1. Introduction

The global packaging market worth was

$1002.48 billion in 2021, and predictions are that this market will reach a value of

$1275.06 billion by 2027 [

1]. The packaging industry growth is mainly driven by the increasing size of key package application industries including the food and beverage industry, fashion industry, cosmetics and pharmaceuticals, personal and home care, and by the growing penetration of e-retail services. Across the industries, the most common packaging materials are petroleum-based, nonbiodegradable polymers used to produce packaging bags, containers, bottles, and wraps [

2]. Despite the fact that synthetic plastic packaging has some positive properties (e.g., low cost, lightweight, resistant, flexible, durable, and impermeable) which makes it preferred over its packaging counterparts, including metal and glass, it poses a severe threat to the natural environment. The packaging industry is the main consumer of natural materials including water, gas, energy, and virgin materials, including plastic and paper, due to the quality of the material required to produce a single package product [

3]. Further, the packaging industry also generates waste in its end-of-life phase due to low or limited conversion rates for most materials. Most packaging parts are discarded immediately after product purchase and the packaging alone is a large and rapidly growing segment of municipal solid waste. As of now, 91 percent of packaging waste is sent to landfills and/or the environment [

4]. As reported by Eurostat’s, the total amount of plastic packaging waste generated in 2018 in Europe, was 14.8 million tons or approximately 20% of the total packaging waste generated [

5]. In the United States, packaging makes up a major proportion of solid waste collected by the municipality, amounting to 82.2 million tons or 28.1% of total packaging waste generated [

6]. According to a 2021 OECD report, only 9% of plastic waste, including packaging waste, worldwide, is recycled. The remaining 19% is incinerated and 50% ends up in landfills, while 22% is mismanaged meaning it evades the natural environment going into natural, uncontrolled dumpsites and aquatic environments [

7]. Under different circumstances, discarded plastic can be naturally decomposed into its monomeric constituents, including “microplastics,” which is almost impossible to recover and it seriously disrupts food chains and human and environmental health [

8]. Because plastic waste seriously affects the natural environment, reducing single-use plastics and increasing the usage of recyclable and biodegradable materials would significantly help to lighten the load for waste-management systems around the world.

To combat the environmental crisis, taxes and bans on single-use plastic packaging are enforced in more than 120 countries [

7]. However, those emerging governmental regulations are not doing enough to prevent packaging waste accumulation and overall pollution. Most of the regulations are limited to single-use plastic packaging items limited mainly to plastic bags, which account for a tiny share of totally accumulated plastic package waste [

9]. Hence, single-use plastic regulations reduce local littering more effectively than they prevent overall plastic consumption. Likewise, plastic packaging recycling is incentivized through landfill and incineration taxes only in a few developed countries, while uncontrolled plastic packaging disposal remains an increasing problem in developing parts of the world. Due to the fact that various waste management instruments such as extended producer responsibility schemes for packaging and durables, landfill taxes, deposit-refund, and pay-as-you-throw systems for single-use packaging and plastic packaging exist depending on the country and industry sectors, it can be argued that economic, technological, and legislative, factors play significant roles in the choice of a packaging system [

10,

11,

12]. In fact, there are noticeable differences in packaging legislation between Europe and the United States, where in the United States it is still possible to find laminated plastic packaging that Europe has banned because it cannot be recycled. In the United States however, this type of packaging can be used a single time, and it ends up being incinerated after its disposal [

1]. Apart from Europe, where emerging government regulations drive a faster transition to sustainable packaging, Canada and Australia have already advanced their sustainable packaging strategies [

13]. Canada has committed to a zero plastic waste strategy by 2030, while Australia has established clear targets to achieve 100% recyclable, compostable, and reusable packaging across industry sectors in the following years [

9].

To reduce plastic pollution, industry players need to take urgent action to tackle the problem at its source. The New Plastics Economy The Global Commitment initiated by the Ellen MacArthur Foundation in partnership with United Nations Environment Program has united more than 500 international companies across sectors to reach concrete 2025 targets to eliminate or reuse plastics in the economy and keep it out of the environment [

14]. Signatory companies of the Global Commitment already made evident progress across product sectors. For example, food and beverage retailers have chosen to return to glass when looking for convenient, sustainable solutions. Large grocery chains such as Target, Walmart, and Metro have initiated some inventive packaging trials. Apart from offering recycled plastic bags, bioplastic packaging emerged as a preferred substitute for conventional petroleum-based, food packaging materials [

14]. The fact that bio-based packaging materials are made from primarily raw renewable materials (which is their defining characteristic) bio-based packaging has numerous advantages compared to conventional plastic, as bioplastic materials are commonly recyclable, biodegradable, or compostable [

15,

16]. Further, some food and beverage retailers in Europe moved most of their products into refillable dispensers designed for customers to bring their own containers [

17]. Similarly, the cosmetic and personal care companies Unilever and Loreal, both Global Commitment signatories, tested zero package alternatives, offering refills on products across categories [

18].

Fashion brands are similarly committed to making all plastic packaging reusable, recyclable or compostable by 2025 [

14]. While sustainable packaging innovation in the fashion sector is receiving increased public attention in recent years [

9], the Sustainable Packaging Coalition (SPC) in the United States recognizes the presence of various economic, technological, and logistical limits that hamper a complete transition to sustainable packaging. According to the SPC, fashion retailers should consider sustainable packaging solutions first, if and when they are available [

19] and when it is deemed effective and efficient. According to SPC, even biodegradable or compostable packaging cannot be considered as a sustainable alternative for the conventional package unless it has proven to be effective and efficient [

19]. This means that retailers cannot promote packages as being “sustainable” based solely on their biodegradability or composability properties, their effectiveness and efficiency must be assessed more holistically [

13]. For example, retailers need to determine whether the package is responsibly sourced and whether it is designed to be safe and effective through entire life cycle. Similarly, they need to determine whether that package meets market expectations for cost, and performance. Further, retailers need to make sure that the package is made using 100% renewable energy, and once it is used, the package can be safely recovered and utilized in closed loop biological and/or industrial cycles [

17]. Only when all these robust criteriums are met can retailers claim that their innovative packaging solutions promote economic and environmental health (SPC).

Due to the relative novelty of sustainable packaging initiatives in the fashion sector, and the fact that fashion brands have focused to improve the sustainability of the production of their garments, and not necessarily in their packaging [

20], it is not known how effectively companies in this sector fight to reduce their virgin plastic consumption. According to scholars Jestratijevic et al. [

13], apparel and footwear brands most often take seven different approaches to improve their packaging. These approaches comprise the so-called 7R’s sustainable packaging framework which includes the following seven approaches: rethinking the packaging solutions, reducing the packaging size, refusing to use plastic packaging, reusing, recycling, and repurposing package/its components, and rotting or composting the package. However, due to the nature of the wide-ranging Jestratijevic et al. [

13] review, which mainly focused on identifying the most common sustainable packaging approaches industry-wide, innovative packaging solutions among individual fashion brands remain unknown. Since the fashion industry heavily relies on packaging, which is used to protect and transport products and to distribute them to stores and ultimately to consumers, it is timely to evaluate fashion brands’ progress towards achieving their commitments for reaching 100% sustainable packaging by 2025. Therefore, the purpose of this study is twofold. First, this study identified individual brand contributions in the area of sustainable and innovative packaging displaying the industry-wide accomplishments and future challenges in this particular area. Second, this study evaluates how successful fashion brands are at meeting sustainable packaging targets, which promise to transform all plastic packaging away from environmentally destructive waste streams into reusable, recyclable or compostable purposes by 2025. The ultimate goal of this research is to foster discussion between stakeholders interested in sustainable packaging to enact actionable improvements to current packaging solutions and to lend an authoritative voice on issues related to packaging sustainability. This research is perhaps especially relevant in the current industry context, where the concept of reusable and sustainable packaging has been significantly challenged due to unease about the spread of COVID-19 via contact with surfaces. In fact, recent research shows that public support for a ban on all single-use plastics plunged from 72% in 2019 to 58% in 2020 [

21], while many fashion retailers emphasized the importance of the product over packaging in an effort to secure sanitary precautions [

22].

2. Materials and Methods

This study reviewed all international fashion retailers that advertised their sustainable packaging advancements from November 2020 to January 2021. A systematic review research methodology was utilized. A data-mining technique was employed to collect sustainable packaging information for brands that were identified as being eligible for inclusion in this study [

13]. We deliberately chose to review only primary sources of information found on fashion companies’ websites and from the most recent sustainability reports [

23]. We did not count secondary sources of information found on the brand’s social media sights, press articles, or third-party websites where there is no link from the brand’s website. The preliminary sample included 574 brands where 174 brands were excluded with the following justification: first we excluded non-English websites; second, we excluded all non-primary sources and sources that were unrelated to the fashion industry. The final sample included 400 brands. Brands in the sample represent a wide spectrum of companies including luxury, premium, and mass market retailers of clothing, footwear, and accessories. Brands are spread across five continents including Europe, America, Australia, Asia, and Africa.

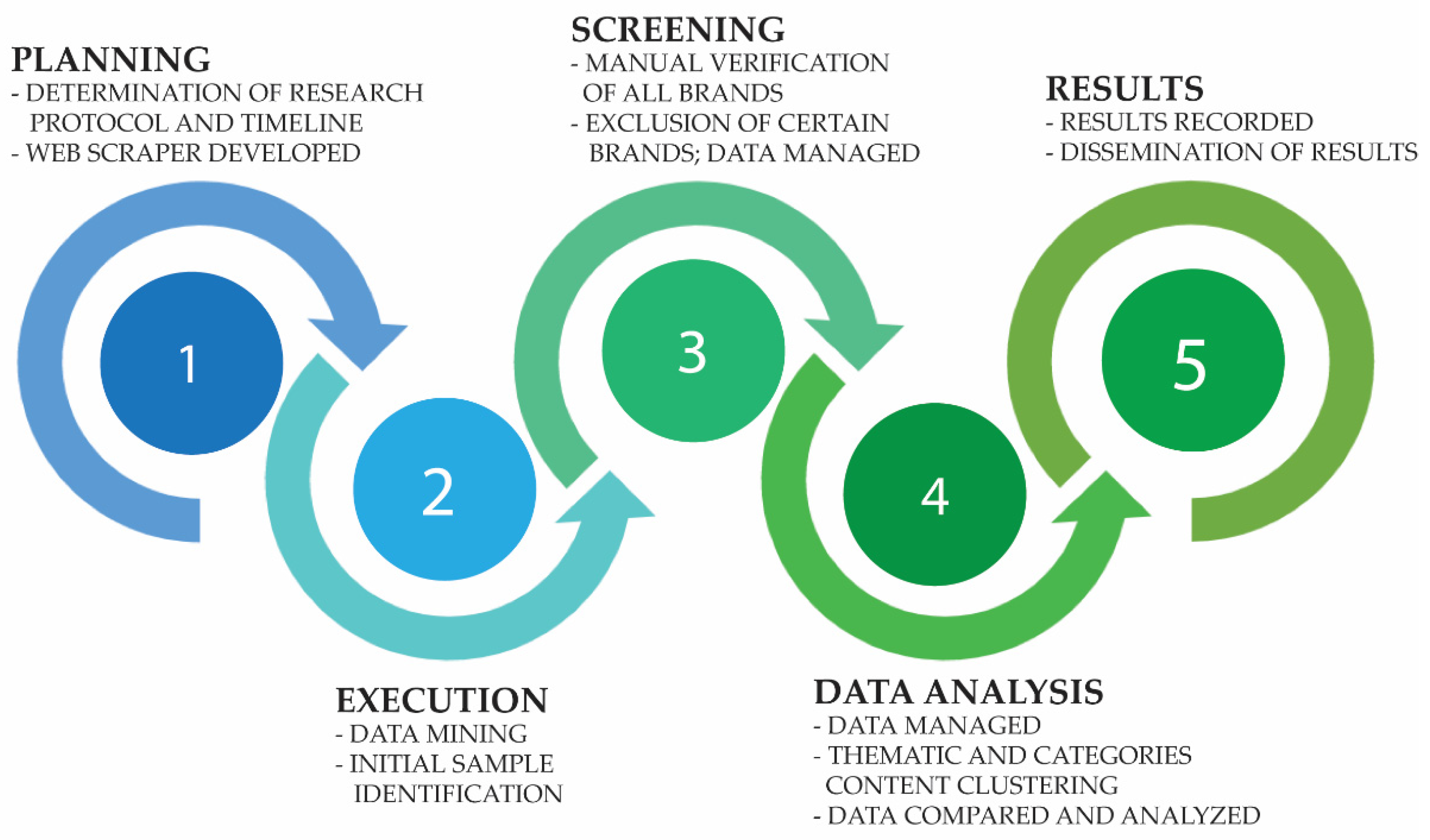

Thematic content clustering was employed to iteratively analyze the data. The study comprised five research stages: (1) planning, (2) executing, (3) screening, (4) data analysis, and (5) results reporting [

13,

23], represented in

Figure 1.

During the first stage, the research protocol was created. The study purpose, objectives, and research methodology were clearly defined to reduce the possibility of researcher bias. Web scraper Python 3.6 programming language was created.

During the second research stage, the web scraper accessed the World Wide Web using Hypertext Transfer Protocol (HTTP) in an automated manner and identified the names of 574 international fashion brands that promoted sustainable advancements of their product packaging.

During the third research stage, manual verification of websites followed in conjunction with records screening and data management. Quality assessment was obtained to ensure the inclusion of primary sources. All other sources were excluded as noneligible. Once non-eligible websites were excluded, the final sample for the systematic review was formed. The final sample included 400 sites of an equal number of fashion brands (n = 400).

During the fourth research stage, the qualitative analytical method of thematic content clustering was employed. Thematic coding was carried out by two researchers with the intention to reach absolute agreement on emerging thematic clusters. Disparities and disagreements were resolved through discussion to reach a consensus.

During the fifth research stage, the findings were synthesized, and the results were reported.

3. Results and Discussion

Study findings confirmed that all investigated fashion brands are committed to innovating and improving their packaging due to established industry-specific targets that aim to transform all plastic packaging waste into reusable, recyclable, or compostable streams by 2025. Amidst the pandemic challenges [

22], many fashion brands have decided (40%, n = 191) to stop using conventional plastic packaging, publicly promoting their single-use plastics bans. Some brands went even a step further, communicating their “plastic-free policy” meaning that no plastic of any sort is used in their packaging. Further, some fashion brands decided to eliminate packaging entirely adopting a “package-free policy.” These brands ask their customers to bring reusable carrier bags when shopping because bags in their stores are not available. These study findings, as well validated previous research [

13], confirm that the most common way to showcase the packaging improvements is to increase the recycled packaging content. However, our findings expand what is already known by specifying that 47.5% of international fashion brands (n = 190) made significant progress in increasing their usage of post-consumer recycled content in their packaging. Although brands often mentioned significant challenges to ensuring 100% recyclability of their packaging, these brands are committed to gradually increasing recycled content in order to create closed-loop packaging systems. In addition, brands commonly reported switching to paper-based packaging alternatives since they are recyclable. Such a trend was typical for the majority of brands in the carrier bag category. However, limited actions were taken to avoid the usage of single-use plastic inserts, films, and wrapping bags, which often serve protective functions. Although the reduction in package components, weight, and size was also common, overpackaging trends were evident among e-commerce retailers who widely practice box-in-box shipping across product categories. It can be argued that due to pandemic concerns, the expansion of reusable plastic packaging was somewhat limited. Of 400 investigated fashion brands, only 67 brands (16.8%) advertised their collaboration with RePack, the third-party reusable packaging provider.

Due to the extensive length of sections with individual itemized brand contributions in the area of sustainable and innovative packaging, these sections are provided in the

Supplementary Materials section (see Supplementary Materials). In the following sections, first, a descriptive analysis of fashion brands and sustainable packaging types is provided to map the industry-wide accomplishments and future challenges in this particular area. Second, it is examined how successfully fashion brands are progressing toward sustainable packaging targets. Brands were divided into four stages depending on which sustainability packaging targets they accomplished so far. To assess a brand’s progress towards achieving sustainable packaging targets, the following data was accounted for: sustainable mission and packaging statement, sustainability-related data, and sustainable packaging solutions.

3.1. Descriptive Analysis of Brands and Sustainable Packaging Types

Different trends toward single-use packaging can be observed among fashion brands located in different geographic regions, validating studies that recognized the dominant influence of economic, technological, and legislative, factors in the choice of a packaging system [

10,

11,

12].

Figure 2 displays the distribution of investigated fashion brands across five continents. The research has shown that European fashion brands are leading innovation in the sustainable packaging sphere due to the fact that 55% of the sample (n = 218) have office headquarters in Europe. Further, 28% (n = 113) of fashion brands that provide sustainable packaging solutions are located in North America, with an additional 2% of retailers (n = 7) located in the South American region. Australian, Asian, and African fashion brands accounted for 11% (n = 42), 4% (n = 14) and 2% (n = 6) of the total sample, respectively.

Results showed also that fashion brands in certain geographical regions were inclined to provide a package that is compliant with national and local regulations. This perhaps explains why European brands commonly refrain from using disposable plastic bags, while brands in the Australian region have packaging that is either/100% recyclable, or compostable and/or biodegradable. Similarly, there was a tendency among sustainably oriented retailers to locally and responsibly source innovative packaging materials. For instance, the packaging components in Africa and Asia were often sourced from local artisanal communities (e.g., hand-stitched cotton pouches, locally woven reusable bags, etc.) We were further interested in exploring each fashion brand’s target market knowing that there are stronger preferences for sustainable product attributes among specific categories of consumers [

24].

Based on target market categories that emerged in our data, we divided our sample into four following segments:

Men and women;

Men;

Women;

Women and children.

As seen in

Figure 3, most of the fashion brands that innovate their packaging are targeting women only (41.50%—166 brands), fewer brands are targeting children only (3.75%—15 brands) and men (3%—12 brands). Next, 34.25% (137 brands) of retailers are offering products for both men and women, while 16% of brands (n = 14) sell products for more inclusive target groups.

Further, we intended to investigate the possibility that improvement of the packaging was related to the specific product category/categories. As displayed in

Figure 4, nine subcategories emerged in our data, and they were used to establish the following product subcategories:

Researcher assumption that packaging improvement was closely tied to the specific product category/categories proved to be correct since results showed that most of the fashion brands were innovating their clothing package (45.5%), followed by footwear packaging (5%), packaging for accessories (6.25%), underwear and socks (3.75%), and other miscellaneous products (12%).

Next, we were interested to explore which type of product packaging is most commonly improved. In general, packaging literature recognizes three types of product packaging including: (1) primary packaging, which serves to directly protect the product (e.g., a cotton t-shirt packed in a bag or plastic foil), (2) secondary packaging, i.e., the larger box or bag in which other packaging materials are grouped (e.g., cardboard boxes or polypropylene bags containing multiple plastic foil-wrapped shirts), (3) tertiary packaging, which is used to group multiple secondary packages together to better transport the product (e.g., pallets or a plastic wrap around multiple cardboard boxes) [

25,

26]. Our research findings confirmed that brands are mostly committed to improving their primary packaging due to its direct proximity to the product itself. Next, the secondary packaging category is commonly improved without mention of potential improvements in the tertiary packaging category. Specifically, there were 111 clothing brands that improved their primary packaging, while 85 clothing brands improved their secondary packaging as well. Slightly different priorities were seen in footwear, accessories, and jewelry brand categories, where 44 brands prioritized the improvement of their secondary packaging over the primary packaging (n = 41). For example, many jewelry and accessories brands were found to improve their shopping cases (where they put smaller boxes) and not necessarily the primary package that protects the product directly.

It is worth mentioning that fashion brands still hesitantly specify which package and packaging components they improved. For example, 40% of brands did not specify the packaging type. Other brands more openly communicated that they prioritized sustainable improvements of their bags (17.75%), boxes (14.5%) and packaging and distribution mailers (21%) (

Figure 5).

Finally, we explored sustainability-related packaging certifications, and the most common strategies brands take in order to improve their packaging. The research findings revealed that brands are still reluctantly using different certification systems to publicly showcase ongoing packaging improvements.

Figure 6 shows that out of 400 brands, 55 fashion brands have forest management certification (FSC certificate), showcasing that the wood they source for paper-based packages come from FSC-certified forests. A toral of 24 fashion brands promoted obtaining the Global Organic Textile Standard (GOTS) for packaging components they make from organic textiles; 17 fashion brands advertised having the Global Recycle Standard (GRS), which confirms the presence of a higher percentage of recycled content in their packaging products. Four brands had the Program for the Endorsement of Forest Certification (PEFC) standard, and another brand had the TUV Austria standard. In total, 12 fashion brands had two different packaging standards, while 284 fashion brands had no packaging certificates. Knowing that legitimate third-party standards significantly contribute to overall product-package-brand sustainability, the prevalent absence of sustainable packaging certificates (of any sort) unfortunately calls into question the sincerity of sustainable packaging commitments for many of the explored brands.

Similar to sustainable packaging certificates that need to be prioritized in the future, strategic partnerships and collaborations to improve product packaging should be more frequently seen among fashion retailers. For example, the analysis has shown that 304 fashion brands do not have any sustainable packaging partnerships (

Figure 7). Among the other 96 brands that have established collaborations to transition to sustainable packaging, 67 fashion brands had partnerships with RePack, a reusable packaging provider that has certified packaging solutions for e-commerce. Next, 13 brands have a partnership with the Responsible Packaging movement (14%), the association of fashion brands that jointly target to eliminate single-use plastic and virgin forest fibers from packaging. Five fashion brands partnered with Noissue Eco Packaging Alliance, an alliance that represents a community of businesses, brands, and artisans who chose sustainable packaging over conventional packaging. Six brands have partnered with the non-profit organization One Tree Planted, which plants one tree per every dollar donated. Five brands signed The new Plastic Economy Global Commitment, while only two fashion brands (1%) had established two partnerships showing a higher determination to change their packaging solutions through collaborative projects. Because packaging partnerships require the determination of the resources and systems that are needed to achieve long-term goals, they are deemed essential to support transformative change in product packaging.

3.2. Packaging Sustainability Progress Stages

Sustainable packaging presents the development and use of packaging that leads to improved sustainability which ultimately reduces negative environmental impact. As suggested by industry practitioners, sustainable packaging solutions should be effective, efficient, and economically viable [

19]. Hence, when considering sustainable packaging solutions, certain sustainability indicators must be considered first, such as if the new packaging helps to reduce packaging waste, whether it is improving product-to-packaging ratios and material efficiency but also whether it is going to be recyclable, returnable, reusable, and biodegradable. Furthermore, packaging and all mentioned solutions must be assessed holistically, as all packaging components, including materials, finishes, coatings, inks, and other additives, should not pose any risk to humans and ecosystems [

13]. Because this study aimed to provide state-of-the-art evidence of sustainable packaging usage in the fashion industry, we needed to benchmark the progress each fashion brand made towards achieving sustainable packaging targets.

To benchmark that progress, we evaluated three areas of information including:

Sustainable mission and packaging statement;

Sustainability-related data;

Sustainable packaging solutions.

Brands were divided into four groups based on gathered results which help us to differentiate how much each brand progressed towards achieving sustainable packaging targets so that brands in a similar stage can be grouped together (

Figure 8).

Stages included the following:

Progress;

Implementation;

Commitment;

Rethinking.

Progress stage. The results have shown that a major part of sampled (57%, n = 228) fashion brands were openly sharing their sustainability mission and commitments while disclosing a solid amount of sustainability-related data to support their sustainability targets, including packaging targets. Additionally, for these brands, information on sustainable packaging solutions was available. Improved packaging solutions for brands in this stage apparently evolved in two distinct directions. First, some brands prioritized the advancement of their packaging systems where they are redesigned to use water and energy more efficiently, reduce unnecessary waste, and/or improve packaging logistics. Second, some brands prioritized improvement of various packaging components (e.g., coatings, inks, pigments, finishes, stiches, and safe additives), improvement of packaging features (reduced weight and package size), and improvement of the circularity of the packaging material used (e.g., recyclable and compostable packaging materials). Because brands in this stage evidently showed that they already transitioned to sustainable packaging, these brands most significantly progressed towards 2025 sustainable packaging targets. Individual contribution of brands in the progress stage are displayed in the

Supplementary materials (see Supplementary materials).

Implementation stage. The study results have shown that 137 fashion brands (n = 34%) were disclosing sustainability-related data to showcase their sustainable packaging innovation, although these brands did not communicate their sustainability mission. Brands included in this group commonly shared a sustainable packaging statement, and they specified in which ways they improved their packaging solutions. Apart from sustainability innovation in the packaging area, other potential sustainability related initiatives were not visible. Because brands in this group frequently report facing various obstacles in achieving full transition to preferred packaging, we named this stage as the implementation stage, meaning that brands in this group are on a good path, but they need more time to implement an actual change in their packaging systems and packaging. Additionally, it would be optimal for these brands to establish and disclose their sustainability missions to align their sustainability initiatives with the subsequent improvements in the remaining business operations.

Commitment stage. The study results have shown that there were 33 fashion brands (n = 8%) committed to improving their packaging sometime in the future. Compared to fashion brands that are in the progress and implementation stages, brands in the commitment stage most commonly had only one sustainability statement. That statement was often reflected in the brands mission, and less commonly it was present solely in a targeted packaging description. For brands in this stage that are yet to identify adequate packaging improvements, it is critical to find sustainable packaging solutions that really solve their most critical sustainability concerns while remaining economically viable. Sometimes avoiding unnecessary packaging helps to reduce packaging waste but also saves a corporation money. Next, to effectively determine the optimal type of packaging, it is important to consider both the perceived sustainable benefits and potential disadvantages. This would help to prevent potential logistical flaws in the new packaging and also avoid potential negative public reactions to new packaging policies, which is especially important for retailers who decide to adopt sustainable packaging policies in such times of external vulnerabilities as witnessed in the current COVID-19 pandemic.

Rethinking stage. There were only two brands (n = 1%) in the sample that did not disclose any of explored information meaning they provided no information about how they wish to improve their packaging. Besides their marketing claims that their packaging was sustainable, it was unclear whether, and how actual improvements in its packaging sustainability were achieved. For example, fashion brands might emphasize the fact that their packaging contains recycled material content without providing instructions for consumers on how to safely discard such packaging at the given geographical location. Because it is clear that the transition to sustainable packaging requires strong determination and a strategical approach, we named this stage as the rethinking stage since tangible evidence of improvement of any sort is missing. However, for brands in this group, it is critical to provide informational clarity on their sustainable packaging targets to protect the brand’s reputation and to prevent accusations of consumer deception and greenwashing [

20].

4. Conclusions

This study represents the first global review of sustainable packaging innovation in the international fashion industry sector. This paper provides up-to-date insights into the latest practical advancements in the sustainable packaging area across a wide range of product categories, including clothing, footwear, accessories, etc. Please refer to

Supplementary materials to review individual and itemized brand contributions in the area of sustainable and innovative packaging for each brand included in the study sample (Global Report.pdf). The findings of this study further prove that all investigated fashion brands are committed to transitioning to low-impact packaging sometimes in the near future. However, fashion brands are to a different degree committed to achieve this transition sooner, rather than later. For example, the results showed that 57% of brands have already made evident progress in the sustainable packaging area. These brands commonly prioritized the direct improvement of packaging components, in addition to the simultaneous advancement of their packaging systems which are designed to use water and energy more efficiently, reduce unnecessary waste, and improve overall packaging logistics. Next, 34% of brands have somewhat initiated the transition from conventional to improved packaging although they are facing various obstacles along the way. For example, technological and logistical flaws were commonly reported as realistic obstacles that prevent a faster transition to fully recyclable packaging. Consequently, for those brands, more than 50% of packaging including consumer-facing flexible packaging such as e-commerce bags and carrier mailers remain non-recyclable. Finally, the remaining fashion brands (n = 9%) have committed to improving their packaging in the long term although these brands are still trying to identify packaging that might solve their most critical environmental concerns while remaining economically viable. The findings of this study further show that all investigated fashion brands are improving mainly their primary and secondary packaging due to its direct proximity to the product in the first case (e.g., first packaging layer such as a plastic pouch holding a t-shirt), or due to the frequency of its public exposure in the second case (e.g., consumer-facing shopping bags, cardboard boxes, or e-commerce mailers). Unlike the primary and secondary packaging which is commonly improved, tertiary or transit so far received no mention and improving intentions.

4.1. Practical Implications

This research confirms that economic, technological, and legislative factors pose natural limits to realistic packaging improvements in a particular geographic area. Consequently, the majority of explored fashion retailers are improving their packaging in order to be compliant with local regulations. Unless legal requirements for improved and safe packaging production, handling, and disposal are all in place, voluntary initiatives to improve product packaging, in unregulated regions alone will not be enough to foster a significant change. For example, European and Australian fashion brands, where the sustainable packaging policies and regulations are most stringent have almost entirely transitioned to reusable, recyclable, and biodegradable packaging alternatives. However, not all the brands in other geographical regions follow the same improvement path. For example, among US fashion brands packaging improvement has largely been driven by recycling but that is not enough to prevent overpackaging or mitigate plastic pollution. Hence, in this locality per se, greater strategic focus is urgently needed on eliminating single-use plastic packaging in the first place. Likewise, the similar strategic, government led initiates to eliminate plastic, and improve packaging are needed in Asia, Africa, and South America. Hence, policymakers in these localities have a significant task to address actual gaps to enable local market conditions where leading brands will be incentives and supported in their sustainability efforts while laggards will be required to actually act upon their sustainability established targets.

Additionally, other important efforts are vital to continue progress toward sustainable packaging. First, there is a greater need for all international fashion brands to showcase their improved packaging components through attaining valid third-party certification. At this point, 71% of fashion brands have no packaging certificates, which seriously questions the sincerity of their sustainable packaging commitments. Second, there is an urgent need to increase strategic partnerships to achieve an easier transition to sustainable packaging. Currently, 76% of investigated brands do not have any collaborative project in place to ensure the faster transition to preferred packaging. Third, since there is no research evidence that COVID-19 can be transmitted via product packaging, fashion retailers must stop overpackaging their goods due to sanitary precautions. Most current efforts to eliminate unnecessary plastic packaging involve substitution to other plastic, or paper, and not a solution to reduce the industry need for disposable plastic packaging in the first place. Less than 2% of explored brands advertised having reusable plastic packaging. While this percentage might increase over time, the more concerning fact is that initiatives to explore reusable plastics usage are very low. Furthermore, supporting policies to ban single-use plastics is important but policies are limited to banning a narrow set of packaging items, and they are not applicable across packaging types or categories. Hence, such policies prevent plastic littering more than they prevent overall plastic packaging consumption. Lastly, but no less important, to achieve sustainable development goals more effectively, significant effort must go into preventing packaging waste from being created in the first place. Thus, packaging elimination and reusage represent feasible but often overlooked solutions to reduce total packaging.

4.2. Limitations

In this study, we relied on publicly available information, which was collected and investigated between November 2020 and January 2021. If brands made any updates on sustainable packaging innovation after January 2021, this change would not be included here. Furthermore, this study did not attempt to capture packaging improvements that, although achieved, were not publicly reported. Despite the fact that researchers made every effort to assure research replicability, we must note that the replicability of findings is limited due to the fact that in many instances companies update website content annually. Thus, our study’s findings best describe the state of sustainable packaging advancements in the international apparel and footwear sectors in the midst of the COVID-19 pandemic.

4.3. Future Studies

Future research should focus on upstream packaging innovation to explore possibilities of packaging repurposing and upcycling, as well as delivering products to consumers without the need to use single-use plastic packaging. The impact of unsafe packaging disposal across geographic areas also deserves greater attention to help the industry benchmark the full complexity of its social and environmental impacts. Demand for plastic packaging is predicted to double in the future (The Future of Packaging), hence it is critical to explore why collection, recycling, and disposal strategies alone fell short of preventing increased plastic leakage in our soil, air, and oceans.