The development of the population in the ecosystem cannot grow indefinitely. The population dynamics model pays attention to the change in population quantity and the competition and coordination mechanism within the population. The more individuals in the population, the more intense the competition.

2.1. Ecosystem Perspective and Population Dynamics

The ecosystem view is widely used in the research of ecology, sociology, economics, and management. Ecosystem theory can link natural ecosystem research with social ecosystem research well [

51]. In the field of social science research, innovation system [

52,

53], education system [

54], and industrial system [

55] can all be explained by ecosystem theory. For example, in the automobile industry, automobile manufacturing enterprises can be regarded as a population. The symbiotic relationship can be expressed as a competitive relationship or a cooperative relationship. A collaborative relationship can promote mutual benefit and common development between enterprises. Population dynamics is one of the classical methods to describe ecological symbiosis.

Population dynamics models focus on changes in population size, variation patterns, and nonlinear growth patterns. The logistic regression model was proposed by the British statistician Cox [

56]. In this paper, the products sold by an enterprise are considered as a product population [

57] and the growth dynamics system is built according to a logistic model.

is the automobile product sales’ growth rate in period t;

is the automobile product sales’ population size in period t;

is the automobile product sales’ maximum population size;

is the intrinsic growth rate;

is the growth retardation factor.

In this study, is the growth rate of automobile product sales in period t; is the sales size of automobile products in period t; is the theoretical maximum sales size of automotive products; and is the intrinsic growth rate of auto product sales.

Based on related studies [

58,

59], the following econometric model is given in this paper:

Because: ,,.

In general, represents the synergy within an automotive product population and is called the intra-firm synergy coefficient.

When , the synergistic effect is significant.

Let , usually, , represent the competitive effect within an automotive product population, called the intra-firm competition coefficient or product population density suppression coefficient. In order to test the stability of the two-stage logistic model, a stability verification model with operating income as the main variable is designed in the empirical research part.

2.2. Empirical Analysis

Under the dual pressure of resources and environment, the traditional manufacturing industry is constrained by resource constraints and carbon emission reduction. Today, when the concept of green and sustainable development is in the people’s hearts, people prefer the development of low-carbon environmental protection industry [

60]. The automobile manufacturing industry is an important part of the manufacturing industry. Sales and use of automobile products are affected by the carbon emission reduction policy. At the same time, the traditional automobile manufacturing industry has been impacted by the NEVs (new energy vehicles) [

61]. Therefore, the life cycle of automobile manufacturing enterprises may change rapidly and dynamically under the influence of the external environment. This is also the primary reason why this paper chooses automobile manufacturing enterprises as the empirical analysis object.

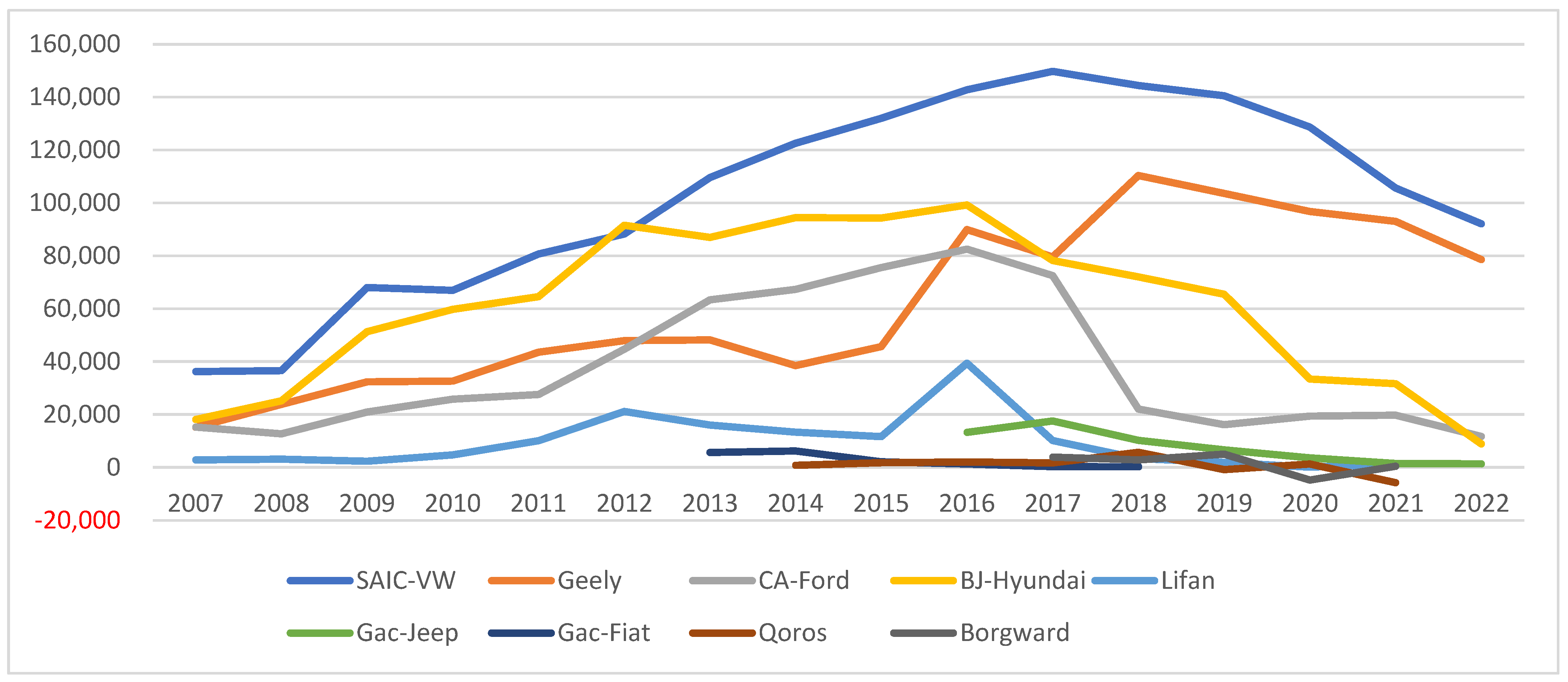

This paper first uses data on total automobile sales in China as a basis for analyzing the overall assessment of the development of China’s automobile industry. Then, enterprises experiencing operational difficulties in China’s auto market and those having withdrawn from the market are selected as the research samples. Top-ranking enterprises were selected as the research sample for a comparative analysis. The sample of enterprises with declining operating performance includes CA-Ford and BJ-Hyundai, and the sample of delisted car manufacturers includes Lifan, Gac-Jeep, Gac-Fiat, Qoros, and Borgward, while the sample of those with mature operation and relatively large sales volume are SAIC-VW and Geely. When choosing the sample enterprises, this paper selects different types of automobile manufacturing enterprises as the research samples. These enterprises include independent brand enterprises, joint ventures, and foreign-funded enterprises. At the same time, enterprises with different operating times are selected as samples. Due to the limitation of space, the descriptive statistics of the sales data of the sample enterprises are given in this paper, and the statistical characteristics are shown in the following table.

As shown in

Table 2, the sales data of sample enterprises show relatively large differences. The sample data can represent the enterprise forms at different life cycle stages. In order to further analyze the specific stages of the life cycle of the sample enterprises, this paper constructs a two-stage logistic regression analysis model. The specific research process is as follows.

- (1)

First-stage logistic model

In this study, the first stage of the logistic model was used to analyze the sample data for enterprise growth. In this phase, the sample data were first segmented and the logistic model regressions were conducted for each year of monthly sales data according to the era to which the sample data belonged. Due to the limitation of space, the monthly sales data of Chinese automobiles by year are given in this paper, as shown in

Table 3.

As shown in

Table 3, there is a clear growth process for total vehicle sales in China. Monthly sales are basically stable for the same period each year from 2018 to 2021. China’s auto sales have obvious seasonal fluctuations. July and August are low seasons for sales, and January and December are peak seasons for sales. The regression results of the sample data are shown in

Table 4.

As shown in

Table 4, the first-stage logistic model regression model for total sales of the Chinese auto market works relatively well. The total sales volume of China’s auto market has shown a booming momentum. The intrinsic growth rate of the auto market has been maintained at positive values, with the intrinsic growth rate reaching above 1 in 2007, 2011, and 2013. The value of the internal inhibition coefficient of the auto market has remained in a reasonable range. From 2007 to 2011, the internal inhibition coefficient gradually increased. The internal inhibition coefficient gradually decreased from 2012 to 2017. From 2018 to 2022, the internal inhibition coefficient rose amid turbulence. This indicates that the competition in the auto market has intensified in recent years, and the theoretical upper limit of the auto market capacity has increased significantly from 2007 to 2022. From 2007, 740,000 sales per month rose to a market capacity ceiling of 2.11 million units in 2017. From 2018 to 2022, the market experienced a small turbulence and remained at a level of about 1.8 million units per month. In summary, the Chinese auto market remained in the development period from 2007 to 2017. China’s auto market entered the maturity period after 2018.

As shown in

Table 5, the sample data are segmented based on the year difference in the observed data, and the population parameter of different years are calculated, respectively.

Table 5 shows the theoretical upper limit of the population, which, in this paper, represents the theoretical upper limit of the sales volume of the enterprise. Observing the data in

Table 5, it can be found that the maximum upper limit of sales volume for the majority of firms occurred in 2016 or 2017. This is basically in line with the trend of the overall sales volume of China’s auto market. The K values of individual firms appear to be less than 0, which is caused by their intrinsic growth rate and internal inhibition coefficient both being less than 0. In real life, one does not usually encounter a negative sales volume situation, such as a firm experiencing a large number of consumer returns. Auto companies, such as Lifan, Gac-Jeep, Gac-Fiat, Qoros, and Borgward, tend to choose to abandon the market when sales decline severely, or even when sales are zero. The theoretical upper limit of sales for each of these enterprises is so low that there is practically no need to continue their production operations. One of the main objectives of this study is to construct a methodology for analyzing the decline measures of the firms, and therefore the second stage of logistic model regression analysis is conducted in this paper. The theoretical upper limit (K

1) of the population measured in the first stage is the most important object of analysis in the second stage of the analysis.

As shown in

Figure 2, the enterprises with a higher theoretical upper limit of sales volume are above the trend line in the figure. From 2007 to 2017, the theoretical upper limit of sales volume of most sample automobile enterprises was steadily increasing, and these enterprises were in the growth period. At the same time, this period was also a period of steady increase in the total volume of China’s automobile market. After 2018, the theoretical upper limit of sales volume of the sample enterprises decreased to varying degrees. Since 2020, the theoretical upper limit of sales volume has decreased significantly, which is mainly due to the direct impact of the epidemic and its prevention and control measures on the production and sales of the automobile market. The whole automobile market is waiting for a chance to recover.

- (2)

Second-stage logistic model

In this stage, logistic model regression analysis was conducted using the theoretical upper limits of sales volume in the maturity and decline periods of the enterprises, focusing on exploring the population dynamics mechanism in the decline period of the enterprises and summarizing the ecological characteristics of mutually declining enterprises. The model regression results are shown in the following table.

As shown in

Table 6, the sales of the above sample enterprises can be classified based on the positive or negative intrinsic growth rate (α

2), internal inhibition coefficient (γ

2), and theoretical market capacity (K

2). The first category is Geely and CA-Ford, who have an intrinsic growth rate greater than zero, an internal inhibition coefficient less than zero, and a theoretical market capacity greater than zero. The values of the correlation regression coefficients of the first category are taken strictly in accordance with the theoretical requirements of population ecology. Among them, Geely is doing well, and its theoretical market capacity is relatively high. The endowment growth rate of CA-Ford is low in intrinsic growth rate, which has approached zero, which also leads to its theoretical market capacity of only 5731 sales volume per month as the upper limit.

The second category is SAIC-VW and BJ-Hyundai, who have an intrinsic growth rate less than zero, an internal inhibition coefficient greater than zero, and a theoretical market capacity greater than zero. The theoretical market capacity of these two enterprises is still relatively high, reaching 164,843 (SAIC-VW) and 96,189 (BJ-Hyundai) per month, respectively. It would be one-sided to evaluate these two companies simply by the actual monthly sales and the theoretical sales online. The sales figures for these two enterprises are promising, but they face many dilemmas in their actual operations. This dilemma is reflected by the values of the intrinsic growth rate (α2) and the internal inhibition coefficient (γ2). The ecological analysis shows that the internal resources of these two enterprises cannot support their relatively high intrinsic growth rates. In the case of SAIC-VW and BJ-Hyundai, the internal resources of these two enterprises cannot support new product development, competitive advantage maintenance, or market share maintenance and expansion. This situation is especially evident in China’s rapidly growing new energy vehicle market. SAIC-VW’s resources and capabilities are much higher than BJ-Hyundai’s, and the internal inhibition coefficient is greater than 0, indicating that both enterprises have high levels of internal synergy, division of labor, and management efficiency. The high level of internal management makes up for the lack of intrinsic growth rate.

The third category is Lifan, Gac-Jeep, Gac-Fiat, Qoros, and Borgward. These enterprises have an intrinsic growth rate and an internal inhibition coefficient less than 0, so the theoretical market capacity also shows a negative value. Negative market capacity indicates that these enterprises should choose bankruptcy and liquidation, restructuring, or withdraw from this market. The internal resources and capabilities are not sufficient to maintain their product sales and market share, and there is significant internal competition and internal consumption within the enterprises. The actual market performance and management decisions of these enterprises also validate the model parameter regression results. These enterprises did not perform well in the Chinese market and eventually withdrew from the market. Among them, Lifan chose to restructure and Qoros and Borgward chose to exit this market. Gac-Jeep and Gac-Fiat also chose to quit the path of localized production in China. On 18 July 2022, according to GAC and Stellantis news, the parties are negotiating an orderly termination of the joint venture due to GAC-Fiat’s continued losses in recent years and its inability to resume normal production operations since February 2022. In the future, Stellantis Group will only retain the import business of the Jeep brand in China; the domestically produced Jeep will cease to exist and consumers will still be able to purchase imported Jeep products. In the era of rapid expansion of the Chinese auto market, the SUV-focused Gac-Jeep took good advantage of the market when after a period of hibernation, it quickly went on to glory. Gac-Jeep is one of those companies that started to fall fast after China’s auto market entered the era of stock competition, and the fate of the Fiat and the Jeep brand in China was somewhat similar, with Gac-Fiat turning down sharply after achieving its best annual sales performance in 2014, with less than 3000 units left in 2017.

Although the size of China’s auto market is still very large, the era “on the gravy train” has long become a thing of the past. In recent years, foreign parties, including Changan Suzuki, Dongfeng Renault, Chang’an PSA, and other joint venture brands, have announced their withdrawal from the Chinese market. Early in 2022, Guangzhou Automobile Acura also rumored the intention to withdraw from the Chinese market. Suzuki, one of the first auto enterprises to enter China, established joint ventures with Chang’an and Changhe in the 1990s. However, in 2018, in order to quickly end the performance drag of the Chinese joint venture, Suzuki even transferred its shares of Chang’an Suzuki to Chang’an Group for only USD 1. The French brand Renault, known for its individuality, also established a joint venture with Dongfeng in 2013. After that, the domestic Koleos and Kadjar products were successively launched, but the sales fell rapidly after a short climbing period, and they opted out in 2020.

The repeated entry into and exit from the Chinese market of some foreign auto brands reflects the charm and full competitiveness of the Chinese market. The withdrawal of weak foreign auto brands reflects that the Chinese auto market has entered a period of elimination of the best and the worst, and warns other joint venture brands to invest more energy in product localization and technological innovation. The life cycle of the Chinese auto industry is in a mature stage and is large in scale, but the life cycle of auto companies does not necessarily align with the industry cycle. The two-stage logistic model developed in this paper can be used to make a better determination of the life cycle in which an enterprise is located, which helps automotive manufacturers to make more accurate decisions.

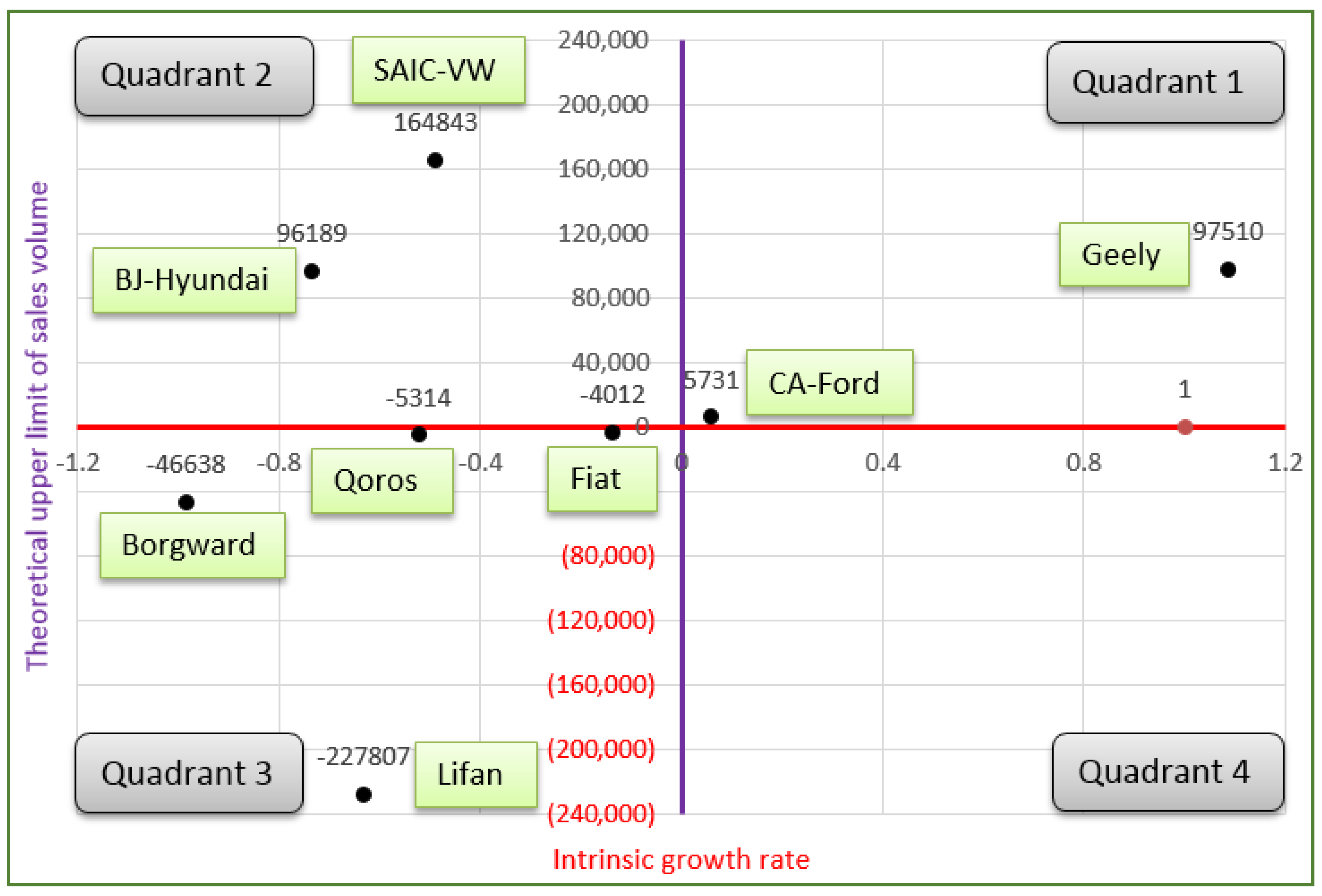

- (3)

Evaluation matrix of intrinsic growth and market potential

In order to more intuitively show the practical significance of the regression results of the two-stage logistic model, this paper constructs a two-coordinate evaluation matrix. This evaluation matrix is somewhat similar to the Boston matrix. The abscissa of the matrix is the intrinsic growth rate (α

2). The ordinate of the matrix is the theoretical market capacity (K

2). Here, this paper defines the theoretical market capacity (K

2) as the market potential variable. The two coordinates divide the whole coordinate system into four quadrants, as shown in

Figure 3.

As shown in the

Figure 3, each quadrant has the following meanings.

Quadrant 1: Enterprises in this quadrant are in the growth period. During this period, the intrinsic growth rate of enterprises’ products was high, and the theoretical upper limit of market sales was also high, which was in a state of double high.

Quadrant 2: Enterprises in this quadrant are in the mature stage. During this period, the intrinsic growth rate of enterprise products was low, but the theoretical upper limit of market sales was high.

Quadrant 3: Enterprises in this quadrant are in recession. During this period, the intrinsic growth rate of enterprise products was low, and the theoretical upper limit of market sales was also low, which was in a state of double low.

Quadrant 4: Enterprises in this quadrant are in the import period. During this period, the new products of the enterprise just came into the market, and the intrinsic growth rate of its products was high, but the theoretical upper limit of market sales was small.

Enterprises located at the edge of the quadrant may migrate to the adjacent quadrant. Enterprises in the import period may migrate to the growth period or the recession period. If the enterprise’s operation measures are appropriate, it will move to the growth period. The normal development of enterprises in the growth stage will migrate to the mature stage. However, if the enterprise makes a wrong management decision, the enterprise may guide the entry migration. This is the situation that enterprises are facing in a second venture.

Some special values may appear in the model operation. Generally, the reliability of data results can be improved by increasing the number of observation values. Due to the large jeep in the measured value of the model in this paper, the coordinate points of other enterprises in the figure are relatively concentrated. In order to improve the recognition between enterprises, we draw the jeep data again after it is presented. The new figure is shown below.

Looking at the

Figure 4, we can find that after excluding special values, the positions determined by the two-coordinate data of other enterprises are relatively scattered. The life cycle judgment of different enterprises can be directly given based on the quadrants of the enterprises. It can be seen that Geely and CA-Ford are in the growth stage, SAIC-VW and BJ-Hyundai are in the mature stage, and Fiat, Qoros, Borgward, and Lifan are in the decline stage. Different enterprises can adjust their operational strategies and strategies based on their own life cycles.

2.3. Robustness Test of Logistic Model

In this paper, the robustness of the model is tested by using a single enterprise with multiple indicators and a single indicator with multiple enterprise scenarios. In the stability test of the single-enterprise multi-index model, diversified financial indicators are comprehensively used to illustrate the stability of the model. These financial indicators include main business income, intangible assets, and employee wages, which can reflect the enterprise characteristics of different life cycles. The data required in this section were taken from the Securities Star website [

62].

- (1)

Multi-indicator test for a single enterprise

In order to verify the robustness of the logistic model, this paper uses a case of model validation analysis with a changed sample, changed main indicators, and changed observation period.

The research variables need to be changed during the stability test, but the key financial data of many automobile manufacturing enterprises are difficult to obtain. Therefore, this paper selects the financial data of listed companies in the automobile manufacturing industry for analysis. BYD Company is a rising star in the automobile manufacturing industry, and its market value ranks first among similar enterprises. The main business income of an automobile manufacturing enterprise is the index data corresponding to the total sales volume. In general, the total sales volume and main business income of an automobile manufacturing enterprise are indicators that change in the same direction. Automobile sales volume is a pure quantitative and scale indicator. The main business income contains more complicated information.

In this paper, the main business revenue, intangible assets, and employee compensation data of BYD Company are selected as the sample data for a single logistic model analysis. The main business revenue data for the study are shown in the following table.

As shown in

Table 7, BYD’s main business revenue shows a continuous upward trend. A logistic regression model is used to analyze the sample data to see if this upward trend is sustainable. The results of the study are shown in the table below.

As shown in

Table 8, the regression of the model is good, and a relatively good fit can be obtained for data of different time periods. This indicates that the population dynamics model can also be used well with the main business revenue data of the enterprise. The theoretical upper limit of BYD’s main business revenue is also gradually increasing from 2010 to 2022, which indicates that BYD’s main business is still in the rising stage, and it is in the growth stage of its life cycle. BYD’s development process is actively pushing innovation-driven and market-driven methods with the help of globalization resources. BYD’s intrinsic growth rate is adjusted downward in the oscillation, and its internal restraint coefficient shows a regular decline. The decline in the internal inhibition coefficient mainly relies on management innovation and management efficiency improvement. The high level of management reduces the internal consumption of the enterprise and allows the synergistic development of all departments within the enterprise. The intangible asset data of BYD Company was selected as the sample data for a single logistic model analysis. The sample data for the study are shown in the following table.

As shown in

Table 9, BYD’s intangible assets show a continuous upward trend. A logistic regression model was used to analyze the sample data to see if this upward trend sustainable. The results of the study are shown in the table below.

As shown in

Table 10, the regression of the model is good, and this indicates that the logistic model can also be used well with the intangible asset data of the enterprise.

As shown in

Table 11, the employee compensation of BYD Company was in a steady growth trend during the observation period. The total remuneration increased from CNY 738 million in September 2010 to CNY 6.693 billion in June 2022. The logistic regression results of total remuneration are shown in the following table.

As shown in

Table 12, although the regression results here are not as good as the first two variables, the theoretical upper limit value is still within a reasonable range, and the regression results are still of good reference value.

- (2)

Single indicator multi-enterprise test

In order to better test the stability of the logistic regression model, this section selects the main business data of eight well-known listed companies from different industries for robustness analysis. Relevant data were taken from Securities Star website [

62], and observation data were selected from March 2015 to March 2022.

Shown in

Table 13 are the statistical characteristics of the main business income data of the sample enterprises. The logistic regression results are shown in the following table.

As shown in

Table 14, the regression effect of the model is very good. The validation case in this subsection fully illustrates the robustness of the logistic model, which still works well under heterogeneous sample and data conditions.