Sources of SMEs Financing and Their Impact on Economic Growth across the European Union: Insights from a Panel Data Study Spanning Sixteen Years

Abstract

:1. Introduction

2. Literature Review

3. Variables of Interest and Research Questions

- Cost of loans (CL): measures the borrowing costs for small loans as compared to large loans. It is expressed as a percentage.

- Equity fund (EF): measures equity funding available for new and developing companies. It is expressed on a Likert scale from 1 to 5.

- Gross domestic product growth rate (GDPGR): measures the percentage growth rate at market-based prices on constant local currency. It is computed by dividing the current GDP size to the GDP size from the previous year.

- Value added growth rate (VAGR): measures the percentage growth rate for value added in services based on local currency. It is computed by dividing the current GDP size to the GDP size from the previous year.

- Strength of legal rights index (SLRI): measures the degree to which borrowers’ and lenders’ rights are protected by collateral and bankruptcy laws (namely, it expresses lending facilitation). The index takes values from 0 to 12, with higher scores showing that access to credit is facilitated by better-designed laws.

- Days sales outstanding (DSO): measures the number of days in which customers pay invoices issued by companies.

- Bad debt loss (BDL): measures the size of receivables that must be written off for not being paid. It is computed as a percentage in overall company turnover.

- Interest rate (IR): measures the interest rate average set for small loans. It is expressed as a percentage.

- Bank support (BS): measures a bank’s lending availability. It is expressed as a percentage of respondents who signaled a deterioration in accessing a loan.

- Business angels (BA): measures funding available from business angels for new and developing companies. It is expressed on a Likert scale from 1 to 5.

- Private lenders (PL): measures funding available from private lenders for new and developing companies. It is expressed on a Likert scale from 1 to 5.

- Public support (PS): measures access to public funding that also includes guarantees. It is expressed as a percentage of respondents who signaled a deterioration in accessing funds.

- a0 indicates the intercept;

- ai indicates the independent variables coefficients;

- X indicates the independent variables;

- i indicates the SME activity in the 28 countries;

- t denotes the time span considered;

- indicates fixed effects that control for common shocks;

- indicates the error term.

4. Empirical Results

4.1. Econometric Models

4.1.1. Central Tendency and Variation Analysis

4.1.2. Correlation Analyses

4.1.3. Econometric Estimations

4.2. Multiplex Time Series Analysis

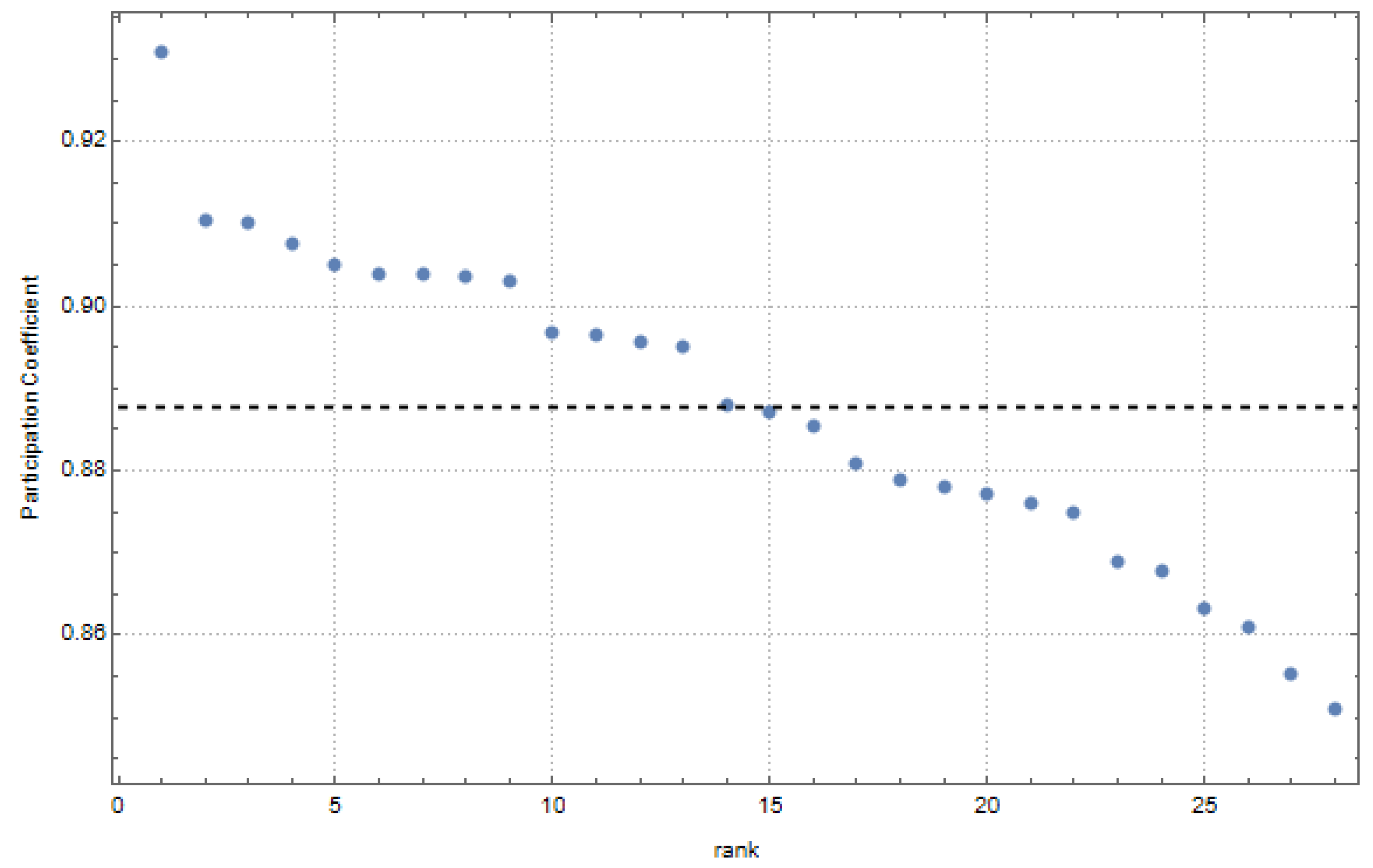

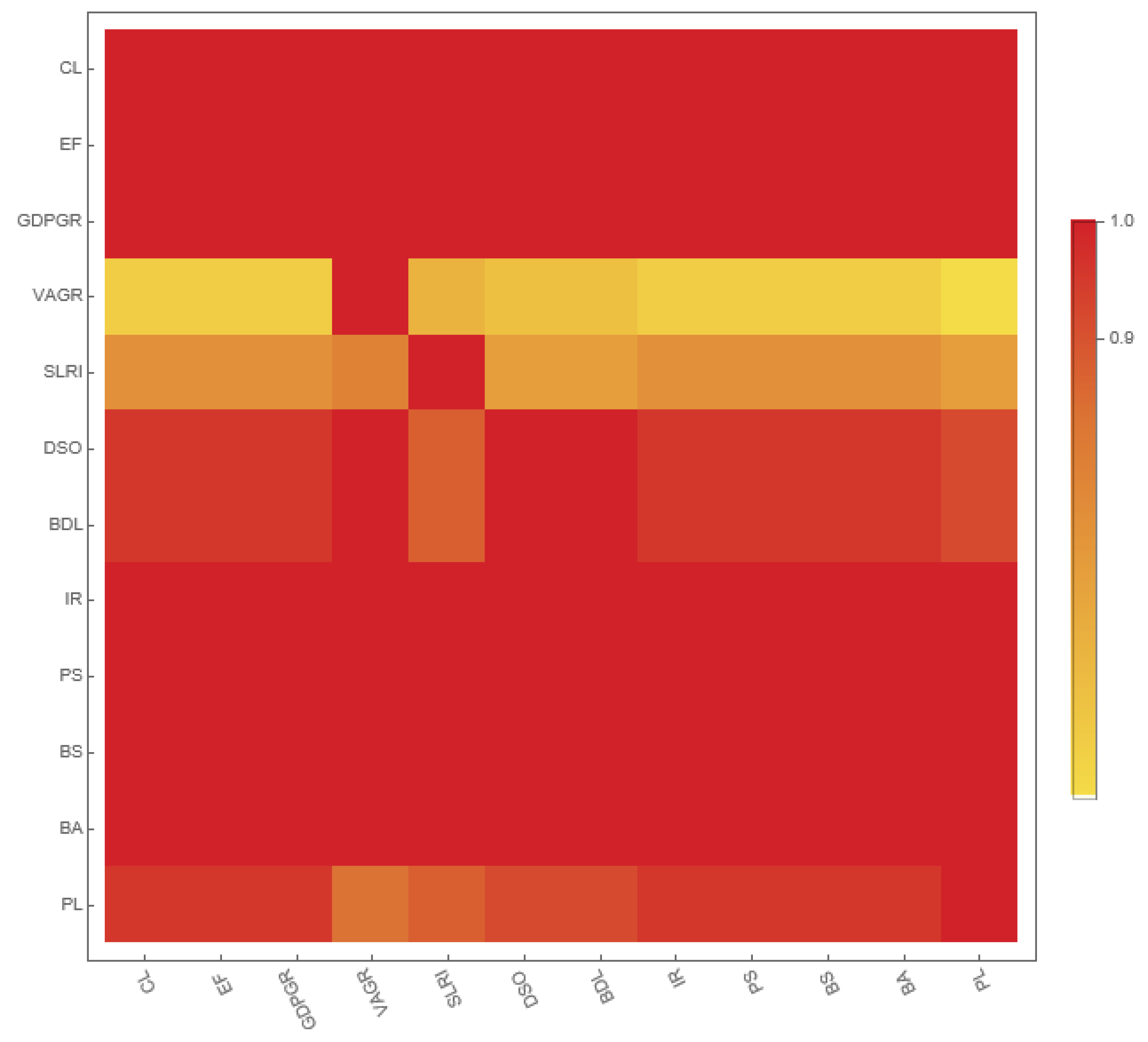

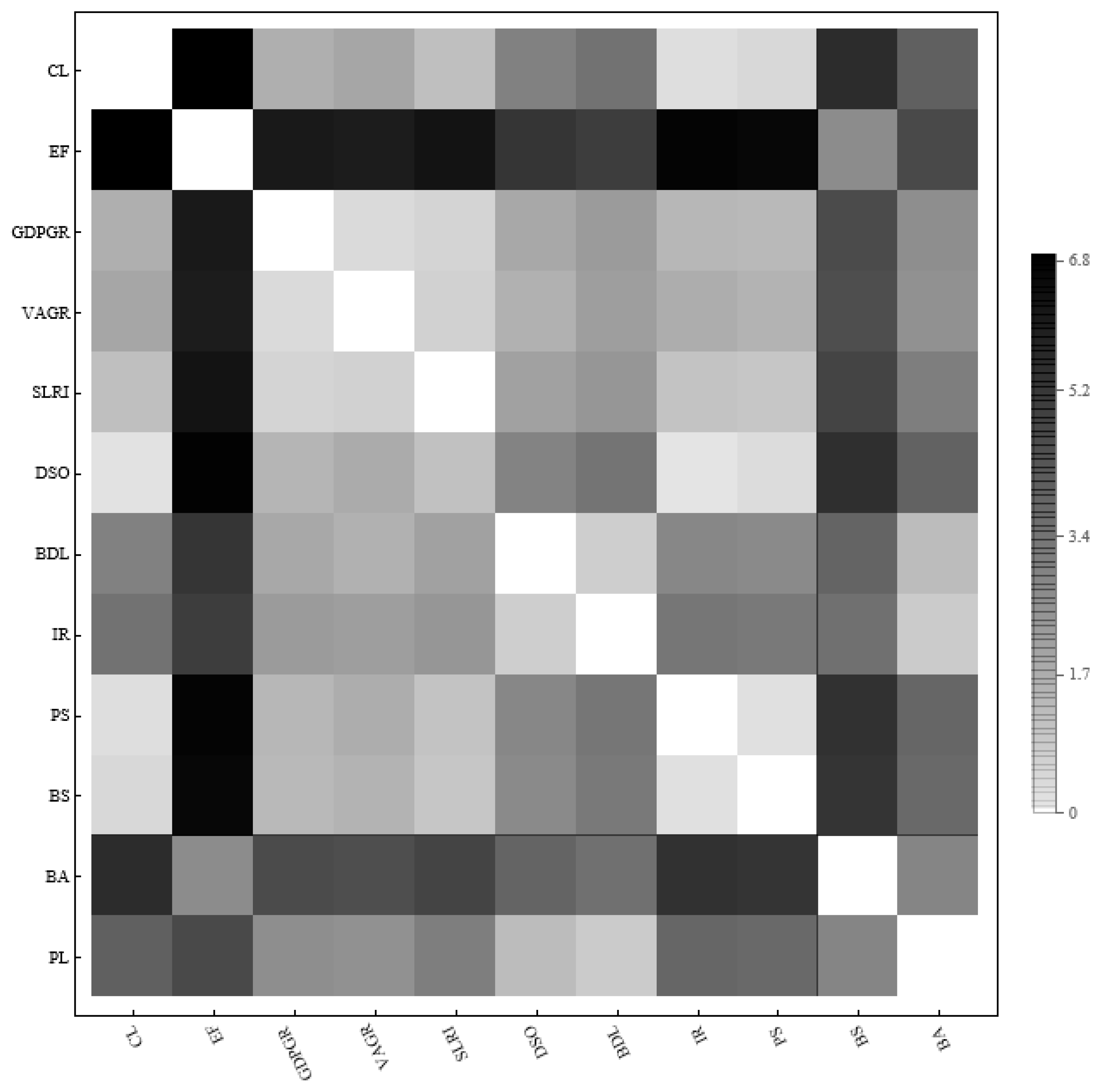

Multiplex Measures

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Abbreviations

| BA | Business angels |

| BS | Bank support |

| BDL | Bad debt loss |

| CL | Cost of loans |

| DSO | Days sales outstanding |

| EF | Equity fund |

| GDPGR | Gross domestic product growth rate |

| GMM | Generalized method of moments |

| IR | Interest rate |

| PL | Private lenders |

| PS | Public support |

| SLRI | Strength of legal rights index |

| SMEs | Small and medium enterprises |

| VAGR | Value added growth rate |

| VIF | Variance inflation factor |

References

- Bammer, G.; Smithson, M. Uncertainty and Risk: Multidisciplinary Perspectives, 1st ed.; Routledge: Oxon, UK, 2009. [Google Scholar]

- Biello, D. Can Math Beat Financial Markets? Scientific American. 2011. Available online: https://www.scientificamerican.com/article/can-math-beat-financial-markets/ (accessed on 12 August 2022).

- Heyman, B. Risk and uncertainty: A review of three recent texts. Health Risk Soc. 2009, 11, 87–90. [Google Scholar] [CrossRef]

- Kirikkaleli, D. Does political risk matter for economic and financial risks in Venezuela? J. Econ. Struct. 2020, 9, 3. [Google Scholar] [CrossRef] [Green Version]

- Ben Ghozzi, B.; Chaibi, H. Political risks and financial markets: Emerging vs. developed economies. EuroMed J. Bus. 2021. [Google Scholar] [CrossRef]

- Beckert, J. The social order of markets. Theory Soc. 2009, 38, 245–269. [Google Scholar] [CrossRef] [Green Version]

- European Commission. User Guide to the SME Definition; Publications Office of the European Union: Luxembourg, 2017. Available online: https://ec.europa.eu/regional_policy/sources/conferences/state-aid/sme/smedefinitionguide_en.pdf (accessed on 12 August 2022).

- Small and Medium Enterprises (SMEs) Finance. Available online: https://www.worldbank.org/en/topic/smefinance (accessed on 12 October 2021).

- International Labour Organization. Small Matters: Global Evidence on the Contribution to Employment by the Self-employed, Micro-Enterprises and SMEs; International Labour Organization: Geneva, Switzerland, 2019. [Google Scholar]

- OECD. Enhancing the Contributions of SMEs in a Global and Digitalised Economy. Available online: https://www.oecd.org/industry/C-MIN-2017-8-EN.pdf (accessed on 14 August 2022).

- Lin, D.-Y.; Rayavarapu, S.N.; Tadjeddine, K.; Yeoh, R. Beyond Financials: Helping Small and Medium-Size Enterprises Thrive. Available online: https://www.mckinsey.com/industries/public-and-social-sector/our-insights/beyond-financials-helping-small-and-medium-size-enterprises-thrive (accessed on 14 August 2022).

- Batrancea, L.M. Determinants of economic growth across the European Union: A panel data analysis on small and medium enterprises. Sustainability 2022, 14, 4797. [Google Scholar] [CrossRef]

- Maow, B.A. The impact of small and medium enterprises (SMEs) on economic growth and job creation in Somalia. J. Econ. Policy Res. 2021, 8, 45–56. [Google Scholar]

- OECD. Small Businesses, Job Creation and Growth: Facts, Obstacles and Best Practices. Available online: https://www.oecd.org/cfe/smes/2090740.pdf (accessed on 15 August 2022).

- Cooney, T.M. Entrepreneurial Skills for Growth-oriented Businesses. In Proceedings of the Skills Development for SMEs and Entrepreneurship, Copenhagen, Denmark, 28 November 2012; Available online: https://www.oecd.org/cfe/leed/Cooney_entrepreneurship_skills_HGF.pdf (accessed on 12 August 2022).

- OECD. SMEs, Entrepreneurship and Innovation; OECD: Paris, France, 2010. Available online: https://read.oecd-ilibrary.org/industry-and-services/smes-entrepreneurship-and-innovation_9789264080355-en#page1 (accessed on 12 August 2022).

- OECD. New Approaches to SME and Entrepreneurship Financing: Broadening the Range of Instruments. Available online: https://www.oecd.org/cfe/smes/New-Approaches-SME-full-report.pdf (accessed on 13 August 2022).

- Clifford, C. Billionaire Richard Branson: This Simple Trick Is the Best Way to Come up with an Idea for a Successful Business. Available online: https://www.cnbc.com/2018/01/03/richard-branson-how-to-come-up-with-a-successful-business-idea.html (accessed on 12 August 2022).

- Yoshino, N.; Taghizadeh-Hesary, F. The Role of SMEs in Asia and Their Difficulties in Accessing Finance; ADBI Working Paper 911; Asian Development Bank Institute: Tokyo, Japan, 2018; Available online: https://www.adb.org/publications/role-smes-asia-and-their-difficulties-accessing-finance (accessed on 13 August 2022).

- Hossain, M.; Yoshino, N.; Taghizadeh-Hesary, F. Optimal branching strategy, local financial development, and SMEs’ performance. Econ. Model. 2021, 96, 421–432. [Google Scholar] [CrossRef]

- Kapitsinis, N.; Munday, M.; Roberts, A. Exploring a low SME equity equilibrium in Wales. Eur. Plan. Stud. 2021, 10, 1777–1797. [Google Scholar] [CrossRef]

- Nigohosyan, D.; Vutsova, A.; Vassileva, I. Effectiveness and efficiency of the EU-supported energy efficiency measures for SMEs in Bulgaria in the period 2014–2020: Programme design implications. Energy Effic. 2021, 14, 24. [Google Scholar] [CrossRef]

- Hasan, I.; Jackowicz, K.; Jagiello, R.; Kowalewski, O.; Kozlowski, L. Local banks as difficult-to-replace SME lenders: Evidence from bank corrective programs. J. Bank. Financ. 2021, 123, 106029. [Google Scholar] [CrossRef]

- Mkhaiber, A.; Werner, R.A. The relationship between bank size and the propensity to lend to small firms: New empirical evidence from a large sample. J. Int. Money Financ. 2021, 110, 102281. [Google Scholar] [CrossRef]

- Ciampi, F.; Giannozzi, A.; Marzi, G.; Altman, E.I. Rethinking SME default prediction: A systematic literature review and future perspectives. Scientometrics 2021, 126, 2141–2188. [Google Scholar] [CrossRef] [PubMed]

- Eldridge, D.; Nisar, T.M.; Torchia, M. What impact does equity crowdfunding have on SME innovation and growth? An empirical study. Small Bus. Econ. 2021, 56, 105–120. [Google Scholar] [CrossRef] [Green Version]

- Mina, A.; Di Minin, A.; Martelli, I.; Testa, G.; Santoleri, P. Public funding of innovation: Exploring applications and allocations of the European SME Instrument. Res. Policy 2021, 50, 104131. [Google Scholar] [CrossRef]

- Kim, H.S.; Cho, K.S. Financing resources of SMEs and firm performance: Evidence from Korea. Asian J. Bus. Account. 2020, 13, 1–26. [Google Scholar] [CrossRef]

- Wang, X.D.; Han, L.; Huang, X.; Mi, B. The financial and operational impacts of European SMEs’ use of trade credit as a substitute for bank credit. Eur. J. Financ. 2021, 27, 796–825. [Google Scholar] [CrossRef]

- Eurostat Database. Available online: https://ec.europa.eu/eurostat (accessed on 12 August 2022).

- Lacasa, L.; Nicosia, V.; Latora, V. Network structure of multivariate time series. Sci. Rep. 2015, 5, 15508. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Newman, M.E.J. Networks: An Introduction; Oxford University Press: Oxford, MS, USA, 2010. [Google Scholar]

- Albert, R.; Barabási, A.-L. Statistical mechanisms of complex networks. Rev. Mod. Phys. 2002, 74, 47. [Google Scholar] [CrossRef] [Green Version]

- D′Arcangelis, A.M.; Rotundo, G. Complex networks in finance. In Complex Networks and Dynamics; Commendatore, P., Matilla-García, M., Varela, L.M., Cánovas, J.S., Eds.; Springer: Cham, Switzerland, 2016; pp. 209–235. [Google Scholar]

- OECD. Financing SMEs and Entrepreneurs 2022; OECD: Paris, France, 2022. Available online: https://www.oecd.org/cfe/smes/financing-smes-and-entrepreneurs-23065265.htm (accessed on 14 August 2022).

- Batrancea, L.; Rathnaswamy, M.M.; Batrancea, I.; Nichita, A.; Rus, M.-I.; Tulai, H.; Fatacean, G.; Masca, E.S.; Morar, I.D. Adjusted net savings of CEE and Baltic nations in the context of sustainable economic growth: A panel data analysis. J. Risk Financ. Manag. 2020, 13, 234. [Google Scholar]

- Deng, X.; Huang, Z.; Cheng, X. FinTech and sustainable development: Evidence from China based on P2P data. Sustainability 2019, 11, 6434. [Google Scholar] [CrossRef]

- Leong, K.; Sung, A.; Teissier, C. Financial technology for sustainable development. In Partnership for the Goals; Leal Filho, W., Marisa Azul, A., Brandli, L., Lange Salvia, A., Wall, T., Eds.; Springer: Cham, Switzerland, 2021; pp. 453–466. [Google Scholar]

- Cen, T.; He, R. Fintech, Green Finance and Sustainable Development. In Proceedings of the 2018 International Conference on Management, Economics, Education, Arts and Humanities (MEEAH 2018); Atlantis Press: Amsterdam, The Netherlands, 2018; pp. 222–225. [Google Scholar]

| CL | SLRI | DSO | BDL | IR | |

|---|---|---|---|---|---|

| Mean | 22.7246 | 6.1076 | 45.8201 | 2.9302 | 4.5909 |

| Median | 20.3105 | 6.0000 | 39.6667 | 2.5000 | 4.0700 |

| Maximum | 78.9699 | 10.0000 | 120.6667 | 10.4000 | 44.3694 |

| Minimum | −29.4355 | 2.0000 | 13.0000 | 0.4000 | 1.5000 |

| Standard dev. | 16.5954 | 2.3218 | 22.2596 | 1.8276 | 2.9029 |

| Skewness | 0.7531 | −0.2245 | 1.3932 | 2.0273 | 6.4567 |

| Kurtosis | 4.1061 | 1.9497 | 4.6072 | 7.9555 | 81.7397 |

| Jarque–Bera test | 65.1827 *** | 24.2486 *** | 190.1228 *** | 765.2705 *** | 118845 *** |

| Observations | 448 | 446 | 441 | 441 | 448 |

| EF | GDPGR | VAGR | BS | BA | PL | PS | |

|---|---|---|---|---|---|---|---|

| Mean | 2.7436 | 1.7050 | 1.9551 | 19.8091 | 2.6552 | 2.5339 | 17.3436 |

| Median | 2.7800 | 2.1079 | 2.1335 | 16.6950 | 2.6400 | 2.4900 | 13.7728 |

| Maximum | 8.5810 | 25.1762 | 43.5553 | 68.0000 | 3.7500 | 4.0300 | 69.2729 |

| Minimum | 1.5400 | −14.8386 | −11.7670 | 1.9413 | 1.6200 | 1.3300 | 1.8932 |

| Standard dev. | 0.4883 | 4.0142 | 4.0599 | 12.9079 | 0.3969 | 0.5522 | 11.1384 |

| Skewness | 3.8269 | −0.4297 | 1.9885 | 0.9578 | 0.0079 | 0.2430 | 1.2219 |

| Kurtosis | 47.5807 | 7.17807 | 28.8316 | 3.4407 | 2.9886 | 2.6908 | 4.43777 |

| Jarque–Bera test | 37936.51 *** | 339.6395 *** | 12295.53 *** | 71.7937 *** | 0.0071 | 6.1682 *** | 149.3905 *** |

| Observations | 445 | 448 | 432 | 446 | 446 | 446 | 446 |

| CL | BDL | DSO | SLRI | IR | |

|---|---|---|---|---|---|

| CL | 1 | ||||

| BDL | −0.329 | 1 | |||

| DSO | −0.099 | 0.090 | 1 | ||

| SLRI | −0.112 | 0.025 | −0.398 * | 1 | |

| IR | −0.333 * | 0.345 * | 0.148 | 0.256 * | 1 |

| EF | GDPGR | VAGR | BS | BA | PL | PS | |

|---|---|---|---|---|---|---|---|

| EF | 1 | ||||||

| GDPGR | 0.769 | 1 | |||||

| VAGR | 0.119 | 0.013 | 1 | ||||

| BS | −0.161 | −0.088 | −0.189 | 1 | |||

| BA | 0.057 | −0.044 | 0.584 ** | −0.263 * | 1 | ||

| PL | −0.017 | −0.082 | 0.378 * | −0.067 | 0.424 * | 1 | |

| PS | −0.089 | −0.027 | −0.188 | 0.736 *** | −0.305 * | 0.005 | 1 |

| VIF | M1 Model | VIF | M2 Model | VIF | M3 Model | VIF | M4 Model | |

|---|---|---|---|---|---|---|---|---|

| CL(−1) | - | 0.4487 *** (30.7446) | - | - | - | - | - | - |

| EF(−1) | - | - | - | 0.2568 *** (7.4826) | - | - | - | |

| GDPGR(−1) | - | - | - | - | - | 0.2665 *** (46.1617) | - | - |

| VAGR(−1) | - | - | - | - | - | - | - | 0.1117 *** (12.3168) |

| SLRI | 1.2918 | −0.3334 * (−2.6981) | ||||||

| DSO | 1.2388 | −0.0175 (−0.2074) | ||||||

| BDL | 1.1366 | −0.3033 (−1.2335) | ||||||

| IR | 1.2771 | −1.4969 *** (−12.3894) | ||||||

| PS | - | 2.2055 | 0.0029 *** (6.4526) | 2.2018 | 0.0126 (0.5034) | 2.3010 | 0.0347 *** (2.6268) | |

| BS | - | 2.1126 | −0.0044 *** (−9.0944) | 2.1071 | −0.0338 * (−1.7699) | 2.1951 | −0.1002 *** (−10.6211) | |

| BA | - | 1.3654 | 0.4454 *** (19.3539) | 1.3649 | 1.6633 *** (6.7495) | 1.3689 | −1.0816 ** (−2.0010) | |

| PL | - | 1.2516 | 0.3321 *** (6.9125) | 1.2512 | −1.1877 (−1.0604) | 1.2545 | −2.2131 (−0.6229) | |

| White cross-section standard errors and covariance (d.f. corrected) | - | Yes | Yes | Yes | Yes | |||

| Cross-section effects | - | Fixed | Fixed | Fixed | Fixed | |||

| Hansen J-statistic | - | 26.3837 | 23.6006 | 25.3661 | 25.4145 | |||

| Prob. (J-statistic) | - | 0.2831 | 0.4262 | 0.3317 | 0.2777 | |||

| AR(1) p-value | - | 0.009 | 0.000 | 0.005 | 0.236 | |||

| AR(2) p-value | - | 0.148 | 0.424 | 0.015 | 0.692 | |||

| Instrument rank | 28 | 28 | 28 | 27 | ||||

| Observations | 382 | 378 | 380 | 366 |

| Region | Region | Region | ||||||

| Austria | 0.9099 | 0.1738 | Finland | 0.8966 | 0.2161 | Lithuania | 0.8808 | 0.4079 |

| Belgium | 0.8872 | −0.1165 | France | 0.9076 | 0.0770 | Luxembourg | 0.8950 | 0.5580 |

| Bulgaria | 0.8679 | −0.3645 | Germany | 0.8966 | 1.6415 | Malta | 0.8554 | 0.5435 |

| Croatia | 0.8748 | −0.6382 | Greece | 0.8759 | −1.5629 | Netherlands | 0.9309 | −0.8543 |

| Cyprus | 0.9039 | −1.5439 | Hungary | 0.8781 | −0.1266 | Poland | 0.9029 | 0.8017 |

| Czech Republic | 0.9038 | 0.2317 | Ireland | 0.8689 | −1.7803 | Portugal | 0.8957 | −0.0912 |

| Denmark | 0.9036 | 1.0036 | Italy | 0.8789 | 0.2159 | Romania | 0.8770 | −2.1103 |

| Estonia | 0.9103 | −0.9651 | Latvia | 0.8633 | 0.3949 | Slovakia | 0.8509 | 1.3978 |

| Slovenia | 0.8611 | 1.1380 | Sweden | 0.8853 | 1.6958 | |||

| Spain | 0.8879 | 0.4076 | UK | 0.9049 | −0.7512 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Batrancea, L.M.; Balcı, M.A.; Chermezan, L.; Akgüller, Ö.; Masca, E.S.; Gaban, L. Sources of SMEs Financing and Their Impact on Economic Growth across the European Union: Insights from a Panel Data Study Spanning Sixteen Years. Sustainability 2022, 14, 15318. https://doi.org/10.3390/su142215318

Batrancea LM, Balcı MA, Chermezan L, Akgüller Ö, Masca ES, Gaban L. Sources of SMEs Financing and Their Impact on Economic Growth across the European Union: Insights from a Panel Data Study Spanning Sixteen Years. Sustainability. 2022; 14(22):15318. https://doi.org/10.3390/su142215318

Chicago/Turabian StyleBatrancea, Larissa M., Mehmet Ali Balcı, Leontina Chermezan, Ömer Akgüller, Ema Speranta Masca, and Lucian Gaban. 2022. "Sources of SMEs Financing and Their Impact on Economic Growth across the European Union: Insights from a Panel Data Study Spanning Sixteen Years" Sustainability 14, no. 22: 15318. https://doi.org/10.3390/su142215318

APA StyleBatrancea, L. M., Balcı, M. A., Chermezan, L., Akgüller, Ö., Masca, E. S., & Gaban, L. (2022). Sources of SMEs Financing and Their Impact on Economic Growth across the European Union: Insights from a Panel Data Study Spanning Sixteen Years. Sustainability, 14(22), 15318. https://doi.org/10.3390/su142215318