External Two Stage DEA Analysis of Bank Efficiency in West Balkan Countries

Abstract

:1. Introduction

2. Theoretical Background

3. Methodology and Data

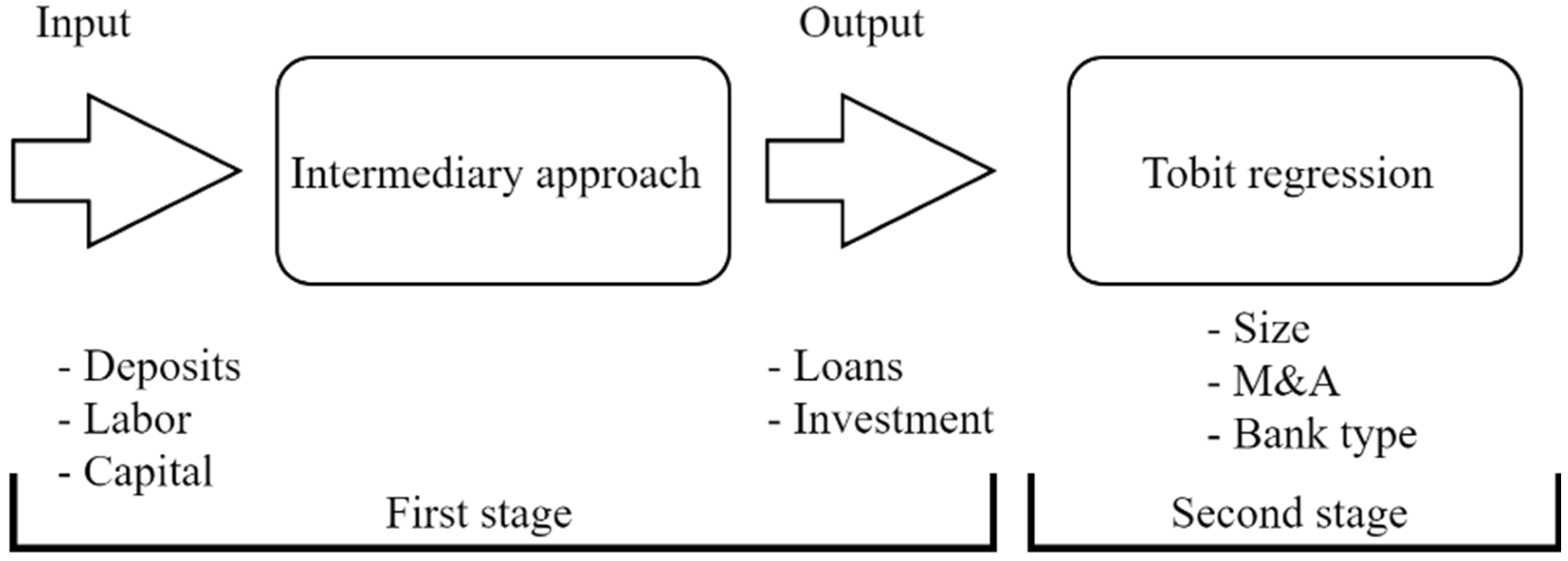

3.1. First-Stage Methodology

- The subjects of efficiency assessment are several decision making units (DMUs) with their input and output data [41].

- DMUs, when precisely defined, are always of the same type of institutions (in our paper, e.g., banks).

- DMUs operate within similar business conditions, but often the initial data for different units are significantly different.

- The number of decision-making units should be at least two or three times higher than the sum of diverse inputs and outputs [42], which is confirmed by numerous examples from the literature in which efficiency measurement was performed.

- Flexible DMUs in terms of the suggestions based on DEA results (reduction/increase of a certain input and output) [43].

3.2. Second-Stage Methodology

3.3. Data and Descriptive Statistics

4. Results and Discussion

4.1. DEA Efficiency Results

4.2. Tobit Regression Results and Disscusion

- CI—dummy variable for commercial or investment banks (0—commercial banks, 1—investment bank)

- MA—dummy variable for merger and acquisitions (0—periods without merger and acquisitions, 1—periods with merger and acquisitions)

- SIZE—dummy variable for division into a group of small and large banks (0—small bank, 1—large bank)

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| 2015 | 2016 | 2017 | 2018 | 2019 | |||||

|---|---|---|---|---|---|---|---|---|---|

| DMU | Score | DMU | Score | DMU | Score | DMU | Score | DMU | Score |

| Albania1 | 0.958 | Albania1 | 0.991 | Albania1 | 0.921 | Albania1 | 1.000 | Albania1 | 1.000 |

| Albania2 | 0.557 | Albania2 | 1.000 | Albania2 | 1.000 | Albania2 | 1.000 | Albania2 | 1.000 |

| Albania3 | 1.000 | Albania3 | 1.000 | Albania3 | 1.000 | Albania3 | 1.000 | Albania3 | 1.000 |

| Albania4 | 1.000 | Albania4 | 1.000 | Albania4 | 1.000 | Albania4 | 1.000 | Albania4 | 1.000 |

| Albania5 | 0.712 | Albania5 | 1.000 | Albania5 | 1.000 | Albania5 | 1.000 | Albania5 | 1.000 |

| Albania6 | 1.000 | Albania6 | 1.000 | Albania6 | 1.000 | Albania6 | 1.000 | Albania6 | 1.000 |

| Albania7 | 0.837 | Albania7 | 0.979 | Albania7 | 1.000 | Albania7 | 1.000 | Albania7 | 1.000 |

| Albania8 | 1.000 | Albania8 | 1.000 | Albania8 | 1.000 | Albania8 | 1.000 | Albania8 | 1.000 |

| Albania9 | 0.564 | Albania9 | 1.000 | Albania9 | 1.000 | Albania9 | 1.000 | Albania9 | 1.000 |

| Albania10 | 0.805 | Albania10 | 1.000 | Albania10 | 1.000 | Albania10 | 0.923 | Albania10 | 0.995 |

| Albania11 | 0.615 | Albania11 | 0.737 | Albania11 | 0.714 | Albania11 | 1.000 | Albania11 | 1.000 |

| Albania12 | 1.000 | Albania12 | 1.000 | Albania12 | 1.000 | Albania12 | 1.000 | Albania12 | 1.000 |

| Average | 0.837 | 0.976 | 0.970 | 0.994 | 1.000 | ||||

| Bosnia&Herzegovina1 | 0.608 | Bosnia&Herzegovina1 | 0.630 | Bosnia&Herzegovina1 | 1.000 | Bosnia&Herzegovina1 | 1.000 | Bosnia&Herzegovina1 | 1.000 |

| Bosnia&Herzegovina2 | 1.000 | Bosnia&Herzegovina2 | 1.000 | Bosnia&Herzegovina2 | 0.926 | Bosnia&Herzegovina2 | 0.998 | Bosnia&Herzegovina2 | 0.932 |

| Bosnia&Herzegovina3 | 1.000 | Bosnia&Herzegovina3 | 0.981 | Bosnia&Herzegovina3 | 0.954 | Bosnia&Herzegovina3 | 1.000 | Bosnia&Herzegovina3 | 1.000 |

| Bosnia&Herzegovina4 | 1.000 | Bosnia&Herzegovina4 | 1.000 | Bosnia&Herzegovina4 | 1.000 | Bosnia&Herzegovina4 | 1.000 | Bosnia&Herzegovina4 | 1.000 |

| Bosnia&Herzegovina5 | 1.000 | Bosnia&Herzegovina5 | 1.000 | Bosnia&Herzegovina5 | 1.000 | Bosnia&Herzegovina5 | 1.000 | Bosnia&Herzegovina5 | 1.000 |

| Bosnia&Herzegovina6 | 1.000 | Bosnia&Herzegovina6 | 1.000 | Bosnia&Herzegovina6 | 1.000 | Bosnia&Herzegovina6 | 1.000 | Bosnia&Herzegovina6 | 1.000 |

| Bosnia&Herzegovina7 | 1.000 | Bosnia&Herzegovina7 | 1.000 | Bosnia&Herzegovina7 | 1.000 | Bosnia&Herzegovina7 | 0.850 | Bosnia&Herzegovina7 | 0.732 |

| Bosnia&Herzegovina8 | 1.000 | Bosnia&Herzegovina8 | 1.000 | Bosnia&Herzegovina8 | 1.000 | Bosnia&Herzegovina8 | 1.000 | Bosnia&Herzegovina8 | 1.000 |

| Bosnia&Herzegovina9 | 1.000 | Bosnia&Herzegovina9 | 1.000 | Bosnia&Herzegovina9 | 1.000 | Bosnia&Herzegovina9 | 1.000 | Bosnia&Herzegovina9 | 1.000 |

| Bosnia&Herzegovina10 | 1.000 | Bosnia&Herzegovina10 | 1.000 | Bosnia&Herzegovina10 | 1.000 | Bosnia&Herzegovina10 | 1.000 | Bosnia&Herzegovina10 | 1.000 |

| Bosnia&Herzegovina11 | 1.000 | Bosnia&Herzegovina11 | 1.000 | Bosnia&Herzegovina11 | 1.000 | Bosnia&Herzegovina11 | 1.000 | Bosnia&Herzegovina11 | 0.947 |

| Bosnia&Herzegovina12 | 1.000 | Bosnia&Herzegovina12 | 1.000 | Bosnia&Herzegovina12 | 1.000 | Bosnia&Herzegovina12 | 1.000 | Bosnia&Herzegovina12 | 1.000 |

| Bosnia&Herzegovina13 | 1.000 | Bosnia&Herzegovina13 | 1.000 | Bosnia&Herzegovina13 | 1.000 | Bosnia&Herzegovina13 | 1.000 | Bosnia&Herzegovina13 | 1.000 |

| Bosnia&Herzegovina14 | 1.000 | Bosnia&Herzegovina14 | 1.000 | Bosnia&Herzegovina14 | 1.000 | Bosnia&Herzegovina14 | 1.000 | Bosnia&Herzegovina14 | 1.000 |

| Bosnia&Herzegovina15 | 1.000 | Bosnia&Herzegovina15 | 1.000 | Bosnia&Herzegovina15 | 1.000 | Bosnia&Herzegovina15 | 1.000 | Bosnia&Herzegovina15 | 1.000 |

| Bosnia&Herzegovina16 | 1.000 | Bosnia&Herzegovina16 | 1.000 | Bosnia&Herzegovina16 | 1.000 | Bosnia&Herzegovina16 | 1.000 | Bosnia&Herzegovina16 | 0.992 |

| Average | 0.976 | 0.976 | 0.993 | 0.990 | 0.975 | ||||

| North Macedonia1 | 1.000 | North Macedonia1 | 1.000 | North Macedonia1 | 1.000 | North Macedonia1 | 1.000 | North Macedonia1 | 1.000 |

| North Macedonia2 | 0.795 | North Macedonia2 | 0.996 | North Macedonia2 | 0.977 | North Macedonia2 | 1.000 | North Macedonia2 | 1.000 |

| North Macedonia3 | 0.987 | North Macedonia3 | 0.764 | North Macedonia3 | 0.922 | North Macedonia3 | 1.000 | North Macedonia3 | 0.913 |

| North Macedonia4 | 1.000 | North Macedonia4 | 1.000 | North Macedonia4 | 1.000 | North Macedonia4 | 1.000 | North Macedonia4 | 1.000 |

| North Macedonia5 | 1.000 | North Macedonia5 | 1.000 | North Macedonia5 | 1.000 | North Macedonia5 | 0.999 | North Macedonia5 | 0.956 |

| North Macedonia6 | 1.000 | North Macedonia6 | 1.000 | North Macedonia6 | 1.000 | North Macedonia6 | 1.000 | North Macedonia6 | 1.000 |

| North Macedonia7 | 1.000 | North Macedonia7 | 1.000 | North Macedonia7 | 1.000 | North Macedonia7 | 1.000 | North Macedonia7 | 1.000 |

| North Macedonia8 | 1.000 | North Macedonia8 | 1.000 | North Macedonia8 | 1.000 | North Macedonia8 | 1.000 | North Macedonia8 | 1.000 |

| North Macedonia9 | 0.506 | North Macedonia9 | 0.630 | North Macedonia9 | 0.784 | North Macedonia9 | 0.839 | North Macedonia9 | 0.889 |

| North Macedonia10 | 0.662 | North Macedonia10 | 0.675 | North Macedonia10 | 0.750 | North Macedonia10 | 0.820 | North Macedonia10 | 0.675 |

| North Macedonia11 | 1.000 | North Macedonia11 | 1.000 | North Macedonia11 | 1.000 | North Macedonia11 | 1.000 | North Macedonia11 | 1.000 |

| North Macedonia12 | 0.806 | North Macedonia12 | 0.843 | North Macedonia12 | 0.870 | North Macedonia12 | 0.865 | North Macedonia13 | 1.000 |

| North Macedonia13 | 1.000 | North Macedonia13 | 1.000 | North Macedonia13 | 1.000 | North Macedonia13 | 1.000 | ||

| Average | 0.904 | 0.916 | 0.946 | 0.963 | 0.953 | ||||

| Montenegro1 | 1.000 | Montenegro1 | 1.000 | Montenegro1 | 1.000 | Montenegro1 | 1.000 | Montenegro1 | 1.000 |

| Montenegro2 | 1.000 | Montenegro2 | 1.000 | Montenegro2 | 1.000 | Montenegro2 | 1.000 | Montenegro2 | 1.000 |

| Montenegro3 | 0.957 | Montenegro3 | 0.841 | Montenegro3 | 0.980 | Montenegro3 | 1.000 | Montenegro3 | 1.000 |

| Montenegro4 | 1.000 | Montenegro4 | 0.950 | Montenegro4 | 1.000 | Montenegro4 | 1.000 | Montenegro4 | 1.000 |

| Montenegro5 | 1.000 | Montenegro5 | 1.000 | Montenegro5 | 1.000 | Montenegro5 | 0.998 | Montenegro5 | 1.000 |

| Montenegro6 | 1.000 | Montenegro6 | 0.940 | Montenegro6 | 1.000 | Montenegro6 | 0.996 | Montenegro6 | 1.000 |

| Montenegro7 | 1.000 | Montenegro7 | 1.000 | Montenegro7 | 1.000 | Montenegro7 | 1.000 | Montenegro7 | 1.000 |

| Montenegro8 | 1.000 | Montenegro8 | 1.000 | Montenegro8 | 1.000 | Montenegro8 | 1.000 | Montenegro8 | 1.000 |

| Montenegro9 | 1.000 | Montenegro9 | 1.000 | Montenegro9 | 1.000 | Montenegro9 | 1.000 | Montenegro9 | 1.000 |

| Montenegro10 | 1.000 | Montenegro10 | 1.000 | Montenegro10 | 1.000 | Montenegro10 | 0.838 | Montenegro10 | 1.000 |

| Montenegro11 | 1.000 | Montenegro11 | 1.000 | Montenegro11 | 1.000 | Montenegro11 | 1.000 | Montenegro11 | 1.000 |

| Montenegro12 | 1.000 | Montenegro12 | 1.000 | Montenegro12 | 1.000 | Montenegro12 | 1.000 | ||

| Average | 0.996 | 0.978 | 0.998 | 0.986 | 1.000 | ||||

| Serbia1 | 1.000 | Serbia1 | 0.920 | Serbia1 | 1.000 | Serbia1 | 1.000 | Serbia1 | 1.000 |

| Serbia2 | 1.000 | Serbia2 | 0.802 | Serbia2 | 1.000 | Serbia2 | 1.000 | Serbia2 | 0.972 |

| Serbia3 | 1.000 | Serbia3 | 1.000 | Serbia3 | 1.000 | Serbia3 | 1.000 | Serbia3 | 0.967 |

| Serbia4 | 1.000 | Serbia4 | 1.000 | Serbia4 | 1.000 | Serbia4 | 1.000 | Serbia4 | 1.000 |

| Serbia6 | 1.000 | Serbia5 | 0.000 | Serbia5 | 1.000 | Serbia5 | 1.000 | Serbia5 | 1.000 |

| Serbia7 | 0.941 | Serbia6 | 0.809 | Serbia6 | 1.000 | Serbia6 | 1.000 | Serbia6 | 0.840 |

| Serbia8 | 1.000 | Serbia7 | 0.961 | Serbia7 | 1.000 | Serbia7 | 1.000 | Serbia7 | 1.000 |

| Serbia9 | 1.000 | Serbia8 | 1.000 | Serbia8 | 1.000 | Serbia8 | 0.911 | Serbia8 | 0.912 |

| Serbia10 | 1.000 | Serbia9 | 1.000 | Serbia9 | 1.000 | Serbia9 | 1.000 | Serbia9 | 1.000 |

| Serbia11 | 0.759 | Serbia10 | 1.000 | Serbia10 | 1.000 | Serbia10 | 1.000 | Serbia10 | 1.000 |

| Serbia12 | 0.939 | Serbia11 | 0.807 | Serbia11 | 0.939 | Serbia11 | 0.978 | Serbia11 | 0.845 |

| Serbia13 | 0.985 | Serbia12 | 0.766 | Serbia12 | 0.951 | Serbia12 | 0.919 | Serbia12 | 0.887 |

| Serbia14 | 1.000 | Serbia13 | 1.000 | Serbia13 | 1.000 | Serbia13 | 0.981 | Serbia13 | 0.865 |

| Serbia15 | 1.000 | Serbia14 | 1.000 | Serbia14 | 1.000 | Serbia14 | 1.000 | Serbia14 | 0.987 |

| Serbia16 | 1.000 | Serbia15 | 0.973 | Serbia15 | 0.900 | Serbia15 | 1.000 | Serbia15 | 1.000 |

| Serbia17 | 0.989 | Serbia16 | 1.000 | Serbia16 | 1.000 | Serbia16 | 1.000 | Serbia16 | 0.931 |

| Serbia18 | 1.000 | Serbia17 | 0.796 | Serbia17 | 0.923 | Serbia17 | 0.926 | Serbia17 | 1.000 |

| Serbia19 | 0.979 | Serbia18 | 1.000 | Serbia18 | 1.000 | Serbia18 | 1.000 | Serbia18 | 1.000 |

| Serbia20 | 0.997 | Serbia19 | 0.662 | Serbia19 | 1.000 | Serbia19 | 1.000 | Serbia19 | 1.000 |

| Serbia21 | 0.967 | Serbia20 | 0.911 | Serbia20 | 1.000 | Serbia20 | 1.000 | Serbia20 | 1.000 |

| Serbia22 | 0.957 | Serbia21 | 0.949 | Serbia21 | 0.820 | Serbia21 | 0.837 | Serbia21 | 0.866 |

| Serbia23 | 1.000 | Serbia22 | 0.829 | Serbia22 | 0.921 | Serbia22 | 0.940 | Serbia22 | 0.975 |

| Serbia24 | 1.000 | Serbia23 | 1.000 | Serbia23 | 1.000 | Serbia23 | 1.000 | Serbia23 | 1.000 |

| Serbia25 | 1.000 | Serbia24 | 0.579 | Serbia24 | 1.000 | Serbia24 | 1.000 | Serbia24 | 0.874 |

| Serbia26 | 0.967 | Serbia25 | 1.000 | Serbia25 | 1.000 | Serbia25 | 1.000 | Serbia25 | 1.000 |

| Serbia26 | 1.000 | Serbia26 | 1.000 | Serbia26 | 1.000 | Serbia26 | 0.879 | ||

| Average | 0.979 | 0.876 | 0.979 | 0.980 | 0.954 | ||||

References

- López-Penabad, M.C.; Iglesias-Casal, A.; Neto, J.F.S. Effects of a negative interest rate policy in bank profitability and risk taking: Evidence from European banks. Res. Int. Bus. Financ. 2021, 60, 101597. [Google Scholar] [CrossRef]

- Kashyap, A.K.; Rajan, R.; Stein, J.C. Banks as Liquidity Providers: An Explanation for the Coexistence of Lending and Deposit-taking. J. Financ. 2002, 57, 33–73. [Google Scholar] [CrossRef] [Green Version]

- ASá, A.I.; Jorge, J. Does the deposits channel work under a low interest rate environment? Econ. Lett. 2019, 185, 108736. [Google Scholar] [CrossRef]

- Junttila, J.; Perttunen, J.; Raatikainen, J. Keep the faith in banking: New evidence for the effects of negative interest rates based on the case of Finnish cooperative banks. Int. Rev. Financ. Anal. 2021, 75, 101724. [Google Scholar] [CrossRef]

- Boungou, W.; Hubert, P. The channels of banks’ response to negative interest rates. J. Econ. Dyn. Control. 2021, 131, 104228. [Google Scholar] [CrossRef]

- Charnes, A.; Cooper, W.; Rhodes, E. Measuring the Efficiency of Decision Making Units. 1978. Available online: https://www.sciencedirect.com/science/article/pii/0377221778901388 (accessed on 30 June 2021).

- Seiford, L.M. A DEA Bibliography (1978–1992). In Data Envelopment Analysis: Theory, Methodology, and Applications; Springer: Dordrecht, The Netherlands, 1994; pp. 437–469. [Google Scholar] [CrossRef]

- Emrouznejad, A.; Yang, G.L. A survey and analysis of the first 40 years of scholarly literature in DEA: 1978–2016. Socio-Econ. Plan. Sci. 2018, 61, 4–8. [Google Scholar] [CrossRef]

- Ahn, H.; Afsharian, M.; Emrouznejad, A.; Banker, R. Recent developments on the use of DEA in the public sector. Socio-Econ. Plan. Sci. 2018, 61, 1–3. [Google Scholar] [CrossRef] [Green Version]

- Nourani, M.; Malim, N.A.K.; Mia, A. Revisiting efficiency of microfinance institutions (MFIs): An application of network data envelopment analysis. Econ. Res. -Ekon. Istraživanja 2021, 34, 1146–1169. [Google Scholar] [CrossRef]

- Jurčević, B.; Žaja, M.M. Banks and insurance companies efficiency indicators in the period of financial crisis: The case of the Republic of Croatia. Econ. Res. -Ekon. Istraživanja 2013, 26, 203–224. [Google Scholar] [CrossRef] [Green Version]

- Lo, S.F.; Lu, W.M. Does Size Matter? Finding the Profitability and Marketability Benchmark of Financial Holding Companies. Asia-Pac. J. Oper. Res. 2006, 23, 229–246. [Google Scholar] [CrossRef]

- Paradi, J.C.; Sherman, H.D.; Tam, F.K. Data Envelopment Analysis in the Financial Services Industry; Springer: Berlin/Heidelberg, Germany, 2018; Volume 266, Available online: http://link.springer.com/10.1007/978-3-319-69725-3 (accessed on 21 September 2021).

- Berger, A.N.; Humphrey, D.B. Efficiency of financial institutions: International survey and directions for future research. Eur. J. Oper. Res. 1997, 98, 175–212. [Google Scholar] [CrossRef] [Green Version]

- Kočišová, K. Two-Stage DEA: An Application in Banking. In Scientific and Technical Revolution: Yesterday, Today and Tomorrow; Springer: Dordrecht, The Netherlands, 2020; Volume 129, pp. 1483–1517. [Google Scholar] [CrossRef]

- Cvetkoska, V.; Savić, G. Efficiency of bank branches: Empirical evidence from a two-phase research approach. Econ. Res. -Ekon. Istraživanja 2017, 30, 318–333. [Google Scholar] [CrossRef] [Green Version]

- Golany, B.; Storbeck, J.E. A data envelopment analysis of the operational efficiency of bank branches. Interfaces 1999, 29, 14–26. [Google Scholar] [CrossRef]

- Svitalkova, Z. Comparison and Evaluation of Bank Efficiency in Selected Countries in EU. Procedia Econ. Financ. 2014, 12, 644–653. [Google Scholar] [CrossRef] [Green Version]

- Boďa, M.; Zimková, E. Efficiency in the slovak banking industry: A comparison of three approaches. Prague Econ. Pap. 2015, 24, 434–451. [Google Scholar] [CrossRef] [Green Version]

- Berger, A.N.; Humphrey, D.B. Measurement and Efficiency Issues in Commercial Banking. In Output Measurement in the Service Sectors; University of Chicago Press: Chicago, IL, USA, 1992; pp. 245–300. [Google Scholar]

- Jemric, I.; Vujcic, B. Efficiency of Banks in Croatia: A DEA Approach. Comp. Econ. Stud. 2002, 44, 169–193. [Google Scholar] [CrossRef]

- Jansen, E.S.; Berg, S.A.; Førsund, F.R. Technical efficiency of Norwegian banks: The non-parametric approach to efficiency measurement. J. Prod. Anal. 1991, 2, 127–142. [Google Scholar] [CrossRef]

- Chen, Y.; Cook, W.D.; Li, N.; Zhu, J. Additive efficiency decomposition in two-stage DEA. Eur. J. Oper. Res. 2009, 196, 1170–1176. [Google Scholar] [CrossRef]

- Chen, Y.; Liang, L.; Zhu, J. Equivalence in two-stage DEA approaches. Eur. J. Oper. Res. 2009, 193, 600–604. [Google Scholar] [CrossRef]

- Maghbouli, M.; Amirteimoori, A.; Kordrostami, S. Two-stage network structures with undesirable outputs: A DEA based approach. Meas. J. Int. Meas. Confed. 2014, 48, 109–118. [Google Scholar] [CrossRef]

- Henriques, I.C.; Sobreiro, V.A.; Kimura, H.; Mariano, E.B. Two-stage DEA in banks: Terminological controversies and future directions. Expert Syst. Appl. 2020, 161, 113632. [Google Scholar] [CrossRef]

- Simar, L.; Wilson, P.W. Two-stage DEA: Caveat emptor. J. Prod. Anal. 2011, 36, 205–218. [Google Scholar] [CrossRef]

- Paleckova, I. Cost efficiency measurement using two-stage data envelopment analysis in the Czech and Slovak banking sectors. Acta Oeconomica 2019, 69, 445–466. [Google Scholar] [CrossRef]

- Dar, Q.F.; Ahn, Y.-H.; Dar, G.F. The Impact of International Trade on Central Bank Efficiency: An Application of DEA and Tobit Regression Analysis. Stat. Optim. Inf. Comput. 2021, 9, 223–240. [Google Scholar] [CrossRef]

- Jackson, P.M.; Fethi, M.D. Evaluating the Technical Efficiency of Turkish Commercial Banks: An Application of DEA and Tobit Analysis. University of Leicester, Janaury 2000. Available online: /articles/report/Evaluating_the_efficiency_of_Turkish_commercial_banks_an_application_of_DEA_and_Tobit_Analysis/10077092/1 (accessed on 15 June 2021).

- Sufian, F. Assessing the impact of financial sector restructuring on bank performance in a small developing economy. Econ. Res. -Ekon. Istraživanja 2010, 23, 11–33. [Google Scholar] [CrossRef] [Green Version]

- Luo, X. Evaluating the profitability and marketability efficiency of large banks: An application of data envelopment analysis. J. Bus. Res. 2003, 56, 627–635. [Google Scholar] [CrossRef]

- Liu, W.; Zhou, Z.; Ma, C.; Liu, D.; Shen, W. Two-stage DEA models with undesirable input-intermediate-outputs. Omega 2015, 56, 74–87. [Google Scholar] [CrossRef]

- Seiford, L.M.; Zhu, J. Profitability and marketability of the top 55 U.S. commercial banks. Manag. Sci. 1999, 45, 1270–1288. [Google Scholar] [CrossRef] [Green Version]

- Wanke, P.; Barros, C. Two-stage DEA: An application to major Brazilian banks. Expert Syst. Appl. 2014, 41, 2337–2344. [Google Scholar] [CrossRef]

- Wang, K.; Huang, W.; Wu, J.; Liu, Y.-N. Efficiency measures of the Chinese commercial banking system using an additive two-stage DEA. Omega 2014, 44, 5–20. [Google Scholar] [CrossRef]

- Barth, W.; Staat, M. Environmental variables and relative efficiency of bank branches: A DEA-bootstrap approach. Int. J. Bus. Perform. Manag. 2005, 7, 228–240. [Google Scholar] [CrossRef]

- Wu, D.; Yang, Z.; Liang, L. Using DEA-neural network approach to evaluate branch efficiency of a large Canadian bank. Expert Syst. Appl. 2006, 31, 108–115. [Google Scholar] [CrossRef]

- Horvat, A.M.; Budimcevic, K. Efficiency Analysis of Airlines using DEA model. In 3rd International Thematic Monograph—Thematic Proceedings, Modern Management Tools and Economy of Tourism Sector in Present Era; Udruženje Ekonomista i Menadžera Balkana: Beograd, Serbia, 2018; pp. 221–230. [Google Scholar]

- Radovanov, B.; Dudic, B.; Gregus, M.; Horvat, A.M.; Karovic, V. Using a two-stage DEA model to measure tourism potentials of EU countries and Western Balkan countries: An approach to sustainable development. Sustainability 2020, 12, 4903. [Google Scholar] [CrossRef]

- Kao, C. Network data envelopment analysis: A review. Eur. J. Oper. Res. 2014, 239, 1–16. [Google Scholar] [CrossRef]

- Golany, B.; Roll, Y. An application procedure for DEA. Omega 1989, 17, 237–250. [Google Scholar] [CrossRef]

- Beasley, J.E. OR-Notes. 1996. Available online: http://people.brunel.ac.uk/~mastjjb/jeb/or/dea.html (accessed on 18 October 2021).

- Banker, R.D.; Charnes, A.; Cooper, W.W. Some Models for Estimating Technical and Scale Inefficiencies in Data Envelopment Analysis. Manag. Sci. 1984, 30, 1078–1092. [Google Scholar] [CrossRef] [Green Version]

- Kočišová, K. Application of the DEA on the measurement of efficiency in the EU countries. Agric. Econ. 2016, 61, 51–62. [Google Scholar] [CrossRef] [Green Version]

- Zimková, E. Technical Efficiency and Super-efficiency of the Banking Sector in Slovakia. Procedia Econ. Financ. 2014, 12, 780–787. [Google Scholar] [CrossRef] [Green Version]

- Barros, C.P.; Chen, Z.; Bin Liang, Q.; Peypoch, N. Technical efficiency in the Chinese banking sector. Econ. Model. 2011, 28, 2083–2089. [Google Scholar] [CrossRef]

- Řepková, I. Efficiency of the Czech Banking Sector Employing the DEA Window Analysis Approach. Procedia Econ. Financ. 2014, 12, 587–596. [Google Scholar] [CrossRef] [Green Version]

- Qiu, L.; Chen, Z.-Y.; Lu, D.-Y.; Hu, H.; Wang, Y.-T. Public funding and private investment for R&D: A survey in China’s pharmaceutical industry. Health Res. Policy Syst. 2014, 12, 27. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Chen, X.; Skully, M.; Brown, K. Banking efficiency in China: Application of DEA to pre- and post-deregulation eras: 1993-2000. China Econ. Rev. 2005, 16, 229–245. [Google Scholar] [CrossRef]

- Sufian, F. Benchmarking the efficiency of the Korean banking sector: A DEA approach. Benchmarking Int. J. 2011, 18, 107–127. [Google Scholar] [CrossRef]

- Holod, D.; Lewis, H.F. Resolving the deposit dilemma: A new DEA bank efficiency model. J. Bank. Financ. 2011, 35, 2801–2810. [Google Scholar] [CrossRef]

- Yannick, G.Z.S.; Hongzhong, Z.; Thierry, B. Technical Efficiency Assessment Using Data Envelopment Analysis: An Application to the Banking Sector of Côte D’Ivoire. Procedia—Soc. Behav. Sci. 2016, 235, 198–207. [Google Scholar] [CrossRef]

- Asmild, M.; Matthews, K. Multi-directional efficiency analysis of efficiency patterns in Chinese banks 1997-2008. Eur. J. Oper. Res. 2012, 219, 434–441. [Google Scholar] [CrossRef]

- McDonald, J. Using least squares and tobit in second stage DEA efficiency analyses. Eur. J. Oper. Res. 2009, 197, 792–798. [Google Scholar] [CrossRef]

- Greene, W.H. Econometric Analysis, 5th ed.; Prentice Hall: Hoboken, NJ, USA, 2003. [Google Scholar]

- Berger, A.N.; Mester, L.J. Inside the black box: What explains differences in the efficiencies of financial institutions? J. Bank. Financ. 1997, 21, 895–947. [Google Scholar] [CrossRef] [Green Version]

- Akhigbe, A.; McNulty, J.E. The profit efficiency of small US commercial banks. J. Bank. Financ. 2003, 27, 307–325. [Google Scholar] [CrossRef]

- Cyree, K.B.; Spurlin, W.P. The effects of big-bank presence on the profit efficiency of small banks in rural markets. J. Bank. Financ. 2012, 36, 2593–2603. [Google Scholar] [CrossRef]

- Delis, M.D.; Papanikolaou, N.I. Determinants of bank efficiency: Evidence from a semi-parametric methodology. Manag. Financ. 2009, 35, 260–275. [Google Scholar] [CrossRef] [Green Version]

- Karray, S.C.; eddine Chichti, J. Bank Size and Efficiency in Developing Countries: Intermediation Approach versus Value Added Approach and Impact of Non-Traditional Activities. Asian Econ. Financ. Rev. 2013, 3, 593–613. Available online: https://archive.aessweb.com/index.php/5002/article/view/1034 (accessed on 3 January 2022).

- Yin, H.; Yang, J.; Lu, X. Bank globalization and efficiency: Host- and home-country effects. Res. Int. Bus. Financ. 2020, 54, 101305. [Google Scholar] [CrossRef] [PubMed]

- Radić, N.; Fiordelisi, F.; Girardone, C. Efficiency and Risk-Taking in Pre-Crisis Investment Banks. J. Financ. Serv. Res. 2011, 41, 81–101. [Google Scholar] [CrossRef] [Green Version]

- Cuesta, R.A.; Orea, L. Mergers and technical efficiency in Spanish savings banks: A stochastic distance function approach. J. Bank. Financ. 2002, 26, 2231–2247. [Google Scholar] [CrossRef]

- Hernando, I.; Nieto, M.J.; Wall, L.D. Determinants of domestic and cross-border bank acquisitions in the European Union. J. Bank. Financ. 2009, 33, 1022–1032. [Google Scholar] [CrossRef] [Green Version]

- Hannan, T.H.; Pilloff, S.J. Acquisition Targets and Motives in the Banking Industry. J. Money Crédit Bank. 2009, 41, 1167–1187. [Google Scholar] [CrossRef]

- Correa, R. Cross-border bank acquisitions: Is there a performance effect? J. Financ. Serv. Res. 2008, 36, 169–197. [Google Scholar] [CrossRef]

- Feng, G.; Serletis, A. Efficiency, technical change, and returns to scale in large US banks: Panel data evidence from an output distance function satisfying theoretical regularity. J. Bank. Financ. 2010, 34, 127–138. [Google Scholar] [CrossRef] [Green Version]

- Drake, L.; Hall, M.J. Efficiency in Japanese banking: An empirical analysis. J. Bank. Financ. 2003, 27, 891–917. [Google Scholar] [CrossRef]

- Hughes, J.P.; Mester, L.J. Who said large banks don’t experience scale economies? Evidence from a risk-return-driven cost function. J. Financ. Intermediation 2013, 22, 559–585. [Google Scholar] [CrossRef] [Green Version]

| Country | Year | Deposits | Labor Costs | Capital | Loans | Investment | |

|---|---|---|---|---|---|---|---|

| Albania | 2019 | Average | 1.08 × 108 | 1,260,177 | 14,052,888.83 | 69,770,631 | 27,533,640 |

| St. dev. | 98,441,986 | 1,367,652 | 12,227,157.55 | 68,412,564 | 24,782,725 | ||

| 2015 | Average | 90,092,952 | 890,502.4 | 34,625,635.50 | 54,687,811 | 20,539,133 | |

| St. dev. | 95,523,979 | 748,557.5 | 84,589,667.66 | 60,200,729 | 19,404,261 | ||

| Bosnia and Herzegovina | 2019 | Average | 1,264,682 | 16,146.25 | 206,289.06 | 931,199.1 | 82,138.75 |

| St. dev. | 1,476,473 | 14,725.44 | 217,606.27 | 991,735.6 | 138,146.8 | ||

| 2015 | Average | 844,810.6 | 14,823.13 | 167,476.38 | 670,763.8 | 43,664.31 | |

| St. dev. | 1,004,589 | 14,321.3 | 192,804.82 | 757,179 | 104,953 | ||

| North Macedonia | 2019 | Average | 31,791,816 | 373,602.6 | 5,325,674.33 | 24,664,780 | 4,724,654 |

| St. dev. | 36,356,007 | 345,829.9 | 5,871,199.43 | 24,311,119 | 6,290,253 | ||

| 2015 | Average | 22,553,986 | 318,252.5 | 3,798,362.62 | 19,155,675 | 3,125,367 | |

| St.dev. | 27,985,116 | 278,834.2 | 4,586,664.36 | 20,811,576 | 4,252,715 | ||

| Montenegro | 2019 | Average | 333,511.9 | 5891.5 | 57,535.92 | 264,095.5 | 43,547.08 |

| St.dev. | 229,104.9 | 5145.2 | 58,546.66 | 219,775.4 | 44,111.54 | ||

| 2015 | Average | 253,910.1 | 5159.09 | 47,611.64 | 207,445.7 | 22,525.91 | |

| St.dev. | 198,184.7 | 3544.74 | 45,594.37 | 162,602.5 | 27,174.42 | ||

| Serbia | 2019 | Average | 1.25 × 108 | 1,722,804 | 27,143,917.38 | 1 × 108 | 1.03 × 108 |

| St.dev. | 1.35 × 108 | 1,578,428 | 28,744,289.01 | 1.04 × 108 | 1.1 × 108 | ||

| 2015 | Average | 84,285,343 | 1,445,207 | 22,853,852.48 | 46,058,771 | 22,386,434 | |

| St.dev. | 1 × 108 | 1,357,364 | 28,173,476.05 | 57,787,377 | 33,011,840 |

| Variable | Coefficient | z-Statistic |

|---|---|---|

| Constant | 0.95968 *** | 140.689 |

| Commercial or investment bank | −0.00319 * | −1.74597 |

| Merger and acquisition | −0.01525 ** | −2.39716 |

| Bank size | 0.03267 *** | 2.77225 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Milenković, N.; Radovanov, B.; Kalaš, B.; Horvat, A.M. External Two Stage DEA Analysis of Bank Efficiency in West Balkan Countries. Sustainability 2022, 14, 978. https://doi.org/10.3390/su14020978

Milenković N, Radovanov B, Kalaš B, Horvat AM. External Two Stage DEA Analysis of Bank Efficiency in West Balkan Countries. Sustainability. 2022; 14(2):978. https://doi.org/10.3390/su14020978

Chicago/Turabian StyleMilenković, Nada, Boris Radovanov, Branimir Kalaš, and Aleksandra Marcikić Horvat. 2022. "External Two Stage DEA Analysis of Bank Efficiency in West Balkan Countries" Sustainability 14, no. 2: 978. https://doi.org/10.3390/su14020978