Corporate Social Responsibility, Green Finance and Environmental Performance: Does Green Innovation Matter?

Abstract

:1. Introduction

2. Literature Review and Hypothesis Development

2.1. Theoretical Background

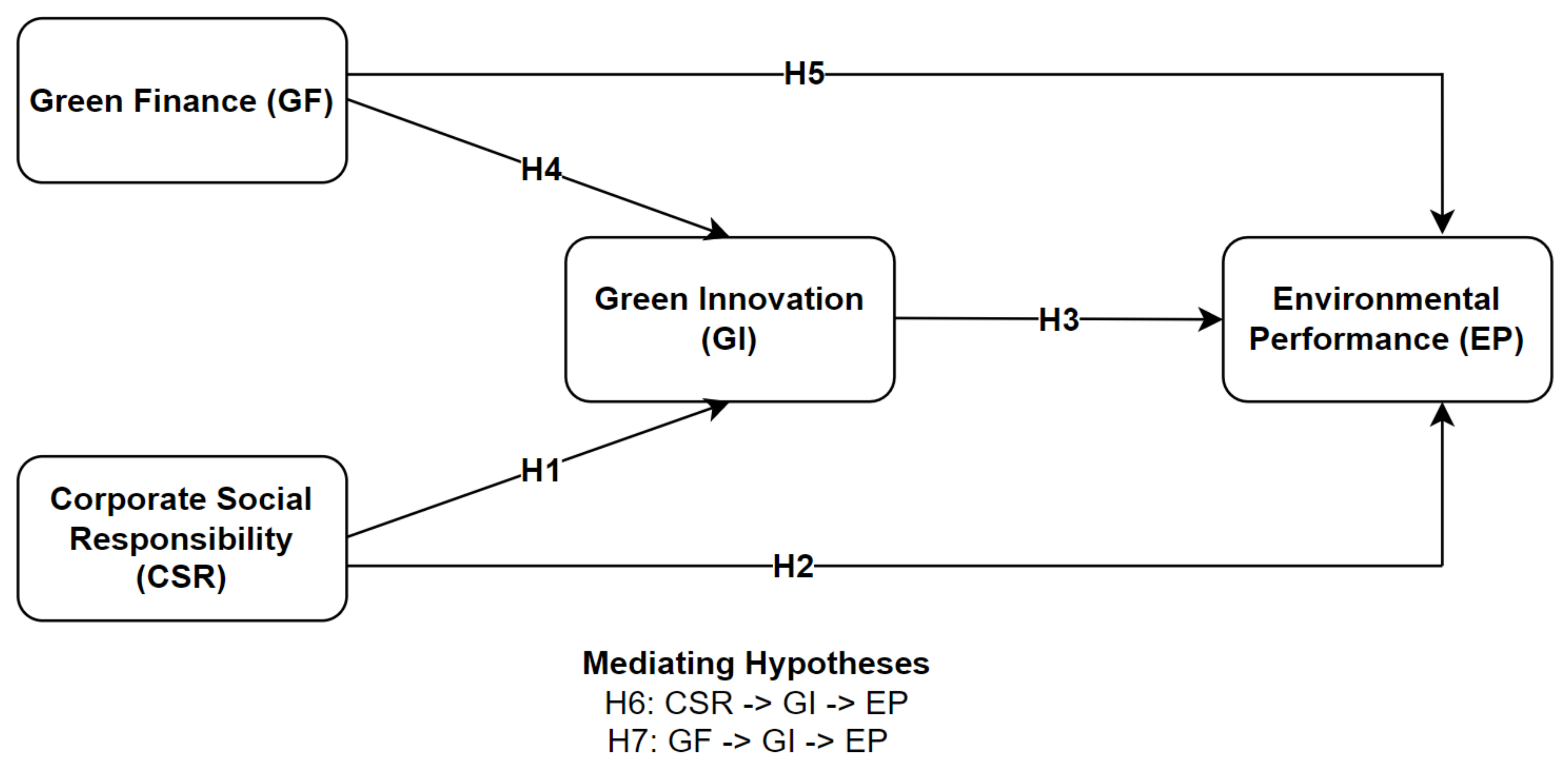

2.2. CSR, Green Innovation and Environmental Performance

2.3. Green Finance, Green Innovation and Environmental Performance

2.4. Green Finance and Environmental Performance

2.5. The Mediating Role of GI

3. Research Methods

3.1. Research Context

3.2. Sampling

3.3. Questionnaire Development

4. Data Analysis and Results

4.1. Measurement Model of the Study

4.2. Structural Model and Hypotheses Testing

4.3. Robustness Tests

5. Discussion and Conclusions

5.1. Theoretical Contributions

5.2. Practical Implications

5.3. Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Green Innovation (GI) | |

|---|---|

| GI1 | Our bank is using green technology. |

| GI2 | Our bank is practicing green banking activities. |

| GI3 | Our bank is implementing a green strategy. |

| GI4 | Our bank is ensuring an eco-friendly work environment. |

| GI5 | Our bank is offering customer service online. |

| Social Dimension of CSR (SD_CSR) | |

| SD_CSR1 | Our bank is creating a balance between work and family life for employees. |

| SD_CSR2 | Our bank is assessing the impact of our activities on the local society. |

| SD_CSR3 | Our bank is ensuring work safety. |

| SD_CSR4 | Our bank is working together on charitable and social projects. |

| Environmental Dimension of CSR (END_CSR) | |

| END_CSR1 | Our bank is analyzing the ecological consequences of activities. |

| END_CSR2 | Our bank is establishing renewable energy sources. |

| END_CSR3 | Our bank is implementing activities that promote environmental responsibility. |

| Economic Dimension of CSR (ED_CSR) | |

| ED_CSR1 | Our bank is offering a competitive salary package. |

| ED_CSR2 | Our bank respects customers and suppliers equally. |

| ED_CSR3 | Our bank is carrying out cost-effective operations. |

| ED_CSR4 | Our bank is managing financial risk. |

| Green Finance (GF) | |

| GF1 | Our bank is investing more in renewable energy sectors. |

| GF2 | Our bank is investing more amount in energy efficiency sectors. |

| GF3 | Our bank is investing more in green sector development. |

| Environmental Performance (EP) | |

| EP1 | Our bank is lowering the carbon footprint from banking activities. |

| EP2 | Our bank is reducing energy consumption from banking activities. |

| EP3 | Our bank is enhancing banks’ adherence to environmental regulations. |

| EP4 | Our bank is delivering the employees’ training on energy conservation and environmental preservation. |

| EP5 | Our bank is collaborating with green suppliers and organizations. |

| EP6 | Our bank is promoting environmentally friendly technologies. |

References

- Zheng, G.W.; Siddik, A.B.; Masukujjaman, M.; Fatema, N.; Alam, S.S. Green finance development in Bangladesh: The role of private commercial banks (PCBs). Sustainability 2021, 13, 795. [Google Scholar] [CrossRef]

- Chen, J.; Siddik, A.B.; Zheng, G.-W.; Masukujjaman, M.; Bekhzod, S. The Effect of Green Banking Practices on Banks’ Environmental Performance and Green Financing: An Empirical Study. Energies 2022, 15, 1292. [Google Scholar] [CrossRef]

- Ying, M.; Tikuye, G.A.; Shan, H. Impacts of Firm Performance on Corporate Social Responsibility Practices: The Mediation Role of Corporate Governance in Ethiopia Corporate Business. Sustainability 2021, 13, 1208. [Google Scholar] [CrossRef]

- Kraus, S.; Rehman, S.U.; García, F.J.S. Corporate social responsibility and environmental performance: The mediating role of environmental strategy and green innovation. Technol. Forecast. Soc. Chang. 2020, 160, 120262. [Google Scholar] [CrossRef]

- Zheng, G.; Siddik, A.B.; Masukujjaman, M.; Fatema, N. Factors Affecting the Sustainability Performance of Financial Institutions in Bangladesh: The Role of Green Finance. Sustainability 2021, 13, 10165. [Google Scholar] [CrossRef]

- Melay, I.; O’Dwyer, M.; Kraus, S.; Gast, J. Green entrepreneurship in SMEs: A configuration approach. Int. J. Entrep. Ventur. 2017, 9, 1–17. [Google Scholar] [CrossRef]

- Yan, C.; Siddik, A.B.; Yong, L.; Dong, Q.; Zheng, G.-W.; Rahman, M.N. A Two-Staged SEM-Artificial Neural Network Approach to Analyze the Impact of FinTech Adoption on the Sustainability Performance of Banking Firms: The Mediating Effect of Green Finance and Innovation. Systems 2022, 10, 148. [Google Scholar] [CrossRef]

- Sánchez-Infante Hernández, J.P.; Yañez-Araque, B.; Moreno-García, J. Moderating effect of firm size on the influence of corporate social responsibility in the economic performance of micro-, small- and medium-sized enterprises. Technol. Forecast. Soc. Chang. 2020, 151, 119774. [Google Scholar] [CrossRef]

- Wang, Y.; Zhi, Q. The Role of Green Finance in Environmental Protection: Two Aspects of Market Mechanism and Policies. Energy Procedia 2016, 104, 311–316. [Google Scholar] [CrossRef]

- Liu, N.; Liu, C.; Xia, Y.; Ren, Y.; Liang, J. Examining the coordination between green finance and green economy aiming for sustainable development: A case study of China. Sustainability 2020, 12, 3717. [Google Scholar] [CrossRef]

- Chen, Y.-S.; Lai, S.-B.; Wen, C.-T. The Influence of Green Innovation Performance on Corporate Advantage in Taiwan. J. Bus. Ethics 2006, 67, 331–339. [Google Scholar] [CrossRef]

- Qiu, L.; Jie, X.; Wang, Y.; Zhao, M. Green product innovation, green dynamic capability, and competitive advantage: Evidence from Chinese manufacturing enterprises. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 146–165. [Google Scholar] [CrossRef]

- Klassen, R.D.; Whybark, D.C. The Impact of Environmental Technologies on Manufacturing Performance. Acad. Manag. J. 1999, 42, 599–615. [Google Scholar] [CrossRef]

- Siddik, A.B.; Zheng, G. Green Finance During the COVID-19 Pandemic and Beyond: Implications for Green Economic Recovery. Foods 2021, 10, 2278. [Google Scholar] [CrossRef]

- Hossain, M. Green Finance in Bangladesh Barriers and Solutions. In Handbook of Green Finance, Sustainable Development; Springer: Amsterdam, The Netherlands, 2019; pp. 1–26. ISBN 9789811087103. [Google Scholar]

- Guang-Wen, Z.; Siddik, A.B. Do Corporate Social Responsibility Practices and Green Finance Dimensions Determine Environmental Performance? An Empirical Study on Bangladeshi Banking Institutions. Front. Environ. Sci. 2022, 10, 858. [Google Scholar] [CrossRef]

- Abbas, J. Impact of total quality management on corporate green performance through the mediating role of corporate social responsibility. J. Clean. Prod. 2020, 242, 118458. [Google Scholar] [CrossRef]

- Zhou, G.; Sun, Y.; Luo, S.; Liao, J. Corporate social responsibility and bank fi nancial performance in China: The moderating role of green credit. Energy Econ. 2021, 97, 105190. [Google Scholar] [CrossRef]

- Al-shuaibi, K.M. A Structural Equation Model of CSR and Performance: Mediation by Innovation and Productivity. J. Manag. Sustain. 2016, 6, 139–153. [Google Scholar] [CrossRef] [Green Version]

- Ansong, A. Corporate social responsibility and firm performance of Ghanaian SMEs: The role of stakeholder engagement Corporate social responsibility and firm performance of Ghanaian SMEs: The role of stakeholder engagement. Cogent Bus. Manag. 2017, 8, 1333704. [Google Scholar] [CrossRef]

- Bahta, D.; Yun, J.; Islam, R.; Bikanyi, K.J. How does CSR enhance the financial performance of SMEs? The mediating role of firm reputation How does CSR enhance the financial performance. Econ. Res. Istraživanja 2021, 34, 1428–1451. [Google Scholar] [CrossRef]

- Famiyeh, S. Corporate Social Responsibility and Firm’s Performance: Empirical Evidence. Soc. Responsib. J. 2017, 13, 390–406. [Google Scholar] [CrossRef]

- Galant, A.; Cadez, S. Corporate social responsibility and financial performance relationship: A review of measurement approaches. Econ. Res. Istraživanja 2017, 30, 676–693. [Google Scholar] [CrossRef]

- Laskar, N. Impact of Corporate Sustainability Reporting on Firm Performance: An Empirical Examination in Asia Journal of Asia Business Studies Article information. J. Asia Bus. Stud. 2018, 12, 571–593. [Google Scholar] [CrossRef]

- Rios-Manrquez, M.; Ferrer-Rios, M.G.; Sanchez-Fernandez, M.D. Structural model of corporate social responsibility. An empirical study on Mexican. PLoS ONE 2021, 16, e0245384. [Google Scholar] [CrossRef]

- Saeidi, P.; Adalid, L.; Robles, A.; Parastoo, S.; Isabel, M.; Zamora, V. Heliyon How does organizational leadership contribute to the fi rm performance through social responsibility strategies? Heliyon 2021, 7, e07672. [Google Scholar] [CrossRef]

- Suganthi, L. Investigating the relationship between corporate social responsibility and market, cost and environmental performance for sustainable business. S. Afr. J. Bus. Manag. 2020, 51, 1–13. [Google Scholar] [CrossRef]

- Ajibike, W.A.; Adeleke, A.Q.; Mohamad, F.; Bamgbade, J.A.; Moshood, T.D. The impacts of social responsibility on the environmental sustainability performance of the Malaysian construction industry. Int. J. Constr. Manag. 2021, 2021, 1929797. [Google Scholar] [CrossRef]

- Bamgbade, J.A.; Kamaruddeen, A.M.; Nawi, M.N.M.; Adeleke, A.Q.; Salimon, M.G.; Ajibike, W.A. Analysis of Some Factors Driving Ecological Sustainability in Construction Firms. J. Clean. Prod. 2018, 208, 1537–1545. [Google Scholar] [CrossRef]

- Ghisetti, C.; Rennings, K. Environmental innovations and pro fi tability: How does it pay to be green? An empirical analysis on the German innovation survey. J. Clean. Prod. 2014, 75, 106–117. [Google Scholar] [CrossRef] [Green Version]

- Sinha, A.; Mishra, S.; Sharif, A.; Yarovaya, L. Does green financing help to improve environmental & social responsibility? Designing SDG framework through advanced quantile modelling. J. Environ. Manag. 2021, 292, 112751. [Google Scholar] [CrossRef]

- Abbas, J.; Mahmood, S.; Ali, H.; Raza, M.A.; Ali, G.; Aman, J.; Bano, S.; Nurunnabi, M. The Effects of Corporate Social Responsibility Practices and Environmental Factors through a Moderating Role of Social Media Marketing on Sustainable Performance of Business Firms. Sustainability 2019, 11, 3434. [Google Scholar] [CrossRef] [Green Version]

- Ajibike, W.A.; Adeleke, A.Q.; Mohamad, F.; Bamgbade, J.A.; Nawi, M.N.M.; Moshood, T.D. An evaluation of environmental sustainability performance via attitudes, social responsibility, and culture: A mediated analysis. Environ. Chall. 2021, 4, 100161. [Google Scholar] [CrossRef]

- Indriastuti, M.; Chariri, A. Social responsibility investment on sustainable The role of green investment and corporate social responsibility investment on sustainable performance. Cogent Bus. Manag. 2021, 8, 1960120. [Google Scholar] [CrossRef]

- Pham, D.C.; Ngoc, T.; Do, A.; Doan, T.N.; Hong, T.X.; Kim, T.; Pham, Y. The impact of sustainability practices on financial performance: Empirical evidence from Sweden The impact of sustainability practices on financial performance: Empirical evidence from Sweden. Cogent Bus. Manag. 2021, 8, 1912526. [Google Scholar] [CrossRef]

- Sadiq, M.; Nonthapot, S.; Shafi, M.; Keong, O.C.; Ehsanullah, S.; Iqbal, N. Does green finance matter for sustainable entrepreneurship and environmental corporate social responsibility during COVID-19? responsibility. China Financ. Rev. Int. 2021, 12, 317–333. [Google Scholar] [CrossRef]

- Zhang, X.; Wang, Z.; Zhong, X.; Yang, S.; Siddik, A.B. Do Green Banking Activities Improve the Banks’ Environmental Performance? The Mediating Effect of Green Financing. Sustainability 2022, 14, 989. [Google Scholar] [CrossRef]

- Rötzel, P.G.; Stehle, A.; Pedell, B.; Hummel, K. Integrating environmental management control systems to translate environmental strategy into managerial performance. J. Account. Organ. Chang. 2019, 15, 626–653. [Google Scholar] [CrossRef]

- Singh, S.K.; Del Giudice, M.; Chierici, R.; Graziano, D. Green innovation and environmental performance: The role of green transformational leadership and green human resource management. Technol. Forecast. Soc. Chang. 2020, 150, 119762. [Google Scholar] [CrossRef]

- Dowling, J.; Pfeffer, J. Organizational Legitimacy: Social Values and Organizational Behavior. Pac. Sociol. Rev. 1975, 18, 122–136. [Google Scholar] [CrossRef]

- Mocan, M.; Rus, S.; Draghici, A.; Ivascu, L.; Turi, A. Impact of corporate social responsibility practices on the banking industry in Romania. Procedia Econ. Financ. 2015, 23, 712–716. [Google Scholar] [CrossRef]

- Chariri, A.; Ratna Sari Br Bukit, G.; Bethary Eklesia, O.; Uly Christi, B.; Tarigan, M. Daisy Does Green Investment Increase Financial Performance? Empirical Evidence from Indonesian Companies. E3S Web Conf. 2018, 31, 9001. [Google Scholar] [CrossRef] [Green Version]

- Minatti Ferreira, D.D.; Borba, J.A.; Rover, S.; Dal-Ri Murcia, F. Explaining Environmental Investments: A Study of Brazilian Companies. Environ. Qual. Manag. 2014, 23, 71–86. [Google Scholar] [CrossRef]

- Ahmad, N.; Ullah, Z.; Arshad, M.Z.; Kamran, H.W.; Scholz, M.; Han, H. Relationship between corporate social responsibility at the micro-level and environmental performance: The mediating role of employee pro-environmental behavior and the moderating role of gender. Sustain. Prod. Consum. 2021, 27, 1138–1148. [Google Scholar] [CrossRef]

- Ait Sidhoum, A.; Serra, T. Corporate social responsibility and dimensions of performance: An application to U.S. electric utilities. Util. Policy 2017, 48, 1–11. [Google Scholar] [CrossRef]

- Suganthi, L. Examining the relationship between corporate social responsibility, performance, employees’ pro-environmental behavior at work with green practices as mediator. J. Clean. Prod. 2019, 232, 739–750. [Google Scholar] [CrossRef]

- Li, Z.; Deng, X.; Peng, L. Uncovering trajectories and impact factors of CO2 emissions: A sectoral and spatially disaggregated revisit in Beijing. Technol. Forecast. Soc. Chang. 2020, 158, 120124. [Google Scholar] [CrossRef]

- Adegbile, A.; Sarpong, D.; Meissner, D. Strategic Foresight for Innovation Management: A Review and Research Agenda. Int. J. Innov. Technol. Manag. 2017, 14, 1750019–1750034. [Google Scholar] [CrossRef]

- Weng, H.-H.; Chen, J.-S.; Chen, P.-C. Effects of Green Innovation on Environmental and Corporate Performance: A Stakeholder Perspective. Sustainability 2015, 7, 4997–5026. [Google Scholar] [CrossRef] [Green Version]

- Wang, H.; Khan, M.A.S.; Anwar, F.; Shahzad, F.; Adu, D.; Murad, M. Green Innovation Practices and Its Impacts on Environmental and Organizational Performance. Front. Psychol. 2021, 11, 3316. [Google Scholar] [CrossRef]

- Edeh, J.N.; Obodoechi, D.N.; Ramos-Hidalgo, E. Effects of innovation strategies on export performance: New empirical evidence from developing market firms. Technol. Forecast. Soc. Chang. 2020, 158, 120167. [Google Scholar] [CrossRef]

- Ferreira, J.J.M.; Fernandes, C.I.; Ferreira, F.A.F. Technology transfer, climate change mitigation, and environmental patent impact on sustainability and economic growth: A comparison of European countries. Technol. Forecast. Soc. Chang. 2020, 150, 119770. [Google Scholar] [CrossRef]

- Chiou, T.-Y.; Chan, H.K.; Lettice, F.; Chung, S.H. The influence of greening the suppliers and green innovation on environmental performance and competitive advantage in Taiwan. Transp. Res. Part E Logist. Transp. Rev. 2011, 47, 822–836. [Google Scholar] [CrossRef]

- Li, X.; Yang, Y. Does Green Finance Contribute to Corporate Technological Innovation? The Moderating Role of Corporate Social Responsibility. Sustainability 2022, 14, 5648. [Google Scholar] [CrossRef]

- Wahba, H.; Elsayed, K. The mediating effect of financial performance on the relationship between social responsibility and ownership structure. Futur. Bus. J. 2015, 1, 1–12. [Google Scholar] [CrossRef] [Green Version]

- Feng, Y.; Akram, R.; Hieu, V.M.; Tien, N.H. The impact of corporate social responsibility on the sustainable financial performance of Italian firms: Mediating role of firm reputation. Econ. Res. Istraživanja 2022, 35, 4740–4758. [Google Scholar] [CrossRef]

- Ahmad, N.; Scholz, M.; AlDhaen, E.; Ullah, Z.; Scholz, P. Improving Firm’s Economic and Environmental Performance Through the Sustainable and Innovative Environment: Evidence From an Emerging Economy. Front. Psychol. 2021, 12, 5105. [Google Scholar] [CrossRef]

- Orazalin, N. Do board sustainability committees contribute to corporate environmental and social performance? The mediating role of corporate social responsibility strategy. Bus. Strateg. Environ. 2020, 29, 140–153. [Google Scholar] [CrossRef]

- Long, W.; Li, S.; Wu, H.; Song, X. Corporate social responsibility and financial performance: The roles of government intervention and market competition. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 525–541. [Google Scholar] [CrossRef]

- Rabbanee, F.K.; Haque, M.M.; Banik, S.; Islam, M.M. Managing engagement in an emerging economy service. J. Serv. Theory Pract. 2019, 29, 610–638. [Google Scholar] [CrossRef]

- Nawaz, M.A.; Seshadri, U.; Kumar, P.; Aqdas, R.; Patwary, A.K.; Riaz, M. Nexus between green finance and climate change mitigation in N-11 and BRICS countries: Empirical estimation through difference in differences (DID) approach. Environ. Sci. Pollut. Res. 2020, 28, 6504–6519. [Google Scholar] [CrossRef]

- Akter, N.; Siddik, A.B.; Mondal, M.S.A. Sustainability Reporting on Green Financing: A Study of Listed Private Sustainability Reporting on Green Financing: A Study of Listed Private Commercial Banks in Bangladesh. J. Bus. Technol. 2018, XII, 14–27. [Google Scholar]

- Hossain, M. Green Finance in Bangladesh: Policies, Institutions, and Challenges. ADBI Work. Pap. 2018, 892, 1–24. [Google Scholar]

- Khairunnessa, F.; Vazquez-Brust, D.A.; Yakovleva, N. A Review of the Recent Developments of Green Banking in Bangladesh. Sustainability 2021, 13, 1904. [Google Scholar] [CrossRef]

- DÖRNYEI, Z. Research Methods in Applied Linguistics; Oxford University Press: New York, NY, USA, 2007. [Google Scholar]

- Yan, C.; Siddik, A.B.; Akter, N.; Dong, Q. Factors influencing the adoption intention of using mobile financial service during the COVID-19 pandemic: The role of FinTech. Environ. Sci. Pollut. Res. 2021, 1–19. [Google Scholar] [CrossRef]

- Currás-Pérez, R.; Dolz-Dolz, C.; Miquel-Romero, M.J.; Sánchez-García, I. How social, environmental, and economic CSR affects consumer-perceived value: Does perceived consumer effectiveness make a difference? Corp. Soc. Responsib. Environ. Manag. 2018, 25, 733–747. [Google Scholar] [CrossRef]

- Chwiłkowska-Kubala, A.; Cyfert, S.; Malewska, K.; Mierzejewska, K.; Szumowski, W. The Relationships among Social, Environmental, Economic CSR Practices and Digitalization in Polish Energy Companies. Energies 2021, 14, 7666. [Google Scholar] [CrossRef]

- Khan, S.N.; Hussain, R.I.; Ur-Rehman, S.; Maqbool, M.Q.; Ali, E.I.E.; Numan, M. The mediating role of innovation between corporate governance and organizational performance: Moderating role of innovative culture in Pakistan textile sector. Cogent Bus. Manag. 2019, 6, 1631018. [Google Scholar] [CrossRef]

- Hair, J.F., Jr.; Black, W.C.; Babin, B.J.; Anderson, R.E. Multivariate Data Analysis, 4th ed.; Prentice Hall: New Jersey, PA, USA, 2010. [Google Scholar]

- Hair, J.F., Jr.; Hult, G.T.M.; Ringle, C.M.; Sarstedt, M. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM); Sage Publications: New York, NY, USA, 2021. [Google Scholar]

- Gerbing, D.W.; Anderson, J.C. An updated paradigm for scale development incorporating unidimensionality and its assessment. J. Mark. Res. 1988, 25, 186–192. [Google Scholar] [CrossRef]

- Fornell, C.; Larcker, D.F. Evaluating Structural Equation Models with Unobservable Variables and Measurement Error. J. Mark. Res. 1981, 18, 39. [Google Scholar] [CrossRef]

- Henseler, J.; Ringle, C.M.; Sarstedt, M. A new criterion for assessing discriminant validity in variance-based structural equation modeling. J. Acad. Mark. Sci. 2015, 43, 115–135. [Google Scholar] [CrossRef] [Green Version]

- Podsakoff, P.M.; Organ, D.W. Self-Reports in Organizational Research: Problems and Prospects. J. Manag. 1986, 12, 531–544. [Google Scholar] [CrossRef]

- Hu, L.T.; Bentler, P.M. Cutoff criteria for fit indexes in covariance structure analysis: Conventional criteria versus new alternatives. Struct. Equ. Model. 1999, 6, 1–55. [Google Scholar] [CrossRef]

- Bentler, P.M.; Bonett, D.G. Significance tests and goodness of fit in the analysis of covariance structures. Psychol. Bull. 1980, 88, 588–606. [Google Scholar] [CrossRef]

- Salisbury, W.D.; Chin, W.W.; Gopal, A.; Newsted, P.R. Research Report: Better Theory Through Measurement—Developing a Scale to Capture Consensus on Appropriation. Inf. Syst. Res. 2002, 13, 91–103. [Google Scholar] [CrossRef]

- Cohen, J. Statistical Power Analysis for the Behavioral Sciences; Lawrence Erlbaum Associates: Hillsdale, MI, USA, 1988; pp. 20–26. [Google Scholar]

- Neiheisel, J.R. The SAGE Encyclopedia of Communication Research Methods; SAGE Publications: New York, NY, USA, 2017. [Google Scholar]

- Sobel, M.E. Asymptotic confidence intervals for indirect effects in structural equation models. Sociol. Methodol. 1982, 13, 290–312. [Google Scholar] [CrossRef]

- Hao, J.; He, F. Corporate social responsibility (CSR) performance and green innovation: Evidence from China. Financ. Res. Lett. 2022, 48, 102889. [Google Scholar] [CrossRef]

- Zhou, Y.; Shu, C.; Jiang, W.; Gao, S. Green management, firm innovations, and environmental turbulence. Bus. Strateg. Environ. 2019, 28, 567–581. [Google Scholar] [CrossRef]

- Bacinello, E.; Tontini, G.; Alberton, A. Influence of maturity on corporate social responsibility and sustainable innovation in business performance. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 749–759. [Google Scholar] [CrossRef]

- Suttipun, M.; Lakkanawanit, P.; Swatdikun, T.; Dungtripop, W. The Impact of Corporate Social Responsibility on the Financial Performance of Listed Companies in Thailand. Sustainability 2021, 13, 8962. [Google Scholar] [CrossRef]

- Kala, K.N.; Vidyakala, K. A Study on The Impact of Green Banking Practices on Bank’s Environmental Performance With Special Reference To Coimbatore City. Afr. J. Bus. Econ. Res. 2020, 15, 1–6. [Google Scholar] [CrossRef]

| Variables/Items | Convergent Validity | Reliability | Descriptive Statistics | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Standard Loadings | Loading Average | CA | CR | AVE | Mean | SD | Skewness | Kurtosis | |

| Green Innovation (GI) | |||||||||

| GI1 | 0.964 | 0.813 | 0.835 | 0.897 | 0.752 | 3.94 | 0.882 | −0.805 | 0.833 |

| GI2 | 0.983 | 3.93 | 0.892 | −0.817 | 0.888 | ||||

| GI3 | 0.601 | 4.01 | 0.770 | −0.358 | −0.405 | ||||

| GI4 | 0.586 | 4.08 | 0.814 | −0.837 | 0.981 | ||||

| GI5 | 0.931 | 4.18 | 0.785 | −0.683 | −0.070 | ||||

| Social Dimension of CSR (SD_CSR) | |||||||||

| SD_CSR1 | 0.897 | 0.751 | 0.794 | 0.840 | 0.572 | 4.09 | 0.757 | −0.546 | 0.208 |

| SD_CSR2 | 0.759 | 4.08 | 0.777 | −0.710 | 0.965 | ||||

| SD_CSR3 | 0.695 | 4.07 | 0.746 | −0.690 | 1.027 | ||||

| SD_CSR4 | 0.651 | 4.05 | 0.750 | −0.681 | 1.000 | ||||

| Environmental Dimension of CSR (END_CSR) | |||||||||

| END_CSR1 | 0.817 | 0.747 | 0.722 | 0.794 | 0.564 | 4.05 | 0.696 | −0.514 | 0.261 |

| END_CSR2 | 0.751 | 4.09 | 0.782 | −0.553 | −0.156 | ||||

| END_CSR3 | 0.678 | 4.07 | 0.696 | −0.443 | 0.234 | ||||

| Economic Dimension of CSR (ED_CSR) | |||||||||

| ED_CSR1 | 0.749 | 0.727 | 0.791 | 0.819 | 0.532 | 3.89 | 0.892 | −0.756 | 0.548 |

| ED_CSR2 | 0.802 | 3.96 | 0.895 | −0.786 | 0.688 | ||||

| ED_CSR3 | 0.647 | 3.92 | 0.874 | −0.660 | 0.381 | ||||

| ED_CSR4 | 0.710 | 3.91 | 0.896 | −0.900 | 1.002 | ||||

| Green Finance (GF) | |||||||||

| GF1 | 0.910 | 0.802 | 0.753 | 0.846 | 0.649 | 4.08 | 0.764 | −0.437 | −0.343 |

| GF2 | 0.725 | 4.05 | 0.707 | −0.307 | −0.244 | ||||

| GF3 | 0.771 | 4.08 | 0.759 | −0.307 | −0.244 | ||||

| Environmental Performance (EP) | |||||||||

| EP1 | 0.776 | 0.741 | 0.854 | 0.880 | 0.553 | 4.08 | 0.760 | −0.490 | 0.034 |

| EP2 | 0.633 | 4.00 | 0.757 | −0.508 | 0.524 | ||||

| EP3 | 0.721 | 4.03 | 0.786 | −0.434 | −0.151 | ||||

| EP4 | 0.819 | 4.01 | 0.805 | −0.631 | 0.604 | ||||

| EP5 | 0.759 | 4.04 | 0.776 | −0.679 | 0.575 | ||||

| EP6 | 0.739 | 4.06 | 0.788 | −0.481 | −0.113 | ||||

| Model fit indices | |||||||||

| χ2/df | p-value | SRMR | GFI | IFI | RMSEA | ||||

| 1.769 | 0.000 | 0.039 | 0.911 | 0.932 | 0.046 | ||||

| Variables | EP | GI | SD_CSR | END_CSR | ED_CSR | GF | VIP |

|---|---|---|---|---|---|---|---|

| EP | 0.743 | - | |||||

| GI | 0.733 | 0.867 | 1.522 | ||||

| SD_CSR | 0.479 | 0.526 | 0.756 | 1.389 | |||

| END_CSR | 0.399 | 0.467 | 0.403 | 0.751 | 1.193 | ||

| ED_CSR | 0.461 | 0.627 | 0.517 | 0.174 | 0.729 | 1.465 | |

| GF | 0.475 | 0.512 | 0.235 | 0.222 | 0.415 | 0.806 | 1.195 |

| Variables | GI | ED_CSR | SD_CSR | END_CSR | GF | EP |

|---|---|---|---|---|---|---|

| GI | ||||||

| ED_CSR | 0.602 | |||||

| SD_CSR | 0.547 | 0.553 | ||||

| END_CSR | 0.467 | 0.180 | 0.439 | |||

| GF | 0.519 | 0.444 | 0.292 | 0.286 | ||

| EP | 0.685 | 0.485 | 0.532 | 0.421 | 0.497 |

| Hypotheses | Paths | β Value | z-Values | p-Values | Remarks |

|---|---|---|---|---|---|

| H1 | CSR → GI | 0.497 | 10.512 | 0.000 *** | Supported |

| H2 | CSR → EP | 0.286 | 4.959 | 0.000 *** | Supported |

| H3 | GI → EP | 0.322 | 4.987 | 0.000 *** | Supported |

| H4 | GF → GI | 0.190 | 3.469 | 0.001 ** | Supported |

| H5 | GF → EP | 0.161 | 2.900 | 0.004 ** | Supported |

| H6 | CSR → GI → EP | 0.160 | 4.506 | 0.000 *** | Full mediation |

| H7 | GF → GI → EP | 0.061 | 2.848 | 0.005 ** | Full mediation |

| Model fit indices | |||||

| χ2/df | p-value | SRMR | GFI | IFI | RMSEA |

| 1.794 | 0.000 | 0.037 | 0.906 | 0.928 | 0.047 |

| Hypotheses | Paths | SEM Outputs | MR Outputs | Remarks | ||||

|---|---|---|---|---|---|---|---|---|

| β Value | z-Values | p-Values | β Value | z-Values | p-Values | |||

| H1 | CSR → GI | 0.497 | 10.512 | 0.000 | 0.493 | 10.769 | 0.000 | Verified |

| H2 | CSR → EP | 0.286 | 4.959 | 0.000 | 0.292 | 5.680 | 0.000 | Verified |

| H3 | GI → EP | 0.322 | 4.987 | 0.000 | 0.315 | 6.074 | 0.000 | Verified |

| H4 | GF → GI | 0.190 | 3.469 | 0.001 | 0.189 | 4.134 | 0.000 | Verified |

| H5 | GF → EP | 0.161 | 2.900 | 0.004 | 0.152 | 3.327 | 0.001 | Verified |

| H6 | CSR → GI → EP | 0.160 | 4.506 | 0.000 | 0.155 | 5.291 | 0.000 | Verified |

| H7 | GF → GI → EP | 0.061 | 2.848 | 0.005 | 0.059 | 3.417 | 0.001 | Verified |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dai, X.; Siddik, A.B.; Tian, H. Corporate Social Responsibility, Green Finance and Environmental Performance: Does Green Innovation Matter? Sustainability 2022, 14, 13607. https://doi.org/10.3390/su142013607

Dai X, Siddik AB, Tian H. Corporate Social Responsibility, Green Finance and Environmental Performance: Does Green Innovation Matter? Sustainability. 2022; 14(20):13607. https://doi.org/10.3390/su142013607

Chicago/Turabian StyleDai, Xiaofei, Abu Bakkar Siddik, and Huawei Tian. 2022. "Corporate Social Responsibility, Green Finance and Environmental Performance: Does Green Innovation Matter?" Sustainability 14, no. 20: 13607. https://doi.org/10.3390/su142013607

APA StyleDai, X., Siddik, A. B., & Tian, H. (2022). Corporate Social Responsibility, Green Finance and Environmental Performance: Does Green Innovation Matter? Sustainability, 14(20), 13607. https://doi.org/10.3390/su142013607