Start-Up Accelerators and Their Impact on Sustainability: Literature Analysis and Case Studies from the Energy Sector

Abstract

:1. Introduction

2. Research Methodology

- 1.

- A systematic literature review on start-up accelerators [23]. This methodology was chosen because of its precise and transparent paper-searching process [24]. The paper uses Tranfield’s guidance [25] and adopts main steps:

- (a)

- Planning the review: In this paper, the authors focus on start-up accelerators and analyse the state-of-the-art research about them. The systematic literature review searched only for articles that use the following terms: a (“startup*” OR “start-up*” OR “startup compan*” OR “start-up compan*”) AND (“start-up* accelerator*” OR “startup* accelerator*”).

- (b)

- Conducting the review: The authors searched (in title, abstract and keywords lines) for the term “start-up accelerator” or its synonyms in the Scopus database. The database is characterised by high-level publications relative to quality posted therein and has a high reputation in the scientific community. Scopus is one of the most frequently used databases by both theoreticians and practitioners. The authors took into consideration papers written in English appearing in journals, conference monographs, and books.

- (c)

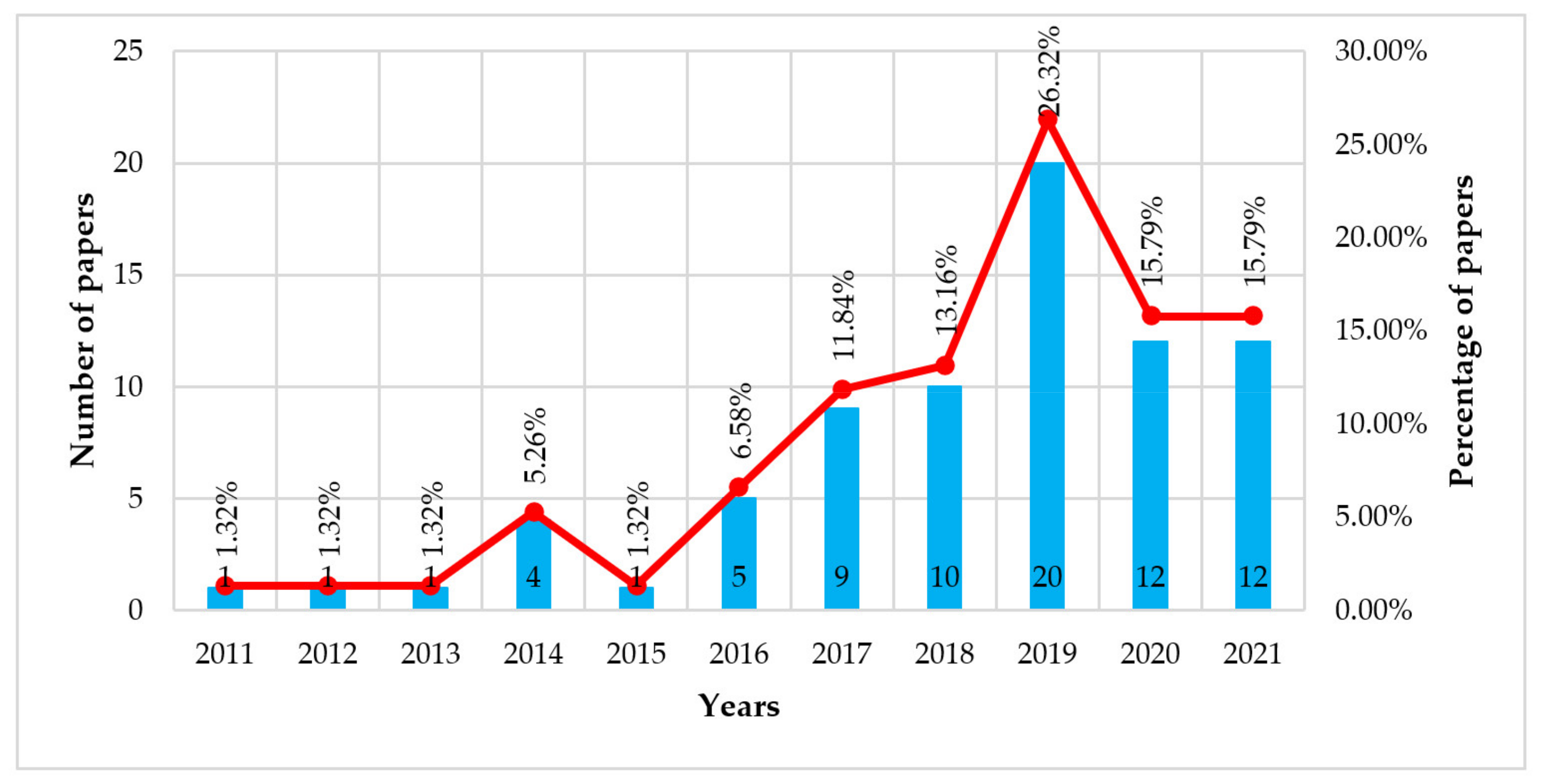

- Reporting and dissemination: An analysis was carried out on start-up accelerators. According to the guidelines, 81 publications dating back to 2011 to 2021 were obtained. Based on the manual verification of publications (reading whole papers), 76 articles focusing on start-up accelerators and their impacts on the sustainable economy were obtained for further analysis.

- 2.

- In this stage of the study, the analysed publications were classified. The selected 76 articles were coded based on the type of acceleration program or accelerator type they described. Six groups were distinguished: (1) general approach to start-up accelerators, (2) corporate accelerators, (3) seed accelerators, (4) academic accelerators, (5) many types of accelerators, and (6) other types of accelerators.

- 3.

- Then, the authors focused on the analysis of sustainability aspects and material features of start-up accelerators in the context of sustainability aspects raised in 76 publications. This allowed the determination of which aspects of sustainability (economic, social, or environmental) are most often taken into account in this research area. This systematises the knowledge on start-up accelerators and provides an excellent summary of the ongoing literature review in the context of sustainable development.

- 4.

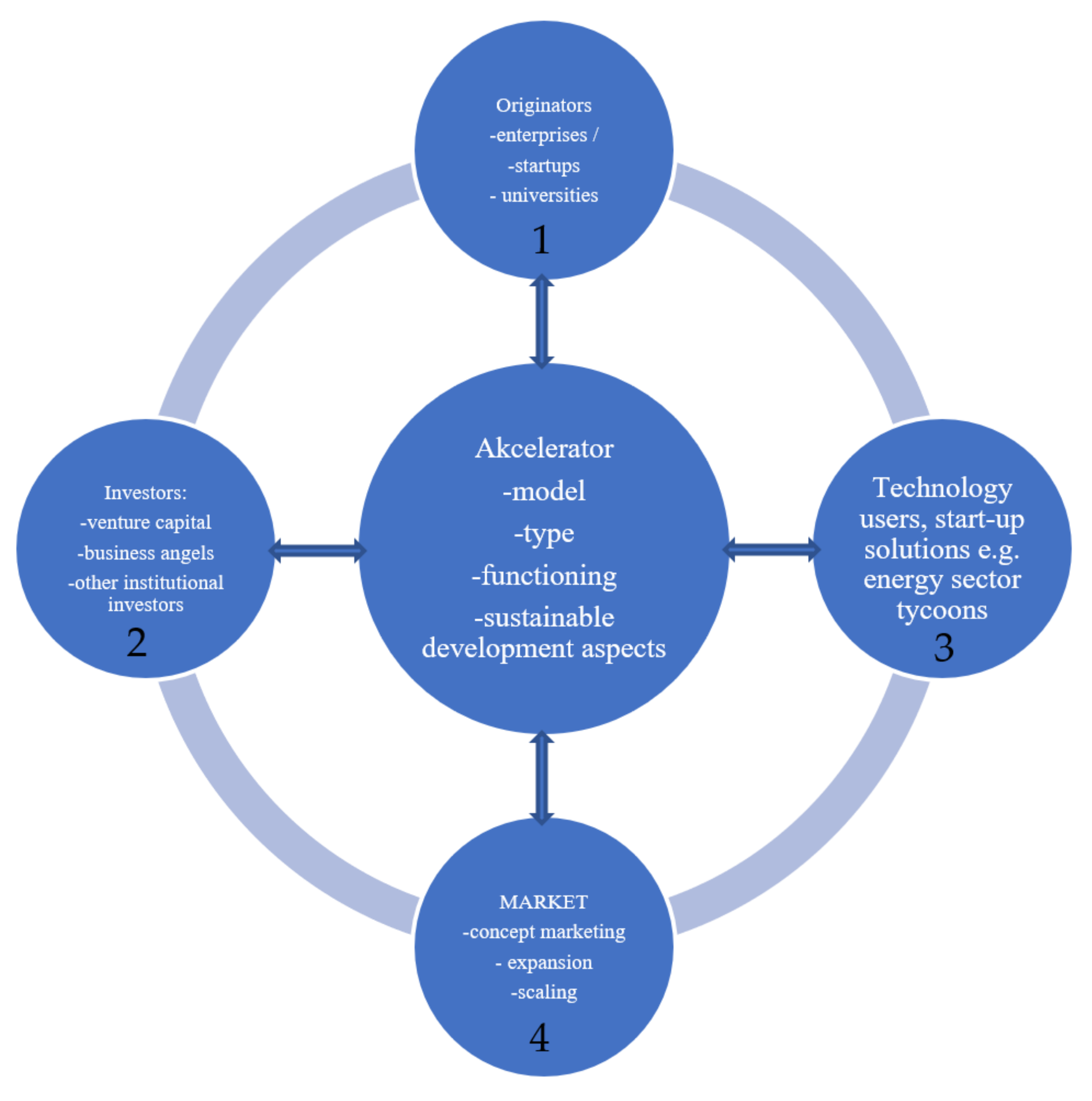

- Acceleration of start-ups in the energy sector: In this research phase three models of cooperation of start-up accelerators with start-ups and corporations were presented: a model of commercial cooperation between the corporation and an external accelerator, a model of independent operation related to the establishment of a corporate accelerator being an internal structure in an energy company, and a hybrid model comprising a mixture of the two previous models. Each of the presented models was supported by case studies of companies operating in Europe.

3. Literature Review

3.1. General Analysis

3.2. Literature Analysis

- The general approach to start-up accelerators group comprises papers covering start-up accelerators and acceleration programs of general interest. The authors of these publications will not identify a specific accelerator or acceleration program. This group comprises 22 articles, written by 54 authors from 46 R&D centres located in 13 countries. In total, all publications in this group were cited 125 times [30,31,32,33,34,35,36,37,38,39,40,41,42,43,44,45,46,47,48,49,50,51,52,53].

- The corporate accelerator category comprises papers covering start-up accelerators and acceleration programs run by multinational corporations. This group consists of 27 articles written by 56 authors from 34 research centres located in 13 countries. In total, all publications included in this category were cited 274 times [19,22,26,27,28,29,54,55,56,57,58,59,60,61,62,63,64,65,66,67,68,69,70,71,72,73,74].

- The category of seed accelerators comprises papers covering start-up accelerators and accelerator programs covering seed activities. The authors of these publications will not identify a specific accelerator or acceleration program. This group consists of 9 papers written by 17 authors from 11 R&D centres that are located in 3 countries. In total, all publications falling into this category were cited 106 times [75,76,77,78,79,80,81].

- The academic accelerators category comprises papers on start-up accelerators and acceleration programs of academic significance. The authors of these publications presented mainly university projects aimed at the implementation of solutions developed at R&D units into industrial practice and supporting entrepreneurship in the academic environment. This category consists of 10 papers written by 23 authors from 10 R&D centres that are located in 8 countries. In total, all publications included in this category were cited 24 times [34,82,83,84,85,86,87,88,89,90,91].

- The “Many types of accelerators” category comprises papers covering start-up accelerators and acceleration programs with a broad view on the subject. The authors of these publications presented many forms of support for start-ups. This category comprises 6 papers written by 11 authors from 18 R&D centres that are located in 7 countries. In total, all publications included in this group were cited 24 times [18,20,21,92,93,94].

- The “Other types of accelerators” category comprises papers comprising new or less popular start-up accelerators and acceleration programs. This category consists of three papers written by six authors from five R&D centres that are located in two countries. In total, all publications included in this category were cited 3 times [29,95,96].

- As most researchers emphasize in their studies, irrespective of the model and the type of accelerator, its functioning contributes to the increase in entrepreneurship and innovativeness in the economy on the local, regional, and macro-scale [19,20,21,22,23,24,25,26,27,28,29,30,31,32,33,34,35,36,37,38,39,40,41,42,43,44,45,46,47,48,49,50,51,52,53,54,55,56,57,58,59,60,61,62,63,64,65,66,67,68,69,70,71,72,73,74,75,76,77,78,79,80,81,82,83,84,85,86,87,88,89,90,91,92,93,94,95].

- There are many types of accelerators and acceleration programs, they are considerably diversified, and their mode of operation are embraced in various types of models, which include, among other things, economic or marketing aspects [40,41,42,43,44,45,46,47,48,49,50,51,52,53,54,55,56,57,58,59,60,61,62,63,64,65].

- A prevailing part of the studied papers comprises statistical analyses, case studies, ethnographic studies, interviews, and surveys [34,35,36,37,38,39,40,41,42,43,44,45,46,47,48,49,50,51,52,53,54,55,56,57,58,59,60,61,62,63,64,65,66,67,68,69,70,71,72,73,74,75,76,77,78,79,80,81,82,83,84,85,86,87,88,89,90,91].

- 1.

- In the group of papers referring to accelerators in general [30,31,32,33,34,35,36,37,38,39,40,41,42,43,44,45,46,47,48,49,50,51,52,53]:

- The research is focused mainly on the priorities of accelerators, and the needs of start-ups are omitted.

- The role of accelerators in the development of entrepreneurship and innovativeness is emphasized, but no criteria are recommended to enterprises for applying for a given accelerator.

- 2.

- Corporate accelerators [19,22,26,27,28,29,54,55,56,57,58,59,60,61,62,63,64,65,66,67,68,69,70,71,72,73,74]:

- The studies note the sources of disturbances of the corporate-start-up collaboration within the frames of the implemented acceleration programs. The main objective of that type of accelerator is not the growth of start-ups but their incorporation. In that model, accelerators perform the function of an intermediary and administrator between a start-up and a corporation rather than an accelerator of a new business.

- The research of the activities taken by corporations with respect to start-ups indicates that their motives result mostly from corporations’ problems with internal innovativeness and/or creation of its culture.

- The conducted research is focused mainly on corporations and, as such, their expectations for start-ups applying for a program.

- A noticeable objective of the research presented in the papers was also to elaborate directions for designing and positioning accelerators with respect to a corporate strategy.

- Start-ups are treated as suppliers of new ideas and projects or potential investment opportunities.

- 3.

- The essence of this type of accelerator is to support newly established undertakings and, thus, create jobs.

- The research is dominated by the point of view of an accelerator, where the success of a start-up is treated rather as the success of the accelerator itself, indicating the necessity for accelerators to select appropriate projects at the stage of their evaluation.

- 4.

- In light of the research results, academic accelerators primarily play an educational role and act as an intermediary in providing knowledge and stimulating entrepreneurship and innovativeness.

- The problem of those accelerators is the transformation of the ideas and the completion of programs that become real business projects.

- Most undertaken activities concern the creation of accelerator programs by academic environments, their analysis, and modelling to serve as a model for other academic facilities

- 5.

- The prevailing approach is to view accelerators as an ecosystem and situate start-ups as one of its elements.

- It is particularly worth mentioning a study in which the authors present a model of an accelerator as a tool for decision makers to decide on the selection of start-ups and their projects. The authors further indicate that start-ups may employ that model to select an adequate accelerator.

- 6.

- A new type of accelerator was identified by the researchers as a start-up supplier, which confirms the objectification of start-ups even more.

- Establishing accelerators founded by family enterprises and impact (social and environmental) accelerators supporting sustainable development is desired.

3.3. Analysis of Sustainability Aspects and Material Features Appearing in the Publications about Start-Up Accelerators

4. Start-Up Acceleration in the Energy Sector

4.1. Model of Cooperation between an Energy Corporation and a Third Party Independent Accelerator

4.2. A Model for Setting up an In-House Structure in an Energy Company as a Corporate Accelerator (Model In-House Accelerator)

4.3. Mixed Model of Cooperation between Energy Companies and Start-ups (MIX Accelerator Model)

4.4. Classification of Energy Accelerator Models

5. Closing Remarks and Conclusions

- A growing trend in the number of publications, especially from 2015 onwards;

- Most publications to date have been written in Europe, with efforts in this area carried out in over 100 R&D centres;

- Within the defined twelve (12) thematic areas, the largest number of publications relates to business, management, and accounting (50 publications);

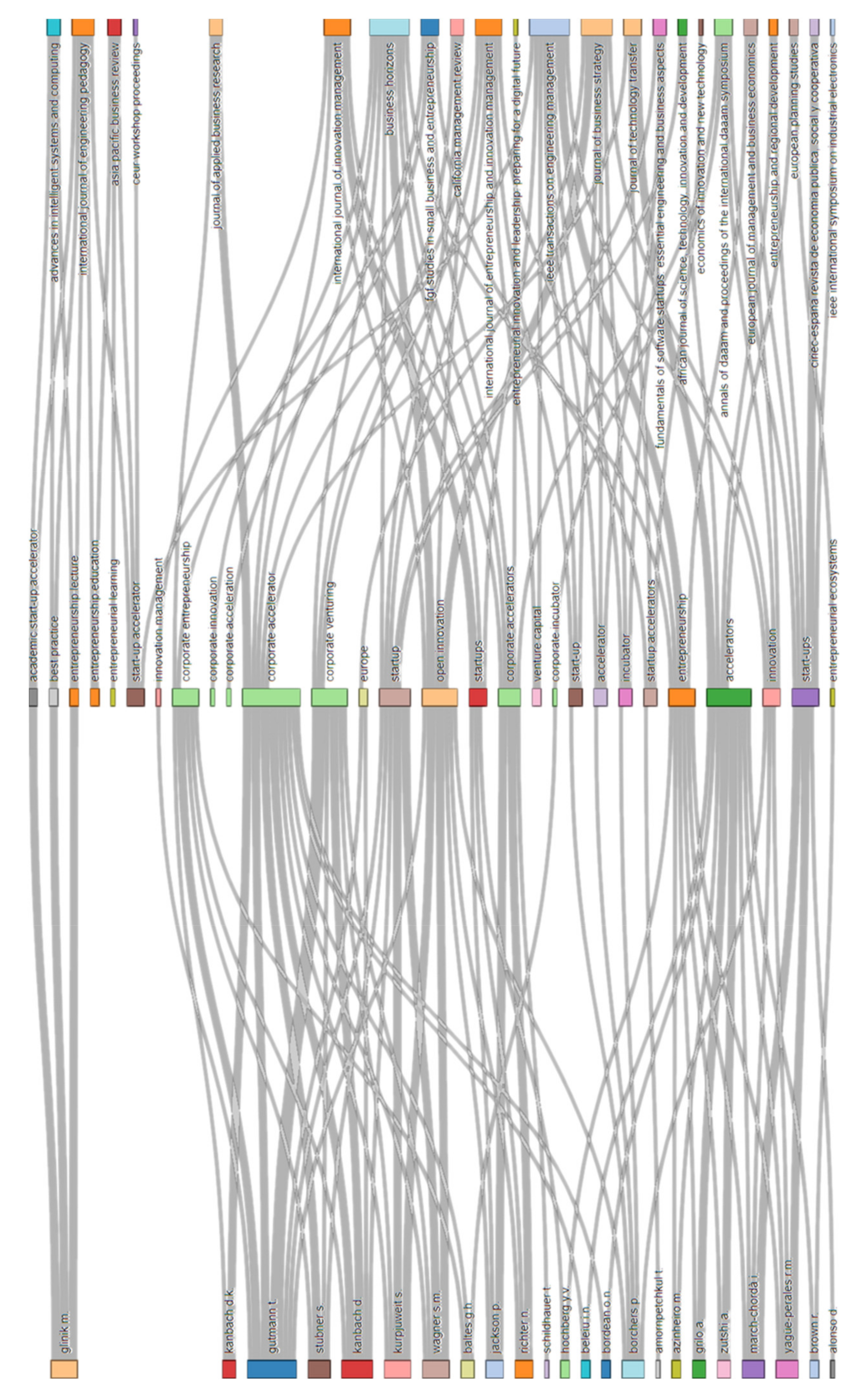

- The developed Sankey Diagram supplemented the quantitative data collected as links among major authors, keywords, and sources;

- Scientific articles published in journals represent the vast majority of published content in the Scopus database;

- Practically speaking, all analysed publications dealt with the question of sustainable development (economic, social, and environmental aspects).

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Aspects of Sustainable Development | Analysis of Important Features Appearing in Publications | |||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Group | Publication | Economic | Social | Environment | Total | Accelerator | Start-up | Entrepreneurship | Innovation | Corporate Accelerator | Incubator | Start-up Accelerator | Open Innovation | Engineering | Ecosystem | Education | Corporate Entrepreneurship | Corporate Venturing | Accelerator Projects | Design | Venture Capital | Investment | Seed accelerator | New venture | Innovation management | Student | Lean Start-up Methodology | Academic Start-up Accelerator | Accelerator Design | Business Idea | Commerce | Corporate-Start-up Collaboration | Engineering Education | Internet of Things | Best Practices | Established Firm | Value Proposition | Entrepreneurial Ecosystem | Entrepreneurship Education | Total |

| General Approach to Start-up Accelerators | [30] | X | 1 | X | X | X | X | X | X | X | 7 | |||||||||||||||||||||||||||||

| [31] | X | X | 2 | X | X | X | 3 | |||||||||||||||||||||||||||||||||

| [32] | X | 1 | X | X | X | 3 | ||||||||||||||||||||||||||||||||||

| [33] | X | 1 | X | X | 2 | |||||||||||||||||||||||||||||||||||

| [34] | X | X | 2 | X | X | X | 3 | |||||||||||||||||||||||||||||||||

| [35] | X | 1 | X | X | X | X | X | X | 6 | |||||||||||||||||||||||||||||||

| [36] | X | 1 | X | X | X | X | X | X | 6 | |||||||||||||||||||||||||||||||

| [37] | X | X | 2 | X | X | 2 | ||||||||||||||||||||||||||||||||||

| [38] | X | X | 2 | X | X | 2 | ||||||||||||||||||||||||||||||||||

| [39] | X | X | 2 | X | X | X | X | X | X | X | 7 | |||||||||||||||||||||||||||||

| [40] | X | X | 2 | X | X | X | X | 4 | ||||||||||||||||||||||||||||||||

| [41] | X | 1 | X | X | X | X | 3 | |||||||||||||||||||||||||||||||||

| [42] | X | X | 2 | X | 1 | |||||||||||||||||||||||||||||||||||

| [43] | X | 1 | X | X | X | X | X | X | X | 7 | ||||||||||||||||||||||||||||||

| [44] | X | X | 2 | X | X | X | X | X | 5 | |||||||||||||||||||||||||||||||

| [45] | X | X | 2 | X | X | 2 | ||||||||||||||||||||||||||||||||||

| [46] | X | 1 | X | 1 | ||||||||||||||||||||||||||||||||||||

| [47] | X | X | X | 3 | X | X | X | X | 3 | |||||||||||||||||||||||||||||||

| [48] | X | X | 2 | X | X | X | X | X | X | 5 | ||||||||||||||||||||||||||||||

| [49] | X | 1 | X | X | X | X | X | 5 | ||||||||||||||||||||||||||||||||

| [50] | X | X | X | 3 | X | X | X | 3 | ||||||||||||||||||||||||||||||||

| [51] | X | 1 | X | X | X | X | 4 | |||||||||||||||||||||||||||||||||

| [52] | X | X | 2 | X | X | 2 | ||||||||||||||||||||||||||||||||||

| [53] | X | X | 2 | X | X | X | 3 | |||||||||||||||||||||||||||||||||

| Corporate Accelerators | [54] | X | 1 | X | X | 2 | ||||||||||||||||||||||||||||||||||

| [55] | X | 1 | X | X | X | X | X | 5 | ||||||||||||||||||||||||||||||||

| [26] | X | 1 | X | X | X | X | X | 5 | ||||||||||||||||||||||||||||||||

| [56] | X | 1 | X | X | X | X | X | X | X | X | 8 | |||||||||||||||||||||||||||||

| [57] | X | X | 2 | X | X | X | X | X | 5 | |||||||||||||||||||||||||||||||

| [58] | X | X | 2 | X | X | X | X | X | 5 | |||||||||||||||||||||||||||||||

| [59] | X | 1 | X | X | X | X | 4 | |||||||||||||||||||||||||||||||||

| [60] | X | 1 | X | X | X | X | X | X | X | 7 | ||||||||||||||||||||||||||||||

| [61] | X | 1 | X | X | X | X | X | X | X | 7 | ||||||||||||||||||||||||||||||

| [62] | X | 1 | X | X | X | X | X | X | X | 7 | ||||||||||||||||||||||||||||||

| [63] | X | X | 2 | X | 1 | |||||||||||||||||||||||||||||||||||

| [64] | X | X | 2 | X | X | X | 3 | |||||||||||||||||||||||||||||||||

| [19] | X | 1 | X | X | X | X | X | X | 6 | |||||||||||||||||||||||||||||||

| [27] | X | 1 | X | X | X | X | X | 5 | ||||||||||||||||||||||||||||||||

| [65] | X | 1 | X | X | X | X | X | X | X | 7 | ||||||||||||||||||||||||||||||

| [66] | X | 1 | X | X | X | X | X | X | X | 7 | ||||||||||||||||||||||||||||||

| [67] | X | 1 | X | X | X | X | X | X | 6 | |||||||||||||||||||||||||||||||

| [68] | X | 1 | X | X | X | X | X | X | X | 7 | ||||||||||||||||||||||||||||||

| [69] | X | X | 2 | X | X | X | 3 | |||||||||||||||||||||||||||||||||

| [28] | X | 1 | X | X | X | X | 4 | |||||||||||||||||||||||||||||||||

| [70] | X | 1 | X | X | X | X | X | X | X | X | 8 | |||||||||||||||||||||||||||||

| [29] | X | X | 2 | X | X | X | X | 4 | ||||||||||||||||||||||||||||||||

| [71] | X | 1 | X | X | X | X | 4 | |||||||||||||||||||||||||||||||||

| [22] | X | 1 | X | X | X | X | 4 | |||||||||||||||||||||||||||||||||

| [72] | X | 1 | X | X | X | X | X | 5 | ||||||||||||||||||||||||||||||||

| [73] | X | 1 | X | X | X | X | 4 | |||||||||||||||||||||||||||||||||

| [74] | X | 1 | X | X | X | X | X | X | 6 | |||||||||||||||||||||||||||||||

| Seed Accelerators | [75] | X | X | X | 3 | X | X | X | 3 | |||||||||||||||||||||||||||||||

| [76] | X | X | 2 | X | X | 2 | ||||||||||||||||||||||||||||||||||

| [77] | X | 1 | X | X | X | X | X | X | X | 7 | ||||||||||||||||||||||||||||||

| [78] | X | X | 2 | X | X | X | X | X | X | X | X | X | 9 | |||||||||||||||||||||||||||

| [79] | X | 1 | X | X | X | X | X | X | 6 | |||||||||||||||||||||||||||||||

| [80] | X | 1 | X | X | X | X | X | 5 | ||||||||||||||||||||||||||||||||

| [81] | X | 1 | X | X | X | 3 | ||||||||||||||||||||||||||||||||||

| Academic Accelerators | [82] | X | X | 2 | X | 1 | ||||||||||||||||||||||||||||||||||

| [34] | X | X | 2 | X | X | X | 3 | |||||||||||||||||||||||||||||||||

| [83] | X | X | 2 | X | X | X | X | X | 5 | |||||||||||||||||||||||||||||||

| [84] | X | 1 | X | X | 2 | |||||||||||||||||||||||||||||||||||

| [85] | X | X | 2 | X | X | X | X | X | X | X | 7 | |||||||||||||||||||||||||||||

| [86] | X | X | 2 | X | X | X | X | X | X | 6 | ||||||||||||||||||||||||||||||

| [87] | X | X | 2 | X | X | X | X | X | X | X | X | X | X | 10 | ||||||||||||||||||||||||||

| [88] | X | X | X | 3 | X | X | X | X | X | 5 | ||||||||||||||||||||||||||||||

| [89] | X | X | 2 | X | X | X | X | X | X | X | 7 | |||||||||||||||||||||||||||||

| [90] | X | X | 2 | X | X | X | X | 4 | ||||||||||||||||||||||||||||||||

| [91] | X | X | 2 | X | X | X | 3 | |||||||||||||||||||||||||||||||||

| Many types of Accelerators | [18] | X | 1 | X | 1 | |||||||||||||||||||||||||||||||||||

| [92] | X | 1 | X | X | X | X | 4 | |||||||||||||||||||||||||||||||||

| [20] | X | 1 | X | X | X | X | X | X | X | 7 | ||||||||||||||||||||||||||||||

| [93] | X | X | X | 3 | X | X | 2 | |||||||||||||||||||||||||||||||||

| [94] | X | 1 | X | X | X | X | 4 | |||||||||||||||||||||||||||||||||

| [21] | X | 1 | X | X | X | X | X | X | 6 | |||||||||||||||||||||||||||||||

| Other types of Accelerators | [95] | X | 1 | X | X | X | X | X | 5 | |||||||||||||||||||||||||||||||

| [29] | X | X | 2 | X | X | X | X | 4 | ||||||||||||||||||||||||||||||||

| [96] | X | X | X | 3 | X | 1 | ||||||||||||||||||||||||||||||||||

| Total | 75 | 35 | 5 | 55 | 48 | 38 | 29 | 20 | 14 | 13 | 11 | 10 | 10 | 9 | 7 | 7 | 6 | 6 | 5 | 5 | 5 | 4 | 4 | 4 | 4 | 3 | 3 | 3 | 3 | 3 | 3 | 3 | 2 | 2 | 2 | 2 | 1 | |||

References

- SET 100. Available online: https://www.start-up-energy-transition.com/set-award/set-100/ (accessed on 1 February 2022).

- Dalton, D.R.; Dalton, C.M. Corporate Growth: Our Advice for Directors Is to Buy “Organic. ” J. Bus. Strategy. 2006, 27, 5–7. [Google Scholar] [CrossRef]

- Yoo, K.; Lee, Y.; Heo, E. Economic Effects by Merger and Acquisition Types in the Renewable Energy Sector: An Event Study Approach. Renew. Sust. Energ. Rev. 2013, 26, 694–701. [Google Scholar] [CrossRef]

- Kwon, O.; Lim, S.; Lee, D.H. Acquiring Startups in the Energy Sector: A Study of Firm Value and Environmental Policy. Bus. Strategy Environ. 2018, 27, 1376–1384. [Google Scholar] [CrossRef]

- Palmié, M.; Boehm, J.; Friedrich, J.; Parida, V.; Wincent, J.; Kahlert, J.; Gassmann, O.; Sjödin, D. Startups versus Incumbents in ‘Green’ Industry Transformations: A Comparative Study of Business Model Archetypes in the Electrical Power Sector. Ind. Mark. Manag. 2021, 96, 35–49. [Google Scholar] [CrossRef]

- Schumpeter, J.; Backhaus, U. The Theory of Economic Development. In Joseph Alois Schumpeter: Entrepreneurship, Style and Vision; Backhaus, J., Ed.; The European Heritage in Economics and the Social Sciences; Springer US: Boston, MA, USA, 2003; pp. 61–116. ISBN 978-0-306-48082-9. [Google Scholar] [CrossRef]

- Gidron, B.; Cohen-Israel, Y.; Bar, K.; Silberstein, D.; Lustig, M.; Kandel, D. Impact Tech Startups: A Conceptual Framework, Machine-Learning-Based Methodology and Future Research Directions. Sustainability 2021, 13, 10048. [Google Scholar] [CrossRef]

- Skawińska, E.; Zalewski, R.I. Success Factors of Startups in the EU-a Comparative Study. Sustainability 2020, 12, 8200. [Google Scholar] [CrossRef]

- Gerdsri, N.; Manotungvorapun, N. Readiness Assessment for IDE Startups: A Pathway toward Sustainable Growth. Sustainability 2021, 13, 13687. [Google Scholar] [CrossRef]

- Hockerts, K.; Wüstenhagen, R. Greening Goliaths versus Emerging Davids—Theorizing about the Role of Incumbents and New Entrants in Sustainable Entrepreneurship. J. Bus. Ventur. 2010, 25, 481–492. [Google Scholar] [CrossRef] [Green Version]

- Napp, J.J.; Minshall, T. Corporate Venture Capital Investments for Enhancing Innovation: Challenges and Solutions. Res. Technol. Manag. 2011, 54, 27–36. [Google Scholar] [CrossRef]

- Pauwels, C.; Clarysse, B.; Wright, M.; Van Hove, J. Understanding a New Generation Incubation Model: The Accelerator. Technovation 2016, 50–51, 13–24. [Google Scholar] [CrossRef]

- Jeong, J.; Kim, J.; Son, H.; Nam, D.-I. The Role of Venture Capital Investment in Startups’ Sustainable Growth and Performance: Focusing on Absorptive Capacity and Venture Capitalists’ Reputation. Sustainability 2020, 12, 3447. [Google Scholar] [CrossRef] [Green Version]

- Passaro, R.; Quinto, I.; Rippa, P.; Thomas, A. Evolution of Collaborative Networks Supporting Startup Sustainability: Evidences from Digital Firms. Sustainability 2020, 12, 9437. [Google Scholar] [CrossRef]

- Bańka, M.; Salwin, M.; Masłowski, D.; Rychlik, S.; Kukurba, M. Start-up Accelerator: State of the Art and Future Directions. Eur. Res. Stud. J. 2022, XXV, 477–510. [Google Scholar] [CrossRef]

- Bărbulescu, O.; Tecău, A.S.; Munteanu, D.; Constantin, C.P. Innovation of Startups, the Key to Unlocking Post-Crisis Sustainable Growth in Romanian Entrepreneurial Ecosystem. Sustainability 2021, 13, 671. [Google Scholar] [CrossRef]

- Aldianto, L.; Anggadwita, G.; Permatasari, A.; Mirzanti, I.R.; Williamson, I.O. Toward a Business Resilience Framework for Startups. Sustainability 2021, 13, 3132. [Google Scholar] [CrossRef]

- Carvalho, A.C.; Grilo, A.; Pina, J.P.; Zutshi, A. How Business Startup Accelerators Envision Their Future. In Proceedings of the International Conference on Industrial Engineering and Operations Management, Rabat, Morocco, 11 April 2017. [Google Scholar]

- Gutmann, T. Harmonizing Corporate Venturing Modes: An Integrative Review and Research Agenda. Manag. Rev. Q. 2019, 69, 121–157. [Google Scholar] [CrossRef]

- Guijarro-García, M.; Carrilero-Castillo, A.; Gallego-Nicholls, J.F. Speeding up Ventures—A Bibliometric Analysis of Start-up Accelerators. Int. J. Intellect. Prop. Manag. 2019, 9, 230–246. [Google Scholar] [CrossRef]

- Crișan, E.L.; Salanță, I.I.; Beleiu, I.N.; Bordean, O.N.; Bunduchi, R. A Systematic Literature Review on Accelerators. J. Technol. Transf. 2021, 46, 62–89. [Google Scholar] [CrossRef]

- Gür, U. Absorptive Capacity Approach to Technology Transfer at Corporate Accelerators: A Systematic Literature Review. In New Perspectives in Technology Transfer; FGF Studies in Small Business and Entrepreneurship; Springer: Cham, Switzerland, 2021; pp. 51–69. [Google Scholar] [CrossRef]

- Pittaway, L.; Robertson, M.; Munir, K.; Denyer, D.; Neely, A. Networking and Innovation: A Systematic Review of the Evidence. Int. J. Manag. Rev. 2004, 5–6, 137–168. [Google Scholar] [CrossRef]

- Annarelli, A.; Nonino, F. Strategic and Operational Management of Organizational Resilience: Current State of Research and Future Directions. Omega 2016, 62, 1–18. [Google Scholar] [CrossRef]

- Tranfield, D.; Denyer, D.; Smart, P. Towards a Methodology for Developing Evidence-Informed Management Knowledge by Means of Systematic Review. Br. J. Manag. 2003, 14, 207–222. [Google Scholar] [CrossRef]

- Kanbach, D.K.; Stubner, S. Corporate Accelerators as Recent Form of Startup Engagement: The What, the Why, and the How. J. Appl. Bus. Res. 2016, 32, 1761–1776. [Google Scholar] [CrossRef]

- Gutmann, T.; Kanbach, D.; Seltman, S. Exploring the Benefits of Corporate Accelerators: Investigating the SAP Industry 4.0 Startup Program. Probl. Perspect. Manag. 2019, 17, 218–232. [Google Scholar] [CrossRef] [Green Version]

- Gutmann, T.; Maas, C.; Kanbach, D.; Stubner, S. Startups in a Corporate Accelerator: What Is Satisfying, What Is Relevant and What Can Corporates Improve? Int. J. Entrepreneurship Innov. Manag. 2020, 24, 443–464. [Google Scholar] [CrossRef]

- Pielken, S.; Kanbach, D.K. Corporate Accelerators in Family Firms—A Conceptual View on Their Design. J. Appl. Bus. Res. 2020, 36, 241–258. [Google Scholar]

- Järvi, A.; Mäkilä, T.; Hyrynsalmi, S. Game Development Accelerator—Initial Design and Research Approach. In Proceedings of the CEUR Workshop Proceedings, Potsdam, Germany, 11 June 2013. [Google Scholar]

- Carmel, E.; Káganer, E. Ayudarum: An Austrian Crowdsourcing Company in the Startup Chile Accelerator Program. J. Bus. Econ. Manag. 2014, 84, 469–478. [Google Scholar] [CrossRef]

- Kim, J.-H.; Wagman, L. Portfolio Size and Information Disclosure: An Analysis of Startup Accelerators. J. Corp. Finance 2014, 29, 520–534. [Google Scholar] [CrossRef]

- Seo, W.S.; Hwangbo, Y.; Ha, K.S. The Current Status and Improvement Strategy of the Korean Start-up Accelerators. Acad. Entrep. J. 2014, 20, 65–74. [Google Scholar]

- Azinheiro, M.; Zutshi, A.; Grilo, A.; Pina, J. Digital Marketing Practices of Start-up Accelerators. In Proceedings of the International Conference on Computers and Industrial Engineering, CIE, Lisbon, Portugal, 11 October 2017. [Google Scholar]

- Heinz, R.; Stephan, Y.; Gillig, H. Scouting of Eearly-Stage Start-Ups: Development and Initial Test of a Conceptual Framework. In Proceedings of the 2017 IEEE European Technology and Engineering Management Summit, E-TEMS 2017; Munich, Germany, 17 October 2017. [CrossRef]

- Hilliger, I.; Mendoza, C.M.; Pérez-Sanagustín, M.; De La Vega, M. Does the Revision of ABET Student Outcomes Include the Competencies Required to Succeed in Start-Ups and Entrepreneurial Companies? In Proceedings of the ASEE Annual Conference and Exposition. Columbus, OH, USA, 25 June 2017. [Google Scholar]

- Sota, F.G.; Farelo, R.M. From labour flexibility to mobile identity: The «Startup» model within the framework of Spanish entrepreneurship. Rev. Minist. Empl. Segur. Soc. 2017, 131, 171–188. [Google Scholar]

- Wallin, A.J.; Fuglsang, L. Service Innovations Breaking Institutionalized Rules of Health Care. J. Serv. Manag. 2017, 28, 972–997. [Google Scholar] [CrossRef]

- Seet, P.-S.; Jones, J.; Oppelaar, L.; Corral de Zubielqui, G. Beyond ‘Know-What’ and ‘Know-How’ to ‘Know-Who’: Enhancing Human Capital with Social Capital in an Australian Start-up Accelerator. Asia Pacific Bus. Rev. 2018, 24, 233–260. [Google Scholar] [CrossRef] [Green Version]

- Cánovas Saiz, L.; March-Chordà, I.; Yagüe-Perales, R.M. Social and economic impact of the Seed Accelerators: Significant factors and implications for the social innovation. CIRIEC–Esp. Rev. Econ. Publ. Soc. Coop. 2018, 93, 211–240. [Google Scholar] [CrossRef] [Green Version]

- Brown, R.; Mawson, S.; Lee, N.; Peterson, L. Start-up Factories, Transnational Entrepreneurs and Entrepreneurial Ecosystems: Unpacking the Lure of Start-up Accelerator Programmes. Eur. Plan. Stud. 2019, 27, 885–904. [Google Scholar] [CrossRef]

- Bustamante, C.V. Strategic Choices: Accelerated Startups’ Outsourcing Decisions. J. Bus. Res. 2019, 105, 359–369. [Google Scholar] [CrossRef]

- Cohen, S.; Fehder, D.C.; Hochberg, Y.V.; Murray, F. The Design of Startup Accelerators. Res. Policy 2019, 48, 1781–1797. [Google Scholar] [CrossRef]

- Fernandes, S.; Castela, G. Start-Ups’ Accelerators Support Open Innovation in Portugal. Int. J. Innov. Learn. 2019, 26, 82–93. [Google Scholar] [CrossRef]

- Harris, W.L.; Wonglimpiyarat, J. Start-up Accelerators and Crowdfunding to Drive Innovation Development. J. Priv. Equity 2019, 23, 124–136. [Google Scholar] [CrossRef]

- Kunes, M. Astropreneurs: Space Start-up Accelerator. In Proceedings of the International Astronautical Congress, IAC, Washington, DC, USA, 21 October 2019. [Google Scholar]

- Kuebart, A.; Ibert, O. Beyond Territorial Conceptions of Entrepreneurial Ecosystems: The Dynamic Spatiality of Knowledge Brokering in Seed Accelerators. Z. Wirtschaftsgeogr. 2019, 63, 118–133. [Google Scholar] [CrossRef]

- Leatherbee, M.; Katila, R. The Lean Startup Method: Early-Stage Teams and Hypothesis-Based Probing of Business Ideas. Strateg. Entrep. J. 2020, 14, 570–593. [Google Scholar] [CrossRef]

- Zarei, H.; Rasti-Barzoki, M.; Moon, I. A Game Theoretic Approach to the Selection, Mentorship, and Investment Decisions of Start-Up Accelerators. IEEE Trans. Eng. Manage. 2020, 69, 1753–1768. [Google Scholar] [CrossRef]

- Boni, A.A.; Gunn, M. Introductory Overview to Special Edition—“Building and Leveraging the Innovation Ecosystem and Clusters: Universities, Startups, Accelerators, Alliances, and Partnerships. ” J. Commer. Biotechnol. 2021, 26, 13–20. [Google Scholar] [CrossRef]

- Charoontham, K.; Amornpetchkul, T. Reputational Impact on Startup Accelerator’s Information Disclosure and Performance. Econ. Innov. New Technol. 2021, 1–25. [Google Scholar] [CrossRef]

- Ramiel, H. Edtech Disruption Logic and Policy Work: The Case of an Israeli Edtech Unit. Learn. Media Technol. 2021, 46, 20–32. [Google Scholar] [CrossRef]

- Shenkoya, T. A Study of Startup Accelerators in Silicon Valley and Some Implications for Nigeria. African J. Sci. Technol. Innov. Dev. 2021, 13, 303–314. [Google Scholar] [CrossRef]

- Hilton, J. Volkswagen Group of America Launches Technology Startup Accelerator at Plug and Play Tech Center: Innovation Accelerator Seeking 10 Startups to Help Develop next Generation of Vehicle Technology. Automot. Ind. AI 2012, 192, 1–2. [Google Scholar]

- Ruseva, R.; Ruskov, P. The Reverse Business-Modelling Framework: A New Approach towards Action-Oriented Entrepreneurship. In Proceedings of the European Conference on Innovation and Entrepreneurship, ECIE, Genoa, Italy, 17 September 2015. [Google Scholar]

- Kohler, T. Corporate Accelerators: Building Bridges between Corporations and Startups. Bus. Horiz. 2016, 59, 347–357. [Google Scholar] [CrossRef]

- Jackson, P.; Richter, N. Situational Logic: An analysis of open innovation using corporate accelerators. Int. J. Innov. Manag. 2017, 21, 1750062. [Google Scholar] [CrossRef]

- Kupp, M.; Marval, M.; Borchers, P. Corporate Accelerators: Fostering Innovation While Bringing Together Startups and Large Firms. J. Bus. Strategy 2017, 38, 47–53. [Google Scholar] [CrossRef]

- Connolly, A.J.; Turner, J.; Potocki, A.D. IGNITE Your Corporate Innovation: Insights from Setting up an Ag-Tech Start-up Accelerator. Int. Food Agribus. Manag. Rev. 2018, 21, 833–846. [Google Scholar] [CrossRef]

- Garcia-Herrera, C.; Perkmann, M.; Childs, P.R.N. Industry-Led Corporate Start-up Accelerator Design: Lessons Learned in a Maritime Port Complex. In Proceedings of the International Design Conference, DESIGN, Dubrovnik, Croatia, 21 May 2018. [Google Scholar] [CrossRef]

- Jung, S. Cooperating with Start-Ups as a Strategy: Towards Corporate Entrepreneurship and Innovation. In Technology Entrepreneurship; FGF Studies in Small Business and Entrepreneurship; Springer: Cham, Switzerland, 2018; pp. 283–298. [Google Scholar] [CrossRef]

- Mahmoud-Jouini, S.B.; Duvert, C.; Esquirol, M. Key Factors in Building a Corporate Accelerator Capability: Developing an Effective Corporate Accelerator Requires Close Attention to the Relationships between Startups and the Sponsoring Company. Res. Technol. Manag. 2018, 61, 26–34. [Google Scholar] [CrossRef]

- Richter, N.; Jackson, P.; Schildhauer, T. Outsourcing Creativity: An Abductive Study of Open Innovation Using Corporate Accelerators. Creat. Innov. Manag. 2018, 27, 69–78. [Google Scholar] [CrossRef]

- Richter, N.; Jackson, P.; Schildhauer, T. Radical Innovation Using Corporate Accelerators: A Program Approach, 1st ed.; Springer International Publishing: Cham, Switzerland, 2018; ISBN 978-3-319-71737-1. [Google Scholar] [CrossRef]

- Kohlert, H. Innovations with Incubation: Recommendations for Corporate Incubators and Corporate Accelerators—Based on an Empirical Study. In Proceedings of the Annals of DAAAM and Proceedings of the International DAAAM Symposium; Zadar, Croatia, 23 October 2019. [CrossRef]

- Moschner, S.-L.; Fink, A.A.; Kurpjuweit, S.; Wagner, S.M.; Herstatt, C. Toward a Better Understanding of Corporate Accelerator Models. Bus. Horiz. 2019, 62, 637–647. [Google Scholar] [CrossRef]

- Prexl, K.-M.; Hubert, M.; Beck, S.; Heiden, C.; Prügl, R. Identifying and Analysing the Drivers of Heterogeneity among Ecosystem Builder Accelerators. R D Manag. 2019, 49, 624–638. [Google Scholar] [CrossRef]

- Shankar, R.K.; Shepherd, D.A. Accelerating Strategic Fit or Venture Emergence: Different Paths Adopted by Corporate Accelerators. J. Bus. Ventur. 2019, 34, 105886. [Google Scholar] [CrossRef]

- Cwik, T.; Kozlov, M.; French, R.; Shapiro, A.; Sewall, E. Space Startup Accelerator Pilot. In Proceedings of the IEEE Aerospace Conference Proceedings, Big Sky, MT, USA, 7 March 2020. [Google Scholar] [CrossRef]

- Heinzelmann, N.; Selig, C.J.; Baltes, G.H. Critical Actions of and Synergies between Corporate Entrepreneurship Programs. In Proceedings of the 2020 IEEE International Conference on Engineering, Technology and Innovation, ICE/ITMC 2020, Cardiff, UK, 15 June 2020. [Google Scholar] [CrossRef]

- Wójcik, P.; Obłój, K.; Wąsowska, A.; Wierciński, S. Corporate Acceleration Process: A Systems Psychodynamics Perspective. J. Organ. Chang. Manag. 2020, 33, 1163–1180. [Google Scholar] [CrossRef]

- Hutter, K.; Gfrerer, A.; Lindner, B. From Popular to profitable: Incumbents’ experiences and challenges with external corporate accelerators. Int. J. Innov. Manag. 2021, 25, 2150035. [Google Scholar] [CrossRef]

- Onetti, A. Turning Open Innovation into Practice: Trends in European Corporates. J. Bus. Strategy 2021, 42, 51–58. [Google Scholar] [CrossRef]

- Urbaniec, M.; Żur, A. Business Model Innovation in Corporate Entrepreneurship: Exploratory Insights from Corporate Accelerators. Int. Entrep. Manag. J. 2021, 17, 865–888. [Google Scholar] [CrossRef] [Green Version]

- Haines, J.K. Emerging Innovation: The Global Expansion of Seed Accelerators. In Proceedings of the ACM Conference on Computer Supported Cooperative Work, CSCW, , Baltimore, MD, USA, 5 February 2014. [Google Scholar] [CrossRef]

- Hochberg, Y.V. Accelerating Entrepreneurs and Ecosystems: The Seed Accelerator Model. Innov. Policy Econ. 2016, 16, 25–51. [Google Scholar] [CrossRef]

- Yin, B.; Luo, J. How Do Accelerators Select Startups? Shifting Decision Criteria across Stages. IEEE Trans. Eng. Manage. 2018, 65, 574–589. [Google Scholar] [CrossRef]

- Stayton, J.; Mangematin, V. Seed Accelerators and the Speed of New Venture Creation. J. Technol. Transf. 2019, 44, 1163–1187. [Google Scholar] [CrossRef]

- Cánovas-Saiz, L.; March-Chordà, I.; Yagüe-Perales, R.M. New Evidence on Accelerator Performance Based on Funding and Location. Eur. J. Manag. Bus. Econ. 2020, 29, 217–234. [Google Scholar] [CrossRef]

- Mariño-Garrido, T.; García-Pérez-de-Lema, D.; Duréndez, A. Assessment Criteria for Seed Accelerators in Entrepreneurial Project Selections. Int. J. Entrep. Innov. Manag. 2020, 24, 53–72. [Google Scholar] [CrossRef]

- Cánovas-Saiz, L.; March-Chordà, I.; Yagüe-Perales, R.M. A Quantitative-Based Model to Assess Seed Accelerators’ Performance. Entrep. Reg. Dev. 2021, 33, 332–352. [Google Scholar] [CrossRef]

- D’Eredita, M.A.; Branagan, S.; Ali, N. Tapping Our Fountain of Youth: The Guiding Philosophy and First Report on the Syracuse Student Startup Accelerator. In Academic Entrepreneurship and Community Engagement: Scholarship in Action and the Syracuse Miracle; Kingma, B., Ed.; Edward Elgar Publishing Ltd.: Cheltenham, UK, 2011; pp. 30–40. ISBN 978-1-84980-155-3. [Google Scholar]

- Ivashchenko, M.; Bodrov, K.; Tolstoba, N. Educational Area for Learning of Optics and Technologies: Union of Open Laboratories of Ideas, Methods and Practices (OLIMP). In Proceedings of the SPIE—The International Society for Optical Engineering, San Diego, CA, USA, 31 August 2016. [Google Scholar] [CrossRef] [Green Version]

- Komarek, R.; Knight, D.; Kotys-Schwartz, D.A. Assessment of a Cross-Disciplinary University Startup Accelerator. In Proceedings of the ASEE Annual Conference and Exposition, Conference Proceedings, New Orleans, LA, USA, 26 June 2016. [Google Scholar] [CrossRef] [Green Version]

- Iborra, A.; Sanchez, P.; Pastor, J.A.; Alonso, D.; Suarez, T. Beyond Traditional Entrepreneurship Education in Engineering Promoting IoT Start-Ups from Universities. In Proceedings of the IEEE International Symposium on Industrial Electronics, Edinburgh, UK, 18 June 2017. [Google Scholar] [CrossRef]

- Glinik, M. Gruendungsgarage—A Best-Practice Example of an Academic Start-up Accelerator. Int. J. Eng. Pedag. 2019, 9, 33–43. [Google Scholar] [CrossRef]

- Glinik, M. Gruendungsgarage: A Five-Year-Experience at Graz University of Technology. Adv. Intell. Syst. Comput. 2019, 917, 237–244. [Google Scholar] [CrossRef]

- Poandl, E.M. Towards Digitalization in Academic Start-Ups: An Attempt to Classify Start-up Projects of the Gruendungsgarage. Int. J. Eng. Ped. 2019, 9, 112–119. [Google Scholar] [CrossRef]

- Mansoori, Y.; Karlsson, T.; Lundqvist, M. The Influence of the Lean Startup Methodology on Entrepreneur-Coach Relationships in the Context of a Startup Accelerator. Technovation 2019, 84–85, 37–47. [Google Scholar] [CrossRef]

- Ismail, A. A Framework for Designing Business-Acceleration Programs: A Case Study from Egypt. Entrep. Res. J. 2020, 10, 20180196. [Google Scholar] [CrossRef]

- Ainamo, A.; Pikas, E.; Mikkelä, K. University Ecosystem for Student Startups: A ‘Platform of Trust’ Perspective. Adv. Intell. Syst. Comput. 2021, 1329, 269–276. [Google Scholar] [CrossRef]

- Yang, S.; Kher, R.; Lyons, T.S. Where Do Accelerators Fit in the Venture Creation Pipeline? Different Values Brought by Different Types of Accelerators. Entrep. Res. J. 2018, 8, 20170140. [Google Scholar] [CrossRef]

- Kwiotkowska, A.; Gȩbczyńska, M. Accelerators for Start-Ups as the Strategic Initiative for the Development of Metropolis. In Proceedings of the IOP Conference Series: Materials Science and Engineering, Prague, Czech Republic, 18 June 2018. [Google Scholar] [CrossRef]

- Tripathi, N.; Oivo, M. The Roles of Incubators, Accelerators, Co-Working Spaces, Mentors, and Events in the Startup Development Process. In Fundamentals of Software Startups; Nguyen-Duc, A., Münch, J., Prikladnicki, R., Wang, X., Abrahamsson, P., Eds.; Springer International Publishing: Cham, Switzerland, 2020; pp. 147–159. ISBN 978-3-030-35982-9. [Google Scholar] [CrossRef]

- Kurpjuweit, S.; Wagner, S.M. Startup Supplier Programs: A New Model for Managing Corporate-Startup Partnerships. Calif. Manage. Rev. 2020, 62, 64–85. [Google Scholar] [CrossRef]

- Butz, H.; Mrożewski, M.J. The Selection Process and Criteria of Impact Accelerators. An Exploratory Study. Sustainability 2021, 13, 6617. [Google Scholar] [CrossRef]

- Singh, M.; Jiao, J.; Klobasa, M.; Frietsch, R. Making Energy-Transition Headway: A Data Driven Assessment of German Energy Startups. Sustain. Energy Technol. Assess. 2021, 47, 101322. [Google Scholar] [CrossRef]

- Kukurba, M.; Waszkiewicz, A.E.; Salwin, M.; Kraslawski, A. Co-Created Values in Crowdfunding for Sustainable Development of Enterprises. Sustainability 2021, 13, 8767. [Google Scholar] [CrossRef]

- Venâncio, A.; Jorge, J. The Role of Accelerator Programmes on the Capital Structure of Start-Ups. Small Bus. Econ. 2022, 59, 1143–1167. [Google Scholar] [CrossRef]

- Hackaton Innowacji. Poznaj Program Hackaton dla Startupów Startup Academy. Available online: https://startupacademy.pl/hackathon-innowacji/ (accessed on 16 December 2021).

- Halvari, S.; Suominen, A.; Jussila, J.; Jonsson, V.; Bäckman, J. Conceptualization of Hackathon for Innovation Management. In Proceedings of the ISPIM Conference Proceedings, Florence, Italy, 16 June 2019. [Google Scholar]

- Briscoe, G.; Mulligan, C. Digital Innovation: The Hackathon Phenomenon. Work. pap. SSN+ 2014. Available online: https://qmro.qmul.ac.uk/xmlui/handle/123456789/11418 (accessed on 8 February 2022).

- Park, J.-H.; Bae, Z.-T. When Are ‘Sharks’ Beneficial? Corporate Venture Capital Investment and Startup Innovation Performance. Technol. Anal. Strateg. Manag. 2018, 30, 324–336. [Google Scholar] [CrossRef]

- Chesbrough, H.; Tucci, C.L. Corporate Venture Capital in the Context of Corporate Innovation. In Proceedings of the Academy of Management Annual Meeting, Seattle, WA, USA, 6 August 2003. [Google Scholar]

- Corporate Innovation through Venture Building. Available online: https://www.insead.edu/sites/default/files/assets/dept/centres/gpei/docs/gpei-corporate-innovation-through-venture-building.pdf (accessed on 10 February 2022).

- Benson, D.; Ziedonis, R.H. Corporate Venture Capital as a Window on New Technologies: Iumplications for the Performance of Corporate Investors When Acquiring Startups. Organ. Sci. 2009, 20, 329–351. [Google Scholar] [CrossRef]

- Malev, M. Corporate Venture Building as a Business Model. Available online: https://dmexco.com/stories/corporate-venture-building/ (accessed on 2 February 2022).

- Genberg, P. Council Post: Corporate Venture Building: The Fastest Path to Innovation. Available online: https://www.forbes.com/sites/forbesbusinesscouncil/2021/09/28/corporate-venture-building-the-fastest-path-to-innovation/ (accessed on 2 February 2022).

- De Vos, W. Venture Building as an Innovation Strategy. Available online: https://www.boardofinnovation.com/blog/venture-building-as-an-innovation-strategy/ (accessed on 2 February 2022).

- KPT ScaleUp. Program Akceleracyjny Dla Młodych Firm. Available online: https://scaleup.kpt.krakow.pl/ (accessed on 10 February 2022).

- Serwatka, A. Accelerators for startups in Europe. Copernican J. Finance Account. 2018, 7, 67–81. [Google Scholar] [CrossRef]

- Trotter, A. Six Lessons for Corporations Building Innovation Accelerators, Innosight. Available online: https://www.innosight.com/insight/six-lessons-for-corporations-building-innovation-accelerators/ (accessed on 9 February 2022).

- Equinor & Techstars Energy Accelerator—Test Your Solution with a Leading Global Energy Provider—Techstars.Equinor.Com. Available online: https://www.techstars.equinor.com/en.html (accessed on 10 February 2022).

- Cohen, S. What Do Accelerators Do? Insights from Incubators and Angels. Innov. Technol. Gov. Glob. 2013, 8, 19–25. [Google Scholar] [CrossRef]

- ORLEN Skylight Accelerator—Model Współpracy. Available online: https://innowacje.orlen.pl/PL/Akcelerator/ModelWspolpracy.Aspx (accessed on 22 February 2022).

- ORLEN Skylight Accelerator—Dlaczego My? Available online: https://innowacje.orlen.pl/PL/Akcelerator/DlaczegoMy.Aspx (accessed on 22 February 2022).

- ORLEN Skylight Accelerator—Kogo Szukamy? Available online: https://innowacje.orlen.pl/PL/Akcelerator/KogoSzukamy.Aspx (accessed on 22 February 2022).

- About us. Available online: https://openinnovability.enel.com/about-us (accessed on 10 February 2022).

- Start-up Ecosystem. Available online: https://openinnovability.enel.com/start-up-ecosystem (accessed on 10 February 2022).

- Inkubator Innvento—Portal Korporacyjny. Available online: https://pgnig.pl/inkubator-innvento (accessed on 9 February 2022).

- Czego Szukamy—InnVento.pl Innowacje PGNiG. Available online: https://innvento.pl/czego-szukamy/ (accessed on 10 February 2022).

- InnVento—Innowacje PGNiG, Startupy i Akcelerator Projektów. Available online: https://innvento.pl/ (accessed on 10 February 2022).

- Space3ac—Start Your Start-up Adventure in Poland! 2017. Available online: https://polandprize.space3.ac/ (accessed on 10 February 2022).

- Tauron. Available online: https://www.tauron.pl/tauron/tauron-innowacje/wspolpraca-ze-startupami/kpt-scaleup (accessed on 10 February 2022).

| Class of Accelerators | Development Stage of the Solution Submitted by the Team/Start-up | Identified Problems of the Team/Start-up | Forms of Offered Support and Their Intensity | Objectives of the Collaboration between the Team/Start-up and the Accelerator | Source |

|---|---|---|---|---|---|

| General start-up accelerators | Minimum Viable Product a prototype/basic version of the product | Uncertainty as to market demand | Mentoring | Product validation | [30,31,32,33,34,35,36,37,38,39,40,41,42,43,44,45,46,47,48,49,50,51,52,53] |

| A program with various thematic paths | Lack of financial resources (problems with financial liquidity) | Networking | Procuring financial resources | ||

| Lack of human resources (poorly coordinated and incomplete team) | Access to office space | Providing for an organisational structure | |||

| Additional financing | Confirming the business model | ||||

| Moderate intensity of activities | Achieving sales readiness of the product/service | ||||

| Gaining a reference client | |||||

| Access to investors centred around the accelerator | |||||

| Promotion | |||||

| Corporate accelerators | Product market fit—the product fits the needs of the market in which the corporation operates | Other investment needs | Access to infrastructure and a testing environment | Gaining and broadening technical expertise | [19,22,26,27,28,29,54,55,56,57,58,59,60,61,62,63,64,65,66,67,68,69,70,71,72,73,74] |

| The product/solution fits an industry-related acceleration program | Industry-related mentoring | Access to the market | |||

| Partnership with a corporation | Scaling sales | ||||

| High intensity of activities | Commercial co-operation | ||||

| Optimising the sales channels | |||||

| Seed accelerators | The product is at the prototype stage and may be used | No sales | Mentoring | Procuring first paying clients | [75,76,77,78,79,80,81] |

| A program with thematic paths | Uncertainty as to market demand | Networking | Confirming the business model | ||

| Lack of financial resources (problems with financial liquidity) | Access to space | Access to investors centred around the accelerator | |||

| Lack of human resources (poorly coordinated, incomplete team) | Additional financing | Promotion | |||

| Lack of required permits (if applicable) | Moderate intensity of activities | ||||

| Academic accelerators | The solution is at the stage of idea | Lack of business model | Mentoring | [34,82,83,84,85,86,87,88,89,90,91] | |

| Basic assumptions of the product/service operation were verified | Lack of tested solution (it is uncertain whether the market will accept the product/service) | Access to space | |||

| Access to research and development infrastructure | |||||

| Access to research personnel | |||||

| Low intensity of activities | |||||

| Many types of accelerators | A product/service at an early development stage | An inadequate pricing model | Mentoring | Confirming the business model | [18,20,21,92,93,94] |

| A program with thematic paths | Low product/service utility | Networking | Development of the product/service | ||

| Access to space | Expansion into new markets | ||||

| Additional financing | Expansion into new markets | ||||

| Low intensity of activities | Access to investors centred around the accelerator | ||||

| Promotion | |||||

| Other types of accelerators | A product/service at various development stages | A new direction for development of the product is searched for without changing the activity (pivot) | Mentoring | Product presentation | [29,95,96] |

| A program with thematic paths | An inadequate pricing model | Networking | Development of the product/service | ||

| Low product/service utility | Access to space | Confirming the business model | |||

| Additional financing | Access to the market | ||||

| Low intensity of activities | Access to investors centred around the accelerator | ||||

| Promotion |

| Class of Accelerators | Strengths | Weaknesses | Opportunities | Threats | Source |

|---|---|---|---|---|---|

| General start-up accelerators | Co-operates | Rapid changes in institutions implemented by start-ups | Updating the business model | Collecting, processing, and sharing information about projects and companies participating in them | [30,31,32,33,34,35,36,37,38,39,40,41,42,43,44,45,46,47,48,49,50,51,52,53] |

| Maximizing the likelihood of a start-up’s success | Transaction and bureaucratic costs | Investment risk reduction | Information policy | ||

| Know-what, know-how, and know-who | Insufficiently strong ties between partners to effectively commercialize technologies and promote them effectively | Developing an official start-up incubation policy | Bad decisions can damage the accelerator’s reputation | ||

| Innovation | No specialization of accelerators in a specific economic sector | Digitization | |||

| High level of knowledge unattainable in traditional cooperation | The large number of supported acceleration programs may affect the quality of acceleration | Generating more businesses | |||

| Business education and mentoring | No prioritization of activities | Increasing the number of full-time employees | |||

| Undertaking activities that disseminate ideas and experiences to create breakthrough change | Carrying out many activities at the same time that do not bring expected results | Educating enterprising engineers who will have the potential to establish innovative start-ups | |||

| Strengthening human capital through social capital | There are no schemes for selecting business partners | Sustainable growth of start-ups | |||

| Corporate accelerators | Open innovation | No prioritization of activities | Organizational culture | Collaboration can be disrupted by conflicts over beliefs, authority, personal goals, and competition | [19,22,26,27,28,29,54,55,56,57,58,59,60,61,62,63,64,65,66,67,68,69,70,71,72,73,74] |

| Development of new technologies | Mentoring | Tips for managers | |||

| Large network of committed external partners | Networking | Emphasis on the greatest possible use of start-up innovativeness | |||

| Development of knowledge and skills | Faster product development and product sales | ||||

| Competitiveness | Checklists | ||||

| Increasing innovative performance | Reduce resources and risk while maximizing the chances of reaping the benefits of innovation | ||||

| Fast flow of information Specialization of accelerators in a specific economic sector | Guarantee that the interests of start-ups and corporations align | ||||

| Faster market entry | |||||

| Seed accelerators | Development of technology and entrepreneurial ecosystems | Lack of experience of entrepreneurs | Taking into account geographical and cultural specifications | Information policy | [75,76,77,78,79,80,81] |

| Access to the resource network | Emphasis on management skills | Real-win-worth table | |||

| New work places | Tips for policymakers, shareholders, entrepreneurs and investors on development prospects | ||||

| Prioritizing criteria when selecting projects | Cohesion | ||||

| Quick market debut | |||||

| Academic accelerators | Partnership between universities and business | Little business experience | Inter-university expansion | Acceptance of business failures | [34,82,83,84,85,86,87,88,89,90,91] |

| Activation of entrepreneurship of young people | The conflict between the information collected from clients and the authority of entrepreneurs | ||||

| Using digital channels to develop business ideas | Motivating innovation among scientists and students | ||||

| Classification of projects | Attracting talent | ||||

| Formulated set of design parameters | Digitization | ||||

| Many types of accelerators | Pipeline model | No prioritization of activities | Organizing knowledge about supporting start-ups | Information policy | [18,20,21,92,93,94] |

| Innovation | Identifying the future challenges of acceleration programs | ||||

| Other types of accelerators | Economic development | The large number of supported acceleration programs may affect the quality of acceleration | Access to innovation | High profit orientation | [29,95,96] |

| Independent Accelerator Model | In-House Accelerator Model | Hybrid Accelerator Model | |

|---|---|---|---|

| Advantages |

|

|

|

| Disadvantages |

|

|

|

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bańka, M.; Salwin, M.; Kukurba, M.; Rychlik, S.; Kłos, J.; Sychowicz, M. Start-Up Accelerators and Their Impact on Sustainability: Literature Analysis and Case Studies from the Energy Sector. Sustainability 2022, 14, 13397. https://doi.org/10.3390/su142013397

Bańka M, Salwin M, Kukurba M, Rychlik S, Kłos J, Sychowicz M. Start-Up Accelerators and Their Impact on Sustainability: Literature Analysis and Case Studies from the Energy Sector. Sustainability. 2022; 14(20):13397. https://doi.org/10.3390/su142013397

Chicago/Turabian StyleBańka, Michał, Mariusz Salwin, Maria Kukurba, Szymon Rychlik, Joanna Kłos, and Monika Sychowicz. 2022. "Start-Up Accelerators and Their Impact on Sustainability: Literature Analysis and Case Studies from the Energy Sector" Sustainability 14, no. 20: 13397. https://doi.org/10.3390/su142013397