Does Companies’ ESG Performance Make a Difference for New Zealand’s Stock Market Investors during the COVID-19 Pandemic?

Abstract

:1. Introduction

2. The Challenge of Matching ESG Performance with CFP

2.1. ESG and Crisis Resilience

2.2. Insights from New Zealand

3. Materials and Methods

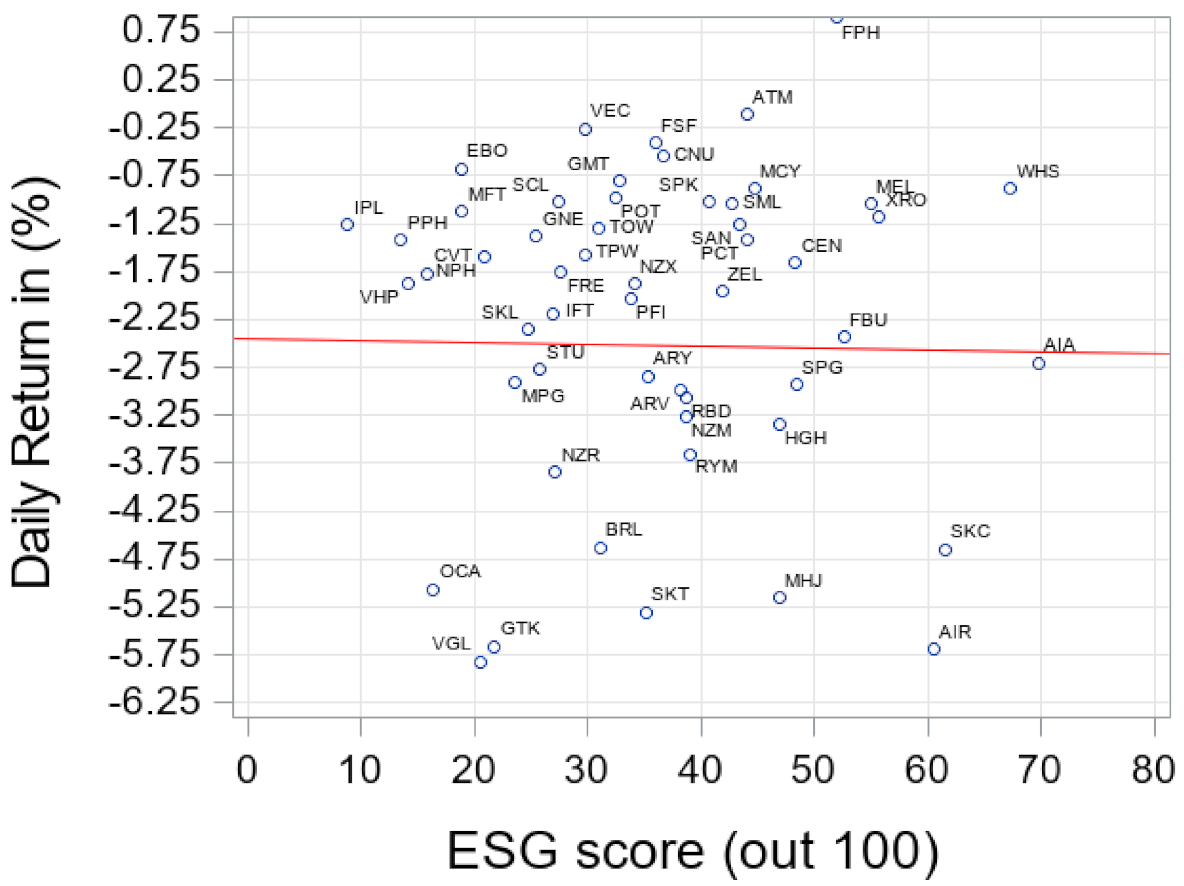

4. Results

5. Discussion and Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Powell, J. Coronavirus as the ESG Acid Test. Financial Times, 2 April 2020. Available online: https://www.ft.com/content/51ea649a-0968-40fe-b65d-382b6f65d81b (accessed on 20 January 2022).

- Alpaslan, C.M.; Green, S.E.; Mitroff, I.I. Corporate governance in the context of crises: Towards a stakeholder theory of crisis management. J. Contingencies Crisis Manag. 2009, 17, 38–49. [Google Scholar] [CrossRef]

- Mitroff, I.I.; Alpaslan, M.C. Preparing for evil. Harv. Bus. Rev. 2003, 81, 109–115. [Google Scholar] [PubMed]

- Lins, K.V.; Servaes, H.; Tamayo, A. Social Capital, Trust, and Corporate Performance: How CSR Helped Companies during the Financial Crisis (and Why It Can Keep Helping Them). J. Appl. Corp. Financ. 2019, 31, 59–71. [Google Scholar] [CrossRef]

- Orlitzky, M.; Schmidt, F.L.; Rynes, S.L. Corporate social and financial performance: A meta-analysis. Organ. Stud. 2003, 24, 403–441. [Google Scholar] [CrossRef]

- Albuquerque, R.; Koskinen, Y.; Yang, S.; Zhang, C. Resiliency of environmental and social stocks: An analysis of the exogenous COVID-19 market crash. Rev. Corp. Financ. Stud. 2020, 9, 593–621. [Google Scholar] [CrossRef]

- Ding, W.; Levine, R.; Lin, C.; Xie, W. Corporate immunity to the COVID-19 pandemic. J. Financ. Econ. 2021, 141, 802–830. [Google Scholar] [CrossRef] [PubMed]

- Huang, H.; Ye, Y. Rethinking capital structure decision and corporate social responsibility in response to COVID-19. Account. Financ. 2021, 61, 4757–4788. [Google Scholar] [CrossRef]

- Global Sustainable Investment Review 2020. 2021. Available online: http://www.gsi-alliance.org/wp-content/uploads/2021/08/GSIR-20201.pdf (accessed on 20 January 2022).

- Boubaker, S.; Cumming, D.; Nguyen, D.K. (Eds.) Research Handbook of Finance and Sustainability; Edward Elgar Publishing: Cheltenham, UK; Northampton, MA, USA, 2018. [Google Scholar]

- Stevens, J.M.; Kevin Steensma, H.; Harrison, D.A.; Cochran, P.L. Symbolic or substantive document? The influence of ethics codes on financial executives’ decisions. Strateg. Manag. J. 2005, 26, 181–195. [Google Scholar] [CrossRef]

- Chakraborty, S.K.; Kurien, V.; Singh, J.; Athreya, M.; Maira, A.; Aga, A.; Gupta, A.K.; Khandwalla, P.N. Management paradigms beyond profit maximization. Vikalpa 2004, 29, 97–118. [Google Scholar] [CrossRef]

- Margolis, J.D.; Elfenbein, H.A.; Walsh, J.P. Does It Pay to Be Good? A Meta-Analysis and Redirection of Research on the Relationship between Corporate Social and Financial Performance. 2007. Available online: https://www.academia.edu/download/40262753/Does_It_Pay_to_Be_Good_._._._and_Does_It20151122-6328-6giv06.pdf (accessed on 20 January 2022).

- Clark, G.L.; Feiner, A.; Viehs, M. From the Stockholder to the Stakeholder. How Sustainability Can Drive Financial Outperformance. 2015. Available online: https://arabesque.com/research/From_the_stockholder_to_the_stakeholder_web.pdf (accessed on 20 January 2022).

- Huang, D.Z. Environmental, social and governance (ESG) activity and firm performance: A review and consolidation. Account. Financ. 2019, 61, 335–360. [Google Scholar] [CrossRef]

- Boubaker, S.; Cellier, A.; Manita, R.; Saeed, A. Does corporate social responsibility reduce financial distress risk? Econ. Model. 2020, 91, 835–851. [Google Scholar] [CrossRef]

- Jo, H.; Harjoto, M.A. Corporate governance and firm value: The impact of corporate social responsibility. J. Bus. Ethics 2011, 103, 351–383. [Google Scholar] [CrossRef]

- Greenwald, C. ESG and Earnings Performance. 2010. Available online: https://www.thomsonreuters.com/content/dam/openweb/documents/pdf/tr-com-financial/case-study/esg-and-earnings-performance.pdf (accessed on 20 January 2022).

- Godfrey, P.C.; Merrill, C.B.; Hansen, J.M. The relationship between corporate social responsibility and shareholder value: An empirical test of the risk management hypothesis. Strateg. Manag. J. 2009, 30, 425–445. [Google Scholar] [CrossRef]

- Renneboog, L.; Ter Horst, J.; Zhang, C. Socially responsible investments: Institutional aspects, performance, and investor behaviour. J. Bank. Financ. 2008, 32, 1723–1742. [Google Scholar] [CrossRef]

- El Ghoul, S.; Guedhami, O.; Kwok, C.C.; Mishra, D.R. Does corporate social responsibility affect the cost of capital? J. Bank. Financ. 2011, 35, 2388–2406. [Google Scholar] [CrossRef]

- Albuquerque, R.; Koskinen, Y.; Zhang, C. Corporate social responsibility and firm risk: Theory and empirical evidence. Manag. Sci. 2018, 65, 4451–4469. [Google Scholar] [CrossRef] [Green Version]

- Koh, P.S.; Qian, C.; Wang, H. Firm litigation risk and the insurance value of corporate social performance. Strateg. Manag. J. 2014, 35, 1464–1482. [Google Scholar] [CrossRef]

- Luo, X.; Bhattacharya, C.B. The debate over doing good: Corporate social performance, strategic marketing levers, and firm-idiosyncratic risk. J. Mark. 2009, 73, 198–213. [Google Scholar] [CrossRef] [Green Version]

- Eccles, R.G.; Ioannou, I.; Serafeim, G. The impact of corporate sustainability on organizational processes and performance. Manag. Sci. 2014, 60, 2835–2857. [Google Scholar] [CrossRef] [Green Version]

- Bénabou, R.; Tirole, J. Individual and corporate social responsibility. Economica 2010, 77, 1–19. [Google Scholar] [CrossRef]

- Lins, K.V.; Servaes, H.; Tamayo, A. Social Capital, Trust, and Firm Performance: The Value of Corporate Social Responsibility during the Financial Crisis. J. Financ. 2017, 72, 1785–1824. [Google Scholar] [CrossRef] [Green Version]

- Ulmer, R.R. Effective Crisis Management Through Established Stakeholder Relationships. Malden Mills as a Case Study. Manag. Commun. Q. 2001, 14, 590–615. [Google Scholar] [CrossRef]

- Freeman, R.E.; Evan, W.M. Corporate governance: A stakeholder interpretation. J. Behav. Econ. 1990, 19, 337–359. [Google Scholar] [CrossRef]

- Harrison, J.S.; St. John, C.H. Managing and partnering with external stakeholders. Acad. Manag. Perspect. 1996, 10, 46–60. [Google Scholar] [CrossRef]

- Ndlela, M.N. Crisis Communication. A Stakeholder Approach; Palgrave Pivot: Cham, Switzerland, 2019. [Google Scholar]

- Sheaffer, Z.; Mano-Negrin, R. Executives’ orientations as indicators of crisis management policies and practices. J. Manag. Stud. 2003, 40, 573–606. [Google Scholar] [CrossRef]

- Ding, D.K.; Ferreira, C.; Wongchoti, U. Reading between the lines: Not all CSR is good CSR. Pac. Account. Rev. 2018, 30, 318–333. [Google Scholar] [CrossRef]

- Reddy, K.; Gordon, L.W. The effect of sustainability reporting on financial performance: An empirical study using listed companies. J. Asia Entrep. Sustain. 2010, 6, 19–42. [Google Scholar]

- Roudaki, J. Corporate governance structures and firm performance in large agriculture companies in NZ. Corp. Gov. Int. J. Bus. Soc. 2018, 18, 987–1006. [Google Scholar]

- Newth, J.; Warner, A. “Impact Investor Insights New Zealand 2019”, Responsible Investment Association Australasia. 2019. Available online: https://responsibleinvestment.org/wp-content/uploads/2019/09/Impact-Investor-Insights-Aotearoa-NZ-2019-FULL-REPORT.pdf (accessed on 20 January 2022).

- RIAA and Mindful Money, Responsible Investment: NZ Survey 2019. 2019. Available online: https://mindfulmoney.nz/media/blog/file/da/nz-consumer-survey-2019.pdf (accessed on 20 January 2022).

- Haerpfer, C.; Inglehart, R.; Moreno, A.; Welzel, C.; Kizilova, K.; Diez-Medrano, J.; Lagos, M.; Norris, P.; Ponarin, E.; Puranen, B. (Eds.) World Values Survey: Round Seven—Country-Pooled Datafile; JD Systems Institute & WVSA Secretariat: Madrid, Spain; Vienna, Austria, 2020; Available online: http://www.worldvaluessurvey.org/WVSDocumentationWV7.jsp (accessed on 20 January 2022).

- Inglehart, R.; Haerpfer, C.; Moreno, A.; Welzel, C.; Kizilova, K.; Diez-Medrano, J.; Lagos, M.; Norris, P.; Ponarin, E.; Puranen, B. (Eds.) World Values Survey: Round Six—Country- Pooled Datafile; JD Systems Institute & WVSA Secretariat: Madrid, Spain; Vienna, Austria, 2018; Available online: https://www.worldvaluessurvey.org/WVSDocumentationWV6.jsp (accessed on 20 January 2022).

- Flint, D.J.; Golicic, S.L. Searching for competitive advantage through sustainability. Int. J. Phys. Distrib. Logist. Manag. 2009, 39, 841–860. [Google Scholar] [CrossRef]

- Mueller, J.; Klandt, H.; McDonald, G.; Finke-Schuermann, T. The Chihuahua sustainability practice: Lots of shivering but no real action. Practical sustainability acceptance is low in German and New Zealand firms. Corp. Gov. Int. J. Bus. Soc. 2007, 7, 227–237. [Google Scholar] [CrossRef] [Green Version]

- De Villiers, C.; Van Staden, C. New Zealand shareholder attitudes towards corporate environmental disclosure. Pac. Account. Rev. 2012, 24, 186–210. [Google Scholar] [CrossRef]

- Global Sustainable Investment Review 2018. 2019. Available online: http://www.gsi-alliance.org/wp-content/uploads/2019/03/GSIR_Review2018.3.28.pdf (accessed on 20 January 2022).

- Thompson, R.; Bayes, S. Responsible Investment Benchmark Report New Zealand 2019; Responsible Investment Association Australasia: Sydney, NSW, Australia, 2019. [Google Scholar]

- Banhalmi-Zakar, Z.; Boele, N.; Bayes, S. Responsible Investment Benchmark Report Aotearoa New Zealand 2021; Responsible Investment Association Australasia: Sydney, NSW, Australia, 2021; Available online: https://responsibleinvestment.org/wp-content/uploads/2021/09/Responsible-Investment-Benchmark-Report-Aotearoa-New-Zealand-2021.pdf (accessed on 20 January 2022).

- Ruggie, J.G. Corporate Purpose in Play: The Role of ESG Investing. In Sustainable Investing: A Path to a New Horizon; Brill, H., Kell, G., Rasche, A., Eds.; Routledge: New York, NY, USA, 2021; pp. 173–189. [Google Scholar]

- Ruggie, J.G.; Middleton, E.K. Money, millennials and human rights: Sustaining ‘sustainable investing’. Glob. Policy 2019, 10, 144–150. [Google Scholar] [CrossRef]

- Nippert, M.; Tutty, C. ‘We expect KiwiSaver providers to follow the law’—Minister. The New Zealand Herald, 18 August 2020.

- Noy, I. The Macroeconomic Consequences of Disasters; Working Paper, No. 07-15; University of California, Santa Cruz Institute for International Economics (SCIIE): Santa Cruz, CA, USA, 2007. [Google Scholar]

- Cavallo, E.; Noy, I. The Economics of Natural Disasters: A Survey; IDB Working Paper Series No. IDB-WP-124; Inter-American Development Bank (IDB): Washington, DC, USA, 2010. [Google Scholar]

- Cavallo, E.; Galiani, S.; Noy, I.; Pantano, J. Catastrophic natural disasters and economic growth. Rev. Econ. Stat. 2013, 95, 1549–1561. [Google Scholar] [CrossRef] [Green Version]

- Edgeclifff-Johnson, A. ESG Groups try to thin a thicket of sustainability metrics. Financial Times, 11 June 2019. Available online: https://www.ft.com/content/1244dc6e-8bec-11e9-a1c1-51bf8f989972 (accessed on 22 November 2022).

- Berg, F.; Koelbel, J.F.; Rigobon, R. Aggregate confusion: The divergence of ESG ratings. 2020. Rev. Financ. 2022, 26, 1315–1344. [Google Scholar] [CrossRef]

- Chacon, R.; Feng, Z.; Wu, Z. Does Investing in ESG Pay Off? Evidence from REITs around the COVID-19 Pandemic”, Working paper (27 June 2022). Available online: https://ssrn.com/abstract=4147749 (accessed on 22 November 2022).

- Morea, D.; Mango, F.; Cardi, M.; Paccione, C.; Bittucci, L. Circular Economy Impact Analysis on Stock Performances: An Empirical Comparison with the Euro Stoxx 50® ESG Index. Sustainability 2022, 14, 843. [Google Scholar] [CrossRef]

- Białkowski, J.; Sławik, A. Does a high ESG score pay off during the pandemic outbreak? In Financial Transformations Beyond the COVID-19 Health Crisis; Boubaker, S., Nguyen, D.K., Eds.; World Scientific Publishing Europe: London, UK, 2022; pp. 501–534. [Google Scholar] [CrossRef]

- Porter, M.E.; Kramer, M.R. Creating shared value. Harv. Bus. Rev. 2011, 89, 62–77. [Google Scholar]

| GICS Sector/Abbreviation | COVID-19 Panic Period (in %) | COVID-19 Rebound Period (in %) | T-Stats | p-Value |

|---|---|---|---|---|

| S&P/NZX All Communication Services (ComS) | −0.95 | 0.11 | −2.91 *** | 0.01 |

| S&P/NZX All Consumer Discretionary (CD) | −4.16 | 0.33 | −7.29 *** | 0.00 |

| S&P/NZX All Consumer Staples (CS) | −0.30 | −0.12 | −0.34 | 0.25 |

| S&P/NZX All Energy (EG) | −2.15 | −0.01 | −3.70 *** | 0.01 |

| S&P/NZX All Financials (FN) | −2.54 | 0.29 | −6.76 *** | 0.00 |

| S&P/NZX All Health Care (HC) | −0.63 | 0.13 | −1.65 * | 0.12 |

| S&P/NZX All Industrials (ID) | −2.24 | 0.24 | −4.88 *** | 0.00 |

| S&P/NZX All Information Technology (IT) | −3.37 | 0.38 | −5.82 *** | 0.00 |

| S&P/NZX All Materials (MT) | −2.41 | 0.28 | −4.29 *** | 0.00 |

| S&P/NZX All Real Estate (RE) | −1.93 | 0.15 | −5.01 *** | 0.00 |

| S&P/NZX All Utilities (UT) | −1.34 | 0.27 | −3.42 *** | 0.00 |

| S&P/NZX 50 | −1.31 | 0.15 | −4.46 *** | 0.01 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Białkowski, J.; Sławik, A. Does Companies’ ESG Performance Make a Difference for New Zealand’s Stock Market Investors during the COVID-19 Pandemic? Sustainability 2022, 14, 15841. https://doi.org/10.3390/su142315841

Białkowski J, Sławik A. Does Companies’ ESG Performance Make a Difference for New Zealand’s Stock Market Investors during the COVID-19 Pandemic? Sustainability. 2022; 14(23):15841. https://doi.org/10.3390/su142315841

Chicago/Turabian StyleBiałkowski, Jędrzej, and Anna Sławik. 2022. "Does Companies’ ESG Performance Make a Difference for New Zealand’s Stock Market Investors during the COVID-19 Pandemic?" Sustainability 14, no. 23: 15841. https://doi.org/10.3390/su142315841