Optimal Structuring of Investments in Electricity Generation Projects in Colombia with Non-Conventional Energy Sources

Abstract

:1. Introduction

- The use and comparison of three metaheuristic techniques applied to the LCOE method. This makes it possible to define a different investment portfolio for each metaheuristic technique that minimizes GC, providing the investor with several investment alternatives.

- Implementation of two risk assessment methods for NCRES investments, taking as reference the optimal portfolios and minimum GC (USD/kWh) calculated with the metaheuristic techniques and the LCOE. These methods are: (1) DCF method with Monte Carlo simulation and VaR, whose financial indicators are NPV(MUSD) and VaR (MUSD), respectively; and (2) RO method with Black and Scholes, whose financial indicator is NPV (MUSD).

- The integration of aforementioned approaches to assess NCRES projects within an iterative methodology that provides potential investors with a set of decision options.

- The proposal of fiscal and economic incentives to make NCRES electricity generation projects viable. In this case, four technologies were considered: forest biomass (FB), urban solid waste (USW), solar photovoltaic (PV), and wind power (WP).

2. Methodology

2.1. Levelized Cost of Electricity and Tax Incentives in Colombia

2.2. Discounted Cash Flow with Monte Carlo and VaR Simulation

2.3. Real Options

2.4. Metaheuristics Applied for GC Minimization

2.5. Genetic Algorithm (GA)

2.6. Particle Swarm Optimization (PSO)

2.7. Differential Evolution (DE)

2.8. Problem Statement

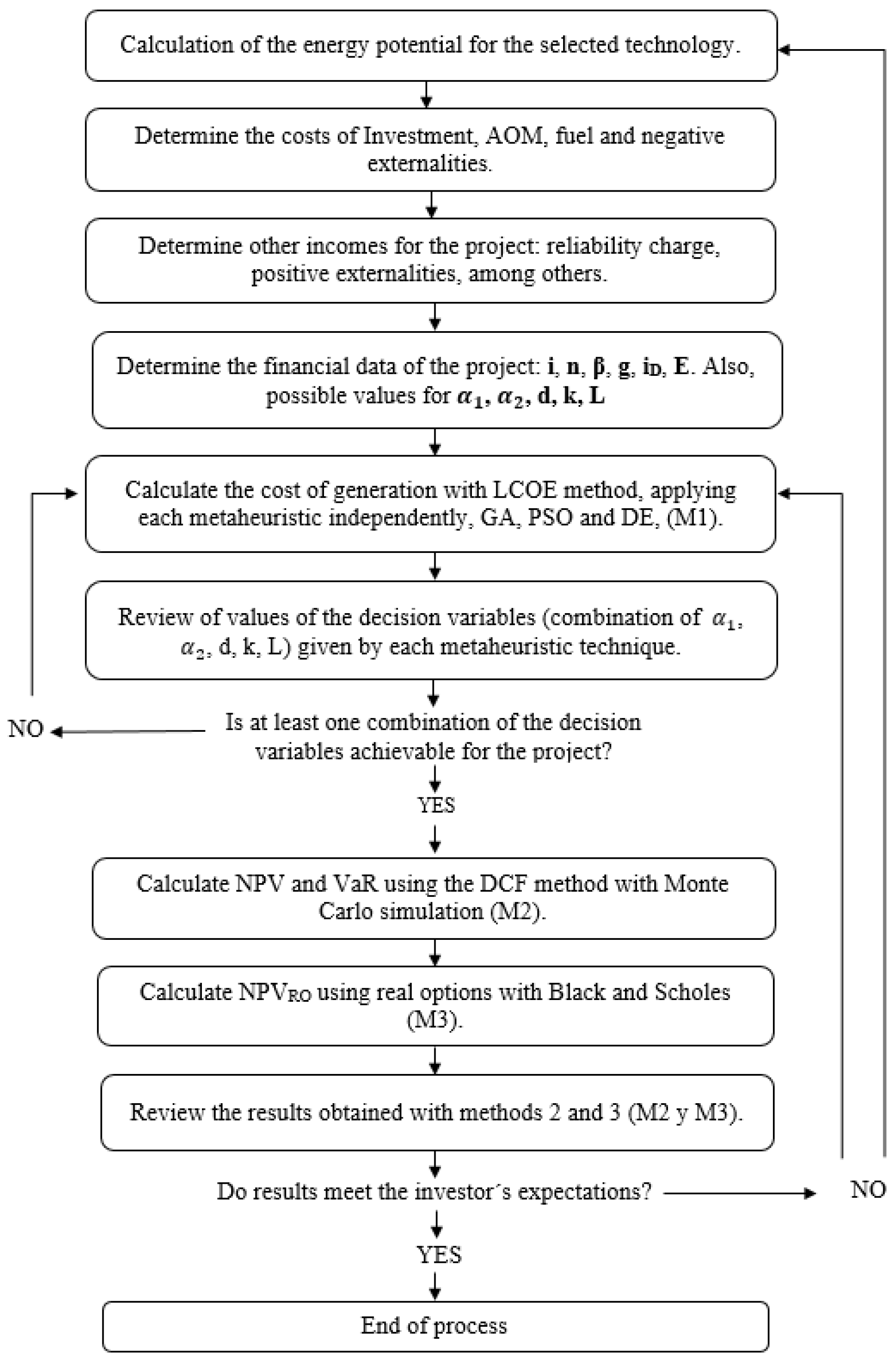

2.9. Summary of the Proposed Methodology

- Step 1: Select the generation technology (FB, USW, PV, or WP) and calculate its energy potential.

- Step 2: Determine the initial investment costs, variable and fixed OM, fuels, negative externalities, and other costs necessary for the installation, commissioning, and operation of the project.

- Step 3: Determine other revenues that the project may have, other than those obtained from electricity production, such as, for example, the reliability charge and positive externalities.

- Step 4: Determine the financial data for the project: discount rate, tax rate, inflation rate, interest rate, term and grace period for the debt, and operating life of the project (in years).

- Step 5: Enter project costs, revenues, and financial data for each metaheuristic technique, GA, PSO, and DE, which are part of M1.

- Step 6: Check if the combinations of project decision variables obtained with M1 are achievable for the investor: (1) equity percentage, (2) debt percentage, (3) depreciation years, (4) grace period, and (5) debt term. In case none of them are achievable, go back to item 5 to run again each metaheuristic technique and review the new combinations.

- Step 6: Evaluate combinations of decision variables and GCs of technologies in M2 and M3.

- Step 7: Review the expected NPV and NPVRO, obtained with M2 and M3, respectively, as well as the VaR obtained with M2. If the results are not as desired, return to item 5 to run each metaheuristic technique again and review the new combinations; otherwise, select the combination of decision variables that is most appropriate for the project and achievable for the investor (end of the methodology).

- Step 8: Revise the technical and financial information of the project or increase the GC of the technology to a value that allows obtaining better results with M2 and M3. This is in case no acceptable combinations of decision variables are obtained for the investor, after n simulations with M1.

3. Tests and Results

4. Recommendations

4.1. Investment Tax Incentives

4.2. Economic Incentives

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Saldarriaga-Loaiza, J.D.; López-Lezama, J.M.; Villada-Duque, F. Methodologies for structuring investments in renewable energy projects. Inf. Tecnol. 2022, 33, 189–202. [Google Scholar] [CrossRef]

- López, A.R.; Krumm, A.; Schattenhofer, L.; Burandt, T.; Montoya, F.C.; Oberländer, N.; Oei, P.Y. Solar PV generation in Colombia—A qualitative and quantitative approach to analyze the potential of solar energy market. Renew. Energy 2020, 148, 1266–1279. [Google Scholar] [CrossRef]

- Robles-Algarín, C.A.; Taborda-Giraldo, J.A.; Ospino-Castro, A.J. Procedimiento para la Selección de Criterios en la Planificación Energética de Zonas Rurales Colombianas. Inf. Tecnol. 2018, 29, 71–80. [Google Scholar] [CrossRef] [Green Version]

- He, L.; Liu, R.; Zhong, Z.; Wang, D.; Xia, Y. Can green financial development promote renewable energy investment efficiency? A consideration of bank credit. Renew. Energy 2019, 143, 974–984. [Google Scholar] [CrossRef]

- Liu, Y.; Zheng, R.; Chen, S.; Yuan, J. The economy of wind-integrated-energy-storage projects in China’s upcoming power market: A real options approach. Resour. Policy 2019, 63, 101434. [Google Scholar] [CrossRef]

- Yang, X.; He, L.; Zhong, Z.; Wang, D. How does China’s green institutional environment affect renewable energy investments? The nonlinear perspective. Sci. Total. Environ. 2020, 727, 138689. [Google Scholar] [CrossRef]

- Wu, Y.; Wang, J.; Ji, S.; Song, Z. Renewable energy investment risk assessment for nations along China’s Belt & Road Initiative: An ANP-cloud model method. Energy 2019, 190, 116381. [Google Scholar] [CrossRef]

- Ziyaei, P.; Khorasanchi, M.; Sayyaadi, H.; Sadollah, A. Minimizing the levelized cost of energy in an offshore wind farm with non-homogeneous turbines through layout optimization. Ocean. Eng. 2019, 249, 110859. [Google Scholar] [CrossRef]

- Petrovic, A.; Durisic, Z. Genetic algorithm based optimized model for the selection of wind turbine for any site-specific wind conditions. Energy 2022, 236, 121476. [Google Scholar] [CrossRef]

- El Hamdani, F.; Vaudreuil, S.; Abderafi, S.; Bounahmidi, T. Determination of design parameters to minimize LCOE, for a 1 MWe CSP plant in different sites. Renew. Energy 2022, 169, 1013–1025. [Google Scholar] [CrossRef]

- Singh, P.; Pandit, M.; Srivastava, L. Optimization of Levelized Cost of Hybrid Wind-Solar-Diesel-Battery System Using Political Optimizer. In Proceedings of the 2020 IEEE First International Conference on Smart Technologies for Power, Energy and Control (STPEC), Nagpur, India, 25–26 September 2020; pp. 1–6. [Google Scholar] [CrossRef]

- Seulki, H.; Kim, J. A multi-period MILP model for the investment and design planning of a national-level complex renewable energy supply system. Renew. Energy 2021, 141, 736–750. [Google Scholar]

- Qadir, S.A.; Al-Motairi, H.; Tahir, F.; Al-Fagih, L. Incentives and strategies for financing the renewable energy transition: A review. Energy Rep. 2021, 7, 3590–3606. [Google Scholar] [CrossRef]

- Radpour, S.; Gemechu, E.; Ahiduzzaman, M.; Kumar, A. Developing a framework to assess the long-term adoption of renewable energy technologies in the electric power sector: The effects of carbon price and economic incentives. Renew. Sustain. Energy Rev. 2021, 152, 111663. [Google Scholar] [CrossRef]

- Veríssimo, P.H.A.; Campos, R.A.; Guarnieri, M.V.; Veríssimo, J.P.A.; do Nascimento, L.R.; Rüther, R. Area and LCOE considerations in utility-scale, single-axis tracking PV power plant topology optimization. Sol. Energy 2020, 211, 433–445. [Google Scholar] [CrossRef]

- Arias-Cazco, D.; Gavela, P.; Panchi, L.C.; Izquierdo, P. Sensitivity Analysis for Levelized Cost of Electricity—LCOE with Multi-objective Optimization. IEEE Lat. Am. Trans. 2020, 20, 2071–2078. [Google Scholar] [CrossRef]

- Martín Barroso, A.M.; Leyva Ferreiro, G. Análisis crítico de la inversión en energías renovables. Enfoque socioeconómico. Cofin Habana 2017, 11, 69–90. [Google Scholar]

- Villada Duque, F.; López Lezama, J.M.; Muñoz Galeano, N. Effects of Incentives for Renewable Energy in Colombia. Ing. Univ. 2017, 21, 257–272. [Google Scholar] [CrossRef] [Green Version]

- Saldarriaga-Loaiza, J.D.; Villada, F.; Pérez, J.F. Análisis de Costos Nivelados de Electricidad de Plantas de Cogeneración usando Biomasa Forestal en el Departamento de Antioquia, Colombia. Inf. Tecnol. 2019, 30, 63–74. [Google Scholar] [CrossRef] [Green Version]

- Montiel-Bohórquez, N.D.; Saldarriaga-Loaiza, J.D.; Pérez, J.F. A Techno-Economic Assessment of Syngas Production by Plasma Gasification of Municipal Solid Waste as a Substitute Gaseous Fuel. J. Energy Resour. Technol. 2021, 143, 90901. [Google Scholar] [CrossRef]

- Montiel-Bohórquez, N.D.; Saldarriaga-Loaiza, J.D.; Pérez, J.F. Analysis of investment incentives for power generation based on an integrated plasma gasification combined cycle power plant using municipal solid waste. Case Stud. Therm. Eng. 2021, 30, 101748. [Google Scholar] [CrossRef]

- Montiel-Bohórquez, N.D.; Saldarriaga-Loaiza, J.D.; Pérez, J.F. Effect of the Colombian Renewable Energy Law on the Levelized Cost of a Substitute Gaseous Fuel Produced from MSW Gasification. Ing. Investig. 2021, 42, e92410. [Google Scholar] [CrossRef]

- Castillo-Ramírez, A.; Mejía-Giraldo, D.; Molina-Castro, J.D. Fiscal incentives impact for RETs investments in Colombia. Energy Sources Part B Econ. Plan. Policy 2017, 12, 759–764. [Google Scholar] [CrossRef]

- Gómez, L.M.J.; Prins, N.M.A.; López, M.D.R. Valoración de opción real en proyectos de generación de energía eólica en Colombia. Rev. Espac. 2016, 37, 26. [Google Scholar]

- Restrepo-Garcés, A.R.; Manotas-Duque, D.F.; Lozano, C.A. Multicriteria Hybrid Method—ROA, for the choice of generation of renewable sources: Case study in shopping centers. Ingeniare Rev. Chil. Ing. 2017, 25, 399–414. [Google Scholar] [CrossRef] [Green Version]

- Bueno López, M.; Rodríguez Sarmiento, L.C.; Rodríguez Sánchez, P.J. Análisis de costos de la generación de energía eléctrica mediante fuentes renovables en el sistema eléctrico colombiano. Ing. Desarro. 2016, 34, 397–419. [Google Scholar] [CrossRef]

- Arango, M.A.A. Modelo de proyectos de evaluación de riesgo en generación de energía térmica. Rev. Espac. 2016, 37, 26. [Google Scholar]

- Rodas, Y.; Arango, M.A. Optimización de la estructura de costos para la generación de energía hidroeléctrica: Una aplicación del Modelo Black Litterman. Rev. Espac. 2016, 38, 26. [Google Scholar]

- Sánchez, M.; Moncada, C.A.L.; Duque, D.F.M. Modelo de valoración de riesgo financiero en la gestión de contratos de suministro de energía eléctrica. Tecnura Tecnol. Cult. Afirmando Conoc. 2014, 18, 110–127. [Google Scholar] [CrossRef] [Green Version]

- Saldarriaga-Loaiza, J.D.; López-Lezama, J.M.; Villada-Duque, F. Levelized Cost of Electricity in Colombia under New Fiscal Incentives. Int. J. Eng. Res. Technol. 2020, 13, 3234–3239. [Google Scholar] [CrossRef]

- Castillo-Ramírez, A.; Mejía-Giraldo, D.; Muñoz-Galeano, N. Large-Scale Solar PV LCOE Comprehensive Breakdown Methodology. CT&F Cienc. Tecnol. Futuro 2015, 7, 117–126. [Google Scholar]

- Castillo-Ramírez, A.; Mejía-Giraldo, D.; Giraldo-Ocampo, J.D. Geospatial levelized cost of energy in Colombia: GeoLCOE. In Proceedings of the Innovative Smart Grid Technologies Latin America (ISGT LATAM), Montevideo, Uruguay, 5–7 October 2015; pp. 298–303. [Google Scholar] [CrossRef]

- Tasas de Interés y Sector Financiero. Available online: https://totoro.banrep.gov.co/analytics/saw.dll?Portal (accessed on 6 October 2022).

- Inflación Total y Meta. Available online: https://www.banrep.gov.co/es/estadisticas/inflacion-total-y-meta/ (accessed on 6 October 2022).

- Hasan, M.; Zhang, M.; Wu, W.; Langrish, T.A. Discounted cash flow analysis of greenhouse-type solar kilns. Renew. Energy 2016, 95, 404–412. [Google Scholar] [CrossRef]

- Franco-Sepulveda, G.; Campuzano, C.; Pineda, C. NPV risk simulation of an open pit gold mine project under the O’Hara cost model by using GAs. Int. J. Min. Sci. Technol. 2017, 27, 557–565. [Google Scholar] [CrossRef]

- Datos históRicos USD/COP. Available online: https://es.investing.com/currencies/usd-cop-historical-data (accessed on 6 October 2022).

- Cheung, K.; Yuen, F. On the uncertainty of VaR of individual risk. J. Comput. Appl. Math. 2020, 367, 112468. [Google Scholar] [CrossRef]

- Balibrea-Iniesta, J.; Rodríguez-Monroy, C.; Núñez-Guerrero, Y.M. Economic analysis of the German regulation for electrical generation projects from biogas applying the theory of real options. Energy 2021, 231, 120976. [Google Scholar] [CrossRef]

- Chowdhury, R.; Mahdy, M.; Alam, a.N.; Al Quaderi, G.D.; Rahman, M.A. Predicting the stock price of frontier markets using machine learning and modified Black–Scholes Option pricing model. Phys. A Stat. Mech. Appl. 2022, 555, 124444. [Google Scholar] [CrossRef] [Green Version]

- Rentabilidad del Bono Estados Unidos 10 añOs. Available online: https://es.investing.com/rates-bonds/u.s.-10-year-bond-yield-historical-data (accessed on 6 October 2022).

- Ramos-Figueroa, O.; Quiroz-Castellanos, M.; Mezura-Montes, E.; Schütze, O. Metaheuristics to solve grouping problems: A review and a case study. Swarm Evol. Comput. 2020, 53, 100643. [Google Scholar] [CrossRef]

- Saldarriaga-Zuluaga, S.D.; López-Lezama, J.M.; Muñoz-Galeano, N. Optimal coordination of over-current relays in microgrids considering multiple characteristic curves. Alex. Eng. J. 2021, 60, 2093–2113. [Google Scholar] [CrossRef]

- Jaramillo Serna, J.d.J.; López-Lezama, J.M. Alternative Methodology to Calculate the Directional Characteristic Settings of Directional Overcurrent Relays in Transmission and Distribution Networks. Energies 2019, 12, 3779. [Google Scholar] [CrossRef] [Green Version]

- Agudelo, L.; López-Lezama, J.M.; Muñoz-Galeano, N. Vulnerability assessment of power systems to intentional attacks using a specialized genetic algorithm. Dyna 2015, 82, 78–84. [Google Scholar] [CrossRef]

- Arrif, T.; Hassani, S.; Guermoui, M.; Sánchez-González, A.; Taylor, A.R.; Belaid, A. GA-GOA hybrid algorithm and comparative study of different metaheuristic population-based algorithms for solar tower heliostat field design. Renew. Energy 2022, 192, 745–758. [Google Scholar] [CrossRef]

- Zeng, Z.; Zhang, M.; Zhang, H.; Hong, Z. Improved differential evolution algorithm based on the sawtooth-linear population size adaptive method. Inf. Sci. 2022, 608, 1045–1071. [Google Scholar] [CrossRef]

- IPC Información téCnica. Available online: https://www.dane.gov.co/index.php/estadisticas-por-tema/precios-y-costos/indice-de-precios-al-consumidor-ipc/ipc-informacion-tecnica (accessed on 6 October 2022).

- Hadidi, L.A.; Omer, M.M. A financial feasibility model of gasification and anaerobic digestion waste-to-energy (WTE) plants in Saudi Arabia. Waste Manag. 2017, 59, 90–101. [Google Scholar] [CrossRef] [PubMed]

- Global Trends. Available online: https://www.irena.org/Statistics/View-Data-by-Topic/Costs/Global-Trends (accessed on 6 October 2022).

- Bruck, M.; Sandborn, P.; Goudarzi, N. A Levelized Cost of Energy (LCOE) model for wind farms that include Power Purchase Agreements (PPAs). Renew. Energy 2018, 122, 131–139. [Google Scholar] [CrossRef]

| Reference | LCOE | OR | Other Methodologies | Optimization Techniques |

|---|---|---|---|---|

| [16] | Yes | No | No | MO |

| [8] | Yes | No | No | GA |

| [10] | Yes | No | No | ANN, RSM |

| [9] | Yes | No | No | GA |

| [11] | Yes | No | No | PO, PSO, IPA |

| [15] | Yes | No | No | TO |

| [19,20,21,22,23,24,25,26,27,28,29,30] | Yes | No | No | No |

| [5] | No | Yes | Vertical and horizontal analysis | No |

| [31] | Yes | No | No | No |

| [18] | Yes | No | No | No |

| [25] | Yes | Yes | AHP, Monte Carlo simulation and discounted flow cash | TOPSIS |

| [26] | No | No | Total Cost and Learning Curve | No |

| [24] | No | Yes | Discounted Cash Flow | No |

| Proposed | Yes | Yes | Discounted cash flow with Monte Carlo simulation and VaR | GA, PSO, DE |

| Technology | Capacity (MW) | Annual Electricity (GWh) | OM Cost (¢USD/kWh) | Fuel Cost (¢USD/kWh) | Income from Externality (¢USD/kWh) | Initial Investment (MUSD) |

|---|---|---|---|---|---|---|

| BF | 21.9 | 174.6 | 0.95 | 4.9 | 0 | 46.67 |

| USW | 56 | 441.5 | 5.4 | 0 | 0.68 | 312.5 |

| PV | 10 | 21.17 | 0.91 | 0 | 0 | 9.1 |

| WP | 12.6 | 110.4 | 1.5 | 0 | 0 | 17.7 |

| Technology | GC without Incentives (¢USD/kWh) | GC with Incentives (¢USD/kWh) | Reduction (%) |

|---|---|---|---|

| FB | 9.3 | 9 | 3.7 |

| USW | 13.9 | 13 | 6.6 |

| PV | 6.3 | 5.8 | 8.6 |

| WP | 11.4 | 10.4 | 8.7 |

| Tec. | M1 with GA | M1 with PSO | M1 with DE | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Combination , , d, k, L | GC (¢USD/kWh) | Red. (%) | Combination , , d, k, L | GC (¢USD/kWh) | Red. (%) | Combination , , d, k, L | GC (¢USD/kWh) | Red. (%) | |

| FB | (2,8,10,10,10) | 7.3 | 21.5 | (1,9,8,10,9) | 7.1 | 23.7 | (1,9,9,10,8) | 7.2 | 22.6 |

| USW | (1,9,7,9,7) | 8.5 | 38.8 | (1,9,6,7,9) | 8.8 | 36.7 | (2,8,7,9,8) | 8.9 | 36 |

| PV | (2,8,3,10,5) | 3.6 | 42.9 | (2,8,9,10,8) | 3.2 | 49.2 | (1,9,8,10,2) | 3.3 | 47.6 |

| WP | (2,8,9,9,8) | 5.9 | 48.2 | (1,9,6,8,8) | 5.8 | 49.1 | (2,8,3,10,8) | 6.0 | 47.4 |

| Parameters | GA | PSO | ED |

|---|---|---|---|

| Maximum number of iterations | 200 | 200 | 200 |

| Population size | 100 | 100 | 100 |

| Crossover rate | 0.7 | - | - |

| Mutation rate | 0.3 | - | - |

| Inertia weight | - | 1 | - |

| Inertia Weight Damping Ratio | - | 0.99 | - |

| Individual Learning Coefficient | - | 1.5 | - |

| Global learning coefficient | - | 2 | - |

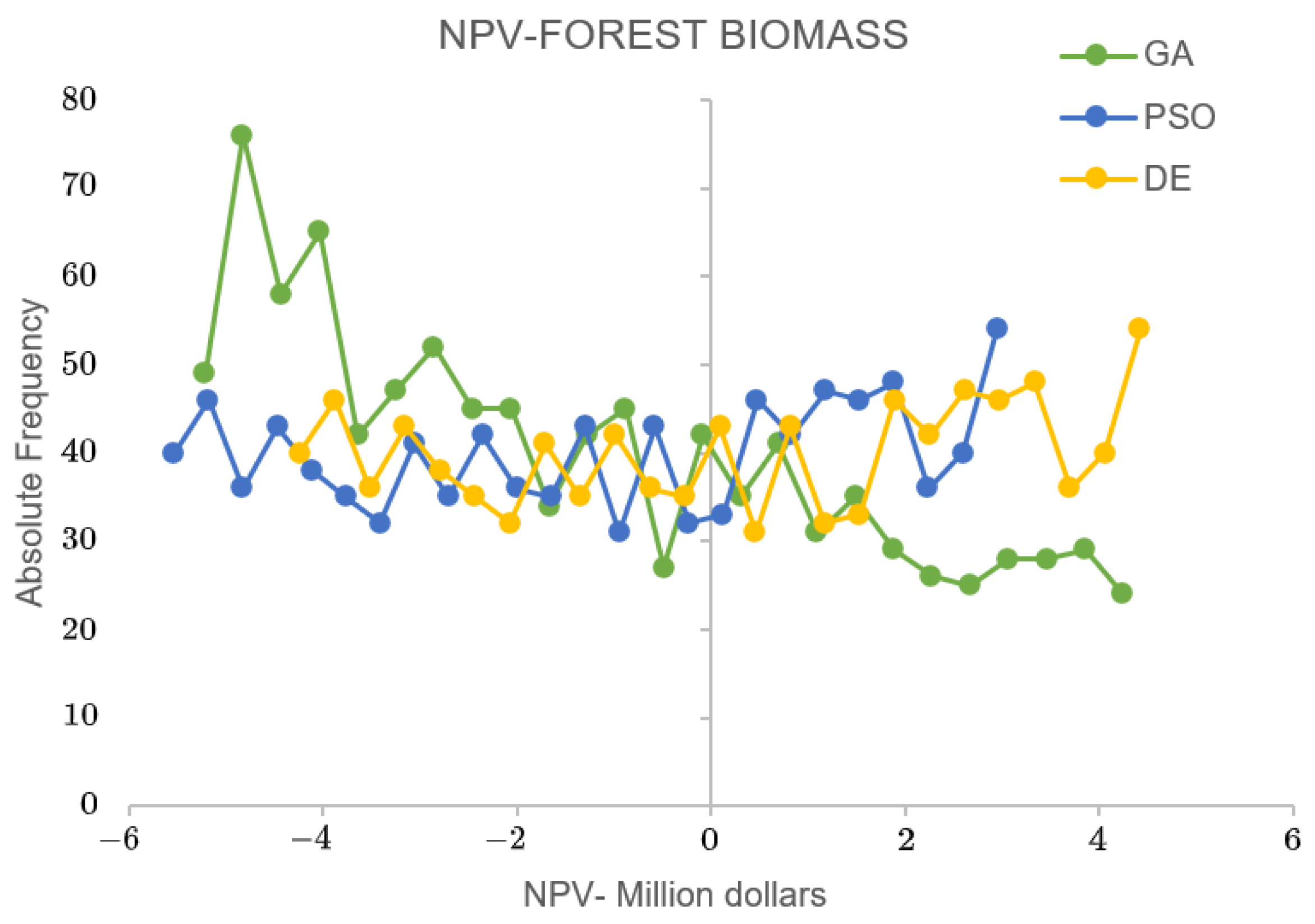

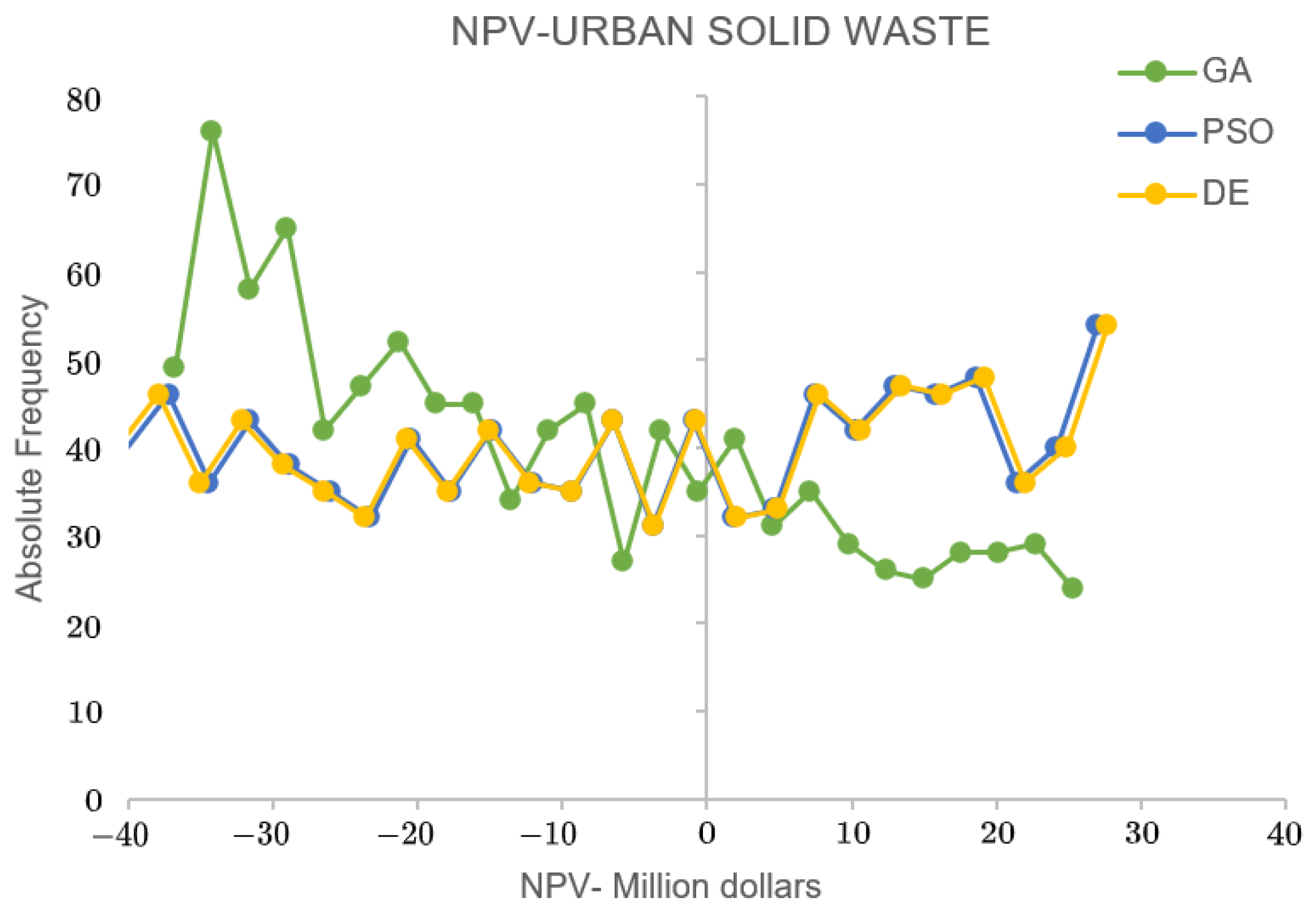

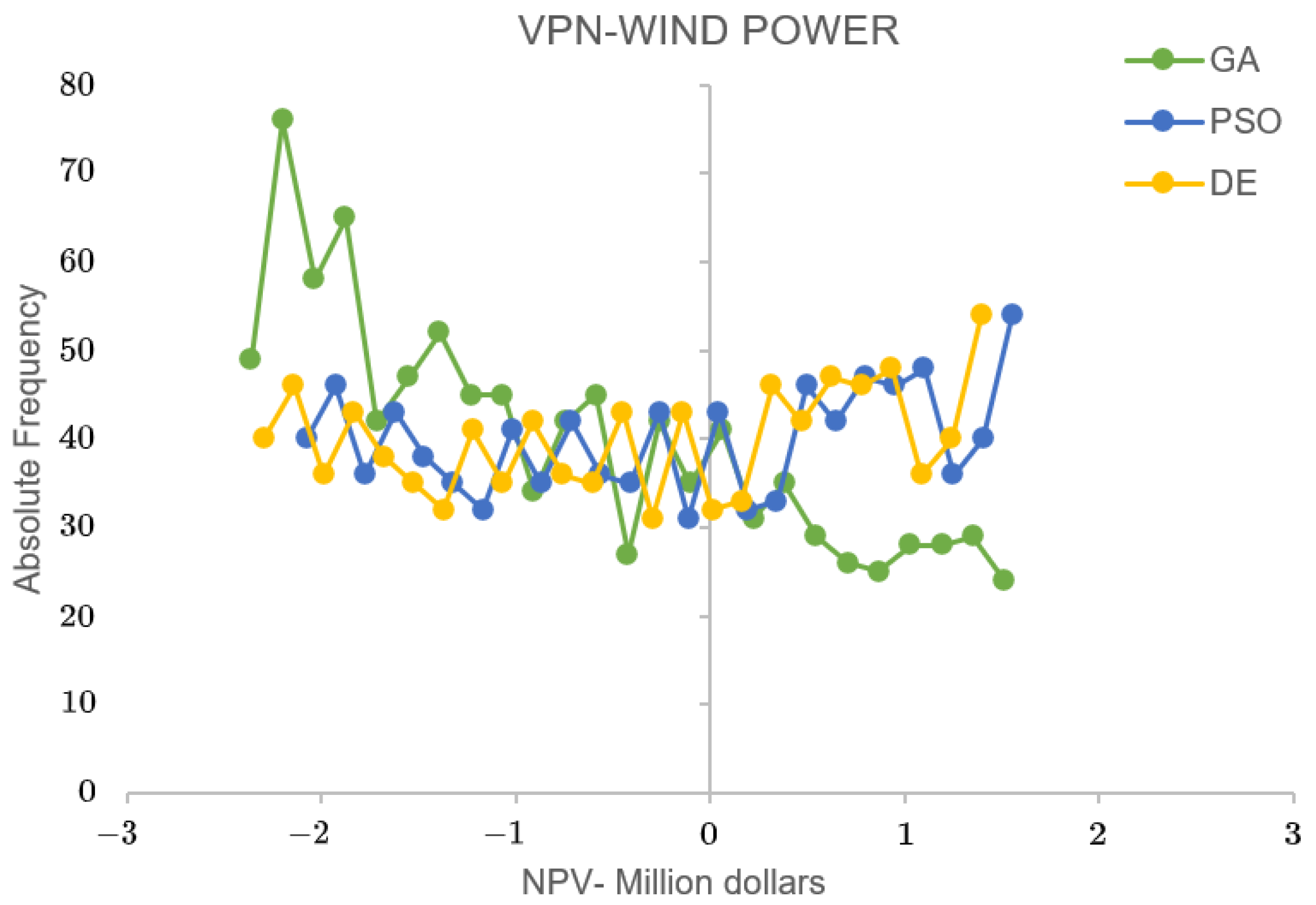

| Tec. | Estimated NPV (MUSD) | Maximum NPV (MUSD) | NPV-Var (MUSD) | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| GA | PSO | DE | GA | PSO | DE | P (%) GA | P (%) PSO | P (%) DE | GA | PSO | DE | |

| FB | 0.5 | −0.4 | 0.7 | 4.2 | 3 | 4.4 | 0.9 | 0.3 | 0.4 | 3.8 | 4 | 3 |

| USW | −0.5 | −0.2 | −0.9 | 25.3 | 27 | 27.7 | 0.8 | 0.2 | 0.5 | 29.4 | 30.6 | 30.8 |

| PV | 0.1 | 0.5 | 0.016 | 0.9 | 1.2 | 0.82 | 0.4 | 0.3 | 0.7 | 0.8 | 0.26 | 0.85 |

| WP | 0.09 | 0.5 | −0.013 | 1.5 | 1.6 | 1.4 | 0.9 | 0.5 | 0.6 | 1.8 | 1.6 | 1.8 |

| Technology | GA | PSO | DE | |||

|---|---|---|---|---|---|---|

| NPV (MUSD) | IV (%) | NPV (MUSD) | IV (%) | NPV (MUSD) | IV (%) | |

| FB | 0.43 | 9.1 | 0.39 | 18.8 | 0.35 | 16.5 |

| USW | 1.7 | 10.9 | 1.1 | 6.6 | 1.7 | 3.9 |

| PV | 0.04 | 2.6 | 0.035 | 0.06 | 0.02 | 3.6 |

| WP | 0.09 | 3.8 | 0.08 | 8.1 | 0.14 | 7.5 |

| Technology | M1-GG (¢USD/kWh) | M2-NPV (MUSD) | M3-NPV (MUSD) | ||||||

|---|---|---|---|---|---|---|---|---|---|

| GA | PSO | DE | GA | PSO | DE | GA | PSO | DE | |

| FB | 7.3 | 7.1 | 7.2 | 0.5 | −0.4 | 0.7 | 0.43 | 0.39 | 0.35 |

| USW | 8.5 | 8.8 | 8.9 | −0.5 | −0.2 | −0.9 | 1.7 | 1.1 | 1.7 |

| PV | 3.6 | 3.2 | 3.3 | 0.1 | 0.5 | 0.016 | 0.04 | 0.035 | 0.02 |

| WP | 5.9 | 5.8 | 6.0 | -0.09 | 0.5 | −0.013 | 0.09 | 0.08 | 0.14 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Saldarriaga-Loaiza, J.D.; Saldarriaga-Zuluaga, S.D.; López-Lezama, J.M.; Villada-Duque, F.; Muñoz-Galeano, N. Optimal Structuring of Investments in Electricity Generation Projects in Colombia with Non-Conventional Energy Sources. Sustainability 2022, 14, 15123. https://doi.org/10.3390/su142215123

Saldarriaga-Loaiza JD, Saldarriaga-Zuluaga SD, López-Lezama JM, Villada-Duque F, Muñoz-Galeano N. Optimal Structuring of Investments in Electricity Generation Projects in Colombia with Non-Conventional Energy Sources. Sustainability. 2022; 14(22):15123. https://doi.org/10.3390/su142215123

Chicago/Turabian StyleSaldarriaga-Loaiza, Juan D., Sergio D. Saldarriaga-Zuluaga, Jesús M. López-Lezama, Fernando Villada-Duque, and Nicolás Muñoz-Galeano. 2022. "Optimal Structuring of Investments in Electricity Generation Projects in Colombia with Non-Conventional Energy Sources" Sustainability 14, no. 22: 15123. https://doi.org/10.3390/su142215123