1. Introduction

Digital technologies, such as 5G networks, oftentimes serve as a catalyst for radical product and service innovation. They also enable a more sustainable future, which in the case of transportation systems translates to reduced environmental impacts; energy, time, and cost savings; and the avoidance of fatal incidents [

1].

It is now more apparent than ever that sheer technological progress must be facilitated by effective adoption procedures to have a positive impact [

2] on enterprises and other public or private authorities. Since the adoption of emerging technologies is not always successful [

3,

4], the systematic study of emerging technological applications and their diffusion into international markets and business models [

5] is a vital prerequisite for organizations that aim at remaining competitive on an international level [

6]. The abovementioned systematic studies have become more pressing nowadays, assisted by a new set of challenges such as supply chain risks, price inflation, the energy crisis, and materials shortages that have emerged mainly as a result of the world-disruptive COVID-19 pandemic and the war in Ukraine.

5G applications, and especially Internet-of-Things (IoT)-centric applications, can bring multiple benefits to CAM. Some of these benefits include narrowband connections, proximity-based services, increased security, less energy consumption per connected device, increased coverage, and low latency connections, to name a few. However, several barriers exist to the adoption of 5G technology across industries, which are mainly attributed to the already-satisfied consumer groups, the requirement for collaborations between multiple stakeholders (Mobile Network Operators (MNOs), policy makers, regulators, technology providers, etc.), and the high infrastructure investments costs [

7].

The current article analyzes business needs and market-related factors that are associated with the adoption of innovative 5G-based products and services in the CAM field within the European T&L sector. This is achieved by firstly discussing the ways in which 5G networks could add value to commercialization clusters of applications in CAM and serve specific T&L market needs within these vertical markets. The three clusters of commercial applications have been selected out of a wider group of vertical markets for 5G technology. This selection is based on the technical and business potential that they currently present or will present over the next few years. Additionally, the authors provide an analysis of the factors that may support or hinder the deployment of those 5G products and services into T&L markets. This discussion is unique and very central to the future of European T&L, especially when considering the emerging needs for increased safety, security, and collaboration between stakeholders who may also be competitors at the same time [

8]. The authors try to bring together the best of both the business and technical worlds and present a comprehensive report that will support professionals in European T&L in understanding the needs of the markets as well as the ‘why’ and ‘how’ of the deployment of 5G products and services.

In that regard, the article is organized as follows:

Section 2 provides an overview of the CAM landscape in Europe as well as an EU-focused marketplace report on the clusters of commercial 5G applications in T&L with the highest potential for the coming years. Special emphasis is applied to the needs that will potentially lead to this adoption of 5G in CAM within each cluster. Next, in

Section 3, the macro-level influences that may complement or delay the deployment of applications under the commercialization clusters presented in

Section 2 are analyzed. This analysis is conducted according to the PESTEL framework, and the factors are grouped as Political, Economic, Social, Technological, Environmental, or Legal influences. The PESTEL analysis is further extended to include the effects of the disruptive events of the COVID-19 pandemic and the War in Ukraine, thus providing a holistic view of the topic. The findings of the analyses carried out in this article are summarized in the conclusion section,

Section 4.

2. EU-Focused Marketplace Report for 5G Products and Services in CAM

2.1. CAM Vision for the Future of Transportation

According to EC’s definition [

9], the notion of CAM is focused on the effective deployment of autonomous/connected vehicles and/or self-driving cars. The vision of the EU Member States (MS), the industry, and the European Commission (EC) is to achieve connected and automated mobility across the EU, taking into consideration all associated stakeholders (public authorities, citizens, cities, and industry interests). Effectively, in order to ensure uninterrupted connectivity when crossing borders, policies and legislation related to digital technology need to be coordinated at the EU level [

10].

CAM and Automated Vehicles (AVs) open up a vast space of possibilities for the ways in which transport demand can be covered, as well as how transport networks can become more efficient, safe, and amusing. From the perspective of an individual traveler, the most obvious benefit is that the drivers essentially do not need to put in the effort and time to drive the transport vehicle that is utilized. This option opens a series of possibilities for travelers that drive their vehicles and can spend this time on other on-board activities, such as reading, socializing, gaming, or eating [

11].

Nonetheless, the most important benefits are the ones that are presented at the system level and concern the efficiency of the transport system as a whole [

12]. Such benefits include an overall reduction in travel costs and the enhancement of accessibility [

13,

14], as well as road capacity enhancement due to a potential replacement of conventional non-automated vehicle fleets with shared AV fleets or robot-taxis [

15]. Additionally, simulation studies have shown that the CAM concept is expected to positively benefit the environment compared to baseline scenarios where human-driven vehicles are used.

However, the CAM vision comes with challenges and related doubts on several levels. As discussed by Kousaridas et al. [

16] and the 5GCroCo project [

17], several legislative, business, and technical challenges exist, especially in long-distance, cross-border trips, where CAM needs to be facilitated throughout multi-country, multi-operator, multi-telco-vendor, and multi-car-manufacturer scenarios. These challenges are especially relevant to the transport and logistics sectors and across corridors. Furthermore, even if these types of challenges are addressed, inherent longer-term problems still need to be addressed before CAM is adopted. These include dread risk [

18] and the improper allocation of vehicle control functions between humans and automation by AV designers [

19], which can lead to over- or under-reliance on automation [

19] and a compromise in safety levels in European transport networks. Without successful and accurate interventions at all of these levels of challenges [

20], the perception of the usefulness and safety of CAM solutions may be negatively affected and lead to the unsuccessful or delayed realization of this futuristic transport vision [

21].

2.2. EU 5G-PPP Context

The EC has been promoting coordinated action in the EU that can drive the realization of its 5G for CAM vision across European cross-border corridors. The most prominent example is the Public–Private Partnership (PPP) on 5G, which was launched in 2013 together with the 5G Infrastructure Association that sits within the broader Connecting Europe Facility (CEF Digital, CEF and CEF2). One can consider the 5G-related CEF advancements to be structured around two pillars:

5G infrastructure deployments in Europe, consisting of:

- ○

5G Corridors—including transport vehicles, the road network, railways, and inland waterways to enable smart mobility services for the transport of passengers and goods;

- ○

5G-focused communities—aiming to help all 5G network’s stakeholders become part of a competitive European digital economy by building on connectivity demand and providing innovative 5G applications;

EU cross-border data infrastructures—offering strategic high-capacity connectivity for High-Performance Computers (HPC) and data infrastructures that will provide benefits to a range of sectors, including agriculture, energy, construction, and health, and will eventually trickle down to impact Small and Medium Enterprises (SMEs) and society.

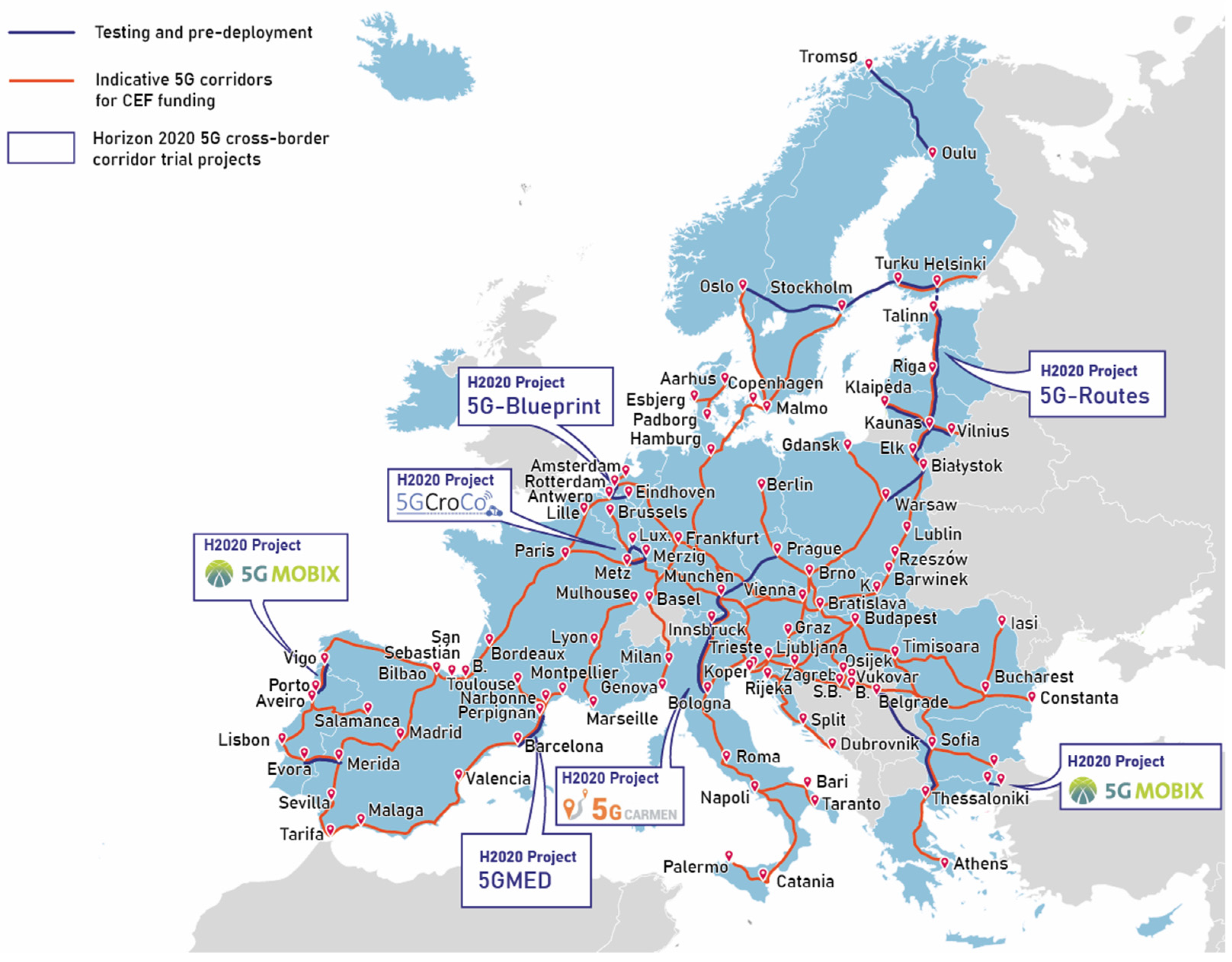

Part of the CEF and the 5G-PPP constitutes a series of projects, including 5G-ROUTES, 5G-CARMEN, 5G-CROCO, 5G-Mobix, 5GMED, 5GBlueprint, and 5GRail, which are all expected to work as catalysts for cross-border, stable 5G connectivity. These projects have a wide set of objectives, such as the creation of high-capacity networks, including uninterrupted 5G system coverage across all major transport corridors within Europe (

Figure 1).

The projects under the 5G PPP aim to both understand what challenges restrict verticals from taking up 5G but also quantify and categorize the potential benefits of this technology. These benefits are very central to European society, public and private bodies, the adoption of 5G technology, and the improvement of T&L networks globally. A common theme across all 5G-PPP activities is that they have a strong commercialization aspect that aims to explore how 5G technology can be exploited and deployed in T&L markets. The remainder of this article considers this commercialization aspect of 5G networks within the EU context and focuses on the practical pathway towards that ambition. In the next few subsections, what can be considered the main commercialization clusters for 5G applications in CAM are presented.

2.3. The Methodology for the Identification of Market Needs and Commercialization Clusters

In the 5G-ROUTES project [

23], an adaptation of the lean-startup methodology originally proposed by Eric Ries [

24] has been used to help assess and support the commercialization potential of use cases of 5G technologies in the Baltic Region. The lean-startup methodology’s foundation is that entrepreneurs should develop products that consumers have already demonstrated that they desire, while their utility is validated through the collection and analysis of data. This methodology has since been embraced by EU projects, in which an adaptation of the overall framework is utilized to create customer-focused, founder-driven, and investor-oriented commercialization plans for project outcomes.

The adapted version of the lean start-up methodology designed and followed in 5G-ROUTES aims to achieve collaboration between researchers and industrial actors, which in turn has allowed the project to (

i) identify market-suitable products and services from their use cases and project outcomes, (

ii) bring these to market more quickly than a traditional corporate approach might allow for, and (

iii) support the commercial activity by identifying sustainable business models. The 5G-ROUTES commercialization methodology revolves around the four pillars of action described in

Figure 2.

Based on

Figure 2, the work conducted within 5G-ROUTES recognizes several commercialization clusters with the most potential for 5G technology applications that have been especially focused on the Baltic area. Although the work in the project is ongoing with respect to the commercialization-planning tasks, the results of the customer validation and solution alignment procedures have produced a set of commercialization clusters and underlying use cases that serve the validated needs of the CAM and T&L industries, while at the same time being in line with the solutions to be developed by industrial actors and research groups within the coming years.

To further support the suitability and importance of the commercialization clusters and related business cases for the 5G-based technologies in CAM, a focused market analysis together with a PESTEL analysis have been performed for the identified groups of solutions. While identifying and validating commercialization clusters and business cases is important, the marketplace and PESTEL analysis are essential for the guidance and focus of subsequent commercialization activity. The work presented in the current article builds on the work conducted in the 5G-ROUTES project. It is mainly focused on extending the results of the state-of-the-art literature review for the Baltic region to an EU level. The main three research questions addressed in this article are as follows:

RQ1: What are the main commercialization clusters of 5G technologies use cases that will drive the demand for the deployment of CAM-related products and services in European markets?

RQ2: What are the main needs within each commercialization cluster that will drive the demand within each commercialization cluster over the next few years?

RQ3: What are the macro-level influences that may affect, favorably or negatively, the deployment of 5G-based products and services in CAM and the T&L sector?

With these questions in mind, a systematic literature review process has been performed across well-established databases: Google Scholar, ScienceDirect, and IEEE Xplore. The keywords of focus were “5G”, “Connected and Automated Mobility”, “CAM”, “T&L”, “cross-border”, and “EU”, and the searches have been specifically extended in order to cover the topics of the commercialization clusters under study. More specifically:

Regarding the automotive cluster, the following keywords have been examined: “safety”, “safety systems”, “safety perception surveys”, “passenger transport”, “VRUs”, “intersection collision control”, “trajectory estimation”, and “driving automation”;

Regarding the infotainment cluster: “infotainment systems”, “in-vehicle infotainment”, “on-the-go”, “streaming”, “leisure activities”, “work purposes”, “AV users”, “out-of-the-vehicle connectivity”, “virtual reality”, and “value of travel time”;

Finally, regarding the Multi-modal T&L cluster: “multi-modality”, “T&L services”, “automation”, “digitalization”, “NB-IoT”, “IoT-centric”, “IoT”, “visibility”, “eFTI regulation”, “warehousing”, and “smart freight systems”.

With that in mind, no specific restrictions have been applied to the literature search, but the authors have sought only to include articles that have been published after 2010 and concern the European continent. The same system has been applied to the related datasets (and related searches), which have been plotted or used in our analysis and usually concern the last five years (multi-year data have been used in a few cases to analyze related trends). The results of this meta-analysis synthesize the findings from 146 sources eventually considered by the authors to support the arguments and conclusions included in this article.

2.4. Market Overview for Selected Commercialization Clusters

Several potential applications of 5G in CAM exist, but only a few of them have been identified as having the highest commercialization potential based on both the technical and business perspective. The grouping of 5G applications for CAM that we have applied in this paper is as follows: automotive cluster, infotainment systems, and multimodal T&L. In this section, a market analysis for each commercialization cluster is given, along with a discussion of the main business needs that will drive the deployment of 5G products and services in that cluster.

2.4.1. The Automotive Cluster

The Automotive or Connected Vehicles market within CAM mainly refers to applications of Vehicle-to-Vehicle (V2V), Vehicle-to-Everything (V2X), Vehicle-to-Infrastructure (V2I), and Infrastructure-to-Vehicle (I2V) communication technologies. These technologies are very central to the operation of autonomous vehicles, telematics systems, and other freight information systems (fleet and cargo management). The applications within this cluster can be considered a continuum of humans’ driving activity that enables innovative ways of communicating, operating, and navigating when utilizing road transport vehicles.

Automotive-Focused Marketplace Report

The Automotive or Connected Vehicles market contains several vehicle sub-systems (sensing devices, communications protocols, etc.), which will ultimately help control vehicles without relying on the human factor. However, the market includes other solutions that do not strictly fit within the autonomous and automated vehicles market and enable vehicle trajectory prediction, collision avoidance, and the communication of the vehicle with outside networks. In

Figure 3, several levels of vehicle-driving automation are included, as portrayed in the SAE Standard J3016.

Along with all 5G services, the connected vehicle market’s potential growth is forecasted to be considerable, rising from an estimated 2020 value of USD 680 Million to a projected USD 4.27 Billion by 2025 [

26]. While substantial growth is expected in both the US and across the Asia-Pacific region, coordinated action in the EU is attempting to accelerate the rollout of the required infrastructure along pre-planned corridors with the goal of reaching at least Level 3 by 2025 [

27].

Several stakeholders exist in the automotive and connected vehicles market that will engage in the development and commercialization of the consumption of products and services over the next few years. The first group are the end-users of CAM that will want to utilize private or shared mobility solutions to cover their transportation demands. Another group is the technology providers who will engage in R&D and commercialization activities. Products and services are expected to exist within several categories, such as data analytics, software development, the provision of cloud services, Mobile Network Operators (MNOs), and Original Engineering Manufacturers (OEMs).

In the next few years, we can expect several advancements in products and services that will also be brought to market by public or private consortia. In the space of private consortia, it is worthwhile mentioning the global 5GAA consortium [

28] that comprises car manufacturers such as Audi, BMW, Daimler, and telecommunications companies such as Samsung Telefonica, T-Mobile, and Huawei. Another private consortium is the CAR2CAR consortium [

29], which includes Toyota, Honda, General Motors, Volkswagen, and Volvo, alongside other technology providers.

The EU’s Public–Private (PP) consortia and projects are expected to have a significant role in developments. Such consortia include the Horizon 2020 projects, the 5G Action Plan (5GAP), and the 5G PPP (as discussed in

Section 2.2). A unique part of these PP consortia is that, along with the development and deployment of 5G-based solutions in CAM in European cross-border corridors, they aim to provide the required legislation and necessary technical standards. A few selected PP projects are referenced below:

The EU MEDIATOR project [

30], which uses AI to assess the strengths and weaknesses of both the driver and the automated-driving system and mediate between them in order to reduce risk;

The EU AVENUE project [

31], which aims to open the way for the adoption of autonomous vehicles in public transportation;

The EU TrustVehicle project [

32], which aimed to increase AVs’ trustworthiness and contribute to end-user acceptance;

The Meridian project [

33], which aims to strengthen the Connected and Autonomous Vehicle-testing facilities along the M40 corridor between Coventry and London.

The Need for Safety and Collision Control Systems within the Automotive Market

With the ever-growing size of road networks and the accumulation of the world population in urban environments, road safety is becoming vastly important to societies and policymakers worldwide. With an estimated number of 18,800 fatalities from road accidents in the EU in 2020 and the EC’s Zero Vision for zero accidents in 2050, a considerable gap must be bridged by EU Member States (MS) to alleviate the road accident-related suffering of citizens. Moreover, aside from fatalities, there is also an estimation that every traffic-related death corresponds to four-permanently disabling injuries, eight serious injuries, and fifty minor injuries [

34]. Despite the current size of this problem, there have been positive developments over the past few years, with road accidents in EU MS being estimated to be decreasing (see

Figure 4 for road deaths per million Inhabitants in 2019 in the EU), with an overall 36% decrease from 2010 to 2020 and a 17% decrease from 2019 to 2020 [

35].

Hence, there is still room for improvement in the current level of safety on European roads, both within and across the borders of MS. CAM can increase safety, especially through Collision Control Systems (CCS), which use modern technologies such as Artificial Intelligence (AI) for image recognition, radars, and cameras in order to monitor an intersection and communicate a warning signal to vehicles and Vulnerable Road Users (VRUs). Such systems can further utilize 5G technology, Vehicle-to-Vehicle (V2V), Vehicle-to-Grid (V2G), and V2X communication frameworks to trigger a vehicle’s emergency-braking functions after calculating dangerous trajectories and possible collision points [

36]. Another likely scenario in which CCS may be useful is the overtaking maneuver of AVs when they are utilized for long-distance highway trips [

37]. All these safety features require effective and efficient Machine-to-Machine (M2M) communication, which is subject to very stringent delay and reliability constraints [

38], and which only 5G can guarantee in safety-critical environments.

CCS can be potentially integrated with Traffic Management Systems (TMS) based on 5G and V2X communication sub-systems. The demand for TMS is already well-established and growing globally. Both the road safety market and the V2X communication technologies market are expected to present considerable growth in the next few years, with the first growing from USD 3.67 Billion in 2021 to USD 5.86 Billion in 2026 [

39] and the latter growing from USD 0.69 Billion in 2020 to USD 12.859 Billion in 2028 [

38] with a Compound Annual Growth Rate (CAGR) of 44.2% for the automotive V2X market.

The importance of CCS for safety is highlighted when one considers the number of accidents that occur in specific parts of the European road network, such as crossroads, multiple junctions, roundabouts, and T-junctions. According to the EC-funded TRACE project [

40], in the EU, about 43% of all road injuries occur at intersections, with approximately 70% of those intersection accidents occurring inside an urban area. Additionally, in about 80% of these intersection accidents, at least one passenger car is involved (in a metropolitan area), and about 45% to 68% of these accidents occur at intersections with traffic regulations. Intelligent TMS with CCS functionalities based on V2X communication and 5G can help improve these statistics and save lives by enabling cooperative intersection crossing between vehicles and VRUs through the coordination of traffic flow [

41].

In the bigger picture, CCS is one of the prospective applications that can vastly improve safety on European roads. To achieve the EC’s Vision Zero for zero fatalities and serious injuries on European Roads by 2050 [

42], the employment of CCS is of great importance, especially when one considers the introduction of new modes of transport in the road networks, such as micro-mobility and autonomous vehicles.

2.4.2. The Infotainment Systems Cluster

Information and entertainment systems have become an integral part of modern transportation systems and the private or commercial vehicles that are used to cover transport demand. They usually comprise audio and visual systems, communication tools, hands-free-telephone-calling systems, vehicle voice control commands, navigation systems, weather and traffic prediction systems, and rear-seat entertainment systems.

Infotainment-Focused Marketplace Report

The recent trends in the infotainment market concern high-end vehicles that are being embedded with infotainment systems within the OEM market, with low and mid-range vehicles employing smartphone integration or tethering. According to reports [

43], the in-vehicle infotainment market is estimated to be worth approx. USD 20.8 billion and is expected to grow to USD 38.4 billion by 2027 with a CAGR of 10.8%. This market size includes products and services for both private and commercial vehicles. A major influencing factor for the development of this market has been the compatibility with smartphones and the features that they can provide when linked to the vehicle’s infotainment system [

44]. This integration has been further supported by smartphone devices’ ubiquity, with smartphone subscriptions having grown to over 433.58 million across Western Europe [

45] and with 396 million unique subscriptions in Central and Eastern Europe [

46].

However, except for the integration of smartphones with vehicles, there are several major categories of in-vehicle components that can be used for infotainment purposes in a vehicle. They can have different installation types (installed by OEM or from aftermarket sales and fitting) and can be grouped as follows:

Lately, a trend in OEMs has been to increase the size of display units, which are likely to accommodate complex control and multimedia features over the next few years. Likewise, navigation and control panels are increasingly included in low-cost vehicles as well. An interesting emerging technology is the installation of a heads-up display, which is likely to be integrated into parts of the vehicle wherein the driver can drive and also pay attention to the information provided at the same time. In

Figure 5, some information on the expected size of the infotainment market is given according to the component type.

Many initiatives in the market are noteworthy and are expected to effect changes within it in the coming decades, if not years. Several private consortia led by OEMs have recently presented advanced systems. One example is the MBUX Hyperscreen from Mercedes-Benz [

47], which is a single glass-covered dashboard that spans nearly 56 inches and has seven customizable passenger profiles. Another example is the consortium led by Ford Mobility (UK) [

48], which developed a digital road safety tool with the ability to predict potential incident hotspots via CAM technologies. Aside from private consortia, the EU and 5G PPP have a strong presence and support R&D in infotainment, mainly through projects such as 5G-ROUTES, 5GMed, and 5G-Mobix. Another notable case is the initiative started by SWR, an affiliate of the German public broadcaster ARD, which partnered with several automotive and telecommunications companies in Germany to launch a 5G broadcast trial to stream audiovisual content to automobiles [

49].

Infotainment functionality for vehicles is based on technical components and equipment that are also very important to CAM and the increased digitalization of several vehicle functions. As demonstrated in the paragraphs above, the infotainment market is a lively and competitive marketplace that requires the cooperation of the private and public sectors and the multiple stakeholders involved, such as OEMs, technology providers, and communication services providers.

The Market Need for the On-the-Go Streaming of High Volumes of Data

With the rise in autonomously driven vehicles over the next few decades, passengers will have more time to spend on other non-driving activities while travelling. This is an emerging privilege for travelers since, up to now, traveling time has been considered a waste, and minimizing travel time has been one of the main criteria for planning on an individual traveler level [

50]. Based on this emerging privilege, travelers can spend time reading, writing, talking, gaming, working, or consuming food and beverages. While many travelers like to relax and engage in entertainment activities, others tend to spend their time traveling for work purposes [

11]. These options are further enhanced with modern technology such as 5G networks, wherein passengers can participate in online events and work meetings and collaborate with other participants in virtual environments. An additional possibility for passengers could be the use of Virtual Reality (VR) headsets to make the collaboration environment more immersive. These emerging technologies enable new ways of communication and engagement with co-workers and clients in 3D environments, where models of the real, virtual, and meta worlds can be developed and used. These applications become even more useful and meaningful when the collaboration platform becomes available across borders. The connection to the services that support such applications’ functionality is uninterrupted throughout the trip. Additionally, connection latency and speed are very important for the experience so that the collaborators can communicate their messages and actions in real-time. It is worth mentioning the findings of the latest research by Correia et al. [

51] that analyzed the value of spare time for AV users and their willingness to pay for transport services that utilize AVs. The related results indicated that, in contrast to what most experts in the field expect, the Value of Travel Time (VOTT) for AV users interested in leisure activities could be the same or even higher compared to the VOTT of conventional car users or AV users that utilize AVs in order to perform work-related activities.

All these infotainment applications require strong out-of-the-vehicle connectivity [

52]. 5G networks can be the core facilitators of these on-board activities that require connections to the out-of-the-vehicle world. This is mainly due to the need for extended coverage along transport corridors, low latency, and the increased bandwidth that is necessary for many modern Use Cases (UC, UCs) that require the streaming of high volumes of data at high speeds. As estimated in recent studies, video-, health-, and VR-related 5G UCs are expected to have the strongest impact on internet traffic growth until 2025 as compared to other domains such as manufacturing, construction, and energy [

53]. Based on this, it can be expected that the application of in-vehicle (car, train, airplane, etc.) entertainment or conferencing solutions can account for a considerable percentage of these markets of in-vehicle video, conferencing, and virtual reality solutions.

While studies have shown that prolonged exposure to content on a VR headset is safe in long-distance journeys [

54], it can be expected that the demand for this use case is likely to rise over the next few years while the technologies involved are maturing and being increasingly adopted and integrated. However, several challenges will have to be addressed along the way, since the entertainment features [

55] that an AV can provide for its users can be a problem and, at the same time, a unique opportunity [

56] for telecommunication companies that will need to provide the bandwidth to support these features. Other problems may need to be addressed for this use case to fulfill its full business potential, such as movement compensations during car rides and the need to be situationally aware of the real environment while in a VR environment.

2.4.3. The Multimodal Transport and Logistics Cluster

Multimodal and sustainable transport systems are the cornerstone for the efficient mobility of freight and passengers as well as the future of European society [

57]. Alongside the introduction of new vehicles, operations, and transport infrastructures, cooperation and compatibility between all these facets of the transportation system are necessary for the improvement and sustainability of passenger mobility services. Moreover, efficient and smart multimodal logistics are central for uninterrupted and sustainable long-haul, regional, and urban freight transport movements. In this section, the dynamic multimodal transport networks and respective emerging digital systems that can bring together the entire transport network based on 5G are discussed.

Multimodal T&L-Focused Marketplace Report

With the increased containerization of shipments and the globalization of economies, multi-modal and inter-modal transportation of freight have become increasingly important in recent decades, with an estimated market CAGR of 16.4% [

58] over the last few years.

Alongside multi-modality in T&L, the needs for increased automation, digitalization, and visibility have emerged. These needs all fall under the umbrella of the Smart Transportation Market, which includes both Smart Freight Solutions and Smart Public/Shared Transport solutions. According to the MarketsAndMarkets report titled, “Smart Transportation Market—Forecast to 2025” [

59], the global market value in 2020 has been estimated to be USD 94.47 billion, and the projected value for 2025 to be USD 156.51 billion growing at a 10.6% CAGR. 5G technology can be particularly useful in the smart transport market and corresponding applications, where its wide coverage and support for the NarrowBand Internet of Things (NB-IoT) enables the essential applications of CAM. With the e-commerce industry leading its market growth, the smart freight market is expected to grow from USD 17.4 billion in 2020 to USD 46.5 billion by 2025 [

60].

An important application of 5G and NB-IoT in multi-modal T&L is goods tracking and visibility through the several stages of the supply chain process and the sharing of data with stakeholders in the logistics networks. By introducing low-power, on-site-IoT-sensing devices at multiple stages of the commodities’ flow process and by combining these IoT devices with smart platforms and analytics products and services, new possibilities emerge for Logistics Service Providers (LSPs), consignees, and consignors. Previously, such features were not widely used in logistics networks due to the high costs of solutions that only allowed for small data volumes to be infrequently transmitted. In that regard, knowledge of the status and position [

61] of a shipment at any time and date, whether that is in an indoor location (i.e., warehouse) or an outdoor location (i.e., road or railway network), can lead to increased automation at the several stages of shipment handling. The multi-modal delivery process is also expected to be fully digitalized and automated by delivery agents (i.e., robots) who will be able to fully handle the process. An interesting connecting application that falls under this category is the truck-platooning application, where several trucks drive as a convoy through a road network. V2V communication is essential for platooning, which is currently being tested across multiple EU regions [

62,

63].

In combination with multimodal T&L, smart-warehousing options can be made available by technology wherein products are handled in-between transportation flows. While smartphones and goods management software platforms have been the first step toward smart warehouses, Artificial Intelligent (AI), Radio Frequency Identification (RFID), robots, and NB-IoT are only a few of the technologies that can be expected to support human operators in handling products in a more efficient way within warehouses. With the full automation of warehousing on the horizon, the smart-warehousing market is expected to grow from approx. USD 14 billion in 2021 globally to USD 25 billion in 2026.

Other related use cases for 5G-technologies in the T&L sector involve utilizing enhanced positioning functionalities based on 5G services, such as tele-operating driving [

64] as well as real-time or on-demand HD mapping and high accuracy-georeferencing, which can also lead to the enhanced analysis of transportation systems through GIS applications [

65]. 5G technologies can also support the deployment of Private Mobile Networks (PMN and PMNs) that can further enhance safety, security, and several resilience mechanisms for several transport networks, such as in the case of railways [

66].

Finally, it is worth mentioning that the multimodal T&L solutions cluster can be expected to be positively affected by the growth of the prescriptive analytics market, which includes solutions that will automate decision making on many levels. The increased digitalization and connectivity through IoT-centric applications is expected to bring a proportional increase in the availability of data in T&L [

67], which favorably impacts decision-making support tools that are based on AI and data science [

67,

68], operations research [

69], and Digital-Twining applications [

70]. Tools within the prescriptive analytics market can then employ models that are tightly integrated with real-world logistics networks and help in network planning on a strategic, tactical, and operational level. The prescriptive analytics market is expected to grow from a global value of USD 4.9 billion in 2021 to USD 14.3 billion in 2026, with a CAGR of 24%.

The Market Need for Visibility in Multi-Modal Cross-Border Logistics

When considering the door-to-door transportation of global supply chains, different modes of transport have to be combined in order for a product shipment to be fulfilled from its production to its consumption and later to the point of its utilization or recycling. Across these multi-modal transport chains, it is important to have access to data about the status of the shipments, independently of the location, so that the product’s authenticity, the identification of insufficiencies, and the forecasting of supply and demand can be further improved. In a more general sense, it is important to have a wide variety of information on the supply chain processes when it is required [

71] to assess and control these same processes dynamically [

72]. With its value of visibility being well-received [

73,

74,

75] by stakeholders across logistics networks, 5G, as a supporting technology for IoT-centric applications in T&L, is very central to increasing the supply chain’s overall performance [

76].

For these reasons, and through modern technological advancements, the tracking of goods and the visibility of shipments throughout the supply chain phases constitute a major need in modern supply chain and logistics management. Aside from the business needs that are slowly starting to apply pressure on enterprises to update their systems to gain and provide increased visibility to their logistics operations, the upcoming EU electronic Freight Transport Information (eFTI) regulation [

77] will further oblige authorities and potentially enterprises to receive and share information about their shipments in an electronic format. Entering into force in 2024, all road, rail, maritime, and air transport operators in all of the EU MS will have to comply with the eFTI.

5G networks can be an important aspect of the application of eFTI. In practice, the larger bandwidth offered by 5G will increase the number of connected devices, resulting in greater automation and the uninterrupted monitoring of goods’ status and their visibility in cross-border corridors. This is achieved by 5G through the introduction of innovative architectures that enable optimal M2M communication between vehicles, road-side units (RSU and RSUs), and on-board units (OBU and OBUs). A prominent example wherein these benefits of 5G are already showcased is the railways sector [

78], where 5G is considered a key technology [

79] for moving towards Automatic Train Control (ATC) as well as wireless, accurate, and cell-free (i.e., moving block architecture) signaling through mountains, valleys, tunnels, and viaducts.

The introduction of the eFTI is a unique opportunity for many technology providers as well to create products and services to help LSPs comply with the regulation and achieve Business-to-Government (B2G) communication. Although data-sharing platforms have been used in transport systems before, the eFTI regulation will create a considerable demand for such systems across Europe by 2024. Another important point is that technology providers, aside from offering ‘basic compliance’ solutions to the LSPs, will also have the opportunity to develop and provide additional visibility features based on the newly available visibility data (descriptive, predictive, and prescriptive analytics; cross-border immutable traceability through distributed blockchain ledgers technologies; distributed identity systems; new governance models through smart contracts; and so on). In

Figure 6, one can notice the key elements of the eFTI legislation upon which the emerging technological solutions will have to be developed or based on.

3. Macro-Economic Factors Affecting the Deployment of 5G Products and Services in CAM

In this section, the macro-level factors that are expected to affect organizations in T&L and the deployment of 5G products and services in CAM are outlined based on a PESTEL analysis. Traditionally, a PESTEL analysis is a strategic planning tool that has a market-oriented scope. Overall, it aims to analyze the business environment in which an organization operates, and it essentially attempts to collect and highlight the most important Political, Economic, Social, Technological, Environmental, and Legal factors. In our analysis, the PESTEL framework is extended to include the recent impacts of the COVID-19 pandemic and the war in Ukraine.

3.1. Political Influences

Political impacts, as included in this analysis, are associated with government strategies and domestic and international trade policies, as well as taxation, regulatory policies, de-regulation trends, and coordinated research initiatives. With a variety of concerns emerging in the broader T&L industry, governments and expert committees are trying to use these political agendas to coordinate the actions of stakeholders in T&L so that their corresponding goals are successfully achieved.

Partnerships for the deployment of 5G products in CAM are expected to benefit from the aligned political actions of MS. The bodies and treaties leveraging this alignment are the European Union (EU), the Eurozone (EZ), the European Economic Area (EEA), and the Schengen Convention (SC). Via the EZ as well as the EEA subscriptions, technology providers, LSPs, and other stakeholders in T&L can join cross-country contracts with increased ease and convenience owing to a lot less bureaucracy, negotiations, and agreements. In addition, provided there is increased interaction, mobility, and communication from the Schengen Convention, improved results can be expected to be derived from the cooperation between sellers and buyers in prospective partnerships. The EU’s coordination is also very important for the R&D and innovation in small and medium-sized enterprises through funding tools such as the Horizon Europe program. In the context of 5G and CAM, a prominent example of successful coordination on an EU level is the 5G-PPP, as discussed in

Section 2.2, which aims to reinforce the EU industry to compete successfully in global markets.

Extra political coordination is attained through global bodies that are shaping the T&L domain through their action plans. To begin with, many European countries are part of the International Maritime Organization (IMO) [

80], which is a United Nations (UN) specialized agency for the safety and security of the shipping industry, legal matters, and the control of the environmental impact of the associated operations. Similarly, and in relation to other transportation modes, a considerable number of European countries are members of the International Civil Aviation Organization (ICAO) [

81], the Intergovernmental Organization for International Carriage by Rail (OTIF), and the International Road Transport Union [

82].

Finally, as the war in Ukraine has re-prioritized the international community’s needs, it can be expected that security alliances will play a crucial role in the state of affairs in the years to come. With the currently growing crisis that started in March 2022, most organizations in the EU whose home nations are a part of NATO can be anticipated to be less impacted by any type of prospective security-related de-stabilization as compared to others that are not [

83].

3.2. Economic Influences

In terms of economic impacts, the 5G-based products and services in CAM are mainly dependent on the overall state of the economy in Europe as well as the degree of R&D expenditure. The R&D expenditure factor is very important if one assumes that a number of 5G-based solutions are not fully developed to the standards of Technology Readiness Level (TRL) 9 yet. With the emergence of the COVID-19 pandemic and the war in Ukraine, it is questionable whether the levels of investment in R&D of previous years can be maintained since a re-prioritization of funding needs will occur for governing bodies. In

Figure 7, the R&D expenditure as a percentage of the GDP for the previous decade from 2010 to 2020 is portrayed.

In

Figure 7, it is evident that the U.S. and Japan have solidified their position as R&D leaders, while China did not raise its expenditure from 2019 to 2020. The EU’s overall gross domestic expenditure was slightly higher than that of China (at 2.3% and 2.2%, respectively), although this percentage fluctuates between MS according to the World Bank’s DataBank [

13]. For instance, in 2018 [

14], Austria had 3.17% of its GDP invested in R&D, while Cyprus had only 0.55%. In another example, Denmark had 3.03%, while Estonia had 1.4%, and Greece had 1.18%. Based on these figures, it can be concluded that the reality of finding funding sources for R&D can be different between EU MS, which, as expected, leads to differentiations when it comes to the development and adoption of 5G-based applications. This differentiation is also depicted by the Global Innovation Index, which was started in 2007 by INSEAD and World Business, a British Magazine, and represents an annual ranking of countries based on their capacity and success in innovation. According to the Global Innovation Index 2021 report [

33], North America and Europe are considered innovation leaders compared to other regions of the world, with southeast Asia, East Asia, and Oceania presenting great progress and a rise in their Global Innovation Index scores.

Figure 8 depicts the scores of several EU MS according to the Global Innovation Index.

While R&D expenditure and an economy’s capacity for innovation are two impacting factors for the deployment of 5G products and services in CAM markets, Gross Domestic Product (GDP) estimations and projections are also very important for the conceptualization of the commercialization and adoption potential of technological solutions. Based on the recent developments in the war in Ukraine and the dependency of European countries on Russian energy imports, a contraction of the global and the EU economies is expected, leading to severe challenges for EU MS. This position is further disadvantaged by the sanctions of the European countries and the U.S. on Russia, possibly leading to a disruption of the relationships between governments and reduced collaboration across multiple industries.

Based on the World Bank’s national accounts data and OECD National Accounts data files [

86], and as noticed in

Figure 9, the world’s GDP has fallen from 2019 to 2020, with China being a prominent exception. In the case of the U.S. and E.U., both GDPs fell in 2020, with the European GDP falling from USD 15.68 trillion in 2019 to USD 15.29 trillion in 2020. With the effects of COVID-19 and the war in Ukraine still unfolding, this emerging economic situation renders a rather unfavorable reality for R&D and technology providers if one considers the possibility of the reallocation of funds towards projects in the energy or military sector. In particular, smaller EU countries with moderate budgets allocated towards R&D may face unprecedented challenges when it comes to the funding of innovative technologies in the field of 5G and CAM. However, overall, it can be expected that if the EU collectively supports the R&D expenditure levels similar to previous years, then the public and private organizations in individual MS will have the opportunity to sustainably support the deployment of 5G applications in CAM over the next years.

3.3. Social Influences

Some of the characteristics of the EU’s population are considered to affect the long-term prospects of organizations that will choose to be active in the field of 5G applications in CAM. To begin with, one very important characteristic to consider is the population size and growth, which in Europe has been steadily rising over the past few decades. Based on the World Bank data [

13], the EU’s population in 1960 was estimated to be approximately 356 million, later growing to around 420 million in 1990 and to 441 and 447 million in 2010 and 2020, respectively. Although the population is rising, which signals long-term economic development [

16], the population growth rate has been steadily declining since the 1960s, from 0.9% in 1961 to 0.1% in 2020.

Another macro-level influence to consider is the aging of the EU’s population, which has been linked to potential decreases in productivity [

17]. In the EU’s population pyramid [

87], it can be noticed that the elderly population is estimated to vastly increase over the years, with the working-age group being expected to be considerably narrowed. Similarly, statistics from the World Bank’s Databank, plotted in

Figure 10, indicate an ever-increasing elderly EU population when compared to the total EU population. This phenomenon can be expected to affect Europe’s capacity for sustainable development since the elderly population is usually in need of support from the working age groups, which are declining in number. Although this is a longer-term problem, public and private institutions in Europe need to consider this aspect in their planning. For companies in the technology space, this can mainly imply both concerns and opportunities, with the main concerns being the lack of technological competence (i.e., young workers in the technological sector) and opportunities, such as emerging market needs to cover the growing elderly populations’ needs.

The importance of CAM is further strengthened by the accumulation of the world and EU’s population in urban environments. Based on data from Eurostat from 2016 [

19], the share of the EU’s urban population continues to rise, with almost three-quarters (72.5%) of EU inhabitants living in cities, towns, and suburbs in 2014. Based on the same source, the number of people living in rural areas of the EU is expected to fall by 7.9 million in 2050 to account for 20% of the EU population. With this estimated increase in the EU population and the accumulation in cities, the density of traffic can be expected to increase, which in turn will lead to increased safety needs that CAM can help to achieve.

Moving on to a transport safety-related topic, although over the last few decades the number of fatalities on European roads has steadily decreased, this reduction is not equally distributed across the different modes of transport.

Figure 11 depicts this difference, with pedestrians and cyclists having the worst trends in the number of serious injuries in the last decade. A possible interdependence is that different types of road network users have different attitudes and perceptions towards road safety, which in turn affects their behavior and overall well-being. Numerous studies offer insightful results about the perception of safety by several types of road users in Europe. A survey conducted in 2012 [

88] in 19 European countries aimed at depicting the perception of pedestrians regarding several topics concerning their transportation needs to provide significant insights into how several other facets of daily transportation can be improved. A study on the concern of pedestrians in several countries (Estonia, Hungary, Czech Republic, and Greece) regarding the level of service (safety, security, and available facilities) showed a very small percentage of “very” satisfied pedestrians. Another interesting result of the same study is that the majority of respondents across the EU are in favor of imposing further safety measures on cars (such as speed-limiting devices and alco-locks). Another study by Azik et al. [

89] focused on measuring and comparing several types of road users’ perceptions of road infrastructure and trip characteristics in Estonia, Greece, Kosovo, Russia, and Turkey. It showcased considerable differences between countries with respect to very crucial safety-related topics, such as the perceived respect by car drivers; 78.9% of Estonian pedestrians felt respected, but only 17.5% of Greek pedestrians felt the same way. In another question of the same study phrased as “Do you feel insecure while walking?”, only 7% of Estonia’s respondents answered “yes”, while the same percentages for Greece and Turkey were 51.20% and 38.70%, respectively. In another study focused on Poland’s safety problems for pedestrians, several hazards for VRUs, such as insufficient facilities for disabled persons and an insufficient driver–pedestrian sight distance, have been identified. Another more recent study [

90] that analyzed data from six European countries presented several notable differences in the behaviors of car drivers and motorcycle drivers, while age seems to play a role in risk perception as compared to more experienced drivers. While many common points were found in the driving attitudes between car drivers and riders, the latter group was found to have the tendency to adopt fast driving behaviors and overall conduct more violations when they find themselves in specific situations.

Altogether, the findings, as included in this section, suggest that the perceived level of service and safety is differentiated to a considerable degree between countries and for different types of road users. Additionally, despite the differences between EU MS, it is important to consider that there is an overall need to make EU citizens feel safer and respected in road networks. This pressure is expected to affect the CAM-related markets and will further promote the requirement for technological systems and infrastructure that will support VRUs safety, as also underlined by the statistics presented in

Figure 4. A series of 5G technologies use cases, such as the ones presented in

Section 2.4, can further enhance safety through improving connectivity, signaling, and communication between stakeholders of the road network [

93], thus supplementing the demand for the further development and commercialization of 5G-based solutions in the field.

3.4. Technology Influences

Several instances of commercial 5G networks are in live operation throughout the world, and while the discussion of the public focuses on speed, the latest advancements and threats in 5G networks involve many more aspects of human communication and overall well-being.

Firstly, it is important to consider that an increasing need for digitalization can be very beneficial to the adoption of 5G in several industries and use cases. With increased network coverage, reliability, and low-latency connectivity, which are very central benefits of 5G applications as compared to 4G networks, businesses can digitalize parts of their operations that they previously could not [

94]. Increased digitalization is also present in the transport and logistics sectors [

95], which benefit from advancements in sciences and emerging technologies. An illustrative example of the upcoming digitalization in logistics is the Physical Internet (PI) framework, which is proposed as a coordination mechanism for the transportation of physical goods in the real world that resembles how data packages are moved on digital networks such as the digital internet [

96]. Aside from advancements in IoT and modern networking technologies such as 5G, the PI is enabled through various advancements in technologies such as digital modeling, artificial intelligence, data analytics, and cyber-physical systems.

Regarding technology, no matter how advanced it can be or what its potential use cases are, it needs to be adopted based on positive profitability estimations from decisions made in public and private bodies. Profitability is affected by the cost [

97] for all the stakeholders taking part in the process of understanding, planning, and implementing a new technological solution to improve existing or new processes. However, not all costs are the same for different stakeholders. In the case of 5G, on the one hand, we have the User Equipment (UE) cost [

98], which is associated with all the facilitating equipment (modems, sensors, antennas, battery lifetime, overall product designs, etc.) on the user side, and which is generally expected to lower in the next few decades. Several constraints may emerge, such as backward compatibility of the UE with all previous network standards as well as design constraints, which requires UE to be even more elegant and compact (especially in the case of handheld devices or equipment that is visible in the daily life of users). On the other hand, on the system level, the cost of the equipment needed to facilitate the operation of the network is a rising challenge for network operators and infrastructure managers. Especially in the case of network traffic density in urban locations, a huge increase is expected by 2025 in metropolitan areas and other capitals around the world, which will require investments to facilitate growth [

99]. While in the case of rural and sub-urban areas this challenge can be addressed by densifying the network, in urban environments, this challenge will require small-cell solutions to be able to withstand the higher concentration of traffic.

Common technological standards across the different CAM-focused 5G use cases and the involved stakeholders are central to the successful adoption of the 5G technologies in the T&L sector. While this is not a solely technological process but also a political and legislative one, in order for a technological ecosystem to flourish, a standard pan-European platform [

100] would need to be used so that products and services can be integrated on an international level and with respect to cross-border CAM settings. In this process, it is very important that these standards are collaboratively developed by stakeholders across public and private institutions so that modularity and interoperability are guaranteed across different 5G ecosystems of products and solutions.

Particularly for frequency bands, which are different between countries and network providers [

101], the integration and layovers of vehicle connection between networks can be even more difficult. However, it can be expected that with recent EU political actions towards the interoperability and standardization of 5G networks in the EU, this issue will become less significant over the years. Common 5G architectures are a high priority for the EU and EC [

102], which are taking massive action by providing pan-European frameworks such as the technical report for a coordinated EU risk assessment (EURAC5G) [

103] and the development of the EU Toolbox on 5G Cybersecurity (EUT5G) [

104].

Other major technological advancements will potentially be introduced in the area of transport and mobility, but they can be expected to have a moderate effect on CAM. One example constitutes the changes in future vehicle fuel technologies. At the moment, we are transitioning from conventional gas-powered vehicles to electric vehicles, but hydrogen-fueled cars could also be introduced in the next few decades. These transitions not only require the replacement of the individual vehicle’s engine system but also a re-design of the embedded systems and software architectures [

105], and they pose a general challenge for the adaptation of the transportation network infrastructure [

106,

107,

108]. Also, blockchain can be a technology that improves how people and products move from one location to another through completely transformed trustless business models. Value transactions can take place based on distributed digital ledgers and smart contracts, in which entries are verified by a trustless network that does not require the human factor to confirm transactions [

109]. Ultimately, the blockchain technology can induce significant benefits (i.e., cost savings) to cross-border logistics, such as automated communication with public authorities and respective monitoring systems (e.g., customs clearance).

Finally, an aggravating factor for the successful deployment of 5G products and services in CAM is constituted by the security concerns regarding 5G networks in Europe. These concerns boil down to the fact that importing and installing 5G equipment from outside of Europe may provide outside countries with access and even control of the information flow within European telecommunications networks. Prominent examples of this concern are the cases of Estonia [

110], Latvia [

111] and the Baltic states in general [

112], whose security authorities have officially stated that organizations from countries with competing interests may use the available information for espionage. One can consider that this problem is only magnified [

113] when the cross-border scenario is considered, where networks of EU MS work cooperatively.

3.5. Environmental Influences

The global measures to preserve the natural environment, as well as to tackle the threats of global warming and air pollution, are becoming increasingly stringent. Transportation accounts for 20% of worldwide energy consumption and is, therefore, a very central sector in the attempt to reduce the environmental impact of human activity. These series of environmental problems are expected to be magnified by emissions from the transport sector accounting for 27% of global emissions in 2019 [

114], and with the total ton–kilometers traveled by road being expected to rise three-fold from 2015 to 2050 [

115].

This set of macro-level influences is in concert with political actions and legislative packages that have been initiated—or are about to be initiated—and will have to be followed by stakeholders in transport systems. The European Green Deal is central to environmental influences, constituting a deal that aims to reduce net emissions of Greenhouse Gases (GHG) to zero by 2050. In addition, the EU Corporate Sustainability Reporting Directive together with the EU Sustainable Reporting Standard—functioning as a key to making sustainability reporting more accurate, common, consistent, comparable, and standardized—will shift the focus of businesses even more towards ESG issues. Corresponding action plans aiming to reduce the environmental impact of logistics operations already exist. These include the EU’s “Sustainable and Smart Mobility Strategy” [

116], which aims to realize the green transformation of the European transportation system. The upcoming eFTI and eFTI-based platforms (as tools that will be used by LSPs and municipalities) are expected to promote visibility and the open sharing of data that can, in turn, be used and analyzed to extract information about emissions. Another central tool of the Green Deal that paves the way for CO2 reductions in many sectors, including that of freight transport and logistics, is the EU’s Fit for 55 package [

107]. It aims to reduce GHG emissions by at least 55% by 2030.

All in all, green initiatives and policies at the EU level will vastly affect legislation and industry standards in the next few years, thereby shaping the demand for numerous technological tools for compliance support. Although 5G applications in CAM will most likely not be vastly affected by these green initiatives, they can, however, be part of wider technical solutions that deal with the reduction in the environmental impact of operations.

3.6. Legal Influences

When it comes to the application of new technologies in industries and the everyday lives of citizens in the EU, common approaches are normally followed so that coordination and cooperation are facilitated [

117]. Not restricted to the case of the EU, the legal and regulatory frameworks introduced by governments and decision makers are not always favorable [

118] towards the adoption of technology across different sectors and geographical locations and can even slow down this process [

119].

One of the very important aspects of commercial 5G deployment in a specific area is the 5G spectrum in which the network’s radio frequency can transmit to maintain a high quality of service and satisfy the growing demand. The 5G spectrum is usually regulated by a license, which is made available to interested parties via auctions. In the last few years, and complementary to the EU’s radio spectrum policy, the EC has defined a harmonization plan [

120] that decides on the 900 MHz and 1800 MHz bands to be used for 5G applications. For EU MS, it can be expected that, while each one can have its own level of technological readiness, they will all be enabled to be part of the wider network that can enhance cross-border 5G applications. A differentiating point for each country is the timing of the auctions, which can be important indicators of the readiness for the commercial use of 5G for each region and corresponding cross-border corridors.

As previously mentioned, the upcoming eFTI legislation [

77] is expected to increase the need for compliance with EU MS. The eFTI will apply to the European transport network starting (est.) 2024 and will “force” public and private authorities in logistics to share information about their shipments, which will foster the market demand for solutions that help stakeholders comply with the eFTI. The eFTI is closely associated with the Green Deal since both can be expected to create space for analytics applications, such as machine learning models and digital twins, to further reduce the environmental impact of operations based on the data that they will make available. Such legislation is, of course, expected to promote the digitalization of transport and further support the deployment of applications that fall under the umbrella of CAM. It can be expected that cross-border goods tracking can benefit from the eFTI since the emerging IT systems that will be needed to support the eFTI will also pave the way for enhanced information exchange on a deeper level (which can cover the information exchange for the goods transported).

Finally, the United Nations Economic Commission for Europe (UNECE) Working Party on General Safety Provisions is expected to propose another supporting legislation under the title of the UN Regulation Development on Heavy Vehicles Direct Vision [

121]. It concerns emerging safety requirements that aim to make general road traffic safer for VRUs, cyclists, and pedestrians [

122]. Its deployment is planned for January 2026 and will require all newly manufactured trucks and buses that will be “type Approved” to include direct vision safety systems in an attempt to reduce the importance of the human factor regarding the blind spots of vehicles while driving. While this legislation is still under development and expected to be formally adopted by the World Forum for Harmonization of Vehicle Regulations later this year, it will be supportive of CAM and the possibility of increased connectivity under 5G networks.

3.7. The Effect of the COVID-19 Pandemic

The COVID-19 pandemic has been a multi-faceted threat that has negatively affected various aspects of life, such as public health [

123], politics [

124], psychological wellness [

125], and economic security [

126], as well as international supply chains [

127] and public transport [

128]. These impacts were not proportional to all social groups, with several groups, such as women, young employees, and those without a college education, being affected more than others [

129].

A major impact of the pandemic has been the way in which many businesses adapted to the social-distancing rules and remote-working legislations. As a direct consequence, a proportion of the daily work in offices has moved online, demanding businesses to digitalize many of their operations and the ways in which their employees collaborate. This wave of digitalization, in turn, brought technological adoption and adaptation, which is usually referred to as the COVID-19 Digital Transformation [

130]. Digital transformation has been beneficial to some businesses and a concern to others since the associated adaptation has not been an easy procedure for all types of organizations in all regions of the globe [

131]. Overall, this technological disruption is expected to bring long-term growth to IoT-supported systems and AI systems, with privacy and security being two major concerns [

132].

Another indirect impact of the COVID-19 pandemic has been the growth of e-commerce and, particularly, the rise in online retail sales, which in turn led to an increase in demand for logistics. If one considers that, based on data from 2016 [

133], the share of the EU’s urban population is three-quarters (72.5%), a unique pressure has been applied to last-mile logistics networks during the pandemic [

134]. Although this effect does not necessarily directly impact 5G applications in CAM, it affects T&L logistics networks overall and will lead to a reconsideration of transport policies and their importance in the post-COVID-19 era [

135].

The major impact of the COVID-19 pandemic has been on the economy. Based on data from the World Bank’s national accounts data and OECD National Accounts data files [

86], the global economy has shrunk by 3.2% from 2019 to 2020 by USD 87,560 million to USD 84.74 trillion. The Global Economic Outlook report by the International Monetary Fund (IMF), published in April 2021, has forecasted global growth in 2021 to be 6%. Despite the worldwide recession of the economy in 2020, vaccine-led policies have supported the recovery from the pandemic, and government assistance towards prone citizens and businesses has also been a vital energizer for the economy. Nonetheless, the longer-term economic effects of the government policies during the COVID-19 pandemic, alongside the emerging reality of the war in Ukraine, can also be expected to have longer-term effects that have not unfolded fully at the time of writing this article.

3.8. The Effect of the War in Ukraine

Russia invaded Ukrainian soil on the 24th of February 2022. The effects have been ongoing for several months now, but the full extent cannot be predicted yet.

Aside from the human toll of the war in Ukraine, and as the political tensions rise, the EU and the US have adopted the fifth round of sanctions on Russia and Belarus; therefore, it can be expected that the economic impact will increase. Especially in the case of transport, the fifth package of sanctions includes a prohibition on the provision of access to European Union countries’ ports for Russian vessels and a ban on the undertaking of any Russian and Belarusian road transport, preventing them from transporting passengers and goods by road within the EU [

136]. These developments can, in turn, affect other projects, such as China’s Belt and Road initiative, leading to funding alternative projects that do not include transporting goods via Russia, Ukraine, and Belarus. In turn, it can be expected that these transport sanctions will affect T&L routes in the EU area, especially in countries that are in close proximity to Russia.

Furthermore, while Russia accounts for less than 2% of the global GDP and Ukraine for 0.14%, the direct impact on global supply chains and the economy can be expected to be moderate (as compared to COVID-19). However, there are specific parts of the economy in particular regions that will be affected more than others. For example, Germany, which has a strong energy dependency on Russia, is expected to face significant problems due to the tense relations. One of the international projects that is likely to be directly affected by this emerging situation is the Nordstream pipeline project, which has the capacity to transport 55 billion cubic meters of natural gas from Russia to Germany across the Baltic Sea [

137]. Of course, energy dependency is not a problem faced only by Germany, but it also concerns other European countries. According to Eurostat [

138], EU countries imported approximately 40% of their gas, 33% of their crude oil, and 29% of their solid fuels from Russia in 2018.

As of the time of writing this report, the war in Ukraine has led to a record-high inflation pressure as well as increases in energy prices by up to 40%. Furthermore, supply chain issues have also been noticed with respect to a series of products worldwide, with corn and wheat prices being affected and further diminishing the living standards in several countries. Another significant problem in supply chains that may affect the technology sector is the dependency of the chip-manufacturing industry on semiconductor-grade neon, a material used in the chip-making process. According to sources [

139], it has been estimated that while the largest chip fabricators have access to inventories of chips of this kind, medium- and small-sized manufacturers may not, which can lead to disruptions in the supply or a rise in the price of chips worldwide. In connection to 5G applications in CAM, the increasing oil prices and a general reduction in the standards of living [

140] could bring a reduction in the mobility of the population, which in turn may affect the demand for the deployment of newly emerging technologies in T&L [

141].

Although the full effects of the war in Ukraine are difficult to assess at the time of this analysis, all of the aforementioned factors usually contribute to reduced economic activity and development—in our case, a redirection of funding from technology adoption and a reprioritization of the development of other sectors of the economy. For example, the energy dependency on Russia will lead to higher energy prices as the EU countries need to diversify their energy imports [

142], reduce the percentage of energy imported from Russia, and increase energy security. It can be expected that the effects of higher energy prices can be connected to the growth of price inflation, the widening of trade deficits, lower productivity of the labor force, and a reduction in the standards of living [

140].

4. Conclusions

In the current article, an analysis of the applications of 5G in CAM and related markets has been presented. This analysis aims at providing the latest technological and market-related insights that are central to the sustainable future of transportation systems and the markets of solutions that will support them. A major contribution of the article is the PESTEL analysis that analyzes the macro-level industry influences that may affect the deployment of products related to 5G networks and CAM into European markets. It has been conducted through the six lenses of PESTEL—Political, Economic, Social, Technological, Environmental, and Legal—and a discussion of two major events, the COVID-19 pandemic and the war in Ukraine, has also been carried out.

Overall, European markets are expected to continue to be open to investments and projects in 5G applications in CAM, despite the pressures imposed on their economies by the impacts of the COVID-19 pandemic and the war in Ukraine. This conclusion mainly stems from the fact that the use cases under the umbrella of 5G applications in CAM are important for the competitiveness of the European T&L sector, as indicated by the analyses included in several sections of this article. This belief is further augmented if one considers the continuous deployment of 5G infrastructure in some EU regions, the development of legislation according to European standards, the EU’s innovation economy, and the more general trend of the digitalization of the T&L sector. To communicate the significance of each macro-level factor, we provide the PESTEL significance table below.

As summarized in

Table 1, The very high significance of the political macro-level factors stems from the fact that most European countries belong to several international bodies with a strong global presence (EU, the EEA, EZ, and the SC). This creates a considerable number of long-term opportunities and stability for EU MS since they can participate in collaborative projects and develop higher levels of TRL independently of each individual Member State’s R&D capabilities, GDPs, and R&D expenditure. Regarding the economic state of affairs, we conclude that this will also have a very high significance for the commercial deployment of new infrastructure in the markets, at least for the next few months after the publication of this article, mainly due to the COVID-19 pandemic and the war in Ukraine. Cross-border corridors in close proximity to Ukraine and Russia will be affected more than others, with the safety and security aspects being prioritized as compared to other facets of the potential projects.

Regarding social and environmental influences, although we consider them to be important pillars of a competitive investment environment; in the context of 5G solutions in CAM, they are the less important factors because they are not expected to directly affect investments in the next few years. However, they are still considered long-term demand drivers.

Finally, the technological and legal influences have been considered high-significance factors for the deployment of potential products based on 5G technology and CAM. In general, technological influences are important because Europe’s IT competency and innovation performance [