The Effects of Network Structure Attributes on Growth Performance of Logistics Service Integrators in Logistics Service Supply Chain: Empirical Evidence

Abstract

1. Introduction

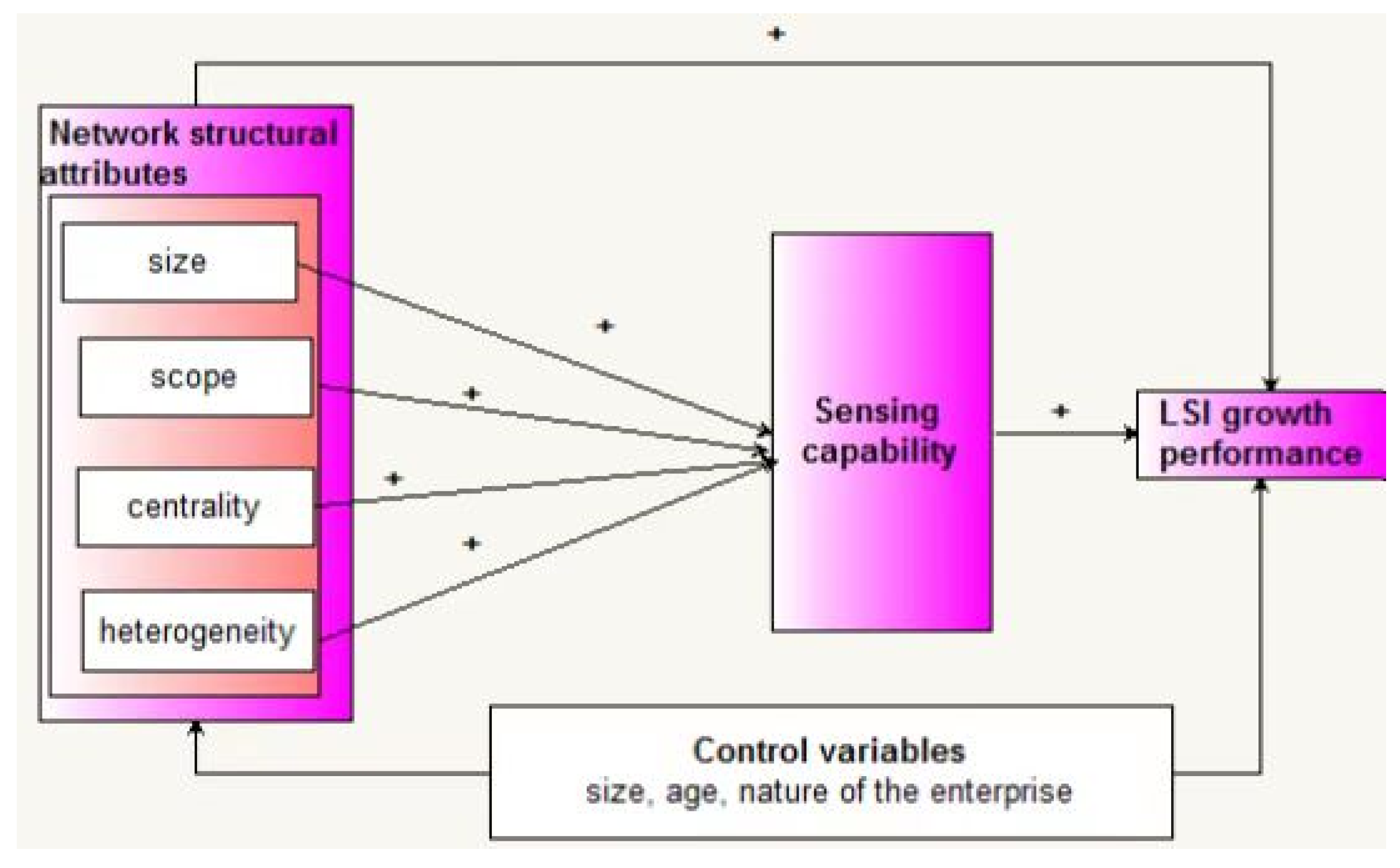

- (1)

- What network structure attributes of LSSC affect LSI growth performance?

- (2)

- What is the mechanism of LSSC network structure attributes improving LSI growth performance, that is, how does the LSSC network affect LSI growth performance?

2. Theoretical Development

2.1. LSSC

2.2. Network Structure Attributes

2.3. Sensing Capability

2.4. Network Structure Attributes, Sensing capability and Enterprise Growth

3. Research Hypotheses

3.1. Network Structural Attributes and LSI Growth

3.2. Relationship between Network Structural Attributes and Sensing Capability

3.3. Relationship between Sensing Capability and LSI Growth

3.4. Intermediary Effect of Sensing Capability on the Relationship between Network Structural Attributes and LSI Growth Performance

4. Empirical Design

4.1. Sampling and Data Collection

4.2. Descriptive Statistical Analysis

4.3. The Results of Reliability and Validity

4.4. Results

4.5. Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Chen, Y.J.; Yang, B. Analysis on the evolution of shipping logistics service supply chain market structure under the application of blockchain technology. Adv. Eng. Inform. 2022, 53, 4–17. [Google Scholar] [CrossRef]

- Zhang, S.; Bi, C.; Zhang, M. Logistics service supply chain order allocation mixed K-Means and Qos matching. Procedia Comput. Sci. 2021, 188, 121–129. [Google Scholar] [CrossRef]

- Hansen, E.L. Entrepreneurial networks and new organization growth. Entrep. Theory Pract. 1995, 19, 7–19. [Google Scholar] [CrossRef]

- Jenssen, J.I. Social networks, resources and entrepreneurship. Int. J. Entrep. Innov. 2001, 2, 103–109. [Google Scholar] [CrossRef]

- Crainic, T.G.; Feliu, J.G.; Ricciardi, N.; Semet, F.; VanWoensel, T. Operations Research for Planning and Managing City Logistics Systems; Technical report CIRRELT-2021-45; CIRRELT–Université de Montréal: Montreal, Canada, 2021. [Google Scholar]

- Ju, Y.; Wang, Y.; Cheng, Y.; Jia, J. Investigating the Impact Factors of the Logistics Service Supply Chain for Sustainable Performance: Focused on Integrators. Sustainability 2019, 11, 538. [Google Scholar] [CrossRef]

- Morana, J. Sustainable Supply Chain Management; John Wiley & Sons: Hoboken, NJ, USA, 2013. [Google Scholar]

- Li, C.; Shi, M.; Qu, B.; Li, X. Deep attributed network representation learning via attribute enhanced neighborhood. Neurocomputing 2022, 508, 170–181. [Google Scholar] [CrossRef]

- Zahoor, N.; Golgeci, I.; Haapanen, L.; Ali, I.; Arslan, A. The role of dynamic capabilities and strategic agility of B2B high-tech small and medium-sized enterprises during COVID-19 pandemic: Exploratory case studies from Finland. Ind. Market. Manag. 2022, 105, 502–514. [Google Scholar] [CrossRef]

- Wang, S.; Hu, Z.-H. Green Logistics Service Supply Chain Games Considering Risk Preference in Fuzzy Environments. Sustainability 2021, 13, 8024. [Google Scholar] [CrossRef]

- Liu, W.; Ji, J. Service Supply Chain: A New Trend in Supply Chain Research; China Material Press: Beijing, China, 2006. [Google Scholar]

- Arsić, M.; Jovanović, Z.; Tomić, R.; Tomović, N.; Arsić, S.; Bodolo, I. Impact of Logistics Capacity on Economic Sustainability of SMEs. Sustainability 2020, 12, 1911. [Google Scholar] [CrossRef]

- Gimenez, C.; van der Vaart, T.; van Donk, D.P. Supply chain integration and performance: The moderating effect of supply complexity. Int. J. Oper. Prod. Manag. 2012, 32, 583–610. [Google Scholar] [CrossRef]

- Ma, F.; Xue, H.; Yuen, K.F.; Sun, Q.; Zhao, S.; Zhang, Y.; Huang, K. Assessing the Vulnerability of Logistics Service Supply Chain Based on Complex Network. Sustainability 2020, 12, 1991. [Google Scholar] [CrossRef]

- Qureshi, M.R.N.M. A Bibliometric Analysis of Third-Party Logistics Services Providers (3PLSP) Selection for Supply Chain Strategic Advantage. Sustainability 2022, 14, 11836. [Google Scholar] [CrossRef]

- Liu, H.; Chen, H.; Zhang, H.; Liu, H.; Yu, X.; Zhang, S. Contract Design of Logistics Service Supply Chain Based on Smart Transformation. Sustainability 2022, 14, 6261. [Google Scholar] [CrossRef]

- Varadarajan, R. Customer information resources advantage, marketing strategy and business performance: A market resources based view. Ind. Mark. Manag. 2020, 89, 89–97. [Google Scholar] [CrossRef]

- Zaheer, A.; Bell, G.G. Benefiting from network position: Firm capabilities, structural holes, and performance. Strateg. Manag. J. 2005, 26, 809–825. [Google Scholar] [CrossRef]

- Cristobal, C.; Angeles, G.; Maria, S. Network resources and social capital in aire alliance portfolios. Tour. Manag. 2013, 36, 441–453. [Google Scholar]

- Burt Ronald, S. Structural Holes: The Social Structure of Competition; Harvard University Press: Cambridge, MA, USA, 1992. [Google Scholar]

- Gulati, R. Alliances and networks. Strateg. Manag. J. 1998, 19, 293–317. [Google Scholar] [CrossRef]

- Higgins, M.C.; Kram, K.E. Reconceptualizing mentoring at work: A developmental network perspective. Acad. Manag. Rev. 2001, 26, 264–288. [Google Scholar] [CrossRef]

- Wellman, B. Network analysis: Some basic principles. Sociol. Theory 1983, 1, 155–200. [Google Scholar] [CrossRef]

- Lin, N.; Zhang, L. Social Capital: Theory of Social Structure and Action; Shanghai People’s Publishing House: Shanghai, China, 2005. [Google Scholar]

- Johanson, J.; Mattsson, L.G. Network positions and strategic action: An analytical framework. In Industrial Networks: Anew View of Reality, Univ.; Axelsson, B., Easton, G., Eds.; Routledge: London, UK, 1992; pp. 205–217. [Google Scholar]

- Makoto, U.; Susumu, S. Influence of a network structure on the network effect in the communication service market. Physica A 2008, 387, 5303–5310. [Google Scholar]

- Palmatier, R.W.; Dant, R.P.; Grewal, D.A. Comparative longitudinal analysis of theoretical perspectives of inter-organizational relationship performance. J. Mark. 2007, 71, 172–194. [Google Scholar] [CrossRef]

- Grant, R.M. The resource-based theory of competitive advantage: Implications for strategy formulation. California. Manag. Rev. 1991, 33, 114–135. [Google Scholar] [CrossRef]

- Teece, D.J. Explicating dynamic capabilities: The nature and micro foundations of (sustainable) enterprise performance. Strateg. Manag. J. 2007, 28, 1319–1350. [Google Scholar] [CrossRef]

- Iansiti, M.; Clark, K.B. Integration and dynamic capability: Evidence from product development in automobiles and mainframe computers. Ind. Corp. Change 1994, 3, 557–605. [Google Scholar] [CrossRef]

- Johnston, D.A.; McCutcheon, D.M.; Stuart, F.I.; Kerwood, H. Effects of supplier trust on performance of cooperative supplier relationships. J. Oper. Manag. 2004, 22, 23–38. [Google Scholar] [CrossRef]

- Zahra, S.; Sapienza, H.; Davidsson, P. Entrepreneurship and dynamic capabilities: A review, model and research agenda. J. Manag. Stud. 2006, 43, 917–955. [Google Scholar] [CrossRef]

- Subramaniam, M.; Youndt, M.A. The influence of intellectual capital on the types of innovative capabilities. Acad. Manag. J. 2005, 48, 450–463. [Google Scholar] [CrossRef]

- Liu, S.Y.; Li, C.; Feng, Y.P.; Rong, G. Clustering structure and logistics: A new framework for supply network analysis. Chem. Eng. Res. Design 2013, 2, 1–7. [Google Scholar] [CrossRef]

- Endres, R.; Helm, R.; Dowling, M. Linking the types of market knowledge sourcing with sensing capability and revenue growth: Evidence from industrial firms. Ind. Mark. Manag. 2020, 90, 30–43. [Google Scholar] [CrossRef]

- Mero, J.; Haapio, H. An effectual approach to executing dynamic capabilities under unexpected uncertainty. Ind. Mark. Manag. 2022, 107, 82–91. [Google Scholar] [CrossRef]

- Alshanty, A.M.; Emeagwali, O.L. Market-sensing capability, knowledge creation and innovation: The moderating role of entrepreneurial-orientation. J. Innov. Knowl. 2019, 4, 171–178. [Google Scholar] [CrossRef]

- Beekman, A.V.; Robinson, R.B. Supplier Partnerships and the Small, High-Growth Firm: Selecting for Success. J. Small Bus. Manag. 2004, 42, 59–77. [Google Scholar] [CrossRef]

- Nybakk, E.; Lunnan, A.; Jenssen, J.I.; Crespell, P. The importance of social networks in the Norwegian firewood industry. Biomass Bioenergy 2013, 57, 48–56. [Google Scholar] [CrossRef][Green Version]

- Baum, J.A.C.; Ingram, P. Survival-enhancing learning in the Manhattan hotel industry, 1898–1980. Manag. Sci. 1998, 44, 996–1016. [Google Scholar] [CrossRef]

- Danilovic, M.; Winroth, M. A tentative framework for analyzing integration in collaborative manufacturing network settings: A case study. J. Eng. Technol. Manag. 2005, 22, 141–158. [Google Scholar] [CrossRef]

- Chang, K.C.; Wong, J.H.; Li, Y.; Lin, Y.C.; Chen, H.G. External social capital and information systems development team flexibility. Inf. Softw. Technol. 2011, 53, 592–600. [Google Scholar] [CrossRef]

- Furnude, J.F. Questionnaire design and Evaluation; Chongqing University Press: Chongqing, China, 2010. [Google Scholar]

| Variables | Secondary Variables | Description | Survey Items | |

|---|---|---|---|---|

| Dependent variable: LSI growth performance | Growth in sales, profits, market share, number of employees, level of specialization of employees, competitive advantage of logistics services/products provided, customer satisfaction | JX1—JX7 | ||

| Intermediary variables:Dynamic ability | sensing capability | The ability to identify and identify market opportunities and threats and their impact on existing strategies/tactics reflect the environmental sensitivity of enterprises | DGZ1—DGZ5 | |

| Independent variables: network attributes | structural attributes | size | Number of LSSC members directly or indirectly associated with LSI during LSSC development. | SJGM1, SJGM2 |

| scope | How many types of relationships between LSI and other members | SJFW1 | ||

| centrality | Reflects LSI advantages in network location | SJZXX1—SJZXX4 | ||

| heterogeneity | Indicators to measure differences in certain characteristics among all members of the network | SJYZX1—SJYZX5 | ||

| Control variables | size | Expressed by number of employees and total assets, respectively | QYGM1 | |

| Age | Length of operation of logistics business | QYNL1 | ||

| nature | State-owned enterprises, private enterprises, collective enterprises, three-capital-domestic holding, three-capital-foreign holding and others | QYXZ1 | ||

| Sample Enterprise Situation | Frequency | Percentage | Accumulative Perception | |

|---|---|---|---|---|

| Enterprise nature | State-owned enterprise | 31 | 9.7 | 9.7 |

| Private companies | 207 | 64.9 | 74.6 | |

| Enterprise under collective ownership | 17 | 5.3 | 79.9 | |

| Three capital-domestic capital holdings | 28 | 8.8 | 88.7 | |

| Foreign capital-foreign capital holding | 32 | 10.0 | 98.7 | |

| others | 4 | 1.3 | 100.0 | |

| size of enterprises (number of employees) | Less than 20 | 5 | 1.6 | 1.6 |

| 20~50 | 23 | 7.2 | 8.8 | |

| 50~200 | 112 | 35.1 | 43.9 | |

| 200~500 | 75 | 23.5 | 67.4 | |

| More than 500 | 104 | 32.6 | 100.0 | |

| size of enterprises (total assets of the sample enterprises) | Under CNY 10 million | 18 | 5.6 | 5.6 |

| CNY 10 million~CNY 30 million | 85 | 26.6 | 32.3 | |

| CNY 30 million~CNY 150 million | 104 | 32.6 | 64.9 | |

| 150 million~300 million | 60 | 18.8 | 83.7 | |

| Over 300 million | 52 | 16.3 | 100.0 | |

| age of enterprises | 3–5 Years | 41 | 12.9 | 12.9 |

| 6–10 Years | 146 | 45.8 | 58.6 | |

| 11–20 Years | 114 | 35.7 | 94.4 | |

| More than 20 years | 18 | 5.6 | 100.0 | |

| Position of Questionnaire Filler | Senior managers | 105 | 32.9 | 32.9 |

| Middle managers | 214 | 67.1 | 100.0 | |

| Grassroots managers | 0 | 0.0 | 0.0 | |

| Common employees | 0 | 0.0 | 0.0 | |

| Path | Path Coefficient | Standard Path Coefficient | C.R. | p | |||

|---|---|---|---|---|---|---|---|

| DGZ<---SJGM | 0.073 | 0.122 | 2.235 | 0.025 | |||

| DGZ<---SJFW1 | 0.013 | 0.164 | 3.600 | *** | |||

| DGZ <---SJZXX | 0.262 | 0.294 | 5.116 | *** | |||

| DGZ<---SJYZX | −0.009 | −0.015 | −0.346 | 0.729 | |||

| JX<---DGZ | 0.165 | 0.136 | 2.414 | 0.016 | |||

| JX<---SJGM | 0.022 | 0.030 | 0.503 | 0.615 | |||

| JX<---SJFW1 | 0.005 | 0.049 | 1.052 | 0.293 | |||

| JX<---SJZXX | 0.125 | 0.116 | 1.836 | 0.066 | |||

| JX<---SJYZX | 0.123 | 0.167 | 3.834 | *** | |||

| χ2 | 74.968 | RMR | 0.006 | NFI | 0.949 | CFI | 0.950 |

| df | 3 | RMSEA | 0.275 | RFI | 0.073 | GFI | 0.961 |

| χ2/df | 24.989 | IFI | 0.951 | AGFI | 0.144 | ||

| Path | Path Coefficient | Standard Path Coefficient | C.R. | p | |||

|---|---|---|---|---|---|---|---|

| DGZ<---SJGM | 0.198 | 0.296 | 5.559 | *** | |||

| DGZ<---SJZXX | 0.270 | 0.303 | 5.191 | *** | |||

| JX<---DGZ | 0.202 | 0.167 | 2.964 | 0.003 | |||

| JX<---SJZXX | 0.158 | 0.146 | 2.531 | 0.011 | |||

| JX<---SJYZX | 0.119 | 0.160 | 3.735 | *** | |||

| χ2 | 9.932 | RMR | 0.004 | NFI | 0.993 | CFI | 1 |

| df | 10 | RMSEA | 0.000 | RFI | 0.968 | GFI | 0.994 |

| χ2/df | 0.993 | IFI | 1 | AGFI | 0.966 | ||

| Heterogeneity | Size | Centrality | Sensing Capability | |

|---|---|---|---|---|

| Sensing capability | 0.000 | 0.148 | 0.303 | 0.000 |

| LSI growth performance | 0.175 | 0.161 | 0.296 | 0.204 |

| Heterogeneity | Size | Centrality | Sensing Capability | |

|---|---|---|---|---|

| Sensing ca-pability | 0.000 | 0.148 | 0.303 | 0.000 |

| LSI growth performance | 0.160 | 0.000 | 0.146 | 0.167 |

| Heterogeneity | Size | Centrality | Sensing Capability | |

|---|---|---|---|---|

| Sensing ca-pability | 0.000 | 0.000 | 0.000 | 0.000 |

| LSI growth performance | 0.016 | 0.161 | 0.150 | 0.038 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xu, X.; He, C. The Effects of Network Structure Attributes on Growth Performance of Logistics Service Integrators in Logistics Service Supply Chain: Empirical Evidence. Sustainability 2022, 14, 16788. https://doi.org/10.3390/su142416788

Xu X, He C. The Effects of Network Structure Attributes on Growth Performance of Logistics Service Integrators in Logistics Service Supply Chain: Empirical Evidence. Sustainability. 2022; 14(24):16788. https://doi.org/10.3390/su142416788

Chicago/Turabian StyleXu, Xu, and Chan He. 2022. "The Effects of Network Structure Attributes on Growth Performance of Logistics Service Integrators in Logistics Service Supply Chain: Empirical Evidence" Sustainability 14, no. 24: 16788. https://doi.org/10.3390/su142416788

APA StyleXu, X., & He, C. (2022). The Effects of Network Structure Attributes on Growth Performance of Logistics Service Integrators in Logistics Service Supply Chain: Empirical Evidence. Sustainability, 14(24), 16788. https://doi.org/10.3390/su142416788