Blockchain Interoperability: Towards a Sustainable Payment System

Abstract

:1. Introduction

- Blockchains themselves cannot access off-chain data and vice versa.

- Using centralized oracles nullifies the advantages of decentralization.

- Security risks are associated with Oracles.

- Providing an overview of existing blockchain interoperability solutions and their classification,

- Survey of cross-chain atomic swap protocols and interoperable application design architecture

- Considering challenges and design issues for interchain technologies

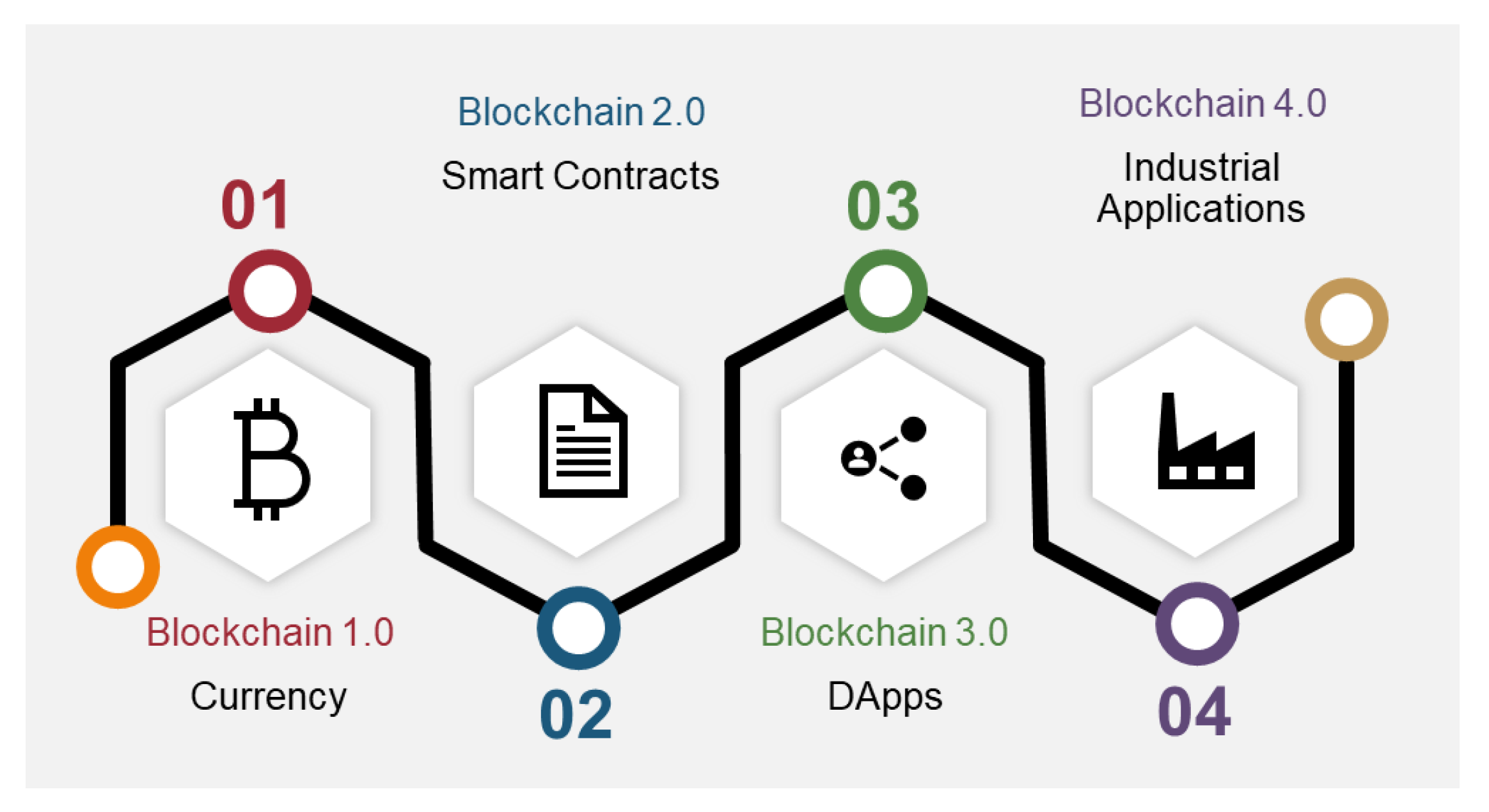

2. Technologies for Blockchain Interoperability

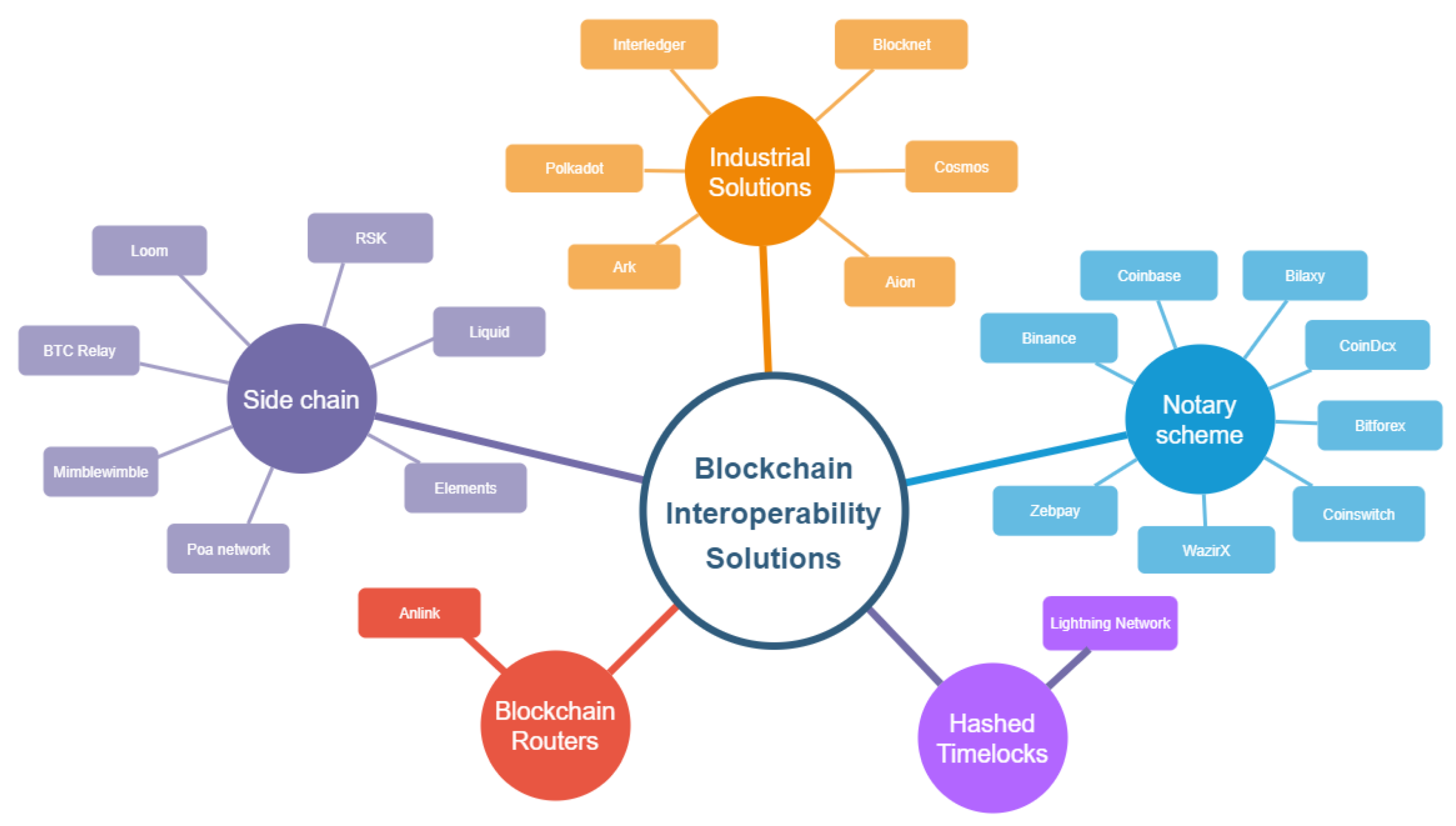

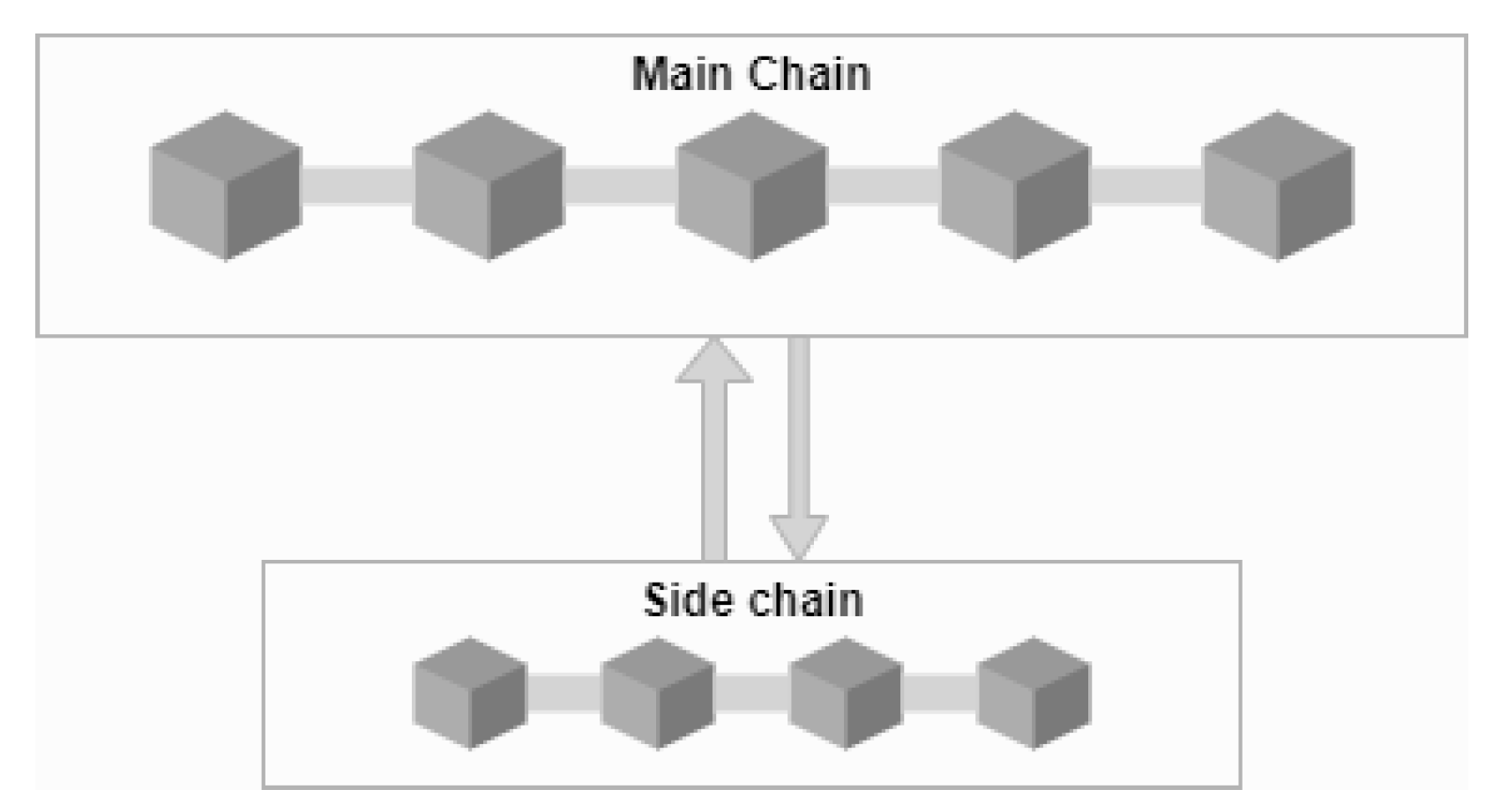

2.1. Sidechains

2.2. Notary Schemes

2.3. Blockchain Routers

2.4. Industrial Solutions

2.5. Hashed Time Locks

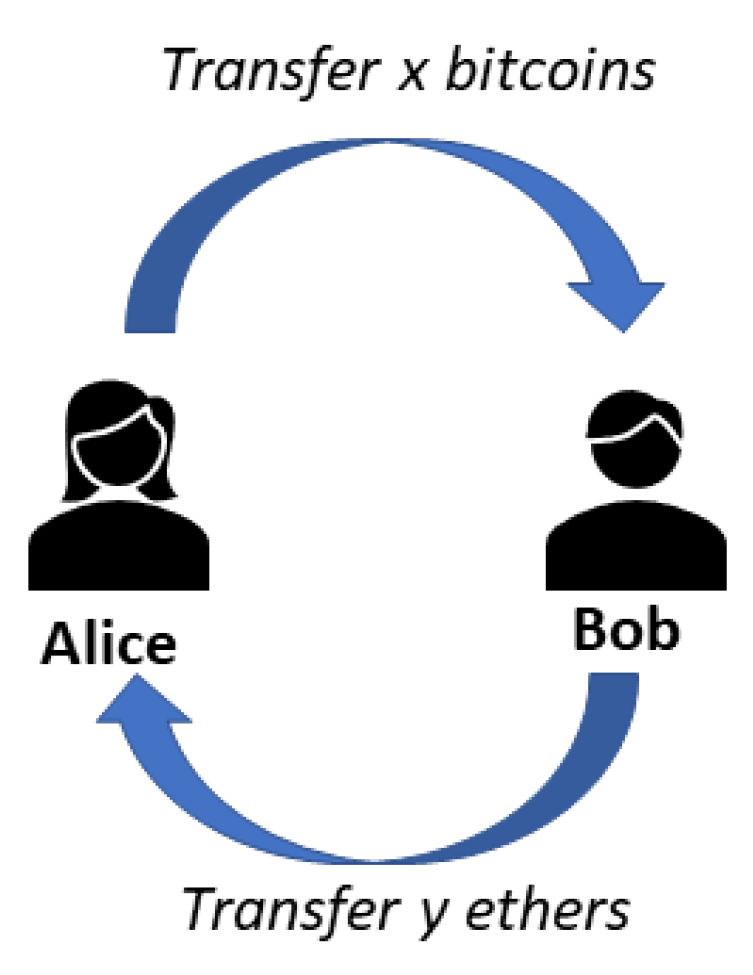

3. Atomic Swaps

- if all parties conform to the protocol, then all swaps take place,

- if some coalition deviates from the protocol, then no conforming party ends up worse off, and

- no coalition has an incentive to deviate from the protocol. Atomic swaps can have applications in fields such as software versioning control, stocks, and commodity market clearing.

- Alice generates a secret s and a hashlock ;

- Alice uses the h to create a smart contract that locks x bitcoins and publishes it to the bitcoin network. If Bob produces s such that , the contract will allocate x bitcoins to Bob. The smart contract is also locked with timelock t1, which means Bob must provide the secret s within time t1 or Alice will receive an x bitcoin refund.

- Since the contract is published in the bitcoin network, Bob can verify the authenticity of the contract.

- Bob learns h from the contract Alice has created. He creates a smart contract and locks y ethers using h. The contract is locked with time lock t2 with t2 < t1. The contract will refund Bob if Alice is unable to provide secret s within t2. He then publishes his smart contract.

- Alice checks the validity of Bob’s contract and provides s within time t2 to unlock Bob’s contract. Alice received y ethers; the secret s is revealed to Bob. Bob provides the secret s to Alice’s smart contract within time t1 and receives x bitcoins.

- If Bob does not provide the secret by t1 due to crash or network failure, he will not receive x bitcoins and Alice is refunded with x bitcoins, thus violating the atomic property.

- The protocol necessitates the publication of smart contracts in a specific order. The sequential publication of smart contracts in atomic swaps with several participants raises the swap’s latency proportionally to the number of contracts sequentially published.

4. Discussion and Conclusions

4.1. Conclusions

4.2. Theoretical Implication

4.3. Practical Implication

4.4. Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Nakamoto, S. Bitcoin: A Peer-to-Peer Electronic Cash System. 2008. Available online: https://bitcoin.org/bitcoin.pdf (accessed on 26 December 2020).

- Bodkhe, U.; Tanwar, S.; Parekh, K.; Khanpara, P.; Tyagi, S.; Kumar, N.; Alazab, M. Blockchain for Industry 4.0: A comprehensive review. IEEE Access 2020, 8, 79764–79800. [Google Scholar] [CrossRef]

- Buterin, V. A Next Generation Smart Contract & Decentralized Application Platform. 2014. Available online: https://blockchainlab.com/pdf/Ethereum_white_paper-a_next_generation_smart_contract_and_decentralized_application_platform-vitalik-buterin.pdf (accessed on 6 January 2021).

- About the Hyperledger Architecture Working Group. Hyperledger architecture. Hyperledger. Org. 2017, 1, 15. [Google Scholar]

- Brown, R.G. The Corda Platform: An Introduction. 2018. Available online: https://www.corda.net/content/corda-platform-whitepaper.pdf (accessed on 6 January 2021).

- Bitcoin Series 24: The Mega-Master Blockchain List—Ledra Capital. Available online: http://ledracapital.com/blog/2014/3/11/bitcoin-series-24-the-mega-master-blockchain-list (accessed on 6 January 2021).

- Jin, H.; Xiao, J.; Dai, X. Towards A Novel Architecture for Enabling Interoperability Amongst Multiple Blockchains. In Proceedings of the 2018 IEEE 38th International Conference on Distributed Computing Systems (ICDCS), Vienna, Austria, 2–6 July 2018; pp. 1203–1211. [Google Scholar]

- Yaga, D.; Mell, P.; Roby, N.; Scarfone, K. Blockchain Technology Overview. 2018. Available online: https://nvlpubs.nist.gov/nistpubs/ir/2018/nist.ir.8202.pdf (accessed on 7 January 2021).

- Ellis, S.; Juels, A.; Nazarov, S. ChainLink A Decentralized Oracle Network. 2017. Available online: https://research.chain.link/whitepaper-v1.pdf (accessed on 6 January 2021).

- Peterson, J.; Krug, J.; Zoltu, M.; Williams, A.K.; Alexander, S. Augur: A Decentralized Oracle and Prediction Market Platform (v2.0). 2018. Available online: https://arxiv.org/pdf/1501.01042.pdf (accessed on 6 May 2021).

- Borkowski, M.; Mcdonald, D.; Ritzer, C.; Schulte, S. Towards Atomic Cross-Chain Token Transfers: State of the Art and Open Questions within TAST. 2018. Available online: https://dsg.tuwien.ac.at/projects/tast/pub/tast-white-paper-1.pdf (accessed on 6 March 2021).

- Coinbase—Buy & Sell Bitcoin, Ethereum, and More with Trust. Available online: https://www.coinbase.com/ (accessed on 2 January 2021).

- Crypto Exchange Bilaxy Loses $21M in Hack|PYMNTS.com. Available online: https://www.pymnts.com/cryptocurrency/2021/crypto-exchange-bilaxy-loses-21m-in-hack/ (accessed on 5 November 2021).

- Number of Crypto Coins 2013-2021|Statista. Available online: https://www.statista.com/statistics/863917/number-crypto-coins-tokens/ (accessed on 5 November 2021).

- Decred Adds Atomic Swap Support for Exchange-Free Cryptocurrency Trading Nasdaq. Available online: https://www.nasdaq.com/articles/decred-adds-atomic-swap-support-for-exchange-free-cryptocurrency-trading-2017-09-20 (accessed on 5 November 2021).

- GitHub-Decred/Atomicswap: On-Chain Atomic Swaps for Decred and Other Cryptocurrencies. Available online: https://github.com/decred/atomicswap (accessed on 5 November 2021).

- First BTC-LTC Lightning Network Swap Completed, Huge Potential. Available online: https://cointelegraph.com/news/first-btc-ltc-lightning-network-swap-completed-huge-potential (accessed on 6 November 2021).

- XMR. Developer Announces Bitcoin to Monero Atomic Swap Capabilities—Privacy Bitcoin News. Available online: https://news.bitcoin.com/xmr-developer-announces-bitcoin-to-monero-atomic-swap-capabilities/ (accessed on 6 November 2021).

- COMIT. Network Launches Monero-Bitcoin Atomic Swaps on Mainnet-AMBCrypto. Available online: https://ambcrypto.com/comit-network-launches-monero-bitcoin-atomic-swaps-on-mainnet/ (accessed on 3 November 2021).

- Liquality. Available online: https://liquality.io/ (accessed on 5 November 2021).

- Belchior, R.; Vasconcelos, A.; Guerreiro, S.; Correia, M. A Survey on Blockchain Interoperability: Past, Present, and Future Trends. ACM Comput. Surv. 2020, 54, 1–41. [Google Scholar] [CrossRef]

- Qasse, I.A.; Talib, M.A.; Nasir, Q. Inter Blockchain Communication: A Survey. In Proceedings of the ArabWIC 6th Annual International Conference Research Track, Rabat, Morocco, 7–9 March 2019. [Google Scholar] [CrossRef]

- Robinson, P. Survey of crosschain communications protocols. Comput. Netw. 2021, 200, 108488. [Google Scholar] [CrossRef]

- Wang, G. SoK: Exploring Blockchains Interoperability. IACR Cryptol. Eprint Arch. 2021, 2021, 537. [Google Scholar]

- Back, A.; Corallo, M.; Dashjr, L.; Friedenbach, M.; Maxwell, G.; Miller, A.; Poelstra, A.; Timón, J.; Wuille, P. Enabling Blockchain Innovations with Pegged Sidechains. 2014. Available online: https://blockstream.com/sidechains.pdf (accessed on 6 January 2021).

- Singh, A.; Click, K.; Parizi, R.M.; Zhang, Q.; Dehghantanha, A.; Choo, K.K.R. Sidechain technologies in blockchain networks: An examination and state-of-the-art review. J. Netw. Comput. Appl. 2020, 149, 102471. [Google Scholar] [CrossRef]

- GitHub-Ethereum/Btcrelay: Ethereum Contract for Bitcoin SPV: Live on. Available online: https://github.com/ethereum/btcrelay (accessed on 6 January 2021).

- Loom Network—Production-Ready, Multichain Interop Platform for Serious Dapp Developers. Available online: https://loomx.io/ (accessed on 7 January 2021).

- Elements|Elementsproject.org. Available online: https://elementsproject.org/ (accessed on 6 January 2021).

- Liquid Network: Sidechain for Traders|Blockstream. Available online: https://blockstream.com/liquid/ (accessed on 17 January 2021).

- Poelstra, A. Mimblewimble. 2016. Available online: https://download.wpsoftware.net/bitcoin/wizardry/mimblewimble.pdf (accessed on 16 January 2021).

- Welcome to POA-POA. Available online: https://www.poa.network/ (accessed on 16 January 2021).

- Lerner, S.D. RSK Rootstock Platform White Paper. 2019. Available online: https://www.rsk.co/Whitepapers/RSK-White-Paper-Updated.pdf (accessed on 17 March 2021).

- Buy/Sell Bitcoin, Ether and Altcoins|Cryptocurrency Exchange|Binance. Available online: https://www.binance.com/en (accessed on 17 January 2021).

- Bilaxy. Available online: https://bilaxy.com/ (accessed on 17 January 2021).

- BitForex|The World’s Leading One-Stop Digital Asset Service Platform. Available online: https://www.bitforex.com/ (accessed on 17 January 2021).

- Buy Bitcoin, Cryptocurrency at India’s Largest Exchange|Trading Platform|WazirX. Available online: https://wazirx.com/ (accessed on 17 January 2021).

- Buy Bitcoin and Cryptocurrency at India’s Leading Exchange|ZebPay. Available online: https://zebpay.com/in/ (accessed on 17 January 2021).

- CoinDCX-Crypto Exchange|Buy, Sell and Trade Bitcoins & Top Altcoins. Available online: https://coindcx.com/ (accessed on 17 January 2021).

- CoinSwitch Kuber-Cryptocurrency Exchange in India. Available online: https://coinswitch.co/ (accessed on 17 January 2021).

- Wang, H.; Cen, Y.; Li, X. Blockchain Router: A Cross-Chain Communication Protocol. In Proceedings of the 6th International Conference on Informatics, Environment, Energy and Applications, New York, NY, USA, 29–31 March 2017; pp. 94–97. [Google Scholar]

- Anlink Blockchain Network Whitepaper V 1.0. 2017. Available online: https://alicliimg.clewm.net/049/389/1389049/1484820492640c2baf37ea3e4f9fd77bd52c2a1e9bbbe1484820484.pdf (accessed on 17 January 2021).

- Whitepaper-Resources-Cosmos Network. Available online: https://v1.cosmos.network/resources/whitepaper (accessed on 17 January 2021).

- Wood, G. Polkadot: Vision For A Heterogeneous Multi-Chain Framework. 2016. Available online: https://polkadot.network/PolkaDotPaper.pdf (accessed on 17 January 2021).

- Thomas, S.; Schwartz, E. A Protocol for Interledger Payments. 2015. Available online: https://interledger.org/interledger.pdf (accessed on 18 January 2021).

- ARK Ecosystem Whitepaper Version 2.1.0. 2019. Available online: https://ark.io/Whitepaper.pdf (accessed on 20 January 2021).

- Culwick, A.; Metcalf, D. The Blocknet Design Specification. 2018. Available online: https://blocknet.co/whitepaper/Blocknet_Whitepaper.pdf (accessed on 7 September 2021).

- Aion Whitepaper-Whitepaper.io. Available online: https://whitepaper.io/document/31/aion-whitepaper (accessed on 26 January 2021).

- Hash Time Locked Contracts-Bitcoin Wiki. Available online: https://en.bitcoin.it/wiki/Hash_Time_Locked_Contracts (accessed on 26 January 2021).

- Poon, J.; Dryja, T. The Bitcoin Lightning Network: Scalable Off-Chain Instant Payments. 2016. Available online: https://lightning.network/lightning-network-paper.pdf (accessed on 28 January 2021).

- Nolan, T. Alt Chains and Atomic Transfers. Available online: https://bitcointalk.org/index.php?topic=193281.msg2224949#msg2224949 (accessed on 6 February 2021).

- Herlihy, M. Atomic Cross-Chain Swaps. In Proceedings of the 2018 ACM Symposium on Principles of Distributed Computing, New York, NY, USA, 23–27 July 2018; pp. 245–254. [Google Scholar]

- Schulte, S.; Sigwart, M.; Frauenthaler, P.; Borkowski, M. Towards Blockchain Interoperability. In Proceedings of the 17th International Conference on Business Process Management: Blockchain and Central and Eastern Europe Forum, Wien, Österreich, 1–6 September 2019. [Google Scholar]

- Zakhary, V.; Agrawal, D.; El Abbadi, A. Atomic commitment across blockchains. Proc. VLDB Endow. 2020, 13, 1319–1331. [Google Scholar] [CrossRef]

- Zié, J.-Y.; Deneuville, J.-C.; Briffaut, J.; Nguyen, B. Extending Atomic Chain Swaps. ESORICS 2019, Data Privacy Management, Cryptocurrencies and Blockchain Technology. In Proceedings of the ESORICS 2019 International Workshops, DPM 2019 and CBT 2019, Luxembourg, 26–27 September 2019. [Google Scholar] [CrossRef]

- Shadab, N.; Houshmand, F.; Lesani, M. Cross-chain Transactions. In Proceedings of the 2020 IEEE International Conference on Blockchain and Cryptocurrency (ICBC), Toronto, ON, Canada, 2–6 May 2020. [Google Scholar] [CrossRef]

- Zhao, D.; Li, T. Distributed Cross-Blockchain Transactions. arXiv 2020, arXiv:2002.11771. [Google Scholar]

- Borkowski, M.; Ritzer, C.; Mcdonald, D.; Schulte, S. Caught in Chains: Claim-First Transactions for Cross-Blockchain Asset Transfers. 2018. Available online: https://dsg.tuwien.ac.at/projects/tast/pub/tast-white-paper-2.pdf (accessed on 11 April 2021).

- Liu, Z.; Xiang, Y.; Shi, J.; Gao, P.; Wang, H.; Xiao, X.; Wen, B.; Hu, Y.-C. HyperService: Interoperability and Programmability Across Heterogeneous Blockchains. In Proceedings of the 2019 ACM SIGSAC Conference on Computer and Communications Security (CCS ’19), London, UK, 11–15 November 2019; p. 18. [Google Scholar]

- Borkowski, M.; Sigwart, M.; Frauenthaler, P.; Hukkinen, T.; Schulte, S. Dextt: Deterministic Cross-Blockchain Token Transfers. IEEE Access 2019, 7, 111030–111042. [Google Scholar] [CrossRef]

- Dziembowski, S.; Eckey, L.; Faust, S. Fairswap: How to fairly exchange digital goods. In Proceedings of the ACM Conference on Computer and Communications Security, Toronto, ON, Canada, 15–19 October 2018; pp. 967–984. [Google Scholar]

- Zero Knowledge Contingent Payment-Bitcoin Wiki. Available online: https://en.bitcoin.it/wiki/Zero_Knowledge_Contingent_Payment (accessed on 16 March 2021).

- Bentov, I.; Kumaresan, R. How to use Bitcoin to design fair protocols. In Lecture Notes in Computer Science (Including Subseries Lecture Notes in Artificial Intelligence and Lecture Notes in Bioinformatics); Springer: Berlin/Heidelberg, Germany, 2014; Volume 8617, pp. 421–439. [Google Scholar]

- Robinson, P.; Ramesh, R. General purpose atomic crosschain transactions. In Proceedings of the IEEE International Conference on Blockchain and Cryptocurrency, ICBC 2021, Sydney, Australia, 3–6 May 2021. [Google Scholar]

- Wüst, K.; Diana, L.; Kostiainen, K.; Karame, G.; Matetic, S.; Capkun, S. Bitcontracts: Supporting Smart Contracts in Legacy Blockchains. In Proceedings of the 2021 Network and Distributed System Security Symposium. Virtual: Internet Society, San Diego, CA, USA, 21–25 February 2021. [Google Scholar] [CrossRef]

- Poelstra, A. Scriptless Scripts. 2017. Available online: https://download.wpsoftware.net/bitcoin/wizardry/mw-slides/2017-05-milan-meetup/slides.pdf (accessed on 16 March 2021).

- Malavolta, G.; Moreno-Sanchez, P.; Schneidewind, C.; Kate, A.; Maffei, M. Anonymous Multi-Hop Locks for Blockchain Scalability and Interoperability. In Proceedings of the Network and Distributed Systems Security (NDSS) Symposium, San Diego, CA, USA, 24–27 February 2019. [Google Scholar]

- Shlomovits, O.; Leiba, O. Jugglingswap: Scriptless Atomic Cross-Chain Swaps. arXiv 2020, arXiv:2007.14423. [Google Scholar]

- Deshpande, A.; Herlihy, M. Privacy-preserving cross-chain atomic swaps. In Lecture Notes in Computer Science (including subseries Lecture Notes in Artificial Intelligence and Lecture Notes in Bioinformatics); Springer: Berlin/Heidelberg, Germany, 2020; Volume 12063, pp. 540–549. [Google Scholar]

- Gibson, A. Flipping the Scriptless Script on Schnorr—Joinmarket.me Archive. Available online: https://joinmarket.me/blog/blog/flipping-the-scriptless-script-on-schnorr/ (accessed on 6 May 2021).

- Buterin, V. Chain Interoperability. 2016. Available online: https://www.r3.com/wp-content/uploads/2017/06/chain_interoperability_r3.pdf (accessed on 6 May 2021).

- Lys, L.; Micoulet, A.; Potop-Butucaru, M. R-SWAP: Relay Based Atomic Cross-Chain Swap Protocol. In Proceedings of the 6th International Symposium, ALGOCLOUD 2021, Lisbon, Portugal, 6–7 September 2021; pp. 18–37. [Google Scholar] [CrossRef]

- Frauenthaler, P.; Sigwart, M.; Spanring, C.; Schulte, S. Testimonium: A Cost-Efficient Blockchain Relay. 2020. Available online: https://arxiv.org/pdf/2002.12837.pdf (accessed on 18 August 2021).

- Miraz, M.H.; Donald, D.C. Atomic Cross-chain Swaps: Development, Trajectory and Potential of Non-monetary Digital Token Swap Facilities. Ann. Emerg. Technol. Comput. 2019, 3, 42–50. [Google Scholar] [CrossRef]

- Nissl, M.; Sallinger, E.; Schulte, S.; Borkowski, M. Towards Cross-Blockchain Smart Contracts. 2020. Available online: https://www.dsg.tuwien.ac.at/projects/tast/pub/tast-white-paper-10.pdf (accessed on 6 May 2021).

- Fynn, E.; Bessani, A.; Pedone, F. Smart Contracts on the Move. In Proceedings of the 2020 50th Annual IEEE/IFIP International Conference on Dependable Systems and Networks (DSN), London, UK, 23–26 August 2021; pp. 233–244. [Google Scholar]

- GitHub-Hyperledger/Burrow. Available online: https://github.com/hyperledger/burrow (accessed on 6 May 2021).

- Qiu, H.; Wu, X.; Zhang, S.; Leung, V.C.M.; Cai, W. ChainIDE: A cloud-based integrated development environment for cross-blockchain smart contracts. In Proceedings of the International Conference on Cloud Computing Technology and Science (CloudCom), Sydney, Australia, 11–13 December 2019; pp. 317–319. [Google Scholar]

- Drescher, D. Thinking in Layers and Aspects. In Blockchain Basics; Apress: New York, NY, USA, 2017; pp. 3–7. [Google Scholar]

- Understanding Blockchain is Way Easier if You Think of It as an Onion. Available online: https://thenextweb.com/news/understanding-blockchain-easier-onion-layer (accessed on 6 May 2021).

- Layer 2 Blockchain Technology: Everything You Need to Know|Lucidity. Available online: https://golucidity.com/layer-2-blockchain-technology/ (accessed on 6 May 2021).

- Gudgeon, L.; Moreno-Sanchez, P.; Roos, S.; Mccorry, P.; Gervais, A. SoK: Layer-Two Blockchain Protocols. In International Conference on Financial Cryptography and Data Security; Springer: Cham, Switzerland, 2020; Volume 12059, pp. 201–226. [Google Scholar] [CrossRef]

- Robinson, P.; Ramesh, R. Layer 2 Atomic Cross-Blockchain Function Calls. 2020. Available online: https://arxiv.org/pdf/2005.09790.pdf (accessed on 6 May 2021).

- Pillai, B.; Biswas, K.; Muthukkumarasamy, V. Cross-chain interoperability among blockchain-based systems using transactions. Knowl. Eng. Rev. 2020, 35, 35. [Google Scholar] [CrossRef]

- Gugger, J. Bitcoin-Monero Cross-chain Atomic Swap. IACR Cryptol. ePrint Arch. 2020, 2020, 1126. [Google Scholar]

- Hoenisch, P.; Soriano Del Pino, L. Atomic Swaps between Bitcoin and Monero. arXiv 2021, arXiv:2101.12332. [Google Scholar]

- Mechkaroska, D.; Dimitrova, V.; Popovska-Mitrovikj, A. Analysis of the Possibilities for Improvement of BlockChain Technology. In Proceedings of the 2018 26th Telecommunications Forum, Belgrade, Serbia, 20–21 November 2018. [Google Scholar]

- Decker, C.; Wattenhofer, R. A fast and scalable payment network with bitcoin duplex micropayment channels. In Lecture Notes in Computer Science (Including Subseries Lecture Notes in Artificial Intelligence and Lecture Notes in Bioinformatics); Springer: Berlin/Heidelberg, Germany, 2015; Volume 9212, pp. 3–18. [Google Scholar]

- Brekke, J.K.; Alsindi, W.Z. Cryptoeconomics. Internet Policy Rev. 2021, 10, 1–9. [Google Scholar] [CrossRef]

- Kim, M.S.; Chung, J.Y. Sustainable Growth and Token Economy Design: The Case of Steemit. Sustainability 2018, 11, 167. [Google Scholar] [CrossRef] [Green Version]

| Type | Blockchain Interoperability Project | Consensus Algorithm | Summary |

|---|---|---|---|

| Sidechain | BTC Relay | Proof of Work | First functional sidechain project Allows Ethereum contracts to securely verify Bitcoin transactions without any intermediaries Uses simplified payment verification (SPV) Mainchain is Bitcoin |

| Mimblewimble | Proof of Work (Cuckoo Cycle) | Provides increased privacy and higher scalability Does not support scripts Mainchain is Bitcoin | |

| Poa network | Proof of Authority | Public sidechain of Ethereum Mainchain is Ethereum Rely on preselected validators Improves scalability | |

| RSK | Proof of Work | Enable execution of smart contracts Faster transactions and better scalability Mainchain is Bitcoin Bitcoins transferred to RSK become “Smart Bitcoins” (RBTC) | |

| Blockchain Router | Anlink | Delegated Stake-Practical Byzantine Fault Tolerance | Ann-router provides connection, communication, and trust between chains Ann-Router can analyze communication data package Can send messages to sub-chain through Cross Blockchain Communication Protocol according to the Routing table dynamically maintained by itself |

| Industrial Solutions | COSMOS | Tendermint | COSMOS consists of a network of independent blockchains called zones The first zone in COSMOS network is called the hub Hub and zones communicate by inter blockchain protocol Interzone token transfer go through the COSMOS hub |

| Polkadot | Nominated Proof of Stake | Defines three types of blockchain classes as Parachains, Relay chains, and bridges The token used in Polkadot is called dot Patachains participate in the Polkadot network Relay Chain serves as a connector to different parachains (or individual blockchains) through a system of bridges Includes three distinct node types (validators, collators, and fishermen) | |

| Hashed Time locks | Lightening Network | Payment Channel | Uses the hashed time lock allowing transaction to be performed off-chain Used as a payment channel |

| Author(s) | Year | Major Contribution(s) |

|---|---|---|

| GPACT protocol which facilitate a call execution tree that spans contracts on multiple blockchains | ||

| P. Robinson et al. [64] | 2021 | Works with EVM-compatible blockchain platforms |

| For non-EVM, requires validators | ||

| L. Lys et al. [72] | 2021 | Formalization of blockchain relay and adapter |

| R-SWAP protocol using blockchain relays and adapters | ||

| Protocol evaluation using Permissioned and Permissionless blockchains | ||

| P. Hoenisch et al. [86] | 2021 | Atomic swap protocol between Bitcoin and Monero |

| Uses adapter signature | ||

| J. Gugger [85] | 2020 | Atomic swap protocol between Bitcoin and Monero |

| Can be generalized to other cryptocurrencies | ||

| Scriptless approach | ||

| P. Robinson et al. [83] | 2020 | Layer 2 atomic cross-chain function calls protocol |

| Multiple signed block headers transfer between blockchains | ||

| 5 types of function calls | ||

| E. Fynn et al. [76] | 2020 | Smart contract migration (move operation) across blockchains |

| B. Pillai et al. [84] | 2020 | An application layer based cross-chain communication model |

| M. Nissl et al. [75] | 2020 | Framework for invoking smart contracts across blockchains |

| N. Shadab et al. [56] | 2020 | 3P three-party exchange protocol |

| Transforms the exchange into an equivalent transaction graph and execution | ||

| A. Deshpande et al. [69] | 2020 | Scriptless script-based protocol |

| Addresses the privacy issues | ||

| O. Shlomovits et al. [68] | 2020 | Scriptless script-based protocol |

| Gradual release of secrets | ||

| V. Zakhary et al. [54] | 2019 | Generalization of atomic cross-chain commitment protocol |

| Centralized trusted witness and permissionless witness network protocol version | ||

| M. Borkowski et al. [60] | 2019 | DeXTT protocol accepting eventual consistency for data synchronization |

| J. Zie et al. [55] | 2019 | Multi-signature based atomic swap protocol |

| Z. Liu et al. [59] | 2019 | Platform for blockchain interoperability and programmability |

| Cross-chain execution of dapps | ||

| H. Jin et al. [7] | 2018 | Five layered blockchain interoperability architecture, properties, challenges |

| M. Borkowski [58] | 2018 | Protocol based of claim first transaction |

| S. Dziembowski et al. [61] | 2018 | Efficient and low-cost FairSwap protocol compared to costly smart contract execution |

| Proof of misbehavior and imposition of penalty for cheaters | ||

| M. Herlihy [52] | 2018 | Formalization of atomic swap and representation in terms of a directed graph |

| Outcome of the atomic swap into any of the 5 states | ||

| 2P atomic swap protocol and its analysis | ||

| T. Nolan [51] | 2013 | Implementation of Atomic swap protocol using HTLC |

| Cryptocurrency | Transactions per Second (TPS) | Support for Smart Contract | Support for Dapps |

|---|---|---|---|

| Bitcoin | 7 | Limited | No |

| Ethereum | 15 | Yes | Yes |

| Ripple (XRP) | 1500 | No (to support in future) | No |

| Bitcoin Cash | 300 | Limited | No |

| EOS | 1000+ | Yes | Yes |

| Litecoin (LTC) | 50 | Yes (recently) | No |

| Stellar | 1000+ | Limited | No |

| Cardano (ADA) | 250 | Yes | Yes |

| Tron (TRX) | 1000+ | Yes | Yes |

| Solana | 50,000 | Yes | Yes |

| Monero (XMR) | 1000 | No | No |

| Avalanche | 4500 | Yes | Yes |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mohanty, D.; Anand, D.; Aljahdali, H.M.; Villar, S.G. Blockchain Interoperability: Towards a Sustainable Payment System. Sustainability 2022, 14, 913. https://doi.org/10.3390/su14020913

Mohanty D, Anand D, Aljahdali HM, Villar SG. Blockchain Interoperability: Towards a Sustainable Payment System. Sustainability. 2022; 14(2):913. https://doi.org/10.3390/su14020913

Chicago/Turabian StyleMohanty, Debasis, Divya Anand, Hani Moaiteq Aljahdali, and Santos Gracia Villar. 2022. "Blockchain Interoperability: Towards a Sustainable Payment System" Sustainability 14, no. 2: 913. https://doi.org/10.3390/su14020913

APA StyleMohanty, D., Anand, D., Aljahdali, H. M., & Villar, S. G. (2022). Blockchain Interoperability: Towards a Sustainable Payment System. Sustainability, 14(2), 913. https://doi.org/10.3390/su14020913