Abstract

In the 21st century, China’s economic development has made great achievements, and at the same time, it has brought about the problem of distribution of production–living–ecology space (PLES). As an important region of population activity and economic development in China, the Yellow River Basin (YRB) is rich in resources but fragile in ecology, and its ecological protection and high-quality development was elevated to a national strategy in 2021. It is crucial to examine the spatiotemporal evolution traits and driving forces of this PLES. Based on the classification system of PLES, the spatiotemporal evolution characteristics and driving factors of the PLES of 73 prefecture-level cities in the YRB from 2005 to 2020 were analyzed by using the land use transfer matrix, land use dynamic degree, and geographically and temporally weighted regression (GTWR) model. The results show that the conversion rate of PLES in the YRB is gradually slowing down, and the frequency of spatial interconversion is in the form of “high-bottom-high”. The conversion types are mainly production space (PS) to living space (LS), PS to ecology space (ES) and ES to PS, and the comprehensive dynamic degree decreases significantly and then shows a slight upwards trend. The impact of each influencing factor on the evolution of PLES varies, and there are different heterogeneous characteristics in time and space. Based on the above analysis, this paper proposes policy recommendations for rational planning of the PLES in the YRB in four dimensions: government governance, social economy, population restriction and industrial structure.

1. Introduction

The YRB is vast and rich in land, energy, minerals and other resources [1], but long-term unjustified exploitation has caused the Yellow River’s high reaches to experience the degradation of grassland, the middle reaches to lose soil, and the lower reaches to become more sedimented [2]. The increasingly fragile ecological environment has widened the economic gap with the eastern regions, affecting the balanced development of China. The YRB is at the core of The Silk Road and is a key area connecting two important regions in eastern and western China [3]. After the ecological protection and high-quality development of the YRB was elevated to a national strategy in 2021, the degree of coupling and coordination [4], spatial conflicts [5] and land use transformation [6] of its PLES have become hot spots for many scholars to study. In order to achieve scientific and rational planning of its territorial spatial pattern and functions and improve the ecological environment, it is necessary to study the spatial and temporal evolution characteristics and driving factors of the PLES in the YRB [4].

Territorial space is a multifunctional human–land relationship system composed of various resources, such as land and water, with functional and dynamic characteristics [7]. Human survival and development require access to resources from the national land space, and the long-term exploitation of the national land space has led to a continuous evolution of its pattern and functions [8]. After the Reform and Opening Up, China’s national economy and people’s lives have been greatly improved [9], and the speed of its economic development has been admired by the world. However, it has also brought about a situation of disorderly development of land space, resulting in a huge waste of land space and resources, intensifying the trend of environmental pollution, resulting in an imbalance in the spatial pattern and function of land [10], and restricting the healthy and continuance development of the Chinese economy.

Based on this, the Chinese government first issued The Main Functional Area Planning in 2011, which is dedicated to the scientific development of national land and space and the transformation of economic development. Since then, scholars have conducted an increasing number of studies on the evolution of territorial space, and the classification of PLES has provided new ideas for the rational planning of territorial space [11]. In the face of the critical situation of resource scarcity and ecological environment deterioration, the 18th National Congress of the Communist Party of China detailed that the spatial structure should be properly adjusted and efforts made to achieve the goal of optimizing the national land space with intensive and efficient PS, livable and moderate LS, and beautiful ES to create a beautiful home for future generations. The report has further improved the theoretical system of territorial space optimization based on the PLES concept. In 2015, the Chinese government further discussed PLES in the Opinions on Accelerating the Construction of Ecological Civilization. Since then, research on the patterns and functional evolution of PLES has intensified.

Hettner, a famous German geographer, first proposed the theory of spatial division in 1927 and studied space from the perspective of the whole [12]. Since then, the theory of spatial division began to be applied in urban construction. In the mid- and late 20th century, accompanied by the process of urbanization, a series of urban problems promoted more planning thought and innovation in practice [13], and scholars gradually began to conduct national spatial function research. Some scholars, from the perspectives of sustainable land use spatial characteristics, gradually improved the theory and method of spatial division. With the deepening of the research, the relevant discussions were gradually subdivided into industrial parks represented by PS, urban living areas represented by LS and green spaces represented by ES. In 1991, Taiwan Province began to implement the development of production–living–ecology agriculture and endowed land with the three functions of production, living and ecology. Since then, relevant studies have been continuously deepened, mainly focusing on the identification and classification of evolution characteristics and regional differences, which are the driving factors of PLES.

The research on the function identification of PLES is divided into single function and dominant function. In the identification of a single functional space, the identification of ES is relatively unified, while the identification of PS and LS is quite different. Regarding the identification of the main function space, most scholars believe that production, life and ecology are the three main functions of land, and a few scholars divide PS into agricultural production space and industrial production space, LS into urban living space and rural living space, and ES into eco-production space and production-eco space according to the strong and weak relationship of land function [14]. There are two main methods for the classification of PLES. The first is the comprehensive evaluation method, which requires the establishment of an evaluation index system through a large amount of data and the quantitative analysis of land function by the entropy weight method to classify PLES [15]. The other is the merging method, which uses land use data and land classification criteria to analyze land use structure and dominant land function [16,17], then incorporates land use types [18,19], and attaches importance to the ecological function of land in the classification process. A few scholars have also used land function evaluation techniques to establish a multidimensional index system to provide a comprehensive evaluation for spatial classification [20]; others have quantitatively scored the production, life and ecological functions of various land use types by the grading scoring method and combined those results with the qualitative analysis of field investigation to classify the land use types of a certain region [21]. The research scales are mainly focused on different regions, such as the country, province, prefecture-level city, county, township or village [22,23], and a single classification system for PLES has not been developed for different scales of research regions.

The current research on the characteristics of the PLES step was unified by scholars with the help of the ArcGIS software platform based on the PLES classification system, with the data of land use based on remote sensing images, using a variety of models and methods for different types of PLES and the evolution of the characteristics of the study area for quantitative analysis. Most scholars have used methods such as land use transfer matrices [16] and landscape metrics [24] to analyze the evolutionary direction and rate of evolution of PLES. Some scholars have also used intensity analysis [25] and land use dynamic degree [26] to analyze the change of land use in the time dimension. Regional differences in the evolutionary characteristics of PLES are due to the different geographical resources of each region in the study area, and the study of the regional differences of PLES is conducive to solving the problems of unbalanced development of territorial space and more accurate planning of territorial space. Some scholars have introduced the Gini coefficient [27,28] and the Theil index [29] from the field of economics to measure income differences to analyze the differences among regions in PLES, and some scholars have also used the spatial statistical analysis method of exploratory spatial data analysis [17] to analyze the differences in land use in PLES from both general and local perspectives.

Research on the drivers of PLES is usually aimed at exploring various factors affecting the evolution characteristics of a certain region to regulate the evolution speed and direction and realize the sustainable utilization of national land space. After selecting the possible influencing factors, it is usually necessary to sort out the variables by the methods of principal component analysis [30] and redundancy analysis [31] and then use models such as multiple linear regression [32], spatial econometrics [33], and geographical detectors [34]. In terms of multiple linear regression analysis, variables’ spatial autocorrelation cannot be handled by ordinary least squares [35]; therefore, a geographically weighted regression (GWR) model has been used by researchers to examine the spatial nonstationarity of the driving forces behind land use change [36]. Regarding the selection of explanatory variables, scholars have selected the ecological quality index [16] or the change in the function of various PLES [32], depending on the focus of the study. By sorting out the research of scholars, it is concluded that the driving factors of PLES are mainly composed of external driving forces and internal binding forces, and economic development and social life are the main influencing factors leading to its change.

To sum up, scholars have various research methods, research fields and research purposes for the territorial space or PLES, and the research conclusions and results are relatively rich. While this has laid a solid foundation for PLES research, the PLES space–time evolution characteristics and driving factors of the route have not been unified. First, the research scale of PLES mainly focuses on the country, province and county, and there are few studies on the river basin level, which is in the core region of economic development. Second, ecological protection and high-quality development have placed gradually strict requirements on the planning of PLES, and the impact of economic and demographic factors on spatial planning has become increasingly obvious; however, the literature mostly focuses on the analysis of natural factors, and the selection range of driving factors needs further improvement. Finally, the theory of spatial interaction suggests that there is temporal and spatial nonstationarity in geospatial data, and changes in both temporal and geospatial locations cause changes in the relationships and structures among variables. The evolution of PLES is influenced by both time and space, and spatial data analysis methods ignore temporal heterogeneity and cannot analyze spatiotemporal data.

Based on this, this paper is supported by the spatial panel data of 73 cities in the YRB from 2005 to 2020 and uses the PLES classification system, land use transfer matrix, land use dynamic degree and GTWR model. We analyzed the factors influencing the evolution of PLES as a spatial and temporal change system to scientifically understand the spatiotemporal evolution of PLES and facilitate the high quality of cities in the YRB. The innovations and contributions of this paper are as follows. (1) Research methods. The GTWR model can comprehensively consider the nonstationarity of space and time, which has a wider application range and can meet the requirements of the analysis of complex spatiotemporal data. (2) Research perspective. The Yellow River Basin covers a wide area, and prefecture-level cities are in the political, economic and cultural centres of the region, so it is more scientific to study the spatiotemporal evolution characteristics and driving factors of PLES with prefecture-level cities as the research objects than with provinces. (3) Research results. The comprehensive dynamic degree characteristics of each city were analyzed, and the spatiotemporal characteristics of the drivers of the evolution of PLES were obtained through the GTWR model.

This paper consists of five sections: the Section 1 is the introduction and the review and summary of the literature; the Section 2 introduces the research area, research methods and data sources; the Section 3 is the research results and analysis; the Section 4 is the discussion; and the Section 5 is the conclusions.

2. Methods and Data

2.1. Research Area

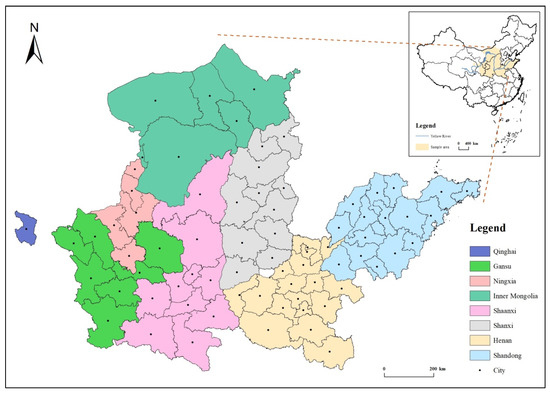

The Yellow River originates from the Yogu Zonglie Basin at the northern foot of Bayankala Mountain on the Qinghai–Tibet Plateau [37] and runs through nine provinces (autonomous regions) from the west to the east into the Bohai Sea, with a length of approximately 5464 km. Referring to the research areas of existing scholars [5], and considering the serious lack of core indicators in Haidong City, Jiyuan City, and autonomous states in Sichuan, Gansu, and Qinghai Provinces, and based on data availability, continuity and scientificity, the specific study was finally determined to be 73 cities in the Yellow River Basin (Figure 1). These include: upstream, including Xining city in Qinghai Province, seven cities in Gansu Province, five cities in the Ningxia Hui Autonomous Region, and six cities in the Inner Mongolia Autonomous Region; midstream, including 11 cities in Shanxi Province and 10 cities in Shaanxi Province; and downstream, including 16 cities in Shandong Province (Laiwu city became Laiwu District in Jinan city in January 2019) and 17 cities in Henan Province.

Figure 1.

Sample area: the Yellow River Basin.

2.2. Research Methods

2.2.1. Classification System of PLES

PS is land space mainly providing production and service functions for people [4] and is the fundamental force behind the balanced development of PLES. LS is land space on which people live [38] and is a crucial link in the balanced development of PLES. ES is land space with an ecological protection function [39] and is a prerequisite for the balanced development of PLES. According to the six first-level land use types and 25 s-level land use types given by the Resource and Environmental Science and Data Center of the Chinese Academy of Sciences [5], a classification system of PLES was constructed, as shown in Table 1.

Table 1.

Classification system of PLES.

2.2.2. Land Use Transfer Matrix

The land use transfer matrix is often used to study the land use change in the same area in different periods; it is an analysis of various land use types based on remote sensing images of land use, and the area of each type of land transfer is listed in the form of a two-dimensional matrix as a land use change preliminary analysis. This method can quantify transformations among various land use types and calculate the transfer rate among various land use types [40,41]. The formula is as follows.

Equation (1): S is the land area, m is the number of land types in the study area, i is the land use type at the beginning of the study period, and j is the land use type at the end of the study period.

2.2.3. Land Use Dynamic Degree

This method can reflect the evolution speed of PLES in a given time period in the research area [42]. Among its options, single dynamic degree reflects the change speed of a certain space in a period of time in the research area, and comprehensive dynamic degree reflects the interconversion speed of PLES in a period of time in the research area. The calculation formulas are, respectively, as follows.

Equation (2): K is the single dynamic degree of a type of PLES in a certain region during the study period, Fm is the roll-in amount of a type of PLES, F0 is the roll-out amount of a type of PLES, and B is the total area of a type of PLES at the beginning of the study period.

Equation (3): C is the comprehensive dynamic degree of PLES of a region during the study period, ∆Sm is the area of PLES type m space at the beginning of the study period, ∆Sm − n is the total area of the class m space of PLES that is transferred to the class n space during the study period, A is the total area of a region in the study period, and T is the difference between the year at the end of the study and the year at the beginning of the study.

2.2.4. Geographically and Temporally Weighted Regression (GTWR)

GTWR adds a temporal dimension to the traditional geographically weighted regression (GWR) model [43], which integrates nonstationary time and space [44] and can better reflect the spatiotemporal heterogeneity of different regions and make the estimation results more accurate [45]. The expression is:

Equation (4):, are the latitude and longitude coordinates of the centre of gravity points of each prefecture-level city, are the spatiotemporal coordinates of sample point j in year t, y is the explained variable, x is the explanatory variable, and n is the number of explanatory variables. is the spatiotemporal intercept term of sample point j, and is the regression coefficient of the k-th explanatory variable for sample point j. is the residual of the j-th sample point in the model.

2.3. Data Sources

The data of land use types in 2005, 2010, 2015 and 2020 of the PLES in the YRB were extracted from the 1 km × 1 km remote sensing monitoring data of the current situation of land use of the Resource and Environmental Science and Data Center of the Chinese Academy of Sciences. The data of each indicator are from the China City Statistical Yearbook, China Urban Construction Statistical Yearbook, statistical yearbooks of each province and statistical bulletins of national economic and social development of each city, and the missing values are substituted by interpolation.

3. Results and Analysis

3.1. Analysis of Evolution Characteristics of PLES

3.1.1. Spatial Pattern Characteristics of PLES

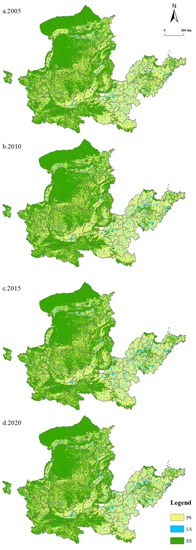

The spatial pattern characteristics of PLES in the YRB are shown in Figure 2. The distribution pattern of PLES remains basically the same from 2005 to 2020, without any significant changes. Among the main characteristics, PS is concentrated in the downstream, and most of these areas are in the North China Plain, which is suitable for agricultural and industrial production. Most of the upper and middle reaches are located in the plateau zone, where there is relatively little PS. The distribution of LS is relatively similar to the distribution of PS; LS’s density in the lower reaches is the highest, and that in the upper and middle reaches is significantly smaller. The reason is that the middle and upper reaches mainly have a temperate continental climate with less precipitation and rugged terrain, while the lower reaches have a temperate monsoon climate, and plain terrain is more suitable for human habitation. ES is widely distributed upstream and midstream, with abundant woodland and grassland, but the grassland and meadow in the upper stream and the Loess Plateau in the midstream are prone to degradation, and ES is reduced due to the weak ecological awareness of people in the early stage. Thus, the upper and middle reaches are ecologically dominant areas with less PS and LS, and the downstream area is dominated by production and living, with less ES.

Figure 2.

Spatial pattern characteristics of PLES.

3.1.2. Spatiotemporal Evolution Characteristics of PLES

The structural change transition matrix (see Table 2) and utilization change and characteristic statistics (see Table 3) of PLES in the YRB from 2005 to 2020 were constructed based on ArcGIS10.2 software.

Table 2.

Land use transfer matrix of PLES in YRB (km2).

Table 3.

Statistics on the changes and characteristics of PLES (area/km2).

From 2005 to 2010, from the perspective of roll-out, PS mainly turns into LS, with a total of 9274 km2; LS mainly turns into PS, with a total of 4440 km2; and ES mainly turns into PS, with a total of 9313 km2. From the point of view of roll-in, PS basically comes from ES, with an area of 9313 km2; LS mainly comes from PS, with an area of 9274 km2; and ES mainly comes from PS, with an area of 7982 km2. The roll-in rates of PS, LS and ES are 3.13%, 17.79% and 1.34%, respectively, and the roll-out rates are 3.89%, 8.93% and 1.71%, respectively. The change in LS is relatively large. In terms of total variation, PS has the largest variation, followed by ES. From the net increment, LS shows an increasing trend, with an increase of 9.73%, while PS and ES show a decreasing trend, with decreases of 0.80% and 0.38%, respectively.

From 2010 to 2015, from the perspective of roll-out, PS mainly transfers to LS, with a total of 2211 km2; LS mainly transfers to PS, with a total of 16 km2; and ES mainly transfers to PS, with a total of 2834 km2. From the point of view of roll-in, PS basically comes from ES, with an area of 2834 km2; LS mainly comes from PS, with an area of 2211 km2; and ES mainly comes from PS, with an area of 963 km2. The roll-in rates of PS, LS and ES are 0.65%, 4.16% and 0.16%, respectively, and the roll-out rates are 0.72%, 0.05% and 0.52%, respectively. The change in PS is relatively large. In terms of total variation, PS has the largest variation, followed by ES. From the net increment, LS shows an increasing trend, with an increase of 4.11%, while PS and ES show a decreasing trend, with decreases of 0.07% and 0.36%, respectively.

From 2015 to 2020, from the roll-out perspective, the area of the PS transfer to LS is the same as that of ES, which is 2454 km2. LS mainly transforms into PS, with a total of 501 km2, while ES mainly transforms into PS, with a total of 4035 km2. From the point of view of roll-in, PS basically comes from ES, with an area of 4035 km2; LS mainly comes from PS, with an area of 2454 km2; and ES mainly comes from PS, with an area of 2454 km2. The roll-in rates of PS, LS and ES are 1.04%, 4.57% and 0.40%, respectively, and the roll-out rates are 1.12%, 0.87% and 0.74%, respectively. The change in PS is relatively large. In terms of total variation, PS has the largest variation, followed by ES. From the net increment, LS shows an increasing trend, with an increase of 3.75%, while PS and ES show a decreasing trend, with decreases of 0.08% and 0.34%, respectively.

In general, from the perspective of roll-out, PS mainly transfers to LS, LS mainly transfers to PS, and ES mainly transfers to PS. From the point of view of roll-in, PS basically comes from ES, LS mainly comes from PS, and ES mainly comes from PS. In terms of the roll-in rate, LS accounted for the largest proportion, which peaked from 2005 to 2010 and then showed a decreasing trend. In terms of the roll-out rate, LS was the largest during 2005–2010, followed by PS. In terms of total variation, PS was the largest, followed by ES. In terms of net increment, although the LS was in the state of expansion, the growth trend slowed down with the evolution of time, while the PS and ES were in the state of reduction, and the reduction trend continued to decrease with the evolution of time.

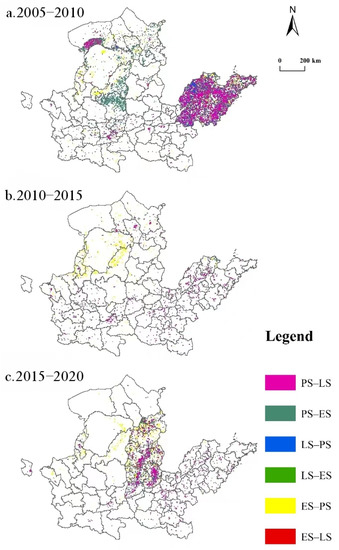

We further explore the spatial distribution of PLES conversion in the YRB in different time periods (see Figure 3). From 2005 to 2010, the conversion of PLES was mainly distributed in Shandong, Shaanxi and Inner Mongolia. From 2010 to 2015, the conversion speed slowed down, and the distribution was relatively discrete. From 2015 to 2020, the conversion was mainly distributed in Shanxi. In general, the conversion of PLES was more frequent during 2005–2010, followed by 2015–2020, and the least frequent during 2010–2015. The conversion frequency was in the form of “high-bottom-high”; in these periods, the conversion type was mainly from PS to LS, followed by the mutual conversion between PS and ES. Thus, it can be seen that the economic and demographic changes in the YRB have led to the continuous expansion of LS, and with the enhancement of ecological awareness, people have also triggered the trade-off between PS and ES.

Figure 3.

Spatial pattern evolution map of PLES.

3.2. Analysis of Dynamic Degree of PLES

3.2.1. Characteristics of Dynamic Degree

The dynamic variation of PLES in the YRB from 2005 to 2020 is significant (see Table 4). From a single dynamic degree, the PS dynamic degree is the largest in 2005–2010, at −0.158%; it is negative in different periods, and the degree of shrinkage has been slowing down. The LS dynamic degree is the largest in 2005–2010, at 2.156%, and is positive in different periods, with decreasing expansion. The ES dynamic degree is the largest in 2005–2010, at −0.075%, and is negative in different periods, with no significant change in the degree of contraction. In terms of the comprehensive dynamic degree, the dynamic degree of PLES in the YRB is 0.293% in 2005–2020 and 0.584%, 0.114%, and 0.179% in 2005–2010, 2010–2015, and 2015–2020, respectively, with a significant decrease and then a slight upwards trend.

Table 4.

Dynamic degree of PLES.

3.2.2. Spatial Pattern of Dynamic Degree

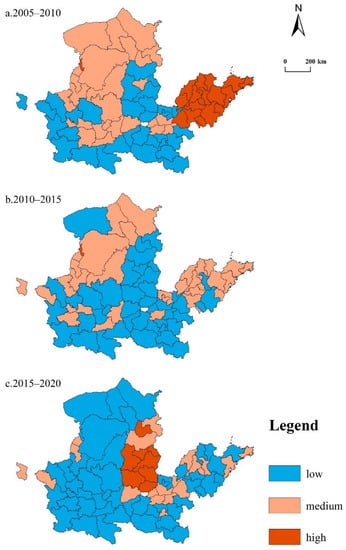

According to the comprehensive dynamic degree of the PLES of each city, the natural breaks class method is used to classify them into high, medium and low (see Figure 4). From 2005 to 2010, the high-value area was concentrated in Shandong, and the low-value areas were scattered in Qinghai, Gansu, Shanxi and Henan. The comprehensive dynamic degrees of Ningxia, Shaanxi and Inner Mongolia were not obvious. From 2010–2015, the only high-value area was Wuhai city in Inner Mongolia, and the low-value areas were scattered in Gansu, Shaanxi, Shanxi and Henan. The comprehensive dynamic degree of Ningxia, Inner Mongolia and Shandong were not obvious. In 2015–2020, the high-value area was mainly concentrated in Shanxi Province, and the other provinces were low-value areas.

Figure 4.

Spatial pattern characteristics of comprehensive dynamic degree in PLES.

Depending on the numerical values of the production, living and ecological single dynamic degree of each city, the natural breaks class method was used to classify them into three classes: expansion, stability, and narrowing [32]. The dynamic degree characteristics of the PLES in each province of the YRB at three time periods are shown in Table 5, with different degrees of changes in PS, LS and ES.

Table 5.

Dynamic degree characteristics of PLES.

On the whole, the single dynamic degree of the region located in the low-value area of the comprehensive dynamic degree is relatively stable, with slight changes in the PS and LS in the upper reaches and generally more stability in the midstream and downstream. The PS, LS and ES of the region located in the medium-value area of the comprehensive dynamic degree have changed to varying degrees. The areas located in the high-value area of the comprehensive dynamic degree have drastic changes in their single dynamic degree, significant reductions in ES, and drastic changes in PS and LS.

To investigate the driving factors of the evolution of the PLES in the YRB, the comprehensive dynamic degree of the PLES of each prefecture-level city was used as the predicted variable and further explored using the GTWR model.

3.3. Analysis of Factors Influencing Evolution of PLES

3.3.1. Determination of Influencing Factors

The evolution of PLES is affected by multiple factors. The research area includes 73 cities in eight provinces, each with a different development status. Based on this, the index system of PLES in the YRB was constructed by selecting variables from four dimensions: government governance, social economy, population restriction and industrial structure. Finally, eight variables were selected to explore the driving mechanism of its evolution (see Table 6).

Table 6.

Indicator system of factors influencing PLES.

Financial revenue. Financial revenue is an important indicator to measure the government’s financial resources, a prerequisite and condition for the government to carry out public expenditure, and an important means for the government to carry out macrocontrol. Local general public budget revenue is fiscal revenue mainly from taxation; it is mainly used to ensure and improve people’s wellbeing and promote economic and social development. Local government planning and the use of administrative areas can change the local general public budget revenue to a certain extent [32]. Local general public budget revenue can reflect the financial revenue of regional governments.

Environmental greening. Environmental greening is an effective means to optimize the ecological environment. Through urban greening, the government can improve the sanitary conditions of the city and effectively improve the living environment of residents. High-quality development requires urban greening and economic development to promote and coordinate development, and environmental greening will improve the ecological environment [37,46] and then affect the evolution of PLES. A green area is a variety of green spaces used for gardening and greening, and it can directly reflect the level of urban environmental greening.

Investment intensity. Investment and economic growth are closely related; investment is the fundamental power of economic growth but also the essential precondition of economic growth. In all aspects of investment, governments and enterprises choose the best land as the target based on the principle of economic maximization [47]. Fixed asset investment is the workload of fixed asset construction and acquisition activities expressed in monetary terms, which can be a good measure of local investment intensity.

Economic development. In the development of the urban economy, land space needs to be developed and utilized [48]. Urban economic development can provide more funds and more advanced technologies for land use and provide a reliable guarantee for ecological environment protection, but it may also break the evolution direction and speed of the original PLES. Economic density is derived from the ratio of regional GDP to total area for each city, which can be a more objective measure of the level of economic development of each region.

Population size. Humans are closely related to land, and their productive lives depend on land resources. High economic growth and changes in population numbers have led to a gradual increase in productivity levels and an increase in access to land resources for the productive lives of human beings, leading to an increase in human–land conflicts [49]. The distribution of the PLES in the YRB is different, and ecological and environmental problems are closely related to the population to a certain extent. To explore the impact of population factors on the evolution of the PLES, this paper selects population density to represent population size. Population density is calculated as the ratio of the annual resident population to the total geographical area.

Land use. With the increase in population, people pay increasing attention to land use efficiency, and the reasonable and efficient use of land is of great significance for sustainable development. Land use intensity is the intensity of a unit of land investment, which directly reflects the impact of human activities on natural ecosystems and is calculated according to the literature [50]. This paper chooses the intensity of land use to measure people’s land use.

Primary industry. Primary industries mainly include agriculture, forestry, animal husbandry, fishing, etc. The primary industries in the YRB are distributed in most areas, and these industries are highly dependent on land. With the upgrading of industries in various regions, the primary industry is squeezed by space, and its changes influence the evolution of PLES [32]. This paper selects the proportion of primary industry in GDP to measure the development of the primary industry.

Secondary industry. Secondary industries are mainly mining, manufacturing, construction, etc. The construction and development of these industries need to be based on all kinds of land. With the continuous increase in industrialization in the YRB, the demand for land in the secondary industry is also increasing, forcing PS to play a continuous game with LS and ES [32,33]. This paper selects the proportion of secondary industry in GDP to measure the development of the secondary industry.

3.3.2. Data Preprocessing

To avoid multicollinearity in the index data, it is necessary to conduct a variance inflation factor test on eight index data. The test shows that the variance inflation factor of each index datum is less than 10 (see Table 7), indicating that there is no multicollinearity. Finally, the data of each variable were standardized and then analyzed for model comparison.

Table 7.

Results of the VIF test.

3.3.3. Model Comparison

To test the applicability and accuracy of the GTWR model, the GWR and GTWR models were used to computationally analyze the standardized spatial panel index data from 2005 to 2020. The relevant parameters of the model are finally derived as shown in Table 8.

Table 8.

Comparison of model test results.

R2 and adjusted R2 reflect the fit degree of the model, and their values range from 0 to 1; the closer the value is to 0, the worse the model fits. RSS is the residual sum of squares, and the smaller its value is, the higher the model accuracy. Sigma denotes the square root of the sum of the remaining squares divided by the effective degrees of freedom of the residuals, and the smaller this statistic is, the better. The smaller the AICc value is, the better the goodness of fit of the model. Comparing the test results of the two models shows that the parameters of the GTWR model are better than those of the GWR model, indicating that the GTWR model is more accurate and can better explain the spatiotemporal distribution of the factors influencing the evolution of the PLES.

3.3.4. Spatiotemporal Distribution of Estimation Coefficients of Driving Factors

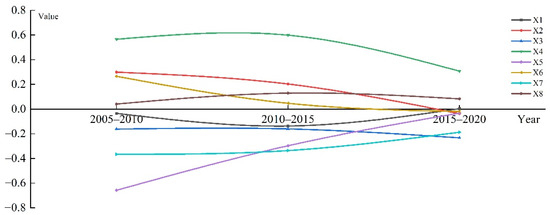

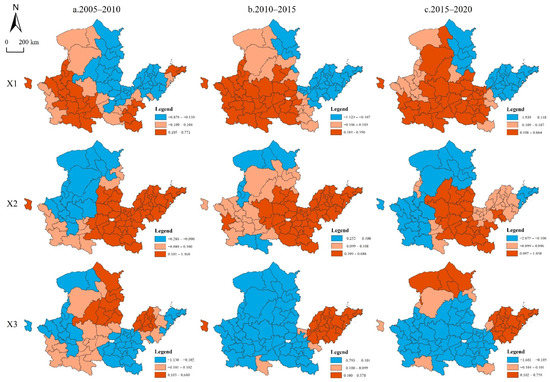

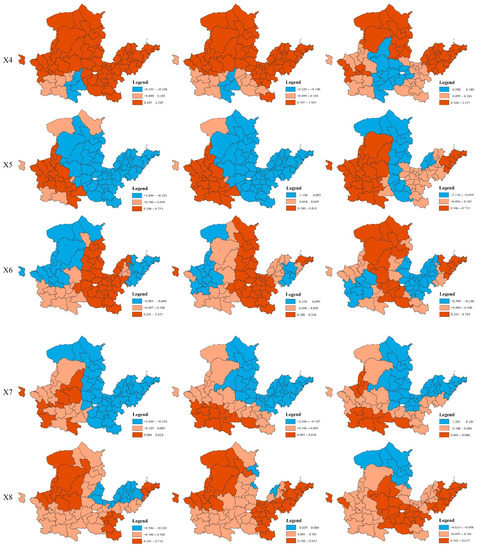

First, the regression coefficients of the influencing factors of the GTWR model were statistically analyzed, and the table of quartiles and averages was drawn (see Table 9). The regression coefficients of each influencing factor vary in magnitude, positive and negative, which indicates that the influencing factors have significant nonstationarity on the evolution of the PLES in the YRB in both time and space. Second, the regression coefficients of the impact factors of the GTWR model for 2005–2010, 2010–2015, and 2015–2020 were visualized, and their averages were plotted on a line graph (see Figure 5) to observe the time change trend. Finally, the regression coefficients of the influencing factors were visualized by ArcGIS 10.2 software, so as to analyze their changing trend in the spatial and temporal dimensions (see Figure 6).

Table 9.

Statistical analysis of regression coefficients of GTWR influencing factors.

Figure 5.

Time trends of the mean GTWR regression coefficients.

Figure 6.

Spatiotemporal distribution of regression coefficients of the GTWR model.

- Financial revenue

According to Table 9, the average regression coefficient of local general public budget revenue is −0.056, with a median of 0.043, indicating that local general public budget revenue has a small negative impact on the evolution of the PLES, and the overall left-biased trend of the coefficients reflects that the index has a positive influence on the spatial evolution of the PLES in most cities. The upper and lower quartiles range from −0.291 to 0.253, indicating that the positive and negative effects of local general public budget revenues are relatively evenly distributed among cities in each year.

In terms of time trends (see Figure 5), the mean value of the local general public budget revenue regression coefficient is −0.035, −0.137, and 0.004 in 2005–2010, 2010–2015, and 2015–2020, respectively, exhibiting a trend of declining and then increasing. This is because the PLES comprehensive dynamic degree as a whole is first a weakening and then an increasing trend, and as the economic development of each region’s local general public budget revenue grows year by year, the negative effect appears to weaken.

In terms of spatial distribution characteristics (see Figure 6), the regional distribution of the positive and negative regression coefficients of local general public budget revenue is more fragmented from 2005 to 2020, with the positive regions gradually expanding from west to east and the negative regions gradually shrinking from west to east. The characteristics of the spatial influence of local general public budget revenue on the dynamic degree of the PLES are mainly related to the distribution of the PS. Shandong relies on the geographical advantage of being located near the sea for rapid development. Its PS and LS have been expanding, but its early economic development model was relatively crude, resulting in the continuous reduction of ecological space, and its long-term overall dynamic degree is large, resulting in the local general public budget revenue not being proportional to the development and utilization of land and in a negative area. Ningxia was in a positive region from 2005–2015 and then shifted to an insignificant region. The reason is that local governments compete to attract investment by providing land at low prices to promote economic development, and the land supply strategy tends to help those land supply areas that can quickly and effectively increase the economy [51]. The gradual expansion of PS promotes the local general public budget revenue, but the shrinkage of ES makes local governments raise their awareness of ES.

- 2.

- Environmental greening

According to Table 9, the average regression coefficient of green area is 0.156, and the median is 0.125, which indicates that green area has a positive influence on the evolution of the PLES, and the coefficient generally has a right-skewed distribution, showing that the positive impact of this index on the evolution of the PLES is small in a few cities. The upper and lower quartiles range from −0.072 to 0.353, which indicates a stronger positive effect of green area in the city in all years.

Regarding the trend of time change (see Figure 5), from 2005 to 2020, the average of the regression coefficient of green space area was 0.300, 0.203, and −0.037, respectively. The value gradually decreased, indicating that the positive influence of green area on the evolution of the PLES gradually decreased and showed a negative influence in 2015–2020.

In terms of spatial distribution characteristics (see Figure 6), from 2005 to 2020, the positive and negative regression coefficients of green area are interspersed and change significantly, and its spatial impact distribution characteristics on the dynamic degree of the PLES are mostly connected with the distribution of ES. The positive region is decreasing and shifting from downstream to midstream, with the most obvious change in Shaanxi. Due to the gradual protection of ES [6], LS is more focused on greening and environmental protection, and long-term soil erosion in the midstream is gradually being managed, with an increasing green area. The negative area tends to decrease first and then increase and is concentrated upstream of the YRB. This is because the upper reaches are mainly ES, the weak awareness of greening construction leads to the trend of shrinking ES, and the LS expands while ignoring the construction of greening.

- 3.

- Investment intensity

According to Table 9, the average regression coefficient of fixed asset investment is −0.185, and the median is −0.193, which indicates that fixed asset investment has a negative influence on the evolution of the PLES. The coefficients generally have a right-skewed distribution, indicating that the index has a strong negative influence on the evolution of the PLES in most cities. The upper and lower quartiles range from −0.423 to 0.086, indicating a stronger negative impact of fixed asset investment in cities in all years.

In terms of time trends (see Figure 5), the mean value of the regression coefficient of fixed asset investment decreases from −0.162 to −0.233 from 2005 to 2020, which indicates that the negative influence gradually increases because some cities in the YRB with a lower dynamic degree of PLES are investing more.

In terms of spatial distribution characteristics (see Figure 6), from 2005 to 2020, fixed asset investment is mainly negative, and its spatial impact on the dynamic degree of the PLES is mainly related to the geographical location. Shandong has long been in a positive region because it relies on its unique geographic location, which has developed faster compared to other provinces in the YRB, and because it has a larger share of investment in land. Most of Shanxi was in the positive zone from 2005–2010 because the local government started to strictly regulate enterprises with serious environmental pollution, such as coal mining, banned the unqualified ones, and gradually invested in new industries. Inner Mongolia’s PLES dynamic degree remains relatively stable but in 2015–2020 in a positive region because the local government has increased investment in green energy with the advantage of local resources. Other provinces are basically in the negative region or inconspicuous region because these provinces do not have unique natural resources, resulting in a relatively small land dynamic attitude and mainly traditional industries resulting in a relatively underdeveloped economy. The local government has increased investment in various industries to achieve common prosperity.

- 4.

- Economic development

According to Table 9, the average regression coefficient of economic density is 0.491, and the median is 0.353, which indicates that it has a great positive influence on the evolution of the PLES in general. The coefficient has a right-skewed distribution in general, indicating that the positive influence of this index on the evolution of the PLES in a few cities is small. The upper and lower quartiles range from 0.036 to 0.876, indicating that the economic density of cities has a predominantly positive influence in each year. The regression coefficients of Shuozhou city, Ulanqab city and Datong city in 2015–2020 are greater than 3. The reason is that in recent years, Shuozhou city and Datong city have relied on their traditional resource advantages to accelerate the construction of a green and diversified energy supply system and have gradually realized the new type of coal resource development, while Ulanqab city has relied on its resource endowment to vigorously develop clean energy, and this reform has greatly driven economic development.

In terms of time trends (see Figure 5), the mean value of the regression coefficient of economic density decreases from 0.566 to 0.307 from 2005 to 2020, indicating that the positive effect gradually diminishes. The possible reason is that the dependence of economic growth on land gradually decreases.

In terms of spatial distribution characteristics (see Figure 6), economic density is dominated by positive effects from 2005 to 2020, with positive regions decreasing and negative regions increasing with the evolution of time. The spatial influence of economic density on the dynamic degree of the PLES is mostly connected with the economic development pattern. The reason for the gradual expansion of negative areas in Shaanxi is that these areas have long been in ecologically fragile zones. In response to the strategy of “ecological protection and high-quality development of the Yellow River Basin”, local governments have increased the improvement of the ecological environment, which, however, has affected the local economic development. Inner Mongolia, Shandong, and Shanxi have been in positive regions for ages, indicating that the economic development of these regions is coordinated with the PLES dynamic degree [52]. However, the ES in most areas of the YRB is in a state of shrinkage due to the excessive pursuit of economic effects at the expense of environmental protection.

- 5.

- Population size

According to Table 9, the mean regression coefficient of population density is −0.329, and the median is −0.200, indicating that population density has a large negative influence on the evolution of the PLES. The coefficient generally has a left-skewed distribution, indicating that this index has a large negative influence on the evolution of the PLES in most cities. The upper and lower quartiles range from −0.728 to 0.147, indicating that the negative effect of population density is more significant in each year.

In terms of time trends (see Figure 5), the mean value of the population density regression coefficient decreases from −0.658 to −0.032 from 2005 to 2020, indicating that the negative effect is weakening. As the population increases, LS needs to expand, and PS needs to deliver more resources and services to people, which also puts great pressure on ES [53]. However, with the gradual slowdown of the population growth rate and the continuous improvement of population quality, the influence of population density on the evolution of the PLES gradually decreases.

In terms of spatial distribution characteristics (see Figure 6), from 2005 to 2020, population density is dominated by negative effects, the positive area is mainly concentrated in the upstream and expanding to the midstream, and negative areas gradually are decreasing and shifting from the lower to the middle reaches. The spatial influence of population density on the dynamic degree of the PLES is mainly related to the distribution of LS. Population growth in the upper reaches poses a challenge to the LS, which has to be expanded. The downstream LS is more adequate to meet the growth of population density, and the dynamic degree of the PLES is mainly focused on the PS.

- 6.

- Land use

According to Table 9, the average regression coefficient of land use intensity is 0.099, and the median is 0.004, which indicates that it has a small positive impact on the evolution of the PLES in general. The coefficient generally has a right-skewed distribution, indicating that this index has a small positive impact on the evolution of the PLES in most cities. The upper and lower quartiles range from −0.152 to 0.243, indicating that the positive and negative impacts of land use intensity are more balanced among cities in each year.

In terms of time trends (see Figure 5), the average of the regression coefficient of land use intensity decreases from 0.266 to −0.019 from 2005 to 2020, indicating that the positive effect gradually decreases. The greater the human development and investment in land are, the greater the land use intensity. With the progress of land development technology and the awareness of high-quality development, land use efficiency gradually increases.

In terms of spatial distribution characteristics (see Figure 6), the regional distribution of the positive and negative regression coefficients of land use intensity in 2005–2020 is relatively dispersed, and its spatial influence on the dynamic degree of the PLES is mainly related to resource endowment. Shanxi in 2005–2015 was a positive region because Shanxi is a large province of coal resources, and land use intensity also caused damage to the ecological environment. In 2015–2020, the positive region significantly decreased because the implementation of ecological and environmental protection continued to eliminate some of the unqualified enterprises, and PS also appeared to shrink. Most of the upper YRB was in the negative region from 2005–2015 because the economic development of the upper reaches depended on the many natural resources given by the ecological environment and people had been using the land with low intensity for a long time. The negative area decreased from 2015 to 2020 because, with the implementation of the “development of the western region in China” policy, the layout of the PLES in the upper reaches of the YRB has changed.

- 7.

- Primary industry

According to Table 9, the average regression coefficient of the proportion of primary industry in GDP is −0.297, and the median is −0.140, which indicates that it has a negative impact on the evolution of the PLES in general. The coefficient has a left-skewed distribution in general, indicating that the negative impact of this index on the evolution of the PLES in a few cities is small. The upper and lower quartiles range from −0.383 to −0.013, indicating that the influence of the proportion of primary industry in GDP is mainly negative in each year. The regression coefficients of Weihai city and Yantai city were in the range of −2.698 to −1.934 from 2005 to 2015 because Weihai city and Yantai city relied on the advantages of the seafront to develop port shipping vigorously, and even reclamation of land occurred during this period [54]. With the implementation of the coastal protection law, however, this behaviour was resisted.

In terms of time trends (see Figure 5), the average of the regression coefficient of the proportion of primary industry in GDP decreases from −0.366 to −0.188 from 2005 to 2020, indicating that the negative influence gradually decreases. The primary industry is the basis of people’s lives and the national economy; therefore, the overall layout of the primary industry does not change significantly, but its proportion of GDP gradually decreases.

In terms of spatial distribution characteristics (see Figure 6), from 2005 to 2020, the positive impact of the proportion of primary industry in GDP decreases along a south-to-north gradient, and the negative impact increases along a south-to-north gradient. Over time, the positive impact area increases, and the negative impact area decreases. The distribution characteristics of the spatial influence of the proportion of primary industry in GDP on the dynamic degree of the PLES are mainly related to the distribution of the primary industry. Positive regions are scattered in Gansu and Shaanxi because these regions have a wide distribution of primary industries but generate limited GDP and are in a lower position within the YRB; with the changing spatial pattern of LS, PS and ES and the increase in GDP creation in the primary sector, the upstream is shifting to the region continuously. Shanxi has been in a negative region for a long time because it is dominated by the mining industry [55], the primary industry is less distributed, and the exploitation of land by the mining industry has a continuous impact on the PLES.

- 8.

- Secondary industry

According to Table 9, the average regression coefficient of the proportion of secondary industry in GDP is 0.085, with a median of 0.084, showing that it has a positive effect on the evolution of the PLES, without a significantly skewed distribution. The minimum value is −0.633, and the maximum value is 0.742, with a small difference in the extreme values. The upper and lower quartiles range from 0.027 to 0.162, indicating that the influence of the proportion of secondary industry in GDP on the evolution of the PLES is mainly positive.

Regarding the trend of time change (see Figure 5), the average regression coefficient of the proportion of secondary industry in GDP from 2005 to 2020 is 0.041, 0.130 and 0.084, respectively, which increased first and then decreased because, in recent years, the proportion of tertiary industry in GDP has increased due to the green and efficient development and structural upgrading of the secondary industry.

In terms of spatial distribution characteristics (see Figure 6), from 2005 to 2020, the proportion of secondary industry in GDP has mainly positive effects, and its spatial impact on the dynamic degree of PLES is mainly related to the distribution of secondary industry. Positive regional contraction from the edge to the centre is because most of the YRB relies on cheap human resources and land, making for the gradual expansion of the secondary industry, which gradually increases in the central region along with the implementation of “The Rise of Central China” policy. Inner Mongolia is the most obvious negative region in 2015–2020 because Inner Mongolia relies on the vast land and other advantages to attract a large number of investors and vigorously develop its secondary industry.

4. Discussion

4.1. Evolution Characteristics of PLES

From 2005 to 2020, complex dynamic changes took place in the PLES of the study area, which were reflected in the following three aspects:

- In terms of spatial evolution, from 2005 to 2020, the transfer speed of PLES in the YRB gradually slowed down. The reduction rate of PS decreased from 0.80% to 0.08%. The expansion rate of LS decreased from 9.73% to 3.75%. The ES reduction rate decreased from 0.38% to 0.34%.

- In terms of spatial transformation, the conversion of PLES was more frequent during 2005–2010, followed by 2015–2020, and the least frequent during 2010–2015, with a conversion frequency of “high-bottom-high”. During these periods, the conversion types are mainly PS to LS, PS to ES and ES to PS.

- In terms of the comprehensive dynamic degree, the dynamic degree of the YRB was 0.293% in 2005–2020, and it was 0.584%, 0.114% and 0.179% in 2005–2010, 2010–2015 and 2015–2020, respectively. After the decline, there is a slight upwards trend.

4.2. Spatiotemporal Heterogeneity of Driving Factors

The influences of various factors on the evolution of PLES are different, and there are different characteristics of differentiation in time and space.

- Financial revenue. In the temporal dimension, the mean value of the regression coefficient of local general public budget revenue decreases first and then increases. In the spatial dimension, the positive and negative regions of the regression coefficient are scattered, and the positive regions gradually expand from west to east, while the negative regions gradually shrink from west to east.

- Environment greening. In the temporal dimension, the mean of the regression coefficient of green area gradually decreased, and in the spatial dimension, the positive and negative areas interleaved and changed significantly. The positive area showed a decreasing trend and shifted from the downstream to the middle stream. The negative area first decreased and then increased and was concentrated in the upper reaches of the YRB.

- Investment intensity. In the time dimension, the mean negative value of the regression coefficient of fixed asset investment decreases. In the space dimension, the positive and negative regions of the regression coefficient are scattered, and the influence is mainly negative.

- Economic development. In the time dimension, the mean value of the regression coefficient of economic density shows a decreasing trend. Spatially, the positive influence decreases along a north-to-south gradient, and the negative influence increases along a north-to-south gradient.

- Population size. In the time dimension of population density, the mean value of the regression coefficient becomes increasingly negative, indicating that the negative influence is gradually weakened. In the spatial dimension, the positive region was mainly concentrated in the upstream and expanded to the middle reaches, while the negative region gradually decreased and shifted from the downstream to the middle reaches.

- Land use. In the temporal dimension, the mean value of the regression coefficient of land use intensity showed a decreasing trend. In the spatial dimension, the positive and negative regions of the regression coefficient were scattered, and the spatial heterogeneity was obvious.

- Primary industry. In the time dimension, the mean value of the regression coefficient on the proportion of primary industry in GDP is increasingly negative. In the spatial dimension, the positive influence decreases from south to north, and the negative influence increases from south to north.

- Secondary industry. In the time dimension, the mean value of the regression coefficient of the proportion of secondary industry in GDP tends to increase and then decrease. In the spatial dimension, the positive high-value area shrank from the edge to the centre, and the negative area shifted from Shandong to Shanxi and Inner Mongolia.

4.3. Policy Recommendations

At present, the ecological protection and high-quality development of the YRB has been upgraded to a national strategy. To realize the “clear water and green mountains” and “gold and silver mountains” of the YRB, the PLES must be scientifically planned, and ecological civilization building must be integrated into all facets of economic, political, cultural, and social development. However, financial revenue, environmental greening, investment intensity, economic development, population size, land use, primary and secondary industries and other factors in the YRB jointly drive the evolution of PLES. Based on the analysis of the GTWR regression coefficients of various factors, the PLES of the YRB should be reasonably planned based on the four dimensions of government governance, social economy, population restriction and industrial structure in the future.

- Government governance. The government plays a leading role in urban building, and fiscal revenue and environmental greening are the driving forces and guarantees of government governance. Therefore, the government should do the following two things in building a city.First, there is financial revenue. On the one hand, local governments should arrange the distribution of PLES scientifically, guide people to make rational use of land, and consider the importance of ES while pursuing production efficiency and expanding living space. On the other hand, it is necessary to optimize the existing tax system according to the unique circumstances of each city, increase the regulation function of taxes, and ensure the fiscal capacity of grassroots governments.Second, there is environmental greening. According to the difference in the eco-environmental quality of cities in the YRB, the land space of production–living–ecology should be rationally planned. Some areas in the upper reaches of the YRB need to strengthen the construction of urban greening in the process of city building due to the substantial improvement of LS. The middle reaches have been in a situation of soil and water loss for a long time, so local governments should pay attention to the timeliness and continuity of policies, strengthen the policies of ecological safety barrier protection and nature reserves, and promote the overall improvement of ES quality. The lower reaches are located in the plains, with a high degree of urbanization and industrialization, and need to strengthen their greening construction and make proper use of ecological compensation mechanisms to guide the conversion of farmland to forest or grassland.

- Social economy. Investment intensity and economic development should be scientifically and rationally arranged according to the resource endowments and geographical differences in the upper, middle and lower streams of the YRB.First, there is investment intensity. In addition to increasing investment in infrastructure, it is necessary to upgrade the original infrastructure, promote the agglomeration of innovation factors to enterprises through scientific and technological innovation, and enhance the innovation ability of enterprises, especially the construction of green power generation facilities such as wind, solar and water conservancy upstream. In addition, local governments should actively guide social capital to invest in emerging industries, accelerate the construction of industrial innovation platforms, promote the development and growth of emerging industry clusters, and enhance the radiating and driving role of regional economic development.Second, there is economic development. The upstream region should make use of its vast ES to promote an efficient ecological economy and realize coordinated development. Long-term exploitation of resources in the middle reaches has caused soil and water losses, and it is necessary to give priority to ecology, give overall consideration to all industrial types, adhere to integrated development, and coordinate the relationship between ecology and economic development. There are more PS and LS areas downstream. While urbanization and industrialization are developing rapidly, the original ES should be stabilized to create a sustainable urban system with a reasonable layout, complete functions and urban–rural integration.

- Population restriction. The increasingly sharp contradiction between humans and land directly affects today’s sustainable human socioeconomic development, and the more human activities disturb and invest in the land, the more easily the original ecosystem is broken.First, there is population size. The increase of population in the upstream and midstream makes the LS expand; at this time, we should enhance the dissemination and education of ecological civilization, advocate the public to form a green way of production and life, and promote the active participation of all people in ecological civilization construction. For the problem of population overload in some downstream areas, the strategy of migration relocation and labour export has been adopted to provide new development opportunities for the transferred labour force. At the same time, all localities should actively build green and low-carbon communities, families, enterprises, government agencies, etc., promote the integration of green and low-carbon concepts in production and life, and alleviate the pressure on regional resources and the environment.Second, there is land use. It is necessary to adhere to the strictest system of land conservation and intensive land use and strengthen land use control. In addition, relevant reform initiatives in the region should be combined according to local conditions, promoting the mutual coordination of land use transformation and economic and social development transformation, implementing the efficient management of land resources and promoting the sustainable use of regional land and coordinated regional development. It is also necessary to reasonably optimize the spatial layout, according to the regional land function positioning and the environmental carrying capacity, and to reasonably divide the core protection zone, control development zone and intensive development zone.

- Industrial structure. Through innovation-driven promotion of industrial transformation and the upgrading and optimization of traditional industries, the cultivation of emerging industries with less resource consumption can be accelerated.First, there is primary industry. Local government should vigorously develop green industries, promote the growth of the primary industry in the direction of specialization and intelligence, and choose different development modes according to the characteristics of the industry. In agriculture, we need to strengthen the construction of high-standard farmland on the basis of farmland protection, develop efficient modern agriculture and green ecological agriculture, and take the road of large-scale, intensive and green agriculture. Animal husbandry should focus on the protection and rational utilization of grassland resources based on a sustainable development strategy to excavate superior regional resources, develop modern animal husbandry and grassland tourism, and take the road of the ecological economy.Second, there is secondary industry. All industries need to accelerate their transformation and upgrading and strictly promote the five priority tasks of cutting overcapacity, reducing excess inventory, deleveraging, lowering costs, and strengthening areas of weakness. The mining industry should give full consideration to the development and utilization conditions and the importance of resources and develop mineral resources in an orderly manner according to the regional resource and environment carrying capacity and mineral resource endowment. The manufacturing sector should actively introduce advanced technologies, prioritize clean energy, deeply integrate global supply chains, and speed up innovation and upgrading. The power industry should strictly abide by pollution emission standards, strengthen the utilization of natural resources, and control the consumption of coal.

5. Conclusions

Based on the panel data of 73 cities in the YRB from 2005 to 2020, we analyzed the evolution characteristics of the PLES through a land transfer matrix and land dynamic attitude. Results show: the conversion rate of PLES in the YRB is gradually slowing down, and the frequency of spatial interconversion is in the form of “high-bottom-high”; the conversion types are mainly PS to LS, PS to ES and ES to PS, and the comprehensive dynamic degree decreases significantly and then shows a slight upwards trend. This paper further selects eight influencing factors from four dimensions of government governance, social economy, population restriction and industrial structure, and analyzed the driving mechanism of the evolution of the PLES by using the GTWR model. The results show the following: In terms of dimensions, social economy > population restriction > industrial structure > government governance. In terms of positive impact, economic development (X4) > environmental greening (X2) > land use (X6) > secondary industry (X8). In terms of negative impact, population size (X5) > primary industry (X7) > investment intensity (X3) > financial revenue (X1). Finally, according to the spatio-temporal heterogeneity of the influencing factors, we propose policy recommendations, in an attempt to provide reference value for scientific planning of PLES, ecological protection and high-quality development of the YRB. However, there are still some shortcomings in the paper. In terms of selecting the influencing factors, it fails to consider the economic, political, cultural and social aspects comprehensively; in terms of the model, although the spatio-temporal non-stationarity and urban spatial interactions are considered comprehensively, there are still many inadequacies in the method to be studied, such as the parameter ratio setting of the temporal and spatial dimensions, the optimization of the model bandwidth and the selection of the time step unit. Future research needs to consider the influencing factors of the spatial evolution of the PLES and improve the deficiencies of the model.

Author Contributions

Conceptualization, G.Z. and Q.Z.; data curation, D.Z.; formal analysis, G.Z. and D.Z.; funding acquisition, G.Z., Q.Z. and T.S.; methodology, G.Z., Q.Z. and D.Z.; supervision, G.Z., Q.Z. and T.S.; software, D.Z.; writing—original draft, D.Z.; writing—review and editing, G.Z., Q.Z., D.Z. and T.S. All authors have read and agreed to the published version of the manuscript.

Funding

This work was funded by grants from the Soft science Key Project of Henan Province (222400410010); the Major Project of Basic Research on Philosophy and Social Science in Henan Higher Education (2021-JCZD-25); the Major projects of China Social Science Foundation (18VSJ036, 21ZDA115).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data available in a publicly accessible repository.

Conflicts of Interest

The authors declare no conflict of interest. The funders had no role in the design of the study; in the collection, analyses, or interpretation of data; in the writing of the manuscript, or in the decision to publish the results.

References

- Qiu, M.; Zuo, Q.T.; Wu, Q.S.; Jang, Z.; Zhang, J. Water ecological security assessment and spatial autocorrelation analysis of prefectural regions involved in the Yellow River Basin. Sci. Rep. 2022, 12, 5105. [Google Scholar] [CrossRef] [PubMed]

- Lu, X.; Qu, Y.; Sun, P.; Yu, W.; Peng, W. Green Transition of Cultivated Land Use in the Yellow River Basin: A Perspective of Green Utilization Efficiency Evaluation. Land 2020, 9, 475. [Google Scholar] [CrossRef]

- Zhao, Y.H.; Hou, P.; Jiang, J.B.; Zhai, J.; Chen, Y.; Wang, Y.; Bai, J.; Zhang, B.; Xu, H. Coordination Study on Ecological and Economic Coupling of the Yellow River Basin. Int. J. Environ. Res. Public Health 2021, 18, 10664. [Google Scholar] [CrossRef] [PubMed]

- Li, J.S.; Sun, W.; Li, M.; Meng, L. Coupling coordination degree of production, living and ecological spaces and its influencing factors in the Yellow River Basin. J. Clean. Prod. 2021, 298, 126803. [Google Scholar] [CrossRef]

- Chen, Y.; Su, X.Y.; Wang, X.K. Spatial Transformation Characteristics and Conflict Measurement of Production-Living-Ecology: Evidence from Urban Agglomeration of China. Int. J. Environ. Res. Public Health 2022, 19, 1458. [Google Scholar] [CrossRef]

- Zhang, Y.D.; Li, F.; Li, K.; Sun, L.D.; Yang, H.J. The Influence of Space Transformation of Land Use on Function Transformation and the Regional Differences in Shaanxi Province. Int. J. Environ. Res. Public Health 2022, 19, 11793. [Google Scholar] [CrossRef]

- Ou, D.H.; Zhang, Q.; Wu, Y.; Qin, J.; Xia, J.; Deng, O.; Gao, X.; Bian, J.; Gong, S. Construction of a Territorial Space Classification System Based on Spatiotemporal Heterogeneity of Land Use and Its Superior Territorial Space Functions and Their Dynamic Coupling: Case Study on Qionglai City of Sichuan Province, China. Int. J. Environ. Res. Public Health 2021, 18, 9052. [Google Scholar] [CrossRef]

- Li, J.Z.; Ouyang, X.; Zhu, X. Land space simulation of urban agglomerations from the perspective of the symbiosis of urban development and ecological protection: A case study of Changsha-Zhuzhou-Xiangtan urban agglomeration. Ecol. Indic. 2021, 126, 107669. [Google Scholar] [CrossRef]

- Wang, S.; Qu, Y.; Zhao, W.; Guan, M.; Ping, Z. Evolution and Optimization of Territorial-Space Structure Based on Regional Function Orientation. Land 2022, 11, 505. [Google Scholar] [CrossRef]

- Liu, C.; Xu, Y.Q.; Wang, Y.; Cheng, L.; Lu, X.; Yang, Q. Analyzing the Value and Evolution of Land Use Functions from “Demand-Function-Value” Perspective: A Framework and Case Study from Zhangjiakou City, China. Land 2022, 11, 53. [Google Scholar] [CrossRef]

- Chen, Y.; Zhu, M.K. Spatiotemporal Evolution and Driving Mechanism of “Production-Living-Ecology” Functions in China: A Case of Both Sides of Hu Line. Int. J. Environ. Res. Public Health 2022, 19, 3488. [Google Scholar] [CrossRef] [PubMed]

- Wardenga, U. The Gradual Consolidation of Hettner’s Geography Construct: 1901–1908. Geogr. Uff 2018, 20, 3–20. [Google Scholar]

- Niu, B.; Ge, D.; Yan, R.; Ma, Y.; Sun, D.; Lu, M.; Lu, Y. The Evolution of the Interactive Relationship between Urbanization and Land-Use Transition: A Case Study of the Yangtze River Delta. Land 2021, 10, 804. [Google Scholar] [CrossRef]

- Cai, E.X.; Jing, Y.; Liu, Y.L.; Yin, C.; Gao, Y.; Wei, J. Spatial-Temporal Patterns and Driving Forces of Ecological-Living-Production Land in Hubei Province, Central China. Sustainability 2018, 10, 66. [Google Scholar] [CrossRef]

- Xie, X.T.; Li, X.S.; Fan, H.; He, W. Spatial analysis of production-living-ecological functions and zoning method under symbiosis theory of Henan, China. Environ. Sci. Pollut. Res. 2021, 28, 69093–69110. [Google Scholar] [CrossRef]

- Li, C.X.; Wu, J.Y. Land use transformation and eco-environmental effects based on production-living-ecological spatial synergy: Evidence from Shaanxi Province, China. Environ. Sci. Pollut. Res. 2022, 29, 41492–41504. [Google Scholar] [CrossRef]

- Zhao, Y.Q.; Cheng, J.H.; Zhu, Y.; Zhao, Y. Spatiotemporal Evolution and Regional Differences in the Production-Living-Ecological Space of the Urban Agglomeration in the Middle Reaches of the Yangtze River. Int. J. Environ. Res. Public Health 2021, 18, 12497. [Google Scholar] [CrossRef]

- Xie, B.; Wang, Q.; Huang, B.; Chen, Y.; Yang, J.; Qi, P. Coordinated State Analysis and Differential Regulation of Territorial Spatial Functions in Underdeveloped Regions: A Case Study of Gansu Province, China. Sustainability 2022, 14, 20. [Google Scholar] [CrossRef]

- Zeng, P.; Wu, S.H.; Sun, Z.; Zhu, Y.; Chen, Y.; Qiao, Z.; Cai, L. Does Rural Production-Living-Ecological Spaces Have a Preference for Regional Endowments? A Case of Beijing-Tianjin-Hebei, China. Land 2021, 10, 1265. [Google Scholar] [CrossRef]

- Tao, Y.Y.; Wang, Q.X. Quantitative Recognition and Characteristic Analysis of Production-Living-Ecological Space Evolution for Five Resource-Based Cities: Zululand, Xuzhou, Lota, Surf Coast and Ruhr. Remote Sens. 2021, 13, 1563. [Google Scholar] [CrossRef]

- Duan, Y.M.; Wang, H.; Huang, A.; Xu, Y.; Lu, L.; Ji, Z. Identification and spatial-temporal evolution of rural “production-living-ecological” space from the perspective of villagers’ behavior—A case study of Ertai Town, Zhangjiakou City. Land Use Policy 2021, 106, 105457. [Google Scholar] [CrossRef]

- Liao, T.; Li, D.; Wan, Q. Tradeoff of Exploitation-protection and Suitability Evaluation of Low-slope hilly from the perspective of “production-living-ecological” optimization. Phys. Chem. Earth 2020, 120, 102943. [Google Scholar] [CrossRef]

- Zhang, X.S.; Xu, Z.J. Functional Coupling Degree and Human Activity Intensity of Production-Living-Ecological Space in Underdeveloped Regions in China: Case Study of Guizhou Province. Land 2021, 10, 56. [Google Scholar] [CrossRef]

- Wu, J.S.; Zhang, D.N.; Wang, H.; Li, X. What is the future for production-living-ecological spaces in the Greater Bay Area? A multi-scenario perspective based on, D.E.E. Ecol. Indic. 2021, 131, 108171. [Google Scholar] [CrossRef]

- Huang, B.; Huang, J.; Pontius, R.G., Jr.; Tu, Z. Comparison of Intensity Analysis and the land use dynamic degrees to measure land changes outside versus inside the coastal zone of Longhai, China. Ecol. Indic. 2018, 89, 336–347. [Google Scholar] [CrossRef]

- Li, S.; Dong, B.; Gao, X.; Xu, H.; Ren, C.; Liu, Y.; Peng, L. Study on spatio-temporal evolution of habitat quality based on land-use change in Chongming Dongtan, China. Environ. Earth Sci. 2022, 81, 1–12. [Google Scholar] [CrossRef]

- Wu, L.F.; Kim, S.K. Exploring the equality of accessing urban green spaces: A comparative study of 341 Chinese cities. Ecol. Indic. 2021, 121, 107080. [Google Scholar] [CrossRef]

- Song, Y.; Chen, B.; Ho, H.C.; Kwan, M.-P.; Liu, D.; Wang, F.; Wang, J.; Cai, J.; Li, X.; Xu, Y.; et al. Observed inequality in urban greenspace exposure in China. Environ. Int. 2021, 156, 106778. [Google Scholar] [CrossRef]

- Zhang, C.Z.; Su, Y.Y.; Yang, G.; Chen, D.; Yang, R. Spatial-Temporal Characteristics of Cultivated Land Use Efficiency in Major Function-Oriented Zones: A Case Study of Zhejiang Province, China. Land 2020, 9, 114. [Google Scholar] [CrossRef]

- Khaledian, Y.; Kiani, F.; Ebrahimi, S.; Brevik, E.C.; Aitkenhead-Peterson, J. Assessment and Monitoring of Soil Degradation during Land Use Change Using Multivariate Analysis. Land Degrad. Dev. 2017, 28, 128–141. [Google Scholar] [CrossRef]

- Song, Y.; Song, X.; Shao, G.; Hu, T. Effects of Land Use on Stream Water Quality in the Rapidly Urbanized Areas: A Multiscale Analysis. Water 2020, 12, 1123. [Google Scholar] [CrossRef]

- Deng, Y.X.; Yang, R. Influence Mechanism of Production-Living-Ecological Space Changes in the Urbanization Process of Guangdong Province, China. Land 2021, 10, 1357. [Google Scholar] [CrossRef]

- Feng, C.C.; Zhang, H.; Xiao, L.; Guo, Y. Land Use Change and Its Driving Factors in the Rural-Urban Fringe of Beijing: A Production-Living-Ecological Perspective. Land 2022, 11, 314. [Google Scholar] [CrossRef]

- Liu, C.; Xu, Y.; Lu, X.; Han, J. Trade-offs and driving forces of land use functions in ecologically fragile areas of northern Hebei Province: Spatiotemporal analysis. Land Use Policy 2021, 104, 105387. [Google Scholar] [CrossRef]

- Naikoo, M.W.; Rihan, M.; Shahfahad; Peer, A.H.; Talukdar, S.; Mallick, J.; Ishtiaq, M.; Rahman, A. Analysis of peri-urban land use/land cover change and its drivers using geospatial techniques and geographically weighted regression. Environ. Sci. Pollut. Res. 2022, 1–19. [Google Scholar] [CrossRef]

- Zhao, C.H.; Jensen JL, R.; Weaver, R. Global and Local Modeling of Land Use Change in the Border Cities of Laredo, Texas, USA and Nuevo Laredo, Tamaulipas, Mexico: A Comparative Analysis. Land 2020, 9, 347. [Google Scholar] [CrossRef]

- Liu, K.; Qiao, Y.R.; Shi, T.; Zhao, Q. Study on coupling coordination and spatiotemporal heterogeneity between economic development and ecological environment of cities along the Yellow River Basin. Environ. Sci. Pollut. Res. 2021, 28, 6898–6912. [Google Scholar] [CrossRef]

- Yang, Y.Y.; Bao, W.K.; Liu, Y.S. Coupling coordination analysis of rural production-living-ecological space in the Beijing-Tianjin-Hebei region. Ecol. Indic. 2020, 117, 6898–6912. [Google Scholar] [CrossRef]

- Lin, G.; Fu, J.Y.; Jiang, D. Production-Living-Ecological Conflict Identification Using a Multiscale Integration Model Based on Spatial Suitability Analysis and Sustainable Development Evaluation: A Case Study of Ningbo, China. Land 2021, 10, 383. [Google Scholar] [CrossRef]

- Liu, W.; Zhan, J.; Zhao, F.; Yan, H.; Zhang, F.; Wei, X. Impacts of urbanization-induced land-use changes on ecosystem services: A case study of the Pearl River Delta Metropolitan Region, China. Ecol. Indic. 2019, 98, 228–238. [Google Scholar] [CrossRef]