1. Introduction

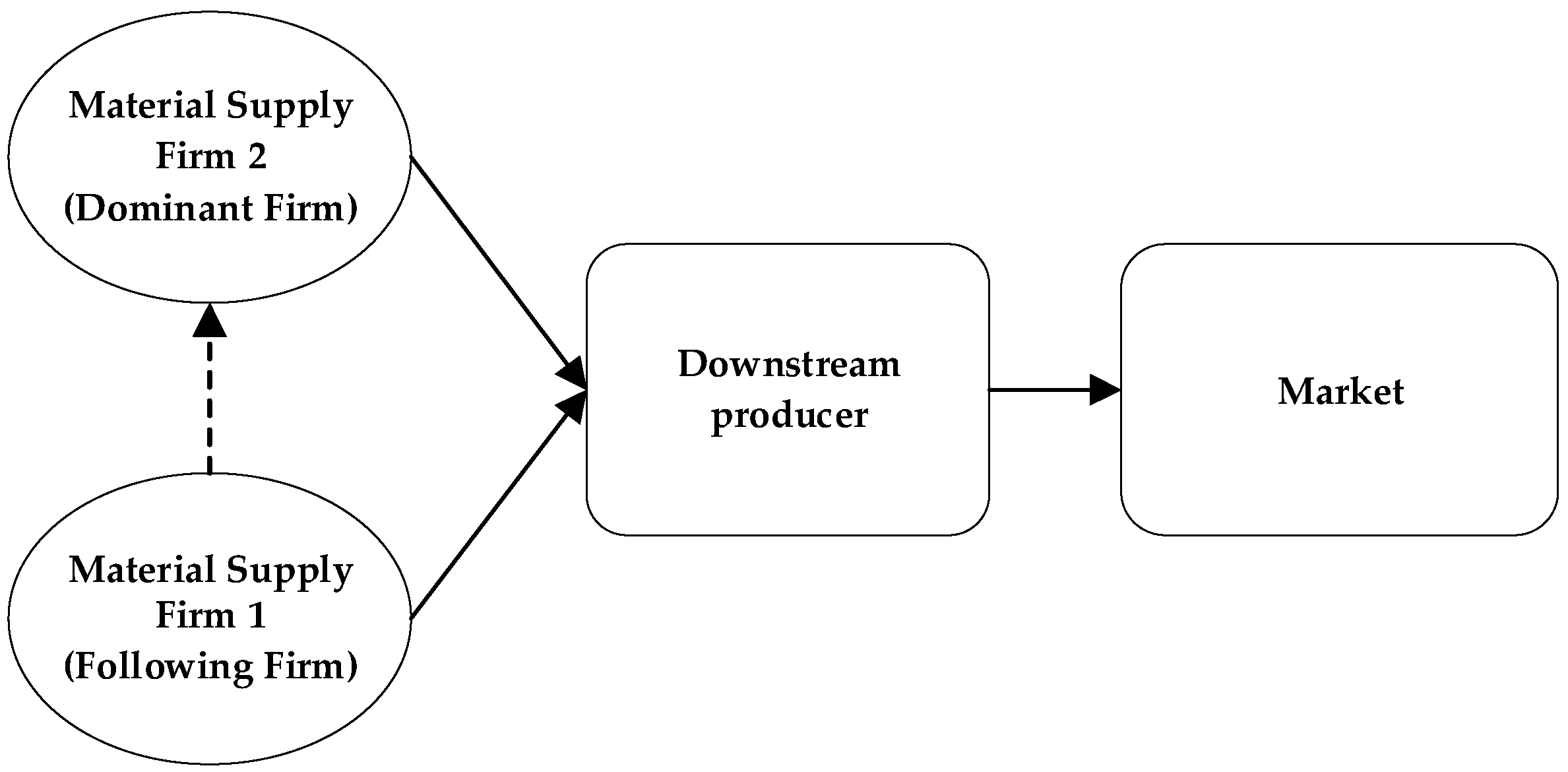

As the social economy has been extensively reformed and opened up alongside its rapid development, the competition among firms is becoming increasingly intense. In a multi-oligopolistic supply chain market, there is market competition among suppliers, who not only have to calculate their own costs and profits, but also must consider multiple games with competitors and downstream firms. Some raw material supply markets are multi-oligopolistic supply chain markets, in which there are usually multiple suppliers, with one supplier in the leading position and others in following positions. The dominant supplier not only has the largest market share, but also has a dominant role in raw material pricing, while the following suppliers have no dominant capacity in the process of raw material pricing, despite having some pricing power, and they often have to adopt the “follow the market” strategy. However, in a context of changing market demand and societal aspirations, firms should adopt a dynamic layout decision-making process to achieve sustainability goals [

1]. Uncertainty in suppliers’ product supply is a common phenomenon in supply chain management, and, to a certain extent, it can cause losses to firms [

2]. A well-configured supply chain (SC) can reduce costs and increase the competitiveness of a firm [

3]. Therefore, to reduce the risk of raw material supply chain breakage, downstream manufacturers often avoid adopting the raw material procurement strategy of “putting eggs in one basket” but sign long-term minimum supply purchase agreements with leading suppliers and also purchase raw materials through various channels. At this point, in the face of demand uncertainty, it is worth determining what pricing mechanism should be adopted by multi-oligopolistic suppliers in order to consolidate their market position and enhance their competitiveness.

Over a long period of time, academics have conducted a great deal of research regarding the pricing problem in supply chains, and many scholars have adopted different game approaches for use in different supply chain structures. Ji et al. [

4] developed a dynamic game model regarding “upstream” wholesale price and retail price to study “upstream” decisions and product pricing in a retail supply chain, considering the differences in the brand image of two suppliers. Wang et al. [

5] developed a bi-objective mixed-integer nonlinear programming model to optimize the supply chain network consisting of raw material suppliers, final product manufacturers, and distribution centers. Bai et al. [

6] used the mixed-integer linear programming (MILP) model to optimize the raw material supply chain of forest biomass power generation enterprises. Razmi et al. [

7] developed a dynamic mixed-integer linear programming (DMILP) model to optimize a seasonal raw material supply chain network by considering a multilevel supply chain with multiple products and multiple time periods. Das et al. [

8] used centralized and decentralized models to study interconnected, three-stage forward and reverse supply chains with green conscious markets providing green products. Taleizadeh et al. [

9] studied a problem related to decentralized, three-level supply chain total cost optimization using the Stackelberg–Nash model. Zarouri et al. [

10] used the Stackelberg model to study a problem related to dynamic pricing in a perishable supply chain with one manufacturer, one retailer, and two production and distribution periods. Gan et al. [

11] utilized the retailer Stackelberg game model to inconsistent pricing strategies for the online channel and offline channel of the O2O supply chain. Guo et al. [

12] used the Stackelberg game to study a problem related to the pricing game regarding two service providers with homogeneous consumers. Keskin and Taskin [

13] constructed a two-stage pricing decision model for a two-oligopolistic game in the presence of asymmetric market shares based on consumer preferences. Jiang and Yang [

14] constructed a dynamic game model to study the pricing mechanism and quality decisions of vendors in a community learning context. Gong and Yang [

15] used a sequential pricing game model to study the pricing mechanisms of suppliers in a raw material supply chain. Ma and Xie [

16] studied the pricing process of boundedly rational retailers for bundled products with limited information access and found that sequential games can be used to obtain a more stable system than simultaneous games. A sequential game is a form of game in which participants choose their strategies in a temporal sequence, and the choice of the first actor affects the choices available to the second actor. Unlike the traditional Bertrand model, it is a more typical dynamic game and provides an analytical tool to represent dynamic games of related firms. It is also different from the general delayed finite rationality model, in which the strategies of firms in the current period are influenced by the strategies of other firms in the previous period. For example, in the raw material supply market mentioned in our paper, Gong and Yang pointed out that the pricing mechanism of this type of market is a sequential game, in which the dominant supplier holds the “boss” position and has dominant power in each period, and its pricing can adopt a “delayed” strategy to make quotations at the end of the period, while the supplier in the following position provides quotations at the beginning of the period. This allows for better characterization of the dynamic evolution of the firm’s game.

Supply chains are complex systems which consist of multiple member firms. In the study of supply-and-demand relationships, the existing literature focuses on the relationship between two suppliers and one retailer [

17,

18,

19,

20,

21,

22,

23,

24,

25,

26] and multilevel supply chain relationships [

7,

9,

27,

28,

29]. Shen et al. [

30] studied a supply chain consisting of used product contributors, used consignment platforms, and new product suppliers, and they analyzed the platforms under the consignment contracts pricing strategy and the product selection strategy under a consignment contract. Huang and Li [

31] investigated how a closed-loop supply chain consisting of a recycler and two competing manufacturers can simultaneously optimize the membership strategy and alleviate problems regarding profit allocation. Sadjadi et al. [

32] developed a game model for a two-level supply chain consisting of a manufacturer and two retailers to study the effects of pricing structure and cooperative advertising decisions on supply chain coordination performance. Dey et al. [

33] used the Stackelberg model to determine the best decision for a closed-loop supply chain consisting of a manufacturer, two suppliers, and two competing retailers. Rajabi et al. [

34] studied joint pricing and inventory in a competitive supply chain consisting of a dominant manufacturer and two follower retailers facing nonlinear, price-dependent demand operating under Gounod model decisions. Hubert et al. [

35] analyzed the role of blockchain adoption decisions and differentiated the pricing strategies of genuine manufacturers in combating counterfeit and counterfeit products based on a single-tier manufacturer framework. Huang [

36] studied the stochastic used-product return problem in a closed-loop supply chain consisting of one manufacturer and one retailer concerned with fairness. Peng et al. [

37] employed the evolutionary game method to develop a tripartite evolutionary game model that reflects the interaction of interests among food raw material suppliers, food manufacturers, and consumers. In this paper, we modeled the game between multi-oligopolistic suppliers and downstream producers, focusing on the purchase of raw materials. In this regard, the goal of our paper was most similar to that of the study by Gong and Yang in [

15]. However, Gong and Yang only considered the sequential pricing game model of two upstream producers, which assumes that the maximum demand and price sensitivity coefficients of downstream firms to two upstream producers are the same and do not fully reflect the characteristics of dominant firms; the model only considers the influence of two upstream firms’ own factors on prices, and other influencing factors such as downstream firms are set as ideal. This approach has some significance in the study of pricing mechanisms, but its results are not in line with the actual market scenario. In fact, upstream firms have certain bargaining power in the process of pricing, and the sales price of downstream firms affects the market demand for the product, which in turn affects the price and profit of upstream producers. Therefore, the purchase volume of downstream firms and the size of the dominant and following coefficients have an impact on the profitability and pricing of firms, and the pricing mechanism studied by Gong and Yang lacks certain degrees of scientificalness and rationality, as such actual influencing factors are not considered.

Considering these problems and ideas, in this paper, we further investigated the problem of the multi-oligopoly pricing mechanism in a raw material supply chain based on the research of Gong and Yang. We constructed a constrained sequential pricing game model by taking relevant parameters such as product demand function, marginal production cost, dominant coefficient, following coefficient, and minimum purchase volume as constraints and transforming the model into a nonlinear bilevel programming model to facilitate model solving. In addition to the Nash equilibrium point, the boundary solution is a stable equilibrium point and enables a following firm to obtain a higher sales price than the Nash equilibrium price. In this paper, we explored this concept. Lastly, we carried out numerical simulations using MATLAB software, which revealed that the constrained sequential pricing game model is more effective than the unconstrained sequential pricing game model in solving multi-oligopoly pricing mechanism problems.

Compared with the existing literature, the marginal contributions of this paper are mainly reflected in three aspects. Firstly, from the perspective of demand uncertainty, the influence of downstream firms on upstream producers’ pricing was incorporated into the game time series, constraints that are more in line with the market reality were added, and a class of sequential pricing game models that are more similar to the real market were constructed, making the pricing mechanism under study more scientific. Secondly, a nonlinear bilevel programming model was established to solve the constrained sequential pricing game model, and analytical solution formulas were derived for six special cases. Thirdly, the validity of the constrained sequential pricing game model proposed in this paper was verified through numerical simulation experiments, and we found that the agreed minimum purchase volume and the dominant and following coefficients affect the stability of the market.

3. Model Solving

According to the sequential pricing rule, the selling price of firm 1 is determined by firm 2’s previous offer and firm 1’s current strategic offer, while firm 2 determines its final selling price on the basis of its own current offer, considering firm 1’s current offer. Therefore, the model was solved by first accounting for the optimal solution of firm 1 under the profit maximization condition using the nonlinear programming algorithm, then substituting the value of this optimal solution into the constraints, and finally continuing to calculate the optimal solution of firm 2 under the profit maximization condition using the nonlinear programming algorithm. The sequential pricing game model with constraints shown in Equation (10) can, thus, be transformed into a nonlinear bilevel programming solution model. For computational convenience and to ensure the evolution of the dynamic system, assuming the boundary conditions

, this nonlinear bilevel programming solution model can be expressed as follows:

where

denotes the optimal offer of firm 2 in period

t − 1 according to Equation (11), and

denotes the optimal offer of firm 1 in period

t,

t = 1, 2, 3, …, according to Equation (11). From Equation (11), the constraints of the model determine the feasible domain (i.e., the range of values taken) of

and

, and this feasible domain varies with

t. A diagram of the feasible domain of the model in period

t if a right-angle coordinate system is constructed with

as the horizontal axis and

as the vertical axis is shown in

Figure 2.

The specific process for solving the game equilibrium solution of this nonlinear bilevel programming model according to Equation (12) is given below and is shown in

Figure 3. The equilibrium solution of the game for the sequential pricing game model with constraints can be seen in this flowchart. However, in some special cases, it is possible to directly find the equilibrium solution of the model without the tedious numerical calculation process shown in

Figure 3. Assuming that

denotes the axis of symmetry corresponding to the first objective function in Equation (12) in period t,

denotes the axis of symmetry corresponding to the second objective function in Equation (12) at period

t,

denotes the axis of symmetry corresponding to the first objective function in Equation (12) at equilibrium, and

denotes the axis of symmetry corresponding to the second objective function in Equation (12) at equilibrium; these special cases can be found according to the relationship between the axis of symmetry and the feasible domain.

The specific expression for the above axis of symmetry can be derived from the expressions for the two objective functions in Equation (11) as

Equation (13) shows that

monotonically decreases and

monotonically increases, while

decreases monotonically with

, and

increases monotonically with

until it enters an equilibrium, provided that the parameters of the model remain unchanged. Thus, one can first determine the feasible domain corresponding to the model in each period by using

Figure 2, and then analyze whether the axis of symmetry appears in the interior or on the boundary of the feasible domain according to

Figure 2 and Equation (13), in order to find those special cases in which the analytical solution formula can be found for the equilibrium solution of the game. The analytical solution formulas for the equilibrium solution of this model in the six special cases in which the symmetry axis is satisfied are given below.

3.1. Situation 1

If the optimal solution corresponding to each period of the sequential pricing game model without constraints automatically satisfies the constraints in Equation (12), i.e., the symmetry axes of the two objective functions are in the feasible domain of Equation (12) in each period, then it is easy to obtain the Nash equilibrium solution of the model by simply taking partial derivatives of the objective function, i.e., by making

The corresponding Nash equilibrium solution can be obtained as

Let

, which gives

This shows that the Nash equilibrium solution satisfies the condition of maximizing the sum of the profits of the two firms, which means that the Nash equilibrium solution of the sequential pricing game model without constraints is also the Pareto-optimal solution. At this point, the market sales prices of firm 1 and firm 2 in equilibrium can be found by substituting Equation (15) into Equations (1) and (2), which makes

This result suggests that the equilibrium market selling price of a firm without constraints depends on the relevant parameters of the product demand function and its own production costs, independent of the following coefficient, the dominance coefficient, and the agreed minimum purchase volume, which are obviously intuitively questionable. Therefore, the sequential pricing game model with constraints should be more in line with the reality of the market.

Obviously, in order to ensure the equilibrium solution of the game corresponds to the sequential pricing game model with constraints, which is also the Pareto-optimal solution, it is adequate to make the optimal solution of the sequential pricing game model without constraints automatically satisfy the constraints contained in Equation (12) in each period by substituting the equilibrium offer represented by Equation (15) into the constraints of Equation (12). The model parameters should satisfy the following conditions:

It follows that the equilibrium solution of the sequential pricing game model with constraints proposed in this paper is the Pareto-optimal solution, in which the model parameters also satisfy Equation (18) under the preconditions of the model assumptions in this paper, which can be directly calculated from the analytical formula shown in Equation (15).

3.2. Situation 2

When the right boundary point of the feasible domain of Equation (12) is always

, and the symmetry axis of the first objective function in period 1 lies on the right of the feasible domain, the optimal solution in each period can only fall on the right boundary point of the feasible domain, meaning that this boundary point is the corresponding game equilibrium solution of the model, which is equivalent to entering the equilibrium state in period 1. At this point, the constraints in Equations (13) and (12) indicate that it is only necessary to ensure the model parameters satisfy the following conditions:

and the corresponding equilibrium solution of the game is

At this point, the substitution of Equation (20) into Equations (1) and (2) yields the market selling prices of firm 1 and firm 2, respectively, in equilibrium:

The results show that the market selling price of a following firm under current conditions is influenced by the following coefficient, the dominant coefficient, the relevant parameters of the product demand function, and the agreed minimum purchase volume, while the market selling price of a dominant firm is influenced only by the firm’s own product demand function and the agreed minimum purchase volume.

It follows that the equilibrium solution of the sequential pricing game model with constraints proposed in this paper can be calculated directly from the analytical formula shown in Equation (20) when the model parameters also satisfy Equation (19), provided that the assumptions of the model are satisfied.

3.3. Situation 3

When the right boundary point of the feasible domain of Equation (12) is always

and the symmetry axis of the first objective function in period 1 also lies to the right side of the feasible domain of the model, the optimal solution of each period can only fall on the right boundary point of the feasible domain; thus, this boundary point is also the corresponding equilibrium solution of the model, which is equivalent to entering the equilibrium state in period 1. At this point, the constraints in Equations (13) and (12) indicate that the model parameters should satisfy the following conditions:

and the corresponding equilibrium solution of the game is

At this point, the substitution of Equation (23) into Equations (1) and (2) yields the market selling prices of firm 1 and firm 2, respectively, in equilibrium:

These results show that the market selling prices of both following and dominant firms under current conditions are influenced by the following coefficient, the dominant coefficient, and the relevant parameters of the product demand function.

It follows that the equilibrium solution of the sequential pricing game model with constraints proposed in this paper can be calculated directly from the analytical formula shown in Equation (23) when the model parameters also satisfy Equation (22), provided that the assumptions of the model are satisfied.

3.4. Situation 4

When the symmetry axis of the first objective function of the Equation (12) in period 1 lies inside the feasible domain, but the symmetry axis of the second objective function in period 1 lies on the negative half-axis of the

axis, the optimal solution in each period can only fall on the lower boundary of the feasible domain at

; thus, the equilibrium solution of the game corresponding to this model can only appear at

, which is equivalent to entering the equilibrium state in period 1. At this point, the constraints in Equations (12) and (13) indicate that the model parameters should satisfy the following conditions:

and the corresponding equilibrium solution of the game is

At this point, the substitution of Equation (26) into Equations (1) and (2) yields the market selling prices of firm 1 and firm 2, respectively, in equilibrium:

These results show that the market selling price of a following firm under current conditions is only influenced by the parameters related to that firm’s own product demand function, while the market selling price of a dominant firm is influenced by the following coefficient, the dominant coefficient, and the parameters related to the product demand function of the following firm.

It follows that the equilibrium solution of the sequential pricing game model with constraints proposed in this paper can be calculated directly from the analytical formula shown in Equation (26) when the model parameters also satisfy Equation (25), subject to the assumptions of the model in this paper.

3.5. Situation 5

When the axis of symmetry of the first objective function of Equation (12) lies inside the feasible domain until equilibrium is reached and on the negative half-axis of the

axis after equilibrium is reached, and the axis of symmetry of the second objective function in each period always lies inside the feasible domain, the equilibrium solution of the game corresponding to this model can only appear on the left boundary of the feasible domain at

. At this point, the constraints in Equations (13) and (12) indicate that the model parameters should satisfy the following conditions:

and the corresponding equilibrium solution of the game is

At this point, the substitution of Equation (28) into Equations (1) and (2) yields the market selling prices of firm 1 and firm 2, respectively, in equilibrium:

This result shows that the market selling price of a following firm under current conditions is influenced by the following coefficient, the dominant coefficient, and the parameters related to the product demand function of the dominant firm, while the market selling price of the dominant firm is only influenced by the parameters related to the demand function of that firm’s own product.

It follows that the equilibrium solution of the sequential pricing game model with constraints proposed in this paper can be calculated directly from the analytical formula shown in Equation (29) when the model parameters also satisfy Equation (28), provided that the assumptions of the model are met.

3.6. Situation 6

When the symmetry axis of the first objective function of Equation (12) lies inside the feasible domain until equilibrium is reached and the negative half-axis of the

axis after equilibrium is reached, while the second objective function lies inside the feasible domain until equilibrium is reached and the upper boundary of the feasible domain after equilibrium is reached

, the equilibrium solution of the game corresponding to this model can only appear on the upper left boundary of the feasible domain

. At this point, the constraints in Equations (13) and (12) indicate that the model parameters should satisfy the following conditions:

and the corresponding equilibrium solution of the game is

At this point, the substitution of Equation (32) into Equations (1) and (2) yields the market selling prices of firm 1 and firm 2 in equilibrium, respectively.

These results show that the market selling price of a following firm under current conditions is only influenced by the parameters related to that firm’s own product demand function, while the market selling price of a dominant firm is influenced by the following coefficient, the dominant coefficient, and the parameters related to the product demand function of the following firm.

It follows that the equilibrium solution of the sequential pricing game model with constraints proposed in this paper can be calculated directly from the analytical formula shown in Equation (32) when the model parameters also satisfy Equation (31), provided that the assumptions of the model are met.

The analytical formulas for the equilibrium solutions of the game in other cases are not analyzed; they can all be solved numerically according to the process shown in

Figure 3.

5. Conclusions

On the basis of the raw material supply chain market, in this paper, we investigated the sequential pricing game of multi-oligopolistic firms under constraints. By analyzing the mutual constraints between oligopolistic firms and downstream producers in the raw material supply chain and setting constraints such as parameters related to the product demand function, dominant coefficient, following coefficient, and agreed minimum purchase volume, a constrained sequential pricing game model was constructed. A numerical simulation of the game model was also conducted using MATLAB software, which showed that changes in each parameter had impacts on the equilibrium quoted prices and profits of both firm 1 and firm 2. The closer the dominant coefficient is to the following coefficient, the more chaotic the market is, i.e., the longer it takes for firms to reach equilibrium, and vice versa, due to the increased stability of the market. The agreed minimum purchase volume between the dominant and downstream firms also affects the quoted prices and profits of the oligopolistic firms, and a larger agreed minimum purchase volume would lead to a decrease in the profits of the oligopolistic firms, which is not conducive to their sustainable development. Therefore, regulators and industry organizations should try to reasonably regulate the gap between the dominant and following coefficients, control a reasonable range of agreed minimum procurement volumes, and determine a reasonable pricing mechanism to maintain a stable market situation and guide the market in an orderly manner.

Compared with the existing unconstrained sequential pricing mechanism, the proposed constrained sequential pricing game model considers constraints such as the parameters related to the product demand function, marginal production cost, dominant coefficient, following coefficient, and agreed minimum purchase volume. The subsequently constructed nonlinear bilevel programming solving model is an extension and effective supplement to the model analysis, thus making the model more similar to the real market. The results of this study can help firm managers reasonably regulate their own dominant degree or following degree. When encountering market fluctuations, they can quickly adjust their pricing strategies to achieve a win/win situation. At the same time, in order to maximize the overall benefits of the supply chain, ensure the price stability and profit optimization of firms, and achieve sustainable development, this paper provides a reference for firm managers to control the reasonable range of the agreed minimum purchase volume and develop the optimal pricing scheme. In addition, it provides theoretical support and methodological reference for regulators and industry organizers to control the internal management of the market and deepen the market-oriented reform of raw material supply chain pricing, which helps maintain the stable development of the market.

Future research could explore the following aspects: (1) this model only considers the case of two firms, whereas, when multiple dominant or following firms are involved, the model becomes more complex, and further research is worthwhile; (2) this paper did not consider the impact of the dynamic demand of downstream firms on the pricing of upstream firms, and further research can be conducted regarding the impact of the product demand of downstream firms on the pricing of upstream firms.