Operational Efficiency Evaluation of Chinese Internet Banks: Two-Stage Network DEA Approach

Abstract

1. Introduction

2. Literature Review

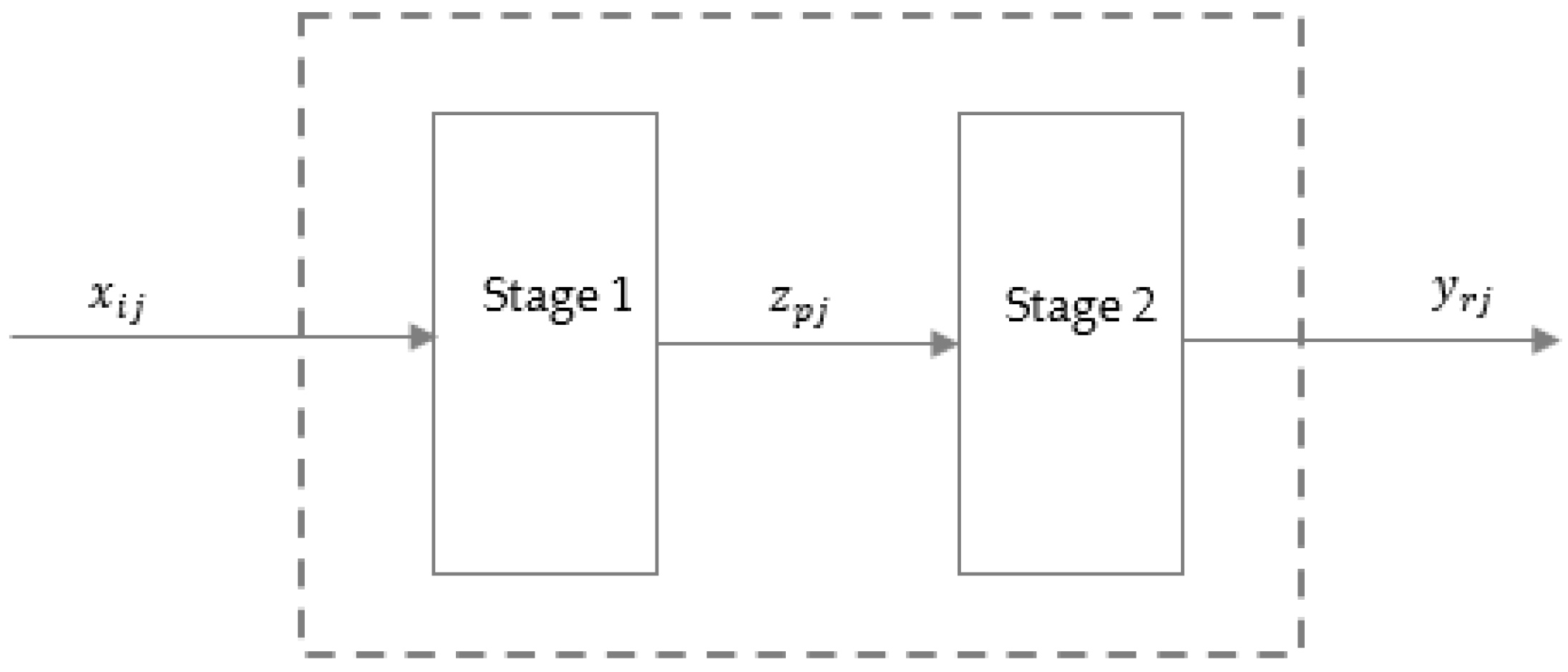

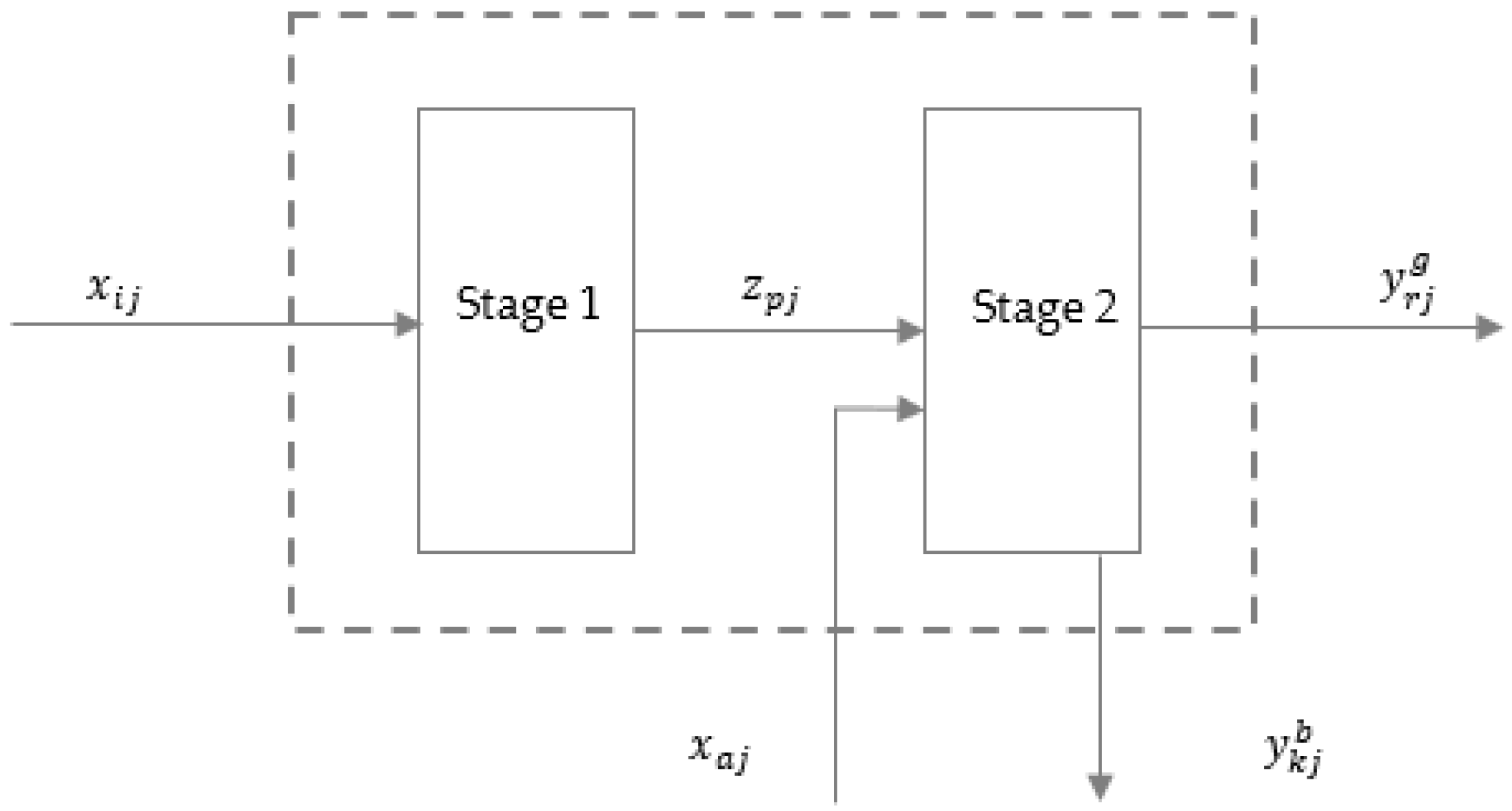

3. Research Methods

4. Empirical Analysis

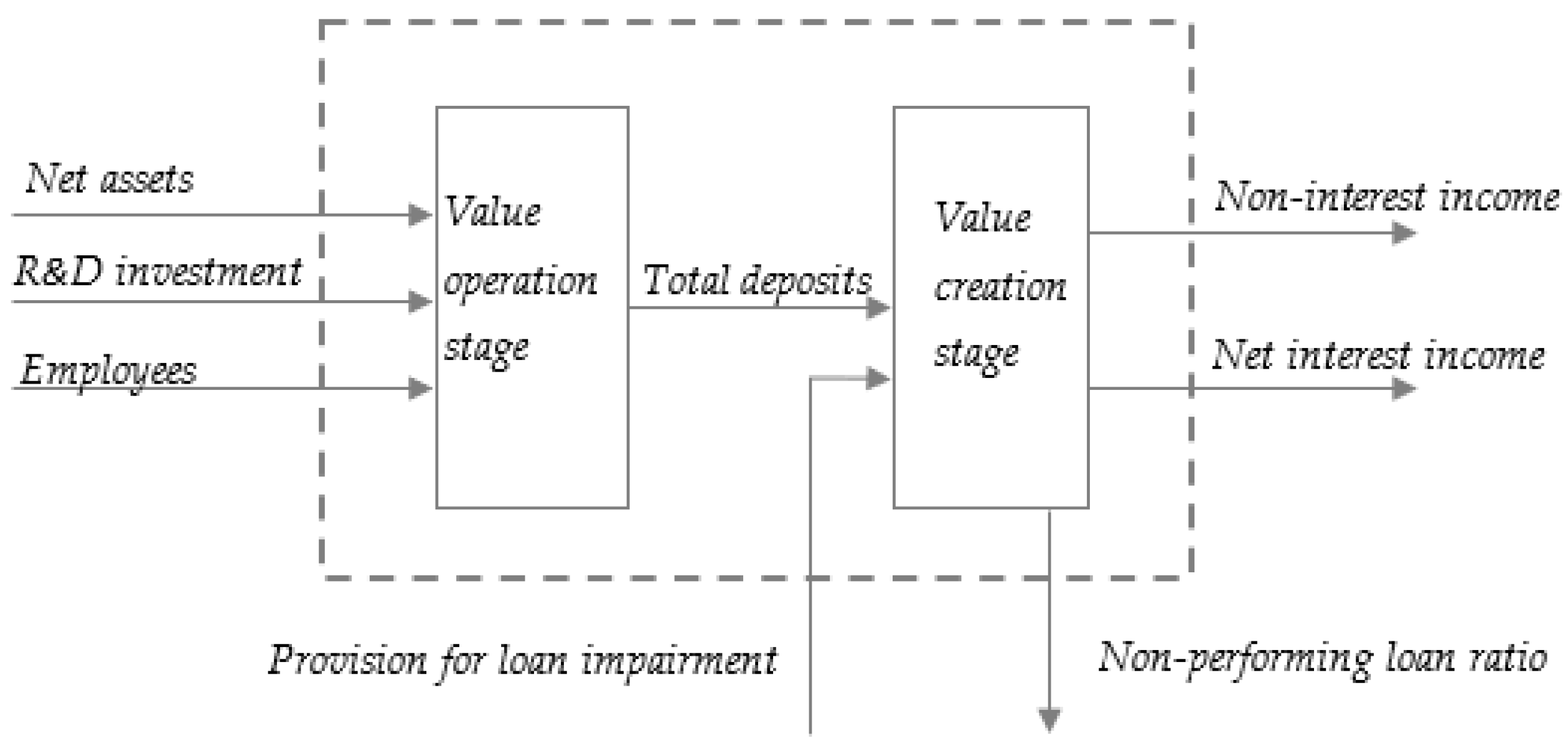

4.1. Index Selection of Internet Banking System

4.2. Sample Selection and Data Sources

4.3. Two-Stage Efficiency Analysis

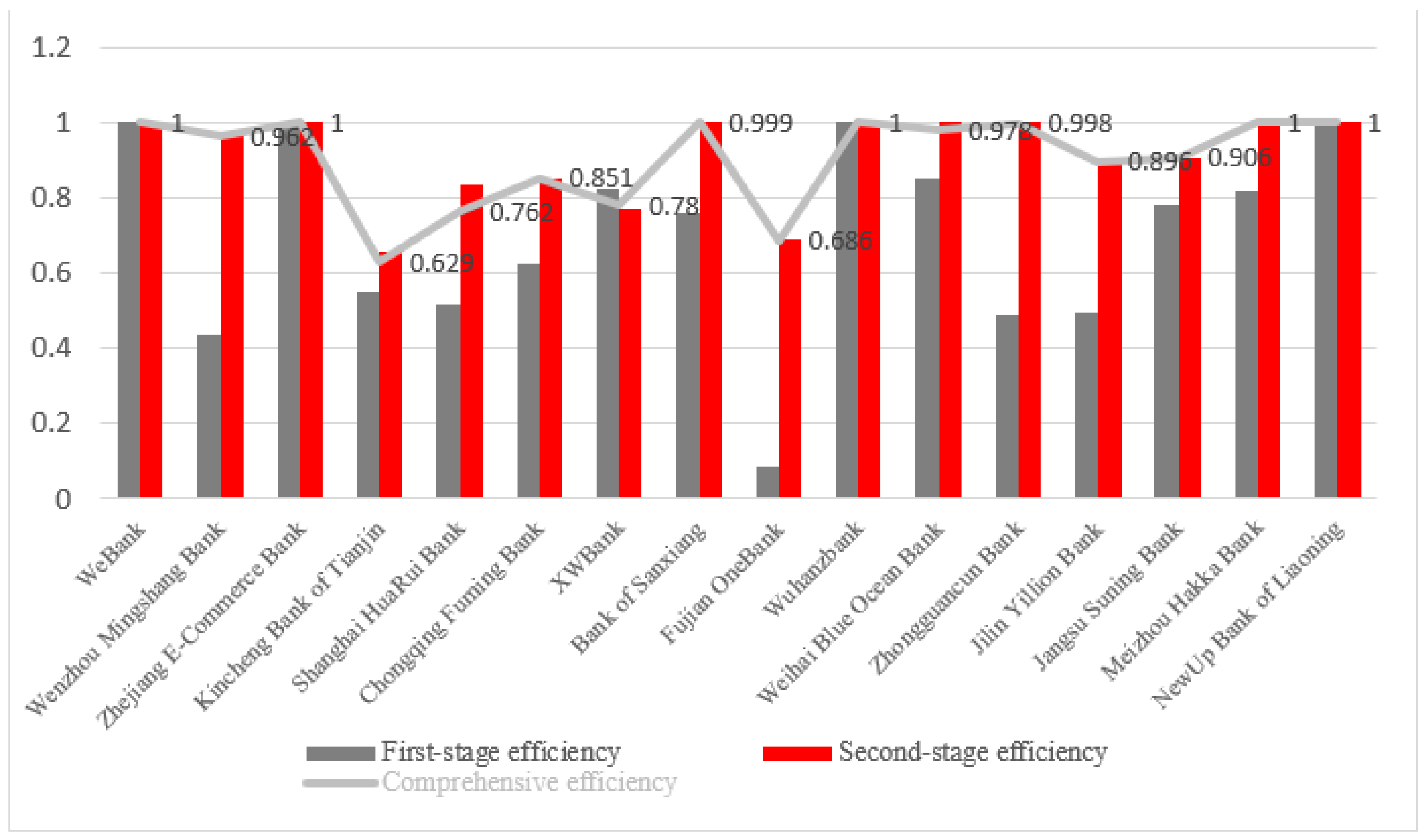

4.3.1. Stage Efficiency and Comprehensive Efficiency Analysis of Internet Banking in 2018

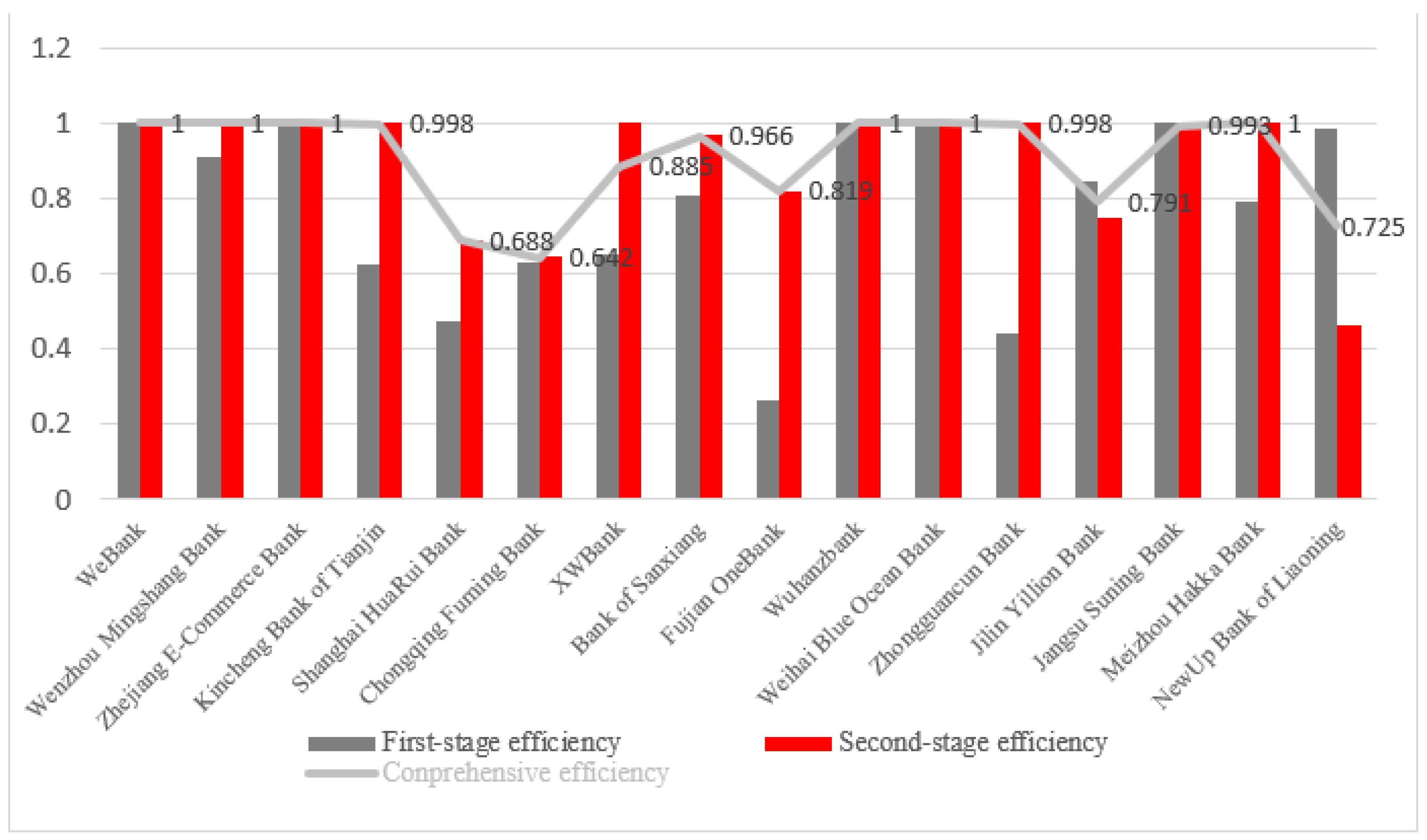

4.3.2. Stage Efficiency and Comprehensive Efficiency Analysis of Internet Banking in 2019

4.4. The Kruskal–Wallis Test

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Alhadeff, D. Monopoly and Competition in Banking; University of California Press: Berkeley, CA, USA, 1954; Volume 65, p. 323. [Google Scholar]

- Farrell, M.J. The Measurement of Productive Efficiency. J. R. Stat. Soc. 1957, 120, 253–290. [Google Scholar] [CrossRef]

- Zhu, N.; Zhuo, X.; Dong, Y. Empirical Analysis and Reform Strategy on the Efficiency of Chinese State-owned Commercial Banks. Manag. World 2004, 18–26. [Google Scholar] [CrossRef]

- Sari, S.; Ajija, S.R.; Wasiaturrahma, W.; Ahmad, R.A.R. The Efficiency of Indonesian Commercial Banks: Does the Banking Industry Competition Matter? Sustainability 2022, 14, 10995. [Google Scholar] [CrossRef]

- Zheng, Y.; Rashid, M.H.U.; Siddik, A.B.; Wei, W.; Hossain, S.Z. Corporate Social Responsibility Disclosure and Firm’s Productivity: Evidence from the Banking Industry in Bangladesh. Sustainability 2022, 14, 6237. [Google Scholar] [CrossRef]

- Xie, Z.; Liu, X.; Najam, H.; Fu, Q.; Abbas, J.; Comite, U.; Cismas, L.M.; Miculescu, A. Achieving Financial Sustainability through Revenue Diversification: A Green Pathway for Financial Institutions in Asia. Sustainability 2022, 14, 3512. [Google Scholar] [CrossRef]

- Chang, M.C.; Chen, C.-P.; Lin, C.-C.; Xu, Y.-M. The Overall and Disaggregate China’s Bank Efficiency from Sustainable Business Perspectives. Sustainability 2022, 14, 4366. [Google Scholar] [CrossRef]

- Zhong, K.; Li, C.; Wang, Q. Evaluation of Bank Innovation Efficiency with Data Envelopment Analysis: From the Perspective of Uncovering the Black Box between Input and Output. Mathematics 2021, 9, 3318. [Google Scholar] [CrossRef]

- Seiford, L.M.; Zhu, J. Profitability and Marketability of the Top 55 U.S. Commercial Banks. Manag. Sci. 1999, 45, 1270–1288. [Google Scholar] [CrossRef]

- Lin, S.H.; Lai, H.H.; Change, T.P.; Chen, Y.J. Discussion on Banking Efficiency and Determinants in the Digital Finance Environment—Evidence in Taiwan. Int. J. Bus. 2022, 27, 1–30. [Google Scholar]

- Omrani, H.; Alizadeh, A.; Emrouznejad, A.; Oveysi, Z. A novel best-worst-method two-stage data envelopment analysis model considering decision makers’ preferences: An application in bank branches evaluation. Int. J. Financ. Econ. 2022. [Google Scholar] [CrossRef]

- Wasiaturrahma; Sukmana, R.; Ajija, S.R.; Salama, S.C.U.; Hudaifah, A. Financial performance of rural banks in Indonesia: A two-stage DEA approach. Heliyon 2020, 6, e04390. [Google Scholar] [CrossRef] [PubMed]

- Milenković, N.; Radovanov, B.; Kalaš, B.; Horvat, A.M. External Two Stage DEA Analysis of Bank Efficiency in West Balkan Countries. Sustainability 2022, 14, 978. [Google Scholar] [CrossRef]

- Li, H.; Xiong, J.; Xie, J.; Zhou, Z.; Zhang, J. A Unified Approach to Efficiency Decomposition for a Two-Stage Network DEA Model with Application of Performance Evaluation in Banks and Sustainable Product Design. Sustainability 2019, 11, 4401. [Google Scholar] [CrossRef]

- Li, F.; Zhu, P.; Liang, L.; Kou, G. Research on Two-Stage Efficiency Evaluation Method of DEA Based on Nearest Distance Projection. Chin. J. Manag. Sci. 2020, 1–13. [Google Scholar] [CrossRef]

- Wu, H.Q.; Yang, J.Y.; Wu, W.S.; Chen, Y. Interest rate liberalization and bank efficiency: A DEA analysis of Chinese commercial banks. Cent. Eur. J. Oper. Res. 2022, 1–32. [Google Scholar] [CrossRef]

- Kumar, V.P.; Kar, S. Measuring the efficiency of Indian public and private banks using the two-stage network DEA model. Benchmarking Int. J. 2022. [Google Scholar] [CrossRef]

- Xie, Q.W.; Xu, Q.F.; Chen, L.F.; Jin, X.; Li, S.Q.; Li, Y.J. Efficiency evaluation of China’s listed commercial banks based on a multi-period leader-follower model. Omega 2022, 110, 102615. [Google Scholar] [CrossRef]

- Phung, Q.T.; Vu, H.V.; Tran, H.P. Do non-performing loans impact bank efficiency? Financ. Res. Lett. 2022, 46, 102393. [Google Scholar] [CrossRef]

- Preeti; Roy, S. Application of Hybrid Approach in Banking System: An Undesirable Operational Performance Modelling. Glob. Bus. Rev. 2022, 09721509211026789. [Google Scholar] [CrossRef]

- Hashem, O.; Zeynab, O.; Ali, E.; Tamara, T. A mixed-integer network DEA with shared inputs and undesirable outputs for performance evaluation: Efficiency measurement of bank branches. J. Oper. Res. Soc. 2022. [Google Scholar] [CrossRef]

- Fukuyama, H.; Matousek, R.; Tzeremes, N.G. A Nerlovian cost inefficiency two-stage DEA model for modeling banks’ production process: Evidence from the Turkish banking system. Omega 2020, 95, 102198. [Google Scholar] [CrossRef]

- Zhang, K.; Zhou, X. Is Promoting Green Finance in Line with the Long-Term Market Mechanism? The Perspective of Chinese Commercial Banks. Mathematics 2022, 10, 1374. [Google Scholar] [CrossRef]

- Lin, T.Y.; Chiu, S.-H.; Wang, Y.; Ouyang, Z. Value Creation Performance Evaluation for Taiwanese Financial Holding Companies during the Global Financial Crisis Based on a Multi-Stage NDEA Model under Uncertainty. Axioms 2022, 11, 35. [Google Scholar] [CrossRef]

- Shao, L.; You, J.; Xu, T.; Shao, Y. Non-Parametric Model for Evaluating the Performance of Chinese Commercial Banks’ Product Innovation. Sustainability 2020, 12, 1523. [Google Scholar] [CrossRef]

- Xue, K.L.; Fan, J.P.; Kuang, H.B.; Zhao, M.; Wu, M.Q. Efficiency Evaluation of Chinese Commercial Banks Based on Two-Stage Cross-Efficiency Model. Chin. J. Manag. Sci. 2021, 29, 23–34. [Google Scholar]

- Wang, M.Q.; Chang, M. An Analysis of the Operational Efficiency of Chinese Commercial Banks Considering the Way of Capital Operation. Chin. J. Manag. Sci. 2021, 1–14. [Google Scholar] [CrossRef]

- Li, Y.P. Research on the Business Model and Efficiency of Internet banking in China; Zhejiang University: Hangzhou, China, 2019. [Google Scholar]

- Tang, M.; Zuo, X.L. Differentiated Supervision of Internet Banking. China Financ. 2020, 41–42. [Google Scholar] [CrossRef]

- Wang, P.P. An Empirical Research on Profitability of Internet Banks in China. J. Financ. Dev. Res. 2020, 79–85. [Google Scholar] [CrossRef]

- Mao, H.Q.; Hu, Z. Empirical Analysis of the Factors Influencing the Operating Efficiency of Private Banks in China: Based on the Development Perspective of “Internet plus Inclusive Finance”. West China Financ. 2021, 32–38. [Google Scholar] [CrossRef]

- Hu, L. Comparative Study on Operating Efficiency of Pure Online Banking; Southwestern University of Finance and Economics: Chengdu, China, 2021. [Google Scholar] [CrossRef]

- Zheng, X.L. Discussion on the Reform of Banking Supervision System under the Background of Internet Finance. China Mark. 2022, 51–52. [Google Scholar] [CrossRef]

- Blagojević, A.; Vesković, S.; Kasalica, S.; Gojić, A.; Allamani, A. The application of the fuzzy AHP and DEA for measuring the efficiency of freight transport railway undertakings. Oper. Res. Eng. Sci. Theory Appl. 2020, 3, 1–23. [Google Scholar] [CrossRef]

- Mitrović Simić, J.; Stević, Ž.; Zavadskas, E.K.; Bogdanović, V.; Subotić, M.; Mardani, A. A novel CRITIC-Fuzzy FUCOM-DEA-Fuzzy MARCOS model for safety evaluation of road sections based on geometric parameters of road. Symmetry 2020, 12, 2006. [Google Scholar] [CrossRef]

- Arsu, T. Investigation into the efficiencies of European football clubs with bi-objective multi-criteria data envelopment analysis. Decis. Mak. Appl. Manag. Eng. 2021, 4, 106–125. [Google Scholar] [CrossRef]

- Kao, C.; Hwang, S.N. Efficiency decomposition in two-stage data envelopment analysis: An application to non-life insurance companies in Taiwan. Eur. J. Oper. Res. 2008, 185, 418–429. [Google Scholar] [CrossRef]

- Kao, C.; Hwang, S.N. Decomposition of technical and scale efficiencies in two-stage production systems. Eur. J. Oper. Res. 2011, 211, 515–519. [Google Scholar] [CrossRef]

- Chen, Y.; Cook, W.D. Additive Efficiency Decomposition in Two-stage DEA. Eur. J. Oper. Res. 2009, 196, 1170–1176. [Google Scholar] [CrossRef]

- Kwon, H.B.; Lee, J. Two-stage production modeling of large U.S. banks: A DEA-neural network approach. Expert Syst. Appl. 2015, 42, 6758–6766. [Google Scholar] [CrossRef]

- Wang, Q.Q.; Wu, Z.B.; Chen, X. Decomposition weights and overall efficiency in a two-stage DEA model with shared resources. Comput. Ind. Eng. 2019, 136, 135–148. [Google Scholar] [CrossRef]

- Huang, T.H.; Chen, K.C.; Lin, C.I. An extension from Network DEA to copula-based network SFA: Evidence from the U.S. 433 commercial banks in 2009. Q. Rev. Econ. Financ. 2018, 67, 51–62. [Google Scholar] [CrossRef]

| Year | Project | Net Assets (Thousand CNY) | Employees (Number) | R&D Investment (Thousand CNY) | Total Deposits (Thousand CNY) | Provision for Loan Impairment (Thousand CNY) | Net Interest Income (Thousand CNY) | Non-Interest Income (Thousand CNY) | Non-Performing Loan Ratio |

|---|---|---|---|---|---|---|---|---|---|

| 2018 | Mean | 3,528,078 | 384 | 241,924 | 31,418,835 | 581,484 | 1,021,746 | 435,069 | 0.43% |

| Std | 2,453,992 | 433 | 662,626 | 42,136,088 | 986,196 | 1,611,883 | 1,161,784 | 0.82% | |

| Min | 1,793,165 | 87 | 528 | 1,976,129 | 51,000 | 21,313 | −156,546 | 0.00% | |

| Max | 11,940,475 | 1906 | 2,698,378 | 175,462,888 | 3,554,500 | 5,520,011 | 4,509,728 | 3.16% | |

| 0.25 | 2,092,616 | 180 | 12,459 | 9,487,995 | 134,115 | 196,037 | 3698 | 0.00% | |

| 0.50 | 3,118,311 | 271 | 39,513 | 20,661,524 | 216,242 | 484,092 | 63,529 | 0.01% | |

| 0.70 | 3,962,590 | 396 | 155,255 | 26,652,582 | 433,465 | 862,893 | 179,550 | 0.56% | |

| 2019 | Mean | 4,289,105 | 475 | 306,542 | 46,232,394 | 878,733 | 1,670,672 | 442,299 | 0.67% |

| Std | 3,767,311 | 568 | 744,399 | 60,823,572 | 1,244,040 | 2,400,071 | 1,404,875 | 0.48% | |

| Min | 1,959,403 | 113 | 7382 | 8,230,615 | 79,520 | 176,085 | −800,378 | 0.00% | |

| Max | 16,119,128 | 2509 | 3,044,986 | 253,423,229 | 4,323,000 | 9,463,779 | 5,406,552 | 1.30% | |

| 0.25 | 2,166,873 | 220 | 25,045 | 15,410,046 | 223,668 | 397,126 | 4509 | 0.17% | |

| 0.50 | 3,369,344 | 321 | 77,082 | 26,489,432 | 472,171 | 934,283 | 56,585 | 0.60% | |

| 0.70 | 4,153,743 | 445 | 208,338 | 41,718,618 | 748,500 | 1,649,300 | 355,514 | 1.14% |

| Bank Name | Value Operation Stage Efficiency | Value Creation Stage Efficiency | Comprehensive Efficiency | Value Operation Stage Weight | Value Creation Stage Weight |

|---|---|---|---|---|---|

| WeBank | 1 | 1 | 1 | 0.4006 | 0.5994 |

| Wenzhou Mingshang Bank | 0.437 | 0.963 | 0.962 | 0.0021 | 0.9979 |

| Zhejiang E-Commerce Bank | 1 | 1 | 1 | 0.3864 | 0.6136 |

| Kincheng Bank of Tianjin | 0.549 | 0.656 | 0.629 | 0.2498 | 0.7502 |

| Shanghai HuaRui Bank | 0.518 | 0.834 | 0.762 | 0.2254 | 0.7746 |

| Chongqing Fuming Bank | 0.625 | 0.852 | 0.851 | 0.0041 | 0.9959 |

| XWBank | 0.825 | 0.771 | 0.780 | 0.162 | 0.838 |

| Bank of Sanxiang | 0.760 | 1 | 0.999 | 0.0035 | 0.9965 |

| Fujian OneBank | 0.087 | 0.688 | 0.686 | 0.0023 | 0.9977 |

| Wuhanzbank | 1 | 1 | 1 | 0.2215 | 0.7785 |

| Weihai Blue Ocean Bank | 0.850 | 1 | 0.978 | 0.1456 | 0.8544 |

| Zhongguancun Bank | 0.490 | 1 | 0.998 | 0.0032 | 0.9968 |

| Jilin Yillion Bank | 0.493 | 0.897 | 0.896 | 0.0023 | 0.9977 |

| Jiangsu Suning Bank | 0.779 | 0.906 | 0.906 | 0.0033 | 0.9967 |

| Meizhou Hakka Bank | 0.817 | 1 | 1 | 0.0012 | 0.9988 |

| NewUp Bank of Liaoning | 1 | 1 | 1 | 0.0787 | 0.9213 |

| Bank Name | Value Operation Stage Efficiency | Value Creation Stage Efficiency | Comprehensive Efficiency | Value Operation Stage Weight | Value Creation Stage Weight |

|---|---|---|---|---|---|

| WeBank | 1 | 1 | 1 | 0.0266 | 0.9734 |

| Wenzhou Mingshang Bank | 0.908 | 1 | 1 | 0.0014 | 0.9986 |

| Zhejiang E-Commerce Bank | 1 | 1 | 1 | 0.4199 | 0.5801 |

| Kincheng Bank of Tianjin | 0.626 | 1 | 0.998 | 0.0042 | 0.9958 |

| Shanghai HuaRui Bank | 0.472 | 0.689 | 0.688 | 0.0053 | 0.9947 |

| Chongqing Fuming Bank | 0.630 | 0.648 | 0.642 | 0.3705 | 0.6295 |

| XWBank | 0.652 | 1 | 0.885 | 0.3319 | 0.6681 |

| Bank of Sanxiang | 0.805 | 0.967 | 0.966 | 0.0054 | 0.9946 |

| Fujian OneBank | 0.262 | 0.820 | 0.819 | 0.0031 | 0.9969 |

| Wuhanzbank | 1 | 1 | 1 | 0.0254 | 0.9746 |

| Weihai Blue Ocean Bank | 1 | 1 | 1 | 0.0962 | 0.9038 |

| Zhongguancun Bank | 0.439 | 1 | 0.998 | 0.0027 | 0.9973 |

| Jilin Yillion Bank | 0.846 | 0.747 | 0.791 | 0.4488 | 0.5512 |

| Jiangsu Suning Bank | 1 | 0.992 | 0.993 | 0.0413 | 0.9587 |

| Meizhou Hakka Bank | 0.794 | 1 | 1 | 0.0017 | 0.9983 |

| NewUp Bank of Liaoning | 0.986 | 0.461 | 0.725 | 0.5035 | 0.4965 |

| Bank Name | Mean Comprehensive Efficiency | Province | Economic Belt | Group |

|---|---|---|---|---|

| WeBank | 1.000 | Guangdong | Eastern | 1 |

| Wenzhou Mingshang Bank | 0.981 | Zhejiang | Eastern | 1 |

| Zhejiang E-Commerce Bank | 1.000 | Zhejiang | Eastern | 1 |

| Kincheng Bank of Tianjin | 0.814 | Tianjin | Eastern | 1 |

| Shanghai HuaRui Bank | 0.725 | Shanghai | Eastern | 1 |

| Chongqing Fuming Bank | 0.746 | Chongqing | Western | 3 |

| XWBank | 0.832 | Sichuan | Western | 3 |

| Bank of Sanxiang | 0.983 | Hunan | Central | 2 |

| Fujian OneBank | 0.752 | Fujian | Eastern | 1 |

| Wuhanzbank | 1.000 | Hubei | Central | 2 |

| Weihai Blue Ocean Bank | 0.989 | Shandong | Eastern | 1 |

| Zhongguancun Bank | 0.998 | Beijing | Eastern | 1 |

| Jilin Yillion Bank | 0.844 | Jilin | Central | 2 |

| Jangsu Suning Bank | 0.949 | Jiangsu | Eastern | 1 |

| Meizhou Hakka Bank | 1.000 | Guangdong | Eastern | 1 |

| NewUp Bank of Liaoning | 0.863 | Liaoning | Eastern | 1 |

| The Null Hypothesis | Test | Sig. | Decision | |

|---|---|---|---|---|

| The distribution of the mean value of comprehensive efficiency has no significant difference among the three economic belts | Independent samples Kruskal–Wallis test | 0.257 | Do not reject the null hypothesis |

| Bank Name | 2018 | 2019 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| MATLAB | Max DEA | MATLAB | Max DEA | |||||||||

| WeBank | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| Wenzhou Mingshang Bank | 0.437 | 0.963 | 0.962 | 0.86 | 0.845 | 0.852 | 0.908 | 1 | 1 | 1 | 1 | 1 |

| Zhejiang E-Commerce Bank | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| Kincheng Bank of Tianjin | 0.549 | 0.656 | 0.629 | 0.588 | 0.651 | 0.619 | 0.626 | 1 | 0.998 | 0.719 | 1 | 0.859 |

| Shanghai HuaRui Bank | 0.518 | 0.834 | 0.762 | 0.556 | 0.913 | 0.734 | 0.472 | 0.689 | 0.688 | 0.514 | 0.731 | 0.623 |

| Chongqing Fuming Bank | 0.625 | 0.852 | 0.851 | 0.619 | 0.401 | 0.51 | 0.630 | 0.648 | 0.642 | 0.603 | 0.589 | 0.596 |

| XWBank | 0.825 | 0.771 | 0.780 | 0.643 | 0.776 | 0.709 | 0.652 | 1 | 0.885 | 0.675 | 1 | 0.837 |

| Bank of Sanxiang | 0.760 | 1 | 0.999 | 0.801 | 1 | 0.901 | 0.805 | 0.967 | 0.966 | 0.624 | 1 | 0.812 |

| Fujian OneBank | 0.087 | 0.688 | 0.686 | 0.909 | 0.688 | 0.798 | 0.262 | 0.820 | 0.819 | 0.959 | 0.732 | 0.845 |

| Wuhanzbank | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| Weihai Blue Ocean Bank | 0.850 | 1 | 0.978 | 0.966 | 1 | 0.983 | 1 | 1 | 1 | 1 | 1 | 1 |

| Zhongguancun Bank | 0.490 | 1 | 0.998 | 0.716 | 1 | 0.858 | 0.439 | 1 | 0.998 | 1 | 1 | 1 |

| Jilin Yillion Bank | 0.493 | 0.897 | 0.896 | 1 | 0.513 | 0.757 | 0.846 | 0.747 | 0.791 | 1 | 0.757 | 0.878 |

| Jiangsu Suning Bank | 0.779 | 0.906 | 0.906 | 0.548 | 0.808 | 0.678 | 1 | 0.992 | 0.993 | 1 | 1 | 1 |

| Meizhou Hakka Bank | 0.817 | 1 | 1 | 1 | 1 | 1 | 0.794 | 1 | 1 | 1 | 1 | 1 |

| NewUp Bank of Liaoning | 1 | 1 | 1 | 1 | 1 | 1 | 0.986 | 0.461 | 0.725 | 1 | 1 | 1 |

| The number of banks with an efficiency value of 1 | 4 | 8 | 5 | 6 | 8 | 5 | 5 | 9 | 6 | 10 | 12 | 9 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, M.; Zhu, N.; He, K.; Li, M. Operational Efficiency Evaluation of Chinese Internet Banks: Two-Stage Network DEA Approach. Sustainability 2022, 14, 14165. https://doi.org/10.3390/su142114165

Li M, Zhu N, He K, Li M. Operational Efficiency Evaluation of Chinese Internet Banks: Two-Stage Network DEA Approach. Sustainability. 2022; 14(21):14165. https://doi.org/10.3390/su142114165

Chicago/Turabian StyleLi, Min, Nan Zhu, Kai He, and Minghui Li. 2022. "Operational Efficiency Evaluation of Chinese Internet Banks: Two-Stage Network DEA Approach" Sustainability 14, no. 21: 14165. https://doi.org/10.3390/su142114165

APA StyleLi, M., Zhu, N., He, K., & Li, M. (2022). Operational Efficiency Evaluation of Chinese Internet Banks: Two-Stage Network DEA Approach. Sustainability, 14(21), 14165. https://doi.org/10.3390/su142114165