1. Introduction

Family farming is widely touted as the most “sustainable” form of agricultural production. Its contribution to social, environmental and economic development is emphasized, ensuring the most efficient food production, positive environmental impacts, and the management of family labor, which contributes to rural economic development [

1].

The profitability of labor in agriculture is the result of the value of income generated in agriculture and the level of employment in this sector. The level of labor profitability is particularly important in European agriculture, where family farms play a dominant role. They are relevant to achieving the objectives of the European Union’s common agricultural policy and also to ensuring the existence of a sustainable agricultural sector and rural areas. There are about 10.3 million farms in the European Union (1.41 million in Poland) [

2], with an annual working unit (AWU) (

Appendix A) of around 9.0 million (1.6 million AWU in Poland), of which about 81% fall under the family farm labor force [

3].

A specific feature of EU agriculture is also the predominance of farms with small utilized agricultural areas. The average farm in the EU-28 had 16.6 ha of UAA (utilized agricultural area) in 2016 (in Poland, 10.2 ha). Most farms in the EU-28 are small in physical terms, two-thirds of the EU’s farms were less than 5 ha UAA in size in 2016 and only 7% had more than 50 ha of utilized agricultural areas in 2016 [

4]. Comparisons to other nations are as follows: U.S.A.—190 ha; Brazil—46 ha; Chile—52 ha; Canada—281 ha; Argentina—367 ha; Australia—more than 2600 ha per farm [

5]. The small scale of production in the majority of farms in the European Union Member States is considered to be one of the main factors that limit the possibilities of improving farming efficiency, including labor profitability [

6]. Taking into account the level of family farm income per annual work unit (AWU) compared to wages in the rest of the economy in the EU, it constitutes, on average, only about 45%. Such a large difference between the level of farmers’ income and wages in the rest of the economy, on the one hand, is a social problem related to the poverty of farmers and, on the other hand, limits the development opportunities of farms and may contribute to their bankruptcy, threatening the sustainability of rural areas. The low profitability of labor in agriculture threatens the sustainable development of farms. This is an existential problem for farmers and their families, but it is also a threat to the sustainable development of rural areas and the natural environment.

It is worth noting that the assessment of the importance of the existence of small farms for regions’ social sustainability and biodiversity in many locations of the world is perceived as crucial [

7]. There is also some evidence that emissions and resource use efficiency are lower in such farms than they are in middle-sized farms [

8,

9], especially in low-income countries [

10].

The bankruptcy of family farms or the limitation of their development opportunities may cause undesirable effects in rural areas, such as the depopulation of rural areas, the loss of biodiversity, the disappearance of folk culture, the impoverishment of the rural population, etc., but they also pose a threat to food security [

11,

12,

13,

14,

15,

16,

17,

18,

19,

20,

21,

22]. For this reason, the EU’s agricultural policy places great emphasis on ensuring a fair standard of living for the rural population, especially by increasing the individual income of people working in agriculture. The development of the factors determining the level of profitability of labor is important from the point of view of the possibility of shaping appropriate agricultural policy instruments adapted to various types of farms which differ in terms of the scope of production, the direction of production, the degree of connection with the market, etc. The literature regarding the profitability of the farms revolves primarily around the factors that influence the absolute level of agricultural income or its changes over time [

23,

24,

25,

26]. According to our knowledge, there is a lack of research regarding the determinants of the profitability of family labor in agriculture, especially taking into account the multi-criteria approach, concerning macroeconomic, microeconomic and technical factors. The degree of agricultural income without reference to the degree of employment of the family workforce is not sufficient to provide a reliable view of the economic situation of the farms. Therefore, despite the high level of agricultural income connected with overly high levels of the use of the family workforce, the costs of the farmer’s own labor and that of their family may not be covered. Such a situation may cause a decline in the standard of living of the farmer’s family and limit the development possibilities of the farm. Hence, from the point of view of the agricultural policy, it is crucial to develop the appropriate instruments to improve the efficiency of using the family workforce in agriculture. The impact of agricultural policy instruments can be twofold. On the one hand, it should aim for the stabilization of the agricultural income, whereas, on the other hand, it should aim for the conditions for the management of surplus labor outside agriculture. The assessment of income support and farm development with subsidies in the EU countries is not clear. It is indicated that the subsidy calculated per output unit is much higher in small farms [

27,

28]. Moreover, in small farms, subsidies are allocated mainly to financing consumption and not to financing development [

29]. Despite that, subsidies supporting the development of small- and medium-sized farms are necessary due to the lack of farmers’ own capital. In some EU countries, insufficient support for farm development leads to the liquidation of a large part of small farms [

30].

The literature suggests that the economic size of a farm is of great importance in shaping economic results and management efficiency in agriculture [

31,

32,

33]. Larger entities are able to manage risk and have easier access to credit [

34]. As a result, it may lead to a greater stabilization of revenues [

35]. The research also points to the fact that the size of farms has a statistically insignificant impact on the variability of income in low-developed countries [

36,

37,

38]. For developed countries, including the countries of the European Union, such as those from the former Soviet bloc, numerous studies show that, with the increase in the size of farms, land and labor productivity and income per working person usually increase [

34,

39,

40,

41,

42]. Moreover, there is a constant decrease in the number of farms and the concentration of land and labor [

22,

43]. For this reason, the problem of the influence of the economic size of a farm is included in the scope of the research related to the analysis of the relationship between the farm size and its economic situation and, in the case of this paper, labor profitability.

In the literature on the subject, there is no strict definition of a “small”, “medium” or “large” farm. There are various ways to classify farms [

44]. The paper adopts the classification of farms according to the economic size commonly used in the EU (economic size of holding expressed in EUR 1000 of standard output on the basis of the community typology). This measure is widely used for statistical and policy purposes within the EU. This measure determines the size of the farm, its production potential and its production possibilities. This measure has an advantage over the measure of farm size expressed in the area of the agricultural land. In this way, you avoid errors resulting from the incorrect assignment of farms with a small area but which carry out intensive industrial agricultural production (e.g., production in greenhouses, fattening poultry or pigs) to small farms. Therefore, in our research paper, we use economic size.

5. Discussion

The analysis of the factors that determine the profitability of work of farms shows the existence of their diversified impact in various groups of farms. Only in the group of the smallest farms (ES1—statistically significant) were dependencies between the labor market and labor profitability recorded (

Table 2). A negative impact of the increase in wages in the national economy (average monthly gross wages and salaries) on the labor profitability was found. Rising wages cause the effects of pull labor. This reduces the involvement of the farmer and their family in working on the farm, thus limiting the possibility of increasing agricultural production and income from agricultural activity. The results of this statistical analysis indicate the necessity to use rural development policy instruments that stimulate the creation of jobs outside agriculture. These instruments should be primarily dedicated to the farmers with small farms. The result of such activities should be the improvement of the living conditions of small farmers, as well as the release of land resources that can be used for the development of other farms. The importance of off-farm income is indicated by many authors [

112,

113,

114,

115]. Emphasizing the importance of this non-agricultural income in ensuring an adequate standard of living for agricultural families, especially in small farms, attention is drawn to the negative impact on agricultural production and the subsequent positive influence on the purchase of means of production. When analyzing the impact of the labor market on the profitability of work in farms, there is no impact of the unemployment level. Only in the group of the smallest farms did the level of remuneration have a statistically significant impact on the profitability of work. This analysis shows that, in the remaining groups of farms, labor resources can be effectively used on the farm, and it does not necessitate the search for additional sources of income outside the farm. However, it should not be considered that, for other farmers (from farms ES2–ES5), the level of wages outside agriculture does not play an important role (

Table 3,

Table 4,

Table 5 and

Table 6). The comparison of agricultural income to wages in the economy is an important aspect that determines the level of job satisfaction on a farm and testifies to the standard of living of farmers. These relationships were not analyzed in the study, which requires further research. Moreover, the lack of a statistically significant impact of the unemployment level, along with the statistically significant influence of the level of wages in the national economy, suggests that farmers take up additional employment if it is possible to obtain satisfactory wages. These data may also indicate the disappearance of the role of small farms in agricultural production in economically developed countries. The decrease in the number of the smallest farms may be beneficial due to the release of resources (especially land) from this type of farms and the taking over of these resources by larger farms. This should stimulate the development of other farms and contribute to the growth of their competitiveness. On the other hand, one should also remember the functions of these farms in rural areas and the public goods they provide [

13,

116]. This requires further research.

The price indices of consumer goods and services (inflation—

X4) were among the explanatory variables in the macroeconomic area that statistically significantly influenced labor profitability in all analyzed groups of farms. The price indices of consumer goods and services had a positive impact on the level of labor profitability (

Table 2,

Table 3,

Table 4,

Table 5 and

Table 6). Research by Baek and Koo [

117] for farms in the U.S. shows that an increase in the interest rate has a negative impact on the level of agricultural income. Similarly, in the study by Beckman and Schimmelpfennig [

25], an increase in the interest rate had a negative impact on the level of agricultural income. The negative relationship between interest rates and agricultural incomes seems obvious, but in our own research, this relationship is reversed. When looking for the reasons for such dependence, attention should be paid to the change in the political situation that Poland experienced after 2004. In 2004, Poland joined the European Union, which had a clear impact on the economic situation in the country. Poland’s accession to the EU improved the situation of farmers in agricultural markets. The downward trends in agricultural commodity prices were reversed, and they stabilized compared to the situation before the accession [

84]. Additionally, the prices of food grew at a much faster pace than the prices of non-food products; moreover, in this period, consumer incomes grew much faster than inflation or food prices [

118]. These factors contributed to the improvement in the economic situation of farms. Moreover, it should be noted that the level of indebtedness of the analyzed farms was low (

Table 1), which did not burden farms with credit costs. Farmers usually reduce the financial risk related to debt, which may inhibit the dynamic development of farms but increase their resistance to financial market disturbances [

38,

119,

120,

121].

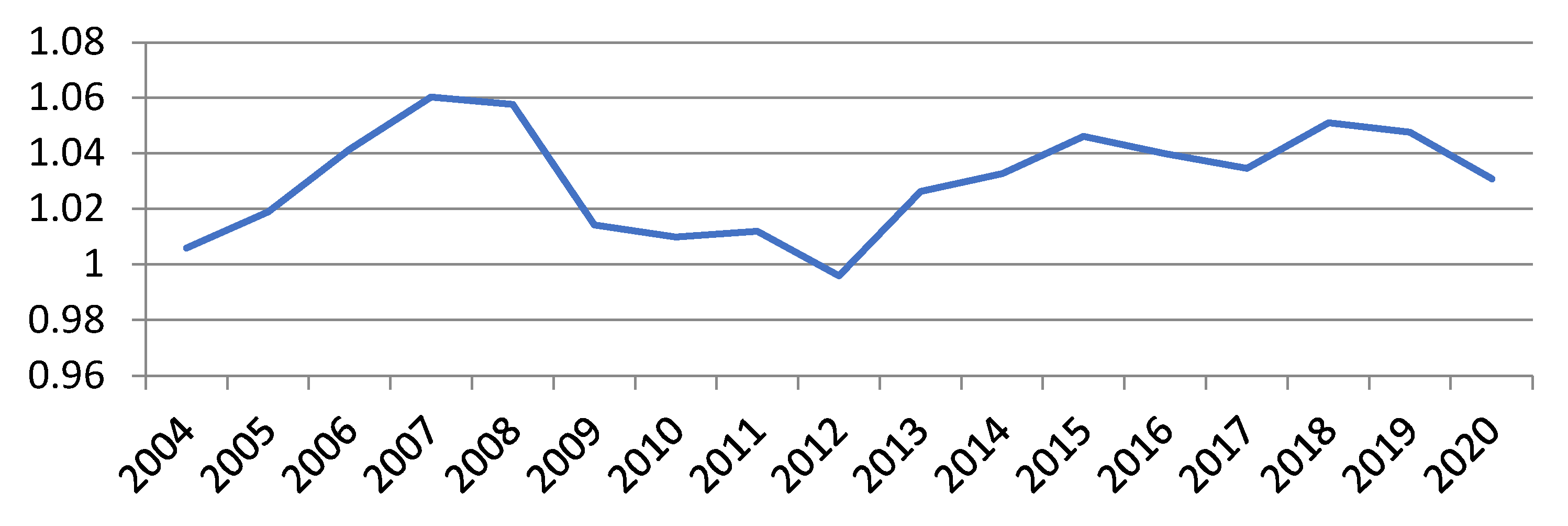

The macroeconomic variable index of price relations (“price gap”—

X1) had a positive and statistically significant impact on the profitability of labor only in the group of ES2 farms (

Table 3). Labor profitability goes up as agricultural commodity prices increase at a faster rate than agricultural input prices. This is confirmed by the results of research by Baek and Koo [

117]. Price relations in agriculture are closely related to the profitability of farms. Low and volatile agricultural commodity prices, coupled with ever-increasing agricultural input prices, are the most common economic risks faced by farmers. Similarly, in the studies by Czyżewski et al. [

47], attention was drawn to the instability of agricultural product prices, which poses a risk of the destabilization of agricultural income. For this reason, agricultural policy should focus on instruments limiting market risk (ex. revenue and margin insurance) [

45,

122,

123,

124,

125,

126,

127,

128]. It is also possible to promote collective forms of farmers’ activity or the integration of farmers with agri-food enterprises, which improves the bargaining power of farmers in the market and allows for the possibility of price negotiation.

The agricultural production efficiency index (

X5) was included in the model, explaining the statistically significant work profitability in farms of the size classes ES1, ES3 and ES4. The increase in the value of this index had a positive effect on the profitability of labor. This confirms the dependencies found in many studies by other authors [

129,

130,

131,

132,

133,

134] and points to the need for undertaking actions supporting technological progress in agriculture. In particular, these actions should be focused on smaller farms, as they may have problems with the implementation of new technological solutions due to the limited financial resources. In the group of ES5 farms, no statistically significant relationships were noted, which may indicate a higher level of technological advancement of these farms. These observations are crucial for the policy of supporting investments in farms. Such instruments should be mainly directed toward the medium-sized farms. Larger farms may introduce new technological solutions without financial help from public funds.

Another group of explanatory variables is that of microeconomic indicators that characterize the analyzed farms. Among the micro-economic variables, the technical equipment for work indicator (

X7) had a statistically significant influence on the profitability of labor. At the same time, a statistically significant positive effect of this index was recorded only in the farms of the ES3 and ES4 groups. The importance of modern equipment for the efficient functioning of farms is often emphasized in the literature of the subject [

133,

135,

136]. Moreover, a change in the ratio of prices of production factors (especially dynamically growing labor costs) makes it necessary to replace labor with capital [

51,

52,

107,

108]. In the analyzed farms, the process of replacing work with capital had a positive and statistically significant impact on the profitability of work only in farms in the ES3 and ES4 groups (

Table 4 and

Table 5); in the remaining analyzed groups, no such correlation was noted. This may result from the fact that, in the group of farms ES1 and ES2, the value of technical equipment for work (

X7) was too small (

Table 1) to obtain a positive effect of the increase in technical equipment for work. On the other hand, the group of farms ES5 was characterized by the highest level of technical equipment for work, and its further increase did not result in the improvement of management efficiency. These farms (ES5) may have already reached the optimum level of technical equipment for work in relation to their size and production capacity. This is an important observation from the point of view of agricultural policy instruments supporting the investment activity of farmers. This indicates the need to precisely define the support criteria and direct it to a selected group of farms. These results correspond to the above-presented relationships between the profitability of labor and the agricultural production efficiency index (

X5). Further research should also pay attention to the marginal efficiency of capital in various farms. In addition, an important issue is also the quality of machinery and equipment, their degree of modernity, technological advancement and innovation. This requires more detailed research. It is worth noting here that the other two indicators concerning the relationship of production factors (technical infrastructure of the land—

X6 and land-to-labor—

X8) had no statistically significant impact on the profitability of work in the analyzed groups of farms (

Table 2,

Table 3,

Table 4,

Table 5 and

Table 6).

Among the microeconomic variables, the debt ratio (

X9) was introduced into the model, but only on farms from groups ES1 and ES5. The increase in the debt ratio had a positive impact on labor profitability in ES1 farms, and it had a negative impact in ES5 farms. The financial literature indicates that the growth in debt may have a diversified impact on the financial situation of farms [

137,

138,

139,

140,

141]. Taking a loan allows for investments and farm development, but too high of a debt level increases the financial risk. In very small farms (ES1), the debt level was low (

Table 1), which allowed for the use of the financial leverage effect. In large farms, the level of debt was much higher (

Table 1), but it should also be noted that it was not a very high level of debt. Despite this, the increase in indebtedness had a negative impact on the level of work profitability. This may indicate a lower resilience of farms, especially larger ones, to the financial risk related to the growing level of debt. Rising operating costs can burden farms for a long time. Moreover, the specific features of agriculture, resulting from its high dependence on natural, climatic, technological and socio-cultural conditions, affect the specificity of finance in agriculture. In agricultural production, there are usually long production cycles that require pre-financing, leading to a high susceptibility to natural risk. There is a need for specialized machinery and equipment, creating demand for long-term capital and leading to a high volatility of cash flows and economic results. For this reason, it is an important signal for the agricultural policy, indicating the need to mitigate the consequences of credit restrictions in agriculture [

142,

143,

144,

145].

In a further analysis, attention was drawn to the relationship between the level of subsidies obtained by farmers as part of state aid and the level of labor profitability. These issues are widely discussed in the literature on the subject, and the conclusions drawn from these studies are not unequivocal. It is indicated that the impact of subsidies on management efficiency, agricultural income and the modernization of agriculture may be positive or negative. It depends on the type of subsidies, the scale of support and the rules for granting subsidies [

29,

87,

146,

147,

148,

149,

150,

151]. The research also found a diversified influence of operating subsidies on the profitability of work. In the smallest farms (ES1), a statistically significant and positive impact of subsidies on the increase in labor profitability was recorded (

Table 2). This is due to the large role of subsidies in shaping the profitability of work (

Table 1). In this type of farms, operating subsidies constitute a significant support of agricultural income and may be responsible for the duration of these farms. In the groups of farms ES2 and ES3, operating subsidies did not have a statistically significant impact on the level of work profitability (

Table 3 and

Table 4). On the other hand, in the largest farms (ES4 and ES5), they had a statistically significant and negative impact on labor profitability (

Table 5 and

Table 6). This may result from the fact that the decreasing level of subsidies forces farmers to take the trouble of looking for other sources of improving the profitability of work, e.g., in terms of improving the efficiency of farming. Operating subsidies may cause the effect of the “laziness” of farmers, consisting in the lack of motivation to improve the efficiency of the functioning of the farm. It is also emphasized that subsidies are an important decision variable taken into account in the profitability and optimization accounts of farm managers [

152], prompting them to behave more riskily. This can also be the cause of negative dependencies between the profitability of work and the level of subsidies. Despite the fact that government support for European agriculture focuses, inter alia, on ensuring an adequate and stable level of income for farming families, the authors’ own research found a diversified impact of agricultural subsidies on labor profitability: positive for very small farms (ES1), negative for large farms (ES5) and no statistically significant correlations in other groups of farms. This indicates a high dependence on the agricultural policy mechanisms of very small farms and a lesser dependence for others. However, this analysis needs to take into account the context of the specificity of Polish agriculture, where very small farms predominate (it is estimated that, out of 1,411,000 farms, only 300–400,000 are potentially developing), which do not produce for the market or occasionally sell their products. For this type of farm, the mechanisms of agricultural policy may be important in shaping agricultural income. In the FADN agricultural accounting system database, commercial farms selling their products on the market are mainly represented. For this reason, the analysis of factors determining the profitability of labor in very small farms of a social nature (production intended for household needs or occasionally sold) requires separate studies that also take into account their role in the social environment related to maintaining the vitality of rural areas and natural environmental benefits (e.g., maintenance of biodiversity). Moreover, the methodology used in the FADN system does not take into account the income obtained by farmers from sources other than agricultural production, which makes the analysis of the income situation difficult [

18]. Further research on the impact of subsidies on labor profitability should focus on the structure of obtained subsidies and their role in shaping agricultural income, as well as on their importance in the process of the modernization of farms.

The last microeconomic factor taken into account was the investment effort index (

X11). A statistically significant influence of this index on work profitability was found only in the smallest farms (ES1 and ES2). The increase in the investment effort negatively influenced the level of work profitability. This may result from the fact that these farms generate a low level of agricultural income, and the implementation of investments (even small ones) significantly burdens such farms, negatively affecting their financial situation, especially in terms of financial liquidity. Moreover, small farms may implement unprofitable, too small, replacement investments which do not allow for the significant development of the farm, achieving a production scale ensuring a significant increase in agricultural income. This may be related to barriers to the development of such farms, but it requires further research. In the remaining groups of farms, no statistically significant impact of the investment effort index on the level of work profitability was recorded. The investment effort in the farms of the ES3–ES5 groups was much higher than that in the farms of ES1 and ES2. This may result from the fact that these farms implement rational and profitable investments that do not burden the economic result with excessive costs, but due to the presence of a technological treadmill, they cannot have a positive impact on the level of agricultural income [

13,

75,

153].

This article estimates models of labor profitability determinants in farms diversified in terms of economic size. The profitability of labor is one of the basic criteria ensuring the sustainability of a farm and its development possibilities, and it is also a prerequisite to providing a wide range of desired services from agriculture, ranging from the provision of food to environmental goods and services and cultural services [

154,

155].

A diversified influence of selected factors determining the level of profitability of work in agriculture in particular groups of farms was found. The econometric models developed also indicate different strategies that are adopted by farmers on various farms. There is no single solution here; strategies for improving the profitability of work must take into account the specificity of a given entity.

6. Conclusions

In conclusion, it is worth paying particular attention to the importance of macro-economic factors and agricultural policy. The analysis showed a diversified influence of macroeconomic factors, but in all analyzed groups of farms, a positive influence was found regarding the price indices of consumer goods and services (inflation—

X4). This analysis shows the importance of macroeconomic factors in shaping the work profitability of farms of various economic sizes, both in small and large ones. In the analyzed group of farms, small farms, despite a small scale of production, were present in agricultural markets (they sold their production; they were not farms focused on production for their own needs). Therefore, thanks to contacts with agricultural markets, macroeconomic conditions were transmitted to farms, even the smallest ones. In the context of the impact of macroeconomic factors and the lack of influence of subsidies on labor profitability, it is worth considering the mechanisms of agricultural policy. Admittedly, subsidies increase the level of agricultural income. It cannot be ruled out, however, that, in the conditions of ceasing subsidization, farmers would be forced to improve the efficiency of farming, which would favor an improvement in income. Secondly, in the absence of subsidies, one should expect an increase in the prices of agricultural products and, on the other hand, a decrease in the prices of the means of production. Thus, it can be concluded that part of the payments from the budget of the Common Agricultural Policy of the European Union (CAP) is capitalized not only in land prices but also in price relations (the so-called “price scissors”). It is therefore clear that the potential elimination of the payments would lead to a smaller drop in income than a simple calculation of the subsidy share in income. The European Commission estimates that this decrease would amount to approximately 17% [

63]. The research confirmed the influence of the price gap index on the profitability of labor in farms. For this reason, an important tool of agricultural policy should be instruments limiting the market risk related to the volatility of prices in agricultural markets. However, this cannot be achieved by providing guaranteed prices. This direction operated for nearly the first 20 years of CAP, generated high costs and turned out to be ineffective. Currently, attention is drawn to the need to introduce risk management instruments in agriculture, not only in the market but also those related to climate change (e.g., revenue and margin insurance, insufficient area yield and weather index, income insurance).

The obtained results can be the basis for presenting a general conclusion. It seems possible that, in situations of supporting farms with subsidies, the importance of market and economic factors will be minor and will not significantly affect the production and organizational decisions of the farmers running small farms. This is due to the lower income per person in small farms, which results in the need to look for employment outside of agriculture. Moreover, such farms will not be an attractive workplace for farmers’ children, and, due to the lack of successors, they will not develop. There will be a dichotomous development of farms. Medium-sized farms will become larger and economically effective, and smaller farms will perform residential functions, with disappearing agricultural production functions. This is due to the need to incur expenditures on development investments, which might be too heavy of a burden in small farms.

The conducted analysis also indicated the need to pay attention to agricultural policy instruments that promote the implementation of new production technologies and innovative solutions. This leads to an improvement in the profitability of agricultural production, which is positively correlated with the increase in labor profitability. However, such instruments should be mainly directed toward the medium-sized and smaller farms that are potentially developing. Large farms can cope without such support.

The models estimated indicate the necessity of using other mechanisms and tools of agricultural policy for farms of various economic sizes. At the same time, particular attention should be paid to the mechanisms that allow one to limit the exposure to the market risk of farms. The analyses relate to a short period of time; in further studies, it is necessary to pay attention to the influence of the dynamics of changes in macroeconomic, technical and microeconomic factors on the level of profitability of labor in agriculture.