A System Thinking Normative Approach towards Integrating the Environment into Value-Added Accounting—Paving the Way from Carbon to Environmental Neutrality

Abstract

:1. Introduction

- (1)

- Due to the predominant focus on climate neutrality in the contemporary manufacturing industry, carbon footprinting (CF) is a far more common concept in business practice than a complete LCA. This restriction to a single-impact category results in a misrecognition of other life-cycle impact categories. Potential trade-offs are often not understood, and thus ignored.

- (2)

- Although standardized in the early 2000s [16,17], LCA is not perceived as an equal method alongside cost- and/or value-added accounting in everyday business, but as a stand-alone approach. This is mostly due to the fact that it relies on a fundamentally different system understanding to traditional business accounting. Today, LCA results are often compared with costs in complicated cost-impact diagrams, which represent a weak precondition for an equal consideration of economic, ecological and social factors. Another alternative is the monetarization of externalities, for which basic approaches exist (e.g., abatement and damage costs). However, only a few methodological frameworks are available for an effective integration into corporate accounting, which represents the main source of decision-making in day-to-day operations.

2. Fundamental Considerations

2.1. A Brief History of the Concept of Value in Society and Economics

2.2. The Value-Added of Production

2.3. State of the Art of Operational Added Value Calculation

3. Results

3.1. eco2-Value-Added Approach

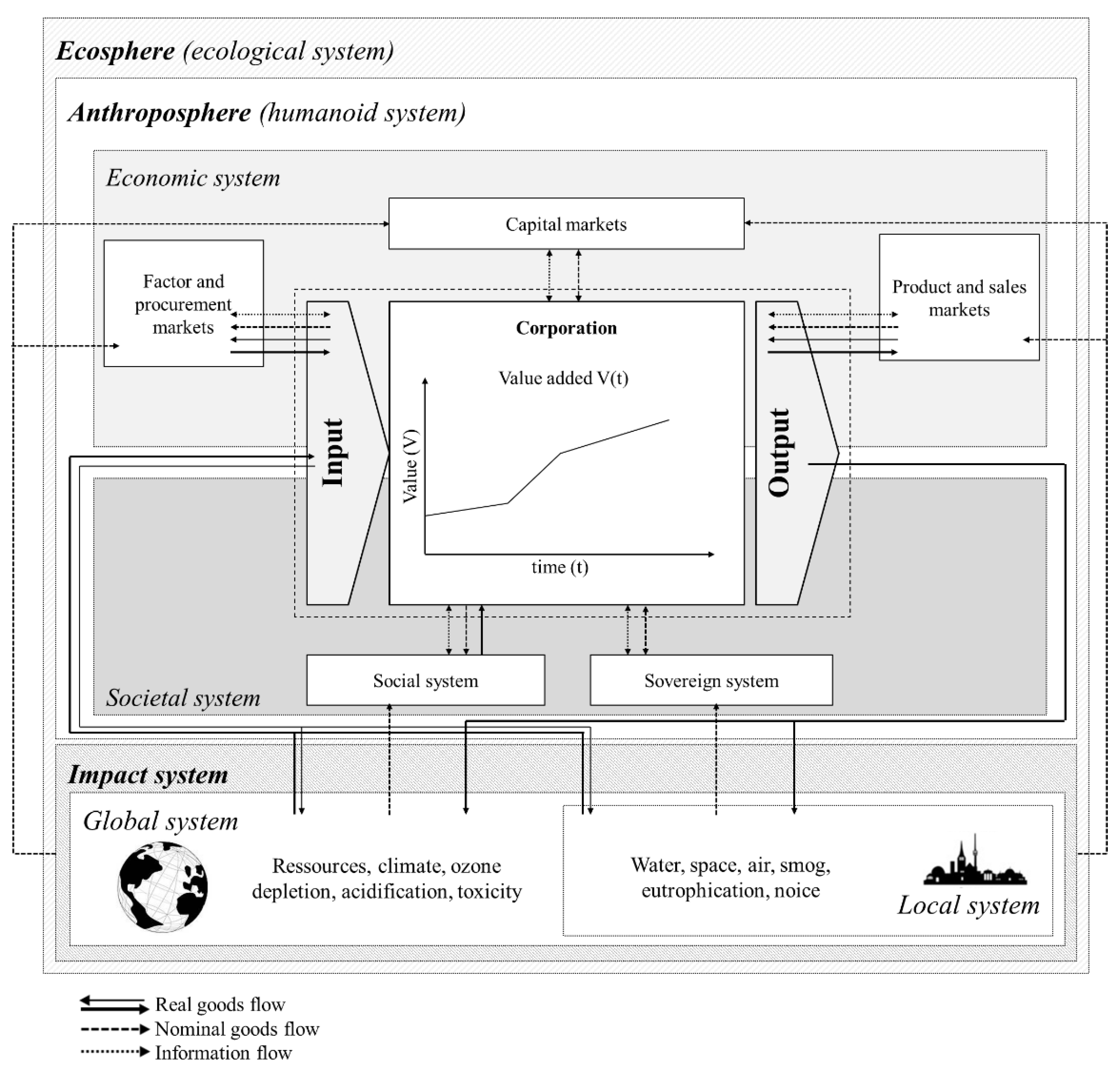

3.1.1. Extended System Understanding

3.1.2. Premises of an Integrated Value-Added Accounting

- ▪

- Value principle: A production–economic activity never exclusively serves the satisfaction of individual needs, but must ensure that its consequences are justified in terms of socially accepted standards. In order to meet this requirement, the sustainable production value of a productive activity is defined as the sum of economic value and natural value.

- ▪

- Sustainability principle: A production–economic activity at the economic–ecological interface is considered sustainable if the difference between external production value and value consumption is greater than or equal to zero. There are only two possibilities for sustainable value creation from a business perspective: An action has a positive natural value, or a company specifically pays the natural debt it has caused.

- ▪

- Superposition principle: Both the amendment and damage cost approach are rejected as insufficient for internalizing external costs. Since it is impossible to predict whether the solution to the environmental problem will be achieved by avoiding, adapting to and accepting the damage, a paradox arises that essentially relates to Schrödinger’s cat. As the solution of the environmental problem is currently conceivable by prevention and by acceptance of the damage, both conditions must be considered equally.

- ▪

- Materiality principle: Since it is rarely possible to identify all the actual consequences of an action, an iterative approach is needed to calculate the NV. If the cause–effect chain of an action is very complex, the first step is to focus on the significant damage.

- ▪

- Damage occurrence principle: Environmental impact does not necessarily result in damage. From the perspective of the system under consideration, however, this is irrelevant. Similar to the superposition principle, there is no clear tendency of whether a damage occurs or not. Therefore, it is assumed in principle that the damage will occur.

- ▪

- Co-production principle: A production process is to be understood as co-production in any case.

3.1.3. Generic Procedural Approach

3.2. Case Studies

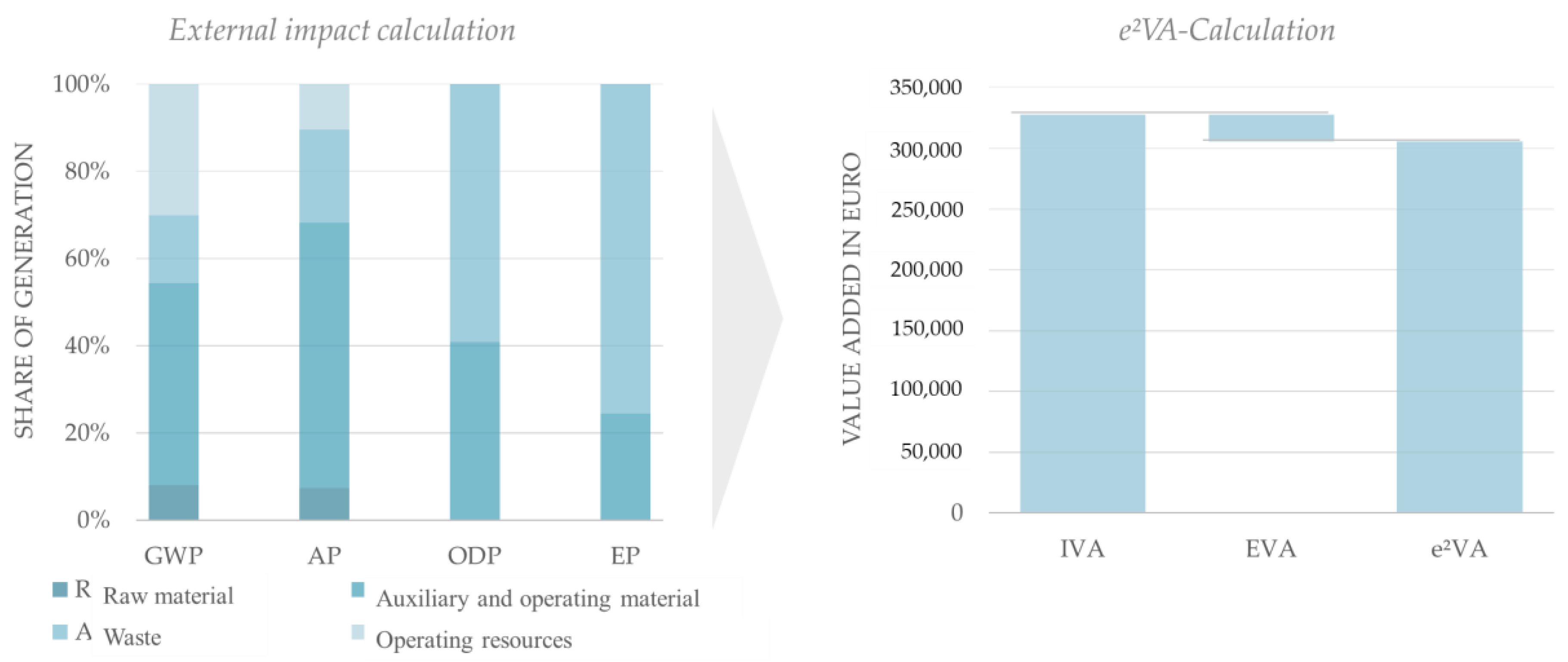

3.2.1. Case Study 1: Company

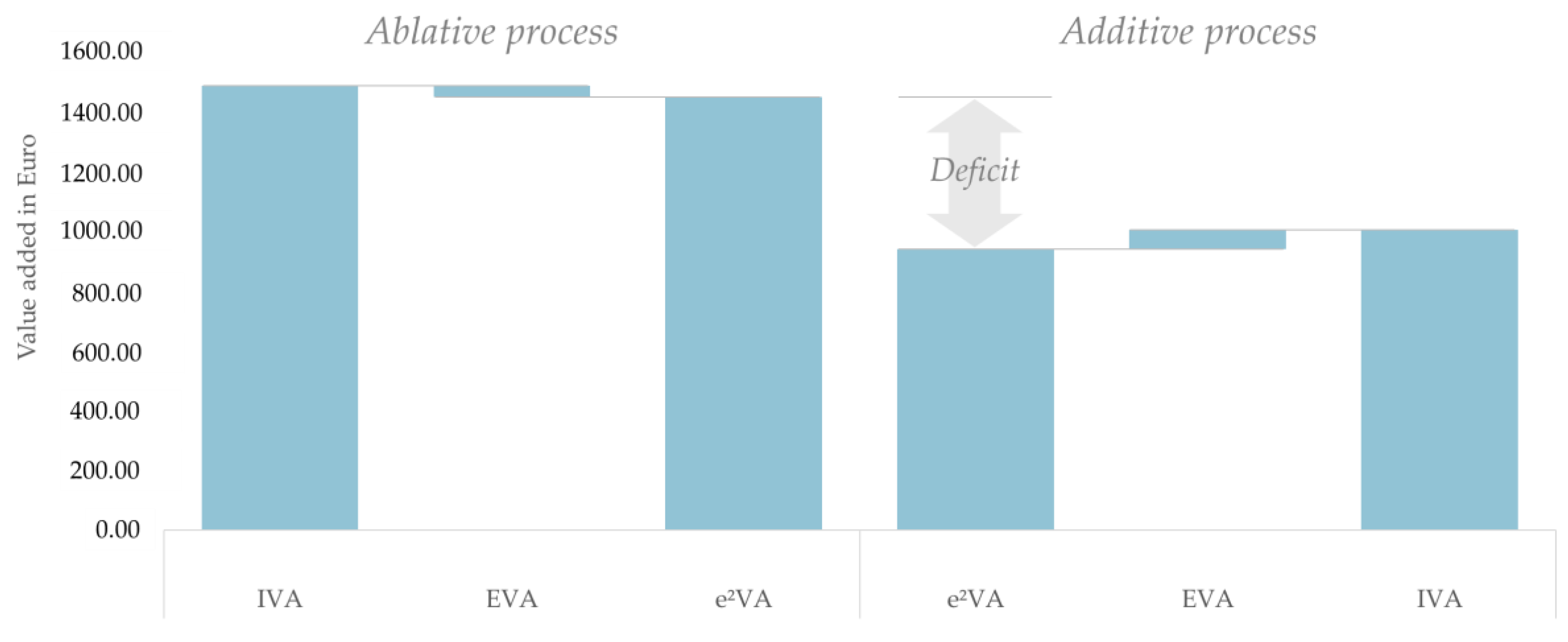

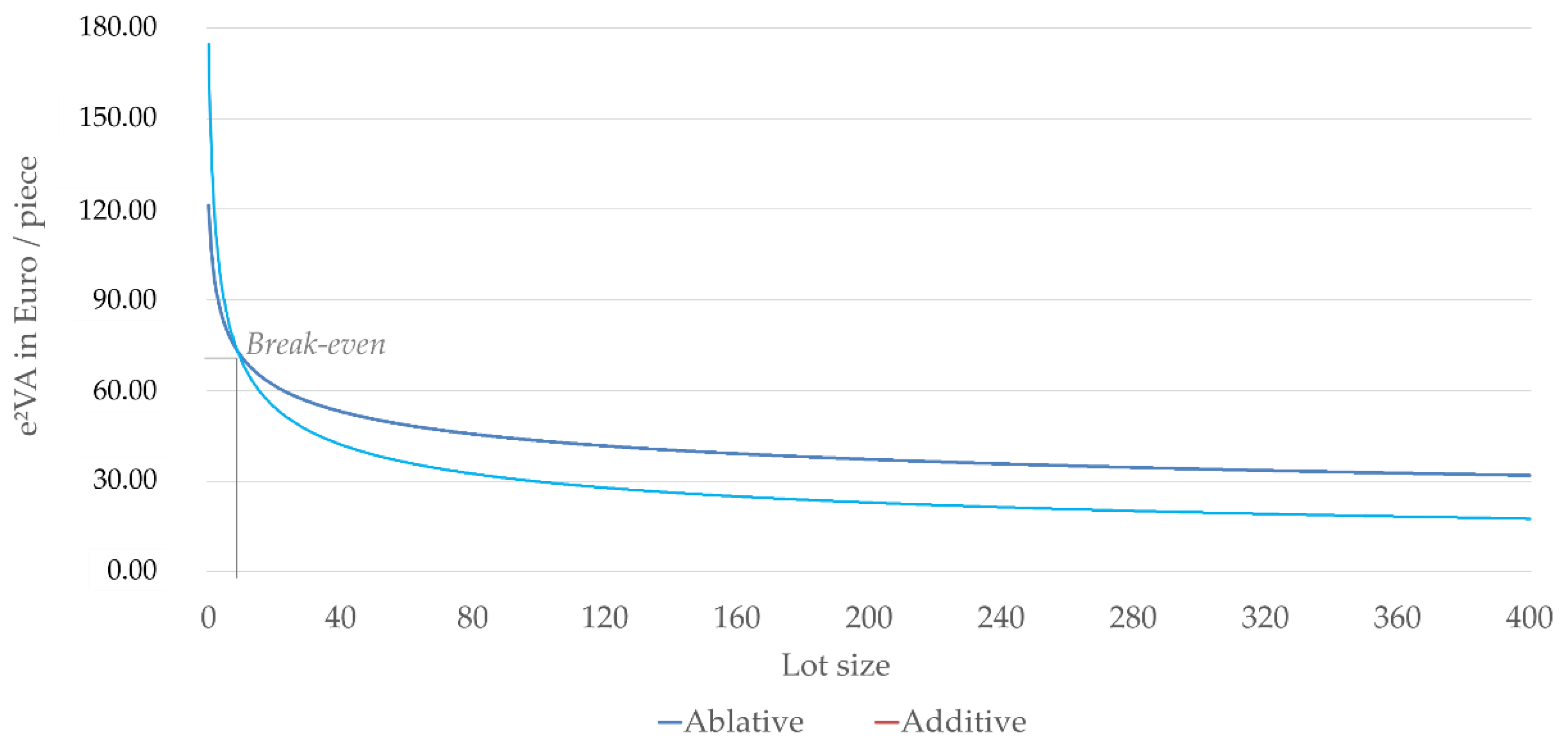

3.2.2. Case Study 2: Process Comparison

4. Conclusions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- World Commission on Environment and Development. Our Common Future: Report of the World Commission on Environment and Development. United Nations. Available online: www.un-documents.net/our-common-future.pdf (accessed on 25 August 2022).

- Ayres, R.; Van den Berrgh, J.; Gowdy, J. Strong versus weak sustainability: Economics, natural sciences, and consilience. Environ. Ethics 2001, 23, 155–168. [Google Scholar] [CrossRef]

- Daly, H.E. Sustainable Development: From Concept and Theory to Operational Principles. Popul. Dev. Rev. 1990, 16, 25–43. [Google Scholar] [CrossRef]

- Dedeurwaerdere, T. Sustainability Science for Strong Sustainability; Edward Elgar Publishing: Cheltenham, UK, 2014; p. 174. [Google Scholar]

- Bonnedahl, K.J.; Heikkurinen, P. The case for strong sustainability. In Strongly Sustainable Societies; Routledge: London, UK, 2018; pp. 1–20. [Google Scholar]

- Landrum, N.E. Stages of corporate sustainability: Integrating the strong sustainability worldview. Organ. Environ. 2018, 31, 287–313. [Google Scholar] [CrossRef]

- Olausson, H. A Tool for Calculating CO2 Emissions in the Manufacturing Industry: Use of GHG Protocol. 2020. Available online: http://www.diva-portal.org/smash/record.jsf?pid=diva2%3A1446855&dswid=-431 (accessed on 25 August 2022).

- Bansal, S.; Garg, I.; Sharma, G.D. Social entrepreneurship as a path for social change and driver of sustainable development: A systematic review and research agenda. Sustainability 2019, 11, 1091. [Google Scholar] [CrossRef] [Green Version]

- Schaltegger, S.; Gibassier, D.; Zvezdov, D. Is environmental management accounting a discipline? A bibliometric literature review. Meditari Account. Res. 2013, 21, 4–31. [Google Scholar] [CrossRef]

- Thomson, I. Mapping the terrain of sustainability accounting. In Sustainability Accounting and Accountability; Routledge: London, UK, 2010; pp. 38–55. [Google Scholar]

- McGrath, D.; Mathews, M. Moving to sustainability: An application of a matrix model to gain insight into the research literature. Account. Account. Perform. 2008, 14, 57–81. [Google Scholar]

- Gunarathne, N.; Lee, K.H. Environmental Management Accounting (EMA) for environmental management and organizational change: An eco-control approach. J. Account. Organ. Change 2015, 11. [Google Scholar] [CrossRef]

- Asiedu, Y.; Gu, P. Product life cycle cost analysis: State of the art review. Int. J. Prod. Res. 1998, 36, 883–908. [Google Scholar] [CrossRef]

- Jamwal, A.; Agrawal, R.; Sharma, M. Life cycle engineering: Past, present, and future. In Sustainable Manufacturing; Elsevier: Amsterdam, The Netherlands, 2021; pp. 313–338. [Google Scholar]

- Nathaniel, S.; Nwodo, O.; Sharma, G.; Shah, M. Renewable energy, urbanization, and ecological footprint linkage in CIVETS. Environ. Sci. Pollut. Res. 2020, 27, 19616–19629. [Google Scholar] [CrossRef]

- ISO 14040:2006; Environmental Management—Life Cycle Assessment—Principles and Framework. ISO: Geneva, Switzerland, 2006.

- ISO 14044:2006; Environmental Management—Life Cycle Assessment—Requirements and Guidelines. ISO: Geneva, Switzerland, 2006.

- Ulrich, P.; Hill, W. Wissenschaftstheoretische Grundlagen der Betriebswirtschaftslehre—Teil I. Wirtsch. Stud. Z. Ausbild. Hochschulkontakt 1976, 5, 304–309. [Google Scholar]

- Waltersmann, L.; Kiemel, S.; Stuhlsatz, J.; Sauer, A.; Miehe, R. Artificial Intelligence Applications for Increasing Resource Efficiency in Manufacturing Companies—A Comprehensive Review. Sustainability 2021, 13, 6689. [Google Scholar] [CrossRef]

- Miehe, R.; Buckreus, L.; Kiemel, S.; Sauer, A.; Bauernhansl, T. A Conceptual Framework for Biointelligent Production—Calling for Systemic Life Cycle Thinking in Cellular Units. Clean Technol. 2021, 3, 844–857. [Google Scholar] [CrossRef]

- Harari, Y.N. Sapiens: A Brief History of Humankind; Harper: New York City, NY, USA, 2016; ISBN 978–0062316097. [Google Scholar]

- Kant, I.; Schneewind, J.B. Groundwork for the Metaphysics of Morals; Yale University Press: New Haven, CT, USA, 2002; ISBN 978–1107401068. [Google Scholar]

- Ulrich, P. Integrative Wirtschaftsethik: Grundlagen einer lebensdienlichen Ökonomie; Haupt: Bern, Switzerland, 2008; ISBN 978–3258072616. [Google Scholar]

- Hornborg, A. Ecological economics, Marxism, and technological progress: Some explorations of the conceptual foundations of theories of ecologically unequal exchange. Ecol. Econ. 2014, 105, 11–18. [Google Scholar] [CrossRef]

- Smith, A. The Wealth of Nations: An Inquiry into the Nature and Causes of the Wealth of Nations; Oxford University Press: Oxford, UK, 2008; ISBN 978–0199535927. [Google Scholar]

- Ricardo, D. From the principles of political economy and taxation. In Readings in the Economics of the Division of Labor: The Classical Tradition; Sun, G.-Z., Ed.; World Scientific Pub. Co. Inc.: Singapore, 2005; pp. 127–130. ISBN 978–9812561244. [Google Scholar]

- Marx, K. Capital: Volume 1: A Critique of Political Economy; CreateSpace Independent Publishing Platform: Scotts Valley, SC, USA, 2014; ISBN 978–1499236316. [Google Scholar]

- von Thünen, J.H. Der Isolirte Staat in Beziehung auf Landwirthschaft und Nationalökonomie; Scientia: Amsterdam, The Netherlands, 1990; ISBN 3511092183. [Google Scholar]

- Jevons, W.S. Coal Question; Augustus M Kelley Pubs: New York, NY, USA, 1906; ISBN 978–0678001073. [Google Scholar]

- Menger, C. Grundsätze der Volkswirtschaftslehre; VDM: Saarbrücken, Germany, 2006; ISBN 3865505236. [Google Scholar]

- Walras, L. Elements of Pure Economics: Or the Theory of Social Wealth; Routledge Chapman & Hall: New York, NY, USA, 2003; ISBN 978–0415313407. [Google Scholar]

- Kapp, K.W. The Social Costs of Private Enterprise; Schocken Books: New York, NY, USA, 1971; ISBN 978-0805233964. [Google Scholar]

- Costanza, R.; d’Arge, R.; De Groot, R.; Farber, S.; Grasso, M.; Hannon, B.; Van Den Belt, M. The value of the world’s ecosystem services and natural capital. Nature 1997, 387, 253–260. [Google Scholar] [CrossRef]

- Socolow, R.; Andrews, C.; Berkhout, F.; Thomas, V. Industrial Ecology and Global Change; Cambridge University Press: Cambridge, UK, 1994; ISBN 0521471974. [Google Scholar]

- Bartelmus, P. Environmental accounting and material flow analysis. In A Handbook of Industrial Ecology; Ayres, R.U., Ayres, L.W., Eds.; Edward Elgar Publishing Inc.: Northampton, MA, USA, 2002; pp. 165–176. ISBN 1840645067. [Google Scholar]

- Burkett, P. The value problem in ecological economics: Lessons from the physiocrats and Marx. Organ. Environ. 2003, 16, 137–167. [Google Scholar] [CrossRef]

- De Chernatony, L.; Harris, F.; Dall’Olmo Riley, F. Added value: Its nature, roles and sustainability. Eur. J. Marketing. 2000, 34, 39–56. [Google Scholar] [CrossRef]

- Rasmussen, S. Production Economics: The Basic Theory of Production Optimization; Springer Science & Business Media: Berlin, Germany, 2012; ISBN 978–3642301995. [Google Scholar]

- Beattie, B.R. The Economics of Production; McGraw-Hill: New York, NY, USA, 2009; ISBN 978–1575242958. [Google Scholar]

- Westkämper, E. Einführung in Die Organisation der Produktion; Springer: Berlin, Germany, 2006; ISBN 3540260390. [Google Scholar]

- Zahn, E.; Schmidt, U. Produktionswirtschaft—Band 1: Grundlagen und Operatives Produktionsmanagement; UTB: Stuttgart, Germany, 1996; ISBN 978–3-8252–8126–7. [Google Scholar]

- Porter, M.E. The value chain and competitive advantage. In Understanding Business Processes; Psychology Press: Brighton, UK, 2001; pp. 50–66. [Google Scholar]

- Womack, J.P.; Jones, D.T.; Roos, D. The Machine That Changed the World: The Story of Lean Production—Toyota’s Secret Weapon in the Global Car Wars That Is Now Revolutionizing World Industry; Free Press: New York, NY, USA, 2007. [Google Scholar]

- Zeithaml, V.A. Consumer perceptions of price, quality, and value: A means-end model of synthesis of evidence. J. Mark. 1988, 52, 2–22. [Google Scholar] [CrossRef]

- Herrmann, C.; Blume, S.; Kurle, D.; Schmidt, C.; Thiede, S. The positive impact factory–transition from eco-efficiency to eco–effectiveness strategies in manufacturing. Procedia Cirp 2015, 29, 19–27. [Google Scholar] [CrossRef]

- Miehe, R.; Stender, S.; Hessberger, N.; Mandel, J.; Sauer, A. Improving manufacturing systems with regard to the concept of ultra-efficiency. In Advances in Manufacturing Technology XXXI; IOS Press: Amsterdam, The Netherlands, 2017; pp. 321–326. [Google Scholar]

- Lazdinis, M. Measuring economic value of biological diversity: Concepts, theories and methods. Balt. For. 2001, 7, 84–89. [Google Scholar]

- Sagoff, M. On the economic value of ecosystem services. Environ. Values 2008, 17, 239–257. [Google Scholar] [CrossRef] [Green Version]

- Mehvar, S.; Filatova, T.; Dastgheib, A.; De Ruyter van Steveninck, E.; Ranasinghe, R. Quantifying economic value of coastal ecosystem services: A review. J. Mar. Sci. Eng. 2018, 6, 5. [Google Scholar] [CrossRef] [Green Version]

- Rockström, J.; Steffen, W.; Noone, K.; Persson, Å.; Chapin, F.S., III; Lambin, E.; Lenton, T.M.; Scheffer, M.; Folke, C.; Schellnhuber, H.; et al. Planetary boundaries: Exploring the safe operating space for humanity. Ecol. Soc. 2009, 14, 32. [Google Scholar] [CrossRef]

- Krol, G.J.; Karpe, J. Ökonomische Aspekte von Nachhaltigkeit: Die Umweltproblematik aus Sozioökonomischer Sicht; LIT: Münster, Germany, 1999; ISBN 978–3825844103. [Google Scholar]

- Klöpffer, W.; Grahl, B. Life Cycle Assessment (LCA): A Guide to Best Practice; John Wiley & Sons: Hoboken, NJ, USA, 2014. [Google Scholar]

- Koedel, C.; Rockoff, J.E. Value-added modeling: A review. Econ. Educ. Rev. 2015, 47, 180–195. [Google Scholar] [CrossRef]

- Fedorovich, V.O.; Fedorovich, T.V. Corporate business value: Asymmetric information in the calculation of economic value added. Finan. Anal. Probl. Solut. 2019, 2, 183–203. [Google Scholar] [CrossRef]

- Wu, N.; Rao, Q. Enterprise value evaluation: Application and improvement based on cash flow model and Economic Value Added model. In 2017 International Conference on Humanities Science, Management and Education Technology (HSMET 2017); Atlantis Press: Berlin, Germany, 2017; pp. 185–190. [Google Scholar]

- Jakub, S.; Viera, B.; Eva, K. Economic Value Added as a measurement tool of financial performance. Procedia Econ. Financ. 2015, 26, 484–489. [Google Scholar] [CrossRef] [Green Version]

- Miehe, R. Methodik zur Quantifizierung der Nachhaltigen Wertschöpfung von Produktionssystemen an der öKonomisch-ökologischen Schnittstelle Anhand Ausgewählter Umweltprobleme; Fraunhofer Verlag: Stuttgart, Germany, 2018. [Google Scholar]

- Bebbington, J.; Gray, R.; Hibbitt, C.; Kirk, E. Full Cost Accounting: An Agenda for Action; ACCA Research Report: London, UK, 2001. [Google Scholar]

- Birkin, F. Ecological accounting: New tools for a sustainable culture. Int. J. Sustain. Dev. World Ecol. 2003, 10, 49–61. [Google Scholar] [CrossRef]

- Egan, M. Making water count: Water accountability change within an Australian university. Account. Audit. Account. J. 2014, 27, 259–282. [Google Scholar] [CrossRef]

- Hazelton, J. Accounting as a human right: The case of water information. Account. Audit. Account. J. 2013, 26, 267–311. [Google Scholar] [CrossRef]

- Samkin, G.; Schneider, A.; Tappin, D. Developing a reporting and evaluation framework for biodiversity. Account. Audit. Account. J. 2014, 27, 527–562. [Google Scholar] [CrossRef]

- Tello, E.; Hazelton, J.; Cummings, L. Potential users’ perceptions of general purpose water accounting reports. Account. Audit. Account. J. 2016, 29, 80–110. [Google Scholar] [CrossRef]

- Russell, S.; Milne, M.J.; Dey, C. Accounts of nature and the nature of accounts: Critical reflections on environmental accounting and propositions for ecologically informed accounting. Account. Audit. Account. J. 2017, 30, 1426–1458. [Google Scholar] [CrossRef]

- Plagiannakos, T. Full Cost Accounting for Decision Making at Ontario Hydro. IPPSO Facto 1996, 10, 22–23. [Google Scholar]

- Jasch, C. Environmental and Material Flow Cost Accounting: Principles and Procedures; Springer: Berlin, Germany, 2009; ISBN 978–1402090271. [Google Scholar]

- Burritt, R.L.; Schaltegger, S.; Ferreira, A.; Moulang, C.; Hendro, B. Environmental management accounting and innovation: An exploratory analysis. Account. Audit. Account. J. 2010. Available online: https://www.emerald.com/insight/content/doi/10.1108/09513571011080180/full/html (accessed on 25 August 2022).

- Burritt, R.L. Environmental management accounting: Roadblocks on the way to the green and pleasant land. Bus. Strategy Environ. 2004, 13, 13–32. [Google Scholar] [CrossRef]

- Mathews, M.R.; Lockhart, J.A. The Use of an Environmental Equity Account to Internalise Externalities; Aston Business School Research Institute: Birmingham, UK, 2001; ISBN 1854495119. [Google Scholar]

- Cullen, D.; Whelan, C. Environmental management accounting: The state of play. J. Bus. Econ. Res. 2006, 4. [Google Scholar] [CrossRef]

- Bartolomeo, M.; Bennett, M.; Bouma, J.J.; Heydkamp, P.; James, P.; Wolters, T. Environmental management accounting in Europe: Current practice and future potential. Eur. Account. Rev. 2000, 9, 31–52. [Google Scholar] [CrossRef]

- Kesicki, F.; Ekins, P. Marginal abatement cost curves: A call for caution. Clim. Policy 2012, 12, 219–236. [Google Scholar] [CrossRef]

- Ward, D.J. The failure of marginal abatement cost curves in optimising a transition to a low carbon energy supply. Energy Policy 2014, 74, 820–822. [Google Scholar] [CrossRef]

- Sukhdev, P.; Wittmer, H.; Schröter-Schlaack, C.; Nesshöver, C.; Bishop, J.; ten Brink, P.; Gundimeda, H.; Kumar, P.; Simmons, B. The Economics of Ecosystems and Biodiversity: Mainstreaming the Economics of Nature: A Synthesis of the Approach, Conclusions and Recommendations of TEEB; UNEP: Geneva, Switzerland, 2010. [Google Scholar]

- Helm, D. Natural Capital: Valuing the Planet; Yale University Press: New Haven, CT, USA, 2015. [Google Scholar]

- Juniper, T. What Has Nature Ever Done for Us?: How Money Really Does Grow on Trees; Synergetic Press: London, UK, 2013. [Google Scholar]

- CIMA. Accounting for Natural Capital: The Elephant in the Boardroom. Available online: www.cimaglobal.com/Documents/Thought_leadership_docs/Sustainability%20and%20Climate%20Change/CIMA-accounting-for-natural-capital.pdf (accessed on 25 August 2022).

- Trucost. Available online: www.trucost.com/ (accessed on 25 August 2022).

- Eftec. Economics for the Environment Consultancy. Available online: www.eftec.co.uk/ (accessed on 25 August 2022).

- Hunkeler, D.; Lichtenvort, K.; Rebitzer, G. Environmental Life Cycle Costing; Taylor & Francis Inc.: Milton Park, UK, 2008; ISBN 978–1420054705. [Google Scholar]

- Vogtländer, J.G.; Bijma, A. The ‘Virtual Pollution Prevention Costs ′99’. Int. J. Life Cycle Assess. 2000, 5, 113–124. [Google Scholar] [CrossRef]

- Vogtländer, J.G.; Brezet, H.C.; Hendriks, C.F. The Virtual Eco-Costs ′99. Int. J. Life Cycle Assess. 2001, 6, 157–166. [Google Scholar] [CrossRef]

- Figge, F.; Hahn, T. Sustainable Value Added: Measuring Corporate Sustainable Performance beyond Eco-Efficiency; Universität Lüneburg: Lüneburg, Germany, 2002; ISBN 978–3935630191. [Google Scholar]

- Burschel, C.J.; Losen, D.; Wiendl, A. Betriebswirtschaftslehre der Nachhaltigen Unternehmung; Oldenbourg Wissenschaftsverlag: München, Germany, 2004; ISBN 978–3486200331. [Google Scholar]

- KPMG/ACCA. Natural Capital and the Accountancy Profession. Available online: www.accaglobal.com/content/dam/ACCA_Global/Technical/sus/NC_and_the_Accounting_Profession.pdf (accessed on 25 August 2022).

- Umweltbundesamt. Ökonomische Bewertung von Umweltschäden: Methodenkonvention 2.0 zur Schätzung von Umweltkosten. Dessau-Roßlau. Available online: http://www.umweltbundesamt.de/sites/default/files/medien/378/publikationen/uba_methodenkonvention_2.0_-_2012_gesamt.pdf (accessed on 25 August 2022).

- European Commission (Ed.) International Reference Life Cycle Data System (ILCD) Handbook: General Guide for Life Cycle Assessment—Detailed Guidance; Publications Office of the European Union: Luxembourg, 2010; ISBN 978-9279190926. [Google Scholar]

- Zhu, Z.; Piao, S.; Myneni, R.B.; Huang, M.; Zeng, Z.; Canadell, J.G.; Ciais, P.; Sitch, S.; Friedlingstein, P.; Arneth, A.; et al. Greening of the Earth and its drivers. Nat. Clim. Change 2016, 6, 791–795. [Google Scholar] [CrossRef]

- Chandra, J.; Schall, S.O. Economic justification of flexible manufacturing systems using the Leontief input-output model. Eng. Econ. 1988, 34, 27–50. [Google Scholar] [CrossRef]

- Heijungs, R. Environmental Life Cycle Assessment of Products; Multicopy: Leiden, The Netherlands, 1992; ISBN 90-5191-064-9. [Google Scholar]

- Umweltbundesamt. Prozessorientierte Basisdaten für Umweltmanagementsysteme. Dessau-Roßlau. Available online: www.probas.umweltbundesamt.de (accessed on 25 August 2022).

| Unit | 2014 | 2020 | 2030 | 2040 | 2050 | |

|---|---|---|---|---|---|---|

| (nominal) | [€/kg CO2e] | 0.048 | 0.055 | 0.071 | 0.092 | 0.120 |

| (real) | [€/kg CO2e] | 0.048 | 0.043 | 0.036 | 0.032 | 0.028 |

| (nominal) | [€/kg R11e] | 559.191 | 667.585 | 1003.761 | 1870.942 | 3577.393 |

| (real) | [€/kg R11e] | 559.191 | 590.441 | 675.936 | 800.592 | 934.180 |

| (nominal) | [€/kg PM2.5e] | 118.788 | 163.948 | 286.731 | 478.473 | 791.136 |

| (real) | [€/kg PM2.5e] | 118.788 | 137.948 | 194.003 | 274.559 | 404.452 |

| (nominal) | [€/kg PO43−e] | 8.700 | 12.204 | 21.279 | 36.775 | 63.099 |

| (real) | [€/kg PO43−e] | 8.700 | 11.073 | 16.415 | 24.117 | 35.175 |

| (nominal) | [€/kg SO2e] | 2.938 | 4.352 | 8.391 | 16.213 | 31.396 |

| (real) | [€/kg SO2e] | 2.938 | 3.586 | 5.936 | 9.828 | 16.276 |

| Ablative | Additive | |||||||

|---|---|---|---|---|---|---|---|---|

| Type | GWP | AP | ODP | EP | GWP | AP | ODP | EP |

| Total | 17.1 | 0.00838 | 0.000122 | 0.00112 | 22.7 | 0.0798 | 0.000476 | 0.00239 |

| Ablative | Additive | |

|---|---|---|

| Direct material costs | 132.00 € | 70.98 € |

| Material overheads | 320.36 € | 172.27 € |

| Wages, salaries, social costs, boni | 1173.50 € | 1647.02 € |

| Production overheads | 455.32 € | 639.04 € |

| Administrative and selling overheads | 116.18 € | 163.06 € |

| Special direct manufacturing costs | 12.40 € | 0.00 € |

| Total | 2209.76 € | 2692.37 € |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Miehe, R.; Finkbeiner, M.; Sauer, A.; Bauernhansl, T. A System Thinking Normative Approach towards Integrating the Environment into Value-Added Accounting—Paving the Way from Carbon to Environmental Neutrality. Sustainability 2022, 14, 13603. https://doi.org/10.3390/su142013603

Miehe R, Finkbeiner M, Sauer A, Bauernhansl T. A System Thinking Normative Approach towards Integrating the Environment into Value-Added Accounting—Paving the Way from Carbon to Environmental Neutrality. Sustainability. 2022; 14(20):13603. https://doi.org/10.3390/su142013603

Chicago/Turabian StyleMiehe, Robert, Matthias Finkbeiner, Alexander Sauer, and Thomas Bauernhansl. 2022. "A System Thinking Normative Approach towards Integrating the Environment into Value-Added Accounting—Paving the Way from Carbon to Environmental Neutrality" Sustainability 14, no. 20: 13603. https://doi.org/10.3390/su142013603

APA StyleMiehe, R., Finkbeiner, M., Sauer, A., & Bauernhansl, T. (2022). A System Thinking Normative Approach towards Integrating the Environment into Value-Added Accounting—Paving the Way from Carbon to Environmental Neutrality. Sustainability, 14(20), 13603. https://doi.org/10.3390/su142013603