts for a fuzzy supply chain with effort and price dependent demand. Appl. Math. Model. 2014, 38, 2476–2489. [Google Scholar] [CrossRef]

- Xu, R.N.; Zhai, X.Y. Analysis of supply chain coordination under fuzzy demand in a two-stage supply chain. Appl. Math. Model. 2010, 34, 129–139. [Google Scholar] [CrossRef]

- Zhang, C.T.; Liu, L.P. Reseach on coordination mechanism in three-level green supply chain under non-cooperative game. Appl. Math. Model. 2013, 37, 3369–3379. [Google Scholar] [CrossRef]

- Wang, F.; Diabat, A.; Wu, L. Supply chain coordination with competing suppliers under price-sensitive stochastic demand. Int. J. Prod. Econ. 2021, 234, 108020. [Google Scholar] [CrossRef]

- Wang, F.; Zhuo, X.; Niu, B. Sustainability analysis and buy-back coordination in a fashion supply chain with price competition and demand uncertainty. Sustainability 2016, 9, 25. [Google Scholar] [CrossRef] [Green Version]

- Inderfurth, K.; Clemens, J. Supply chain coordination by risk sharing contracts under random production yield and deterministic demand. OR Spectr. 2014, 36, 525–556. [Google Scholar] [CrossRef]

- Wang, L.L.; Wu, Y.; Hu, S.Q. Make-to-order supply chain coordination through option contract with random yields and overconfidence. Int. J. Prod. Econ. 2021, 242, 108299. [Google Scholar] [CrossRef]

- Bassok, Y.; Hopp, W.J.; Rohatgi, M. A simple linear heuristic for the service constrained random yield problem. IIE Trans. 2002, 34, 479–487. [Google Scholar] [CrossRef]

- Li, X.C.; Lu, S.; Li, Z.; Wang, Y.; Zhu, L. Modeling and optimization of bioethanol production planning under hybrid uncertainty: A heuristic multi-stage stochastic programming approach. Energy 2022, 245, 123285. [Google Scholar] [CrossRef]

- Xie, L.; Ma, J.; Goh, M. Supply chain coordination in the presence of uncertain yield and demand. Int. J. Prod. Res. 2021, 59, 4342–4358. [Google Scholar] [CrossRef]

- Adhikari, A.; Bisi, A.; Avittathur, B. Coordination mechanism, risk sharing, and risk aversion in a five-level textile supply chain under demand and supply uncertainty. Eur. J. Oper. Res. 2020, 282, 93–107. [Google Scholar] [CrossRef]

- Giri, B.C.; Majhi, J.K.; Chaudhuri, K. Coordination mechanisms of a three-layer supply chain under demand and supply risk uncertainties. RAIRO-Oper. Res. 2021, 55, S2592–S2617. [Google Scholar] [CrossRef]

- Jing, C. Returns with wholesale-price-discount contract in a newsvendor problem. Int. J. Prod. Econ. 2011, 130, 104–111. [Google Scholar]

- Hou, J.; Zeng, A.Z.; Zhao, L. Coordination with a backup supplier through buy-back contract under supply disruption. Transp. Res. Part E Logist. Transp. Rev. 2010, 46, 881–895. [Google Scholar] [CrossRef]

- Zhang, Q.; Dong, M.; Luo, J.; Segerstedt, A. Supply chain coordination with trade credit and quantity discount incorporating default risk. Int. J. Prod. Econ. 2014, 153, 352–360. [Google Scholar] [CrossRef]

- Hou, X.; Li, J.B.; Liu, Z.X.; Guo, Y.J. Pareto and Kaldor–Hicks improvements with revenue-sharing and wholesale-price contracts under manufacturer rebate policy. Eur. J. Oper. Res. 2022, 298, 152–168. [Google Scholar] [CrossRef]

- Pasternack, B.A. Optimal pricing and return policies for perishable commodities. Market. Sci. 2008, 27, 133–140. [Google Scholar] [CrossRef]

- Cachon, G.P. Supply chain coordination with contracts. Handb. Oper. Res. Manag. Sci. 2003, 11, 227–339. [Google Scholar]

- Zhong, Y.; Liu, J.; Zhou, Y.W.; Cao, B.; Cheng, T.C.E. Robust contract design and coordination under consignment contract with revenue sharing. Int. J. Prod. Econ. 2022, 253, 108543. [Google Scholar] [CrossRef]

- Hu, F.; Lim, C.C.; Lu, Z.D. Coordination of supply chains with a flexible ordering policy under yield and demand uncertainty. Int. J. Prod. Econ. 2013, 146, 686–693. [Google Scholar] [CrossRef]

- He, Y.; Zhao, X. Coordination in multi-echelon supply chain under supply and demand uncertainty. Int. J. Prod. Econ. 2012, 139, 106–115. [Google Scholar] [CrossRef]

- Lee, C.H.; Rhee, B.D. Retailer-run resale market and supply chain coordination. Int. J. Prod. Econ. 2021, 235, 108089. [Google Scholar] [CrossRef]

- Gao, Z.; Zhao, L.; Wang, H. Supply chain coordination of product and service bundling basedon network externalities. Sustainability 2022, 14, 7790. [Google Scholar] [CrossRef]

- Ji, C.; Liu, X. Design of risk sharing and coordination mechanism in supply chain under demand and supply uncertainty. RAIRO-Oper. Res. 2022, 56, 123–143. [Google Scholar] [CrossRef]

- Lariviere, M.A.; Porteus, E.L. Selling to the newsvendor: An analysis of price-only contracts. Manuf. Serv. Op. 2001, 3, 293–305. [Google Scholar] [CrossRef]

- Cachon, G.P. The allocation of inventory risk in a supply chain: Push, pull, and advance-purchase discount contracts. Manag. Sci. 2004, 50, 222–238. [Google Scholar] [CrossRef] [Green Version]

| Literature | Uncertain Factors | Contract Involved | ||||

|---|---|---|---|---|---|---|

| Yield Uncertainty | Demand Uncertainty | Wholesale Price | Revenue Sharing | Quantity Discount | Penalty Contract | |

| Shi and Wang [5] | √ | √ | √ | √ | × | × |

| Inderfurth and Clemens [40] | √ | × | √ | × | × | √ |

| Hu et al. [20] | √ | √ | √ | √ | × | √ |

| Ji and Liu [33] | √ | √ | √ | √ | × | × |

| Zhang and Liu [25] | × | √ | × | × | × | × |

| Zhang et al. [18] | × | × | × | × | √ | × |

| Adhikari et al. [29] | √ | √ | × | × | × | √ |

| Giri et al. [32] | √ | √ | √ | √ | × | × |

| This paper | √ | √ | √ | √ | √ | × |

| Parameters | p | s | c | g | v | μ1 | σ1 | μ2 | σ2 |

|---|---|---|---|---|---|---|---|---|---|

| Value | 18 | 12 | 3 | 1 | 2 | 10,000 | 10,000 | 0.5 | 0.083 |

| Profit/Decision | Φ | w | R(cor) | M(cor) | R(cor) + M(cor) |

|---|---|---|---|---|---|

| 0.57 | 5.11 | 16,276.90 | 28,228.74 | 44,505.64 | |

| Centralized: | 0.59 | 4.87 | 15,386.79 | 29,118.85 | 44,505.64 |

| SC = 44,505.64 | 0.61 | 4.63 | 14,496.68 | 30,008.97 | 44,505.64 |

| 0.63 | 4.39 | 13,606.56 | 30,899.08 | 44,505.64 | |

| 0.65 | 4.16 | 12,716.45 | 31,789.19 | 44,505.64 | |

| 0.67 | 3.92 | 11,826.34 | 32,679.30 | 44,505.64 | |

| Decentralized: | 0.69 | 3.68 | 10,936.22 | 33,569.42 | 44,505.64 |

| R = 2671.38 | 0.71 | 3.44 | 10,046.11 | 34,459.53 | 44,505.64 |

| M = 28,228.74 | 0.73 | 3.21 | 9156.00 | 35,349.64 | 44,505.64 |

| w = 12.74087 | 0.75 | 2.97 | 8265.89 | 36,239.76 | 44,505.64 |

| 0.77 | 2.73 | 7375.77 | 37,129.87 | 44,505.64 | |

| 0.79 | 2.49 | 6485.66 | 38,019.98 | 44,505.64 | |

| 0.81 | 2.26 | 5595.55 | 38,910.09 | 44,505.64 | |

| 0.83 | 2.02 | 4705.43 | 39,800.21 | 44,505.64 | |

| 0.85 | 1.78 | 3815.32 | 40,690.32 | 44,505.64 | |

| 0.87 | 1.54 | 2925.21 | 41,580.43 | 44,505.64 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, T.; Liu, C.; Xu, X. Coordination of Perishable Product Supply Chains with a Joint Contract under Yield and Demand Uncertainty. Sustainability 2022, 14, 12658. https://doi.org/10.3390/su141912658

Chen T, Liu C, Xu X. Coordination of Perishable Product Supply Chains with a Joint Contract under Yield and Demand Uncertainty. Sustainability. 2022; 14(19):12658. https://doi.org/10.3390/su141912658

Chicago/Turabian StyleChen, Tianwen, Changqing Liu, and Xiang Xu. 2022. "Coordination of Perishable Product Supply Chains with a Joint Contract under Yield and Demand Uncertainty" Sustainability 14, no. 19: 12658. https://doi.org/10.3390/su141912658