1. Introduction

The global financial crisis of 2009 and the subsequent recession in many parts of the world, coupled with the inability of many African countries including Cameroon to achieve the mandate of the millennium development goals (MDGs), exposed how backward these countries are. The presence of factors such as poverty, limited access to finance and education, and policies have hindered the sustainable development of Cameroon [

1]. Cameroon experienced very slight economic growth in 2019, but it was not inclusive enough to contribute to human capital development meaningfully.

In terms of social indicators, the country has failed to achieve universal basic education [

1]. According to the World Bank [

2], the data for sustainable development goals (SDGs) concerning poverty show that Cameroon faces great socioeconomic inequality between rural areas (where the poverty level is close to 70%) and urban areas (where the poverty rate is around 5%). According to the World Bank’s CPIA macroeconomic score indicators, Cameroon lags behind the average for SDG compliance even though there have been considerable improvements in policies and institutions since 2016. Thus, to help improve the situation, the government and some other organizations, institutions, and agencies are trying to engage the private sector to promote economic growth and diversification. However, private sector organizations are concentrated on health and nutrition, and ignore other vital sectors such as education and financial inclusion.

The UN developed sustainable development goals (SDGs) to complement the leftover MDGs. Thus, many developing countries, particularly Cameroon, developed strategies to reduce poverty and other social vices among citizens to achieve economic growth and sustainable development. Among many areas identified by scholars are areas of financial inclusion, which dwarf the economy of many developing countries, including Cameroon. Hence, many researchers are focused on financial inclusion, financial literacy, and sustainable development issues. According to Alshebami and Aldhyani [

3], financial literacy or awareness is necessary to achieve and maintain well-being among people in general, and young people in particular, in today’s economy.

Some studies in the literature have indicated that many developing countries in Africa face severe macroeconomic problems, ranging from uneven financial stability increasing income inequality to acute poverty and unemployment [

4,

5]. Researchers have suggested using financial inclusion (FI) to improve access to financial services for every segment of society [

6,

7,

8]. The literature established that FI had been a subject of economic research in recent times [

9,

10,

11]. Thus, FI attempts to encourage underprivileged individuals to enjoy financial services. Moreover, FI is now viewed as a policy tool for achieving diverse macroeconomic goals.

Furthermore, FI facilitates capital mobility, creates investment opportunities, promotes savings, improves financial stability, and drives economic progress to achieve sustainable development [

12,

13,

14,

15,

16,

17]. FI has a wide range of positive effects on economic development. It offers low-cost basic financial and banking services to struggling consumers and those who cannot access regular banking services, and it expands access to financial services for low-income individuals [

18]. However, it may be hampered by a lack of financial literacy, preventing financial services from being capitalized to their full potential, thus diluting its impact on sustainable development [

8,

19,

20]. Financial literacy is the ability of an individual to become familiar and/or knowledgeable with financial market products so that they can make informed decisions.

Scholars emphasize the significance of FI, highlighting its role in facilitating easy access to useful and affordable financial products and services. It has recently received much attention from policymakers and practitioners because of its proven effect on improving the wellbeing of poorer individuals. However, the world is still a long way from achieving the financial inclusion for all goal by 2030, with 1.7 billion adults unbanked as of 2017 [

21]. One of the reasons for many unbanked adults and low levels of FI in many parts of the world is the reluctance of formal financial institutions to provide financial services to the poor because it is considered non-profiteering (Mia et al., 2019). A lack of financial literacy is also to blame [

8].

Many established studies in the literature focused on FI and sustainable development. The outcome of the studies varies; some are supportive of the concept while others are not. However, the most significant issue is that FI is associated with economic growth and sustainability [

22,

23,

24]. Investigations show that the dilemma of effective FI is linked to developing countries, while developed countries have functional access to financial services. According to Aguera [

25], approximately 77% of people living on less than

$2 per day do not have a bank account, hence do not have access to financial services.

Therefore, it is significant for developing countries, particularly Africa, to embark on policies that will promote access to financial services to boost their economic growth and achieve sustainability. Thus, research has revealed a plethora of benefits linked to FI for both individuals and businesses. For example, FI is crucial in alleviating poverty and economic disparities [

13,

26,

27]. Furthermore, it encourages entrepreneurship and promotes productive investment and economic development. Access to and use of financial services boosts household welfare through higher consumption, increases investments, productivity, and entrepreneurship among women, and minimizes gender income inequality [

28].

In Africa, the level of economic activities, growth, and development between countries determines FI. There is significant variation in FI between sub-Saharan African countries. Some regions are ahead of others with regards to FI, such as Southern Africa, West Africa, and Central Africa. In support of the preceding discussion, Demirgüç-Kunt et al. [

29] opined that South Africa’s experience primarily drives the high level of financial inclusion in the Southern Africa region. In contrast, Kenya’s large mobile money system adoption is primarily driven by Eastern Africa. While in West Africa, it is driven by Nigeria’s economy, the largest in Africa. Compared to neighboring regions, financial inclusion in Central Africa remains relatively low, at least in terms of account penetration. According to Demirgüç-Kunt and Klapper [

30], only 11% of adults in the Central African sub-region operate an account with financial institutions, lower than the average of 27% in sub-Saharan Africa.

However, information and communications technology (ICT) and the digital economy have a growing influence in accessing financial services across the continent, including Cameroon. For example, the Central African economic and monetary community (CEMAC) region has an estimated internet and mobile phone penetration rate of 80% [

31]. In Cameroon, the value of mobile banking transactions as a proportion of GDP has risen from 0.08% in 2013 to 4.50% in 2016, and then to 30.24% in 2018. This demonstrates the significance of these phenomena and helps to explain the country’s growth rates [

32]. Additionally, Cameroon saw a notable increase in terms of FI, whether in terms of deposits or borrowings in commercial banks, with a growth rate of 3.8% in 2018 [

33]. Moreover, Cameroon benefits immensely from this scenario as research demonstrates that financial inclusion lowers information and transaction costs. This impacts savings rates, investment decisions, technological innovation, and sustainable development [

18].

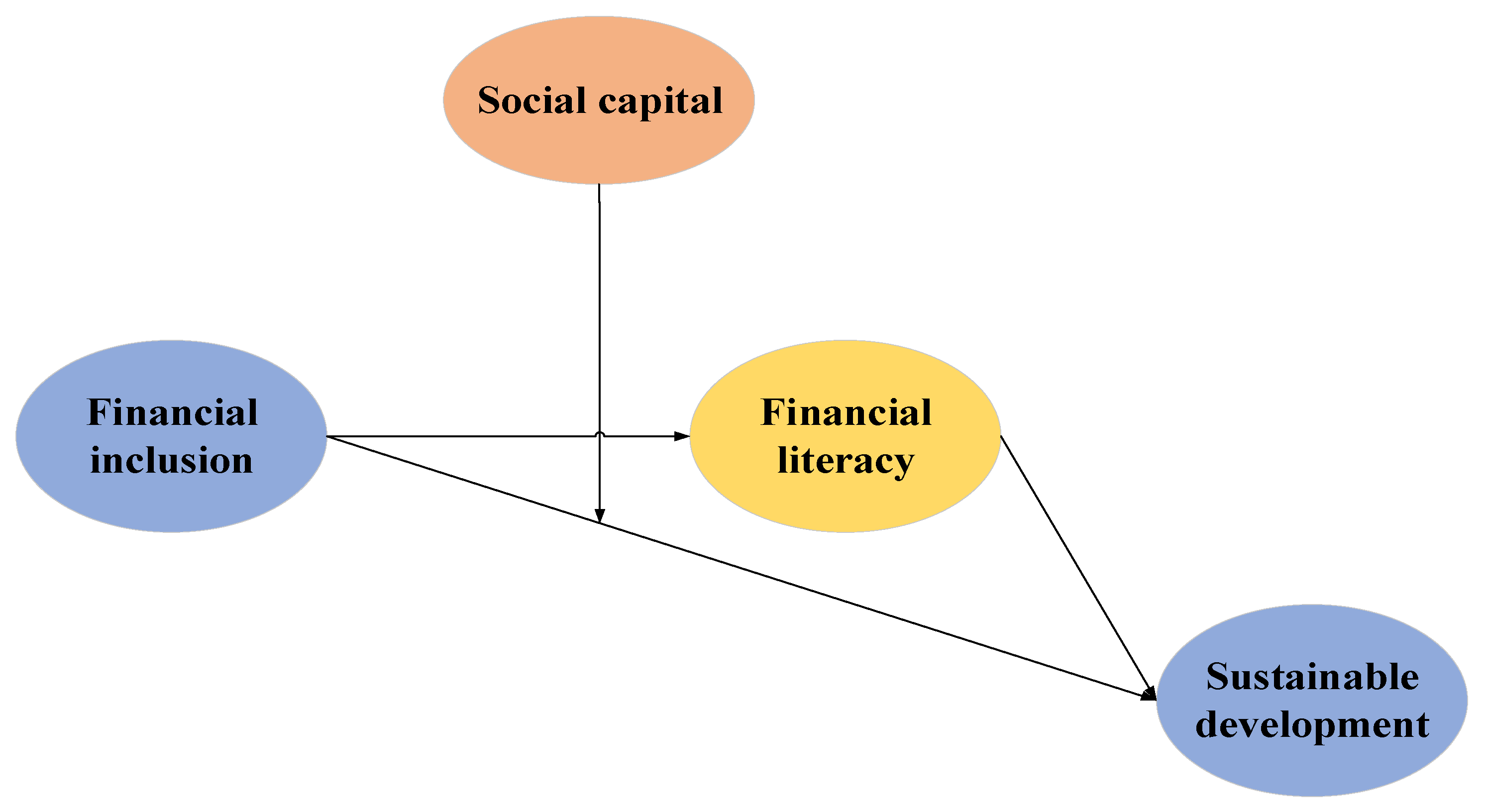

Therefore, having established the current trends from the literature between the two dimensions (FI and sustainable development), the current study introduced two intervening variables (financial literacy and social capital) as mediating and moderating variables. Although sustainable development appears to be macro, it can be captured at the micro-level, similar to the other constructs of financial inclusion, financial literacy, and social capital. This is because previous studies [

24,

34,

35,

36] have used them together across different domains. In addition, since the human development index has been used as a proxy for sustainable development, Castells-Quintana [

37] and Sen [

38] emphasized that it is the most accurate method of measuring development. It considers literacy rates and life expectancy, which affect productivity and may lead to inclusive economic growth. According to Jāhāna [

39], the human development index creates more education, healthcare, employment, and environmental conservation opportunities. All these issues that define sustainable development could be measured using individual perceptions. With competing pressure worldwide regarding access to financial services, which some previous studies suggested are limited by financial literacy [

8,

20], the current study introduced the intervening variables to fill this gap in the literature. The two intervening variables have not been jointly tested previously in the relationship between FI and sustainable development. Therefore, this paper aims to examine the mediating effect of financial literacy and the moderating role of social capital on the relationship between financial inclusion and sustainable development. The paper would make significant theoretical and practical contributions in that two intervening variables were introduced. This paper is structured into six sections: introduction, literature review and concepts, theoretical underpinning and research model, research design and methods, data analysis and results, conclusions and limitations.

3. Theoretical Underpinning and Research Model

The current study is underpinned by a good public theory of FI, which is one of the FI beneficiaries’ theories. There are various arguments regarding who benefits from the outcomes of FI. Growing evidence shows poor people primarily benefit most from FI [

100]. In contrast, the literature indicates that women are most likely to benefit from FI outcomes [

101,

102,

103]. Furthermore, some studies believe the largest beneficiaries of FI are the economy and the financial system [

103,

104,

105,

106]. Aside from women and the poor, the literature has overlooked the young and the elderly. Others include institutionalized people expelled from the financial sector likely due to criminal offenses committed.

Formal financial services, according to the theory, are a public good that should be made available to everyone for everyone’s benefit. As a result, everyone should have unrestricted access to finance. According to the literature, as a public good, one person’s access to formal financial services does not limit its availability to others. Similarly, all elements of the population could be integrated into the formal financial sector for the benefit of all. According to this theory, all population members benefit from FI, and no one is excluded [

107]. From the preceding discussion, the good public theory of FI can explain the theoretical model of the current study. The major objective of the study is to investigate the relationship between FI and SD in Cameroon.

Financial inclusion, as previously mentioned, focuses on providing formal, accessible financial services to all persons and enterprises, whereas sustainable development aims to meet the requirements of the present without jeopardizing the ability of future generations to do the same [

108]. The economic, environmental, and social components of sustainable development are its three main pillars [

109]. Financial inclusion meets sustainable development in its aspects of economic and social dimensions. The economic dimension of sustainable development relates to financial inclusion because financial institutions can reach out to the unbanked segments through account ownership schemes and affordable financial services to improve their economic conditions. This could improve the welfare of the people and increase the profitability of financial institutions which in turn contributes to job creation and higher economic growth, leading to sustainable development.

On the other hand, the social dimension of sustainable development relates to financial inclusion. This is because financial institutions must deal with financially included people with respect, care, and fairness through fair pricing of basic financial products and services. Thus, when financial inclusion policies are implemented by financial institutions that function within the existing economic and social systems that are crucial for sustainable development, there is a connection between financial inclusion and sustainable development.

Recent literature implies that a sizable portion of Africa’s population is still financially excluded [

110,

111]. Thus, the theory entails how the poor, women, and others less privileged in society should have unrestricted access to financial services, leading to economic growth and sustainability. The best way to achieve this is through effective FL.

Figure 1 shows the proposed conceptual model of the study. The model indicates the relationship between financial inclusion and sustainable development. Financial inclusion has three dimensions (access, usage, and barrier). In the same vein, sustainable development has three dimensions (social, economic, and environmental). The model also shows the two intervening variables, mediating effect of financial literacy and moderating role of social capital with four dimensions (collective action, bridging, bonding, and trust).

3.1. Hypotheses Development and Conceptual Model

3.1.1. Financial Inclusion and Sustainable Development Relationship

Many studies on economics and finance indicate a significant relationship between FI and SD [

8,

24]. Fine [

112] considers economic development to increase or improve living standards, self-esteem needs, freedom from oppression, and increased choice. The study also emphasized that the human development index (HDI) is the most accurate method for measuring development. It considers literacy rates and life expectancy, which affect productivity and lead to inclusive economic growth. According to UNDP [

40], the human development index creates more education, healthcare, employment, and environmental conservation opportunities. It simply means that everyone’s per capita income will rise. Thus, economic development can be more meaningful and sustainable if human development is prioritized in development plans. Thus, the literature supports financial inclusion to provide access to financial services to reduce poverty and improve the standard of living [

10].

Dipasha [

22] examines the relationship between the various dimensions of FI and the economic development of the emerging Indian economy. The findings of the empirical study show a positive relationship between economic development and various aspects of FI, specifically banking penetration, availability of banking services, and deposit usage. Babajide et al. [

113] examined the impact of FI on economic growth in Nigeria. The study focused on the factors that influence FI and its impact on economic growth. Secondary data were obtained from world development indicators, and the data were analyzed using the ordinary least square regression model. The study results revealed that FI is a significant determinant of total production and capital per worker, which determines the final level of output in the economy.

Sarma and Pais [

34] investigated the issue of FI concerning India’s development. The study focused on the relationship between FI and development across the country. According to their findings, the country’s levels of human development and FI are closely related, with a few exceptions. Income is positively associated with levels of FI among socioeconomic factors. However, the study of Adah and Abu [

36] examined FI and SD in Nigeria. An empirical diagnosis presents a different outcome. Credit and capital market penetrations thus serve as proxies for FI, while the HDI serves as a proxy for long-term economic development. The results show significant probability values for the credit penetration variable at 0.05 significance levels, but the coefficient is negative. Despite its significant value, it has a negative impact on the economy during the study period.

On the other hand, the capital market has a positive beta coefficient despite not having a significant probability value at 0.05. This also implies that CMP appears to positively impact the economy, albeit with a low probability value. As a result, the null hypothesis of this study, that financial inclusion has had no significant impact on Nigeria’s sustainable economic development, is not rejected.

Furthermore, Khan et al. [

8] examined the impact of FI on poverty, income inequality, and financial stability using panel data from 54 African countries. Thus, to accomplish this, the current study employed multiple regressions on an unbalanced panel dataset of 54 African countries based on the four-year mean value from 2001 to 2019. According to the findings, FI is an important indicator because it reduces poverty, income inequality and improves financial stability, leading to economic development. From the preceding discussion, the study suggests the following hypothesis:

H1. Financial inclusion is significantly associated with sustainable development in Cameroon.

3.1.2. Financial Inclusion and Financial Literacy Relationship

As mentioned earlier, scholars are interested in issues concerning FI and its effect on the overall economy, which many studies indicated were limited by FL. Studies have examined the relationship between FI and FL, many of which present a significant association between the two dimensions. Thus, describing financial illiteracy as a significant impediment to the process of financial inclusion [

68,

114,

115,

116,

117,

118,

119]. Hasan et al. [

120] investigated how FL impacts inclusive finance. The study used three econometrics models: logistic regression, probit regression, and complementary log-log regression, to see if FL has a significant impact on removing barriers that prevent people from accessing and using financial services to better their lives. The empirical findings revealed that knowledge about various financial services significantly impacted obtaining financial access. Some variables, such as income level, profession, knowledge of depositing and withdrawing money, and knowledge of interest rates, significantly impacted overall access to finance.

According to Kou et al. [

121], access to finance is a challenge; thus, various national and international organizations regarded FL as one of the influential FI components. Shen et al. [

122] showed that, except for internet usage, there is a statistically significant relationship between digital financial product usage and FL. FI was not influenced solely by FL; however, combining FL and internet use may improve financial access [

120]. Similarly, Hussain et al. [

123] investigated the link between education level and business owners’ use of financial services. They discovered that FL influenced a firm’s access to finance and its growth.

Furthermore, due to the increased use of technology, Tryon [

120] identified financial education as one of the twenty-first century’s most popular financial and economic terms. In this case, it was necessary to obtain technical education to discover new ways to operate new financial technologies. Based on the evidence above, the study suggests the following hypothesis:

H2. Financial inclusion is significantly associated with financial literacy in Cameroon.

3.1.3. The Mediating Effect of Financial Literacy on Financial Inclusion and Sustainable Development

The preceding discussion presents enough evidence in the finance and economics literature that FI leads to sustainable economic development. There is also growing evidence that this link hinges upon effective FL. As a result, the UN agency proposed that targeted FI and financial education policies help bridge inclusion gaps by directing assistance where it is most needed, thereby contributing to inclusive growth and more sustainable societies worldwide. Furthermore, recent cross-country empirical evidence suggests that increased FL leads to increased FI at the national level. Improving FL would benefit all countries at different stages of economic and financial development [

124]. FL regards the ability of individuals to process economic facts and figures to make informed decisions about financial planning, wealth accumulation, annuities, and debt management [

52].

Scholars and experts believe that FL consists of financial attitude, financial knowledge, and financial behavior [

42,

125,

126,

127,

128]. Thus, policymakers and stakeholders can achieve FI through effective FL to ensure sustainable economic growth and development [

129]. Scholars have discovered that financial knowledge influences financial management performance and behavior and that consumers with more financial knowledge have better financial behavior [

130,

131,

132]. Therefore, by understanding better financial behavior, excluded members of society can now have access to financial services, improve their standard of living, and achieve economic growth and sustainability.

Kaur and Bansal [

133] investigated the role of financial products and services in mediating the relationship between financial access and MSME growth in India. The primary goal of the research is to determine what role financial goods and services play in mediating the link between financial access and the growth of micro, small, and medium-sized enterprises (MSMEs) in developing markets. The results confirmed the mediating effect though the finding could still be confirmed in other emerging economies. Using data from rural Uganda, Bongomin et al. [

134] sought to establish the mediating role of financial intermediaries in the relationship between financial literacy and financial inclusion of the poor in developing countries. The study used the PLS-SEM model, and the findings reveal that financial intermediaries significantly mediate the relationship between FL and FI.

According to Huston [

125], financial knowledge was specified as an input to model the need for financial education and explain variation in financial outcomes. According to Wang et al. [

135], a lack of financial knowledge increases the likelihood of making unsecured P2P and personal loans. According to the literature, FL impedes financial inclusion and may stymie economic development [

68,

115,

116,

117,

118,

119,

120,

121,

122,

123,

124,

125,

126,

127,

128,

136]. Furthermore, financial literacy is strongly linked to developing every country’s financial system and economic development by accelerating economic security and lowering unemployment. As a result, it has far-reaching implications for personal financial decisions [

50,

52,

53,

54,

56,

57,

131]. Therefore, FL can mediate the relationship between FI and SD. Based on the above evidence in the literature, the study suggests the next hypothesis:

H3. Financial literacy significantly mediates the relationship between financial inclusion and sustainable development in Cameroon.

3.1.4. The Moderating Role of Social Capital on Financial Inclusion and Sustainable Development

Social capital could provide an important strength in ensuring FI and can lead to sustainable economic development. People who fall into rural organizations or production groups consider SC as immaterial assets. This creates a collective action capacity for them, allowing access to resources, identifying new ways of meeting needs, and responsible use of financial services [

137]. Shim et al. [

138] discovered that adolescent financial education is linked to financial behavior, attitudes, and learning, whether at school, home, or workplace.

Many studies have used SC as a moderating variable, some with similar independent variables similar to the current study, while others have different dimensions. Onodugo et al. [

65] investigated the role of social capital in moderating the effect of financial behavior on FI. The study’s goal was to empirically test the moderating effects of collective action, bonding, trust, and bridging on the impact of financial behavior on FI. The findings indicate that financial behavior has a positive main effect on financial inclusion. Two of the four dimensions of social capital (collective action and bridging) had a significant moderating effect in the relationship, while bonding and trust were statistically insignificant. Rezazadeh et al. [

139] investigated the moderating role of SC in developing tourism and urban sustainable development in Zahedan. According to the findings, SC had a moderating effect on the relationship between tourism development and sustainable urban development, to the extent that social capital explains 25% of the variation in the variable of interest.

Khaki and Sangmi [

140] assess the impact of access to finance on the socio-political empowerment of Swarnjayanti Gram Swarozgar Yojana (SGSY) beneficiaries, now known as the National Rural Livelihood Mission (NRLM). According to the findings, access to finance positively impacts almost all socio-political indicators of empowerment, with the impact on FL and economic awareness being relatively lower. Moreover, Bongomin et al. [

61] discovered that bonding acts as a mediator between FL and FI. As a result, bonding could increase the amount of financial information available to businesses, allowing them to execute financial strategies that allow them to access financial services continuously. Based on the above evidence, the study suggests the following hypothesis:

H4. Social capital significantly moderates the relationship between financial inclusion and sustainable development in Cameroon.

5. Data Analysis and Results

To test the study’s measurement model, the researcher looked at the reliability of the items, measuring each potential structure and the internal consistency reliability (discriminant validity, construct reliability, and convergence validity) [

150]. Hair et al. [

151] proposed an external load of between 0.40 and 0.70 as reliable and acceptable. They believe that an item should only be deleted when it will increase the reliability of constructs AVE or composite reliability.

Figure 2 shows that the endogenous variable, FI, has 13 indicators (as BRR2 was deleted), while SD has 13 as none were removed from its indicators. The moderator, SC, has 7 indicators (as BND2, BND3, TRS1, TRS2, and TRS3 were deleted), while the mediating variable, FL, has 7 indicators. None had a loading below the threshold.

As shown in

Figure 2, the loading must be between 0.40 and 0.70 to retain a specific indicator; hence, the deletion is subject to the AVE and CR increment. As a result of Hair et al.’s [

152] rule of thumb, only 6 items out of 45 measuring 4 constructs in this study were deleted, leaving the remaining 39 items for further analysis (see

Figure 2).

Table 1 shows the loading of the individual items.

From

Table 1, the indicators have loadings of 0.50 and higher. Although some of the items have loadings below 0.70, they were retained because they are above the critical level of 0.40. However, removing the items with lower loadings would have no significant impact on the AVE or CR. Based on the criterion established by [

147], it is concluded that all the remaining items are reliable in measuring their respective reflective latent constructs.

5.1. Discriminant Validity of the Model

The extent to which a construct differs from one another empirically is referred to as discriminant validity. As a result, the study assesses discriminant validity using the heterotrait–monotrait (HTMT) ratio and the Fornell and Larcker correlation criterion. The study used only the HTMT.

The heterotrait–monotrait (HTMT) ratio of correlation was used to assess the discriminant validity further. Henseler et al. [

153] emphasized the superior performance of the HTMT ratio (also see [

154]) using the Monte Carlo simulation study. They discovered that HTMT achieves higher specificity and sensitivity rates (97% to 99%) when compared to the cross-loadings criterion (0.00%) and Fornell–Lacker (20.82%).

From

Table 2, it can be seen that using the HTMT involves comparing it to a predetermined threshold. Thus, if the HTMT value is greater than the predefined threshold, it can be concluded that there is an absence of discriminant validity. Several authors propose a benchmark of 0.85 [

155]. Furthermore, Gold et al. [

156] proposed a value of 0.90 as the acceptable threshold. Based on this criterion, this study’s reflective latent constructs have achieved discriminant validity, as none exceed 0.90.

5.2. Structural Model Assessment: Direct Relationship

After all the requirements of the measurement model are satisfied, the structural model is then evaluated. Therefore, this section presents the results of the structural equation model. Both the direct and indirect relationships were analyzed using bootstrap analysis. Specifically, the standard bootstrapping procedure was employed for 381 cases to assess the significance of the path coefficients of both direct and indirect relationships [

147], [

150].

Considering the objective of this study, the researcher analyzed the data using structural equation modelling for both direct and indirect relationships (see [

147,

157,

158]). The first evaluation was undertaken to assess the theoretical relationships. Specifically, standard bootstrap was adopted on a sample of 381 to evaluate the importance of path coefficients for the direct relationships [

147,

150,

159]. The structural model was used to test the study’s hypotheses and assess the model’s coefficient of determination, effect size, and predictive relevance, as shown in

Figure 3.

Table 3 presents the results of the test of hypotheses. The relationship between FI was found to be positive and significantly related to FL (β = 0.767 t−value = 21.627 and

p value < 0.000). FI was also found to have a positive and significant relationship with SD (β = 0.401 t−value = 6.477 and

p value < 0.000). FL was found to have a positive and significant effect on the SD of Cameroon (β = 0.305 t−value = 5.509 and

p value < 0.000). The results further show that SC has a positive and significant effect on SD (β = −0.214 t−value = 3.536 and

p value < 0.000). However, the results show that SC does not moderate the relationship between FI and SD (β = −0.049 t−value = 2.358 and

p value < 0.000). The relationship between SC and SD was found to be positive and significant (β = 0.214 t−value = 3.536 and

p value < 0.000). Finally, the results show that FL mediates the relationship between FI and SD (β = 0.233 t−value = 5.312 and

p value < 0.000). The mediation is complimentary because both the direct relationship and the indirect relationship are significant.

In summary, five alternate hypotheses out of six were supported empirically for all the direct and indirect relationships between the latent exogenous and endogenous constructs, while one hypothesis was not supported.

5.3. Coefficient of Determination for the Relationships

Apart from assessing the significance and relevance of the path model, another commonly used measure of evaluating the structural model relationships is assessing the level of R-square or the coefficient of determination [

160]. The R-square (R²) measures the predictive power of a model; thus, it is computed as the squared correlation between the independent variable’s actual and predicted value [

147].

Table 4 reports the R-square stood at 0.834, which implies that the exogenous variable of the study explains approximately 83.4% of the variation in the sustainable development of Cameroon. In comparison, the remaining 16.6% is explained by other factors not captured in this study. The Q² values appeared to be greater than zero, which implies that they have predictive relevance in the model. The results also show that financial inclusion has a large effect when it comes to contribution to sustainable development.

5.4. Discussion

The study attempts to answer the research question: what is the mediating effect of financial literacy and the moderating effect of social capital on the relationship between financial inclusion and sustainable development? The study was able to answer the question using empirical data, thereby revealing the effects of the two intervening variables. The results show that the relationship between FI and FL was found to be positive and significant. This finding is in line with the findings of previous studies [

119,

122], which found a positive and significant relationship between FI and FL. The findings also reveal that FI was found to have positively and significantly affected sustainable development. This corroborates the findings of some previous studies [

104,

113] conducted in other climes.

In addition, the results of this study further indicate that SC has a positive and significant effect on SD. This finding corroborates that of Bongomin et al. [

61]. Furthermore, the results show that FL mediates the relationship between FI and SD. The finding is in line with previous studies [

50,

51,

53,

56]. Finally, the results reveal that SC does not moderate the relationship between FI and SD. This might be as a result of the fact that the direct relationship between social capital and sustainable development is positive and significant, as Soyemi, and Olowofela [

161] confirmed. However, the finding is contrary to most previous studies, which found a positive and significant moderating effect of SC [

65,

114,

139].

5.5. Implications

The findings imply that FL influences a firm’s access to finance and its growth. This means that the knowledge of firms and individuals about various financial products and services significantly impacts financial access, which promotes financial inclusion. Knowledge of other factors, such as income level, profession, deposits and withdrawals, and interest rates could improve access to finance. This suggests that when customers are aware that the financial institutions are located in convenient places, their loan processes are simplified, and that they can carry out so many banking transactions with ease, the level of financial inclusion will be higher. Thus, policymakers and stakeholders can achieve financial inclusion through adequate FL to ensure sustainable economic growth and development.

Moreover, the findings of this study suggest that the availability of affordable financial services that are easily accessible by the masses enables them to access education and health services that promote SD. In the same vein, the findings indicate that FI (in terms of access and usage) could help to reduce poverty levels and differences in income in Cameroon. This further suggests that FI reduces unemployment and facilitates investments in agriculture and livestock sectors, supporting sustainable development. Therefore, the more people that are financially included in Cameroon, the more social, economic, and environmental development goals can be achieved. Another implication of this finding is that some factors, such as income level, knowledge of depositing and withdrawing money, interest rate awareness, and occupation, significantly impacted overall access to finance, promoting SD. The study’s findings provide policymakers with helpful advice for improving financial inclusion in emerging countries.

The results of this study suggest that the value of trust, reciprocity, shared values, networking, and norms in connections between people in firms and between enterprises and other firms greatly impacts Cameroon’s sustainable development. Therefore, positive SC endowment creates conditions for an inclusive financial process and strengthens the population’s capacity to engage in social learning, improve risk management, and facilitate social and economic development.

Furthermore, another important implication of this study following the findings is that when people are familiar with and understand financial market products to make informed decisions, particularly rewards and risks, they would be more financially included, leading to sustainable development. This shows that financial inclusion in developing countries such as Cameroon is influenced by motivation for saving, borrowing, and using financial products and services, which eventually supports sustainable development. This further suggests that developing countries can use financial literacy as a conduit through which financial inclusion facilitates social, economic, and environmental development.

The testing of financial literacy and social capital as mediating and moderating variables in the relationship between financial inclusion and sustainable development has generated a new framework which extends the previous models in the field of sustainable development literature. Modelling the intervening variables in the said relationship has added novelty and new perspectives to the theories’ postulations using empirical evidence.

The study has identified factors that developing countries, especially Cameroon, could take advantage of to achieve sustainable development. The knowledge of those factors, such as income level, profession, deposits and withdrawals, and interest rates could lead to improved access to finance. This implies that when the government formulates policies to place financial institutions in convenient places and simplifies loan processes, the level of financial inclusion will be higher. Thus, policymakers and stakeholders can achieve financial inclusion through effective financial literacy to ensure sustainable economic growth and development.

Finally, the results of this study imply that social capital does not strengthen the relationship between FI and SD to promote FI. The lack of moderation by SC might not be unconnected with the positive and significant effect of the direct relationship (Baron and Kenny, 1986). The results imply that complex interactions between social components of the internal network structure, connections and links with external actors, and a synergistic relationship between the institution and the state did not strengthen the relationship between FI and SD.

6. Conclusions and Limitations

The study examined the mediating effect of financial literacy and the moderating effect of social capital on the relationship between financial inclusion and the sustainable development of Cameroon. It concludes that financial inclusion is an important predictor of sustainable development. Therefore, usage and access to finance could facilitate social, economic, and environmental development. The study also concludes that knowledge of various financial products and services by firms and individuals across Cameroon significantly influences financial access, promoting FI and facilitating socio-economic development. It is also concluded that FL, through the knowledge of factors such as income level, deposits and withdrawals, and interest rates, could lead to improved access to finance, which positively affects SD. FL, therefore, becomes an important conduit through which FI, by providing affordable financial products and services, can trigger the betterment of the wellbeing of citizens in Cameroon.

Furthermore, the study concludes that SC is an important predictor of SD, but does not strengthen the relationship between FI and SD. With this conclusion, the study has provided empirical and additional evidence to the literature regarding the mediating role of FL on the relationship between FI and SD. Thus, the study lends theoretical and empirical support to the good public theory of financial inclusion. The findings of this study have confirmed the postulations of the theory and the linkage between FI and SD. The findings and contributions of this study also provide useful insights and practical implications for financial institutions and governments, especially in developing countries.

The major limitation of this study was that it covered only Cameroon rather than many developing countries considering the variable of interest, SD. Sustainable development is an issue of concern to many African countries, and as a result, a cross-country investigation will be needed. The study was also cross-sectional in nature, and thus a longitudinal approach is required to ascertain the impacts of FI on SD over different periods. Another limitation for this study was the use of convenience sampling. This might have caused inaccurate representation and researcher bias. However, effort was made to ensure that such bias was eliminated by the researchers to ensure accurate data was collected. Future studies can use other sampling techniques not prone to those limitations mentioned. Finally, since social capital was found to have no moderating effect on the relationship between FI and SD, future studies can test its mediating effect on the same relationship.