Whether and How ESG Impacts on Corporate Financial Performance in the Yangtze River Delta of China

Abstract

1. Introduction

2. Literature Review and Research Hypothesis

2.1. Literature Review

2.1.1. ESG

2.1.2. ESG and Corporate Financial Performance

2.2. Research Hypothesis

3. Research Design

3.1. Selection of Samples and Variables

3.1.1. Selection of Samples

3.1.2. Selection of Dependent Variable

ESG Index System

Control Variables

3.2. Model Specification

4. Empirical Analysis of E, S, G and Financial Performance

4.1. Descriptive Statistics

4.2. Correlation Analysis

4.3. Regression Analysis of E, S and G

4.4. Robustness Test

5. Empirical Analysis on ESG and Financial Performance

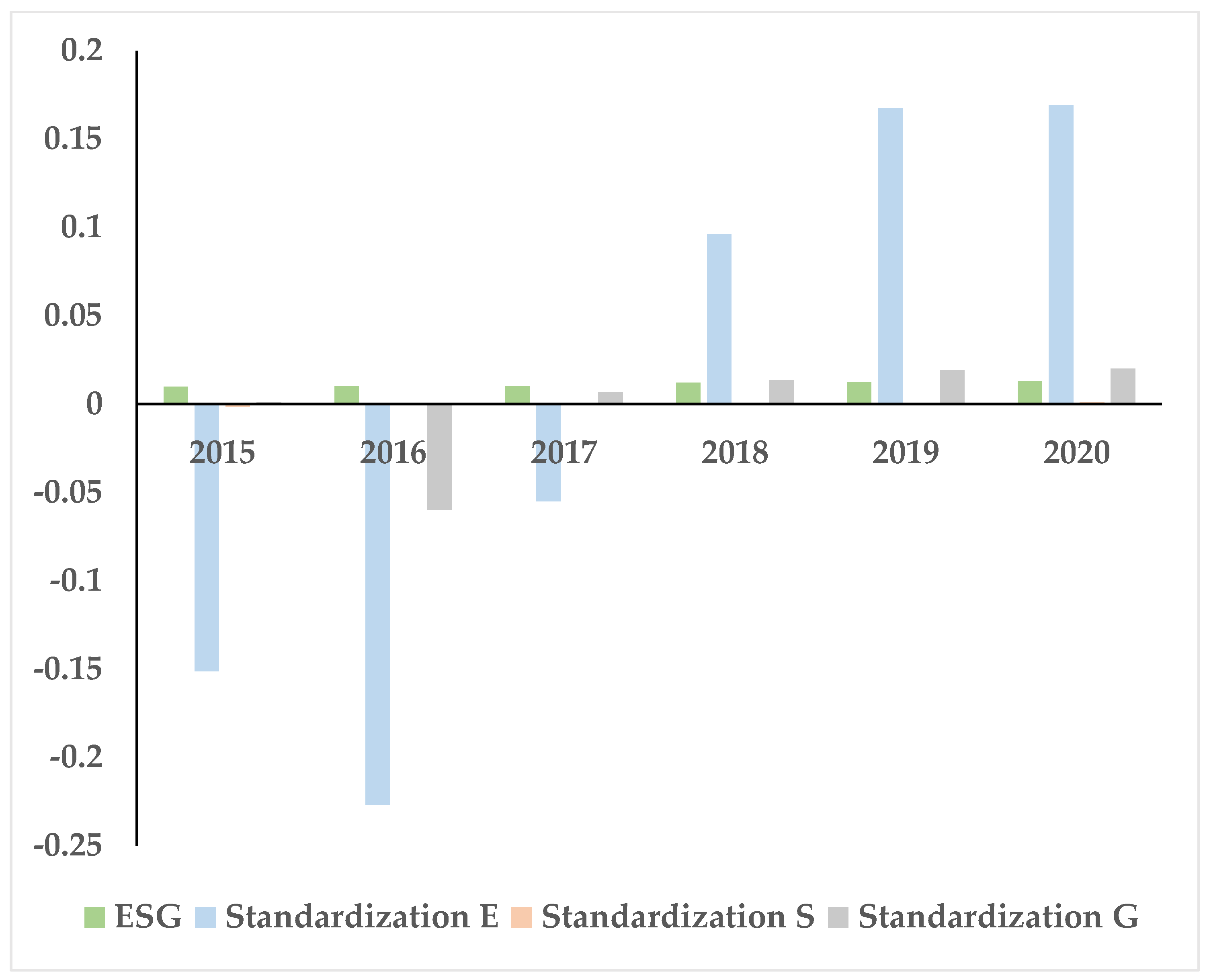

5.1. How Is ESG Performing?

5.2. Regression Analysis of ESG

5.3. Robustness Tests

6. Conclusions and Suggestions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Wang, Z.; Sarkis, J. Corporate social responsibility governance, outcomes, and financial performance. J. Clean. Prod. 2017, 162, 1607–1616. [Google Scholar] [CrossRef]

- Asset Management Association of China; Institute of Finance; Development Research Center of the State Council. Research Report on the ESG Evaluation System of Chinese Listed Companies. 2018. Available online: https://www.amac.org.cn/industrydynamics/guoNeiJiaoLiuDongTai/jjhywhjs/esg/202001/t20200120_6471.html (accessed on 3 September 2020).

- Cao, Q.; Xu, Q. Research on the construction of financial “Environment, Society and Governance” (ESG) system. Financ. Regul. Res. 2019, 4, 95–111. [Google Scholar] [CrossRef]

- Sanches Garcíia, A.; Mendes-Da-Silva, W.; Orsato, R.J. Sensitive industries produce better ESG performance: Evidence from emerging markets. J. Clean. Prod. 2017, 150, 135–147. [Google Scholar] [CrossRef]

- Fatemi, A.; Glaum, M.; Kaiser, S. ESG performance and firm value: The moderating role of disclosure. Glob. Financ. J. 2017, 4, 1–64. [Google Scholar] [CrossRef]

- Rezaee, Z.; Tuo, L. Voluntary disclosure of non-financial information and its association with sustainability performance. Adv. Account. 2017, 39, 47–59. [Google Scholar] [CrossRef]

- Ng, A.C.; Rezaee, Z. Business sustainability performance and cost of equity capital. J. Corp. Financ. 2015, 34, 128–149. [Google Scholar] [CrossRef]

- Shen, H.; Ma, Z. Local Economic Development Pressure, Firm Environmental Performance and Debt Financing. J. Financ. Res. 2014, 2, 153–166. [Google Scholar]

- Yang, J.; Yang, W. Executive Compensation, Social Responsibility and Corporate Performance. J. Zhengzhou Univ. Aeronaut. 2019, 1, 62–71. [Google Scholar] [CrossRef]

- He, M.; Chen, J. An Empirical Study on the Correlation between Corporate Governance and Corporate Performance Based on Factor Analysis. Commer. Account. 2018, 17, 56–58. [Google Scholar] [CrossRef]

- The Study Group of Green Finance, ICBC; Zhang, H.; Zhou, Y. A Study of ESG Green Rating and Green Index. Financ. Forum 2017, 9, 5–16. [Google Scholar]

- International Institute of Green Finance, CUFE. International institute of Green Finance, CUFE. Research on the Correlation between ESG Performance and Corporate Performance of Chinese Listed Companies. For. Chem. Rev. 2022, 1, 1501–1514. [Google Scholar]

- Qiu, M.; Yin, H. An Analysis of Enterprises’ Financing Cost with ESG Performance under the Background of Ecological Civilization Construction. J. Quant. Tech. Econ. 2019, 3, 108–123. [Google Scholar]

- Velte, P. Does ESG performance have an impact on financial performance? Evidence from Germany. J. Glob. Responsib. 2017, 80, 169–179. [Google Scholar] [CrossRef]

- Margolis, J.D.; Elfenbein, H.A.; Walsh, J.P. Does it pay to be good and does it matter? A meta-analysis of the relationship between corporate social and financial performance. Work. Pap. Harv. Univ. 2009, 1–79. [Google Scholar] [CrossRef]

- Al-Tuwaijri, S.A.; Christensen, T.E.; Hughes, K.E., II. The relations among environmental disclosure, environmental performance, and economic performance: A simultaneous equations approach. Account. Organ. Soc. 2004, 29, 447–471. [Google Scholar] [CrossRef]

- Kuo, T.C.; Chen, H.M.; Meng, H.M. Do corporate social responsibility practices improve financial performance? A case study of airline companies. J. Clean. Prod. 2021, 310, 127380. [Google Scholar] [CrossRef]

- Galletta, S.; Mazzù, S.; Naciti, V. A bibliometric analysis of ESG performance in the banking industry: From the current status to future directions. Res. Int. Bus. Financ. 2022, 62, 101684. [Google Scholar] [CrossRef]

- Alsayegh, M.F.; Rahman, R.A.; Homayoun, S. Corporate Economic, Environmental, and Social Sustainability Performance Transformation through ESG Disclosure. Sustainability 2020, 12, 3910. [Google Scholar] [CrossRef]

- Ng, T.-H.; Lye, C.-T.; Chan, K.-H.; Lim, Y.-Z. Sustainability in Asia: The Roles of Financial Development in Environmental, Social and Governance (ESG) Performance. Soc. Indic. Res. 2020, 150, 17–44. [Google Scholar] [CrossRef]

- Zhou, G.; Liu, L.; Luo, S. Sustainable development, ESG performance and company market value: Mediating effect of financial performance. Bus. Strategy Environ. 2022, 31, 3371–3387. [Google Scholar] [CrossRef]

- Chen, Z.; Xie, G. ESG disclosure and financial performance: Moderating role of ESG investors. Int. Rev. Financ. Anal. 2022, 83, 102291. [Google Scholar] [CrossRef]

- Freeman, R.E.; McVea, J. A Stakeholder Approach to Strategic Management. Work. Pap. Univ. Va. 2001. [Google Scholar] [CrossRef]

- Roberts, R. Determinants of corporate social responsibility disclosure: An application of stakeholder theory. Account. Organ. Soc. 1992, 17, 595–612. [Google Scholar] [CrossRef]

- Clarkson, P.M.; Li, Y.; Richardson, G.D.; Vasvari, F.P. Revisiting the relation between environmental performance and environmental disclosure: An empirical analysis. Account. Organ. Soc. 2008, 33, 303–327. [Google Scholar] [CrossRef]

- Kim, Y.; Park, M.S.; Wier, B. Is earnings quality associated with corporate social responsibility? Account. Rev. 2012, 87, 761–796. [Google Scholar] [CrossRef]

- Kimmel, P.D.; Weygandt, J.J.; Kieso, D.E. Financial Accounting: Tools for Business Decision Making, 7th ed.; John Wiley & Sons: Hoboken, NJ, USA, 2013. [Google Scholar]

- Sila, I.; Cek, K. The impact of environmental, social and governance dimensions of corporate social responsibility: Australian evidence. Procedia Comput. Sci. 2017, 120, 797–804. [Google Scholar] [CrossRef]

- Bai, C.E.; Liu, Q.; Lu, Z.; Song, M.; Zhang, J.X. An Empirical Study on Chinese Listed Firms’ Corporate Governance. Econ. Res. J. 2005, 2, 81–91. [Google Scholar]

- Zhang, X.; Liao, L. Split-Share Structure Reform, Voluntary Disclosure and Corporate Governance. Econ. Res. J. 2010, 4, 28–53. [Google Scholar]

- Mao, Z.; Jin, L. Corporate Governance, Corporate Social Responsibility and Accounting Information Relevance. Mod. Econ. Sci. 2016, 38, 112–126. [Google Scholar] [CrossRef]

- Rangan, S. Earnings management and the performance of seasoned equity offerings. J. Financ. Econ. 1998, 50, 101–122. [Google Scholar] [CrossRef]

- Luo, M. The Mixed Ownership, Corporate Governance Quality and Equity Capital Cost: An Analysis based on Empirical Evidence from China’s Capital Market. Commer. Res. 2017, 7, 89–95. [Google Scholar] [CrossRef]

- Harjoto, M.A.; Jo, H. Corporate Governance and CSR Nexus. J. Bus. Ethics 2011, 100, 45–67. [Google Scholar] [CrossRef]

- Wang, Y.; Li, Z. Green-Efficiency of Stock Market in China: Stock Markets Reaction to 2003—2012 Environmental Events. Financ. Trade Econ. 2013, 2, 37–48. [Google Scholar]

| Variable Name and Variable Symbol | Data Sources | Variable Definition | Theoretical Basis |

|---|---|---|---|

| Return on assets ROA (Dependent variable) | CSMAR | =Net profit/Total assets | Wang and Sarkis [1] |

| Tobin’s Q Tobin’s Q (dependent variable) | CSMAR | =Market value/Book value | Wang and Sarkis [1] |

| Environmental performance of ESG E (independent variable) | IPE website | =The maximum value of environmental punishment data of all listed enterprises and their subsidiaries in 2012–2017—the number of environmental penalties of listed enterprises in the current year. | Qiu and Yin [13] Wang and Sarkis [1] |

| Social performance of ESG S (independent variable) | CSMAR | First principal component: the company’s annual social donations, a dummy variable of whether to disclose the protection policy of shareholders’ rights and interests, a dummy variable of whether to disclose the protection policy of creditors’ rights and interests, a dummy variable of whether to disclose the protection policy of employees’ rights and interests, a dummy variable of whether to disclose the protection policy of suppliers’ rights and interests, a dummy variable of whether to disclose the protection policy of customers’ rights and interests and consumers’ rights and interests, a dummy variable of whether to disclose the safety production | Luo [33]; He and Chen [10] Qiu and Yin [13] |

| Governance performance of ESG G (independent variable) | CSMAR | First principal component: the proportion of shares held by the largest shareholder, the proportion of shares held by the top ten shareholders, the number of shareholders’ meetings, the proportion of tradable shares, the dummy variables of the integration of two positions (director and general manager concurrently), the management shareholding, the proportion of independent directors, the number of boards of directors, the dummy variable of whether it is state-owned or not | Mao and Jin [28] |

| ESG performance ESG (independent variable) | E, S, G | E, S and G indicators were standardized first, and then weighted according to the weight of 3-2-5 | China Securities Investment Fund Association (2018) |

| Company size SIZE (control variable) | Wind | =Natural logarithm of total assets | Harjoto and Jo [34] Wang and Sarkis [1] |

| Liquidity ratio LR (control variable) | Wind | =Current assets/Current liabilities | Garcia et al. [4] Qiu and Yin [13] |

| Quick ratio QR (control variable) | Wind | =Quick assets/Current liabilities | Garcia et al. [4] Qiu and Yin [13] |

| Net profit margin growth NETBENE (control variable) | Wind | =3-year average growth rate of net profit | Garcia et al. [4] Qiu and Yin [13] |

| Asset turnover ASSET_TURN (control variable) | Wind | =Total turnover/Total assets | Garcia et al. [4] Qiu and Yin [13] |

| Variable | Mean | Median | Standard Deviation | Maximum | Minimum |

|---|---|---|---|---|---|

| Panel A: E, S, G | |||||

| E | 12.54 | 13.00 | 0.49 | 13.00 | 0.00 |

| S | 14.62 | 6.51 | 40.97 | 250.87 | 0.00 |

| G | 5.76 | 4.78 | 2.13 | 25.35 | 0.48 |

| Panel B: Financial performance | |||||

| ROA | 9.84 | 7.76 | 6.08 | 30.44 | −9.25 |

| TOBIN’S Q | 2.33 | 2.21 | 1.99 | 9.01 | 0.12 |

| Panel C: Control variable | |||||

| SIZE | 20.28 | 19.21 | 1.75 | 22.39 | 5.77 |

| LR | 2.87 | 2.23 | 12.01 | 9.97 | 0.33 |

| QR | 2.01 | 1.12 | 1.52 | 9.54 | 0.09 |

| NETBENE (%) | 112.24 | 50.77 | 401.51 | 2551.18 | −901.37 |

| ASSET_TURN | 0.89 | 0.77 | 0.89 | 2.95 | 0.04 |

| Variable | ROA | TOBIN’S Q | E | S | G | SIZE | LR | QR | NETBENE | ASSET_TURN |

|---|---|---|---|---|---|---|---|---|---|---|

| ROA | 1 | |||||||||

| TOBIN’S Q | 0.336 (***) | 1 | ||||||||

| E | 0.011 | 0.041 (**) | 1 | |||||||

| S | −0.098 | −0.023 (**) | −0.011 | 1 | ||||||

| G | −0.101 (***) | 0.079 (**) | 0.075 | 0.027 | 1 | |||||

| SIZE | −0.121 (***) | −0.296 (***) | −0.265 (***) | 0.408 (***) | 0.104 (***) | 1 | ||||

| LR | 0.413 (***) | 0.610 (***) | 0.076 (*) | -0.101 | 0.057 | −0.599 (***) | 1 | |||

| QR | 0.391 (***) | 0.508 (***) | 0.107 (**) | −0.096 (**) | 0.010 | −0.486 (***) | 0.802 (***) | 1 | ||

| NETBENE | 0.478 (***) | 0.265 (***) | −0.024 | −0.072 | 0.171 (**) | −0.062 | 0.066 | 0.093 | 1 | |

| ASSET_TURN | 0.295 (***) | −0.033 | −0.098 (***) | 0.009 | −0.234 (***) | 0.078 | −0.165 (***) | −0.021 | 0.044 | 1 |

| (1) Dependent Variable ROA | (2) Dependent Variable Tobin’s Q | |

|---|---|---|

| Constant term | 8.438 (4.136) ** | 9.744 (0.932) *** |

| E | −0.280 (0.140) ** | 0.018 (0.032) |

| S | −0.184 (0.134) | 0.005 (0.030) |

| G | 0.359 (0.166) ** | 0.044 (0.037) |

| SIZE | −0.691 (0.374) * | −0.869 (0.084) *** |

| LR | −1.171 (0.483) ** | −0.236 (0.109) ** |

| QR | 1.928 (0.533) *** | 0.342 (0.120) *** |

| NETBENE | 0.005 (0.000) *** | 0.0004 (0.0000) *** |

| ASSET_TURN | 7.187 (0.736) *** | 0.327 (0.166)** |

| Observations | 1146 | 1146 |

| Adjusted R2 | 68.54% | 74.58% |

| F | 9.78 | 9.14 |

| Variable | Mean | Median | Standard Deviation | Maximum | Minimum |

|---|---|---|---|---|---|

| Standardization E | −6.55 × 10−8 | 0.310 | 1.000 | 0.408 | −20.009 |

| Standardization S | 1.588 × 10−7 | −0.109 | 1.000 | 8.159 | −0.298 |

| Standardization G | 5.963 × 10−5 | −0.098 | 1.000 | 10.335 | −2.001 |

| ESG | 0.011 | 0.108 | 0.524 | 4.103 | −5.536 |

| (3) Dependent Variable ROA | (4) Dependent Variable Tobin’s Q | |

|---|---|---|

| Constant term | 6.020 (4.040) | 9.556 (0.907) *** |

| ESG | −0.707 (0.428) * | 0.101 (0.096) |

| SIZE | −0.528 (0.366) | −0.843 (0.082) *** |

| LR | −1.095 (0.484) ** | −0.232 (0.109) ** |

| QR | 1.854 (0.534) *** | 0.338 (0.120) *** |

| NETBENE | 0.005 (0.000) *** | 0.0004 (0.0000) *** |

| ASSET_TURN | 7.233 (0.737) *** | 0.318 (0.166)* |

| Observations | 1146 | 1146 |

| Adjusted R2 | 68.34% | 74.61% |

| F | 9.82 | 9.41 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, H.; Wu, K.; Zhou, Q. Whether and How ESG Impacts on Corporate Financial Performance in the Yangtze River Delta of China. Sustainability 2022, 14, 16584. https://doi.org/10.3390/su142416584

Liu H, Wu K, Zhou Q. Whether and How ESG Impacts on Corporate Financial Performance in the Yangtze River Delta of China. Sustainability. 2022; 14(24):16584. https://doi.org/10.3390/su142416584

Chicago/Turabian StyleLiu, Huiyuan, Kaiyao Wu, and Qiuhua Zhou. 2022. "Whether and How ESG Impacts on Corporate Financial Performance in the Yangtze River Delta of China" Sustainability 14, no. 24: 16584. https://doi.org/10.3390/su142416584

APA StyleLiu, H., Wu, K., & Zhou, Q. (2022). Whether and How ESG Impacts on Corporate Financial Performance in the Yangtze River Delta of China. Sustainability, 14(24), 16584. https://doi.org/10.3390/su142416584