Favorable Fiscal Self-Sufficiency Enables Local Governments to Better Improve the Environmental Governance—Evidence from China’s Lower-Pollution Areas

Abstract

:1. Introduction

2. Literature Review

3. Methods

3.1. Data

3.2. Variables

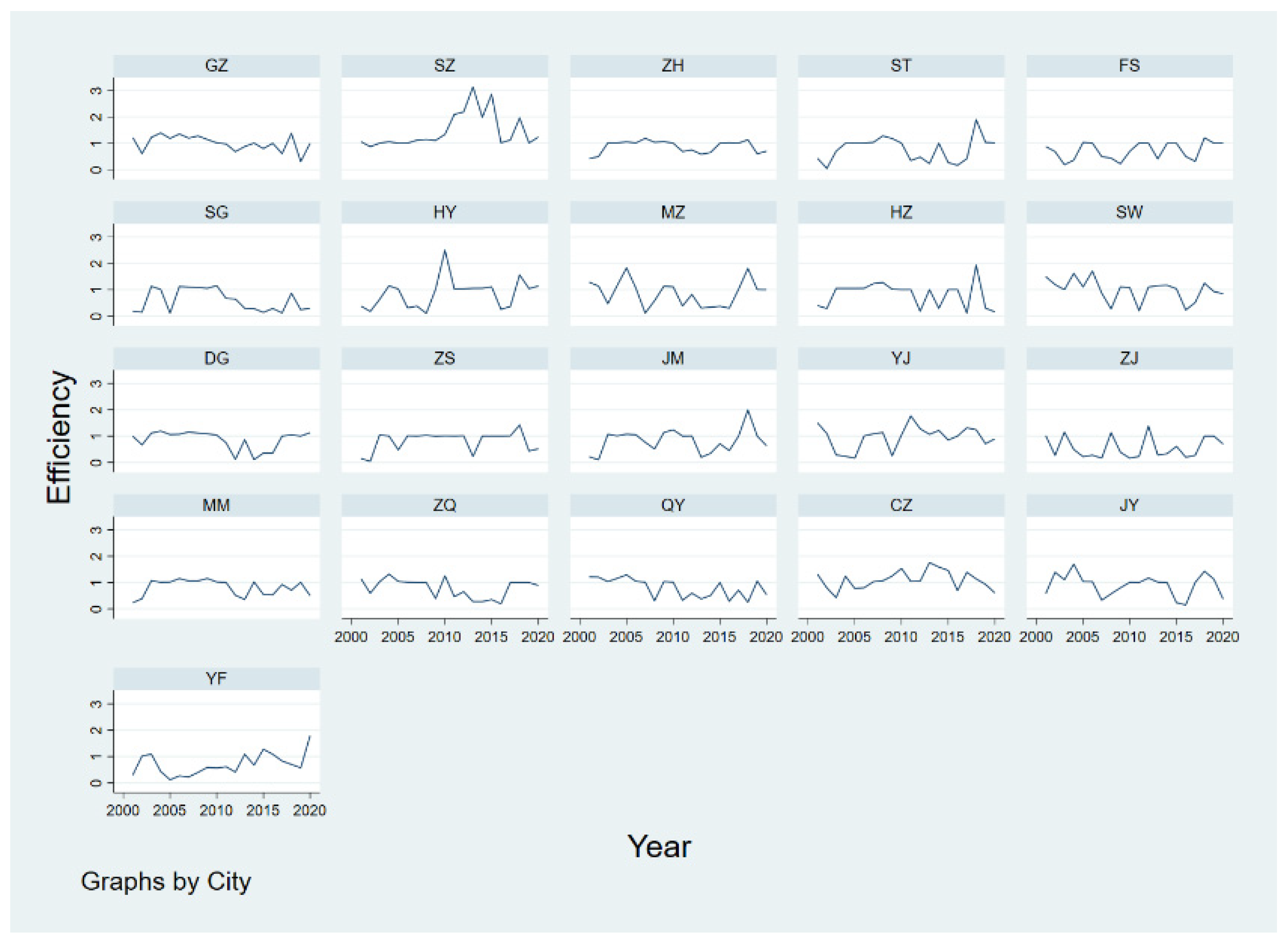

3.3. Environmental Governance Efficiency Calculation with DEA

3.4. Regressions

4. Results

5. Discussion

5.1. Regionalism of Environmental Governance

5.2. The Effect of Fiscal Policies to Promote Sustainable Development

5.3. Strengthening the Policy Collaboration and Assessment

6. Conclusions

6.1. Theoretical and Practical Implications

6.2. Research Limitations and Recommendations for Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Conflicts of Interest

References

- He, Q. Fiscal decentralization and environmental pollution: Evidence from Chinese panel data. China Econ. Rev. 2015, 36, 86–100. [Google Scholar] [CrossRef]

- Liu, X.; Yang, X. Impact of China’s environmental decentralization on carbon emissions from energy consumption: An empirical study based on the dynamic spatial econometric model. Environ. Sci. Pollut. Res. 2022, 29, 72140–72158. [Google Scholar] [CrossRef]

- Peng, B.; Li, Y.; Elahi, E.; Wei, G. Dynamic evolution of ecological carrying capacity based on the ecological footprint theory: A case study of Jiangsu province. Ecol. Indic. 2019, 99, 19–26. [Google Scholar] [CrossRef]

- Liu, Y.; Xing, P.; Liu, J. Environmental performance evaluation of different municipal solid waste management scenarios in China. Resour. Conserv. Recycl. 2017, 125, 98–106. [Google Scholar] [CrossRef]

- Rauscher, M. Economic Growth and Tax-Competing Leviathans. Int. Tax Public Financ. 2005, 12, 457–474. [Google Scholar] [CrossRef] [Green Version]

- Chirinko, R.S.; Wilson, D.J. Tax competition among U.S. states: Racing to the bottom or riding on a seesaw? J. Public Econ. 2017, 155, 147–163. [Google Scholar] [CrossRef] [Green Version]

- Pien, C.P. Local environmental information disclosure and environmental non-governmental organizations in Chinese prefecture-level cities. J. Environ. Manag. 2020, 275, 111225. [Google Scholar] [CrossRef]

- Cai, H.; Tong, Z.; Xu, S.; Chen, S.; Zhu, P.; Liu, W. Fiscal decentralization, government behavior, and environmental pollution: Evidence from China. Front. Environ. Sci. 2022, 10, 901079. [Google Scholar] [CrossRef]

- Zang, J.; Liu, L. Fiscal decentralization, government environmental preference, and regional environmental governance efficiency: Evidence from China. Ann. Reg. Sci. 2020, 65, 439–457. [Google Scholar] [CrossRef]

- Chen, S.; Liu, X.; Lu, C. Fiscal decentralization, local government behavior, and macroeconomic effects of environmental policy. Sustainability 2022, 14, 11609. [Google Scholar] [CrossRef]

- Knight, K.W.; Schor, J.B.; Jorgenson, A.K. Wealth Inequality and Carbon Emissions in High-income Countries. Soc. Curr. 2017, 4, 403–412. [Google Scholar] [CrossRef]

- Su, F.; Tao, R.; Xi, L.; Li, M. Local officials’ incentives and China’s economic growth: Tournament thesis reexamined and alternative explanatory framework. China World Econ. 2012, 20, 1–18. [Google Scholar] [CrossRef]

- Kremer, P.; Haase, A.; Haase, D. The future of urban sustainability: Smart, efficient, green or just? Introduction to the special issue. Sustain. Cities Soc. 2019, 51, 101761. [Google Scholar] [CrossRef]

- Lopez, R.; Galinato, G.; Islam, A. Fiscal spending and the environment: Theory and empirics. J. Environ. Econ. Manag. 2011, 62, 180–198. [Google Scholar] [CrossRef]

- Zhang, K.; Zhang, Z.; Liang, Q. An empirical analysis of the green paradox in China: From the perspective of fiscal decentralization. Energy Policy 2017, 103, 203–211. [Google Scholar] [CrossRef]

- Lin, B.; Zhu, J. Fiscal spending and green economic growth: Evidence from China. Energy Econ. 2019, 83, 264–271. [Google Scholar] [CrossRef]

- Zhang, W.; Li, G. Environmental decentralization, environmental protection investment and green technology innovation. Environ. Sci. Pollut. Res. 2020, 24, 1–16. [Google Scholar] [CrossRef]

- Guo, S.; Wen, L.; Wu, Y.; Yue, X.; Fan, G. Fiscal decentralization and local environmental pollution in China. Int. J. Environ. Res. Public Health 2020, 17, 8661. [Google Scholar] [CrossRef]

- Oates, W.E. An essay on fiscal federalism. J. Econ. Lit. 1999, 137, 1120–1149. [Google Scholar] [CrossRef] [Green Version]

- Oates, W.E. Toward a second-generation theory of fiscal federalism. Int. Tax Public Financ. 2005, 12, 349–373. [Google Scholar] [CrossRef]

- Qian, Y.; Barry, R.W. Federalism as a commitment to preserving market incentives. J. Econ. Perspect. 1997, 11, 83–92. [Google Scholar] [CrossRef]

- Wilson, J.D.; Gordon, R.H. Expenditure competition. J. Public Econ. Theory 2003, 5, 399–417. [Google Scholar] [CrossRef] [Green Version]

- Basoglu, A.; Uzar, U. An empirical evaluation about the effects of environmental expenditures on environmental quality in coordinated market economies. Environ. Sci. Pollut. Res. 2019, 26, 23108–23118. [Google Scholar] [CrossRef] [PubMed]

- Kunce, M.; Shogren, J. Destructive interjurisdictional competition: Firm, capital, and labor mobility in a model of direct emission control. Ecol. Econ. 2007, 60, 543–549. [Google Scholar] [CrossRef]

- Ederington, J.; Levinson, A.; Minier, J. Footloose and pollution-free. Rev. Econ. Stat. 2005, 87, 92–99. [Google Scholar] [CrossRef]

- Fomby, T.B.; Lin, L. A change point analysis of the impact of environmental federalism on aggregate air quality in the United States: 1940-98. Econ. Enq. 2006, 44, 109–120. [Google Scholar] [CrossRef] [Green Version]

- Millimet, D.L.; List, J.A. A natural experiment on the ‘Race to the Bottom’ hypothesis: Testing for Stochastic dominance in temporal pollution trends. Oxf. Bull. Econ. Stat. 2003, 65, 395–420. [Google Scholar] [CrossRef]

- Fare, R.; Grosskopf, S.; Pasurka, C. Environmental production functions and environmental directional distance functions. Energy 2007, 32, 1055–1066. [Google Scholar] [CrossRef]

- Bian, Y.; Liang, N.; Xu, H. Efficiency evaluation of Chinese regional industrial systems with undesirable factors using a two-stage slacks-based measure approach. J. Clean. Prod. 2015, 87, 348–356. [Google Scholar] [CrossRef]

- Castellet, L.; Senante, M. Efficiency assessment of wastewater treatment plants: A data envelopment analysis approach integrating technical, economic, and environmental issues. J. Environ. Manag. 2016, 167, 160–166. [Google Scholar] [CrossRef]

- Li, Y.; Zhang, Q.; Wang, L.; Liang, L. Regional environmental efficiency in China: An empirical analysis based on entropy weight method and non-parametric models. J. Clean. Prod. 2020, 276, 124147. [Google Scholar] [CrossRef]

- Deng, G.; Li, L.; Song, Y. Provincial water use efficiency measurement and factor analysis in China: Ased on SBM-DEA model. Ecol. Indic. 2016, 69, 12–18. [Google Scholar] [CrossRef]

- Zhou, X.; Luo, R.; Yao, L.; Cao, S.; Wang, S.; Lev, B. Assessing integrated water use and wastewater treatment systems in China: A mixed network structure two-stage SBM DEA model. J. Clean. Prod. 2018, 185, 533–546. [Google Scholar] [CrossRef]

- Wu, J.; An, Q.; Yao, X.; Wang, B. Environmental efficiency evaluation of industry in China based on a new fixed sum undesirable output data envelopment analysis. J. Clean. Prod. 2014, 74, 96–104. [Google Scholar] [CrossRef]

- Li, S.J.; Chang, T.H.; Chang, S.L. The policy effectiveness of economic instruments for the photovoltaic and wind power development in the European Union. Renew. Energy 2017, 101, 660–666. [Google Scholar] [CrossRef]

- Tong, X.; You, M.; Gu, L. The Impact of fiscal policy on the sustainable development of China’s photovoltaic industry. Front. Environ. Sci. 2022, 10, 883546. [Google Scholar] [CrossRef]

- Zhou, C.; Shi, C.; Wang, S.; Zhang, G. Estimation of eco-efficiency and its influencing factors in Guangdong province based on Super-SBM and panel regression models. Ecol. Indic. 2018, 86, 67–80. [Google Scholar] [CrossRef]

- Li, H.; Fang, K.; Yang, W.; Wang, D.; Hong, X. Regional environmental efficiency evaluation in China: Analysis based on the Super-SBM model with undesirable outputs. Math. Comput. Model. 2013, 58, 1018–1031. [Google Scholar] [CrossRef]

- Huang, J.; Yang, X.; Cheng, G.; Wang, S. A comprehensive eco-efficiency model and dynamics of regional eco-efficiency in China. J. Clean. Prod. 2014, 67, 228–238. [Google Scholar] [CrossRef]

- Besley, T.; Ilzetzki, E.; Persson, T. Weak states and steady states: The dynamics of fiscal capacity. Am. Econ. J. Macroecon. 2013, 5, 205–235. [Google Scholar] [CrossRef]

- Tang, G.; Lin, M.; Xu, Y.; Li, J.; Chen, L. Impact of rating and praise campaigns on local government environmental governance efficiency: Evidence from the campaign of establishment of national sanitary cities in China. PLoS ONE 2021, 16, e0253703. [Google Scholar] [CrossRef] [PubMed]

- Wu, L.; Ma, T.; Bian, Y.; Li, S.; Yi, Z. Improvement of regional environmental quality: Government environmental governance and public participation. Sci. Total Environ. 2020, 717, 137265. [Google Scholar] [CrossRef] [PubMed]

- Brehm, S. Fiscal Incentives, Public Spending, and Productivity–County-Level Evidence from a Chinese Province. World Dev. 2013, 46, 92–103. [Google Scholar] [CrossRef]

- Liu, H.; Zhou, R.; Yao, P.; Zhang, J. Assessing Chinese governance low-carbon economic peer effects in local government and under sustainable environmental regulation. Environ. Sci. Pollut. Res. 2022, 1–20. [Google Scholar] [CrossRef] [PubMed]

- Ran, Q.; Zhang, J.; Hao, Y. Does environmental decentralization exacerbate China’s carbon emissions? Evidence based on dynamic threshold effect analysis. Sci. Total Environ. 2020, 721, 137656. [Google Scholar] [CrossRef]

- Sun, Y.; Zhu, D.; Zhang, Z.; Yan, N. Does fiscal stress improve the environmental efficiency? perspective based on the urban horizontal fiscal imbalance. Int. J. Environ. Res. Public Health 2022, 19, 6268. [Google Scholar] [CrossRef] [PubMed]

- Wu, H.; Li, Y.; Hao, Y.; Ren, S.; Zhang, P. Environmental decentralization, local government competition, and regional green development: Evidence from China. Sci. Total Environ. 2020, 708, 135085. [Google Scholar] [CrossRef]

- Lyu, Y.; Zhang, J.; Yang, F.; Wu, D. The “Local Neighborhood” effect of environmental regulation on green innovation efficiency: Evidence from China. Int. J. Environ. Res. Public Health 2022, 19, 10389. [Google Scholar] [CrossRef]

- Que, W.; Zhang, Y.; Liu, S.; Yang, C. The spatial effect of fiscal decentralization and factor market segmentation on environmental pollution. J. Clean. Prod. 2018, 184, 402–413. [Google Scholar] [CrossRef]

- Wang, A. The search for sustainable legitimacy: Environmental law and bureaucracy in China. Harv. Environ. Law Rev. 2013, 365, 13–31. [Google Scholar] [CrossRef]

- Fang, Y.; Cao, H. Environmental Decentralization, Heterogeneous Environmental Regulation, and Green Total Factor Productivity—Evidence from China. Sustainability 2022, 14, 11245. [Google Scholar] [CrossRef]

- Udemba, E. Triangular nexus between foreign direct investment, international tourism, and energy consumption in the Chinese economy: Accounting for environmental quality. Environ. Sci. Pollut. Res. 2019, 26, 24819–24830. [Google Scholar] [CrossRef] [PubMed]

- Qiu, S.; Wang, Z.; Geng, S. How do environmental regulation and foreign investment behavior affect green productivity growth in the industrial sector? An empirical test based on Chinese provincial panel data. J. Environ. Manag. 2021, 287, 112282. [Google Scholar] [CrossRef] [PubMed]

- Charnes, A.; Cooper, W. Measuring the efficiency of decision making units. Eur. J. Oper. Res. 1978, 2, 429–444. [Google Scholar] [CrossRef]

- Oueslati, W. Growth and welfare effects of environmental tax reform and public spending policy. Econ. Model. 2015, 45, 1–13. [Google Scholar] [CrossRef]

- Cao, H.; Qi, Y.; Chen, J.; Shao, S.; Lin, S. Incentive and coordination: Ecological fiscal transfers’ effects on eco-environmental quality. Environ. Impact Assess. Rev. 2021, 87, 106518. [Google Scholar] [CrossRef]

- Wang, Z.; Xia, C.; Xia, Y. Dynamic relationship between environmental regulation and energy consumption structure in China under spatiotemporal heterogeneity. Sci. Total Environ. 2020, 738, 140364. [Google Scholar] [CrossRef]

| Variable | Obs | Mean | Std. dev. | Min | Max |

|---|---|---|---|---|---|

| Efficiency | 420 | 0.863484 | 0.4477596 | 0.042754 | 3.139752 |

| Sufficiency | 420 | 0.5914937 | 0.2673007 | 0.1488 | 1.7743 |

| GovtSize | 420 | 0.1228089 | 0.0331438 | 0.0509 | 0.2204 |

| GDPpc | 420 | 45,137.31 | 39,688.52 | 3164.33 | 203,825.5 |

| Ecar | 420 | 2635.686 | 6207.747 | 43 | 38728 |

| Tertiary | 420 | 41.48755 | 8.31252 | 24.44 | 72.50714 |

| FDI | 420 | 98,521.27 | 155847 | 1611 | 862,924.8 |

| EnvInput | 420 | 98,517.71 | 296,233.9 | 469 | 3,316,349 |

| Popu | 420 | 488.6666 | 282.9899 | 128.45 | 1874.03 |

| AreaDummy | 420 | 0.4285714 | 0.4954618 | 0 | 1 |

| Suffiency2 | 420 | 0.4211443 | 0.3725204 | 0.0221414 | 3.14814 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Variables | OSL | FE1 | FE2 | FE3 |

| Sufficiency | 0.652 *** | 0.737 *** | 0.848 *** | |

| (0.163) | (0.104) | (0.176) | ||

| Sufficiency2 | 3.819 ** | |||

| (1.063) | ||||

| GovtSize | 0.188 | 0.188 | 3.166 | 0.035 |

| (0.678) | (0.663) | (4.757) | (0.791) | |

| GDPpc | −1.112 * | 2.373 | −9.808 | |

| (1.167) | (1.307) | (5.798) | ||

| Ecar | 0.003 ** | 0.024 *** | 1.148 ** | 0.008 ** |

| (6.491) | (0.03) | (1.689) | (0.001) | |

| Tertiary | −0.007 | 0.0174 | −0.006 | |

| FDI EnvInput Popu AreaDummy | (0.005) 1.112 (5.153) −7.853 (1.146) −0.012 (0.001) −0.209 * (0.094) | (0.07) 1.408 (1.119) 2.137 (−7.858) 1.637 ** (−0.031) 1.26 (0.209) | 2.079 * (−4.287) 1.673 * (−1.697) 2.37 * (−0.0713) 0.987 (0.131) | (0.004) −2.251 ** (6.983) −0.01 ** (0.002) |

| Constant | 0.673 ** | 0.313 * | 0.405 ** | 0.913 |

| (0.253) | (0.673) | (0.362) | (0.228) | |

| F-test | 11.58 | 40.81 | 77.38 | 16.34 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gu, Z.; Tian, C.; Zheng, Z.; Zhang, S. Favorable Fiscal Self-Sufficiency Enables Local Governments to Better Improve the Environmental Governance—Evidence from China’s Lower-Pollution Areas. Sustainability 2022, 14, 16202. https://doi.org/10.3390/su142316202

Gu Z, Tian C, Zheng Z, Zhang S. Favorable Fiscal Self-Sufficiency Enables Local Governments to Better Improve the Environmental Governance—Evidence from China’s Lower-Pollution Areas. Sustainability. 2022; 14(23):16202. https://doi.org/10.3390/su142316202

Chicago/Turabian StyleGu, Zhijun, Chaowei Tian, Zeyuan Zheng, and Shujian Zhang. 2022. "Favorable Fiscal Self-Sufficiency Enables Local Governments to Better Improve the Environmental Governance—Evidence from China’s Lower-Pollution Areas" Sustainability 14, no. 23: 16202. https://doi.org/10.3390/su142316202