The Impact of Science and Technology Finance on Regional Collaborative Innovation: The Threshold Effect of Absorptive Capacity

Abstract

:1. Introduction

2. Literature Review

2.1. Science and Technology Finance

2.2. Regional Collaborative Innovation

2.3. Science and Technology Finance and Regional Science and Technology Collaborative Innovation

3. Empirical Model and Methodology

3.1. Measurement of Collaborative Innovation in Beijing-Tianjin-Hebei Region

3.1.1. Indicators of Collaborative Innovation Measurement

3.1.2. Calculation Method of Regional Collaborative Innovation

3.2. Econometric Models

4. Data Description

4.1. Variable Declaration

4.1.1. Dependent Variable

4.1.2. Independent Variable

4.1.3. Threshold Variable

4.1.4. Control Variables

4.2. Sample Selection and Data Sources

5. Analysis and Discussion of Empirical Results

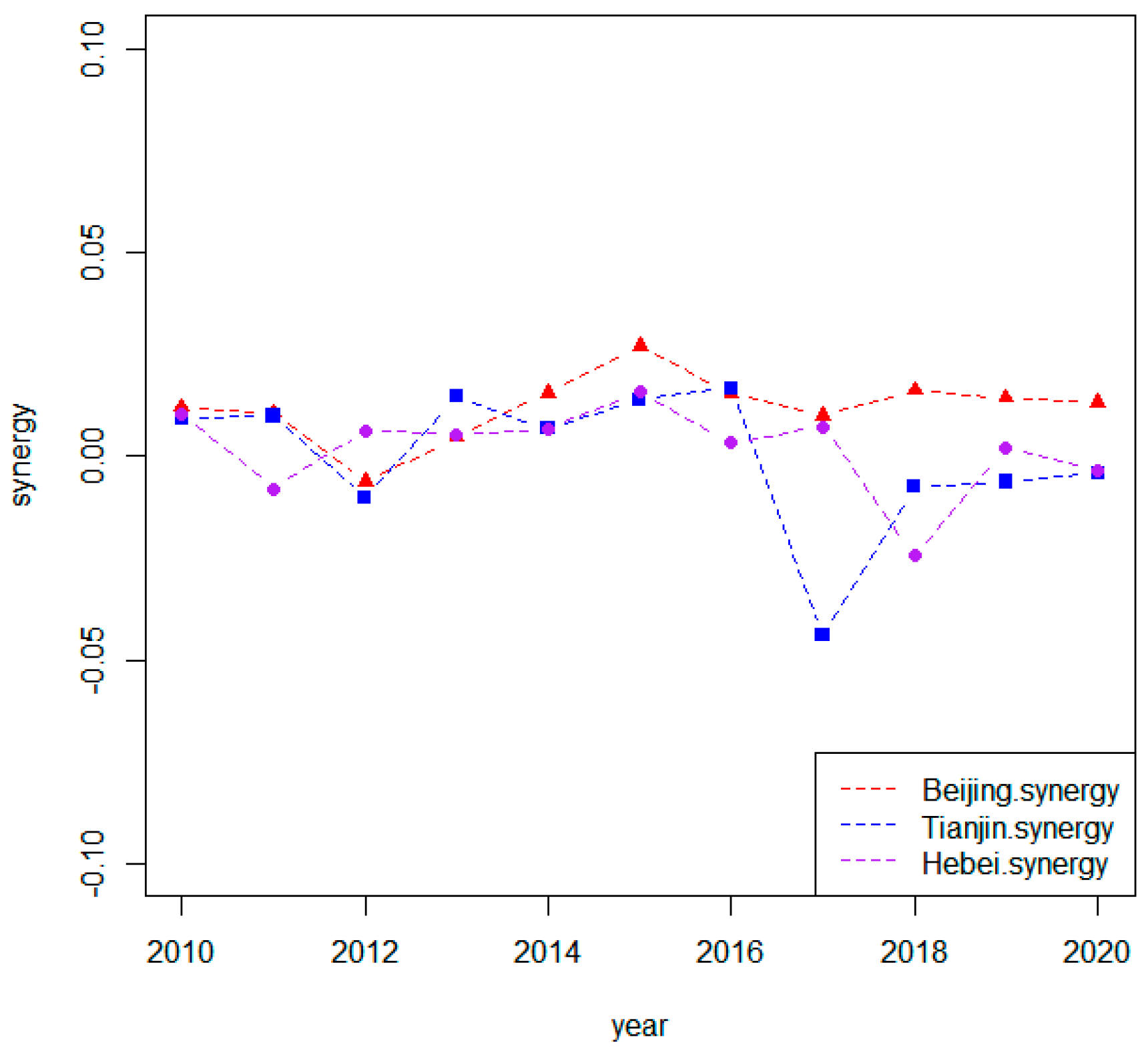

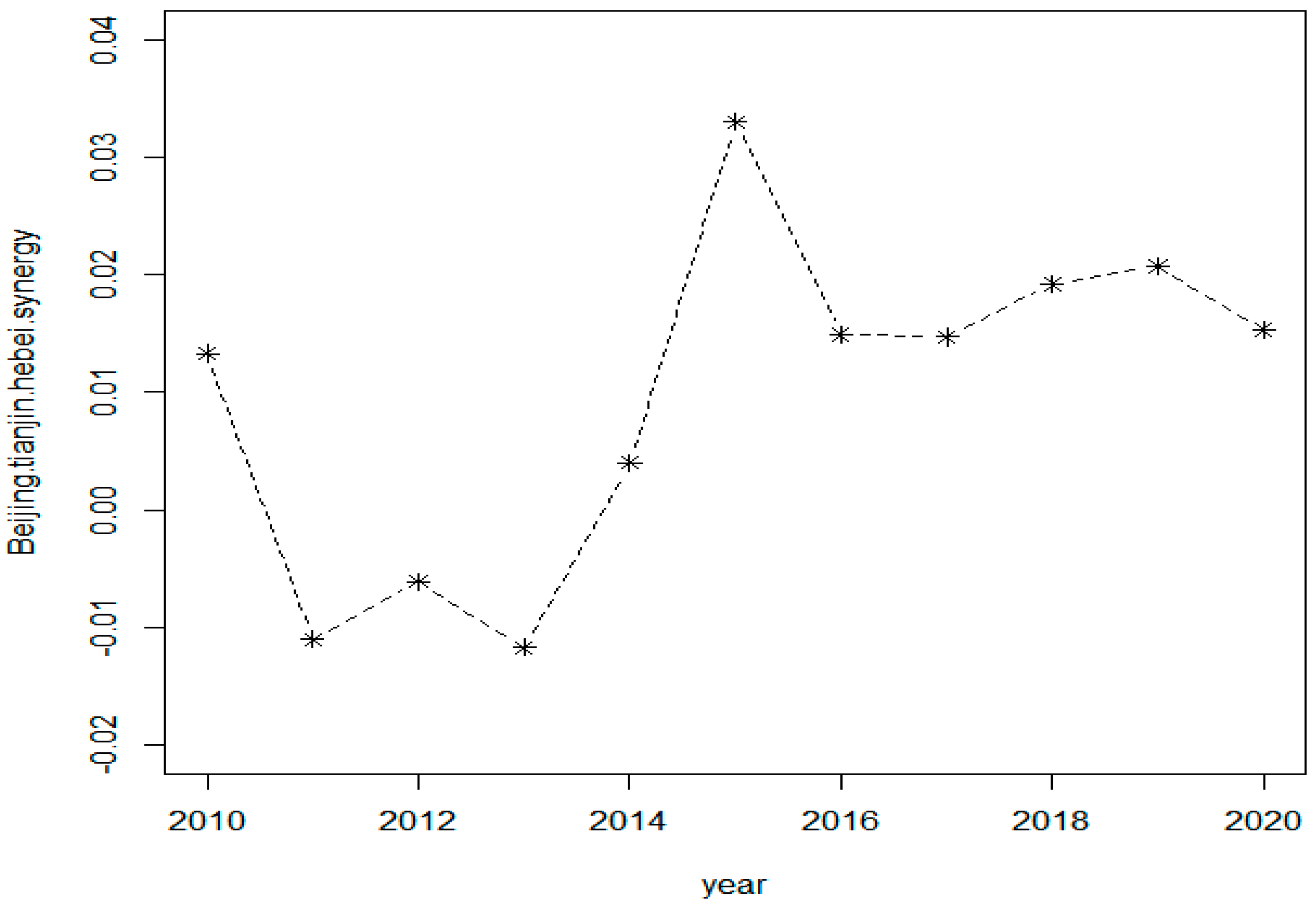

5.1. Collaborative Innovation of Beijing-Tianjin-Hebei Region

5.2. Analysis and Discussion of Threshold Effect

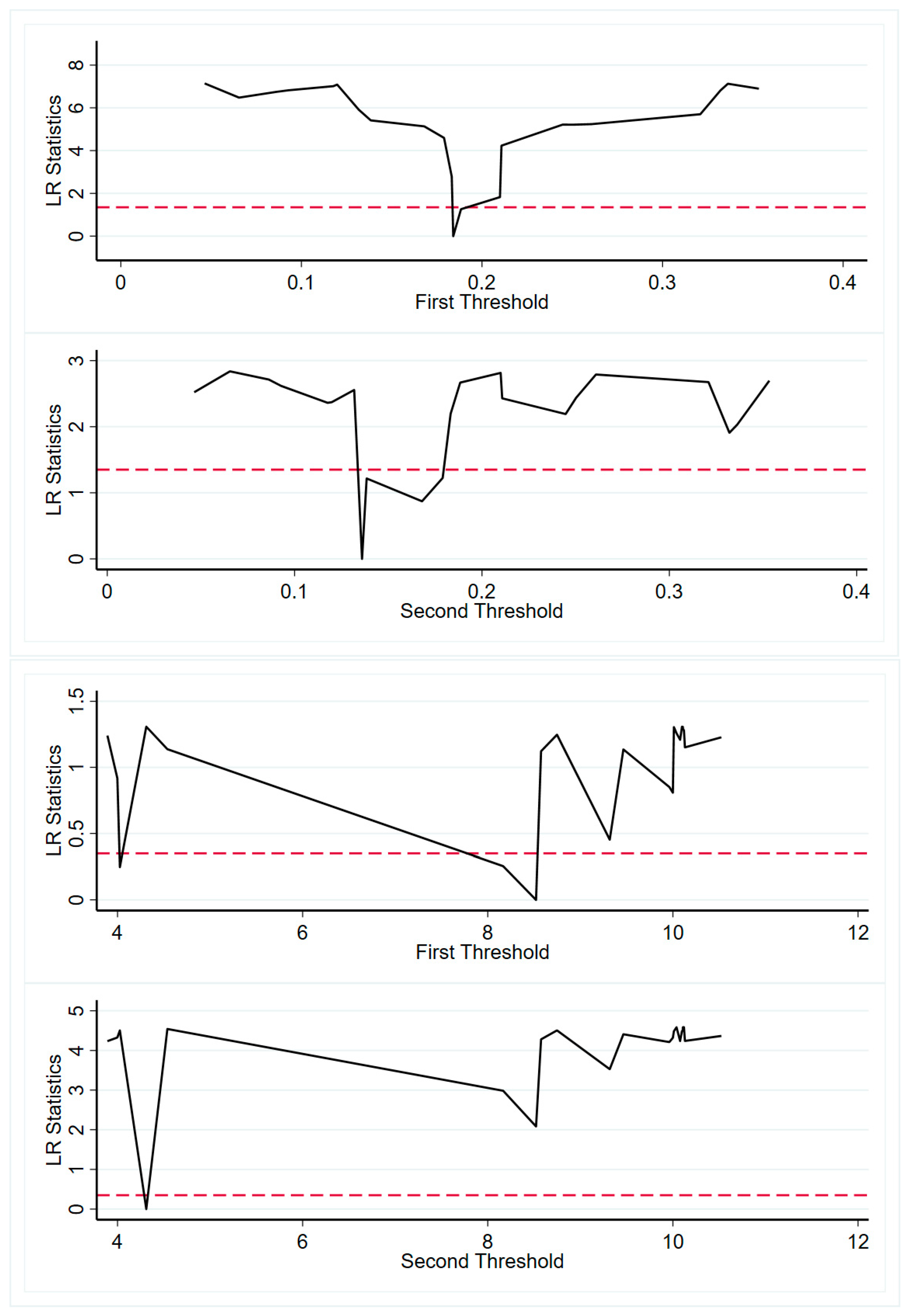

5.2.1. Public S&T Finance and Regional Collaborative Innovation under the Effect of Absorptive Capacity

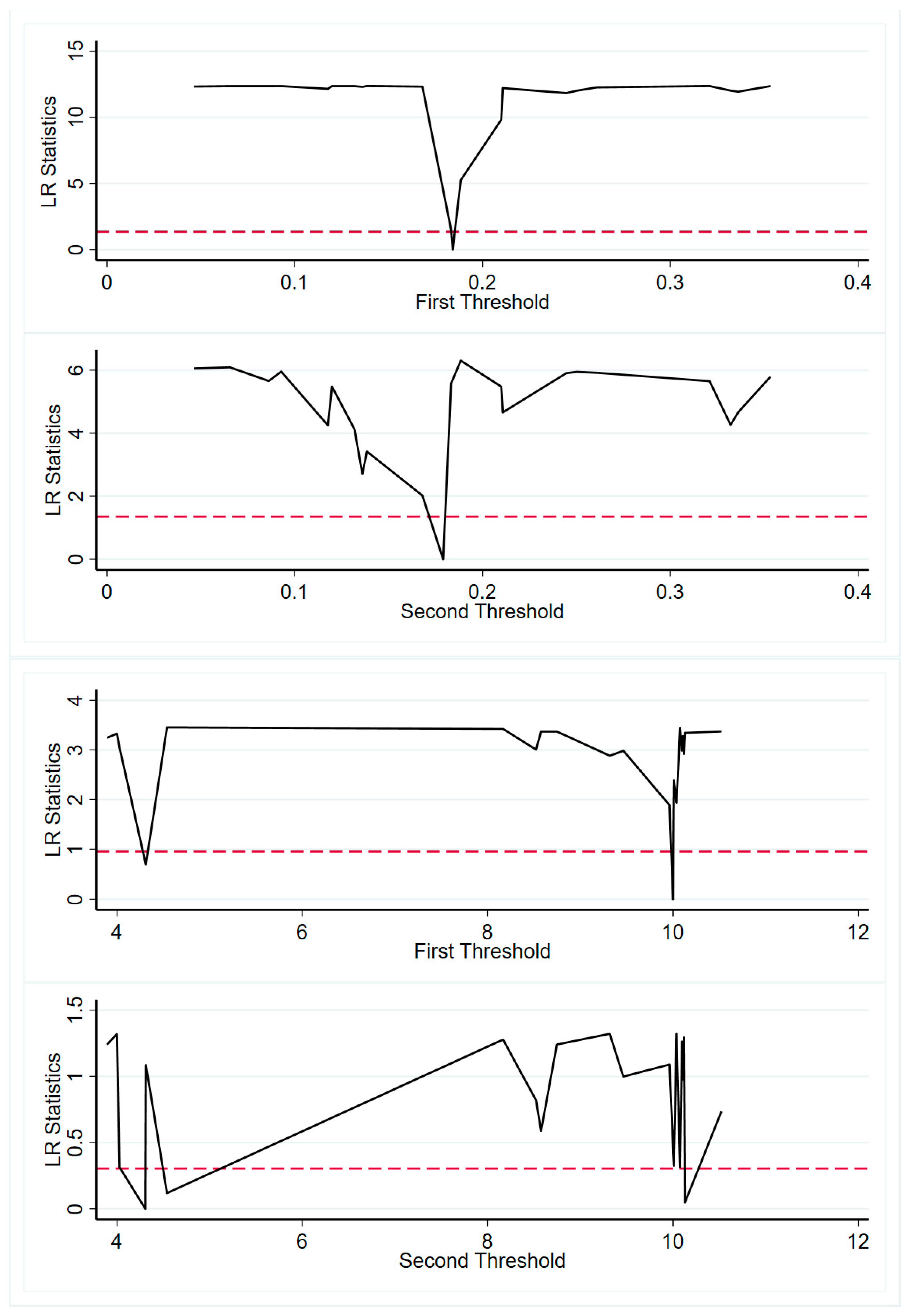

5.2.2. Market S&T Finance and Regional Collaborative Innovation under the Effect of Absorptive Capacity Factors

6. Conclusions and Policy Implication

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Zhu, X.; Asimakopoulos, S.; Kim, J. Financial development and innovation-led growth: Is too much finance better? J. Int. Money Financ. 2020, 100, 102083. [Google Scholar] [CrossRef]

- Guariglia, A.; Liu, P. To what extent do financing constraints affect Chinese firms’ innovation activities? Int. Rev. Financ. Anal. 2014, 36, 223–240. [Google Scholar] [CrossRef]

- Law, S.H.; Lee, W.C.; Singh, N. Revisiting the finance-innovation nexus: Evidence from a non-linear approach. J. Innov. Knowl. 2018, 3, 143–153. [Google Scholar] [CrossRef]

- Fan, F.; Lian, H.; Wang, S. Can regional collaborative innovation improve innovation efficiency? An empirical study of Chinese cities. Growth Chang. 2020, 51, 440–463. [Google Scholar] [CrossRef]

- Zhao, Q.W.; Fu, J.F.; Liu, H.J. Key issues in science and technology finance: A review of China science and Technology Finance 2014 Annual Meeting. Manag. World 2015, 164–167. [Google Scholar] [CrossRef]

- Wang, W.; Wang, S. Review and prospect of public science and technology finance research. Sci. Manag. Res. 2021, 39, 129–134. [Google Scholar]

- Wang, H.T.; Liu, J.; Lei, D. Research on the function orientation of science and technology finance in the coupling development of new and old industries. Manag. World 2014, 178–179. [Google Scholar] [CrossRef]

- Zou, K.; Ni, Q.S. Is there substitution effect in public technology finance? China Soft Sci. 2019, 3, 164–173. [Google Scholar]

- Xie, X.M.; Zuo, L.L. Collaborative innovation network characteristics and innovation performance: A mediating effect based on knowledge absorptive capacity. Nankai Manag. Rev. 2013, 16, 47–56. [Google Scholar]

- Miguélez, E.; Moreno, R. Knowledge flows and the absorptive capacity of regions. Res. Policy 2015, 44, 833–848. [Google Scholar] [CrossRef]

- Xie, R.; Fu, W.; Yao, S.; Zhang, Q. Effects of financial agglomeration on green total factor productivity in Chinese cities: Insights from an empirical spatial Durbin model. Energy Econ. 2021, 101, 105449. [Google Scholar] [CrossRef]

- Lau, A.K.W.; Lo, W. Regional innovation system, absorptive capacity and innovation performance: An empirical study. Technol. Forecast. Soc. Chang. 2015, 92, 99–114. [Google Scholar] [CrossRef]

- King, R.G.; Levine, R. Finance, entrepreneurship and growth. J. Monet. Econ. 1993, 32, 513–542. [Google Scholar] [CrossRef]

- Ding, R.; Chen, S.; Zhang, B.; Shen, S.; Zhou, B. The reduce of energy consumption intensity: Does the development of science and technology finance matter? Evidence from China. Energy Rep. 2022, 8, 11206–11220. [Google Scholar] [CrossRef]

- Zhao, X.; Li, X.; Wu, J. The Research on Connection Mechanism Between Innovation Subjects and Regional Innovation System. J. Jiangsu Univ. 2009, 11, 68–72. [Google Scholar]

- Wang, H.Q.; Xu, Y.L. A measure model for synergy degree between sci-tech innovation and sci-tech finance and its application. China Soft Sci. 2012, 129–138. [Google Scholar] [CrossRef]

- Pan, J.; Zhang, Y.X. The regional S&T innovation performance of government, enterprises and financial institutions of S&T investment. Stud. Sci. Sci. 2018, 36, 831–838. [Google Scholar]

- Zheng, L.; Zhang, W.K. The non-linear influence of tech-finance on tech-innovation: A U-shaped relationship. Soft Sci. 2018, 32, 16–20. [Google Scholar]

- Haken, H. Synergetics: An Introduction; Springer: New York, NY, USA, 1983; pp. 120–127. [Google Scholar]

- Freeman, C. Networks of Innovation: A Synthesis of Research Issue. Res. Policy 1991, 20, 499–514. [Google Scholar] [CrossRef]

- Cooke, P. Regional Innovation Systems: Competitive Regulation in the New Europe. Geoforum 1992, 23, 365–372. [Google Scholar] [CrossRef]

- Li, X.D.; Zhao, Y.T. The Analysis of Behaviors of Local Government in the Regional Innovation System. Ind. Technol. Econ. 2007, 26, 16–19. [Google Scholar]

- Feldman, M.P.; Audretsch, D.B. Knowledge spillovers and the geography of innovation. Handb. Reg. Urban Econ. 2004, 4, 2713–2739. [Google Scholar]

- Basile, R.; Roberta, C.; Andrea, C. Technological interdependence and regional growth in Europe: Proximity and synergy in knowledge spillovers. Pap. Reg. Sci. 2012, 91, 697–722. [Google Scholar] [CrossRef]

- Arratt, D.G.; Duncan, R.; Bossomaier, T. It’s not only what you know: Simulating research networks in the UK university sector. Emerg. Complex. Organ. 2014, 16, 1–28. [Google Scholar]

- Kavita, S.; Anuraag, S.; Ambuj, D.S. Strengthening science, technology, and innovation-based incubators to help achieve Sustainable Development Goals: Lessons from India. Technol. Forecast. Soc. Chang. 2020, 157, 47–62. [Google Scholar]

- Di Giacinto, V. On vector autoregressive modeling in space and time. J. Geogr. Syst. 2010, 12, 125–154. [Google Scholar] [CrossRef]

- Márquez, M.A.; Julián, R.; Hewings, G.J. Regional growth and spatial spillovers: Evidence from an SpVAR for the Spanish regions. Reg. Sci. 2015, 94, S1–S18. [Google Scholar] [CrossRef]

- Wang, H.Y.; Liu, Y. Measurement and analysis of the development level of regional science and technology finance. Technol. Econ. 2019, 38, 50–56. [Google Scholar]

- Xu, Y.Q.; Li, T.; Lu, L.L. Research on the Influence of the Pilot Policy of combining Science and Technology with Finance on regional economic growth—Based on the perspective of science and technology innovation and industrial structure rationalization. J. Chongqing Univ. (Soc. Sci. Ed.) 2021, 27, 1–15. [Google Scholar]

- Hall, B.H.; Maffioli, A. Evaluating the impact of technology development funds in emerging economies: Evidence from Latin America. Eur. J. Dev. Res. 2008, 20, 172–198. [Google Scholar] [CrossRef]

- Bloch, C.; Graversen, E.K. Additionality of public R&D funding for business R&D–A dynamic panel data analysis. World Rev. Sci. Technol. Sustain. Dev. 2012, 9, 204–220. [Google Scholar]

- Ang, J.B. Research, technological change and financial liberalization in South Korea. J. Macroecon. 2010, 32, 457–468. [Google Scholar] [CrossRef]

- Yu, Z.-F.; Wang, W.-Q.; Yan, Y.; Liu, X.-S. Energy loss evaluation in a Francis turbine under overall operating conditions using entropy production method. Renew. Energy 2021, 69, 982–999. [Google Scholar] [CrossRef]

- Bochko, V.S. The Accelerating and Constraining Factors of the Coordinated and Balanced Development of Regions. Econ. Reg. 2015, 41, 39–52. [Google Scholar] [CrossRef]

- Xu, M.; Chen, C.; Deng, X. Systematic analysis of the coordination degree of China’s economy-ecological environment system and its influencing factor. Environ. Sci. Pollut. Res. 2019, 26, 29722–29735. [Google Scholar] [CrossRef] [PubMed]

- Wang, R.X.; Yang, M. Absorptive Capacity and Technology-Finance Coupling Value Chain Realization: Empirical Evidence from Cross-country Data and Application in China. Manag. Rev. 2020, 32, 29–39. [Google Scholar]

- Seo, M.H.; Kim, S.; Kim, Y.J. Estimation of dynamic panel threshold model using Stata. Stata J. 2019, 19, 685–697. [Google Scholar] [CrossRef]

- Ahmad, M.; Majeed, A.; Khan, M.A.; Sohaib, M.; Shehzad, K. Digital financial inclusion and economic growth: Provincial data analysis of China. China Econ. J. 2021, 14, 291–310. [Google Scholar] [CrossRef]

- Wu, H.; Hao, Y.; Weng, J.H. How does energy consumption affect China’s urbanization? New evidence from dynamic threshold panel models. Energy Policy 2019, 127, 24–38. [Google Scholar] [CrossRef]

- Li, Z.D.; Yu, Z.X.; Wang, M.J. A two-step sequential estimation for dynamic panel threshold model. Stat. Res. 2014, 31, 72–80. [Google Scholar]

- Yano, G.; Shiraishi, M. Finance, institutions, and innovation activities in China. Econ. Syst. 2020, 44, 100835. [Google Scholar] [CrossRef]

- Qiu, B.; Tang, B.Q.; Sun, S.Q.; Liu, X.Y. Factor endowment, institutional dividend and new comparative advantage of exports. Econ. Res. J. 2014, 49, 107–109. [Google Scholar]

- Mukherji, N.; Silberman, J. Absorptive capacity, knowledge flows, and innovation in US metropolitan areas. J. Reg. Sci. 2013, 53, 392–417. [Google Scholar] [CrossRef]

- Liu, X.W.; Zou, K. Does Sci-tech Finance Promote the Synergy of Economy and Innovation? J. Hunan Univ. Sci. Tech. (Soc. Sci. Ed.) 2021, 24, 71–81. [Google Scholar]

- Ke, H.; Dai, S.; Yu, H. Spatial effect of innovation efficiency on ecological footprint: City-level empirical evidence from China. Environ. Technol. Innov. 2021, 22, 101536. [Google Scholar] [CrossRef]

| Subsystem | Measurement Index | Units | Weight |

|---|---|---|---|

| Input subsystem | R&D investment | Wan Yuan | 0.1 |

| Full time equivalent of R&D personnel | Ten thousand years | 0 | |

| Financial expenditure on science and technology | 100 million yuan | 0.1 | |

| Foreign technology import expenses of the enterprise | Wan Yuan | 0.1 | |

| New product development project personnel input | man-year | 0 | |

| Investment in new product development | Wan Yuan | 0.1 | |

| Output subsystem | Total R&D projects | item | 0 |

| Number of patents granted | piece | 0.2 | |

| Three major retrieval papers published number | piece | 0.1 | |

| Market technology turnover | 100 million yuan | 0.1 | |

| Revenue from new product sales | Wan Yuan | 0 | |

| Environmental subsystem | Wholesale and retail added value | 100 million yuan | 0 |

| Industrial added value | 100 million yuan | 0 | |

| Regional GDP growth | 100 million yuan | 0 | |

| revenue in the general public budgets | 100 million yuan | 0.1 |

| Variable Types | Variable Name | Measuring Method |

|---|---|---|

| Explained variable | RSTS | Input-output-environment system coordination |

| kernel variable | PubFin | Government expenditure on science and technology/fiscal expenditure |

| MarFin | Amount of technology loans from financial institutions/Science and technology expenditure | |

| Enterprise R&D investment/Main business income of the enterprise | ||

| Number of technology listed companies/Total number of listed companies | ||

| threshold variable | tech | Patent authorization traffic data is converted into stock |

| eco | per capital GDP | |

| control variable | Mar | fiscal expenditure/GDP |

| Hc | researcher/Urban Employed Persons | |

| Fin | Balance of loans from financial institutions/GDP |

| Year | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Beijing-Tianjin-Hebei synergy degree | 0.0133 | −0.0110 | −0.0061 | −0.0117 | 0.0040 | 0.0330 | 0.0149 | 0.0147 | 0.0192 | 0.0207 | 0.0153 |

| Beijing sci&tech synergy degree | 0.0120 | 0.0106 | −0.0063 | 0.0045 | 0.0155 | 0.0270 | 0.0154 | 0.0099 | 0.0162 | 0.0143 | 0.0132 |

| Tianjing sci&tech synergy degree | 0.0093 | 0.0099 | −0.0102 | 0.0147 | 0.0067 | 0.0138 | 0.0167 | −0.0439 | −0.0074 | −0.0633 | −0.0421 |

| Hebei sci&tech synergy degree | 0.0102 | −0.0079 | 0.0064 | 0.0053 | 0.0066 | 0.0159 | 0.0032 | 0.0073 | −0.0245 | 0.0021 | −0.035 |

| m = 1 | PubFin | MarFin |

|---|---|---|

| LM test | 0.004619 | 0.000261 |

| F test | 0.000 | 0.000 |

| Threshold Variable | Threshold Model | Public Technology Finance | Market Technology Finance | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| F-Value | p-Value | Critical Value | F-Value | p-Value | Critical Value | ||||||

| 1% | 5% | 10% | 1% | 5% | 10% | ||||||

| tech | single threshold | 5.49 | 0.08 | 32.48 | 17.33 | 11.58 | 5.78 | 0.06 | 20.89 | 14.24 | 11.18 |

| double threshold | 6.31 | 0.06 | 37.88 | 16.09 | 10.52 | 11.06 | 0.03 | 14.74 | 10.43 | 7.54 | |

| triple threshold | 6.39 | 0.5 | 33.38 | 23.98 | 20.75 | 1.51 | 0.75 | 12.7 | 10 | 8.37 | |

| eco | single threshold | 3.84 | 0.06 | 11.54 | 8.06 | 6.46 | 2.26 | 0.07 | 30.06 | 18.18 | 10.75 |

| double threshold | 2.47 | 0.02 | 10.06 | 7.79 | 7.1 | 3.13 | 0.04 | 21.18 | 12.79 | 10.77 | |

| triple threshold | 5.86 | 0.11 | 7.55 | 6.83 | 5.98 | 1.47 | 0.94 | 20.64 | 14.86 | 13.36 | |

| Threshold Variable | Threshold Model | Public Technology Finance | Market Technology Finance | ||

|---|---|---|---|---|---|

| Threshold Estimate | 95% CI | Threshold Estimate | 95% CI | ||

| tech | first threshold | 0.188374 | (0.0169, 0.4687) | 0.1384 | (0.02, 0.47) |

| second threshold | 0.3320411 | (0.0822, 0.4687) | 0.1884 | (0.18, 0.47) | |

| third threshold | 0.4686667 | (0.0169, 0.4687) | 0.47 | (0.02, 0.47) | |

| eco | first threshold | 8.1658 | (2.8668, 11.9) | 3.9984 | (2.906, 11.905) |

| second threshold | 9.961134 | (9.95, 11.9) | 10.07775 | (10.056, 11.895) | |

| third threshold | 11.8944 | (2.8668, 11.9) | 11.8944 | (2.906, 11.905) | |

| Threshold Range | PubFin | LRSTS | Mar | Hc | Fin | _cons |

|---|---|---|---|---|---|---|

| tech ≤ 0.1790 | −8.58995 ** | 0.25968 | 14.42075 *** | −0.9046 | 4.6203 | −0.00912 |

| 0.1790 < tech ≤ 0.3320 | −10.4774 *** | |||||

| tech < 0.3320 | −8.38083 ** | |||||

| eco ≤ 4.3062 | −5.6386 | 0.1779 | 19.5307 *** | −1.3783 *** | 1.5408 | 0.0277 |

| 4.3062 < eco ≤ 7.2994 | −8.8848 ** | |||||

| eco < 7.2994 | −12.271 *** |

| Threshold Range | MarFin | LRSTS | Mar | Hc | Fin | _cons |

|---|---|---|---|---|---|---|

| tech ≤ 0.0822 | 0.6067 * | 0.2374 | 8.64845 * | −0.2528 | 7.593 | −0.1484 ** |

| 0.0822 < tech ≤ 0.1841 | 0.4332 | |||||

| tech < 0.1841 | 0.6114 * | |||||

| eco ≤ 7.2994 | −0.0050 ** | 0.268 | 9.6251 * | −1.1922 ** | 1.1874 | −0.0178 |

| 7.2994 < eco ≤ 10.0776 | 0.0671 * | |||||

| eco < 10.0776 | −0.0178 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, Z.; Li, H.; Wang, S.; Lu, X. The Impact of Science and Technology Finance on Regional Collaborative Innovation: The Threshold Effect of Absorptive Capacity. Sustainability 2022, 14, 15980. https://doi.org/10.3390/su142315980

Li Z, Li H, Wang S, Lu X. The Impact of Science and Technology Finance on Regional Collaborative Innovation: The Threshold Effect of Absorptive Capacity. Sustainability. 2022; 14(23):15980. https://doi.org/10.3390/su142315980

Chicago/Turabian StyleLi, Zibiao, Han Li, Siwei Wang, and Xue Lu. 2022. "The Impact of Science and Technology Finance on Regional Collaborative Innovation: The Threshold Effect of Absorptive Capacity" Sustainability 14, no. 23: 15980. https://doi.org/10.3390/su142315980

APA StyleLi, Z., Li, H., Wang, S., & Lu, X. (2022). The Impact of Science and Technology Finance on Regional Collaborative Innovation: The Threshold Effect of Absorptive Capacity. Sustainability, 14(23), 15980. https://doi.org/10.3390/su142315980