Abstract

To investigate the effects of carbon trading pricing and overconfidence on supply chain emission reduction decisions, this paper establishes a supply chain model consisting of a manufacturer and a retailer and applies the Stackelberg game model. The objective is to explore the effects of carbon trading pricing and overconfidence on supply chain members’ decisions and profits. The study shows that carbon trading prices can be a good guide for low-cost manufacturers to reduce emissions when manufacturers are rational under carbon trading policies. However, the ability of carbon trading prices to act as a guide starts to fail as the cost of emission reduction increases. When manufacturers are overconfident, this causes manufacturers to increase the emission reduction rate of their products under carbon trading policies. In addition, this effect increases in line with increases in carbon trading prices. When manufacturers face different emission reduction costs, higher carbon trading prices do not necessarily always generate benefits for rational manufacturers. For overconfident manufacturers, however, overconfidence is always detrimental, especially when the price of carbon trading increases. Retailers tend to choose to work with manufacturers who are less overconfident, when the higher price of carbon trading results in higher gains for the retailer.

1. Introduction

Over the past few years, excessive greenhouse gas emissions have exacerbated global warming. The frequency of climate-related changes and extreme weather events has also had a negative impact on the environment and society [1,2,3]. In order to control carbon emissions and maintain sustainable economic development, governments have started to implement low-carbon policies. The more commonly used policies currently include the introduction of carbon taxes [4], the implementation of carbon trading systems [5] and low-carbon subsidy policies [6]. Among them, a carbon trading policy, as an effective measure used to control carbon emissions, on the one hand, raises the cost of reducing emissions for enterprises and controls carbon emissions at source [7]. On the other hand, a carbon trading policy enhances the efficiency of resource allocation, while simultaneously enriching financial sources and realizing the unity of environmental and economic benefits [8]. The experience of the European Union’s carbon trading market (EU-ETS) also confirms the policy’s role in promoting emissions reduction [9].

Under a carbon trading policy, the carbon trading price is the most direct market signal. The price effectively guides enterprises in terms of regulating their carbon emissions in their production processes [10]. Enterprises make emission reduction decisions with the goal of maximizing profits. As such, enterprise managers need to consider both costs and benefits when making decisions. From a cost perspective, enterprises often need to anticipate the price of carbon trading in their production activities. If the price of carbon trading fluctuates more than expected, the original production plan will be adjusted, resulting in additional emergency disposal costs [11]. From a revenue perspective, when the price of carbon trading shows a steady upward trend, the benefits of emission reduction will increase, and, conversely, with a downward trend, the benefits will decrease. Therefore, changes in the price of carbon trading affect enterprises’ revenue, and these price changes are an important basis for regulating emission reduction decisions [12].

However, in the face of government pressure to reduce carbon emissions, coupled with the uncertainty faced in the carbon market, enterprises tend to show limited rationality [13]. Overconfidence, a common irrational psychological characteristic in corporate decision making, not only reduces the quality of corporate decisions to a certain extent, but also affects the performance of the whole supply chain [14]. For example, Nokia was overconfident regarding its self-developed Symbian system and was unwilling to use Android. Eventually, Nokia sold its mobile phone business to Microsoft. Therefore, there is relevance in studying the impact of overconfidence on corporate decision making and profits.

The research in this paper makes three contributions, as follows: first, it enriches the study of overconfidence in low-carbon supply chains. Considering both the impact of overconfidence and the need for firms to reduce emissions, a game model is constructed to analyze the impact of overconfidence on supply chain emissions reduction decisions. Second, this study provides new insights into the operational strategies of supply chain members. When the manufacturer is overconfident, the retailer’s profit change depends on the degree of the manufacturer’s overconfidence. In addition, this overconfidence does not necessarily harm the retailer’s profits. Finally, the paper analyzes the impact of carbon trading prices on the emission reduction decisions of different types of manufacturers and provides suggestions for government involvement in setting carbon pricing mechanisms.

2. Literature Review

The literature relevant to this paper focuses on three areas of research: carbon trading prices, overconfidence (particularly in the area of supply chain management) and supply chain mitigation decisions under a carbon policy.

2.1. Studies Related to Carbon Trading Prices

Under a carbon trading mechanism, carbon emission rights can be used for trading as a general commodity to achieve complementary resources between trading parties. With the establishment of the EU-ETS, for the first time, a carbon trading price was established in Europe. Most studies on carbon prices have focused on predicting carbon prices [15,16,17,18] and their influencing factors [19,20,21]. For example, Yan made a hybrid model of carbon price prediction based on feature selection and multi-objective optimization algorithms, setting up models with lower errors [22]. Fan et al. [23] investigated which policy adjustments in the EU carbon trading mechanism actually affect carbon prices. Hao et al. [24] investigated the impact of different factors on carbon trading prices. However, very few studies have focused on the impact of carbon prices on firms’ carbon emissions. Among the ones that have, most of the research affirms the role of carbon trading prices, arguing that a higher carbon trading price can motivate manufacturers to increase investment in and make improvements in emissions reduction [25,26]. Li et al. [27] suggested that the government should reduce carbon quotas and encourage manufacturers to increase green investments by increasing the carbon trading prices. However, as time increases, the effect of a carbon trading policy on firms diminishes and can have a negative effect on long-term profits when carbon trading prices are high [28]. Xia et al. [29] found that carbon trading prices have very different impacts on clean and polluting manufacturers. The study concluded that, in order to better reduce emissions, the government needs to set appropriate carbon trading prices, according to different types of manufacturers. In addition, setting a price floor in carbon trading policies can stabilize investors’ expectations of future carbon prices and better promote low-carbon investments [30]. As a market set up by the government, a carbon market can effectively reduce the total carbon emissions of companies by regulating the price of carbon trading [31]. For firms, deciding how to use carbon trading prices to determine their productivity and trading volumes is challenging [32], and yet, little attention has been paid to carbon trading prices as an important indicator. Therefore, exploring the mechanism of the impact of carbon trading prices on carbon emissions is conducive to a sound carbon trading policy. The results may help ensure that the potential curbing effect of carbon trading on carbon emissions can be fully exploited.

2.2. Overconfidence

Overconfidence, the most prevalent, prominent and influential irrational behavior [33], has been studied in many fields. Moore et al. [34] classified overconfident behavior into three types, based on statistics and a summary of previous research: overestimation, overplacement (one’s belief that he or she is better than others) and overprecision (one’s exaggerated certainty that they know the truth). The first two types are based on overconfidence in the decision maker’s ability, i.e., the belief that one is above average. The third type is overconfidence based on predictive accuracy, i.e., people believe that they are more accurate in predicting the actual situation and outcome. Subsequent scholars have built on previous research and found that the overconfidence of supply chain members not only affects their own decisions, but also the performance of the whole supply chain [35,36]. Related studies fall into two main categories. One considers overconfidence in supply chain decision making; for example, considering the impact of overconfidence on optimal decision making in inventory management [37], the decision-making problem of overconfident retailers when their beliefs about market demand are biased [38], and the impact of overconfidence of a single oligarch on the pricing and ordering decisions of another oligarch [39]. Some studies also examine the impact of the interaction effect of overconfidence and social preferences on supply chains. Examples include discussing the interaction effect of overconfidence with equity concerns [40,41,42] and risk aversion [43] on supply chain performance. The second strand of literature examines the impact of overconfidence on supply chain coordination. These studies discuss the impact of overconfidence on traditional supply chain coordination contracts, including quantity discount contracts [44], wholesale price contracts [45] and option contracts [46].

In addition, some other scholars have analyzed the impact of overconfidence on supply chain reduction decisions in the background of a low-carbon economy. Liu et al. [47] stated that overconfidence makes manufacturers increase the greenness of their products, compared to rational manufacturers. This will increase the profits of retailers and the whole supply chain [48] but hurts the manufacturer’s own profits [49].

Existing related studies have achieved fruitful results in areas such as the overconfidence of supply chain members. However, few scholars have studied supply chain decision making when overconfidence is considered in the context of a low-carbon economy. Carbon trading is a policy tool used to encourage and strengthen manufacturers’ motivation to reduce emissions. Therefore, this paper introduces the psychology of overconfidence under a carbon trading policy and explores the impact of overconfidence on supply chain members’ decision making.

2.3. Research Related to Supply Chain Emissions Reduction Decisions under a Carbon Policy

Existing discussions regarding the impact of carbon policies on the level of firms’ emission reduction efforts and low-carbon investment decisions have mostly used mathematical modelling [50]. However, some scholars have also demonstrated through empirical studies that carbon trading systems influence firms’ emission reduction behavior by regulating low-carbon management systems and carrying out carbon asset transactions [51]. The retrieved literature can be divided into two categories. First, some studies have explored the effectiveness of carbon policies on supply chain emissions reduction. Yang investigated manufacturers’ channel choices and emissions reduction decisions when considering carbon emission constraints [52]. Li et al. [53] explored the impact of two types of government subsidies on supply chain emissions reduction decisions and found that higher subsidies encourage firms to use more expensive (but cleaner) low-carbon technologies. The second type of study has explored the effects of carbon policies on supply chain firms’ choice of low-carbon technologies [54]. Xu et al. [55] constructed a dynamic production model to derive both the optimal carbon trading policy and the optimum production strategy (low-carbon product or common product) while considering the inventory strategy. Diao et al. [56] explored the relationship between manufacturers’ optimal emission reduction decisions and carbon quotas and taxes under a mixed carbon policy. The study aimed to provide a theoretical basis for government policies. Wang et al. [57] investigated manufacturers’ production decisions regarding whether to remanufacture or invest in emission reduction under a carbon tax policy [58]. In addition, some studies have explored supply chain R&D cooperation for emissions reduction [59]. These studies have suggested that manufacturers and suppliers make higher emissions reduction efforts and higher profits under a cooperative emissions reduction model than under a non-cooperative model [60].

In summary, there is a wealth of domestic and international research on carbon policy and supply chain carbon emissions. Importantly, however, few scholars have analyzed the impact of overconfidence on supply chain emissions reduction decisions in the context of carbon trading policies. Carbon trading, as a policy tool used to drive manufacturers to reduce emissions, undoubtedly strengthens manufacturers’ incentives to reduce emissions. However, what are the implications for their decisions and those of other members of the supply chain when manufacturers overestimate the benefits that may be accrued from their emissions reduction inputs?

3. Methodology and Model Assumptions

3.1. Methodology

The effectiveness of carbon markets has been the focus of scholarly research since the implementation of carbon trading policies. In this paper, a low-carbon supply chain (details can be found in the problem description) is studied, to explore the effects of carbon trading prices and manufacturer overconfidence on manufacturers and retailers in the supply chain. Considering the methodology and contributions, this paper adopts the Stackelberg game model, a research method based on a large body of existing studies; the game is widely used to solve supply chain decision problems. In the existing literature, few scholars have introduced overconfidence into the field of low-carbon supply chains; neither have they considered the impact of carbon trading price volatility on the supply chains. This paper aims to fill this research gap. To highlight the novelty more clearly, Table 1 shows the differences between this study and previous studies.

Table 1.

The differences between this study and previous studies.

3.2. Problem Description

This paper constructs a supply chain consisting of a manufacturer and a retailer under a carbon trading policy. Since manufacturers carry out emission reduction activities and are more sensitive to fluctuations in carbon trading prices, they are prone to make biased estimates of expected returns [50]. In other words, there is an overconfidence mentality that causes manufacturers to overestimate the signals released by the carbon trading price. They are also overconfident that they can increase their sales while gaining higher returns through emission reduction. Therefore, this paper focuses on the impact of carbon trading prices and overconfidence on supply chain members and makes the following assumptions for further analysis.

3.3. Model Assumptions

Assumption 1.

When a manufacturer is faced with a carbon trading policy, the initial carbon quota per unit of product is hardly enough to meet the carbon emissions required for the company’s production, i.e., .

Assumption 2.

The product emission reduction rate is denoted by , and the green input cost of producing a low-carbon product is , where is the low-carbon input cost factor.

Assumption 3.

The market demand function for the product is assumed to be linear, with being the total potential market demand, being the sensitivity of demand to price, and ; being the sensitivity of consumers to the low-carbon level of the product [61], and the actual market demand being:

Assumption 4.

Manufacturer overconfidence is manifested by a bias in the estimation of emission reduction effects; manufacturers believe that consumers prefer products with a high rate of emission reduction, and the overconfident manufacturer market demand is assumed to be:

where , is the manufacturer overconfidence level, is the manufacturer overconfidence coefficient, indicates that the manufacturer is perfectly rational and is the carbon trading price in the carbon market, which acts as a market signal to influence the manufacturer’s overconfidence level.

Assumption 5.

Since the potential market demand is usually large, it is reasonable to assume here that , i.e., .

The specific parameters and variable symbols are described in Table 2.

Table 2.

Symbol description of the model’s relevant basic parameters.

4. Decision-Making Models

4.1. Decision-Making Model for Emission Reduction by Manufacturers without Carbon Trading (Scenario 1)

When supply chain members are not in the carbon trading market, the manufacturer and retailer profit function is as follows:

Using the inverse induction method to obtain the optimal decision for the manufacturer and the retailer, , from Equation (2):

Bringing into Equation (1), the Hessen matrix corresponding to is . The second order sequential principal subformula shows that the matrix is negative definite, and optimal solutions exist for .

where , and .

Bringing into Equation (3) gives

From Equations (4)–(6), we get manufacturer and retailer profit.

4.2. Decision-Making Model for Manufacturers to Reduce Emissions under the Carbon Trading Market (Scenario 2)

When supply chain members are in the carbon trading market, the manufacturer and retailer profit function is as follows:

Using the inverse induction method to obtain the optimal decision for the manufacturer and the retailer, , from Equation (10):

Bringing into Equation (9), the Hessen matrix corresponding to is . The second-order sequential principal sub-formula shows that the matrix is negative definite, and optimal solutions exist for :

where , .

From Equations (11)–(13), we get manufacturer and retailer profit.

4.3. Emission Reduction Decision-Making Model Considering Manufacturer Overconfidence under a Carbon Trading Market (Scenario 3)

Using the inverse induction method to obtain the optimal decision for the manufacturer and the retailer, , from Equation (18):

Bringing into Equation (16), the Hessen matrix corresponding to is . The second-order sequential principal sub-formula shows that the matrix is negative definite, and optimal solutions exist for and , where , , .

Substituting Equations (19)–(21) into Equations (17) and (18), the manufacturer’s actual profit is the profit obtained from the calculation based on the actual demand . The actual profit of the overconfident manufacturer is:

where .

5. Model Analysis and Discussion

5.1. Analysis of the Impact of Carbon Trading Markets on Manufacturers’ Emissions Reductions and Profits

Proposition 1.

Rational manufacturers in carbon trading markets tend to increase their emission reduction rates (compared to non-carbon trading markets), with higher carbon trading prices contributing to manufacturers’ emission reduction rates when the emission reduction cost . However, the opposite is true when the emission reduction cost .

Proof.

See Appendix A. □

Proposition 1 suggests that manufacturers in a carbon trading market will increase their emission reduction rate. This is because, after being included in the carbon trading market, the manufacturers will first reduce a portion of their carbon emissions per unit by strengthening their production management, thereby reducing the cost of purchasing a carbon quota. Once a manufacturer has reached the upper limit of the reduction rate that can be achieved through management, the optimal reduction rate increases in line with the carbon trading price for manufacturers with a reduction cost between . This is because the manufacturer’s abatement cost factor is small at this point, so the marginal cost of emission reduction is relatively low. When the carbon trading price increases, these manufacturers will choose to invest in emission reduction to maximize their returns, in order to increase their carbon trading revenue or reduce the cost of purchasing a carbon quota. Therefore, manufacturers at this time are more inclined to increase emissions reductions. For manufacturers with emission reduction costs where , the optimal emission reduction rate decreases as the carbon trading price rises. This rate is lower than the emission reduction rate for manufacturers without a carbon trading market when the carbon trading price rises to . This is because the excessive emission reduction costs make it difficult for manufacturers to make gains from the carbon trading market through emission reduction. As the price of carbon trading rises, the expenditure from purchasing carbon quotas also remains lower than the cost of acquiring an equivalent carbon quota through carbon emission reduction. As a result, manufacturers will buy carbon quotas outright, rather than increase their emission reduction rates.

Proposition 2.

Compared to a situation with no carbon trading market, (i) manufacturers can earn more under the carbon trading policy when the abatement cost , and the carbon trading price positively affects manufacturers’ profits. The exact opposite is true when the emission reduction cost . (ii) When the emission reduction cost is between , the carbon trading price , manufacturers are less profitable under the carbon trading policy, and the carbon trading price has a negative impact on manufacturers’ profits. When the carbon trading price , the exact opposite is true.

Proof.

See Appendix A. □

Proposition 2 shows that: (i) manufacturers with emission reduction costs of between gain a portion of their profits by reducing carbon emissions through better management. In addition, as the price of carbon trading rises, the manufacturer’s emission reduction gains from the carbon trading market are higher than the expenses incurred when buying a carbon quota, and as the cost of emission reduction is lower, manufacturers’ profits rise as the price of carbon trading increases. Manufacturers with emission reduction costs of between , on the one hand, suffer from higher emission reduction costs. On the other hand, as the price of carbon trading rises, the expense of purchasing carbon quotas is higher than the revenue gained from emission reduction, so profits are lower than those of manufacturers without a carbon trading market. In this case, the price of carbon trading inversely affects manufacturers’ profits. (ii) For manufacturers with emission reduction costs of between , profits first decrease as the carbon trading price rises, and then show a U-shaped increasing trend when the trading price becomes small. This is due to the fact that the increase in the price of carbon trading makes it more and more expensive for these manufacturers to trade carbon. Therefore, manufacturers continue to increase their investment in emissions reduction while bearing the cost of carbon trading, causing their own profits to continuously decline. As the rate of emission reduction increases and the price of carbon trading rises, the amount of carbon emissions generated is close to the manufacturer’s carbon allowance. As such, the manufacturer can sell the excess carbon quota on the carbon trading market and make a profit.

5.2. Analysis of the Impact of Overconfidence on Supply Chain Members’ Emissions Reductions and Profits

Proposition 3.

Under a carbon trading policy, overconfidence leads manufacturers to increase the rate of their products’ emissions reduction, relative to the rational case. In addition, the higher the price of carbon trading is, the higher the rate of emission reduction will be.

Proof.

See Appendix A. □

Proposition 3 suggests that, compared to rational manufacturers, overconfident manufacturers believe that consumers have a higher willingness to pay for their products. The overconfident manufacturers incorrectly overestimate the demand for their products. Higher carbon trading prices amplify the overconfident mentality of manufacturers, when higher emission reduction rates will increase the benefits manufacturers receive from carbon trading. Thus, under a carbon trading policy, manufacturers’ emission reduction rates will gradually increase as their overconfidence grows.

Proposition 4.

In a carbon trading market, overconfidence makes manufacturers’ real profits lower than they would be if the manufacturers were rational. In addition, manufacturers’ real profits decrease as their overconfidence increases, and they also decrease as the price of carbon trading increases, relative to the rational case.

Proof.

See Appendix A. □

Proposition 4 suggests that overconfident manufacturers will incorrectly overestimate market demand and will seek to maximize revenue by increasing the wholesale price of their products. Meanwhile, retailers will also increase the retail price of their products, which will ultimately result in lower sales and lower profits. In addition, according to Proposition 3, the emission reduction rate of overconfident manufacturers is always higher than the optimal emission reduction rate under rational conditions. As the price of carbon trading rises, even though more revenue can be gained from the carbon market, the manufacturers’ level of overconfidence will also rise. In this scenario, the revenue brought by the carbon trading market will not be enough to compensate for the decrease in product revenue and the manufacturers’ increase in emission reduction investment. Therefore, an increase in the carbon trading price has a negative impact on manufacturers’ profit.

Proposition 5.

In a carbon trading market, relative to the rational case, (i) the retailer’s profit is higher when the manufacturer’s overconfidence is low; the opposite is true when the manufacturer’s overconfidence is high. (ii) The price of carbon trading only has a negative effect on retailers’ profits when the manufacturer’s overconfidence is high and when the emission reduction cost . In all other cases, the price of carbon trading has a positive effect on retailers’ profits.

Proof.

See Appendix A. □

Proposition 5 shows that: (i) for retailers, partnering with manufacturers with lower levels of overconfidence can increase their own profits. This is due to the fact that, even if manufacturers have lower levels of overconfidence, they will still increase their product reduction rates. In addition, it follows from Proposition 3 that the price of carbon trading has a positive effect on the reduction rates of overconfident manufacturers, and that the low-carbon attributes of the product attract a higher number of consumers than under the optimal reduction decision. In addition, profits rise as demand rises. Therefore, retailer profits increase and are positively correlated with the carbon trading price. However, as the manufacturer’s level of overconfidence increases, the manufacturer will transfer the emissions reduction cost to the retailer by increasing the wholesale price. The retailer will then increase the retail sales price and reduce its own sales volume, in order to maintain its revenue. (ii) For manufacturers with a high level of overconfidence, emission reduction costs are relatively low for manufacturers with emission reduction costs in the range of . The emission reduction costs invested by the manufacturer are much higher than the rational optimum, and more of the emission reduction costs are transferred to the retailer, resulting in lower profits for the retailer. Therefore, the retailer’s profit is inversely proportional to the carbon trading price when the manufacturer’s emission reduction cost is In addition, the retailer’s profit is positively proportional to the carbon trading price when the manufacturer’s emission reduction cost is .

6. Numerical Study

This section uses MATLAB R2020b software to explore the impact of manufacturer overconfidence and carbon trading prices on supply chain members’ decisions and profits. In this study’s experiments, some parameters were adopted from existing papers. All the parameters satisfy the constraint conditions and assumptions of the three models. This is achieved by combining numerical calculations with relevant parameters taken as: , .

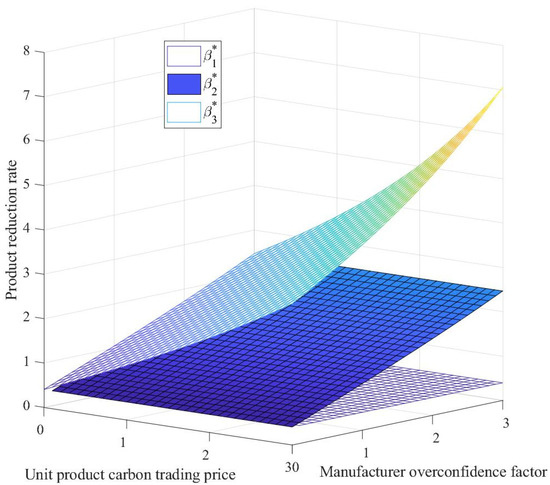

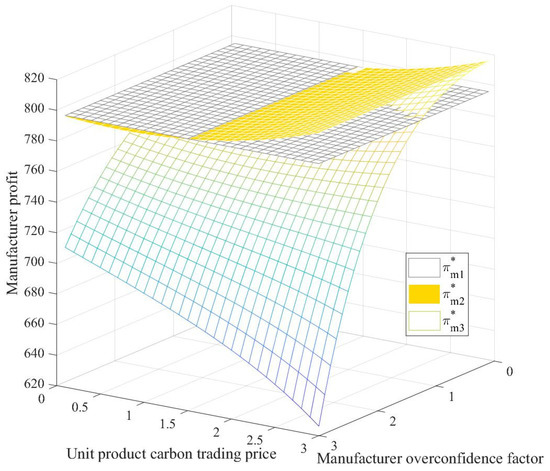

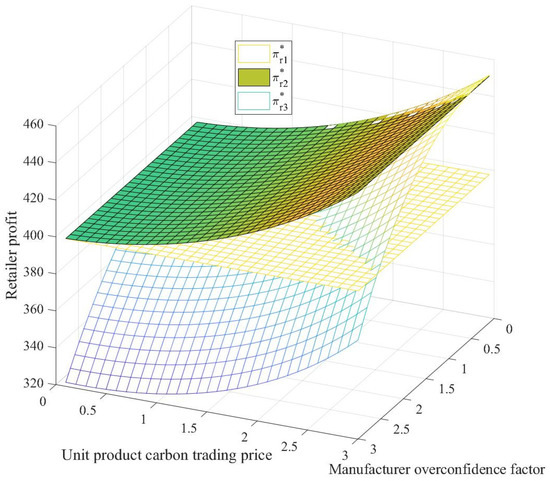

6.1. Overconfidence and the Impact of Carbon Trading Prices on Supply Chain Members

For the parameters related to overconfidence, some adjustments to parameters were made, similar to [43,45]. Let the carbon trading price vary over the interval and the manufacturer’s overconfidence level varies over the interval . The effects of manufacturers’ overconfidence levels and carbon trading prices on manufacturers and retailers under the three scenarios are shown in Figure 1, Figure 2 and Figure 3.

Figure 1.

The impact of carbon trading prices and overconfidence on manufacturers’ decisions to reduce emissions.

Figure 2.

The impact of carbon trading prices and overconfidence on manufacturers’ profits.

Figure 3.

The impact of carbon trading prices and overconfidence on retailers’ profits.

Figure 1 shows that, in a carbon trading market, manufacturers’ emission reduction rates are positively correlated with the price of carbon trading. This is mainly because higher carbon trading prices increase the cost of carbon trading for manufacturers, who in turn have to increase their reduction rates to reduce their carbon emissions per unit of product. When manufacturers are overconfident, their reduction rate is positively correlated with their own level of overconfidence, and the effect of manufacturer overconfidence on the manufacturers’ reduction rate increases as the carbon trading price rises. This is because overconfidence makes manufacturers believe that they can gain more by selling their excess carbon quota, giving them an incentive to invest in greater carbon reduction efforts. This finding is consistent with Propositions 1 and 3.

Figure 2 shows that, in a carbon trading market, the profits of rational manufacturers tend to fall and then rise as the price of carbon trading increases. This finding suggests that an increase in the price of carbon trading gives manufacturers an incentive to invest more in reducing carbon emissions, which in turn allows them to accrue gains from selling their excess carbon quota. The profitability of overconfident manufacturers decreases with the level of their overconfidence and with the increase in the price of carbon trading. This finding is consistent with Propositions 2 and 4.

Figure 3 shows that, in a carbon trading market, retailer profits are positively proportional to the carbon trading price and inversely proportional to the level of manufacturer overconfidence. Retailer returns are highest when manufacturer overconfidence levels are lower and carbon trading prices are higher. This finding is also consistent with Proposition 5.

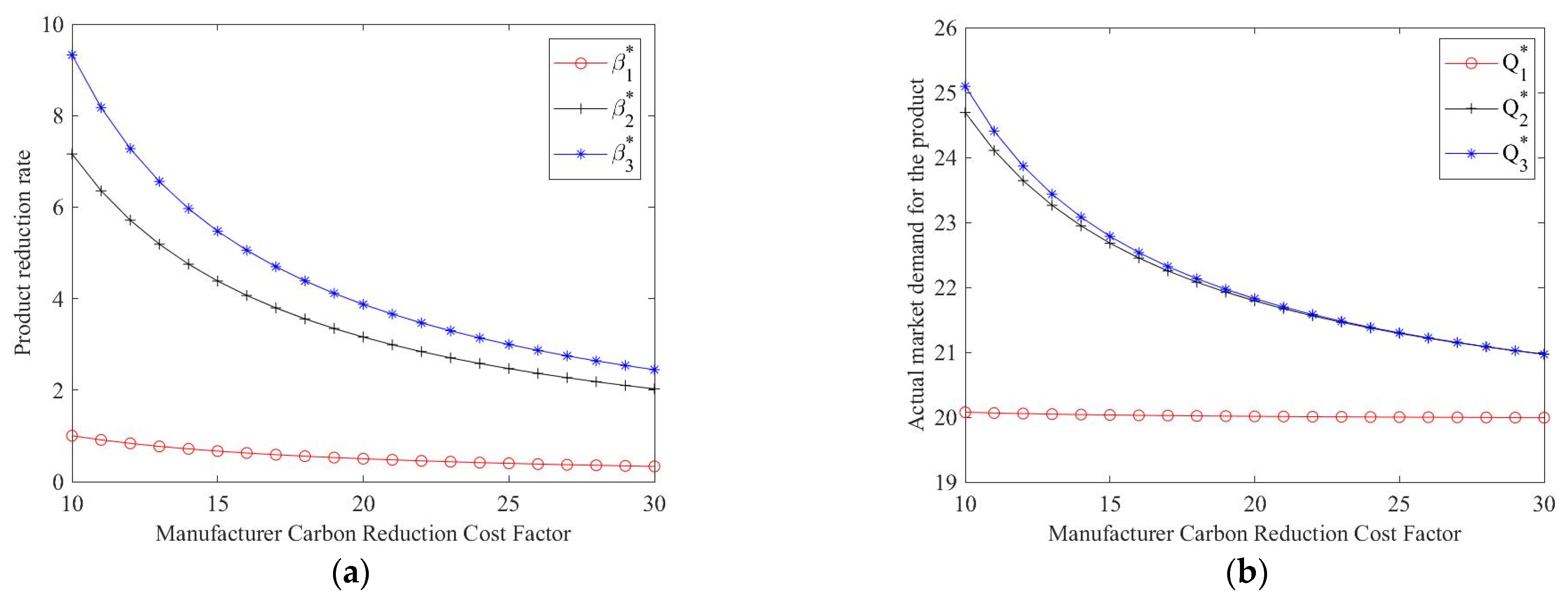

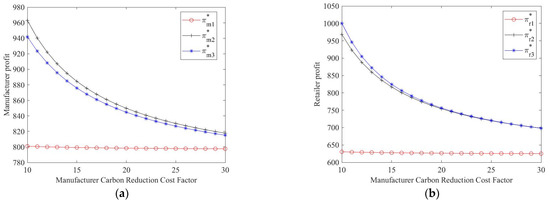

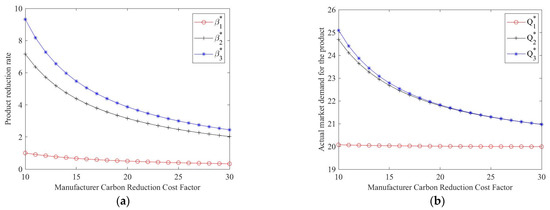

6.2. Impact of the Manufacturer’s Emission Reduction Cost Factor

When the manufacturer’s emission reduction cost is , the carbon trading price , the overconfidence coefficient , and other parameters are taken as above.. The impact of the manufacturer’s emission reduction cost coefficient on the decision and demand of supply chain members was analyzed, and the results are shown in Figure 4 and Figure 5.

Figure 4.

Impact of emission reduction costs on supply chain members’ profits. (a) Impact of emission reduction costs on manufacturers’ profits. (b) Impact of emission reduction costs on retailers’ profits.

Figure 5.

Impact of emission reduction costs on emission reduction rates and demand. (a) Impact of emission reduction costs on emission reduction rates. (b) Impact of emission reduction costs on demand.

From Figure 4 and Figure 5, one can see that, in all three scenarios, the product emission reduction rate, market demand and supply chain members’ profits are inversely proportional to the manufacturer’s emission reduction costs coefficient. In addition, the impact of manufacturers’ overconfidence on supply chain members will gradually decrease as the emission reduction costs increase. In particular, supply chain members are more affected by the emission reduction cost coefficient in the carbon trading market. This finding indicates that companies with low emission reduction costs are more likely to make gains in the carbon trading market. In addition, as the abatement cost increases, the positive effect of the carbon trading market will gradually decrease.

7. Conclusions

Most previous studies have explored the effect of carbon trading policies on emission reduction decisions in the context of supply chain members’ rationality [27,28,29,30]. However, these studies did not take into account the overconfident behavior of supply chain members. In addition, most studies on overconfidence relate to the field of inventory management [37,41], because overconfident inventory managers not only incur more costs (which may stem from higher inventories) but also generate more inventory backlogs. However, in low-carbon supply chains, overconfidence can also affect the amount of money firms invest in R&D for emission reduction. Studies by Liu [47] and Lu [48] et al. concluded that overconfidence can lead to greener, low-carbon products, but at the same time can lead to higher costs and less profitability for firms [42]. This paper constructs a supply chain system with one retailer and one manufacturer and introduces the behavioral characteristics of manufacturer overconfidence. The aim is to discuss the optimal supply chain reduction decision under three models: (1) no carbon trading policy and rational supply chain members, (2) consideration of a carbon trading policy and rational supply chain members, and (3) consideration of a carbon trading policy and manufacturer overconfidence. To confirm previous studies, the impact of overconfident manufacturers in the supply chain on retailers is explored.

7.1. Main Conclusions

The main findings of this paper show that:

(1) Under a carbon trading policy, when manufacturers are overconfident, their emission reduction rate is proportional to the carbon trading price and is always higher than the emission reduction rate when manufacturers are rational. When manufacturers are rational and the cost of emission reduction is below a certain threshold, the higher the carbon trading price is, the higher the emission reduction rate will be. The opposite is true when the cost of emission reduction is above the threshold.

(2) When manufacturers are overconfident, their profits fall, because the benefits in the carbon market are not sufficient to cover their emission reduction inputs; this rate of decline is inversely proportional to manufacturers’ emission reduction costs. When manufacturers are rational, higher carbon trading prices have a negative impact on the profits of manufacturers with high emission reduction costs; the opposite is true when emission reduction costs are too low. In addition, for manufacturers with moderate emission reduction costs, profits change in a U-shape as carbon trading prices increase.

(3) Retailer profits are higher when manufacturer overconfidence levels are low, compared to profits when manufacturers are rational. However, retailer profits are inversely related to manufacturer overconfidence levels, and higher carbon trading prices negatively affect retailer profits when both manufacturer overconfidence levels, and emission reduction costs, are high.

7.2. Management Insights and Future Research

Based on the above findings, this paper gives the following management insights:

From the perspective of product emission reduction, manufacturers’ overconfidence can increase the rate of product emission reduction and promote the low-carbon development of the social economy. However, ignoring the cost of emission reduction and blindly increasing the input of emission reduction will lead to a decrease in profits; this is not conducive to the long-term development of a low-carbon economy. From the perspective of product promotion, the higher the level of manufacturer overconfidence is, the lower the profits of retailers will be, and this is not conducive to the promotion of low-carbon products. Therefore, retailers should try to choose to work with manufacturers with a lower level of overconfidence, in order to avoid losing or reducing their own profits. While the government cannot directly set the price of carbon trading, it can participate in carbon quota trading, set a peak price for carbon trading, develop a carbon financial market, and restrict the sale and purchase of carbon quotas to form a guide price for the carbon trading market. This would help to correct the impact of manufacturers’ overconfidence and guide the benign development of carbon emission reduction and the carbon trading market.

To simplify the above problems, this paper only considers the supply chain decision problem when the manufacturer is overconfident. If further consideration is given to the case where both the manufacturer and the retailer have a tendency to be overconfident, a more accurate measure of overconfidence will need to be used. This will be an important topic for the next step of research in this field.

Author Contributions

All authors contributed to the study conception and material preparation. The first draft of the manuscript was written by L.S. The review and editing of the manuscript were performed by J.Y. All authors have read and agreed to the published version of the manuscript.

Funding

This study was supported by the National Natural Science Foundation of China (No. 71874071).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

All data or code used to support the findings of this study are available from the corresponding author.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Proof of Proposition 1.

when the manufacturer emission reduction cost , , . When the manufacturer emission reduction cost , , at which point if the carbon trading price , at which point if the carbon trading price . □

Proof of Proposition 2.

When emission reduction cost , . When abatement cost , . When emission reduction cost , if the carbon trading price , then . If the carbon trading price then . □

Proof of Proposition 3.

From and , it follows that and . Since , , , and . □

Proof of Proposition 4.

Since , so , , . □

Proof of Proposition 5.

when manufacturer overconfidence is low, i.e., , then and . When manufacturer overconfidence is high, i.e., , then . When if the manufacturer’s emission reduction rate is low, i.e., , and if the manufacturer’s emission reduction costs are high, i.e., . □

References

- Shakoor, A.; Ashraf, F.; Shakoor, S.; Mustafa, A.; Rehman, A.; Altaf, M.M. Biogeochemical transformation of greenhouse gas emissions from terrestrial to atmospheric environment and potential feedback to climate forcing. Environ. Sci. Pollut. Res. 2020, 27, 38513–38536. [Google Scholar] [CrossRef] [PubMed]

- Hu, Y.G.; Xu, B.X.; Wang, Y.N.; He, Z.Z.; Zhang, P.; Wang, G.J. Reference for different sensitivities of greenhouse gases effluxes to warming climate among types of desert biological soil crust. Sci. Total Environ. 2022, 830, 11. [Google Scholar] [CrossRef]

- Li, H.M.; Wang, X.C.; Zhao, X.F.; Qi, Y. Understanding systemic risk induced by climate change. Adv. Clim. Chang. Res. 2021, 12, 384–394. [Google Scholar] [CrossRef]

- Kannan, D.; Solanki, R.; Kaul, A.; Jha, P.C. Barrier analysis for carbon regulatory environmental policies implementation in manufacturing supply chains to achieve zero carbon. J. Clean. Prod. 2022, 358, 18. [Google Scholar] [CrossRef]

- Hintermann, B.; Zarkovic, M. A carbon horse race: Abatement subsidies vs. permit trading in Switzerland. Clim. Policy 2021, 21, 290–306. [Google Scholar] [CrossRef]

- Ma, C.; Yang, H.G.; Zhang, W.P.; Huang, S. Low-carbon consumption with government subsidy under asymmetric carbon emission information. J. Clean. Prod. 2021, 318, 17. [Google Scholar] [CrossRef]

- Chen, X.; Lin, B.Q. Towards carbon neutrality by implementing carbon emissions trading scheme: Policy evaluation in China. Energy Policy 2021, 157, 12. [Google Scholar] [CrossRef]

- Yang, X.; Pang, J.; Teng, F.; Gong, R.X.; Springer, C. The environmental co-benefit and economic impact of China’s low-carbon pathways: Evidence from linking bottom-up and top-down models. Renew. Sustain. Energy Rev. 2021, 136, 22. [Google Scholar] [CrossRef]

- Teixido, J.; Verde, S.F.; Nicolli, F. The impact of the EU Emissions Trading System on low-carbon technological change: The empirical evidence. Ecol. Econ. 2019, 164, 13. [Google Scholar] [CrossRef]

- Stern, N. Towards a carbon neutral economy: How government should respond to market failures and market absence. J. Gov. Econ. 2022, 6, 100036. [Google Scholar] [CrossRef]

- Cheng, Y.; Fan, T.; Zhou, L. Optimal strategies of automakers with demand and credit price disruptions under the dual-credit policy. J. Manag. Sci. Eng. 2022, 7, 453–472. [Google Scholar] [CrossRef]

- Cheng, F.; Chen, T.; Chen, Q. Cost-reducing strategy or emission-reducing strategy? The choice of low-carbon decisions under price threshold subsidy. Transp. Res. Pt. E-Logist. Transp. Rev. 2022, 157, 20. [Google Scholar] [CrossRef]

- Kahneman, D.; Tversky, A. Prospect Theory: An Analysis of Decision under Risk. Econometrica 1979, 47, 263–292. [Google Scholar] [CrossRef]

- Fischhoff, B.; Slovic, P.; Lichtenstein, S. Knowing with certainty the appropriateness of extreme confidence. J. Exp. Psychol. 1977, 3, 552–564. [Google Scholar] [CrossRef]

- Zhou, J.G.; Wang, Q.Q. Forecasting Carbon Price with Secondary Decomposition Algorithm and Optimized Extreme Learning Machine. Sustainability 2021, 13, 17. [Google Scholar] [CrossRef]

- Zhou, J.G.; Chen, D.F. Carbon Price Forecasting Based on Improved CEEMDAN and Extreme Learning Machine Optimized by Sparrow Search Algorithm. Sustainability 2021, 13, 20. [Google Scholar] [CrossRef]

- Wang, J.J.; Cui, Q.; Sun, X. A novel framework for carbon price prediction using comprehensive feature screening, bidirectional gate recurrent unit and Gaussian process regression. J. Clean. Prod. 2021, 314, 19. [Google Scholar] [CrossRef]

- Yun, P.; Zhang, C.; Wu, Y.; Yang, X.; Wagan, Z.A. A Novel Extended Higher-Order Moment Multi-Factor Framework for Forecasting the Carbon Price: Testing on the Multilayer Long Short-Term Memory Network. Sustainability 2020, 12, 1869. [Google Scholar] [CrossRef]

- Song, X.H.; Zhang, W.; Ge, Z.Q.; Huang, S.Q.; Huang, Y.M.; Xiong, S.J. A Study of the Influencing Factors on the Carbon Emission Trading Price in China Based on the Improved Gray Relational Analysis Model. Sustainability 2022, 14, 27. [Google Scholar] [CrossRef]

- Zhang, S.B.; Ji, H.; Tian, M.X.; Wang, B.Y. High-dimensional nonlinear dependence and risk spillovers analysis between China’s carbon market and its major influence factors. Ann. Oper. Res. 2022. [Google Scholar] [CrossRef]

- Xu, Y.; Zhai, D. Impact of Changes in Membership on Prices of a Unified Carbon Market: Case Study of the European Union Emissions Trading System. Sustainability 2022, 14, 13806. [Google Scholar] [CrossRef]

- Hao, Y.; Tian, C.S.; Wu, C.Y. Modelling of carbon price in two real carbon trading markets. J. Clean. Prod. 2020, 244, 15. [Google Scholar] [CrossRef]

- Fan, Y.; Jia, J.J.; Wang, X.; Xu, J.H. What policy adjustments in the EU ETS truly affected the carbon prices? Energy Policy 2017, 103, 145–164. [Google Scholar] [CrossRef]

- Hao, Y.; Tian, C.S. A hybrid framework for carbon trading price forecasting: The role of multiple influence factor. J. Clean. Prod. 2020, 262, 20. [Google Scholar] [CrossRef]

- Hasan, M.R.; Roy, T.C.; Daryanto, Y.; Wee, H.-M. Optimizing inventory level and technology investment under a carbon tax, cap-and-trade and strict carbon limit regulations. Sustain. Prod. Consum. 2021, 25, 604–621. [Google Scholar] [CrossRef]

- Fleschutz, M.; Bohlayer, M.; Braun, M.; Henze, G.; Murphy, M.D. The effect of price-based demand response on carbon emissions in European electricity markets: The importance of adequate carbon prices. Appl. Energy 2021, 295, 15. [Google Scholar] [CrossRef]

- Li, J.; Liang, L.; Xie, J.Q.; Xie, J.P. Manufacture’s entry and green strategies with carbon trading policy. Comput. Ind. Eng. 2022, 171, 15. [Google Scholar] [CrossRef]

- Wu, D.; Yang, Y. Study on the Differential Game Model for Supply Chain with Consumers’ Low Carbon Preference. Chin. J. Manag. Sci. 2021, 29, 126–137. [Google Scholar]

- Xia, L.; Kong, Q.; Li, Y.; Xu, C. Emission Reduction and Pricing Strategies of a Low-carbon Supply Chain Considering Cross-shareholding. Chin. J. Manag. Sci. 2021, 29, 70–81. [Google Scholar]

- Ohlendorf, N.; Flachsland, C.; Nemet, G.F.; Steckel, J.C. Carbon price floors and low-carbon investment: A survey of German firms. Energy Policy 2022, 169, 113187. [Google Scholar] [CrossRef]

- Stern, N. The economics of climate change. Am. Econ. Rev. 2008, 98, 1–37. [Google Scholar] [CrossRef]

- Entezaminia, A.; Gharbi, A.; Ouhimmou, M. A joint production and carbon trading policy for unreliable manufacturing systems under cap-and-trade regulation. J. Clean. Prod. 2021, 293, 19. [Google Scholar] [CrossRef]

- De Bondt, W.F.M.; Thaler, R.H.; Thaler, R.H. Do Security Analysts Overreact? Am. Econ. Rev. 1990, 80, 52–57. [Google Scholar]

- Moore, D.A.; Healy, P.J. The trouble with overconfidence. Psychol. Rev. 2008, 115, 502–517. [Google Scholar] [CrossRef] [PubMed]

- Wan, X.; Wang, H.; Du, Y.; Meng, Q. Study on a Cross-shareholding Supply Chain Decision Considering Over-confidence. Chin. J. Manag. Sci. 2022, 30, 191–203. [Google Scholar]

- Li, M.; Petruzzi, N.C.; Zhang, J. Overconfident Competing Newsvendors. Manag. Sci. 2017, 63, 2637–2646. [Google Scholar] [CrossRef]

- Ancarani, A.; Di Mauro, C.; D’Urso, D. Measuring overconfidence in inventory management decisions. J. Purch. Supply Manag. 2016, 22, 171–180. [Google Scholar] [CrossRef]

- Du, X.J.; Zhan, H.M.; Zhu, X.X.; He, X.L. The upstream innovation with an overconfident manufacturer in a supply chain. Omega-Int. J. Manag. Sci. 2021, 105, 14. [Google Scholar] [CrossRef]

- Xu, L.; Shi, X.R.; Du, P.; Govindan, K.; Zhang, Z.C. Optimization on pricing and overconfidence problem in a duopolistic supply chain. Comput. Oper. Res. 2019, 101, 162–172. [Google Scholar] [CrossRef]

- Pu, X.; Zhuge, R. Impact of Overconfidence and Fairness Concerns on the Performance of R&D Cooperation in the Equipment Manufacturing Industry Supply Chain. J. Ind. Eng. Eng. Manag. 2017, 31, 10–15. (In Chinese) [Google Scholar]

- Xiao, Q.Z.; Chen, L.; Xie, M.; Wang, C. Optimal contract design in sustainable supply chain: Interactive impacts of fairness concern and overconfidence. J. Oper. Res. Soc. 2021, 72, 1505–1524. [Google Scholar] [CrossRef]

- Zhang, Z.; Wang, P.; Wan, M.; Guo, J.; Liu, J. Supply Chain Decisions and Coordination under the Combined Effect of Overconfidence and Fairness Concern. Complexity 2020, 2020, 3056305. [Google Scholar]

- Song, J.; Chutani, A.; Dolgui, A.; Liang, L. Dynamic innovation and pricing decisions in a supply-Chain. Omega-Int. J. Manag. Sci. 2021, 103, 24. [Google Scholar] [CrossRef]

- Zhao, D.Z.; Lv, X. Vender Managed Inventory Model Based on Overconfident Suppliers under Stochastic Demand. Syst. Eng. 2011, 29, 1–7. (In Chinese) [Google Scholar]

- Liu, Z.B.; Zhao, R.Q.; Liu, X.Y.; Chen, L. Contract designing for a supply chain with uncertain information based on confidence level. Appl. Soft. Comput. 2017, 56, 617–631. [Google Scholar] [CrossRef]

- Wang, L.L.; Wu, Y.; Hu, S.Q. Make-to-order supply chain coordination through option contract with random yields and overconfidence. Int. J. Prod. Econ. 2021, 242, 19. [Google Scholar] [CrossRef]

- Liu, J.; Zhou, H.; Wan, M.Y.; Liu, L. How Does Overconfidence Affect Decision Making of the Green Product Manufacturer? Math. Probl. Eng. 2019, 2019, 14. [Google Scholar] [CrossRef]

- Lu, X.; Shang, J.; Wu, S.Y.; Hegde, G.G.; Vargas, L.; Zhao, D.Z. Impacts of supplier hubris on inventory decisions and green manufacturing endeavors. Eur. J. Oper. Res. 2015, 245, 121–132. [Google Scholar] [CrossRef]

- Zhou, H.; Liu, L.; Jiang, W.F.; Li, S.S. Green Supply Chain Decisions and Revenue-Sharing Contracts under Manufacturers’ Overconfidence. J. Math. 2022, 2022, 11. [Google Scholar] [CrossRef]

- Handayani, D.I.; Masudin, I.; Rusdiansyah, A.; Suharsono, J. Production-Distribution Model Considering Traceability and Carbon Emission: A Case Study of the Indonesian Canned Fish Food Industry. Logistics 2021, 5, 59. [Google Scholar] [CrossRef]

- Luo, Y.J.; Li, X.Y.; Qi, X.L.; Zhao, D.Q. The impact of emission trading schemes on firm competitiveness: Evidence of the mediating effects of firm behaviors from the guangdong ETS. J. Environ. Manag. 2021, 290, 9. [Google Scholar] [CrossRef] [PubMed]

- Yang, L.; Ji, J.N.; Wang, M.Z.; Wang, Z.Z. The manufacturer’s joint decisions of channel selections and carbon emission reductions under the cap-and-trade regulation. J. Clean. Prod. 2018, 193, 506–523. [Google Scholar] [CrossRef]

- Li, Z.M.; Pan, Y.C.; Yang, W.; Ma, J.H.; Zhou, M. Effects of government subsidies on green technology investment and green marketing coordination of supply chain under the cap-and-trade mechanism. Energy Econ. 2021, 101, 14. [Google Scholar] [CrossRef]

- Xia, X.Q.; Li, C.Y.; Zhu, Q.H. Game analysis for the impact of carbon trading on low-carbon supply chain. J. Clean. Prod. 2020, 276, 12. [Google Scholar] [CrossRef]

- Xu, X.Y.; Xu, X.P.; He, P. Joint production and pricing decisions for multiple products with cap-and-trade and carbon tax regulations. J. Clean. Prod. 2016, 112, 4093–4106. [Google Scholar] [CrossRef]

- Diao, X.; Zeng, Z.; Sun, C. Research on Coordination of Supply Chain with Two Products Based on Mix Carbon Policy. Chin. J. Manag. Sci. 2021, 29, 149–159. [Google Scholar]

- Wang, X.F.; Zhu, Y.T.; Sun, H.; Jia, F. Production decisions of new and remanufactured products: Implications for low carbon emission economy. J. Clean. Prod. 2018, 171, 1225–1243. [Google Scholar] [CrossRef]

- Salcedo-Diaz, R.; Ruiz-Femenia, J.R.; Amat-Bernabeu, A.; Caballero, J.A. A cooperative game strategy for designing sustainable supply chains under the emissions trading system. J. Clean. Prod. 2021, 285, 19. [Google Scholar] [CrossRef]

- Liu, H.; Kou, X.; Xu, G.; Qiu, X.; Liu, H. Which emission reduction mode is the best under the carbon cap-and-trade mechanism? J. Clean. Prod. 2021, 314, 128053. [Google Scholar] [CrossRef]

- Wang, Y.L.; Xu, X.; Zhu, Q.H. Carbon emission reduction decisions of supply chain members under cap-and-trade regulations: A differential game analysis. Comput. Ind. Eng. 2021, 162, 18. [Google Scholar] [CrossRef]

- Gao, Y.; Xu, J.T.; Xu, H.X. A Flexible Cap-and-Trade Policy and Limited Demand Information Effects on a Sustainable Supply Chain. Sustainability 2021, 13, 23. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).