1. Introduction

As environmental problems become increasingly prominent, green operations have received substantial attention in recent years. Governments around the world have introduced different environmental regulations, such as emission permits, carbon emission limits, carbon taxes, and carbon trading, as well as energy-saving and low-carbon certification measures for products. For example, the No. 1 official document of China proposed that the government would take promoting green agricultural development as an important part of accelerating agricultural modernization and put forward relatively comprehensive policies and measures in 2021 [

1]. In addition, with the aggravation of the environmental problems, more and more firms are not only concerned about their profits but are also considering their environmental performance. That is, many firms have an increasing awareness of environmental responsibility, and they are also expanding the production scale of green products. For example, BYD Co., Ltd., Shenzhen, China. stopped producing fuel vehicles to reduce environmental hazards. Producing clean and green products is also the main means for enterprises to enhance their market competitiveness. To maintain sustainable competitive advantages in the context of the green economy, many enterprises try to provide green products that are more energy efficient and environmentally friendly than ordinary products by introducing clean energy and investing in green technology. A global study by Accenture concluded that more than 80% of respondents are concerned about product green degrees when they make purchasing decisions (Hong et al. [

2]). Improving the product green level is not only a crucial way for businesses to expand market demand and enhance competitiveness but also a principal element to be considered in improving supply chain competitiveness. For example, Toshiba has made a vision plan: environment outlook 2050, to better realize the rich and colorful life of humans and the earth (Yang et al. [

3]); From 2016 to 2020, Shanghai General Motors plans to invest 26.5 billion yuan in efficient powertrain and new energy technology, and some retail commercial enterprises also attach great importance to green products (Yang et al. [

4]). As a leader of responsible companies, Patagonia has invested a lot in improving global environmental issues like global warming. Adidas, a well-known sportswear manufacturer, optimizes its packaging and manufacturing materials to make its products more environmentally friendly. These retail giants that occupy a dominant position in the retail market because of their high market share dominate the sales of green products in the supply chain, such as Walmart and the online platform JD.com. In order to cater to consumers’ green preferences, these companies also encourage manufacturers to produce green products.

However, in practice, green products are produced by manufacturers and green investments are made by manufacturers, whereas the production cost of green products is higher and the price is more expensive than traditional products. In general, the development of green technology requires a great deal of money consisting of research and development costs, equipment renewal costs, etc. On the one hand, green investment requires additional investment costs, which increases the cost burden of manufacturers. On the other hand, especially in the highly competitive market, it is more difficult for manufacturers to obtain market demand information due to the increasingly diversified consumer demands and the differentiation of green preferences, and the increasing uncertainty of such demands leading to the enhancement of manufacturers’ risk awareness. Faced with the fierce competition environment and the potential risks brought by the uncertain demand, manufacturers tend to be more cautious and even take risk-averse behavior when making decisions. Under the risk-averse attitude of the manufacturer, the goal of the manufacturer is not only to maximize the expected profit or minimize the expected cost in the case of risk neutrality but to realize the operation goal of the enterprise under the premise of minimizing the loss. In other words, the different risk attitude held by the manufacturer has an increasingly prominent impact on the manufacturer’s decision-making. Chen et al. [

5] found that enterprises with a risk-averse attitude pay more attention to how to maintain the stability of profits in production and operation, and they are more willing to sacrifice part of expected profits to avoid the lower fluctuation of profits in practice. In this case, manufacturers will not try to reduce the level of green investment, which results in a decline in the production of green products and harms the environment. Therefore, how to mitigate or eliminate the impact of manufacturers’ risk aversion on green investment has become a problem worth studying. As an attitude toward risk, risk aversion has been deeply studied in operation management. CvaR, VaR, standard deviation of profit, variance of profit, etc., have been proposed to help explore risks in operations, and as a performance measure, the mean-variance (MV) theory can capture the profit risk of the associated operations (Choi et al. [

6]). Therefore, in this paper, we use the MV theory for conducting risk analysis. In addition, we also use the optimization theory to analyze the model.

A survey conducted by Accenture shows that 80 percent of consumers will consider green features before paying for a product, from which we know that environmentally conscious consumers like green products very much (Xiao et al. [

7]). However, the production of green products requires additional green investment costs, and the price of green products is higher than that of ordinary products, which also reduces the purchasing power of many consumers and makes it difficult to promote green products. For instance, according to the research report “China Green Consumption Market Development Analysis in 2013” released by Zhiyan Data Research Center, about 66 percent of consumers in China believe that the price of green products is too high, which has become one of the important reasons that prevent green products from becoming mainstream consumer goods (zhou et al. [

8]). Although the green degree of green products is greatly improved compared with that of ordinary products, the rise of the price that consumers are willing to pay for green products is lower compared with that of green products, which also leads to lower market demand for green products and difficult popularization of green products. Therefore, how to reduce the retail price of green products and promote the rise of market demand while improving the green degree of green products is also a problem worth studying.

Based on the contents described above, our study addresses the following questions:

- (a)

In a retailer-dominated supply chain, which contract can achieve Pareto improvement of manufacturer and retailers’ profit, improve green degree, and reduce product prices to increase product market demand in the case of manufacturers’ risk aversion, two-part tariff contract, or cost-sharing contract?

- (b)

How to reduce or eliminate the impact of manufacturers’ risk aversion on the green supply chain system?

- (c)

What is the impact of a manufacturer’s risk aversion on consumer surplus and social welfare in a retailer-dominated green supply chain system? How is it possible to use the manufacturer’s risk aversion reasonably to maximize consumer surplus and social welfare?

The main purpose of this study is to find the answers to these questions. To achieve this, we assume that the manufacturer is risk aversion and the retailer is risk neutral, and we construct a two-echelon green supply chain composed of a risk-averse manufacturer and a risk-neutral retailer, in which the retailer as the leader and the manufacturer as the follower. The manufacturer is responsible for green investment in green products, and the retailer sells green products to consumers. They play a Stackelberg game with the maximization of their interests as the center. We discuss four modes, including the centralized supply chain, wholesale price contract, cost-sharing contract, and two-part tariff contract. Our analytical results show that the two-part tariff contract has more flexibility when coordinating the risk-averse green supply chain.

This study examined how to coordinate the green investment decision and pricing of the green supply chain composed of a risk-averse manufacturer and a risk-neutral retailer.

This paper has theoretical significance for improving the green degree of products and reducing retail prices by using manufacturers’ risk aversion. At the same time, it also provides references for the decision-making of consumers and the government and has certain practical value.

To summarize, our contributions are as follows:

- (1)

We applied the mean-variance theory to the two-part tariff contract, which increases the application scope of the mean-variance theory. At the same time, we found that in the two-part tariff contract, the manufacturer‘s risk aversion has no effect on green degree, retail price, supply chain profit, and so on, which provides a theoretical basis for how to reduce and eliminate the impact of manufacturers’ risk aversion.

- (2)

We proposed the two-part tariff contract to effectively relieve or eliminate the impact of the manufacturer’s risk aversion on the expected utility of the supply chain and green degree of the product, which realizes the Pareto improvement of supply chain enterprises, promotes the green investment level of the supply chain system, improves the market demand, and reduces the green product retail price effectively.

- (3)

We found that the manufacturer’s risk aversion has a positive effect on social welfare in wholesale and cost-sharing contracts, which provides a theoretical basis for how to use the manufacturer’s risk aversion to improve social welfare when the two-part contract cannot be reached.

The rest of this paper is organized as follows.

Section 2 presents the literature review related to this study. In

Section 3, we describe the research questions and define the problem and assumptions. The equilibrium solution is obtained, and the optimal decision for each variable is solved in

Section 4.

Section 5 is mainly involved in model comparison and analysis.

Section 6 is a numerical analysis that demonstrates the effectiveness of the proposed model. Finally, we summarize the results and provide recommendations for future research in

Section 7.

5. Model Comparison and Analysis

By analyzing the relationship between risk aversion and the green degree in different contracts, we obtain the following lemma.

5.1. Green Degree Analysis of Green Products

Lemma 5. In the three contracts, the green degree of green products has the following relationship.

From the above lemma, we can see that the green degree of the product in the cost-sharing contract is higher than that in the wholesale price contract, and the green degree of the product in the two-part contract is higher than that in the cost-sharing contract, which is the highest among the three contracts. In the cost-sharing contract mode, the retailer shares the green investment cost of the manufacturer, and the manufacturer’s enthusiasm for green investment increases so that the green degree level of the product is higher. In the two-part contract, the manufacturer obtains fixed transfer payments from the retailer, and the enthusiasm for green investment is higher. Therefore, the green degree level is higher than the supply chain in the cost-sharing contract and the supply chain in the wholesale price contract.

5.2. Market Utility Analysis

Lemma 6. In the three contracts, the manufacturer’s optimal wholesale price has the following relationship.

From Lemma 6, we can see that in the cost-sharing contract, the wholesale price of the product is the highest, while the wholesale price in the two-part contract is the lowest. The reason is that in the cost-sharing contract, the manufacturer has increased the investment in green technology, and the green degree of the product has been greatly improved, which has led to an increase in product costs and an increase in wholesale prices. In the two-part contract, the retailer’s additional payment makes the two parties share the cost. Compared with the retailer’s non-sharing cost, the product cost is lower and the wholesale price is further reduced.

Lemma 7. In the three contracts, the retailer’s optimal marginal profit and optimal pricing have the following relationship; If , .

From Lemma 7, we can see that in the two-part tariff contract, the retailer’s marginal revenue is the highest. In the cost-sharing contract, the retailer’s marginal revenue is higher than that of the wholesale price contract. The retailer’s marginal revenue is the lowest. This is because in the two-part contract, the wholesale price of the goods given by the manufacturer to the retailer is the lowest, and the lower wholesale price greatly improves the marginal revenue of the retailer. In the cost-sharing contract, the manufacturer and the retailer share the investment cost. The manufacturer’s green investment is higher, the green degree is greatly improved, and the marginal income is improved so that the retailer’s marginal income is higher than the retailer’s marginal income in the wholesale price contract. We also know that in the cost-sharing contract, the market retail price of green products is the highest, and when the above conditions are met, the market retail price of green products in the two-part tariff contract is the lowest. Combined with the previous proposition, we can know that in the two-part tariff contract, the expected revenue of both sides of the supply chain achieves Pareto improvement, and the green degree of green products is the highest. In Lemma 7, we know that the retailer achieves the lowest retail price in the two-part tariff contract. Therefore, the two-part tariff contract can not only satisfy the upstream and downstream sides of the supply chain but also enable consumers to obtain green products with the lowest price and the highest green degree.

Lemma 8. In the three contracts, the market demand for green products has the following relationship.

From Lemma 8, we can obtain that in the two-part tariff contract, the market demand for green products is the highest. In the cost-sharing contract, the market demand for green products is higher than that for green products in the wholesale price contract. The market demand for green products in the wholesale price contract is the lowest among the three contracts. The reason is that in the two-part tariff contract, the green degree of green products is the highest, and consumers with higher environmental awareness have greater demand for green products. In addition, in the two-part tariff contract, the retail price of green products is the lowest, which makes the market demand the largest. Similarly, in the cost-sharing contract, the green degree of green products is higher than that of green products in the wholesale price contract, and consumers’ preference for the green degree will make their sales volume higher than the market demand under the wholesale price contract.

5.3. Analysis of the Impact of Risk Aversion on Decision Variables

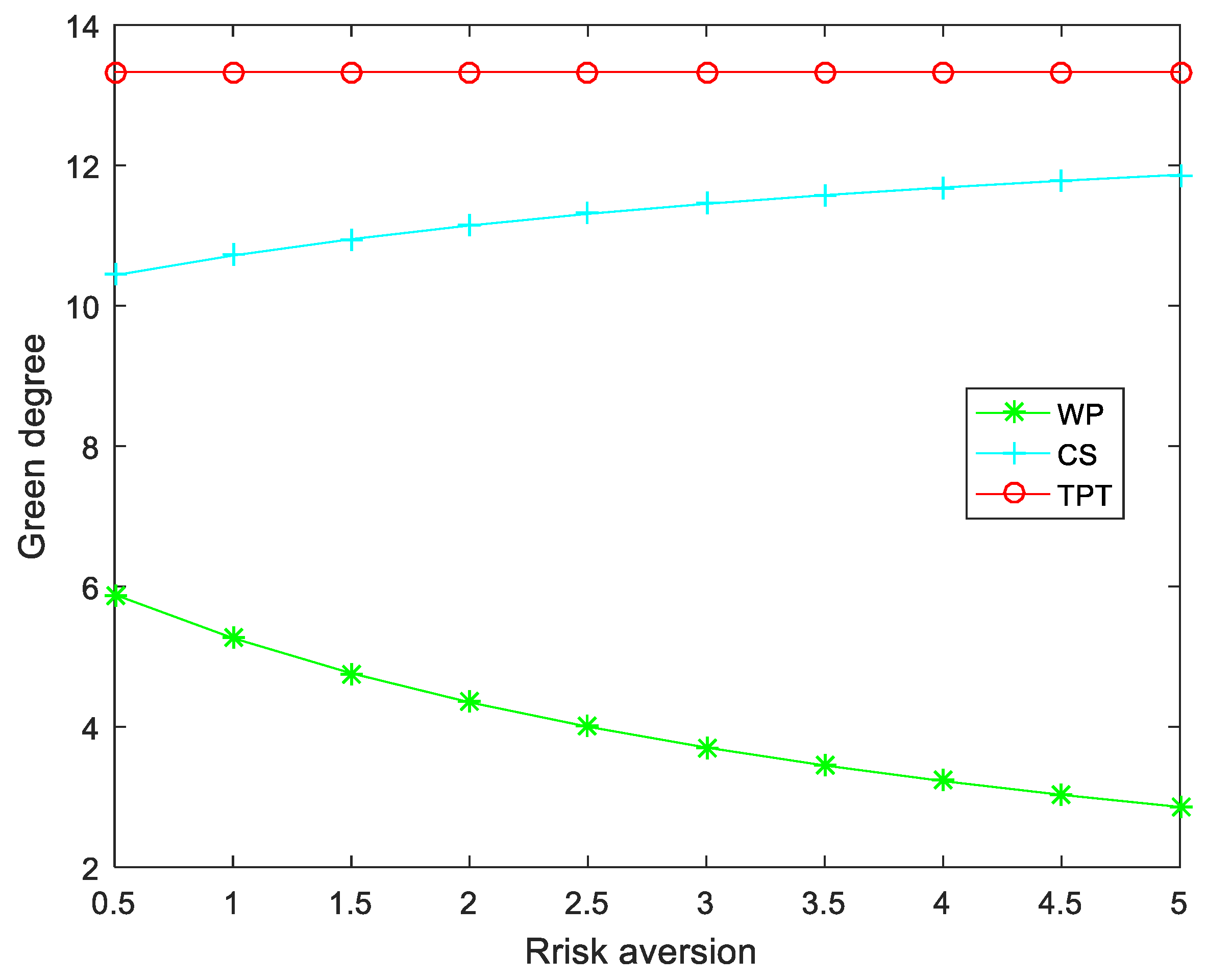

Lemma 9. ; let, if, we have; Ifand, we have;.

From Lemma 9, we can obtain that in the wholesale price contract, the greater the risk aversion of the manufacturer, the smaller the green degree of the green product. In the cost-sharing contract, under certain conditions, the two are positively correlated, and when another condition is met, the two are negatively correlated. The green degree of the green product in the two-part contract has nothing to do with the risk aversion of the manufacturer. This is because, in the wholesale price contract, a risk-averse manufacturer will avoid risks in pursuit of profits. The greater the degree of risk aversion, the less willing they are to make green investments, resulting in a smaller green degree of green products. In the cost-sharing contract, when the risk aversion reaches the threshold, because the seller shares the green investment cost, the greater the risk aversion of the manufacturer, the higher the absolute value of the green investment cost shared by the retailer, which will increase the green investment of the manufacturer. Therefore, the green degree of green products is higher. In the two-part contract, due to the additional transfer payment of the retailer, the manufacturer gets additional income, so the green degree of the green product has nothing to do with risk aversion.

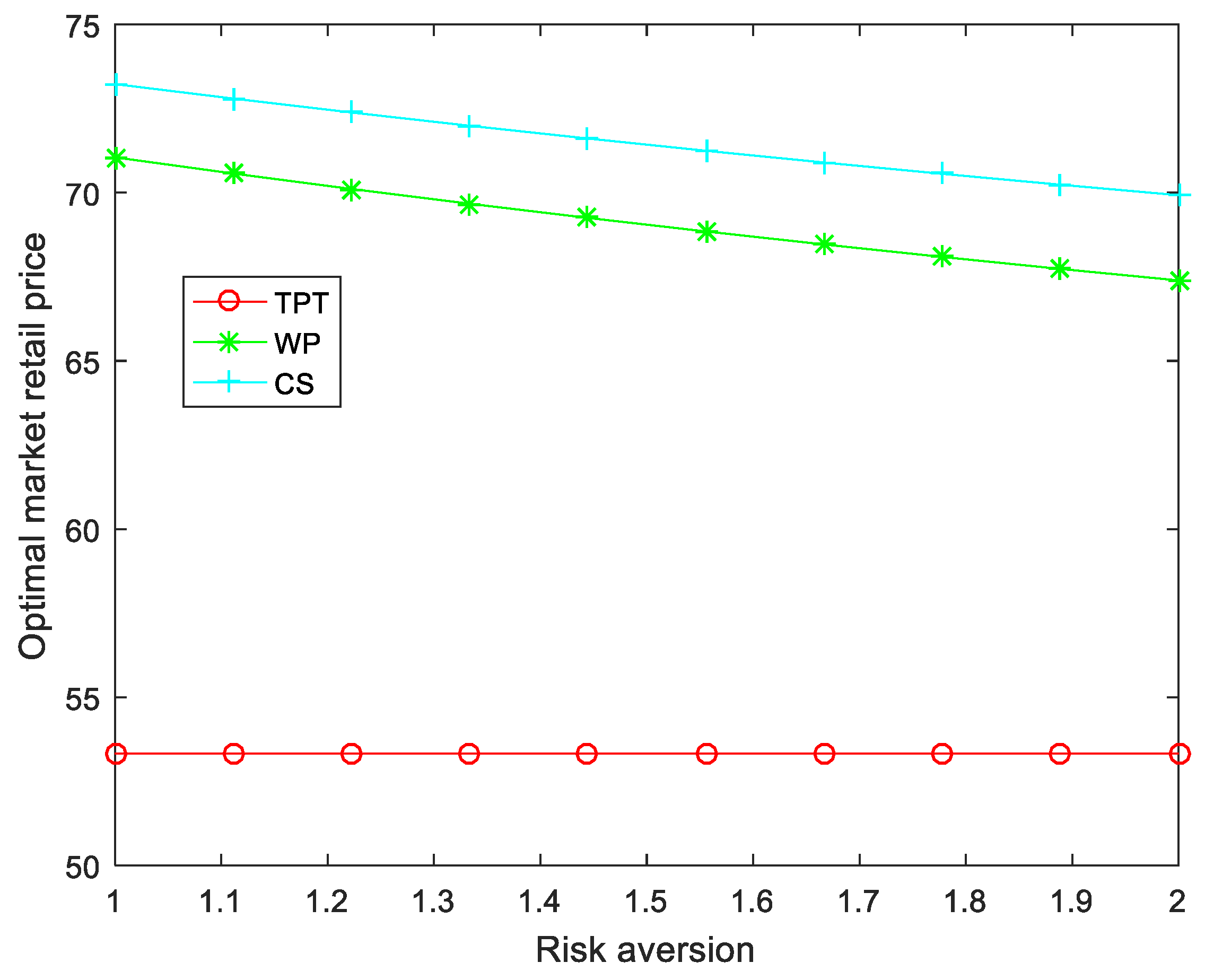

Lemma 10. , , .

From Lemma 10, we know that in the wholesale price contract and the cost-sharing contract, the retailer’s optimal retail price is negatively correlated with the manufacturer’s risk aversion, while in the two-part contract, the retailer’s optimal retail price is independent of the manufacturer’s risk aversion. The reason is that in the wholesale price contract and cost-sharing contract, with the increase of the manufacturer’s risk aversion, the green investment level of the manufacturer decreases, the green degree of the green product also decreases, and the demand for green products by environmentally conscious consumers also decreases, eventually leading to a lower retail price. In the two-part tariff contract, the retailer’s additional transfer payment to the manufacturer eliminates the manufacturer’s concern about the uncertainty of market demand caused by green investment so that the market demand for green products is independent of the manufacturer’s risk aversion and, ultimately, the price is also independent of the manufacturer’s risk aversion.

Lemma 11. , ;, ;, .

From Lemma 11, we can see that in the three contracts, the manufacturer’s risk aversion is negatively correlated with its own expected utility and positively correlated with the retailer’s expected utility; that is, the greater the manufacturer’s risk aversion, the smaller the expected utility of the manufacturer and the greater the retailer’s expected utility. The reason is that compared with risk-neutral manufacturers, risk-averse manufacturers worry about the uncertainty of market demand due to green investment. Therefore, they will reduce the level of green investment, thus reducing the demand for products, which will lead to a decrease in expected utility. For risk-neutral retailers, retailers do not need to avoid the risk of uncertain market demand for green products, and the profits of supply chain channels will be more inclined to flow to retailers, resulting in higher risk aversion of the manufacturer and higher expected utility of the retailer.

5.4. Analysis of Consumer Surplus and Social Welfare

To further discuss the impact of green investment on consumers under three contracts, we introduce consumer surplus and social welfare to compare and analyze the impact on downstream markets.

For the consumer surplus of a single product, referring to Liu et al. [

9], consumer surplus can be expressed as

. Where

is the optimal retail price,

is the maximum retail price, and we obtain the consumer surplus in three contracts as follows:

Comparing the consumer surplus in the three contracts, we can obtain the following lemma:

Lemma 12. .

From Lemma 12, we can see that in the two-part tariff contract, the consumer surplus is the highest, while in the wholesale price contract, the consumer surplus is the lowest, and the consumer surplus in this sharing contract is higher than that in the wholesale price contract. The reason is that in the two-part contract, manufacturers have the highest level of green investment so that the green products have the highest green degree, the lowest market retail price, and the largest market demand. In the cost-sharing contract, manufacturers enhance the level of green investment, enhance the green degree of green products, cater to the green environmental awareness of consumers, and enhance consumer surplus. In the wholesale price contract, both manufacturers and retailers make decentralized decisions to maximize their respective interests. The green degree of green products is the lowest, and the consumer surplus is the lowest. Therefore, rational consumers should choose green products produced in the two-part contract.

Lemma 13. , , ;, ;, .

From Lemma 13, we can see that consumer surplus is positively correlated with manufacturer risk aversion and consumer environmental awareness and negatively correlated with the green investment cost coefficient. This shows that the greater the manufacturer’s risk aversion, the higher the consumer’s awareness of environmental protection, the higher the consumer surplus, the greater the investment cost coefficient, and the smaller the consumer surplus. The reason is that in the case of greater manufacturer risk aversion, the manufacturer will reduce the level of green investment, and the green degree of green products will decline, resulting in price falls, so that consumers obtain more benefits, and in the case of higher consumer awareness of environmental protection, the green degree of the product is high, the manufacturer will cater to the needs of consumers, improve the green investment level of green products, and increase the welfare of consumers. When the investment cost coefficient increases, the effective green investment decreases, so the green degree of green products decreases, resulting in a decline in consumer surplus.

To further analyze the impact of green investment on social welfare under each contract, we refer to Niu et al. [

59]; social welfare can be expressed as

; therefore, we calculate the expected social welfare in the three contracts as follows:

where,

,

.

Analyzing the social welfare in the three contracts, we can obtain the following lemma.

Lemma 14. .

From Lemma 14, we can see that the social welfare in the two-part tariff contract is significantly higher than that in the cost-sharing contract and the wholesale price contract, and the social welfare in the cost-sharing contract is higher than that in the wholesale price contract. The reason is that in the two-part tariff contract, the expected utility, green degree, and consumer surplus of the supply chain are the highest, so social welfare is also the highest. In the wholesale price contract, the supply chain expected utility, green degree, and consumer surplus are the lowest, so social welfare is the lowest. In the cost-sharing contract, the green degree and consumer surplus are higher than those in the wholesale price contract, so the social welfare is higher than that in the wholesale price contract.

Due to the complexity of the social welfare formula, the influence of related parameters on social welfare will be analyzed in the numerical analysis.

7. Conclusions

Under the background of the green economy, this paper takes the bilateral monopoly green supply chain dominated by the retailer as the research object and explores the coordination of joint green investment contracts to improve the green degree of green products and market demand. This paper constructs a green supply chain composed of a risk-averse manufacturer and a risk-neutral retailer and studies the optimal green decision-making and supply chain coordination of a green supply chain with a risk-averse manufacturer. The centralized decision-making, wholesale price contract, cost-sharing contract, and two-part tariff contract are constructed to explore how to improve the green investment level of the supply chain system, reduce the price of green products, and achieve a win-win situation for supply chain members.

Compared with the existing literature, we highlight several interesting findings.

(1) In a retailer-dominated green supply chain system with the manufacturer’s risk aversion, the cost-sharing contract increases the green degree of green products and the expected utility of the retailer but decreases the utility of the manufacturer. Therefore, the Pareto improvement of the manufacturer’s and retailer’s profits cannot be realized, and the contract cannot be used as an effective coordination mechanism, which is in line with [

8]. In the cost-sharing contract, when the manufacturer’s risk aversion meets certain conditions, the green degree of green products is positively correlated with the manufacturer’s risk aversion, which provides a theoretical basis for using the manufacturer’s risk aversion to enhance the green degree of products. (2) When the constraints are satisfied, in the two-part tariff contract, the market retail price of the green supply chain system is the lowest, and the green degree of the green product is the highest, which can achieve the maximum market demand of the green product, and realize the Pareto improvement of the expected utility of the retailer and the manufacturer so that the green supply chain system can be perfectly coordinated. The same findings were found in [

52]. (3) In the two-part tariff contract, the manufacturer’s risk aversion has no effect on the green degree of the product, the market retail price, and the expected utility of the supply chain. Therefore, the two-part tariff contract eliminates the impact of risk aversion on the supply chain system. (4) Consumers’ environmental awareness can promote supply chain enterprises to improve the green degree of products and enhance the expected utility of the supply chain. Therefore, guiding and promoting consumers to improve their environmental awareness is conducive to more enterprises practicing green supply chain management. (5) When the investment cost coefficient is greater than a certain threshold, the market retail price of green products in the two-part tariff contract is the lowest among the three contracts, which indicates that the retail price in the two-part tariff contract is closely related to the investment cost coefficient. Supply chain decision-makers should make full use of the relationship between the investment cost coefficient and retail price. (6) In the two-part tariff contract, consumer surplus and social welfare are significantly better than those in the cost-sharing contract and the wholesale price contract. The two-part tariff contract effectively improves consumer surplus and social welfare. On the other hand, in the two-part tariff contract, the consumer surplus and social welfare are not affected by the manufacturer’s risk aversion, while in the wholesale price contract and the cost-sharing contract, the consumer surplus and social welfare increase with the manufacturer’s risk aversion. Therefore, the decision-makers of the supply chain should make full use of the manufacturer’s risk aversion to maximize the consumer surplus and social welfare even if the two-part tariff contract cannot be reached.

This research has some academic significance. (1) We apply the mean-variance theory to the study of two-part tariff contracts, consumer surplus, and social welfare. We construct a two-part tariff, consumer surplus, and social welfare model based on the mean-variance theory, which is an extension of the mean-variance theory. (2) Our model eliminates the impact of manufacturer risk aversion on market sales and product green degree and reduces the retail price of green products, which is a new development of green investment decision issues about the green supply chain. (3) We put forward a cost-sharing and two-part tariff contract to encourage and coordinate supply chain members considering the manufacturer’s risk aversion. This expands the application environment of cost-sharing and two-part tariff contracts.

Some valuable managerial insights are obtained as follows. First, in a retailer-led supply chain, the retailer should take the initiative to sign a two-part tariff contract with the risk-averse manufacturer because the contract can achieve the highest green degree of green products and maximize profits, and can eliminate the impact of the manufacturer’s risk aversion on the supply chain. Second, the government should formulate policies to encourage retailers to sign a two-part tariff contract with risk-averse manufacturers, which can promote the maximization of social welfare. At the same time, the government should also control the green investment level of the supply chain by increasing rewards and punishments and strengthening supervision. Last, consumers should have a preference for the products produced in the two-part tariff contract because the green degree level of the product is the highest, and consumers can also obtain the largest consumer surplus.

There are still some limitations in this study, which can be the direction of further attention in the future. First of all, in order to simplify the problem, this paper uses the mean-variance theory to measure the degree of risk aversion. In the future, more complex CvAR criteria can be used to measure the degree of risk aversion; secondly, this paper assumes that the demand function is a linear form of the green degree of products. In the future, we can further relax the assumptions and consider more general demand function forms.