Macroeconomic Determinants of Credit Risk: Evidence on the Impact on Consumer Credit in Central and Eastern European Countries

Abstract

:1. Introduction

- (i)

- to develop the classifications of factors influencing the banking credit risk and the classification of macroeconomic factors influencing banking credit risk, considering the fact that there is no single approach to classifications of factors influencing the credit risk in theoretical studies and empirical research;

- (ii)

- to select macroeconomic factors having an impact on the credit risk in each group, having identified the groups of the factors influencing the banking credit risk (FIBCR); and

- (iii)

- to develop the assessment models.

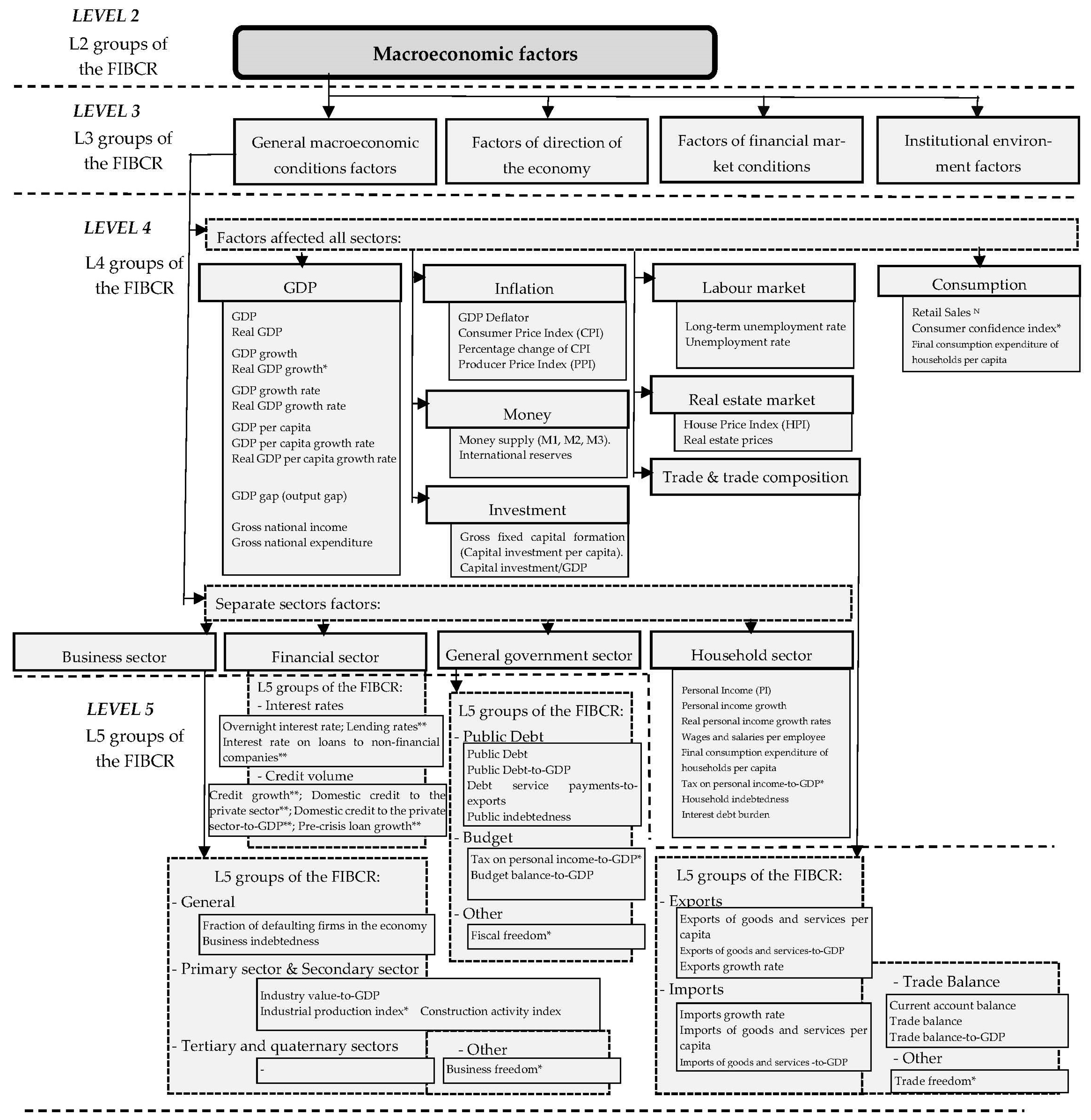

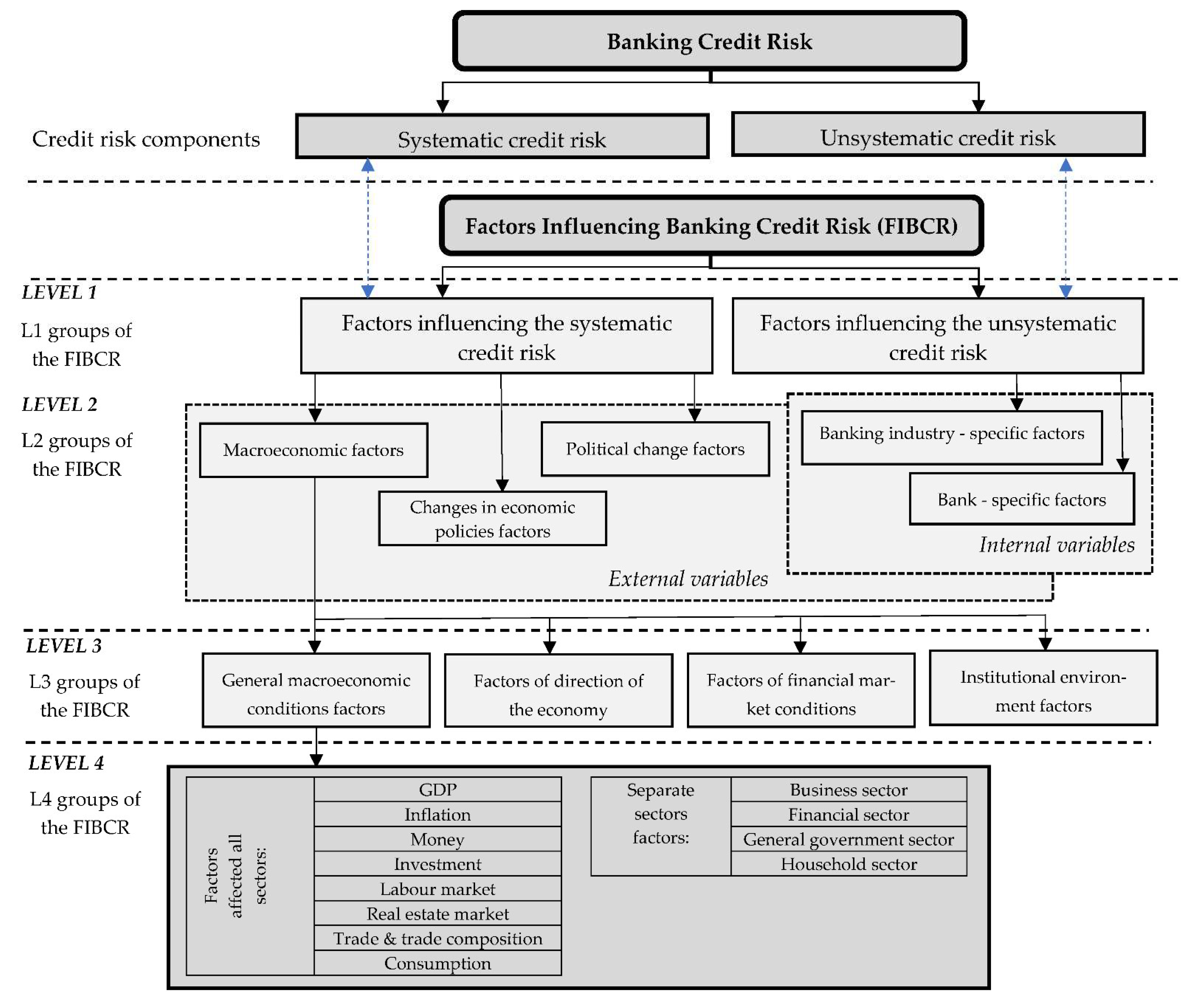

2. Classifications of Factors Influencing Banking Credit Risk

- (a)

- According to Castro [3], Mpofu, and Nikolaidou [20], the factors influencing systematic credit risk are divided into three groups (L2 groups in our classification): (i) macroeconomic factors (e.g., growth in GDP, employment rate, stock index, inflation rate, exchange rate movements), (ii) changes in economic policies factors, and (iii) political change factors.

- (b)

- (1)

- The study by Liao and Chang [22] combines economic and financial variables into the following explanatory factors: (i) the real economy, (ii) inflation, and (iii) housing.

- (2)

- (3)

- Feldkircher [36] divides macroeconomic determinants into six groups: (i) GDP and investment, (ii) money and inflation, (iii) monetary regime, (iv) trade and trade composition, (v) business environment and labour market, (vi) institutional quality.

- (4)

- After the literary analysis of the country’s credit risk economic determinants, Maltritz and Molchanov [10] state that variables describing the country’s macroeconomic conditions can be divided into the following groups: (i) general economic indicators, (ii) external relations indicators and (iii) variables that describe a country’s debt situation.

3. Research Hypotheses

3.1. The Dependent Variables

3.2. The Independent Variables and Development of Hypotheses

3.2.1. GDP Variables

- (1)

- The results of correlation analysis indicate the following conclusion. Gila-Gourgoura and Nikolaidou [2] (as cited by Makri et al. [44]) declare strong correlations between NPLs and GDP. Meanwhile, Mpofu and Nikolaidou [20] (as cited by Ombaba; Viswanadham and Nahid) go into more detail: a negative correlation is stated between NPLs and GDP.

- (2)

- Researchers document a significant impact of GDP variables on credit risk. For example, Nikolaidou and Vogiazas [31], according to Castro [3], state a significant impact of GDP growth on banks’ credit risk. Karoglou, Mouratidis, and Vogiazas [43] cite Hoggarth et al. and point out that “real GDP has a significant impact on loan portfolio quality” (the case of the UK).

- (3)

- (4)

- Researchers document a significant negative influence of GDP variables on credit risk. Mpofu and Nikolaidou [20], based on the studies [8,15,21,37], point out that real GDP growth rate has a significant negative relationship with NPLs. The empirical findings show that GDP variables (GDP per capita growth rate [11], GDP growth rate [17], and real GDP growth rate [20]) have a negative and significant relationship with NPLs.

- (5)

- However, Haniifah’s [38] findings show that GDP growth is insignificant in influencing NPLs (the case of Uganda, 2000–2013).

3.2.2. Inflation Variables

3.2.3. Money Variables

3.2.4. Investment Variables

3.2.5. Labour Market Variables

3.2.6. Real Estate Market Variables

3.2.7. Trade and Trade Composition Variables

3.2.8. Consumption Variables

3.2.9. Business Sector Variables

3.2.10. Financial Sector Variables

- (1)

- the overnight interest rate. For example, Harada and Kageyama [41] use this variable to investigate the macro aspects of bankruptcies in Japan over the period of 1975–2005.

- (2)

- short-term interest rate. For instance, when investigating the country’s credit risk, Maltritz and Molchanov [10] use the one-year US interest rate to describe the short-term US interest rate. By analysing credit risk determinants in the Romanian and Bulgarian banking systems, Karoglou, Mouratidis, and Vogiazas [43] approximate the monetary policy shock by the changes in the short-term interest rate.

- (3)

- long-term interest rate. For example, it is used to assess firms’ default probability in the Eurozone (over the period of 2007–2017). Carvalho, Curto, and Primor [42] use the 10-year treasury bond yield as a macroeconomic determinant. The long-term interest rate is used by Castro [3] to analyse the banking credit risk in the GIPSI (Greece, Ireland, Portugal, Spain, and Italy) countries (1997–2011).

- (4)

- the real interest rate. For instance, it is employed to detect the determinants of the NPLs for a sample of 85 banks in Italy, Greece, and Spain (2004–2008); Messai and Jouini [45] include this interest rate in their study. To examine determinants of the NPLs for all commercial banks and savings institutions in the US states (1984–2013), Ghosh [31] employs this interest rate as well. The long-term interest rate and real interest rate are used by Castro [3] to analyse the banking credit risk in the GIPSI countries (1997–2011).

- (5)

- several variables or other variables are used. For example, Umar and Sun [41] use the “effective interest rate”. Carvalho, Curto, and Primor [42] use the “interest rate on loans to non-financial companies (annual average)”. Castro [3] employs the “long-term interest rate”, the “real interest rate” and the “spread between the long and short-term interest rate”. Gila-Gourgoura and Nikolaidou [2] include three interest rates, i.e., “interest rate on loans granted to households”, “interest rate on loans granted to non-financial companies”, and “interest rate on deposits”. Aver [70] uses thirteen interest rates, five of which are statistically significant.

- (6)

3.2.11. General Government Sector Variables

3.2.12. Households Sector Variables

- (a)

- Personal Income. After combining various economic and financial variables and establishing three explanatory factors, i.e., the real economy, inflation, and housing, Liao and Chang [22] conclude that the real economic factor has a significant negative effect on the default risk, while the personal income, a variable that is part of the real economic factor, is significantly positive.

- (b)

- Personal income growth. For example, Liao and Chang [22] distinguish this indicator in the theoretical background for empirical analysis. The authors claim that studies (e.g., Duffie et al. [75]) propose that corporate default and bankruptcy can be better understood by using macroeconomic indicators, one of which is personal income growth.

- (c)

- Real personal income growth rate is also distinguished in the theoretical background for empirical analysis (e.g., [30,31,41,60]). With regard to regional economic factors, in empirical research, Ghosh [30] finds that a higher real personal income growth rate reduces the NPLs; i.e., this variable has a negative impact on the NPLs.

- (d)

- Some researchers do not use personal income but only part of the income, i.e., wages and salaries. More precisely, Kjosevski, Petkovski, and Naumovska [51] reveal that the net increase in salaries has a negative impact on the growth of NPLs. In this research, it is suggested to use wages and salaries per employee, as it seems to be a more informative indicator.

- (e)

- Final consumption expenditure of households per capita [4]. This indicator is not widely used. It might be because of its calculation since, as the World Bank states, “many of the estimates are based on household surveys, which tend to be one-year studies with limited coverage”.

- (f)

- Tax on personal income and the tax on personal-income-to-GDP. Tax on personal income is distinguished in the theoretical background for empirical analysis by Gila-Gourgoura and Nikolaidou [2]. However, they do not use it in their empirical research. This factor (measured by the tax on personal-income-to-GDP ratio) is empirically tested by Dimitrios, Helen, and Mike [29]. The researchers highlight the importance of their study as it is the first empirical study to examine the role of a tax on personal income. Dimitrios, Helen, and Mike [29] reveal that the tax on personal-income-to-GDP has a significant and positive influence on the NPLs; i.e., as the tax on personal income increases, disposable income and the ability to repay loans decrease.

- (g)

- As stated in Section 3.2.9, after the analysis of the macroeconomic determinants of banking sector distresses, Pesola [68] reveals that high customer indebtedness contributed to the distress in the banking sector. However, in Pesola’s [68] study, the private „indebtedness indicator covers both the corporate and household sectors”. Castro [3] describes “private indebtedness” in a similar manner. Moreover, this researcher finds that private indebtedness has a significantly positive impact on NPLs. On the other hand, if we want to show the separate impact of the business sector and household sector, the indebtedness indicator has to be decomposed into two components: business indebtedness and household indebtedness, which we suggest measuring by the household-loans-to-GDP ratio. It is expected that the impact of household indebtedness on the NPLs is positive. As in the case of business indebtedness, this assumption is based on the following explanation: high indebtedness makes borrowers “more vulnerable to adverse shocks affecting their wealth or income, which raises the chances that they would run into debt servicing problems” [3,15].

- (h)

4. Data and Methodology

4.1. Data Selection

4.2. Model Specification

- (i)

- Simple OLS regression. As a starting point, similarly to Washington [11], Haniifah [38] and others who have used the simple OLS regression technique to identify the determinants of credit risk, the impact of selected macroeconomic variables on consumer loan credit risk is assessed using bivariate simple OLS regression models, which are constructed for each pair of dependent and independent variables in Table A2.

- (ii)

- Least squares with breakpoints regression. When assessing the relationship between selected macroeconomic variables and consumer loan credit risk, the existence of the structural breaks is also taken into account in this research. Thus, linear bivariate regression is also conducted using least squares with breakpoints method. Structural breaks are estimated according to the Bai-Perron procedure.

- (iii)

- Markov regime–switching model. Finally, it is also taken into account that the period selected for this research includes both relatively stable and crisis periods. As it is stated by Danielsson [76] and Haldane [77], the statistical properties of data during stable periods differ from those during stable periods. Thus, following Davig and Leeper [78] and Karoglou, Mouratidis and Vogiazas [43], endogenous breaks are assumed and coefficients of the models are allowed to change across different regimes. A Markov regime-switching model (MRS SVAR) is employed since it “allows for the data generating a process to exhibit completely different dynamics across a predefined number of regimes” [43]. The existence of two different regimes is predetermined in this research.

5. Results

- (i)

- according to simple OLS regression models, 9 out of 33 selected macroeconomic variables appeared to have a statistically significant impact on consumer loan credit risk;

- (ii)

- according to Least Squares with Breakpoints regression models, 18 out of 33 selected macroeconomic variables appeared to have a statistically significant impact on consumer loan credit risk in at least one of the selected periods;

- (iii)

- according to Markov Regime Switching models, 15 out of 33 selected macroeconomic variables appeared to have a statistically significant impact on consumer loan credit risk under one of two different regimes.

5.1. GDP Variables

5.2. Inflation Variables

5.3. Money Variables

5.4. Investment Variables

5.5. Labour Market Variables

5.6. Real Estate Market Variables

5.7. Trade and Trade Composition Variables

5.8. Consumption Variables

5.9. Business Sector Variables

5.10. Financial Sector Variables

5.11. General Government Sector Variables

5.12. Household Sector Variables

6. Discussion and Implications

7. Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Variables | Theoretical Research | Empirical Research | |

|---|---|---|---|

| Authors (Secondary) | Authors (Primary Source) | ||

| Directional impact: negative | |||

| GDP | Mpofu and Nikolaidou, 2018 [20] | Ombaba, 2013, Viswanadham and Nahid, 2015 | |

| GDP | Umar and Sun, 2018 [41] | Ghosh, 2015 [30]; Louzis et al., 2012 [18]; Espinoza and Prasad, 2010 [8] | |

| GDP | Priyadi et al., 2021 [31] | Firmansyah, 2014 | |

| Real GDP rate | Nikolaidou and Vogiazas, 2017 [33] | Ghosh, 2015 [30] | |

| GDP growth | Gila-Gourgoura and Nikolaidou, 2018 [2] | Yurdakul, 2014 [46] | |

| GDP growth | Gila-Gourgoura and Nikolaidou, 2018 [2] | Messai and Jouini, 2013 [45] | |

| GDP growth | Mpofu and Nikolaidou, 2018 [20] | De Bock and Demynanets, 2012 [37] | |

| GDP growth rate | Koju, Koju, and Wang, 2020 [17] | ||

| GDP growth rate | Koju, Koju, and Wang, 2020 [17] | Salas and Saurina, 2002 [28]; Škarica, 2014; Fofack, 2005 [13] | |

| Real GDP growth rate | Castro, 2013 [3] | ||

| Real GDP growth rate | Mpofu and Nikolaidou, 2018 [20] | Beck et al., 2015 [21] | |

| Real GDP growth rate | Mpofu and Nikolaidou, 2018 [20] | Castro, 2013 [3] | |

| Real GDP growth rate | Mpofu and Nikolaidou, 2018 [20] | Nkusu, 2011 [15] | |

| Real GDP growth rate | Mpofu and Nikolaidou, 2018 [20] | Espinoza and Prasad, 2010 [8] | |

| Real GDP growth rate | Mpofu and Nikolaidou, 2018 [20] | ||

| GDP per capita | Abusharbeh, 2020 [12] | Nkusu, 2011 [15], Vouldis and Louzis, 2017 [51] | |

| GDP per capita growth rate | Mpofu and Nikolaidou, 2018 [20] | Washington, 2014 [11] | |

| GDP per capital growth rate | Washington, 2014 [11] | Thiagarajan et al., 2011; Derbali, 2011; Ali and Daly, 2010 [21] | |

| GDP gap (output gap) | Carvalho, Curto and Primor, 2020 [42] | Bruneau et al., 2012 [79] | |

| GDP gap (output gap) | Dimitrios, Helen, and Mike, 2016 [29] | ||

| Gross national income (GNI) per capita growth rate | Koju, Koju, and Wang, 2020 [17] | ||

| Directional impact: insignificant | |||

| GDP growth | Mpofu and Nikolaidou, 2018 [20] | Haniifah, 2015 [38] | Haniifah, 2015 [38] |

| National expenditure as a percentage of GDP | Koju, Koju, and Wang, 2020 [17] | ||

| Symbol | Variable | Measurement Unit | Data Source |

|---|---|---|---|

| Dependent variables | |||

| Y1 | Non-performing loans for consumption-to-total loans | Per cent | Bank of Lithuania, Deloitte (for CEE countries) |

| Y2 | Total loans for consumption | Mln. Eur. | ECB Statistical Data Warehouse |

| GDP | |||

| X1 | GDP | Mln. Eur. | ECB Statistical Data Warehouse |

| X2 | Real GDP | Mln. of Chained 2010 Eur. | FRED Economic Data |

| X3 | GDP growth | Per cent | Own calculations |

| X4 | Real GDP growth rate | Per cent | Own calculations |

| X5 | GDP per capita | Eur. per capita | OECD Statistics |

| X6 | GDP GAP (Output gap) | Per cent | OECD Statistics |

| X7 | Gross national income | Per cent of GDP | Worldbank Data |

| X8 | Gross national expenditure | Per cent of GDP | CEIC Data Global Database |

| Inflation | |||

| X9 | GPD deflator | Per cent | CEIC Data Global Database |

| X10 | Consumer price index (CPI) | Per cent | Eurostat |

| X11 | Percentage change of CPI | Per cent | Own calculations |

| X12 | Producer price index (PPI) | Per cent | OECD Statistics |

| Money | |||

| X13 | Money supply (M2) | Growth rate, per cent | CEIC Data Global Database |

| X14 | International reserves | Per cent of GDP | CEIC Data Global Database |

| Investment | |||

| X15 | Gross fixed capital formation per capita | Percentage change | Own calculations based on Eurostat |

| X16 | Capital investment | Per cent of GDP | The Global Economy |

| Labour market | |||

| X17 | Long-term unemployment rate | Per cent | OECD Statistics |

| X18 | Unemployment rate | Per cent | Eurostat |

| Real estate market | |||

| X19 | House price index | Index (points, annual average) | Eurostat |

| Trade and trade composition | |||

| X20 | Exports of goods and services per capita | Percentage change | Own calculations based on Eurostat |

| X21 | Exports of goods and services to GDP | Per cent | Eurostat |

| X22 | Exports growth rate | Per cent | Own calculations based on Eurostat |

| X23 | Imports of goods and services per capita | Percentage change | Own calculations based on Eurostat |

| X24 | Imports of goods and services to GDP | Per cent | Eurostat |

| X25 | Imports growth rate | Per cent | Own calculations based on Eurostat |

| X26 | Current account balance | Per cent | Worldbank Data |

| X27 | Trade-balance-to-GDP | Per cent | Own calculations based on CEIC Data Global Database |

| X28 | Trade freedom | Index (points) | The Heritage Foundation |

| Consumption | |||

| X29 | Consumer confidence index (CCI) | Index (points) | Eurostat |

| X30 | Final consumption expenditure of households per capita | Percentage change | Own calculations based on OECD Statistics and Eurostat |

| Business sector | |||

| X31 | Industrial production index | Per cent | OECD Statistics |

| X32 | Industry-value-to-GDP | Per cent | Worldbank Data |

| X33 | Business Freedom | Index (points) | The Heritage Foundation |

| Financial sector | |||

| X34 | Overnight interest rate | Per cent | OECD Statistics |

| X35 | Credit growth | Percentage change | CEIC Data Global Database |

| X36 | Domestic credit to the private sector | Mln. Eur. | ECB Statistical Data Warehouse |

| X37 | Domestic credit to private-sector-to-GDP | Per cent | Worldbank Data |

| X38 | Interest rates on loans to non-financial companies | Per cent | OECD Statistics |

| General government sector | |||

| X39 | Public debt | Mln. Eur. | Eurostat |

| X40 | Public-debt-to-GDP | Per cent | Eurostat |

| X41 | Budget-balance-to-GDP | Per cent | Eurostat |

| X42 | Private-to-public indebtedness | Per cent | Own calculations based on Eurostat |

| Households sector | |||

| X30 | Final consumption expenditure of households per capita | Eur. | Own calculations based on OECD Statistics and Eurostat |

| X43 | Tax on personal-income-to-GDP | Per cent | Eurostat |

| X44 | Wages and salaries per employee | Eur. | OECD Statistics |

| Symbol | Variable | CEE | Probability | Lithuania | Probability | ||

|---|---|---|---|---|---|---|---|

| t-Statistic (Levin, Lin and Chu t*) | t-Statistic (Augmented Dickey–Fuller) | ||||||

| Dependent variables | |||||||

| Y1 | Non-performing loans for consumption-to-total loans | −4.259 | 0.000 ** | −5.173 | 0.000 ** | 1st diff | |

| Y2 | Total loans for consumption | −6.626 | 0.000 ** | −5.714 | 0.000 ** | 1st diff | |

| GDP | |||||||

| X2 | Real GDP | −5.321 | 0.000 ** | 1st diff | −6.895 | 0.000 ** | 2nd diff. |

| X3 | GDP growth | −9.354 | 0.000 ** | 2nd diff. | −6.518 | 0.000 ** | |

| X4 | Real GDP growth | −7.432 | 0.000 ** | 2nd diff. | −6.542 | 0.000 ** | |

| X6 | GDP gap (Output gap) | −7.018 | 0.000 ** | - | - | - | |

| X7 | Gross national income | −8.760 | 0.000 ** | −6.504 | 0.000 ** | ||

| X8 | Gross national expenditure | −6.869 | 0.000 ** | - | - | - | |

| Inflation | |||||||

| X9 | GDP deflator | −3.874 | 0.000 ** | 1st diff. | −5.509 | 0.000 ** | 1st diff. |

| X10 | Consumer price index (CPI) | −6.863 | 0.000 ** | 2nd diff. | −9.688 | 0.000 ** | 2nd diff. |

| X11 | Percentage change of CPI | −9.999 | 0.000 ** | −10.835 | 0.000 ** | 1st diff | |

| X12 | Producer price index (PPI) | −2.559 | 0.005 ** | −6.015 | 0.000 ** | 1st diff. | |

| Money | |||||||

| X13 | Money supply (M2) | −2.384 | 0.009 ** | −6.224 | 0.000 ** | 1st diff. | |

| X14 | International reserves | −11.571 | 0.000 ** | −10.056 | 0.000 ** | 1st diff | |

| Investment | |||||||

| X15 | Gross fixed capital formation | −10.915 | 0.000 ** | −4.812 | 0.000 ** | ||

| X16 | Capital investment | −14.219 | 0.000 ** | −3.459 | 0.012 * | ||

| Labour market | |||||||

| X17 | Long-term unemployment rate | −7.243 | 0.000 ** | 1st diff. | −3.557 | 0.009 ** | 1st diff. |

| X18 | Unemployment rate | −4.309 | 0.000 ** | −3.919 | 0.003 ** | 1st diff. | |

| Real estate market | |||||||

| X19 | House price index | −6.276 | 0.000 ** | 1st diff. | −3.657 | 0.007 ** | 1st diff. |

| Trade and trade composition | |||||||

| X20 | Exports of goods and services per capita | −14.675 | 0.000 ** | −6.239 | 0.000 ** | ||

| X21 | Exports of goods and services to GDP | −2.163 | 0.015 * | −7.657 | 0.000 ** | 1st diff. | |

| X22 | Exports growth rate | −14.822 | 0.000 ** | −6.295 | 0.000 ** | ||

| X23 | Imports of goods and services per capita | −14.024 | 0.000 ** | −6.678 | 0.000 ** | ||

| X24 | Imports of goods and services-to-GDP | −2.786 | 0.003 ** | −7.496 | 0.000 ** | 1st diff. | |

| X25 | Imports growth rate | −14.013 | 0.000 ** | −6.674 | 0.000 ** | ||

| X26 | Current account balance | −5.773 | 0.000 ** | −3.107 | 0.031 * | 1st diff. | |

| X27 | Trade-balance-to-GDP | −4.905 | 0.000 ** | −9.415 | 0.000 ** | 1st diff. | |

| Consumption | |||||||

| X29 | Consumer confidence index (CCI) | −2.291 | 0.000 ** | −5.079 | 0.000 ** | 1st diff. | |

| X30 | Final consumption expenditure per capita | −9.786 | 0.000 ** | 1st diff. | −6.663 | 0.000 ** | |

| Business sector | |||||||

| X31 | Industrial production index | −5.969 | 0.000 ** | −6.032 | 0.000 ** | 1st diff. | |

| X32 | Industry-value-to-GDP | −3.154 | 0.001 ** | - | - | - | |

| X33 | Business Freedom | −6.531 | 0.000 ** | 1st diff. | - | - | - |

| Financial sector | |||||||

| X35 | Credit growth | −10.080 | 0.000 ** | −3.342 | 0.017 * | ||

| X36 | Domestic credit to the private sector | −2.319 | 0.010 * | 1st diff. | −3.678 | 0.007 ** | 1st diff. |

| X37 | Domestic credit to private-sector-to-GDP | −5.929 | 0.000 ** | - | - | - | |

| General government sector | |||||||

| X39 | Public debt | −4.607 | 0.000 ** | 1st diff. | −7.639 | 0.000 ** | 1st diff. |

| X40 | Public debt/GDP | −5.748 | 0.000 ** | −7.326 | 0.000 ** | 1st diff. | |

| X41 | Budget-balance-to-GDP | −9.339 | 0.000 ** | 1st diff. | −12.190 | 0.000 ** | 1st diff. |

| X42 | Private-to-public indebtedness | −19.191 | 0.000 ** | −2.916 | 0.049 * | 1st diff. | |

| Households sector | |||||||

| X43 | Tax on personal-income-to-GDP | −10.006 | 0.000 ** | 1st diff. | - | - | - |

| X44 | Wages and salaries per employee | −8.679 | 0.000 ** | 1st diff. | −4.808 | 0.000 ** | 1st diff. |

| Symbol | Variable | Mean | Median | Maximum | Minimum | Std. Dev. | Skewness | Kurtosis | Jarque-Bera | Probability | Sum | Sum Sq. Dev. | Observations |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dependent variables | |||||||||||||

| Y1 | Non-performing loans for consumption-to-total loans | 6.127 | 5.200 | 19.200 | 0.300 | 4.055 | 1.104 | 4.021 | 27.412 | 0.000 | 680.100 | 1809.279 | 111 |

| Y2 | Total loans for consumption | 7724.799 | 4443.000 | 48,122.00 | 437.000 | 10,037.43 | 2.210 | 7.603 | 235.947 | 0.000 | 1,073,747 | 1.39 × 1010 | 139 |

| GDP | |||||||||||||

| X2 | Real GDP | 3330.078 | 308.450 | 66,325.00 | −66,815.00 | 13,228.89 | 0.370 | 14.688 | 662.996 | 0.000 | 386,289.0 | 2.01 × 1010 | 116 |

| X3 | GDP growth | −0.812 | −0.169 | 16.268 | −15.015 | 6.095 | −0.151 | 3.016 | 0.337 | 0.844 | −71.510 | 3232.720 | 88 |

| X4 | Real GDP growth | −1.074 | −0.700 | 6.300 | −12.200 | 3.805 | −0.569 | 2.871 | 5.415 | 0.066 | −106.400 | 1418.887 | 99 |

| X6 | GDP GAP (Output gap) | −1.589 | −1.800 | 9.500 | −11.800 | 3.749 | 0.248 | 4.327 | 10.539 | 0.005 | −200.176 | 1757.663 | 126 |

| X7 | Gross national income | 2.004 | 2.803 | 14.752 | −12.635 | 3.842 | −0.865 | 5.037 | 41.401 | 0.000 | 278.670 | 2037.848 | 139 |

| X8 | Gross national expenditure | 98.956 | 98.784 | 119.749 | 90.714 | 4.834 | 0.961 | 4.991 | 45.615 | 0.000 | 14,150.71 | 3317.932 | 143 |

| Inflation | |||||||||||||

| X9 | GDP deflator | 2.396 | 2.040 | 14.512 | −9.370 | 2.663 | 0.687 | 8.953 | 205.357 | 0.000 | 316.273 | 929.101 | 132 |

| X10 | Consumer price index (CPI) | 1.921 | 2.000 | 5.890 | −1.640 | 1.675 | 0.047 | 2.246 | 3.435 | 0.179 | 274.830 | 398.829 | 143 |

| X11 | Percentage change of CPI | 2.334 | 2.149 | 15.402 | −1.544 | 2.548 | 1.837 | 9.008 | 295.592 | 0.000 | 333.773 | 922.2449 | 143 |

| X12 | Producer price index | 100.229 | 100.000 | 118.400 | 83.948 | 5.531 | 0.083 | 4.208 | 6.445 | 0.039 | 10,423.87 | 3150.890 | 104 |

| Money | |||||||||||||

| X13 | Money supply (M2) | 39.770 | 48.000 | 75.000 | 3.300 | 23.253 | −0.648 | 1.844 | 19.351 | 0.000 | 6124.600 | 82,732.84 | 154 |

| X14 | International reserves | −0.777 | −0.363 | 7.796 | −21.814 | 4.113 | −1.380 | 7.692 | 176.600 | 0.000 | −111.204 | 2403.342 | 143 |

| Investment | |||||||||||||

| X15 | Gross fixed capital formation per capita | 3.143 | 3.833 | 41.347 | −45.474 | 13.300 | −0.769 | 5.603 | 53.343 | 0.000 | 440.149 | 24,604.25 | 140 |

| X16 | Capital-investment-to-GDP | 23.241 | 22.650 | 36.950 | 12.470 | 3.903 | 0.627 | 4.107 | 16.695 | 0.000 | 3323.586 | 2164.157 | 143 |

| Labour market | |||||||||||||

| X17 | Long-term unemployment rate | −0.943 | −0.900 | 19.190 | −19.044 | 6.186 | 0.463 | 4.525 | 17.399 | 0.0001 | −123.567 | 4975.246 | 131 |

| X18 | Unemployment rate | 5.464 | 7.350 | 19.700 | −50.100 | 11.535 | −3.116 | 13.765 | 863.981 | 0.000 | 732.20 | 17,699.01 | 134 |

| Real estate market | |||||||||||||

| X19 | House price index | 3.664 | 3.700 | 43.200 | −45.280 | 11.088 | −0.723 | 9.344 | 245.275 | 0.000 | 509.302 | 16,966.93 | 139 |

| Trade and trade composition | |||||||||||||

| X20 | Exports of goods and services per capita | 6.953 | 6.819 | 40.417 | −25.312 | 11.710 | −0.275 | 3.685 | 4.860 | 0.088 | 1049.912 | 20,569.32 | 151 |

| X21 | Exports of goods and services to GDP | 64.813 | 65.619 | 96.288 | 26.023 | 17.426 | −0.250 | 2.018 | 7.789 | 0.020 | 9981.335 | 46,465.34 | 154 |

| X22 | Exports growth rate | 6.582 | 6.580 | 39.663 | −25.980 | 11.490 | −0.3350 | 3.746 | 6.329 | 0.042 | 994.021 | 19,803.78 | 151 |

| X23 | Imports of goods and services per capita | 5.882 | 6.402 | 33.542 | −35.721 | 13.203 | −0.660 | 4.219 | 20.333 | 0.000 | 888.313 | 26,150.44 | 151 |

| X24 | Imports of goods and services/-to- | 63.791 | 66.046 | 94.499 | 32.449 | 14.762 | −0.119 | 2.082 | 5.771 | 0.058 | 9823.848 | 33,343.60 | 154 |

| X25 | Imports growth rate | 5.519 | 6.365 | 33.17 | −36.296 | 13.025 | −0.713 | 4.329 | 23.947 | 0.000 | 833.484 | 25,449.51 | 151 |

| X26 | Current account balance | 7.560 | 7.266 | 33.069 | −10.540 | 5.425 | 0.866 | 6.804 | 111.404 | 0.000 | 1156.813 | 4473.509 | 153 |

| X27 | Trade balance/GDP | 18.551 | 18.501 | 66.693 | 0.017 | 14.361 | 0.846 | 3.949 | 24.041 | 0.000 | 2838.373 | 31,349.01 | 153 |

| Consumption | |||||||||||||

| X29 | Consumer confidence index (CCI) | −16.867 | −15.150 | 3.9000 | −50.100 | 12.610 | −0.468 | 2.413 | 7.73 | 0.01 | −2563.800 | 24,011.28 | 152 |

| X30 | Final consumption expenditure per capita | 51.042 | 90.648 | 4116.450 | −6259.750 | 1341.354 | −0.874 | 8.898 | 208.217 | 0.000 | 6737.611 | 2.36 × 108 | 132 |

| Business sector | |||||||||||||

| X31 | Industrial production index | 113.951 | 114.526 | 124.468 | 103.059 | 5.1590 | −0.199 | 2.404 | 0.684 | 0.710 | 3646.436 | 825.089 | 32 |

| X32 | Industry-value-to-GDP | 23.950 | 26.371 | 38.695 | −11.600 | 9.896 | −1.912 | 6.362 | 155.594 | 0.000 | 3448.869 | 14,003.58 | 144 |

| X33 | Business Freedom | −0.397 | −0.700 | 10.400 | −9.400 | 3.030 | 0.622 | 4.653 | 25.5005 | 0.000 | −56.700 | 1304.028 | 143 |

| Financial sector | |||||||||||||

| X35 | Credit growth | 4827.333 | 6.215 | 67,838.00 | −14.740 | 15,515.78 | 2.991 | 10.287 | 570.539 | 0.000 | 743,409.2 | 3.68 × 1010 | 154 |

| X36 | Domestic credit to private sector | 1991.087 | 667.500 | 22,432.00 | −10,747.00 | 4867.840 | 2.211 | 9.089 | 325.698 | 0.000 | 274,770.0 | 3.25 × 109 | 138 |

| X37 | Domestic to private-sector-to-GDP | 53.135 | 50.288 | 101.388 | 24.735 | 14.599 | 0.688 | 3.683 | 13.676 | 0.001 | 7385.811 | 29,414.82 | 139 |

| General government sector | |||||||||||||

| X39 | Public debt | 3611.930 | 1493.050 | 47,431.30 | −19,610.30 | 6990.063 | 2.732 | 16.454 | 1142.286 | 0.000 | 469,550.9 | 6.30 × 109 | 130 |

| X40 | Public-debt-to-GDP | 44.401 | 41.750 | 87.300 | 4.500 | 21.265 | 0.159 | 2.253 | 4.230 | 0.120 | 6837.900 | 69,192.85 | 154 |

| X41 | Budget-balance-to-GDP | −0.144 | 0.200 | 9.100 | −10.60 | 2.878 | −0.801 | 4.902 | 36.864 | 0.000 | −20.600 | 1176.732 | 143 |

| X42 | Private-to-public indebtedness | 3.671 | 1.918 | 32.865 | 0.948 | 4.704 | 3.342 | 16.113 | 1317.976 | 0.000 | 536.06 | 3208.787 | 146 |

| Household sector | |||||||||||||

| X43 | Tax on personal-income-to-GDP | 0.0082 | 0.000 | 3.100 | −2.400 | 0.459 | 0.779 | 23.164 | 2283.636 | 0.000 | 1.100 | 28.001 | 134 |

| X44 | Wages and salaries per employee | 238.506 | 249.6420 | 1080.078 | −1291.876 | 360.262 | −0.856 | 5.241 | 47.405 | 0.000 | 34,106.35 | 18,430,085 | 143 |

| Symbol | Variable | Mean | Median | Maximum | Minimum | Std. Dev. | Skewness | Kurtosis | Jarque-Bera | Probability | Sum | Sum Sq. Dev. | Observations |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dependent variables | |||||||||||||

| Y1 | Non–performing loans for consumption–to–total loans | 7.973 | 6.345 | 25.060 | 1.370 | 6.570 | 0.714 | 2.369 | 6.507 | 0.038 | 510.330 | 2719.940 | 67 |

| Y2 | Total loans for consumption | 8.750 | 7.500 | 153.000 | −248.000 | 55.746 | −1.099 | 8.4103 | 96.643 | 0.000 | 595.000 | 20,8210.8 | 68 |

| GDP | |||||||||||||

| X2 | Real GDP | 60.080 | 81.000 | 366.600 | −1028.700 | 175.067 | −4.329 | 26.139 | 1704.006 | 0.000 | 4025.400 | 2,022,800 | 62 |

| X3 | GDP growth | −0.013 | −0.042 | 11.538 | −12.065 | 2.655 | 0.345 | 15.452 | 434.215 | 0.000 | −0.913 | 465.548 | 62 |

| X4 | Real GDP growth | 0.779 | 0.950 | 3.900 | −12.900 | 2.111 | −4.454 | 28.397 | 2052.477 | 0.000 | 53.000 | 298.811 | 62 |

| X7 | Gross national income | 1.851 | 2.089 | 7.788 | −12.534 | 2.844 | −2.087 | 11.895 | 265.515 | 0.000 | 122.204 | 525.825 | 62 |

| Inflation | |||||||||||||

| X9 | GDP deflator | 0.051 | −0.010 | 7.070 | −5.030 | 1.994 | 0.289 | 4.600 | 8.080 | 0.017 | 3.450 | 262.549 | 62 |

| X10 | Consumer price index (CPI) | 0.109 | −0.030 | 3.350 | −3.250 | 1.055 | 0.215 | 4.424 | 6.180 | 0.045 | 7.360 | 73.499 | 61 |

| X11 | Percentage change of CPI | 0.086 | −0.027 | 2.577 | −3.600 | 1.066 | −0.141 | 4.295 | 4.983 | 0.082 | 5.853 | 76.143 | 62 |

| X12 | Producer price index | 0.542 | 0.899 | 7.700 | −16.200 | 4.325 | −1.324 | 5.768 | 40.982 | 0.000 | 36.366 | 1234.697 | 68 |

| Money | |||||||||||||

| X13 | Money supply (M2) | −0.135 | 0.365 | 25.988 | −27.795 | 5.602 | −0.350 | 16.868 | 538.303 | 0.000 | −9.059 | 2071.627 | 67 |

| X14 | Foreign exchange reserves | −0.121 | 0.042 | 4.492 | −15.286 | 2.372 | −3.768 | 26.284 | 1672.162 | 0.000 | −8.140 | 371.398 | 67 |

| Investment | |||||||||||||

| X15 | Gross fixed capital formation per capita | 1.864 | 2.410 | 20.297 | −22.124 | 8.070 | −0.400 | 3.981 | 4.480 | 0.106 | 124.901 | 4299.272 | 67 |

| X16 | Capital investment | 20.661 | 19.335 | 35.039 | 10.271 | 5.785 | 0.497 | 2.605 | 3.244 | 0.197 | 1404.970 | 2242.332 | 67 |

| Labour market | |||||||||||||

| X17 | Long−term unemployment rate | −0.041 | −0.100 | 1.800 | −1.100 | 0.521 | 0.812 | 4.745 | 15.869 | 0.000 | −2.800 | 17.922 | 67 |

| X18 | Unemployment rate | −0.040 | −0.100 | 2.600 | −1.600 | 0.873 | 1.076 | 4.264 | 17.400 | 0.000 | −2.700 | 50.301 | 67 |

| Real estate market | |||||||||||||

| X19 | House price index | 1.408 | 1.580 | 10.570 | −24.570 | 4.754 | −2.593 | 15.803 | 500.941 | 0.000 | 88.760 | 1401.410 | 67 |

| Trade and trade composition | |||||||||||||

| X20 | Exports of goods and services per capita | 2.856 | 3.347 | 17.965 | −17.776 | 6.691 | −0.669 | 4.806 | 14.318 | 0.001 | 194.256 | 2999.828 | 68 |

| X21 | Exports of goods and services–to–GDP | 0.355 | 0.300 | 11.300 | −13.800 | 4.098 | −0.527 | 5.588 | 21.814 | 0.000 | 23.800 | 1108.446 | 67 |

| X22 | Exports growth rate | 2.605 | 3.102 | 18.089 | −17.808 | 6.621 | −0.676 | 4.885 | 15.264 | 0.000 | 177.147 | 2937.847 | 68 |

| X23 | Imports of goods and services per capita | 2.813 | 2.410 | 22.725 | −21.876 | 7.959 | −0.532 | 5.556 | 21.732 | 0.000 | 191.327 | 4244.327 | 68 |

| X24 | Imports of goods and services–to–GDP | 0.468 | 0.900 | 8.700 | −9.900000 | 3.483520 | −0.585 | 4.317 | 8.663 | 0.013 | 31.400 | 800.904 | 67 |

| X25 | Imports growth rate | 2.559 | 2.139 | 22.855 | −21.906 | 7.850 | −0.585 | 5.645 | 23.704 | 0.000 | 174.027 | 4128.784 | 68 |

| X26 | Current account balance | 0.089 | 0.649 | 11.224 | −11.369 | 4.160 | −0.193 | 3.5347 | 1.216 | 0.544 | 6.028 | 1142.589 | 67 |

| X27 | Trade balance–to–GDP | −0.014 | −0.075 | 2.364 | −1.729 | 0.760 | 0.245 | 3.381 | 1.080 | 0.582 | −0.947 | 38.131 | 67 |

| Consumption | |||||||||||||

| X29 | Consumer confidence index (CCI) | −0.043 | 0.172 | 2.145 | −4.708 | 1.291 | −1.041 | 4.715 | 20.608 | 0.000 | −2.896 | 111.689 | 68 |

| X30 | Final consumption expenditure per capita | 1.693 | 1.772 | 9.057 | −12.249 | 2.938 | −2.057 | 11.644 | 259.700 | 0.000 | 115.136 | 578.556 | 67 |

| Business sector | |||||||||||||

| X31 | Industrial production index | 0.000 | 1.150 | 11.767 | −73.373 | 9.913 | −6.034 | 45.588 | 5551.693 | 0.000 | 0.000 | 6584.235 | 68 |

| Financial sector | |||||||||||||

| X35 | Credit growth | 11.445 | 4.726 | 69.580 | −10.490 | 19.836 | 1.390 | 4.044 | 25.006 | 0.000 | 778.314 | 26,364.21 | 68 |

| X36 | Domestic credit–to–private sector | 391.209 | 328.905 | 3002.100 | −1467.260 | 834.546 | 0.502 | 3.808 | 4.575 | 0.101 | 25,819.80 | 45,270,419 | 66 |

| General government sector | |||||||||||||

| X39 | Public debt | 332.631 | 224.550 | 4262.220 | −5261.340 | 1126.062 | −1.046 | 12.371 | 257.401 | 0.000 | 22,286.31 | 83,689,024 | 67 |

| X40 | Public debt–to–GDP | 0.401 | −0.100 | 8.300 | −3.500 | 2.174 | 1.134 | 4.844 | 23.151 | 0.000 | 26.100 | 302.489 | 67 |

| X41 | Budget balance–to–GDP | 0.003 | 0.050 | 15.300 | −13.900 | 3.014 | 0.446 | 17.757 | 601.068 | 0.000 | 0.200 | 590.619 | 67 |

| X42 | Private–to–public indebtedness | −0.011 | −0.008 | 1.091 | −1.073 | 0.312 | −0.291 | 7.106 | 48.019 | 0.000 | −0.750 | 6.459 | 67 |

| Households sector | |||||||||||||

| X44 | Wages and salaries per capita | 76.121 | 84.000 | 279.000 | −497.000 | 111.531 | −2.113 | 12.221 | 282.980 | 0.000 | 5024.000 | 808,555.0 | 67 |

| General Macroeconomic Conditions Factors | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Symbol | Variable | Coefficient | t-Statistic | Prob. | R Sq. | Observ. | F Test | Hausman Test | Model |

| GDP | |||||||||

| X2 | Real GDP | 5.25 × 10−8 | 0.003 | 0.998 | 0.001 | 95 | 0.000 | 0.992 | Random effects |

| X3 | GDP growth | 0.181 | 3.501 | 0.001 ** | 0.062 | 85 | 0.000 | 0.399 | Random effects |

| X4 | Real GDP growth | 0.229 | 2.713 | 0.008 ** | 0.058 | 93 | 0.000 | 0.017 | Fixed effects |

| X6 | GDP gap (Output gap) | −0.130 | −1.014 | 0.313 | 0.011 | 94 | 0.000 | 0.968 | Random effects |

| X7 | Gross national income | 0.024 | 0.231 | 0.463 | 0.001 | 107 | 0.000 | 0.469 | Random effects |

| X8 | Gross national expenditure | 0.065 | 0.583 | 0.561 | 0.003 | 111 | 0.000 | 0.444 | Random effects |

| Inflation | |||||||||

| X9 | GDP deflator | −0.857 | −6.047 | 0.000 ** | 0.003 | 108 | 0.000 | 0.005 | Fixed effects |

| X10 | Consumer price index (CPI) | −0.516 | −2.817 | 0.005 ** | 0.069 | 108 | 0.000 | 0.283 | Random effects |

| X11 | Percentage change of CPI | −0.397 | −2.426 | 0.017 * | 0.051 | 111 | 0.000 | 0.131 | Random effects |

| X12 | Producer price index (PPI) | −0.147 | −1.867 | 0.066 | 0.042 | 82 | 0.000 | 0.582 | Random effects |

| Money | |||||||||

| X13 | Money supply (M2) growth rate | −0.012 | −0.747 | 0.456 | 0.005 | 111 | 0.000 | 0.032 | Fixed effects |

| X14 | International reserves | −0.021 | −0.164 | 0.869 | 0.0002 | 111 | 0.000 | 0.776 | Random effects |

| Investment | |||||||||

| X15 | Gross fixed capital formation per capita | −0.057 | −1.771 | 0.077 | 0.031 | 101 | 0.000 | 0.879 | Random effects |

| X16 | Capital investment | −0.247 | −1.812 | 0.073 | 0.029 | 111 | 0.000 | 0.745 | Random effects |

| Labour market | |||||||||

| X17 | Long-term unemployment rate | 0.135 | 2.419 | 0.017 * | 0.049 | 106 | 0.000 | 0.072 | Random effects |

| X18 | Unemployment rate | −0.0001 | −0.022 | 0.983 | 0.001 | 105 | 0.000 | 0.136 | Random effects |

| Real estate market | |||||||||

| X19 | House price index | −0.233 | −5.787 | 0.000 ** | 0.024 | 106 | 0.000 | 0.191 | Random effects |

| Trade and trade composition | |||||||||

| X20 | Exports of goods and services per capita | 0.053 | 1.649 | 0.102 | 0.024 | 111 | 0.000 | 0.536 | Random effects |

| X21 | Exports of goods and services to GDP | −0.032 | −0.787 | 0.433 | 0.006 | 111 | 0.000 | 0.398 | Random effects |

| X22 | Exports growth rate | 0.053 | 1.614 | 0.431 | 0.024 | 111 | 0.000 | 0.802 | Random effects |

| X23 | Imports of goods and services per capita | 0.019 | 0.601 | 0.549 | 0.004 | 111 | 0.000 | 0.294 | Random effects |

| X24 | Imports of goods and services to GDP | −0.035 | −0.718 | 0.475 | 0.004 | 111 | 0.000 | 0.379 | Random effects |

| X25 | Imports growth rate | 0.018 | 0.561 | 0.576 | 0.002 | 111 | 0.000 | 0.591 | Random effects |

| X26 | Current account balance | −0.197 | −3.657 | 0.000 ** | 0.110 | 111 | 0.000 | 0.810 | Random effects |

| X27 | Trade-balance-to-GDP | 0.026 | 0.838 | 0.403 | 0.142 | 111 | 0.000 | 0.013 | Fixed effects |

| Consumption | |||||||||

| X29 | Consumer confidence index (CCI) | −0.094 | −3.599 | 0.001 ** | 0.107 | 110 | 0.000 | 0.177 | Random effects |

| X30 | Final consumption expenditure of households per capita | −0.0003 | −1.546 | 0.465 | 0.003 | 108 | 0.000 | 0.384 | Random effects |

| Business sector | |||||||||

| X31 | Industrial production index (CCI) | −0.068 | −1.624 | 0.115 | 0.083 | 32 | 0.000 | 0.754 | Random effects |

| X32 | Industry-value-to-GDP | 0.885 | 4.040 | 0.000 ** | 0.032 | 111 | 0.000 | 0.002 | Fixed effects |

| X33 | Business Freedom | 0.139 | 1.424 | 0.157 | 0.019 | 108 | 0.000 | 0.144 | Random effects |

| Financial sector | |||||||||

| X35 | Credit growth | −0.0001 | −1.687 | 0.097 | 0.166 | 111 | 0.000 | 0.016 | Fixed effects |

| X36 | Domestic credit to private sector | −0.0001 | −1.379 | 0.171 | 0.018 | 108 | 0.000 | 0.947 | Random effects |

| X37 | Domestic credit to private-sector-to-GDP | 0.191 | 5.391 | 0.000 ** | 0.003 | 111 | 0.000 | 0.011 | Fixed effects |

| General government sector | |||||||||

| X39 | Public debt | −7.76 × 10−6 | −0.238 | 0.812 | 0.002 | 96 | 0.000 | 0.503 | Random effects |

| X40 | Public-debt-to-GDP | 0.058 | 1.842 | 0.068 | 0.109 | 111 | 0.000 | 0.750 | Random effects |

| X41 | Budget-balance-to-GDP | 0.298 | 3.109 | 0.002 ** | 0.081 | 108 | 0.000 | 0.039 | Fixed effects |

| X42 | Private-to-public indebtedness | 0.077 | 0.346 | 0.730 | 0.001 | 111 | 0.000 | 0.025 | Fixed effects |

| Household sector | |||||||||

| X43 | Tax on personal-income-to-GDP | −0.783 | −1.129 | 0.263 | 0.012 | 108 | 0.000 | 0.139 | Random effects |

| X44 | Wages and salaries per employee | −0.002 | −2.159 | 0.033 * | 0.149 | 108 | 0.000 | 0.011 | Fixed effects |

| Symbol | Variable | Coefficient | t-Statistic | Prob. | R Sq. | Observ. |

|---|---|---|---|---|---|---|

| GDP | ||||||

| X2 | Real GDP | −0.003 | −2.981 | 0.004 ** | 0.129 | 62 |

| X3 | GDP growth | −0.232 | −2.902 | 0.005 ** | 0.123 | 62 |

| X4 | Real GDP growth | −0.232 | −2.911 | 0.005 ** | 0.124 | 62 |

| X7 | Gross national income | −0.143 | −2.223 | 0.029 * | 0.076 | 62 |

| Inflation | ||||||

| X9 | GDP deflator | −0.074 | −0.795 | 0.429 | 0.010 | 62 |

| X10 | Consumer price index (CPI) | 0.045 | 0.233 | 0.817 | 0.001 | 61 |

| X11 | Percentage change of CPI | 0.042 | 0.234 | 0.816 | 0.001 | 62 |

| X12 | Producer price index | −0.026 | −0.609 | 0.545 | 0.006 | 62 |

| Money | ||||||

| X13 | Money supply (M2) | 0.002 | 0.055 | 0.956 | 0.001 | 62 |

| X14 | International reserves | −0.077 | −1.018 | 0.313 | 0.017 | 62 |

| Investment | ||||||

| X15 | Gross fixed capital formation per capita | −0.032 | −1.430 | 0.158 | 0.033 | 62 |

| X16 | Capital investment | −0.011 | −0.347 | 0.730 | 0.002 | 62 |

| Labour market | ||||||

| X17 | Long-term unemployment rate | 0.909 | 2.689 | 0.009 ** | 0.108 | 62 |

| X18 | Unemployment rate | 0.802 | 4.369 | 0.000 ** | 0.241 | 62 |

| Real estate market | ||||||

| X19 | House price index | −0.023 | −0.579 | 0.564 | 0.005 | 61 |

| Trade and trade composition | ||||||

| X20 | Exports of goods and services per capita | −0.019 | −0.723 | 0.472 | 0.009 | 62 |

| X21 | Exports of goods and services to GDP | −0.013 | −0.291 | 0.772 | 0.001 | 62 |

| X22 | Exports growth rate | −0.019 | −0.729 | 0.468 | 0.009 | 62 |

| X23 | Imports of goods and services per capita | −0.021 | −0.919 | 0.361 | 0.013 | 62 |

| X24 | Imports of goods and services to GDP | 0.003 | 0.054 | 0.958 | 0.001 | 62 |

| X25 | Imports growth rate | −0.022 | −0.936 | 0.353 | 0.014 | 62 |

| X26 | Current account balance | 0.028 | 0.635 | 0.528 | 0.007 | 62 |

| X27 | Trade-balance-to-GDP | 0.143 | 0.575 | 0.567 | 0.005 | 62 |

| Consumption | ||||||

| X29 | Consumer confidence index (CCI) | −0.123 | −0.857 | 0.395 | 0.012 | 62 |

| X30 | Final consumption expenditure of households per capita | −0.158 | −2.635 | 0.011 * | 0.103 | 62 |

| Business sector | ||||||

| X31 | Industrial production index | −0.041 | −0.855 | 0.386 | 0.012 | 62 |

| Financial sector | ||||||

| X35 | Credit growth | 0.013 | 0.145 | 0.885 | 0.001 | 62 |

| X36 | Domestic credit to the private sector | −0.0002 | −1.152 | 0.254 | 0.022 | 62 |

| General government sector | ||||||

| X39 | Public debt | 9.54 × 10−5 | 0.588 | 0.559 | 0.005 | 62 |

| X40 | Public-debt-to-GDP | 0.161 | 1.946 | 0.056 | 0.059 | 62 |

| X41 | Budget-balance-to-GDP | 0.113 | 1.906 | 0.061 | 0.057 | 62 |

| X42 | Private-to-public indebtedness | −1.286 | −2.323 | 0.023 * | 0.083 | 62 |

| Households sector | ||||||

| X44 | Wages and salaries per capita | −0.003 | −2.298 | 0.025 * | 0.081 | 62 |

| Symbol | Variable | Periods According to Breaks (Bai-Perron) | Coefficient | t-Statistic | Prob. | R Sq. | Observ. |

|---|---|---|---|---|---|---|---|

| GDP | |||||||

| X2 | Real GDP | 2005Q2–2011Q2 | −0.003 | −2.779 | 0.007 ** | 0.374 | 25 |

| 2011Q3–2021Q1 | −0.002 | −1.267 | 0.210 | 37 | |||

| X3 | GDP growth | 2005Q2–2011Q2 | −0.217 | −2.827 | 0.006 ** | 0.380 | 25 |

| 2011Q3–2021Q1 | −0.213 | −1.402 | 0.166 | 37 | |||

| X4 | Real GDP growth | 2005Q2–2011Q2 | −0.217 | −2.824 | 0.007 ** | 0.380 | 25 |

| 2011Q3–2021Q1 | −0.213 | −1.514 | 0.162 | 37 | |||

| X7 | Gross national income | 2005Q2–2011Q2 | −0.211 | −3.443 | 0.001 ** | 0.399 | 25 |

| 2011Q3–2021Q1 | −0.552 | −0.513 | 0.609 | 37 | |||

| Inflation | |||||||

| X9 | GDP deflator | 2005Q2–2008Q3 | −0.048 | −0.283 | 0.778 | 0.432 | 15 |

| 2008Q4–2011Q2 | −0.079 | −0.843 | 0.403 | 11 | |||

| 2011Q3–2021Q1 | −0.009 | −0.054 | 0.967 | 39 | |||

| X10 | Consumer price index (CPI) | 2005Q2–2008Q3 | 0.077 | 0.138 | 0.890 | 0.432 | 11 |

| 2008Q4–2011Q2 | 0.186 | 0.777 | 0.440 | 13 | |||

| 2011Q3–2021Q1 | 0.044 | 0.215 | 0.831 | 27 | |||

| X11 | Percentage change of CPI | 2005Q2–2008Q3 | 0.061 | 0.146 | 0.885 | 0.432 | 12 |

| 2008Q4–2011Q2 | 0.170 | 0.799 | 0.427 | 13 | |||

| 2011Q3–2021Q1 | 0.058 | 0.276 | 0.783 | 37 | |||

| X12 | Producer price index | 2005Q2–2008Q4 | −0.040 | −0.787 | 0.435 | 0.545 | 15 |

| 2009Q1–2011Q2 | −0.092 | −1.296 | 0.200 | 10 | |||

| 2011Q3–2021Q1 | −0.082 | −1.410 | 0.164 | 37 | |||

| Money | |||||||

| X13 | Money supply (M2) | 2005Q2–2008Q4 | −0.079 | −1.062 | 0.293 | 0.416 | 15 |

| 2009Q1–2011Q2 | −0.155 | −1.668 | 0.101 | 10 | |||

| 2011Q3–2021Q1 | 0.031 | 1.092 | 0.279 | 37 | |||

| X14 | International reserves | 2005Q2–2008Q3 | −0.069 | −0.354 | 0.724 | 0.465 | 14 |

| 2008Q4–2011Q2 | −0.317 | 1.299 | 0.199 | 11 | |||

| 2011Q3–2021Q1 | −0.099 | −1.585 | 0.119 | 27 | |||

| Investment | |||||||

| X15 | Gross fixed capital formation per capita | 2005Q2–2011Q2 | −0.053 | −2.283 | 0.026 * | 0.337 | 25 |

| 2011Q3–2021Q1 | 0.002 | 0.089 | 0.929 | 37 | |||

| X16 | Capital investment | 2005Q2–2011Q2 | −0.101 | −3.024 | 0.004 ** | 0.374 | 25 |

| 2011Q3–2021Q1 | −0.021 | −0.434 | 0.666 | 37 | |||

| Labour market | |||||||

| X17 | Long-term unemployment rate | 2005Q2–2008Q3 | 0.227 | 0.304 | 0.762 | 0.479 | 14 |

| 2008Q4–2011Q2 | −0.860 | −1.724 | 0.090 | 11 | |||

| 2011Q3–2021Q1 | 0.962 | 1.694 | 0.096 | 37 | |||

| X18 | Unemployment rate | 2005Q2–2011Q2 | 0.479 | 2.489 | 0.016 * | 0.434 | 25 |

| 2011Q3–2021Q1 | 1.058 | 3.208 | 0.002 ** | 37 | |||

| Real estate market | |||||||

| X19 | House price index | 2005Q2–2008Q4 | −0.014 | −0.422 | 0.674 | 0.491 | 15 |

| 2009Q1–2011Q2 | −0.375 | −1.627 | 0.109 | 10 | |||

| 2011Q3–2021Q1 | 0.195 | 2.487 | 0.016 * | 36 | |||

| Trade and trade composition | |||||||

| X20 | Exports of goods and services per capita | 2005Q2–2008Q4 | −0.013 | −0.359 | 0.721 | 0.459 | 15 |

| 2009Q1–2011Q2 | −0.089 | −2.035 | 0.047 * | 10 | |||

| 2011Q3–2021Q1 | −0.025 | −0.785 | 0.436 | 37 | |||

| X21 | Exports of goods and services to GDP | 2005Q2–2008Q4 | −0.042 | −0.713 | 0.479 | 0.454 | 15 |

| 2009Q1–2011Q2 | −0.192 | −1.878 | 0.066 | 10 | |||

| 2011Q3–2021Q1 | −0.023 | −0.484 | 0.631 | 37 | |||

| X22 | Exports growth rate | 2005Q2–2008Q4 | −0.012 | −0.349 | 0.728 | 0.475 | 15 |

| 2009Q1–2011Q2 | −0.091 | −2.007 | 0.049 * | 10 | |||

| 2011Q3–2021Q1 | −0.023 | −0.716 | 0.477 | 37 | |||

| X23 | Imports of goods and services per capita | 2005Q2–2008Q4 | −0.028 | −0.864 | 0.391 | 0.452 | 15 |

| 2009Q1–2011Q2 | −0.058 | −1.716 | 0.092 | 10 | |||

| 2011Q3–2021Q1 | −0.017 | −0.645 | 0.522 | 37 | |||

| X24 | Imports of goods and services to GDP | 2005Q2–2008Q4 | −0.007 | −0.098 | 0.923 | 0.456 | 15 |

| 2009Q1–2011Q2 | −0.286 | −2.033 | 0.047 * | 10 | |||

| 2011Q3–2021Q1 | −0.032 | −0.619 | 0.538 | 37 | |||

| X25 | Imports growth rate | 2005Q2–2008Q4 | −0.028 | −0.861 | 0.393 | 0.451 | 15 |

| 2009Q1–2011Q2 | −0.061 | −1.719 | 0.091 | 10 | |||

| 2011Q3–2021Q1 | −0.016 | −0.587 | 0.559 | 37 | |||

| X26 | Current account balance | 2005Q2–2008Q3 | 0.053 | 0.690 | 0.483 | 0.432 | 14 |

| 2008Q4–2011Q2 | 0.035 | 0.562 | 0.575 | 11 | |||

| 2011Q3–2021Q1 | −0.008 | −0.166 | 0.869 | 37 | |||

| X27 | Trade-balance-to-GDP | 2005Q2–2008Q3 | 0.220 | 0.542 | 0.589 | 0.441 | 14 |

| 2008Q4–2011Q2 | 0.455 | 1.125 | 0.265 | 11 | |||

| 2011Q3–2021Q1 | −0.101 | −0.379 | 0.706 | 37 | |||

| Consumption | |||||||

| X29 | Consumer confidence index (CCI) | 2005Q2–2008Q4 | −0.229 | −1.286 | 0.707 | 0.444 | 15 |

| 2009Q1–2011Q2 | −0.296 | −1.268 | 0.210 | 10 | |||

| 2011Q3–2021Q1 | −0.008 | −0.040 | 0.968 | 37 | |||

| X30 | Final consumption expenditure of households per capita | 2005Q2–2011Q2 | −0.197 | −3.172 | 0.002 ** | 0.409 | 25 |

| 2011Q3–2021Q1 | −0.146 | −1.803 | 0.077 | 37 | |||

| Business sector | |||||||

| X32 | Industrial production index | 2005Q2–2008Q3 | 0.029 | 0.393 | 0.696 | 0.427 | 14 |

| 2008Q4–2011Q2 | −0.011 | −0.131 | 0.896 | 11 | |||

| 2011Q3–2021Q1 | −0.024 | −0.467 | 0.642 | 37 | |||

| Financial sector | |||||||

| X35 | Credit growth | 2005Q2–2011Q2 | −0.030 | −3.361 | 0.001 ** | 0.399 | 25 |

| 2011Q3–2121Q1 | 0.031 | 0.875 | 0.385 | 37 | |||

| X36 | Domestic credit to the private sector | 2005Q2–2011Q2 | −0.001 | −4.038 | 0.000 ** | 0.555 | 25 |

| 2011Q3–2013Q3 | 0.003 | 3.661 | 0.001 ** | 9 | |||

| 2013Q4–2021Q1 | −6.17 × 10−5 | −0.159 | 0.874 | 28 | |||

| General government sector | |||||||

| X39 | Public debt | 2005Q2–2008Q3 | −0.001 | −0.232 | 0.817 | 0.562 | 14 |

| 2008Q4–2011Q2 | −0.001 | −0.745 | 0.459 | 11 | |||

| 2011Q3–2017Q4 | −0.001 | −3.124 | 0.003 ** | 24 | |||

| 2018Q1–2021Q1 | 0.001 | 1.505 | 0.138 | 13 | |||

| X40 | Public-debt-to-GDP | 2005Q2–2011Q2 | 0.219 | 1.719 | 0.091 | 0.317 | 25 |

| 2011Q3–2021Q1 | 0.076 | 0.865 | 0.391 | 37 | |||

| X41 | Budget balance to GDP | 2005Q2–2008Q3 | −0.088 | −0.392 | 0.697 | 0.654 | 14 |

| 2008Q4–2011Q2 | −0.214 | −1.073 | 0.288 | 11 | |||

| 2011Q3–2018Q1 | 0.205 | 4.879 | 0.000 ** | 25 | |||

| 2018Q2–2021Q1 | −0.239 | −2.122 | 0.039 * | 12 | |||

| X42 | Private-to-public indebtedness | 2005Q2–2011Q2 | −1.487 | −3.706 | 0.001 ** | 0.583 | 25 |

| 2011Q3–2017Q4 | 12.294 | 4.535 | 0.000 ** | 24 | |||

| 2018Q1–2021Q1 | −2.671 | −1.585 | 0.119 | 13 | |||

| Households sector | |||||||

| X44 | Wages and salaries per employee | 2005Q2–2011Q2 | −0.005 | −2.457 | 0.017 * | 0.346 | 25 |

| 2011Q3–2021Q1 | 0.002 | 0.622 | 0.537 | 37 | |||

| Symbol | Variable | Regimes | Coefficient | t-Statistic | Prob. | Log-Likelihood | Durbin-Watson |

|---|---|---|---|---|---|---|---|

| GDP | |||||||

| X2 | Real GDP | Regime 1 | −0.002 | −1.042 | 0.298 | −101.656 | 1.824 |

| Regime 2 | −0.003 | −2.511 | 0.012 * | ||||

| X3 | GDP growth | Regime 1 | −0.126 | −1.379 | 0.167 | −101.349 | 1.649 |

| Regime 2 | −0.096 | −0.699 | 0.484 | ||||

| X4 | Real GDP growth | Regime 1 | −0.215 | −2.687 | 0.007 ** | −101.471 | 1.853 |

| Regime 2 | −0.201 | −1.208 | 0.227 | ||||

| X7 | Gross national income | Regime 1 | 1.288 | 2.356 | 0.019 * | −97.509 | 1.555 |

| Regime 2 | −0.161 | −3.099 | 0.002 ** | ||||

| Inflation | |||||||

| X9 | GDP deflator | Regime 1 | −0.078 | −0.767 | 0.425 | −102.368 | 1.661 |

| Regime 2 | 0.007 | 0.056 | 0.966 | ||||

| X10 | Consumer price index (CPI) | Regime 1 | 0.243 | 0.338 | 0.735 | 129.679 | 1.327 |

| Regime 2 | −0.065 | −0.323 | 0.747 | ||||

| X11 | Percentage change of CPI | Regime 1 | 0.065 | 0.329 | 0.742 | 105.617 | 1.585 |

| Regime 2 | 0.148 | 0.653 | 0.513 | ||||

| X12 | Producer price index | Regime 1 | −0.030 | −0.573 | 0.566 | −102.125 | 1.643 |

| Regime 2 | −0.045 | −0.893 | 0.371 | ||||

| Money | |||||||

| X13 | Money supply (M2) | Regime 1 | 0.019 | 0.648 | 0.517 | 106.399 | 1.620 |

| Regime 2 | −0.052 | −0.679 | 0.496 | ||||

| X14 | International reserves | Regime 1 | −0.146 | −0.516 | 0.605 | −101.541 | 1.619 |

| Regime 2 | −0.089 | −1.385 | 0.296 | ||||

| Investment | |||||||

| X15 | Gross fixed capital formation per capita | Regime 1 | 0.821 | 8.173 | 0.000 ** | −88.415 | 1.771 |

| Regime 2 | −0.051 | −3.458 | 0.001 ** | ||||

| X16 | Capital investment | Regime 1 | −0.082 | −1.296 | 0.195 | −101.542 | 1.727 |

| Regime 2 | 0.026 | 0.695 | 0.487 | ||||

| Labour market | |||||||

| X17 | Long-term unemployment rate | Regime 1 | 7.113 | 7.034 | 0.000 ** | −96.867 | 1.861 |

| Regime 2 | 0.401 | 1.468 | 0.142 | ||||

| X18 | Unemployment rate | Regime 1 | 2.538 | 3.517 | 0.000 ** | −94.401 | 1.657 |

| Regime 2 | 0.649 | 4.073 | 0.000 ** | ||||

| Real estate market | |||||||

| X19 | House price index | Regime 1 | −0.034 | −1.086 | 0.277 | −100.014 | 1.253 |

| Regime 2 | 1.793 | 2.245 | 0.025 * | ||||

| Trade and trade composition | |||||||

| X20 | Exports of goods and services per capita | Regime 1 | −0.005 | −0.166 | 0.689 | −101.598 | 1.624 |

| Regime 2 | −0.049 | −1.419 | 0.156 | ||||

| X21 | Exports of goods and service to GDP | Regime 1 | −0.008 | −0.171 | 0.864 | −102.310 | 1.607 |

| Regime 2 | −0.056 | −0.848 | 0.396 | ||||

| X22 | Exports growth rate | Regime 1 | −0.051 | −1.409 | 0.159 | −101.623 | 1.631 |

| Regime 2 | −0.003 | −0.109 | 0.913 | ||||

| X23 | Imports of goods and services per capita | Regime 1 | −0.035 | −1.216 | 0.224 | 104.899 | 1.617 |

| Regime 2 | −0.002 | −0.077 | 0.938 | ||||

| X24 | Imports of goods and service to GDP | Regime 1 | −0.091 | −0.989 | 0.323 | −102.103 | 1.610 |

| Regime 2 | −0.019 | −0.368 | 0.713 | ||||

| X25 | Imports growth rate | Regime 1 | −0.036 | −1.211 | 0.226 | −101.909 | 1.622 |

| Regime 2 | −0.001 | −0.013 | 0.989 | ||||

| X26 | Current account balance | Regime 1 | −0.016 | −0.614 | 0.538 | −91.207 | 2.205 |

| Regime 2 | 2.150 | 10.004 | 0.000 ** | ||||

| X27 | Trade-balance-to-GDP | Regime 1 | 0.398 | 0.955 | 0.339 | −102.072 | 1.599 |

| Regime 2 | −0.121 | −0.501 | 0.616 | ||||

| Consumption | |||||||

| X29 | Consumer confidence index (CCI) | Regime 1 | −0.064 | −0.345 | 0.729 | −102.232 | 1.662 |

| Regime 2 | −0.096 | −0.453 | 0.651 | ||||

| X30 | Final consumption expenditure of households per capita | Regime 1 | −0.196 | −3.037 | 0.002 ** | −100.081 | 1.909 |

| Regime 2 | −0.141 | −1.637 | 0.102 | ||||

| Business sector | |||||||

| X31 | Industrial production index | Regime 1 | −0.011 | −0.129 | 0.897 | −102.681 | 1.638 |

| Regime 2 | −0.012 | −0.251 | 0.802 | ||||

| Financial sector | |||||||

| X35 | Credit growth | Regime 1 | −0.030 | −2.756 | 0.006 ** | −100.328 | 1.709 |

| Regime 2 | 0.014 | 1.269 | 0.204 | ||||

| X36 | Domestic credit to the private sector | Regime 1 | −0.001 | −3.521 | 0.000 ** | −97.305 | 1.888 |

| Regime 2 | 0.001 | 2.691 | 0.007 ** | ||||

| General government sector | |||||||

| X39 | Public debt | Regime 1 | −0.002 | 2.852 | 0.004 ** | −100.139 | 1.449 |

| Regime 2 | 0.001 | 1.803 | 0.071 | ||||

| X40 | Public-debt-to-GDP | Regime 1 | 0.053 | 0.641 | 0.522 | −102.468 | 1.605 |

| Regime 2 | −0.041 | −0.220 | 0.826 | ||||

| X41 | Budget-balance-to-GDP | Regime 1 | 0.700 | 9.356 | 0.000 ** | −92.408 | 1.131 |

| Regime 2 | −0.018 | −0.372 | 0.710 | ||||

| X42 | Private-to-public indebtedness | Regime 1 | −1.554 | −3.781 | 0.000 ** | −94.915 | 1.535 |

| Regime 2 | 15.575 | 3.055 | 0.002 ** | ||||

| Households sector | |||||||

| X44 | Wages and salaries per employee | Regime 1 | −0.003 | −2.030 | 0.042 * | −106.787 | 1.487 |

| Regime 2 | 0.007 | 0.504 | 0.614 | ||||

| General Macroeconomic Conditions Factors | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Symbol | Variable | Coefficient | t-Statistic | Prob. | R Sq. | Observ. | F Test | Hausman Test | Model |

| GDP | |||||||||

| X2 | Real GDP | −0.003 | −0.159 | 0.873 | 0.078 | 115 | 0.000 | 0.007 | Fixed effects |

| X3 | GDP growth | −34.926 | −0.951 | 0.344 | 0.011 | 88 | 0.000 | 0.808 | Random effects |

| X4 | Real GDP growth | −69.884 | −1.205 | 0.231 | 0.015 | 99 | 0.000 | 0.583 | Random effects |

| X6 | GDP gal (Output gap) | 24.412 | 0.328 | 0.744 | 0.001 | 115 | 0.000 | 0.098 | Random effects |

| X7 | Gross national income | −30.648 | −0.515 | 0.607 | 0.002 | 135 | 0.000 | 0.128 | Random effects |

| X8 | Gross national expenditure | −103.971 | −1.694 | 0.093 | 0.021 | 139 | 0.000 | 0.886 | Random effects |

| Inflation | |||||||||

| X9 | GDP deflator | 117.411 | 1.095 | 0.309 | 0.008 | 130 | 0.000 | 0.593 | Random effects |

| X10 | Consumer price index (CPI) | 232.007 | 1.742 | 0.084 | 0.023 | 130 | 0.000 | 0.337 | Random effects |

| X11 | Percentage change of CPI | 107.502 | 1.116 | 0.267 | 0.009 | 139 | 0.000 | 0.485 | Random effects |

| X12 | Producer price index (PPI) | 5.379 | 0.097 | 0.923 | 0.001 | 102 | 0.000 | 0.831 | Random effects |

| Money | |||||||||

| X13 | Money supply (M2) | 10.489 | 1.115 | 0.267 | 0.009 | 139 | 0.000 | 0.668 | Random effects |

| X14 | International reserves | 72.588 | 1.177 | 0.241 | 0.009 | 139 | 0.000 | 0.081 | Random effects |

| Investment | |||||||||

| X15 | Gross fixed capital formation per capita | −15.089 | −0.842 | 0.401 | 0.006 | 128 | 0.000 | 0.558 | Random effects |

| X16 | Capital investment | −83.957 | −1.144 | 0.255 | 0.009 | 139 | 0.000 | 0.829 | Random effects |

| Labour market | |||||||||

| X17 | Long-term unemployment rate | −44.346 | −1.366 | 0.174 | 0.015 | 128 | 0.000 | 0.898 | Random effects |

| X18 | Unemployment rate | −141.013 | −4.727 | 0.000 ** | 0.157 | 123 | 0.000 | 0.136 | Random effects |

| Real estate market | |||||||||

| X19 | House price index | 23.405 | 0.977 | 0.330 | 0.008 | 127 | 0.000 | 0.804 | Random effects |

| Trade and trade composition | |||||||||

| X20 | Exports of goods and services per capita | −6.201 | −0.307 | 0.759 | 0.001 | 137 | 0.000 | 0.700 | Random effects |

| X21 | Exports of goods and services to GDP | 62.802 | 1.984 | 0.049 * | 0.027 | 139 | 0.000 | 0.104 | Random effects |

| X22 | Exports growth rate | −7.218 | −0.351 | 0.726 | 0.001 | 137 | 0.000 | 0.479 | Random effects |

| X23 | Imports of goods and services per capita | −13.067 | −0.718 | 0.474 | 0.004 | 137 | 0.000 | 0.865 | Random effects |

| X24 | Imports of goods and services to GDP | 55.332 | 1.372 | 0.172 | 0.013 | 139 | 0.000 | 0.072 | Random effects |

| X25 | Imports growth rate | −14.075 | −0.761 | 0.448 | 0.004 | 137 | 0.000 | 0.610 | Random effects |

| X26 | Current account balance | −29.053 | −0.662 | 0.509 | 0.003 | 139 | 0.000 | 0.086 | Random effects |

| X27 | Trade-balance-to-GDP | 75.790 | 2.766 | 0.007 ** | 0.053 | 139 | 0.000 | 0.773 | Random effects |

| Consumption | |||||||||

| X29 | Consumer confidence index (CCI) | −7.698 | −0.382 | 0.703 | 0.001 | 138 | 0.000 | 0.368 | Random effects |

| X30 | Final consumption expenditure of households per capita | 0.206 | 1.231 | 0.221 | 0.012 | 130 | 0.000 | 0.362 | Random effects |

| Business sector | |||||||||

| X31 | Industrial production index | 104.214 | 2.211 | 0.035 * | 0.144 | 32 | 0.000 | 0.880 | Random effects |

| X32 | Industry-value-to-GDP | 58.429 | 0.579 | 0.563 | 0.002 | 139 | 0.000 | 0.294 | Random effects |

| X33 | Business Freedom | −62.287 | −0.946 | 0.346 | 0.007 | 130 | 0.000 | 0.251 | Random effects |

| Financial sector | |||||||||

| X35 | Credit growth | 0.214 | 2.904 | 0.049 * | 0.058 | 139 | 0.000 | 0.439 | Random effects |

| X36 | Domestic credit to the private sector | −0.013 | −0.201 | 0.841 | 0.002 | 128 | 0.000 | 0.000 | Fixed effects |

| X37 | Domestic credit to private-sector-to-GDP | 32.683 | 1.493 | 0.138 | 0.017 | 137 | 0.000 | 0.214 | Random effects |

| General government sector | |||||||||

| X39 | Public debt | 0.054 | 1.554 | 0.123 | 0.035 | 118 | 0.000 | 0.000 | Fixed effects |

| X40 | Public-debt-to-GDP | −15.164 | −0.619 | 0.537 | 0.003 | 139 | 0.000 | 0.560 | Random effects |

| X41 | Budget-balance-to-GDP | −70.621 | −0.978 | 0.329 | 0.007 | 130 | 0.000 | 0.680 | Random effects |

| X42 | Private-to-public indebtedness | 44.681 | 0.483 | 0.630 | 0.002 | 139 | 0.000 | 0.348 | Random effects |

| Household sector | |||||||||

| X43 | Tax on personal income to GDP | 29.291 | 0.066 | 0.947 | 0.001 | 130 | 0.000 | 0.522 | Random effects |

| X44 | Wages and salaries per employee | 0.367 | 0.568 | 0.571 | 0.002 | 130 | 0.000 | 0.137 | Random effects |

| Symbol | Variable | Coefficient | t-Statistic | Prob. | R Sq. | Observ. |

|---|---|---|---|---|---|---|

| GDP | ||||||

| X2 | Real GDP | 0.086 | 2.290 | 0.025 * | 0.075 | 67 |

| X3 | GDP growth | 7.709 | 2.491 | 0.015 * | 0.087 | 67 |

| X4 | Real GDP growth | 7.666 | 2.485 | 0.016 * | 0.087 | 67 |

| X7 | Gross national income | 8.056 | 3.618 | 0.001 ** | 0.169 | 66 |

| Inflation | ||||||

| X9 | GDP deflator | 2.235 | 0.653 | 0.516 | 0.007 | 67 |

| X10 | Consumer price index (CPI) | 1.937 | 0.294 | 0.769 | 0.001 | 67 |

| X11 | Percentage change of CPI | 1.291 | 0.201 | 0.842 | 0.001 | 68 |

| X12 | Producer price index | 3.169 | 2.067 | 0.043 * | 0.062 | 67 |

| Money | ||||||

| X13 | Money supply (M2) | −0.096 | −0.079 | 0.938 | 0.0001 | 67 |

| X14 | International reserves | −2.424 | −0.844 | 0.401 | 0.011 | 67 |

| Investment | ||||||

| X15 | Gross fixed capital formation per capita | 2.066 | 2.555 | 0.013 * | 0.091 | 67 |

| X16 | Capital investment | 6.113 | 6.817 | 0.000 ** | 0.417 | 67 |

| Labour market | ||||||

| X17 | Long-term unemployment rate | −19.786 | −1.533 | 0.130 | 0.035 | 67 |

| X18 | Unemployment rate | −8.624 | −1.110 | 0.271 | 0.018 | 67 |

| Real estate market | ||||||

| X19 | House price index | −0.324 | −0.212 | 0.833 | 0.001 | 63 |

| Trade and trade composition | ||||||

| X20 | Exports of goods and services per capita | 1.609 | 1.615 | 0.111 | 0.039 | 67 |

| X21 | Exports of goods and services to GDP | 1.406 | 0.847 | 0.400 | 0.011 | 67 |

| X22 | Exports growth rate | 1.740 | 1.733 | 0.088 | 0.044 | 67 |

| X23 | Imports of goods and services per capita | 1.419 | 1.690 | 0.096 | 0.042 | 67 |

| X24 | Imports of goods and services to GDP | 0.666 | 0.339 | 0.736 | 0.002 | 67 |

| X25 | Imports growth rate | 1.531 | 1.803 | 0.076 | 0.047 | 67 |

| X26 | Current account balance | −0.037 | −0.023 | 0.982 | 0.0001 | 67 |

| X27 | Trade-balance-to-GDP | −12.513 | −1.411 | 0.163 | 0.029 | 67 |

| Consumption | ||||||

| X29 | Consumer confidence index (CCI) | −2.543 | −0.479 | 0.633 | 0.003 | 68 |

| X30 | Final consumption expenditure per capita | 5.952 | 2.694 | 0.009 ** | 0.100 | 67 |

| Business sector | ||||||

| X31 | Industrial production index | −0.679 | −0.989 | 0.326 | 0.015 | 68 |

| Financial sector | ||||||

| X35 | Credit growth | 1.538 | 5.250 | 0.000 ** | 0.299 | 67 |

| X36 | Domestic credit to the private sector | 0.047 | 7.939 | 0.000 ** | 0.496 | 66 |

| General government sector | ||||||

| X39 | Public debt | −0.014 | −2.448 | 0.017 * | 0.084 | 67 |

| X40 | Public-debt-to-GDP | −6.736 | −2.155 | 0.035 * | 0.068 | 65 |

| X41 | Budget-balance-to-GDP | 6.273 | 2.893 | 0.005 ** | 0.116 | 66 |

| X42 | Private-to-public indebtedness | 95.772 | 5.213 | 0.000 ** | 0.295 | 67 |

| Households sector | ||||||

| X44 | Wages and salaries per employee | 0.125 | 2.247 | 0.028 * | 0.073 | 66 |

| Symbol | Variable | Periods According to Breaks (Bai-Perron) | Coefficient | t-Statistic | Prob. | R Sq. | Observ. |

|---|---|---|---|---|---|---|---|

| GDP | |||||||

| X2 | Real GDP | 2005Q2–2008Q3 | 0.072 | 0.587 | 0.559 | 0.413 | 14 |

| 2008Q4–2021Q4 | 0.053 | 1.671 | 0.099 | 53 | |||

| X3 | GDP growth | 2005Q2–2008Q3 | 4.611 | 0.505 | 0.615 | 0.087 | 14 |

| 2008Q4–2021Q4 | 4.347 | 1.610 | 0.112 | 53 | |||

| X4 | Real GDP growth | 2005Q2–2008Q3 | 4.629 | 0.504 | 0.616 | 0.410 | 14 |

| 2008Q4–2021Q4 | 4.340 | 1.615 | 0.111 | 53 | |||

| X7 | Gross national income | 2005Q2–2008Q3 | −1.869 | −0.237 | 0.813 | 0.431 | 14 |

| 2008Q4–2021Q3 | 4.628 | 2.258 | 0.028 * | 52 | |||

| Inflation | |||||||

| X9 | GDP deflator | 2005Q2–2008Q3 | −4.144 | −0.690 | 0.495 | 0.507 | 14 |

| 2008Q4–2011Q4 | 0.873 | 0.266 | 0.791 | 13 | |||

| 2012Q1–2021Q3 | 2.381 | 0.460 | 0.640 | 40 | |||

| X10 | Consumer price index (CPI) | 2005Q3–2008Q3 | 13.601 | 0.910 | 0.366 | 0.511 | 13 |

| 2008Q4–2011Q4 | −12.256 | −1.448 | 0.153 | 13 | |||

| 2012Q1–2021Q4 | 6.717 | 1.072 | 0.288 | 41 | |||

| X11 | Percentage change of CPI | 2005Q2–2008Q3 | 10.779 | 0.920 | 0.361 | 0.508 | 14 |

| 2008Q4–2011Q4 | −10.805 | −1.402 | 0.166 | 13 | |||

| 2012Q1–2021Q4 | 5.975 | 0.878 | 0.383 | 41 | |||

| X12 | Producer price index (PPI) | 2005Q2–2008Q3 | −2.320 | −0.692 | 0.491 | 0.517 | 14 |

| 2008Q4–2011Q4 | 1.006 | 0.585 | 0.561 | 13 | |||

| 2012Q1–2021Q3 | 2.126 | 1.113 | 0.261 | 40 | |||

| Money | |||||||

| X13 | Money supply (M2) | 2005Q2–2008Q3 | −0.478 | −0.152 | 0.879 | 0.536 | 14 |

| 2008Q4–2011Q4 | 5.032 | 2.124 | 0.038 * | 13 | |||

| 2012Q1–2021Q4 | −0.321 | −0.330 | 0.742 | 40 | |||

| X14 | International reserves | 2005Q2–2008Q3 | 8.550 | 1.313 | 0.194 | 0.578 | 14 |

| 2008Q4–2011Q4 | −23.782 | −3.034 | 0.004 ** | 13 | |||

| 2012Q1–2021Q4 | −1.023 | −0.480 | 0.633 | 40 | |||

| Investment | |||||||

| X15 | Gross fixed capital formation per capita | 2005Q2–2008Q3 | 1.021 | 0.617 | 0.539 | 0.519 | 14 |

| 2008Q4–2011Q4 | 1.267 | 1.348 | 0.183 | 13 | |||

| 2012Q1–2021Q4 | −0.415 | −0.491 | 0.689 | 14 | |||

| X16 | Capital investment | 2005Q2–2012Q1 | 8.721 | 7.941 | 0.000 ** | 0.517 | 28 |

| 2012Q2–2021Q4 | 2.718 | 1.679 | 0.098 | 39 | |||

| Labour market | |||||||

| X17 | Long-term unemployment rate | 2005Q2–2008Q3 | 21.522 | 0.821 | 0.415 | 0.549 | 14 |

| 2008Q4–2011Q4 | 34.536 | 2.347 | 0.022 * | 13 | |||

| 2012Q1–2021Q4 | −9.640 | −0.527 | 0.599 | 40 | |||

| X18 | Unemployment rate | 2005Q2–2008Q3 | −3.087 | −0.262 | 0.794 | 0.504 | 14 |

| 2008Q4–2011Q4 | 4.090 | 0.479 | 0.633 | 13 | |||

| 2012Q1–2021Q4 | −2.902 | −0.242 | 0.809 | 40 | |||

| Real estate market | |||||||

| X19 | House price index | 2005Q2–2008Q3 | −0.311 | −0.234 | 0.816 | 0.435 | 14 |

| 2008Q4–2020Q4 | 4.774 | 2.875 | 0.066 | 49 | |||

| Trade and trade composition | |||||||

| X20 | Exports of goods and services per capita | 2005Q2–2008Q3 | −0.243 | −0.145 | 0.885 | 0.517 | 14 |

| 2008Q4–2011Q4 | 1.721 | 1.390 | 0.169 | 13 | |||

| 2012Q1–2021Q4 | 0.241 | 0.217 | 0.829 | 40 | |||

| X21 | Exports of goods and services to GDP | 2005Q2–2008Q3 | −1.578 | −0.484 | 0.623 | 0.513 | 14 |

| 2008Q4–2011Q4 | 2.339 | 1.083 | 0.283 | 13 | |||

| 2012Q1–2021Q4 | 0.562 | 0.344 | 0.732 | 40 | |||

| X22 | Exports growth rate | 2005Q2–2008Q3 | −0.138 | −0.082 | 0.935 | 0.517 | 14 |

| 2008Q4–2011Q4 | 1.819 | 1.427 | 0.159 | 13 | |||

| 2012Q1–2021Q4 | 0.260 | 0.234 | 0.816 | 40 | |||

| X23 | Imports of goods and services per capita | 2005Q2–2008Q3 | −0.927 | −0.516 | 0.608 | 0.514 | 14 |

| 2008Q4–2011Q4 | 1.062 | 1.086 | 0.282 | 13 | |||

| 2012Q1–2021Q4 | 0.417 | 0.452 | 0.653 | 40 | |||

| X24 | Imports of goods and services to GDP | 2005Q2–2008Q3 | −0.349 | −0.108 | 0.914 | 0.519 | 14 |

| 2008Q4–2011Q4 | 4.602 | 1.496 | 0.139 | 13 | |||

| 2021Q1–2021Q4 | 0.019 | 0.011 | 0.992 | 40 | |||

| X25 | Imports growth rate | 2005Q2–2008Q3 | −0.825 | −0.454 | 0.652 | 0.514 | 14 |

| 2008Q4–2011Q4 | 1.139 | 1.121 | 0.266 | 13 | |||

| 2012Q1–2021Q4 | 0.429 | 0.465 | 0.644 | 40 | |||

| X26 | Current account balance | 2005Q2–2008Q3 | 2.789 | 1.055 | 0.296 | 0.519 | 14 |

| 2008Q4–2011Q4 | 2.102 | 0.976 | 0.333 | 13 | |||

| 2012Q1–2021Q4 | −0.953 | −0.571 | 0.570 | 40 | |||

| X27 | Trade-balance-to-GDP | 2005Q2–2008Q3 | 0.599 | 0.042 | 0.967 | 0.511 | 14 |

| 2008Q4–2011Q4 | −3.956 | −0.277 | 0.782 | 13 | |||

| 2012Q1–2021Q4 | −9.509 | −1.105 | 0.274 | 40 | |||

| Consumption | |||||||

| X29 | Consumer confidence index | 2005Q2–2008Q3 | −2.156 | −0.246 | 0.807 | 14 | |

| 2008Q4–2011Q4 | 5.581 | 0.936 | 0.353 | 13 | |||

| 2012Q1–2021Q1 | −6.398 | −0.988 | 0.327 | 41 | |||

| X30 | Final consumption expenditure of households per capita | 2005Q2–2008Q3 | −2.564 | −0.374 | 0.709 | 0.406 | 14 |

| 2008Q4–2021Q4 | 2.099 | 1.481 | 0.144 | 53 | |||

| Business sector | |||||||

| X31 | Industrial production index | 2005Q2–2008Q4 | 3.083 | 1.505 | 0.137 | 15 | |

| 2009Q1–2011Q4 | 12.464 | 2.668 | 0.009 ** | 12 | |||

| 2012Q1–2021Q1 | −1.038 | −2.043 | 0.045 * | 41 | |||

| Financial sector | |||||||

| X35 | Credit growth | 2005Q2–2008Q3 | −1.299 | −1.705 | 0.093 | 0.533 | 14 |

| 2008Q4–2011Q4 | −0.749 | −0.577 | 0.566 | 13 | |||

| 2012Q1–2021Q4 | 1.044 | 1.041 | 0.302 | 40 | |||

| X36 | Domestic credit to the private sector | 2005Q2–2008Q3 | 0.003 | 0.210 | 0.834 | 0.567 | 14 |

| 2008Q4–2021Q3 | 0.045 | 5.307 | 0.000 ** | 52 | |||

| General government sector | |||||||

| X39 | Public debt | 2005Q2–2008Q3 | 0.039 | 1.141 | 0.258 | 0.637 | 14 |

| 2008Q4–2011Q4 | −0.062 | −4.584 | 0.000 ** | 13 | |||

| 2021Q1–2021Q4 | −0.003 | −0.756 | 0.453 | 40 | |||

| X40 | Public-debt-to-GDP | 2005Q2–2008Q3 | 11.583 | 1.048 | 0.298 | 0.554 | 14 |

| 2008Q4–2011Q4 | −12.531 | −2.298 | 0.025 * | 13 | |||

| 2021Q1–2021Q2 | 0.768 | 0.281 | 0.779 | 38 | |||

| X41 | Budget-balance-to-GDP | 2005Q2–2008Q3 | −1.841 | −0.242 | 0.809 | 0.718 | 14 |

| 2008Q4–2011Q4 | 14.794 | 6.808 | 0.000 ** | 13 | |||

| 2021Q1–2021Q3 | 0.693 | 0.422 | 0.675 | 39 | |||

| X42 | Private-to-public indebtedness | 2005Q2–2008Q3 | −18.513 | −0.567 | 0.573 | 0.510 | 14 |

| 2008Q4–2021Q4 | 86.351 | 3.992 | 0.000 ** | 53 | |||

| Households sector | |||||||

| X44 | Wages and salaries per employee | 2005Q2–2008Q3 | −0.113 | −0.681 | 0.498 | 0.421 | 14 |

| 2008Q4–2021Q3 | 0.097 | 1.894 | 0.063 | 52 | |||

| Symbol | Variable | Regimes | Coefficient | t-Statistic | Prob. | Log-Likelihood | Durbin-Watson |

|---|---|---|---|---|---|---|---|

| GDP | |||||||

| X2 | Real GDP | Regime 1 | 0.052 | 1.524 | 0.127 | −350.903 | 2.141 |

| Regime 2 | 0.112 | 1.086 | 0.277 | ||||

| X3 | GDP growth | Regime 1 | 4.262 | 1.473 | 0.141 | −351.073 | 2.114 |

| Regime 2 | 8.062 | 9.362 | 0.389 | ||||

| X4 | Real GDP growth | Regime 1 | 8.104 | 0.869 | 0.385 | −351.064 | 2.116 |

| Regime 2 | 4.257 | 1.472 | 0.141 | ||||

| X7 | Gross national income | Regime 1 | 32.710 | 1.481 | 0.139 | −342.603 | 1.635 |

| Regime 2 | 7.362 | 3.936 | 0.000 ** | ||||

| Inflation | |||||||

| X9 | GDP deflator | Regime 1 | 2.329 | 0.753 | 0.451 | −352.078 | 1.997 |

| Regime 2 | −3.564 | −0.598 | 0.549 | ||||

| X10 | Consumer price index (CPI) | Regime 1 | −58.523 | −0.775 | 0.439 | −365.245 | 1.359 |

| Regime 2 | 1.577 | 0.269 | 0.788 | ||||

| X11 | Percentage change of CPI | Regime 1 | −1.465 | −0.239 | 0.811 | −359.309 | 1.829 |

| Regime 2 | 9.811 | 0.740 | 0.459 | ||||

| X12 | Producer price index (PPI) | Regime 1 | 1.560 | 1.071 | 0.285 | −251.782 | 1.999 |

| Regime 2 | −2.333 | −0.598 | 0.550 | ||||

| Money | |||||||

| X13 | Money supply (M2) | Regime 1 | −0.289 | −0.045 | 0.964 | −352.397 | 1.932 |

| Regime 2 | 0.611 | 0.580 | 0.562 | ||||

| X14 | International reserves | Regime 1 | −3.542 | −1.458 | 0.145 | −350.761 | 1.986 |

| Regime 2 | −3.565 | −2.306 | 0.266 | ||||

| Investment | |||||||

| X15 | Gross fixed capital formation per capita | Regime 1 | 2.535 | 0.884 | 0.377 | −351.212 | 2.038 |

| Regime 2 | 0.964 | 1.133 | 0.257 | ||||

| X16 | Capital investment | Regime 1 | 5.815 | 8.752 | 0.000 ** | −327.510 | 1.899 |

| Regime 2 | 1.817 | 0.019 | 0.985 | ||||

| Labour market | |||||||

| X17 | Long-term unemployment rate | Regime 1 | −31.914 | −2.961 | 0.003 ** | −349.819 | 1.602 |

| Regime 2 | 153.148 | 2.255 | 0.024 * | ||||

| X18 | Unemployment rate | Regime 1 | 171.437 | 4.006 | 0.000 ** | −351.173 | 1.412 |

| Regime 2 | −16.327 | −2.523 | 0.011 * | ||||

| Real estate market | |||||||

| X19 | House price index | Regime 1 | −0.293 | −0.189 | 0.849 | −330.887 | 1.999 |

| Regime 2 | 4.757 | 1.782 | 0.075 | ||||

| Trade and trade composition | |||||||

| X20 | Exports of goods and services per capita | Regime 1 | 0.950 | 1.005 | 0.315 | −353.028 | 1.951 |

| Regime 2 | −0.144 | −0.066 | 0.948 | ||||

| X21 | Exports of goods and services to GDP | Regime 1 | −9.920 | −1.579 | 0.114 | −352.145 | 1.964 |

| Regime 2 | −1.537 | −0.408 | 0.683 | ||||

| X22 | Exports growth rate | Regime 1 | −0.023 | −0.064 | 0.949 | −351.939 | 1.949 |

| Regime 2 | 1.038 | 1.086 | 0.278 | ||||

| X23 | Imports of goods and services per capita | Regime 1 | 0.856 | 1.127 | 0.259 | −351.796 | 1.979 |

| Regime 2 | −0.914 | −0.426 | 0.670 | ||||

| X24 | Imports of goods and services to GDP | Regime 1 | −0.166 | −0.064 | 0.949 | −352.495 | 1.937 |

| Regime 2 | 0.732 | 0.414 | 0.679 | ||||

| X25 | Imports growth rate | Regime 1 | −0.798 | −0.365 | 0.716 | −351.728 | 1.977 |

| Regime 2 | 0.926 | 1.202 | 0.229 | ||||

| X26 | Current account balance | Regime 1 | 45.711 | 3.523 | 0.000 ** | −354.346 | 1.339 |

| Regime 2 | −0.604 | −0.417 | 0.677 | ||||

| X27 | Trade-balance-to-GDP | Regime 1 | −634.462 | −6.206 | 0.000 ** | −352.919 | 1.484 |

| Regime 2 | −10.185 | −1.449 | 0.147 | ||||

| Consumption | |||||||

| X29 | Consumer confidence index (CCI) | Regime 1 | −1.977 | −0.154 | 0.877 | −359.606 | 1.881 |

| Regime 2 | 1.475 | 0.259 | 0.796 | ||||

| X30 | Final consumption expenditure of households per capita | Regime 1 | −2.522 | −0.333 | −0.730 | −351.412 | 1.976 |

| Regime 2 | 2.950 | 1.425 | 0.154 | ||||

| Business sector | |||||||

| X31 | Industrial production index | Regime 1 | −0.417 | −0.671 | 0.502 | −359.256 | 1.748 |

| Regime 2 | 2.173 | 1.351 | 0.177 | ||||

| Financial sector | |||||||

| X35 | Credit growth | Regime 1 | −46.772 | −1.954 | 0.051 | −338.486 | 1.432 |

| Regime 2 | 1.423 | 6.016 | 0.000 ** | ||||

| X36 | Domestic credit to the private sector | Regime 1 | 0.173 | 10.733 | 0.000 ** | −318.307 | 2.426 |

| Regime 2 | 0.038 | 9.271 | 0.000 ** | ||||

| General government sector | |||||||

| X39 | Public debt | Regime 1 | 0.039 | 0.889 | 0.374 | −349.353 | 1.928 |

| Regime 2 | −0.001 | −2.292 | 0.022 * | ||||

| X40 | Public-debt-to-GDP | Regime 1 | −4.488 | −1.676 | 0.094 | −340.529 | 2.110 |

| Regime 2 | 11.385 | 0.885 | 0.377 | ||||

| X41 | Budget-balance-to-GDP | Regime 1 | 1.299 | 0.717 | 0.474 | −335.612 | 1.426 |

| Regime 2 | 20.963 | 8.372 | 0.000 ** | ||||

| X42 | Private-to-public indebtedness | Regime 1 | 889.857 | 3.974 | 0.000 ** | −339.037 | 2.164 |

| Regime 2 | 85.887 | 5.895 | 0.000 ** | ||||

| Households sector | |||||||

| X44 | Wages and salaries per employee | Regime 1 | 0.095 | 1.801 | 0.072 | −345.845 | 2.050 |

| Regime 2 | −0.120 | −0.678 | 0.497 | ||||

| Symbol | Variable | CEE Panel Estimation | Lithuania Simple Regression | Lithuania Regression with Structural Breaks | Lithuania under Different Regimes |

|---|---|---|---|---|---|

| GDP | |||||

| X2 | Real GDP | Insignificant | Sign. Positive | Insignificant | Insignificant |

| X3 | GDP growth | Insignificant | Sign. Positive | Insignificant | Insignificant |

| X4 | Real GDP growth | Insignificant | Sign. Positive | Insignificant | Insignificant |

| X6 | Output gap | Insignificant | - | - | - |

| X7 | Gross national income | Insignificant | Sign. Positive | Sign. positive (2008Q4–2021Q3)/Insig. | Sign. positive/Insig. |

| X8 | Gross national expenditure | Insignificant | - | - | - |

| Inflation | |||||

| X9 | GDP deflator | Insignificant | Insignificant | Insignificant | Insignificant |

| X10 | Consumer price index (CPI) | Insignificant | Insignificant | Insignificant | Insignificant |

| X11 | Percentage change of CPI | Insignificant | Insignificant | Insignificant | Insignificant |

| X12 | Producer price index (PPI) | Insignificant | Sign. Positive | Insignificant | Insignificant |

| Money | |||||

| X13 | Money supply (M2) | Insignificant | Insignificant | Sign. positive (2008Q4–2011Q4)/Insig. | Insignificant |

| X14 | International reserves | Insignificant | Insignificant | Sign. negative (2008Q4–2011Q4)/Insig. | Insignificant |

| Investment | |||||

| X15 | Gross fixed capital formation per capita | Insignificant | Sign. Positive | Sign. Positive | Insignificant |

| X16 | Capital investment | Insignificant | Sign. Positive | Sign. positive (2005Q2–2012Q1)/Insig. | Sign. Positive/Insig. |

| Labour market | |||||